Invoice Template for Independent Contractor

Efficiently managing payments is essential for freelancers and those offering services on a short-term basis. One of the most effective ways to ensure smooth transactions is by using a well-organized document that clearly outlines the details of the work completed and the amount due. This helps both parties avoid misunderstandings and ensures timely compensation.

Crafting a professional document that meets legal and financial requirements can seem challenging, but with the right structure, it becomes a simple process. By including necessary information and customizing it to reflect your business needs, you can maintain a smooth financial flow and project a professional image.

In this guide, we will explore how to design and use an efficient document to request payments, ensuring that your work is valued and compensated properly. You’ll learn how to personalize it to your specific needs and make sure it reflects the professionalism that clients expect from you.

Invoice Template for Independent Contractor

Creating a clear and professional document to request payment is a crucial step in any freelance or self-employed business. This document serves as an official record of the services provided and ensures that both parties understand the terms of the transaction. A well-structured request helps prevent confusion and promotes timely payment.

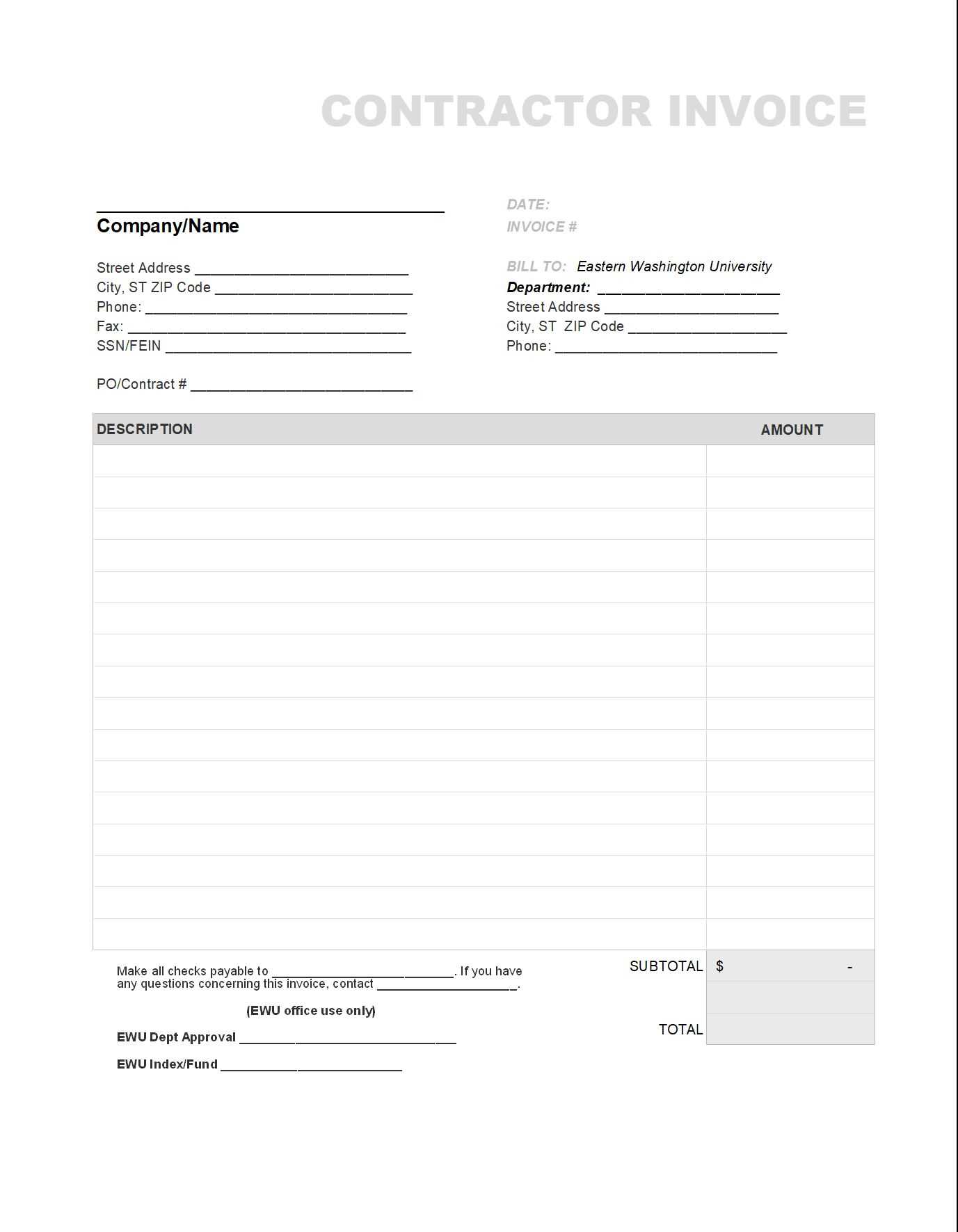

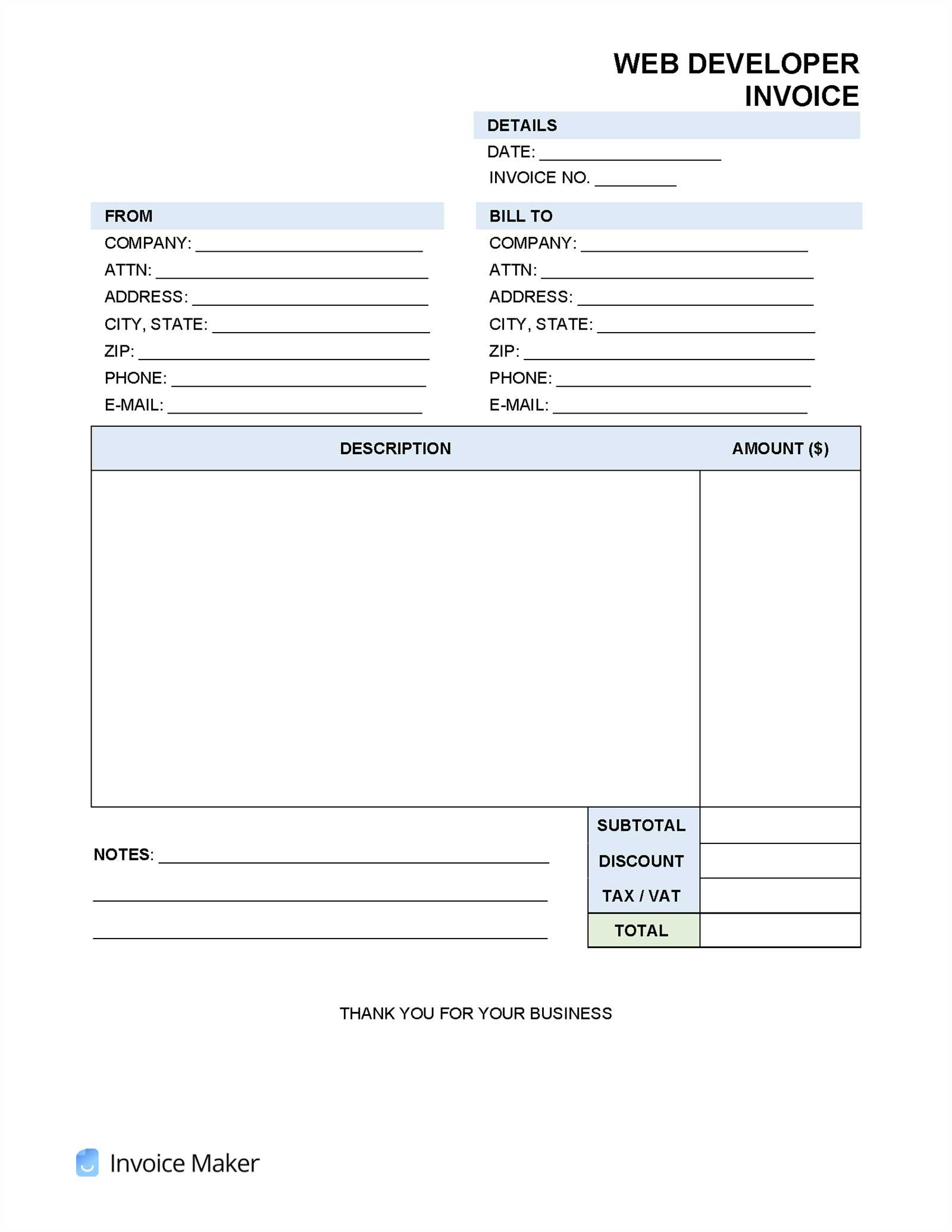

To ensure your payment requests are effective and professional, consider including the following elements:

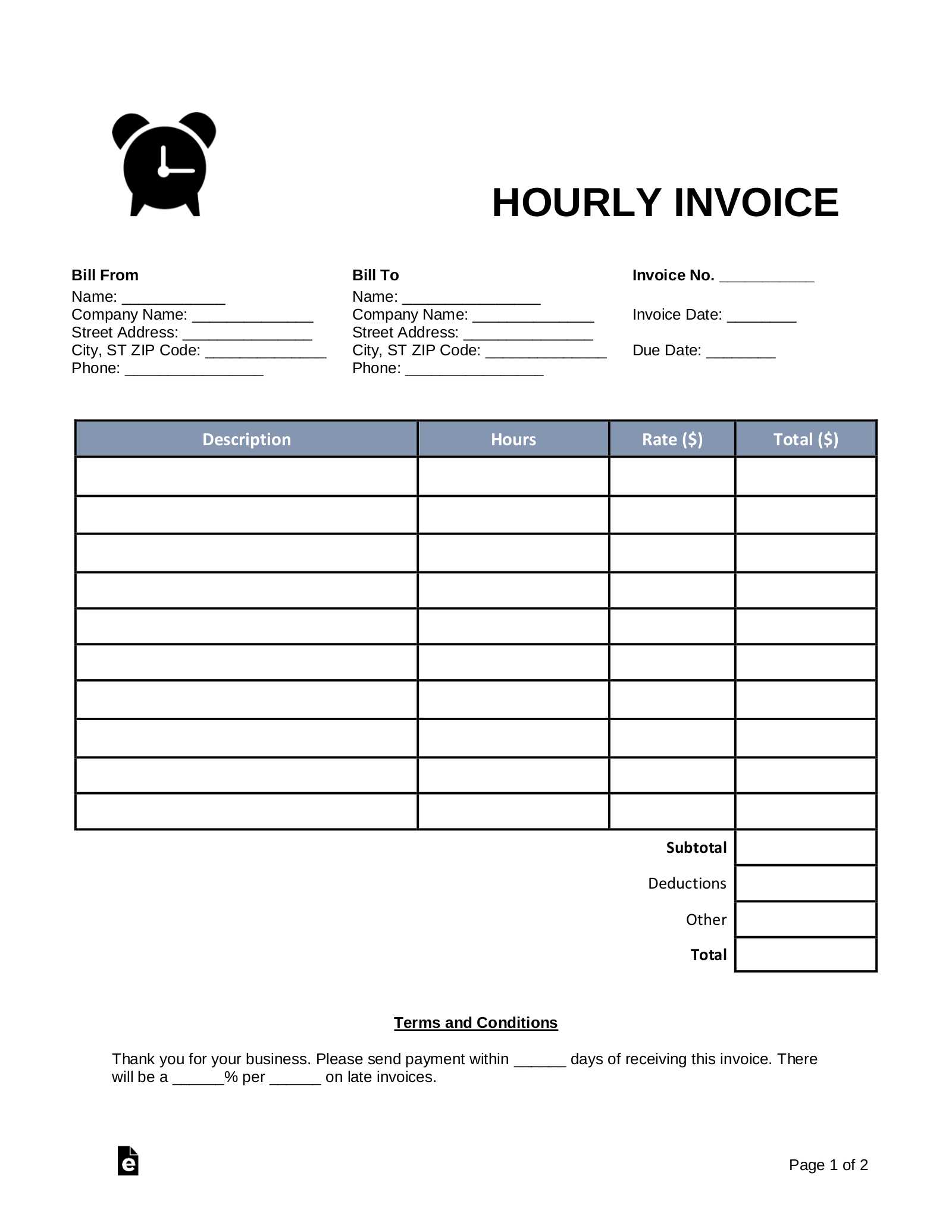

- Service Details: Clearly list the work completed, including descriptions, hours worked, and any relevant dates.

- Payment Terms: Specify the amount due, payment methods accepted, and any deadlines for payment.

- Contact Information: Include both your details and the recipient’s information to ensure smooth communication.

- Legal Information: Mention any applicable taxes or fees, as well as your business registration details, if required.

- Personalized Design: Customize the layout to reflect your brand identity or professional style, making it look polished.

By incorporating these components into your payment request, you create a document that is both functional and visually appealing. This approach not only helps ensure timely payments but also builds trust with clients by demonstrating professionalism and clarity in financial transactions.

Why Independent Contractors Need Invoices

Managing payment requests is essential for anyone offering services or working on a freelance basis. A structured document not only helps track payments but also serves as an official record of the work completed and the terms agreed upon. Without such a document, misunderstandings can arise, and it may become difficult to ensure timely compensation.

Here are several reasons why this type of document is crucial:

- Clarity and Transparency: A well-organized document ensures both parties understand the work completed and the amount due, leaving no room for confusion.

- Professionalism: Presenting a formal request enhances your image and shows clients that you take your business seriously.

- Legal Protection: It provides a written record of the agreement, offering protection in case of disputes.

- Efficient Tracking: A detailed document helps track payments, making it easier to monitor overdue amounts and stay on top of finances.

- Tax Purposes: Proper records are necessary for tax filing and can simplify the process during audits.

Incorporating these documents into your workflow not only streamlines the financial side of your business but also enhances your professional reputation.

Key Features of a Good Invoice

A well-crafted document to request payment serves not only as a formal record but also as a key element in maintaining clear and professional communication with clients. To ensure this document is effective, it must include all relevant details that help both parties understand the terms and avoid potential issues.

Here are the essential features of an effective payment request:

- Clear Identification: Include your name, business name, and contact information, as well as the recipient’s details for easy reference.

- Service Description: Provide a concise breakdown of the work completed, including specific tasks, hours worked, or milestones achieved.

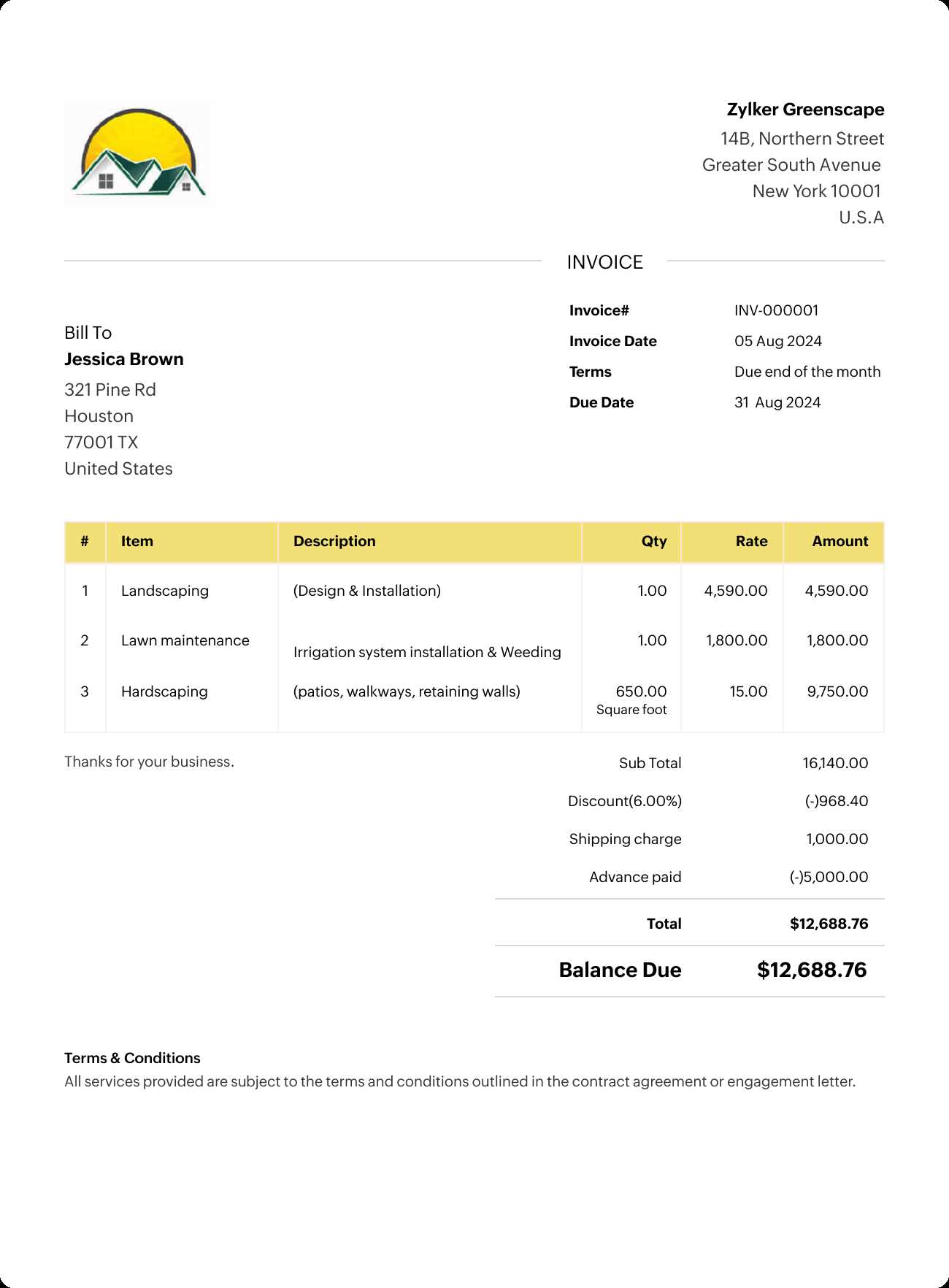

- Payment Details: Specify the total amount due, payment methods accepted, and due date for payment.

- Tax Information: Clearly state any applicable taxes or additional fees that are part of the total amount.

- Professional Layout: Use a clean, organized design that makes it easy to read and highlights the most important information.

By ensuring these key elements are included, you create a document that not only looks professional but also functions as a clear and legally sound request for compensation.

How to Create an Invoice Easily

Creating a professional document to request payment doesn’t need to be complicated. By following a few simple steps, you can create an effective and clear payment request in no time. The key is to include all the necessary details while keeping the process straightforward and organized.

Here’s how to get started:

- Choose a Platform: Select a tool or software that suits your needs, whether it’s an online service, a word processor, or a spreadsheet.

- Include Your Information: Start by adding your contact details, business name, and payment information. Don’t forget to include the recipient’s name and contact details as well.

- Describe the Work: List the services you provided, detailing the tasks completed and the time spent, if applicable.

- Set the Payment Terms: Clearly state the total amount due, payment methods, and the due date to avoid confusion later.

- Double-Check the Details: Review the document to ensure all information is accurate, including any tax or additional fees.

By following these steps, you can quickly create a professional and clear payment request that ensures smooth transactions with clients.

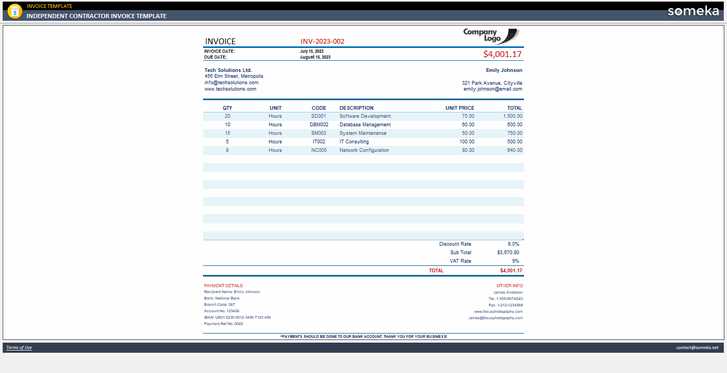

Best Formats for Invoice Templates

When creating a document to request payment, choosing the right format is crucial for clarity and professionalism. The format you use can make a significant difference in how easily the information is understood and how well it represents your business. Different formats offer unique advantages depending on your needs and preferences.

Digital Documents

One of the most popular formats for creating payment requests is digital documents, such as PDFs or word processing files. These formats are easy to customize, share, and store, making them convenient for both freelancers and clients. They also allow for quick adjustments if changes need to be made, and they can be professionally designed to suit your brand.

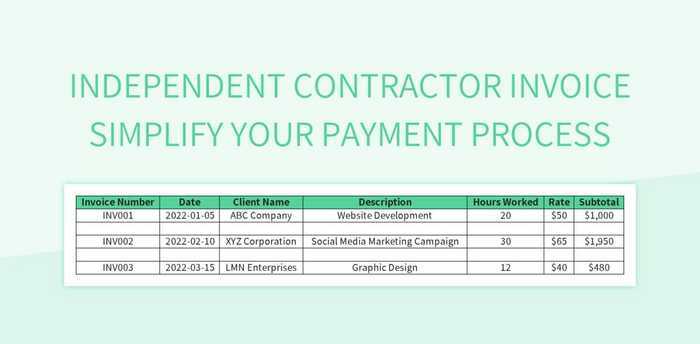

Spreadsheets

Spreadsheets are another excellent format, especially for those who want to easily calculate totals, taxes, and discounts. Using spreadsheet software such as Excel or Google Sheets can automate calculations and keep everything organized in one place. Spreadsheets are especially useful for those who bill clients regularly, as they can quickly copy and adapt previous records for new projects.

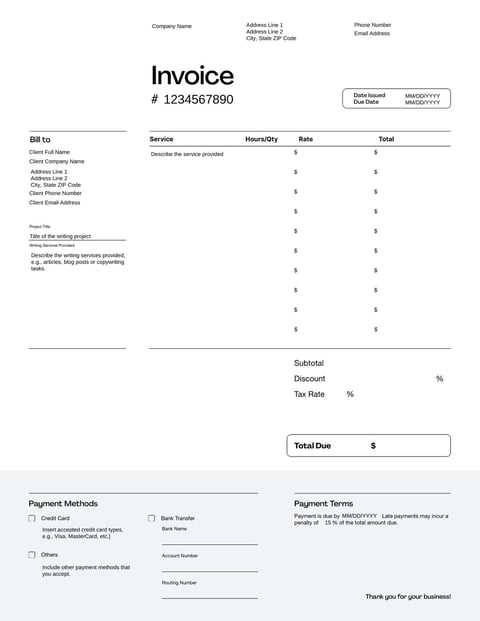

What to Include in Your Invoice

When creating a document to request payment, it’s essential to ensure that all necessary information is clearly outlined. This not only helps avoid confusion but also ensures that both you and the client are on the same page regarding the work completed and the amount due. Here are the key elements to include:

- Your Contact Information: Include your full name or business name, address, phone number, and email address.

- Recipient’s Contact Details: Make sure to add the client’s name or business name, along with their contact details.

- Document Number: Assign a unique reference number for tracking purposes. This helps you stay organized and makes it easier to refer back to past records.

- Services Provided: List the specific tasks or services performed, including a brief description and the time spent or the project details.

- Amount Due: Clearly state the total amount owed, breaking it down by hourly rate, flat fee, or any other applicable charges.

- Payment Terms: Specify the payment methods accepted, due date, and any late fees or penalties for delayed payments.

- Tax Information: If applicable, include the tax rate and the amount of tax applied to the total amount due.

- Due Date: Set a clear deadline for when the payment is expected to be received.

Including all these details ensures that the document is clear, professional, and legally sound, minimizing potential issues with payments or misunderstandings.

Choosing the Right Invoice Software

Selecting the right software to manage your payment requests can greatly streamline your business operations. With the right tool, you can easily create, send, and track your documents, helping you stay organized and professional. The software you choose should match your needs and provide the features necessary to handle your specific requirements efficiently.

Key Features to Consider

When choosing the right software, consider the following key features:

- User-Friendly Interface: Look for a platform that is easy to navigate, allowing you to create and manage documents quickly without any technical difficulties.

- Customization Options: Ensure the software allows you to personalize your documents with your business logo, color scheme, and preferred layout.

- Payment Integration: Some tools integrate directly with payment systems, making it easier for clients to pay you as soon as they receive your request.

- Tracking Capabilities: A good software solution should help you track unpaid documents and send reminders to clients automatically.

- Cloud Access: Opt for software that stores your documents in the cloud, giving you access from anywhere and helping you avoid lost records.

Popular Software Options

There are many software options available, ranging from simple to advanced. Some of the most popular choices include:

- FreshBooks: Known for its user-friendly interface and excellent customer support, making it ideal for small businesses.

- QuickBooks: A powerful accounting tool with comprehensive features for invoicing, accounting, and tracking payments.

- Zoho Invoice: An affordable option that offers a wide range of customizable features.

Choose a tool that fits your business size, workflow, and budget, and one that can grow with your needs as your business expands.

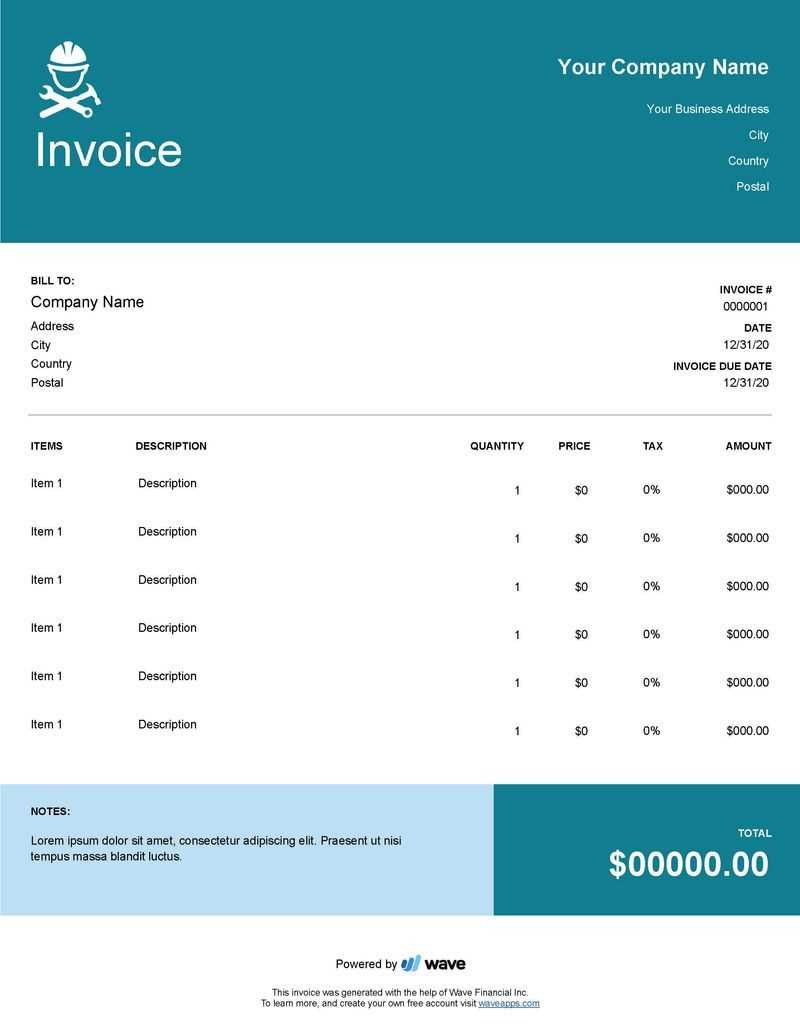

How to Customize Your Invoice Template

Personalizing your payment request document is an important step to ensure it reflects your brand and professionalism. By making small adjustments to the structure and design, you can create a unique format that aligns with your business identity while maintaining clarity for your clients. Customization allows you to make the document stand out and ensures it contains all the necessary information in an easily understandable format.

Key Customization Options

Here are a few key elements you can personalize to suit your needs:

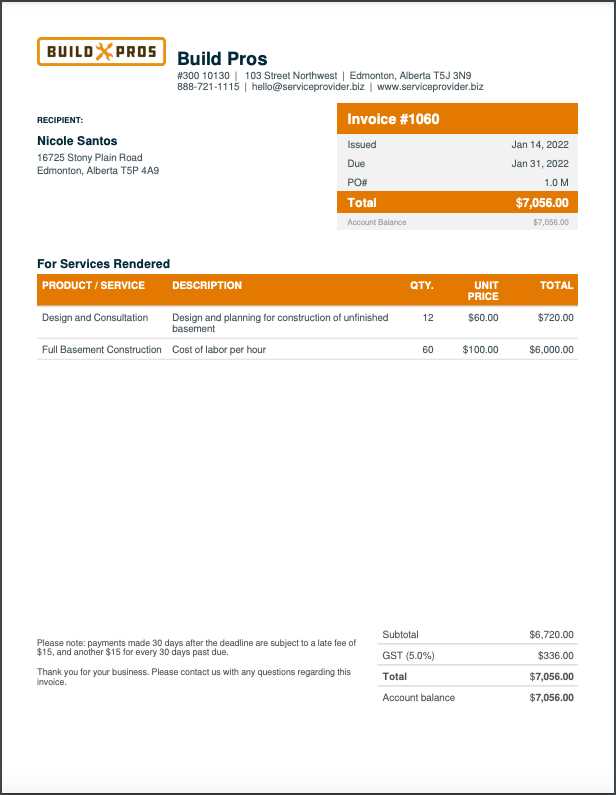

- Logo and Branding: Add your business logo and choose a color scheme that reflects your brand. This makes the document more recognizable and professional.

- Font and Layout: Customize the font style and size to make the document visually appealing and easy to read. Ensure the layout is clean and well-organized.

- Terms and Conditions: Include your business’s payment terms, policies, and any specific conditions related to your services. This will help prevent misunderstandings with clients.

- Unique Reference Number: Assign a unique number for each document to make tracking and referencing easier, especially when dealing with multiple clients.

Using Tools to Streamline Customization

Many software tools and platforms offer pre-designed layouts that allow easy customization. You can adjust fields, colors, and fonts with just a few clicks, ensuring the document is aligned with your business style without having to create everything from scratch. Choose a tool that supports these customizations and enables you to save templates for repeated use, saving you time for future requests.

How to Handle Late Payments on Invoices

Dealing with overdue payments can be a challenging aspect of managing your finances. When clients fail to pay within the agreed timeframe, it can affect your cash flow and overall business operations. However, addressing these situations professionally and promptly can help you maintain a positive working relationship while ensuring you receive the compensation you’re owed.

The first step in managing late payments is to set clear expectations from the outset. Clearly state your payment terms, including deadlines and any late fees, in your agreement or initial discussions. This can help avoid confusion and set the tone for timely payments.

If payment is delayed, it’s important to address the issue professionally. Start by sending a polite reminder to the client. Ensure that your communication is clear, respectful, and includes all necessary details, such as the amount owed, the due date, and any relevant reference numbers.

If the payment continues to be overdue, consider taking more formal steps, such as implementing a late fee or sending a final notice. In extreme cases, legal action may be required, but this should be a last resort after all other options have been exhausted.

Understanding Tax Information on Invoices

When issuing a payment request, it’s essential to understand the tax details that should be included to comply with legal requirements. Properly outlining tax information ensures both parties are clear on the total amount due and that the transaction aligns with local tax laws.

Different regions and countries have varying tax rules, which can affect how tax is applied. Understanding these rules helps avoid potential issues and ensures the document is legally sound. Key tax elements include sales tax, VAT, or service tax, depending on where the work is being done or the product is being delivered.

Essential Tax Details to Include

- Tax Identification Number: Include your business or personal tax ID to verify your status for tax purposes.

- Tax Rate: The applicable tax rate should be clearly stated. This might vary based on the location of the service or product delivery.

- Total Tax Amount: Clearly show how much tax is being charged, based on the tax rate and the total amount due.

- Exemptions: If the transaction is exempt from tax or falls under a special category, make sure this is indicated as well.

Why Tax Information is Important

Proper tax information helps avoid legal complications and ensures that both parties can accurately report income and expenses. Failure to include the correct tax details can lead to fines or disputes later on. It also makes it easier for your client to keep their records in order when it’s time for them to file their taxes.

Common Mistakes in Invoice Creation

When preparing a document requesting payment, certain common errors can lead to confusion, delayed payments, and even legal issues. It’s essential to pay attention to detail to ensure the request is clear, professional, and accurate.

One of the most frequent mistakes is the omission of crucial information, such as the correct amount, due date, or payment method. Incomplete or inaccurate details can result in misunderstandings or delays in processing payments.

Key Mistakes to Avoid

- Incorrect Client Information: Always verify the recipient’s name, address, and contact details to ensure accuracy. A mistake here can lead to confusion or missed payments.

- Failure to Include Payment Terms: Not specifying when the payment is due or the accepted payment methods can cause delays. It’s vital to make these clear to avoid uncertainty.

- Missing Tax Information: Neglecting to include tax details, such as applicable rates or tax identification numbers, can lead to legal complications and potential fines.

- Not Tracking Previous Payments: If there are multiple payments or ongoing projects, it’s essential to keep track of any outstanding balances to prevent double billing or errors in payment history.

- Unclear Descriptions of Services: Vague descriptions can confuse the client and lead to disputes. Be as specific as possible about the work completed or the products delivered.

Ensuring Accuracy

To avoid these mistakes, double-check the information before sending. Using a consistent format and ensuring all necessary details are included helps maintain professionalism and ensures timely payment. Keeping records and staying organized will minimize the risk of errors in the future.

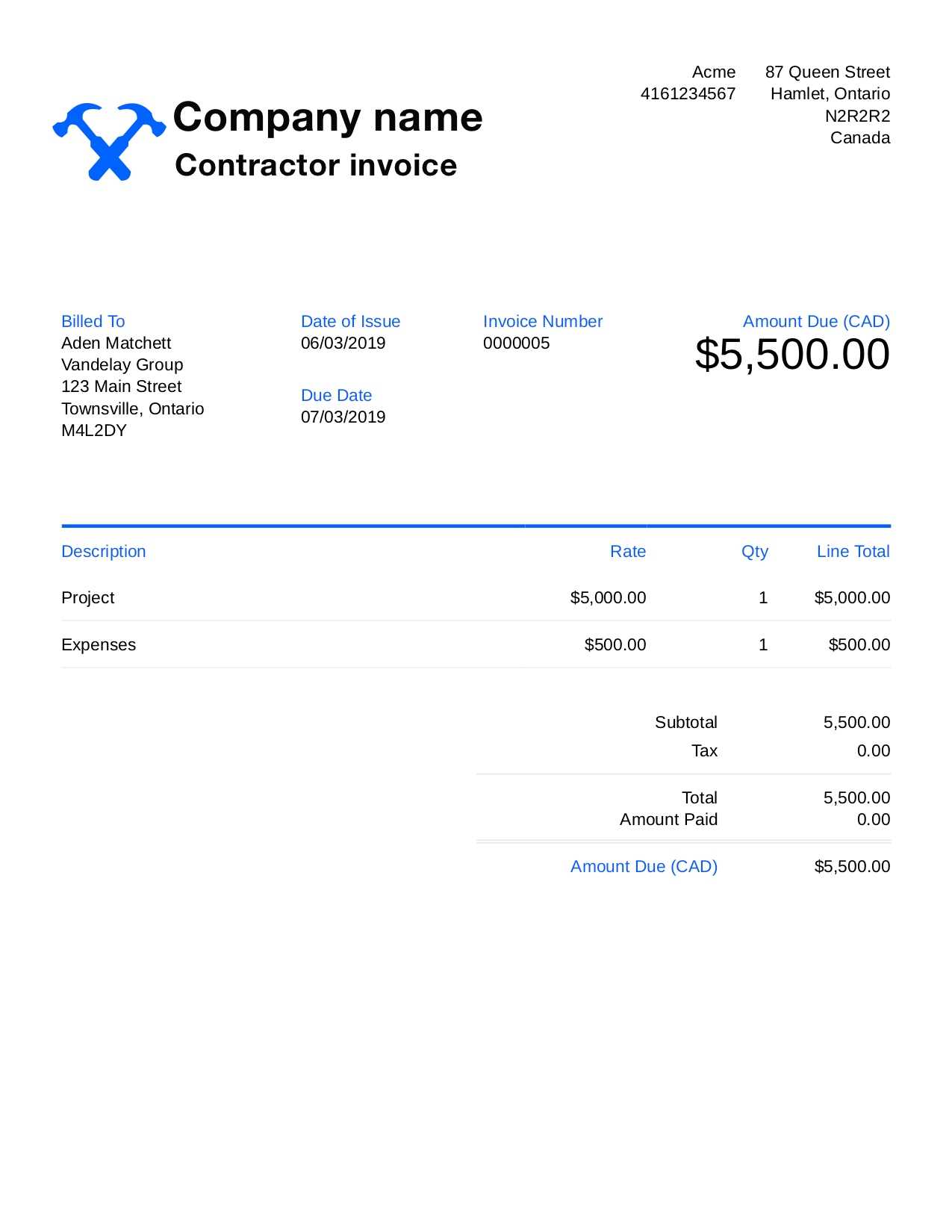

Designing a Professional Invoice

Creating a polished and well-organized payment request not only reflects professionalism but also ensures clarity and reduces the chance of disputes. The design and structure of such a document are key to conveying the necessary information in an efficient and easy-to-read manner.

A professional-looking document should strike the right balance between functionality and aesthetics. It should be clean, straightforward, and easy to navigate. Ensuring it includes all the essential elements while maintaining a visually appealing layout will enhance your business’s credibility.

Essential Design Elements

- Clear Branding: Include your logo, business name, and contact details at the top. This helps establish your identity and makes the document easily recognizable.

- Consistent Formatting: Use a consistent font, color scheme, and layout throughout. Avoid clutter, as simplicity makes the information more digestible.

- Logical Structure: Organize the content into distinct sections. Separate client information, services rendered, costs, and payment terms clearly to avoid confusion.

- Readable Fonts: Choose easy-to-read fonts and maintain a good font size. Important details, such as the total amount due, should be prominently displayed.

Additional Tips for a Professional Look

- Incorporate White Space: Adequate spacing between sections and text blocks helps prevent the document from looking crowded and difficult to read.

- Use Tables for Clarity: Use tables to list services or products with clear headings. This allows for easy scanning and helps avoid misunderstandings about what’s being charged.

- Ensure a Balanced Layout: Place your business details at the top, followed by client information, then the list of services or products, payment terms, and total. Keep the total amount due noticeable and at the bottom.

By following these tips, you can create a streamlined, professional-looking payment request that reflects your business’s quality and helps facilitate prompt payments.

How to Send Invoices Electronically

Sending payment requests electronically has become a fast, efficient, and environmentally friendly way of handling transactions. This method allows for quicker delivery and processing, reducing paperwork and ensuring that recipients receive documents without delay. It also provides the added benefit of reducing physical storage space and improving communication efficiency.

To ensure your documents are sent securely and professionally, there are several methods and tools you can use. Below are some common approaches to sending payment requests electronically:

Methods to Send Documents Electronically

- Email: The most straightforward and commonly used method. Simply attach the document as a PDF or other widely accepted file format and send it directly to your client’s email address. Ensure the subject line is clear and includes important details such as “Payment Request” or “Amount Due.”

- Online Payment Platforms: Platforms like PayPal, Stripe, or Square not only allow for secure transactions but also give the option to create and send payment requests directly through their system. This provides a more automated process and often includes reminders for overdue payments.

- Accounting Software: Many accounting software tools offer built-in options for sending documents electronically. These systems can create, track, and automatically send requests, making it easier to manage payments and ensure records are kept up to date.

Best Practices When Sending Electronically

- Use Clear Subject Lines: Ensure that the subject of the email is clear and includes key information like the client’s name, project details, and the amount due. This helps your client immediately recognize the document’s importance.

- Send as PDF: PDFs are universally readable and can’t be easily edited, making them the preferred format for official documents. It also ensures that your document’s formatting stays intact across different devices.

- Double-Check the Recipient: Before sending any payment request, verify that you are sending it to the correct email address. A simple mistake could lead to significant delays or confusion.

- Track Your Sent Documents: Use tools that offer tracking options, allowing you to confirm when your client has received and opened the document. This feature can help you follow up more effectively.

By following these guidelines, you can ensure that sending your documents electronically is both efficient and professional, allowing you to maintain smooth business operations.

Tracking Payments Effectively

Maintaining a clear overview of payments is crucial for managing cash flow and ensuring timely receipts. Without an organized approach, following up on overdue balances and keeping accurate records can quickly become overwhelming. Establishing a streamlined system for monitoring transactions not only helps to prevent missed payments but also enables better financial planning and communication with clients.

To efficiently track payments, it is essential to use reliable methods and tools that provide accurate updates and reminders. Here are some effective strategies to consider:

Methods for Tracking Payments

- Spreadsheets: A simple yet effective method is using spreadsheets like Excel or Google Sheets. You can manually record payment details, such as due dates, amounts, and payment status. This method offers flexibility and control but requires regular updates and attention to detail.

- Accounting Software: Software like QuickBooks, Xero, or FreshBooks can automate the tracking process. These tools can generate real-time reports on payment statuses, send reminders for overdue balances, and integrate with banking systems to confirm when payments have been received.

- Payment Platforms: Many digital payment platforms, such as PayPal, Stripe, and Square, offer features that automatically track payments and provide reports. These platforms can help you monitor transaction statuses and easily reconcile records, ensuring all payments are accounted for.

Best Practices for Payment Tracking

- Set Clear Payment Terms: Establish clear terms with clients from the beginning, including due dates and penalties for late payments. This sets expectations and reduces confusion when tracking payments.

- Send Regular Reminders: Use automated reminders or send gentle follow-up messages to clients about upcoming or overdue payments. This can significantly improve your chances of receiving timely payments.

- Record Every Transaction: Ensure that every payment received is recorded promptly. This helps avoid any discrepancies and ensures that all financial records are up-to-date.

- Review Payment History: Regularly review your payment history to identify patterns, such as late payments from specific clients. This information can guide future decisions about payment terms or the need for a more structured approach to follow-up.

By implementing these tracking strategies and best practices, you can ensure that all transactions are properly managed, minimizing delays and maintaining healthy cash flow in your business.

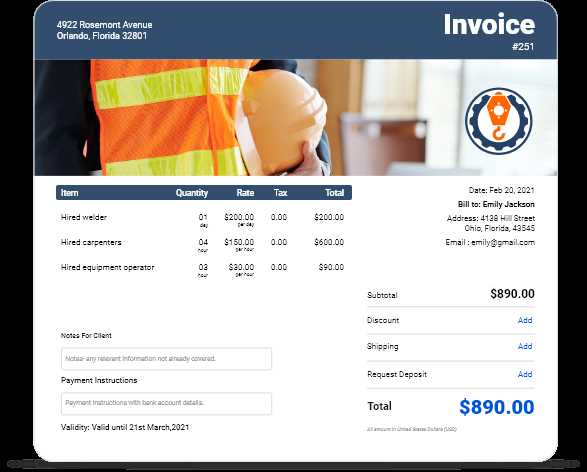

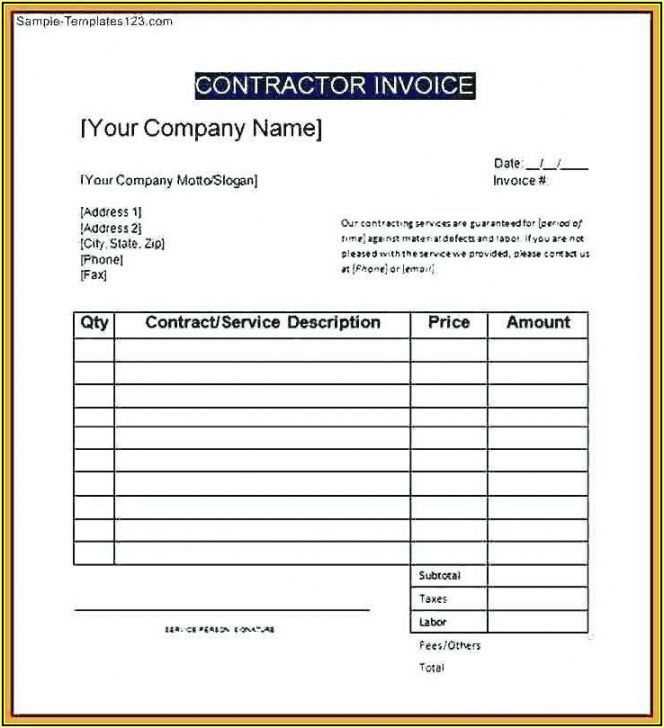

Document Formats for Various Industries

Different industries have unique requirements when it comes to creating business documents, and understanding these differences is essential for maintaining professionalism and clarity. Whether you are providing a service, selling a product, or working on a project basis, having a well-structured record can help ensure smoother transactions and communication with clients. Tailoring the format to suit the industry can make a significant impact on how your records are perceived and how efficient the payment process will be.

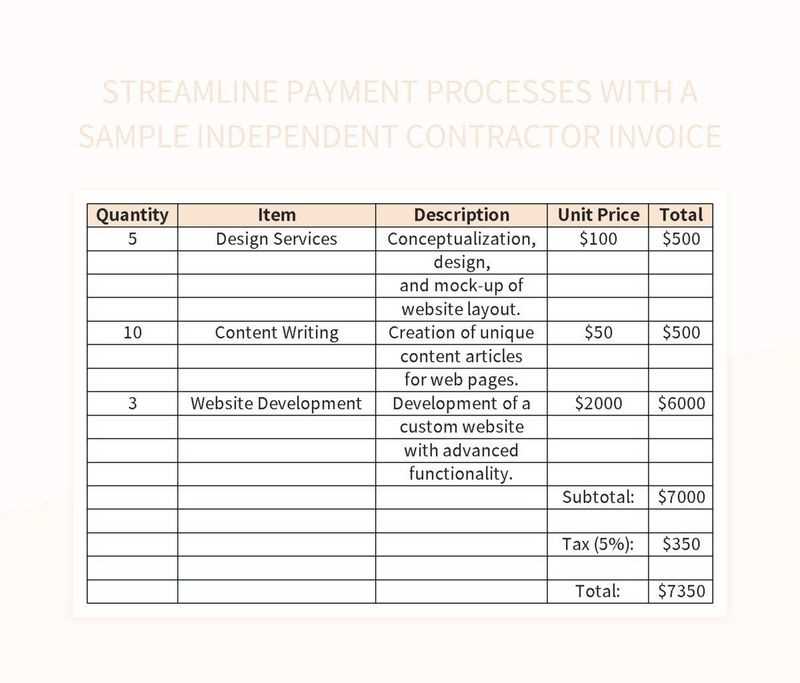

Creative and Design Industry

In fields like graphic design, photography, or marketing, the focus is often on showcasing your work and detailing the services provided. These documents should highlight your creative contributions, including hourly rates, project milestones, and usage rights for any deliverables. It’s important to include clear descriptions of the work completed, along with any revisions or additional services requested by the client. Furthermore, including a visual element or portfolio link can enhance the presentation of your work.

- Itemized List: Break down each task or service delivered with detailed descriptions and rates.

- Visual Appeal: Design a document that aligns with your creative style, using color, logos, and branding to give it a personal touch.

- Usage Rights: Specify the usage rights for any designs or media produced to avoid future misunderstandings.

Consulting and Professional Services

Consultants, legal advisors, and accountants typically need a straightforward, formal approach. These records should focus on time spent, specific tasks or advice given, and hourly or flat-rate fees. The document must clearly outline the agreed-upon terms, including payment schedules, deadlines, and any additional fees for expedited services or travel costs.

- Service Breakdown: List all services performed, including consultations, research, and reports.

- Hourly/Flat Rates: Clearly state your rates and provide a total for the services rendered.

- Payment Terms: Include payment terms such as due dates, late fees, and preferred payment methods.

By tailoring your business documents to the specific needs of your industry, you ensure that your clients understand exactly what they are paying for and can process the payment smoothly. Each field will have nuances that require customization, but following these key guidelines will help establish clear, professional, and efficient communication in every transaction.

Legal Considerations for Freelancers

When engaging in a self-employed role, it’s essential to understand the legal aspects that govern the working relationship with clients. These considerations help avoid misunderstandings, protect both parties, and ensure that your business operations are compliant with local regulations. A clear understanding of contracts, taxes, and intellectual property rights is critical to maintaining a professional and secure environment. Below, we outline the key legal elements that freelancers must be aware of.

Contractual Agreements

A solid contract is crucial for establishing the terms of service and protecting both parties involved. This document should outline the scope of work, deadlines, payment terms, and any other relevant details. It helps prevent disputes by clearly defining expectations from the outset.

| Key Elements of a Contract | Description |

|---|---|

| Scope of Work | Clearly defines the tasks and services to be delivered. |

| Payment Terms | Includes the payment amount, method, and due dates. |

| Deadlines | Outlines the timeline for completion of the project or milestones. |

| Confidentiality | Protects sensitive information from being disclosed without consent. |

| Termination Clauses | Specifies the terms for ending the agreement before completion, including notice periods. |

Tax Obligations

Freelancers must be aware of their tax responsibilities, which can vary based on location and business structure. It’s important to set aside a portion of earnings for taxes and file the required forms with the tax authorities. Some regions may also require freelancers to register as a business or obtain specific licenses, so it’s vital to check local tax laws.

By ensuring that these legal aspects are addressed, freelancers can protect themselves from potential legal complications and build more successful, long-term relationships with clients. Clear contracts, a strong understanding of tax requirements, and protection of intellectual property are essential steps in maintaining a smooth and professional workflow.

How to Improve Payment Speed

Ensuring that payments are received promptly is crucial for maintaining a healthy cash flow in any business. There are several strategies that can be implemented to encourage quicker settlements and avoid delays. By streamlining the payment process, clearly communicating terms, and using efficient tools, you can significantly improve the speed at which clients pay for services rendered.

1. Set Clear Payment Terms

Establishing well-defined payment terms from the outset is key. Include details such as the due date, payment method, and any penalties for late payments. By setting clear expectations, you minimize confusion and help clients understand their obligations.

2. Offer Multiple Payment Options

Providing a variety of payment methods, such as credit cards, bank transfers, and online platforms, can make it easier for clients to settle their accounts promptly. The more convenient you make the payment process, the more likely clients are to pay on time.

3. Send Payment Reminders

Gentle reminders can go a long way in ensuring timely payments. If a payment is approaching its due date or has been missed, sending a polite follow-up message can encourage the client to pay sooner rather than later.

4. Offer Early Payment Incentives

Consider offering a small discount to clients who pay before the due date. This can be an effective incentive for faster payments and help improve your cash flow.

5. Automate Invoicing and Payment Processing

Using automated systems to generate invoices and track payments can help eliminate delays caused by manual processes. Automation ensures that invoices are sent on time, reminders are triggered, and payments are processed without unnecessary intervention.

By implementing these strategies, you can help reduce delays and improve the overall speed at which you receive payments, contributing to the smooth operation of your business.

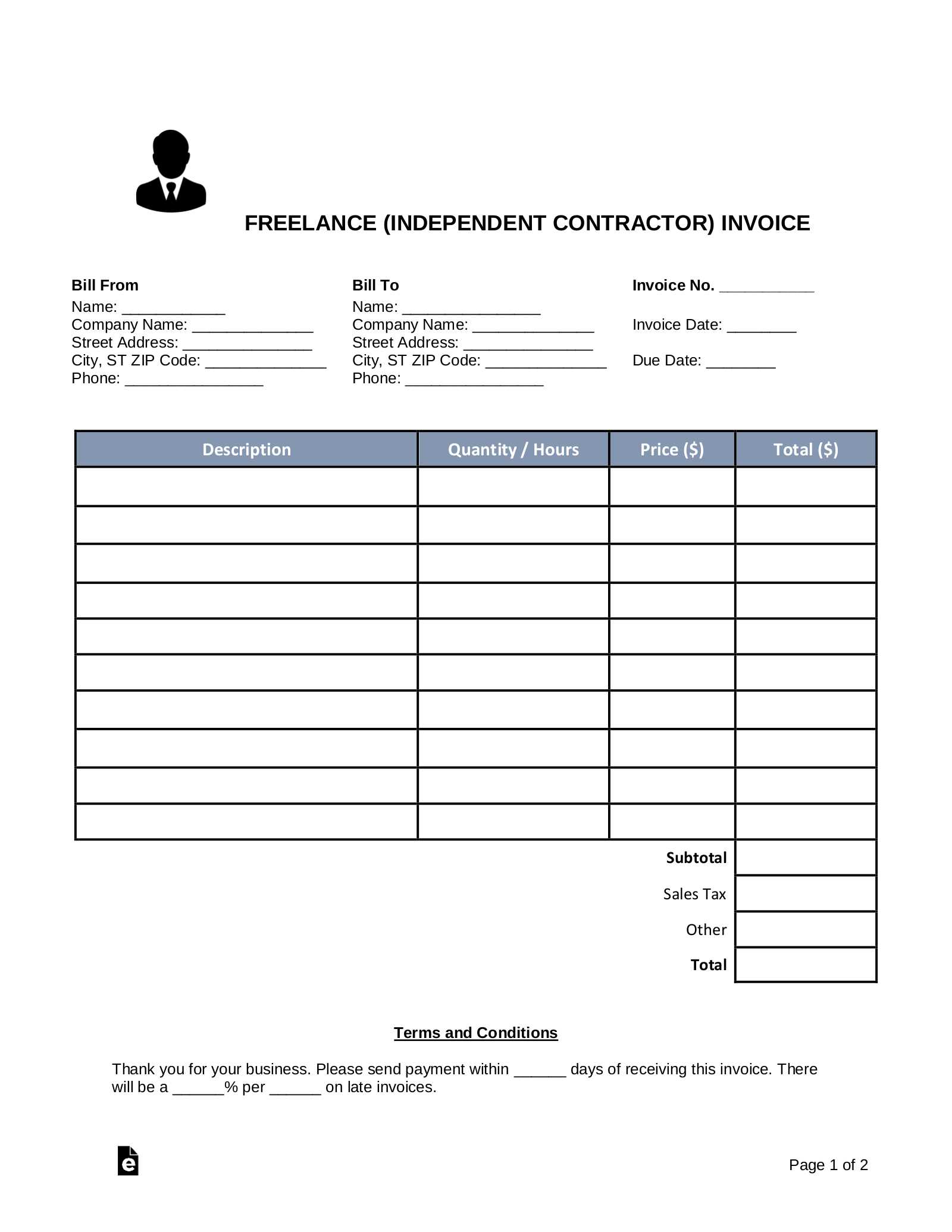

Free Document Designs for Professionals

Having access to customizable forms for billing is essential for many service providers. With the right document formats, professionals can easily request payment from clients while maintaining a professional image. Free designs offer a great way to get started without having to invest in expensive software or hire a designer.

1. Simple and Clear Layout

Choosing a clean, straightforward design ensures that clients can quickly understand the details of the payment request. A well-organized layout that includes essential information such as services provided, payment terms, and amounts due helps prevent confusion and delays.

2. Customizable Fields

The flexibility to tailor documents for each job is crucial. Free forms often come with customizable sections where you can add specific details like project milestones, hourly rates, or any discounts. This customization allows you to create accurate and personalized requests for payment every time.

3. Easy-to-Use Formats

Many free billing designs are available in formats that are simple to edit and share, such as Word, Excel, or PDF files. These user-friendly formats make it easy for professionals to complete and send documents to clients, reducing the time spent on administrative tasks.

4. Digital Tools for Efficiency

For those seeking even more efficiency, many free billing designs integrate with online tools. These tools can help automate reminders and track payments, making it easier to stay on top of outstanding balances and ensure timely payments.

Using free billing documents is a cost-effective solution that allows professionals to manage their finances effectively, while also presenting a polished and professional appearance to their clients.