Free Insurance Invoice Template for Easy and Professional Billing

Managing payments and keeping track of transactions is a crucial part of any business. Having the right tools to ensure accuracy and professionalism in your financial documents can save both time and effort. By using a structured approach to document charges, businesses can stay organized and maintain clear communication with clients.

Pre-designed forms are an effective way to streamline the billing process. These ready-made documents allow you to input necessary details quickly and ensure that each transaction is recorded correctly. They help avoid errors and simplify the workflow, making it easier to manage multiple accounts.

With the ability to customize these forms to fit your specific needs, you can easily adjust them for various types of services or clients. This flexibility allows businesses to maintain consistency while adapting to different requirements, ultimately creating a smoother, more efficient payment process.

Free Insurance Invoice Template for Billing

Having access to pre-made billing documents is essential for businesses that need to provide clear and professional charges to clients. These documents are designed to make the process more efficient and reduce the chances of errors. By using well-structured forms, you can focus more on your work and less on the administrative side of things.

Why You Need Ready-Made Billing Forms

Ready-made billing documents come with all the essential fields required for a proper charge statement. These documents can be filled in quickly, allowing businesses to issue statements without worrying about formatting or missing information. Here are the main benefits:

- Time-saving: Ready-to-use designs save hours of creating new files from scratch.

- Consistency: Using the same format for every transaction ensures uniformity and professionalism.

- Accuracy: Pre-made documents reduce the likelihood of missing key details or making formatting errors.

- Customization: They can be easily customized to suit the needs of different clients or services.

Where to Find Reliable Templates

Numerous platforms offer templates at no cost, allowing businesses to quickly access and use them. Some popular options include:

- Online template repositories: Websites dedicated to offering a variety of document formats that are easy to download.

- Software tools: Many billing or accounting software solutions come with customizable pre-designed forms.

- Microsoft Office or Google Docs: Both tools offer downloadable and customizable forms for businesses of all sizes.

By using these resources, businesses can ensure they always have a professional document ready to issue at a moment’s notice. This can significantly streamline payment processes and reduce administrative burdens.

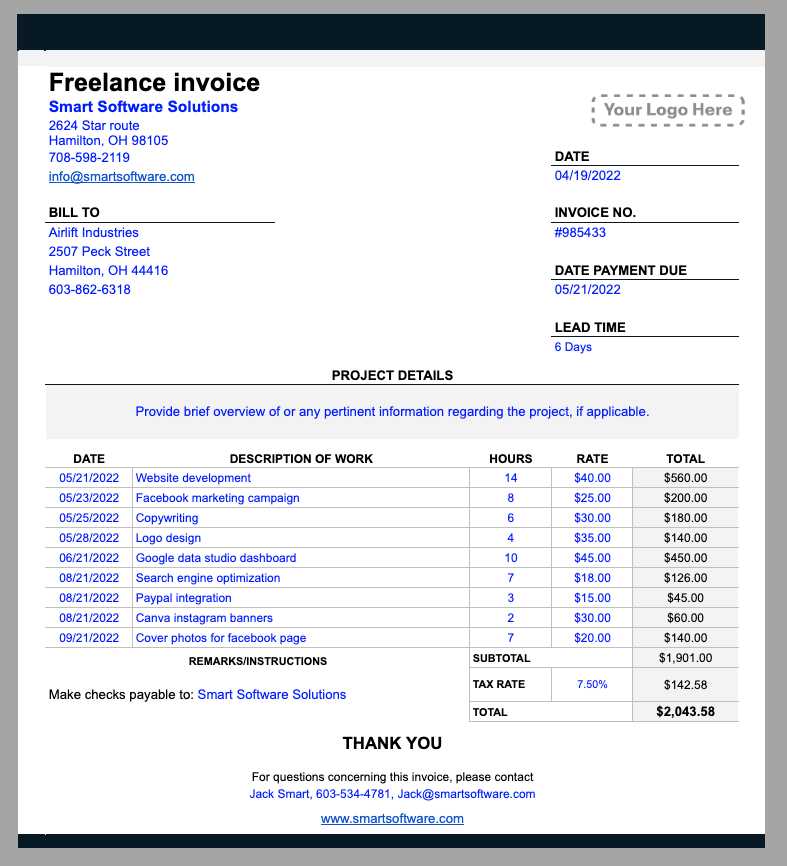

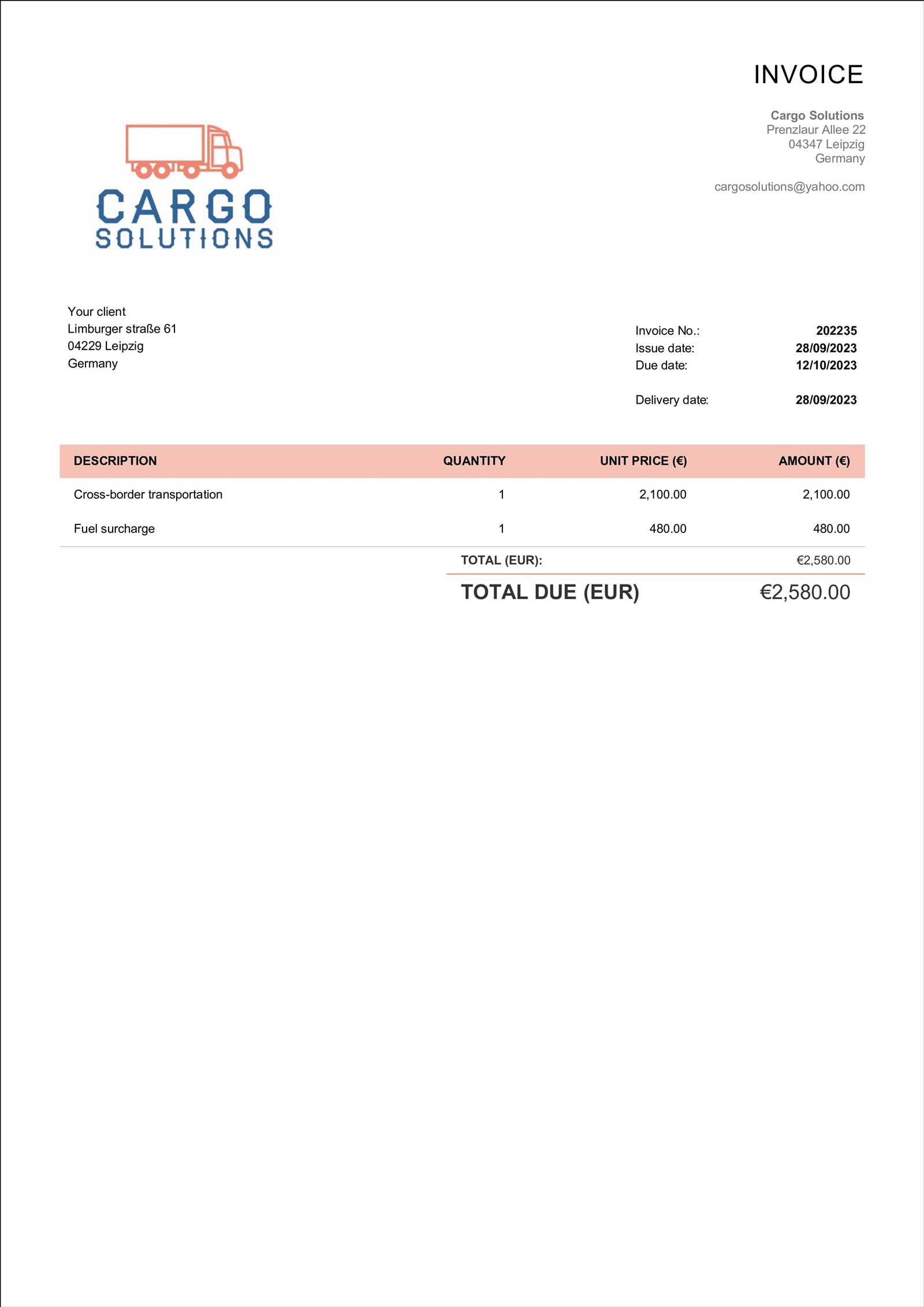

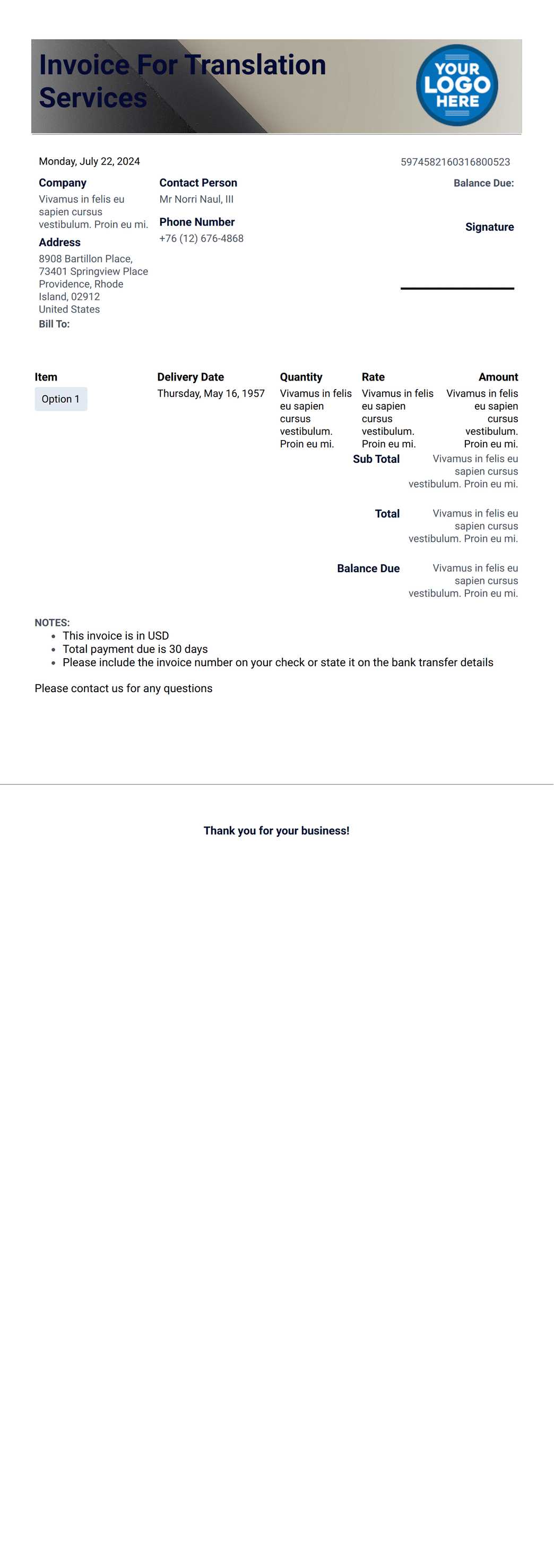

How to Create a Professional Invoice

Creating a professional billing document is crucial for maintaining credibility and ensuring smooth financial transactions with clients. A well-designed document not only communicates the necessary payment details but also reflects the professionalism of your business. The key is to include all essential information clearly and in an organized manner.

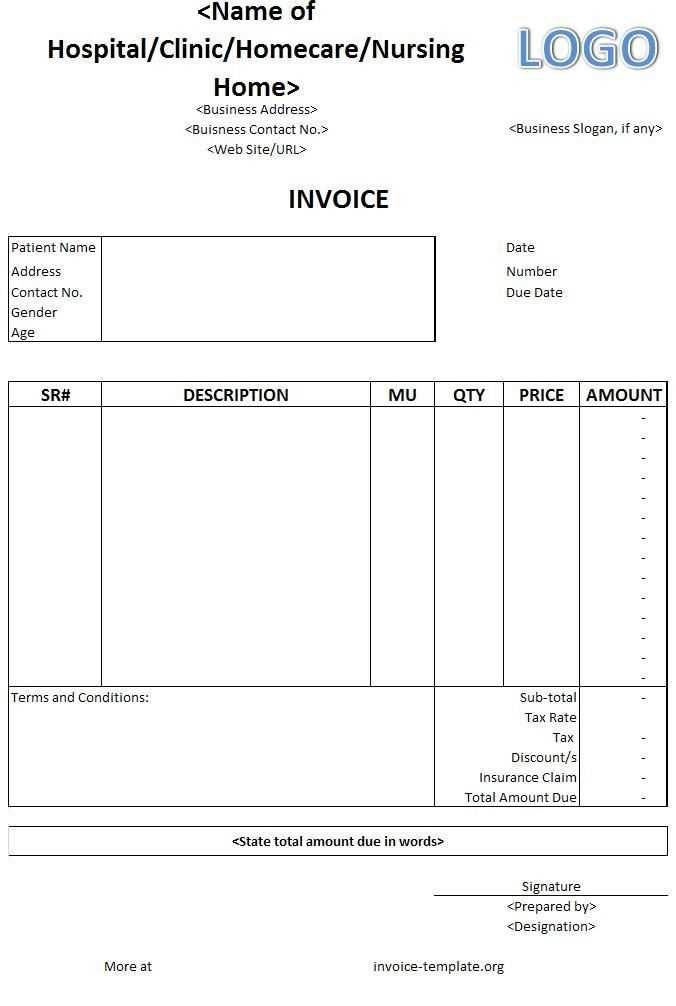

Essential Elements of a Billing Document

A properly structured billing statement should contain several key components. These elements ensure the document is comprehensive and provides the client with everything they need to process the payment without confusion.

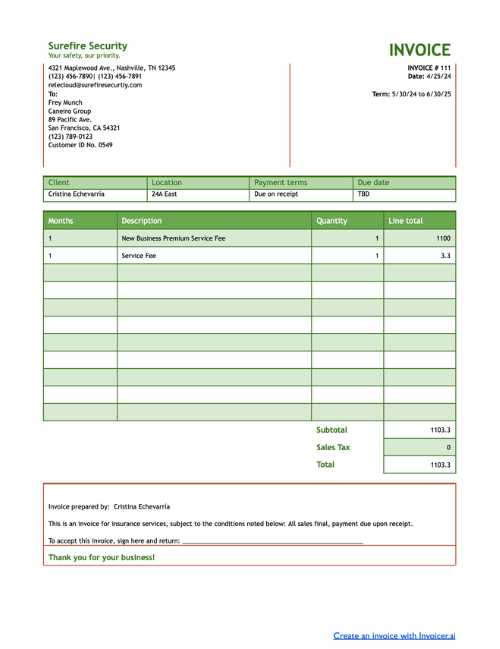

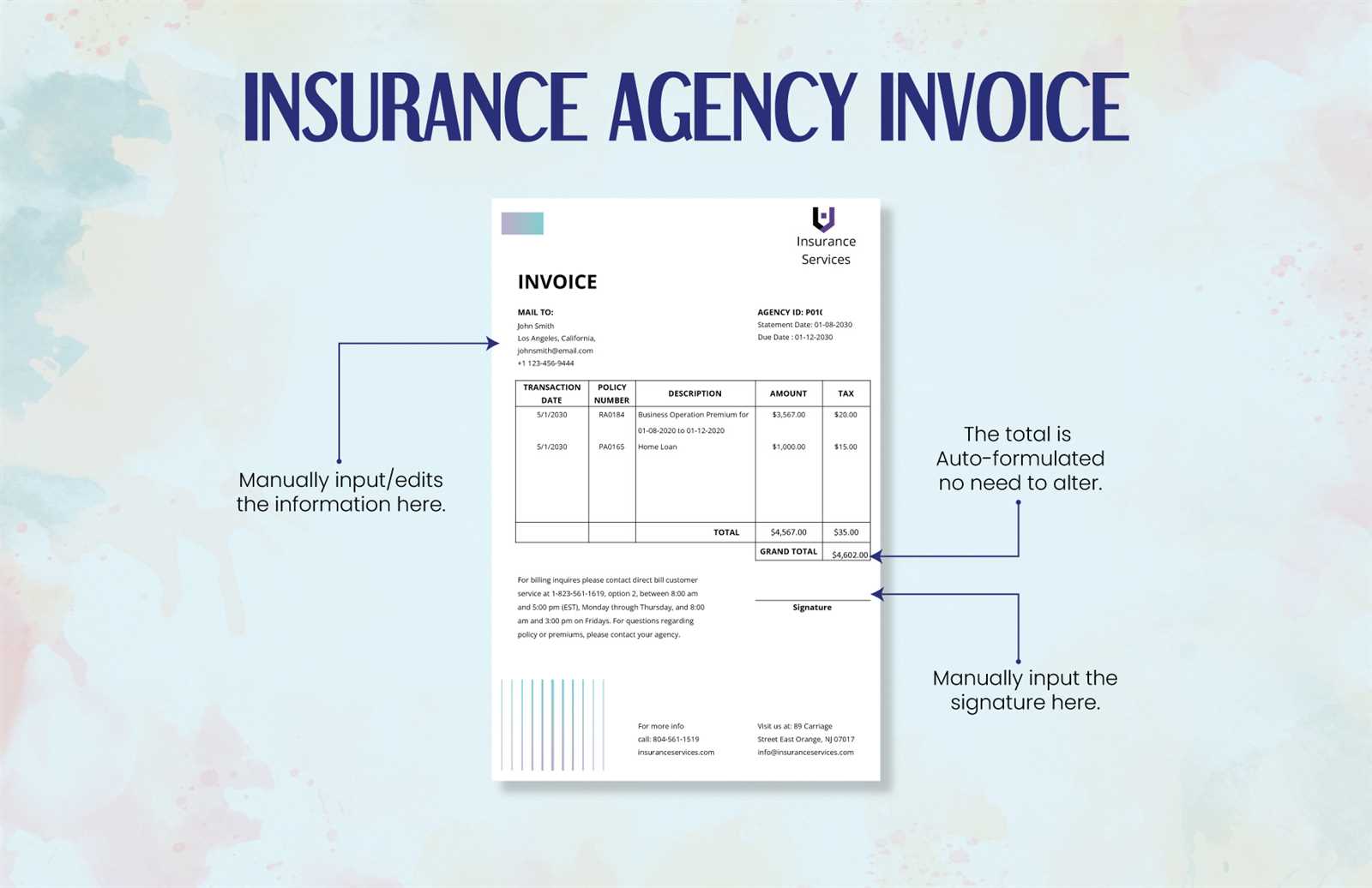

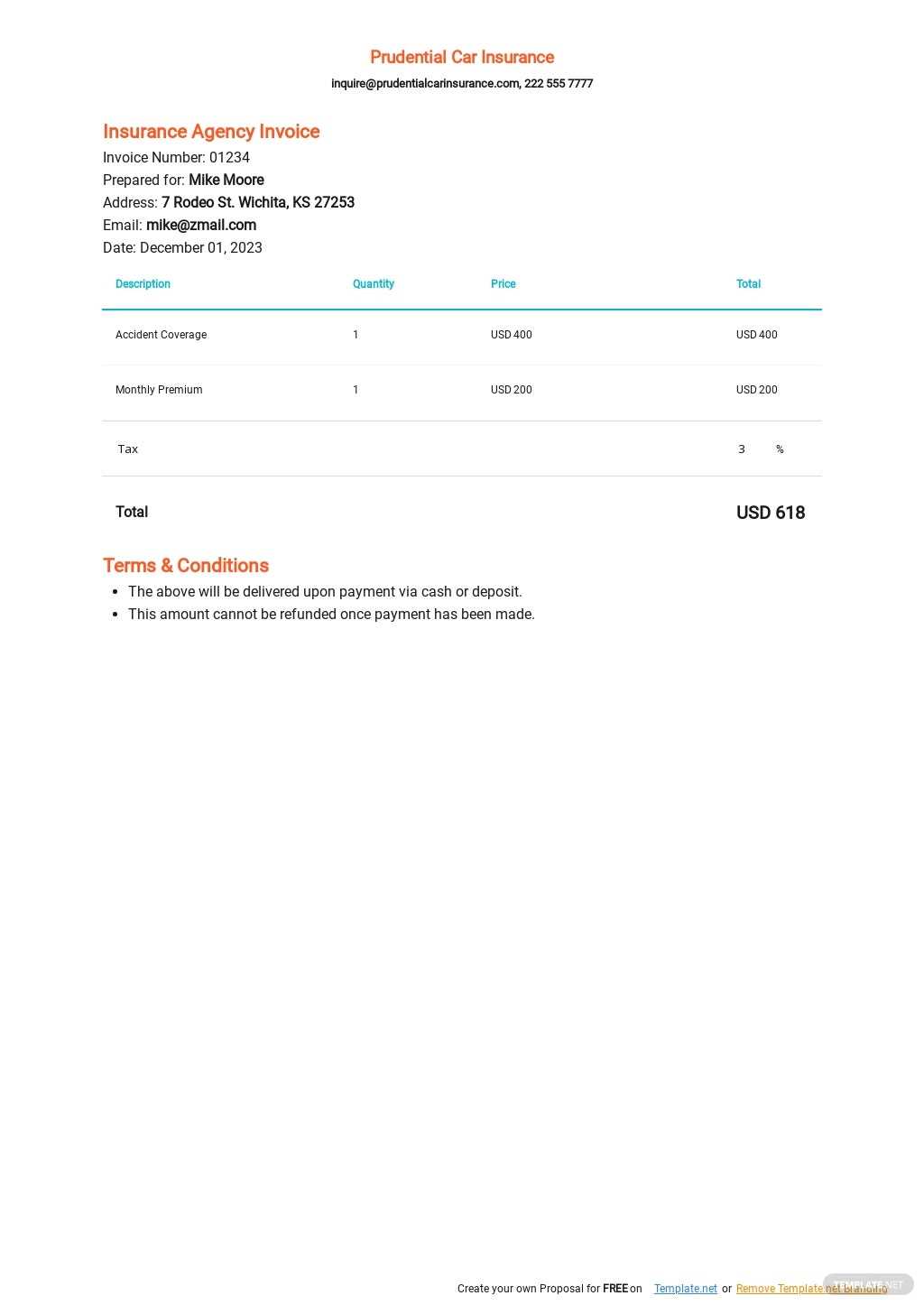

- Header Information: Include your business name, logo, and contact details at the top.

- Client Information: Add the client’s name, address, and contact details.

- Unique Document Number: Assign a unique identifier to each document for tracking purposes.

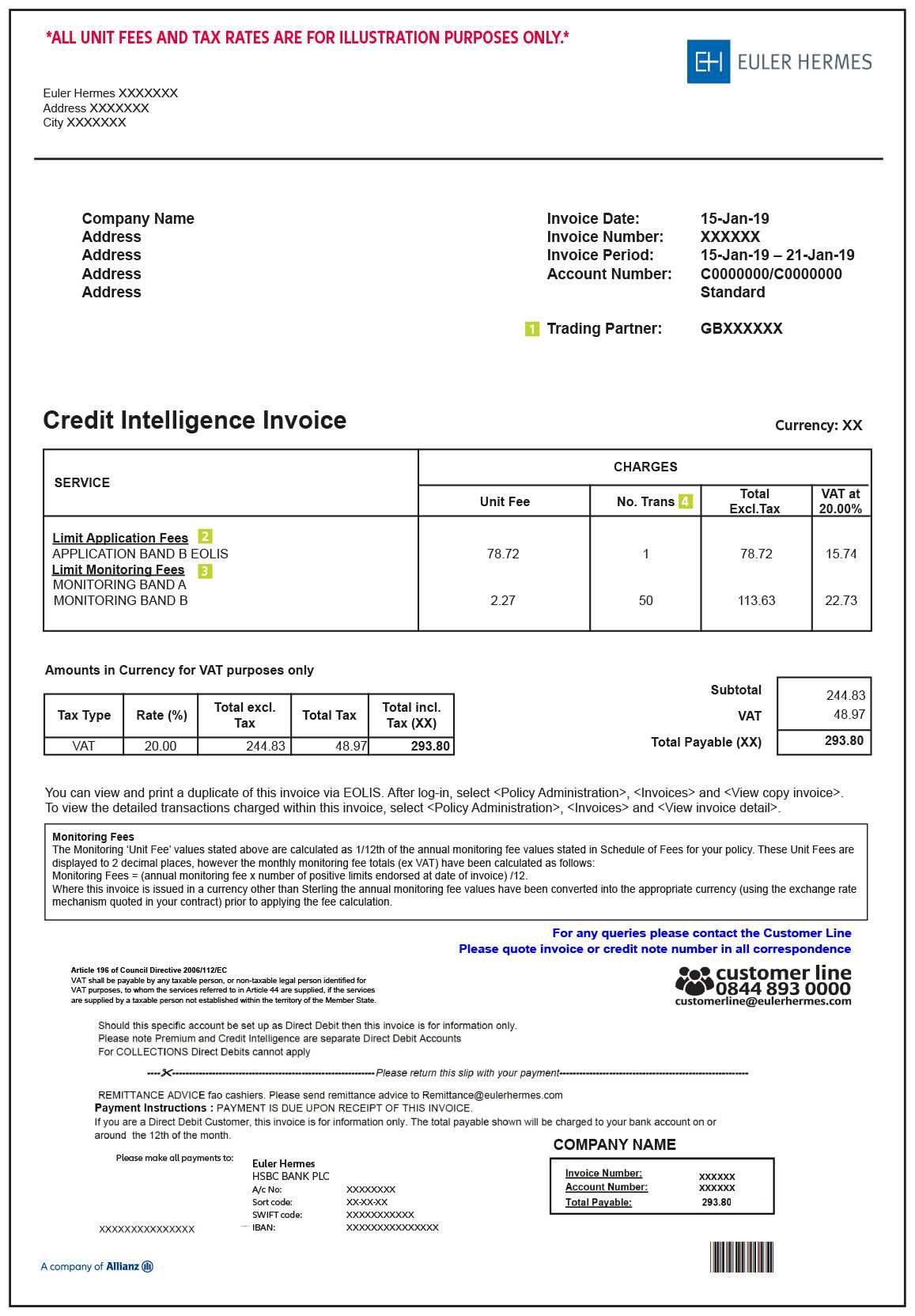

- Detailed Description of Services: Clearly list the services or products provided, with dates and quantities if applicable.

- Amount Due: Specify the total charge and any applicable taxes or discounts.

- Payment Terms: Clearly state the due date, payment methods accepted, and any late fee policy.

Designing and Formatting for Clarity

When designing your document, clarity should be your primary focus. Keep the layout simple, with sufficient white space to prevent the content from feeling crowded. Use a clean, legible font and make sure all important sections are easy to identify. Here are a few tips:

- Use bold headings to separate sections clearly.

- Ensure alignment for consistent and tidy presentation.

- Break down complex charges into easy-to-understand line items.

By following these guidelines, you’ll be able to create a polished document that enhances your business reputation and helps facilitate prompt payments.

Why Use an Insurance Invoice Template

Using a pre-designed billing document can significantly simplify the process of managing payments. By relying on a structured format, businesses can streamline their operations, reduce the risk of errors, and present a more professional image to clients. Having a standard format for each transaction ensures consistency and saves time when creating new records.

Here are some reasons why adopting a pre-made form is beneficial:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed documents eliminate the need to start from scratch, allowing businesses to quickly create billing statements and focus on other tasks. |

| Accuracy | Standardized formats ensure all necessary details are included, reducing the chance of forgetting key information or making formatting errors. |

| Professional Appearance | Using a consistent, polished layout helps build trust with clients and reflects a business’s attention to detail and professionalism. |

| Customization | Many pre-designed forms allow for easy customization, enabling businesses to tailor the document to suit specific needs or client requirements. |

By utilizing these ready-made forms, businesses can ensure smooth transactions and maintain a level of professionalism that reflects positively on their brand.

Benefits of Free Invoice Templates

Utilizing pre-designed billing documents offers significant advantages, especially when they come at no cost. These documents allow businesses to simplify the payment process, ensuring both speed and accuracy. With minimal effort, you can have a polished and professional statement ready to send to clients, saving time and reducing administrative burden.

Key Advantages of Using Pre-Made Billing Forms

When choosing a ready-to-use format, businesses experience several benefits. From cost savings to improved efficiency, these documents can be an essential tool for any organization.

| Advantage | Description |

|---|---|

| Cost-Effective | Many pre-designed billing documents are available at no cost, helping businesses save money on expensive software or design services. |

| Ease of Use | These documents are straightforward to fill out, making it easy for businesses to generate bills quickly without technical expertise. |

| Consistency | By using a uniform format for each transaction, businesses ensure their documents look professional and are easy to read. |

| Customization | Pre-designed forms can often be customized to fit specific needs, such as adjusting fields for services or adding business logos. |

| Time-Saving | Ready-made formats eliminate the need to design documents from scratch, allowing businesses to focus on their core operations instead. |

Maximizing Efficiency with Pre-Formatted Documents

Using readily available, well-structured forms ensures that businesses can streamline their billing process while maintaining a high standard of accuracy and professionalism. This efficiency can lead to quicker payments and smoother interactions with clients.

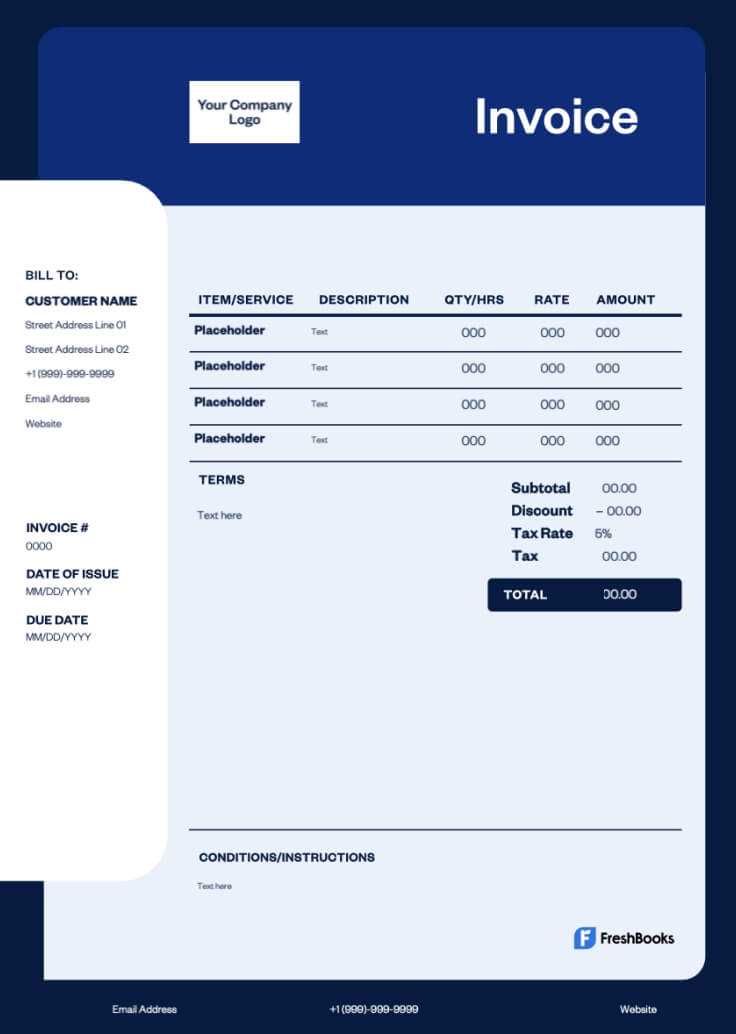

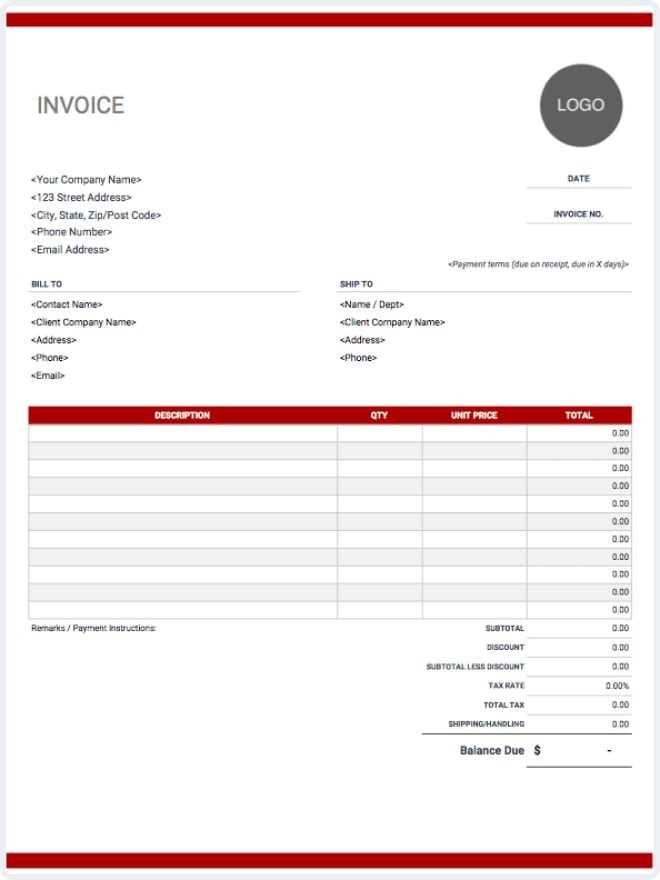

Customizing Your Insurance Invoice Template

Personalizing your billing documents allows you to tailor them to your specific business needs, making them more relevant and professional for your clients. By adjusting key elements such as branding, layout, and content, you can create a document that represents your company’s identity while ensuring all necessary details are clear and easily understood.

Important Customization Options

There are several areas you can modify to align the document with your business’s unique requirements. Customizing these sections ensures that your billing statement not only looks professional but also provides all essential information in a format that works best for your workflow.

| Customization Option | Description |

|---|---|

| Logo and Branding | Incorporate your company’s logo, colors, and fonts to create a consistent brand image across all documents. |

| Business Contact Information | Ensure your contact details, including phone numbers, email addresses, and website, are prominently displayed for easy access. |

| Itemized Service Descriptions | Break down services clearly by adding detailed descriptions, quantities, and unit prices, so the client understands what they are paying for. |

| Payment Terms | Modify the payment terms section to reflect your preferred methods, due dates, and any late fees or discounts offered. |

| Unique Document Number | Customize the numbering system for easy reference and record-keeping, ensuring each document is easily trackable. |

Maximizing Efficiency Through Customization

Personalizing your billing statements not only makes them visually aligned with your brand but also ensures they meet your specific operational needs. Whether it’s adjusting payment instructions or adding a personal touch, a customized document can lead to smoother transactions and improved client relationships.

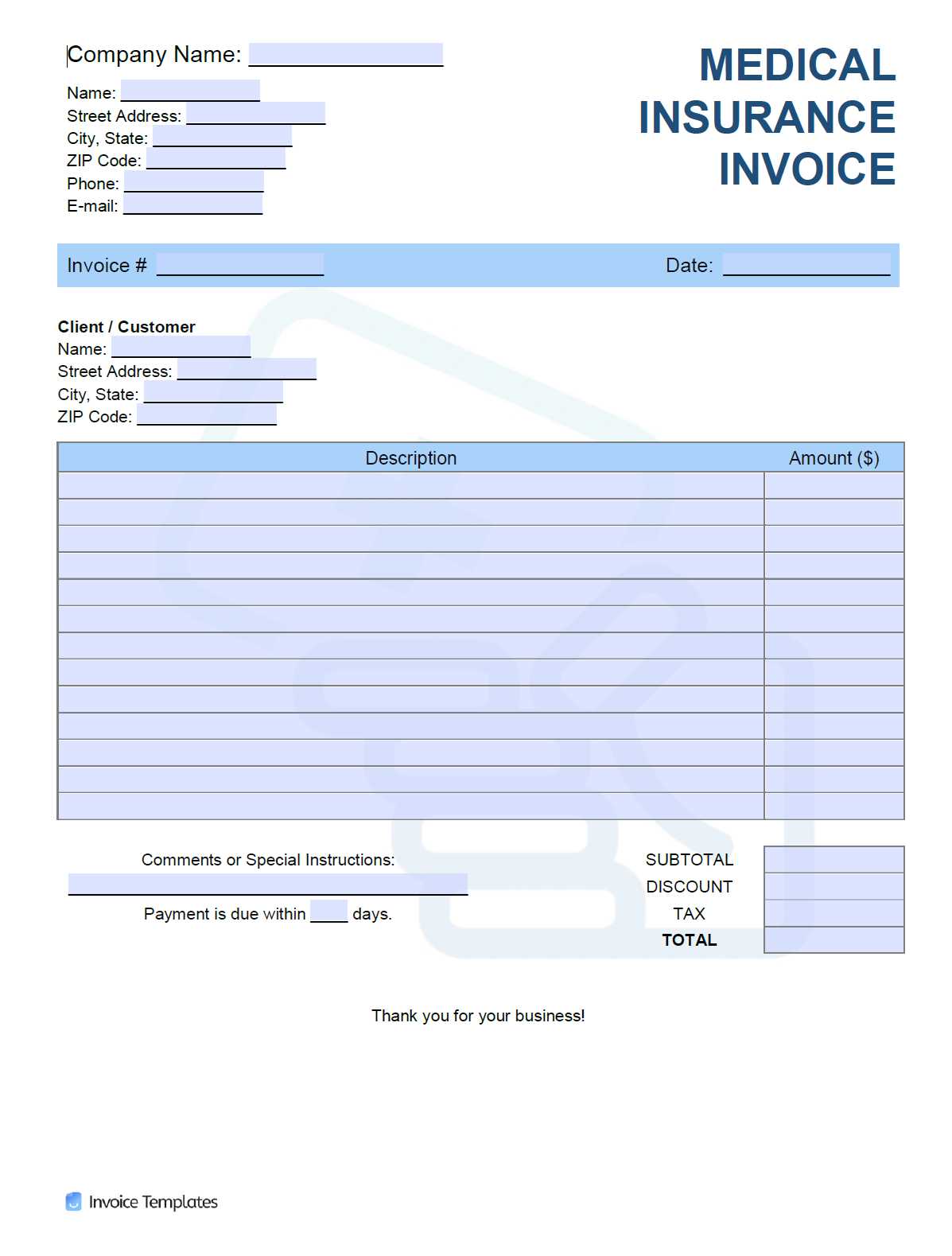

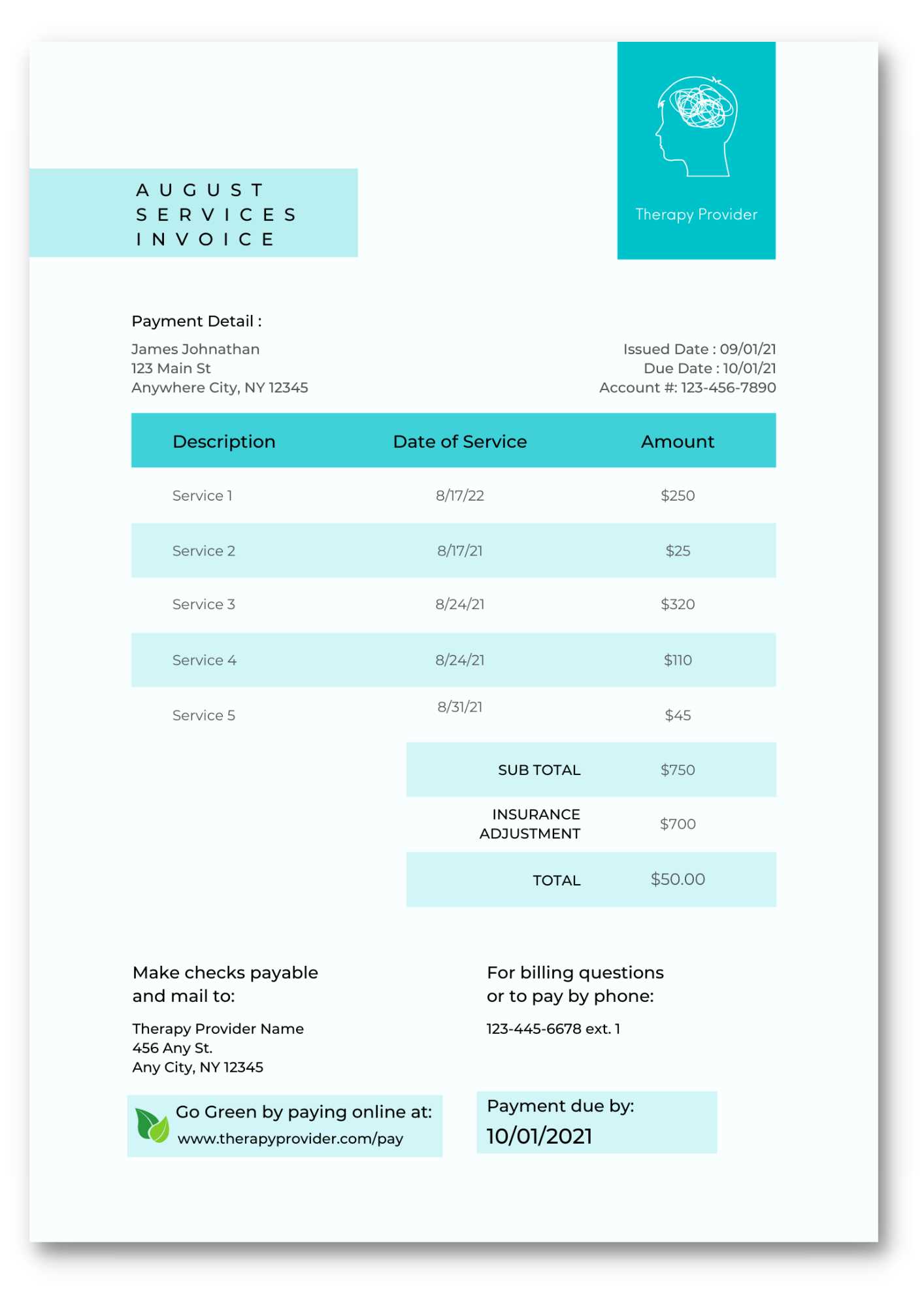

Essential Details in Insurance Invoices

To ensure smooth transactions and clear communication with clients, it’s important that each billing statement includes the necessary details. A well-crafted document should cover all the relevant information to avoid confusion and help clients understand what they are being charged for. Including essential components in your document can make the payment process more efficient and transparent.

Key Components to Include

Each statement should contain specific sections that provide clarity and transparency. The following are the critical elements that should never be overlooked:

- Business Information: Include your company’s name, address, and contact details for easy reference.

- Client Information: Make sure to list the client’s name, address, and any other relevant contact details.

- Unique Document Number: Assign a unique identifier for tracking and referencing the document.

- Service Details: Describe the services or products provided, including the date of service, quantities, and individual prices.

- Total Amount Due: Clearly indicate the total amount owed, including any applicable taxes, fees, or discounts.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or penalti

Free Templates vs Paid Options

When it comes to choosing a pre-designed document format for billing purposes, businesses are often faced with a choice between using free resources or opting for paid solutions. Both options have their pros and cons, and the right choice depends on your business’s specific needs, budget, and the level of customization required. It’s important to weigh the benefits of each to determine which will provide the most value for your organization.

Advantages of Free Resources

Many businesses turn to free pre-designed forms for quick and simple solutions. These documents are accessible at no cost and can serve as a starting point for generating professional records. Some key benefits of using no-cost options include:

- Zero upfront costs: These resources are completely free, making them an attractive option for small businesses with limited budgets.

- Quick access: Free formats are often readily available online, allowing businesses to start using them immediately without any setup fees or long waiting times.

- Basic functionality: Free formats usually cover the essential fields required for basic billing needs, which may be sufficient for simpler transactions.

Benefits of Paid Solutions

On the other hand, paid options often come with additional features and higher levels of customization, making them ideal for businesses with more complex needs or those looking for a more polished look. Some advantages of investing in a paid resource include:

- Advanced customization: Paid solutions allow businesses to fully customize the design and layout to match their branding, helping to maintain a professional and consistent appearance.

- Integrated features: Many paid solutions come with integrated payment gateways, automated reminders, and other tools that can streamline billing and collection processes.

- Ongoing support: Paid options typically come with customer support, allowing businesses to get help if any issues arise or if additional features are needed in the future.

Ultimately, the decision between free and paid formats depends on the specific needs of your business. If you need a simple, cost-effective solution, free formats might be a great place to start. However, if you require more advanced features, customization, and ongoing support, investing in a paid option could provide long-term value.

Where to Find Free Invoice Templates

Finding reliable and accessible pre-made billing forms can be an essential step in streamlining your business’s financial processes. Whether you’re just starting or looking for a quick solution, there are many resources available online to help you access the right format at no cost. These platforms offer a variety of options that cater to different industries and business needs, providing templates that are easy to download and customize.

Here are some places where you can find quality, no-cost billing forms:

- Online Template Directories: Websites dedicated to offering a wide range of pre-designed documents for various purposes. These platforms often categorize forms by industry, making it easy to find one suited to your business.

- Business Software Providers: Many software solutions for accounting or project management include pre-built forms as part of their offerings, which can be downloaded or used directly within the platform.

- Google Docs and Microsoft Office: Both Google Docs and Microsoft Office offer free templates within their respective applications. These can be accessed easily and modified to suit specific needs.

- Freelancer and Design Platforms: Websites like Canva and other graphic design platforms often feature free, customizable billing forms that can be personalized to fit your brand’s style.

These resources make it simple to find a well-designed document that meets your needs, allowing you to maintain professionalism and efficiency without spending money on premium solutions.

How to Edit an Insurance Invoice Template

Editing a pre-made billing document is a simple and efficient way to make it fit your specific business needs. Customizing a ready-made form allows you to add your branding, adjust the layout, and input the necessary information to ensure that each transaction is clear and professional. With just a few steps, you can modify the document to match your company’s standards.

Steps to Edit Your Billing Document

Editing a pre-designed document typically involves adjusting several key elements to ensure the information is accurate and aligned with your business’s requirements. Below are the essential steps:

- Open the Document: First, open the pre-designed document in the software you will be using, such as Microsoft Word, Google Docs, or any PDF editor.

- Customize Header Information: Replace default business details with your own, including your company’s name, logo, and contact information.

- Update Client Information: Ensure the client’s name, address, and any relevant details are correct for the current transaction.

- Modify Service Descriptions: Edit the list of services or products provided, making sure each item is clearly described, with accurate quantities and prices.

- Adjust Payment Terms: Review the payment due date, acceptable payment methods, and any other terms to ensure they reflect your current policies.

- Save and Export: After making all the necessary changes, save the document and export it in your preferred file format (e.g., PDF) for easy sharing with clients.

Tips for Efficient Editing

To streamline the process and maintain professionalism, keep the following tips in mind when editing your document:

- Maintain Consistency: Keep the fonts, colors, and design elements consistent with your branding for a professional look.

- Check for Accuracy: Double-check all the details, especially the totals, dates, and client information, to avoid errors.

- Use Simple Formatting: Keep the layout clean and easy to navigate. Use bullet points or tables to break down detailed information.

With these steps and tips, editing your billing document becomes a quick and straightforward task, ensuring yo

Best Practices for Sending Invoices

Sending clear and timely billing statements is essential for maintaining a professional relationship with your clients and ensuring smooth cash flow for your business. How you send these documents and when can have a significant impact on payment processing times and client satisfaction. Following best practices helps you avoid confusion, prevent delays, and build a reputation for reliability and professionalism.

Key Considerations for Effective Billing

To ensure the payment process is efficient and smooth, consider the following best practices when sending your billing documents:

- Send Promptly: Ensure that you send the document as soon as possible after the service is completed or products are delivered. This sets the tone for timely payments.

- Use Clear Language: Make sure the details in your document are clear and easy to understand. Avoid jargon or complicated terms that might confuse your client.

- Provide Payment Options: Offer various methods for payment, such as bank transfer, credit card, or online payment platforms, to make it easier for clients to settle their accounts.

- Include Payment Terms: Clearly outline when the payment is due and what the consequences are for late payments, such as late fees or interest charges.

- Follow Up if Necessary: If a payment hasn’t been made by the due date, send a polite reminder. It’s essential to follow up while maintaining a professional tone.

Choosing the Right Delivery Method

How you deliver your documents also plays a role in the process. Consider the following options to ensure timely and secure delivery:

- Email: The most common method for sending documents. Make sure to attach the billing statement as a PDF to maintain formatting integrity and reduce the risk of errors.

- Mail: For clients who prefer physical copies, sending a printed document by postal mail may be necessary. Be sure to allow extra time for delivery and ensure that all information is correct.

- Online Platforms: Many businesses use online payment systems or accounting software that allows you to send and track payments digitally. These platforms often integrate reminders and other helpful features to make the process easier for both parties.

By adhering to these best practices, you will enhance your professionalism, speed up payment processing, and maintain strong relationships with your clients.

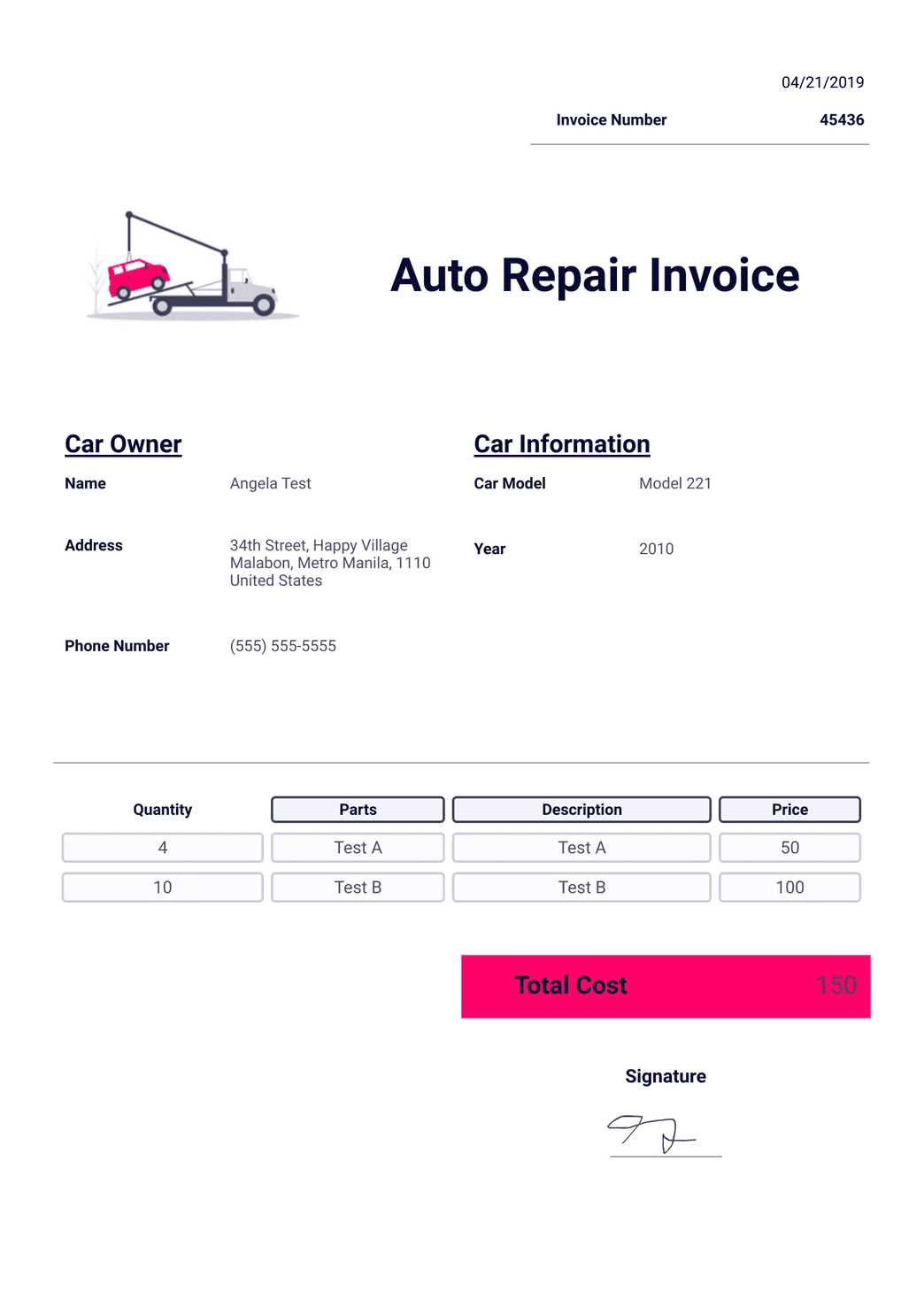

How to Format Insurance Invoices Properly

Properly formatting billing documents is crucial to ensure that all necessary details are clear, organized, and easy to understand for both your business and your clients. A well-structured document not only reflects professionalism but also minimizes confusion and errors, facilitating faster payments and smoother transactions.

Key Elements of a Properly Formatted Document

To create a document that is both professional and easy to read, there are several key elements you should always include and organize in a clear manner:

- Header Section: This section should clearly display your company name, logo, and contact information, along with a unique identifier for the document, such as an invoice number.

- Client Details: Include the client’s full name, address, and contact information to ensure the document is personalized and directed to the right recipient.

- Itemized List of Services: List all services or products provided, including descriptions, quantities, and unit prices. Each item should be clearly separated and easy to identify.

- Subtotal and Totals: Provide a breakdown of the subtotal, applicable taxes, and any discounts or additional fees. The total amount due should be clearly highlighted at the bottom.

- Payment Instructions: Clearly state the payment methods you accept and any specific instructions or deadlines for making payments.

- Terms and Conditions: If applicable, include terms regarding late fees, cancellation policies, or other important information related to payment.

Formatting Tips for Clarity

Proper formatting enhances the clarity and professionalism of your document. Consider the following tips to improve readability:

- Use Consistent Fonts and Sizes: Stick to one or two easy-to-read fonts (such as Arial or Times New Roman) and ensure that headings and body text are appropriately sized for legibility.

- Organize with Tables: For the itemized list, use tables to clearly separate each service or product with columns for descriptions, quantities, and costs.

- Highlight Key Information: Make the total amount due and payment instructions stand out by using bold text or la

Saving Time with Pre-made Templates

Using pre-designed billing forms can significantly streamline the process of preparing and sending financial documents to clients. By leveraging ready-made structures, businesses can save time on repetitive tasks, focus on their core operations, and ensure consistent quality in their records. These resources allow you to quickly input specific details, reducing the time spent on document creation and enabling faster turnaround times for payment processing.

How Pre-made Documents Save Time

Here are some ways in which using a pre-designed format can make your workflow more efficient:

- No Need for Rebuilding: Instead of starting from scratch each time, pre-made documents provide a consistent framework where you simply update the necessary fields, saving you from redoing layout and formatting every time.

- Quick Customization: These formats allow for easy customization, so you can add your business logo, client details, and service descriptions without having to design from the ground up.

- Standardized Information: With a pre-designed layout, all your documents will maintain the same professional appearance, ensuring consistency across all client communications.

- Ready-to-Use Structure: Many pre-made forms include sections that you might overlook if creating a document from scratch, such as tax rates, payment terms, and unique document numbers, allowing you to avoid missing essential information.

Benefits of Consistency

Using pre-made documents not only saves time but also ensures consistency in your communication. Clients will become familiar with your format, making it easier for them to process payments quickly. Consistency also helps in building a more professional image for your business, which can lead to stronger relationships and greater trust with your clients.

By adopting pre-designed forms, businesses can work more efficiently, reduce administrative overhead, and maintain high standards of professionalism without spending extra time on document creation.

Improving Accuracy with Invoice Templates

Using pre-designed billing formats can greatly enhance the accuracy of your financial documents. When you rely on a ready-made structure, you reduce the chances of human error that often arise when creating a document from scratch. By having a standardized layout, all the necessary fields are already in place, helping you avoid omissions and inconsistencies in calculations or client details.

How Pre-made Billing Formats Improve Accuracy

Here are several key ways in which using a structured document can help you maintain precision in your business transactions:

- Consistent Layout: With a pre-designed format, the same fields are always used in the same order, reducing the likelihood of forgetting important information such as payment terms or item descriptions.

- Automatic Calculations: Many pre-designed formats include built-in formulas for calculating totals, taxes, and discounts, minimizing the risk of manual calculation errors.

- Pre-filled Sections: Some formats come with pre-populated sections for standard information, such as your company’s name, address, and payment instructions, so you don’t have to enter them each time.

- Clear Structure: The clear separation of sections, such as product or service descriptions, prices, and total amounts, makes it easier to spot errors before sending the document.

Reducing Common Mistakes

By using a pre-designed document, you can significantly reduce common mistakes that may otherwise occur when drafting a billing statement manually. Some of these mistakes include:

- Missing or incorrect client information

- Incorrect totals or calculations

- Omitting important terms or conditions

- Inconsistent formatting

By relying on structured formats, you minimize the risk of these errors and ensure that your clients receive accurate and professional records every time.

Legal Considerations for Insurance Invoices

When preparing and sending financial documents, it’s crucial to ensure they comply with local laws and regulations. Legal requirements can vary by jurisdiction and industry, and failing to meet these standards could lead to complications, including disputes or even legal action. Understanding the key legal elements to include in your billing documents is essential for protecting your business and maintaining transparency with your clients.

Essential Legal Elements in Billing Documents

To ensure your financial records meet legal requirements, there are certain elements that should always be included in the document. These elements help safeguard both the business and the client by providing clear terms and documentation for the transaction.

Legal Requirement Description Business Identification Your business name, address, and contact details should be clearly stated to identify the party issuing the document. Client Information Include the client’s full name, address, and other contact details to ensure the document is directed to the correct individual or entity. Legal Terms and Conditions Clearly state payment terms, including the due date, late fees, and any other relevant policies regarding the transaction. Unique Identifier Include a unique reference number or code for each document. This helps with tracking and prevents confusion in case of disputes. Applicable Taxes Ensure that all relevant taxes, such as VAT or sales tax, are listed separately and in compliance with tax laws. Compliance with Local Laws and Regulations

In addition to these basic requirements, it’s essential to be aware of any industry-specific or local regulations that might apply to your documents. For example, certain industries may have specific guidelines on what must be included in billing records, such as licensing numbers or other official credentials. Ensuring your documents meet these regulations not only protects your business legally but also enhances your professionalism in the eyes of clients.

Consulting with a legal advisor or accounting professional is often a wise step to ensure your records comply with all relevant laws and standards. This way, you can avoid potential pitfalls and focus on maintaining smooth business operations.

How to Track Payments Efficiently

Tracking payments effectively is crucial for maintaining accurate financial records and ensuring timely cash flow. Whether you’re managing a small business or overseeing multiple transactions, a reliable system for monitoring payments helps prevent missed or delayed payments and ensures that all accounts are up to date. With the right tools and practices in place, you can simplify the process and keep your finances in order.

Key Strategies for Efficient Payment Tracking

Here are some essential practices to help you stay on top of incoming payments:

- Use Accounting Software: Invest in reliable accounting or bookkeeping software that automates the tracking process. Many of these tools can integrate with payment platforms and provide real-time updates, making it easier to monitor payments and manage your financial records.

- Create a Payment Schedule: Set clear deadlines for when payments are due and establish a routine for checking whether clients have made their payments. This ensures you don’t miss any outstanding amounts and can follow up in a timely manner.

- Record Payments Immediately: As soon as a payment is received, make sure it is entered into your tracking system. This prevents any confusion and ensures that your financial records are always up to date.

- Generate Regular Reports: Periodically review payment status reports. This helps you quickly identify outstanding balances and take the necessary action before they become overdue.

Utilizing Payment Methods for Easier Tracking

Different payment methods can provide different levels of tracking efficiency. By offering a variety of options, you can streamline the process and make it easier to track funds as they come in:

- Online Payment Platforms: Tools like PayPal, Stripe, or other digital payment systems automatically update your records, providing real-time confirmation and minimizing manual entry.

- Bank Transfers: If clients are paying via bank transfer, make sure to regularly check your account statements to record incoming payments and cross-check them against outstanding balances.

- Credit Cards: Many businesses use credit card processing systems that offer detailed reports of all transactions, which simplifies tracking and reconciling payments.

By incorporating these strategies into your financial practices, you can keep track of payments more efficiently, reduce the risk of errors, and ensure that your accounts are always accurate and up to date.