Pledge Invoice Template for Easy Payment Tracking

Managing financial agreements and tracking payments can be a challenging task for businesses, nonprofits, and individuals alike. Whether you’re handling donations, loans, or other forms of financial support, it’s crucial to have a structured approach to ensure accuracy and accountability. By using a well-designed document that outlines payment terms, you can streamline the process and avoid confusion down the line.

One of the most efficient ways to keep track of such financial arrangements is by utilizing a formalized document that clearly details the agreed-upon amounts, payment schedules, and any other important terms. This document not only provides clarity for all parties involved but also serves as a professional record of the commitment, ensuring smooth transactions and fostering trust between the concerned parties.

In this article, we will explore how to create and use such documents effectively, focusing on their essential elements, benefits, and practical applications. Whether you are managing a donation campaign, tracking loan payments, or handling corporate financial agreements, the right approach can save you time, prevent errors, and help maintain strong relationships with your financial partners.

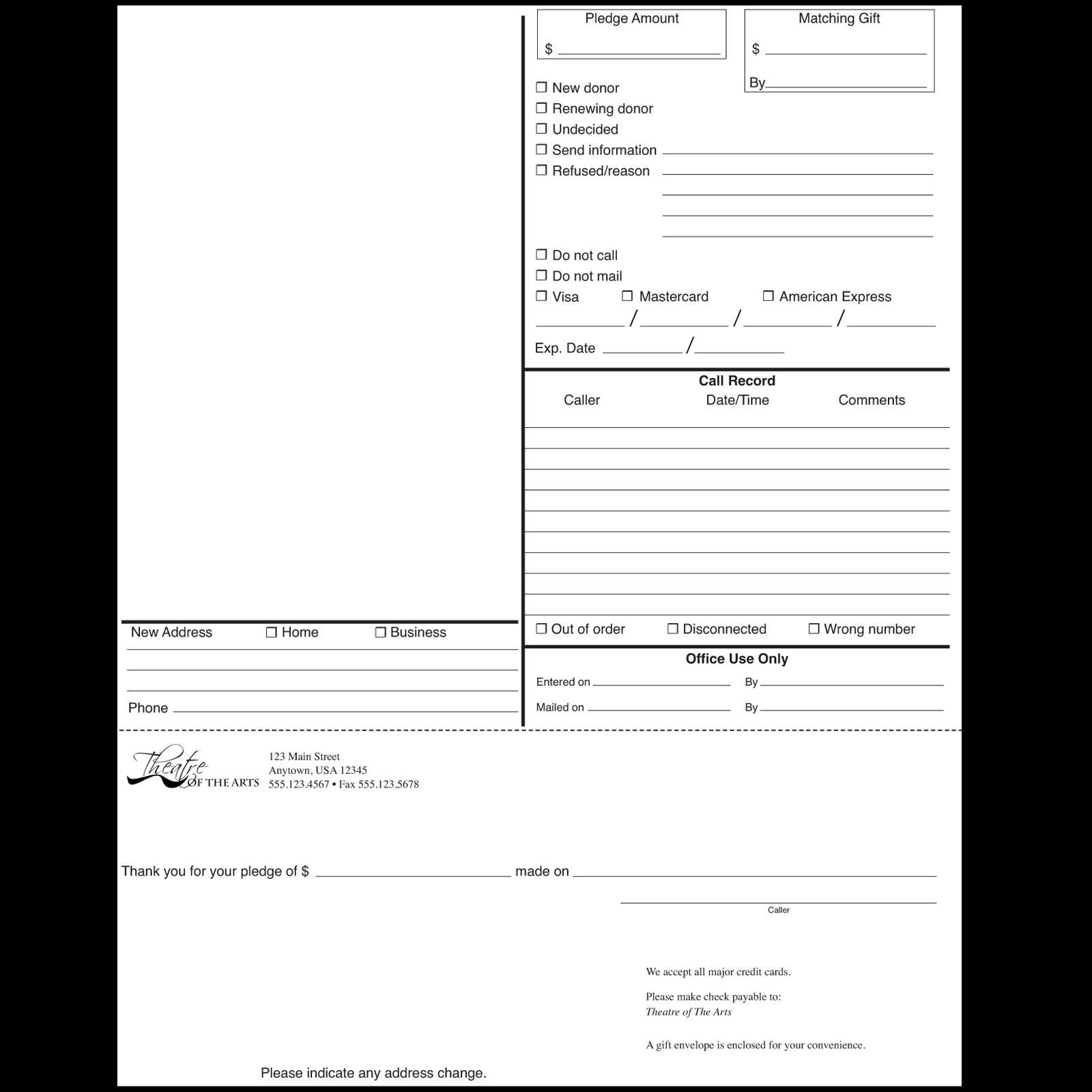

What is a Pledge Invoice Template?

In any financial agreement where a party commits to making payments over time, it’s essential to have a clear and organized document that outlines the terms. This document serves as a record of the commitment, ensuring both sides understand the expectations regarding payment amounts, due dates, and other important details. It functions not only as a reminder but also as a formal reference throughout the duration of the arrangement.

Such a document typically includes key information such as the total amount, payment schedule, and contact details for both the payer and the recipient. It is designed to provide clarity and prevent misunderstandings, making sure that all aspects of the financial agreement are properly documented and easy to follow.

The purpose of this document is to maintain transparency between the involved parties, ensuring that both are on the same page regarding financial obligations. By having a structured form to refer to, both the giver and the recipient can easily track the progress of the financial commitment.

| Element | Description |

|---|---|

| Amount | The total amount committed to be paid. |

| Payment Schedule | Details of when payments are due, whether in installments or as a lump sum. |

| Recipient Information | Details of the party receiving the payment, including name, address, and contact details. |

| Payer Information | Details of the person or entity making the payment. |

| Terms | Any additional conditions, such as interest rates, penalties for missed payments, or flexibility in payment dates. |

How to Create a Pledge Invoice

Creating a clear and professional document for tracking financial commitments involves several key steps to ensure all terms are accurately outlined. This document should not only include the agreed amount and payment schedule but also provide a structured format that makes it easy for both parties to understand and follow. A well-crafted document helps avoid confusion, ensuring that both the giver and the receiver are aligned on all aspects of the arrangement.

To create this kind of document, you’ll need to start by gathering all the necessary information. This includes the total amount agreed upon, the payment deadlines, and the contact details for both parties. Next, you will want to format the document in a clear, organized way that makes all of these details easy to read and reference.

Once you have all the relevant details, here are the basic steps to follow:

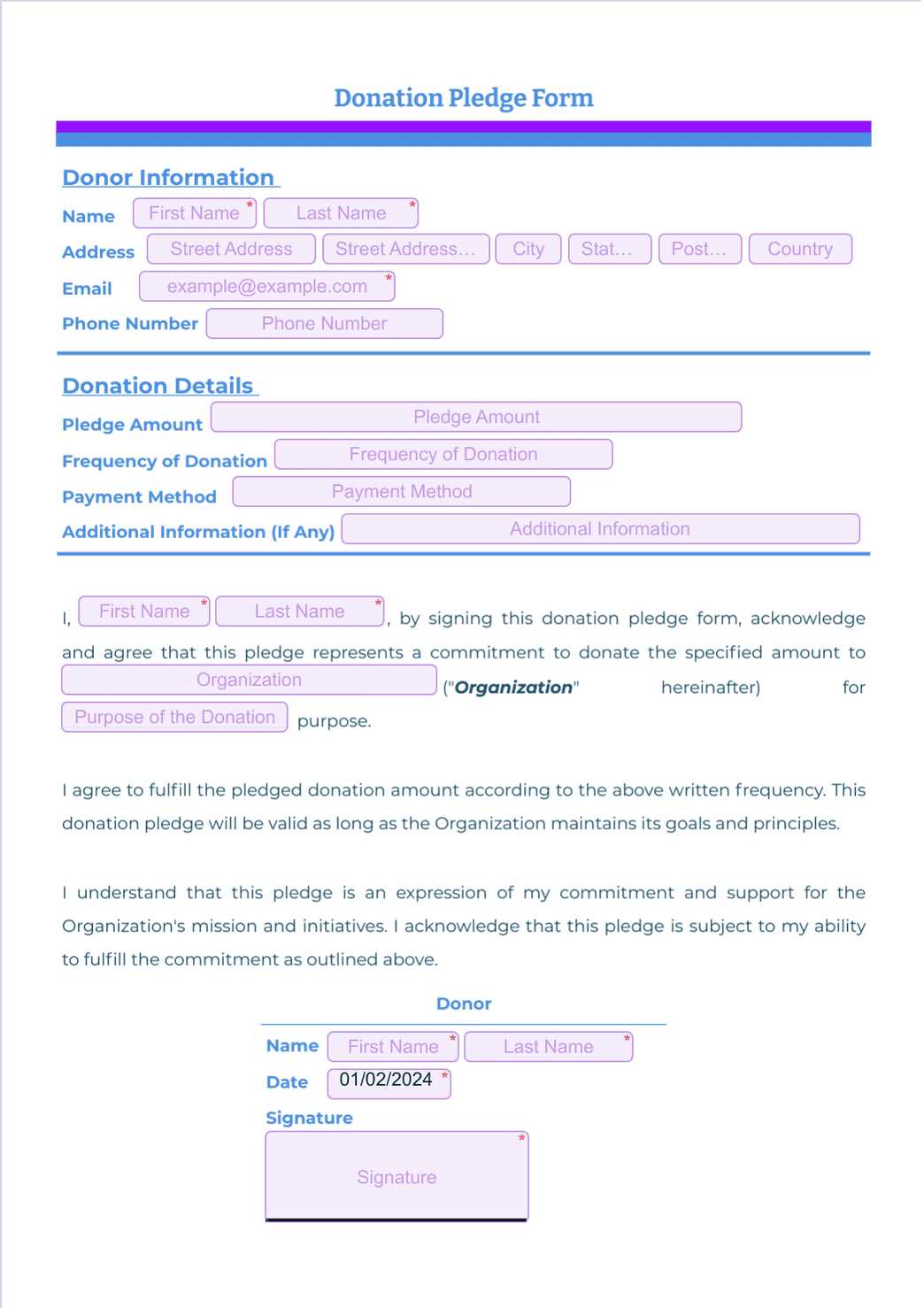

- Include basic contact information: Start by listing the names, addresses, and phone numbers for both the payer and the recipient. This helps to identify the parties involved in the agreement.

- Clearly state the total amount: Specify the total amount to be paid, ensuring that both parties know the full commitment.

- Detail the payment schedule: Break down when payments are due, whether they are due in full or in installments. Specify the dates and any relevant conditions (such as penalties for late payments).

- Outline any terms and conditions: This might include interest rates, additional fees, or any flexibility in the payment timeline.

- Provide space for signatures: Both parties should sign the document to indicate their agreement to the terms outlined.

By following these steps, you will create a comprehensive and clear record of the financial commitment. Having this document not only formalizes the agreement but also provides both parties with a reference point should any questions or issues arise during the process.

Benefits of Using a Pledge Invoice

Having a formalized document to track financial commitments provides numerous advantages for both the payer and the recipient. Whether managing donations, loans, or other forms of payment agreements, a structured record ensures clarity and prevents misunderstandings. It helps maintain a smooth transaction process by making all terms explicit and transparent for both parties.

Increased Clarity and Transparency

One of the primary benefits of using a structured financial record is the clarity it brings to the arrangement. It ensures that both parties are on the same page regarding the agreed amount, due dates, and any other conditions. This can help avoid confusion and disagreements, as every detail is laid out in a clear and understandable format.

Enhanced Accountability and Record-Keeping

A well-organized document serves as a reliable record for future reference. It can be used to track payments, review the history of financial commitments, and serve as proof of agreement in case of disputes. This level of documentation ensures that both parties are held accountable to the terms of the agreement, reducing the risk of missed payments or forgotten obligations.

| Benefit | Description |

|---|---|

| Clear Communication | Ensures both parties understand the terms of the financial agreement. |

| Accurate Record-Keeping | Provides a formalized document for tracking payments and obligations. |

| Legal Protection | Acts as a formal reference in case of disputes or legal issues. |

| Improved Trust | Demonstrates professionalism and commitment to transparency. |

In addition to these benefits, using such a document can also foster trust between the involved parties. It shows a commitment to maintaining professional standards and ensures that both sides have a solid understanding of their

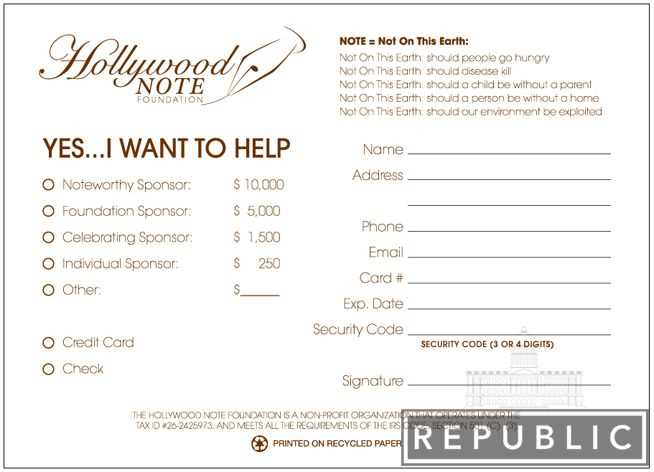

Key Components of a Pledge Invoice

For a financial agreement to be clear and legally binding, it must include certain essential details. These elements ensure both parties fully understand the terms, reducing the potential for confusion or disputes. A well-structured document should contain comprehensive information that covers all aspects of the commitment, from the total amount to payment terms and contact details.

Here are the key components that should be included in any financial agreement document:

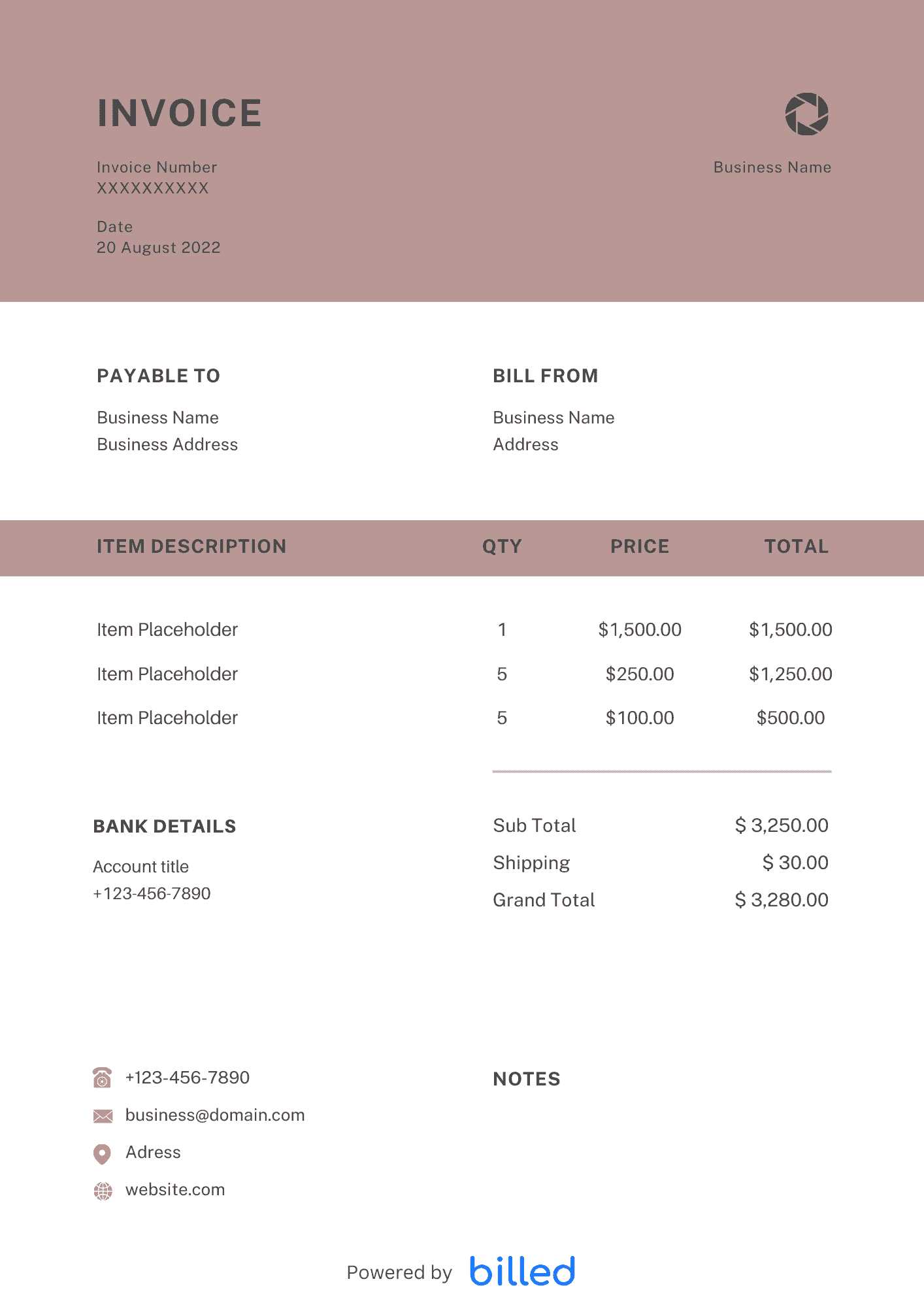

- Contact Information: Both the payer and the recipient should be clearly identified, including their names, addresses, and phone numbers. This ensures both parties can be easily reached if needed.

- Total Amount: Clearly state the total amount that is to be paid. This provides transparency and ensures there is no misunderstanding about the financial commitment.

- Payment Schedule: Outline the payment dates and whether payments are made in full or in installments. Include the frequency of payments, such as monthly or quarterly, and specify any grace periods or penalties for late payments.

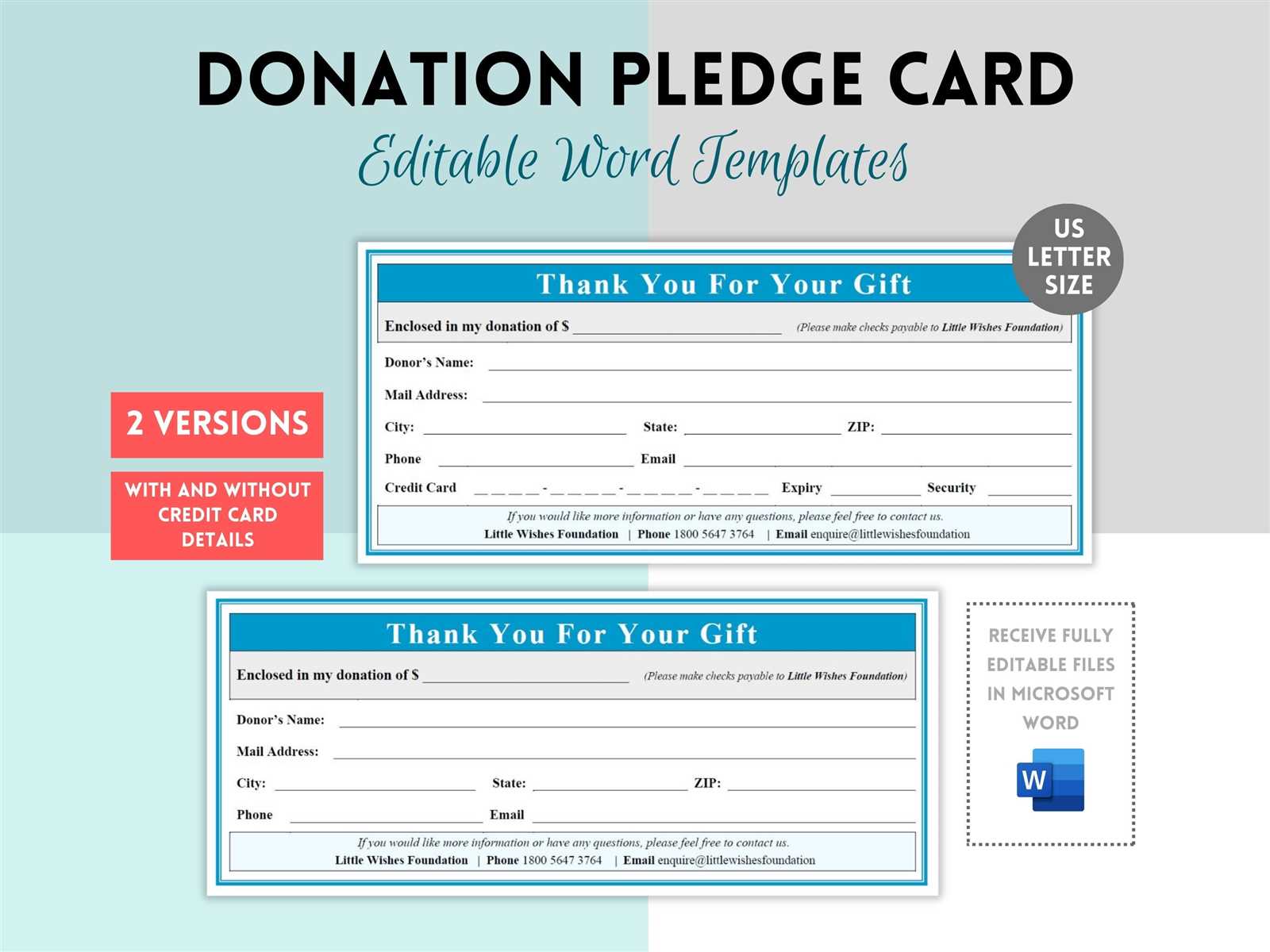

- Payment Methods: Indicate how payments should be made (e.g., bank transfer, credit card, check). This ensures both parties know the preferred method for transaction completion.

- Terms and Conditions: Any special terms, such as interest rates, early repayment options, or flexibility regarding payment delays, should be clearly listed to avoid potential conflicts.

- Signatures: Both parties should sign the document to formally acknowledge and agree to the terms outlined. This provides legal validation to the arrangement.

These components ensure that all necessary details are included, making the financial agreement transparent and secure for both parties. By having a complete and clear document, both the payer and recipient can move forward with confidence, knowing that all terms have been explicitly stated and agreed upon.

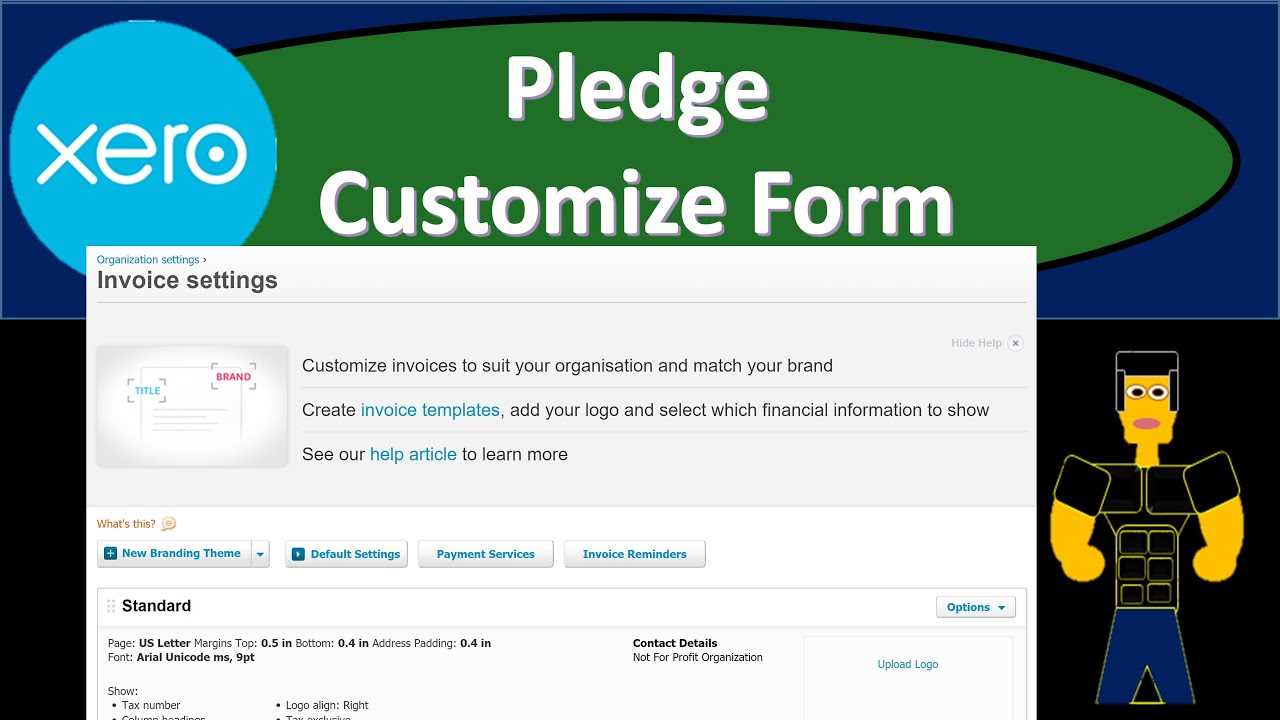

Customizing Your Pledge Invoice Template

Personalizing your financial agreement document ensures that it fits the specific needs of your arrangement, whether it’s for a donation, loan, or any other form of commitment. Customization allows you to tailor the layout, information, and even the terms to best suit your unique situation. A customized document can help make the process more efficient and align it with your organization’s branding or personal preferences.

Here are several ways you can personalize the structure and content of your financial record:

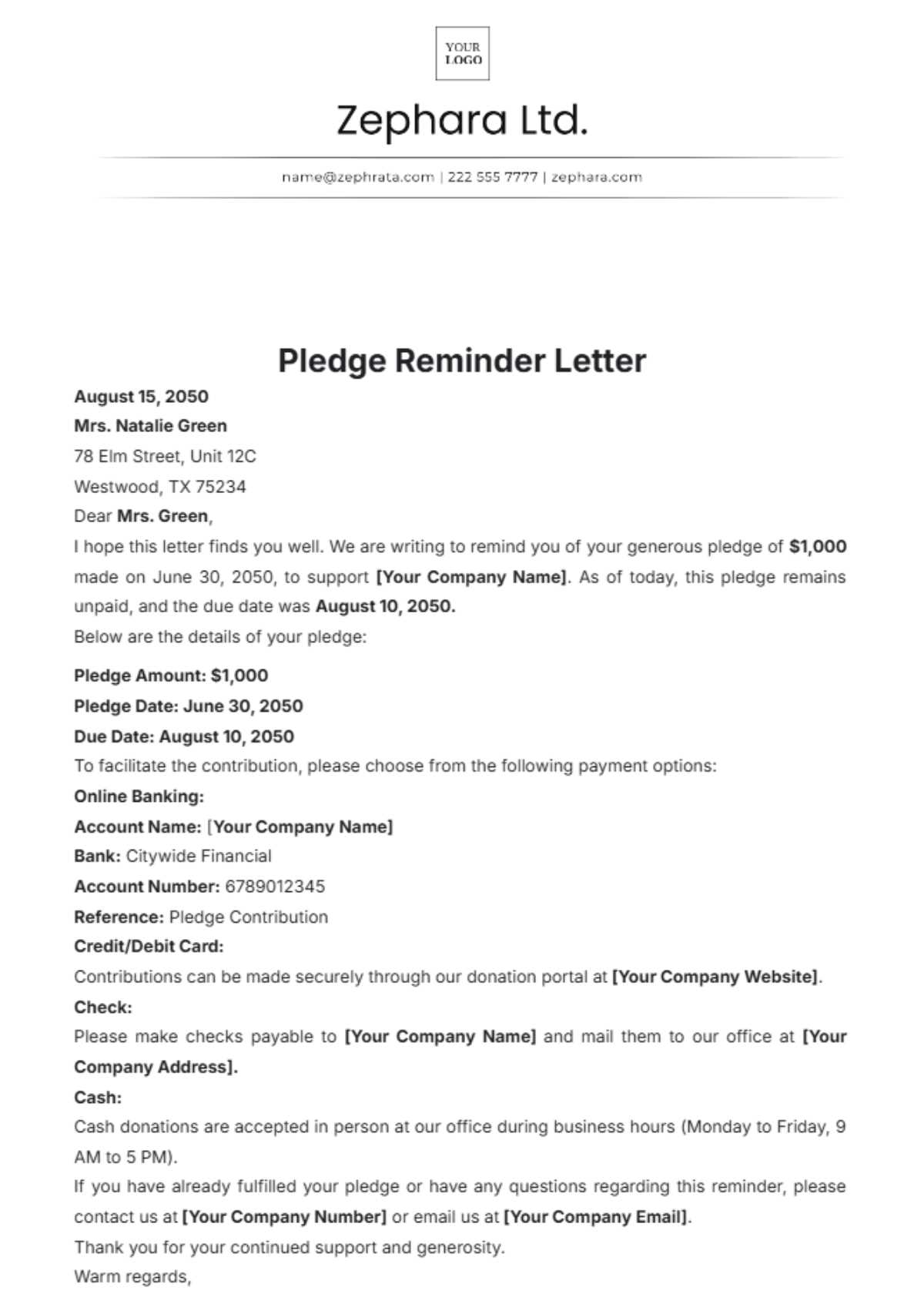

- Design and Branding: Customize the document’s appearance by adding your logo, choosing specific fonts, and using colors that align with your brand. This makes the document not only functional but professional and visually appealing.

- Personalized Terms: Depending on the type of agreement, you may want to adjust the payment terms to reflect your unique requirements. For instance, you might include flexible payment options, customized late fees, or specific conditions regarding early repayment.

- Additional Information: If necessary, you can include extra fields for additional details, such as a description of the services provided, any project milestones, or conditions for ongoing support. This makes the document more comprehensive.

- Payment Instructions: Include specific instructions for how payments should be made, such as bank account details, PayPal information, or other payment methods, ensuring the process is as straightforward as possible.

- Multiple Payment Options: If your arrangement allows for different payment methods, customize the document by clearly listing each option and any associated fees or conditions that might apply to each method.

By customizing the financial agreement document, you make it more effective for both the payer and recipient, ensuring all terms are clearly defined and easy to follow. Personalization not only increases clarity but also reflects professionalism and helps maintain a positive relationship between both parties throughout the course of the agreement.

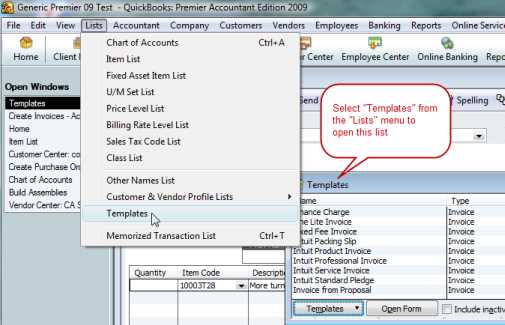

How to Save Time with Templates

When managing tasks that involve repetitive documentation, efficiency becomes key. Having pre-designed structures that can be easily customized for different needs allows for quick execution and reduces the chances of errors. By using pre-built formats, you can save time on formatting, organizing, and ensuring consistency, allowing you to focus on more important aspects of your work.

One of the most significant benefits is the ability to streamline workflows. Instead of starting from scratch every time a new document is required, you can quickly input the necessary details into a ready-made layout. This not only speeds up the process but also reduces the cognitive load of having to think through every step from the beginning.

Additionally, using ready-made structures ensures uniformity across all your documents, helping to maintain a professional appearance. This is particularly valuable when handling multiple projects or clients, as consistency reinforces credibility and trust.

Overall, the time saved by using pre-established formats can be redirected toward other important tasks, making it a smart strategy for enhancing productivity and meeting deadlines more efficiently.

Common Mistakes to Avoid in Invoices

Creating accurate financial documents is essential for smooth transactions and maintaining a professional image. Small errors can lead to misunderstandings, delays in payments, or even damaged relationships with clients. It’s crucial to pay attention to details to avoid common pitfalls that could affect the clarity and professionalism of your paperwork.

Missing or Incorrect Details

One of the most frequent mistakes is leaving out essential information or providing incorrect details. Ensure all contact information, payment terms, and item descriptions are accurate to avoid confusion and disputes. Even minor errors, like misspelled names or incorrect dates, can cause unnecessary delays in processing.

| Error Type | Possible Impact |

|---|---|

| Omitted Contact Information | Delays in communication and payment issues |

| Incorrect Payment Terms | Confusion and payment delays |

| Wrong Date or Amount | Client disputes and trust issues |

Unclear or Ambiguous Terms

Another common mistake is using vague or ambiguous language in your documentation. It’s essential to be clear about payment deadlines, late fees, and any other terms of the agreement. Ambiguity in such areas can lead to confusion and conflicts later on, so always aim for clear and precise wording.

Legal Considerations for Pledge Invoices

When creating financial documents that involve a formal commitment or promise of payment, it’s essential to be aware of the legal framework surrounding them. A clear understanding of the relevant laws ensures that both parties are protected and that the terms are enforceable in case of disputes. Failing to meet legal requirements can lead to complications, penalties, or even invalid agreements.

Compliance with Local Regulations

Different jurisdictions have varying regulations that govern financial agreements and documentation. It’s important to research and adhere to local laws to ensure that the terms of the agreement are valid and enforceable. This includes correctly documenting payment deadlines, the amount due, and any applicable taxes or fees. Non-compliance with legal requirements could result in fines, delayed payments, or invalidation of the agreement.

Clarity in Terms and Conditions

Clear and precise terms are critical to avoid future disputes. It is essential to specify the rights and obligations of both parties in detail, including payment terms, penalties for late payments, and other conditions. Vague or ambiguous clauses may not hold up in a legal context, so ensure that all conditions are explicitly stated and understood by both parties. Transparency in terms not only fosters trust but also strengthens the legal standing of your document if any issues arise.

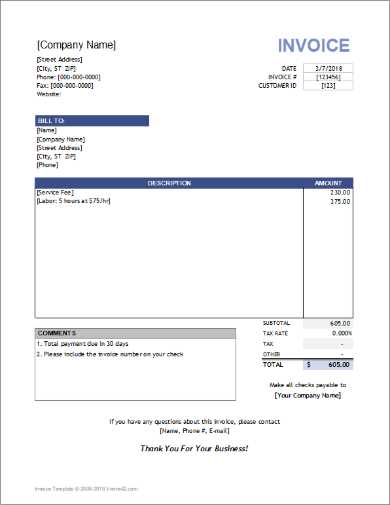

Choosing the Right Invoice Template

Selecting the appropriate structure for your financial documents is a key step in ensuring clarity and professionalism. The right format not only enhances the appearance of your documents but also streamlines the process of documenting transactions. Whether you are creating a basic or detailed record, the correct choice can make a significant difference in how efficiently you handle payments and maintain consistency.

Consider Your Business Needs

Different types of businesses may require different document formats. For example, a service-based business may need a simple, straightforward design, while a company dealing with multiple products or services might benefit from a more detailed layout. Understanding your specific needs helps you choose a structure that will efficiently capture all necessary information without being overly complex.

Focus on Simplicity and Clarity

While a detailed layout might seem appealing, simplicity is often the best approach. The easier your documents are to read and understand, the fewer chances there are for mistakes or confusion. Look for a structure that allows for clear itemization, easy customization, and logical organization. Prioritizing simplicity ensures that both you and your clients can quickly access and review the necessary information.

How to Format Your Pledge Invoice

Proper formatting of financial documents is essential to ensure that all necessary information is presented clearly and professionally. A well-structured record not only facilitates easy understanding for both you and your clients but also helps avoid any confusion or disputes regarding the transaction details. It’s important to organize your content in a logical way that highlights key information while maintaining readability.

Organize Key Information Clearly

Start by ensuring that the most critical details are easy to find. Your document should include the following sections: client information, a description of the goods or services, the payment amount, and the terms of payment. These sections should be clearly labeled and easy to read. Use headers and bold text to highlight these important areas so they stand out at a glance.

Maintain Consistency and Clean Design

A clean and consistent design helps build trust and makes the document easier to follow. Use a simple layout with a logical flow of information. Avoid clutter and ensure that there’s enough white space between sections. Consistent fonts and alignment contribute to a polished, professional look and make your document easier to navigate for clients.

Integrating Payment Options into Invoices

Offering a variety of payment methods within your financial documents not only enhances convenience for your clients but also speeds up the payment process. By clearly presenting different ways to settle a balance, you make it easier for customers to choose the method that works best for them. This approach can reduce delays and increase the likelihood of on-time payments.

Common Payment Methods to Include

Including multiple payment options is essential for accommodating clients with different preferences. Here are some popular methods to consider:

- Bank transfers

- Credit or debit card payments

- Online payment platforms (e.g., PayPal, Stripe)

- Checks

- Cryptocurrency (for tech-savvy clients)

Clear Instructions and Payment Deadlines

Ensure that the instructions for each payment method are clear and easy to follow. For instance, provide the necessary bank account details for wire transfers or a payment link for online platforms. Additionally, clearly state the due date and any late fee policies. This ensures clients know exactly how to pay and when, reducing the risk of delays.

Why Accuracy Matters in Pledge Invoices

When it comes to financial documents, precision is crucial. Any errors or inconsistencies can lead to confusion, delayed payments, and potential disputes. Ensuring that all details are accurate not only protects your business but also builds trust with your clients. A small mistake, such as a wrong amount or incorrect date, can have significant consequences, impacting both your reputation and cash flow.

Key Reasons for Maintaining Accuracy

Here are some important reasons why accuracy is essential in your financial records:

- Prevents Payment Delays: Incorrect information can lead to confusion, delaying the payment process.

- Minimizes Disputes: Accurate documentation reduces the chance of disagreements over amounts, terms, or services provided.

- Enhances Professionalism: Well-documented and precise records reflect a high level of professionalism, instilling confidence in your clients.

- Maintains Legal Compliance: Errors can lead to legal issues, especially if contractual obligations are not clearly outlined.

Common Accuracy Pitfalls to Avoid

To ensure accuracy, pay attention to these common mistakes:

- Incorrect payment amounts or missing fees

- Wrong or outdated contact details

- Ambiguous or vague payment terms

- Failure to update tax rates or other regulatory information

By avoiding these pitfalls, you can ensure smoother transactions and maintain a positive relationship with your clients.

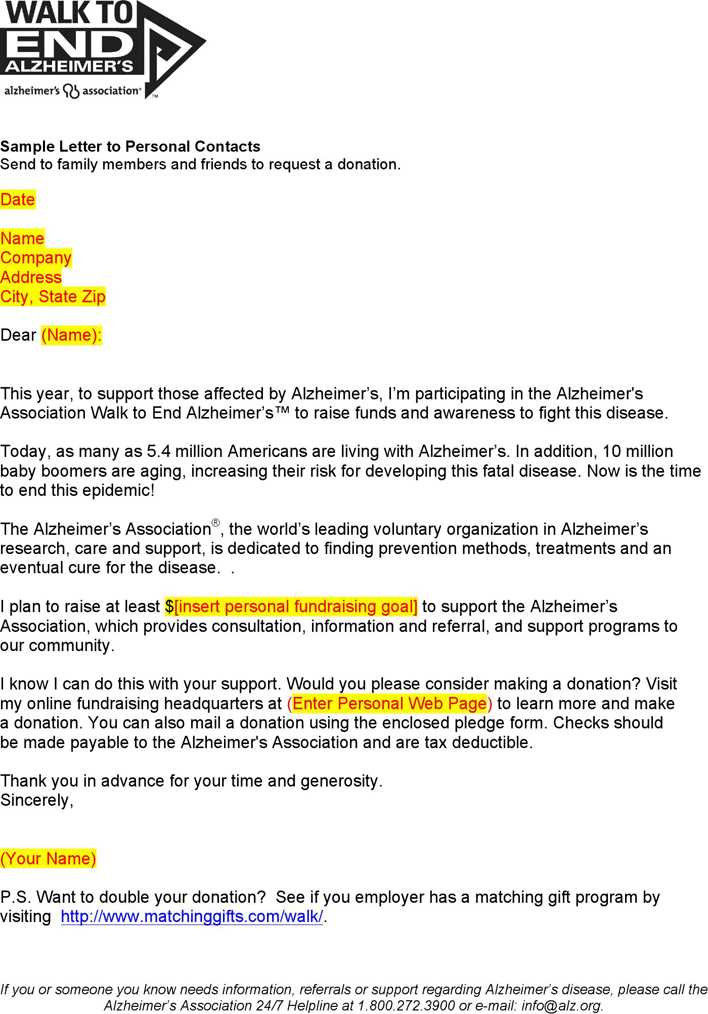

Using Pledge Invoices for Fundraising

In fundraising efforts, clear documentation is key to tracking contributions and ensuring that promises of support are properly acknowledged. By using formal financial records for commitment-based donations, organizers can easily manage and follow up with donors, creating transparency and trust throughout the process. These documents help outline the agreed-upon amounts and deadlines, ensuring both parties are aligned on expectations.

Benefits of Using Structured Documents for Fundraising

Incorporating formalized records into your fundraising strategy provides several advantages:

- Clarity: Clearly outlines the donor’s commitment, amount, and due date, leaving no room for confusion.

- Accountability: Helps both the donor and the organization stay accountable for their responsibilities.

- Tracking and Reporting: Makes it easier to track pledged donations and provide reports to stakeholders or regulatory bodies.

- Professionalism: A formal, professional approach can encourage higher levels of trust and participation from potential donors.

Key Elements to Include for Fundraising Commitments

When creating these financial records for donations, be sure to include the following essential details:

- Donor information (name, contact details)

- Amount pledged and currency

- Payment schedule or deadlines

- Method of payment (e.g., bank transfer, online payment, check)

- Any terms regarding tax deductions or benefits

By integrating these elements, you ensure that the fundraising process is organized and that your organization is prepared to handle all aspects of donor commitments effectively.

Tracking Payments with Pledge Invoices

Efficiently tracking payments is crucial for managing commitments and ensuring that all transactions are completed on time. By systematically documenting each pledged amount and its corresponding payment, you can easily monitor outstanding balances and follow up with clients or donors. A structured approach to tracking payments helps avoid confusion and ensures transparency throughout the process.

Key Steps for Effective Payment Tracking

To stay organized and on top of payments, follow these essential steps:

- Record Payment Details: Document the pledged amount, the payment method, and the due date for each contribution.

- Update Payment Status Regularly: As payments are made, update your records to reflect partial or full payments received.

- Track Outstanding Balances: Keep track of any remaining amounts to be paid, ensuring that no payments are missed or overlooked.

- Generate Reports: Regularly create payment summaries or reports to provide an overview of the status of all outstanding commitments.

Tools for Managing and Monitoring Payments

Using digital tools and software can make tracking payments even more efficient. Consider utilizing:

- Accounting software that integrates payment tracking features

- Online platforms that allow donors or clients to make payments directly

- Spreadsheets or databases to manually track payments and update records

By leveraging these tools, you can easily manage the entire payment process and ensure timely and accurate tracking of each commitment.

Best Practices for Pledge Invoices

When it comes to requesting payments for commitments, it is essential to ensure clarity, professionalism, and efficiency in your approach. This section outlines key considerations for structuring a financial request that supports timely payments while maintaining positive relationships with contributors. By following these practices, you can enhance transparency and ensure all necessary information is easily accessible to recipients.

Clear and Detailed Information

Provide all relevant details in an organized manner. This includes the recipient’s name, the total amount due, the specific purpose or agreement behind the financial request, and the due date for payment. The clearer the information, the easier it will be for the individual to understand the request and make the necessary payment without confusion.

Polite and Professional Tone

It is crucial to maintain a respectful and courteous tone in all communications. Ensure that the message is formal, yet friendly, and reflects your appreciation for the recipient’s support. This helps to create a positive atmosphere and encourages prompt action while fostering trust and respect in your relationship.