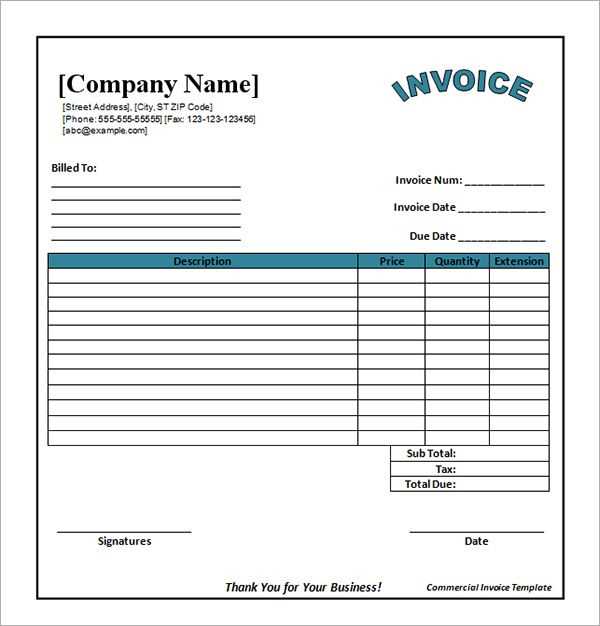

Download and Customize Company Invoice Template in Word Format

Efficiently managing financial records is essential for any business. One of the most important aspects of this process is the ability to generate clear and professional documents for transactions. Having the right format can save time, reduce errors, and ensure that clients and partners receive the correct information in a well-organized manner.

Using pre-designed formats can simplify the process of preparing these documents. With customizable options available, businesses can easily tailor the layout to suit their unique needs, while also maintaining a professional appearance. This approach not only enhances consistency but also ensures that all necessary details are included every time.

In this guide, we will explore how to utilize editable files to create streamlined and effective billing documents. Whether you’re new to the process or looking to improve your current practices, these tools can help you stay organized and on top of your financial operations.

Company Invoice Template Word Overview

Efficient financial management requires streamlined documentation that ensures clarity and consistency. A well-structured document for requesting payments is crucial for businesses of all sizes, providing essential details in an organized manner. Utilizing customizable files can simplify the process of creating these documents while maintaining a professional standard.

These editable formats are designed to meet the needs of various businesses, offering flexibility for customization while ensuring that all key components are included. By using pre-built designs, you can avoid the need to create a layout from scratch, saving time and reducing errors. Below are the main advantages of using such tools:

- Time-Saving – Quickly generate accurate documents without starting from zero.

- Consistency – Maintain uniformity across all financial communications with a reliable structure.

- Customization – Adjust fields, text, and design elements to suit your brand and business needs.

- Professionalism – Deliver polished and clear communication to clients and partners.

Whether you’re handling a single transaction or managing a high volume of payments, using such documents can ensure you stay organized and efficient. These tools are ideal for businesses that need a simple, editable solution to handle billing communications smoothly.

Why Use a Word Invoice Template

Creating clear and professional billing documents is essential for businesses that want to maintain good financial practices. By utilizing a pre-designed, editable document, businesses can quickly produce customized statements that meet their needs. These ready-made layouts offer a convenient and efficient way to handle financial transactions with accuracy and consistency.

Benefits of Using Editable Formats

Using pre-designed formats for payment requests offers several advantages that can streamline the process and improve the overall experience for both businesses and clients. Some key benefits include:

- Ease of Use – Simple to edit and modify to match specific business requirements.

- Efficiency – Time-saving as the layout and structure are already in place, requiring minimal adjustments.

- Consistency – Helps maintain uniformity across all financial documents, ensuring professionalism in every communication.

- Customization – Ability to adjust fields such as client details, payment terms, and item descriptions to suit individual transactions.

Comparing Different Document Formats

While there are various ways to create financial documents, editable formats provide a unique combination of simplicity and flexibility. Here’s a comparison of some common options:

| Document Format | Ease of Use | Customization Options | Professional Appearance |

|---|---|---|---|

| Moderate | Limited | High | |

| Excel | Easy | High | Moderate |

| Editable Format | Very Easy | High | High |

As shown above, editable formats offer a balance of ease and flexibility, allowing businesses to efficiently create professional documents tailored to their needs. Whether you’re a small business or a larger enterprise, using these layouts helps ensure accuracy and saves valuable time in managing your transactions.

How to Create a Custom Invoice

Creating a personalized billing document allows you to ensure that all essential details are included in a clear, organized format. Whether you’re invoicing a client for services rendered or products sold, having a structured layout helps maintain professionalism and avoid confusion. Customizing a document for your specific needs is simple and can be done in just a few steps.

Here are the key steps to follow when creating a tailored billing document:

- Choose a Suitable Layout – Select a pre-designed format that closely matches your needs. This provides a foundation for customization and saves time.

- Add Business Information – Include your name, address, phone number, and email at the top of the document. This ensures your client can contact you if needed.

- Include Client Information – Provide the client’s details, including their business name, address, and contact information, so there is no confusion about who the payment is for.

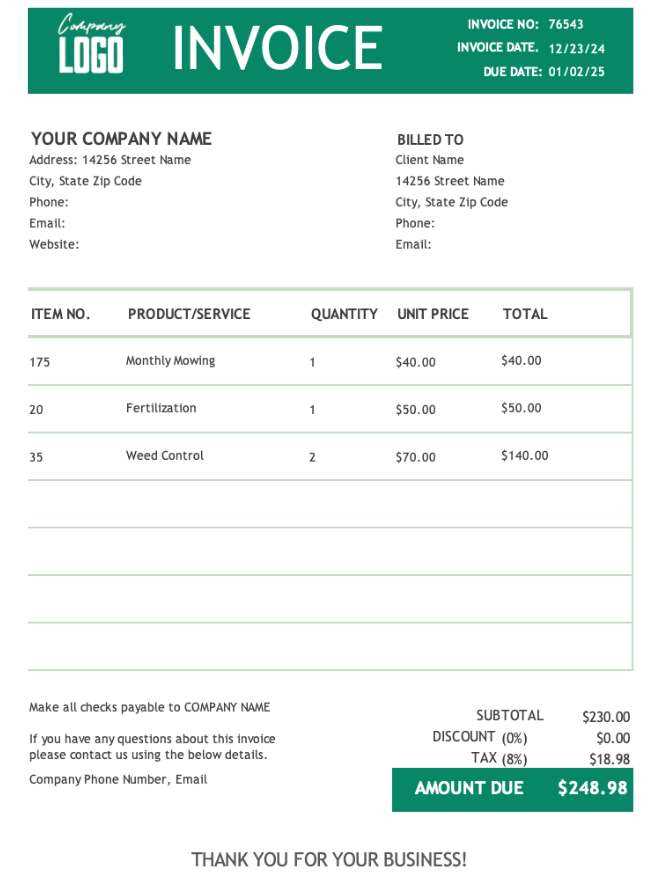

- Describe Products or Services – List the items or services being billed, along with their quantity, unit price, and total cost. Be clear and specific to avoid misunderstandings.

- Set Payment Terms – Define the payment deadline and any additional conditions, such as late fees or discounts for early payments.

- Review and Finalize – Double-check all the details for accuracy, ensuring the amounts, dates, and contact information are correct. This will help avoid errors and disputes.

Once all information is included, you can save, print, or send the customized document directly to your client. Keeping a template on hand allows you to streamline future transactions while maintaining consistency and professionalism in your financial communications.

Key Elements of an Invoice Template

To ensure smooth transactions and clear communication with clients, certain components must be included in any billing document. These essential elements provide clarity and transparency, helping both the business and the client understand the terms of the transaction. A well-structured document includes the necessary information for processing payments and avoiding misunderstandings.

Essential Components of a Billing Document

When creating or customizing a document, it’s important to include the following key elements:

- Business Details – The name, address, contact number, and email of your business should be clearly visible at the top. This ensures that clients can reach out if needed.

- Client Information – Similarly, the recipient’s name, address, and contact details should be included, so there is no confusion regarding who the payment is intended for.

- Unique Reference Number – Including a unique number or code helps to track the document and simplifies reference for both parties in case of questions or disputes.

- Date of Issue – The date the document is created or sent is crucial for determining payment deadlines and terms.

- Detailed Description of Goods/Services – Each item or service should be listed with clear descriptions, quantities, unit prices, and total costs to avoid confusion.

- Payment Terms – Specify the payment due date, accepted payment methods, and any late fees or discounts for early payment.

- Total Amount Due – Clearly display the total sum due, including taxes, discounts, and any other applicable charges, so clients know the exact amount to pay.

Optional but Helpful Additions

While the above elements are essential, some additional information can further enhance the document’s usefulness:

- Purchase Order Number – If applicable, including a purchase order number can help both the business and client cross-reference the transaction more easily.

- Notes or Special Instructions – Any special terms, reminders, or conditions related to the transaction can be noted at the bottom to provide additional context.

- Bank Account Information – If payments are to be made by transfer, providing bank details ensures easy and quick payment processing.

Incorporating these elements ensures that your billing document is not only professional but also functional, offering all necessary information for an efficient transaction.

Choosing the Right Template for Your Business

Selecting the right format for billing documents is crucial for maintaining professionalism and streamlining financial operations. The right structure ensures that all necessary details are clearly presented, making the process smoother for both the business and its clients. By carefully considering the specific needs of your business, you can choose a layout that fits your requirements and enhances your overall workflow.

Factors to Consider When Choosing a Format

When deciding on the right layout, several key factors should be taken into account to ensure it meets your specific business needs:

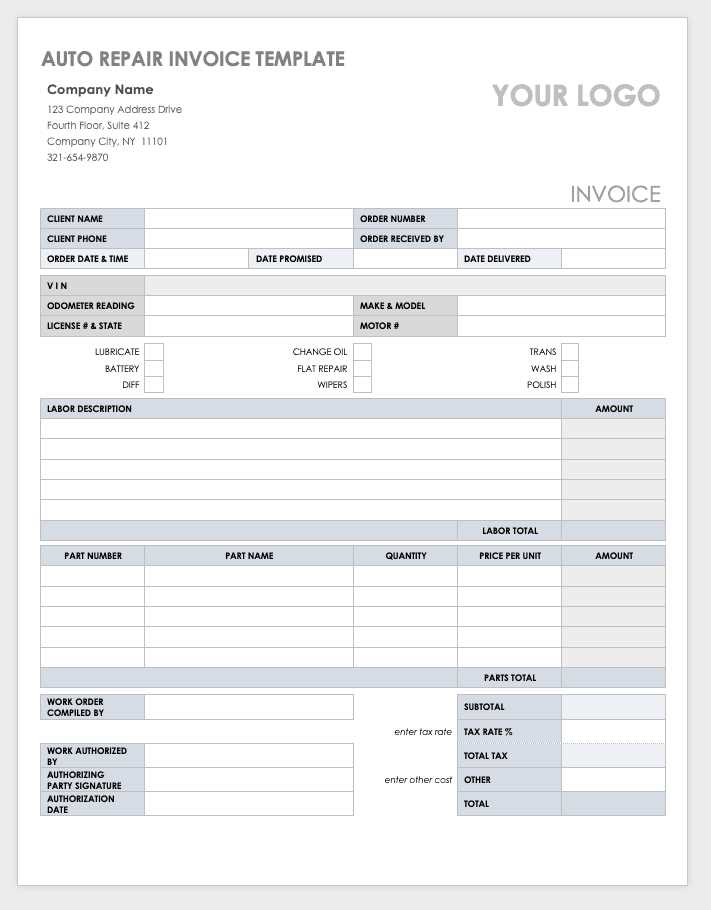

- Industry Requirements – Different sectors may require specific details on the billing documents. For instance, a service-based business might need to include labor hours, while a retail business will list product quantities.

- Branding Needs – Choose a design that aligns with your company’s image. A customized format with your logo, brand colors, and font styles helps maintain a cohesive look across all communication materials.

- Payment Terms – Ensure the layout allows you to clearly define payment deadlines, methods, and any penalties for late payments, especially if your business works with multiple payment systems.

- Ease of Use – The format should be simple to edit and update for different transactions. Choose a layout that allows you to quickly fill in specific client details and payment amounts.

Types of Layouts for Different Businesses

Different types of businesses have different needs when it comes to documenting financial transactions. Here are some common layout types to consider:

- Simple Formats – Ideal for small businesses or freelancers, where only basic details (product/service description, price, and total amount) need to be included.

- Detailed Formats – Useful for larger businesses or industries with complex pricing structures, such as wholesale suppliers or consultants, where additional fields (e.g., itemized costs, taxes, and discounts) may be necessary.

- Customizable Formats – Best for businesses with unique needs or multiple payment options, offering flexibility to adjust the layout to fit various transactions or customer requirements.

Choosing the right format is an important decision that can help streamline your financial processes and improve client relationships. By selecting the layout that suits your business’s needs, you ensure that all important information is presented clearly and professionally, making transactions easier for both parties.

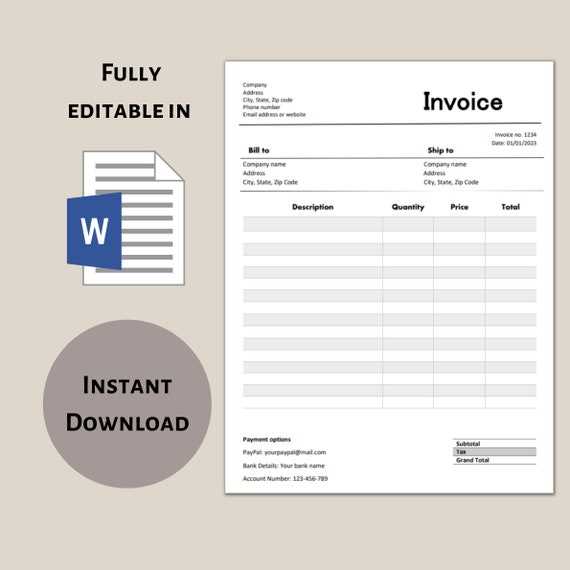

How to Edit Your Invoice in Word

Once you’ve selected a suitable format for your billing document, editing it to fit your specific needs is an important step in ensuring accurate and professional communication with your clients. Customizing the fields and details within a document is straightforward, and you can make changes as necessary to reflect each unique transaction.

Steps to Customize Your Billing Document

Follow these simple steps to efficiently edit your financial document:

- Open the Document – Start by opening the pre-designed file you wish to modify. Most editing programs allow you to open these documents quickly, making the process more efficient.

- Edit Client Information – Update the recipient’s details such as name, address, and contact information. This ensures the document is tailored to the specific client.

- Adjust the Date – Always ensure that the document date is accurate and reflects the actual time the transaction took place or the bill is being issued.

- Modify Product or Service Descriptions – Review and edit the items listed, including quantity, unit price, and total amount. This is especially important if you offer a range of products or services.

- Change Payment Terms – If needed, update the payment terms based on the agreement with the client, such as payment deadlines, discounts, or fees for late payments.

- Review and Save – Once you’ve made all the necessary edits, review the document to ensure all information is accurate and consistent. After reviewing, save the document for distribution.

Tips for Efficient Editing

To make the editing process faster and more effective, keep the following tips in mind:

- Use Predefined Fields – If possible, use editable fields for client names, addresses, and amounts. This reduces manual errors and makes the process faster.

- Customize for Branding – Adjust fonts, colors, and logos to match your company’s branding for a professional look.

- Save as a Template – After editing the document for one client, save it as a template for future use. This will save you time on future transactions.

Editing your billing document is a simple yet vital task that ensures accuracy and maintains a high standard of professionalism. By following these steps and tips, you can quickly modify the file to meet the specific needs of each transaction.

Benefits of Using Word for Invoices

When it comes to managing financial documents, using a reliable software program provides several advantages. Editing and customizing your billing paperwork in such a platform can save time, reduce errors, and enhance the overall process. This approach offers flexibility, ease of use, and a professional look that helps businesses manage their transactions more efficiently.

Advantages of Using This Software for Billing

Here are some key benefits to using a popular word processing program for preparing your financial documents:

- Ease of Customization – With its user-friendly interface, modifying your document is quick and simple. You can easily add or remove fields, change the layout, and adjust the design to suit your needs.

- Professional Appearance – The software allows you to create polished, professional documents with formatting tools that enhance the overall presentation, helping you maintain a consistent, branded look.

- Flexible File Management – You can easily save, share, and store your financial records in different formats (such as PDFs) for better organization and accessibility. This flexibility also makes it easy to send invoices electronically or print them for physical delivery.

- Compatibility – Documents created in this program are compatible with various devices and platforms, ensuring that clients and business partners can view and access them without issues.

- Templates for Speed – Pre-designed layouts can significantly speed up the creation process. You can quickly adjust templates to fit your specific needs, saving time on every new document.

- Tracking and Updates – It’s easy to track changes, especially if you’re making edits to multiple documents. You can also make real-time adjustments, which is particularly useful if you’re working on multiple transactions at once.

Streamlining Business Operations

By using such a platform for your financial documents, businesses can streamline operations, reduce manual errors, and ensure that all rel

Free vs Paid Invoice Templates

When selecting a document layout for financial transactions, businesses have the option of choosing between free and paid designs. Both options offer benefits, but the choice ultimately depends on the specific needs of the business, the complexity of the documents, and the level of customization required. Understanding the differences between these two options can help businesses make an informed decision that best fits their operations.

Advantages of Free Designs

Free formats are an attractive option for small businesses or individuals just starting out. Here are some key benefits:

- No Cost – The most obvious advantage is that these documents are available at no cost, making them an appealing choice for businesses with limited budgets.

- Quick Setup – Free designs are typically simple to download and use, requiring little customization to get started.

- Basic Customization – While the design options may be more limited, free formats can still be adjusted to add basic details like client information and payment amounts.

- Widely Available – Many free resources are accessible online, making it easy to find a layout that works for your needs.

Benefits of Paid Designs

Paid formats offer more advanced features and customization options. Here are some advantages of opting for a premium design:

- Advanced Customization – Premium layouts often come with more flexibility, allowing you to adjust not only the text and numbers but also the design elements, such as colors, fonts, and logos.

- Professional Look – Paid designs often have a more polished, professional appearance, which can help strengthen your brand identity.

- Additional Features – Premium options may include extra fields for complex pricing structures, automatic calculations, and integration with other business tools or software.

- Customer Support – Many paid services offer customer support, which can be helpful if you encounter issues or need assistance with customization.

Choosing between free and paid designs depends largely on the scale of your business, your branding needs, and how much time you’re willing to invest in customization. While free designs may work well for small or temporary needs, paid options are often better suited for growing businesses looking for more

Common Mistakes in Invoice Creation

When preparing financial documents for transactions, there are several common errors that can lead to confusion, delays in payment, or even strained client relationships. These mistakes can easily be avoided with careful attention to detail, but they still occur frequently in the business world. Recognizing and addressing these issues is essential for maintaining professionalism and ensuring smooth operations.

Some of the most common mistakes when creating billing documents include:

- Incorrect or Missing Information – Failing to include essential details such as the correct business or client name, contact information, or payment terms can create confusion and delay payments.

- Not Including a Unique Reference Number – Without a unique number or code, it becomes difficult for both you and your client to track payments, leading to potential disputes or confusion over which transaction is being discussed.

- Missing Dates – Failing to include the correct issue and due dates is a frequent oversight. This can lead to misunderstandings regarding payment timelines and can result in late payments.

- Unclear or Inaccurate Itemization – Not clearly describing the products or services being billed, or failing to list the quantities, unit prices, or total costs accurately, can lead to disputes over charges.

- Incorrect Calculations – Mistakes in calculating the total amount due–such as missing taxes, applying incorrect rates, or adding the wrong total–can result in overcharging or undercharging the client.

- Overlooking Payment Terms – If payment terms are not clearly outlined, or if they’re inconsistent with prior agreements, this can create confusion about when the payment is due, what methods are acceptable, or if any late fees apply.

- Failure to Proofread – Small typographical errors, such as misspelled client names or incorrect figures, may seem minor but can undermine your credibility and professionalism. Always take the time to proofread the document before sending it out.

By being mindful of these common mistakes, you can create clearer, more accurate documents that improve communication with clients and help ensure timely payments. Careful attention to detail will protect your business’s reputation and prevent avoidable errors in the billing process.

How to Format Your Invoice Properly

Proper formatting is crucial for creating clear and professional billing documents. A well-structured layout helps ensure that all necessary details are easy to find and understand, making it simpler for clients to process payments quickly. By following a consistent and logical format, you can improve communication, avoid confusion, and present your business in a more professional light.

Here are some essential steps for formatting your billing document effectively:

Key Formatting Elements

Ensure your document includes the following components in a well-organized and easy-to-read layout:

- Header Section – At the top, include your business name, logo, and contact information. Below this, provide the client’s name, address, and contact details. This section should be clear and immediately visible.

- Title of the Document – Label the document clearly as a “Bill” or “Receipt,” and if needed, include the document’s reference number. This helps to identify the document type and avoid confusion.

- Unique Reference Number – Assign a unique reference number to each transaction to facilitate easy tracking and future reference.

- Dates – Include the date the document is issued and the payment due date. This clarifies the timeline for both parties.

- Itemized List – Present each product or service with a detailed description, quantity, unit price, and total cost. This should be clearly organized in rows, using columns to separate each element.

- Tax and Discounts – If applicable, clearly list any taxes, discounts, or additional charges separately, and specify the rates and amounts applied.

- Total Amount Due – The total amount due should be prominently displayed at the bottom, ensuring it’s easy to locate for your client.

- Payment Terms – Include a section outlining the payment methods accepted and the due date. Also, mention any late fees or penalties if applicable.

Best Practices for Formatting

In addition to the basic elements, consider these formatting tips for a more professional look:

- Use Consistent Fonts and Colors – Stick to a professional font (like Arial or Times New Roman) and use color sparingly to highlight important details like the total amount due.

- Clear Section Breaks – Use bold text, lines, or larger font sizes to differentiate between sections (e.g., business information, item list, payment details). This improves rea

Adding Branding to Your Invoice

Incorporating branding into your financial documents not only makes them look more professional but also reinforces your business identity. When clients receive a document that reflects your brand, it helps build recognition and trust. Adding personalized elements like logos, colors, and fonts ensures your business stands out and leaves a lasting impression.

Here are several ways you can add branding to your financial paperwork:

Key Branding Elements to Include

- Logo – Place your business logo at the top of the document. This immediately associates the document with your brand and helps clients recognize it as a legitimate and professional communication.

- Color Scheme – Use your brand’s colors in the document’s layout. Apply them to the header, section dividers, or the background to create a cohesive look that matches your marketing materials.

- Custom Fonts – Choose fonts that align with your business’s style guide. Using your brand’s fonts in the header and throughout the document helps maintain consistency across all communications.

- Tagline or Slogan – If applicable, include your business’s tagline or slogan in the footer or header. This can subtly reinforce your brand message and increase brand recall.

Benefits of Branding Your Documents

Incorporating branding into your documents can provide several advantages:

- Professional Appearance – A branded document looks more polished and credible, signaling that you are a legitimate and established business.

- Improved Recognition – Clients are more likely to remember and trust a business that consistently uses its branding across all communications, including billing documents.

- Stronger Client Relationships – Personalized documents create a more engaging experience for your clients. When clients see that you pay attention to detail, they are more likely to feel valued.

- Consistency – A branded document ensures consistency across your marketing and financial materials. Clients will see a unified representation of your business, which reinforces your overall brand identity.

How to Save and Share Invoices

Once your financial document is complete, it’s important to save and share it in a way that ensures security, ease of access, and proper organization. Whether you are storing the file for future reference or sending it to a client, knowing the best practices for saving and sharing can streamline your workflow and maintain professionalism.

Saving Your Financial Document

There are several options for saving your document, each suited to different needs:

Method Advantages Cloud Storage Accessible from any device, easy to back up, and reduces risk of losing files. Ideal for businesses with multiple employees. Local Storage Keeps files securely stored on your personal or business computer. Best for smaller operations where files don’t need to be shared frequently. External Hard Drives Offers large capacity for storing multiple files. Suitable for businesses handling large volumes of documents. Encrypted File Formats Helps protect sensitive information from unauthorized access. Great for companies handling confidential financial data. Sharing Your Financial Document

Sharing documents securely is crucial for protecting both your and your clients’ information. Here are a few reliable methods:

- E

Using Word’s Built-In Invoice Templates

Many software programs offer pre-designed layouts that can help simplify the process of creating financial documents. These built-in layouts come with predefined sections and styles, saving you time while ensuring consistency. If you are looking for a fast and efficient way to create a professional document, using these ready-made formats can be a great choice.

Advantages of Built-In Layouts

There are several key benefits to using the built-in layouts available in most text processing programs:

- Time-Saving – Pre-designed layouts are ready to use, allowing you to quickly enter relevant details without worrying about formatting.

- Professional Look – These layouts are designed by experts to ensure that your documents appear polished and visually appealing.

- Customization Options – While the format is pre-built, you still have the flexibility to adjust details like colors, fonts, and section labels to match your branding.

- Easy-to-Follow Structure – These layouts are structured in a way that ensures all critical information is included, reducing the likelihood of missing important details.

How to Access and Use Built-In Layouts

Here is a step-by-step guide for using these pre-designed options in your text processing software:

Step Action Step 1 Open your text processing software and navigate to the “File” menu. Step 2 Select “New” to start a new document. Step 3 In the search bar, type in terms like “billing” or “statement” to find the available pre-designed layouts. Step 4 Choose the layout that best fits your needs and click on it to open. Step 5 Customize the document by f Automating Invoice Creation in Word

Automating the process of generating billing documents can significantly improve efficiency and reduce human error. By setting up automated systems, you can save time on repetitive tasks and ensure that each document adheres to a consistent format. Automation also reduces the chance of mistakes, such as missing information or incorrect calculations, making your workflow smoother and more reliable.

Here are some methods to automate the creation of your financial documents:

1. Using Macros for Automation

Macros are sequences of commands that you can program to run automatically. In text processing programs, macros can be used to fill in standard details and streamline the document creation process. Here’s how to get started:

- Record a Macro – Set up the template with your desired layout and design, then use the macro recorder to capture the repetitive tasks you perform (e.g., adding business information, client details, etc.).

- Assign Fields – Define variables for sections that change with each document, such as the client’s name, address, or transaction details. These fields can be auto-filled every time the macro runs.

- Save and Run – After recording, save your macro and assign it to a button or shortcut for easy access. Running the macro will instantly generate a new document with updated details.

2. Using Mail Merge for Bulk Creation

If you need to create multiple documents at once (for example, for several clients), mail merge can help automate the process. This tool links a template with a database of client information and creates personalized documents in bulk.

- Prepare Your Data – Use a spreadsheet or database to list all the necessary client information (e.g., names, addresses, product details, amounts).

- Create the Base Document – Set up a basic structure for your document, leaving placeholders for the client-specific information you want to auto-fill.

- Merge the Data – Use the mail merge function to automatically insert the data from your list into the template, creating individual documents for each client.

3. Using Add-Ins for Enhanced Automation

There are also third-party add-ins and plugins available that can simplify and speed up the automation process even further. These tools often offer advanced feature

Legal Considerations When Issuing Invoices

When preparing financial documents for transactions, it is essential to ensure that they comply with legal requirements. These documents are not just a means of requesting payment; they also serve as a formal record of an agreement between parties. Properly structured and legally sound documents can help protect your business and ensure that payments are made in a timely manner while also preventing disputes.

Here are the key legal considerations you should keep in mind when issuing billing documents:

1. Include All Required Information

A legal document must contain specific information to be enforceable. Missing or inaccurate details can lead to delays or confusion. The essential components of any billing document include:

- Business Details – Your full legal name, business name, contact information, and registration number, if applicable.

- Client Information – Accurate details of the recipient, such as their name, address, and contact info.

- Unique Reference Number – A unique identifier for each document, which helps track and reference the transaction easily.

- Itemized List of Services or Products – A clear breakdown of goods or services provided, including quantities, unit prices, and any applicable discounts.

- Payment Terms – Specify when payment is due, including deadlines, late fees, and accepted payment methods.

2. Adhere to Tax Regulations

Depending on your location and the nature of your business, tax obligations may require you to charge sales tax, VAT, or other taxes. Legal requirements vary by jurisdiction, so it’s important to:

- Include Tax Information – Clearly state the applicable tax rate and calculate the total tax charged.

- Ensure Correct Tax Registration – Make sure you are registered for taxes if required by law, and include your tax identification number on the document.

- Follow Local Laws – Be aware of regional tax laws to ensure you comply with the rates and regulations in your area.

3. Be Transparent About Payment Terms

Clear payment terms help prevent disputes and ensure both parties understand the expectations. Legal issues can arise if payment terms are not properly outlined. Important aspects to include are:

- Payment Due Date – Clearly state when payment is due, whether it’s on receipt or within a set period (e.g., 30 days).

- Late Fees – If applicable, specify any late fees or interest charges for overdue payment

Tips for Faster Invoice Processing

Efficiently handling financial documents can significantly improve cash flow and reduce administrative workload. The quicker you can process and send these documents, the sooner you can receive payment, keeping your operations running smoothly. Streamlining your procedures ensures accuracy, reduces errors, and minimizes delays. Here are several strategies to accelerate the processing of your billing documents.

1. Standardize Your Document Format

Consistency is key when it comes to processing billing statements quickly. By using a uniform format for all your documents, you can save time on adjustments and avoid confusion when reviewing or tracking payments.

- Use Pre-Designed Layouts – Utilize standardized layouts that include all necessary fields. This reduces the time spent creating new documents from scratch each time.

- Set up Templates – Create reusable templates with placeholders for client-specific details, so you only need to update key information for each transaction.

- Define Clear Sections – Include clearly defined sections for services, amounts, taxes, and payment terms, so all relevant information is easy to find.

2. Automate Key Steps

Automation can drastically reduce the amount of manual input needed, allowing you to focus on other tasks while the system handles routine processes.

- Use Macros – Set up macros to automatically fill in repetitive fields, such as your business details and payment instructions, saving you time on every document.

- Implement Mail Merge – If you need to send many documents at once, mail merge allows you to generate personalized documents in bulk, automatically filling in client-specific information.

- Integrate with Accounting Software – Linking your financial software to your document generation tools can ensure that amounts, taxes, and payment dates are automatically populated based on existing records.

3. Keep Information Up to Date

Accurate and current details help prevent delays and avoid having to go back to update documents later. Ensure the information you need is always accessible and up to date.

Step Action Client Details Regularly update client co

- E