Download Blank Invoice Template in Word for Easy Customization

Managing financial transactions efficiently is crucial for any business or individual. One of the most important aspects of this process is generating accurate, clear, and well-organized payment records. To simplify this task, pre-designed formats can be a valuable resource, enabling you to quickly produce professional documents without the need for extensive design or technical skills.

These customizable forms allow users to input relevant details such as client information, amounts owed, and payment terms. By utilizing a straightforward and adaptable layout, creating a professional-looking statement becomes easy and efficient. Whether you’re a freelancer, small business owner, or managing personal finances, having a ready-to-use structure can save you time and ensure consistency in your financial documentation.

Utilizing these tools not only enhances the appearance of your documents but also helps maintain accuracy and clarity, which is essential for smooth transactions. By following simple guidelines, you can customize your record sheets to reflect your unique business or personal needs.

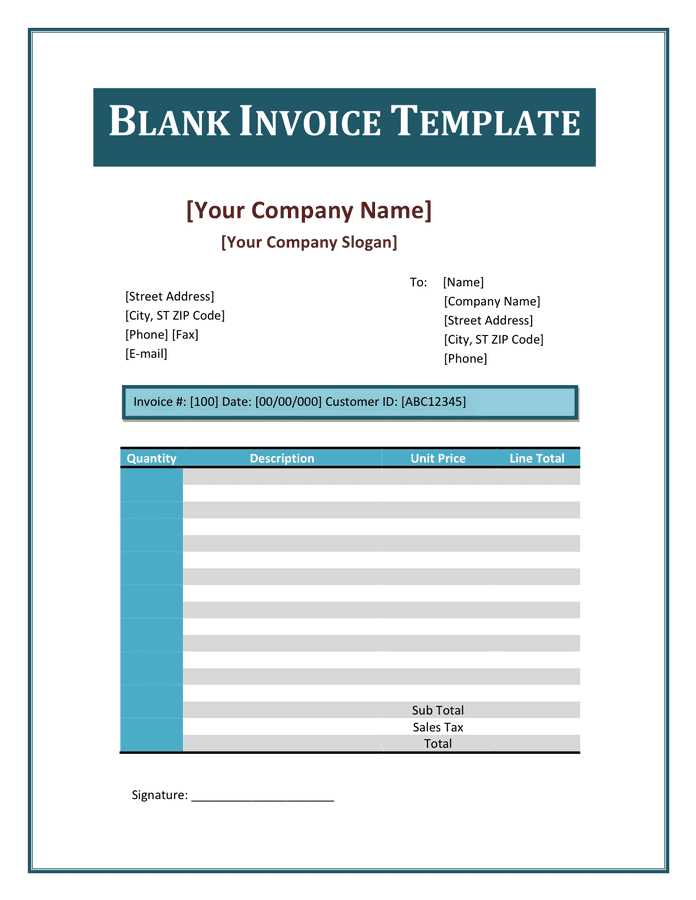

Blank Invoice Template in Word

Creating professional billing documents is essential for maintaining clear financial records. Having an accessible and customizable structure can make this process much easier, whether you’re working for a client, running a small business, or handling personal finances. With a pre-designed layout, you can quickly enter all necessary details and produce polished, consistent statements every time.

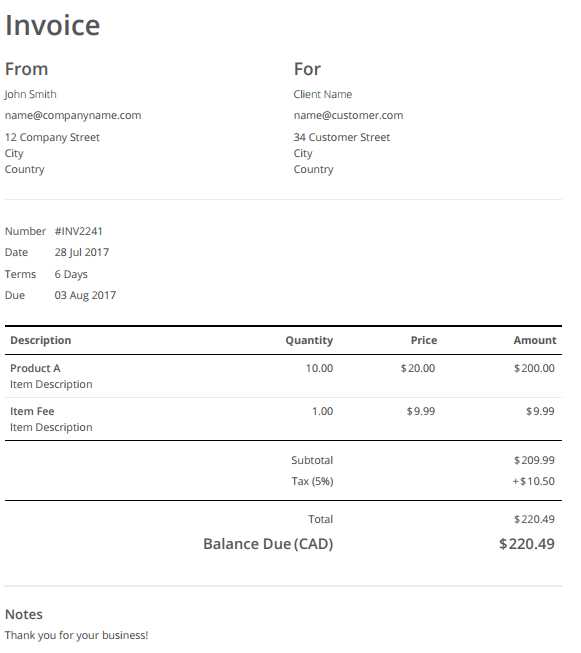

These ready-to-use documents typically feature all the required fields for a proper transaction record, such as:

- Client name and contact details

- Itemized list of services or products

- Amounts due and payment terms

- Due date for payment

- Your business or personal details

Once the layout is in place, customization is easy. You can update the fields with relevant information and adjust the design elements to match your branding or personal preferences. This flexibility makes it possible to create documents that align with the unique needs of each transaction.

By using a standardized format, you reduce the risk of missing important details or making mistakes, ensuring that both parties have clear expectations and understanding. Additionally, the uniformity of the structure helps create a professional image for your business or freelance work.

Whether you are a freelancer, a small business owner, or someone who needs to generate occasional financial records, using a pre-designed document ensures you maintain professionalism while saving valuable time. Customizing the layout in a simple text editor or design software allows you to adapt the form to your specific needs with minimal effort.

Why Use a Blank Invoice Template

Having a pre-designed format for creating financial records offers numerous advantages. It saves valuable time, reduces errors, and helps ensure consistency across all documents. Whether you’re an entrepreneur, freelancer, or managing personal finances, using a ready-made layout allows you to focus on the content rather than the design of your documents. The simplicity and flexibility of such a layout make it an ideal solution for those looking for efficiency and professionalism.

Time Efficiency

Using a ready-made structure eliminates the need to design a new document from scratch every time you need to issue a payment record. This allows you to focus on the key details, such as the services provided or the amounts due, rather than worrying about formatting and layout.

Consistency and Professionalism

When you rely on a standardized layout, you create uniform documents every time. This consistency enhances your professional image, ensuring that your clients or business partners receive clear and organized statements. A uniform format helps build trust and credibility in your financial transactions.

| Benefit | Explanation |

|---|---|

| Time-saving | Quickly generate documents without needing to format or design each one manually. |

| Accuracy | Pre-defined fields minimize the risk of missing important information or making errors. |

| Flexibility | Easily customize the document to suit your unique needs and business style. |

| Professional image | Standardized, clear layout helps establish a trustworthy and polished reputation. |

Overall, using a pre-designed layout streamlines the process of generating financial records while ensuring they are accurate, clear, and professional. This approach saves time and effort, allowing you to focus on what matters most: your business or services.

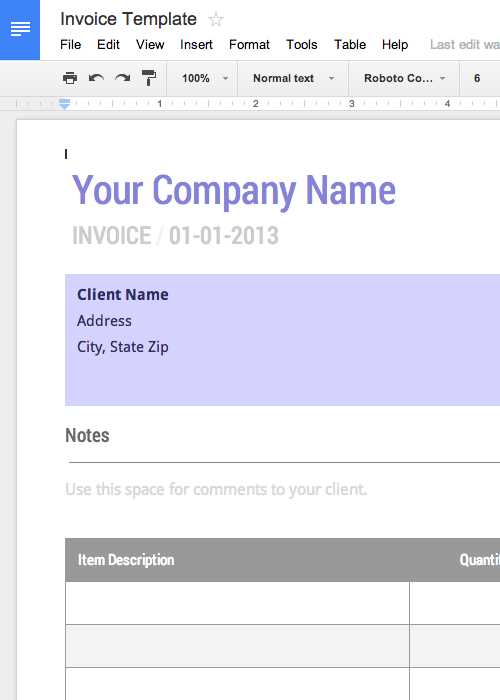

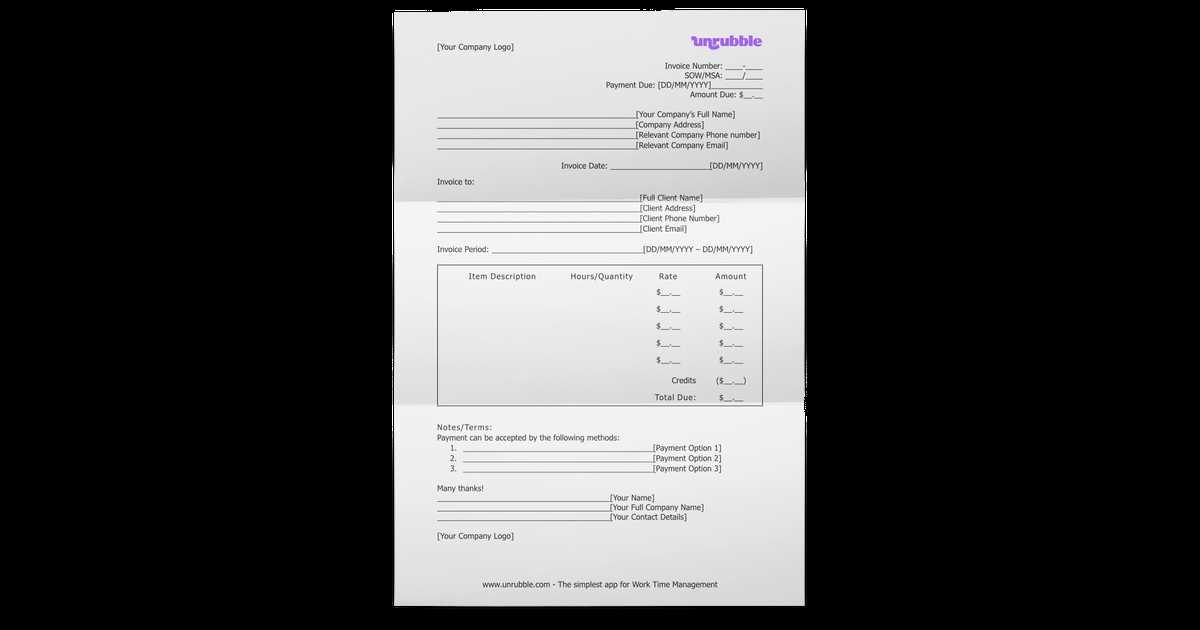

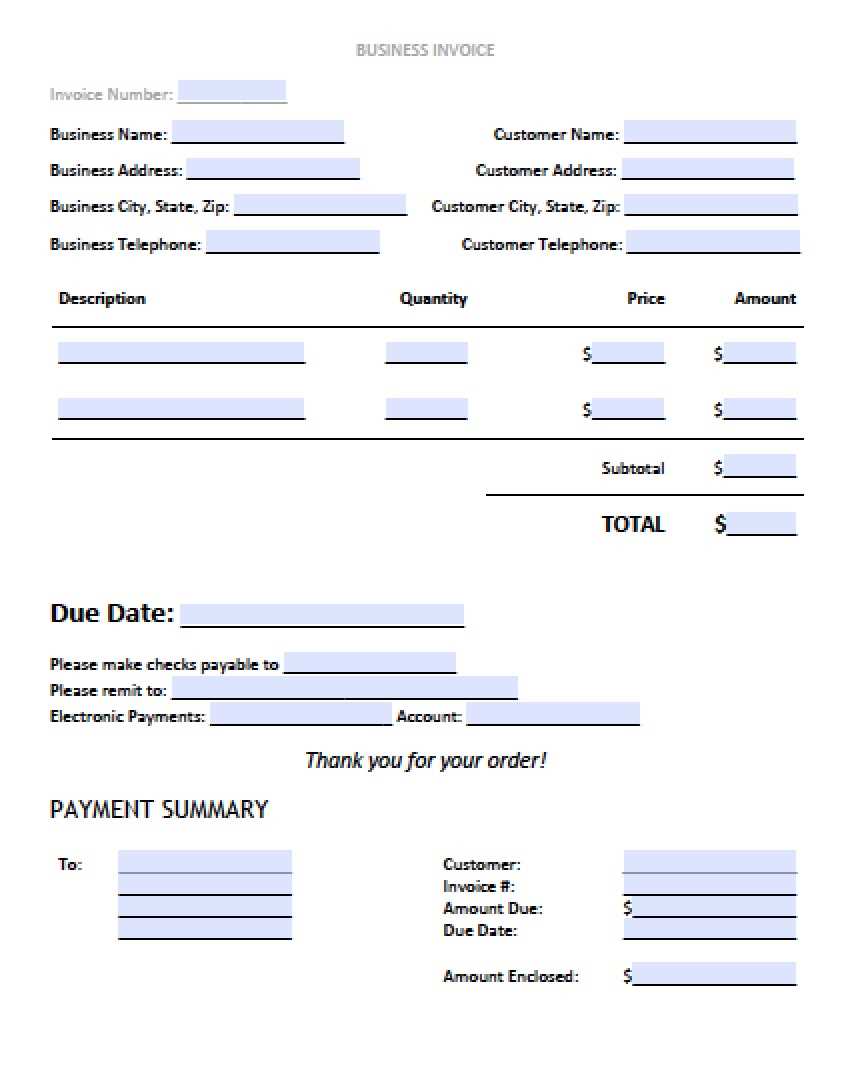

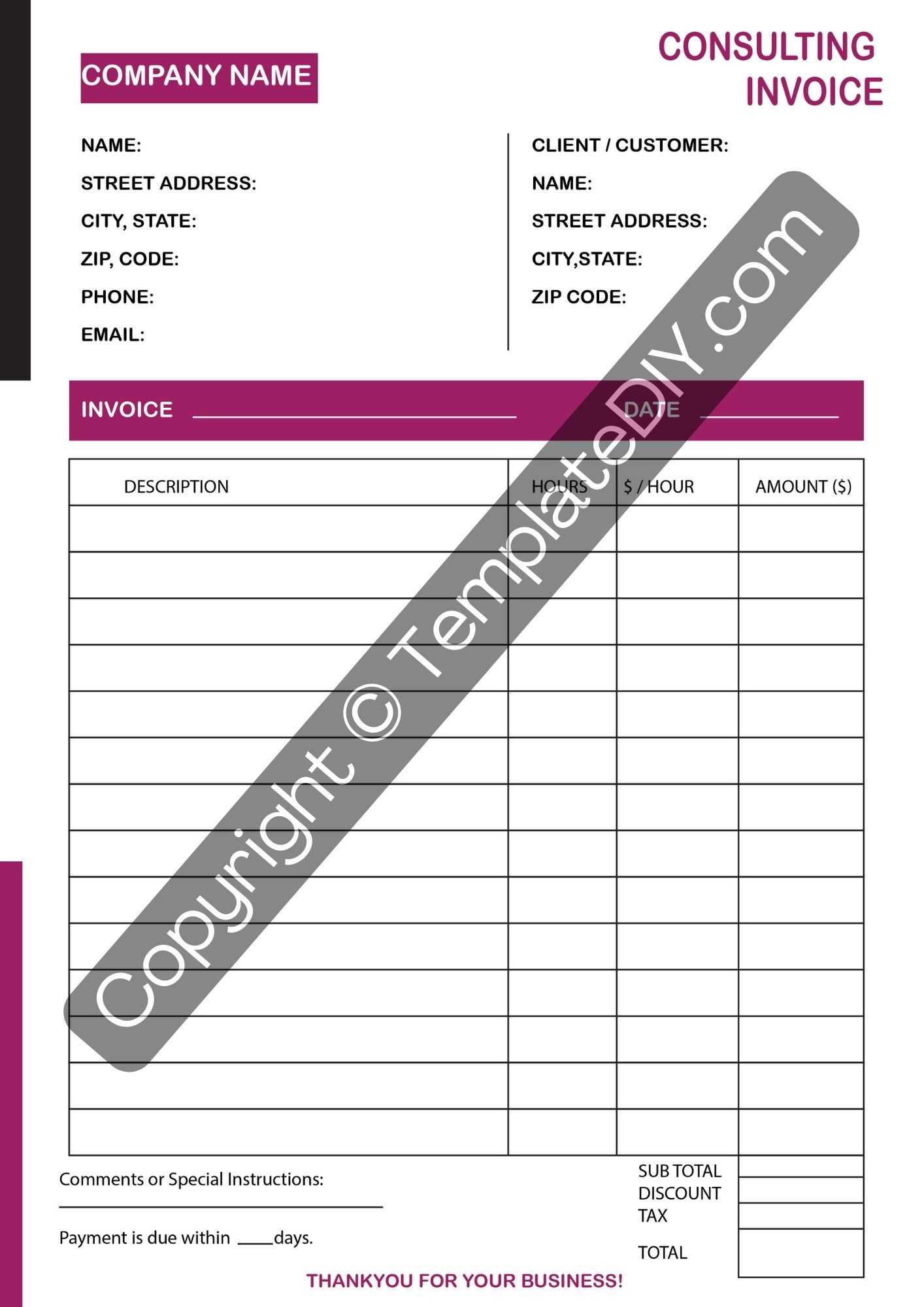

How to Customize an Invoice in Word

Customizing a financial record layout is an essential step in personalizing your documents for your business or freelance needs. Once you have selected a basic structure, the next step is to adjust it to suit your specific requirements. Customization allows you to add relevant details, modify the design, and ensure the document reflects your brand or personal style.

The process is straightforward and doesn’t require advanced technical skills. With a few simple modifications, you can adapt the layout to include essential fields such as contact information, item descriptions, and payment terms. Below is a step-by-step guide to customizing your billing document.

| Step | Action |

|---|---|

| 1. Open the Document | Launch your document editor and open the selected structure you want to use. |

| 2. Adjust Header Information | Replace default details with your company name, logo, and contact information. |

| 3. Customize Client Details | Insert the client’s name, address, and contact details in the appropriate sections. |

| 4. Modify Line Items | Edit the list of services or products you provided, including descriptions and quantities. |

| 5. Update Payment Terms | Adjust payment due dates and terms based on the agreement with the client. |

| 6. Review and Save | Check for accuracy and save the document for future use or printing. |

After these steps, your document will be ready to send to your client or keep for your own records. Customizing the layout ensures the document aligns with your business practices and maintains professionalism in your financial interactions.

Benefits of Word Invoice Templates

Using pre-made structures for creating billing documents offers a range of advantages that streamline the invoicing process. These formats allow for quick and efficient creation of professional financial records without the need for advanced design skills. Whether you’re a freelancer, small business owner, or managing personal finances, leveraging these layouts can enhance accuracy and improve your workflow.

Time Efficiency

One of the primary benefits is the significant time saved by not having to start from scratch every time you need to generate a record. With a pre-designed structure, you can simply fill in the relevant details, such as client information and services rendered. This reduces the need for manual formatting, enabling you to focus on the essential aspects of the transaction.

Professional Appearance

Maintaining a consistent and professional image is crucial in any business transaction. Using a standardized layout ensures that your documents are well-organized and visually appealing. A polished format increases credibility, making a positive impression on clients and partners alike.

Additionally, a structured format reduces the risk of leaving out important details or creating confusion. The layout helps you include all the necessary fields, such as payment terms, due dates, and service descriptions, ensuring clarity and accuracy.

Overall, using these formats helps maintain a professional approach to record-keeping while saving valuable time and effort. With easy customization, they can be tailored to fit the specific needs of any transaction, ensuring that every document is clear, concise, and well-organized.

Steps to Create an Invoice in Word

Generating a professional billing document can be a simple task if you follow a few straightforward steps. By utilizing an editable layout, you can easily insert the necessary information to produce clear and accurate records for your transactions. This process ensures that each document meets your needs while maintaining a consistent and professional appearance.

The following steps outline how to create a detailed billing document from scratch or by using a pre-designed format, making the entire process efficient and user-friendly.

Step 1: Open Your Document Editor

Begin by opening your preferred document editing software. If you are using a pre-designed layout, open the file from your template collection. If you are creating a new one, start with a blank page or choose a simple table-based layout to structure your content.

Step 2: Add Your Business Details

At the top of the page, include your name or business name, logo, and contact information. This helps the recipient easily identify the source of the document and get in touch if necessary.

Step 3: Insert Client Information

Next, add the recipient’s name, address, and contact details. This ensures that the billing statement is correctly addressed, and the client knows exactly which services or products the document pertains to.

Step 4: List the Services or Products

Provide a detailed list of the services rendered or products sold. Include descriptions, quantities, individual prices, and the total cost for each item. This section should be clear and easy to read to avoid any misunderstandings.

Step 5: Include Payment Terms

Clearly state the payment terms, including the total amount due, the due date, and any applicable taxes or discounts. If there are late payment penalties or additional fees, be sure to mention those as well.

Step 6: Review and Save the Document

Before finalizing the document, review all the details to ensure accuracy. Once everything is correct, save the file in your desired format, whether for printing, emailing, or keeping a digital record.

By following these steps, you can quickly generate professional, customized documents for every transaction, making the invoicing process more efficient a

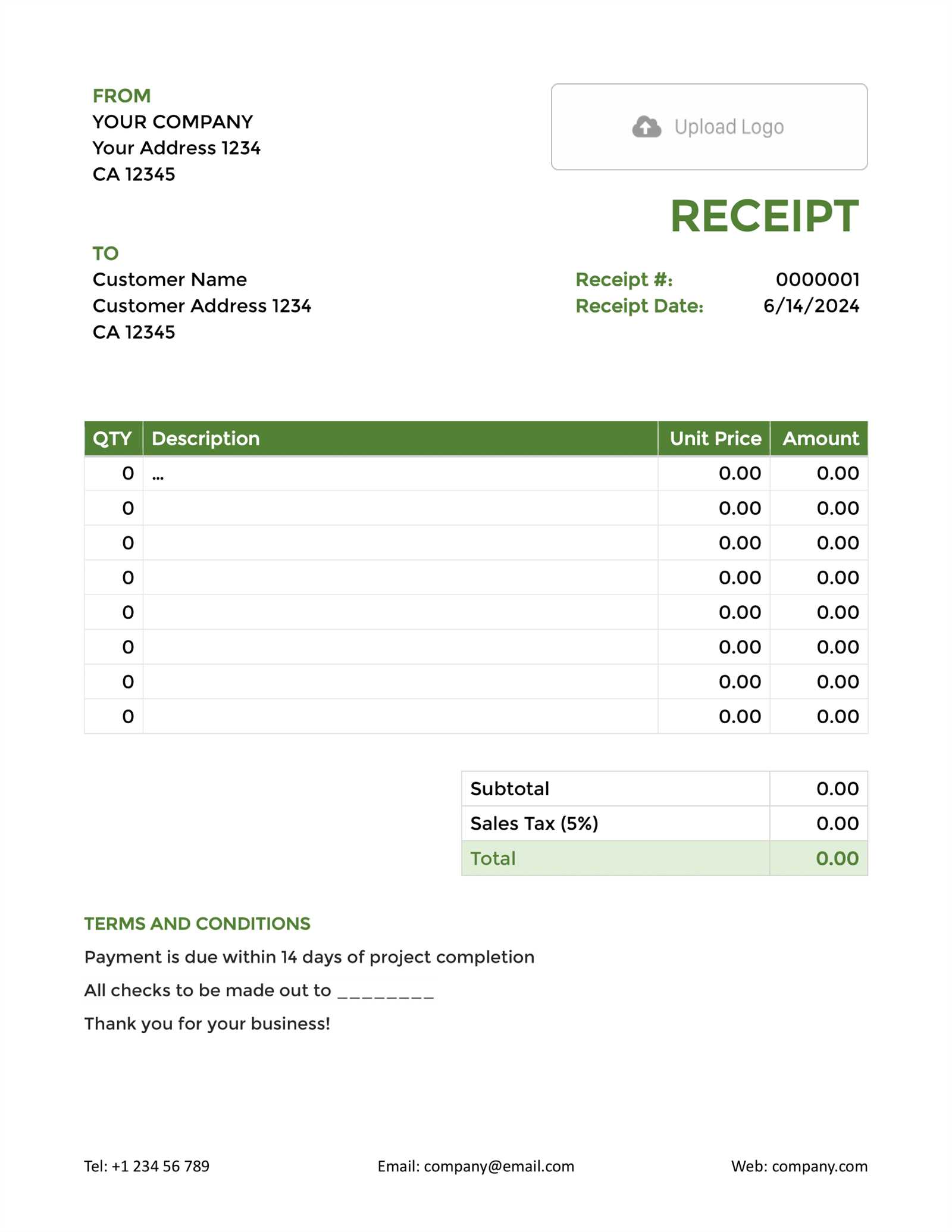

Essential Elements of an Invoice

Creating a clear and well-structured payment record requires certain key elements to ensure accuracy and transparency. These components help both the service provider and the client understand the terms of the transaction, reducing the likelihood of confusion or disputes. Whether you’re managing your business finances or handling personal transactions, these essential elements should always be included for completeness and professionalism.

Contact Information

The first and most important piece of information to include is the contact details for both parties. This typically involves the name, address, and phone number of the service provider or business, as well as the client’s contact information. Having this information on hand makes it easy to reference the transaction and facilitates future communication if needed.

Detailed Itemization

One of the most critical parts of any payment record is the detailed breakdown of the services provided or products sold. It’s important to include:

- Description: A clear description of each service or product.

- Quantity: The number of items or hours worked.

- Unit Price: The cost per item or hour.

- Total Price: The total cost for each line item, calculated based on quantity and unit price.

This section ensures that both parties have a shared understanding of what is being billed, making the payment process transparent and straightforward.

Payment Terms and Due Date

Including the payment terms and due date is crucial for setting clear expectations. This section should specify the total amount due, payment methods accepted, and any late fees or penalties that may apply. Additionally, be sure to indicate the due date so that the client knows when payment is expected. If any discounts or special offers apply, this is also the section to mention them.

By including these essential elements, you ensure that your documents are both professional and comprehensive, fostering trust and clarity in every transaction.

Free Invoice Templates for Word

There are many free resources available online that offer pre-designed formats for creating billing records. These customizable structures can save you significant time by providing a professional layout, allowing you to focus on entering the relevant details instead of formatting the document from scratch. With these free options, anyone can generate clear, accurate, and polished financial documents without the need for expensive software or design skills.

These free layouts often come in a variety of styles, from basic designs to more advanced options that cater to different industries and preferences. Whether you need a simple format for freelance work or a more detailed structure for complex transactions, there is a wide range of free choices that can fit your needs.

By using these resources, you can ensure that each billing document is consistent and professional, while also making the process more efficient. Many of these pre-designed files are editable, meaning you can adjust the content to suit your business or personal requirements with just a few clicks.

How to Save and Edit Invoice Templates

Once you have selected or created a structured layout for your billing documents, the next step is to ensure that it can be easily edited and saved for future use. This allows you to quickly generate new documents for each transaction while maintaining a professional appearance and consistency. Learning how to save and modify these formats will save you time and effort with every new record you create.

Saving Your Document for Future Use

After customizing your structure with the necessary details, the first thing you’ll need to do is save the file in a format that allows for easy access and editing in the future. Follow these simple steps:

- Click “File” in the menu bar.

- Select “Save As” from the drop-down options.

- Choose the location on your computer or cloud storage where you want to keep the document.

- Give the file a descriptive name, such as “Client Billing Record” or “Business Payment Statement,” so it’s easy to locate later.

- Save the file in an editable format, such as .docx or .rtf, which can be modified anytime.

Editing Your Document for New Transactions

To make the document applicable for different transactions, you can edit the fields to reflect the updated details for each client or service. Here’s how you can do it:

- Open the saved file.

- Replace the previous client’s name, contact details, and transaction information with the new client’s data.

- Adjust the services or products listed, including descriptions, quantities, and prices.

- Update the payment terms, such as the total amount, due date, and any discounts or taxes.

- Review the document for accuracy and save it again with a new file name, if desired, for future reference.

By following these steps, you can quickly update and save your billing records, making the process of managing payments seamless and efficient.

Common Mistakes When Creating Invoices

When preparing billing documents, it’s easy to overlook certain details that can lead to confusion, errors, or delays in payment. Even small mistakes can affect the professionalism of the document or cause misunderstandings with clients. Being aware of common pitfalls can help you avoid these issues and ensure that your records are clear, accurate, and complete.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include the correct contact details for both the service provider and the client. Missing or incorrect information can cause confusion and delay communication. Always double-check the following:

- Business or personal name

- Address and phone number

- Email and website

Make sure these details are up to date to avoid any communication issues down the line.

2. Incorrect Pricing and Calculations

Another frequent error is entering the wrong price or quantity, or forgetting to calculate the total amount correctly. Even a small mistake in pricing can lead to significant discrepancies. Common mistakes to avoid include:

- Not including taxes or discounts

- Calculating totals incorrectly

- Forgetting to update prices for different clients or projects

Always double-check the calculations and ensure that all figures are accurate before finalizing the document.

3. Not Specifying Payment Terms

Omitting important payment terms is another mistake that can cause confusion. It’s essential to clearly state when payment is due, what methods are accepted, and if there are any late fees or penalties for overdue payments. Be sure to include:

- Due date for payment

- Accepted payment methods (e.g., bank transfer, PayPal, check)

- Late payment penalties, if applicable

Clearly outlining these terms ensures both parties are on the same page and helps prevent misunderstandings.

4. Lack of Detailed Descriptions

Failing to provide clear descriptions of the products or services provided can lead to confusion or disputes. Make sure to list each item with the following details:

- Description: Clear and concise informat

Best Practices for Professional Invoices

Creating professional financial records is essential for maintaining clear communication with clients and ensuring timely payments. By following best practices, you can ensure that each document is organized, accurate, and easy to understand. This not only helps streamline the payment process but also reinforces your business’s professionalism and reliability.

1. Use a Clear and Organized Layout

One of the most important aspects of a professional billing document is its layout. A well-organized structure makes it easy for the recipient to find the information they need, such as the total amount due, payment terms, and service details. Ensure that your document is neat and clean by using:

- Headings and subheadings to organize sections.

- Tables for listing services or items with descriptions, quantities, and prices.

- Bold text for highlighting key information, such as the total amount due.

Keep the design simple and easy to read, avoiding clutter or excessive decoration.

2. Include All Relevant Information

Make sure your billing record includes all the necessary details to avoid confusion and disputes. Some key elements to always include are:

- Business details: Your name, address, and contact information.

- Client information: The client’s name, address, and any relevant contact details.

- Service or product details: Clear descriptions, quantities, and prices.

- Payment terms: The total amount due, payment methods, due date, and any late fees or discounts.

By including all necessary details, you help ensure there are no misunderstandings between you and your clients, and the payment process is smooth and efficient.

Adhering to these best practices will enhance the professionalism of your documents, ensuring that your clients receive accurate, clear, and timely records. This attention to detail helps foster trust and builds a positive reputation for your business.

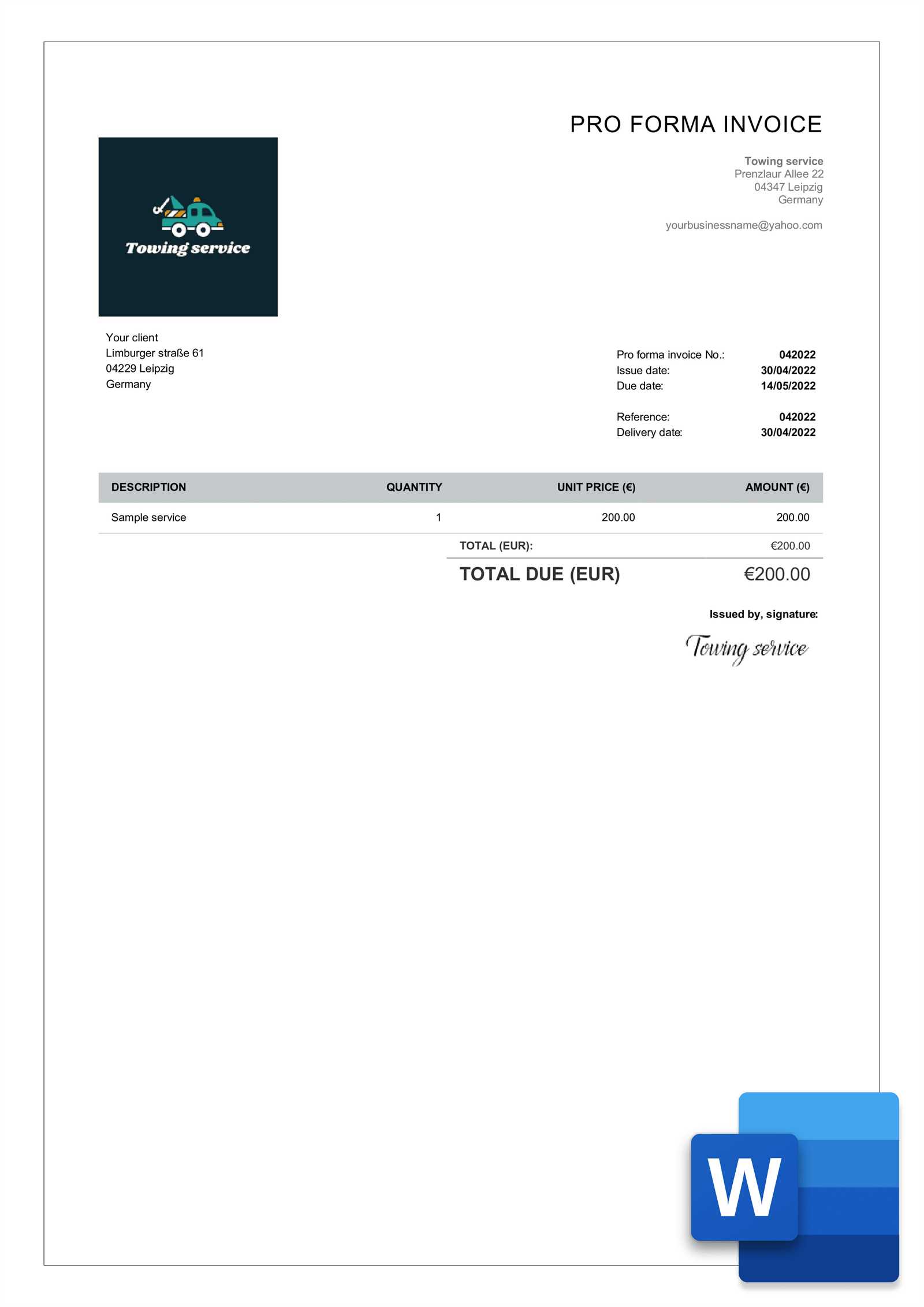

Choosing the Right Template for Your Business

Selecting the right structure for your billing documents is crucial for maintaining professionalism and ensuring that all necessary information is clearly presented. Depending on your business type and the nature of your transactions, the right layout can help streamline your processes, improve client communication, and enhance the overall presentation of your financial records.

When choosing a design for your payment statements, it’s important to consider several factors to make sure it aligns with your specific needs. Different industries and services require different details and formatting, so it’s essential to select a format that can be easily customized and tailored to reflect your business accurately.

1. Assess Your Business Needs

Consider the complexity of your services or products when choosing a structure. If you provide multiple services or products, you’ll need a format that allows for detailed itemization. For simpler transactions, a more basic format may be sufficient. Here are a few points to consider:

- Service or product complexity: Are you providing a single service or multiple items?

- Frequency of updates: Do you regularly need to modify the document for each client?

- Branding consistency: Does the design align with your business’s branding and overall style?

2. Look for Customization Options

It’s important to choose a design that allows you to easily customize it with your business information, client details, and service descriptions. The best structures provide flexibility while maintaining a clean, professional look. Pay attention to the following:

- Editable sections: Look for formats where you can easily change the text, add logos, and update payment terms.

- Professional layout: Ensure that the design is simple yet visually appealing, with clear sections for each piece of important information.

- Branding options: Choose a layout that allows you to incorporate your company’s logo, color scheme, and fonts.

Choosing the right structure ensures that your documents are not only functional but also visually appealing and aligned with your business image. By selecting a customizable, industry-appropriate format, you can create a seamless experience for your clients and maintain a high level of professionalism in all your transactions.

How to Add Tax Information to an Invoice

Including tax details in your billing records is essential for both legal compliance and transparency with your clients. Whether you’re required to collect sales tax, VAT, or another type of levy, accurately reflecting these charges ensures that your documents are clear and professional. Additionally, it helps your clients understand the total cost they need to pay, including any taxes applicable to the transaction.

When adding tax information, it’s important to follow the guidelines for your local jurisdiction. This can vary depending on the country, state, or region in which you do business. Below, we outline the steps for incorporating tax details into your billing documents, ensuring that all necessary information is included and correctly calculated.

1. Include a Separate Tax Section

Clearly itemizing the tax amount on your billing document is critical for transparency. Create a distinct section for taxes that lists the type of tax (e.g., sales tax, VAT) and the applicable rate. You should include:

- Tax Type: Specify the type of tax you are charging (e.g., Sales Tax, VAT, GST).

- Tax Rate: Include the percentage or rate of tax being applied (e.g., 5%, 10%).

- Tax Amount: The amount calculated based on the tax rate and the total price of the goods or services.

Make sure the tax is clearly separated from the total amount for better understanding.

2. Update Total with Tax Included

After calculating the tax, update the overall total by adding the tax amount to the original subtotal. The final price should reflect both the cost of the items or services provided and any applicable taxes. Here’s how to structure it:

- Subtotal: The total cost of the goods or services before tax.

- Tax Amount: The total tax charge based on the rate and subtotal.

- Total Due: The final amount after tax is added to the subtotal.

Ensure the tax amount is clear and visible, so there’s no confusion about the total cost.

3. Include Your Tax Identification Number (TIN)

For businesses required to collect taxes, it’s important to include your tax identification number (TIN) on the document. This provides proof that you’re registered to collect taxes and reassures clients that the tax is being handled correctly. Make sure to include:

- Your TIN or VAT ID: This number identifies your business for tax purposes.

- How to Add Payment Terms to Invoices

Including clear and precise payment terms in your billing documents is crucial for setting expectations with clients and ensuring timely payments. Payment terms outline how and when a client should pay, as well as any conditions related to late fees, discounts, or other payment-related matters. By defining these terms, both you and your client have a clear understanding of what is expected, helping to avoid confusion and potential disputes.

When adding payment conditions, it’s important to be specific and comprehensive. The terms should cover key aspects like the due date, payment methods, and any penalties for delayed payments. Below, we explain how to effectively incorporate payment terms into your billing documents.

1. Specify the Due Date

One of the most important aspects of payment terms is the due date. This is the date by which the client is expected to settle the payment. It should be clearly stated to avoid confusion. Some ways to phrase the due date are:

- Net 30: Payment is due 30 days from the date of the billing document.

- Due on receipt: Payment is expected as soon as the document is received.

- Due within 14 days: Payment should be made within two weeks of receiving the bill.

By specifying a due date, you make it clear when the payment should be made, ensuring there is no ambiguity in your agreement with the client.

2. Include Accepted Payment Methods

Clarifying the accepted methods of payment is essential for avoiding delays. Whether you accept bank transfers, credit cards, checks, or online payment platforms, you should make these options clear to the client. Some examples include:

- Bank Transfer: Provide your banking details for direct payments.

- Credit Card: If applicable, include instructions for online payment or provide a link for payment processing.

- PayPal: Include your PayPal account details or a payment link.

- Check: If you accept checks, specify the mailing address or location for sending the check.

Listing payment methods ensures that the client knows how to pay and prevents any delays caused by confusion over payment options.

3. Define Late Fees or Penalties

To encourage timely payments, it is advisable to include penalties for late payments. These terms should clearly state any additional charges the client will incur if they miss the due date. Some common ways to phrase late fees are:

- Late Fee: A percentage (e.g.,

Formatting Tips for Clear Invoices

Properly formatting your billing documents is essential for clarity and professionalism. A well-organized layout ensures that your clients can quickly and easily understand the charges, payment terms, and other critical details. Clear formatting reduces the risk of confusion or errors and makes the payment process smoother for both parties.

By using a consistent structure, choosing appropriate fonts, and organizing information logically, you can create documents that are easy to read and process. Below are some key formatting tips to help you create well-structured and visually appealing billing records.

1. Use Readable Fonts and Sizes

Choosing the right font is crucial for readability. Opt for simple, clean fonts that are easy to read both on-screen and in print. Some recommended fonts include Arial, Times New Roman, and Helvetica. Additionally, ensure the font size is appropriate, typically between 10-12 points for the body text. Here are a few suggestions:

- Font Style: Stick to standard, professional fonts like Arial or Calibri.

- Font Size: Use 10-12 point size for the body, and slightly larger (14-16 point) for headings.

- Consistency: Keep the same font throughout the document to maintain a clean and uniform look.

Using a readable font ensures that all the important details, including item descriptions, total amounts, and payment instructions, are easy to interpret.

2. Organize Information in Logical Sections

Structure your billing document in a way that makes sense for your client. Clear separation between different sections helps readers quickly locate the information they need. Use headings, tables, and bullet points to break up text and improve organization. For example:

- Heading Sections: Create clear headers for different sections such as “Client Information,” “Services Rendered,” and “Payment Terms.”

- Tables: Use tables to list services, products, quantities, and prices for easy reference.

- Bold and Italics: Use bold for headings and important details, and italics for notes or supplementary information.

By organizing the document in this manner, clients can quickly navigate through the information, ensuring they understand all details and are not confused by excessive text or clutter.

3. Use Adequate Spacing and Alignment

Proper spacing and alignment are essential for creating a clean and professional look. Ensure that sections are clearly separated and text is aligned correctly. This enhances the overall readability of your document. Some helpful tips include:

- Spacing: Leave sufficient space between sections and key pieces of information to avoid a crowded look.

- Alignment: Align text to the left or center, depending on the section. Numbers, such as totals and amounts, should be right-aligned for easier reading.

- Margins: Use standard margins (1 inch on all sides) to ensure the document is not too cramped.

Proper alignment and spacing ensure that the document is visually appealing and easy to read,

Managing Multiple Invoices in Word

Handling multiple billing documents can become challenging, especially as your business grows. Efficiently managing numerous records is essential for maintaining accuracy, organization, and ease of access. Whether you need to track payments, edit documents, or keep them in order, having a clear strategy for managing your financial records will save time and reduce the risk of errors.

In this section, we will explore some effective strategies for organizing and handling multiple billing documents in a word processing program. From creating a system for naming and storing files to using features that improve document navigation, these tips will help streamline the management of your business’s financial paperwork.

1. Organize Files by Date or Client

To keep track of various records, it’s important to establish a logical organization system. You can choose to categorize files by date, client, or project. A well-structured folder system helps you quickly locate the correct document when needed. Consider the following options:

- By Date: Create folders based on year and month to organize your documents chronologically. This makes it easier to locate records from specific periods.

- By Client: Organize your documents into client-specific folders. Each folder can contain all billing records related to that particular customer.

- By Project or Service: If your business handles multiple types of services or projects, organize documents by service type or project name for easy reference.

By choosing a consistent method to name and organize your files, you ensure that no document gets lost and that it’s easy to find the information you need when necessary.

2. Use Document Versions and Templates for Consistency

To save time and maintain consistency, consider using version control and standard layouts. For example, create a base format that you can reuse for every transaction, eliminating the need to start from scratch each time. Some ways to use templates and versions effectively include:

- Version Control: Keep track of changes by saving different versions of each document. Use a consistent naming system like “ClientName_Invoice_001,” “ClientName_Invoice_002,” etc.

- Reusable Formats: Save your most frequently used layouts as a document that can be easily duplicated for each new transaction. This ensures consistency and reduces editing time.

- Change Tracking: Enable change tracking features in your word processing software to monitor and review ed

How to Print or Share Invoices

Once you’ve created and customized your billing documents, the next step is to distribute them to your clients. Whether you choose to print hard copies or share digital versions, ensuring that the document is accessible and well-presented is crucial for a smooth transaction. Knowing the best methods for both printing and sharing can help you deliver documents in a professional manner and ensure that your clients receive them promptly.

This section will guide you through the process of printing and sharing your financial records. We will discuss the best practices for both physical and digital delivery, including how to ensure that your documents maintain their formatting and readability when shared or printed.

1. Printing Invoices Professionally

Printing billing documents allows you to send physical copies, which can be useful for clients who prefer hard copies or for record-keeping purposes. To ensure that the printed version is clear and professional, follow these tips:

- Check Margins: Before printing, ensure the document fits within standard paper margins (1-inch on all sides) to avoid cutting off any information.

- Paper Quality: Use high-quality paper, preferably 24 lb. weight or higher, to make a positive impression and ensure the document is durable.

- Print Preview: Always use the print preview feature to check how the document will look on paper, ensuring all content is correctly aligned and visible.

- Printer Settings: Select the best print quality in your printer settings to ensure clarity, especially for text and numbers.

By following these simple steps, you ensure that your printed documents are clear, professional, and ready for distribution.

2. Sharing Documents Digitally

Sharing billing records electronically is fast and convenient. Here are some common methods for delivering documents digitally while maintaining their professional appearance:

- Email Attachments: Save the document as a PDF or another widely accepted format and attach it to an email. Make sure the file size is not too large for easy downloading.

- Cloud Storage Links: Upload the document to a cloud storage service like Google Drive or Dropbox, and share the link with your client. This is a great option for easy access and long-term storage.

- Secure Document Sharing Platforms: Consider using services like DocuSign or Adobe Sign if you need clients to sign or approve the document electronically.

- Online Payment Systems: Many payment systems, such as PayPal or Stripe, allow you to send billing documents directly through their platform, making the process seamless for both parties.

When sharing documents digit