Free Invoice Spreadsheet Template for Easy Billing Management

Managing payments and financial records is essential for any business, whether small or large. Having a structured approach to documenting transactions can save time and prevent mistakes. With the right tools, you can easily keep track of what is owed, when payments are due, and ensure everything is well-organized.

Effective organization is key to smooth financial management. Using well-designed systems allows for quick customization, easy tracking, and accurate reporting. By choosing a solution tailored to your needs, you can focus more on growing your business rather than spending hours on manual calculations.

Modern tools make it easy to manage finances efficiently without the need for advanced software. These solutions allow you to create detailed records that can be adjusted and personalized to fit your specific requirements. Whether you are a freelancer or part of a growing company, having a streamlined method will make your financial tracking a breeze.

Why Use a Free Invoice Spreadsheet

Managing financial transactions and keeping accurate records is a fundamental part of running any business. Having a structured, easily accessible tool to track payments, sales, and customer information can save time and reduce the risk of errors. Using a simple yet effective document solution allows you to focus on growing your business rather than spending unnecessary time on manual tasks.

One of the biggest advantages of using such tools is the ease of customization. Unlike complex accounting software, these solutions provide flexibility to adapt to your specific needs. Whether you are tracking one-time payments or ongoing subscriptions, you can easily modify the layout and content without being tied to rigid structures.

- Cost-effective: Avoid expensive software or hiring professionals by using a no-cost solution that serves your needs just as well.

- Time-saving: Quickly create and organize your records, saving valuable hours each week.

- Simple interface: User-friendly designs make it easy to input and update information with minimal learning curve.

- Flexible: Customize the layout, fields, and categories according to your specific business needs.

Moreover, using a basic tool means no need for complicated setups or steep learning curves. The documents are easy to fill out, and you can organize them in a way that suits your workflow. Whether you’re a freelancer, a small business owner, or part of a larger team, these simple yet powerful solutions help streamline your financial operations.

Benefits of Customizable Invoice Templates

Having the ability to adjust your financial tracking documents to meet your specific needs is an invaluable asset for any business. Customization allows you to create an organized, personalized system that reflects your unique workflow and industry requirements. Instead of relying on rigid, one-size-fits-all solutions, you can design a structure that is as simple or complex as your operations demand.

Tailored to Your Business

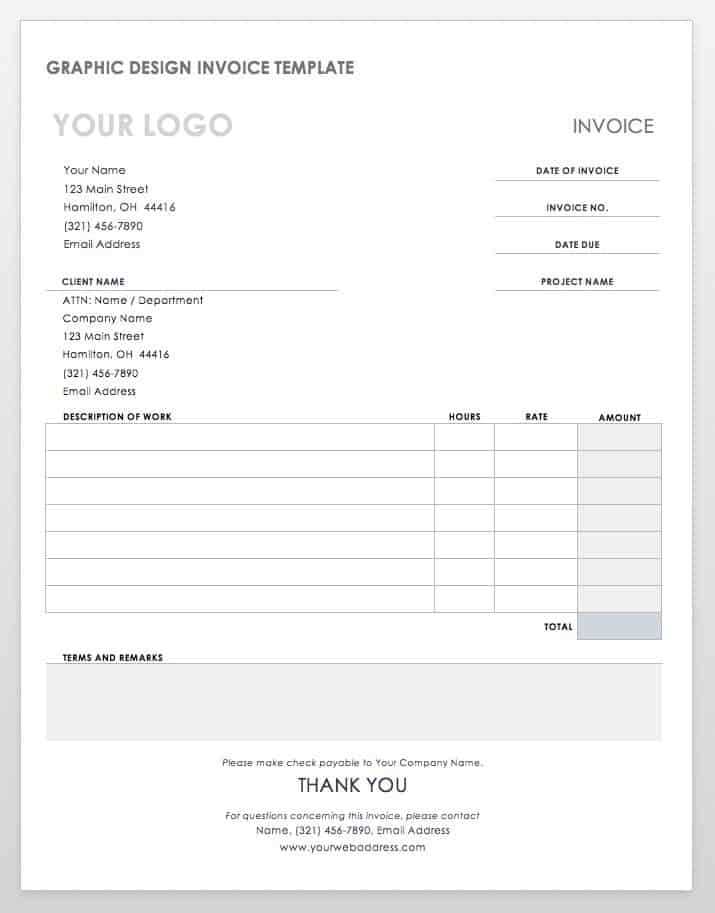

One of the primary advantages of customizable documents is their ability to be adapted to fit the nature of your business. Whether you offer different types of services or products, or have varying pricing models, you can adjust the layout to accommodate all these factors.

- Flexible design: Modify fields, categories, and sections to suit your industry and business style.

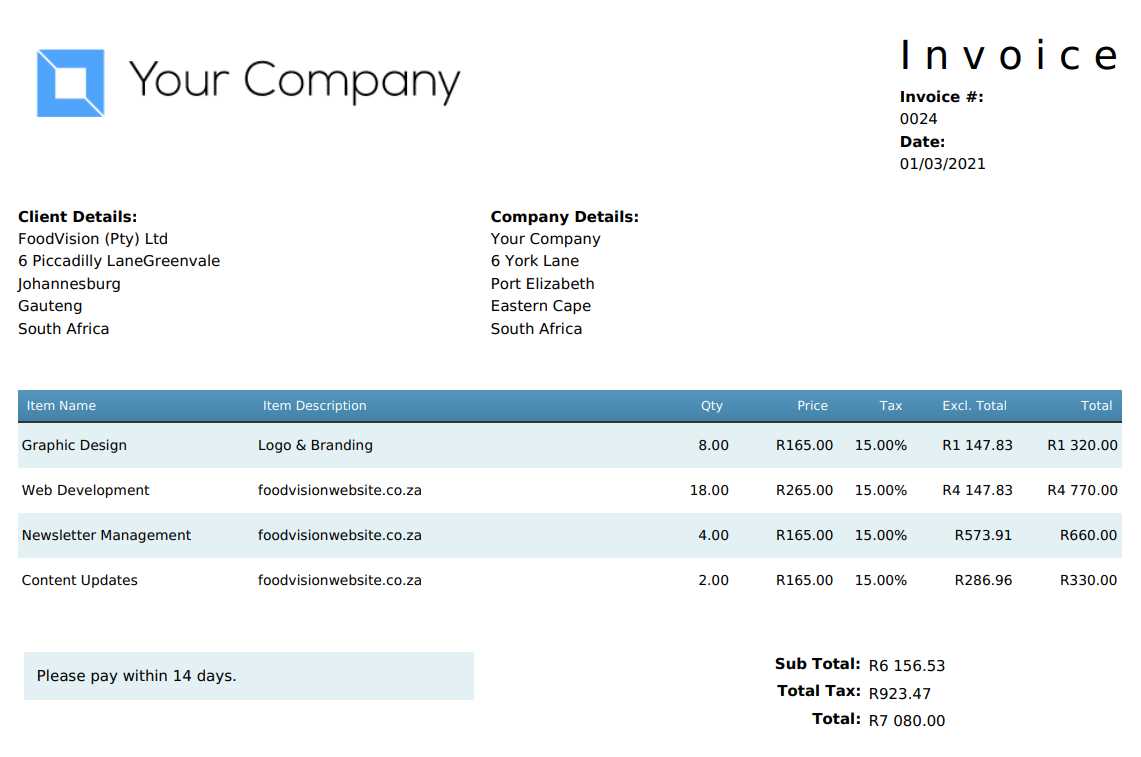

- Adjustable formulas: Include formulas to automatically calculate totals, taxes, discounts, or shipping costs based on your specific needs.

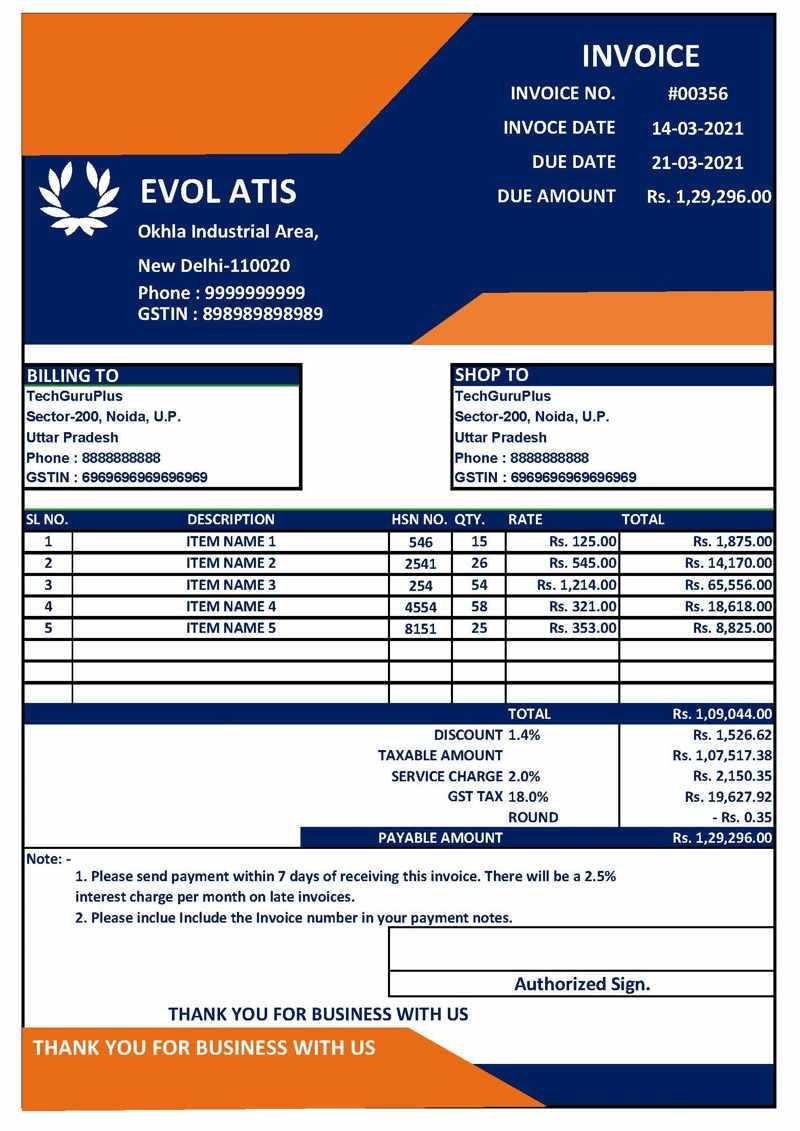

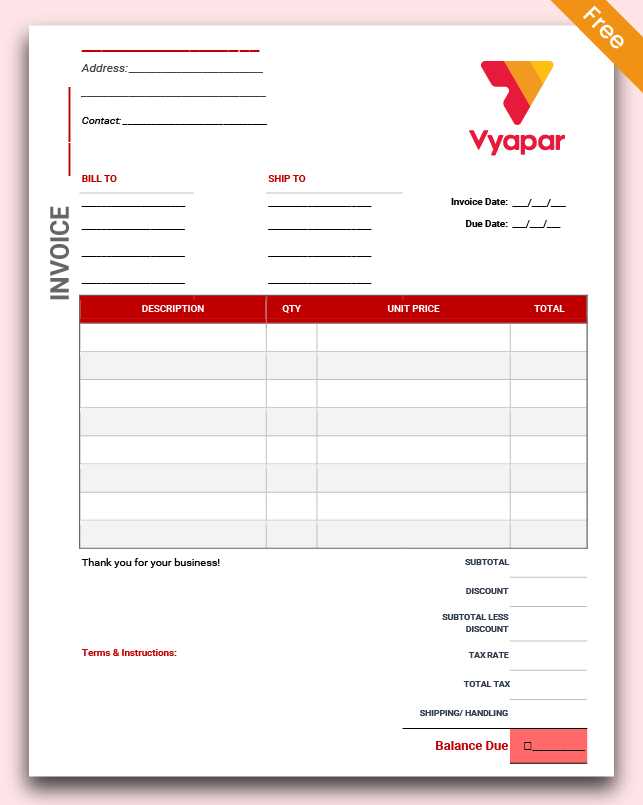

- Personalized branding: Add your company logo, colors, and contact details to maintain a professional and cohesive look.

Improved Accuracy and Efficiency

Customizable documents can streamline your workflow, ensuring all necessary information is captured in a consistent and easy-to-access format. With personalized templates, you reduce the chances of missing important details, which ultimately improves accuracy and saves time.

- Consistency: Ensure that every record is formatted the same way, minimizing mistakes and improving clarity.

- Faster entry: Pre-filled fields and standardized categories speed up the process of entering data, reducing manual work.

- Automated calculations: Automatically calculate totals and taxes, cutting down on the time spent on manual calculations.

How to Create Your Own Invoice Template

Designing your own document for tracking payments and transactions can be a straightforward process. With a few key steps, you can create a custom solution that matches your business’s needs. By starting with a basic structure and gradually adding personalized elements, you can ensure your document is both functional and professional.

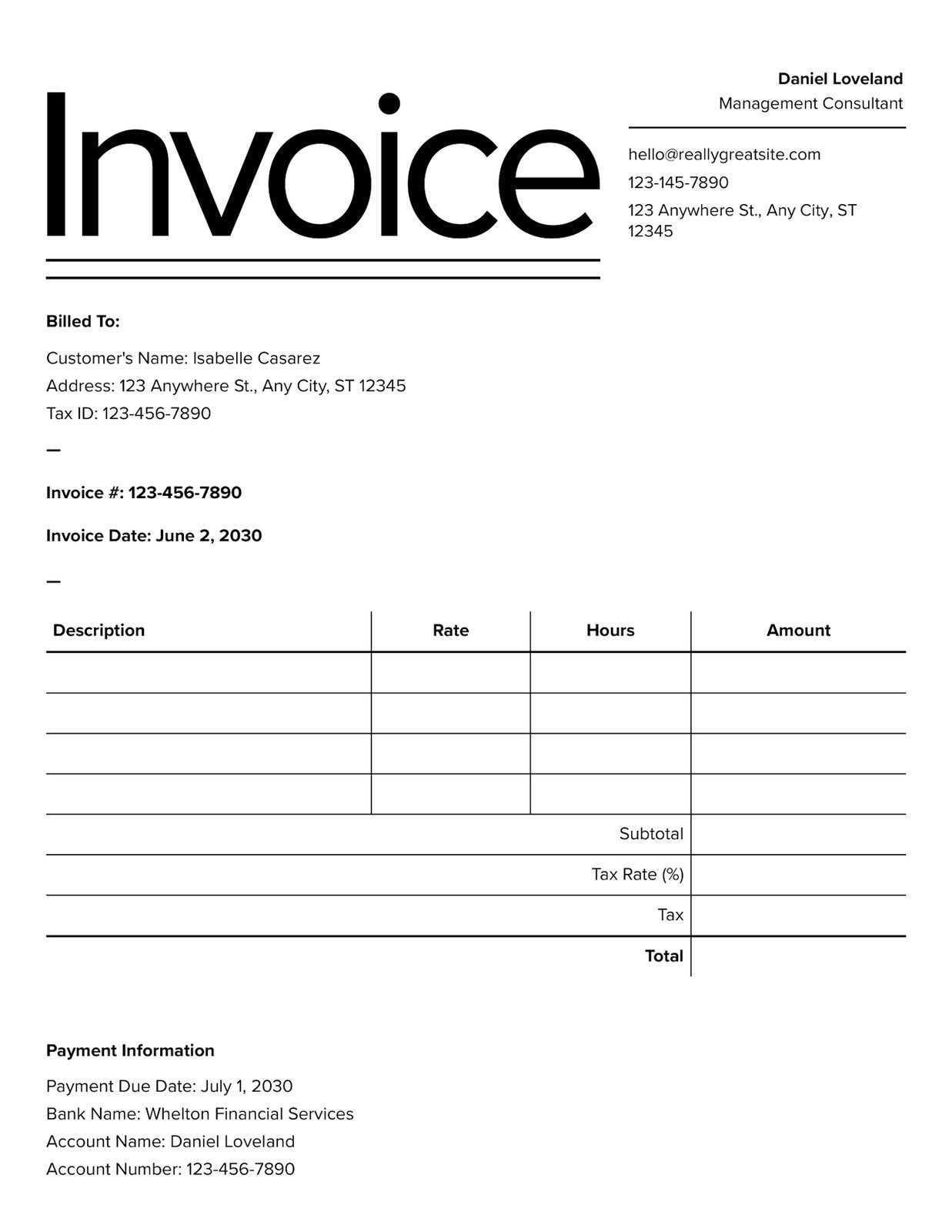

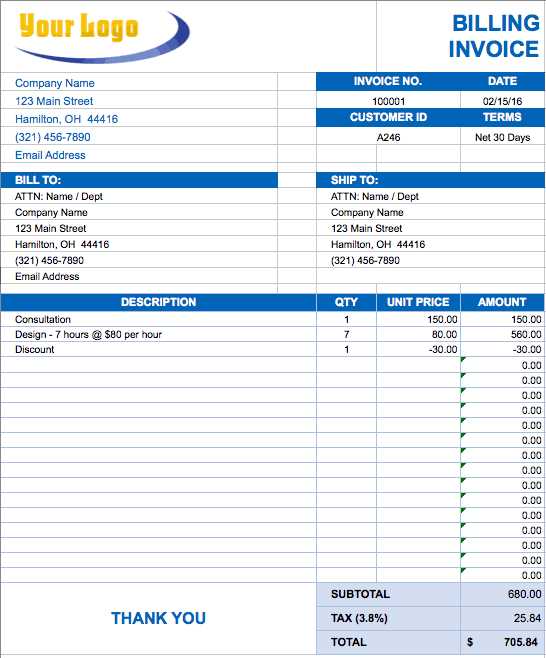

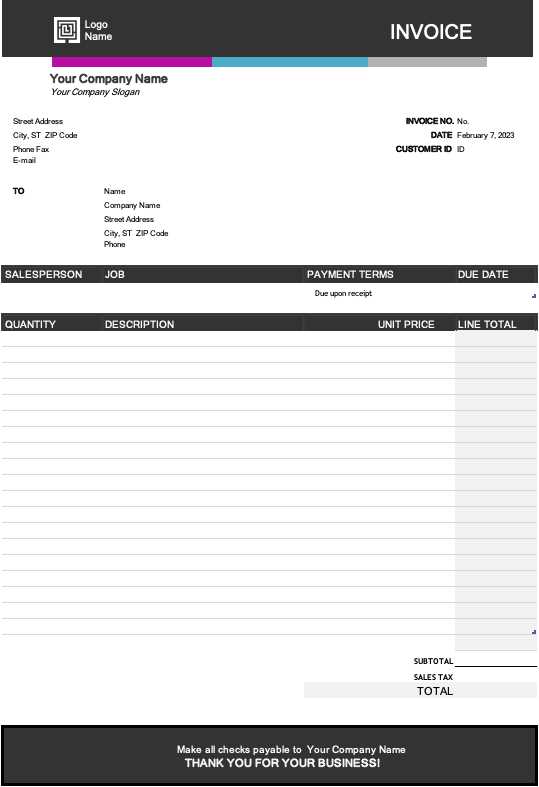

First, begin by outlining the essential information that should be included. Typically, this will involve sections for customer details, products or services, quantities, pricing, taxes, and the total amount due. You can also include payment terms, due dates, and any specific notes that may be relevant to the transaction.

Once you have a basic layout, consider the following steps:

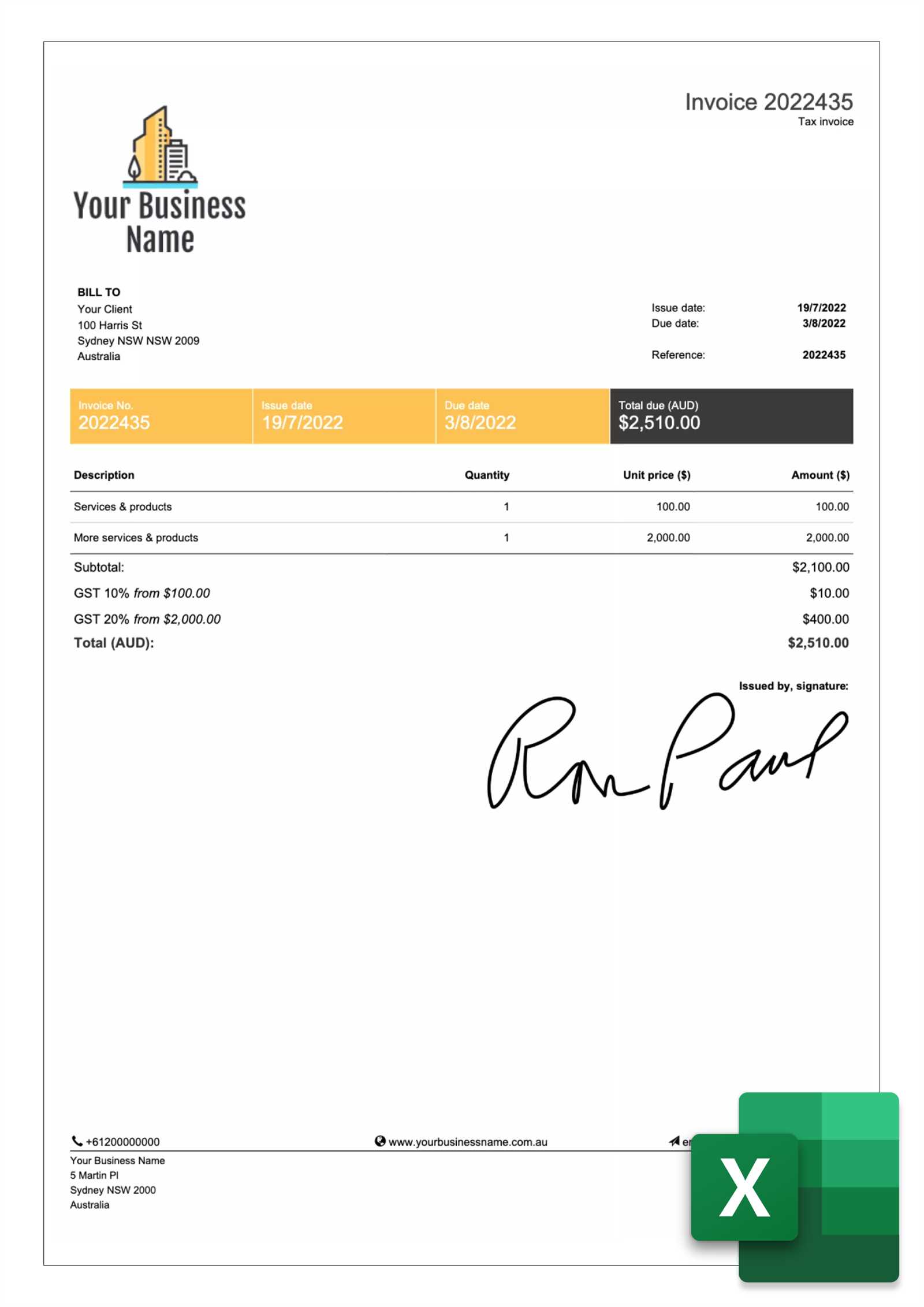

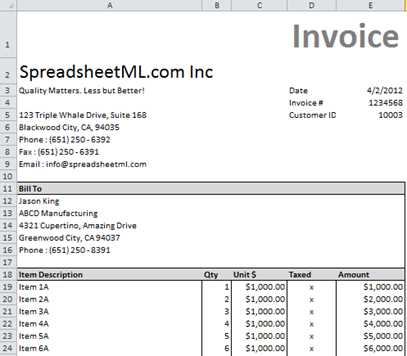

- Choose a software tool: Use simple tools like Excel or Google Sheets, or explore more advanced software if needed. Both options allow for easy customization.

- Design the layout: Organize the document into clearly defined sections for easy readability. Ensure that it looks clean and professional by using headings, lines, and spaces.

- Add formulas: If you want to automate calculations (like totals or taxes), input simple formulas to streamline the process and avoid errors.

- Personalize with branding: Add your business name, logo, and color scheme to ensure the document reflects your company’s identity.

Once you have created your custom document, save it as a reusable file. This way, you can quickly modify the details for each new transaction, making it easy to stay organized and consistent.

Top Features of Invoice Spreadsheets

When managing financial records, certain features can make the process smoother and more efficient. By incorporating specific functionalities into your tracking documents, you can save time, reduce errors, and ensure that all information is captured accurately. The right features allow you to automate tasks, customize layouts, and ensure consistency across all your financial records.

Essential Functionalities

Customizable features are a key component of any business record-keeping tool. Here are some of the most important ones:

- Automated calculations: With built-in formulas, you can instantly calculate totals, taxes, discounts, and shipping costs, saving time and reducing the chances of errors.

- Pre-filled fields: Add predefined categories and values that help you quickly input customer details, item descriptions, and pricing without starting from scratch every time.

- Dynamic date fields: Automatically update dates, including payment due dates, and track payment history for each client.

Customization and Organization

Being able to tailor your records to suit your business is crucial for maintaining a professional image and streamlining operations. These features allow for flexibility and enhanced organization:

- Branding elements: Include your company logo, address, and contact details to maintain a consistent, branded look across all documents.

- Customizable sections: Adjust headings, sections, and categories to match your unique workflow, such as adding new fields for additional charges or services.

- Consistent layout: Ensure uniformity by using structured formats, making it easier for clients and your team to understand and track payments.

By incorporating these features, you can create a more efficient and professional process for managing financial transactions and client interactions.

Where to Find Free Invoice Templates

Finding the right documents for managing payments and transactions can be a challenge, especially when you’re looking for cost-effective options. Luckily, there are a variety of places where you can access no-cost solutions that are simple to use and easy to customize. These resources allow you to create professional-looking records without the need for expensive software or advanced technical skills.

Here are some of the best sources for accessing ready-to-use business record templates:

- Online document platforms: Websites like Google Docs and Microsoft Office Online offer a wide range of pre-designed files that can be easily customized for your specific needs. Simply search through their template libraries for options suited to your business type.

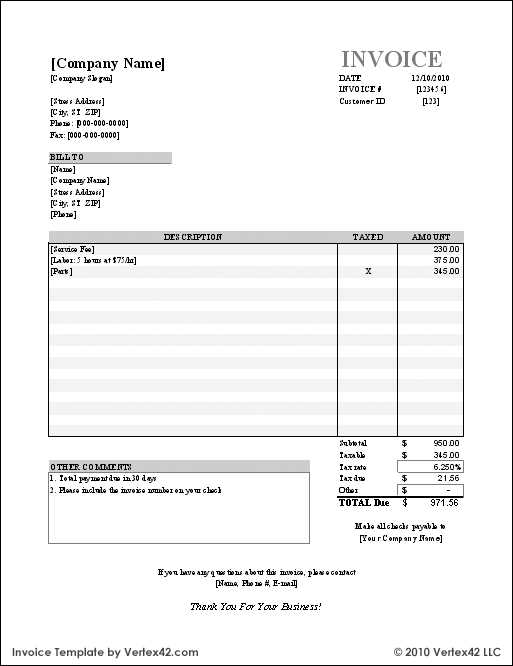

- Template-sharing websites: Platforms like Canva, Template.net, and Vertex42 provide free downloadable files that can be used right away or modified as needed. These sites often feature various layouts, styles, and formats.

- Accounting blogs and forums: Many business-related blogs and forums offer downloadable resources for managing financial records. These files are often shared by experienced users and designed with small business owners in mind.

- Open-source software tools: Some open-source accounting programs, such as GnuCash or Wave, provide free customizable documents as part of their toolset. These solutions are perfect for businesses seeking a comprehensive financial management system.

By exploring these options, you can easily find a solution that meets your needs and helps you stay organized while keeping costs to a minimum.

Best Tools for Invoice Spreadsheet Design

Designing business records to track payments and transactions effectively requires the right tools. The right software can offer customization options, automate calculations, and ensure that your documents are organized and professional. Whether you’re looking for a simple, intuitive solution or a more advanced platform, there are several tools that can help you create high-quality, customizable forms tailored to your business needs.

Popular Platforms for Customization

Several platforms offer user-friendly designs and customization features, making it easy to create documents that fit your business style and requirements:

- Google Sheets: An easy-to-use cloud-based tool that allows for quick customization. Google Sheets offers various templates and the ability to use custom formulas to automate calculations, making it ideal for small businesses and freelancers.

- Microsoft Excel: A widely-used and powerful platform with robust features, including advanced formatting, formula options, and templates. It offers a more comprehensive solution for those who need detailed control over their document designs.

- Canva: A design-focused platform that provides pre-built, visually appealing templates. It’s perfect for businesses looking to add branding elements such as logos, colors, and typography while maintaining ease of use.

Advanced Tools for Businesses

For those who require more advanced features, especially in terms of automation and reporting, the following tools provide additional functionality:

- Zoho Invoice: An online tool that offers extensive customization, automatic payment reminders, and integration with other accounting features. Great for businesses looking to streamline their entire billing process.

- Wave Accounting: A free online tool that combines accounting and invoicing features, allowing for the creation of customized records with an intuitive interface and built-in payment tracking.

- QuickBooks Online: A comprehensive financial management tool that includes invoicing and reporting capabilities. Best for businesses that require integrated accounting solutions and detailed financial tracking.

With these platforms, you can easily design professional documents to suit your needs, whether you’re managing a small freelance business or a larger enterprise. Each of these tools

How to Download an Invoice Template

Downloading a ready-made document for tracking payments and transactions is a simple process that can save you time and effort. With many platforms offering customizable forms, all you need to do is find the right one, choose a layout that fits your needs, and download it to get started. Whether you’re using a cloud service or a desktop application, the steps are straightforward and user-friendly.

Step-by-Step Guide

Follow these easy steps to download a customizable form:

- Choose your platform: Begin by selecting a website or software that offers pre-designed documents. Some of the best platforms include Google Sheets, Microsoft Excel, and various design-focused sites like Canva.

- Browse available options: Once you’ve selected your platform, explore the library of available forms. Look for one that fits your specific business needs, whether you’re tracking product sales, services, or recurring payments.

- Select your design: Choose a style that best represents your business. Many platforms allow you to filter results based on style, functionality, and industry. Select the design that offers the features you require, such as custom fields or automated calculations.

- Download the document: After selecting your preferred layout, click the download button to save the file to your computer or cloud storage. Ensure that the file format is compatible with the software you plan to use, such as Excel (.xlsx) or Google Sheets.

Additional Tips

After downloading your document, you can personalize it to better fit your workflow:

- Customize fields: Add or remove sections to match your business’s requirements, such as adding a discount field or adjusting the payment due date format.

- Adjust formulas: If the document contains automatic calculations, review and modify the formulas to reflect your specific pricing structure and tax rates.

- Save as a template: Once customized, save the file as a reusable document that you can update for each new transaction without needing to start from scratch.

By following these steps, you’ll quickly have a fully functional document that can streamline your payment tracking and help keep y

How to Edit and Customize Invoice Spreadsheets

Customizing your financial documents to suit your business needs can be a simple process. By adjusting layouts, adding or removing fields, and automating certain calculations, you can create a document that fits your unique requirements. Whether you need to track specific products, services, or payment methods, the ability to modify key elements helps ensure accuracy and efficiency in your record-keeping.

Basic Edits to Consider

Here are some common changes you can make to tailor the document to your business:

- Modify fields: You can add or remove sections depending on what you need to track. For example, add fields for discounts, shipping costs, or extra charges based on your business model.

- Change text labels: Customize headings to fit your industry. For instance, you can rename “Item” to “Service” if you provide consulting or use a different term that better describes your offerings.

- Update contact information: Always ensure that your company name, address, phone number, and payment details are accurate and up-to-date.

Advanced Customization

For more advanced editing, you can enhance your document with additional features:

- Automate calculations: Use formulas to calculate totals, taxes, and discounts automatically. This helps reduce errors and saves time on manual calculations.

- Adjust the layout: Reorganize sections and adjust column widths to ensure that everything fits neatly. This helps make the document more readable and professional-looking.

- Add branding elements: Include your company logo, color scheme, and specific fonts to ensure that the document aligns with your brand identity.

With these simple edits and customizations, you can create a document that’s not only functional but also tailored to your business needs. Whether you’re creating it from scratch or adjusting an existing file, personalizing your business records can improve your workflow and enhance your professionalism.

Free Invoice Spreadsheet for Small Businesses

For small businesses, keeping financial records organized and easily accessible is critical to maintaining smooth operations. Many small business owners seek simple, cost-effective solutions for managing their billing and payments. Using customizable documents to track transactions can help save time and reduce the complexity of financial management, especially for businesses that don’t need advanced software solutions.

Accessing a no-cost solution can be an excellent way to manage accounts without the added burden of expensive tools. These documents often come with basic features that allow you to track client information, item details, pricing, and payment status efficiently.

- Simple to use: Most small businesses need a straightforward, user-friendly tool that doesn’t require extensive training or technical knowledge. Many available options provide easy-to-fill fields and an intuitive layout.

- Cost-effective: By choosing a no-cost option, you avoid the expenses of subscription-based software, making it easier for businesses with limited budgets to stay organized without compromising on functionality.

- Customizable: Even without paying for advanced tools, you can personalize the layout to fit your unique business needs. Adding your branding, adjusting categories, and modifying formulas ensures the document works for you.

For small businesses looking to streamline their billing and maintain clear, organized records, using a simple, no-cost solution is a practical and efficient option. These documents can help you keep track of payments, set up due dates, and improve client communication–all without needing to invest in costly software.

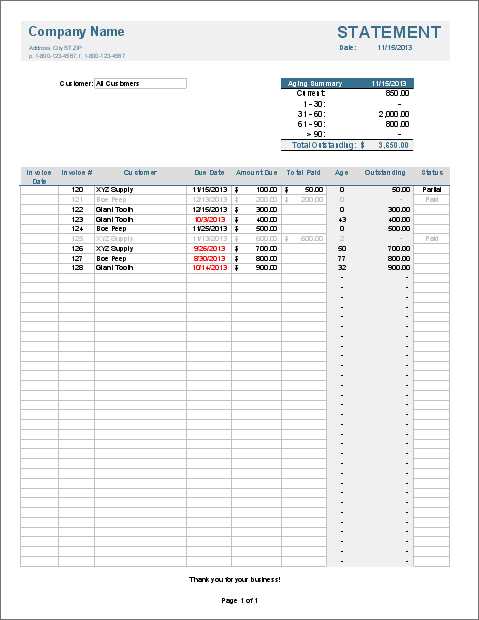

How to Track Payments with Spreadsheets

Tracking payments effectively is essential for any business, big or small. Using a well-organized document system allows you to monitor transactions, follow up on overdue payments, and ensure you’re paid on time. By maintaining clear and up-to-date records, you can easily identify who has paid, who owes, and how much is outstanding, helping you stay on top of your cash flow.

Spreadsheets provide an easy way to track payments, offering flexibility and customization options to suit your business needs. Below are steps and tips on how to effectively use these documents to manage your finances:

- Organize with key columns: Start by setting up essential columns like Client Name, Amount Due, Payment Status, Payment Date, and Method of Payment. This structure helps keep track of all important details for each transaction.

- Use conditional formatting: Highlight overdue payments or those marked as unpaid with different colors. This makes it easier to spot late transactions and take action quickly.

- Automate totals: Implement formulas to calculate totals automatically as payments are made. This can help you quickly see how much revenue you’ve received and what remains unpaid.

- Track partial payments: If a client makes a partial payment, add a column to track the amount paid and subtract it from the total due. This way, you’ll always know what’s still outstanding.

- Update regularly: Keep your records current by updating them as soon as payments are made. This ensures that you’re always working with the most accurate data.

By following these steps, you can maintain organized, easily accessible records that will help you manage cash flow and improve your overall financial health. With just a few key adjustments, spreadsheets can become an invaluable tool for tracking payments efficiently and effectively.

How to Avoid Common Invoice Mistakes

Creating accurate financial documents is crucial for maintaining smooth business operations and fostering positive relationships with clients. Small errors in your records can lead to confusion, delayed payments, and damaged trust. Avoiding common mistakes ensures that your records are clear, professional, and easily understood by both you and your clients.

Common Errors to Watch For

Here are some of the most common mistakes businesses make when creating transaction records and how to prevent them:

- Missing contact information: Ensure that all relevant details are included, such as your company name, client’s name, address, and contact information. Missing or incorrect contact details can lead to confusion and delayed payments.

- Incorrect payment terms: Clearly state the payment due date and any late fees or discounts. If these terms are unclear or not stated, it can result in misunderstandings and delays.

- Wrong amounts or calculation errors: Always double-check the amounts, including taxes and discounts, to ensure accuracy. Small calculation errors can undermine your professionalism and lead to disputes.

- Not tracking partial payments: If clients make partial payments, track them carefully. Failing to update your records can lead to confusion about what is still owed.

Best Practices for Accurate Documentation

To avoid these mistakes, follow these best practices:

- Review your work: Take time to double-check all details before sending out any records. A quick review can prevent a lot of common mistakes.

- Use templates with built-in checks: Utilize documents with pre-set formulas for calculations and conditional formatting to highlight overdue payments or discrepancies.

- Stay organized: Keep all transaction records in a single, easily accessible location. Having a clear system for storing and retrieving documents reduces the chances of missing critical details.

By being mindful of these common mistakes and implementing best practices, you can maintain professionalism in your records and avoid costly errors. Consistently delivering accurate documents will help build trust with your clients and ensure timely payments.

Organizing Your Invoice Records Effectively

Efficiently managing your payment records is essential for staying on top of finances and ensuring smooth business operations. Proper organization helps you track incoming and outgoing funds, follow up on overdue payments, and maintain clear documentation for tax and accounting purposes. An organized system can also improve your overall workflow and reduce the risk of mistakes or missed payments.

Here are some key strategies to help you keep your financial records in order:

Key Steps to Organize Your Records

- Create categories: Divide your records into logical categories based on payment types, client names, or billing periods. This helps you easily locate and reference any document when needed.

- Use a consistent naming system: Give each record a clear, descriptive name that includes relevant details, such as the client’s name, the transaction date, and a unique identifier. This makes searching through records much easier.

- Store in one place: Keep all your records in a central, easily accessible location, whether it’s a cloud storage service or a dedicated folder on your computer. A well-organized digital filing system allows you to retrieve any document in moments.

Tracking and Updating Your Records

Maintaining an up-to-date and accurate record-keeping system is just as important as organizing the files in the first place. Consider these tips for effective tracking:

- Update records regularly: After every transaction, promptly add or adjust the corresponding document. Regular updates help you avoid backlog and ensure that your records reflect the latest information.

- Track overdue payments: Use color-coding, filters, or automated reminders to highlight overdue payments. This will help you follow up efficiently without missing any deadlines.

- Backup your data: Regularly back up your records to ensure that nothing is lost due to unexpected errors or system failures. Consider using both physical and cloud-based backups for extra security.

By implementing these organizational strategies, you can ensure that your records are always in order, easy to track, and ready for any review or reporting. Clear and effective organization not only improves your workflow but also strengthens the financial management of your business.

How to Save Time with Invoice Templates

Managing financial documentation can be time-consuming, but it doesn’t have to be. By using pre-designed formats, you can eliminate the need to start from scratch each time you need to create a record. These ready-to-use documents allow you to quickly input necessary details, automate calculations, and streamline your workflow, saving you valuable time and effort.

Here’s how using pre-made formats can help you save time on your billing process:

- Pre-set structure: Instead of creating a new document every time, a ready-made design comes with a built-in layout that includes all the essential fields, such as payment amounts, client information, and due dates. This structure saves you time by eliminating the need to manually format each entry.

- Automated calculations: Many pre-designed forms include formulas that automatically calculate totals, taxes, and discounts. This reduces the chances of errors and eliminates the need to manually compute these details for each transaction.

- Customization for repeated use: Once you’ve selected and customized a design, you can reuse it for every new transaction. This minimizes the time spent adjusting the layout, as you only need to update the specifics for each new client or payment.

- Faster invoicing process: By having everything laid out and ready, you can quickly fill in the details, saving you from the lengthy process of formatting and organizing each document. This means you can focus more on running your business instead of dealing with administrative tasks.

Incorporating pre-made formats into your business operations helps you maintain efficiency while ensuring that your records remain professional and organized. The time saved on documentation can then be redirected toward other critical tasks, allowing your business to grow without getting bogged down by administrative burdens.

Invoice Spreadsheet Security Tips

When managing financial documents, security is a top priority. These records often contain sensitive information, such as payment details, client data, and business financials, which can be vulnerable to theft or unauthorized access. Protecting your documents not only ensures the safety of your data but also helps maintain your business’s credibility and compliance with privacy regulations.

Here are some essential security tips to safeguard your financial records:

| Tip | Description |

|---|---|

| Use Password Protection | Ensure that your documents are password-protected to prevent unauthorized access. This adds an extra layer of security, especially when files are shared or stored on shared devices. |

| Limit Access | Only provide access to financial records to trusted employees or collaborators. By limiting who can view and edit these documents, you reduce the risk of accidental or intentional data breaches. |

| Encrypt Files | Encrypt your files before storing or sending them. Encryption makes it difficult for unauthorized users to access or read the contents, even if they manage to intercept the file. |

| Use Secure Storage Solutions | Store your documents on secure platforms, such as encrypted cloud services or password-protected local drives. Avoid storing sensitive data on unsecured public platforms or devices. |

| Regularly Backup Documents | Back up your records regularly to secure locations. This ensures that in case of data loss, accidental deletion, or system failure, you will still have access to your important documents. |

| Monitor File Access | Track who accesses and modifies your financial records. Many cloud services offer audit logs to help you monitor changes and detect any suspicious activity. |

By following these security practices, you can ensure that your business’s sensitive financial records are well protected from unauthorized access, theft, and data loss. Regularly updating your security measures and being mindful of potential risks will help safeguard both your data and your reputation.

Why Excel is Perfect for Invoicing

For businesses of all sizes, keeping track of transactions and maintaining organized financial records is essential. Excel offers a powerful and flexible solution for managing these records, providing tools that simplify the creation and tracking of payments. With its built-in functions and user-friendly interface, Excel allows users to automate calculations, customize formats, and easily update documents as needed.

Here are some reasons why Excel is an ideal tool for managing your payment records:

- Easy to Use: Excel’s intuitive interface allows even beginners to quickly learn how to create and modify documents. With its drag-and-drop functionality and simple formatting options, users can create professional-looking records without any design experience.

- Automated Calculations: One of the standout features of Excel is its ability to automatically calculate totals, taxes, and discounts. This eliminates manual calculation errors and saves time when processing multiple transactions.

- Customization: Excel offers extensive customization options, allowing you to personalize your documents. Whether it’s adding your logo, adjusting column widths, or formatting fonts, Excel makes it easy to tailor your documents to your specific needs.

- Organization and Tracking: With Excel, you can efficiently track payments and manage financial data. Its filtering and sorting functions allow you to quickly find specific records, check payment statuses, and monitor overdue amounts.

- Integration with Other Tools: Excel seamlessly integrates with other business tools, such as accounting software or financial applications, making it easy to transfer data between different platforms.

- Cost-Effective: Excel is often included as part of Microsoft Office, making it a cost-effective option for businesses that already use the suite. There is no need for additional investments in invoicing or accounting software when Excel meets most needs.

Whether you’re managing a small business or handling large volumes of transactions, Excel provides a versatile and efficient solution. Its customizable features, ease of use, and powerful functions make it the perfect choice for creating, tracking, and managing your financial documents.

Legal Considerations for Invoices and Templates

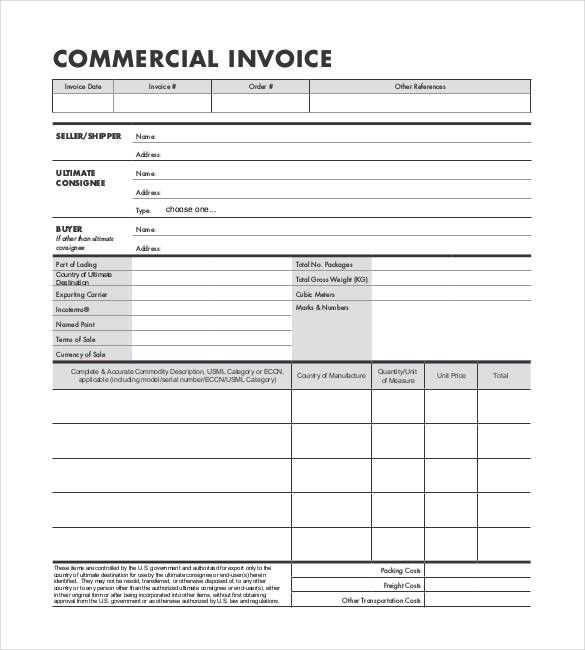

When creating financial documents, it’s important to be aware of the legal requirements that may apply. These records are not only tools for tracking transactions but also legally binding documents that can be used in disputes, audits, or legal proceedings. Ensuring that your documents comply with relevant laws and regulations will help avoid legal issues and protect both your business and your clients.

Here are some key legal aspects to consider when creating and using financial documents:

- Correct Information: Always ensure that your documents contain accurate and complete details, such as the correct business name, contact information, and tax identification number. Providing false or incomplete information could lead to legal consequences or disputes over payment.

- Compliance with Tax Laws: Different jurisdictions may have specific requirements for taxes, such as VAT or sales tax, that need to be clearly stated on the document. Make sure that you include the appropriate tax rates and that they align with local tax regulations to avoid potential penalties or issues with tax authorities.

- Payment Terms: Clearly outline payment terms, including the due date and any late fees or interest charges that may apply if the payment is delayed. By doing so, you establish clear expectations with your clients and protect your rights to receive payment on time.

- Record Retention: In many regions, businesses are required by law to retain financial records for a certain period (e.g., 5 to 7 years). Make sure to keep all documents in a secure and organized manner for the required duration to stay compliant with financial record-keeping laws.

- Confidentiality and Data Protection: Financial records often contain sensitive client information, such as payment details and addresses. Be sure to follow any data protection laws, like the GDPR or other privacy regulations, to protect your clients’ information and avoid fines for data breaches.

- Legal Language and Conditions: Ensure that any terms and conditions included in your documents are legally sound. If you have specific policies regarding refunds, late payments, or disputes, these should be clearly outlined in your documents to prevent future misunderstandings.

By keeping these legal considerations in mind, you can help ensure that your financial documents are compliant with relevant laws, safeguarding both your business interests and your professional reputation. Taking the time to understand and implement legal requirements will pay off in the long run, especially in