Duplicate Invoice Template for Quick and Efficient Billing

In any business, the process of managing transactions smoothly and efficiently is essential. Properly prepared documents help keep financial exchanges organized, ensuring clarity for both sender and recipient. Having a well-structured document for recording purchases, payments, or services provided can make financial management simpler and reduce misunderstandings.

Using structured forms specifically designed for financial documentation not only improves organization but also supports effective communication between businesses and their clients. With pre-designed forms, you can quickly generate accurate records that facilitate easy tracking and verification, creating a seamless experience for everyone involved.

These forms also allow companies to maintain consistency in their interactions, fostering trust and professionalism. By using templates that cater to business needs, companies can minimize errors, track payments, and ensure all financial exchanges are documented accurately. Tailored forms become an invaluable resource for businesses seeking to maintain clarity, efficiency, and reliability in their financial processes.

Understanding the Benefits of Invoice Copies

Keeping accurate records is a cornerstone of successful financial management. Copies of financial documents provide a reliable method for tracking transactions, verifying payments, and ensuring that each exchange is thoroughly documented. They also serve as essential references, helping both businesses and clients maintain a clear understanding of completed transactions.

Using organized document copies offers a range of advantages that support efficiency and transparency in business operations. These benefits include:

- Improved Record-Keeping: Copies help businesses maintain a thorough history of all exchanges, making it easy to retrieve past records for analysis or clarification.

- Enhanced Accuracy: By providing consistent formats, copies minimize the risk of errors, ensuring all transaction details are clearly outlined and accurate.

- Seamless Communication: Copies of financial records simplify communication between parties by providing a shared reference point that helps avoid misunderstandings.

- Time Efficiency: With ready-to-use forms, creating and managing records becomes faster, allowing businesses to focus on core activities without delays.

- Compliance Support: Maintaining well-o

What Is a Duplicate Invoice Form

In the world of business transactions, maintaining clear and consistent records is essential. A structured form designed for recording financial details plays a vital role in keeping track of payments, services, or product exchanges. These forms help standardize documentation, providing a consistent method for recording each transaction and ensuring that all relevant details are accurately captured.

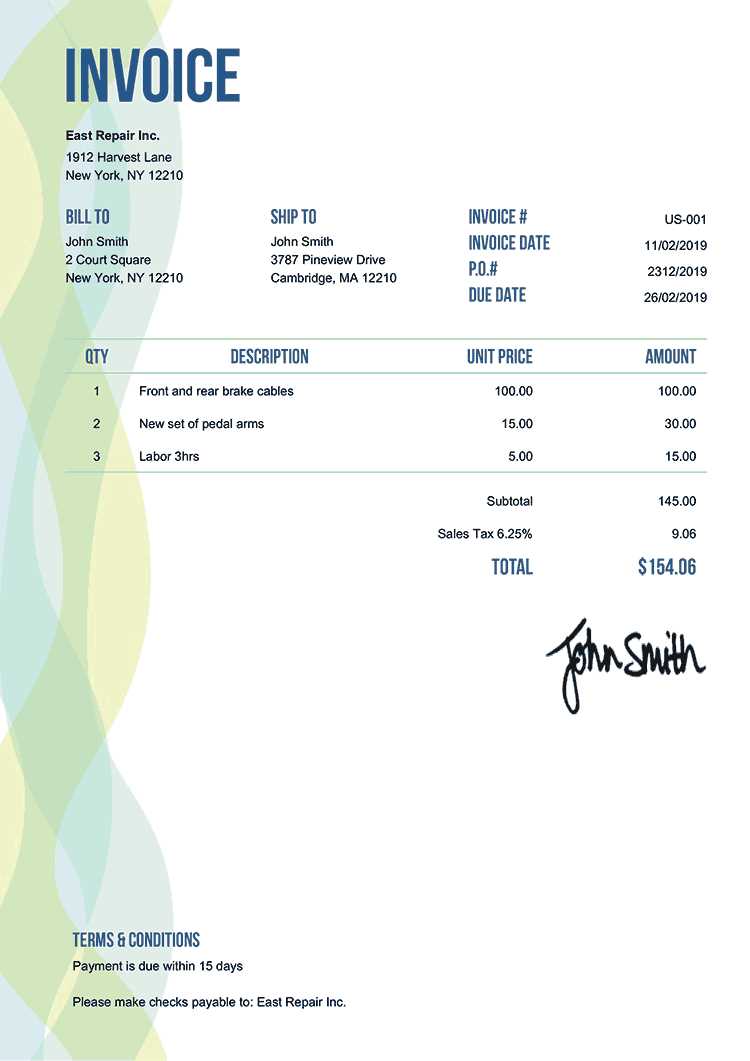

Using such forms is advantageous for businesses looking to streamline record-keeping while enhancing transparency and organization. Below is a breakdown of common elements that can be found in these financial forms:

Field Description Date of Transaction Indicates when the exchange took place, allowing easy reference to the timing of each record. Key Features of Duplicate Invoice Templates Effective financial record-keeping tools streamline transactions, providing clarity and consistency in documenting services or products provided. These structured forms are designed to ensure that every essential detail is captured, making it easier for businesses to keep track of financial exchanges and facilitate communication with clients.

Here are the main attributes that make these forms invaluable for efficient business operations:

Clear and Concise Layout – A well-organized structure allows easy reading and quick reference, helping both the business and the client find the necessary information without confusion.

Customizable Sections – Tailoring sections to fit specific business needs ensures that all relevant details, such as service descriptions, pricing, and terms, are clearly outlined, which supports smooth processing and transparency.

Automated Calculations – Many forms incorporate features that automatica

When to Use a Duplicate Invoice

Maintaining accurate records is essential for both businesses and clients. Situations often arise where additional copies of billing documents are needed for various reasons, such as tracking outstanding balances or replacing misplaced originals. Knowing when to generate an extra copy ensures that all parties have clear documentation, which is crucial for maintaining transparency and avoiding potential misunderstandings.

For Client Reference

An additional copy can be useful for clients who need extra documentation to reconcile payments or file expenses. Providing an extra document makes it easier for clients to organize their records, especially when dealing with multiple transactions. This added convenience can enhance client satisfaction and foster stronger relationships.

To Track Payments

For businesses, extra copies can assist in tracking and managing payments more effectively. A second record can be kept as a backup in accounting systems, helping to monitor outstanding balances, detect missed payments, or identify any discrepancies. This practice helps ensure that the business has a comprehensive record for each financial transaction, providing reassurance in case of future queries or audits.

By providing clear and organized records, businesses can use these documents strategically, enhancing internal record-keeping and supporting clients in their own financial management efforts.

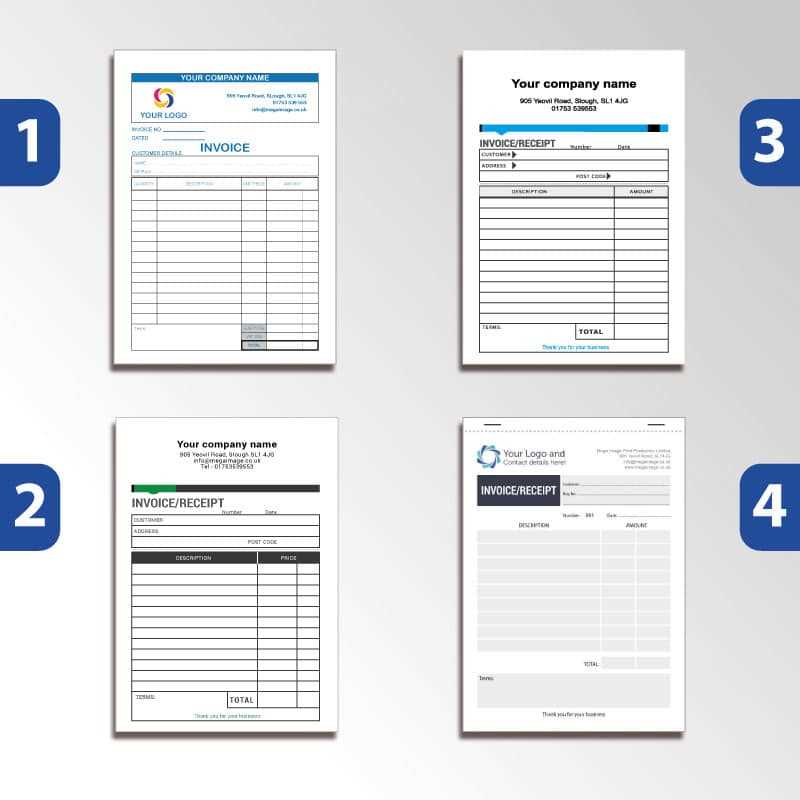

How to Customize Invoice Copies

Customizing billing records allows businesses to maintain a professional appearance while ensuring that all necessary information is conveyed clearly. Personalizing these documents can involve adding branding elements, adjusting the layout to highlight key details, or tailoring sections to fit specific transaction types. By customizing, businesses make their records more functional and visually aligned with their brand identity.

Incorporate Branding Elements – Adding a company logo, contact details, and brand colors enhances professionalism and strengthens brand recognition. This not only gives the document a polished look but also makes it easily identifiable to clients.

Highlight Key Information – Emphasizing essential sections, such as payment terms or itemized lists, improves readability and helps clients quickly find critical details. Using bold text or larger fonts for important fields can make these areas stand out, ensuring that the document is both visually appealing and easy to navigate.

Adjust Sections for

Best Practices for Duplicate Invoices

Implementing effective strategies for creating and managing financial documents is crucial for maintaining clarity and efficiency in business transactions. Following best practices ensures that these records are accurate, professional, and easy to use for both businesses and clients. Adopting a systematic approach not only enhances organizational capabilities but also fosters trust and transparency in financial dealings.

Maintain Consistency – Using a standardized format across all financial documents helps avoid confusion and ensures that all necessary information is presented uniformly. Consistency in layout, font, and style makes it easier for both the business and clients to locate relevant details quickly.

Verify Details Before Sending – Always double-check the information included in these records before distributing them. Ensuring accuracy in amounts, dates, and client details minimizes errors and prevents disputes, reinforcing the integrity of the documentation.

Use Clear and Descriptive Language – The wording used in these records should be straightforward and professional. Clearly stating terms, conditions, and item descriptions helps clients understand their obligations and the nature of the transactions, reducing the likelihood of misunderstandings.

Keep Organized Records – Systematically storing these documents, both digitally and physically, is essential for easy retrieval and reference. Implementing an organized filing system helps businesses track transactions, manage outstanding payments, and maintain a comprehensive financial history.

By following these practices, businesses can enhance the effectiveness of their financial documentation, leading to smoother operations and stronger client relationships.

Maintaining Accuracy in Invoice Copies

Ensuring precision in financial documents is essential for successful business transactions. Accurate records not only reflect professionalism but also foster trust between businesses and their clients. By implementing systematic practices, organizations can significantly reduce errors and improve overall efficiency in their financial processes.

Regularly Review Information

One of the most effective ways to maintain accuracy is through consistent reviews of the information included in these documents. Before sending copies to clients, it is crucial to verify key details such as amounts, dates, and client information. This diligence helps prevent misunderstandings and enhances the credibility of the documentation.

Utilize Automated Systems

Incorporating automated solutions for generating financial records can greatly enhance accuracy. Using software that automatically fills in repetitive information minimizes the risk of human error and ensures that all data is up-to-date. Additionally, many programs allow for easy tracking of changes and provide templates that adhere to best practices, further supporting precision in documentation.

Implementing quality control measures and utilizing technology can help organizations maintain high standards of accuracy in their financial records, leading to improved communication and stronger relationships with clients.

Top Reasons for Issuing Duplicates

Issuing additional copies of financial documents can be necessary for a variety of reasons, reflecting the need for clarity and efficient communication in business operations. Understanding these circumstances helps organizations recognize when and why these records may be needed, ensuring that all parties remain informed and engaged throughout the transaction process.

Client Requests for Replacements

Clients may occasionally misplace their copies or require replacements for various reasons, such as lost paperwork or changes in their filing systems. In such cases, promptly providing an additional copy demonstrates good customer service and helps maintain a positive relationship with clients. Being responsive to these requests can enhance satisfaction and trust in the business.

Correcting Errors in Original Documents

Errors may occur in initial documents, whether due to typos or incorrect data entries. When such inaccuracies are identified, issuing a corrected version is essential to ensure that all parties have access to accurate information. This not only prevents potential disputes but also reinforces the organization’s commitment to maintaining high standards in its financial practices.

By understanding the top reasons for issuing additional copies, businesses can enhance their responsiveness and maintain clarity in financial communications, ultimately supporting stronger client relationships.

Choosing the Right Invoice Format

Selecting an appropriate format for financial documents is crucial for effective communication and professionalism in business transactions. The format not only influences the clarity and organization of the information presented but also impacts how recipients perceive the quality and reliability of the service or product being offered. Various factors should be considered when determining the most suitable style for these documents.

Consider the Recipient’s Preferences

Understanding the needs and preferences of the recipient can significantly influence the choice of format. Here are some aspects to consider:

- Industry Standards: Different industries may have specific expectations regarding document formats. Researching these norms can guide your decision.

- Client Requests: Some clients may prefer a particular layout or design. Being flexible to their preferences can enhance client satisfaction.

- Compatibility: Ensure that the chosen format is compatible with the software and systems used by the recipient to facilitate easier processing.

Evaluate Functional Requirements

The intended purpose of the document should also guide the format selection. Consider the following factors:

- Complexity of Information: If the document contains detailed calculations or itemized listings, a structured format with clear sections may be necessary.

- Branding Elements: Including company logos and branding colors in the layout can strengthen brand identity.

- Legal Considerations: Ensure that the format complies with any relevant regulations or legal requirements that govern documentation in your industry.

Choosing the right format for financial documents is essential for clear communication and professionalism, enhancing both client relationships and operational efficiency.

Streamlining Payments with Duplicate Templates

Enhancing the efficiency of payment processes is essential for maintaining healthy cash flow and fostering positive client relationships. Utilizing additional versions of financial documents can simplify transactions and minimize delays. By providing clients with well-organized and easily accessible records, businesses can ensure a smoother payment experience.

Improving Client Communication

Clear communication is vital in any business transaction. Here are some ways that supplementary versions can help improve interactions with clients:

- Clarity of Details: Including comprehensive information, such as payment terms and item descriptions, ensures that clients understand their obligations, reducing confusion.

- Quick Reference: Providing an easily retrievable copy allows clients to reference their financial commitments promptly, facilitating timely payments.

- Consistent Follow-ups: Having a standardized document helps businesses send reminders and follow-up communications with ease, promoting accountability.

Streamlining Internal Processes

In addition to enhancing client interactions, supplementary versions can also optimize internal workflows:

- Organized Record Keeping: Maintaining clear and accessible copies improves record management, making it easier to track payments and reconcile accounts.

- Reduced Administrative Errors: A consistent format reduces the likelihood of mistakes during data entry, leading to more accurate financial reporting.

- Efficient Audits: Having readily available records simplifies the audit process, as all relevant information can be gathered quickly.

By leveraging additional versions of financial documents, businesses can enhance payment efficiency, improve client relations, and streamline internal operations, ultimately contributing to overall success.

Organizing Financial Records with Invoice Copies

Efficient management of financial documents is crucial for any business aiming to maintain accurate accounting and streamline operations. Utilizing additional copies of billing statements plays a significant role in ensuring that financial records are organized and easily accessible. This practice not only enhances clarity but also supports better decision-making processes.

Benefits of Organized Financial Records

Maintaining well-structured financial documents provides several advantages for businesses:

- Improved Accuracy: A systematic approach to managing records reduces the chances of errors, ensuring that all transactions are properly documented.

- Enhanced Accessibility: Keeping organized copies allows for quick retrieval of information, making it easier to respond to inquiries and audits.

- Streamlined Reporting: Accurate records facilitate efficient reporting, enabling businesses to analyze financial performance and make informed decisions.

Strategies for Effective Organization

To maximize the benefits of organized financial documents, consider implementing the following strategies:

- Consistent Naming Conventions: Use clear and uniform naming conventions for all copies to make searching for specific documents straightforward.

- Digital Storage Solutions: Utilize cloud storage or specialized software to keep documents secure and easily accessible from anywhere.

- Regular Audits: Periodically review records to ensure they are up-to-date and accurately reflect current financial standings.

By adopting effective organization practices for financial records, businesses can improve their operational efficiency, enhance accuracy, and support better financial management overall.

Preventing Errors in Duplicate Invoices

Ensuring accuracy in financial documents is essential for maintaining a healthy business relationship and avoiding potential disputes. Errors in billing statements can lead to confusion, delayed payments, and strained partnerships. Implementing effective measures to prevent mistakes in these documents is vital for operational efficiency.

Common Errors to Avoid

Understanding the typical mistakes that can occur helps in formulating strategies to mitigate them. Here are some common errors to watch out for:

- Incorrect Amounts: Double-check the figures to ensure that all charges are calculated correctly, including taxes and discounts.

- Missing Details: Ensure that all necessary information, such as recipient details and service descriptions, is included to avoid ambiguity.

- Inconsistent Formats: Maintain a uniform format across all documents to prevent confusion and make data retrieval easier.

Strategies for Error Prevention

Adopting specific practices can greatly reduce the likelihood of errors in financial documents:

- Use of Software: Implement invoicing software that automates calculations and reduces the risk of human error.

- Regular Reviews: Conduct periodic audits of billing records to catch and correct any discrepancies promptly.

- Staff Training: Train employees on best practices for document management to ensure everyone understands the importance of accuracy.

By recognizing potential pitfalls and employing proactive measures, businesses can enhance the reliability of their financial documents and maintain strong relationships with clients.

How to Automate Invoice Templates

Automating the creation of financial documents can significantly enhance efficiency and reduce the likelihood of errors. By streamlining the process, businesses can save valuable time and ensure consistency across their records. Automation tools enable the quick generation of essential paperwork, allowing teams to focus on more strategic tasks.

To successfully implement automation for these documents, consider the following steps:

Select the Right Software: Choose an automation solution that fits your business needs. Look for features such as customizable designs, integration with accounting systems, and user-friendly interfaces.

Customize Your Document Structure: Tailor the layout and information fields to match your business requirements. This includes adding company branding, payment terms, and item descriptions to create a professional appearance.

Set Up Automated Workflows: Create workflows that trigger document generation based on specific events, such as completing a sale or providing a service. This ensures that the necessary documentation is produced without manual input.

Test and Refine: After implementing the automation process, conduct tests to identify any issues or areas for improvement. Gathering feedback from users can help in refining the system for better performance.

Monitor Performance: Continuously track the effectiveness of your automated processes. Analyze metrics such as time saved and error rates to determine if adjustments are needed to optimize the workflow.

By following these steps, businesses can leverage automation to enhance their financial documentation processes, leading to improved accuracy and efficiency.

Legal Considerations for Duplicate Invoices

When generating and managing financial documents, it is essential to be aware of the legal implications associated with their use. Ensuring compliance with regulations can help protect businesses from potential disputes and financial liabilities. Understanding the legal framework surrounding these documents is vital for maintaining transparency and accountability.

Compliance with Tax Regulations

Organizations must adhere to tax laws when issuing financial documents. This includes accurately reporting transactions and maintaining records for a specified period. Failing to comply with these regulations can result in penalties, fines, or audits from tax authorities.

Data Privacy and Security

Protecting sensitive information is crucial in the management of financial documentation. Businesses must implement measures to safeguard personal data contained within these records. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is necessary to avoid legal repercussions.

Documentation Retention Policies: Establishing clear policies regarding the retention and disposal of financial documents is essential. Companies should define how long to keep records and the appropriate methods for secure disposal once they are no longer needed.

Ensuring Accuracy and Integrity: It is important to maintain the accuracy of these documents to prevent legal disputes. Any discrepancies or errors can lead to misunderstandings with clients or suppliers, potentially damaging business relationships.

By understanding and addressing these legal considerations, organizations can navigate the complexities of financial documentation effectively and minimize risks associated with non-compliance.

Tips for Designing Effective Invoice Templates

Creating visually appealing and functional financial documents is crucial for ensuring clarity and professionalism in business transactions. A well-structured document not only reflects the brand image but also facilitates easier communication of essential information. Here are some key strategies to consider when crafting these essential records.

Maintain Clarity and Simplicity

Ensuring that the information is easy to read and understand is paramount. Here are some tips:

- Use clear fonts and adequate spacing to enhance readability.

- Organize details in a logical flow, grouping related information together.

- Avoid clutter by limiting the amount of text and focusing on key points.

Incorporate Branding Elements

Integrating your brand’s visual identity can strengthen recognition and credibility. Consider the following:

- Include your company logo prominently at the top of the document.

- Use brand colors for headings, borders, and highlights.

- Maintain consistency in font styles and sizes that align with your branding guidelines.

By implementing these tips, you can create effective financial documents that not only serve their purpose but also enhance your business’s image and foster trust with clients and partners.

Common Mistakes with Invoice Copies

Creating effective financial documents is essential for maintaining clear communication and ensuring accurate transactions. However, several common errors can occur during the process, leading to misunderstandings and potential issues with clients or partners. Recognizing these pitfalls can help streamline operations and enhance the overall quality of financial records.

Mistake Description Inaccurate Information Failing to double-check details such as amounts, dates, or client information can lead to confusion and disputes. Unclear Formatting Poorly structured documents can make it difficult for recipients to locate important information quickly. Lack of Personalization Using generic content without addressing the specific client can create a disconnect and affect relationship building. Missing Payment Terms Not clearly stating payment deadlines and methods can result in delays and misunderstandings. Neglecting Follow-Up Failing to follow up on unpaid documents can lead to cash flow issues and strained client relationships. By being aware of these common mistakes, businesses can take proactive steps to enhance the accuracy and professionalism of their financial records, ultimately fostering stronger relationships with clients and improving operational efficiency.

Why Duplicate Templates Save Time

Utilizing pre-designed documents can significantly enhance efficiency in financial operations. By having structured formats readily available, businesses can streamline their processes and focus more on core activities. This practice not only minimizes the time spent on repetitive tasks but also ensures consistency across various transactions.

- Reduced Preparation Time: Pre-existing formats allow for quicker document generation, as essential details can be auto-filled or easily copied from previous records.

- Consistency in Communication: Standardized documents ensure that all information is presented uniformly, reducing the risk of errors and misunderstandings.

- Faster Approval Processes: When all parties are familiar with the format, it accelerates the review and approval stages, enabling quicker transactions.

- Easier Record Keeping: Having a consistent structure makes it simpler to organize and retrieve past documents, which aids in maintaining accurate financial records.

- Enhanced Professionalism: Well-designed documents reflect professionalism, fostering trust and confidence among clients and partners.

By adopting this approach, businesses can save valuable time and resources, allowing them to allocate more focus on growth and customer satisfaction.