Tow Invoice Template for Easy and Efficient Towing Service Billing

Efficient billing is crucial for any service-oriented business, especially in industries where customers rely on immediate assistance. When providing roadside help, ensuring that every transaction is documented accurately can help maintain professionalism and improve cash flow. Having a well-structured system for generating payment requests is an essential part of streamlining financial processes.

By using the right resources, businesses can ensure their clients receive clear, accurate, and timely statements for services rendered. Properly formatted records can prevent confusion, reduce disputes, and ultimately support smooth business operations. The key to effective billing lies in creating clear, concise, and detailed requests that cover all necessary information.

Adopting efficient billing practices that are easy to understand and quick to create will save time for both service providers and their customers. A simple yet professional approach ensures that each transaction is transparent and prompt, reinforcing trust and reliability with every job completed.

Why You Need a Billing Document Structure

Having a consistent and organized method for generating payment requests is crucial for any service-based business. It ensures that all necessary details are included, leaving little room for errors or misunderstandings. A well-designed framework helps standardize the process, making it easier to manage multiple transactions and track payments effectively.

Without a structured approach, businesses risk missing critical information, such as the exact services provided or payment terms. This could lead to confusion, delays in receiving payments, and even disputes with customers. A clear and professional layout helps both parties stay on the same page and makes the entire transaction process smoother.

Additionally, using a predefined format can save time. Once the structure is set up, it can be quickly adjusted for each new job, reducing the need to create new documents from scratch. This not only increases efficiency but also ensures that no key details are forgotten, making the billing process faster and more reliable.

Benefits of Using a Billing Document Structure

Utilizing a predefined structure for payment requests offers numerous advantages for service providers. It ensures consistency, accuracy, and professionalism in every transaction. When a set format is in place, creating and managing payment records becomes more efficient, saving both time and effort. Below are some of the key benefits:

Improved Efficiency

By having a ready-to-use framework, you can quickly generate and send payment documents. This eliminates the need to start from scratch each time, allowing you to focus on other important tasks. The process becomes streamlined, helping you manage your business more effectively.

Consistency and Accuracy

A predefined layout ensures that all necessary details are included in each request. This reduces the risk of missing important information or making errors, which could otherwise lead to confusion or delayed payments. Standardizing the process guarantees that every payment document is clear and complete.

- Less chance of human error

- Ensures uniformity across all records

- Reduces the need for manual corrections

Professional Appearance

Presenting a polished and organized document adds credibility to your business. It reflects well on your professionalism and can make a positive impression on clients. A well-structured payment request shows that you value organization and detail, which can build trust and improve customer satisfaction.

- Enhances customer trust

- Improves brand perception

- Fosters long-term client relationships

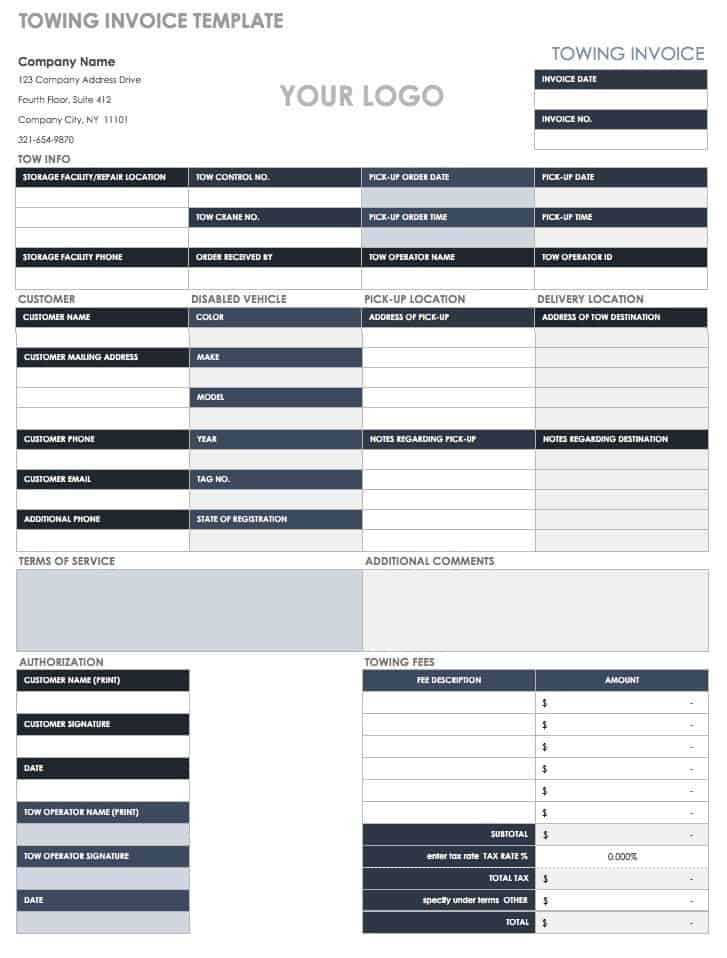

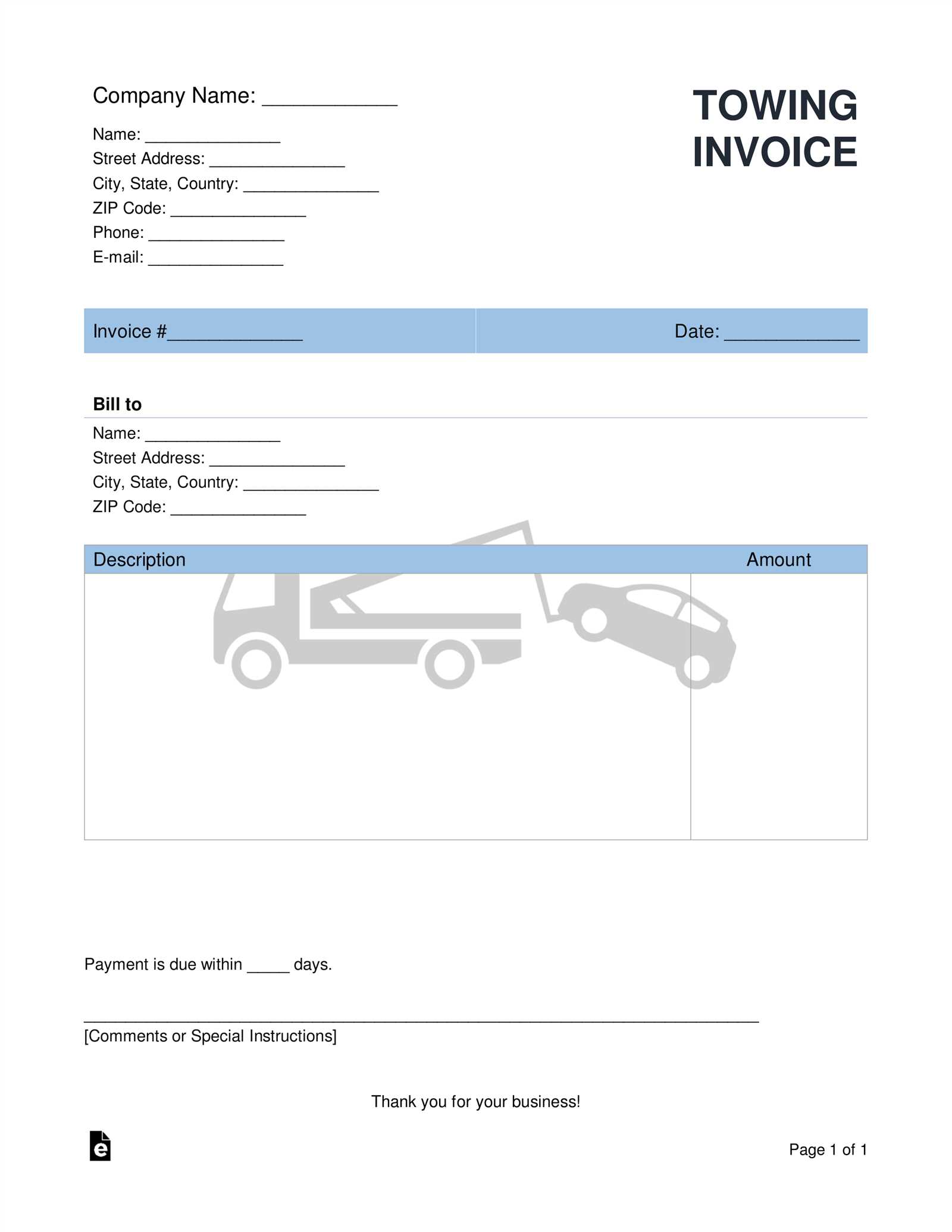

How to Create a Payment Request Document

Creating a clear and accurate payment request is essential for any service provider. This document should include all the necessary details, ensuring both the service provider and the client understand the terms of the transaction. By following a simple structure, you can easily generate a professional-looking statement that facilitates smooth payment processing.

The first step in creating a payment record is to gather all the relevant information. This includes the service date, client details, and a breakdown of the services provided. It is important to be as detailed as possible to avoid any confusion later on.

Key elements to include:

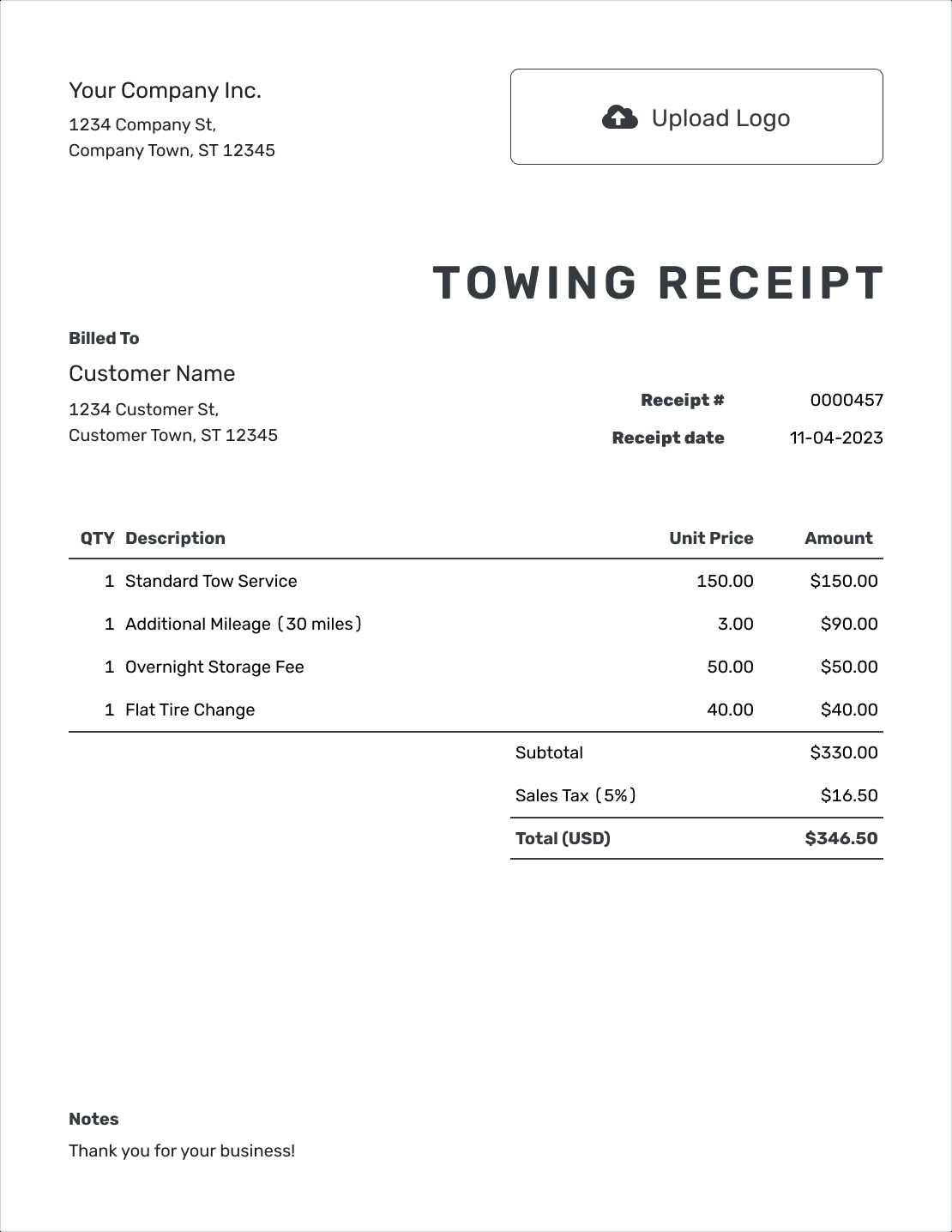

- Client’s name and contact information

- Date of service

- Clear description of the work completed

- Cost breakdown for each service or item

- Total amount due

- Payment terms and methods

Once you’ve gathered this information, organize it into a clean, easy-to-read format. Ensure that the layout is straightforward and that all amounts are clearly listed. Including a professional logo or branding can also enhance the document’s appearance and make it look more credible.

Remember, clarity and simplicity are key. A payment request document should leave no room for ambiguity, making it easy for your client to understand the charges and pay promptly.

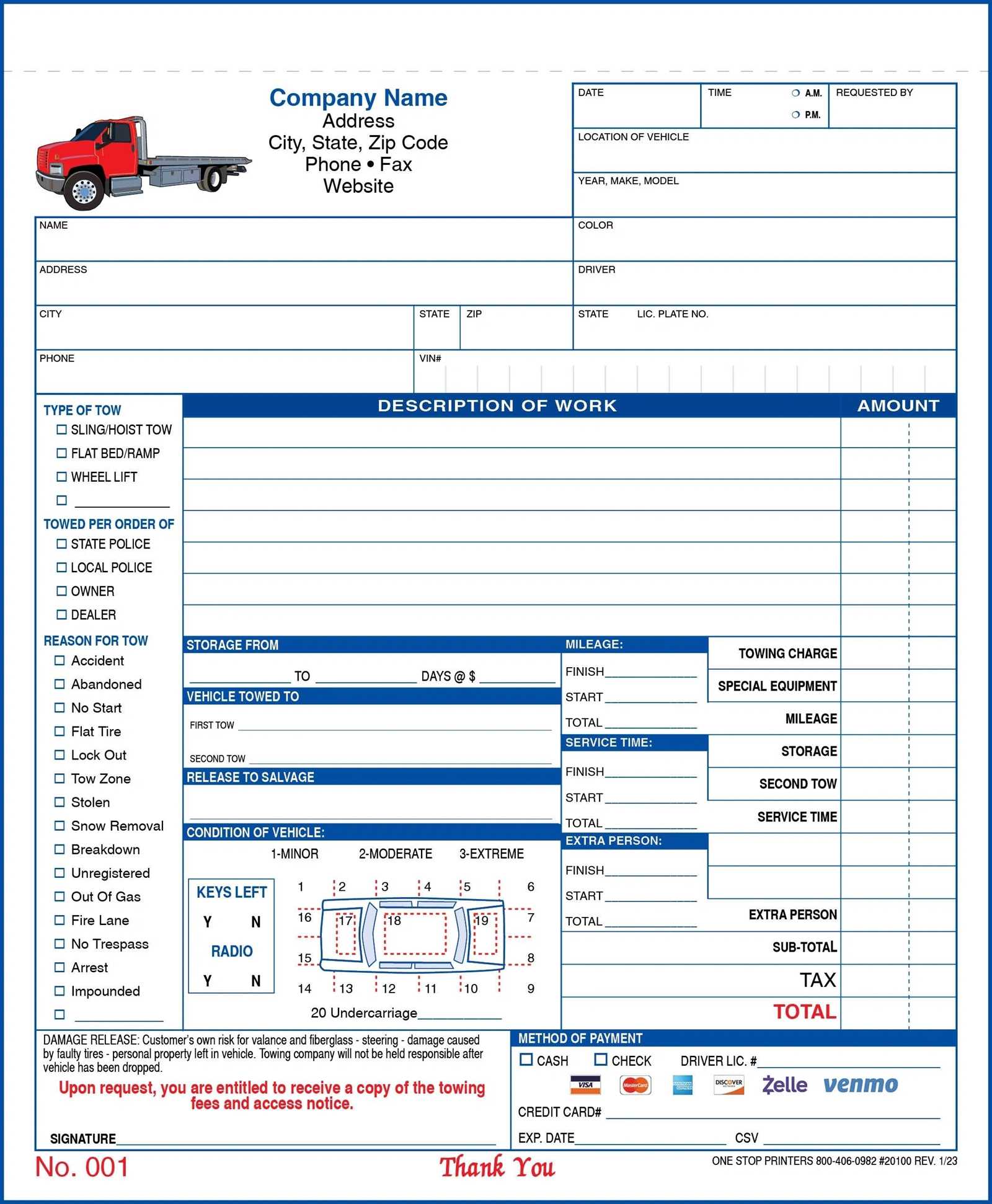

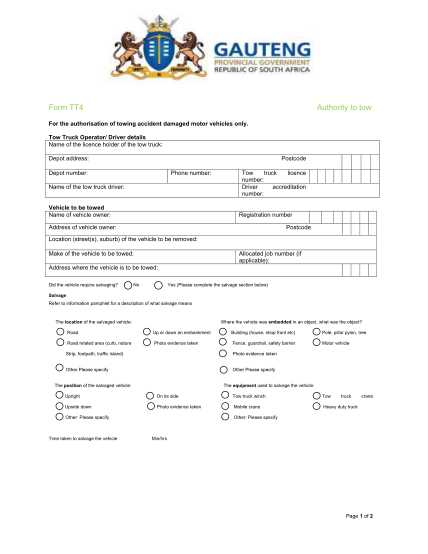

Essential Details for Billing Documents

When preparing a payment record for services rendered, it’s crucial to include all the necessary details to ensure clarity and avoid misunderstandings. A well-organized document helps both the provider and the client stay informed about the specifics of the service and the payment terms. Without these key elements, confusion can arise, potentially delaying the payment process or causing disputes.

Key Information to Include

- Client Information: Include the full name, address, and contact details of the customer.

- Service Date: Specify the exact date when the service was provided to avoid ambiguity.

- Description of Services: A detailed breakdown of the work performed, including any specific items or tasks completed.

- Cost Breakdown: Clearly list the price for each individual service or item, including any applicable fees.

- Total Amount Due: The final amount the client owes, which should include all services and additional charges.

- Payment Terms: Outline when payment is due, any late fees, and acceptable payment methods (e.g., cash, credit card, bank transfer).

Why Accuracy Matters

Ensuring all these details are accurately listed in a clean, easy-to-read format is essential. It provides transparency, which helps prevent confusion and builds trust between service providers and clients. Accurate billing documents also make record-keeping easier, ensuring that both parties have a reliable reference for future transactions.

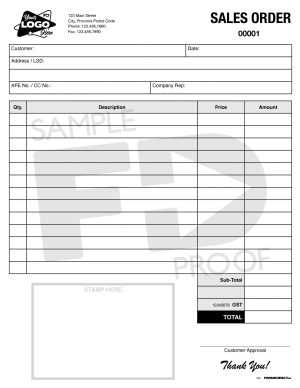

Customizing Your Billing Document Layout

Personalizing your payment record layout helps create a more professional appearance while aligning the document with your business branding. A well-customized design not only makes the document visually appealing but also ensures that all essential information is presented in a clear and organized way. Customizing allows you to highlight important details and improve the client experience, making it easier for them to understand the charges and payment terms.

Design Elements to Consider

- Logo and Branding: Incorporating your company’s logo and colors adds a professional touch and reinforces your brand identity.

- Fonts and Layout: Choose easy-to-read fonts and organize the information in a logical flow, ensuring clients can quickly find the details they need.

- Color Scheme: Use colors that match your branding, but keep them subtle to avoid overwhelming the recipient with too much visual information.

- Itemized Sections: Ensure services are broken down into clear categories, making it easy for clients to understand each charge.

Making the Document User-Friendly

Customization isn’t just about aesthetics; it’s about functionality too. Ensure that the layout is straightforward, allowing for quick adjustments in future documents. By incorporating a customizable structure, you can easily adapt the record to fit various types of services or different clients. This flexibility not only saves time but also ensures that the document remains consistent across all transactions.

Designing a Professional Billing Layout

Creating a well-organized and professional payment record is essential for establishing credibility and fostering positive client relationships. A well-designed document not only helps convey important information clearly but also reflects the professionalism of your business. The layout should be clean, easy to navigate, and visually appealing, ensuring that clients can quickly understand the charges and payment terms.

Key Elements of a Professional Layout

- Company Branding: Including your logo and business name at the top of the document establishes a strong brand presence and adds a personal touch.

- Contact Information: Clearly list your contact details, including phone number, email, and physical address, so clients can easily reach you if needed.

- Clear Service Descriptions: Provide a concise yet detailed description of the services rendered, allowing clients to understand exactly what they are being billed for.

- Readable Fonts: Use clean, professional fonts that are easy to read. Avoid overly decorative fonts that may make the document harder to follow.

Structure and Flow

Arrange the information logically, starting with your business details, followed by the client’s information, service descriptions, and payment terms. Grouping related information together ensures that the document is easy to follow. A well-structured layout helps clients quickly find the information they need, whether it’s the total due amount or the services performed.

Consistency in design across all payment records will enhance your business’s professional image and help establish trust with your clients.

Common Mistakes in Billing Documents

When preparing a payment request, it’s easy to overlook certain details that can lead to confusion, delays, or disputes with clients. Common errors can range from simple formatting mistakes to failing to include crucial information. Understanding and avoiding these pitfalls can help streamline the payment process and maintain a positive relationship with clients.

Frequent Errors to Avoid

- Missing Client Information: Failing to include the client’s full name, address, or contact details can delay communication and make it harder to follow up on unpaid balances.

- Inaccurate Service Descriptions: A vague or incomplete description of the work performed can lead to misunderstandings. Ensure that each service is clearly outlined and easy to understand.

- Incorrect Amounts: One of the most critical errors is miscalculating the total due. Double-checking numbers, including taxes, fees, and discounts, is essential to avoid confusion.

- Omitting Payment Terms: Clearly state when the payment is due and what methods are accepted. Without these terms, clients may be unsure about when and how to pay.

- Inconsistent Formatting: Using inconsistent fonts, styles, or layouts can make the document difficult to read and appear unprofessional. Stick to a simple, uniform design to enhance readability.

How to Prevent These Mistakes

- Double-check all client details and service descriptions before sending the document.

- Ensure that all calculations are correct and account for any additional fees.

- Review the document layout to ensure consistency in formatting and organization.

By avoiding these common mistakes, you can create clear, professional payment records that build trust and facilitate timely payments.

How to Avoid Billing Errors

Billing errors can lead to delays in payments and cause frustration for both service providers and clients. These mistakes can be as simple as incorrect calculations or as complex as failing to include essential information. By adopting a systematic approach and implementing a few key practices, you can significantly reduce the likelihood of errors in your payment requests and ensure smoother transactions.

Best Practices for Error-Free Billing

- Double-check all calculations: Always verify the amounts to ensure the total due is accurate, including any discounts, taxes, and fees.

- Confirm client information: Ensure that the client’s name, address, and contact details are up-to-date and accurate to avoid confusion.

- Use a consistent format: Keep your document layout uniform to prevent important details from being overlooked. A clear, organized layout makes it easier to review the payment record.

- Include clear service descriptions: Be specific about the services provided, including dates and detailed descriptions of each task, so there is no room for misinterpretation.

Useful Tools for Accurate Billing

Many businesses use software or digital tools that automatically calculate totals, taxes, and discounts, reducing human error. These tools can also help you generate consistent, professional payment records quickly.

| Tool | Description | Benefits |

|---|---|---|

| Billing Software | Automates calculations and generates standardized documents. | Reduces errors, saves time, ensures accuracy. |

| Spreadsheet Templates | Pre-designed templates to input and calculate totals. | Flexible, cost-effective, customizable for various services. |

| Accounting Apps | Syncs with your financial records for accurate billing. | Keeps all records in one place, simplifies reporting. |

By following these guidelines and leveraging helpful tools, you can reduce the risk of errors and ensure that your payment requests are accurate, p

Best Tools for Billing Document Creation

Choosing the right tools to streamline the process of creating professional payment records can save both time and effort. With the right software, you can quickly generate accurate, polished documents that reflect your business’s professionalism. These tools often come with built-in features to ensure accuracy, consistency, and customization, making it easier to manage your financial transactions.

Top Tools for Creating Payment Records

- FreshBooks: An intuitive accounting software that simplifies billing by offering customizable templates, automatic calculations, and detailed client tracking features.

- QuickBooks: A widely-used platform that integrates billing with other financial management tasks, helping users to create accurate, professional documents and manage payments efficiently.

- Zoho Invoice: A versatile invoicing tool that allows for easy creation and personalization of payment records. It also includes features for recurring billing and online payments.

- Wave: A free tool that offers a variety of customizable templates, automatic tax calculations, and the ability to accept online payments, making it ideal for small businesses and freelancers.

Features to Look For in a Billing Tool

When selecting a tool for your billing needs, look for features that improve efficiency and accuracy:

- Customizable templates: Ensure the software allows you to personalize documents with your company logo, colors, and preferred layout.

- Automated calculations: The tool should automatically calculate totals, taxes, and discounts to minimize human error.

- Payment integration: A good tool will offer options for clients to pay directly through the document, improving convenience and speeding up payment processing.

- Client tracking: Being able to track outstanding payments and send reminders is a helpful feature for maintaining smooth cash flow.

By utilizing the best tools available, you can create billing records that are accurate, professional, and tailored to your business needs.

Top Software for Creating Billing Documents

Choosing the right software to generate professional payment records can enhance efficiency and reduce errors. Many applications are designed to automate the creation of these documents, ensuring they are accurate, visually appealing, and easy to send to clients. These tools offer a range of features, including customizable layouts, automatic calculations, and payment tracking, all of which help streamline the billing process for businesses of any size.

Here are some of the best software options available for creating and managing payment records:

- FreshBooks: This cloud-based solution is known for its user-friendly interface and powerful billing features. It allows users to create customizable payment records, automate calculations, and track client payments in real-time.

- QuickBooks: A popular choice among small and medium-sized businesses, QuickBooks integrates accounting and billing functions. It offers customizable document templates, recurring billing options, and integration with payment gateways.

- Zoho Invoice: With a focus on flexibility and ease of use, Zoho allows users to create professional billing documents, manage time tracking, and accept online payments. It also includes powerful reporting tools.

- Wave: A free and accessible tool, Wave provides customizable layouts and automated tax calculations. It’s a great option for freelancers and small businesses that need a simple solution for managing their billing.

Each of these software solutions offers a range of features that can help streamline the process of generating payment records. By selecting the right one for your needs, you can improve your billing accuracy, enhance your business professionalism, and ensure timely payments.

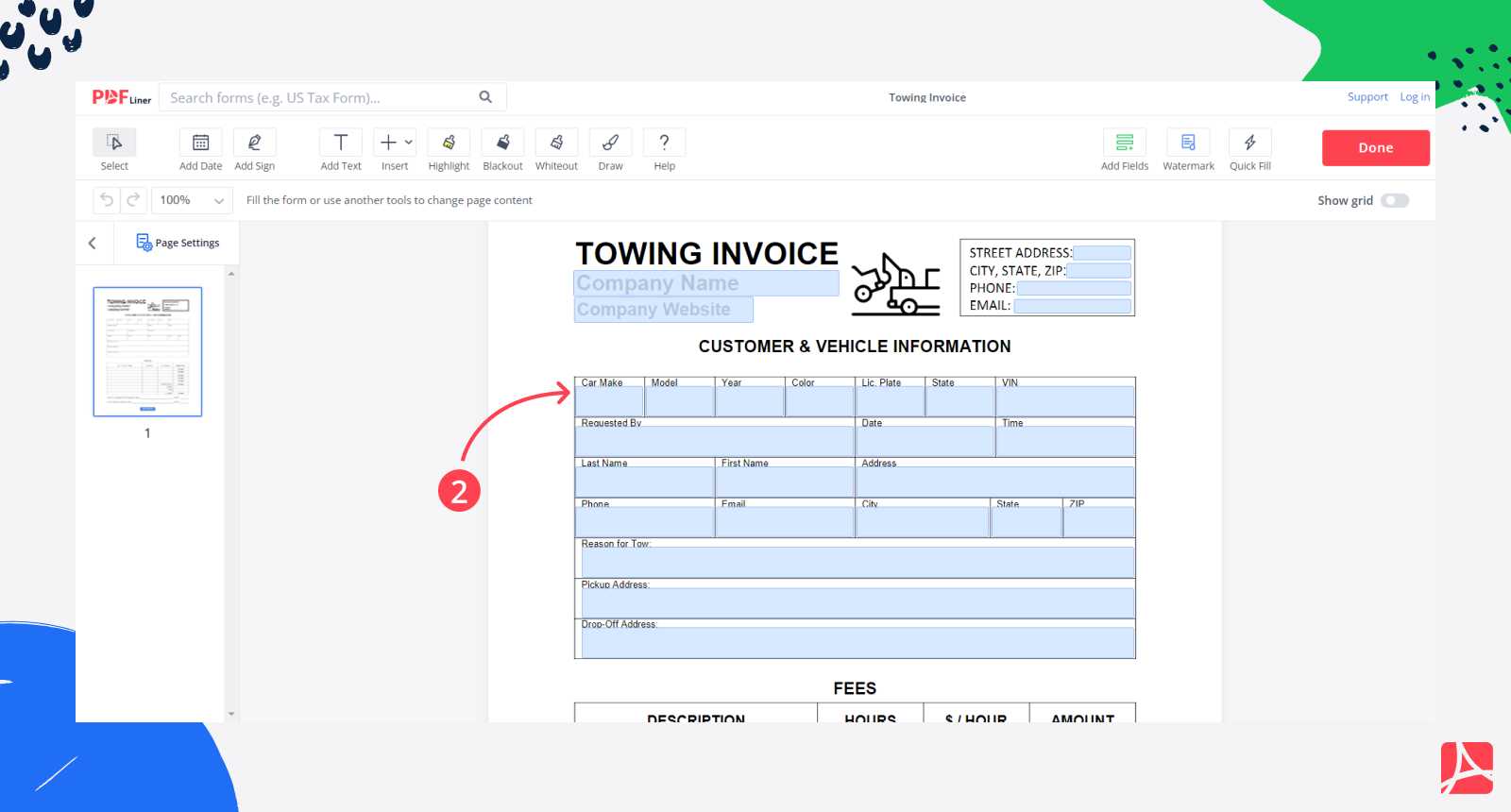

Free Billing Document Templates Available Online

There are numerous free resources online that offer pre-designed layouts for creating professional payment records. These resources allow businesses to save time and avoid the hassle of designing documents from scratch. With customizable fields and easy-to-use formats, these free options make it possible for small business owners and freelancers to create accurate and polished billing documents without the need for expensive software or advanced skills.

Here are some of the best platforms offering free options for generating billing records:

- Invoice Simple: A user-friendly platform that offers a variety of free customizable document layouts. It’s perfect for creating professional-looking records quickly, with options for including payment terms, service descriptions, and client information.

- Free Invoice Generator: This tool allows users to create personalized payment records using simple drag-and-drop features. You can select a layout, add necessary details, and generate a professional document in minutes.

- Zoho Invoice (Free Version): Zoho offers a free version of its billing software, providing basic functionalities like customizable templates, time tracking, and reporting for smaller businesses.

- Wave: Wave offers free tools for creating and managing professional billing documents, including invoice customization options, tax calculations, and the ability to accept online payments.

By taking advantage of these free resources, businesses can efficiently create and manage their billing processes, ensuring consistency and professionalism with minimal investment.

Where to Find Free Billing Document Layouts

There are many online platforms where businesses and freelancers can access free pre-designed formats for creating professional payment records. These resources offer a variety of customizable options, allowing users to quickly generate accurate documents without the need for complex design skills or expensive software. Whether you need a simple, clean layout or a more detailed format, these free templates are available for immediate use.

Popular Platforms Offering Free Formats

- Microsoft Office Templates: Microsoft’s official website provides a wide selection of free templates for creating billing documents. You can choose from simple layouts to more complex designs, all available in Word or Excel formats for easy editing.

- Google Docs: Google Docs offers free, editable layouts that can be accessed and customized directly from your Google Drive. These templates are perfect for those who prefer working in the cloud and need quick access to their documents from any device.

- Canva: Known for its ease of use, Canva offers a range of free customizable templates. You can create personalized documents using Canva’s drag-and-drop editor, which makes it easy to add logos, images, and other elements to your billing records.

Other Useful Resources

- Invoice Generator Websites: Platforms like Invoice Generator and Free Invoice Generator offer free, easy-to-use tools for creating professional payment documents. They allow you to quickly input your information and generate a ready-to-send record.

- Template.net: This site offers a wide array of downloadable templates, including many for billing purposes. You can filter the options based on your industry or needs and download the templates in various file formats.

By exploring these platforms, you can find high-quality, free resources that will help streamline your billing process while maintaining a professional appearance.

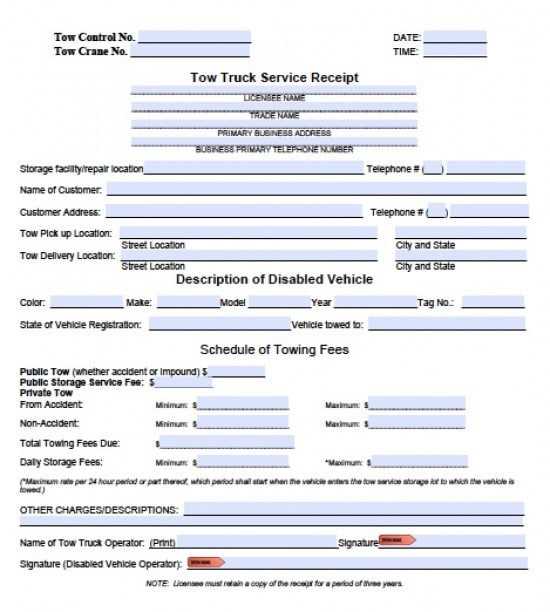

Understanding Vehicle Recovery Service Charges

When it comes to vehicle recovery services, charges can vary depending on several factors. These costs are typically influenced by the distance traveled, the complexity of the recovery, and any additional services provided, such as storage or urgent assistance. It’s essential to understand how these charges are calculated to ensure transparency and avoid misunderstandings between service providers and clients.

Here are some of the key factors that contribute to the overall cost of recovery services:

- Distance Traveled: The farther the vehicle needs to be transported, the higher the charge. Many service providers calculate a base rate and add a fee per mile or kilometer traveled.

- Type of Vehicle: Larger or more specialized vehicles may require different equipment for safe recovery, which can affect the cost. For instance, heavy-duty trucks or vehicles stuck in difficult locations may incur additional fees.

- Time of Service: Emergency or after-hours assistance typically comes with higher charges. Services rendered during peak hours or late at night are often priced at a premium.

- Recovery Location: If the vehicle is in a hard-to-reach or hazardous location, extra labor and equipment may be required, leading to an increase in service costs.

- Additional Services: Services such as winching, storage, or repair may also add to the overall cost. Some companies offer bundled packages, while others charge separately for each additional service provided.

It’s crucial for both customers and service providers to clearly communicate the pricing structure upfront to avoid disputes. A detailed breakdown of charges can help customers understand what they are paying for and ensure they receive fair service for the work performed.

Breaking Down Vehicle Recovery Charges on Payment Records

When detailing service fees on payment records, it’s important to provide clarity and transparency regarding the costs involved. A well-structured breakdown helps clients understand exactly what they are paying for, ensuring there are no surprises and fostering trust between the service provider and customer. By separating each charge and explaining its purpose, you make it easier for customers to accept and process the payment.

Here are some common components that should be included when breaking down vehicle recovery charges:

- Base Service Fee: This is the standard fee for performing the recovery, which covers the basic cost of labor and equipment. It’s typically the first charge listed and can vary depending on the company’s pricing structure.

- Distance Fee: If the vehicle needs to be transported over a certain distance, a per-mile or per-kilometer fee is often applied. This is especially relevant for long-distance recoveries.

- Vehicle Type Charge: Larger or more complex vehicles may require special equipment, resulting in an additional charge. For example, heavy-duty vehicles may need a different type of truck or crane to complete the service.

- Time of Service Premium: Some companies apply extra fees for services rendered outside of regular working hours, such as nighttime or holiday recoveries. These should be clearly identified on the record.

- Additional Services: Charges for extra services, such as winching, vehicle storage, or roadside assistance, should be listed separately. These fees should include a brief description of what each service entailed.

- Hazardous or Difficult Location Fee: If the recovery takes place in a difficult-to-reach area, such as off-road terrain or congested urban environments, an additional fee for this challenge should be included.

By organizing the costs in a detailed and understandable format, clients will have a clear view of how the final amount was determined, promoting a positive experience and reducing the likelihood of disputes. This level of transparency ensures that both parties are fully aware of the charges involved in the service provided.

How to Include Tax on Vehicle Recovery Payment Records

When documenting charges for vehicle recovery services, it’s important to correctly apply tax rates to ensure compliance with local regulations. Tax should be added to the total amount due, and it should be calculated based on the applicable percentage for your region. Including the correct tax calculation is essential for providing transparency and avoiding potential legal issues.

Here are some key steps to properly include tax on recovery service payment records:

- Identify the Tax Rate: The first step is to know the tax rate that applies to your service in your jurisdiction. This may vary based on the type of service provided or the location where the service is performed.

- Calculate the Tax Amount: Once you know the rate, multiply the total charges (before tax) by the tax percentage. For example, if the total charge is $200 and the tax rate is 10%, the tax amount would be $20.

- List the Tax Separately: Clearly separate the tax amount from the base charges on the payment record. This helps clients see the breakdown of what they are paying, with a specific line item for tax.

- Provide the Total Due: After calculating the tax, add it to the total amount of the service and clearly show the final amount due. This total should reflect both the service charges and the tax applied.

It’s important to be transparent and accurate in calculating and listing tax on service documents. By clearly showing both the taxable amount and the tax, you ensure that customers understand the full cost of the service and comply with financial regulations.

Calculating Tax for Vehicle Recovery Services

When providing vehicle recovery services, it’s essential to ensure that tax is properly calculated and applied to the final charges. This not only helps businesses stay compliant with local tax laws but also maintains transparency for customers. Tax calculations may vary depending on the location, service type, and local regulations, so understanding the correct process is crucial for both service providers and clients.

Steps for Accurate Tax Calculation

- Determine the Applicable Tax Rate: Research the tax rate for recovery services in your area. Different regions may have varying tax rates based on the type of service provided or location.

- Calculate the Base Amount: Before tax, calculate the total cost of the service, including any additional fees or charges. This should reflect all charges that are subject to tax.

- Multiply by the Tax Rate: Once the base amount is determined, multiply it by the applicable tax rate to calculate the tax amount. For example, if the total service fee is $150 and the tax rate is 8%, the tax would be $12.

- Add Tax to Final Total: After calculating the tax, add it to the base fee. The total amount due will be the sum of the service charges and the tax.

Example of Tax Calculation

- Service Fee: $200

- Tax Rate: 10%

- Calculated Tax: $200 × 0.10 = $20

- Total Amount Due: $200 + $20 = $220

By following these steps, businesses can easily calculate the appropriate tax and ensure their customers are charged accurately. Always verify the local tax rules and rates, as these can fluctuate based on various factors such as service types and regional laws.

Automating Service Charge Generation

Automating the process of generating billing statements can save significant time and reduce errors for service providers. With the right tools, businesses can streamline the creation of detailed documents, ensuring accuracy and efficiency. Automation helps in quickly producing consistent documents, making it easier to handle large volumes of transactions while maintaining a professional appearance for each service.

Benefits of Automating Billing Statements

- Time-Saving: Automation allows businesses to generate documents in minutes rather than hours, freeing up time for other essential tasks.

- Consistency: Automated systems ensure that each document follows the same format, which improves professionalism and reduces the risk of mistakes.

- Error Reduction: By removing manual entry, automation minimizes the risk of human errors in calculations and data entry.

- Efficiency in Tracking: Automation allows for easy tracking and management of all created records, which simplifies accounting and customer follow-ups.

Steps to Automate Service Charge Creation

- Select Software or Tools: Choose a software or platform that offers automation features. Many billing systems include templates that auto-fill client details and service charges.

- Set Up Service Rates: Input your rates for various services, including any extra charges. The system can then calculate the total for each document automatically.

- Integrate with Your System: Link your automation tools with your customer database to allow seamless population of client details, reducing manual entry.

- Generate and Send Automatically: Once set up, the system can automatically generate and send the document to your clients, reducing administrative workload.

By embracing automation, businesses can create efficient workflows, enhance customer satisfaction, and focus on growing their services rather than spending time on repetitive tasks. Whether you’re a small operation or a large enterprise, automated systems can make a significant difference in managing service records and financial documents.

How Automation Can Save Time

In today’s fast-paced world, efficiency is key to success. Automating repetitive tasks within your business processes can save valuable time, allowing you to focus on higher-priority projects. By using automated systems to handle routine administrative functions, you can significantly reduce manual labor and minimize the potential for errors.

Key Advantages of Time-Saving Automation

- Speed: Automation allows tasks to be completed in a fraction of the time it would take manually. This means faster turnaround for your clients and quicker invoicing or service completion.

- Consistency: Automated systems follow predefined rules and templates, ensuring that every document or service record is created the same way, reducing inconsistencies and improving workflow.

- Reduced Human Error: By removing the human factor from repetitive tasks, automation reduces the chances of errors, such as data entry mistakes or miscalculations.

- Freeing Up Resources: The time saved can be redirected to other areas of your business, whether it’s improving customer service, developing new products, or managing business growth.

How Automation Cuts Down on Time-Wasting Tasks

- Streamlining Processes: Automation can simplify complex workflows, reducing the need for constant decision-making or intervention, and thus speeding up the overall process.

- Batch Processing: With automation, multiple documents or tasks can be handled simultaneously, allowing you to process a large volume of work without additional effort.

- Continuous Operation: Unlike human workers, automated systems can run 24/7, ensuring that tasks are being completed even when the team is offline or busy with other duties.

By incorporating automation into your operations, you not only speed up your processes but also increase overall productivity. This means more time for innovation, customer interaction, and growing your business while keeping operational costs in check.