Free Carpet Cleaning Invoice Template for Easy Billing

Managing the financial side of a service-based business requires organization and precision. One of the most crucial elements is the creation of professional documents that detail the work performed and the corresponding charges. These documents help ensure transparency, streamline payments, and maintain positive client relationships. However, manually creating them each time can be time-consuming and prone to errors.

Using a standardized format can significantly simplify this process. By leveraging readily available resources, business owners can quickly generate accurate and consistent billing statements. This allows them to focus on their core services while maintaining a professional appearance with minimal effort. Whether you’re a small business owner or a freelancer, having the right tool to handle invoicing can make all the difference in your efficiency and customer satisfaction.

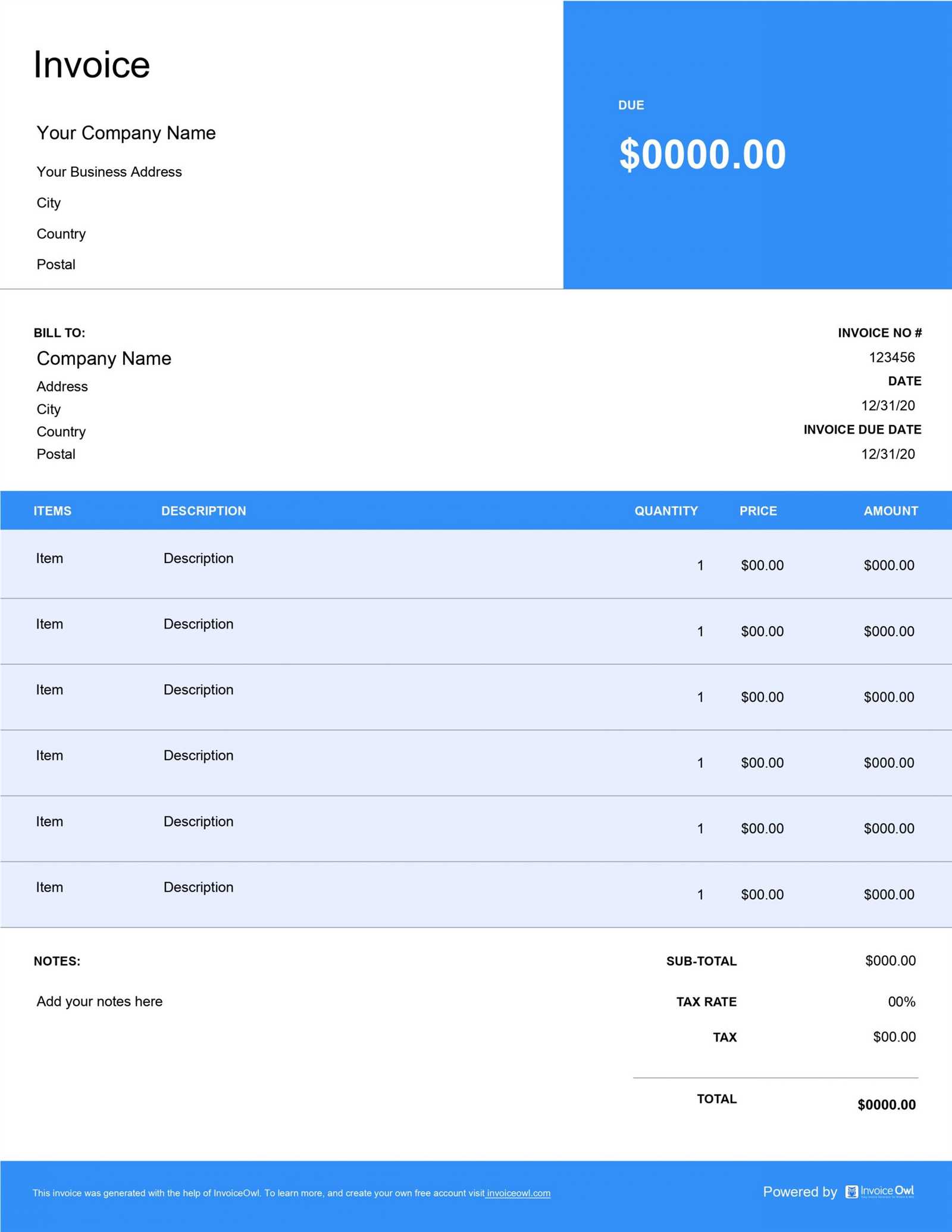

Carpet Cleaning Invoice Template Free Download

For businesses offering cleaning services, creating professional billing documents is essential for maintaining clear financial records and ensuring prompt payments. Instead of starting from scratch each time, utilizing an established structure can save significant time and effort. You can easily access templates that allow you to input necessary details, ensuring accuracy and consistency with every job. Below is an example of what a standard document might look like, which can be downloaded and customized according to your needs.

| Service Description | Unit Price | Quantity | Total |

|---|---|---|---|

| General cleaning of living room | $50.00 | 1 | $50.00 |

| Stain removal in bedroom | $30.00 | 2 | $60.00 |

| Deep sanitation of hallway | $40.00 | 1 | $40.00 |

| Subtotal | $150.00 | ||

| Tax (5%) | $7.50 | ||

| Total Due | $157.50 | ||

With this structure, you can easily adjust the services and prices based on the specific requirements of each job. This ensures that your records are not only professional but also tailored to your unique business operations.

Why You Need an Invoice Template

In any service-oriented business, documenting transactions is crucial for maintaining transparency and ensuring accurate financial records. Having a consistent method for creating detailed statements not only improves professionalism but also helps avoid misunderstandings with clients. By using a standardized structure, you can streamline the process and reduce the risk of errors, saving you time and effort on every job.

Ensures Accuracy and Consistency

When you use a pre-made structure for your billing documents, you eliminate the possibility of missing important details or making formatting mistakes. A uniform format allows you to always include the necessary information, such as service description, pricing, and payment terms, which ensures clarity for both you and your clients. This consistency builds trust and keeps your business running smoothly.

Saves Time and Increases Efficiency

Instead of drafting a new document from scratch for every job, a ready-made system enables you to quickly fill in the relevant details. This reduces the time spent on administrative tasks, allowing you to focus more on delivering quality services. The faster you can generate accurate statements, the quicker you can get paid, which is essential for maintaining cash flow in your business.

In conclusion, using a predefined structure for billing tasks brings numerous benefits, from improved accuracy to time savings. It’s a simple yet effective way to ensure your business operations are both organized and professional, providing a smoother experience for both you and your clients.

Benefits of Using Free Templates

Utilizing pre-designed documents for business transactions offers numerous advantages, especially for those looking to streamline their administrative tasks. These ready-made solutions are not only cost-effective but also help to maintain a consistent level of professionalism with minimal effort. By adopting such tools, you can improve your workflow and focus more on providing quality services rather than spending time on paperwork.

Cost-Effective Solution for Small Businesses

For small business owners or independent contractors, avoiding extra expenses is crucial. Accessing no-cost resources can help reduce overhead costs while still achieving high-quality results. Instead of hiring professionals to create billing documents from scratch, you can easily download and modify them as needed, saving money that could be used for other important aspects of your business.

Quick Setup and Customization

One of the major benefits is the speed at which you can set up and start using these documents. Customization options allow you to tailor each file to match your specific needs, ensuring that every detail is accurate and aligned with your branding. This efficiency is particularly valuable when managing multiple clients and projects at once, allowing you to stay organized and meet deadlines without delay.

In summary, opting for pre-made solutions gives you the flexibility to manage your business tasks effectively while minimizing costs and time spent on administrative work. This approach not only boosts efficiency but also enhances the overall customer experience, leading to better client relationships and smoother business operations.

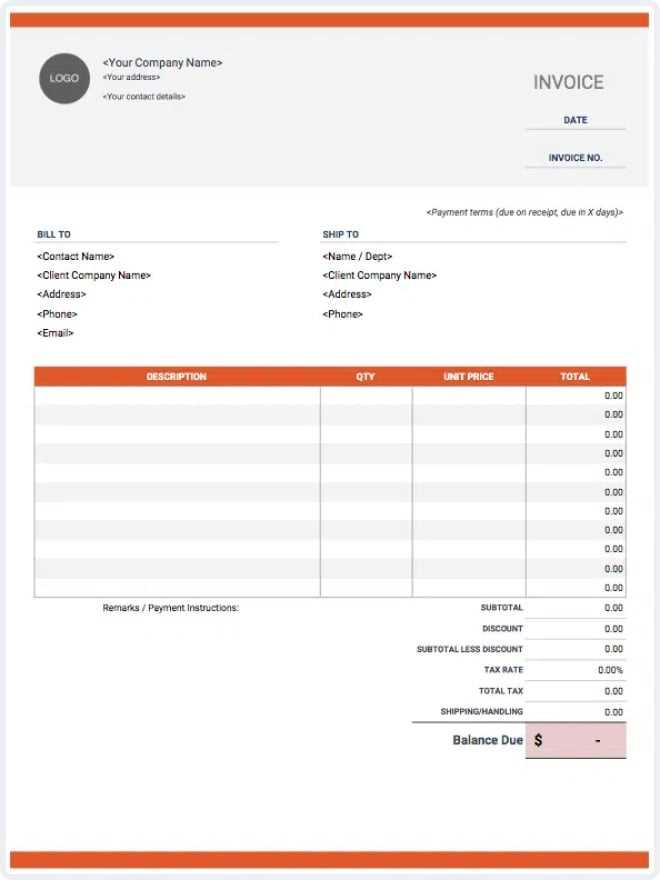

How to Customize Your Invoice

Personalizing your billing documents is an essential step to ensure that they align with your business needs and brand identity. Customization allows you to include specific information that will make each document clear and professional. This way, you can better represent your services and make the payment process more seamless for your clients. With a few simple adjustments, you can create a unique billing format that reflects your style and requirements.

Step 1: Include Essential Information

Start by ensuring that all the necessary details are present in the document. This includes the client’s name and contact information, the date of the service, a clear description of the services provided, and the total amount due. Having this key information readily available will avoid confusion and help maintain transparency between you and your customers.

Step 2: Adjust Design and Branding

To create a more personalized experience, adjust the design elements to match your business’s visual identity. You can add your logo, choose the right font, and set a color scheme that complements your brand. Customizing the appearance not only makes your document look professional but also reinforces your brand’s presence with each interaction.

In conclusion, customizing your billing documents is a simple yet impactful way to enhance your business image. By personalizing the content and design, you create a polished, professional document that meets your specific needs and builds trust with your clients.

Essential Information for Carpet Cleaning Invoices

For any service-based business, having the right details in your billing documents is crucial to avoid misunderstandings and ensure that payments are processed smoothly. A well-structured document helps both you and your client keep track of the transaction. Below are the key elements you should include in every billing statement to make sure it’s clear, professional, and complete.

Key Elements to Include

- Business Information: Your company name, address, and contact details.

- Client Information: Name, address, and contact details of the client receiving the service.

- Service Details: A clear description of the services provided, including the type of work, the area covered, and any special treatments applied.

- Date of Service: The date when the service was performed or completed.

- Total Amount Due: The full amount for the services rendered, including any applicable taxes or fees.

- Payment Terms: The due date for payment, preferred methods of payment, and any late fees for overdue amounts.

Additional Considerations

- Discounts or Promotions: If applicable, include any discounts offered for specific services or as part of a promotion.

- Special Notes: Any additional notes, such as recommendations for future services, warranties, or care instructions.

- Invoice Number: A unique identifier for the billing document to keep track of each transaction for accounting purposes.

By ensuring that all these elements are included, you make it easier for your clients to understand the charges and for you to maintain accurate records. This also enhances professionalism and builds trust with your customers.

Top Features of a Good Template

A well-designed document for billing purposes should offer more than just space to fill in numbers. It must be structured in a way that ensures clarity, efficiency, and professionalism. The right document format can make all the difference in creating a positive experience for both you and your client. Below are the key features that define a high-quality document structure for service-based businesses.

Essential Elements for Clarity

- Clear Layout: A clean, easy-to-read design with sections clearly marked for each piece of information, helping both parties quickly find what they need.

- Itemized Breakdown: Detailed sections that clearly list services provided, their individual cost, and any additional fees, making it easy for clients to understand how charges were calculated.

- Company Branding: The document should feature your logo, company name, and colors to reinforce your brand identity and create a professional impression.

- Contact Information: Your business details, including phone number, email, and address, should be easily visible to facilitate communication and payment queries.

Functionality and Flexibility

- Customizable Fields: The ability to edit fields easily, such as service descriptions, prices, and payment terms, to suit the specifics of each transaction.

- Automatic Calculations: Features like automatic summing of totals and taxes help reduce human error and speed up the process.

- Space for Notes: An area for additional comments or special instructions allows you to communicate any important details that might be specific to the job.

- Payment Terms: Clear spaces for specifying payment deadlines, late fees, and preferred methods, which help avoid confusion regarding financial expectations.

A document with these features enhances efficiency and professionalism while providing a clear and consistent method for handling transactions. Whether you’re creating one document or managing dozens, the right layout ensures you always maintain control and clarity in your financial communications.

Common Mistakes in Invoice Creation

Creating a billing document might seem straightforward, but even small errors can lead to confusion, delayed payments, or strained client relationships. Ensuring that your statements are accurate and complete is essential for maintaining professionalism and a smooth cash flow. Below are some common mistakes that many businesses make when preparing their billing statements, and how to avoid them.

Missing Key Information

One of the most frequent mistakes is failing to include important details, such as the client’s contact information, service descriptions, or payment terms. Without these key components, the document may be unclear, leading to confusion and delays in payment. Always double-check that all necessary fields are filled out completely and accurately before sending a document to your client.

Errors in Pricing or Calculations

Simple arithmetic errors can have a significant impact on your financials. Failing to correctly calculate totals, taxes, or applying discounts incorrectly can result in either overcharging or undercharging your clients. It’s essential to use automatic calculation features or double-check your math to ensure that the final amount is accurate. This not only helps avoid mistakes but also builds trust with your clients.

In summary, paying attention to the details and double-checking your calculations are key to avoiding common mistakes. By being thorough and organized, you can maintain professionalism and keep your business operations running smoothly.

How to Save Time with Templates

Time management is crucial for any business, especially when it comes to administrative tasks. Creating documents from scratch for each transaction can be a tedious and time-consuming process. However, by using a pre-designed structure, you can drastically reduce the amount of time spent on this task, allowing you to focus on the core aspects of your work.

With a ready-made system in place, all you need to do is fill in the specific details for each job, such as client information, services rendered, and payment amounts. This eliminates the need for repetitive formatting, calculations, and layout design. A well-organized document not only saves time but also ensures consistency and accuracy across all your billing records.

Key time-saving benefits include faster creation, fewer errors, and a more efficient workflow. Whether you handle one job or many, the ability to quickly generate professional documents allows you to devote more energy to meeting client needs and growing your business. Streamlining your paperwork process leads to less stress and more time for productivity.

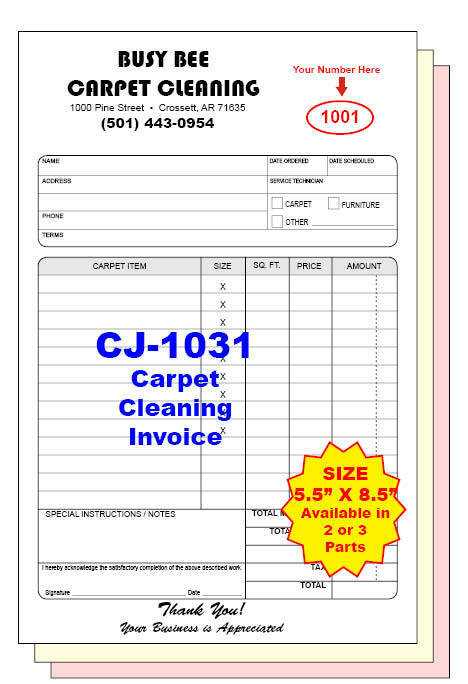

Different Invoice Formats Explained

When creating billing documents for your business, choosing the right format can make a significant difference in terms of clarity, ease of use, and professionalism. There are several formats available, each catering to different business needs and client preferences. Below, we explore the most common formats and their unique advantages to help you select the best option for your operations.

1. Standard Billing Format

The standard format is the most commonly used and straightforward layout. It includes all the essential fields, such as service descriptions, pricing, and payment details. This format is simple and easy to read, making it ideal for businesses that provide basic services on a regular basis.

2. Detailed Breakdown Format

This format offers a more in-depth view of the work completed. It is ideal for businesses that offer complex services or multiple pricing categories. It includes detailed sections that break down each task performed, associated costs, and any additional charges or discounts applied.

3. Recurring Billing Format

For businesses that offer subscription-based or ongoing services, the recurring billing format is helpful. This format allows you to specify the frequency of payment, such as weekly or monthly, and set clear terms for recurring charges. It ensures that clients are aware of the regular payment schedule and helps maintain consistent cash flow.

4. Proforma Format

A proforma document is typically issued before a job begins, outlining the estimated costs. This format is often used for larger projects or when a client requires a clear understanding of costs before committing. Once the work is completed, a final document is issued with actual charges.

5. Simple One-Page Format

For businesses that need to keep things simple and direct, the one-page format is ideal. This layout features a compact design with only the most crucial details, making it easy to complete quickly and send to clients. It is commonly used by freelancers or small businesses offering minimal services.

| Format | Key Features | Best For |

|---|---|---|

| Standard Billing | Basic layout, simple pricing, and payment terms | Businesses with regular, uncomplicated services |

| Detailed Breakdown | Itemized services, additional charges | Complex services with varied tasks and pricing |

| Recurring Billing | Regular charges, payment intervals | Subscription-based or ongoing services |

| Proforma | Estimates for future work | Projects requiring cost approval before starting |

| One-Page | Concise, essential details only | Freelancers or small businesses |

By understanding the different formats available, you can choose the one that best suits your business needs, ensuring that your clients receive clear, professional documents tailored to your services.

How to Add Discounts and Taxes

When creating billing documents, including discounts and taxes is an essential step in providing a clear and accurate total for your clients. Whether you’re offering a special promotion or need to account for local tax rates, properly applying these adjustments ensures that your statement reflects the correct amount due. In this section, we’ll explain how to easily add both discounts and taxes to your documents.

Adding Discounts

Discounts are a great way to incentivize customers or reward loyalty. There are a few ways to apply discounts, depending on the structure of your pricing. You can offer a percentage discount on the total amount or a fixed amount off the price of individual services. It is important to clearly indicate the discount applied and show the adjusted total after the discount is subtracted.

- Percentage Discount: For example, if you are offering a 10% discount on the total cost of services, you would calculate 10% of the subtotal and subtract it from the final total.

- Fixed Amount Discount: If you’re giving a specific dollar amount off, simply subtract that amount from the total cost.

- Clear Labeling: Always label the discount clearly on the document (e.g., “10% Discount” or “$20 Discount”) to avoid confusion for your client.

Adding Taxes

Taxes are often a legal requirement depending on your location and the services you offer. To ensure that taxes are properly applied, you need to calculate the correct tax rate and include it in the final amount. This can either be calculated as a percentage of the total or based on specific items if the tax rules are itemized.

- Tax Percentage: To apply a tax, multiply the subtotal by the applicable tax rate. For example, a 5% tax on a $100 subtotal would result in $5 of tax.

- Itemized Tax: If different services have different tax rates, itemize each tax separately to provide transparency.

- Clearly Displayed: Always show the tax as a separate line item, labeling it appropriately (e.g., “Sales Tax: 5%”).

In conclusion, adding discounts and taxes not only ensures that your document reflects the true cost of the services provided but also builds trust by clearly showing your calculations. By following these steps, you make the bil

Simple Steps to Create a Billing Statement

Creating a clear and professional billing statement doesn’t have to be complicated. With a few simple steps, you can easily generate a document that accurately reflects the services provided and the amount due. By following a structured approach, you ensure that your clients understand the charges and can process payment without confusion. Below are the essential steps to create an efficient billing statement for any service-based business.

Step 1: Include Your Business Information

Start by adding your company name, address, and contact details at the top of the document. This makes it easy for your clients to reach out with any questions or concerns about the bill. It also adds a professional touch to the statement.

- Business Name: Ensure your company name is prominently displayed.

- Address: Include your physical or mailing address.

- Contact Details: Provide a phone number, email, and website (if applicable).

Step 2: Add Client Information

Next, include the client’s name, address, and contact details. This ensures there is no confusion about who the bill is for, especially if your clients are businesses or large organizations with multiple contacts.

- Client Name: Make sure to list the client’s full name or company name.

- Address: Include the client’s billing address for clarity.

- Client Contact: Add a phone number or email for easy communication.

Step 3: List the Services Provided

Clearly describe the services you performed or products you provided. Be as detailed as possible so the client understands exactly what they are being charged for. This can help avoid disputes and promote transparency.

- Description: Provide a brief, clear description of each service offered.

- Quantity: If applicable, include the quantity of work done (e.g., hours worked, items cleaned, etc.).

- Rate: List the rate for each service or product provided.

Step 4: Calculate the Total Amount Due

Sum up the costs

Free vs Paid Invoice Templates: What’s Best?

When choosing a design for your billing documents, one of the main decisions is whether to opt for a no-cost option or invest in a premium version. Both options come with their own set of advantages and limitations. Understanding the key differences can help you make an informed decision about what best suits your business needs. Below, we’ll explore the pros and cons of both options to help you determine which one is right for you.

Free Templates

Free options are attractive because of their cost-effectiveness, especially for small businesses or those just starting. They are often simple and easy to use, offering basic features for generating straightforward documents. However, free options may lack customization features, advanced functionality, and design flexibility.

- Cost: No financial investment required.

- Ease of Use: Typically simple and user-friendly.

- Customization: Limited options for customization and personalization.

- Functionality: May not include advanced features like automated calculations or built-in tax rates.

Paid Templates

Paid versions, on the other hand, often come with a wide range of advanced features and design options that allow you to fully customize your documents. They can save you time with automated functions and offer higher-quality, professional designs. However, there is an upfront cost to consider, which might not be ideal for businesses with tight budgets.

- Cost: Requires a financial investment, but can offer better value in the long term.

- Design: Professional, polished designs that can be tailored to reflect your brand identity.

- Functionality: More advanced features, including automatic tax calculations, customizable fields, and payment tracking.

- Support: Access to customer support for troubleshooting or assistance with customization.

Comparison Table

| Feature | Free Option

Where to Find Reliable Free TemplatesFinding dependable resources for your business documents doesn’t have to be a challenge. With numerous online platforms offering no-cost options, it’s important to choose sources that provide high-quality, easy-to-use designs. The key is to find reputable websites that offer customizable layouts, ensuring that the final product aligns with your professional needs. Below are some of the best places to locate reliable resources for creating documents that are both functional and polished. 1. Online Business Tool Websites Many websites dedicated to business tools provide a variety of downloadable document structures at no charge. These platforms often have sections specifically for professional documents, including agreements, receipts, and billing statements. The designs are usually simple but effective, allowing for easy editing to suit your business. 2. Document Sharing Platforms Platforms like Google Docs and Microsoft Office templates offer numerous options for various business needs. These sites allow you to access free documents that are pre-designed and easily customizable. With cloud-based services, you can edit and save your documents directly in your browser, making it a convenient and accessible option. 3. Freelance and Small Business Websites Freelance platforms or small business advice websites sometimes provide helpful tools, including document templates, to assist entrepreneurs in running their businesses. These resources are often tailored to specific industries or niches and can be a great place to find specialized options. 4. Open-Source Template Repositories If you’re comfortable with basic editing software, open-source repositories like GitHub offer a range of customizable design files. These platforms often feature free options that allow you to tweak the structure according to your specific needs. Many open-source resources come with detailed instructions for easy setup and use. 5. Design and Creative Websites Creative websites such as Canva and Adobe Spark offer free design elements that can be used for business purposes. These platforms often have simple drag-and-drop tools that make it easy to customize documents to suit your business’s style while maintaining a professional appearance. When choosing a source for your document designs, always ensure that the platform is reputable and provides templates that meet your specific business requirements. By utilizing trusted resources, you can create polished, professional documents with minimal effort and cost. Integrating Billing Documents with Accounting SoftwareEfficiently managing financial records is essential for any business, and integrating billing documents directly with accounting software can streamline this process. By syncing your payment requests with your accounting system, you can automate the tracking of sales, manage expenses more effectively, and ensure accurate financial reporting. This integration helps save time, reduce errors, and improve overall efficiency in managing business finances. 1. Streamlining Data Entry One of the primary benefits of integration is the reduction in manual data entry. Instead of manually entering information from your payment records into accounting software, the integration process allows for automatic population of relevant fields, such as client names, service descriptions, and amounts. This not only saves time but also minimizes the risk of human error. 2. Real-Time Updates With the right software integration, any updates made to billing documents will be reflected in your accounting system in real-time. This ensures that your financial records are always up to date, and you can quickly view the most current information about your business’s performance, including outstanding payments and total revenue. 3. Improved Accuracy in Financial Reporting Integrating your payment records with accounting software helps maintain consistent and accurate financial data. Since the information is automatically synced, it eliminates discrepancies between different platforms, ensuring that your financial reports are correct and reliable. This is particularly important when preparing for tax season or financial audits. 4. Automated Tax Calculations Many accounting platforms offer built-in tax calculation features that can be automatically applied to your documents. By integrating your billing documents with these systems, taxes are calculated instantly, ensuring that the correct amounts are charged without the need for manual input or complex calculations. 5. Better Financial Insights Integration allows you to access detailed analytics and reports based on your billing records. This enables you to make informed decisions about cash flow management, budgeting, and long-term financial planning. With real-time data at your fingertips, you can better monitor your business’s financial health and make adjustments when necessary. In conclusion, integrating billing documents with accounting software is a valuable step toward increasing How to Send Billing Statements ProfessionallySending billing documents in a professional manner is crucial for maintaining good business relationships and ensuring prompt payments. A well-organized, clear, and polite communication approach can enhance your brand’s image and reduce the likelihood of delays or misunderstandings. Here are some best practices for sending your payment requests in a professional way. 1. Ensure Accuracy and ClarityBefore sending any document, double-check the details to ensure all information is accurate. Mistakes or unclear entries can cause confusion and delay payments. Pay attention to the following details:

2. Use a Professional and Clear FormatA well-structured document is easier to read and looks more professional. Stick to a clean, simple design that includes all necessary details but avoids unnecessary clutter. Follow these guidelines:

3. Choose the Right Delivery MethodSending your documents through the right channels is key to ensuring they are received and processed promptly. You can choose from the following methods:

|

|---|