Mobile Notary Invoice Template for Efficient Billing

Managing payments and billing can be a complex task for service providers, especially when working in a freelance or mobile setting. To maintain a streamlined and professional approach, many opt for structured documents that ensure all charges are clearly outlined and easily understood by clients. This method not only improves organization but also enhances the overall client experience.

Whether you’re offering legal, administrative, or consulting services, having a reliable system for recording your work and requesting compensation is essential. These tools help track services rendered, associated costs, and payment terms, ensuring that both parties are aligned and satisfied with the transaction. An effective payment request document can save time, reduce errors, and foster better client relationships.

In this guide, we will explore how to create and utilize a well-organized billing document to fit your needs. By understanding the key components and customizing your approach, you can ensure every job is properly accounted for and paid without hassle.

Mobile Notary Invoice Template Overview

Efficient billing is crucial for any service-based professional. Having a structured document to outline charges for work completed is essential for ensuring clarity and professionalism. This type of document helps both the service provider and the client to have a clear understanding of the services rendered, along with the corresponding costs. By using a consistent format, you can streamline the payment process and maintain a high level of organization in your business operations.

For professionals who travel to meet clients or perform services on-site, creating a customized record of services and fees is even more important. The document should reflect the specific nature of the service, time spent, and any additional charges such as travel fees or specialized services. A well-crafted billing statement allows you to present yourself as organized and trustworthy, which can have a positive impact on client retention and referrals.

Key Features of a Professional Billing Record

A well-designed billing document typically includes several important sections. These may include the service provider’s contact details, client information, a description of the services performed, the total amount due, and payment terms. Additionally, it may account for any unique fees associated with the work, such as mileage or administrative costs. Below is an example of common fields included in such a document:

| Field | Description |

|---|---|

| Service Provider Details | Name, Address, Contact Information |

| Client Information | Name, Address, Contact Details |

| Description of Services | Detailed List of Services Rendered |

| Additional Fees | Travel, Administrative, or Other Extra Charges |

| Total Amount Due | Sum of All Charges, Including Extras |

| Payment Terms | Due Date, Accepted Payment Methods |

Why Use a Structured Document?

Utilizing a standardized format for your billing records ensures that every important detail is captured. This not only helps prevent mistakes but also builds a reputation of professionalism and reliability. By presenting clear and well-organized document

Why Use a Notary Invoice Template

Having a standardized document to request payment for services helps maintain consistency and professionalism. This structured approach ensures that all necessary details are included, preventing confusion and minimizing the risk of errors. Whether you are an independent professional or a business, using a well-designed document is key to smooth financial transactions and positive client relationships.

Using such a format not only streamlines the billing process but also saves time, allowing you to focus on the services you provide rather than the administrative work. Additionally, it can help protect both the service provider and the client by clearly outlining the terms of the agreement and avoiding misunderstandings over charges.

Clarity and Professionalism

A well-crafted billing document creates a clear and transparent record of the services rendered. This transparency not only helps clients understand what they are paying for but also enhances your credibility as a professional. The presence of detailed descriptions, terms, and totals in a consistent format signals to clients that you are organized and committed to quality service. Clarity in billing reduces the likelihood of disputes, making the payment process smoother for both parties.

Time-Saving and Efficiency

By using a pre-designed structure, you avoid the need to create a new document from scratch each time. This efficiency saves time and ensures consistency across all your records. With the right document in place, you can quickly fill in the relevant information, making the billing process faster and more efficient. This efficiency can be especially valuable when dealing with multiple clients or frequent service engagements.

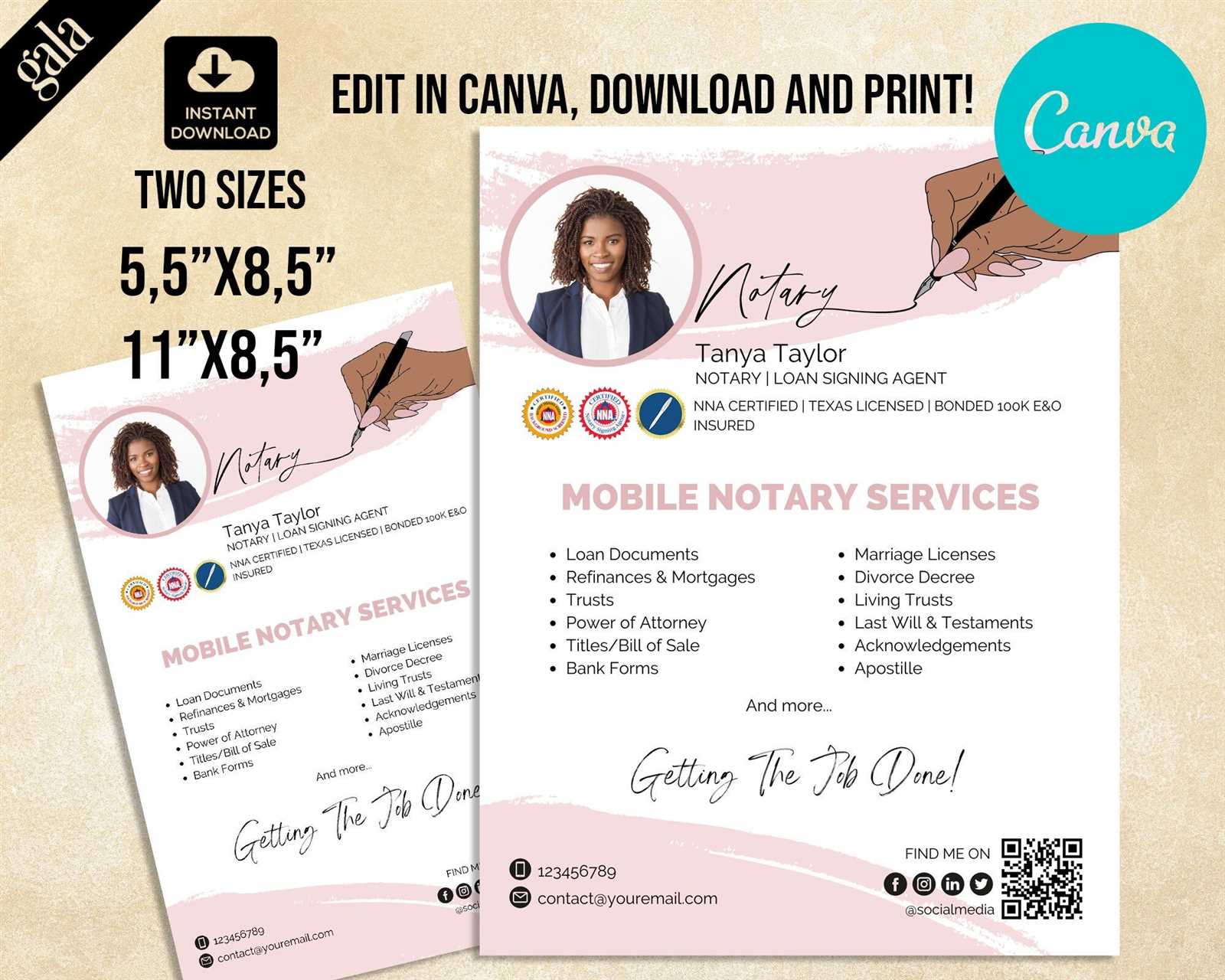

Benefits of Customizing Your Invoice

Tailoring your billing documents to fit your specific services provides numerous advantages. By customizing the layout and content, you can ensure that each record reflects the unique nature of the work you perform. This approach not only enhances clarity but also helps maintain a professional image with clients. A personalized document can set you apart from competitors and demonstrate attention to detail.

Furthermore, adjusting your billing format to suit your business model allows you to include all relevant charges, discounts, and payment terms. This flexibility helps prevent confusion and ensures both you and your clients are on the same page regarding financial expectations.

Improved Professionalism

Customizing your document allows you to incorporate your business branding, making it immediately recognizable to clients. Including your logo, contact information, and any relevant disclaimers or terms creates a more polished presentation. This added level of personalization conveys that you are a professional and committed to providing high-quality services. A unique layout helps reinforce your brand identity and establishes trust with clients.

Flexibility and Accuracy

By adjusting the document to fit the specifics of each job, you can ensure that all charges are accurate and up-to-date. This includes adding travel fees, hourly rates, or any other additional costs that may apply. Customization allows you to clearly define payment terms, making the document more transparent. Clients will appreciate the clarity, which can lead to quicker payments and fewer disputes.

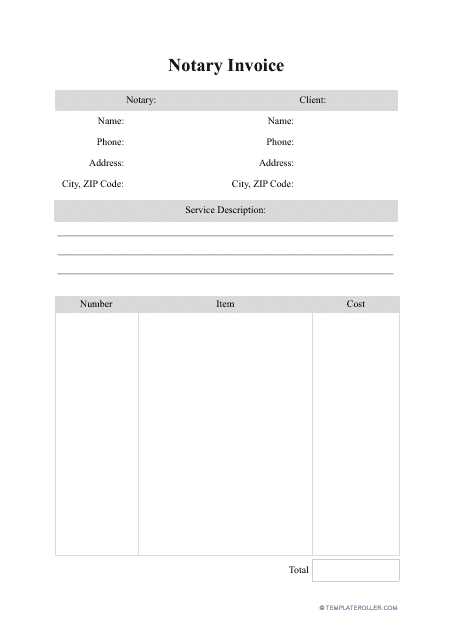

Key Elements of a Notary Invoice

A comprehensive and clear billing document is essential for maintaining transparency in business transactions. It serves as both a record for the service provider and a reference for the client. By including specific components in your document, you ensure that both parties are aligned on the terms of the agreement, reducing the likelihood of confusion or disputes. Below are the key elements that should be present in every professional billing document.

Important Sections to Include

- Service Provider Information: Name, business name (if applicable), contact details, and address.

- Client Information: Client’s name, contact details, and billing address.

- Description of Services: A detailed list of the work completed, including dates and specific tasks performed.

- Payment Amount: The total sum for services rendered, clearly broken down into individual charges if necessary.

- Additional Fees: Any additional costs, such as travel expenses or special service charges, should be itemized.

- Payment Terms: Due date, accepted payment methods, and any late fees or discounts offered for early payment.

- Invoice Number: A unique identifier for the document to ensure easy tracking and reference.

Why These Elements Matter

Each of these elements plays a crucial role in creating an accurate and professional record. Including thorough descriptions helps avoid misunderstandings, while clear payment terms establish expectations for both the service provider and the client. A well-structured billing document not only ensures timely payments but also enhances your reputation as a reliable and organized professional.

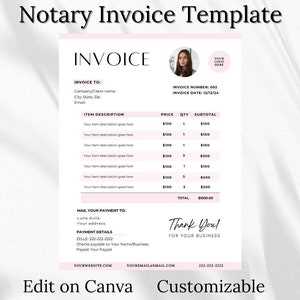

How to Create a Professional Billing Document

Creating a professional payment request document requires careful attention to detail and a clear structure. A well-designed document ensures that all necessary information is communicated effectively, preventing confusion and promoting timely payments. By including essential elements, such as a breakdown of services and payment terms, you can present yourself as a reliable and organized service provider.

The process of crafting a professional billing statement is straightforward. Start by organizing the content in a logical flow and making sure that the information is easy to understand. A clear and concise document will help you maintain a good relationship with clients, providing them with a transparent record of the services they have received and the costs involved.

Steps to Create Your Billing Document

- Include Business Information: Make sure your name or business name, contact details, and address are clearly visible at the top.

- List Client Information: Add the client’s name, address, and contact details to personalize the document.

- Describe the Services: Provide a detailed description of the work performed, including the dates of service and the specific tasks completed.

- Break Down the Charges: Itemize each service and associated cost. This helps the client see exactly what they are being charged for.

- Define Payment Terms: Clearly state the total amount due, the payment deadline, and any late fees or discounts offered.

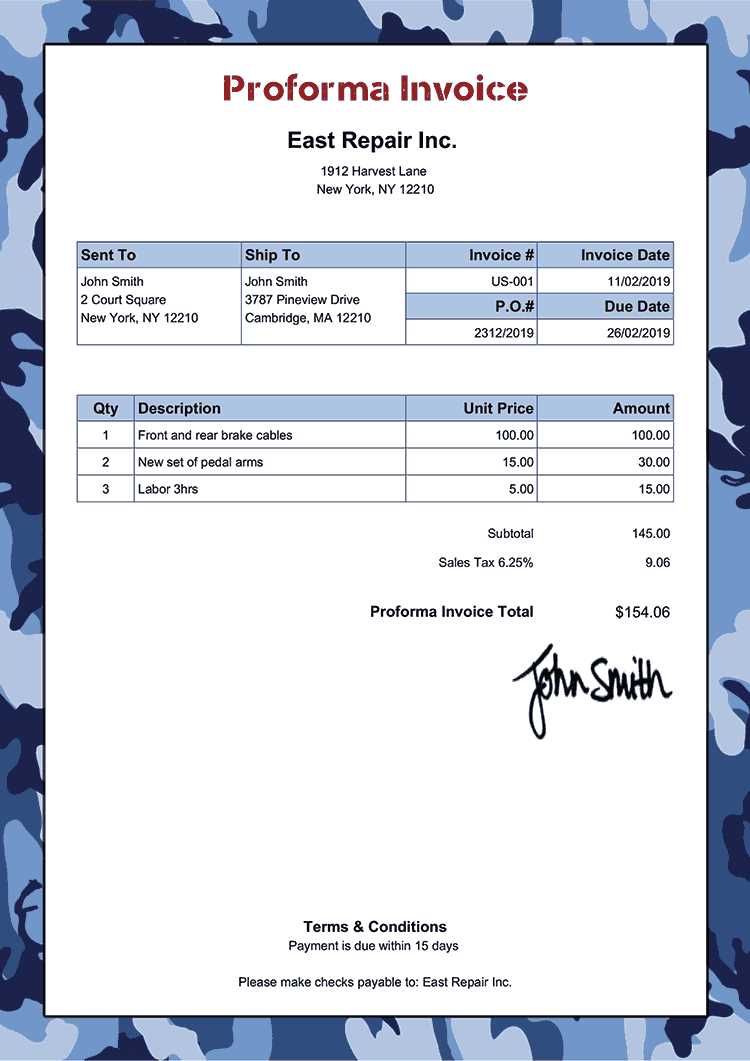

Example of a Professional Billing Document

Below is an example of how you can structure your billing document to ensure clarity and professionalism:

| Section | Details | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service Provider | Your Name / Business Name, Contact Information, Address | |||||||||||||||||||||||||||||||||||||||||

| Client Information | Client’s Name, Contact Information, Address | |||||||||||||||||||||||||||||||||||||||||

| Services Provided | Detailed List of Work Completed, Date of Service | |||||||||||||||||||||||||||||||||||||||||

| Itemized Charges | Co

Best Practices for Notary BillingTo maintain a smooth and professional payment process, it’s essential to follow best practices when creating payment requests for services rendered. By adhering to these practices, you can ensure accuracy, reduce misunderstandings, and build trust with your clients. Effective billing not only helps you get paid on time but also reflects your professionalism and attention to detail. Following clear guidelines when preparing your payment documents can help you avoid common mistakes and ensure that both you and your clients are on the same page. The key to successful billing lies in being transparent, organized, and consistent with the information you provide. Key Best Practices to Follow

By following these best practices, you ensure a more efficient billing process, reduce the chances of payment delays, and enhance your professional reputation. With each transaction, your clients will app Choosing the Right Invoice FormatSelecting the correct format for your billing document is crucial for ensuring clarity and professionalism. The format you choose can influence how easily your client understands the charges, as well as how efficiently you can track payments. A well-organized document that is easy to read and process will help facilitate smoother financial transactions, reducing the likelihood of confusion or disputes. There are various options available for structuring your payment request document. Whether you prefer a simple layout or a more detailed, customized approach, the key is to choose a format that suits both the nature of the services you provide and your clients’ preferences. Below are some important factors to consider when selecting the right layout. Factors to Consider When Choosing a Format

Types of Formats to Consider

|