Hotel Invoice Template DOC Free Download and Customization

In any business, having a streamlined process for managing transactions and client payments is crucial. Ensuring that every payment request is clear, detailed, and professionally formatted helps maintain strong relationships with clients and keeps financial records organized. The ability to produce customizable and efficient billing documents is essential for businesses aiming to provide a seamless experience for their customers.

Whether you’re a small guesthouse owner or manage a larger accommodation service, creating a professional-looking statement can be done easily with the right tools. These documents not only serve as proof of the services rendered but also ensure that the transaction is accurately recorded and easy to reference later. Using a well-designed structure can save time and effort, making billing less of a hassle.

Customizable formats allow businesses to tailor the content to their specific needs, ensuring that all necessary details are included. From listing services to adding payment terms and contact information, these documents can be adjusted quickly to fit various scenarios. With easy-to-use, editable formats available for download, business owners can efficiently manage their accounting tasks without the need for complex software.

Hotel Invoice Template DOC Free Download

Accessing a free, customizable document format for billing is an easy way to streamline your financial management. By downloading an editable file, you gain the flexibility to modify the details according to your specific needs, saving both time and effort in preparing requests for payment. Whether you’re running a small guest accommodation or managing a larger establishment, having the right structure in place ensures clarity and accuracy in your financial records.

These files are designed to be user-friendly and compatible with most word processing software. You can easily replace placeholders with your details, such as guest names, services rendered, and payment terms. Downloading a pre-formatted file means you don’t have to start from scratch each time you need to generate a new record. With a simple structure, these documents are both professional and easy to use.

By downloading a free file, you eliminate the need to purchase expensive software or hire professionals to create billing statements. The flexibility to make edits and reuse the format makes it an ideal solution for businesses looking to stay organized and efficient. Get started by downloading your own customizable document today and simplify your financial processes.

Why Choose a Hotel Invoice Template

Using a structured format for billing is essential for businesses that need to present clear, professional payment requests. By choosing a pre-designed document, you ensure that all necessary information is included, making it easier to communicate details about services rendered and amounts due. This reduces the likelihood of errors and confusion, improving both the customer experience and your internal accounting processes.

Save Time and Effort

With a pre-set layout, you eliminate the need to create a new billing document from scratch each time. You can quickly fill in the relevant details, such as dates, charges, and payment terms, allowing you to focus on other aspects of your business. The time saved can be reinvested into improving services or enhancing the guest experience.

Professional Appearance and Accuracy

Using a standardized format ensures that your billing documents have a professional look, helping to build trust with clients. A well-organized document reflects attention to detail, while also making it easier for clients to understand their charges. Accuracy is key, and by using a proven structure, you can ensure that all necessary fields are included without missing any important information.

Benefits of Using DOC Format

Opting for a widely used file format for creating billing documents offers numerous advantages, particularly when it comes to ease of editing and compatibility across various devices and platforms. The flexibility of this format ensures that businesses can easily make changes to documents while maintaining a professional layout. It also allows for seamless integration with most word processing software, ensuring that anyone with basic technical skills can manage the document effortlessly.

Easy Editing and Customization

One of the key advantages of using this format is its ability to be quickly edited. You can adjust the content, such as client names, service details, or payment terms, without hassle. The format allows for easy customization of text, fonts, and layout, giving you the freedom to create a document that fits your specific needs. With just a few clicks, you can adapt it for various occasions or customer requirements.

Wide Compatibility and Accessibility

Another significant benefit is the format’s compatibility with almost all word processing software, including popular programs like Microsoft Word and Google Docs. This makes it easy to access and modify your files on different devices, whether you’re at the office or working remotely. Additionally, the format ensures that your document remains consistent and readable across all platforms.

How to Customize Your Hotel Invoice

Personalizing your billing documents allows you to tailor the information to meet specific client needs while maintaining a professional appearance. The process of customization involves adjusting the key details and design elements, ensuring that the document reflects the unique aspects of your business. By modifying fields such as service descriptions, payment terms, and contact information, you can create a document that is both clear and functional.

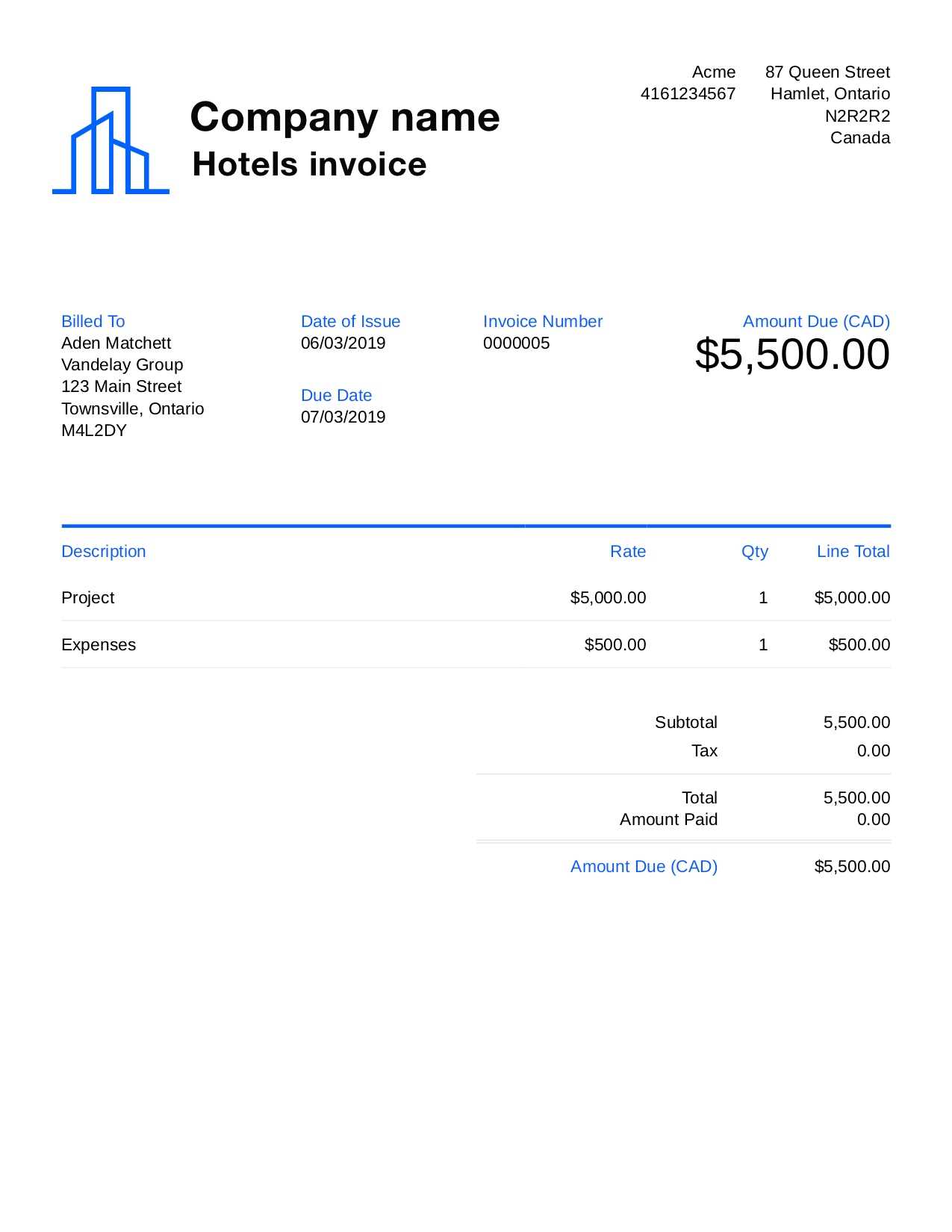

Start by filling in the necessary information for each section, such as the client’s name, address, and the specific charges for the services provided. Below is an example of a simple layout that can be customized:

| Item Description | Amount |

|---|---|

| Accommodation for 2 nights | $200 |

| Breakfast Service | $30 |

| Cleaning Fee | $20 |

| Total | $250 |

Once you have filled in the charges, you can adjust the layout by changing the fonts, colors, or adding your business logo for a personalized touch. Always ensure that the most important information, such as payment instructions and contact details, is clear and easy to find. By making these small adjustments, you can create a professional and customized document that reflects your brand and facilitates smooth transactions.

Essential Fields in a Hotel Invoice

When preparing a billing document, it’s important to include all the necessary details to ensure clarity and accuracy. Key fields in a billing document help both the provider and the customer to understand the charges, terms, and payment requirements. Having these essential fields in place ensures that nothing is overlooked and that both parties can easily refer to the document when needed.

Important Information to Include

- Client Information: The guest’s full name, address, and contact details should be listed at the top of the document.

- Service Breakdown: A detailed list of the services provided, including the type of service, duration, and individual charges.

- Total Amount Due: Clearly display the total sum, including any applicable taxes or additional fees.

- Payment Terms: Information on payment deadlines, accepted methods of payment, and any late fee policies.

- Provider Information: The name of the business, address, phone number, and email for contact purposes.

Additional Considerations

- Invoice Number: A unique identifier for tracking and referencing the document.

- Dates of Service: Include both the check-in and check-out dates, or the duration of the stay if applicable.

- Special Instructions: Any additional notes or details that might be necessary for clarity.

Including these key elements ensures that your billing documents are both professional and comprehensive, helping to avoid misunderstandings and making the payment process smoother for everyone involved.

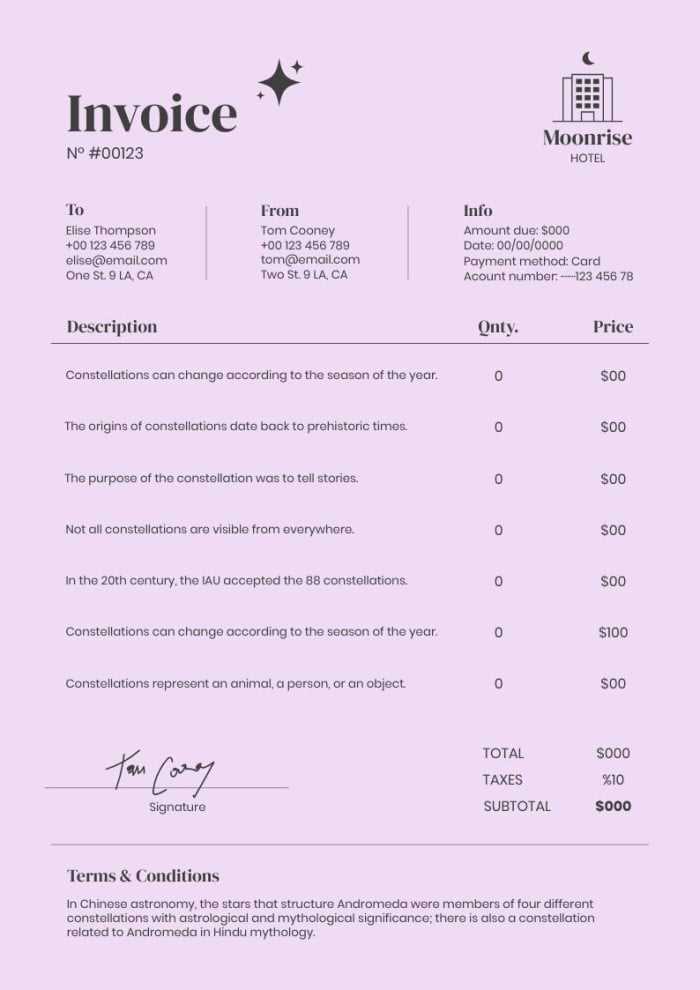

Professional Design Tips for Invoices

A well-designed billing document is not only functional but also contributes to the professionalism of your business. The way the document is structured and presented can leave a lasting impression on your clients. A clean, organized layout ensures that all necessary information is easy to read and understand, which in turn improves the overall customer experience and helps prevent any confusion regarding payments.

When creating your document, focus on the following design tips to enhance clarity and professionalism:

- Use a Simple, Clean Layout: Avoid clutter by keeping the design minimalistic. Make sure there is enough white space to make the document easy to read and visually appealing.

- Highlight Important Information: Use bold or larger fonts for key details like the total amount due and payment terms to make them stand out.

- Consistent Branding: Include your logo, business name, and brand colors to make the document reflect your company’s identity. This adds a personal touch and reinforces professionalism.

- Use Clear and Legible Fonts: Choose fonts that are easy to read, such as Arial or Times New Roman. Avoid overly decorative fonts that may confuse your clients.

- Organize Data in Tables: Present charges and itemized services in a neat table format. This will allow clients to quickly scan the details and understand the breakdown of costs.

By following these tips, you’ll ensure that your documents not only serve their practical purpose but also reflect the professionalism and attention to detail that your business stands for.

How to Save Time with Templates

Using a pre-designed structure for your billing documents can drastically reduce the time spent on creating each one from scratch. By having a consistent format ready, you eliminate the need to repeatedly enter the same details, allowing you to focus on other aspects of your business. This approach not only increases efficiency but also ensures consistency across all your transactions.

Benefits of Using a Pre-Formatted Structure

- Quick Editing: You only need to update essential details, such as client information and specific services rendered, making the process faster.

- Consistency: A standard format ensures that each document is uniform, reducing errors and maintaining a professional look for every client.

- Reusability: Once you have a template, you can reuse it for multiple clients, saving time on formatting and layout adjustments.

- Reduced Mistakes: With a predefined layout, the chances of missing key details or making formatting errors are minimized.

How to Maximize Efficiency

- Save Frequently Used Information: Include placeholders for your most common data, like company name, payment terms, and contact details, so you don’t need to enter them each time.

- Automate Calculations: Use simple formulas in your document software to automatically calculate totals, taxes, and discounts.

- Keep Your File Organized: Store your formatted file in a location where it’s easy to access and update when needed.

By implementing these strategies, you can significantly reduce the time spent creating billing documents and increase the efficiency of your financial operations.

Legal Requirements for Hotel Invoices

When preparing a billing document for clients, it is crucial to ensure that the information included meets legal and regulatory standards. Each jurisdiction may have specific requirements regarding what must be listed, the format of the document, and the tax information provided. Failing to comply with these legal standards can result in financial penalties or issues with tax authorities.

Key Legal Elements to Include

- Business Details: The full name, address, and tax identification number of the business must be clearly stated.

- Client Information: The recipient’s name and address should also be included to ensure the document is traceable to the right party.

- Date of Service: The exact date(s) when the services were provided must be listed, along with the transaction date.

- Service Description: A detailed breakdown of services provided, including the quantity, price, and applicable taxes.

- Total Amount Due: The final amount, including any taxes or additional fees, must be clearly stated and easy to identify.

Other Considerations

- Tax Information: Depending on your region, the document may need to specify the tax rate, tax identification number, or VAT number for compliance.

- Payment Terms: Indicate the payment due date, methods accepted, and any late fee policies that apply.

- Unique Identification Number: Some jurisdictions require a unique document number for tracking purposes.

By ensuring these elements are included, you can stay compliant with legal requirements and ensure smooth business transactions without any complications.

Integrating Hotel Invoices with Accounting Software

Integrating billing documents with accounting software can significantly streamline financial management for any business. By automating the transfer of transaction details directly from your records into the accounting system, you reduce the need for manual data entry and minimize the risk of errors. This integration not only saves time but also ensures that your financial records are accurate and up-to-date, making tax preparation and financial reporting much easier.

Here are some key advantages of linking your billing system to accounting software:

- Automated Data Transfer: Directly inputting transaction details into the accounting software eliminates the need for manual entry, saving valuable time and preventing mistakes.

- Accurate Financial Records: By automatically syncing billing documents with accounting software, you ensure that all financial data is accurate, consistent, and easily accessible for analysis.

- Real-Time Updates: Integration provides instant updates to your accounting records as soon as a transaction occurs, helping you maintain real-time visibility into your business’s financial status.

- Improved Tax Compliance: With accurate and up-to-date financial data, you can easily generate tax reports and ensure compliance with local tax regulations, reducing the risk of costly errors during audits.

- Time and Cost Efficiency: The automation of data entry and reconciliation reduces the workload on your finance team and allows them to focus on higher-level tasks that require more attention.

By connecting your billing system to accounting software, you can streamline your financial operations and ensure that all aspects of your business remain organized and efficient.

Different Invoice Templates for Hotels

In any business that deals with customer transactions, having a well-organized structure for documenting charges is crucial. A variety of styles are available to meet different operational needs, whether it’s for a small establishment or a large corporation. Each format serves to capture essential details while providing a professional presentation for the client.

Here are a few common types of billing formats used by lodging establishments:

| Type of Format | Key Features | Best For |

|---|---|---|

| Basic Service Breakdown | Simple layout with a detailed breakdown of services provided, taxes, and total charges. | Small lodgings or short stays |

| Customizable Detailed Record | Offers flexible sections for adding extra services, amenities, and taxes. | Mid to large-sized operations |

| Corporate Billing | Includes additional fields for company name, purchase order number, and VAT details. | Corporate clients and business conferences |

| Online Payment Integration | Includes links for online payment and integrates with digital payment platforms. | Modern businesses with e-commerce solutions |

| Single-Page Statement | Concise and easy-to-read format, typically designed for single transactions. | Guest houses and B&Bs |

Each format has its own advantages depending on the needs of your business and the type of guests you serve. Selecting the right structure can improve your operational efficiency and ensure clear communication with your clients.

How to Handle Taxes in Hotel Billing

Managing taxes effectively is a vital aspect of any business that provides services. In order to ensure compliance and transparency, it’s crucial to apply the correct tax rates and clearly present them to the customer. Tax calculations can vary by location, type of service, and the nature of the transaction, so understanding the rules specific to your region and industry is essential.

Here are some steps to correctly handle taxes in billing:

- Identify the Applicable Tax Rate: Different regions may apply different tax rates based on the type of service provided. Make sure to check local tax laws to determine whether your business should charge a sales tax, value-added tax (VAT), or other applicable fees.

- Determine Taxable Services: Some services might be exempt from tax or taxed at a lower rate. For example, basic room rates may be taxed differently from additional services like meals or spa treatments. Clearly define which services are taxable.

- Ensure Transparency: Always itemize taxes separately on the final document. This way, customers can easily identify the tax rate applied to their charges, which helps avoid confusion and fosters trust.

- Account for Local Tax Laws: Tax laws can vary greatly depending on the location of the service provider. For instance, some jurisdictions impose specific taxes on lodging services, while others might require tax reporting for special services. Stay updated on any changes to local tax regulations.

- Offer Digital Payment and Tax Reporting Options: If you provide digital payment methods, ensure that tax amounts are accurately reflected in electronic records. This can simplify the process for both you and the customer, especially when it comes time for tax reporting.

By handling taxes correctly and maintaining clear records, you not only comply with legal requirements but also provide a transparent and professional service to your clients.

Best Practices for Sending Hotel Invoices

Sending a bill to a client is more than just a routine task–it is an essential part of maintaining professional relationships and ensuring proper financial documentation. To streamline this process and ensure a positive customer experience, it’s important to follow best practices that guarantee accuracy, clarity, and timeliness. Below are some key guidelines to consider when sending customer bills.

- Timeliness: Send the bill as soon as possible after the service is provided. Prompt billing ensures that customers remember the details of their stay, and it reduces the chances of any disputes or confusion about the charges.

- Clear Itemization: Break down the charges in detail. This helps customers understand exactly what they are being charged for, whether it’s accommodation, additional services, taxes, or any other fees. Transparency in billing fosters trust and minimizes disputes.

- Preferred Method of Delivery: Consider your customer’s preferences when sending the bill. Some may prefer email, while others might want a printed copy. Offering multiple options ensures convenience for your clients.

- Professional Design: Ensure that your billing document looks professional and is easy to read. Use a consistent and clean layout with all necessary details such as your business name, contact information, payment instructions, and a clear breakdown of charges.

- Payment Instructions: Provide clear instructions on how the client can pay. Include information on accepted payment methods, due dates, and any late payment penalties. Make it easy for customers to settle their accounts.

- Follow-up Reminders: If payment is not received by the due date, send a polite reminder. Include a copy of the original bill and any updated payment details. Being courteous but firm helps maintain professional relationships while ensuring timely payments.

By following these best practices, you can streamline your billing process, avoid misunderstandings, and improve your relationship with customers. Clear communication and a professional approach will reflect positively on your business and encourage repeat customers.

What to Include in an Invoice Footer

The footer of any billing document plays an essential role in providing additional information to the client while also reinforcing the professional image of the business. It is the final section of the document and should contain details that help complete the transaction smoothly. In this section, you can include elements that clarify payment terms, encourage prompt payment, and offer customer support details. Below are the key components you should consider including in the footer.

Essential Information to Include

- Payment Terms: Clearly state the payment terms, including the due date, any applicable late fees, and the preferred method of payment. This ensures that clients are aware of your expectations and avoids potential delays in receiving payment.

- Contact Details: Provide your contact information for any billing-related questions. This may include an email address, phone number, and physical address. Make it easy for clients to get in touch in case of any queries.

- Thank You Message: A simple thank-you message can go a long way in building good customer relations. It shows appreciation for the client’s business and can encourage repeat transactions.

- Legal Information: Depending on your region, it may be required to include your tax identification number, business registration number, or any legal disclaimers relevant to the transaction.

Optional Additions

While the above elements are essential, there are optional pieces of information that may be relevant to your specific industry or business practices:

- Discount Information: If the client is eligible for a discount, it may be helpful to mention it in the footer. This reinforces the value of the service provided.

- Social Media Links: Including links to your business’s social media pages is a way to build connections and keep clients engaged with your brand beyond the transaction.

| Element | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Terms | State the due date and payment method. Include any late fees. | |||||||||

| Contact Information | Provide a way for clients to reach out for inquiries or assistance. | |||||||||

Thank You

How to Track Payments and Due DatesTracking payments and managing due dates is crucial for maintaining smooth financial operations and ensuring timely cash flow. Whether you’re running a small business or managing a large organization, keeping a detailed record of when payments are due and when they are received helps prevent errors and delays. In this section, we will explore effective strategies and tools for staying on top of your financial transactions. The first step in tracking payments is setting clear due dates from the outset. Ensure that the terms are well-defined and communicated to your clients. Use a consistent system to record these dates, whether manually or through digital tools, to avoid confusion or oversight. To streamline the process, many businesses opt for software or apps that automate payment tracking. These tools can send reminders to both the business owner and the client when a payment is approaching or overdue. Additionally, many systems allow for the automatic generation of reports, which can be useful for bookkeeping and audits. Here are a few methods to consider for tracking payments and their due dates:

By implementing these tracking methods, you can ensure timely payments, minimize errors, and keep your finances organized. The right system will help improve cash flow and provide peace of mind, knowing that no due date or payment is missed. How to Create Recurring Hotel InvoicesManaging regular transactions can be time-consuming, especially when the same charges need to be issued consistently. To streamline this process, setting up recurring billing is an efficient solution. By automating the creation and delivery of regular payments, businesses can ensure accuracy, save time, and reduce the chances of errors. This section will guide you through the process of creating recurring billing cycles and how to automate them effectively. First, identify which services or charges require a recurring cycle. These are typically services or agreements that are billed on a regular basis, such as monthly room rates, long-term stays, or membership subscriptions. Once you’ve identified these, you can set up a system to generate and send payment requests at specified intervals. There are several methods to create recurring charges:

Once the process is established, it’s important to regularly r Why Free Hotel Invoice Templates Work BestWhen it comes to managing billing efficiently, many businesses find that using a no-cost solution works best. Free billing forms are not only cost-effective, but they also offer the flexibility and ease of customization that many businesses need. Whether you’re handling a few transactions or managing a larger volume, these free resources provide a straightforward way to streamline your payment management process without the need for complex software or expensive tools. One of the key advantages of free billing forms is accessibility. Most of these resources are available for immediate download, which means you can begin using them right away without any delay. Moreover, they are often designed with a user-friendly structure that makes it easy to input the necessary details. You don’t have to be a tech expert to create professional records, which is a huge benefit for small businesses and startups. Benefits of Free Resources

Key Features of Free Forms

Ultimately, free billing forms provide an efficient and prac |