Number Invoice Template for Streamlined and Professional Billing

Managing transaction records can be a complex task, especially when handling numerous client interactions. Establishing an organized format helps to simplify billing, ensuring that each record is clear and accessible. This structured approach to documentation supports better accuracy, prevents errors, and allows for a more professional presentation.

Whether running a small business or managing larger accounts, using a predefined format for each billing document aids in maintaining consistency. These formats are often designed to include essential fields, allowing quick customization while maintaining an orderly sequence. With an efficient layout, tracking becomes faster, making it easier to follow payment statuses and understand financial overviews.

Automated systems or downloadable formats can add further efficiency, especially for businesses that process multiple transactions regularly. By incorporating these structured tools into your workflow, you can reduce administrative workload, improve client satisfaction, and uphold a polished image. The following guide explores effective document layouts and practical tips for their use.

Complete Guide to Number Invoice Templates

Organized billing documents play a vital role in efficient financial management. By adopting a consistent approach, businesses can simplify tracking and enhance the clarity of each transaction record. This method not only reduces administrative tasks but also builds a more professional relationship with clients, ensuring transparent and structured financial exchanges.

A well-structured document helps both the issuer and recipient understand essential details at a glance. Each section is strategically designed to capture key information, including service descriptions, amounts, and terms, making it easy to follow the transaction flow. With a standardized layout, it becomes far simpler to maintain consistency, avoid errors, and establish a reliable filing system.

Using preformatted layouts or automated tools can significantly improve the overall process, especially when managing high volumes. These formats are crafted to fit various needs, offering flexibility while preserving uniformity. As a result, businesses can save time on documentation, ensuring that billing remains accurate and up

Benefits of Using Numbered Invoices

Implementing a systematic approach to billing records provides numerous advantages, particularly for tracking and organization. Each entry becomes more accessible and straightforward to review, reducing confusion and improving efficiency in financial management. For businesses and freelancers alike, an orderly system supports accurate record-keeping and a more streamlined workflow.

Enhanced Organization and Tracking

A structured format allows businesses to quickly locate specific transaction records, reducing the time spent searching through extensive data. This method improves the visibility of each transaction, making it easier to verify details or manage follow-ups if necessary.

Improved Professionalism and Client Trust

Presenting a clear, well-organized document establishes a positive impression on clients. It reflects attention to detail and reliability, reinforcing the credibility of your business and fostering trust. Additionally, it reduces potential errors, ensuring that both parties have a clear understanding of the transaction.

| Advantage |

|---|

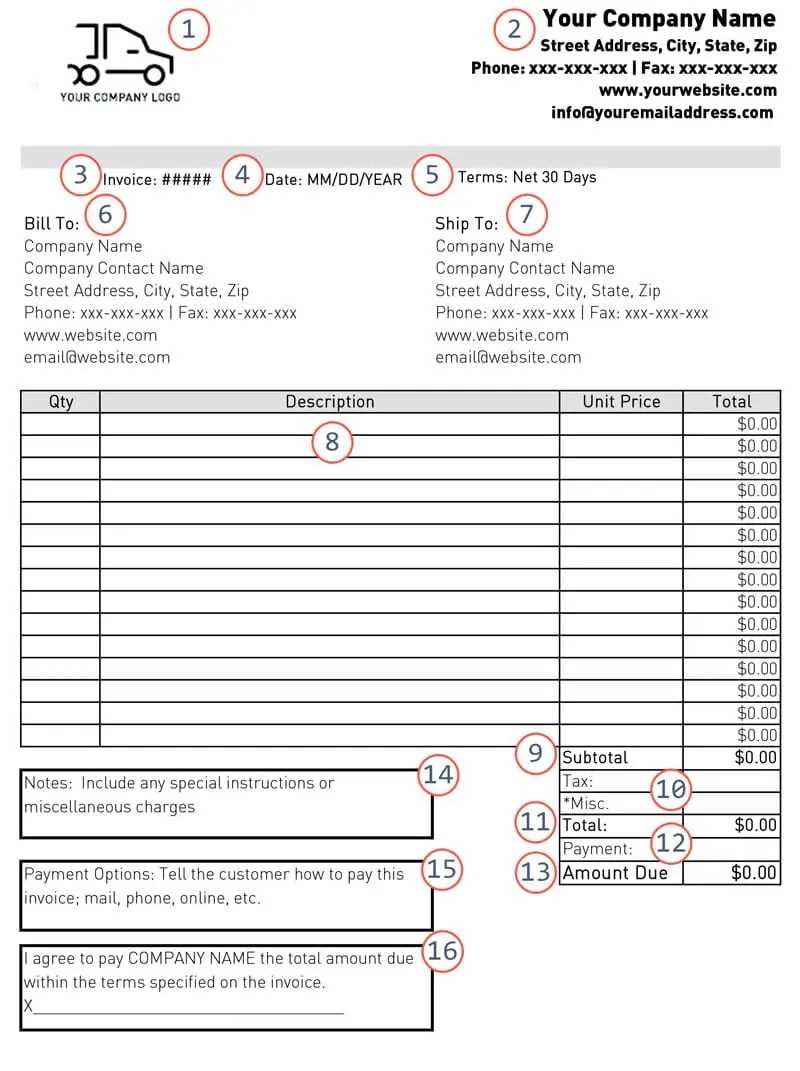

| Element | Description |

|---|---|

| Unique Identifier | A distinct code or reference that helps track and differentiate each transaction. |

| Client Information | Details of the customer, such as name, address, and contact information, to identify the recipient. |

| Transaction Details | A clear description of the goods or services provided, including quantities, rates, and totals. |

| Payment Terms | The agreed-upon terms for payment, including deadlines and any late fees or discounts. |

| Dates | The issue date and due date to ensure timely processing and payment. |

Common Mistakes in Invoice Numbering

When managing transaction records, it’s easy to overlook small errors in the sequencing process. However, these mistakes can lead to confusion, disrupt business operations, and complicate the management of payments. Understanding the common errors can help businesses establish a more efficient and reliable system for tracking transactions.

Frequent Errors in Record Sequencing

Some of the most common mistakes made when assigning identifiers include:

- Skipping numbers: Leaving gaps in the sequence can cause confusion and make it harder to track records.

- Reusing identifiers: Using the same reference for different transactions can lead to errors and miscommunication.

- Non-sequential numbering: Jumping around in the sequence or using non-logical codes makes record-keeping more difficult and prone to errors.

- Lack of clarity: Not having a standardized system for formatting numbers can create ambiguity in identifying specific transactions.

How to Avoid These Mistakes

To ensure proper record-keeping, businesses should establish clear rules for assigning unique identifiers, avoid skipping or reusing numbers, and maintain a consistent format. Automation tools can help reduce human error and make it easier to maintain an organized system over time. Following these practices will ensure a more streamlined process and minimize issues related to tracking transactions.

Tips for Organizing Invoices Efficiently

Efficient organization of transaction records is crucial for smooth business operations. A well-structured system helps ensure that payments are tracked accurately, clients are billed correctly, and all financial documents are easy to access. By adopting a few simple strategies, businesses can streamline their process and minimize errors, leading to improved productivity and professionalism.

One key approach is to implement a clear, consistent system for categorizing and storing documents. Using logical identifiers and organizing records by date, client, or service type can make it easier to locate specific entries. Additionally, adopting digital tools for tracking and storing documents can significantly reduce clutter and improve overall organization. These practices will ensure that your records are always up to date and easily accessible when needed.

Importance of Sequential Invoice Numbers

Maintaining a logical and consistent order for transaction references plays a crucial role in business operations. A sequential system for tracking billing records ensures that each document can be easily identified, located, and reconciled. This method not only helps in keeping track of payments but also ensures clarity in financial management, reducing the risk of errors and confusion.

Benefits of Using Sequential Systems

Adopting a consistent sequence for billing references offers several key advantages:

- Improved organization: A clear, ordered system makes it easier to find specific documents, especially during audits or financial reviews.

- Prevention of duplication: Sequential identifiers prevent the accidental reuse of references, ensuring each transaction is unique and traceable.

- Better client communication: With a reliable reference system, businesses can provide clients with clear and accurate information about their bills.

How to Maintain Sequential Integrity

To maintain the integrity of a sequential system, businesses should establish a clear process for assigning references. Using automated tools can ensure that each new document receives a unique and correctly ordered identifier, minimizing human error and improving overall efficiency. This practice not only streamlines internal processes but also enhances professional relations with clients and stakeholders.

Automating Your Invoice Numbering System

Streamlining the process of assigning unique identifiers to financial records can significantly improve business efficiency. Automating this system reduces the likelihood of human errors and saves time, allowing employees to focus on more critical tasks. By integrating technology into the numbering process, businesses can ensure that each document is generated correctly and consistently without manual intervention.

Automation tools can be set up to generate sequential references for each transaction, ensuring that records are easily organized and traceable. These tools can also offer additional features, such as the ability to customize the format, track progress, and even send automated reminders or notifications. This approach not only improves accuracy but also enhances the overall workflow of financial documentation.

Printable Number Invoice Templates

Having a physical copy of billing records is often essential for various business purposes, including client meetings, audits, and record-keeping. Printable forms offer a convenient way to produce hard copies that can be handed over, filed, or archived. By using pre-designed documents, companies can ensure consistency across their paperwork while saving time and effort in creating custom formats from scratch.

These printable formats can be customized to suit the specific needs of a business, allowing for adjustments in layout, content, and branding. The ability to print these documents on demand makes them an invaluable tool for businesses that need to quickly generate and distribute records, all while maintaining a professional and organized appearance.

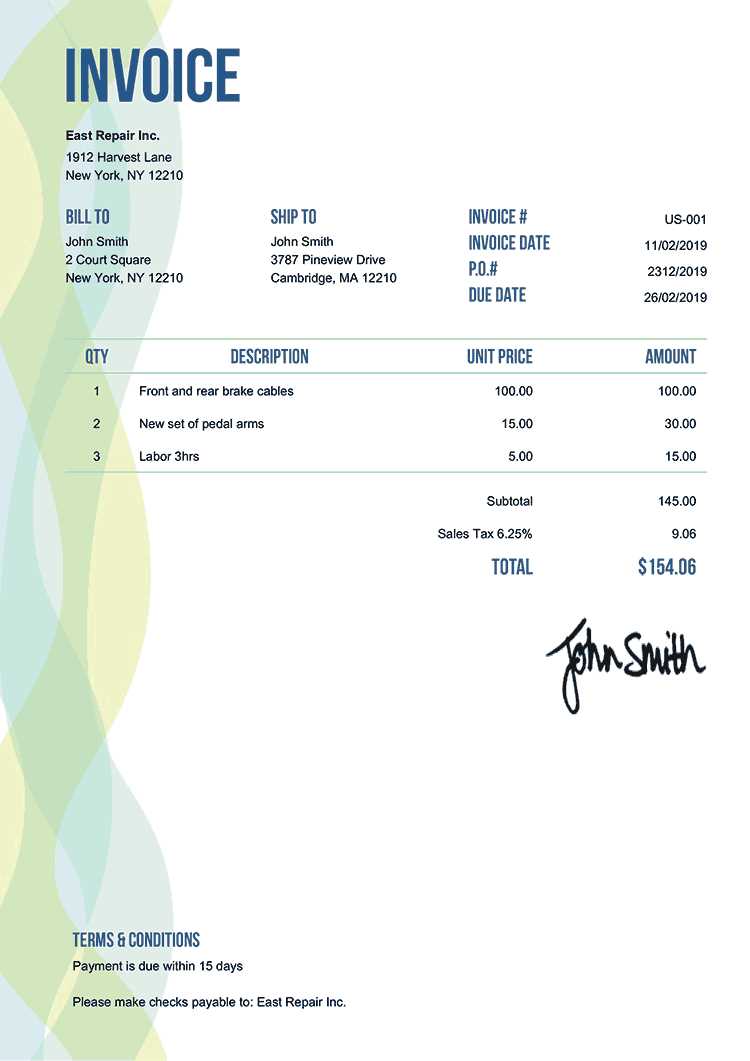

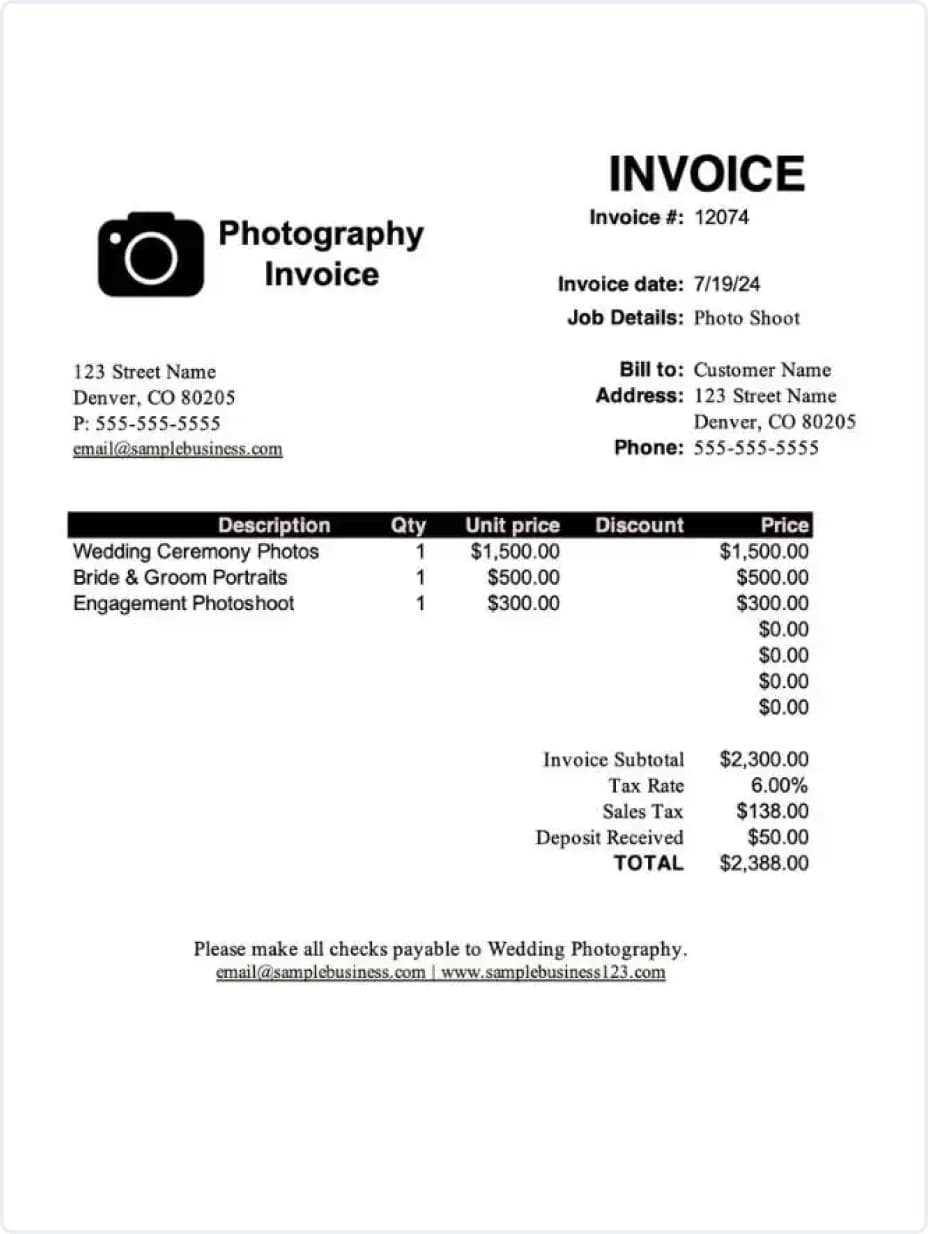

Examples of Number Invoice Formats

There are various ways businesses can structure their billing documents to meet both organizational and client needs. These formats are designed to present essential information in a clear and professional manner. Whether you are creating a simple, minimalistic design or a detailed, comprehensive document, the format you choose plays a crucial role in how easily clients can understand the charges and terms.

Some common examples include:

- Basic Format: A straightforward document listing the services rendered, their costs, and the total amount due. This format is ideal for smaller transactions or businesses with simple billing needs.

- Detailed Format: This format includes additional sections such as itemized descriptions, tax calculations, payment terms, and contact information. It is often used by companies with complex pricing structures.

- Professional Format: Includes company branding, logos, and legal terms. This version is designed to reinforce the professionalism of your business, suitable for high-value clients or corporate environments.

Each format can be customized to suit different industries and preferences, ensuring that all necessary details are presented clearly and accurately.

Ensuring Accuracy in Invoice Records

Accurate record-keeping is crucial for any business, as it ensures both legal compliance and smooth operations. When documenting financial transactions, every detail must be precise to avoid errors in billing, payments, and accounting. This process involves careful attention to all aspects of the document, including the client’s details, service descriptions, amounts, and due dates.

Verification of Details

One of the first steps to ensuring accuracy is verifying all the details before finalizing the document. This includes checking the client’s name, address, and contact information, as well as confirming the services or products listed, quantities, and prices. Double-checking this information helps prevent misunderstandings and disputes later on.

Consistency in Record-Keeping

Maintaining consistency in your documentation practices is equally important. Implementing a standardized system for recording and organizing details will reduce the chance of mistakes. Whether you use manual methods or automated systems, ensure that all entries follow a set pattern for easy retrieval and verification.

Regular audits and cross-checks are essential to maintaining the integrity of your records. By proactively reviewing and confirming data accuracy, you can prevent costly errors and ensure that financial records are always up to date.

Software Options for Numbered Invoices

In today’s digital world, there are various software solutions available to help businesses create and manage their billing documentation efficiently. These tools not only streamline the process but also ensure that all necessary details are recorded accurately and consistently. Selecting the right software can make a significant difference in improving workflow and reducing human errors in financial record-keeping.

Key Features to Look For

When choosing software for managing financial documents, certain features can greatly enhance the overall process. These include:

| Feature | Description |

|---|---|

| Customization Options | Allows businesses to tailor the layout and content of their documentation to match their branding and specific needs. |

| Automatic Number Generation | Helps in automatically assigning unique identifiers to each document to ensure proper tracking and organization. |

| Integration with Accounting Systems | Ensures seamless synchronization with accounting software, making it easier to track payments and generate reports. |

| Cloud Storage | Provides secure storage of documents online, making them accessible from any location and reducing the risk of data loss. |

Popular Software Solutions

Several software options are widely used for managing documentation, each offering a variety of features. Some of the most popular choices include:

- QuickBooks: Ideal for businesses that need a comprehensive solution with invoicing, accounting, and reporting capabilities.

- FreshBooks: A user-friendly option known for its simplicity and ease of use, designed for small businesses and freelancers.

- Zoho Invoice: Offers customization, time tracking, and project management features, perfect for growing businesses.

- Wave: A free solution that includes billing, accounting, and receipt scanning, making it suitable for small businesses on a budget.

Choosing the right software depends on the size of your business and the specific needs of your billing process. Evaluate each option based on the features that best support your operational efficiency.

When to Use Different Numbering Systems

Choosing the right method to assign unique identifiers to business documents is essential for maintaining proper organization and facilitating easy tracking. The approach to this process can vary depending on factors such as business size, industry, and specific needs. Understanding when to apply various systems can help streamline operations, improve accuracy, and meet regulatory requirements.

Sequential System: This is the most commonly used method, where identifiers are assigned in a continuous, numerical order. It is ideal for businesses that require simplicity and consistency. This system is particularly useful for smaller businesses or when creating a straightforward record-keeping structure. It ensures that each document can be easily referenced in a predictable manner, reducing the risk of confusion or duplication.

Custom Systems: Some businesses may need a more tailored approach, incorporating alphanumeric codes or additional details into the identifier. Custom systems are often employed by larger organizations or those with specific regulatory requirements. For example, adding a department code or a year prefix can help categorize and organize documents more effectively. This is especially valuable when dealing with high volumes of records or when you need to differentiate between various document types or locations.

Randomized System: A randomized approach may be appropriate in certain circumstances, such as in businesses where confidentiality is a priority, or where documents must be kept secure. This system can help minimize the risk of fraud or duplication, as each identifier is unique and not easily predictable. However, this method may not be as intuitive as a sequential or custom system, so it should be used when higher levels of security are needed.

Ultimately, the choice of numbering system will depend on the specific goals of the business and the complexity of its operations. By carefully considering these factors, businesses can implement an effective system that enhances workflow and ensures the accuracy of records.