Bookkeeper Invoice Template for Efficient Financial Management

Proper financial documentation is essential for maintaining organized and accurate records in any business. Having a reliable structure for billing is crucial for smooth operations, ensuring both timely payments and clear communication with clients. Using standardized formats can simplify the process and minimize errors, leading to better financial management.

By using a well-designed billing format, businesses can easily track transactions, reduce confusion, and ensure compliance with financial regulations. These documents serve as a clear record of services rendered, making it easier to manage cash flow and maintain healthy relationships with clients. A clear and professional format also helps businesses present themselves more credibly and efficiently.

Investing in a structured approach to financial documentation is a smart move for any entrepreneur or company. It allows for better control over finances, smooth interactions with clients, and the potential for growth. Whether you’re just starting or managing a large-scale operation, having an effective system in place is vital for ongoing success.

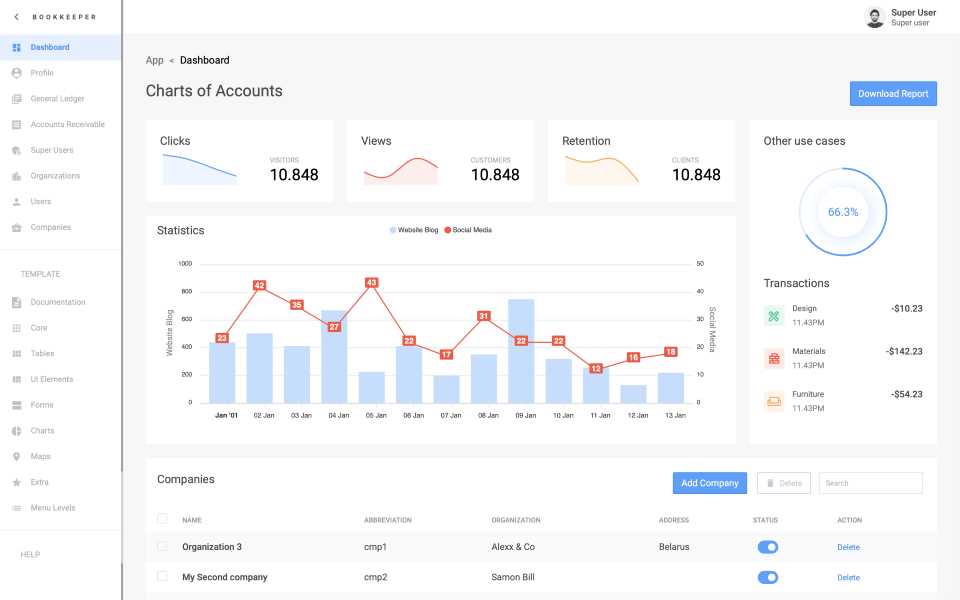

Bookkeeper Invoice Template Overview

Efficient financial record-keeping is essential for maintaining a smooth and organized business workflow. By utilizing a standardized document for billing, businesses can ensure accuracy, streamline payment processes, and create professional interactions with clients. Such a document should encompass all necessary details while remaining easy to understand and straightforward.

Core Components of a Billing Document

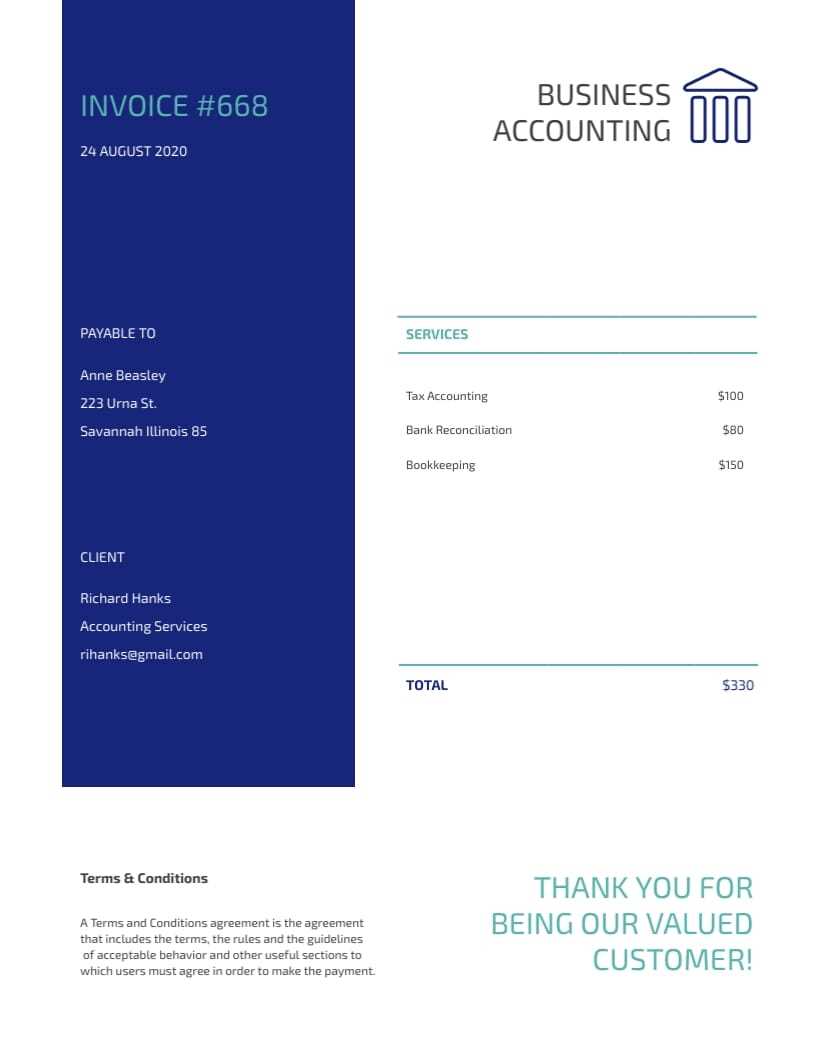

An ideal billing format includes several key elements that help both the service provider and client stay on the same page. These components help ensure transparency and reduce any potential confusion. Some of the key sections include:

- Service Description: A clear breakdown of services rendered or products delivered.

- Amounts Due: Precise amounts that are owed for each service or item listed.

- Payment Terms: The due date, late fees, or any other terms that govern the payment process.

- Client Information: Details about the client, including name, contact, and address.

- Contact Information: Business details, including the address, phone number, and email for future communication.

Advantages of Using a Standardized Format

Using a consistent and well-structured format provides several advantages for any business:

- Time Efficiency: Reduces the time spent creating custom documents for each client.

- Accuracy: Minimizes the chance for errors by ensuring that all necessary information is included.

- Professionalism: Enhances the business’s credibility and fosters trust with clients.

- Streamlined Tracking: Simplifies record-keeping and makes it easier to track payments and outstanding balances.

Why Use an Invoice Template

Having a well-organized structure for financial documents is crucial for maintaining order in business transactions. By utilizing a standardized format, companies can ensure consistency, reduce errors, and save valuable time. These documents play an important role in facilitating clear communication between businesses and their clients while ensuring accurate record-keeping.

Time and Effort Saving

Creating a new document from scratch for each client or project can be time-consuming. By using a pre-structured format, businesses can quickly fill in the necessary details and avoid spending unnecessary time formatting or adjusting the layout. This efficiency allows more time to focus on other essential tasks.

Improved Accuracy

Using a consistent structure helps eliminate common errors in financial records. The predefined sections ensure that all required information is included, and the layout provides clarity. This consistency can also reduce misunderstandings between the business and clients regarding payments and services rendered.

| Benefit | Description |

|---|---|

| Consistency | Ensures all documents have the same structure and necessary details, preventing omissions. |

| Time-saving | Reduces the need to create documents from scratch every time, improving efficiency. |

| Clarity | Clearly presents all relevant information, making it easier for both parties to understand. |

| Professionalism | A polished, well-designed format enhances business reputation and credibility. |

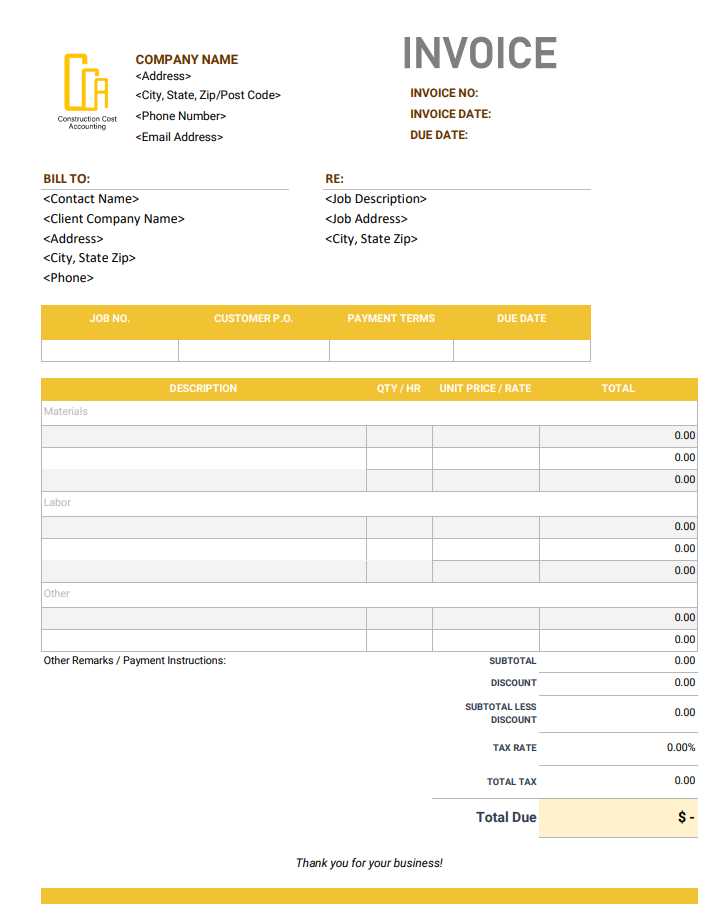

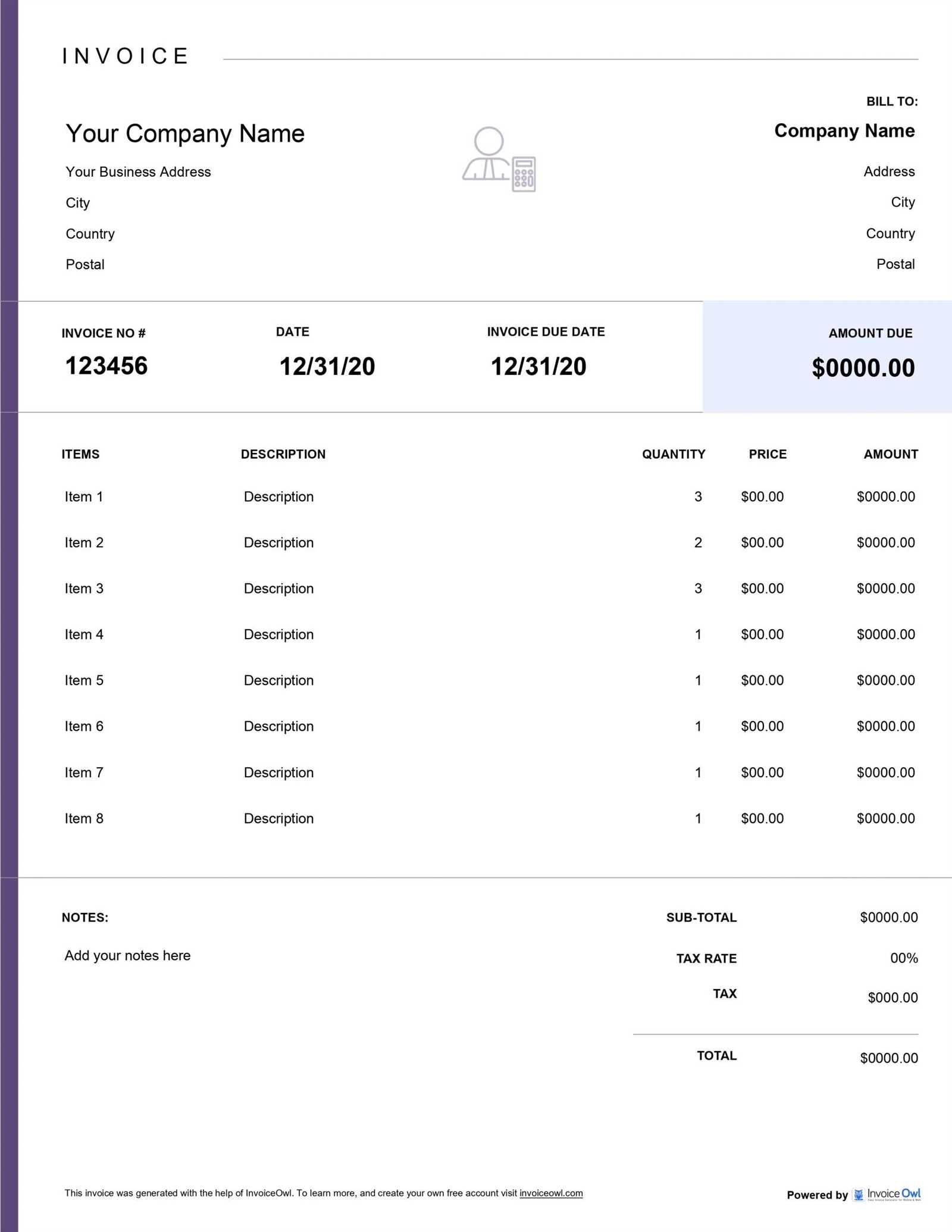

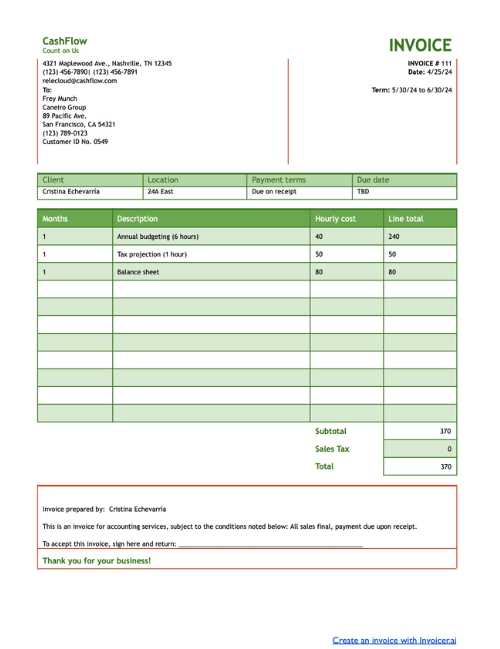

Key Features of a Billing Document

A well-organized financial document is essential for keeping track of transactions and ensuring smooth communication between a business and its clients. The right structure not only facilitates accurate payments but also builds trust and professionalism. Several critical elements should be included to ensure that these documents serve their intended purpose effectively.

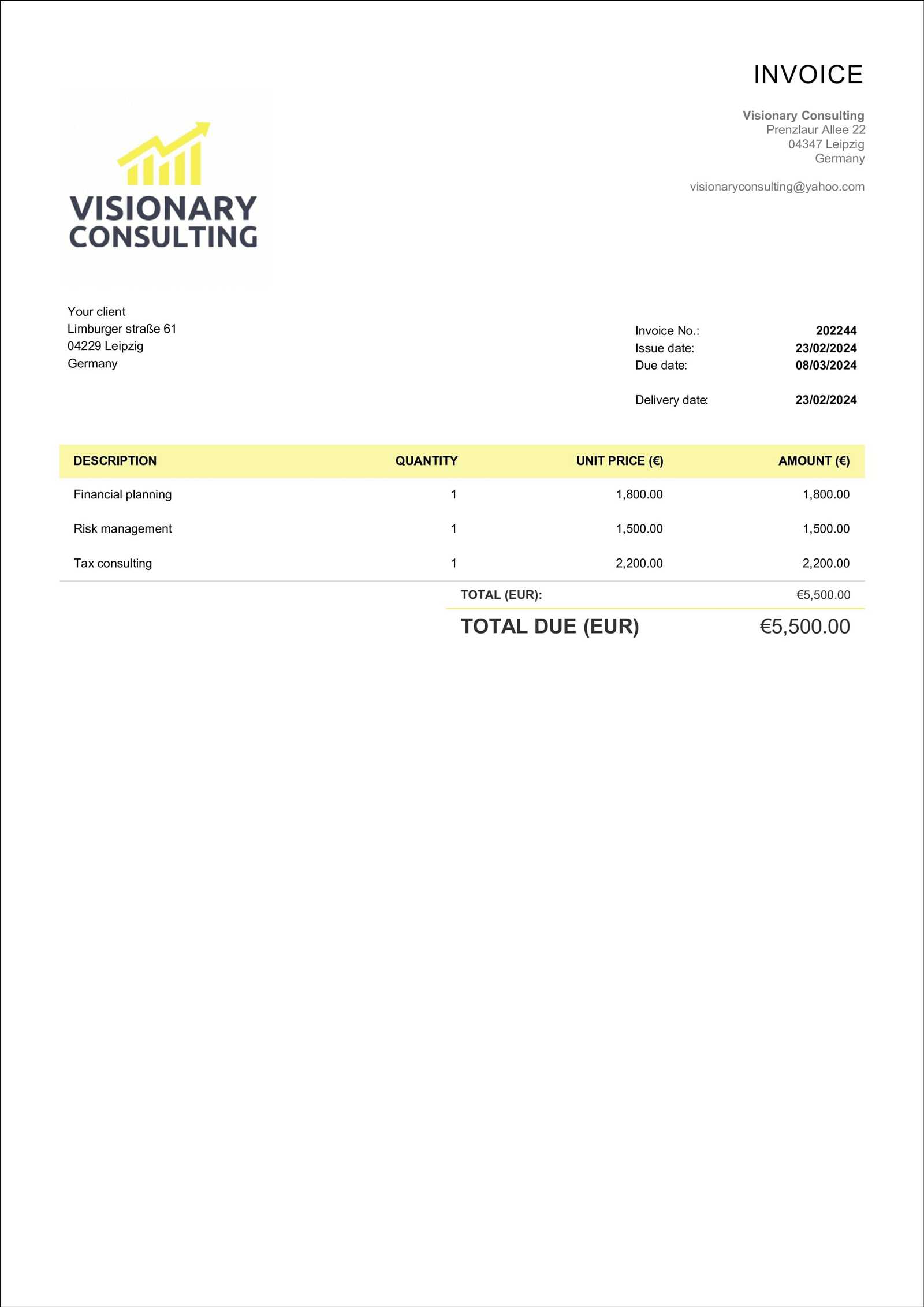

Essential Information

Each financial record should contain the necessary details to avoid confusion and ensure transparency. Key sections typically include:

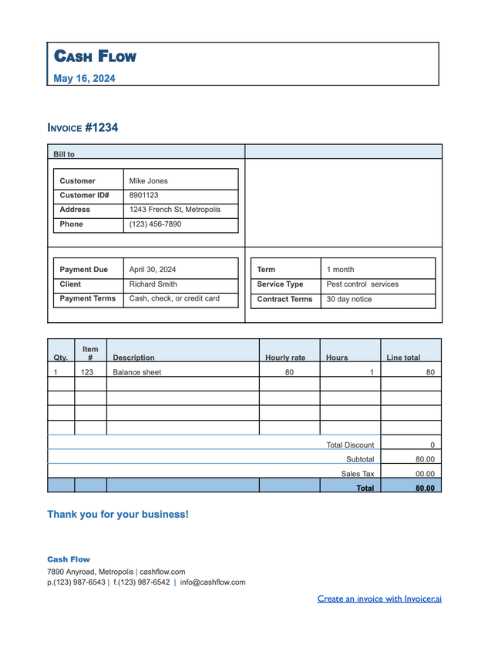

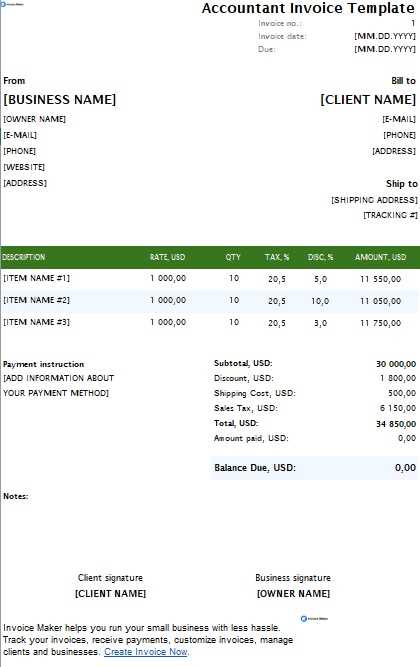

- Client Information: Full details of the customer or company receiving the service, including contact information and billing address.

- Service Breakdown: Clear descriptions of the products or services provided, including quantities and pricing for each item.

- Payment Terms: Details on payment deadlines, methods accepted, and any late fees or discounts applied.

- Unique Identifier: A unique reference number for the document, which helps both parties track the record in future correspondence.

Design and Structure

The appearance of the financial document is just as important as its content. A clean and professional design ensures that the document is easily readable and that no critical information is overlooked. This includes proper alignment, clear headings, and consistent fonts. A well-organized layout helps both parties understand the charges quickly, preventing misunderstandings and delays in payment.

Customizing Your Billing Document

Tailoring your financial document to meet the specific needs of your business and clients can enhance both functionality and professionalism. Customization allows you to align the design and content with your brand, making the document more personal and effective in communication. By adjusting key elements, businesses can ensure that every transaction is represented clearly and consistently.

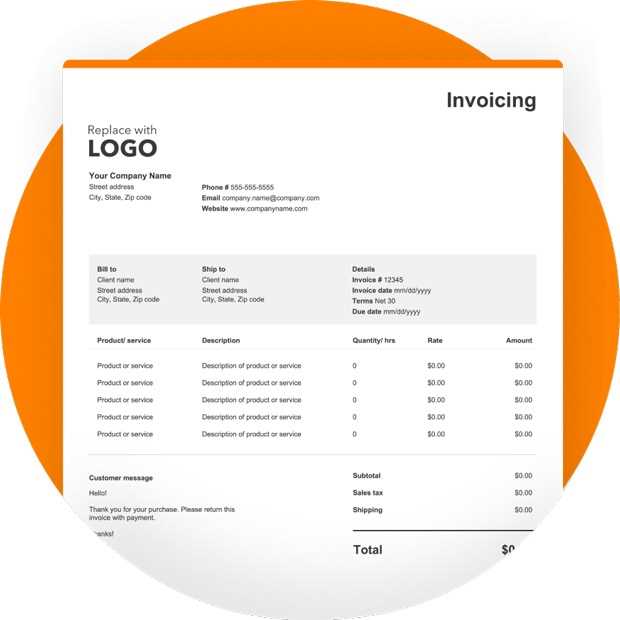

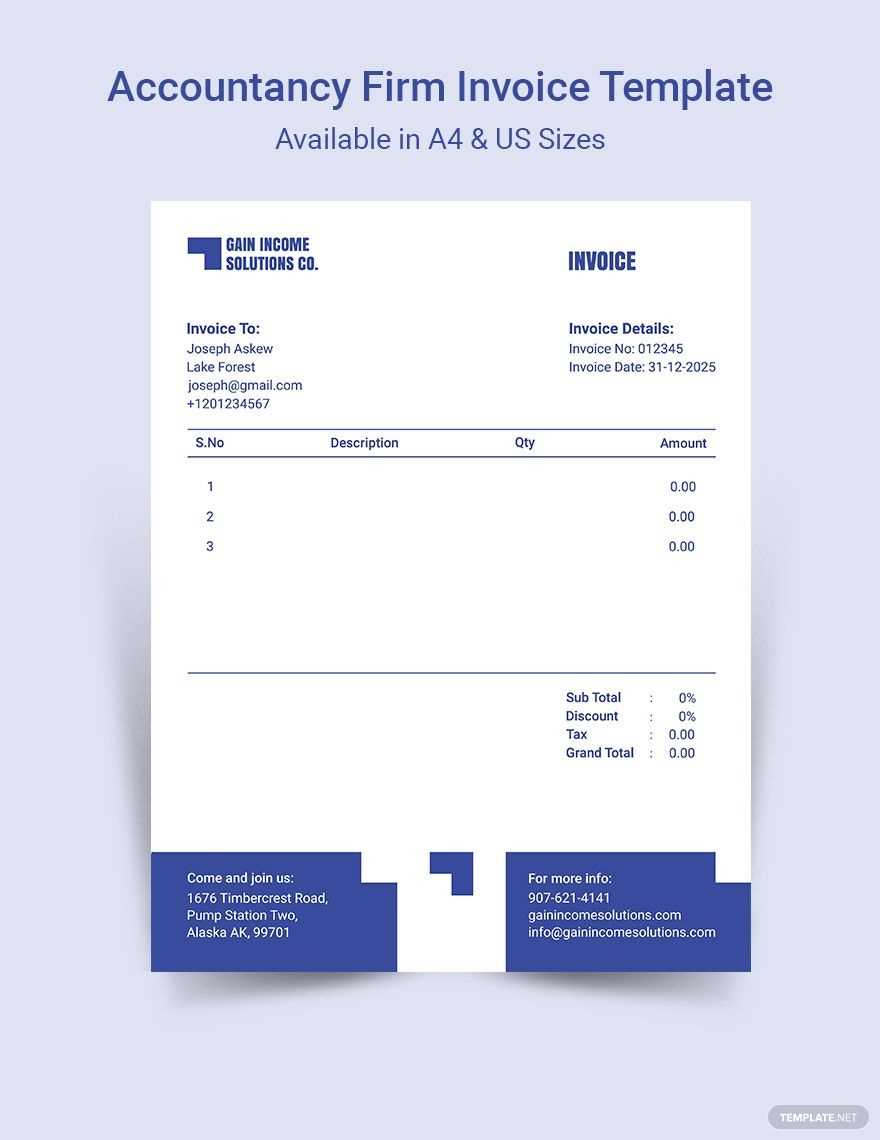

Adjusting Layout and Design

One of the first steps in personalizing your document is choosing the right layout. A clean, professional design with an intuitive flow can improve readability and make it easier for clients to understand the charges. Consider adding your company’s logo, using your brand’s colors, and selecting a clear font. This can help reinforce your business’s identity while making the document visually appealing.

Including Specific Details

Different businesses may have unique needs when it comes to what information should be included. Customizing the sections of your document ensures that the relevant details are emphasized. For example, you might add:

- Additional Payment Methods: If your business accepts various forms of payment, list all available options clearly.

- Custom Notes or Terms: You may want to include special instructions, such as discount offers or specific payment deadlines.

- Recurring Information: For subscription-based businesses, include billing cycles or recurring service details for clarity.

Essential Information on a Billing Document

To ensure smooth transactions and clear communication between businesses and clients, it is essential to include key details in every financial record. These components not only help in tracking payments but also ensure transparency and avoid misunderstandings. Properly structured documents provide both parties with all the necessary information to fulfill payment obligations on time.

Each document should contain the following critical elements:

- Client Information: Full name or business name, address, and contact details.

- Business Information: Your company name, logo, contact details, and address.

- Unique Reference Number: A distinct identifier for easy tracking of the document.

- Description of Services or Goods: Clear details about the provided services or delivered items, along with quantities and prices.

- Total Amount Due: The total sum that needs to be paid, including taxes or discounts.

- Payment Terms: Information about the payment deadline, methods accepted, and any late fee charges.

Benefits of Professional Invoicing

Using a structured and polished format for financial documentation offers numerous advantages to businesses. A professional approach not only ensures accuracy and clarity but also helps in building trust and credibility with clients. Properly designed documents are essential for maintaining efficient payment cycles, minimizing errors, and reinforcing your brand’s image.

Enhanced Client Trust

Providing clients with well-organized and clear financial documents reflects professionalism and builds trust. It shows that your business values accuracy and transparency, encouraging timely payments and positive client relationships.

Faster Payment Processing

When clients receive clear, well-structured documents, they are more likely to process payments without delay. An easy-to-read format with all the necessary information reduces confusion and speeds up the payment process.

| Benefit | Description |

|---|---|

| Consistency | Standardized documents ensure that all details are consistently presented, reducing the risk of missing information. |

| Time Efficiency | Streamlined and organized formats make it quicker for both businesses and clients to handle payments. |

| Brand Identity | A polished design reflects the professionalism and credibility of your brand, improving client perception. |

| Legal Protection | Proper documentation helps protect both parties in case of disputes by clearly outlining terms and agreements. |

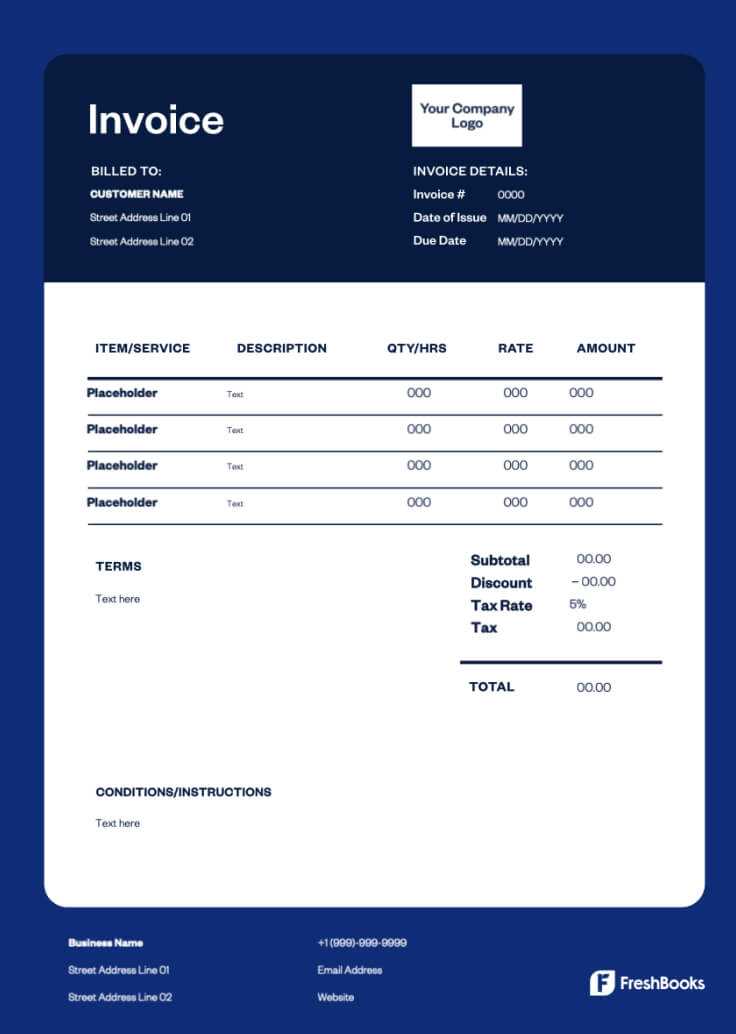

How to Create a Billing Document

Creating a professional financial record involves several key steps to ensure all necessary details are included. Whether you’re managing services rendered or goods sold, a well-crafted document ensures clarity and helps maintain smooth transactions. Follow these guidelines to create a clear, accurate, and organized document that meets both business and client needs.

Step 1: Gather Essential Information

Before starting, make sure you have all the relevant details for both your business and your client. This includes:

- Business name, address, and contact details.

- Client’s name, address, and contact information.

- A unique reference number for easy tracking.

- Clear descriptions of products or services provided.

- Total amount due, including taxes or discounts.

Step 2: Choose a Format

Decide whether you want to create the document from scratch using a word processor or use a pre-made layout. Using a consistent format makes your documents more professional and easier for clients to read. Some options include:

- Blank document with custom formatting.

- Online tools or software with built-in layouts.

- Customizable forms tailored to your industry.

Step 3: Add Detailed Information

Ensure that all essential fields are filled in correctly, including the itemized list of services or products and their corresponding prices. Don’t forget to include payment terms such as due dates, accepted payment methods, and any penalties for late payments.

Step 4: Review and Send

Before finalizing the document, double-check all entries for accuracy. Verify that the amounts are correct, client details are up to date, and no information is missing. Once reviewed, send the completed document to your client via email or postal service, depending on your agreement.

Common Mistakes in Billing Document Creation

When preparing financial records, it’s easy to overlook certain details that can cause confusion or delays in payment. These common errors can affect the clarity of the document and lead to misunderstandings between businesses and clients. Recognizing and avoiding these mistakes ensures a smoother, more professional transaction process.

1. Missing or Incorrect Contact Information

Accurate contact details are vital for ensuring your document reaches the right person. Common mistakes include:

- Forgetting to include client or business contact information.

- Listing outdated or incorrect addresses.

- Omitting phone numbers or emails for follow-up inquiries.

2. Not Including Payment Terms

Clearly stated payment terms are essential for a timely transaction. Common issues include:

- Failure to specify due dates for payment.

- Not mentioning late fees or penalties for overdue payments.

- Omitting payment method options (e.g., credit card, bank transfer).

3. Incorrect Item Descriptions or Prices

One of the most common errors in financial records is failing to accurately describe services or products provided. This can lead to:

- Discrepancies between what was agreed upon and what’s listed.

- Unclear descriptions of services, causing confusion about what is being charged.

- Wrong pricing, either due to typos or calculation errors.

4. Not Using Unique Document Numbers

Unique reference numbers are crucial for tracking and organizing transactions. Errors often include:

- Using duplicate or missing reference numbers.

- Not having a consistent numbering system, making it harder to locate past documents.

5. Failing to Proofread

Omitting a final review of the document can lead to mistakes that could have been easily corrected. Some common proofreading mistakes include:

- Spelling or grammatical errors that reduce professionalism.

- Forgetting to include crucial details, such as tax rates or discounts.

- Incorrect formatting that affects readability.

Billing Document Design Tips

When creating a professional financial record, the design plays a crucial role in ensuring clarity and readability. A well-structured layout not only improves the visual appeal but also makes it easier for clients to understand the details. Thoughtful design choices help create a positive impression and reduce the likelihood of errors or confusion during the payment process.

1. Prioritize Simplicity and Clarity

Keep the structure of your document clean and organized to facilitate understanding. Some helpful tips include:

- Use clear headings for each section to make important information stand out.

- Avoid excessive text or complex jargon that may confuse the reader.

- Use a legible font size and type to ensure readability.

2. Consistent Formatting

Consistency in formatting helps maintain a professional appearance. Here are key elements to consider:

- Maintain uniform margins, font styles, and spacing throughout the document.

- Use bold or underlined text for important details like totals and due dates.

- Align figures and text properly to avoid visual disorganization.

3. Use Visual Elements Wisely

Adding visuals such as logos or color schemes can enhance the overall presentation. Keep these tips in mind:

- Incorporate your company’s logo for brand recognition, but avoid overcrowding the document.

- Choose a color scheme that reflects your brand while maintaining readability.

- Use lines or boxes to separate different sections for better visual hierarchy.

How to Track Payments Using Billing Documents

Tracking payments is an essential task for any business. A well-organized financial record can help you keep track of outstanding balances, identify paid amounts, and ensure timely follow-ups. By leveraging detailed payment logs, you can maintain clear communication with clients and ensure that all transactions are properly documented.

1. Include Payment Terms and Due Dates

Make sure to specify payment terms and due dates clearly on every document. This not only sets expectations but also helps you monitor deadlines. Some important details to include:

- Due Date: Indicate the exact date when the payment should be made.

- Late Fees: Outline any penalties for late payments to encourage timely settlements.

- Payment Methods: Clearly state the available payment methods (e.g., bank transfer, check, online payments).

2. Track Payment Status

To effectively manage your finances, it’s crucial to keep a record of payment status. This includes:

- Paid Amount: Mark the amount received and the date of payment.

- Outstanding Balance: Keep track of any remaining balance if the full payment hasn’t been made.

- Partial Payments: If clients make partial payments, record the amount paid and update the remaining balance accordingly.

3. Maintain a Payment Log

To stay organized, maintain a payment log for easy tracking. Include:

- Payment date

- Payment method

- Reference or transaction number

- Outstanding or paid balance

Regularly updating this log ensures that your records stay accurate and helps with future financial planning and reporting.

Best Software for Managing Billing Documents

Choosing the right software for handling financial transactions is crucial for ensuring smooth operations. The right tools can help automate the process, keep your records organized, and reduce the chances of errors. Below are some of the best options available for professionals who need to create and track payments effectively.

1. QuickBooks

QuickBooks is one of the most popular accounting software options for small businesses. It offers a wide range of features, such as:

- Customizable billing layouts

- Automated payment reminders

- Real-time expense tracking

- Integration with various payment systems

QuickBooks is an all-in-one solution that simplifies financial management and reporting.

2. FreshBooks

FreshBooks is known for its simplicity and ease of use. Ideal for freelancers and small business owners, it offers features like:

- Easy invoicing and payment tracking

- Time tracking for billable hours

- Automated recurring billing

- Cloud-based, accessible anywhere

FreshBooks ensures that all financial records are accurate and readily available for review.

3. Zoho Books

Zoho Books is a powerful tool for businesses that need robust financial management. Its key features include:

- Multi-currency support

- Client portal for easy payment tracking

- Automatic tax calculation

- Expense tracking and reporting

Zoho Books provides a comprehensive solution for both small and medium-sized businesses.

4. Wave

Wave is a free, cloud-based software that is ideal for small businesses with basic accounting needs. Key features are:

- Unlimited invoicing and receipts

- Real-time transaction tracking

- Easy integration with bank accounts

- No monthly fees for basic services

Wave is perfect for those who need a simple and cost-effective way to manage finances.

How to Handle Late Payments

Dealing with overdue payments is an inevitable part of managing financial transactions. When clients fail to meet payment deadlines, it can create disruptions in cash flow. However, handling such situations with professionalism and clarity can help maintain healthy business relationships and ensure timely payments in the future.

1. Set Clear Terms and Expectations

One of the most effective ways to avoid late payments is to establish clear payment terms from the start. Make sure to communicate:

- The exact payment due date

- Accepted payment methods

- Any penalties or interest charges for late payments

- Grace periods, if applicable

By setting expectations upfront, clients are more likely to respect deadlines and avoid delays.

2. Send Gentle Reminders

When the due date passes, it is important to follow up promptly but politely. A gentle reminder can be sent via email or phone, and should include:

- Polite language

- Clear information about the outstanding amount

- A request for confirmation of payment arrangements

It is important to remain respectful and understanding, as clients may have missed the deadline unintentionally.

3. Implement Late Fees or Interest

If reminders do not lead to payment, consider enforcing a late fee or interest charges. This can be an effective deterrent for future delays and incentivize prompt payment. Be sure to:

- Clearly outline the late fee terms in your agreement

- Ensure that the charges are reasonable and compliant with local laws

Late fees should be used as a tool to encourage timely payments rather than to punish clients.

4. Offer Payment Plans

If the client is experiencing financial difficulties, offering a payment plan can help ensure you receive the funds owed without causing undue strain on their business. Some options include:

- Splitting the total amount into smaller, manageable payments

- Extending the payment period with clear, written terms

Payment plans can maintain goodwill and ensure that both parties can fulfill their obligations.

5. Know When to Seek Legal Assistance

If all efforts to collect overdue payments fail, it may be necessary to take legal action. Before doing so, consult with a legal expert to understand your options and ensure that you are within your rights. Legal action should be considered a last resort, after all other avenues have been exhausted.

Legal Aspects of Bookkeeper Invoices

Understanding the legal framework surrounding financial documents is crucial for any business. These records not only serve as a tool for tracking transactions but also hold legal significance. From ensuring compliance with tax regulations to safeguarding your rights in case of disputes, knowing the legal aspects of creating and handling such documents can protect both your business and your clients.

1. Legal Requirements for Financial Documents

Each country or region has specific rules regarding the content and structure of financial documents. These documents must include key details to ensure they are legally enforceable. Typically, they should contain:

- Names and contact information of both parties

- A clear description of the goods or services provided

- The agreed-upon amount due for the transaction

- The payment due date and method of payment

- Any applicable taxes or additional charges

Failure to meet these legal standards could result in non-compliance, making it difficult to enforce the terms in a legal setting.

2. Tax Implications and Record Keeping

For businesses, proper documentation is not only essential for transparency but also for fulfilling tax obligations. Depending on local regulations, businesses may be required to maintain copies of all financial records for a specific period. This is important for:

- Tax reporting and audits

- Calculating value-added tax (VAT), sales tax, or other applicable levies

- Proving deductions and expenses

Ensuring that all necessary information is included on each document is crucial to avoid penalties or legal issues with tax authorities.

3. Payment Terms and Legal Enforcement

Clearly stated payment terms are not only a good practice but also a legal safeguard. Terms regarding late fees, interest charges, and payment deadlines can protect your business from delayed payments. In the case of non-payment, these clauses are legally enforceable, providing you with the right to pursue payment through:

- Sending formal reminders

- Charging interest on overdue balances

- Taking legal action if necessary

Including these provisions helps avoid misunderstandings and supports legal recourse when needed.

How to Format Invoice Dates Correctly

Accurately formatting dates in financial documents is vital for clarity and proper record-keeping. A clear date format helps both the issuer and recipient understand key deadlines and timelines for payments. Using consistent date formatting not only enhances professionalism but also ensures that the transaction is tracked properly for accounting and legal purposes.

When choosing the format for dates, it is essential to consider the region in which the business operates, as different locations may use different conventions. However, regardless of the format, it is crucial to maintain consistency throughout all financial documents.

1. Common Date Formats

There are several common ways to format dates, and selecting the appropriate one for your documents is important. The most widely accepted formats include:

- MM/DD/YYYY: Commonly used in the United States, this format places the month first, followed by the day and year.

- DD/MM/YYYY: Popular in Europe and many other regions, this format starts with the day, followed by the month and year.

- YYYY/MM/DD: The international standard (ISO 8601), which is used for uniformity, placing the year first, then the month, and the day.

Choose the format that best suits your business location, but ensure consistency across all transactions to avoid confusion.

2. Key Dates to Include

Besides the date of issue, there are a few other important dates that should be clearly stated on financial documents:

- Due Date: The date by which payment is expected. Make sure this date is easy to spot and distinct from the issuance date.

- Late Payment Date: Some businesses include a date after which late fees will be applied. This provides a clear incentive for timely payment.

- Payment Received Date: When payments are received, this date should be recorded for accurate tracking of the transaction.

Including these dates clearly and correctly formatted ensures there is no ambiguity regarding deadlines and helps maintain proper records for both parties involved.

Creating Recurring Invoices for Clients

For businesses offering ongoing services or products, setting up recurring billing can streamline financial operations. By automating regular charges for clients, companies can ensure timely payments and reduce administrative workload. Recurring invoices help establish predictable cash flow and create long-term relationships with customers through consistent, hassle-free transactions.

To implement a successful recurring billing system, there are several factors to consider, including frequency, payment methods, and clear communication with clients regarding their charges. Automation tools and software can simplify this process, allowing businesses to set up schedules and automatically generate bills at the designated times.

1. Key Elements of Recurring Billing

When setting up a recurring payment system, certain details need to be consistently included in each transaction for clarity and accuracy:

| Element | Description |

|---|---|

| Frequency | Specify whether the payment is weekly, monthly, quarterly, or annually. |

| Amount | Clearly state the recurring charge amount for the service or product being provided. |

| Payment Terms | Set clear terms for payment, including any penalties for late payments or discounts for early payments. |

| Start and End Dates | Identify the start date for billing and the end date or renewal terms. |

| Payment Method | Specify how payments will be collected (e.g., credit card, bank transfer, direct debit). |

2. Benefits of Recurring Billing

Implementing recurring billing brings numerous advantages for both businesses and clients:

- Predictable Cash Flow: Regular payments ensure a steady revenue stream, making financial planning more accurate and reliable.

- Reduced Administrative Burden: Automating payments reduces the need for manual invoicing and follow-ups, saving time and effort.

- Convenience for Clients: Customers appreciate the ease of automatic payments, leading to better customer satisfaction and retention.

By setting up a recurring billing system, businesses can increase efficiency, reduce the risk of missed payments, and strengthen customer relationships.

Tips for Maintaining Accurate Financial Records

Keeping precise and up-to-date financial records is crucial for businesses of all sizes. Effective tracking of transactions ensures that all income, expenses, and assets are correctly accounted for, helping to maintain financial health and avoid potential tax issues. By staying organized and consistent with record-keeping practices, businesses can gain better insights into their financial status and make informed decisions.

1. Implement Consistent Record-Keeping Practices

Establishing a clear system for recording financial transactions is essential. Consistency is key in ensuring that all data is captured accurately, preventing errors that can lead to significant discrepancies down the line. Here are a few practices to keep in mind:

- Daily Tracking: Record all transactions as they occur to avoid missing or forgetting important details.

- Use Software Tools: Leverage financial management tools that can automate data entry, reducing human error and ensuring accuracy.

- Organize Receipts and Documents: Store receipts and relevant documents in an organized manner, either digitally or physically, for easy reference.

2. Reconcile Accounts Regularly

Account reconciliation involves comparing your records with external statements to ensure that both match. Regularly reconciling accounts can help identify errors, discrepancies, or fraudulent activities before they become serious issues. Consider the following tips:

- Set a Schedule: Reconcile your accounts at least once a month to stay on top of any irregularities.

- Match with Bank Statements: Cross-check internal records with bank statements to ensure that all transactions align.

- Address Discrepancies Promptly: Investigate any differences right away to avoid carrying forward errors.

By following these practices, businesses can maintain accurate financial records that support long-term growth and ensure compliance with regulations.

Improving Client Relationships with Invoices

Building and maintaining strong client relationships is vital for the success of any business. One often overlooked aspect of this process is how financial documentation is managed. By delivering clear, accurate, and timely records, businesses can foster trust and transparency, which in turn enhances customer satisfaction and long-term loyalty. The way financial transactions are communicated can reflect professionalism and attention to detail.

1. Ensure Clarity and Transparency

Clients appreciate clarity when it comes to the financial aspects of a business transaction. Providing well-organized and understandable records can avoid confusion and disputes. Consider the following tips:

- Clear Breakdown: Include detailed descriptions of products or services rendered, along with the corresponding charges.

- Simple Language: Avoid jargon or overly technical terms. Keep the wording simple and easy to understand for clients of all backgrounds.

- Timely Delivery: Send financial records promptly to prevent delays in payment or misunderstanding.

2. Personalize Communication

Personalized communication can strengthen the relationship between businesses and clients. Taking the time to include a personal message or a thank-you note in financial documents can go a long way. Here are a few ways to make the experience more personal:

- Friendly Greeting: Add a warm and professional greeting to each document.

- Offer Support: Include contact information for clients to easily reach out if they have questions or concerns.

- Thank You Notes: Always express appreciation for their business, even in the financial documentation.

By making the documentation process a smooth and thoughtful experience, businesses can build stronger, more trusting relationships with their clients, leading to repeat business and positive referrals.

Free and Paid Invoice Template Options

When managing financial records, choosing the right document format can make a significant difference in efficiency and professionalism. Whether you are just starting a business or looking to improve your existing processes, various tools are available to help streamline the creation and organization of financial records. These options can range from free resources to more advanced, paid solutions, each offering unique features to meet different needs.

Free Options

There are several free tools available for businesses that require basic functionality for generating financial documents. These tools are ideal for individuals or small businesses just getting started. Key benefits of free options include ease of use and cost-effectiveness. Here are a few options:

- Online Generators: Websites like Invoice Generator or Zoho Invoice offer simple, no-cost solutions for creating professional records on the go.

- Spreadsheet Templates: Templates available through Google Sheets or Excel provide a customizable format to track and organize financial transactions.

- Word Document Templates: Free templates available from various sources offer a basic, customizable design for businesses that need minimal features.

Paid Options

For businesses that require more advanced features, paid tools offer greater customization, automation, and support. These solutions typically come with a price but provide enhanced functionality, such as recurring billing, reporting features, and integration with accounting software. Some notable paid options include:

- QuickBooks: A popular solution for small to medium-sized businesses, QuickBooks provides robust financial management tools, including invoicing, reporting, and payment tracking.

- FreshBooks: Known for its ease of use and powerful features, FreshBooks offers customizable document creation, time tracking, and automatic payment reminders.

- Wave: A free version is available, but the premium version offers advanced features such as custom branding, credit card processing, and more extensive reporting tools.

While free tools provide essential features, paid options are often worth the investment for businesses that require more advanced capabilities and scalability.