How to Use an Itemized Invoice Template for Clear and Organized Billing

For businesses and freelancers alike, clear and detailed billing is crucial. A well-structured format allows for accurate records, helping both the service provider and the client stay informed and organized. By categorizing each charge, you can eliminate confusion and make the process more transparent for all parties involved.

Organizing each charge within a simple document enables smoother transactions and reduces the chances of misunderstandings. When each service or product is outlined with its respective cost, clients can better understand where their expenses lie. This builds trust and encourages timely payments, supporting long-term relationships.

In addition, adopting a structured billing format is highly efficient. It saves time by reducing the need for follow-up questions and makes record-keeping easier for both the client and the business. Creating a format that is both visually clear and informative not only improves communication but also reflects a professional approach to business practices.

Understanding the Purpose of Itemized Invoices

For any business or independent contractor, providing a clear breakdown of services or products rendered is essential. When charges are organized and listed in a structured way, clients gain insight into the specific work completed or items supplied. This transparent approach reduces misunderstandings and promotes a stronger relationship between providers and clients.

Clarity in billing isn’t only beneficial for the client; it also helps the business stay organized. With every charge laid out, record-keeping becomes straightforward, and tracking past transactions is simplified. A structured list of charges allows each party to see exactly what they’re paying for and why, minimizing potential disputes and ensuring mutual understanding.

How Organized Billing Helps Businesses

An organized approach to billing benefits businesses in several ways. First, it establishes a professional standard, showing clients

Benefits of Using a Detailed Invoice

For both small and large businesses, providing clients with a structured breakdown of charges brings many advantages. A well-organized document helps clarify the specifics of each service or product, ensuring that both the provider and the client understand the scope of work completed and its cost. This approach not only promotes transparency but also strengthens professional relationships by creating a clear financial record.

Improving Financial Clarity

Breaking down charges in a detailed document aids clients in understanding exactly what they are paying for. This clarity helps avoid confusion and minimizes the likelihood of disputes over costs. Here are some key reasons why detailed billing is valuable:

- Increased Transparency: Each service or product is listed individually, allowing clients to see the specifics behind the total amount.

- Accurate Record-Keeping: Both parties can refer back to the list of charges, making it easier to address any questi

Benefits of Using a Detailed Invoice

For both small and large businesses, providing clients with a structured breakdown of charges brings many advantages. A well-organized document helps clarify the specifics of each service or product, ensuring that both the provider and the client understand the scope of work completed and its cost. This approach not only promotes transparency but also strengthens professional relationships by creating a clear financial record.

Improving Financial Clarity

Breaking down charges in a detailed document aids clients in understanding exactly what they are paying for. This clarity helps avoid confusion and minimizes the likelihood of disputes over costs. Here are some key reasons why detailed billing is valuable:

- Increased Transparency: Each service or product is listed individually, allowing clients to see the specifics behind the total amount.

- Accurate Record-Keeping: Both parties can refer back to the list of charges, making it easier to address any questions or discrepancies.

- Stronger Client Trust: A transparent bill shows the client that the provider values honesty and clarity in transactions.

Enhancing Business Efficiency

Aside from building trust, detailed billing also streamlines business operations. By organizing each charge in a standardized format, businesses can reduce the time spent on billing inquiries and follow-up. Some specific benefits include:

- Time Savings: With a clear breakdown, there’s less need for lengthy explanations, saving time for both the provider and client.

- Professional Presentation: A well-structured bill reflects a polished approach to business, enhancing the provider’s image.

- Easy Tracking: Organized documents make it simpler to monitor expenses, manage cash flow, and prepare for tax season.

Incorporating a detailed format into billing practices ultimately helps businesses maintain strong relationships, improve efficiency, and project a professional image.

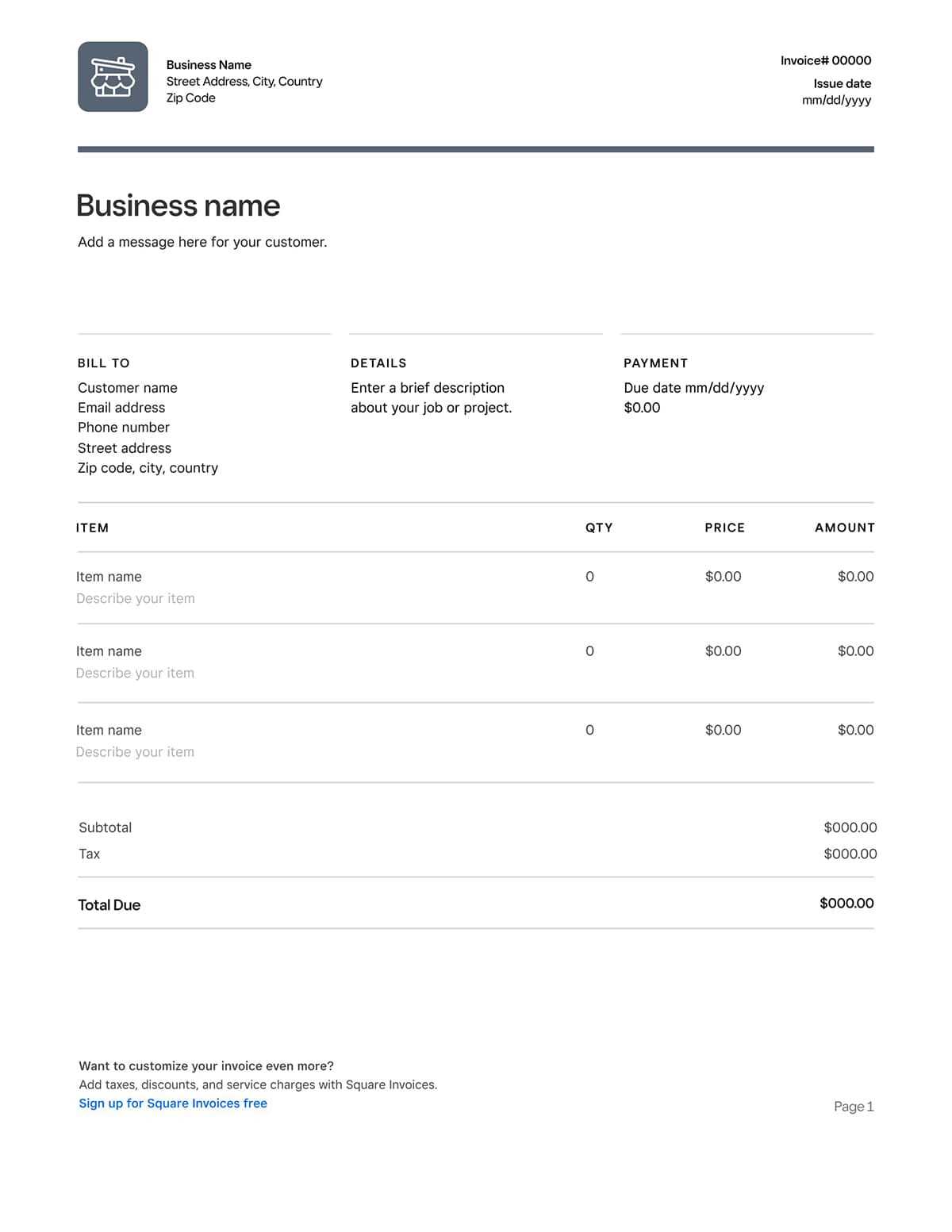

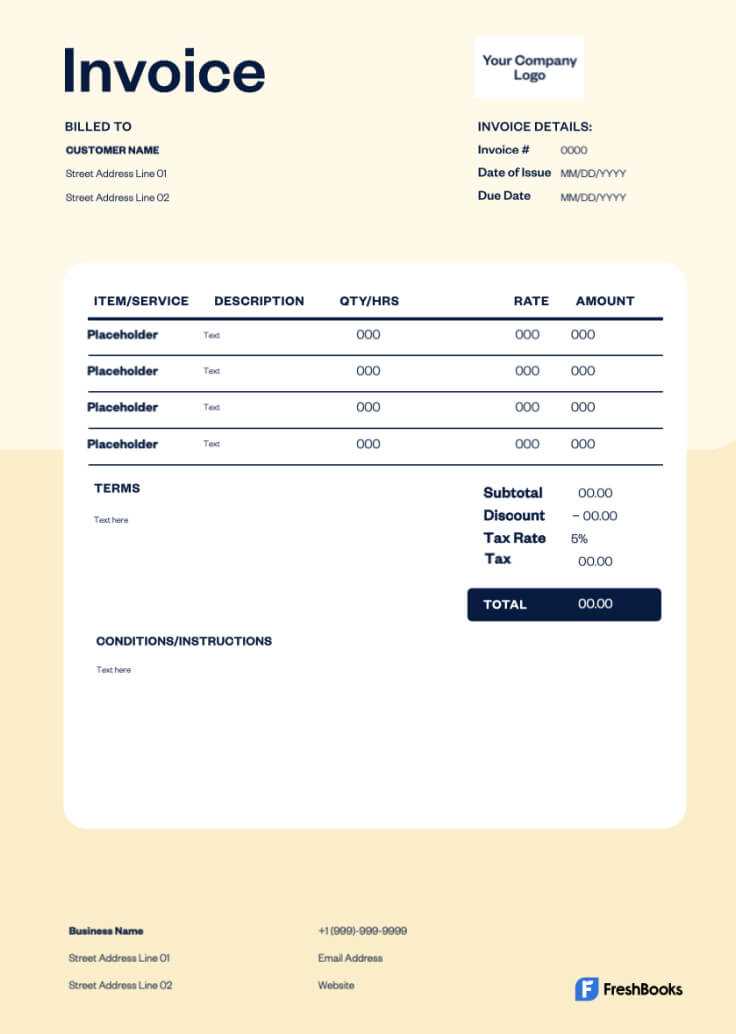

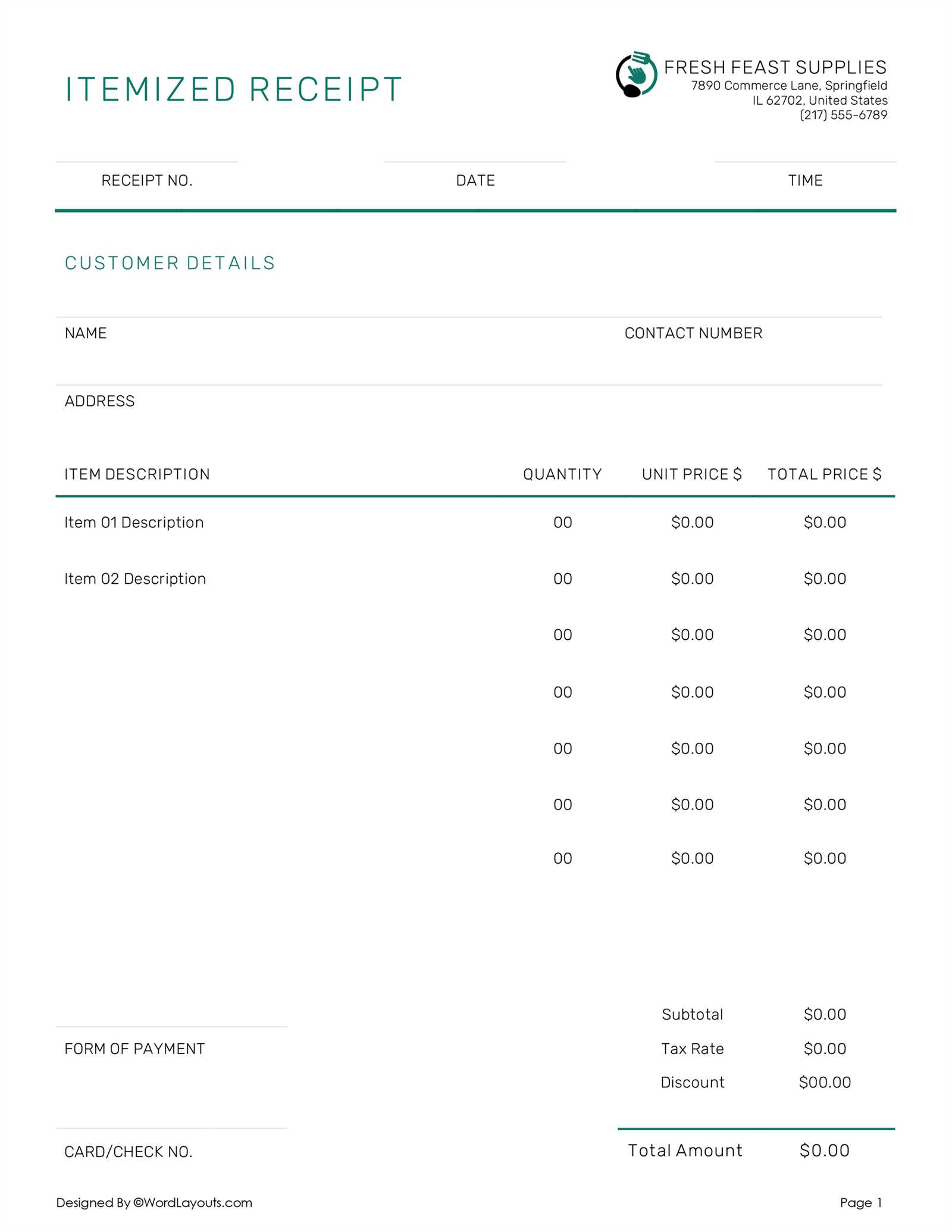

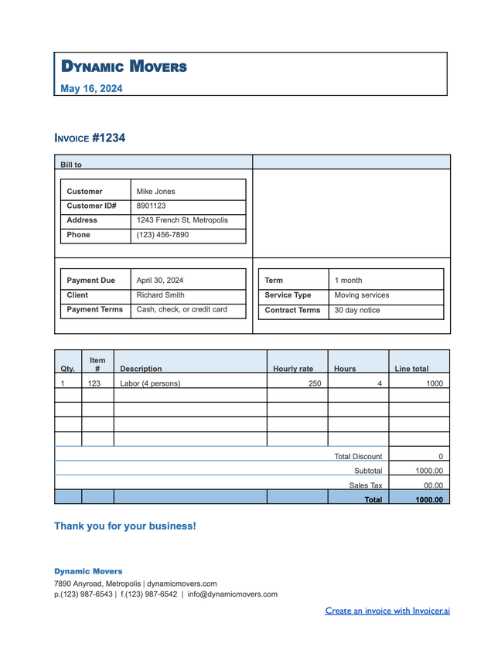

How to Create an Invoice from Scratch

Building a clear and organized billing document from the ground up ensures that all necessary details are included. This approach allows you to customize each part of the layout to best suit your needs, providing a smooth, professional experience for your clients and ensuring that no essential information is overlooked.

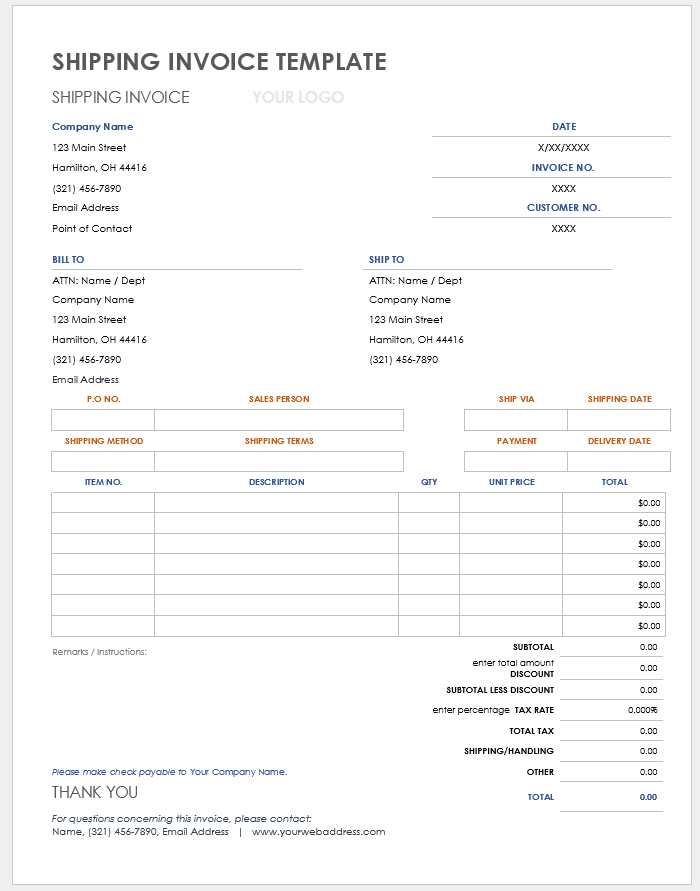

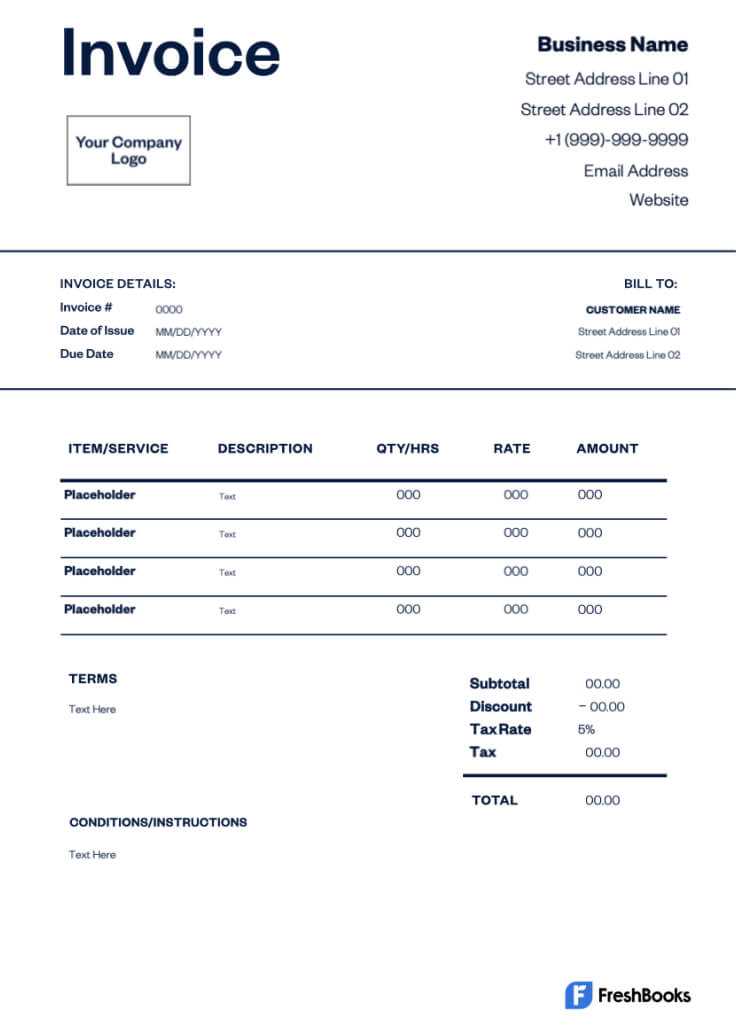

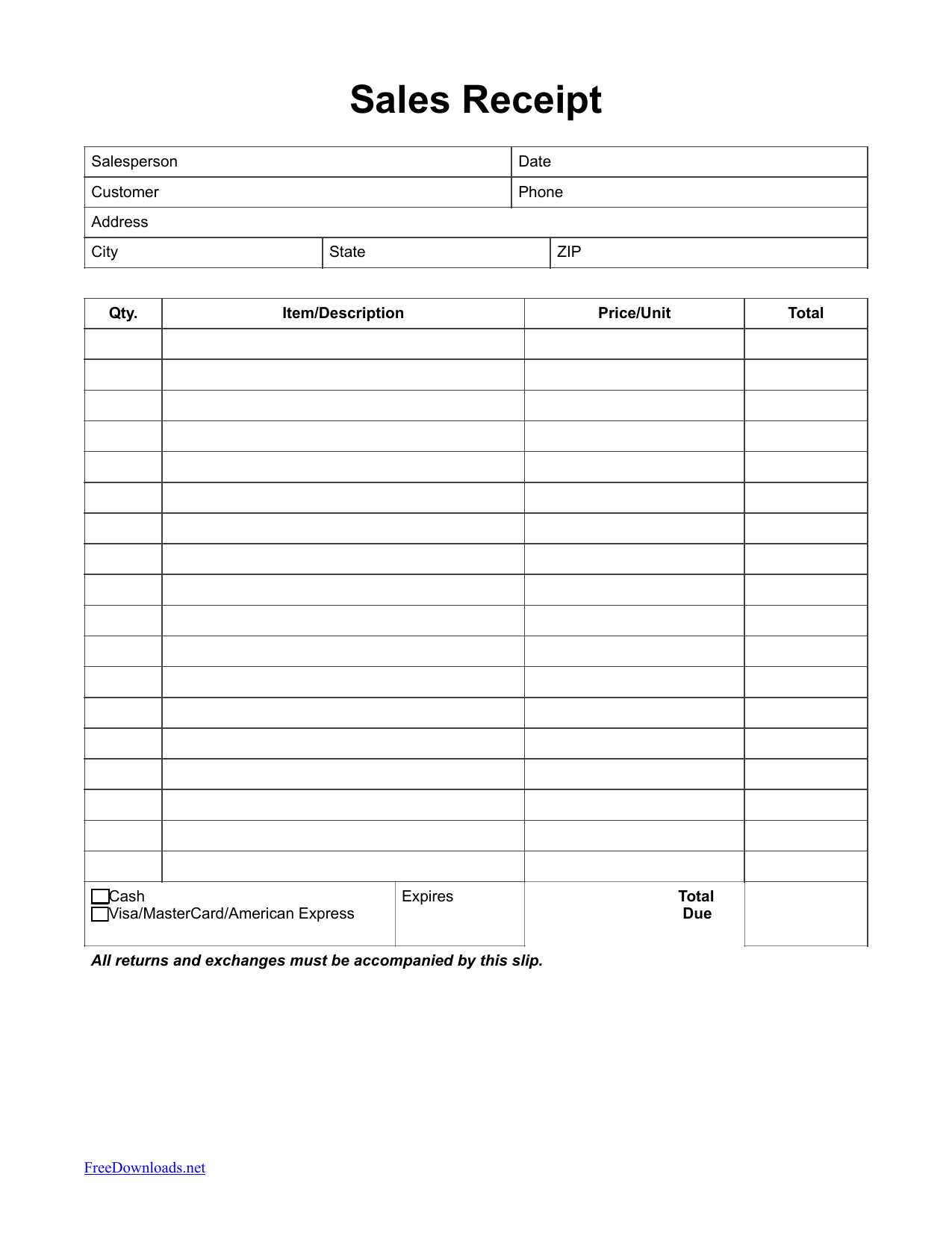

Start by adding your business information, including your name, address, and contact details, so clients know exactly who is providing the service. Include the recipient’s details as well, such as their name and address, to personalize the document and specify who is responsible for payment.

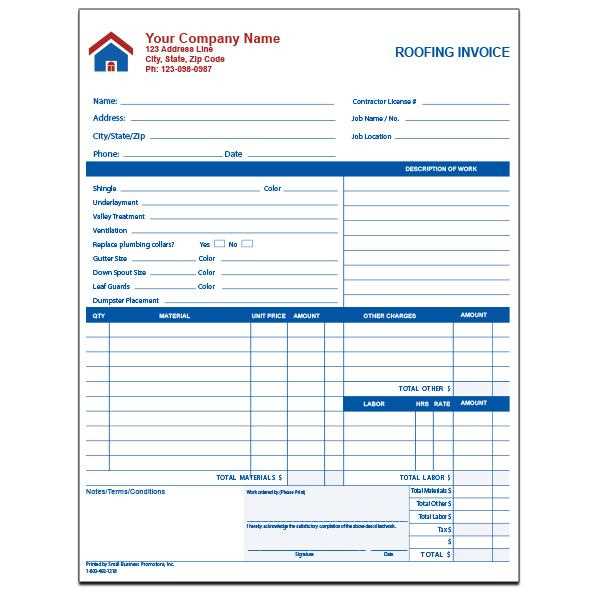

Next, create a section to outline each service or product provided, listing descriptions and costs line by line. Be as specific as possible with descriptions to help clients understand each charge. Following each line, add a column for costs, which will allow both you and the client to easily track expenses.

At the bottom, calculate the total amount owed, clearly separating any taxes or additional fees, so the final amount is

Best Practices for Billing Clarity

Ensuring that your billing is clear and straightforward benefits both you and your clients, reducing the likelihood of misunderstandings and enhancing your professional reputation. When each part of a billing document is organized and transparent, clients can easily understand the services or products provided and their associated costs, fostering trust and encouraging timely payments.

Use Simple, Direct Language

Avoid technical jargon or overly complex terms when describing services or items on the bill. Using clear, concise language helps clients quickly grasp the details without needing additional explanations. A brief, specific description of each line item also aids in eliminating any potential confusion.

Organize Charges with Logical Grouping

Group similar items or services together where possible, especially in larger projects, as this creates a more organized presentation. For example, all labor-related charges could be listed together, followed by material costs. Logical grou

Customizing an Invoice for Your Business

Adapting your billing documents to reflect the unique needs and branding of your business can enhance professionalism and create a memorable impression on clients. Tailoring the layout, content, and style allows you to communicate essential details effectively while reinforcing your brand identity.

Incorporate Branding Elements

One of the simplest ways to personalize your billing is by adding branding elements such as your logo, color scheme, and font style. A consistent look across your business documents makes your brand easily recognizable and projects a polished image. Adding a tagline or slogan can also serve as a subtle reminder of your mission or values.

Adjust Content to Suit Your Services

Depending on the type of services or products you offer, adjust the structure to meet specific requirements. For instance, a creative business might include a section for project milestones or unique service details, while a retailer might focus more on quantities and itemized costs. Customizing the content en

Common Mistakes to Avoid in Invoices

Even small errors in billing documents can lead to confusion, delays in payment, or strained business relationships. Ensuring that each aspect of your billing is correct and clear is essential to maintaining professionalism and ensuring smooth financial transactions. Below are some common mistakes that should be avoided to keep the process efficient and transparent.

- Missing Contact Information: Always include both your details and the client’s, including full names, addresses, and contact information. This ensures clarity if any follow-up is needed.

- Unclear Descriptions: Avoid vague terms. Each item or service should have a clear description, with enough detail for the client to understand what they are being charged for.

- Incorrect Dates: Ensure that the billing date and payment due date are accurate. Mistakes here can lead to confusion about payment deadlines and delayed payments.

- Not Including a Payment Method: Specify how clients can make payments. Leaving this out can result in delays and frustration.

Additional Errors to Watch Out For

- Incorrect Calculations: Double-check all figures, especially totals, taxes, and discounts, to avoid mistakes that could lead to disputes or delays.

- Failing to Number the Document: Every billing document should have a unique reference number for easy tracking and organization.

- Not Detailing Terms and Conditions: Always include any relevant terms, such as payment deadlines or late fees, so there are no misunderstandings.

Avoiding these common mistakes helps ensure your billing process runs smoothly, allowing you to maintain positive relationships with clients and secure timely payments.

Effective Layout Tips for Invoices

A well-organized layout is crucial to creating a clear and professional billing document. A thoughtful design helps ensure that all necessary information is easy to locate and understand. Clients appreciate simplicity and efficiency when reviewing charges, so structuring your document with care can prevent confusion and delays in payments.

Key Layout Considerations

- Prioritize Key Information: Place the most important details, such as your business name, contact information, and payment terms, at the top of the document for easy access.

- Use Consistent Formatting: Consistency in fonts, colors, and spacing contributes to a polished appearance. It ensures the document is easy to read and looks professional.

- Clear Itemization: Organize the charges into easily distinguishable sections. Use tables or bullet points to separate products or services, making it easier for clients to review.

Additional Design Tips

- Leave White Space: Don’t overcrowd the document. Allow adequate white space around each section, making the document look neat and legible.

- Highlight Important Dates: Ensure that the due date and any other key deadlines stand out by using bold text or color.

- Group Related Items: If the charges are related, such as labor and materials, consider grouping them together to improve clarity.

By focusing on these layout principles, you create a document that is not only professional but also enhances the client’s experience, helping to streamline communication and payments.

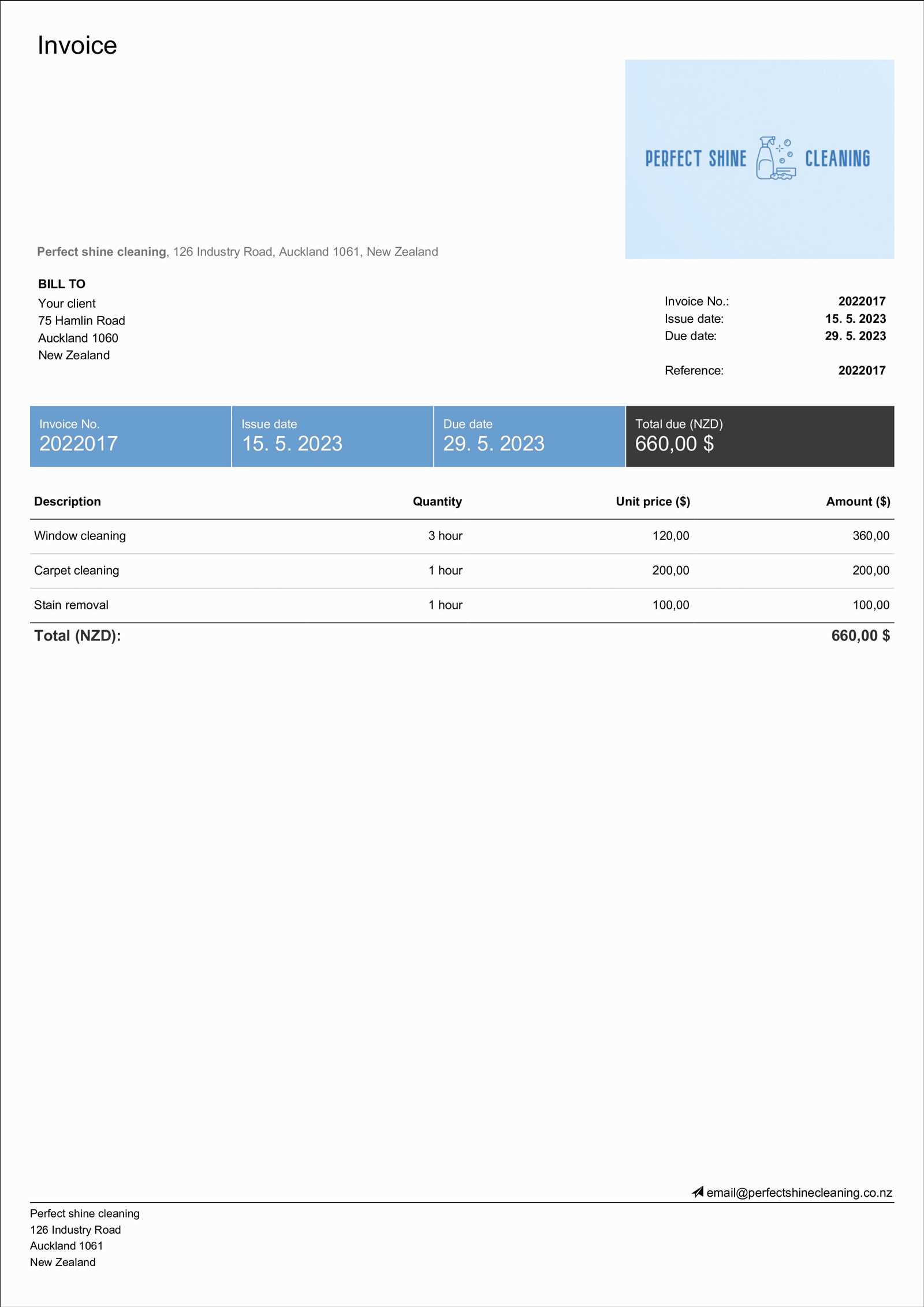

Organizing Charges and Fees in Invoices

Properly organizing the various charges and fees in a billing document is crucial for transparency and clarity. When clients can easily navigate through a breakdown of charges, it fosters trust and prevents misunderstandings. Clear organization also helps avoid errors that could delay payment or cause disputes.

Strategies for Effective Organization

- Group Related Items: Whenever possible, group similar services or products together. This could mean combining labor and materials costs or separating one-time charges from recurring fees.

- Use Descriptive Labels: Each charge should be labeled in a way that makes sense to the client. For instance, use “Consultation Fee” or “Monthly Subscription” rather than vague terms like “Service Fee.”

- Breakdown Complex Charges: If a fee is complicated, break it down into sub-categories to show how it was calculated. For example, if there is a shipping fee, list individual costs like packaging, handling, and postage.

Best Practices for Clarity

- Include Quantity and Rate: Always specify the quantity and rate for each item or service. This helps clients easily verify the accuracy of the charge.

- Highlight Discounts and Taxes: If applicable, clearly list any discounts or taxes that apply to the total. Ensure they are easy to identify and calculated correctly.

- Summarize at the End: After listing all charges, provide a final summary that shows the total amount due, taxes, and any other adjustments. This makes it easy for the client to review the full amount quickly.

Organizing your charges in a clear and systematic way helps ensure a smooth transaction and fosters professional relationships with clients.

Why Transparency Matters in Billing

Transparency in billing ensures that clients fully understand the charges they are being asked to pay. When details are clear and easily accessible, it prevents confusion and builds trust. By offering complete clarity on all costs, businesses demonstrate integrity, which in turn fosters long-term relationships with clients.

Clients appreciate when they can easily identify what they are paying for, how the charges were calculated, and any discounts or taxes that apply. This openness reduces the likelihood of disputes and encourages timely payments. Furthermore, when clients trust the process, they are more likely to return for future business.

Key Reasons for Transparency:

- Builds Trust: Being upfront about fees and charges helps establish credibility and reliability, showing that there are no hidden costs.

- Avoids Misunderstandings: Clear communication reduces the risk of confusion or conflict regarding what the client owes.

- Encourages Faster Payments: Clients are more likely to pay promptly when they understand the breakdown of charges and feel confident in the accuracy of the document.

Incorporating transparency in billing not only promotes fairness but also enhances client satisfaction and strengthens the reputation of the business.

Tracking Payments with Detailed Billing Statements

Keeping track of payments is crucial for maintaining accurate financial records. A detailed breakdown of charges helps businesses monitor which amounts have been paid and which are still outstanding. By ensuring each item or service is clearly listed, businesses can track transactions more effectively and avoid errors or missed payments.

By documenting all charges in a comprehensive manner, companies can quickly reference previous payments and identify any discrepancies. This organized approach makes it easier to follow up on overdue payments and ensure that all financial obligations are met promptly.

Advantages of Using Clear Statements for Payment Tracking

- Easy Reconciliation: Detailed records simplify the process of comparing payments received with amounts due.

- Clear Payment History: Clients and businesses can review all transactions without confusion, promoting transparency.

- Effective Dispute Resolution: In case of discrepancies, a detailed breakdown provides solid evidence to resolve issues quickly.

Incorporating detailed billing statements enhances financial accuracy, helps manage cash flow, and supports stronger client relationships.

How to Automate Your Billing Process

Automating the billing process can save time, reduce human error, and improve efficiency in financial management. By leveraging software solutions, businesses can streamline the creation, sending, and tracking of payment requests, making the process more accurate and less time-consuming. Automation allows for timely and consistent billing, ensuring that clients are invoiced promptly without manual intervention.

Using automated systems, companies can set up recurring billing cycles, generate detailed records instantly, and even send reminders for overdue payments. This eliminates the need for manually creating each document, freeing up valuable time for other business tasks. With integration features, automation can also sync with accounting software to maintain up-to-date financial records.

Benefits of Automation

- Time Savings: Automating tasks such as billing reduces the time spent on repetitive processes.

- Consistency: Automated systems ensure that all clients receive invoices with the same professional formatting and detailed breakdowns.

- Accuracy: By minimizing manual input, automation reduces the chance of errors in financial records.

With automation, businesses can focus more on growth and customer service while the system handles routine tasks effectively.

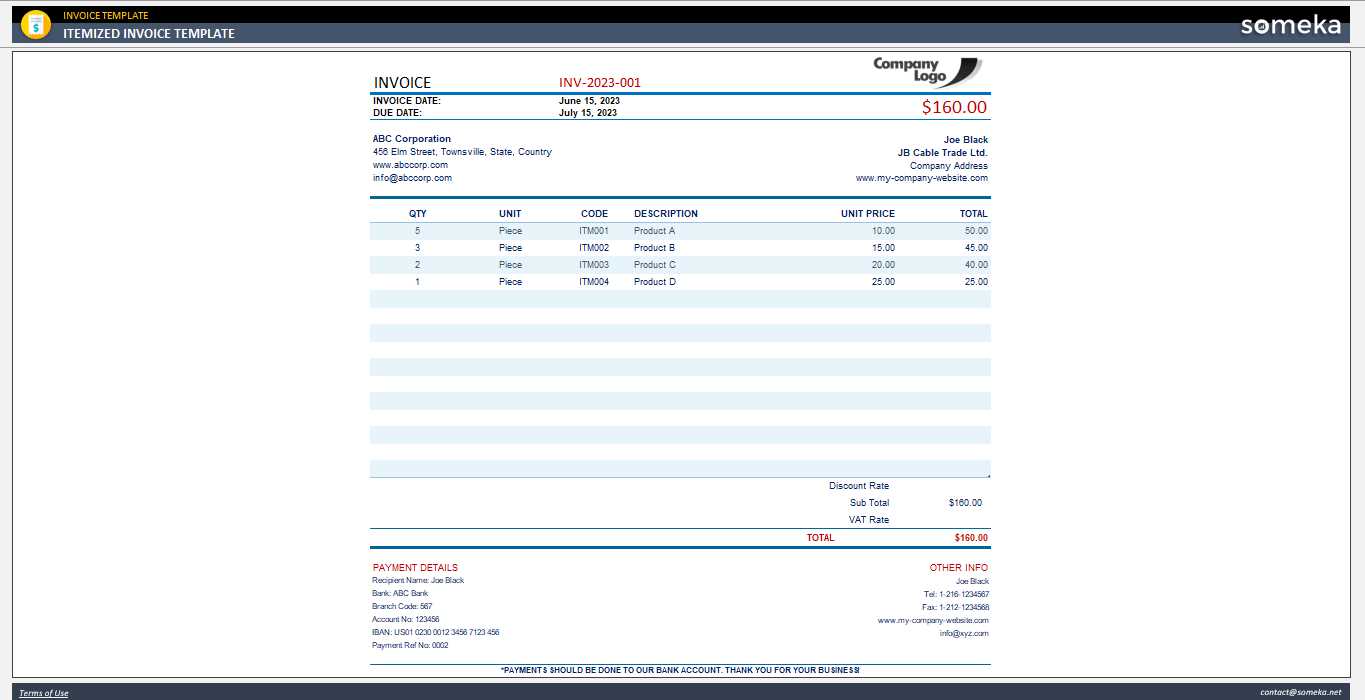

When to Use a Detailed Billing Statement

Creating a detailed billing statement is essential in various business scenarios, especially when transparency and clarity are required for both the service provider and the client. This approach helps break down each charge or fee, providing an easy-to-understand summary of the costs associated with a particular service or product. Such a detailed breakdown becomes particularly useful when the charges are complex or when a customer requests an explanation for the amounts listed.

Using this method is particularly advantageous for businesses that offer multiple services or products within one transaction. It enables clients to see exactly what they are paying for and helps prevent disputes over unclear charges. Additionally, a clear breakdown makes it easier for businesses to track what services or products were delivered and their corresponding costs.

Scenarios for Using a Detailed Breakdown

- Complex Transactions: When services or products are varied and require detailed descriptions.

- Client Requests: If a client asks for a clear explanation of the charges.

- Large Projects: For billing multiple phases of a project with different cost structures.

By offering detailed statements, businesses can maintain better relationships with their clients and ensure smooth, transparent financial exchanges.

Example Breakdown

Description Cost Consultation Fee $100.00 Material Costs $250.00 Labor Charges $300.00 Total $650.00 Enhancing Customer Trust with Clear Billing

Establishing trust with customers is a fundamental aspect of any business relationship. One of the most effective ways to build this trust is through transparent and easily understandable billing practices. When customers can clearly see how the charges are structured and what they are paying for, it fosters a sense of fairness and reliability. Clarity in billing helps to eliminate confusion and potential disputes, ensuring customers feel confident in the transaction.

Incorporating a well-organized breakdown of charges is a simple yet powerful tool for demonstrating honesty and professionalism. When customers feel informed and secure about the fees, they are more likely to return and recommend the service to others. Clear billing practices not only enhance customer satisfaction but also promote long-term business growth.

Benefits of Clear Billing

- Prevents Confusion: Customers easily understand the charges they are paying for.

- Increases Credibility: Transparent breakdowns create a sense of professionalism.

- Reduces Disputes: Clear charges help avoid misunderstandings about payment expectations.

How Transparency Strengthens Relationships

When businesses adopt clear billing practices, they send a message that they have nothing to hide. This transparency helps customers feel respected and valued, enhancing the overall relationship. Clear financial interactions lead to greater customer loyalty, as individuals are more likely to trust a company that demonstrates integrity in every aspect of their operations.

Choosing the Right

Selecting the appropriate approach for managing financial transactions is crucial for any business. The method you choose can affect not only your operations but also how your customers perceive the professionalism and transparency of your business. Whether you’re managing a small business or a large corporation, finding the right structure for presenting charges is essential to maintaining clear communication and trust with your clients.

When deciding on the most suitable option, consider the complexity of your services or products, the preferences of your clients, and the level of detail required to avoid misunderstandings. The right choice should make the payment process as simple and transparent as possible for both you and your customers.

Factors to Consider

- Complexity of Services: For simple transactions, a straightforward format may suffice. For detailed offerings, a more elaborate breakdown may be necessary.

- Client Preferences: Some clients prefer a quick summary, while others appreciate a detailed explanation of each charge.

- Frequency of Transactions: If you issue payments regularly, an efficient and streamlined approach may be more beneficial.

Benefits of Making the Right Choice

- Improved Customer Experience: Clients will appreciate knowing exactly what they are paying for, leading to higher satisfaction.

- Reduced Errors: A well-structured system minimizes the chance of mistakes in calculations or misunderstandings.

- Faster Payments: When clients clearly understand charges, they are more likely to make timely payments.