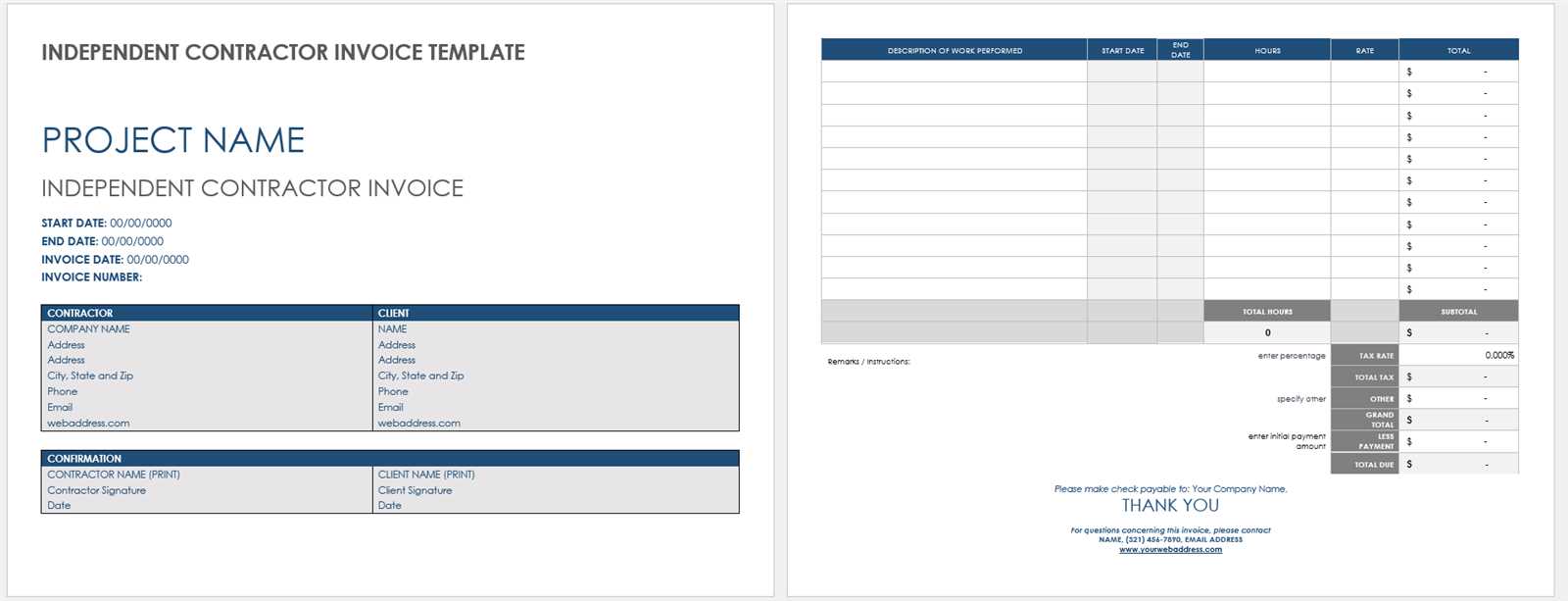

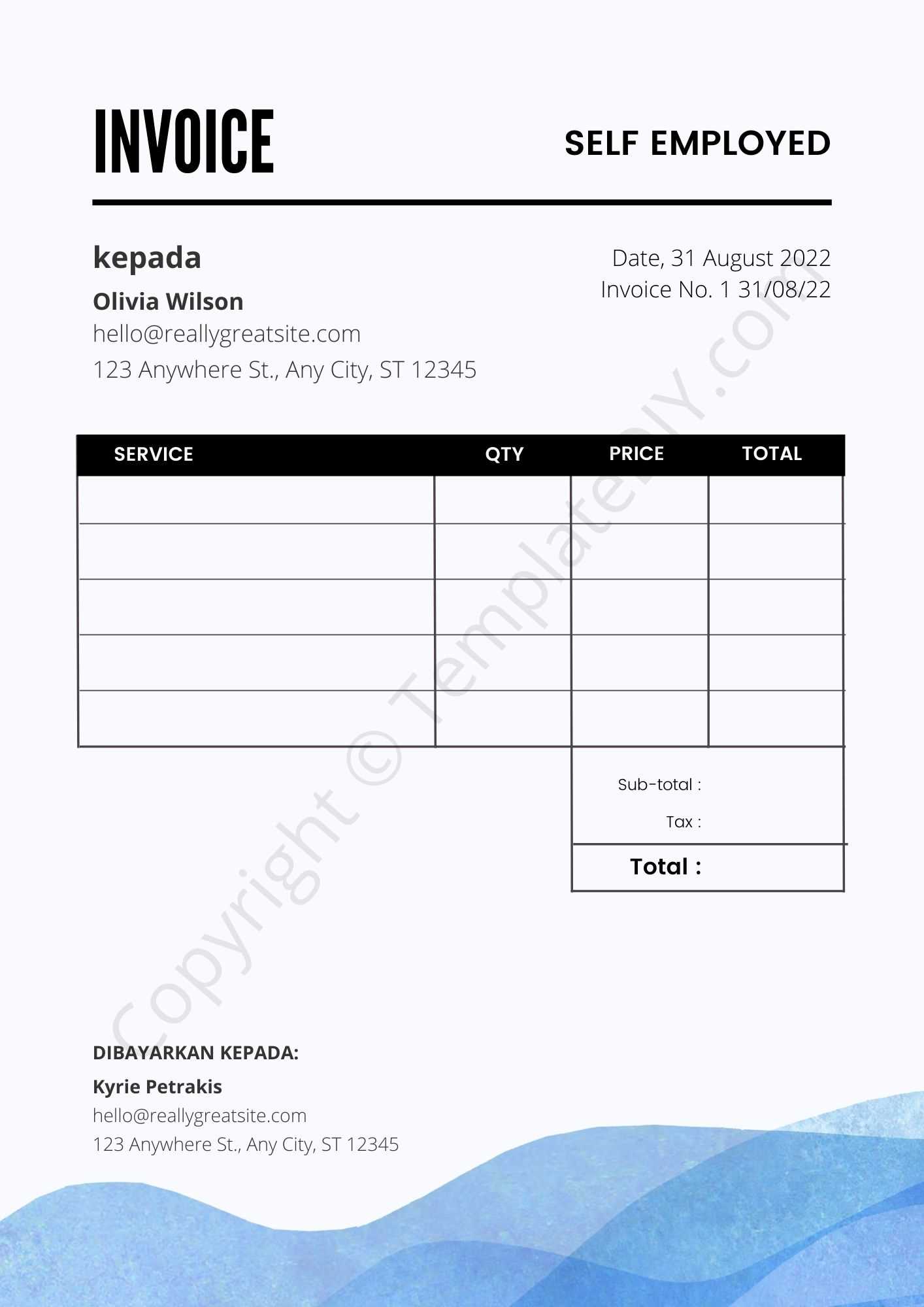

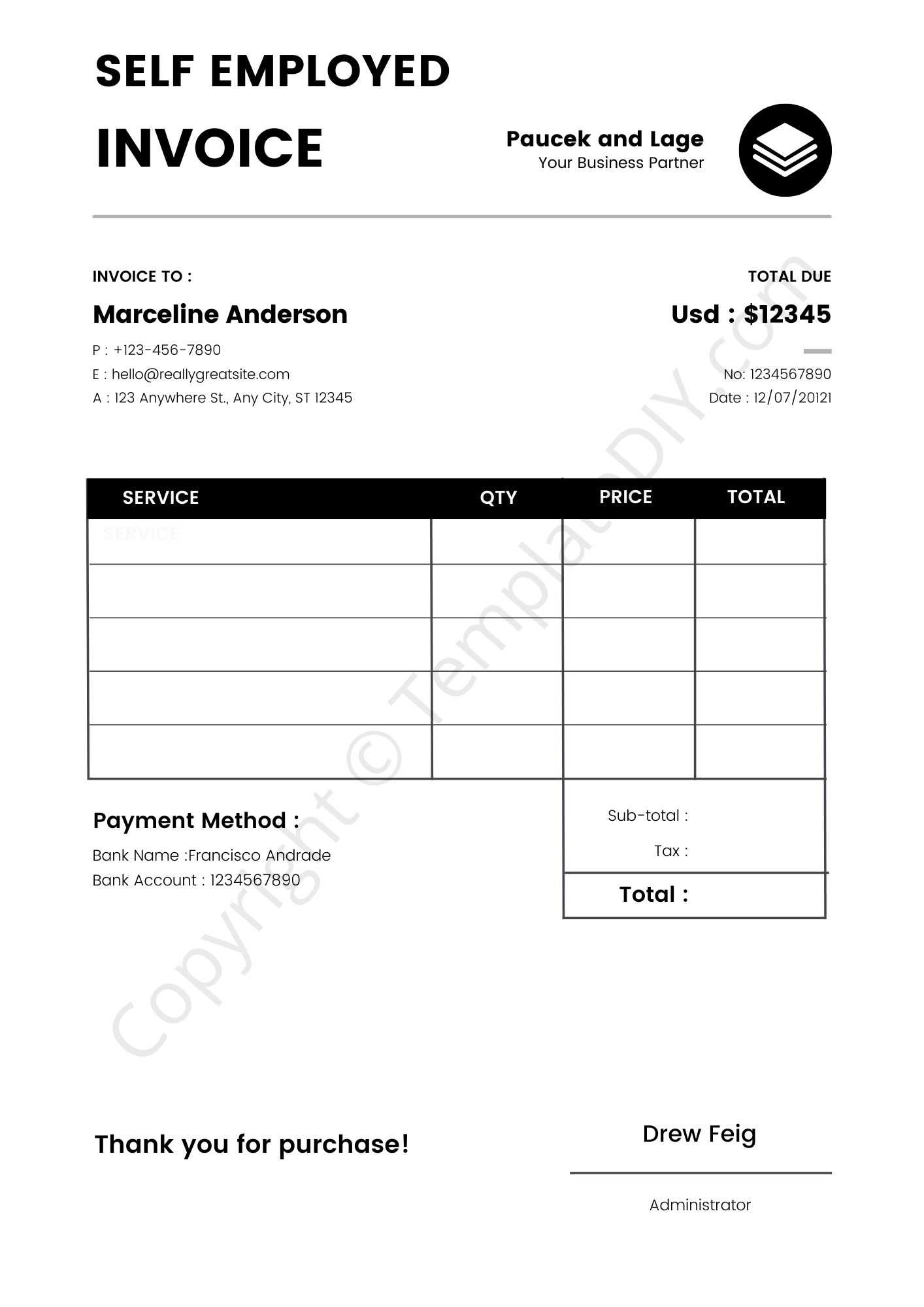

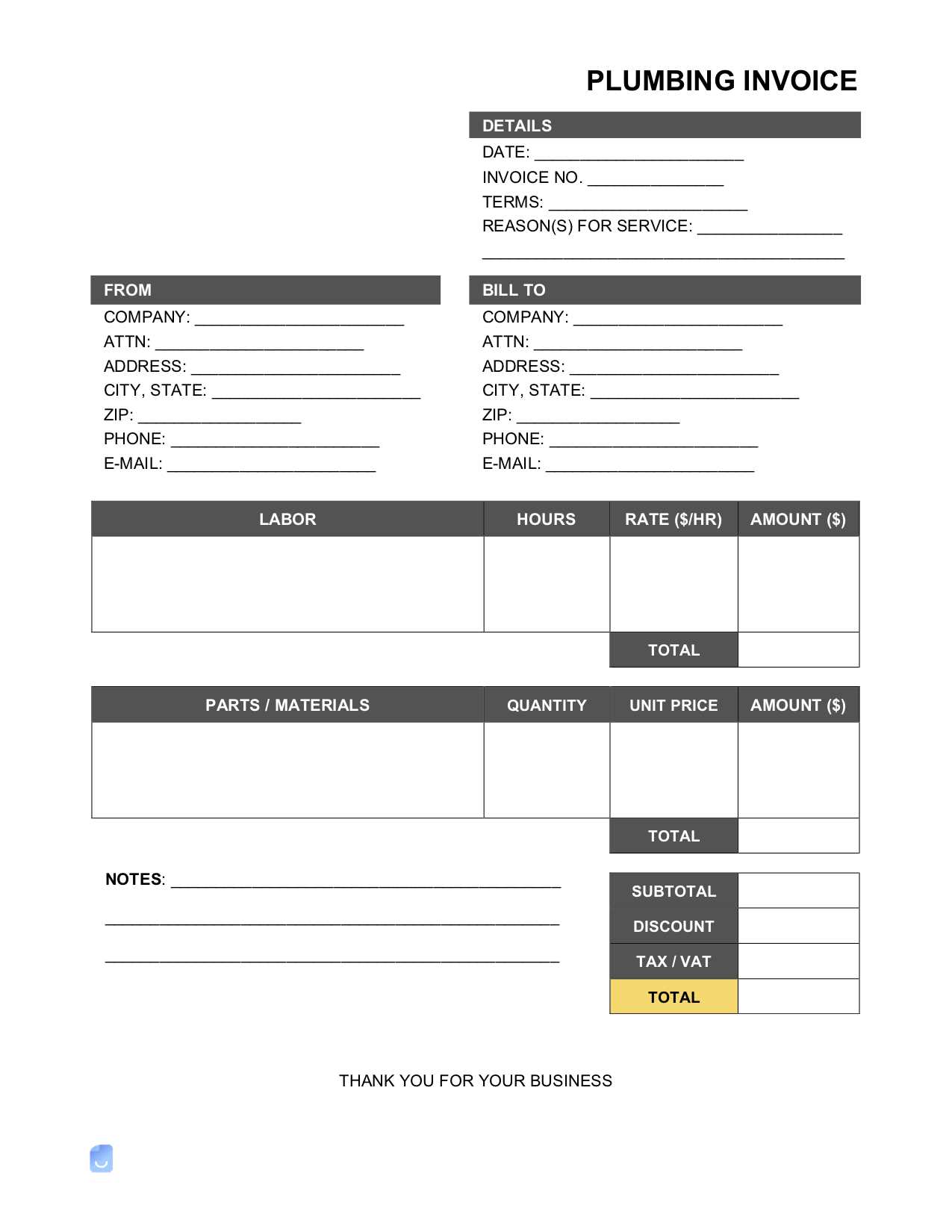

Self-Employed Contractor Invoice Template for Efficient Billing

For individuals offering specialized services, having a reliable system to request payment is crucial. Crafting a formal document that outlines work completed, payment details, and terms ensures transparency and professionalism. A well-organized statement not only fosters trust with clients but also helps maintain clear financial records.

Designing a payment request that aligns with your business needs can simplify the process of receiving compensation. Whether you’re providing one-time services or ongoing assistance, a structured approach to billing is necessary. Customizing these documents allows you to highlight essential information, such as the nature of the work, agreed rates, and due dates.

In this guide, we’ll explore how to structure these important documents effectively, ensuring they meet both your and your client’s expectations. By focusing on clarity and consistency, you can create documents that reflect the quality of your work and streamline financial transactions.

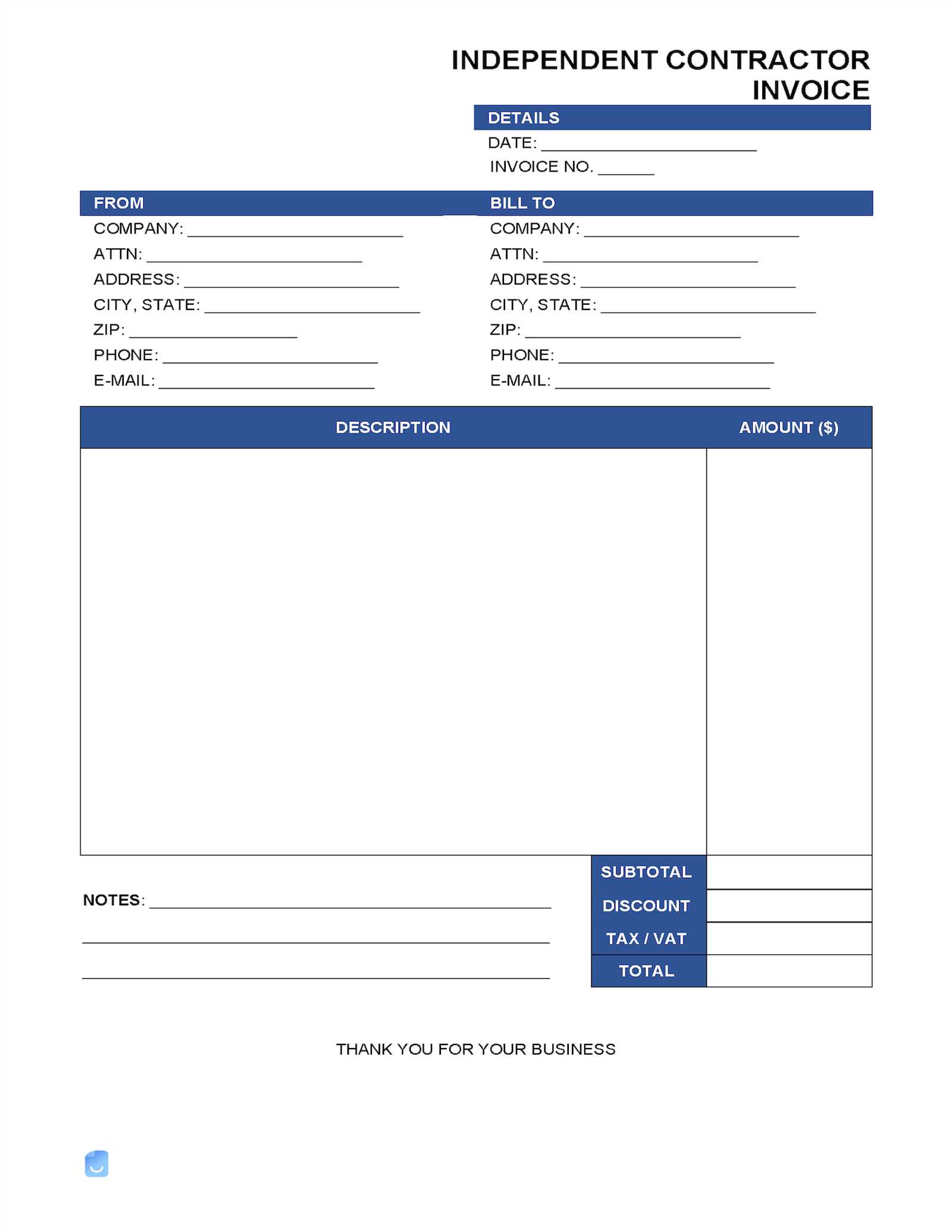

Choosing the Right Invoice Format

When preparing to request payment for services rendered, selecting the appropriate structure for your billing document is essential. The format should be clear, concise, and professional, ensuring that all necessary information is easily accessible. A well-structured document minimizes confusion and helps establish trust with your clients.

Factors to Consider When Selecting a Format

- Clarity: The format should clearly highlight key details, such as the work provided, total amount due, and payment terms.

- Readability: Choose a layout that is simple to follow, ensuring clients can quickly find the information they need.

- Customization: Make sure the structure allows for customization based on the type of service provided or the needs of different clients.

Popular Formats for Billing Documents

- Traditional Paper Format: A printed format with all the necessary fields, ideal for clients who prefer physical records.

- Digital Format: An editable PDF or Word document that can be easily sent via email or other digital platforms.

- Online Tools: Billing platforms or software that offer pre-designed formats with the option for automatic updates and record-keeping.

Choosing the right format ultimately depends on your business practices and client preferences. By selecting a layout that is both functional and professional, you can streamline the payment process and ensure that your work is compensated accurately and promptly.

Essential Elements of an Invoice

Creating a billing document requires careful attention to key details that ensure clarity and accuracy. A well-structured document not only specifies the amount due but also outlines the terms and conditions under which payment is expected. Each element plays an important role in making the process smooth for both the service provider and the client.

Key Information to Include

| Element | Description |

|---|---|

| Header | Includes your name or business name, contact information, and a unique identifier for the document. |

| Client Details | Client’s name, address, and contact details for easy reference and communication. |

| Work Description | A clear breakdown of services provided, with dates and quantities if applicable. |

| Total Amount Due | The sum of all charges, including taxes or discounts, presented in a clear and straightforward manner. |

| Payment Terms | Details on when payment is due, accepted payment methods, and any late fees or discounts for early payment. |

| Additional Notes | Any other important information, such as warranty, conditions, or special requests from the client. |

Why These Elements Matter

Each section ensures that both parties are on the same page regarding expectations. Including detailed descriptions and clear payment terms prevents misunderstandings and helps with record-keeping. Properly formatting these elements promotes professionalism and can lead to smoother transactions.

How to Customize Your Template

Personalizing your billing document allows you to reflect your brand and provide a more tailored experience for your clients. Customization involves adjusting various elements to suit specific needs, whether it’s altering the layout, adding unique fields, or incorporating your business identity. A well-customized document enhances professionalism and ensures that all relevant details are covered.

Steps for Customizing Your Document

| Step | Description |

|---|---|

| Modify the Header | Include your company logo, business name, and contact information to make the document clearly identifiable. |

| Adjust Service Details | Adapt the sections to match the specific services or products you offer, ensuring each one is described accurately. |

| Set Payment Terms | Customize the payment conditions, such as due dates, discounts for early payment, or late fees. |

| Add Branding | Use your business’s colors, fonts, and style to align the document with your brand identity. |

| Include Legal Information | If needed, include terms of service, business registration details, or any legal disclaimers specific to your industry. |

Why Customization is Important

Customizing your document not only ensures that it meets your specific needs but also enhances its professionalism. By incorporating your brand’s elements and personalizing the sections, you create a document that is unique to your business and easy to understand for your clients. A personalized approach strengthens client relationships and improves payment processes.

Incorporating Payment Terms Effectively

Establishing clear and concise payment terms is essential for ensuring timely compensation and maintaining healthy financial practices. These terms set expectations for both the service provider and the client, outlining the agreed-upon deadlines, acceptable payment methods, and any additional conditions such as late fees or early payment discounts. Including these details in your document helps avoid misunderstandings and fosters professional relationships.

Key Aspects of Payment Terms should include due dates, acceptable payment methods (such as bank transfers, credit cards, or online payment systems), and any consequences for delayed payments. It’s important to be transparent and clear about these terms to prevent confusion later. For example, stating a clear due date, such as “Payment is due within 30 days of receipt,” provides a straightforward reference for clients.

Late Fees and Discounts are additional aspects to consider when establishing your terms. Offering a discount for early payment can incentivize clients to settle their balances promptly, while setting up a late fee structure ensures that you are compensated for any delays. Both of these elements should be included in a clear and professional manner to encourage compliance with payment deadlines.

Legal Requirements for Contractors

When providing services to clients, it is important to be aware of the legal obligations that come with the job. These requirements help ensure that both parties are protected and that all work is conducted within the bounds of the law. Understanding the essential legal elements will allow you to manage your business practices effectively and avoid potential issues in the future.

Key Legal Obligations to Consider

| Requirement | Description |

|---|---|

| Tax Compliance | Make sure to report income properly and pay applicable taxes, including income, sales, or VAT taxes, depending on your location and business type. |

| Contractual Agreements | Draft clear contracts outlining the terms and conditions of the service agreement, including timelines, payment schedules, and deliverables. |

| Insurance Requirements | Ensure that you have the necessary insurance coverage, such as liability insurance, to protect both yourself and your clients from potential risks. |

| Licensing and Permits | Check if your industry requires any special licenses or permits and make sure to renew them as necessary. |

Why Legal Compliance Matters

Being aware of and complying with legal requirements ensures that you are operating within the law and can avoid costly fines or legal disputes. Proper documentation, including signed contracts and clear payment terms, helps prevent misunderstandings. By meeting these requirements, you build trust with your clients and establish a solid foundation for your business.

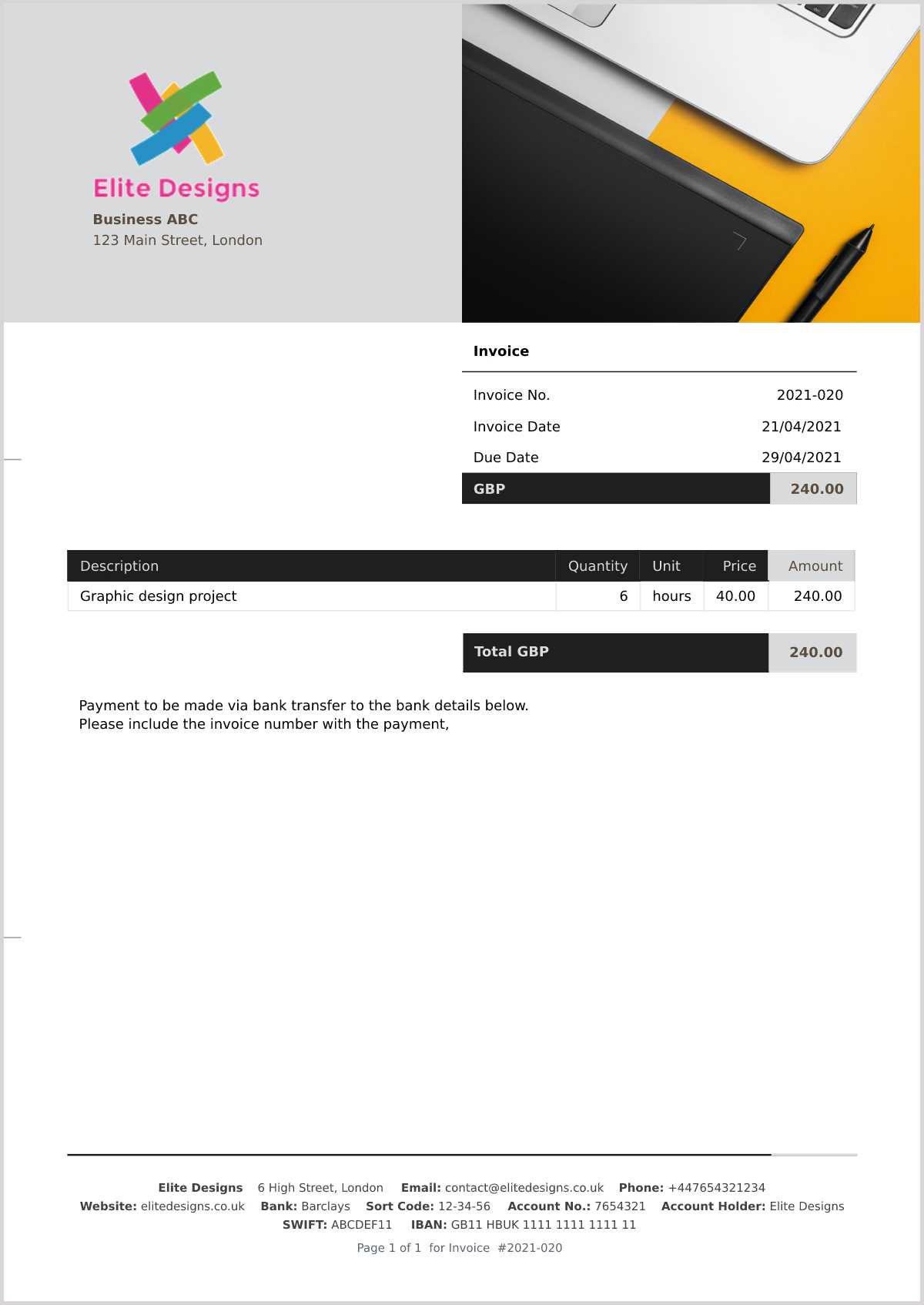

How to Add Client Information

Including client details in your billing documents is an essential part of maintaining clear and organized records. This section ensures that both you and your clients can easily identify the transaction and its associated details. By correctly adding client information, you foster transparency and professionalism in your business transactions.

Important Details to Include

When adding client information, ensure you capture the following:

- Client’s Full Name: This helps personalize the document and avoid confusion when working with multiple clients.

- Company Name: If applicable, list the client’s company or organization for business-to-business transactions.

- Address: Include the full address of the client, which is important for shipping, taxation, and legal purposes.

- Contact Information: Provide phone numbers or email addresses to ensure easy communication in case of questions or clarifications.

- Client ID or Account Number: If you have a system to track clients, include their unique identifier for better organization.

Why Client Information is Crucial

Accurate client details prevent errors and miscommunication. This ensures that all correspondence, payment reminders, and documents are directed to the correct person or organization. It also creates a formal record of the business relationship, which is valuable for future references or legal purposes.

Invoicing for Different Project Types

Different types of work require distinct approaches when it comes to billing. Whether you are offering a one-time service or ongoing assistance, tailoring your billing method to the specific project helps maintain clarity and professionalism. Each project type may have unique factors that influence the way you structure your payment requests and terms.

Types of Projects and Their Billing Structures

- Fixed-Price Projects: These are projects with a set cost agreed upon in advance. The total amount is usually broken down into milestones or paid in full upon completion.

- Hourly Projects: For projects where time is the main factor, billing is done based on the number of hours worked. This method often requires tracking time meticulously and noting the hours worked for transparency.

- Retainer-Based Projects: In ongoing work, a retainer fee is charged on a regular basis, such as monthly. This ensures a steady income stream while covering continuous service or support.

- Milestone Payments: For larger projects, payments may be structured around specific milestones or phases. Each completed stage triggers the next payment, which aligns with the progress of the work.

Factors to Consider for Accurate Billing

- Scope of Work: The complexity and scale of the project will influence how you charge and what to include in the payment request.

- Payment Deadlines: Clear timelines should be set, especially for long-term or milestone-based projects, to ensure payments are made on time.

- Additional Costs: Ensure that any extra expenses or changes to the original agreement are accounted for in the final amount.

How to Include Tax Information

Incorporating tax information into your billing documents is essential to ensure compliance with local regulations and transparency with your clients. Properly outlining tax details helps prevent confusion and ensures both you and your clients are clear on financial obligations. This section explains how to correctly add tax-related information in your billing documents.

Types of Taxes to Include

- Sales Tax: This tax is typically added to goods or services that are taxable in your region. It’s essential to state the percentage rate and the total amount of sales tax charged.

- Value Added Tax (VAT): If applicable, VAT is included in transactions in many countries. Make sure to specify the rate and whether the price is shown before or after VAT is added.

- Withholding Tax: Some regions require a withholding tax for specific types of work. Clearly state the amount or percentage of tax withheld from the total amount due.

- Other Applicable Taxes: Depending on your industry or location, there may be other taxes to consider. Always check the local tax laws to ensure compliance.

Best Practices for Including Tax Information

- Clearly Specify Tax Rates: Always mention the applicable tax rates and how they are calculated. This ensures the client understands the breakdown of the final amount.

- Separate Tax Amounts: It is advisable to separate the tax amount from the base price to make it easier for clients to understand the total cost.

- Provide a Tax Identification Number: If required, include your tax ID number or business registration number to confirm the legitimacy of the transaction.

Organizing Your Invoice Numerically

Maintaining a clear and organized numerical system for your billing documents is essential for both personal record-keeping and client management. A well-structured numbering system helps you easily track each transaction, maintain consistency, and avoid confusion. It also aids in meeting tax and legal requirements by providing a simple way to reference past records when necessary.

Benefits of Numerical Organization

- Consistency: Using a sequential numbering system ensures every document has a unique reference number, making it easier to track and follow up on payments.

- Professionalism: A well-organized system reflects professionalism and helps build trust with clients, showing that you handle administrative tasks efficiently.

- Legal Compliance: Some regions or businesses may require invoices to be numbered sequentially for legal and tax purposes. This ensures all documents are accounted for in case of audits or inquiries.

How to Set Up a Numbering System

- Sequential Numbers: Begin with a simple sequence like 001, 002, 003, and so on. This is easy to maintain and ensures no two documents are identical.

- Incorporating Date Codes: You can also include the date in your numbering system, such as 2024-001, 2024-002, to easily distinguish invoices from different periods.

- Project or Client Codes: For larger projects or clients, adding a unique identifier to the number can help further organize your records (e.g., CLIENT001-001, CLIENT001-002).

Importance of Payment Methods Listing

Clearly listing payment options on your billing documents is essential for facilitating smooth transactions between you and your clients. By providing multiple methods for settling balances, you increase the likelihood of timely payments and help ensure that clients can choose the most convenient way for them to pay. It also reduces confusion and minimizes delays caused by unclear instructions or limited options.

Benefits of Clear Payment Instructions

- Ease of Payment: When clients have a clear understanding of available payment methods, they are more likely to settle their bills promptly without unnecessary follow-ups.

- Improved Cash Flow: Offering various payment methods, such as bank transfers, credit cards, or online payment systems, can speed up the payment process, improving your cash flow.

- Client Satisfaction: Clients appreciate the flexibility to choose a payment method that fits their preferences, contributing to a positive business relationship.

Best Practices for Payment Methods Listing

- Be Specific: Clearly state the details for each payment method, such as account numbers or payment links, to avoid any confusion.

- Offer Multiple Options: Including a variety of payment methods–such as PayPal, bank transfer, or credit card–ensures that clients can select the most convenient method for them.

- Include Deadlines: Make sure to indicate any payment deadlines for each method to ensure timely processing.

Setting Clear Deadlines for Payments

Establishing specific and clear payment deadlines is a critical aspect of any business arrangement. By outlining exact dates for when payments are due, both you and your clients have a mutual understanding of expectations. This practice helps avoid delays, improves cash flow, and promotes professionalism in your financial transactions. Clear deadlines also provide a framework for resolving any payment issues that may arise.

Why Payment Deadlines Matter

Clearly defined payment deadlines serve as an effective way to ensure timely transactions. It removes ambiguity and encourages clients to prioritize their financial obligations. Furthermore, payment terms help maintain a healthy business relationship by ensuring that both parties are on the same page when it comes to payments.

Best Practices for Setting Deadlines

| Best Practice | Description |

|---|---|

| Specify the Date | Always provide an exact date for payment. This prevents confusion over when the payment is expected. |

| Grace Period | Consider offering a short grace period after the due date, giving clients some flexibility while still emphasizing the importance of timely payments. |

| Late Fees | Clearly communicate any late fees or penalties for missed payments to encourage on-time transactions. |

| Multiple Reminders | Send reminders at regular intervals before and after the payment due date to prompt clients to settle their balances. |

How to Handle Late Payments

Late payments can create unnecessary stress and disrupt your business operations. It’s essential to approach these situations with professionalism and clarity, ensuring that you maintain a positive relationship with clients while also protecting your financial interests. Having a structured process in place for managing overdue payments helps to reduce the chances of delays and ensures a fair resolution.

Communicate Clearly and Politely

The first step in addressing late payments is to reach out to your client promptly. Approach the situation with a polite and professional tone, acknowledging any possible reasons for the delay. A clear communication strategy will prevent misunderstandings and pave the way for timely payments moving forward.

Set Payment Terms in Advance

To prevent future issues, it’s crucial to set clear payment terms from the beginning of any business relationship. Clearly outline the due date, late fees, and any other relevant terms in your agreements. Having these terms upfront ensures that both you and the client are on the same page.

Implement Late Fees and Penalties

If payments are overdue, consider enforcing late fees or penalties as outlined in your agreement. This encourages clients to prioritize settling their balances on time and discourages delayed payments. Make sure to communicate these fees in advance so that there are no surprises for your clients.

Offer Payment Plans

In some cases, clients may face financial difficulties and struggle to pay the full amount on time. Offering a structured payment plan can be a viable solution that helps both parties. It shows flexibility while still ensuring that you receive the agreed-upon amount.

Know When to Seek Legal Action

If repeated attempts to collect the payment fail, it may be necessary to seek legal assistance. Before taking this step, ensure that you have exhausted all other options, including amicable negotiations and reminders. Legal action should be considered a last resort after all other avenues have been explored.

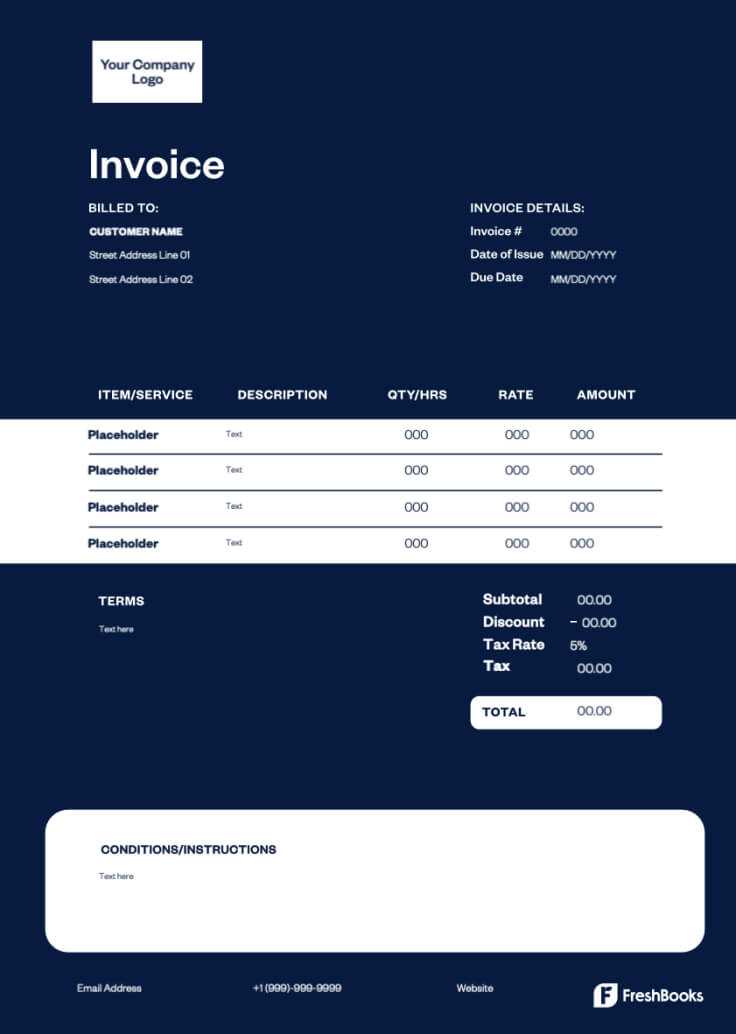

Design Tips for Professional Invoices

Creating a visually appealing and well-organized payment request document is crucial for making a positive impression on your clients. A professional design not only conveys trustworthiness but also ensures that important information is easy to locate. Implementing a clean and structured layout can help avoid confusion and speed up the payment process.

Here are some design tips to ensure your document stands out for all the right reasons:

- Keep the Layout Clean and Simple – Avoid clutter by using a minimalist design. Prioritize clarity and ensure that the document’s key information is prominent. This makes it easier for clients to find what they need quickly.

- Use Clear Headings and Sections – Organize the document into sections such as “Billing Information,” “Itemized Charges,” and “Total Amount Due.” This will make it easier for the client to navigate the document.

- Choose Readable Fonts – Select professional, easy-to-read fonts. Avoid using too many different styles or sizes, as this can create a chaotic appearance. Stick to one or two fonts for consistency.

- Incorporate Your Branding – If you have a logo or brand colors, incorporate them into the design. This gives the document a personalized touch and reinforces your brand identity.

- Highlight Important Information – Use bold or larger fonts to make critical details, such as the total amount due, payment terms, and due date, stand out. This draws attention to the most important aspects of the document.

- Leave White Space – White space is essential for a clean, professional look. It helps prevent the document from looking too crowded and makes the content more digestible for the reader.

- Ensure Consistency – Maintain a consistent style throughout the entire document. Use the same color scheme, fonts, and layout structure to present a unified, professional appearance.

cssCopy code

Tracking and Storing Invoices

Maintaining an organized system for tracking and storing your financial records is essential for both operational efficiency and compliance with tax regulations. By keeping proper records, you ensure that all payments are accounted for and that you have easy access to past documents when needed, whether for audits or future reference.

Why It’s Important

Having a reliable system to track and store these documents helps you manage your cash flow more effectively, monitor overdue payments, and stay on top of your finances. Additionally, proper storage safeguards against potential disputes and makes tax filing simpler.

Methods for Tracking and Storing

There are several methods you can use to track and store your financial documents, depending on your preferences and business needs:

- Digital Systems: Many businesses use software or cloud-based solutions to store documents securely. These tools often offer features like automated reminders for overdue payments, making them convenient for managing records efficiently.

- Spreadsheets: A simple yet effective option is using spreadsheets to keep a manual record of issued documents. With proper organization, it can be easy to filter and find specific transactions when needed.

- Physical Storage: Some businesses prefer physical storage, where hard copies are kept in a safe or filing cabinet. While this method is increasingly less common, it may still be useful for certain industries or preferences.

vbnetCopy code

Regardless of the system you choose, consistency is key. Make sure every document is labeled correctly and stored in an organized manner to prevent any confusion or loss of records.

How to Include Discounts and Credits

Providing discounts or applying credits to a transaction can help build customer loyalty and encourage timely payments. It’s important to clearly communicate these reductions to your clients, ensuring they understand the adjustments made to the total amount due. By including this information in an organized and transparent manner, you maintain professionalism and avoid confusion.

Methods for Including Discounts and Credits

There are several ways to incorporate discounts and credits into your billing documents. Here are the most common approaches:

- Flat Amount Discount: This is a specific reduction in the total amount, often used for early payments or promotions. For example, offering a $50 discount for payment within 10 days.

- Percentage Discount: A percentage reduction from the total bill. This is often applied to larger transactions or during special sales events. For instance, “10% off for orders over $500.”

- Credit Application: If a client has overpaid or is entitled to a credit from a previous transaction, it should be clearly stated. Make sure to include the reason for the credit and how it is being applied to the current balance.

- Discount Codes: When using promotional or seasonal offers, it’s effective to list a discount code and indicate how it applies to the overall sum. This ensures that clients are aware of their savings and the promotional terms.

vbnetCopy code

Presenting the Adjustments Clearly

For clarity, always list the discount or credit separately under the main charges, so the client can see the breakdown of how the total was reduced. Here’s an example of how you might present it:

| Description | Amount |

|---|---|

| Original Amount | $500.00 |

| Discount (10%) | -$50.00 |

| Total Amount Due | $450.00 |

By keeping these entries clear and straightforward, both you and your client will have a better understanding of the final charge, leading to fewer disputes and smoother transactions.

Ensuring Clarity in Service Descriptions

Clear and precise descriptions of the services provided are crucial in any billing document. This ensures that the client understands exactly what they are being charged for, which helps avoid misunderstandings or disputes. A detailed breakdown helps both parties stay on the same page regarding the scope of work and the associated costs.

When outlining services, it’s essential to avoid vague language and focus on providing specific details. This not only boosts professionalism but also enhances transparency in the transaction process.

How to Present Service Details Effectively

Here are a few tips for presenting services clearly:

- Be Specific: Avoid using general terms like “consulting” or “work done.” Instead, describe the task in detail, such as “website development” or “marketing strategy creation.” This provides the client with a clearer picture of what was done.

- Use Bullet Points: For multiple tasks or services, list them in bullet points or a table to keep everything organized and easy to read.

- Include Timeframes: Mention the duration or completion date for each service. This helps the client understand how long the task took and how the pricing correlates with the time spent.

- Show Quantities and Rates: If applicable, list the quantity of services provided (e.g., “5 hours of consultation”) along with the rate for transparency in pricing.

Example of a Clear Service Breakdown

Here’s an example of how to structure the service descriptions in a well-organized way:

| Description | Quantity | Rate | Total |

|---|---|---|---|

| Website Design | 1 project | $1,000.00 | $1,000.00 |

| Content Creation | 5 articles | $100.00 per article | $500.00 |

| Total | $1,500.00 |

By organizing and clearly describing the services provided, you not only improve your communication with the client but also reduce the chance of any confusion about the work done and the associated costs.

Creating a Reusable Template

Building a reusable document for billing purposes can save valuable time and effort. By designing a structured layout that can be easily adapted for different clients and services, you streamline the process, ensuring consistency and professionalism in all transactions. A well-organized structure also minimizes errors and allows for quick updates as necessary.

When creating such a structure, focus on key elements that remain constant, such as contact details, payment terms, and service descriptions. The ability to quickly adjust the amounts, dates, and other specifics for each new client or job will make your workflow more efficient and effective.

Core Elements to Include

- Header: Include your name, business name, or brand, and contact information for easy identification.

- Service List: Create a section to list the services provided with space for descriptions, quantities, rates, and totals.

- Payment Terms: Clearly state the due date and any penalties for late payments to ensure timely transactions.

- Footer: Include any additional notes, such as thank you messages or instructions for the client, to leave a professional impression.

How to Organize for Reuse

Once the essential sections are established, save the layout in a versatile format, such as a word processor or a spreadsheet, that can be easily accessed and edited. By creating a master document with placeholders, you only need to adjust a few details for each project, significantly speeding up the process for future use.

Why Use Digital Invoices?

Utilizing electronic billing methods offers numerous advantages over traditional paper-based systems. Digital formats provide increased efficiency, enhanced organization, and streamlined communication, all while reducing the risk of errors. By embracing modern technology, individuals and businesses can manage their payment requests in a more sustainable and user-friendly way.

With the ability to send, track, and store documents quickly, digital methods offer both time-saving and environmental benefits. Furthermore, they improve accessibility, as they can be easily retrieved from multiple devices, ensuring clients can view or settle their dues without delays.

Benefits of Going Digital

- Faster Transactions: Electronic documents can be sent immediately via email or other online platforms, eliminating postal delays and speeding up payment processing.

- Environmental Impact: Reducing the need for paper means less waste, contributing to environmental sustainability.

- Automation: Digital tools often allow for automatic generation and delivery of documents, reducing manual input and increasing consistency.

- Security: Electronic records are easier to secure and back up, minimizing the risk of loss or damage compared to physical copies.

Practical Considerations

Although digital systems require an initial setup and a level of technical familiarity, the long-term benefits far outweigh the initial learning curve. Moreover, many platforms offer templates and customization options, making it simple to create a professional layout that suits individual needs. Transitioning to digital methods ultimately promotes better workflow management, especially for those handling multiple requests or clients.