Ultimate Staffing Invoice Template for Easy Billing and Customization

Managing financial transactions and ensuring timely payments are critical aspects of any service-based business. Creating professional documents for billing purposes helps maintain clarity, reduce errors, and streamline the entire payment process. With the right tools, you can make invoicing faster, more accurate, and hassle-free.

In this article, we will explore a reliable solution that simplifies the billing process, making it easier for businesses to request payment for services rendered. By using well-structured documents, you can save time, avoid misunderstandings, and improve your financial management. Whether you are a freelancer, a small business owner, or part of a larger organization, having a clear and organized way to request payment is essential.

Understanding the importance of professional billing is key to building trust with your clients and ensuring smooth transactions. A well-organized document not only reflects your professionalism but also sets the tone for how your business is perceived by customers and partners alike.

Staffing Invoice Template Overview

In any service-based business, ensuring that payment requests are clear and professional is crucial for maintaining positive relationships with clients. A well-structured billing document serves as an official request for compensation for services provided, helping to prevent misunderstandings and ensuring timely payments. With the right structure, these documents can be easily customized to fit various business needs and client expectations.

For businesses offering personnel or project-based services, creating an efficient billing system is essential for smooth operations. A reliable document not only tracks the details of services rendered but also provides a professional appearance that reassures clients and partners of your business’s reliability. Whether you’re providing temporary help, specialized contractors, or any other type of service, having the proper documentation is key to efficient financial management.

Why Clear Payment Requests Matter

When requesting compensation for work performed, clarity is paramount. A well-organized billing document helps clients quickly understand the services they are being charged for, the associated rates, and the total amount due. This transparency helps avoid confusion and disputes, making the payment process smoother and faster for both parties.

How a Properly Structured Document Benefits Your Business

Using a structured document for payment requests enhances the professional image of your business. It shows attention to detail, reliability, and helps establish a strong reputation. Moreover, an efficient system for creating and sending billing documents can save time, allowing business owners and contractors to focus on what matters most: providing excellent service.

Why Use a Staffing Invoice Template?

Maintaining an organized and professional approach to payment requests is crucial for any service-based business. Using a consistent format for these documents can streamline the billing process, reduce errors, and enhance the overall efficiency of your financial operations. With the right structure in place, creating these documents becomes quicker, and your clients will appreciate the clarity and professionalism.

Having a standardized approach to billing is particularly valuable when dealing with contract-based or personnel services. A structured document ensures that all relevant details are included, making it easier for both the service provider and the client to track and manage payments. By using a reliable format, you can avoid confusion and ensure that your business maintains a strong reputation for professionalism and efficiency.

Time and Effort Savings

Creating consistent payment requests from scratch each time can be time-consuming and error-prone. By using a pre-designed format, you can save valuable time and effort. Key benefits include:

- Faster document creation without missing essential details.

- Consistency across all billing requests, making your business appear organized.

- The ability to easily update or customize the document based on the specific services provided.

Professionalism and Clarity

Having a clear, professionally formatted request for payment helps build trust and credibility with your clients. Key advantages include:

- Ensuring that clients understand exactly what they are being charged for, reducing the potential for disputes.

- Presenting your business as reliable and well-organized, which can improve client satisfaction.

- Providing a transparent breakdown of services, rates, and terms, which enhances communication and prevents misunderstandings.

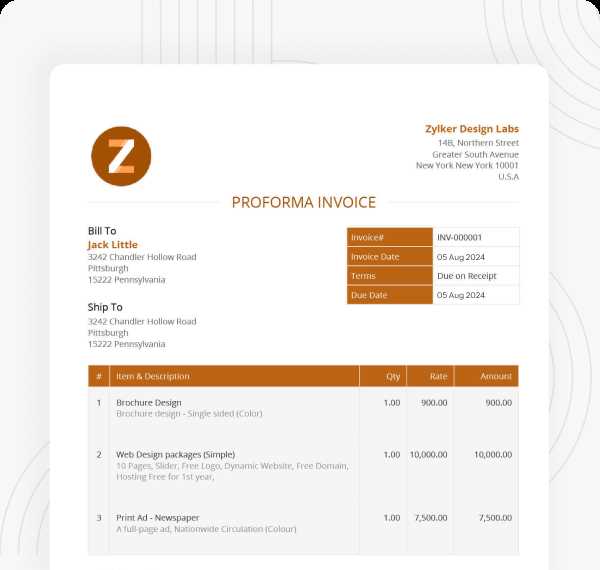

Key Components of an Invoice

For any billing document to be effective, it must contain all the necessary details to ensure both clarity and accuracy. A well-structured payment request should outline exactly what services were provided, the amount due, and the terms of payment. Ensuring that all relevant information is included helps prevent confusion and ensures that your clients can easily understand and process the payment.

There are several essential elements that should be included in any billing document to make sure it is clear, professional, and legally sound. These components not only help streamline the payment process but also serve to protect both parties in case of disputes or misunderstandings.

Essential Information to Include

The following elements are vital for any payment request document:

- Contact Information: Ensure both the service provider’s and client’s contact details are clear and accurate.

- Service Details: List the exact services or tasks completed, including descriptions and dates when applicable.

- Pricing Breakdown: Clearly state the charges for each service or task, along with the total amount due.

- Payment Terms: Outline the agreed payment schedule, methods, and any late fees or discounts.

- Invoice Number: Assign a unique identifier for each request to help with tracking and organization.

Additional Considerations

In addition to the basics, there are other elements that can enhance your payment request document:

- Tax Information: Include any relevant tax details, such as tax rates or registration numbers, if applicable.

- Due Date: Specify when payment is due to encourage timely processing and avoid delays.

- Terms and Conditions: Add any specific terms, including cancellation policies or warranties, if relevant.

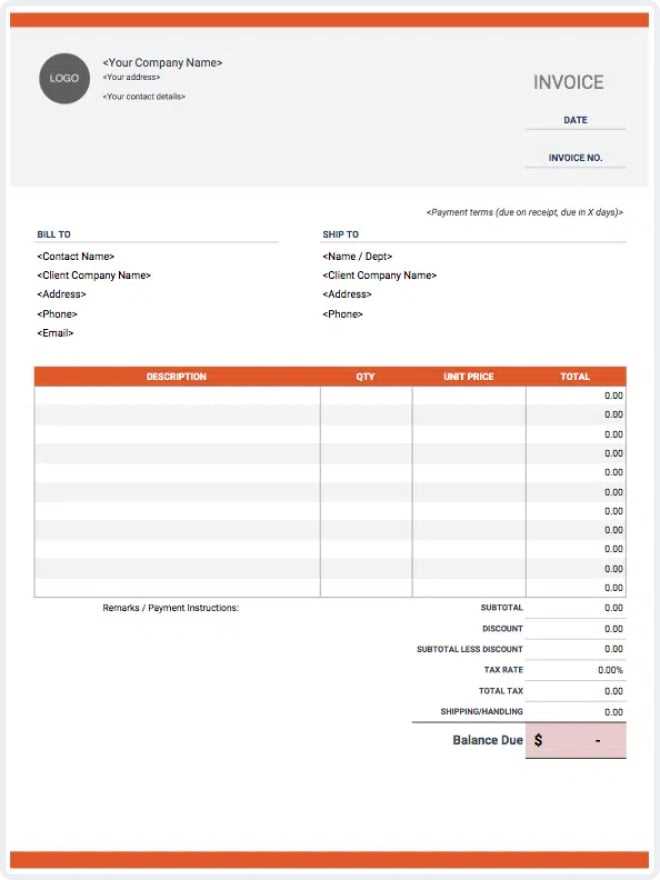

How to Customize Your Template

Personalizing your payment request format is an essential step to ensure it aligns with your business needs and enhances your professional image. Customization allows you to include specific details relevant to your services, set terms that reflect your policies, and present a branded, consistent look that clients will recognize and trust.

Customizing a document for billing is straightforward, and even small changes can make a significant impact on its clarity and professionalism. By making sure your format accurately represents your business and clearly communicates the details of the transaction, you can improve both your workflow and client relations.

Steps to Tailor Your Billing Document

Here are some key areas to focus on when modifying your payment request document:

- Logo and Branding: Add your business logo, colors, and fonts to maintain brand consistency. This makes the document look more professional and ensures it aligns with your company’s visual identity.

- Contact Information: Ensure that your business contact details (address, phone number, email) are up to date and easy to find. This makes it easier for clients to reach you with any questions.

- Service Descriptions: Tailor the service or product descriptions to match the specific work completed, providing clear and concise details to avoid any confusion.

Customizing Payment Terms

Adjusting payment terms to suit your business practices is another important customization step. Consider the following:

- Payment Methods: Clearly state which payment methods are accepted (e.g., bank transfer, PayPal, credit card) and provide relevant details.

- Due Dates: Set specific deadlines for payments and consider offering discounts for early payments or charging late fees for overdue invoices.

- Tax Rates: If applicable, customize the tax rates based on your location or service type to ensure that the right amount is charged.

Benefits of Automated Invoicing

Automating the process of generating payment requests offers numerous advantages for businesses, especially when dealing with large volumes of transactions or recurring billing. By relying on automated systems, you can streamline operations, reduce human errors, and ensure faster and more consistent billing. This not only saves time but also enhances the overall accuracy and efficiency of financial management.

One of the primary benefits of automation is that it frees up valuable time, allowing businesses to focus on other important tasks, such as customer service or growing the business. Automation also helps maintain consistency in the appearance and structure of billing documents, reducing the chances of discrepancies or missed details. Additionally, automation can lead to faster payments, improved cash flow, and a more organized financial process.

Key Advantages of Automation

| Benefit | Description | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | Automating the creation of payment requests eliminates the need to manually generate each document, saving significant time. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Reduced Errors | Automated systems minimize the risk of human errors in calculations or data entry, ensuring accuracy in all billing documents. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Consistency | By using an automated system, every document follows the same structure and format, promoting professionalism and reducing discrepancies. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Faster Payments | Automation helps send payment requests immediately upon completion of work, speeding up the collection process and improving cash flow. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Reduced Administrative Burden | With automatic generation and dispatching of documents, businesses can reduce the time spent on administrative tasks, enabling employee

Choosing the Right Template for Your BusinessSelecting the right format for your payment requests is crucial for maintaining a professional appearance and ensuring smooth financial transactions. The right document should align with the specific needs of your business, whether you are offering project-based services, long-term contracts, or temporary personnel. Customizing a suitable document can help streamline your billing process and ensure accuracy while promoting trust and clarity with clients. When deciding on a format, it is important to consider several factors that influence how the final document will function. The structure should support all necessary details, be easy to modify, and provide a clear presentation of services and charges. A well-chosen format can enhance your business efficiency, while a poor choice can create confusion and delays in payment. Factors to Consider When Choosing a FormatConsider the following elements when selecting the right structure for your payment requests:

Where to Find the Best FormatsYou can find suitable document formats through several sources, such as:

|