Blank Pest Control Invoice Template for Easy Billing

When running a service-based business, maintaining accurate and efficient financial documentation is essential. Properly formatted records not only ensure timely payments but also help build trust with clients. Whether you’re offering specialized treatments or routine maintenance, clear and professional billing is a key aspect of smooth operations.

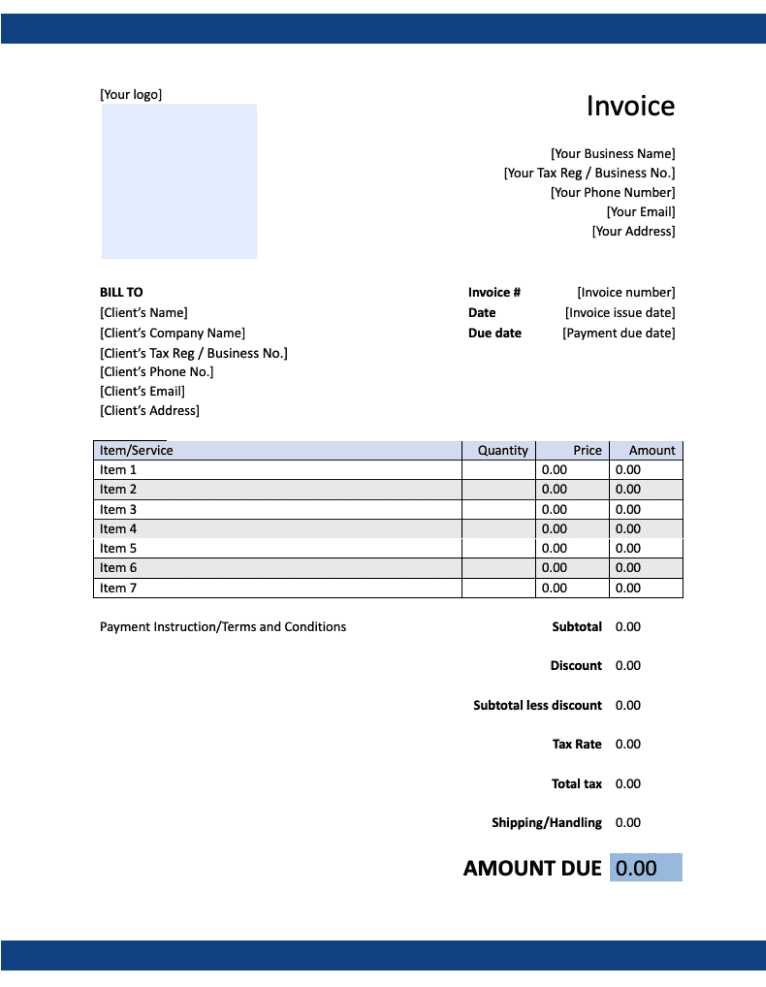

Customizable templates make the invoicing process faster and more efficient. With the right structure, you can easily include all necessary details, such as service descriptions, rates, and payment terms, while also keeping the design clean and straightforward. Using a structured approach allows you to present a polished image and avoid confusion in client transactions.

In this article, we’ll explore how to create and use a flexible document that meets your needs. Whether you are a freelancer, small business owner, or part of a larger company, having a reliable format for billing ensures consistency and professionalism in every transaction. Read on to discover how to streamline your invoicing and improve your cash flow management.

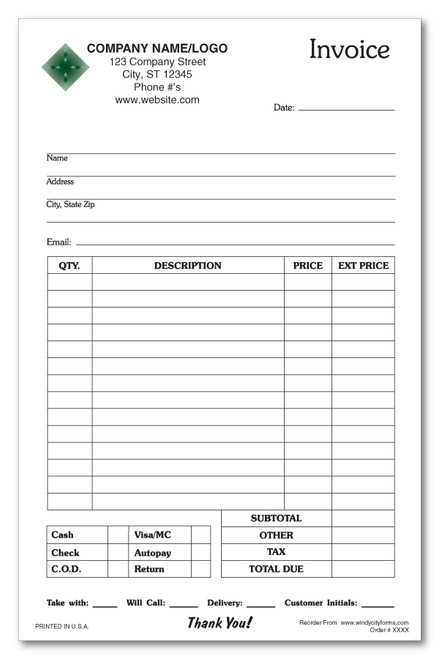

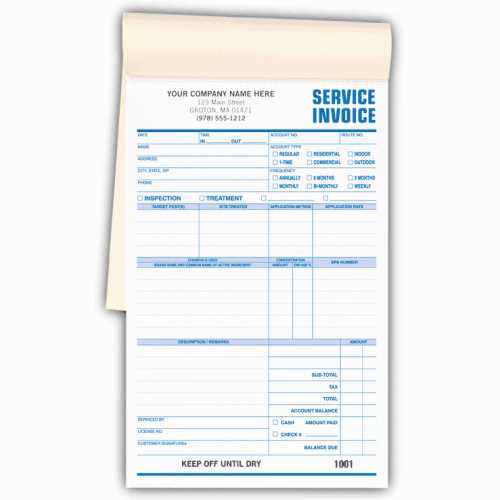

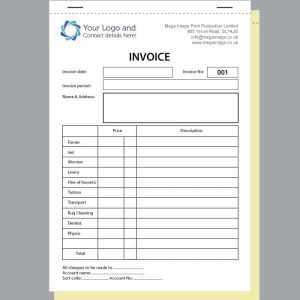

Blank Pest Control Invoice Template

Having a reliable document for billing services is essential for any business. It helps ensure accuracy, clarity, and professionalism when collecting payments. A well-structured form can save time, reduce errors, and create a streamlined process for clients to understand the charges and terms associated with your services.

Benefits of Using a Structured Billing Document

Using a predefined structure allows you to focus on delivering quality service rather than spending time formatting each bill manually. With a consistent layout, you can quickly fill in necessary details such as the client’s name, service performed, costs, and payment terms. This method not only speeds up the billing process but also ensures that all important information is included every time.

How to Customize Your Billing Document

One of the best features of these tools is the ability to customize them based on your business needs. You can adjust fields for specific services, add company branding, and even set up payment terms that align with your business model. This flexibility ensures that the document works for you and your clients, offering both convenience and professionalism. Whether you’re an independent contractor or part of a larger team, having an adaptable system helps maintain consistency across your operations.

Why You Need an Invoice Template

Efficient billing is a cornerstone of successful business operations. Without a structured way to document and communicate charges, it becomes difficult to maintain consistency, reduce errors, and ensure timely payments. A standardized form helps you organize important details, making the transaction process smoother for both you and your clients.

Having a predefined structure not only saves time but also improves the professionalism of your business. It reduces the risk of missing critical information and ensures that all parties involved have clear expectations regarding costs, payment terms, and service descriptions. This organized approach fosters trust and increases the likelihood of prompt payment, helping to maintain healthy cash flow and client relationships.

How to Customize Your Invoice

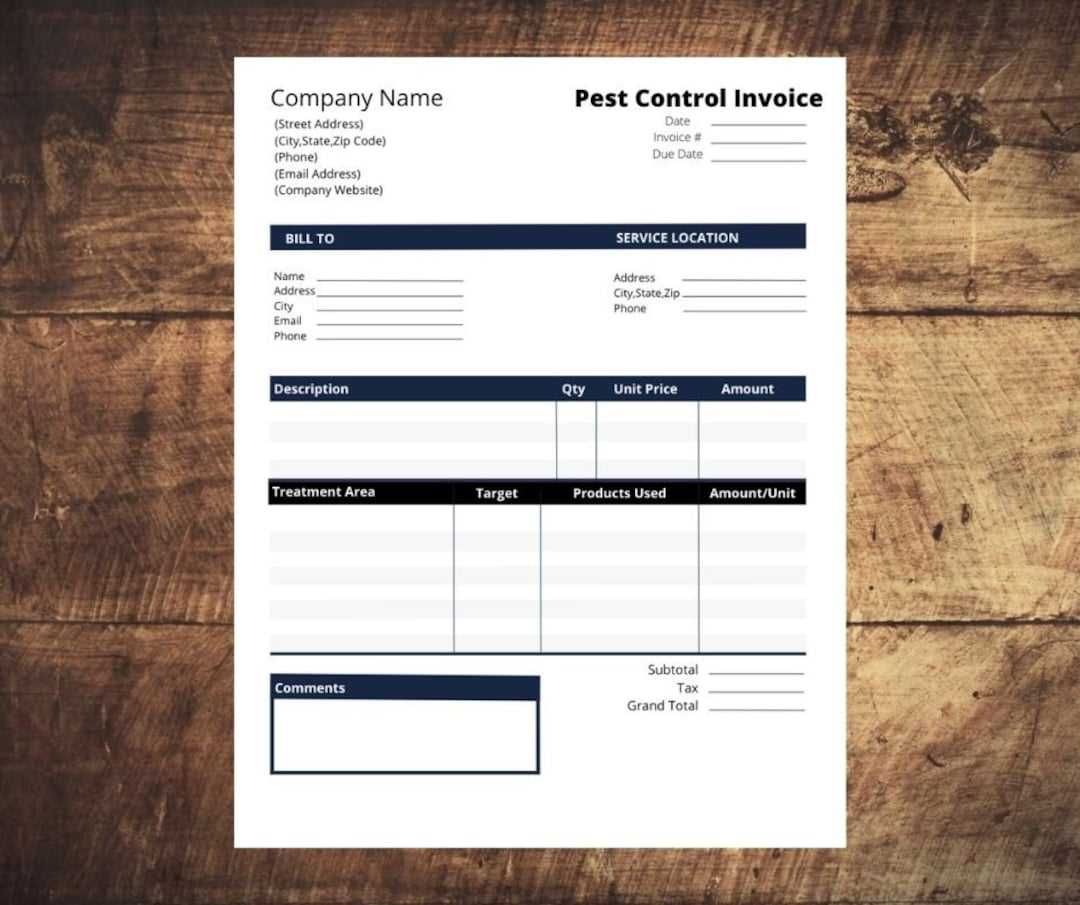

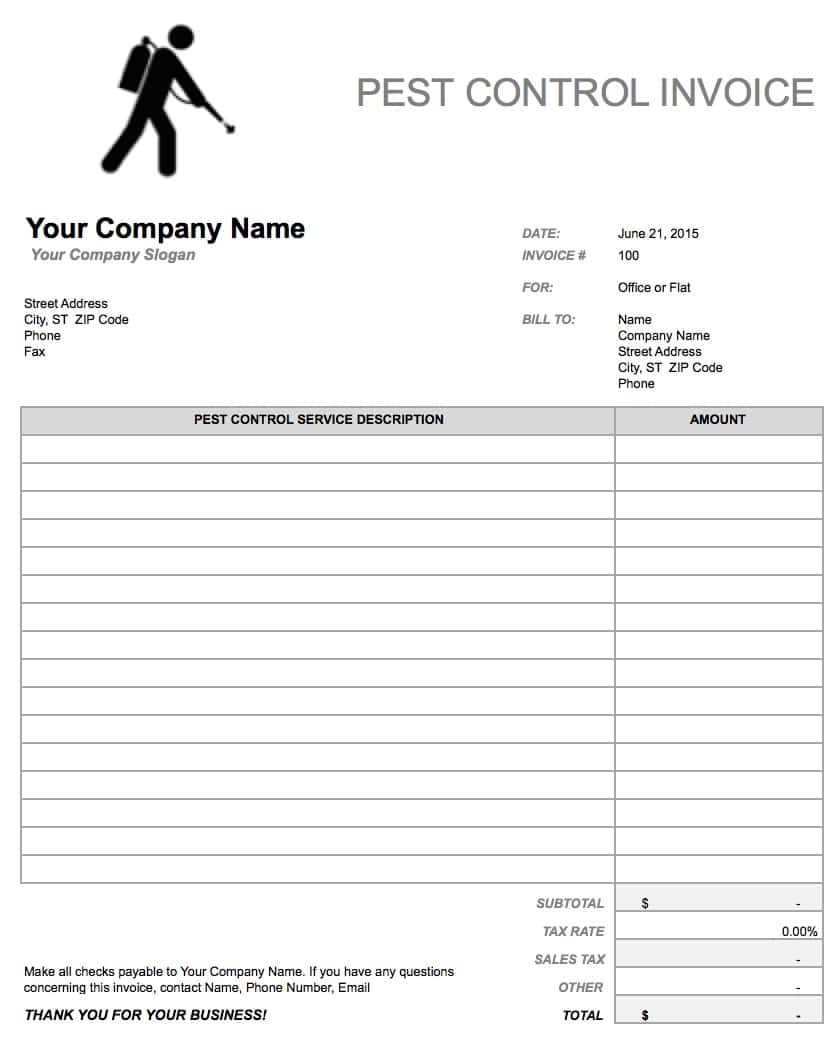

Customizing your billing document allows you to tailor it to your specific business needs, ensuring that it accurately reflects your services and provides all necessary details. By personalizing the format, you can present a professional image and ensure consistency across all client transactions. This process is crucial for maintaining clarity and preventing any confusion about the charges or terms associated with your services.

Adding Your Business Branding

One of the first steps in customization is incorporating your business branding into the document. This includes adding your logo, business name, contact information, and any other relevant details that reinforce your company’s identity. A well-branded document not only looks professional but also helps clients recognize your business at a glance.

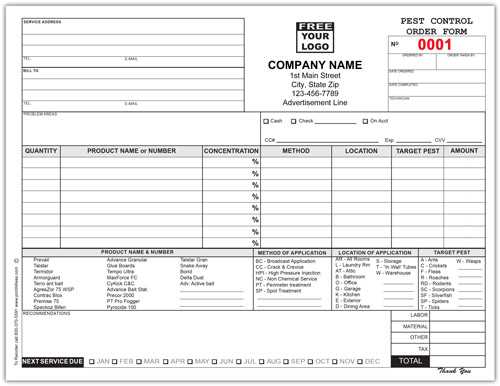

Including Service-Specific Details

Each business has unique needs when it comes to billing. Depending on the services provided, you may want to add specific fields, such as the type of work done, hours spent, materials used, or any special charges. By customizing the document to reflect these factors, you ensure that clients have a clear understanding of what they are being charged for, helping to avoid misunderstandings and disputes.

Free Billing Samples for Service Providers

When it comes to managing your billing process, having access to ready-made examples can save time and ensure accuracy. Free samples allow you to explore different layouts and find a structure that suits your needs, without starting from scratch. These resources are invaluable for businesses looking to streamline their documentation and improve efficiency when handling client payments.

Benefits of Using Free Samples

Free billing samples offer the advantage of simplicity and convenience. They provide a starting point with predefined fields, allowing you to quickly insert client details, service descriptions, and amounts owed. These samples often come in easy-to-edit formats, so you can modify them according to your specific requirements while maintaining a professional appearance. By using a sample, you ensure that no critical information is overlooked and that the document is clear and easy for your clients to understand.

Where to Find Free Samples

Many online resources offer free examples tailored to different industries, including service-based businesses. These samples are typically available in multiple formats, such as Word documents or PDFs, making it easy to download and customize them. You can find a variety of options, from simple, minimalist designs to more detailed templates that include additional features like tax breakdowns or payment terms. Choosing the right sample is a great way to get started with professional billing without investing in expensive software or services.

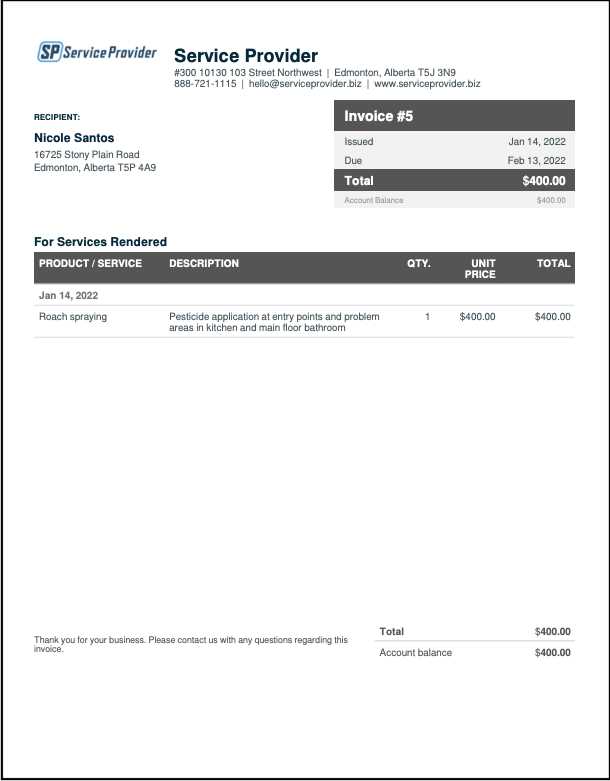

Essential Information for Your Invoice

For a billing document to be effective and clear, it must include specific details that help both you and your clients understand the terms of the transaction. A well-structured bill ensures that nothing is overlooked and promotes transparency. Below are the key elements you should always include in your billing records to avoid confusion and ensure prompt payment.

| Information to Include | Description |

|---|---|

| Business Information | Include your business name, contact details, and logo if possible. This helps clients recognize who the bill is from and how to reach you. |

| Client Information | List the client’s full name, address, and contact details to ensure the document is correctly attributed to the right person or company. |

| Service Details | Clearly describe the services provided, including dates and any relevant specifics, so clients can easily understand what they are being charged for. |

| Amounts Charged | List the price for each service or product provided, along with any additional charges such as materials or travel fees. |

| Payment Terms | Specify payment deadlines, accepted payment methods, and any late fees or interest that may apply for overdue payments. |

By ensuring these key components are included in your billing document, you create a clear and professional record that helps clients understand their obligations and facilitates smoother transactions.

Benefits of Using an Invoice Template

Utilizing a predefined document format for billing offers numerous advantages that streamline your business operations. By relying on a ready-made structure, you ensure consistency, accuracy, and professionalism in every transaction. These benefits contribute to smoother client interactions and a more organized approach to handling finances.

Time Efficiency

One of the primary advantages of using a standardized billing document is the time saved. Instead of manually creating a new document from scratch for each client, you can quickly fill in the necessary details, such as service descriptions and payment amounts. This reduces administrative work and allows you to focus more on delivering your services.

Consistency and Professionalism

A consistent format not only makes your billing process faster but also reinforces a professional image. Clients will appreciate receiving well-organized documents that clearly outline the terms and amounts owed. It helps establish credibility and builds trust, ensuring that your business is seen as reliable and thorough.

| Benefits of a Predefined Billing Document | How It Helps Your Business |

|---|---|

| Time Saving | By using a ready-made format, you reduce the time spent on formatting and focus on more critical tasks like service delivery. |

| Consistency | A structured format ensures that every bill contains the same essential details, reducing the risk of errors and confusion. |

| Professional Appearance | A clear and organized document helps maintain a professional image, encouraging timely payments and repeat business. |

| Accuracy | Standardized fields help ensure that no critical information is overlooked, reducing the chances of mistakes and disputes. |

By adopting a standardized structure for your billing, you streamline your workflow, maintain accuracy, and enhance your business’s professionalism, leading to more efficient financia

Common Mistakes in Pest Control Invoices

Even with the best intentions, errors in billing documents are common and can lead to confusion, delayed payments, and even disputes with clients. These mistakes can range from simple oversights to more complex issues that impact the clarity and accuracy of the charges. Understanding and avoiding these common pitfalls is essential for maintaining a smooth invoicing process and ensuring that both you and your clients are on the same page.

One of the most frequent mistakes is failing to include all relevant details about the service provided. This can lead to misunderstandings about what is being charged and why. Without clear descriptions, clients may not recognize the value of the work completed, which can delay payment or lead to complaints.

Another common error is the incorrect calculation of taxes or additional fees. Missing or inaccurate tax rates can result in undercharging or overcharging, both of which are problematic. Always double-check tax rates, discounts, and any other added charges to ensure that the final amount is correct.

Leaving out payment terms is another mistake that can complicate the payment process. Clients may be unsure about when payments are due or how they should be made. Clearly defining payment deadlines, accepted methods, and penalties for late payments helps set expectations and ensures smoother transactions.

How to Format Your Invoice Professionally

A well-organized document is crucial to ensuring that your clients understand the charges and terms associated with your services. The way you format your billing document speaks volumes about your business’s professionalism. By adhering to a clean, consistent structure, you can convey reliability and attention to detail, which fosters trust and enhances the likelihood of timely payment.

Key Elements of Professional Formatting

To achieve a polished and professional look, make sure your document includes the following components:

- Business Information: Include your company name, logo, contact details, and any other relevant identifiers.

- Client Information: Clearly state the client’s name and contact details to avoid any confusion.

- Service Descriptions: Be specific about what was provided, using clear and concise language.

- Dates and Terms: List the date of service and the payment due date, along with any applicable terms like late fees or discounts.

- Payment Details: Make payment methods clear, and include bank account details or online payment links if applicable.

Formatting Tips for a Clean Layout

Besides content, the layout is equally important. Here are some tips to help you format the document effectively:

- Use Consistent Fonts and Sizes: Stick to one or two easy-to-read fonts, and use larger text for headings.

- Balance White Space: Don’t overcrowd the document. Ensure there is enough white space between sections to make it easy to read.

- Align Elements Neatly: Align text, numbers, and columns properly to avoid visual clutter.

- Use Grids or Tables: Organize service line items, prices, and taxes in a neat grid or table for better readability.

By following these guidelines, you can create a visually appealing and easy-to-read document that reflects the professionalism of your business.

Top Tools for Creating Invoices

In today’s fast-paced business environment, having the right tools for managing your financial documentation is essential. Whether you’re a freelancer, small business owner, or part of a larger company, choosing the right software can streamline your billing process, reduce errors, and save you time. There are various tools available that offer user-friendly features, automation, and customization options to fit your needs.

Best Free Tools

For those who need a simple, cost-effective solution, free tools can offer all the basic features required for creating well-organized billing documents. Many of these platforms allow you to quickly generate and download customizable files, often in multiple formats such as PDFs or Word documents. Some free tools also include limited features for managing payments and sending reminders.

- Wave: This tool offers an intuitive interface for creating professional documents and tracking payments. It’s ideal for small businesses and freelancers who need a free, easy-to-use option.

- Zoho Invoice: Zoho’s free plan includes customizable fields, time tracking, and invoicing capabilities, making it a great choice for independent contractors.

- PayPal Invoicing: PayPal provides a simple invoicing tool that integrates with their payment system, which can be especially useful for businesses already using PayPal to receive payments.

Premium Tools for Advanced Features

If you’re looking for more robust features, including automation and recurring billing options, premium software might be the right choice. These tools often offer additional functionalities such as tax calculations, multi-currency support, and customizable designs. While they may come at a cost, they provide a more professional solution for businesses with higher billing volume or complex needs.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks also offers powerful billing capabilities, such as automatic invoice generation and integration with payment gateways.

- FreshBooks: This tool combines accounting and billing, providing customizable invoicing options, time-tracking, and automated reminders for overdue payments.

- Invoice2go: A mobile-friendly platform that allows you to create and send professional documents on the go, Invoice2go

Incorporating Payment Terms in Your Invoice

Clear payment terms are crucial for ensuring that both you and your clients are on the same page regarding financial expectations. Including specific details about when payments are due, acceptable payment methods, and any penalties for late payments helps set clear boundaries and avoids confusion. Properly outlining these terms creates a professional atmosphere and can prevent payment delays or disputes down the line.

By clearly communicating payment terms, you make it easier for clients to understand their obligations and help ensure that they pay on time. Whether you offer discounts for early payments or impose late fees for overdue amounts, these details should always be included in your billing records. Below are key components to include when outlining payment terms:

Payment Term Description Payment Due Date Clearly specify when the payment is expected, whether it’s upon receipt, within 30 days, or another timeframe. Accepted Payment Methods List all the methods you accept (e.g., bank transfer, credit card, online payment), making it easy for clients to pay. Late Payment Penalties Outline any interest charges or late fees for payments not made by the due date. This encourages clients to pay on time. Early Payment Discounts If applicable, offer a discount for early payment to incentivize quicker settlements. By integrating these payment terms into your billing documents, you help create transparency and improve the likelihood of receiving payments on time, while also reinforcing your professional image.

What to Include in Pest Control Billing

When creating a billing document for your services, it’s important to include all relevant details to ensure that the client understands the scope of work, charges, and payment expectations. Clear and thorough documentation helps maintain transparency and can prevent misunderstandings or disputes down the line. Here are the key components to include in your billing records to ensure a smooth and professional process.

Essential Details to Include

Each billing document should have several key pieces of information that outline the services performed, the associated costs, and any specific terms that the client needs to be aware of. These elements help ensure clarity and make it easier for clients to process and approve the charges.

- Client Information: Include the name, address, and contact details of the client receiving the service.

- Service Description: Clearly describe the work completed, including any treatments, inspections, or follow-up services provided.

- Date of Service: Specify the date when the service was completed to help both parties track the timeline of the work.

- Cost Breakdown: List each service provided along with its individual price. This ensures clients understand exactly what they are paying for.

- Payment Terms: Define the payment due date, accepted payment methods, and any late fees or discounts for early payment.

Optional Additions for Clarity

While the basic information is essential, adding extra details can further clarify the terms of service and improve client satisfaction. These optional additions help ensure that clients have all the information they need at hand.

- Materials Used: If any special materials or products were required for the service, list them along with their costs.

- Follow-up Instructions: If any follow-up services or actions are necessary, provide clear instructions or timelines.

- Tax Details: Ensure that any applicable taxes are clearly stated, including tax rates and total amounts owed.

By including these key components, you can provide your clients with clear and professional billing records, helping to foster trust, encourage prompt payments, and reduce potential confusion.

Understanding Tax Calculations on Invoices

Tax calculations are an essential aspect of any billing process, as they ensure compliance with local laws and help both you and your clients understand the true cost of services provided. Whether you are required to charge sales tax, value-added tax (VAT), or other specific taxes, it’s important to know how to accurately apply these charges. Incorrect tax calculations can lead to legal issues or dissatisfaction from clients, making it crucial to have a clear understanding of how to calculate and present taxes on your financial records.

First and foremost, it’s important to understand the tax rates that apply to your services. These rates can vary based on location, the type of service provided, and other factors such as whether you’re offering goods along with services. Always make sure you are aware of the correct rates that apply to your business and industry to avoid errors.

Next, tax should be calculated based on the total value of the service before any discounts, credits, or additional fees are applied. This ensures that taxes are correctly applied to the full amount of the service you are providing, rather than just to a portion of it. It’s also important to ensure that tax is calculated and added separately from the main charges, making it easier for clients to see exactly what they are being charged for in terms of taxes.

Additionally, if you are operating in multiple regions, you may need to apply different tax rates depending on the location of the client. Some tools and software allow you to automate this process, ensuring that you always apply the correct rate based on the customer’s location. This can be especially helpful for businesses that provide services to clients across various jurisdictions.

Finally, don’t forget to include tax-related information on your billing records. Clearly display the tax rate applied and the total amount of tax charged. This helps build transparency with your clients and ensures that both parties understand the financial breakdown of the charges.

How to Automate Your Invoicing Process

Automating your billing procedures can save you time, reduce errors, and improve cash flow by ensuring that invoices are sent on time and consistently. With the right tools and systems in place, you can streamline the entire process–from generating billing records to sending reminders for overdue payments. This not only enhances efficiency but also reduces the likelihood of human errors and increases your professional image with clients.

One of the most straightforward ways to automate your billing process is by using specialized software. These platforms can create, track, and send billing documents automatically based on predefined schedules. Many tools also allow for customization, enabling you to set up recurring charges, payment terms, and automatic follow-up emails for unpaid balances.

Additionally, integrating payment gateways with your billing system can simplify the transaction process for your clients. Once a bill is sent, clients can pay directly through the platform, and the payment is automatically recorded in your system. This integration ensures that no manual entry is needed and that all payments are tracked in real time.

Another key advantage of automation is the ability to set up notifications and reminders. You can program your system to send reminders to clients a few days before the payment is due and follow-up messages if the payment is late. This reduces the need for manual communication and encourages clients to pay on time.

By automating your billing system, you not only save valuable time but also create a smoother, more professional process for both you and your clients. This allows you to focus more on growing your business while maintaining financial accuracy and reliability.

Importance of Accurate Invoice Tracking

Keeping a detailed and accurate record of all your billing documents is essential for maintaining financial control and ensuring smooth operations in your business. Without proper tracking, it can be difficult to follow up on overdue payments, monitor cash flow, or verify financial data when needed. Accurate tracking provides clarity and ensures that nothing slips through the cracks, helping to maintain a healthy relationship with clients and keeping your business on solid financial ground.

By carefully tracking every payment request, you can quickly identify which clients have paid and which have not. This helps in preventing miscommunication and delays in receiving payments. Moreover, having a clear record allows you to spot any discrepancies, whether it’s a missed payment, overcharge, or an error in the amount billed, which can be promptly addressed before it turns into a bigger issue.

Accurate tracking also simplifies tax reporting and financial audits. When your records are well-organized, you can easily retrieve the necessary information at the end of the fiscal year or when preparing for audits, ensuring that you comply with regulations and avoid penalties. Additionally, it helps you to forecast cash flow more effectively, allowing for better financial planning and decision-making.

In short, accurate tracking is not just about keeping records for the sake of compliance; it’s a tool that helps you optimize your business operations, build trust with clients, and improve overall financial management. The time spent organizing and maintaining your records will pay off in terms of better business practices and improved financial outcomes.

How to Handle Late Payments

Late payments can be a challenge for businesses of all sizes, impacting cash flow and creating unnecessary stress. However, with the right approach, you can handle overdue payments professionally and effectively. Clear communication, firm payment terms, and a consistent follow-up process are key to ensuring that your business receives payments promptly while maintaining positive client relationships.

Steps to Take When Payments Are Late

When a payment is overdue, it’s important to address the situation calmly and professionally. Here’s a step-by-step guide to handling late payments:

- Send a Gentle Reminder: A polite email or phone call is often the best way to start. Sometimes, clients simply forget to make a payment, and a gentle reminder can resolve the issue without any further complications.

- Offer Payment Options: If a client is having financial difficulties, consider offering flexible payment options such as installment plans or extended deadlines. This can help maintain a positive relationship while still ensuring you get paid.

- Send a Formal Payment Request: If reminders don’t result in payment, follow up with a more formal request. Be clear about the overdue amount, including any late fees, and set a firm deadline for when the payment is expected.

- Charge Late Fees: If outlined in your terms, implement late fees to encourage timely payments. This can act as a deterrent for future delays and compensate for the inconvenience caused.

Tracking Late Payments and Penalties

It’s crucial to track overdue payments and any late fees applied. A clear record helps avoid confusion and provides transparency for both you and your clients. Below is an example of how you can track overdue payments and apply penalties:

Client Name Original Due Date Amount Due Late Fee Applied New Total Due John Doe 2024-10-01 $500 $50 $550 Jane Smith 2024-09-15 $200 $20 $220 By staying organized and following up promptly, you can effectively manage overdue payments while preserving a professional relationship with your clients. Clear communication, coupled with firm payment terms and penalties, will ensure you receive compensatio

Creating Recurring Invoices for Clients

Setting up recurring billing for clients is an efficient way to manage regular payments for services that are provided on an ongoing basis. This process eliminates the need to manually generate new billing documents each time, saving time and reducing the chance of missed payments. By automating this process, businesses can ensure that clients are charged consistently and on time, while also improving cash flow and reducing administrative workload.

Steps to Set Up Recurring Billing

Creating recurring billing is straightforward, especially with the right tools and systems in place. Here are the key steps to get started:

- Determine Billing Frequency: Decide how often you want to bill your clients. Common options include weekly, monthly, quarterly, or annually. Be sure to choose a schedule that aligns with the services you provide and your clients’ expectations.

- Agree on Payment Terms: Make sure both you and your client are clear on the payment terms, including the due date, accepted payment methods, and any penalties for late payments. These terms should be outlined upfront to avoid confusion later.

- Set Up Payment Automation: Use a payment platform or software that allows you to automatically generate and send billing documents according to the agreed schedule. Most modern platforms support recurring billing, with options for auto-payment collection as well.

- Monitor and Adjust as Needed: Keep track of recurring payments to ensure they are processed correctly. If the service or pricing changes, make sure to update the billing details accordingly and notify your clients in advance.

Advantages of Recurring Billing

There are several benefits to setting up recurring payments for your clients, both for your business and for them:

- Predictable Cash Flow: Regular, automatic payments provide a steady stream of income, making it easier to manage expenses and forecast your financials.

- Reduced Administrative Burden: With automated payments, there’s less need for manual intervention, allowing you to focus on providing services and growing your business.

- Improved Client Retention: Clients appreciate the convenience of automatic payments, and it can enhance their experience by reducing the need to constantly review and approve new bills.

By creating recurring payment plans, businesses can streamline operations, improve financial stability, and offer a more convenient service to their clients. Setting clear expectations and automating the process ensures that payments are received promptly without the need for manual follow-ups.

Legal Considerations for Pest Control Invoices

When creating billing documents for services rendered, it’s essential to be aware of the legal aspects that ensure both your business and your clients are protected. Proper documentation helps prevent disputes, ensures compliance with local regulations, and establishes clear expectations for both parties. Understanding the key legal considerations, such as terms of service, payment deadlines, and required disclosures, can help you avoid unnecessary complications and maintain a professional reputation.

Key Legal Aspects to Include

There are several critical elements to consider when crafting your financial documentation to ensure it meets legal requirements:

- Clear Terms of Service: Outline the specific terms of the agreement, including the scope of work, services provided, and any guarantees or warranties. This ensures there is no confusion about what is being charged for and what the client is entitled to receive.

- Payment Terms and Deadlines: Specify the payment due date, including any late fees or penalties for overdue payments. These terms should be in alignment with the contract or agreement signed by the client, ensuring both parties understand the consequences of delayed payments.

- Applicable Taxes: Be sure to include information on any taxes or levies that apply to the services provided. This is particularly important if you are required to charge sales tax or other region-specific taxes, as it ensures compliance with tax laws.

- Refund and Cancellation Policy: Include information about your refund policy and any cancellation terms, particularly if the client is entitled to a refund or credit under certain circumstances. This protects both you and the client in case services need to be altered or refunded.

Best Practices for Legal Protection

In addition to including these key elements, there are best practices to follow in order to minimize legal risks:

- Keep Detailed Records: Maintain copies of all contracts, service agreements, and communications with clients. This helps protect your business in the event of a dispute and provides a clear timeline of events should you need to reference them later.

- Consult Legal Professionals: Depending on the nature of your services and location, it may be beneficial to consult a lawyer to ensure that your documentation complies with local laws and regulations. This step can help safeguard your business from potential legal issues.

- Clear Dispute Resolution Process: Include a section that outlines how any disputes will be handled. This could involve arbitration or mediation as a means to resolve conflicts without resorting to litigation, saving both time and money.

Example of a Payment Breakdown

It is also important to clearly outline all charges to avoid confusion and potential disputes. Below is an example of how you might break down the costs in your documentation:

Service Description Amount Tax Applied Total Due Optimizing Your Invoicing for Efficiency

Streamlining the process of billing is essential for reducing administrative overhead, speeding up payment cycles, and ensuring consistency across your business operations. By adopting efficient strategies and using the right tools, you can minimize errors, save time, and improve cash flow. Automation, clear communication, and well-organized records are just a few ways to optimize your invoicing system.

Steps to Improve Efficiency

To optimize your billing process, consider implementing the following strategies:

- Automate Billing Tasks: Use software or platforms that automate the creation, sending, and tracking of payment requests. Automation eliminates manual data entry and ensures that invoices are sent on time every time.

- Standardize Your Formats: Create consistent and professional billing formats that can be reused for all clients. This reduces the need for customization with each new payment cycle and ensures that all relevant information is included in every document.

- Use Payment Integration: Integrate payment options directly into your billing documents, allowing clients to pay online quickly and easily. This will reduce delays associated with mailing checks or waiting for bank transfers to be processed.

- Set Up Recurring Billing: For clients who require regular services, set up recurring payment schedules. This will automate the entire payment process, ensuring clients are billed at the correct intervals without you needing to manually create new documents.

Key Elements for Streamlined Billing

To ensure your billing process is efficient and error-free, there are several important elements to focus on:

- Clear Payment Terms: Clearly state the payment due date, late fees, and acceptable payment methods in every document. Clients should know exactly when and how to pay, reducing misunderstandings and delays.

- Proper Documentation: Always include relevant information such as service details, dates, and amounts in your billing. This helps reduce confusion and prevents disputes down the line.

- Follow-Up Reminders: Set up automatic reminders for clients when payments are due or overdue. This saves time and effort in manually reaching out to clients for follow-ups.

Example of Efficient Billing Breakdown

To visualize a stream