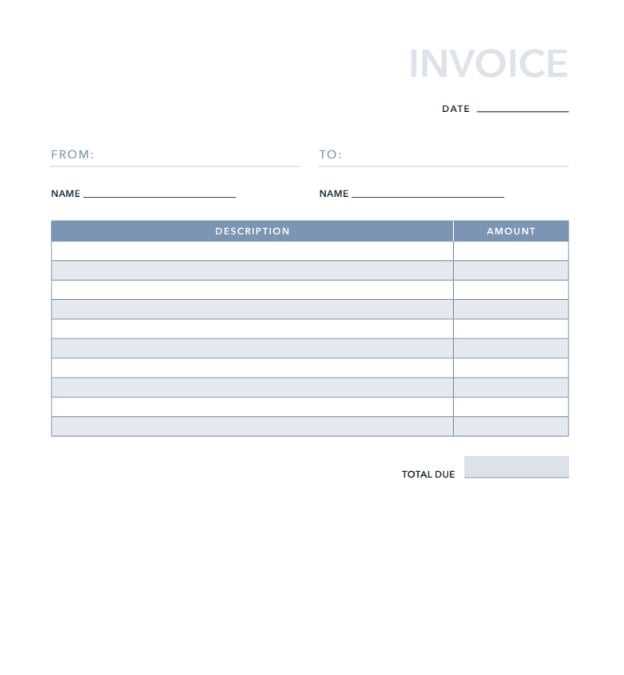

Download Free Invoice Template for Quick and Professional Invoicing

Running a business involves many tasks, and one of the most important is ensuring that your customers are billed accurately and on time. Simplifying this process can save you valuable time and avoid errors that could impact cash flow. Whether you’re a freelancer, small business owner, or part of a larger organization, having a reliable system in place for issuing bills is essential.

With the right tools, creating professional and clear invoices becomes quick and efficient. Many business owners turn to pre-designed documents to manage their billing, as these resources are often customizable, easy to use, and can fit various industries. By leveraging these resources, you can ensure that your financial records are well-organized and meet the needs of your clients.

There are various ways to access these resources, many of which are cost-effective and simple to implement. In this guide, we’ll explore how these tools can streamline your accounting tasks and enhance your workflow. Whether you are just starting out or looking to optimize your current process, finding the right solution can make a significant difference.

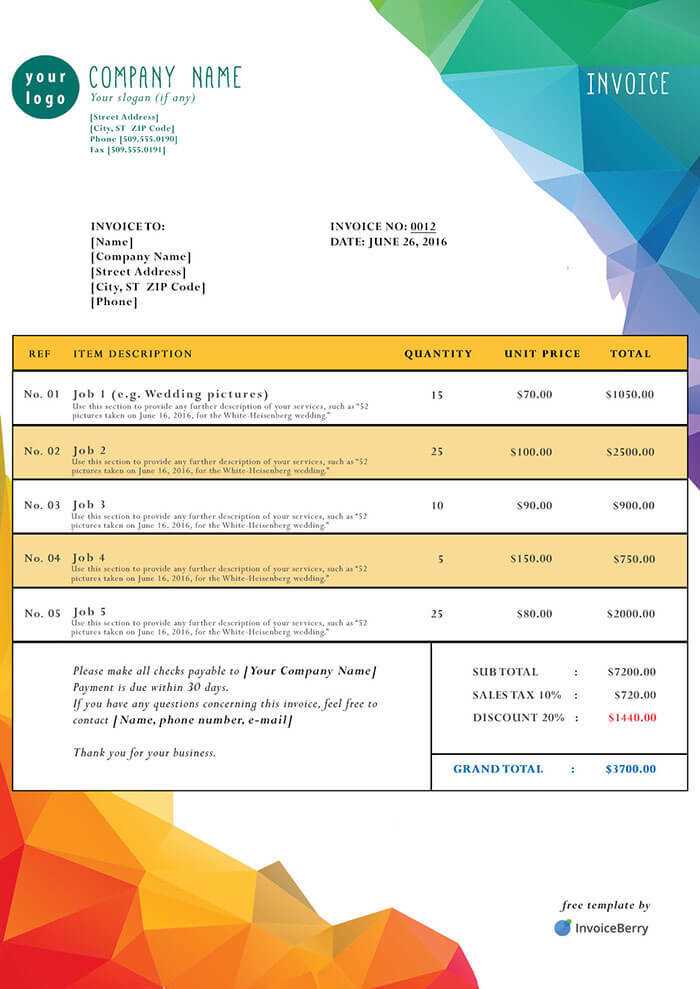

Free Invoice Templates for Your Business

Managing the financial aspect of your business requires an efficient and professional approach to billing. Many entrepreneurs and small businesses choose to use ready-made billing solutions that streamline the process and ensure accuracy. These resources help you create polished and clear statements for your clients without the need for advanced design or accounting skills. In this section, we’ll explore some of the best options available to you for simplifying your billing system and improving your workflow.

Why Choose Pre-Made Billing Solutions

Using a pre-made billing document can save you a significant amount of time, allowing you to focus more on growing your business. These documents are designed with key details in mind, ensuring you don’t miss any important information when billing your clients. They are also highly customizable, which means you can adjust the content to suit your specific needs, whether it’s for one-time services or recurring payments.

Where to Find These Resources

There are numerous platforms offering a variety of billing documents that can be used across different industries. Whether you’re looking for a simple design or something more complex, you’ll find numerous options that cater to your business type. Many websites offer these resources without charge, allowing you to integrate them into your business with minimal effort.

| Platform | Features | Best For |

|---|---|---|

| Template Websites | Easy-to-use, customizable layouts | Small businesses, freelancers |

| Accounting Tools | Integrated with financial software | Entrepreneurs, accountants |

| Business Resource Blogs | Variety of designs and styles | Startups, creative professionals |

By exploring these resources, you’ll be able to find the best options that meet your needs and help you maintain a professional image while improving your billing efficiency.

Why You Need a Custom Invoice Template

Creating a tailored billing solution is essential for ensuring that your business operations run smoothly and professionally. While there are many standard options available, customizing your billing documents allows you to present a consistent and polished image to your clients. A personalized approach can help you stand out, reflect your brand, and make the process of tracking payments easier and more accurate.

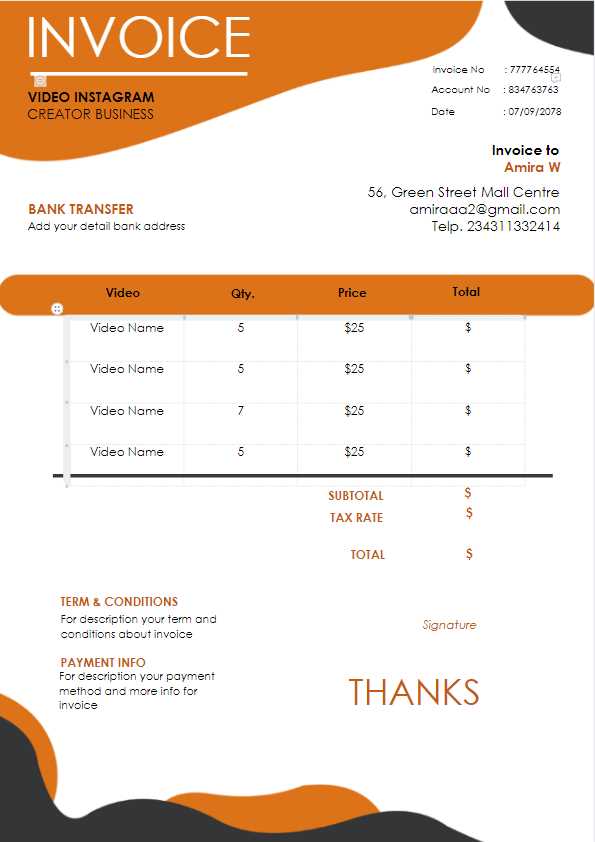

Branding and Professionalism

When you customize your billing documents, you have the ability to incorporate your company’s branding elements, such as your logo, color scheme, and contact details. This not only enhances your professionalism but also strengthens your brand identity. A well-designed bill conveys to your clients that you take your business seriously and are committed to providing a high-quality service.

Efficiency and Accuracy

Having a personalized billing format ensures that all necessary fields are included and easy to fill out, reducing the chance of missing important information. Custom documents can also be set up to automatically calculate totals, taxes, and discounts, saving you time and eliminating errors. This makes managing payments and keeping track of financial records much easier, helping you avoid mistakes and delays.

Ultimately, having a customized solution for billing not only improves the overall client experience but also streamlines your internal processes, allowing you to focus on what truly matters–growing your business.

How to Download an Invoice Template

Accessing a ready-made billing document is a straightforward process that can save you time and effort. These pre-designed forms allow you to quickly create professional-looking statements for your business. By choosing the right resource, you can easily obtain a document that suits your needs and customize it to fit your brand. Below, we’ll walk you through the steps involved in accessing and utilizing these resources for your business.

There are several ways to obtain a pre-made billing form, each offering various features and customization options. Whether you prefer using online platforms, software tools, or other services, the process is quick and simple. Below is a comparison of the most popular methods for obtaining your business documents.

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Platforms | Wide selection, easy to use | Limited customization options |

| Accounting Software | Integrated with financial tools, automated | May require a subscription or fee |

| Business Resource Websites | Variety of designs, often customizable | May require additional editing |

Once you’ve selected the best method, you can typically choose from a range of designs and formats. Many resources allow you to preview the documents before making them part of your workflow, ensuring you choose the most suitable option. With just a few clicks, you’ll be able to access a ready-to-use solution to simplify your billing tasks.

Top Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers a variety of advantages that can help streamline your business operations. These resources are not only time-saving but also help ensure accuracy and professionalism in your financial transactions. By adopting ready-made solutions, you can focus more on providing services and less on creating documents from scratch. Below are some key benefits of incorporating these resources into your workflow.

- Time Efficiency: Pre-made billing formats eliminate the need to start from scratch, allowing you to generate statements quickly and with minimal effort.

- Consistency: Using standardized documents ensures that your business maintains a professional appearance, giving clients a consistent experience across all transactions.

- Reduced Errors: Ready-made formats often include automatic calculations, helping to avoid costly mistakes such as incorrect totals or missing fields.

- Customization Options: Many pre-designed documents offer customizable sections, enabling you to add your company details, branding, and personalized terms to suit your specific needs.

- Easy Record Keeping: Organized and clear statements make it easier to track payments, manage finances, and maintain accurate records for tax purposes.

By leveraging these benefits, businesses can improve efficiency, reduce administrative burdens, and maintain a high level of professionalism in their financial dealings.

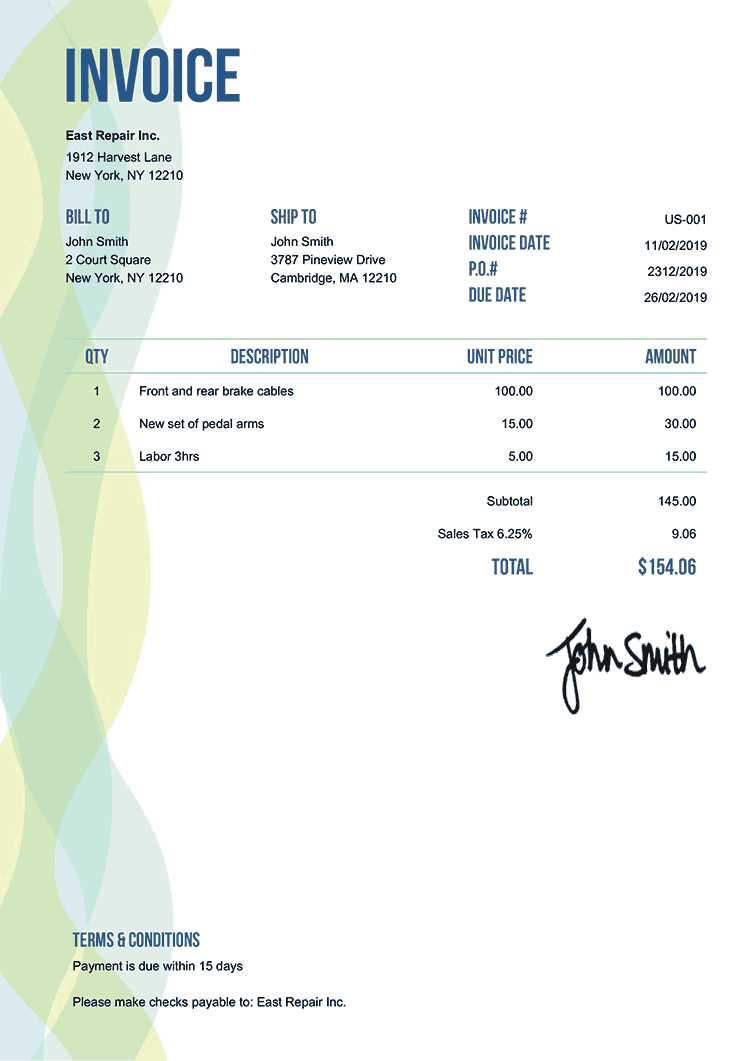

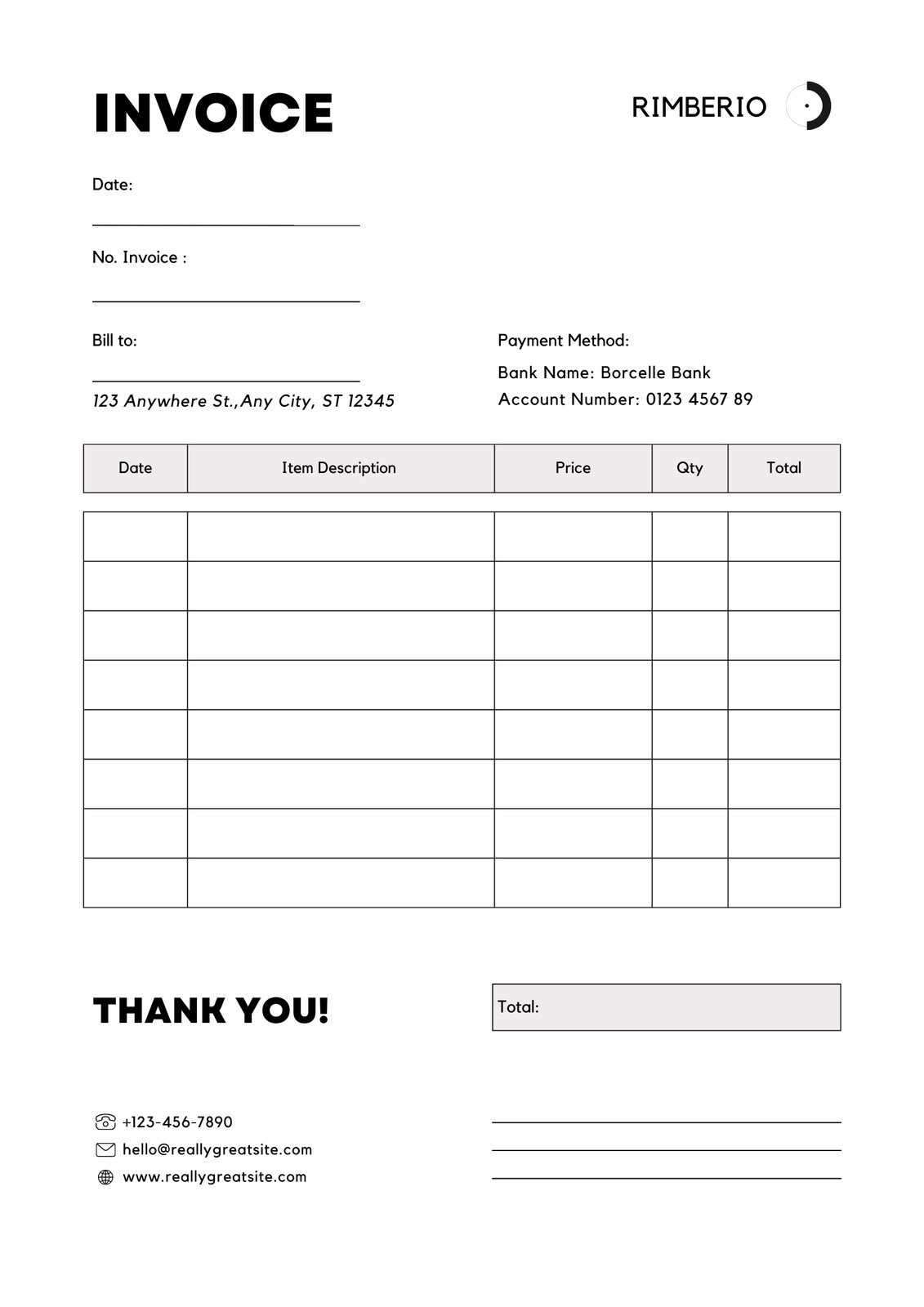

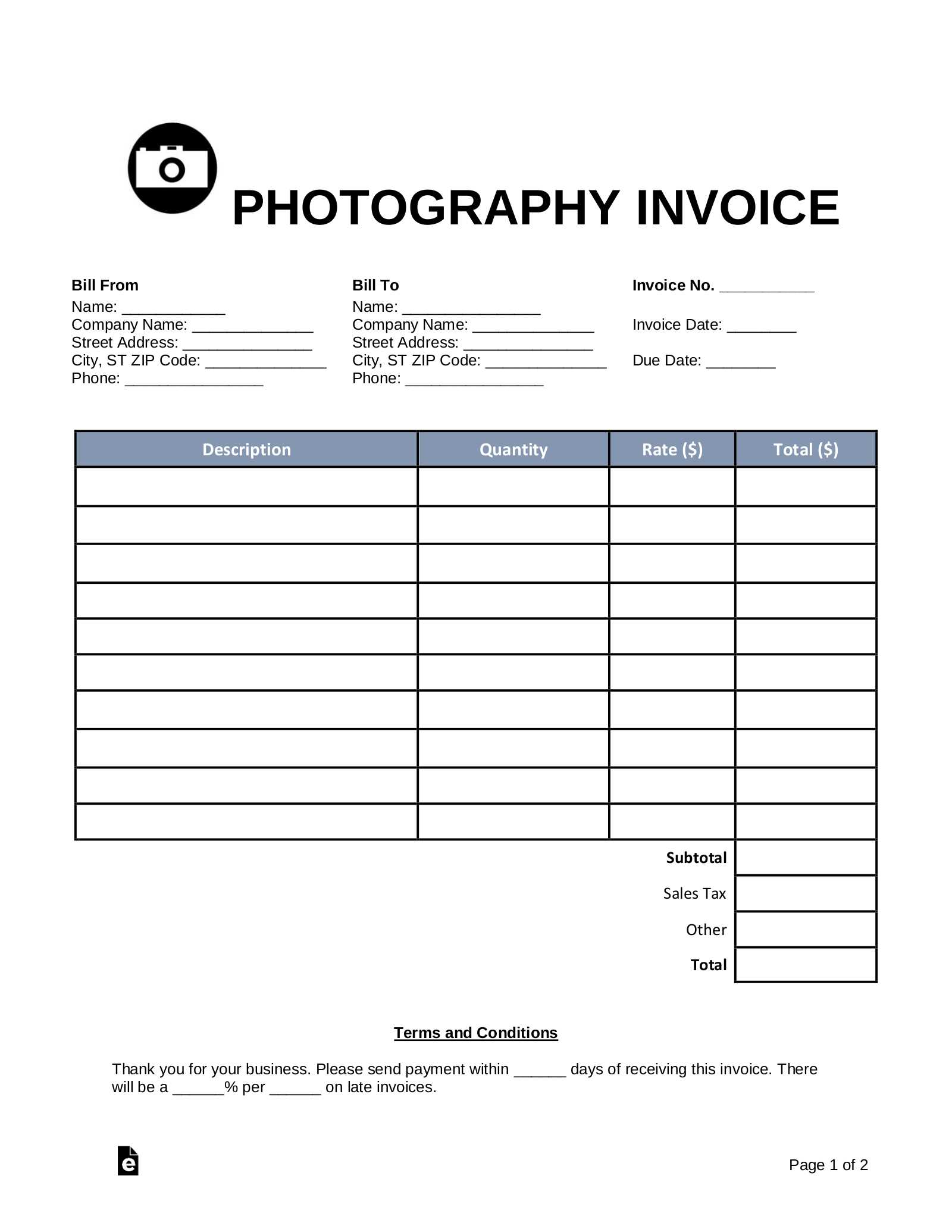

Different Types of Invoice Templates Available

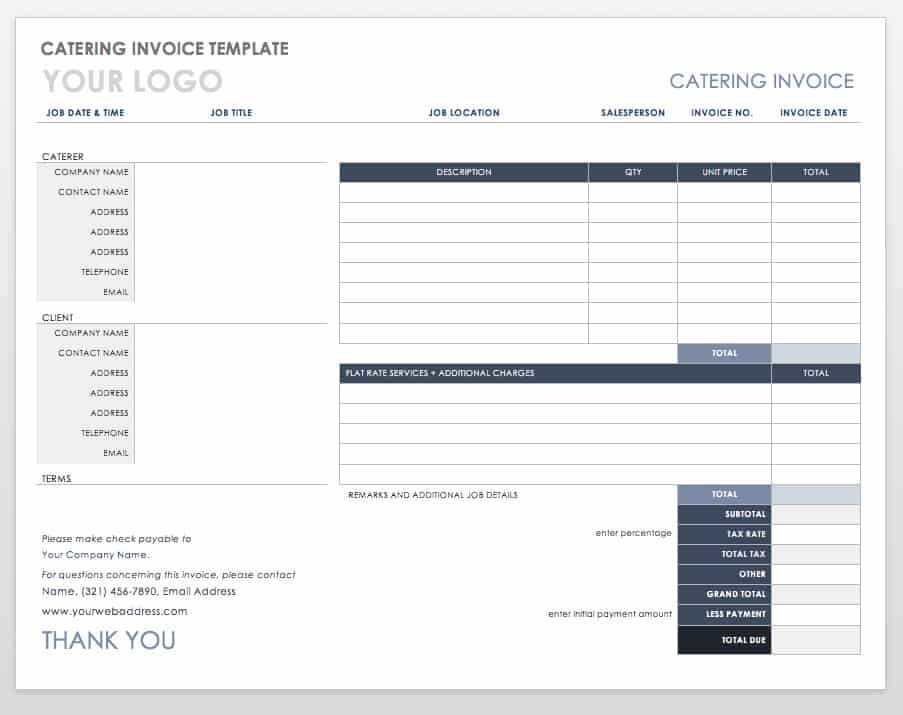

When managing your business’s billing process, choosing the right format for your financial documents is crucial. There are various styles and structures to suit different types of services, industries, and customer needs. Each design has its own set of features that can help you present the necessary information clearly and efficiently. Understanding the different types available ensures that you select the most appropriate one for your business.

Here are some of the most common types of billing formats you can consider:

- Simple Billing Forms: These are basic and straightforward, perfect for freelancers or small businesses that offer one-time services or products. They typically include essential details such as the service provided, total amount, and payment terms.

- Itemized Billing Forms: Used when you need to provide a breakdown of products or services. These formats are great for businesses offering multiple items or services, allowing clients to see the cost of each individually.

- Recurring Billing Statements: Ideal for subscription-based businesses or services with regular payments, these documents are designed to automatically calculate recurring charges, making it easier for both you and your clients to keep track of ongoing services.

- Proforma Statements: Often used as preliminary bills or estimates, these documents are typically issued before the actual service or product delivery. They are used to outline potential costs and terms before finalizing the agreement.

- Credit Notes: When issuing a refund or adjusting an existing transaction, a credit note format is used to provide clients with a statement reflecting the correction or refund amount.

By selecting the right type for your needs, you can ensure that your clients receive clear and accurate documentation while making your billing process more efficient and professional.

Choosing the Right Template for Your Business

Selecting the appropriate billing format is an essential step in optimizing your financial processes. The right document not only saves you time but also helps maintain consistency and professionalism when dealing with clients. There are a variety of options to choose from, and it’s important to consider your business type, services, and customer expectations before making a decision. Below are key factors to keep in mind when choosing the most suitable option for your business.

- Business Type: Different industries have unique needs. For example, service-based businesses may require more detailed descriptions of work done, while product-based businesses may need itemized lists of purchased goods.

- Frequency of Transactions: If your business involves regular, recurring charges (such as subscriptions), it’s beneficial to choose a format that simplifies the process of automatic calculations and payment tracking.

- Branding Requirements: The design of your billing document should reflect your business’s branding. If you’re in a creative industry, you might want something visually appealing, while a more formal look might be better for financial services or legal work.

- Legal and Tax Considerations: Ensure that your billing document complies with local regulations and includes all necessary information, such as tax rates, payment terms, and legal disclaimers. This is crucial for maintaining transparency with clients and avoiding potential legal issues.

- Ease of Use: Choose a design that is simple and easy to navigate. A clear, straightforward layout makes it easier for clients to understand the charges and terms without confusion.

By carefully considering these factors, you can select a document format that fits your business’s unique needs while ensuring smooth and professional communication with your clients.

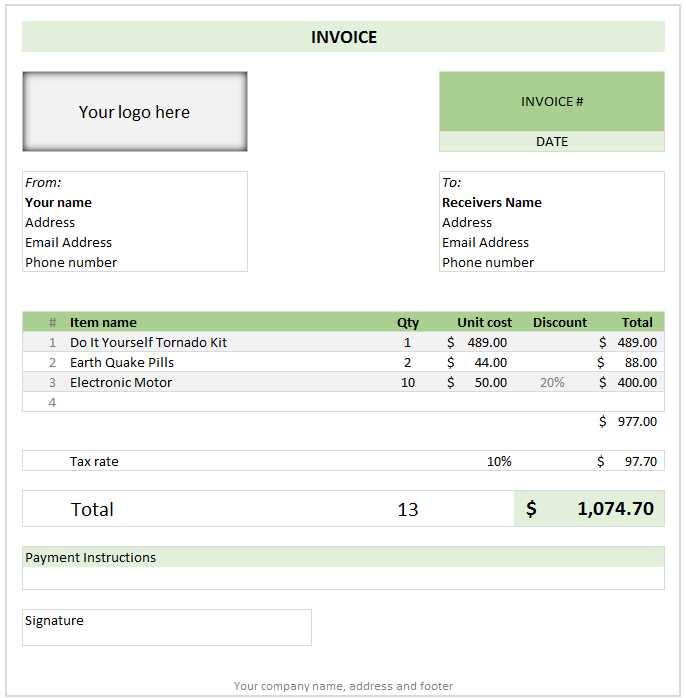

How to Edit an Invoice Template

Customizing a pre-designed billing document is a simple yet important task that ensures your statements meet your business’s specific needs. By making a few edits, you can tailor the document to reflect your brand, payment terms, and unique services. In this section, we’ll guide you through the steps involved in modifying an existing document to fit your requirements.

Step 1: Choose the Right Tool for Editing

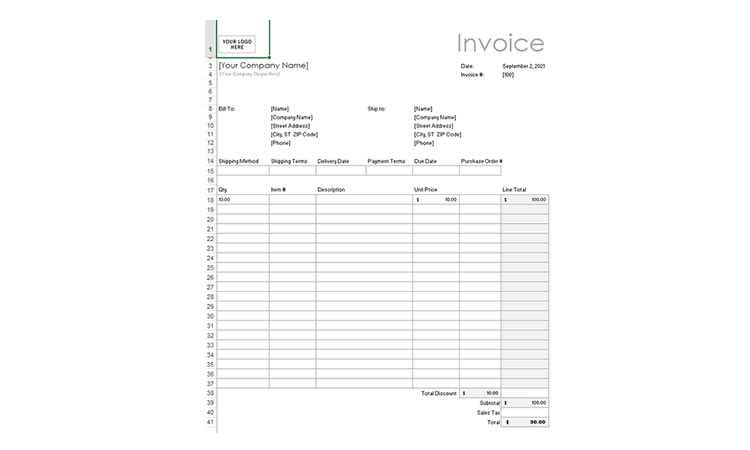

Before you begin, make sure you have the right tool for editing your billing document. Most formats can be edited using software such as Microsoft Word, Google Docs, Excel, or specialized accounting tools. If the document is in a more advanced format like PDF, you’ll need a PDF editor, or you may want to convert it to an editable format first.

Step 2: Customize the Key Elements

Once you open the document, focus on the key fields that need to be personalized. Here are the main elements to edit:

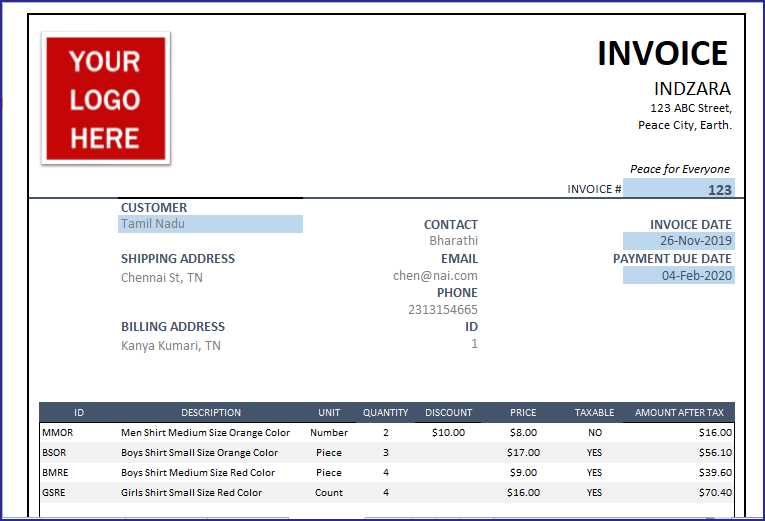

- Business Details: Add your business name, address, contact information, and logo to ensure the document represents your company’s identity.

- Client Information: Update the customer’s name, billing address, and contact details to make sure everything is accurate.

- Service or Product Description: List the items or services provided, including clear descriptions, quantities, and individual prices.

- Payment Terms: Ensure that payment due dates, late fees, and other terms are clearly stated so that your clients understand the expectations.

These edits will make the document relevant to your transaction and ensure that all necessary details are included.

After making the necessary adjustments, save your work in an appropriate format. It’s always a good idea to keep a copy of the original document for future use and to store the edited versions in an organized manner for easy access.

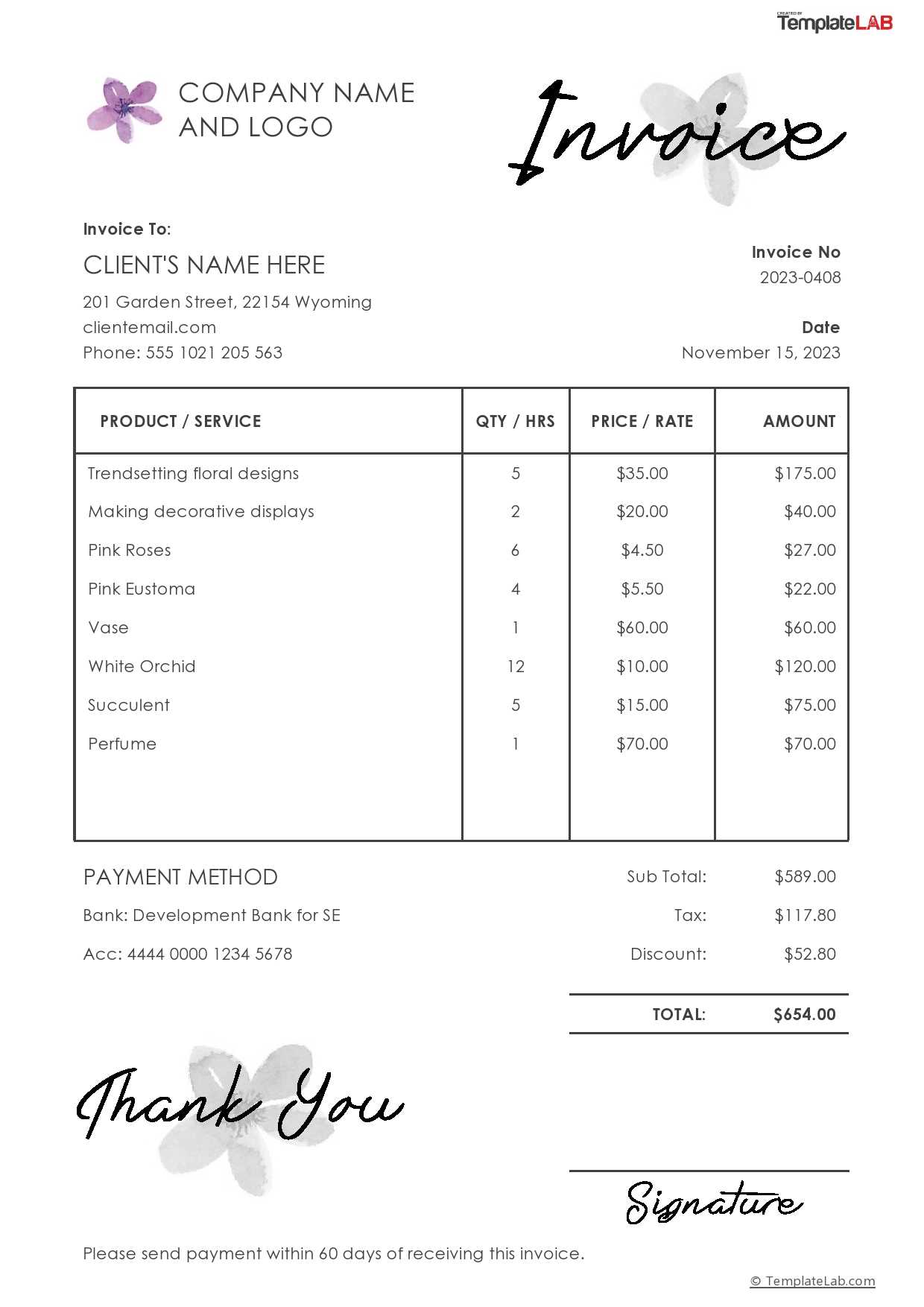

Understanding the Essential Invoice Fields

Creating a clear and effective billing document involves including all the necessary information that both you and your client need to understand the transaction. Certain fields are essential for ensuring that the document is professional, complete, and legally compliant. Knowing what to include and where to place it can help you avoid confusion and potential payment delays. Below, we will outline the key sections that should be included in any billing document.

Key Sections to Include

Each billing statement should contain specific details to ensure clarity and proper tracking of the transaction. The most important sections to focus on are as follows:

- Business and Client Information: The document should clearly state your business name, contact details, and logo, along with the client’s name and contact information.

- Unique Identification Number: Every document should have a unique reference number for tracking purposes. This helps both you and your client to locate specific transactions quickly.

- Service or Product Details: A clear description of the services provided or products sold, including quantities and individual prices.

- Payment Terms: Make sure to outline the payment deadline, accepted methods, and any late fees or early payment discounts that apply.

- Total Amount Due: Clearly indicate the total amount the client owes, along with any applicable taxes or discounts.

Table Overview of Essential Fields

| Field | Description | Importance |

|---|---|---|

| Reference Number | Unique identifier for each document | Helps track and reference transactions |

| Client Information | Client’s name and contact details | Ensures the document is addressed correctly |

| Service/Product Details | Description, quantity, and price of items | Provides transparency for the client |

| Payment Terms | Deadline, methods, and penalties/discounts | Clarifies payment expectations |

| Total Amount | Total cost, including taxes and discounts | Summarizes the final amount due |

Including these fields in your documents ensures that both you and your clients are on the same page regarding the terms and details of the transaction. It also helps maintain a professional standard in your f

Creating Professional Invoices with Templates

Crafting well-organized, polished billing statements is crucial for establishing trust and professionalism with your clients. Using pre-designed formats can significantly streamline the process, ensuring that every document is not only functional but also reflects your business’s quality and attention to detail. These ready-made options allow you to present all the necessary information clearly while maintaining a cohesive look that aligns with your brand.

By incorporating the right elements and customizing them to suit your business needs, you can ensure that each document looks professional and is easy for your clients to understand. This can help minimize confusion and disputes, making your payment process smoother and more efficient.

Here are some tips for creating a polished, professional document:

- Use a Consistent Layout: Maintain a uniform design across all of your billing documents. This consistency builds trust and reinforces your brand identity.

- Include Clear Contact Information: Ensure that both your and your client’s details are easy to locate. This helps with communication and reduces the chances of errors.

- Be Transparent with Pricing: List services or products in a clear, detailed manner, breaking down the costs where necessary. This ensures your client knows exactly what they’re being charged for.

- Professional Design Elements: Incorporate your business logo, colors, and fonts. These small details go a long way in conveying professionalism and making your documents more recognizable.

- Provide Payment Instructions: Clearly state the payment methods accepted, due dates, and any late fees. This helps set clear expectations for your clients.

Using these tips and a ready-made format, you can create high-quality documents that not only look professional but also contribute to smoother business transactions.

Common Mistakes to Avoid in Invoices

While creating billing documents may seem straightforward, there are several common pitfalls that can lead to confusion, delays in payment, or even legal complications. Avoiding these mistakes ensures that your documents are clear, professional, and legally sound, which in turn fosters good business relationships and promotes timely payments. Below are some of the most frequent errors made when generating billing statements, along with tips for avoiding them.

- Missing Contact Information: Failing to include complete contact details–both for your business and your client–can cause confusion and delay the payment process. Always ensure that names, addresses, and contact numbers are clearly listed.

- Incorrect or Incomplete Payment Terms: Not clearly stating the payment due date, accepted payment methods, or any late fees can result in misunderstandings. Be sure to outline payment expectations and consequences for late payments.

- Omitting a Unique Reference Number: Every document should have a unique number for tracking purposes. Without it, both you and your client may have difficulty referencing or searching for past transactions, which can lead to disputes.

- Vague Descriptions of Products or Services: If the services provided or goods sold aren’t described in enough detail, clients may not fully understand the charges. Be specific about what’s being billed, including quantities and unit prices.

- Failure to Calculate Correctly: Simple errors in calculations–such as adding wrong totals or neglecting taxes–can cause frustration for both parties. Double-check all calculations before finalizing your document.

- Missing Legal Information: Depending on your location and the type of business, your document may need to include specific legal or tax information, such as tax identification numbers or business registration details. Ensure that these are clearly stated, especially if you operate in a regulated industry.

- Unprofessional Design: While content is crucial, the appearance of your document matters too. A cluttered, hard-to-read, or poorly designed statement can hurt your business’s image. Stick to a clean, professional layout with clear sections and organized information.

Avoiding these common errors will not only make your billing process smoother but also enhance your business’s professionalism and credibility. Alwa

How Invoice Templates Save Time and Money

Using pre-designed billing documents can significantly streamline your financial processes, saving both time and resources. Instead of creating a new document from scratch for each transaction, a ready-made format allows you to quickly input the relevant details and generate a professional, accurate statement. This efficiency not only reduces administrative work but also minimizes the risk of errors that could lead to costly mistakes or delays in payments.

Time Savings

One of the most obvious advantages of using ready-made billing formats is the time saved in document creation. Rather than starting with a blank page, you simply fill in the essential details–such as client information, service descriptions, and amounts owed–allowing you to move on to other important tasks. With fewer steps required, you can generate multiple billing statements in less time, increasing overall productivity.

- Faster Creation: Pre-designed documents provide all the necessary fields and sections, eliminating the need to manually format or arrange them.

- Reduced Decision-Making: By choosing from existing designs, you save time spent deciding on layout, structure, or design choices.

- Consistency: With a consistent format, you don’t have to rework every document; you can use the same structure for all clients, improving workflow efficiency.

Cost Efficiency

Besides saving time, using pre-designed formats can also help reduce costs associated with document creation. By simplifying the process, businesses can avoid hiring extra administrative help or spending excessive time on tasks that could otherwise be automated. Additionally, eliminating errors or incomplete information reduces the risk of having to redo documents, which can be costly in terms of time and effort.

- Reduced Administrative Costs: With quicker document creation, there’s less need for additional staff or overtime to manage billing.

- Minimized Errors: Ready-made formats often have built-in fields and automatic calculations that help prevent costly mistakes.

- Streamlined Workflow: By improving overall efficiency, your business can process more transactions in less time, potentially increasing revenue.

In conclusion, by using pre-designed billing documents, businesses can save significant amounts of time and money, improving both productivity and accuracy in their financial processes. The ease of use and automation that these formats provide make them an invaluable tool for any organization looking to o

Free vs Paid Invoice Templates: What’s Best?

When choosing a ready-made document format for your business, you’ll encounter two primary options: free versions and paid ones. Each has its own set of benefits and limitations, making it important to understand the key differences before deciding which is the best fit for your needs. While both can be effective for billing purposes, factors like customization, features, and support often make the decision more nuanced.

Advantages of Free Options

Free documents are an appealing choice for small businesses or startups with limited budgets. They often provide a basic, easy-to-use format that can be customized to include essential details, such as services provided, amounts due, and client information. These can be great for simple transactions, especially when you’re just starting and want to keep costs low.

- No Initial Investment: The biggest advantage is, of course, the cost. There’s no financial commitment required to use free documents.

- Quick and Easy to Access: Free options are often readily available for download or use, so you can start working on your documents right away without any waiting period.

- Simple to Use: Free formats are usually straightforward and user-friendly, making them ideal for businesses that don’t need overly complex billing systems.

Benefits of Paid Options

On the other hand, opting for a paid version can provide additional features and customization options that may better suit growing businesses or those with more specific needs. Paid documents typically come with added benefits such as advanced design elements, detailed calculations, and customer support, which can enhance both the look and functionality of your financial documents.

- Advanced Customization: Paid formats offer more flexibility in design and functionality, allowing you to match your brand’s style and meet specific business needs.

- Built-In Calculations: Many paid options come with automated fields for calculations like taxes, discounts, and totals, reducing the risk of errors.

- Customer Support: With paid formats, you often receive dedicated support in case you run into any technical issues or need help customizing the document.

Ultimately, the choice between free and paid options depends on the complexity of your billing process and your business’s specific requirements. Free documents can be ideal for businesses with basic needs, while paid versions are better suited for those who require advanced features and more robust support.

Where to Find Reliable Invoice Templates

When it comes to creating professional billing documents, finding a reliable source for pre-designed formats is crucial. Whether you’re looking for a simple, basic layout or a more complex design with advanced features, there are numerous platforms where you can access high-quality options. The key is to choose reputable sources that offer well-structured, customizable formats that align with your business needs and ensure smooth transactions with clients.

Trusted Online Platforms

Many websites offer a variety of professionally designed billing documents for businesses of all sizes. These platforms provide both free and paid options, often with a wide selection of styles, designs, and features to choose from. Here are some of the most reliable places to find pre-designed formats:

- Business Software Providers: Companies that offer accounting or invoicing software often provide pre-made documents as part of their services. These formats are specifically designed to integrate seamlessly with their tools, ensuring a smooth workflow.

- Document Libraries: Websites like Microsoft Office, Google Docs, or Canva offer a wide variety of customizable formats that are both free and easy to edit. These are particularly helpful if you need a simple and quick solution.

- Online Marketplaces: Platforms such as Etsy or Creative Market feature high-quality, premium formats designed by professionals. These options often come with more advanced designs and additional customization features.

What to Look for in a Reliable Source

Not all sources are created equal, so it’s important to be discerning when choosing where to find your billing documents. Here are a few factors to consider to ensure you’re getting a reliable, professional option:

- Customization Options: The source should provide formats that allow you to easily edit and personalize the fields with your business and client information.

- Ease of Use: Choose platforms that offer user-friendly formats with intuitive editing tools. Complicated or confusing designs can slow down your workflow.

- Quality and Professionalism: Always opt for sources that offer high-quality, polished designs. Poorly designed documents may create a negative impression with clients.

By choosing a trustworthy platform, you can access a variety of high-quality billing documents that suit your business needs, streamline your processes, and maintain a professional appearance with every transaction.

Best Practices for Using Invoice Templates

Using pre-designed billing formats can streamline the process of creating professional documents for your business. However, to make the most out of these ready-made formats, it’s important to follow best practices that ensure accuracy, consistency, and professionalism. Adhering to these guidelines will not only improve the efficiency of your workflow but also enhance your credibility with clients.

1. Customize for Your Brand

While pre-made documents offer a solid foundation, personalizing them with your own branding elements is essential. This includes adding your logo, choosing brand colors, and using fonts that align with your company’s identity. Customization doesn’t just make your documents look professional–it also reinforces your brand image, making your communications instantly recognizable.

- Use your business logo: Place it at the top of the document for a consistent and polished appearance.

- Brand colors and fonts: Stick to your company’s color scheme and font choices to create a cohesive look across all your business documents.

2. Ensure Accurate and Clear Information

Even the most polished format is only as effective as the accuracy of the information it contains. Double-check all the details, including pricing, client information, and any dates. Miscommunication or errors can lead to delayed payments or misunderstandings, which is why attention to detail is essential. A clear and precise document will not only help you get paid faster but also reduce the chances of disputes with clients.

- Verify contact details: Ensure both your company and client’s information is correct and up-to-date.

- Accurate pricing: Double-check amounts, quantities, and any taxes or discounts to avoid mistakes that could affect your bottom line.

- Clear payment terms: Be explicit about payment due dates, accepted methods, and any late fees.

3. Keep It Simple and Organized

Simplicity is key when creating professional billing documents. Avoid unnecessary clutter and ensure that all sections are clearly labeled and easy to navigate. A clean, organized format will make it easier for clients to review the details and make payments promptly. Use logical section headings and ensure that the most important details, such as the total amount due and payment instructions, are prominently displayed.

- Use headings and subheadings: Break the information into clearly defined sections like services provided, payment details, and total amount due.

- Limit clutter: Keep

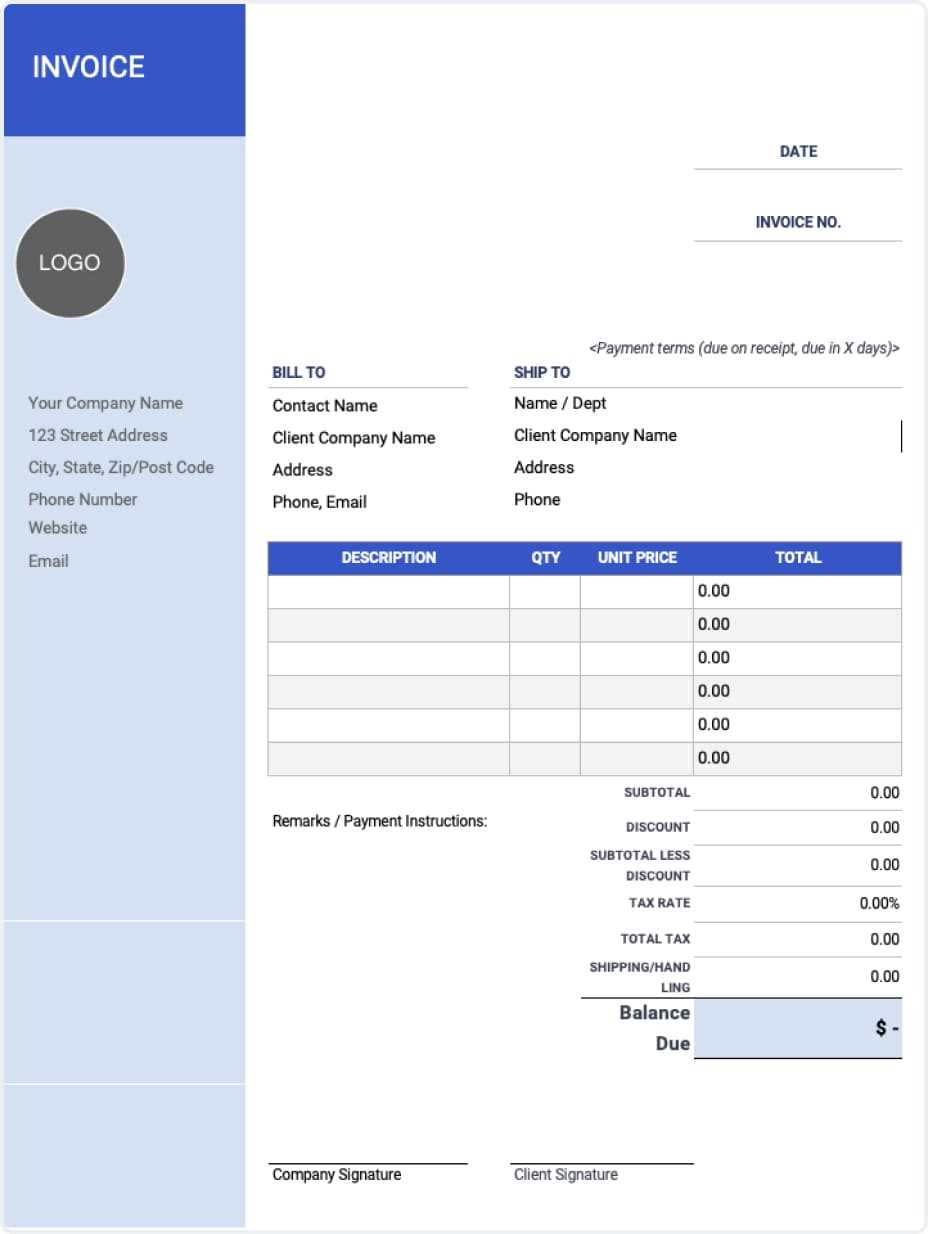

How to Personalize Your Invoice Template

Customizing your billing documents is essential for creating a professional and branded look that aligns with your business identity. Personalization not only makes your documents more recognizable but also helps build trust with your clients. By adjusting key elements, you can tailor the format to meet your needs and ensure that all necessary information is included in a clear and consistent manner.

1. Add Your Business Branding

Your business’s identity should be at the forefront of every communication, including billing. Personalizing your documents with your company’s logo, colors, and fonts helps reinforce your brand image and makes the documents feel more official. Here’s how you can incorporate your branding:

- Include your logo: Place your logo prominently at the top of the document to help with brand recognition.

- Choose brand colors: Match the document’s color scheme with your company’s colors to maintain consistency in your branding.

- Use consistent fonts: Select fonts that are used in your marketing materials to create a unified look across all platforms.

2. Customize Client and Service Details

Make sure that all relevant client information is easily accessible and personalized. Including specific details about the products or services provided helps make the document feel more tailored to the customer, improving their experience. Here’s what you can do:

- Client Information: Include the client’s name, address, and contact details so that it’s clear who the document is intended for.

- Product or Service Descriptions: Include detailed descriptions of the services rendered or goods sold to ensure clarity for the client.

- Individual Pricing: List the costs of each item or service provided, showing clients a breakdown of charges.

3. Set Payment Terms and Instructions

It’s important to personalize the payment terms to reflect your business policies. Setting clear expectations can help avoid confusion and ensure timely payments. Here’s how you can make payment instructions clear and specific:

- Specify Payment Methods: Indicate what payment methods are accepted, such as credit cards, bank transfers, or online payment systems.

- State Due Dates: Make sure to clearly list the payment due date, along with any penalties or late fees if applicable.

- Include Your Contact Details: Provide your business’s contact informa

Integrating Templates with Accounting Software

Integrating ready-made billing formats with accounting software can significantly enhance your workflow, automate routine tasks, and improve overall efficiency. By syncing your documents with software tools designed for managing finances, you can streamline the invoicing process, reduce human error, and ensure consistency across your business’s financial records. This integration not only saves time but also simplifies the management of payments, taxes, and client information.

1. Automating Data Entry

When using accounting software, one of the key benefits is the ability to automatically populate fields within your billing documents. Instead of manually entering client details, prices, or transaction dates, you can set up the software to pull this information from your customer database and automatically fill in the relevant fields in your documents. This reduces the chance of errors and ensures consistency across all your communications.

- Link Client Database: Integrate your accounting software with your client database to pull up-to-date contact details and transaction history directly into your billing documents.

- Automate Product or Service Entries: Set up the system to automatically list the items or services purchased, with prices and quantities, without manual input.

- Tax Calculation: Many accounting tools automatically calculate applicable taxes based on your location and business type, ensuring accuracy every time.

2. Streamlining Payment Tracking

Integrating your billing system with accounting software makes tracking payments far easier. You can monitor whether clients have paid their bills, see which invoices are overdue, and quickly send reminders or issue follow-ups. Most software also provides real-time payment tracking, making it easy to update your records as payments are received.

- Real-Time Updates: Sync your payment statuses with your billing documents to immediately reflect changes once payments are made.

- Set Reminders: Use your accounting software to set up automated reminders for overdue invoices, ensuring you don’t miss any follow-up opportunities.

- Payment Reconciliation: Easily match incoming payments to specific documents and update the status automatically within the software.

3. Enhancing Reporting and Analysis

Another major benefit of integrating your billing formats with accounting software is the ability to generate detailed reports. Software tools often allow you to track your financial data over time, giving you insights into trends such as income, expenses, and o

Legal Considerations When Using Invoice Templates

When creating financial documents for your business, it is important to ensure that they meet legal requirements to protect both your company and your clients. Whether you’re using a pre-designed format or customizing one for your specific needs, certain elements must be included to comply with local and international laws. Failure to do so could lead to issues with payment disputes, tax compliance, and even legal penalties.

1. Include Required Legal Information

To ensure your documents are legally binding and clear, they must include specific details about your business, the transaction, and the payment terms. These key elements can vary depending on your location, industry, and the type of goods or services you provide, but there are common requirements that apply in most cases:

- Business Information: Include your business name, address, phone number, and registration number (if applicable). This helps verify the legitimacy of your company.

- Client Information: Ensure the recipient’s full name or company details are included, along with their address and contact information.

- Description of Goods/Services: Provide a detailed breakdown of the products or services delivered, including quantities and unit prices.

- Payment Terms: Specify the payment due date, accepted payment methods, and any applicable late fees or interest charges for overdue payments.

- Tax Information: In many jurisdictions, you must include tax identification numbers or VAT registration numbers to ensure proper tax reporting.

2. Comply with Tax Regulations

Tax laws vary widely depending on your country and business structure. It’s essential to ensure that all required taxes are calculated accurately and displayed on your financial documents. Many regions require businesses to charge value-added tax (VAT), sales tax, or other applicable taxes on their transactions. Not adhering to these regulations can result in financial penalties or legal issues.

- Correct Tax Rates: Make sure to apply the correct tax rates for the region in which your business operates, as well as the location of the client.

- Tax Identification Number: If applicable, include your business’s tax ID or VAT number to ensure compliance with tax authorities.

- Tax Breakdown: Clearly state how much tax is being charged, separating it from the base price of the goods or services.

3. Protect Your Intellectual Property

If you’re using or creating customized documents for your business, it’s e