Free Cleaning Service Invoice Template Excel Download

Managing financial transactions efficiently is essential for any professional venture. Keeping track of payments, details of work performed, and customer information can be tedious without a reliable system. Using the right tools can simplify the entire process, making it quicker and more organized. Whether you’re running a small business or a larger operation, an effective document for tracking charges is crucial.

For many entrepreneurs, a customizable format for documenting payments provides an easy solution. With a few simple adjustments, it’s possible to create a clear, professional record of all financial exchanges. This not only saves time but also ensures that no important detail is overlooked. Tools that allow for easy editing and updating, while maintaining a clean layout, are key to running a smooth operation.

In this guide, we’ll explore how to use a structured approach to organize financial records, track billing, and make the process easier for both you and your clients. Whether you are just starting out or looking to improve your existing workflow, understanding how to use efficient documentation tools will give you an edge in maintaining professionalism and organization.

Why Use a Billing Document Format

Maintaining clear financial records is essential for any business. A well-structured billing system helps ensure that all transactions are documented accurately, making it easier to track payments and outstanding balances. By adopting a standardized format for creating these documents, businesses can streamline their processes and avoid potential errors in billing.

Using a predefined format offers several advantages. It saves time, as the document is ready for quick customization and immediate use. It also promotes consistency, ensuring that each record looks professional and includes all necessary information. This can increase client trust and reduce confusion regarding the details of the transaction.

Additionally, a professional layout can reduce the chances of misunderstandings or disputes. With all key details clearly laid out, both the provider and the customer can easily verify the terms and amounts agreed upon. In the long run, adopting this approach helps maintain smooth operations and fosters better relationships with clients.

Benefits of Excel for Invoices

Using spreadsheet software for documenting financial transactions offers numerous advantages. It provides an efficient, organized method for tracking payments, managing client details, and calculating totals automatically. With a wide range of customizable features, this tool helps streamline the billing process, making it quicker and more accurate.

Key Advantages

- Flexibility: You can easily modify layouts and include any necessary details, from the work performed to payment terms.

- Automatic Calculations: Built-in formulas can instantly calculate totals, taxes, and discounts, reducing manual errors.

- Organization: Keep all client data and billing records in one place, making it easier to manage and reference past transactions.

- Easy Tracking: Monitor payment statuses and outstanding balances efficiently, ensuring timely follow-ups with clients.

Enhanced Professionalism

With ready-to-use functions and clean formatting, this software ensures that documents look polished and accurate, boosting your business image. Customization allows you to include your branding elements, creating consistency in your financial communications.

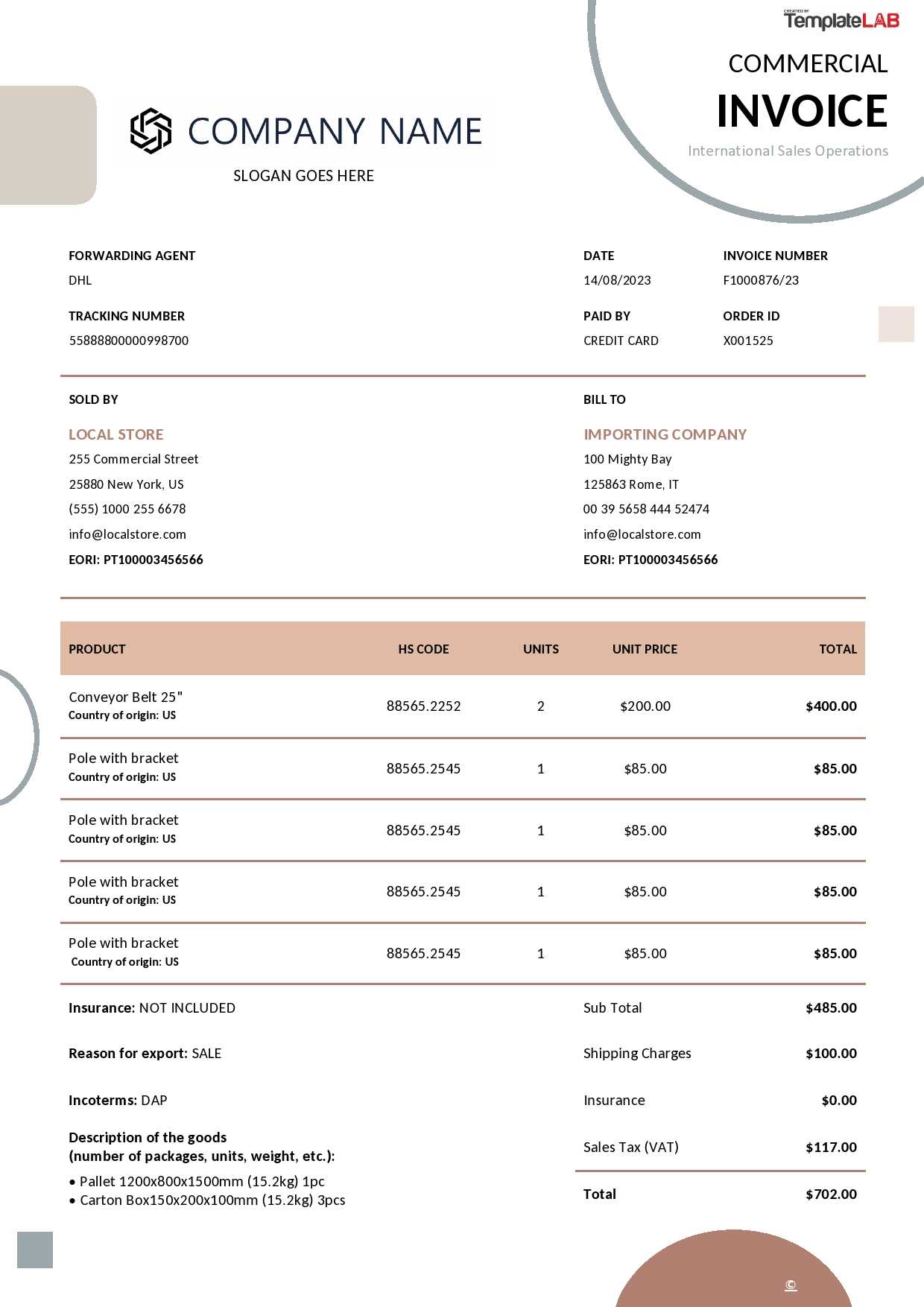

How to Customize Your Billing Document

Personalizing your financial records allows you to tailor the document to suit your business needs. A customized approach ensures that all the relevant information is included and presented clearly. You can adjust layout, text, and calculation fields to match your branding and operational requirements, giving your documents a professional and consistent appearance.

Here are some key steps to customize your billing document:

| Step | Action | Details |

|---|---|---|

| 1 | Adjust Layout | Modify sections such as contact details, work description, and total amount for a more personalized look. |

| 2 | Insert Branding | Add your logo, company name, and color scheme to align with your brand identity. |

| 3 | Edit Terms and Conditions | Include specific payment terms, due dates, and other legal notes to avoid confusion. |

| 4 | Update Item Descriptions | Clearly define the services or work performed to ensure both parties are aligned on deliverables. |

| 5 | Automate Calculations | Use formulas to calculate totals, taxes, and discounts automatically for faster processing. |

By following these steps, you can create a document that meets your specific needs while maintaining clarity and professionalism. Customization not only saves time but also builds trust with clients by providing transparent and easily understandable records.

Step-by-Step Guide to Editing Documents

Editing your financial documents is a straightforward process that allows you to personalize them according to your business needs. By following a clear set of steps, you can ensure that all important information is included and formatted properly, making the document both professional and easy to understand. This guide will walk you through the process of customizing a basic document layout to suit your specific requirements.

Step 1: Open the Document

Start by opening the file you want to edit. Most business documents are designed to be user-friendly, with predefined sections that can be quickly updated. Depending on the software you’re using, you may be able to open a pre-existing file or start with a blank layout.

Step 2: Modify Key Sections

Now it’s time to update the core details. You should focus on the following sections to ensure accuracy and clarity:

| Section | Action | Details |

|---|---|---|

| Header | Insert business name and logo | Ensure your company branding is visible at the top of the document. |

| Client Information | Update client name and contact details | Double-check spelling and ensure all contact info is correct. |

| Work Description | List services or tasks provided | Be clear and concise to avoid confusion over what was delivered. |

| Amount | Enter payment details | Include pricing, taxes, and totals. Make sure formulas are applied correctly for automatic calculations. |

| Footer | Add payment terms and contact info | State the due date and any late fees, if applicable. |

Once these sections are updated, you can save and review the document to ensure everything is accurate before sending it out.

Top Features of a Billing Document Format

A well-structured billing document offers several features that make the process of recording and tracking payments much more efficient. These features not only help to ensure accuracy but also enhance the overall professionalism of your financial records. Understanding the key elements that make a billing document functional and user-friendly is essential for managing transactions smoothly.

- Customizable Layout: The ability to adjust the layout allows for easy addition or removal of sections, ensuring the document fits your specific needs.

- Automatic Calculations: Built-in formulas for summing up totals, taxes, and discounts make the process quicker and reduce the chances of errors.

- Clear Itemization: A well-organized document lists each service or product separately with descriptions and corresponding charges, preventing confusion for both parties.

- Payment Tracking: Options for tracking payments, due dates, and outstanding balances help keep everything organized and ensure timely follow-ups.

- Professional Appearance: Customizable fonts, logos, and color schemes contribute to a clean, branded document that reflects your business’s professionalism.

- Easy Data Entry: Predefined fields and spaces for important information make it easy to enter relevant details without missing anything crucial.

These features combine to make the document efficient, organized, and professional, improving not only your workflow but also your relationship with clients by ensuring transparency and clarity in every transaction.

How to Track Payments with Excel

Keeping track of payments is essential for managing cash flow and ensuring that all transactions are recorded accurately. By utilizing spreadsheet software, you can easily monitor outstanding balances, track payment dates, and keep detailed records of all financial exchanges. The ability to update and organize payment information in real time helps you stay on top of your financial records and avoid any missed payments or discrepancies.

Here’s how to track payments efficiently:

- Use Separate Columns: Create columns for the invoice number, client name, payment due date, amount owed, and amount paid. This will allow you to quickly reference each transaction and ensure accurate tracking.

- Track Status: Add a column to indicate the status of each payment, such as “Paid,” “Pending,” or “Overdue.” This helps you easily identify which transactions need follow-up.

- Set Up Payment Reminders: Use built-in date functions to set reminders for payment due dates. This ensures you are notified when a payment is approaching or overdue.

- Automate Calculations: Use formulas to automatically calculate the balance remaining after each payment is made. This reduces the need for manual updates and minimizes errors.

- Generate Reports: You can easily generate reports by filtering payment data. This helps provide a clear overview of your financial situation and gives you insights into client payment behavior.

By following these steps, you can maintain accurate, up-to-date payment records, ensuring smoother financial operations and reducing the risk of late or missed payments.

Common Mistakes in Billing Documents

While creating financial documents, it’s easy to overlook certain details that can lead to confusion or errors in transactions. Small mistakes can impact client trust and affect timely payments. Understanding common pitfalls in the process allows you to avoid these issues and ensure that every record is accurate and clear. Below are some typical mistakes that can occur when preparing such documents.

- Missing or Incorrect Client Details: Always double-check the client’s name, address, and contact information to ensure they match your records. Errors in this area can delay communication or payment processing.

- Unclear Descriptions of Services: Failing to provide specific details about the work performed can lead to confusion. Be clear and concise, listing the tasks or products provided with corresponding charges.

- Wrong or Incomplete Payment Terms: Not specifying the due date or payment methods can create misunderstandings. Always outline the exact terms, including late fees or discounts, if applicable.

- Incorrect Pricing or Calculations: One of the most common errors is entering incorrect rates or forgetting to apply taxes. Double-check all amounts, especially totals, discounts, and taxes, before finalizing the document.

- Not Including Reference Numbers: Including invoice numbers or other reference identifiers is crucial for tracking and organizing documents. Omitting them makes it difficult to locate specific records in the future.

- Neglecting to Review Before Sending: Sending out documents without reviewing them can lead to errors that could have been caught during a quick check. Always take a moment to proofread the document for accuracy before submission.

Avoiding these common mistakes will help you maintain professionalism and reduce the chance of disputes or delays in payment. Always ensure your documents are clear, correct, and well-organized for the best outcome.

Tips for Accurate Billing in Excel

Ensuring accuracy in your financial records is essential for maintaining smooth business operations and client relationships. Even small errors in billing can lead to confusion or delayed payments. By using the right techniques and tools, you can streamline the process, avoid mistakes, and maintain professionalism in every transaction.

- Use Clear Column Labels: Label each column appropriately, such as “Amount,” “Quantity,” “Description,” and “Total,” to ensure all necessary details are included and easy to find.

- Double-Check Formulas: Verify that all formulas, especially those for calculating totals, taxes, or discounts, are working correctly. Incorrect formulas can lead to significant errors in the final amount.

- Keep a Consistent Layout: Maintaining the same format for each document makes it easier to spot errors and ensures consistency across all your records.

- Use Data Validation: To avoid errors in data entry, use data validation tools to restrict the type of information that can be entered into each cell. This helps prevent entering incorrect data such as text where numbers should go.

- Automate Recurring Charges: If you have recurring charges, use automation features to set up recurring payments or reminders for due dates. This helps ensure that no charges are missed or forgotten.

- Keep Track of Changes: Use the version history feature to track changes made to your document. This allows you to undo any incorrect modifications and keeps a record of your edits.

- Save Templates for Efficiency: Create a basic structure that you can use for every transaction, so you don’t have to start from scratch each time. This will save time and reduce the likelihood of mistakes.

By following these tips, you can ensure that your financial documents are accurate, easy to read, and professionally presented, which will help you maintain smooth operations and build trust with your clients.

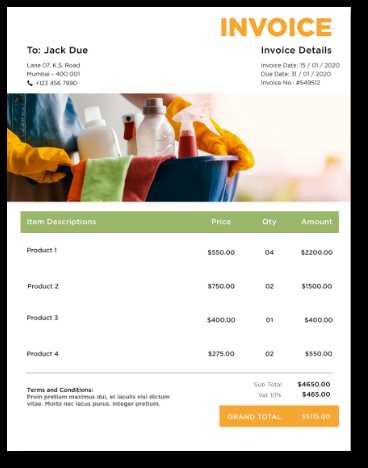

How to Add Taxes and Discounts

When preparing financial documents, including taxes and discounts is a critical aspect of ensuring that all charges are accurately reflected. Whether you’re applying a sales tax, offering a discount, or both, it’s important to calculate these elements properly to avoid errors. Knowing how to structure these adjustments can make the process much easier and more transparent for your clients.

Adding Taxes

Taxes are often a necessary part of any transaction, and they must be applied correctly to ensure compliance with regulations. Here’s how to add them:

- Determine the Tax Rate: First, identify the tax rate based on the region or jurisdiction in which the transaction occurs.

- Calculate the Tax Amount: Multiply the total amount by the tax rate. For example, if the total amount is $100 and the tax rate is 10%, the tax will be $10.

- Apply the Tax: Add the calculated tax to the total amount to get the final price. This should be clearly indicated on the document as a separate line item.

Applying Discounts

Discounts are often offered to encourage prompt payment or as a special promotion. Here’s how to apply them correctly:

- Identify the Discount Type: Decide whether the discount is a fixed amount (e.g., $10 off) or a percentage (e.g., 10% off).

- Calculate the Discount: For a fixed amount, subtract that amount directly from the total. For a percentage discount, multiply the total amount by the discount percentage and subtract that from the total.

- Display the Discount Clearly: Make sure the discount is clearly listed on the document, showing both the original price and the final amount after the discount is applied.

By properly adding taxes and discounts, you can ensure that all charges are transparent and the total amount due is calculated correctly. This helps build trust with clients and ensures that the billing process is smooth and efficient.

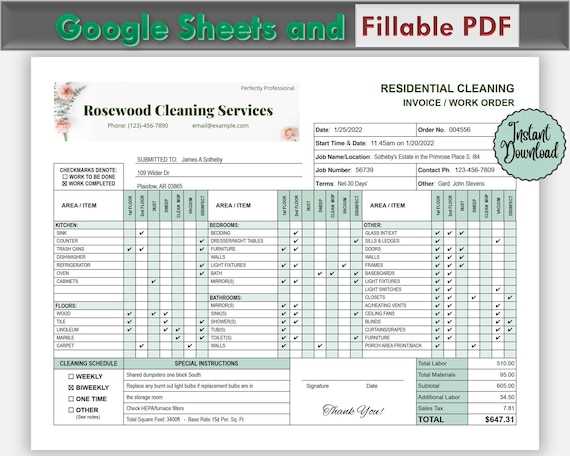

Including Service Details on Your Document

Accurate and clear descriptions of the work performed are essential in any financial record. Including detailed information about the tasks or products provided ensures transparency and helps both parties understand exactly what was agreed upon. It also serves as a reference in case of any questions or disputes, providing clarity on what was delivered and the corresponding charges.

Essential Information to Include

When documenting the work done, make sure to include the following key details:

- Task Descriptions: Clearly describe each task or item, specifying what was done and any particular details that may be relevant to the client.

- Time Spent: If applicable, indicate the amount of time spent on each task or job. This helps justify the charges and allows the client to see the breakdown.

- Quantity: For products or services sold in units, ensure that the quantity is listed accurately, along with the unit price.

- Hourly or Fixed Rates: Specify whether the pricing is based on hourly rates or fixed amounts, and ensure that the corresponding amounts are calculated correctly.

Example Breakdown

Here is an example of how to structure the work details:

| Description | Quantity | Rate | Total |

|---|---|---|---|

| General cleaning of the office space | 5 hours | $20/hour | $100 |

| Window washing | 2 windows | $15/window | $30 |

| Total | $130 |

By including detailed descriptions, the client is fully informed about the nature of the work performed and the corresponding costs. This not only improves professionalism but also reduces the likelihood of misunderstandings or disputes regarding the charges.

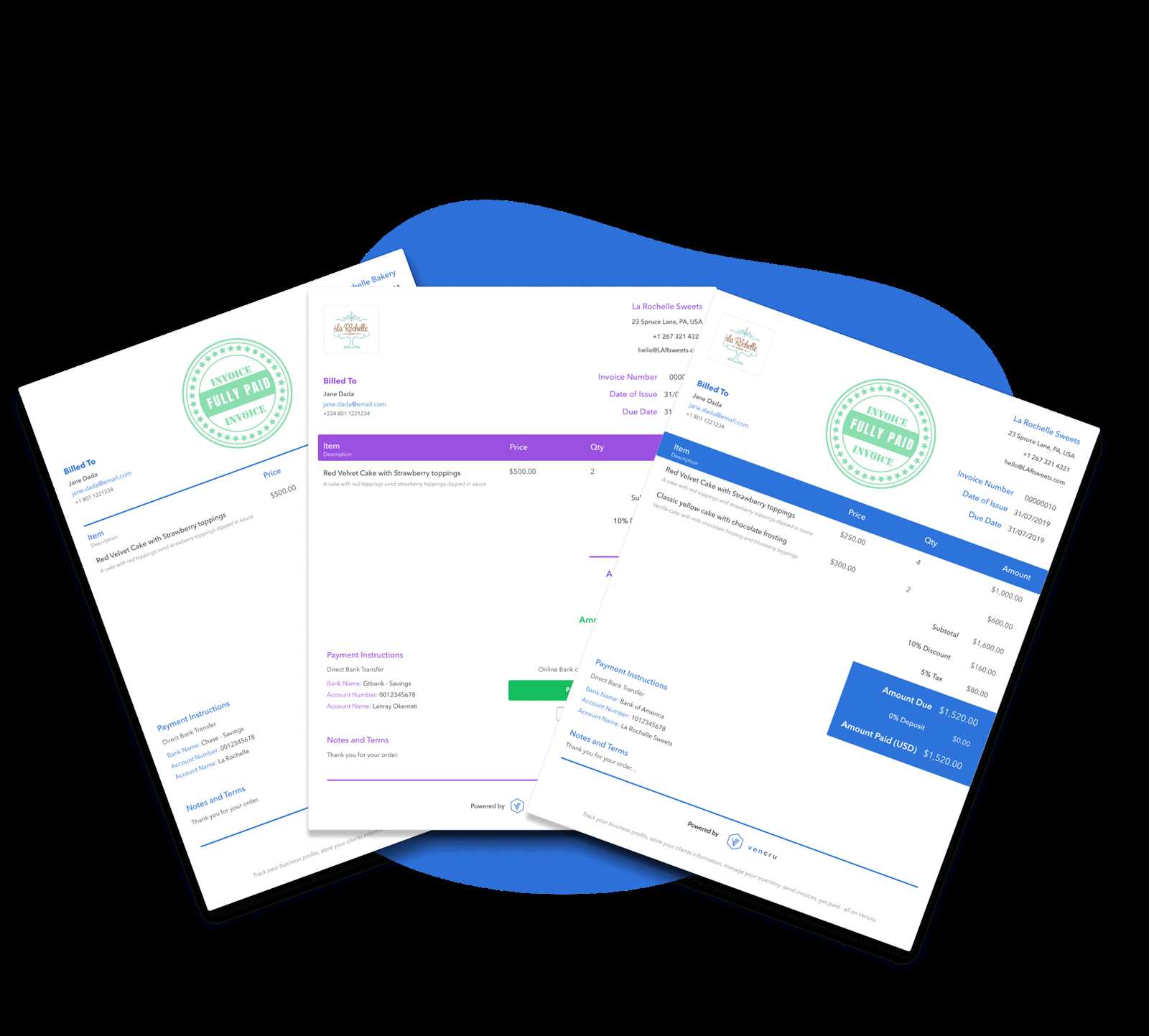

Save Time with Pre-Made Templates

When managing transactions, creating a document from scratch for each client or job can be time-consuming. Using pre-designed formats allows you to streamline the process, ensuring that you don’t have to repeatedly start from zero. These ready-made layouts provide a structure that can be quickly customized, saving you significant time while maintaining consistency and professionalism in your financial records.

- Quick Setup: With pre-designed formats, you can skip the initial setup and jump straight to adding the necessary details, significantly reducing the time it takes to prepare each document.

- Consistency: Pre-made formats ensure a uniform appearance across all documents, creating a professional and cohesive look that strengthens your brand image.

- Customization: Even though these formats are pre-designed, they are fully customizable. You can easily adjust fields, change pricing, and add personalized information to meet the specific needs of each transaction.

- Error Reduction: By using a pre-set structure, you minimize the chances of forgetting important sections, such as payment terms or contact information, which can lead to errors.

- Automation: Many pre-made formats come with built-in features like automatic calculations, which ensure that totals, taxes, and discounts are correctly applied without manual input.

By adopting pre-designed layouts, you save both time and effort while maintaining accuracy and consistency in your financial records. This approach allows you to focus on more important aspects of your business, such as customer relations and service delivery.

How to Avoid Document Errors

Accuracy is crucial when preparing financial documents. Even small mistakes can lead to confusion, delays, and potential disputes with clients. By being diligent and following best practices, you can minimize the risk of errors and ensure your records are always correct and professional. Below are several strategies to help avoid common mistakes in your billing documents.

Key Tips to Prevent Mistakes

- Double-Check Client Information: Always verify client names, contact details, and payment addresses before sending the document. Incorrect details can lead to payment delays and confusion.

- Accurate Calculations: Ensure all numbers, including totals, taxes, and discounts, are calculated correctly. A simple mistake in a formula can lead to discrepancies in the final amount owed.

- Clear and Concise Descriptions: Avoid vague descriptions of tasks or products. Be as detailed as possible so that the client knows exactly what they are being charged for.

- Check Dates and Terms: Make sure the due date and payment terms are clearly stated and accurate. Missing or unclear terms can create confusion and delay payments.

- Use Consistent Formatting: Stick to a uniform layout for all your documents. Consistency not only improves professionalism but also helps you spot any missing or misplaced information easily.

- Proofread Before Sending: Always review your document for spelling or grammatical errors, as well as missing information. A final check can help you spot mistakes that you might have missed during earlier stages.

Tools to Help Prevent Errors

- Automated Calculations: Utilize software that includes automatic calculations for totals, taxes, and discounts. This minimizes the chance of human error in math.

- Templates with Pre-filled Fields: Using a structured layout where fields are pre-filled can help ensure consistency and reduce the risk of omitting important details.

- Version Control: Keep track of document versions to avoid using outdated or incorrect versions by accident. This also allows you to track changes if necessary.

By following these tips and using the right tools, you can ensure that your financial documents are error-free, professional, and accurate, reducing the likelihood of confusion and promoting timely payments.

Why Professionals Should Use Digital Billing Documents

As businesses continue to move towards more efficient practices, digital records are becoming an essential tool for professionals in various industries. Digital financial documents offer a range of benefits over traditional paper records, especially for those who manage multiple clients or projects. The ability to quickly create, send, and track financial transactions can save time, reduce errors, and improve organization.

- Time Efficiency: Digital billing allows professionals to quickly generate and send records with minimal effort. Templates and automated calculations streamline the process, enabling faster turnaround times.

- Environmentally Friendly: Switching to digital documents reduces paper waste and helps businesses adopt a more eco-conscious approach. This is particularly important in industries looking to reduce their carbon footprint.

- Improved Accuracy: Using digital tools reduces the risk of human errors, such as incorrect calculations or missing information. Built-in features like automated totals, taxes, and discounts ensure accuracy every time.

- Easy Tracking and Record Keeping: Digital records are easier to store, organize, and retrieve. You can keep all your financial documents in one place, making it simple to find them when needed and reducing clutter.

- Faster Payment Processing: With digital documents, clients can receive records immediately and process payments without waiting for physical copies. This speeds up cash flow and makes transactions more efficient.

- Professional Appearance: Digital records often appear more polished and professional compared to handwritten or printed documents. They can be customized with logos, fonts, and branding to align with your business identity.

Incorporating digital tools for managing billing can provide a competitive advantage, helping professionals streamline their operations, reduce costs, and improve client satisfaction. By adopting this modern approach, you can ensure that your business stays organized, efficient, and ahead of the curve.

How to Organize Your Billing Records

Efficient organization of financial documents is crucial for maintaining clear records and ensuring smooth business operations. By structuring your records properly, you can easily track payments, manage overdue accounts, and keep a comprehensive history of all transactions. Using a spreadsheet tool can help streamline this process, offering a centralized location for all relevant information.

Key Steps for Organizing Your Documents

- Create Separate Folders: Divide your documents into different folders based on clients, projects, or time periods (e.g., monthly or quarterly). This will make it easier to locate and manage specific records.

- Use Consistent Naming Conventions: Develop a naming system that is both descriptive and consistent. For example, use client names, dates, or job types in the file names to make them easily identifiable.

- Set Up Columns for Key Information: In your spreadsheet, include columns for client names, project descriptions, dates, amounts, and payment status. This will allow you to filter and sort data as needed.

- Track Payment Status: Add a column to indicate whether each transaction is paid, pending, or overdue. This will help you stay on top of outstanding balances and follow up with clients when necessary.

- Use Color Coding: Implement color coding to highlight key information, such as overdue payments or completed transactions. This visual aid can quickly draw attention to critical items.

Automating Your Document Organization

- Use Filters and Sorting Features: Take advantage of sorting and filtering tools to view your records by date, client, or payment status. This will help you quickly find the information you need.

- Implement Automatic Calculations: Set up formulas that automatically calculate totals, taxes, and any other adjustments. This eliminates manual errors and ensures accurate records.

- Backup Your Data: Regularly back up your documents to avoid losing important information. Cloud storage or external drives can help keep your data safe and accessible at all times.

By following these steps and utilizing the right tools, you can keep your financial records well-organized, accurate, and easy to access. This structure not only saves time but also provides peace of mind knowing that all transactions are properly documented and easily retrievable.

Improve Professionalism with Custom Billing Documents

Presenting well-crafted and personalized financial records is essential for building trust and demonstrating professionalism. A custom approach not only reflects your brand’s identity but also provides your clients with a clear and concise breakdown of their transactions. By tailoring your documents, you can make them more visually appealing, organized, and aligned with your business values.

Why Customization Matters

- Brand Identity: Customizing your documents with your logo, brand colors, and fonts reinforces your business’s image and adds a personal touch that sets you apart from competitors.

- Clarity and Transparency: When your documents are clearly laid out and tailored to your needs, clients can easily understand the charges and services rendered. This reduces confusion and strengthens the relationship between you and your clients.

- Consistency: A uniform design across all your financial documents ensures that each interaction with clients feels cohesive and polished. This attention to detail reflects well on your business and increases customer satisfaction.

- Professional Appearance: Customized billing records look more polished and professional than generic, off-the-shelf formats. This helps create a positive impression and may even encourage faster payments.

Ways to Customize Your Documents

- Add Your Business Logo: Incorporating your logo at the top of the document reinforces your brand identity and makes the record look official and personalized.

- Use Tailored Layouts: Design your document layout to suit your specific needs. Group related charges together, highlight important information, and ensure all necessary fields are included for client convenience.

- Include Personalized Notes: Adding a personal message or thank-you note at the bottom of the document can leave a lasting impression on your clients and make them feel valued.

- Choose Appropriate Fonts and Colors: Select fonts and colors that align with your brand’s aesthetic. This not only makes the document visually appealing but also reinforces your business’s identity and professionalism.

By investing a little extra time into customizing your financial documents, you can improve client relationships, enhance your business’s reputation, and ultimately increase customer loyalty. A well-designed, personalized document is more than just a record; it’s an opportunity to showcase your professionalism and attention to detail.