Invoice Breakdown Template for Simplified Billing and Expense Tracking

Effective billing is crucial for maintaining clear financial records and ensuring smooth transactions with clients. When you provide a detailed summary of all costs and services rendered, it minimizes confusion and helps both parties stay on the same page. A structured approach to organizing charges not only promotes professionalism but also builds trust with your customers.

For businesses of all sizes, having a clear document that outlines specific charges, quantities, and rates is essential. Such documents allow for accurate payment tracking and simplify the accounting process. Whether you’re working on a long-term project or managing multiple clients, these organized records can save time and prevent potential errors.

Customizing your records to fit the nature of your work can make the billing process even more effective. By tailoring your details, you ensure that clients understand exactly what they are paying for, which in turn leads to faster payments and fewer disputes. The right approach can transform a simple receipt into a comprehensive statement of work.

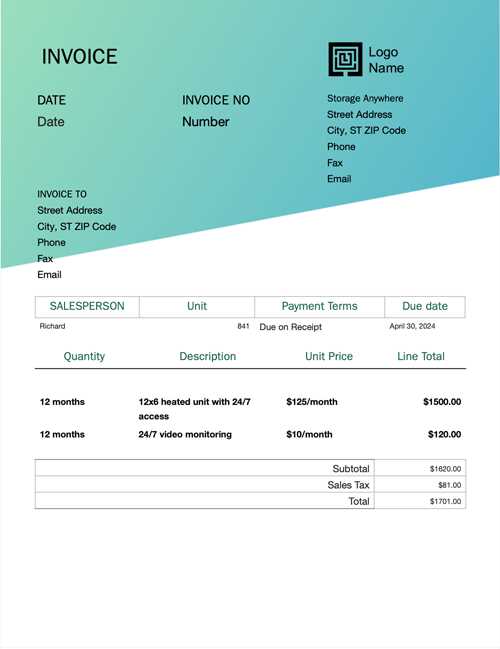

Invoice Breakdown Template Overview

When it comes to financial transactions, clarity and precision are essential. Organizing charges, services, and costs in an easy-to-understand manner allows businesses and clients to avoid misunderstandings. A detailed document that lists all relevant fees and rates ensures both parties have a clear record of the exchange, contributing to smoother operations and faster payments.

Key Features of an Effective Billing Document

A well-structured financial statement should provide a comprehensive overview of all relevant costs. Here are some of the essential components that make up a reliable and organized billing summary:

- Detailed Service List – A breakdown of all services or products provided, including quantities and individual prices.

- Clear Payment Terms – Clear instructions on when and how payments are due, as well as any late fees or discounts for early payment.

- Accurate Total – A summation of all costs, including taxes or additional charges, to present a final, all-inclusive amount due.

- Client Information – Basic contact details of both the client and the service provider for reference and clarity.

Why This Approach is Important

Using a well-organized document to outline costs not only simplifies the payment process but also improves financial transparency. It minimizes errors, reduces misunderstandings, and promotes accountability on both sides. Moreover, it can be customized to reflect different business needs, whether for ongoing projects, one-time services, or products sold.

Such clear records also make it easier to track payments and manage cash flow effectively, contributing to the overall health of the business. When every detail is accounted for, there is less chance for confusion or dispute later in the process.

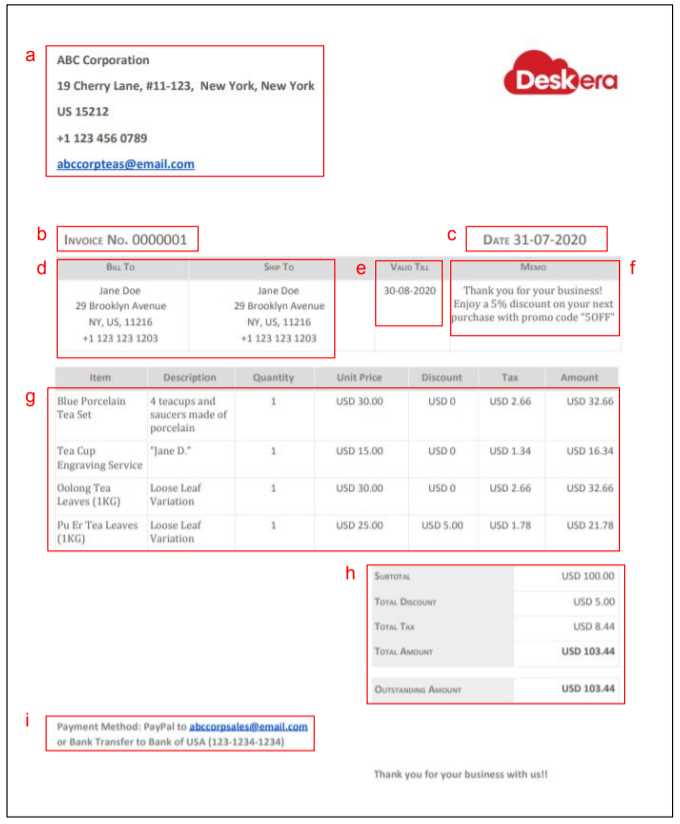

Why Use an Invoice Breakdown Template

Having a structured and detailed record of services rendered and products delivered is essential for maintaining clear communication between businesses and their clients. By clearly outlining each cost and its corresponding details, you ensure transparency and avoid any potential confusion or disputes regarding payment. This approach simplifies the entire financial process and helps keep both parties informed and on track.

Using a well-organized document can save time, reduce errors, and enhance your professional image. Whether you’re managing a one-off transaction or an ongoing contract, having a standard format for financial documentation provides consistency and reliability. Below is an example of how structuring your charges can make all the difference:

| Service/Product | Quantity | Unit Price | Total |

|---|---|---|---|

| Website Design | 1 | $1,500 | $1,500 |

| Hosting (1 Year) | 1 | $200 | $200 |

| SEO Services | 5 hours | $100 | $500 |

| Subtotal | $2,200 | ||

| Sales Tax (8%) | $176 | ||

| Total Amount Due | $2,376 |

With this structure, your client can quickly see the breakdown of all costs and understand exactly what they are being charged for, leading to more efficient transactions and smoother business relationships.

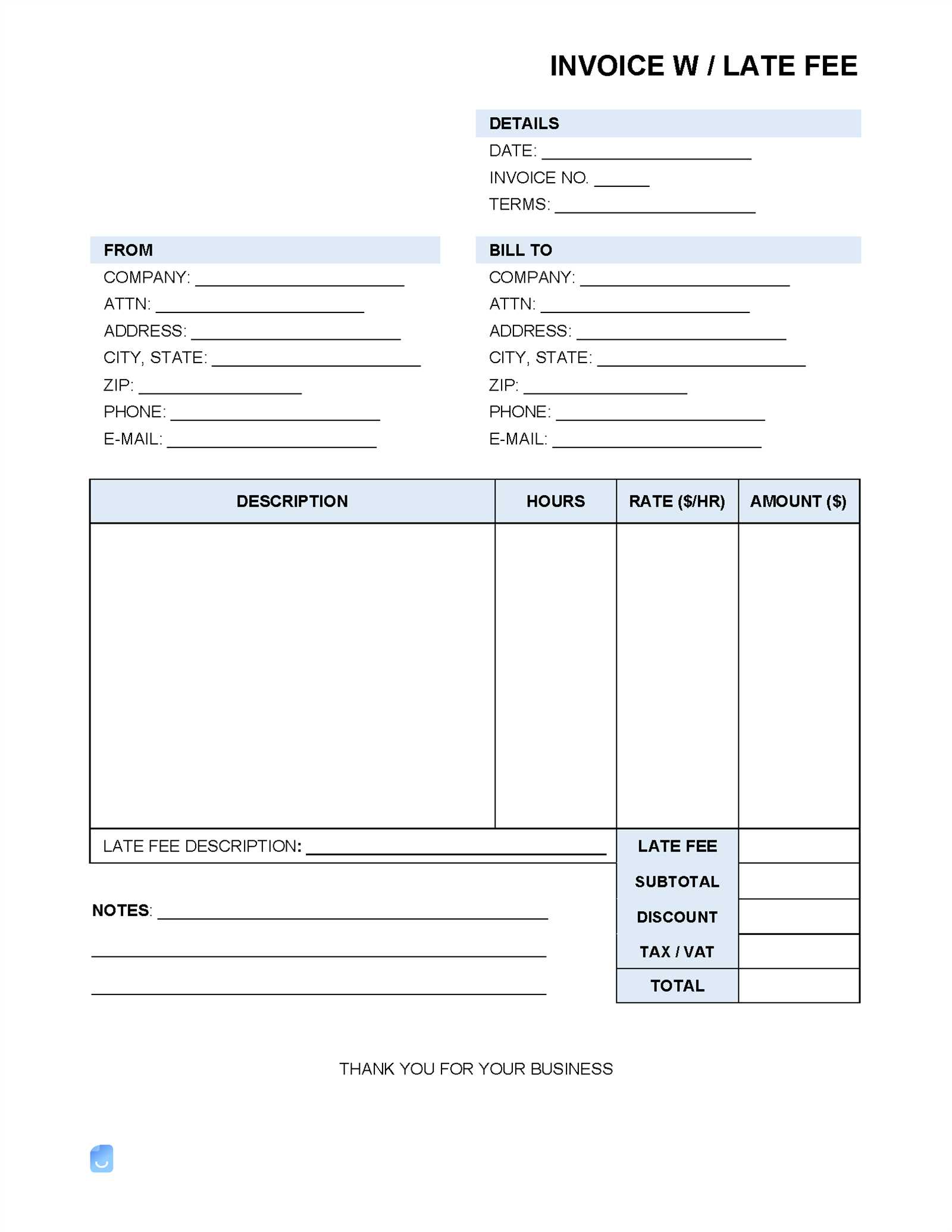

Key Components of an Invoice Breakdown

When organizing a financial statement, it is essential to include the right elements to ensure clarity and transparency. Every item, charge, and fee should be clearly outlined to help both parties understand the costs involved. These components serve as the foundation for a well-structured document, ensuring accurate record-keeping and simplifying the payment process.

Essential Elements to Include

A comprehensive record typically includes the following key components:

- Client Information – Includes the name, address, and contact details of both the service provider and the client, ensuring proper identification for the transaction.

- Description of Services or Products – A clear list of all items or services rendered, including detailed descriptions to avoid confusion.

- Quantity and Unit Price – Specifies how many units or hours were provided and the agreed-upon rate for each.

- Total Cost – A subtotal showing the cost of each item multiplied by its respective quantity, before any taxes or discounts are applied.

- Taxes and Additional Charges – Any relevant taxes, shipping fees, or extra costs should be clearly outlined to ensure the total amount is accurate.

- Payment Terms – Clearly defined deadlines and payment methods, including information about any penalties for late payments or discounts for early settlement.

Importance of Detailed Information

Providing this level of detail not only reduces the likelihood of errors but also ensures that both parties have a clear understanding of the financial arrangement. When each component is listed out systematically, clients are more likely to be satisfied with the clarity of the document, which leads to faster payments and fewer disputes.

Transparency is a crucial element in maintaining good business relationships. When every charge is accounted for and easy to understand, it promotes trust and strengthens the professionalism of your business.

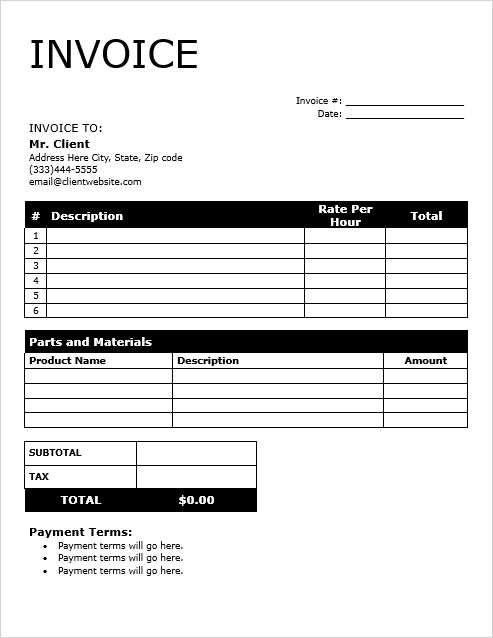

How to Customize Your Invoice Template

Adapting your financial documents to suit your specific needs is an important step in creating professional and effective records. Customizing these documents allows you to reflect your brand identity, cater to different client requirements, and streamline your billing process. By adjusting key details, you can make the document more relevant to the services you offer while maintaining clarity and accuracy.

Steps to Personalize Your Document

Here are a few steps to ensure that your record-keeping document is tailored to your business:

- Include Your Branding – Add your logo, company name, and contact details to the top of the document. This ensures that the document reflects your business identity and makes it easy for clients to reach out if needed.

- Adjust the Layout – Modify the layout to suit the nature of your business. For example, you can include sections for project milestones or add space for notes if you need to provide additional explanations.

- Personalize Descriptions – Customize the service or product descriptions to better reflect the specific terms of your agreement with the client. Be clear and concise about what was provided to avoid confusion.

- Payment Methods and Terms – Ensure that your payment instructions are relevant and up to date. You may want to include various options like bank transfers, credit card payments, or online payment systems.

Ensuring Consistency and Professionalism

Customizing your records does not only mean adjusting the text. Consistency across all documents helps maintain professionalism. Stick to a clear format, use a uniform font, and ensure that your charges and payment terms are easy to read. This consistency builds trust with your clients and presents your business in a more professional light.

By tailoring the document to your needs, you can enhance communication, ensure accuracy, and improve the overall billing experience for your clients.

Benefits of Clear Invoice Itemization

Providing a detailed list of all charges and services in a financial document offers numerous advantages for both the service provider and the client. When each cost is broken down into its individual components, it leads to a more transparent and efficient transaction process. This level of clarity minimizes confusion and ensures both parties are fully aware of what is being paid for.

Advantages for the Business

For businesses, itemizing each service or product clearly can significantly improve overall operations:

- Reduces Disputes – By clearly listing each charge, clients can quickly understand what they are paying for, which helps prevent misunderstandings and disputes over prices.

- Improves Cash Flow – When charges are detailed, clients are more likely to pay promptly, as they can see exactly what they owe. This contributes to a more predictable cash flow.

- Builds Trust – Transparency in the payment process demonstrates professionalism and fosters trust between the service provider and the client.

- Enhances Professional Image – A well-organized document reflects positively on the business, showing that you pay attention to detail and value your clients’ needs.

Benefits for the Client

Clients also benefit from clear itemization in several key ways:

- Better Understanding – When every charge is itemized, the client can quickly see how the total was calculated, which prevents confusion.

- Fewer Questions – Clients are less likely to raise questions or concerns about charges, as everything is clearly listed and easy to understand.

- Increased Satisfaction – A transparent process leads to greater satisfaction and the likelihood of repeat business.

Overall, clear itemization helps streamline the payment process, ensures accurate record-keeping, and contributes to a better business relationship. The benefits of clarity and transparency extend to both the business and the client, creating a smoother experience for all parties involved.

How to Track Payments with Invoices

Tracking payments effectively is crucial for maintaining accurate financial records and ensuring timely cash flow. By using clear and organized documents, businesses can easily monitor which payments have been received and which are still outstanding. This process allows you to stay on top of your accounts and avoid any confusion regarding unpaid balances.

Steps to Track Payments

To keep an accurate record of payments, it is important to follow a systematic approach. Here are key steps to help you track payments efficiently:

- Record Payment Dates – Note the exact date each payment is received. This helps track overdue payments and ensures that the payment timeline is clear.

- Update Payment Status – Regularly update the status of each item, whether it’s paid, partially paid, or overdue.

- Maintain a Payment Log – Keep a separate log where you can track all incoming payments against the amounts due, including client names and payment methods.

- Use a Payment Reference Number – Assign a unique reference number to each transaction for easy identification and tracking.

Tracking Payments Example

Below is an example of how you can track payments for a specific transaction. Using a table to record each transaction’s status helps ensure clarity and avoids missing payments:

| Client Name | Amount Due | Amount Paid | Payment Date | Status | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| John Doe | $1,500 | $1,500 | 2024-10-01 | Paid | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jane Smith | $2,000 | $1,000 | 2024-10-05 | Partially Paid | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acme Corp | $3,000 | $0 | 2024-10-10 |

| Item/Service | Quantity | Unit Price | Total | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Web Development | 10 hours | $50 | $500 | |||||||||||||||||||||||||||||||||||||||||

| Logo Design | 1 | $200 | $200 | |||||||||||||||||||||||||||||||||||||||||

| SEO Optimization | 5 hours | $75 | $375 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | $1,075 | |||||||||||||||||||||||||||||||||||||||||||

| Sales Tax (8%) |

| Service | Hours/Quantity | Rate | Total | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Website Design | 15 hours | $50/hour | $750 | ||||||||||||||||||||||||||

| Content Writing | 10 articles | $100/article | $1,000 | ||||||||||||||||||||||||||

| SEO Optimization | 5 hour

How to Avoid Common Invoice MistakesWhen preparing financial records for clients, it’s easy to make mistakes that could delay payments or create confusion. These errors can range from simple clerical issues to more significant oversights that affect your cash flow and professionalism. By being mindful of the most common pitfalls, you can ensure that your documents are accurate, clear, and easy to process, helping to build trust and reduce misunderstandings with clients. Here are some of the most frequent mistakes to avoid when preparing your financial documents:

By avoiding these common mistakes, you can ensure a smoother billing process and maintain a professional relationship with your clients. A well-structured and error-free document not only speeds up payment but also enhances your credibility and helps manage your business finances more efficiently. Tracking Expenses with Invoice TemplatesFor businesses of all sizes, keeping track of expenses is essential for maintaining healthy cash flow and ensuring accurate financial records. By using structured documents to record transactions, you can easily track spending, categorize costs, and identify areas for potential savings. This level of organization helps streamline your accounting processes and ensures that all expenditures are accounted for properly. How Expense Tracking WorksWhen you create a detailed record of every expense incurred in your business, it becomes easier to track where money is going and how it aligns with your budget. A well-structured financial document helps break down costs into clear categories, so you can spot trends and make informed decisions about future spending.

Example of Expense Tracking FormatHere’s an example of how you might structure your expenses within a financial document:

|