Sample Work Invoice Template for Easy and Professional Billing

Creating clear and accurate billing documents is essential for maintaining smooth financial transactions with clients. A well-organized bill ensures both parties are on the same page regarding services provided and payment expectations. Whether you’re a freelancer or a business owner, having a reliable way to draft such documents can save time and prevent misunderstandings.

In this guide, we will explore how to design an efficient billing format that suits your specific needs. We will cover key elements that make a document not only easy to understand but also legally compliant. By using a customizable format, you can simplify your financial operations while presenting a professional image to clients.

From basic sections like itemized lists to advanced features like payment terms and tax calculations, this resource will help you create a comprehensive and professional billing document. With a few adjustments, your document can meet industry standards and reflect your unique business practices.

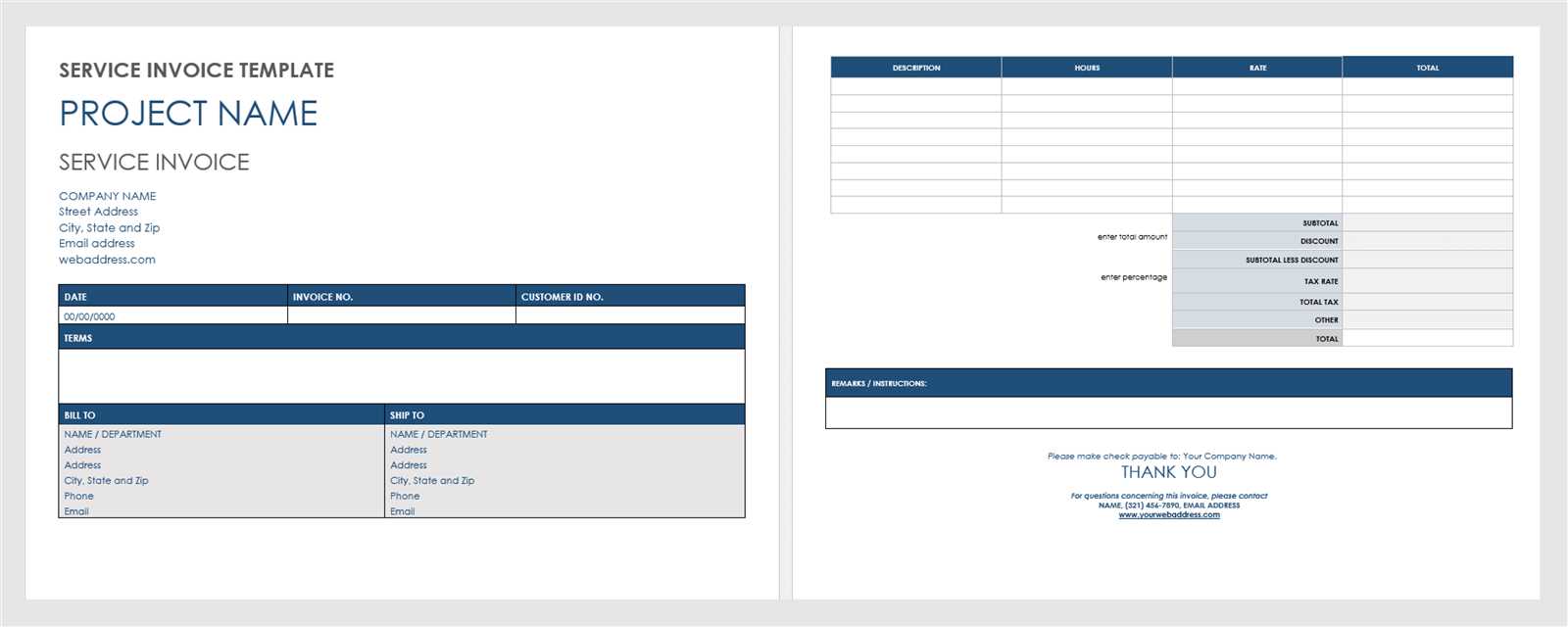

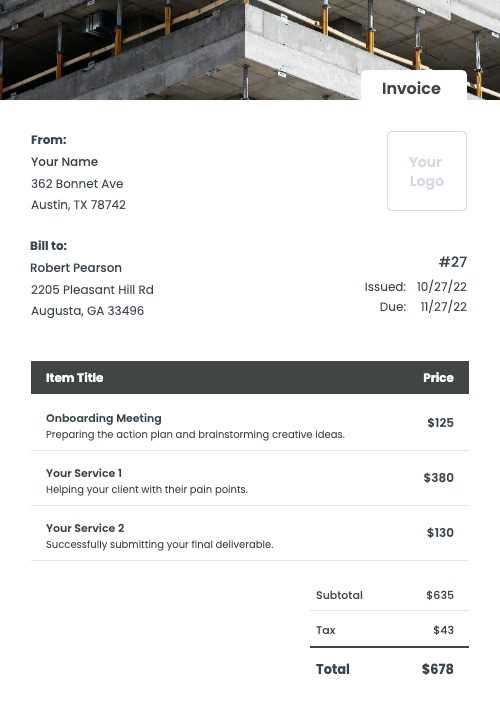

Professional Billing Document Format

When managing client payments, having a pre-designed, easy-to-use format can significantly simplify the process. A reliable billing structure helps both businesses and clients keep track of transactions, ensuring clarity and preventing disputes. With the right approach, you can craft a document that is both professional and efficient, making the payment process smooth for everyone involved.

Key Components to Include

A well-structured document should include several essential sections. These might consist of details like the service provider’s information, client contact, date of service, a breakdown of tasks performed, and the agreed payment terms. Each section contributes to a clearer understanding between both parties, reducing confusion.

Customizing for Your Business

While there are standard elements, customization allows you to tailor the document to your specific business needs. This may include adding company logos, adjusting the layout, or incorporating payment options. A personalized design enhances your professional image and builds trust with clients.

Why Use a Billing Document Format

Having a pre-designed structure for billing makes the entire payment process more organized and efficient. By using a set framework, you ensure that all essential information is included and presented clearly. This not only speeds up the creation of each document but also reduces errors, ensuring consistency across all transactions.

Here are some reasons why utilizing a standardized structure can benefit your business:

- Saves Time: With a ready-to-use format, you can quickly generate a document without starting from scratch every time.

- Enhances Professionalism: A polished, consistent document reflects positively on your business and fosters trust with clients.

- Minimizes Mistakes: Standardized layouts ensure that important details are never overlooked, reducing the risk of missing crucial information.

- Improves Accuracy: Built-in fields help avoid calculation errors and ensure the correct amount is charged.

- Legal Compliance: An established format can help ensure that your billing documents meet industry regulations and legal requirements.

By incorporating such a structured approach, you not only simplify your administrative work but also present a clear, professional image to clients, helping maintain strong business relationships.

Benefits of Customizing Billing Documents

Adapting your billing structure to suit the unique needs of your business can provide numerous advantages. A personalized approach ensures that the document reflects your brand while meeting specific requirements for both you and your clients. Customization allows you to incorporate essential details and features that standard formats may overlook, enhancing both functionality and professionalism.

Key Advantages of Customization

- Branding Consistency: Tailoring the design with your company logo, colors, and fonts helps maintain brand identity across all business communications.

- Improved Client Experience: A document that includes client-specific details like agreed payment terms or project references fosters better communication and a more personalized touch.

- Better Organization: By arranging sections in a way that fits your workflow, you can streamline the process of creating and reviewing bills.

- Enhanced Legal Compliance: Customizing the structure allows you to easily incorporate necessary legal clauses or terms specific to your industry or region.

Efficiency and Flexibility

- Save Time: With a personalized format, the time spent creating each document is reduced, allowing you to focus on other tasks.

- Adaptability: Custom designs allow you to make quick adjustments based on evolving business needs or changes in client requirements.

Ultimately, a customized approach gives you greater control over your billing processes while enhancing the overall client experience and improving operational efficiency.

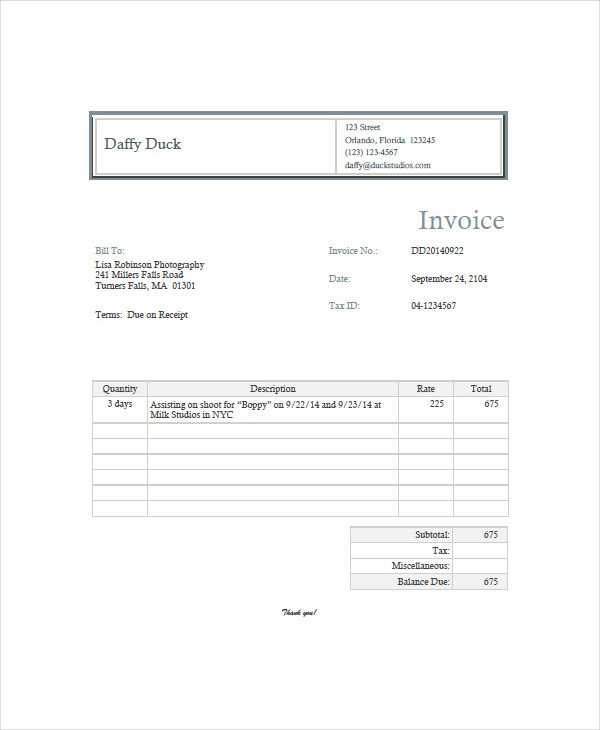

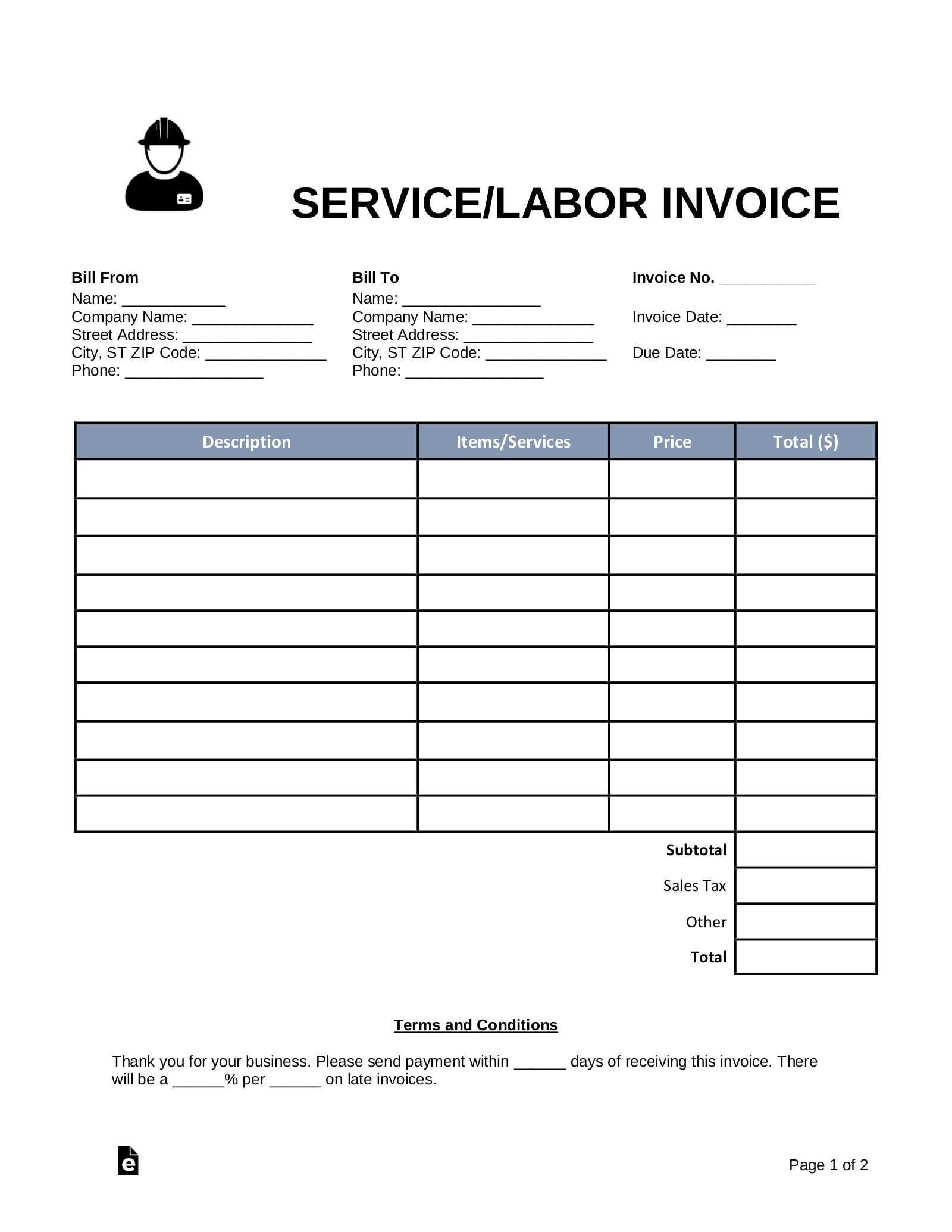

How to Create a Billing Document

Creating a clear and accurate billing document is a straightforward process if you follow the right steps. This ensures that all necessary details are included, making the document both professional and easy to understand. The key to an effective billing statement is to be thorough without overcomplicating the layout, keeping it simple yet informative.

Steps to Prepare the Document

- Step 1: Include Your Information: Start by adding your business name, address, and contact details at the top of the document. This ensures your client knows exactly who the bill is from.

- Step 2: Add Client Information: Include the client’s name, address, and contact details to clearly identify the recipient of the document.

- Step 3: Specify the Date: Always include the date the document is issued and the due date for payment. This helps keep track of timelines.

- Step 4: List Services or Products: Clearly outline the services or products provided. Include descriptions, quantities, rates, and any additional fees if applicable.

- Step 5: Total Amount: Provide a breakdown of costs, including taxes or discounts if necessary, and then sum them up to get the total amount due.

- Step 6: Payment Terms: Clearly state the terms for payment, including accepted methods, due dates, and any late fees or penalties.

Additional Tips for Creating a Professional Document

- Use a Clear Layout: Make sure the document is easy to read, with distinct sections and clearly marked totals.

- Maintain Consistency: If you’re using a design or structure, keep it consistent across all documents to help with organization.

- Provide a Unique Reference Number: Assign a unique number to each document for tracking purposes.

By following these steps, you can create a professional and efficient billing document that ensures clarity and timely payments.

Key Elements of a Billing Document Format

To create a professional and effective billing document, there are several critical elements that must be included. These components ensure clarity, transparency, and that both parties understand the terms of the transaction. Each section plays an important role in providing all the necessary details for proper record-keeping and efficient payment processing.

Essential Information to Include

- Business and Client Information: The document should clearly display your company’s name, contact details, and the client’s information, including their name and address. This helps identify both parties involved.

- Document Date: It’s essential to include the date the document is issued and the due date for payment. This ensures that there is no confusion about deadlines.

- Description of Services or Products: A detailed breakdown of the services rendered or products provided, including quantities, rates, and dates of service. This section should be itemized to make the charges clear and understandable.

- Total Amount Due: Clearly outline the total cost, including any applicable taxes, discounts, or additional charges. This helps the client quickly understand the overall amount they are expected to pay.

Additional Elements to Consider

- Payment Terms: Include specific instructions on how and when payments should be made, including payment methods and any late fees that may apply.

- Unique Reference Number: Every document should have a unique reference or number to help track and organize transactions.

- Legal or Contractual Clauses: In some cases, it’s important to add terms that protect both parties, such as refund policies, dispute resolution clauses, or payment instructions.

By including these key elements, you can ensure that your bil

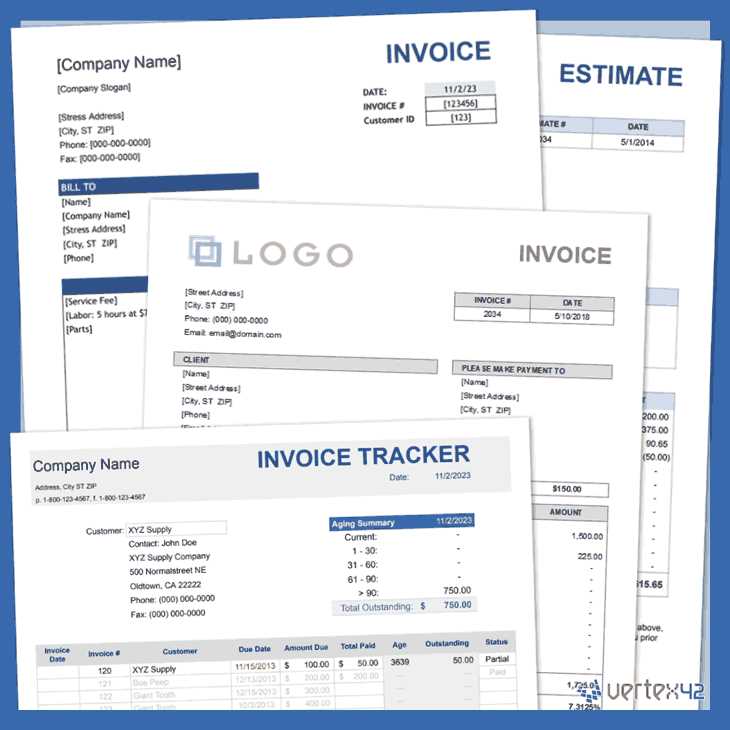

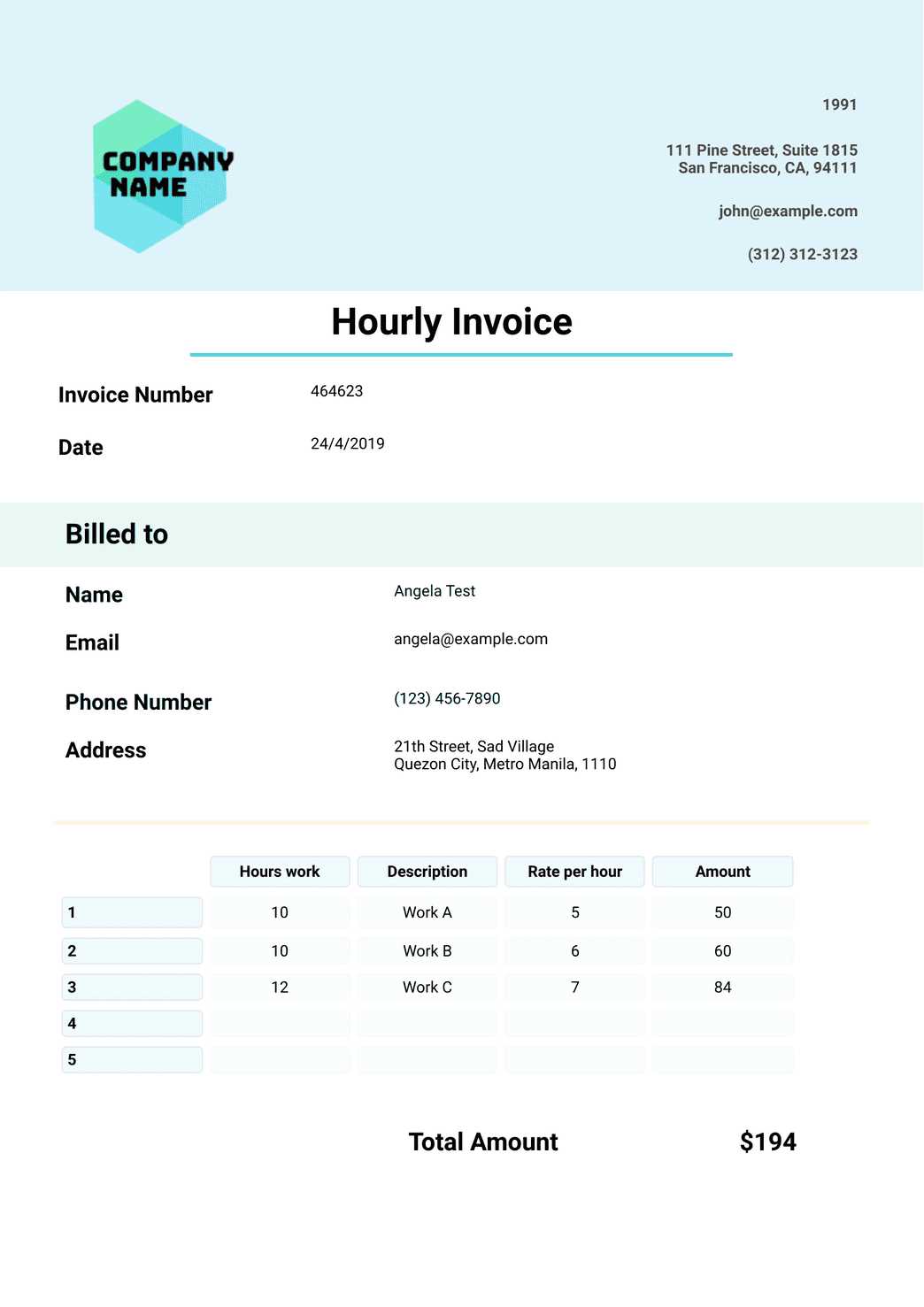

Understanding Billing Document Formats

When creating a professional billing document, it’s important to understand the different formats available, as each format serves a unique purpose. The format you choose will determine how the information is presented, how easy it is for clients to read, and how well it aligns with your business needs. Choosing the right structure can help streamline your billing process and ensure that your documents look polished and are easy to process.

Common Format Options

- Simple Format: A basic structure with essential details like business information, services rendered, and total payment amount. This format is suitable for small businesses or freelancers with straightforward billing needs.

- Detailed Format: Includes a more comprehensive breakdown of services, with itemized lists, payment terms, taxes, and additional notes. This is ideal for businesses offering multiple services or products, or when dealing with larger transactions.

- Online Formats: Many businesses now use digital platforms to generate and send bills. These online formats often include features like automatic calculations, templates, and easy integration with payment systems, making them efficient and convenient.

Factors to Consider When Choosing a Format

- Ease of Use: Select a format that is easy to fill out and understand for both you and your clients. A clean, organized layout will minimize confusion.

- Customization: Make sure the format you choose can be easily customized to fit your business branding and specific needs, such as adding logos or custom payment instructions.

- Compatibility: Ensure the format you choose works well with your accounting software, or integrates with other systems you may be using for business management.

By understanding the different format options and selecting the one that best suits your business, you can improve both the efficiency and professionalism of your billing process. Whether you opt for a simple structure or a more detailed format, the goal is to create a document that is clear, comprehensive, and easy to process.

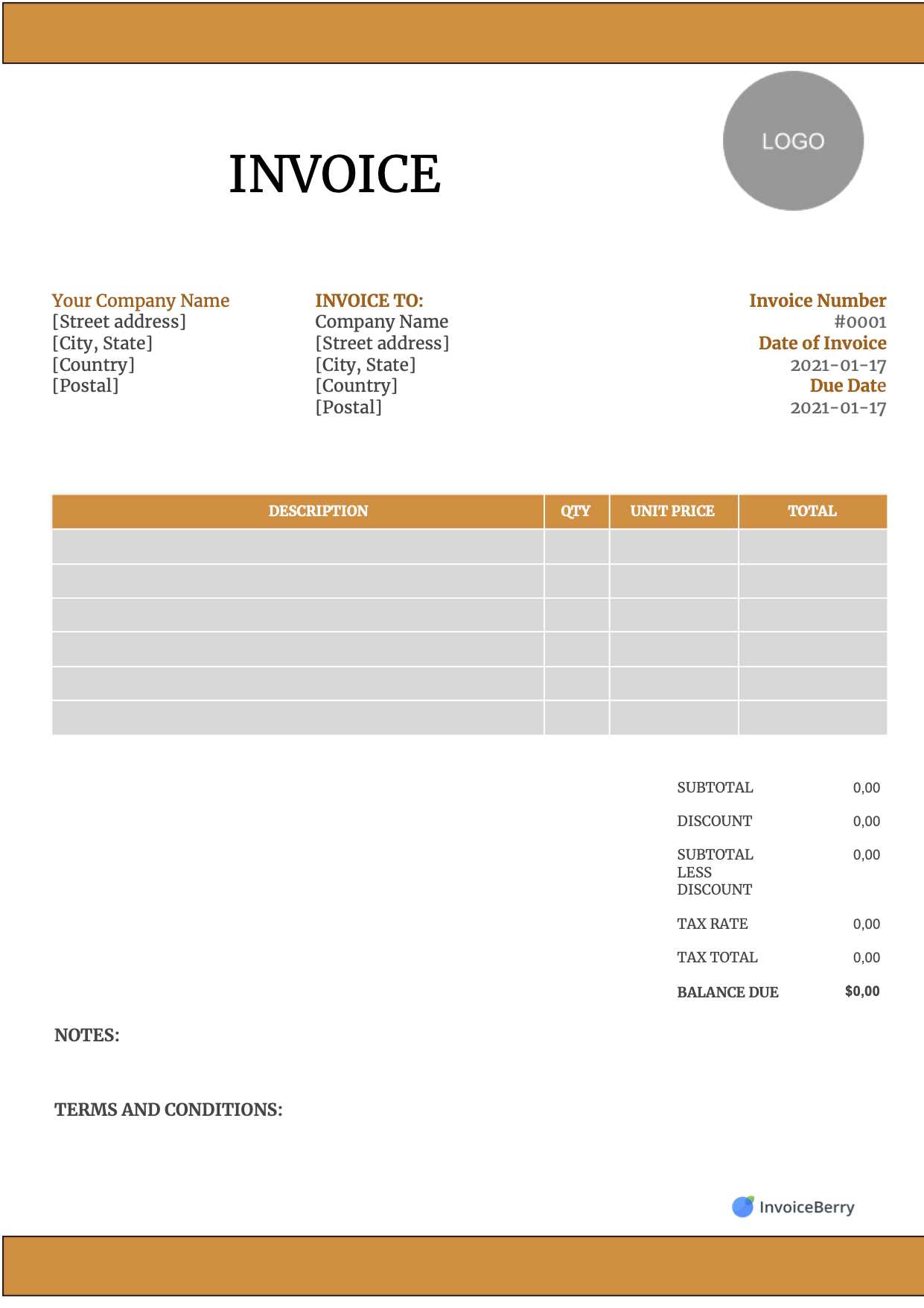

Free vs Paid Billing Document Formats

When choosing a structure for your billing documents, you may be faced with the decision of using a free or a paid option. Both have their advantages and limitations, depending on the needs of your business. Free formats are often a good starting point for small businesses or freelancers, while paid options may offer additional features and customization for more complex billing requirements.

Advantages of Free Formats

- Cost-Effective: As the name suggests, free options come with no upfront costs, making them ideal for startups or businesses with limited budgets.

- Simple to Use: Free formats are often straightforward and easy to implement, making them perfect for basic billing needs.

- Quick Setup: Most free structures can be downloaded or accessed online immediately, allowing you to get started quickly without much preparation.

Advantages of Paid Formats

- Advanced Features: Paid options often come with additional functionalities, such as automatic calculations, tax integration, and more detailed customization options.

- Customization: With a paid structure, you can often personalize the design and content to better fit your branding and business needs.

- Support: Paid services often come with customer support, ensuring that any issues or questions are addressed quickly.

- Professional Design: Paid options often offer more polished, modern designs that can help make your billing documents look more professional and trustworthy.

Choosing between free and paid formats depends on the complexity of your business and the specific features you require. While free options are great for simplicity and cost savings, paid versions offer advanced tools and customization that may better serve larger businesses or those with specific billing needs.

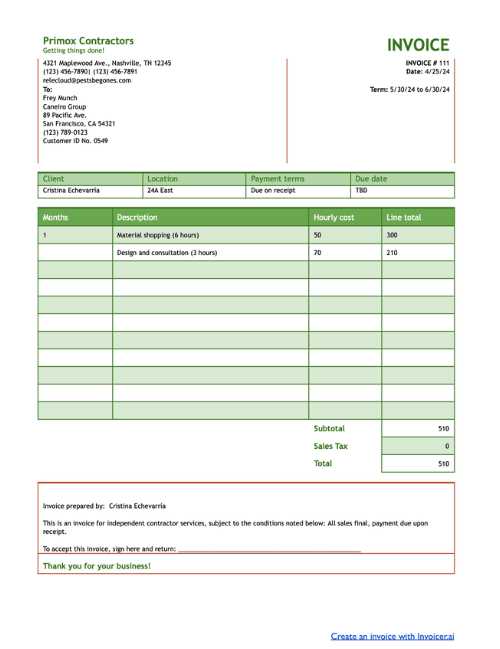

How to Personalize Your Billing Document

Personalizing your billing document can help strengthen your brand and make the billing process more professional. Customizing key elements ensures that your documents stand out, reflect your business identity, and create a more personalized experience for your clients. Simple adjustments such as design changes, content additions, and layout modifications can make a significant impact on how your document is perceived.

Key Areas to Personalize

- Business Branding: Include your company logo, colors, and fonts that align with your brand identity. This adds a personal touch and ensures consistency across all communications.

- Custom Payment Instructions: Add specific payment terms, methods, and account details that suit your business needs. This ensures clarity and makes it easy for clients to know how to settle their bills.

- Client-Specific Notes: Customize the document with personalized notes for each client, such as project references, deadlines, or discounts offered. This creates a more tailored and professional experience.

- Unique Style: Adjust the layout, font sizes, and spacing to create a clean and organized look that aligns with your brand’s aesthetic and enhances readability.

Tools for Customization

- Design Software: Tools like Canva or Adobe Spark allow you to fully customize your document design with ease, even if you don’t have graphic design experience.

- Online Billing Platforms: Many online platforms, such as QuickBooks or Zoho Invoice, offer customizable billing solutions with pre-designed elements that you can adjust to fit your business style.

By personalizing your billing documents, you not only enhance your professionalism but also foster stronger relationships with clients. Customization helps to create a seamless, consistent experience and reflects the values and identity of your business.

Best Practices for Billing Document Layout

A well-organized billing document layout is essential for ensuring clarity and professionalism. The way the information is arranged affects how easily the document can be read and understood by clients. A clean, structured layout helps avoid confusion and ensures that the client knows exactly what is being charged and why. Following best practices in design can improve both the effectiveness of your document and your reputation with clients.

Essential Design Principles

- Clarity and Simplicity: Keep the layout simple and straightforward. Avoid cluttering the document with unnecessary details or overly complex formatting. Use clear headings and bullet points to guide the reader.

- Consistent Structure: Use a consistent structure for all your documents. This includes having the same sections in the same order (e.g., business details, client information, list of services, payment terms) to make the document easy to navigate.

- Legible Fonts: Choose easy-to-read fonts, like Arial or Times New Roman, and maintain appropriate font sizes (e.g., 12-point for body text). Avoid using too many different fonts, as it can make the document look disorganized.

- Proper Alignment: Ensure that all sections are well-aligned, with columns neatly separated and text uniformly placed. This makes the document visually appealing and easier to read.

Additional Layout Tips

- Highlight Important Information: Use bold text or borders to highlight key details like the total amount due or the payment due date. This makes it easier for clients to spot important information quickly.

- Use White Space Wisely: Adequate white space between sections and text improves readability. Don’t overcrowd the document; give the content room to breathe.

- Responsive Design: Ensure the layout works well both on paper and on digital devices. If sending electronic copies, make sure the document is easy to read on any screen size.

By adhering to these best practices, you can create a visually appealing and user-friendly billing document that communicates all necessary information efficiently. A well-designed layout will not only help streamline the payment process but also enhance your business’s professionalism.

Choosing the Right Billing Document Software

Selecting the appropriate software to create and manage your billing documents is crucial for improving efficiency and accuracy. With many options available, it’s important to choose a solution that aligns with your business needs and simplifies the process. The right software can help you generate professional documents quickly, track payments, and integrate with other systems for seamless financial management.

Factors to Consider When Choosing Software

- Ease of Use: Choose software that is intuitive and user-friendly, with a simple interface that allows you to generate and customize documents with minimal effort.

- Customization Options: Ensure the software offers flexibility in design, allowing you to add your branding elements (like logos, colors, and custom text) to create professional-looking documents.

- Integration Capabilities: Opt for software that integrates easily with other tools you use, such as accounting software, CRM systems, or payment gateways. This integration streamlines your workflow and reduces manual data entry.

- Automated Features: Look for software with automated features like recurring billing, automatic tax calculations, and payment reminders. These tools save time and reduce human error.

Additional Features to Look For

- Cloud-Based Access: Cloud-based software allows you to access your documents from any device, providing flexibility for remote work or on-the-go billing.

- Mobile-Friendly: If you frequently need to create or send documents from a mobile device, choose software that offers a mobile app or a responsive design for easy access on smartphones and tablets.

- Customer Support: Ensure the software comes with responsive customer support to help you resolve any issues quickly and avoid disruptions

Common Mistakes to Avoid in Billing Documents

Creating a billing document may seem simple, but there are several common mistakes that can lead to confusion or delays in payment. These errors can damage your professional reputation and create unnecessary back-and-forth with clients. Avoiding these pitfalls ensures your documents are clear, accurate, and easy for clients to process.

Top Errors to Watch Out For

- Missing or Incorrect Client Information: Ensure that the client’s name, address, and contact details are accurate. Errors in this section can delay payments or lead to confusion.

- Unclear or Incomplete Descriptions: Failing to provide detailed descriptions of the services or products provided can cause misunderstandings. Be specific about what was delivered, including quantities, rates, and any applicable dates.

- Not Including Payment Terms: Always specify payment methods, due dates, and any late fees. Omitting these details can lead to delays or disputes over payment expectations.

- Incorrect Calculations: Double-check all calculations, including totals, taxes, and discounts. Mistakes in this area can create confusion and erode trust with clients.

Additional Pitfalls to Avoid

- Failing to Add a Unique Reference Number: Without a reference number, tracking the document becomes difficult for both you and your client. Ensure each document has a distinct identifier.

- Overcomplicating the Layout: A cluttered, difficult-to-read document can be frustrating for clients. Keep the layout simple and organized, with clear headings and plenty of white space.

- Not Proofreading: Always proofread your document for spelling or grammatical errors. Mistakes in text can make your billing document appear unprofessional.

Avoiding these common mistakes will help ensure that your billing documents are clear, professional, and efficient, reducing delays and m

How to Include Payment Terms

Including clear payment terms in your billing document is essential for avoiding confusion and ensuring timely payments. Payment terms outline when and how the client should pay, as well as any conditions related to late fees or discounts. By clearly specifying these terms, both you and your client will have a mutual understanding of expectations, which can help prevent delays and disputes.

Key Elements of Payment Terms

- Due Date: Specify the exact date by which payment is expected. This sets a clear deadline and helps both parties track the timeline.

- Accepted Payment Methods: Indicate the different ways your client can pay, such as bank transfer, credit card, online payment systems, or checks. This ensures that the client knows their options.

- Late Fees: Outline any penalties for late payments. Include the percentage or fixed fee charged for overdue payments and when it will be applied. This encourages clients to pay on time.

- Discounts for Early Payment: If applicable, offer discounts for early payment and specify the percentage and deadline. This can incentivize clients to settle bills more quickly.

Best Practices for Clear Payment Terms

- Be Specific: Avoid vague terms. Instead of stating “payment due soon,” clearly indicate a specific date, like “payment due within 30 days of receipt.”

- Make It Easy to Find: Position payment terms in a prominent location within the document, typically near the total amount due, so the client can easily reference them.

- Use Simple Language: Keep the wording simple and direct to avoid any ambiguity. Ensure that your client can quickly understand the payment expectations.

Clearly stating your payment terms helps maintain professional relationships and reduces misunderstandings. By making these details transparent, you create an atmosphere of trust and encourage prompt payment, which benefits your business’s cash flow.

Managing Billing Document Numbers Effectively

Properly managing document numbers is crucial for maintaining organization, tracking payments, and ensuring smooth financial operations. A well-structured numbering system helps prevent confusion, enables easy reference, and supports accurate record-keeping. Whether you’re dealing with a small volume of transactions or a high number of clients, a consistent numbering approach ensures your documents are easily identifiable and sequentially organized.

Best Practices for Document Numbering

- Use Sequential Numbers: Always number your documents in a sequential order. This helps maintain an organized system and prevents duplicate or missing entries. For example, “001,” “002,” “003,” and so on.

- Incorporate Date or Client Information: Consider adding elements like the date or client name to the number for better identification. For instance, “2024-001” or “C1234-001” can help differentiate documents, especially if you have multiple clients or issue bills frequently.

- Don’t Skip Numbers: Even if a document is voided or canceled, avoid skipping numbers. Skipping can lead to confusion and issues during audits or when tracking payment histories.

- Ensure Unique Identification: Make sure each document number is unique. This is critical for record-keeping, avoiding duplication, and ensuring that each entry is accounted for properly.

Tools for Efficient Management

- Accounting Software: Most accounting platforms automatically generate unique document numbers for each transaction, ensuring consistency and eliminating human error.

- Manual Tracking Systems: If you prefer to manage documents manually, use spreadsheets or digital logs to keep track of issued numbers, dates, and associated client details.

By managing document numbers carefully, you create a streamlined, organized system that benefits both you and your clients. A well-implemented numbering strategy makes it easier to reference and track your billing documents, ensures professionalism, and supports smooth business operations.

How to Add Taxes on Billing Documents

Including taxes in your billing documents is essential for compliance with tax regulations and ensuring accurate payments. Properly calculating and displaying taxes on your documents not only helps you meet legal requirements but also provides clarity for your clients. It’s important to understand how to correctly apply the tax rates based on your location, the nature of your services, and your client’s location.

Steps to Add Taxes

- Determine Applicable Tax Rates: The first step is to know the correct tax rates for your services or products. These rates can vary based on your region, the nature of your offering, or whether your client is located in a different area. Check local tax laws or consult with a tax professional to ensure accuracy.

- Identify Taxable Items: Not all services or products are taxable. Be sure to list which items or services are subject to taxes and which are exempt. This helps prevent errors in calculating the total amount due.

- Include Tax Line Items: On your billing document, create a separate line for each tax applied. For example, if you have multiple taxes (sales tax, value-added tax, etc.), each one should be clearly listed with the applicable percentage or amount next to it.

- Clearly Display the Total: After adding taxes, clearly show the total amount due, including the base amount plus taxes. This ensures that the client can easily see the breakdown of costs.

Best Practices for Tax Display

- Use Clear Descriptions: Label each tax line clearly, using terms such as “Sales Tax,” “VAT,” or “Service Tax” so your client can easily understand what each charge represents.

- Separate Taxes from Other Charges: Keep taxes as a separate line item distinct from the price of the product or service. This ensures that taxes are easily identifiable and not confused with the original cost.

- Double-Check Your Calculations: Before sending your document, double-check all tax calculations to ensure they are accurate. Even small errors in tax rates can lead to discrepancies and delays in payment.

By following these steps and best practices, you can accurately include taxes in you

Time-Saving Tips for Billing Document Creation

Creating billing documents efficiently can save you valuable time, especially if you have multiple clients or frequent transactions. Streamlining your process allows you to focus on other important aspects of your business while ensuring accuracy and professionalism. By following a few simple tips, you can speed up the creation process and reduce the chances of errors or delays.

Effective Strategies to Save Time

- Use Pre-Built Structures: Utilize pre-designed formats that already include all the necessary sections. This eliminates the need to manually create the layout every time and helps ensure consistency.

- Automate Repetitive Information: Store frequently used information such as your business name, client details, and payment terms in a database or a contact management system. This allows you to quickly insert this data into new documents without re-entering it each time.

- Leverage Accounting Software: Use accounting or billing software that automatically generates and tracks your documents. Many platforms can pre-fill fields and even calculate totals and taxes for you, saving time and reducing the chance of errors.

- Create Customizable Fields: Design your billing documents so that you can quickly modify or add specific details, such as product descriptions or quantities, without starting from scratch each time.

Additional Time-Saving Tips

- Batch Process Documents: If you need to generate multiple documents, batch them together and process them at once. This is more efficient than creating each one individually.

- Set Reminders for Recurring Billing: Set up automated reminders for recurring payments or monthly billing cycles. This way, you won’t need to manually track or remember when to create new documents.

- Utilize Cloud-Based Solutions: Cloud-based tools allow you to access your documents from anywhere and collaborate with your team in real time, further speeding up the process and reducing the time spent on administrative tasks.

By implementing these strategies, you can significantly reduce the amount of time spent creating billing documents. These tips help increase productivity, minimize errors, and ensure that your business runs more smoothly. With a more efficient process in place, you’ll have more time to focus on other aspects of your work while maintaining professionalism in your client interactions.

Ensuring Legal Compliance with Billing Documents

Maintaining legal compliance when creating billing documents is essential for avoiding potential legal issues and ensuring that your business operates within the law. Different regions and industries may have specific regulations regarding what information must be included, how taxes should be applied, and how payments should be documented. By ensuring your billing documents meet these requirements, you protect yourself from fines, disputes, and delays in payment.

Key Legal Requirements to Include

- Business Information: Include your business name, address, tax identification number, and other relevant contact details. This helps confirm the legitimacy of your business and is required for tax reporting purposes.

- Client Information: Ensure that the client’s name, address, and other identifying details are accurate. This is necessary for both legal clarity and for proper record-keeping.

- Tax Information: Include any applicable taxes, such as sales tax or VAT. Make sure to specify the tax rate and clearly show how it affects the total amount due. Compliance with local tax laws is essential to avoid legal complications.

- Payment Terms and Conditions: Clearly state the payment terms, including the due date, late fees, and accepted methods of payment. Specific terms prevent misunderstandings and can be used in case of a legal dispute over payments.

Best Practices for Legal Compliance

- Consult Local Laws: Different jurisdictions have varying requirements, such as mandatory information that must be included or specific formatting rules. Consult a legal expert or research the tax and business regulations in your area to ensure compliance.

- Regularly Update Your Documents: Laws and regulations can change, so it’s important to review and update your billing documents regularly. Ensure that any changes to tax laws or business regulations are reflected in your documents.

- Use Professional Software: Consider using accounting or billing software that is specifically designed to meet legal standards. These platforms often include templates that automatically comply with local tax laws and formatting rules.

By following these steps and best practices, you can ensure that your billing documents are legally compliant. This not only reduces the risk of legal challenges but also builds trust with your clients, demonstrating that you operate t

How to Handle Billing Disputes

Disputes over payment details can occur for various reasons, ranging from misunderstanding the charges to discrepancies in the agreed-upon terms. Effectively handling such situations requires clear communication, a professional approach, and a commitment to resolving the issue amicably. The key is to stay calm, listen to your client’s concerns, and work towards a mutually beneficial resolution.

Steps to Resolve Billing Disputes

- Review the Discrepancy: Carefully examine the details of the dispute. Compare the client’s claims against your records to identify any errors or misunderstandings. This will help you determine whether the dispute is valid or if there was simply a miscommunication.

- Communicate Clearly: Open a direct line of communication with the client. Address the issue professionally, remain neutral, and avoid being defensive. Clearly explain your position and be prepared to provide evidence, such as contracts, previous communications, or service records.

- Negotiate a Solution: If the dispute is based on an error or misunderstanding, offer to correct the issue or adjust the amount owed if necessary. In case the disagreement is over terms, try to find a compromise that satisfies both parties.

- Document Everything: Keep a detailed record of all communications related to the dispute, including emails, phone calls, or meeting notes. Documentation can serve as evidence in case the issue escalates or requires legal intervention.

Best Practices for Preventing Disputes

- Set Clear Terms: From the beginning, ensure that your payment terms, services, and expectations are clearly defined and agreed upon by both parties. Having everything in writing helps avoid future disputes.

- Provide Detailed Billing: Always provide a clear breakdown of the charges, including descriptions, quantities, rates, and taxes. This transparency can help clients understand the costs and reduce the likelihood of confusion.

- Be Proactive: If you anticipate any potential issues, address them proactively with the client before the payment is due. Open and honest communication can prevent disputes from arising in the first place.

Handling disputes with professionalism and transparency not only resolves the immediate issue but also strengthens your reputation as a trustworthy business partner. By following these steps and practices, you can prevent future disagreements and maintain positive client relationships.

Storing and Tracking Billing Documents

Efficiently storing and tracking your billing records is crucial for maintaining organized financial management. Proper documentation helps you stay on top of payments, easily access past transactions, and ensures compliance during audits or legal reviews. A systematic approach to storing and monitoring your records also reduces the risk of errors and delays in payment.

Best Practices for Storing Billing Records

- Use Cloud Storage: Storing documents in cloud-based systems provides easy access from anywhere and helps prevent data loss due to hardware failure. It also facilitates secure sharing with clients or accountants when needed.

- Organize by Date or Client: Categorizing your records by the date or client helps keep them well-organized. This allows for quick retrieval when you need to review past transactions or send a follow-up reminder.

- Back Up Regularly: Make sure to back up your records periodically. Having a secondary copy, either on a different cloud service or an external hard drive, ensures the safety of your documents in case of technical issues.

- Ensure Secure Access: Protect sensitive data by using encryption and limiting access to authorized personnel only. This helps maintain client privacy and ensures that your financial records are secure.

Effective Ways to Track Payments

- Use Accounting Software: Accounting platforms can automatically track payments, notify you of overdue amounts, and update the status of each record as payments are made. This automation reduces the need for manual tracking and helps avoid errors.

- Create a Payment Log: For a more manual approach, create a spreadsheet or ledger to record each transaction, including dates, amounts, and payment methods. This helps you track the status of outstanding balances.

- Set Up Payment Reminders: To prevent missed payments, set automated reminders for upcoming due dates. Follow up with clients promptly if payments are delayed, ensuring that you maintain a steady cash flow.

- Monitor Outstanding Amounts: Regularly review your records to identify outstanding payments. Keeping track of overdue amounts helps you stay proactive about collection and manage your cash flow more effectively.

By implementing these storage and tracking practices, you can streamline your billing process, avoid errors, and ensure that all payments are collected in a timely manner. A well-organized approach to managing your billing records can also help you respond quickly to client inquiries and keep your financials in good order for tax season or audits.