Digital Marketing Invoice Template for Easy and Efficient Billing

For any business providing online promotional services, clear and professional billing documents are essential. These documents not only help keep track of completed work but also ensure that payments are prompt and accurate. Using pre-designed formats can simplify this aspect of business management, allowing you to focus more on what truly matters: delivering quality results to clients.

Well-structured billing layouts offer numerous benefits. They clarify the services rendered, break down costs transparently, and build trust with clients. By utilizing a format specifically tailored for promotional services, businesses can avoid the common pitfalls of generic billing and present an organized, consistent approach to financial management. This en

How to Create an Invoice for Marketing Services

Preparing a detailed billing document for promotional services is essential for any professional working with clients. A well-structured document ensures that clients understand the scope of work completed, the associated costs, and the payment expectations. This approach also simplifies record-keeping for both parties, making it easier to maintain an organized workflow and avoid misunderstandings.

Start by clearly listing the services provided, using simple, direct descriptions. Specify the dates of service or project milestones, as these details help clients see the timeline of work completed. Be sure to itemize costs for each component of the project to make the total amount transparent. Itemizing each service offered not only clarifies costs but also demonstrates professionalism and attention to detail.

Next, include any necessary payment terms to avoid delays. Clearly state accepted payment methods, due dates, and any late fee policies. Payment terms encourage timely settlements and help clients feel secure about the payment process. Additionally, add contact information in cas

Essential Elements of a Marketing Invoice

Creating an organized billing document requires certain key components to ensure clarity and professionalism. Including these elements helps clients easily understand the services provided, the associated costs, and any payment terms, which can lead to a smoother billing process and fewer misunderstandings.

Clear Identification and Contact Information

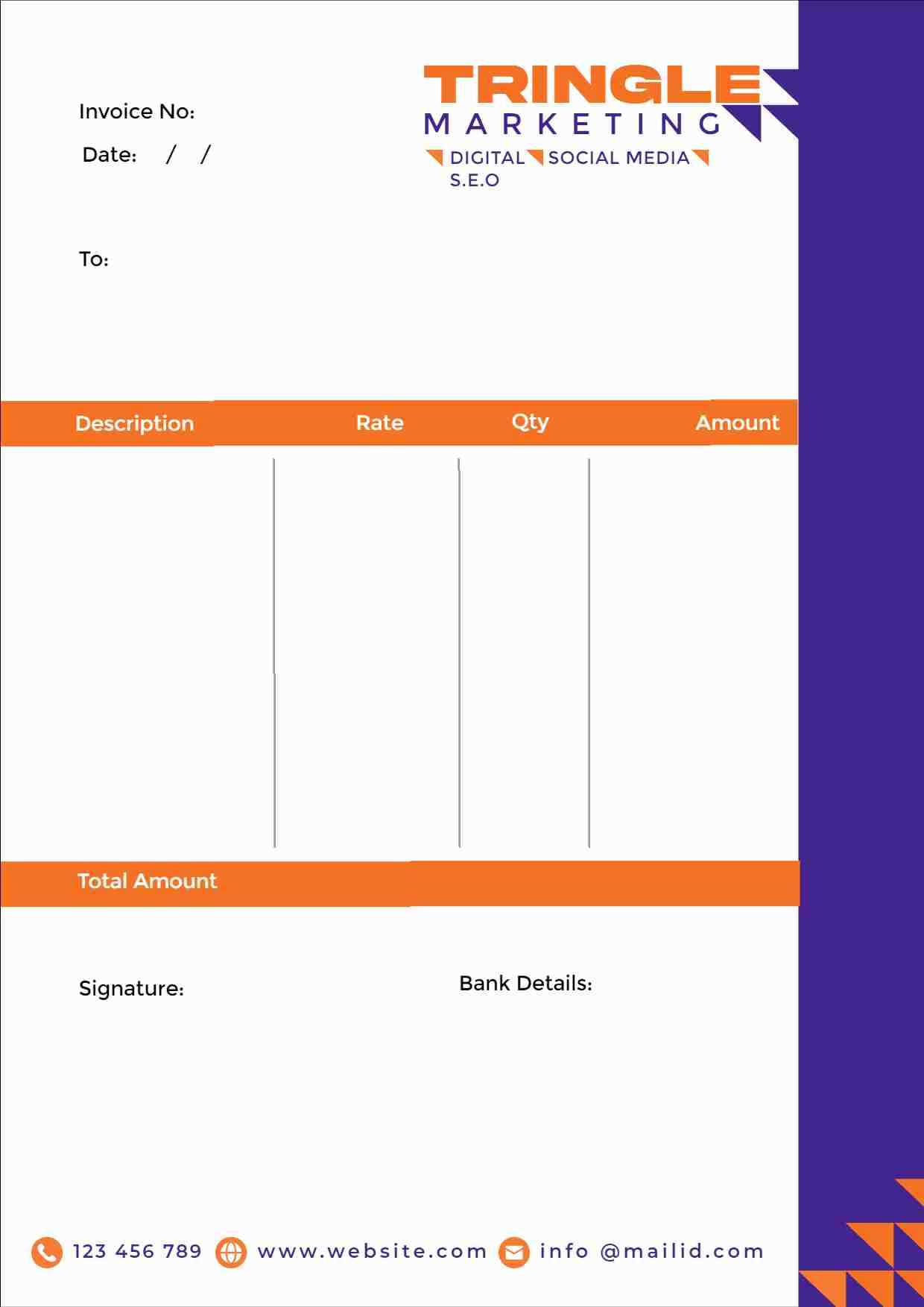

At the top of the document, always place your business name, logo, and contact details. These should be followed by the client’s name and contact information. This initial section serves to identify both parties involved in the transaction, making it clear who is sending the bill and who is responsible for payment. Adding a unique reference number also aids in tracking and organizing records.

Itemized List of Services

Break down each service you’ve provided into individual items, specifying quantities or time spent if relevant. Each item should include a brief description and the corresponding rate or fee. Itemization clarifies what the client is paying for and allows them to review each part of the project separately. This level of transparency is especially valuable for building trust and ensuring clear communication.

Include a summary of the

Design Tips for Professional Invoices

A well-designed billing document enhances clarity and leaves a strong impression on clients. By focusing on visual appeal and organization, you can create documents that are not only easy to understand but also reflect your brand’s professionalism. Here are key design tips to help you craft polished, effective billing forms.

- Use a Clean Layout: Avoid clutter by arranging information in sections with plenty of white space. This improves readability and helps clients find details like amounts, dates, and contact information quickly.

- Choose a Simple Font: Stick with basic, professional fonts that are easy to read on any device. Limit font variations to two styles–one for headings and one for the body text–to maintain a consistent look.

- Incorporate Branding: Add your business logo and choose colors that align with your brand identity. A cohesive color scheme makes your document memorable and visually appealing.

- Highlight Important Information: Make

Benefits of Using a Template for Billing

Pre-made billing forms simplify the process of creating and sending financial documents to clients, making it easier to keep track of transactions. These formats save time, ensure consistency, and help maintain a professional appearance. Here are some of the primary advantages of using ready-made forms for your financial records.

Time and Effort Savings

- Quick Customization: Pre-made layouts allow you to add specific details with minimal adjustments, saving you the hassle of creating new documents from scratch each time.

- Consistency Across Transactions: Using a standard form keeps your records uniform, making it easier to review and compare them over time. This consistency is also beneficial for clients who appreciate familiar, well-organized documents.

- Automated Calculations: Many pre-made forms come with fields for automatic calculations, reduc

How to Personalize Your Invoice Layout

Customizing your billing document allows you to reflect your brand’s unique identity and cater to the specific needs of your clients. A personalized layout not only enhances the professional appearance but also makes the document more user-friendly and memorable.

Begin by incorporating your brand elements such as logo, color scheme, and typography. Consistent use of these elements reinforces brand recognition and creates a cohesive look across all your financial documents. Choose colors that align with your brand personality and ensure that text is easily readable against the background.

Next, adjust the structure to highlight the most important information. You might want to emphasize sections like the total amount due or the payment due date by using larger fonts or bold text. Organizing content in a clear and logical manner helps clients quickly find the details they need, reducing confusion and speeding up the payment process.

Additionally, consider adding personalized messages or notes to your clients. A short thank-you note or a reminder about future services can strengthen your professional relationship and encourage repeat business. These small touches make your billing documents feel more tailored and considerate.

Finally, ensure that your layout is adaptable to different types of services or projects. Flexibility in your design allows you to easily modify sections as needed without compromising the overall aesthetic. By personalizing your billing layout, you create a professional and efficient system that supports your business growth and client satisfaction.

Best Practices for Clear Invoice Formatting

Effective document layout plays a vital role in ensuring your billing forms are clear and easy to understand. By organizing information logically and keeping the design simple, you can make it effortless for clients to process payments and review their charges. Below are some best practices for formatting financial documents that ensure clarity and professionalism.

- Use a Structured Layout: Break down your document into clearly defined sections, such as billing details, services rendered, and payment information. This makes it easier for clients to locate and understand each part of the document.

- Incorporate Clear Headers: Use bold headers for each section. This helps to guide the reader through the content quickly, preventing them from missing important information like the total amount due or payment terms.

- Ensure Readable Fonts: Select a simple, legible font that’s easy to read on both screen and paper. Avoid using more than two different fonts, as excessive styling can make the document look cluttered.

- Provide Itemized Lists: When listing services or products, include a brief description, quantity, rate, and total for each entry. This transparency minimizes confusion and ensures the client understands what they are paying for.

- Highlight Key Information: Important details, such as the due date and total amount, should be prominently displayed. Use bold or larger text to make these sections stand out, so they catch the reader’s attention immediately.

- Maintain Consistent Spacing: Adequate spacing between sections and lines improves readability and prevents the document from looking too crowded. Keep the layout neat and organized to make it easy for the client to follow the content.

By following these best practices, you can ensure that your financial documents are both clear and professional. A well-organized layout fosters trust, reduces errors, and makes the payment process smoother for both you and your clients.

Key Details to Include in Your Invoice

When creating a billing document, it’s essential to include all the necessary information that allows your client to understand the charges and process the payment smoothly. A well-structured document ensures transparency and reduces any confusion or delays in payment.

The following details are crucial to include in every billing document:

- Business Information: Clearly display your business name, address, contact details, and logo. This helps clients easily identify the document and get in touch if necessary.

- Client Information: Include the client’s name, address, and contact details. This ensures the correct recipient is being billed, especially when dealing with multiple contacts within a company.

- Unique Reference Number: Each document should have a unique reference number. This makes tracking payments easier and helps maintain organized records for both parties.

- Detailed Description of Services: List the services or products provided with clear descriptions, quantities, and the agreed-upon price for each. This helps avoid misunderstandings and ensures the client knows exactly what they are paying for.

- Payment Terms: Clearly state the due date, accepted payment methods, and any late fees or discounts that apply. This ensures there are no surprises and that both parties are on the same page regarding payment expectations.

- Total Amount Due: Make sure to include the total amount due, including any taxes, fees, or additional costs. This section should be easy to locate, as it is the most important detail for the client.

By including these essential elements, you can create a clear, professional, and effective billing document that ensures prompt payments and fosters good relationships with your clients.

Common Mistakes to Avoid in Invoicing

While creating billing documents is a routine task, several common errors can lead to confusion, delayed payments, or even strained client relationships. Avoiding these mistakes ensures that the billing process remains smooth and professional. Below are some common pitfalls and how to prevent them.

- Incomplete Information: Failing to include essential details, such as business or client contact information, can create confusion and delay payments. Always ensure your document has all necessary data to help clients easily identify and process the charges.

- Missing Due Dates: Not specifying a due date can result in missed payments. Always include a clear deadline for when the payment is expected and state any penalties for late payments.

- Unclear Descriptions: Vague or unclear descriptions of services or products can lead to misunderstandings. Be specific about what was provided, including quantities, unit prices, and any agreed-upon terms.

- Wrong or Missing Calculations: Errors in math or missing totals can undermine the professionalism of your document. Double-check calculations to ensure accuracy and avoid discrepancies that may require revisions.

- Unorganized Layout: A cluttered or confusing document layout can make it difficult for clients to locate important information, such as the total amount due. Maintain a clean, logical structure with headers and spaces to make the document easy to read.

- Omitting Payment Instructions: If payment methods or instructions are not clearly stated, clients may hesitate or delay payment. Always specify how payments can be made, including bank details or online payment options.

Avoiding these common mistakes helps streamline the payment process, builds trust with clients, and ensures that you get paid on time. By keeping your billing process clear, accurate, and professional, you can avoid unnecessary issues and maintain a smooth workflow.

Understanding Payment Terms for Digital Services

When providing online or remote services, it is essential to establish clear payment terms to ensure that both parties are on the same page regarding expectations and obligations. Payment terms are critical for determining when and how payment will be made, ensuring a smooth transaction and maintaining healthy client relationships. Clear agreements on payment methods, deadlines, and penalties can prevent confusion and disputes.

Common Payment Terms for Online Services

The following are typical payment terms to consider when offering online services:

Term Description Net 30 Payment is due within 30 days of the service being completed or the invoice being issued. Due on Receipt Payment is expected immediately upon receiving the invoice or service delivery. 50/50 Payment 50% of the payment is due upfront, with the remaining 50% due after the service is delivered or completed. Installment Payments Payment is split into several smaller installments, typically paid over the course of the service or project. Late Fees If payment is not made by the due date, a late fee may be applied, often calculated as a percentage of the total amount due. Factors Influencing Payment Terms

Several factors influence the payment terms you choose, including the length of the service, the complexity of the work, and the nature of the client relationship. For example, more complex or long-term projects might require installment payments, while smaller, one-off tasks may be due upon receipt. It’s important to be flexible but also to protect your business by establishing clear terms in writing before beginning any work.

When to Send Invoices for Prompt Payments

Timing is a crucial factor when it comes to receiving payments for the services you provide. Sending the request for payment at the right moment can help ensure a quick turnaround and prevent delays. Knowing when to send the request for compensation not only enhances cash flow but also maintains positive relationships with clients.

Optimal Times to Issue a Payment Request

- Immediately Upon Completion: For short-term projects or services that don’t require prolonged work, it’s often best to send the payment request immediately after the job is completed.

- After Milestones: For longer-term or complex projects, consider sending payment requests after specific milestones are reached. This keeps clients accountable and ensures that you’re compensated for work already completed.

- Before the Due Date: If the client has agreed to a set payment schedule, it’s beneficial to remind them a few days before the due date to ensure on-time payments.

- At Regular Intervals: For recurring services, sending a request for payment on a regular basis–weekly, bi-weekly, or monthly–ensures consistent cash flow.

How Early to Send Payment Requests

- Early Enough to Avoid Delays: It’s important to send your payment requests early enough to allow clients sufficient time to process them. For example, sending it a week before the due date can help avoid last-minute payments.

- Avoid Sending Too Early: Sending requests too early, especially for large projects or ongoing work, may lead to confusion or premature payments that don’t align with the client’s expectations.

Sending requests for compensation at the right time not only encourages prompt payments but also establishes professionalism in your financial transactions. Always consider the nature of the service, the agreement with the client, and their preferred payment habits to decide the best time to issue the payment request.

How to Manage Recurring Client Billing

For businesses that offer ongoing services or products, handling recurring payments can be an essential part of maintaining smooth financial operations. Setting up a system to manage regular billing ensures that both the service provider and client are aligned on payment schedules, reducing misunderstandings and preventing payment delays.

Establish Clear Terms with Clients

- Payment Frequency: Clearly define the frequency of payments, whether it’s weekly, monthly, or annually, to ensure clients know when to expect payment requests.

- Amount and Scope: Agree on the amount for each payment as well as the specific services included in the agreement to avoid confusion later on.

- Payment Method: Decide on the preferred method of payment, such as bank transfers, credit cards, or automated payments, to make the process seamless for both parties.

Use Automated Systems for Convenience

- Set Up Recurring Billing: Many payment processors and financial management tools offer automated systems that can generate and send payment requests at specified intervals. This reduces manual work and ensures that payments are requested on time.

- Track Due Dates: Make sure to use a system that tracks due dates and sends reminders to clients ahead of time to ensure payments are not missed.

- Provide Detailed Records: Maintain a clear record of all transactions for both your business and your client. Detailed billing statements help avoid disputes and ensure transparency.

Managing recurring payments doesn’t have to be complicated. By setting clear terms from the outset and utilizing automated tools, you can streamline the billing process and maintain a healthy cash flow with minimal effort.

Tracking Invoices for Improved Cash Flow

Monitoring financial transactions is a critical aspect of managing a business effectively. Keeping track of payments helps ensure that income is consistent and any delays are promptly addressed. By maintaining a clear record of outgoing requests for payment, businesses can better manage their cash flow and avoid financial strain.

To track payments efficiently, it’s important to organize and update records regularly. Here are some key strategies to help maintain smooth financial operations:

Tracking Method Advantages Best For Automated Billing Systems Reduces manual work, sends reminders, updates payment status automatically Businesses with a high volume of transactions Manual Record-Keeping Cost-effective, customizable, simple to implement Small businesses with fewer transactions Cloud-Based Solutions Access from anywhere, real-time updates, collaboration-friendly Remote teams and businesses needing real-time visibility By choosing the right tracking method and maintaining regular updates, businesses can ensure their finances are in order, reducing the risk of cash flow problems and enhancing overall financial health.

Why Digital Invoices Save Time

In today’s fast-paced business environment, efficiency is key. Streamlining processes that involve requesting payments can greatly reduce the time spent on administrative tasks. Using modern methods for generating and sending payment requests can significantly speed up the overall workflow.

There are several advantages to using technology for managing payment requests:

- Instant Delivery: Payments can be sent directly to clients via email or cloud systems, eliminating the need for postal services and reducing delays.

- Automation: Many systems allow automatic generation of requests, ensuring that businesses can focus on other tasks instead of manually creating documents.

- Easy Tracking: Electronic records are easier to update and track, ensuring that all transactions are documented and up-to-date without having to sift through paper records.

- Reduced Errors: The automated processes help avoid common mistakes that often occur with paper-based methods, such as incorrect calculations or lost documents.

- Faster Payment Processing: With integrated payment options, clients can settle their dues quicker, improving cash flow.

By switching to more efficient systems for requesting and managing payments, businesses can significantly save time and focus on what matters most – growth and customer service.

Top Tools for Creating Marketing Invoices

When it comes to managing payments, having the right tools can save time and reduce errors. There are various solutions available that simplify the process of creating and managing billing documents. These tools offer features that automate the process, help track payments, and ensure that all details are accurate, leaving you more time to focus on your business.

Popular Solutions for Payment Request Creation

Here are some widely used tools that can help streamline the process of generating payment requests:

Tool Key Features FreshBooks Easy-to-use, automatic reminders, customizable templates, time-tracking integration QuickBooks Customizable formats, financial reports, cloud-based access, integration with payment platforms Zoho Invoice Invoice scheduling, multi-currency support, recurring billing, detailed reporting Wave Free to use, easy design, customizable features, automated payment tracking Choosing the Right Tool

The best tool for your business depends on your specific needs. Consider factors such as ease of use, the volume of transactions, and whether you need additional features like payment tracking or client management. Most of these platforms offer free trials, allowing you to explore their features before committing.

Invoicing Strategies for Small Agencies

Effective billing practices are crucial for the financial health of small businesses. For smaller agencies, managing client payments and ensuring a smooth cash flow can sometimes feel like a daunting task. However, with the right strategies in place, agencies can streamline their payment process, reduce administrative overhead, and foster strong client relationships.

One key strategy is to implement clear and transparent payment terms from the outset. By setting expectations early, such as due dates, payment methods, and late fees, agencies can avoid confusion and ensure timely payments. Additionally, automating the payment request process can save time and reduce human error, allowing businesses to focus on their core activities while keeping track of incoming payments with ease.

Another important consideration is offering flexible payment options. Providing clients with various ways to pay, such as through bank transfers, credit cards, or online platforms, can improve payment turnaround and reduce friction. Finally, staying organized with detailed records and reminders can help agencies stay on top of unpaid bills, ensuring no payments are overlooked.

How to Follow Up on Unpaid Invoices

Chasing overdue payments can be uncomfortable, but it’s essential for maintaining a healthy cash flow. Following up on outstanding balances requires a balance of professionalism and persistence. By using a consistent and polite approach, businesses can encourage clients to settle their accounts without damaging the relationship.

1. Send a Friendly Reminder

Start by sending a gentle reminder soon after the due date has passed. Often, clients may simply forget or be delayed in processing payments. A courteous email or message that reminds them of the outstanding amount, along with a polite request for payment, can resolve many issues quickly.

2. Escalate with a Formal Request

If the payment is still not received after the first reminder, follow up with a more formal request. In your communication, outline the payment terms clearly and emphasize the importance of settling the balance. It’s a good idea to include the original due date and any applicable late fees as stipulated in the payment agreement.

Tip: Always keep the tone professional and maintain a positive relationship with the client, as this can encourage timely payment in the future.

3. Offer Payment Options

Sometimes clients delay payment due to cash flow issues or difficulties with the payment method. Offering flexible payment options, such as installment plans or different payment methods, can help resolve the issue faster and show understanding from your side.

Legal Tips for Accurate Billing

Ensuring your billing process is legally sound is crucial for avoiding disputes and ensuring that payments are collected in a timely manner. Clear, legally binding agreements and proper documentation can protect your business and foster trust with clients. In this section, we will discuss essential legal tips to help ensure that your billing practices are compliant and precise.

1. Always Have a Written Agreement

Before starting any work or providing services, it is essential to have a written agreement with your clients. This contract should clearly outline the terms of service, payment schedules, and any potential penalties for late payments. Having a signed contract protects both parties and provides a reference point should a dispute arise.

2. Be Transparent About Fees

Transparency is key to maintaining legal accuracy in your billing. Always make sure that all fees, including potential additional charges or taxes, are clearly communicated upfront. Avoid hidden costs that could lead to misunderstandings or legal issues down the line. Being upfront about your pricing helps set clear expectations and can prevent legal challenges.