Explore Our Invoice Template Gallery

Managing financial transactions with clients can often be a time-consuming and complex task, especially when it comes to maintaining clear, organized records. One of the most effective ways to streamline this process is by using well-structured, customizable forms designed to suit a variety of needs. These documents not only ensure accuracy but also contribute to a professional image when dealing with clients and customers.

Whether you’re a freelancer, small business owner, or working in a larger company, having access to a variety of designs tailored to different industries can make all the difference. The right documents can simplify the invoicing process, reduce errors, and save valuable time. With a selection of easy-to-use formats, it becomes easier to maintain consistency in your billing system.

In this section, you will find a wide range of options that cater to different business needs, offering flexibility in how details are presented. The variety allows for personalization, ensuring that each document aligns with your branding and professional requirements. By exploring these choices, you can find the perfect fit for your business’s financial transactions.

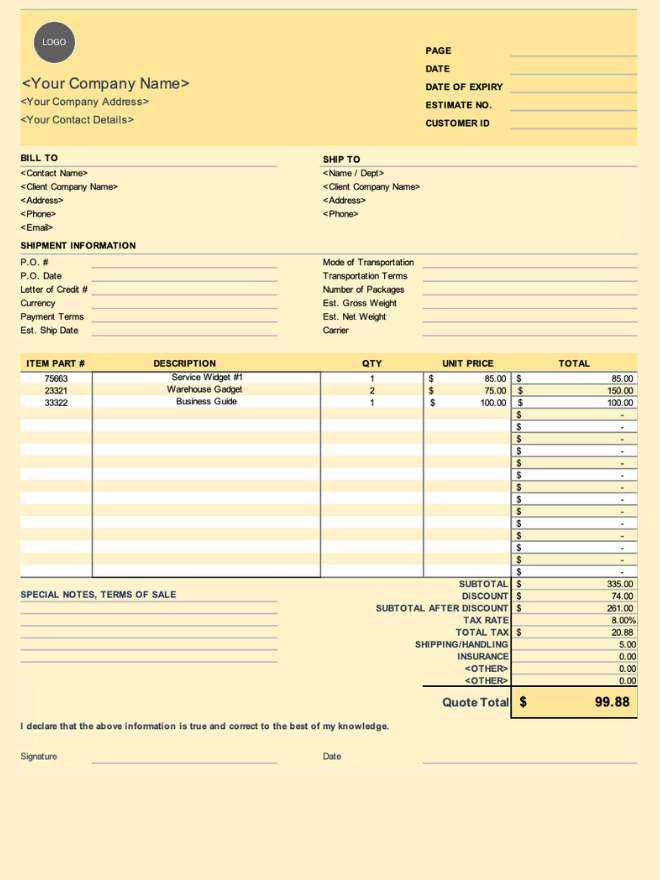

Invoice Template Gallery

When it comes to handling client transactions, having a set of well-designed, customizable forms is essential for ensuring smooth and professional billing. The variety of options available can cater to different industries and business needs, allowing for flexibility and personalization. A carefully selected form not only helps in maintaining organization but also reflects the professionalism of your business.

In this section, you’ll discover a range of document styles that are designed to meet various requirements. Whether you need a simple structure or something more complex, there are options that can be easily tailored to your preferences.

- Basic Billing Forms: Ideal for small businesses and freelancers who require a straightforward, easy-to-use solution.

- Detailed Transaction Sheets: Perfect for industries with more complex billing structures, such as consultancy or project-based work.

- Customizable Layouts: These are great for businesses looking to add personal branding elements, like logos and color schemes, to their financial documents.

- Industry-Specific Designs: Forms crafted specifically for certain sectors, such as healthcare, retail, or construction, making it easier to include relevant information.

- Recurring Payment Documents: Created for businesses with subscription models or regular payments, these forms allow for the inclusion of repeat billing cycles.

By exploring these various styles, you can easily find a suitable solution to streamline your financial processes. Each option can be customized to include all necessary fields, ensuring clarity and professionalism in every transaction.

Why Use an Invoice Template

Maintaining organized and accurate records is essential when it comes to managing financial transactions with clients. A structured approach to creating billing documents not only ensures professionalism but also reduces the risk of errors, helping businesses save time and avoid confusion. Utilizing pre-designed formats can significantly improve efficiency and consistency in your billing process.

Benefits of Using Pre-Designed Documents

- Time Savings: Pre-made designs reduce the time spent on manually creating forms from scratch. This allows you to focus more on your core business operations.

- Professional Appearance: A well-structured document reflects your business’s professionalism and attention to detail, fostering trust with clients.

- Consistency: By using the same design across all transactions, you ensure uniformity in your records, making it easier to track payments and reconcile accounts.

- Customization: Many designs are flexible and can be easily customized to include your business branding, logos, and specific information.

- Error Reduction: Pre-designed forms include all the necessary fields and reduce the chance of missing important details, helping avoid costly mistakes.

How Pre-Designed Forms Improve Billing Efficiency

- Streamlined Data Entry: With predefined fields for key details like client information, services, and payment terms, entering data becomes faster and more accurate.

- Automatic Calculations: Many formats come with built-in formulas to automatically calculate totals, taxes, and discounts, saving you time and ensuring accuracy.

- Easy Record Keeping: Consistent formats make it easier to store and retrieve past transactions, helping you stay organized and on top of your finances.

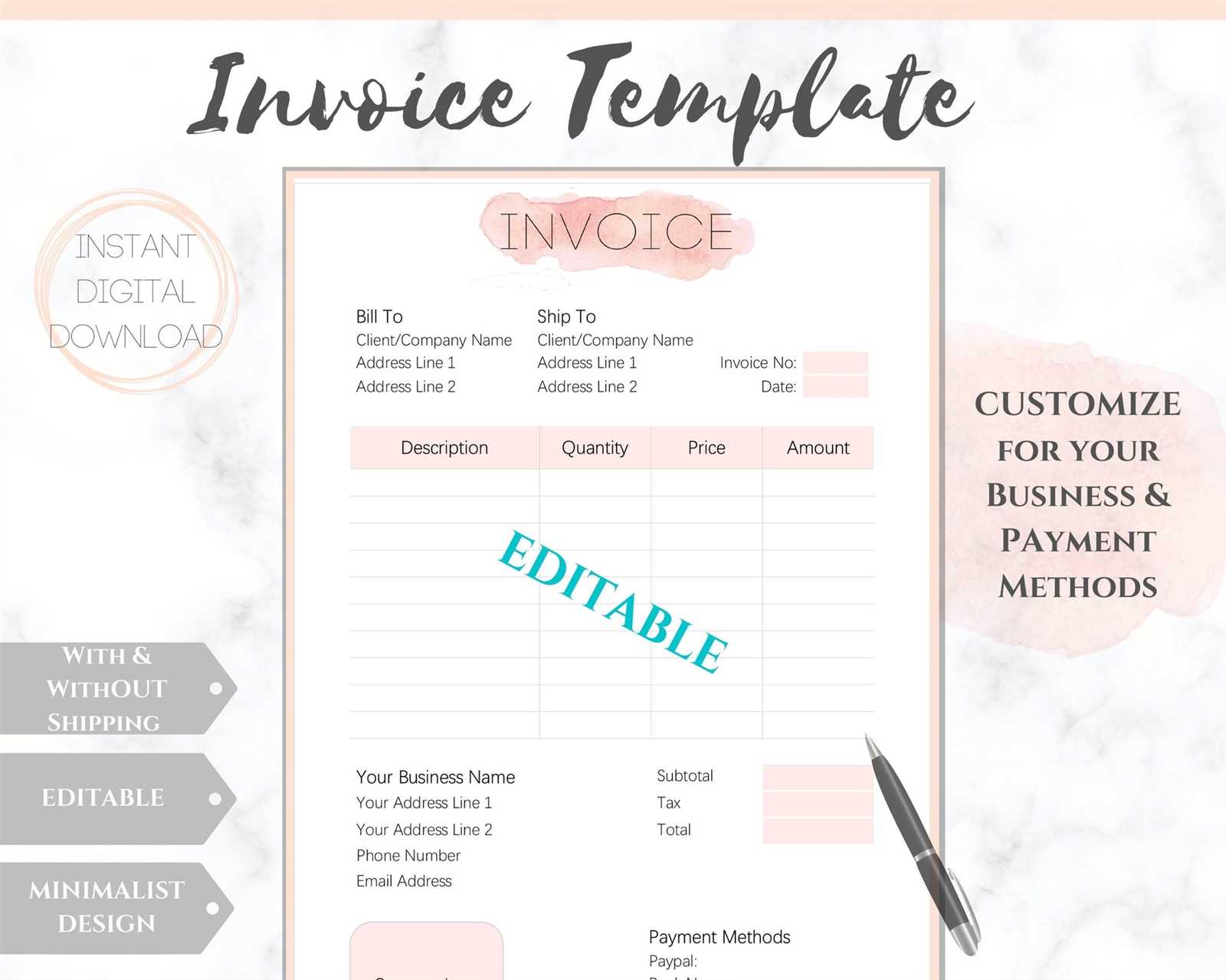

Benefits of Customizable Invoice Designs

Having the ability to adjust your billing documents to fit your specific business needs can greatly enhance both the functionality and appearance of your financial records. Customizable formats provide flexibility, allowing you to add or remove elements as necessary, ensuring the document serves its purpose without unnecessary complexity. This adaptability not only saves time but also contributes to a more personalized and professional interaction with clients.

Personalization for Business Branding

Customizable designs allow you to incorporate your brand’s identity into every transaction. This includes adding your business logo, adjusting color schemes, and choosing fonts that align with your overall branding. By maintaining a consistent visual presence, you reinforce brand recognition and professionalism in every communication.

Flexibility to Meet Specific Needs

- Tailored Information: Customizable formats allow you to include industry-specific details, such as itemized services, project milestones, or billing cycles, which can vary across businesses.

- Adapt to Client Preferences: Some clients may prefer specific formats or information to be presented in a certain way. Customizable options allow you to easily adjust documents to meet those preferences.

- Scalable for Growth: As your business evolves, your financial documents can evolve too. Add new fields or change layouts to match your growing operations without starting from scratch.

Incorporating customization into your billing documents ensures that they remain relevant, professional, and aligned with your business goals. This flexibility provides not only aesthetic appeal but also practical benefits that contribute to smoother business transactions.

Top Features to Look for in Templates

When selecting a design for your billing documents, it’s important to consider certain features that will enhance both functionality and ease of use. A good structure should not only make the document visually appealing but also ensure that all necessary information is included and easy to understand. Here are the key features you should look for in any form you plan to use for your business transactions.

| Feature | Description |

|---|---|

| Clarity and Readability | The design should be clean and simple, with clear headings, labels, and sections that make the document easy to read and navigate. |

| Customizable Fields | The ability to add, remove, or adjust fields allows you to tailor the document to your specific needs, ensuring all relevant details are included. |

| Professional Layout | A well-organized structure not only looks professional but also helps present all information in a logical, easy-to-understand order. |

| Automated Calculations | Some designs include built-in formulas that automatically calculate totals, taxes, and discounts, saving you time and reducing the chance of errors. |

| Legal Compliance | The format should include all necessary legal elements, such as terms of service, payment terms, and tax information, depending on your region or industry. |

| Brand Customization | Look for options that allow you to incorporate your company’s logo, color scheme, and fonts, helping to maintain brand consistency in all communications. |

Choosing a design with these essential features will make your billing process more efficient and ensure that your documents are both functional and professional. By prioritizing these key elements, you can create a smooth and error-free experience for both you and your clients.

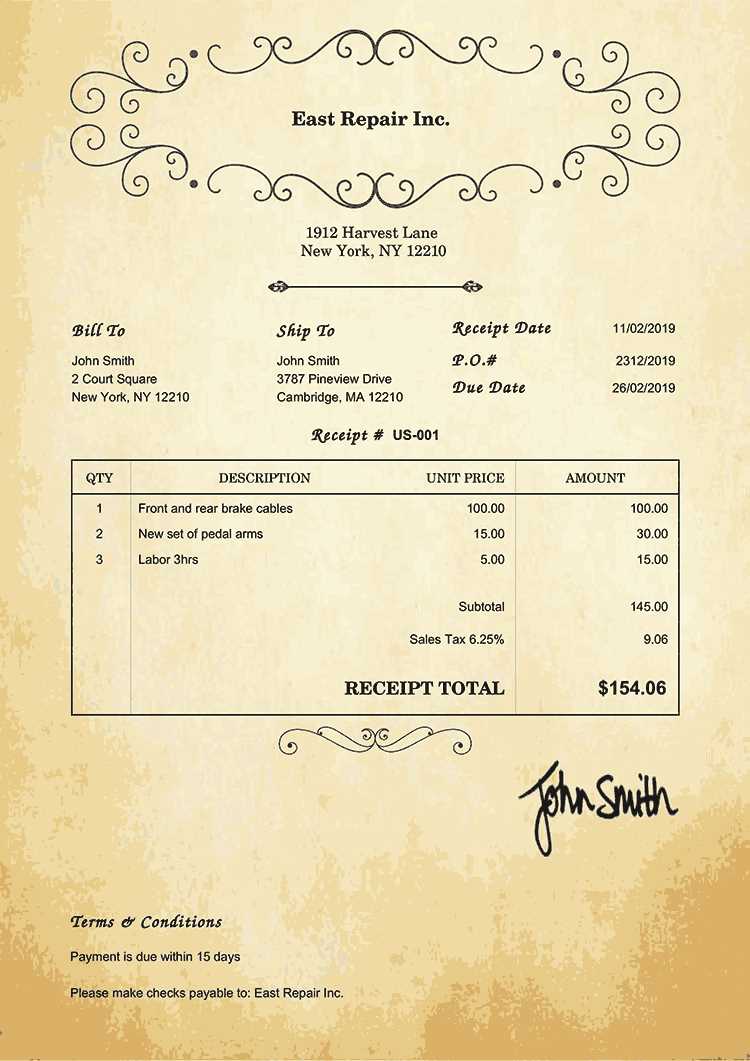

How to Create Professional Invoices

Creating a professional billing document is essential for maintaining a positive relationship with clients and ensuring smooth business transactions. A well-crafted document not only ensures clarity but also reflects the professionalism of your business. Whether you’re a freelancer or a business owner, following a few key steps will help you create effective and polished records for every transaction.

- Include Essential Information: Always start with the basic details such as your business name, contact information, and the client’s details. This ensures that the document is personalized and easy to identify.

- Clearly List Services or Products: Provide a detailed breakdown of the products or services provided, including quantities, unit prices, and descriptions. This helps clients understand exactly what they’re being billed for.

- Specify Payment Terms: Clearly state the payment due date, any late fees, and accepted payment methods. This helps set expectations and avoid confusion.

- Provide a Total: Ensure that the total amount is clearly visible and includes any applicable taxes, discounts, or additional fees. This allows clients to easily see what they owe.

- Maintain a Consistent Layout: Use a clean, organized layout that makes it easy for clients to read and understand. Consistency in your document style builds trust and professionalism.

By following these steps, you can create professional billing records that are not only easy to understand but also reinforce your credibility. A polished, well-structured document ensures that your business transactions remain smooth and efficient, while also maintaining a professional appearance with every client interaction.

Choosing the Right Template for Your Business

Selecting the right design for your financial documents is a crucial step in ensuring your business runs efficiently and professionally. A well-suited format can help you maintain organization, streamline processes, and project a polished image to your clients. The right structure depends on your business type, client needs, and the level of customization required.

Consider Your Business Type

Different industries may have different requirements for their billing documentation. For example, service-based businesses might need a layout that highlights time worked or project milestones, while product-based businesses will focus more on itemized lists with quantities and prices. By choosing a format that reflects your business operations, you can ensure clarity and relevance for your clients.

Flexibility and Customization

- Industry-Specific Design: Choose a structure that fits your niche, whether you’re in construction, consulting, or retail. Customization options should allow you to tailor the format to meet industry norms and expectations.

- Space for Branding: Look for options that let you add your logo, business name, and color scheme to maintain a consistent brand identity in all client-facing documents.

- Ease of Use: The format should be user-friendly, offering clear fields for all necessary information and making the process of completing the document as straightforward as possible.

Choosing the right design for your billing process is not just about functionality but also about reflecting your business values and enhancing your professional image. A carefully chosen format ensures that each transaction is handled with precision and professionalism, contributing to positive client relationships and smooth operations.

Free vs Paid Invoice Templates

When deciding between free and paid designs for your financial documents, it’s important to weigh the benefits and limitations of each option. Free formats can be a good starting point, especially for small businesses or freelancers with limited resources. However, as your business grows, you may find that paid designs offer more advanced features, greater customization, and additional support that free versions simply can’t match.

Free Options typically come with basic features and can be a great choice if you’re just starting out or have a limited budget. These formats are usually easy to find and can serve the purpose of simple record-keeping and transactions. However, they may lack some of the advanced functionalities you need for larger or more complex operations.

Paid Options, on the other hand, often offer more robust features, such as automatic calculations, customizable fields, and professional design layouts. These formats are typically more refined, allowing for greater customization to suit your business needs and branding. While they come with a cost, the investment may be worthwhile if it leads to improved efficiency and a more polished appearance for your financial documents.

Ultimately, the choice between free and paid options depends on your specific business needs, budget, and the level of professionalism you wish to convey. A free format might be sufficient for basic needs, but as your business expands, investing in a paid design can provide the tools and flexibility required for growth.

How to Edit and Personalize Templates

Customizing your billing documents is an essential step in making them more relevant to your business needs. Whether you’re adjusting the design, adding specific fields, or ensuring the document aligns with your brand, the process of personalization can help ensure your communications are clear, professional, and tailored to your requirements. By following a few simple steps, you can transform a standard format into one that reflects your business identity and meets your functional needs.

Start with the Basics – Begin by adding your company name, logo, and contact details. This establishes your brand presence and makes the document identifiable to clients. If you have a specific layout in mind, adjust the order of sections to highlight what matters most to your business, such as payment terms or service descriptions.

Modify Fields to Suit Your Needs – Depending on your business type, you may need to add or remove certain sections. For example, service-based businesses might include work hours or project milestones, while product-based businesses may focus more on itemized pricing and quantities. Be sure to include all necessary information to avoid confusion.

Enhance Visual Appeal – Personalization isn’t just about content; it’s also about how the document looks. Choose fonts and colors that align with your branding, and ensure there is enough contrast to keep the document easy to read. Well-chosen colors and logos contribute to a polished, professional appearance.

By editing and personalizing your billing documents, you create a unique, branded experience that communicates professionalism and clarity to your clients. Customization ensures that every transaction is reflected in a manner that suits both your business operations and your clients’ expectations.

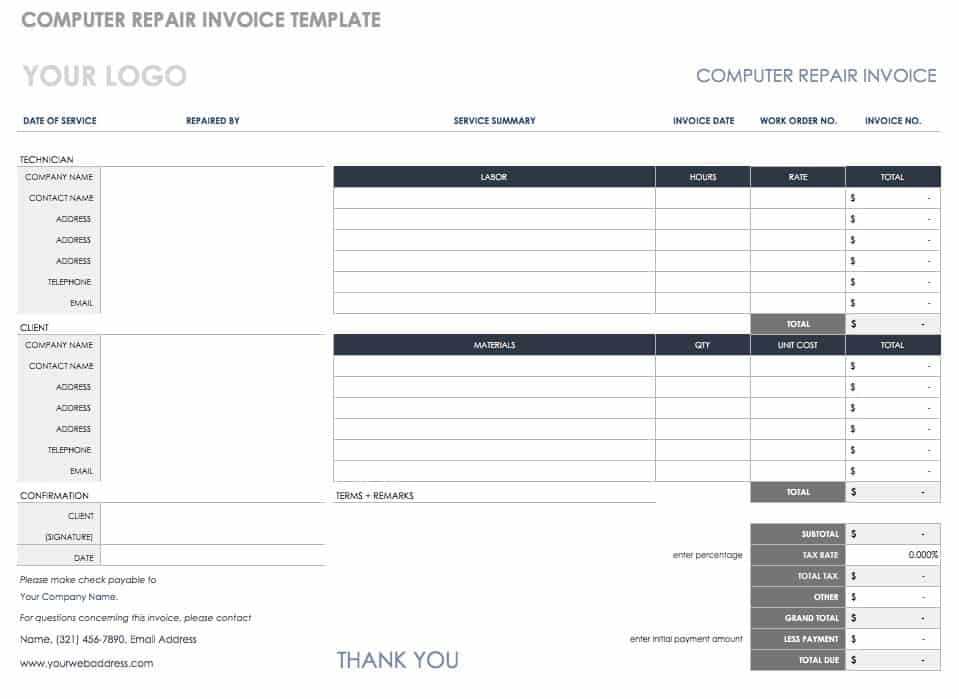

Invoice Templates for Different Industries

Every business has its unique set of needs when it comes to documenting transactions. The right format for your financial documents can make a significant difference in how clearly and efficiently you communicate with your clients. Various industries require specific features and layouts, depending on the type of goods or services offered. Tailoring your billing format to your industry ensures that all essential details are included, and the document serves its intended purpose effectively.

Service-Based Industries

In fields like consulting, marketing, or design, a streamlined, professional document is key. These formats often need space to break down hourly rates, project milestones, or ongoing service costs. Adding sections for hours worked, detailed descriptions, and any applicable taxes or service fees is essential to avoid confusion and provide transparency.

Product-Based Businesses

For businesses selling physical goods, the focus tends to be on listing items with quantities, unit prices, and product descriptions. A clean, organized layout that helps clients quickly understand what they’re being charged for is important. These formats often feature more extensive itemized sections, allowing for the inclusion of inventory numbers, item categories, and any shipping or handling charges.

Industry-Specific Features: Depending on your niche, your format may include specialized elements. For example, construction businesses may need space for project milestones, while retailers may require options to handle bulk discounts and loyalty points.

By choosing or customizing the right design for your industry, you can ensure that your financial records meet both your business’s needs and the expectations of your clients. Tailoring your documents accordingly helps maintain professionalism and boosts the credibility of your business.

Ensuring Legal Compliance with Invoices

Proper documentation is a critical aspect of running a business, and ensuring that your financial records meet legal requirements is essential to avoid potential issues. A well-structured document not only helps maintain professionalism but also guarantees that you are complying with local tax laws and business regulations. Understanding what details are legally required can help you stay on the right side of the law and avoid penalties.

To stay compliant, it’s important to include key information in your records, such as:

| Required Information | Purpose |

|---|---|

| Business Name and Address | Identifies the company issuing the document and its location, as required by law. |

| Client Name and Address | Ensures that the transaction is properly linked to the correct party. |

| Unique Reference Number | Helps track transactions and avoid confusion, ensuring proper documentation. |

| Tax Identification Number | Required by many jurisdictions for tax purposes to verify your business as a tax-registered entity. |

| Breakdown of Goods or Services | Legally necessary for transparency, showing what was purchased and at what price. |

| Payment Terms | Ensures clarity around when payment is due and any penalties for late payment, if applicable. |

| Date of Transaction | Confirms when the sale took place, which is important for tax reporting and record-keeping. |

Adhering to Legal Standards: Many countries have specific rules about what must be included in billing documents. It’s important to stay informed about the laws in your jurisdiction and to adjust your documentation practices accordingly. This not only helps you avoid legal trouble but also fosters trust with clients, who can rest assured that all transactions are handled transparently and professionally.

By ensuring your records are in compliance with legal requirements, you protect your business from potential legal disputes and penalties. A little attention to detail can go a long way in maintaining a professional reputation and smooth operations.

Tips for Streamlining Your Billing Process

Efficient billing is crucial for maintaining smooth operations and ensuring timely payments. By simplifying and automating various aspects of the process, businesses can reduce errors, save time, and improve cash flow. Here are some actionable strategies to help you streamline your billing procedures and make the entire process more efficient.

Automate Routine Tasks

One of the most effective ways to optimize your billing process is by automating repetitive tasks. Use accounting software or online tools that can generate and send bills automatically, reducing the need for manual input. Automated systems can also track overdue payments and send reminders, helping to ensure timely settlements without requiring constant oversight.

Standardize Your Formats

Consistency in your documentation is key to efficiency. Using a standardized format for all your records helps save time and ensures clarity. Whether you’re dealing with a client for the first time or sending recurring bills, having a uniform structure for your documents reduces the chances of mistakes and makes the entire process smoother for both parties.

Consolidate Payments – Where possible, offer your clients multiple payment methods, and consider offering discounts for early payments or bulk transactions. Consolidating payments into fewer, larger transactions can reduce the number of bills you have to manage and expedite the payment process.

By applying these strategies, you can significantly reduce administrative time, increase accuracy, and keep your billing process running smoothly. Streamlining your workflow not only enhances efficiency but also helps maintain strong client relationships and ensures a steady cash flow.

Understanding Invoice Formatting and Layout

The structure and presentation of your financial documents play a crucial role in how clearly the details are conveyed to your clients. An organized, professional layout helps prevent confusion, ensures transparency, and makes it easier to track transactions. Proper formatting not only improves the overall user experience but also ensures that all required information is easily accessible and readable.

A well-designed document should follow a logical flow, guiding the reader through essential details such as payment terms, itemized charges, and due dates. The layout should be simple yet comprehensive, prioritizing clarity without overwhelming the reader with unnecessary information. By creating a clean, consistent structure, you can enhance professionalism and reduce the likelihood of disputes or misunderstandings.

Key Considerations for Layout: Ensure that the layout includes sections for all necessary information, such as client details, item descriptions, total amount due, and payment instructions. Group related information together and leave enough white space to keep the document easy to navigate. Clear headings and bold text for key figures can also help make important details stand out.

Mastering document layout is not just about aesthetics; it’s about functionality. A well-structured design enables both you and your clients to quickly access and verify crucial information, ensuring a smooth and professional experience for all parties involved.

How to Add Payment Terms and Conditions

Clear payment terms and conditions are essential for setting expectations and ensuring smooth transactions between businesses and clients. These guidelines help establish the rules for when and how payments should be made, preventing confusion and minimizing the potential for disputes. By including detailed terms and conditions in your financial documentation, you set clear boundaries and avoid any misunderstandings regarding payments.

Key Elements to Include

When outlining your payment terms, make sure to include the following key elements:

- Due Date: Specify the exact date when the payment is expected to be made. This helps avoid any ambiguity and encourages timely payments.

- Accepted Payment Methods: Clearly state which payment methods you accept, such as bank transfers, credit cards, or digital wallets, to ensure clients know how to pay.

- Late Payment Fees: Mention any penalties or interest charges for overdue payments. This serves as a deterrent to late payments and ensures that clients take your deadlines seriously.

- Discounts for Early Payments: If applicable, offer a discount for early sett

Common Mistakes to Avoid with Invoices

When handling financial documents, small mistakes can lead to bigger problems, including delayed payments, client dissatisfaction, and even legal issues. Ensuring that all the details are accurate and well-organized is essential for maintaining professionalism and ensuring smooth business transactions. Below are some of the most common errors to avoid when preparing your financial records.

- Missing or Incorrect Information: Always double-check that your client’s name, address, and contact details are correct. An error in this section can delay payments and cause confusion.

- Ambiguous Payment Terms: Make sure that the terms of payment are clear. Vague statements can result in misunderstandings and disputes regarding due dates and amounts owed.

- Failure to Include All Fees: If there are any additional costs, such as taxes or delivery fees, be sure to list them separately. Omitting this can lead to a lack of clarity and potentially unpaid balances.

- Not Including a Unique Reference Number: Every document should have a unique identifier. This helps with organization and ensures that payments can be tracked and matched with the correct client and transaction.

- Incorrect Calculation of Totals: Always verify your totals before sending. Simple errors in math can lead to clients paying incorrect amounts and create unnecessary confusion.

- Using Unprofessional Formatting: A messy or unorganized document can make your business appear unprofessional. Always use a clear, structured layout with readable fonts and well-spaced sections.

Avoiding these common mistakes can help prevent delays and misunderstandings, allowing you to maintain positive relationships with clients while ensuring that you are paid on time. By focusing on accuracy, clarity, and professionalism, you can create a more efficient and effective financial process for your business.

How to Handle Late Payments with Invoices

Late payments are a common challenge for businesses of all sizes. When clients delay their financial obligations, it can affect cash flow and disrupt operations. Handling late payments effectively requires a combination of clear communication, firm policies, and legal considerations. Below are some strategies to ensure that overdue payments are addressed promptly and professionally.

- Set Clear Payment Terms: From the outset, make sure your payment terms are clearly outlined. Specify the due date and any penalties for late payments to set expectations from the beginning.

- Send Reminders: If payment has not been received by the due date, send a polite reminder. Often, clients may have simply overlooked the payment, and a friendly reminder can help resolve the issue quickly.

- Offer Multiple Payment Methods: Providing various ways for clients to make payments–such as bank transfer, credit card, or online payment systems–can reduce barriers and encourage prompt payments.

- Apply Late Fees: Clearly state any late payment fees that will be charged after the due date. Applying these fees consistently can serve as a deterrent to future delays and help maintain cash flow.

- Communicate Directly: If a payment is significantly overdue, contact the client directly. Be firm but respectful, and inquire if there are any issues preventing payment. Understanding the reason behind the delay can sometimes lead to a solution.

- Offer Payment Plans: If a client is struggling to pay the full amount, consider offering a payment plan. This can help you recover the funds while maintaining a good relationship with the client.

- Use Legal Channels: If payments remain unpaid after multiple reminders and negotiations, you may need to seek legal advice. This can include sending a formal demand letter or, in extreme cases, pursuing legal action to recover the debt.

By taking proactive steps and maintaining a professional approach, businesses can manage late payments more effectively. Having a clear payment structure, coupled with consistent follow-ups, ensures that overdue invoices are addressed and that your business’s financial health remains intact.

Invoice Templates for Small Businesses

For small businesses, maintaining a consistent and professional approach to billing is crucial. Using standardized documents helps ensure that transactions are processed efficiently and all necessary information is conveyed clearly to clients. These documents not only streamline financial operations but also contribute to a company’s image and credibility. Below are key aspects to consider when choosing the right documents for your small business.

- Simplicity and Clarity: Small businesses often deal with a variety of customers, so it’s important to have documents that are straightforward and easy to understand. Avoid overly complex layouts and focus on providing essential information like amounts due, services rendered, and payment terms.

- Branding Consistency: The look of your billing documents should align with your business’s branding. This includes using your logo, business colors, and fonts that are consistent with your website and marketing materials.

- Customization Options: Having documents that can be easily customized allows for personalization based on the client’s needs or the type of service provided. This ensures that each document fits the unique nature of the transaction while maintaining a professional appearance.

- Legal Compliance: It’s important to ensure your documents adhere to any local tax or legal requirements. This may include having space for tax identification numbers, clear payment terms, or other legal stipulations depending on your location.

- Tracking Capabilities: Good business documents should also include tracking features to help monitor unpaid bills. This can be easily achieved with numbered entries and a due date, ensuring that you can follow up on overdue payments efficiently.

By implementing well-designed documents for your billing process, you can enhance your business’s professionalism, improve client relationships, and avoid misunderstandings over payments. Properly formatted and detailed documents are key to efficient financial management, even for the smallest businesses.

How to Automate Invoice Generation

Automating the creation of billing documents can save businesses a significant amount of time and effort. With the right tools and processes in place, generating accurate and timely documents becomes a seamless task that reduces human error and increases efficiency. By leveraging software or cloud-based solutions, you can automate key aspects of the billing process, ensuring that each document is generated and sent promptly without manual intervention.

Choosing the Right Software

To begin automating your billing documents, it’s important to select software that suits your business needs. There are numerous tools available, ranging from simple invoicing apps to more comprehensive accounting software with automation features. When evaluating options, consider the following:

- Ease of Use: Choose a tool with a user-friendly interface that doesn’t require a steep learning curve.

- Customization Options: Ensure the software allows you to customize documents with your branding, payment terms, and required fields.

- Integration with Other Systems: Look for tools that integrate with your existing accounting software or CRM to streamline data flow.

Setting Up Automation Rules

Once you’ve selected your software, the next step is to configure it for automated generation. Here are some key components to set up:

- Recurring Billing: Set up automation for clients who require recurring payments. The software will automatically generate and send documents on a scheduled basis.

- Payment Reminders: Configure automatic reminders for overdue payments, helping you follow up with clients without manual tracking.

- Pre-Filled Data: Input client details, services rendered, and payment terms so that every document is generated with accurate, pre-filled information.

By automating the creation of billing documents, businesses can streamline their processes, reduce errors, and save valuable time, allowing them to focus on other important aspects of operations.

Maintaining Consistency in Your Invoices

Consistency in your billing documents is essential for building trust with clients and ensuring smooth business operations. Whether you’re sending invoices manually or through automated systems, maintaining a uniform format helps present your business as professional and organized. It also makes it easier for both you and your clients to track payments and understand the details of each transaction.

To maintain consistency, it’s important to establish a clear, repeatable structure for your billing documents. This includes using the same layout, fonts, colors, and fields across all documents. Standardizing these elements not only improves readability but also reduces the risk of errors or omissions, ensuring that each document reflects your brand accurately.

Furthermore, consistency can help streamline the administrative process. When your documents follow a uniform style, your team will spend less time reviewing and correcting discrepancies. This attention to detail also fosters better relationships with clients, who will appreciate the clarity and professionalism of each communication.