Top Personal Invoice Templates for Simple and Professional Invoicing

Professionals and freelancers alike need a practical and efficient way to handle financial documentation for their clients. Customizable layouts allow individuals to establish a unique and consistent style, enhancing the overall presentation and organization of each record. Adapting these forms to reflect personal branding and functional details can significantly improve their clarity and impact.

Using tailored documents provides flexibility to adjust details according to specific business needs. Custom formats help streamline the management process, ensuring that each transaction is accurately represented and easy to track. With a focus on clarity and professionalism, anyone can create polished, user-friendly records that enhance their workflow.

In this guide, we explore the essentials of developing well-structured financial documents, emphasizing key elements that simplify billing. By following these recommendations, you can establish a streamlined, professional look that fits your unique brand and service approach.

Creating Effective Personal Invoice Templates

Crafting an efficient billing document is essential for establishing a streamlined process and ensuring clarity in financial transactions. A well-designed structure not only enhances readability but also helps in organizing all necessary details for both the provider and the recipient. By focusing on key design elements, you can create documents that reflect professionalism and simplify the payment process.

Structuring Essential Information

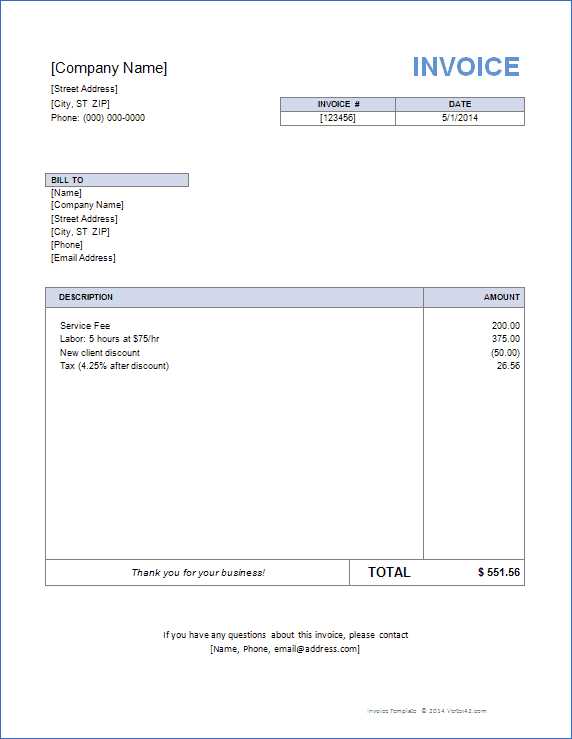

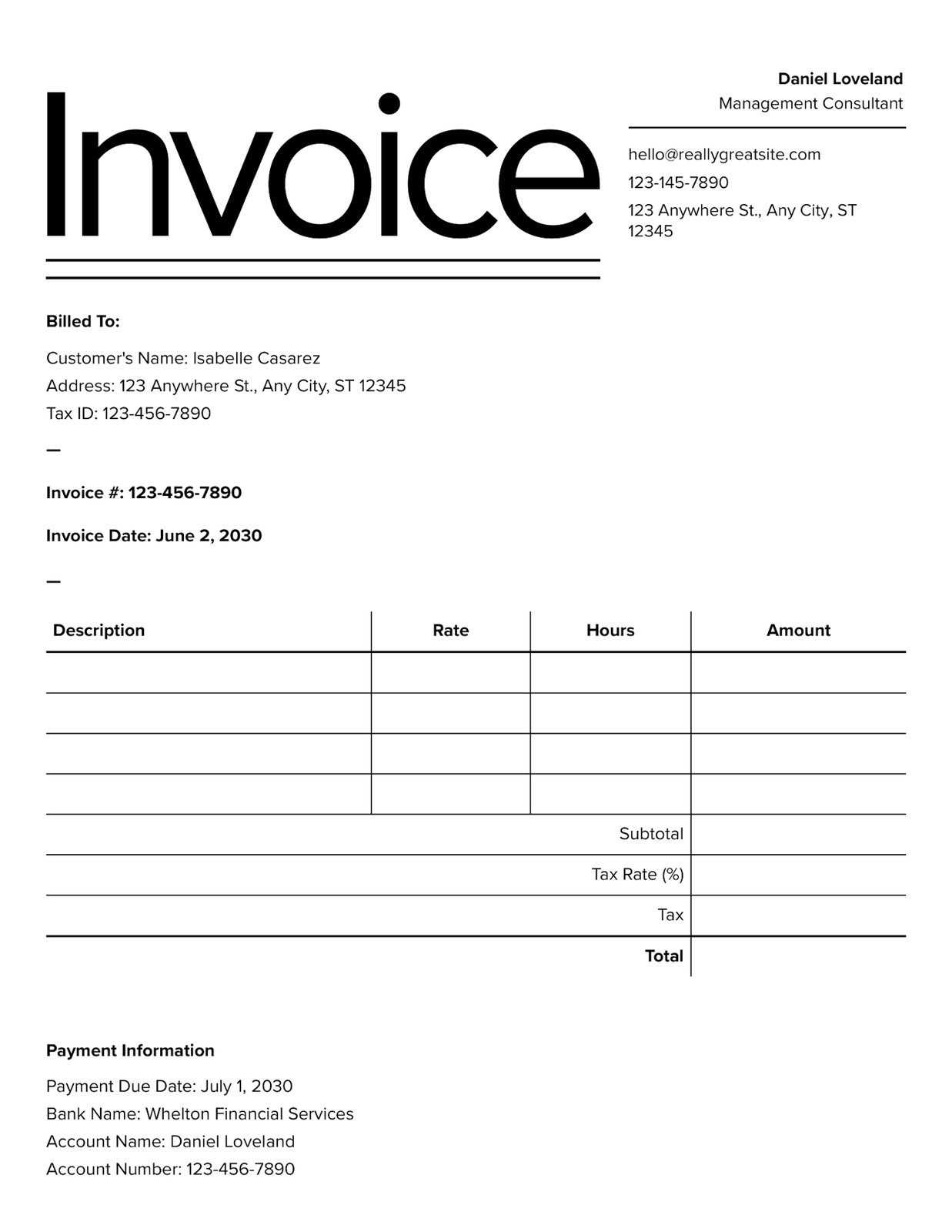

One of the most critical aspects of an effective billing layout is a clear arrangement of information. This includes contact details, payment terms, and any required references, all neatly divided into sections. Each component should be easy to locate, reducing the chance of confusion and making it simpler for the recipient to process the document.

Highlighting Key Details

To enhance clarity, it’s helpful to emphasize important data points, such as amounts due, deadlines, and payment methods. Use bold or italicized text to draw attention to these elements, ensuring they stand out. This simple approach can greatly

Benefits of Using Custom Invoices

Adapting financial documents to reflect unique business needs offers a range of advantages. Custom formats provide greater flexibility, ensuring that all relevant information is presented clearly and professionally. These adaptable designs allow you to control the document’s appearance and functionality, which can improve both branding and client communication.

- Professional Appearance: A tailored format lets you incorporate branding elements, such as logos and color schemes, giving a polished and cohesive look to every document.

- Enhanced Clarity: By organizing information in a way that suits your workflow, you make it easier for clients to understand each detail, from payment terms to contact information.

- Increased Efficiency: Custom designs often allow you to streamline repetitive processes, reducing the time spent on document preparation and improving overall productivity.

- Better Record Keeping: With layouts adapted to your specific requirements, it’s easier to manage and store financial records, simplifying access

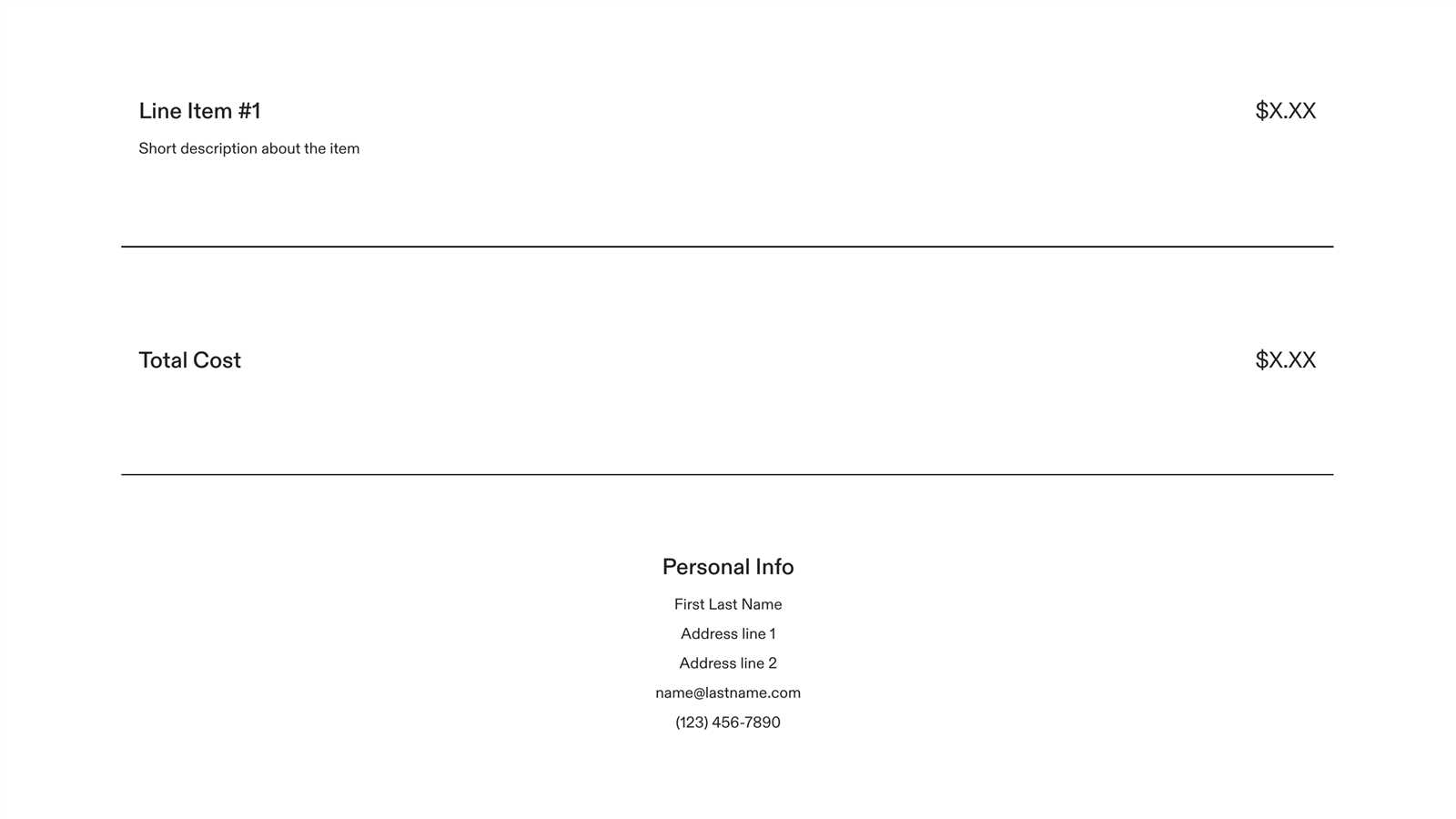

Key Elements of a Personal Invoice

Creating a clear and functional billing document requires careful attention to essential details that ensure accuracy and ease of use. A well-structured layout enhances understanding and helps avoid miscommunication, providing both the sender and recipient with a seamless experience. Including all necessary components is key to effective financial record-keeping.

Essential Information

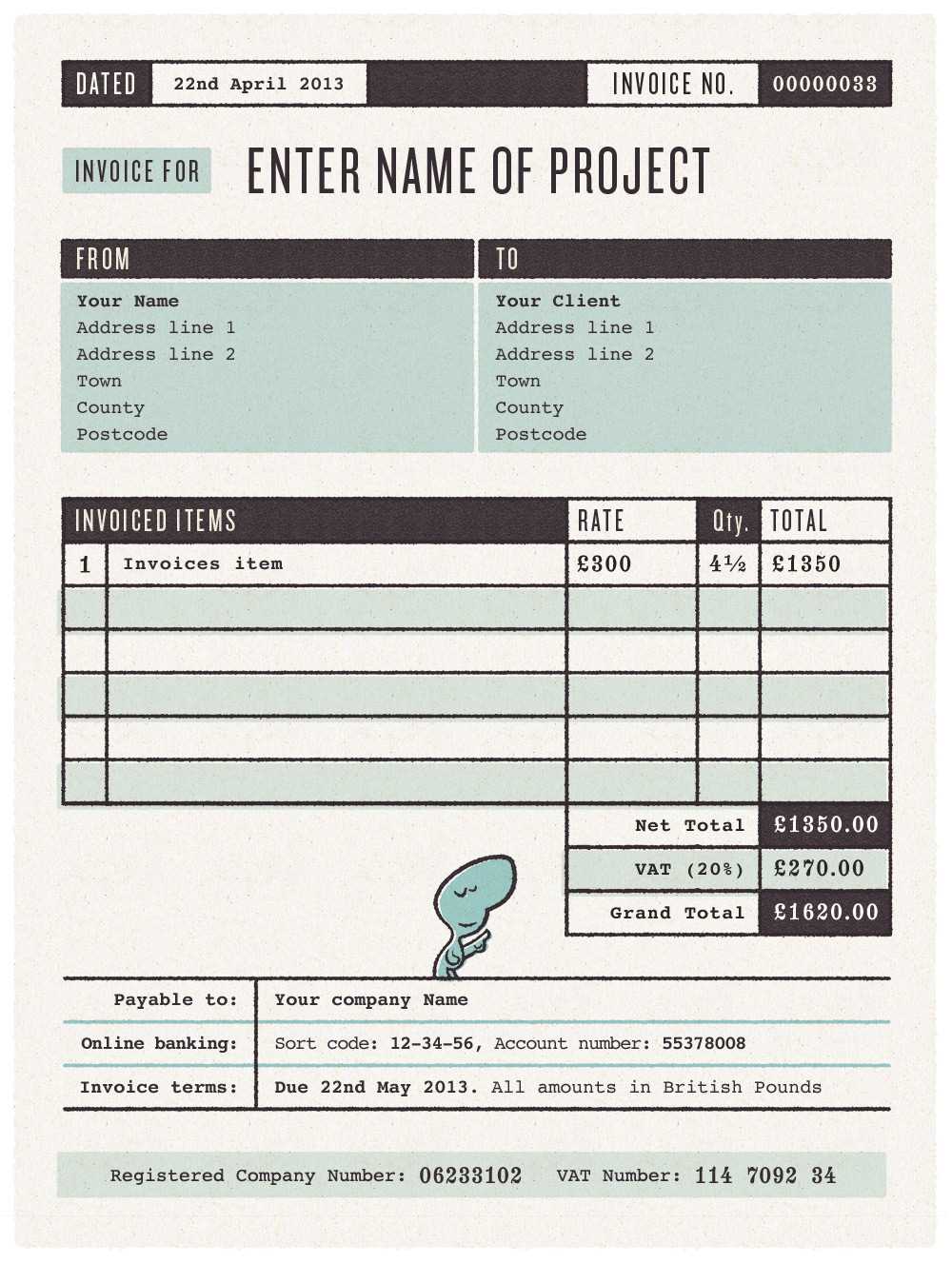

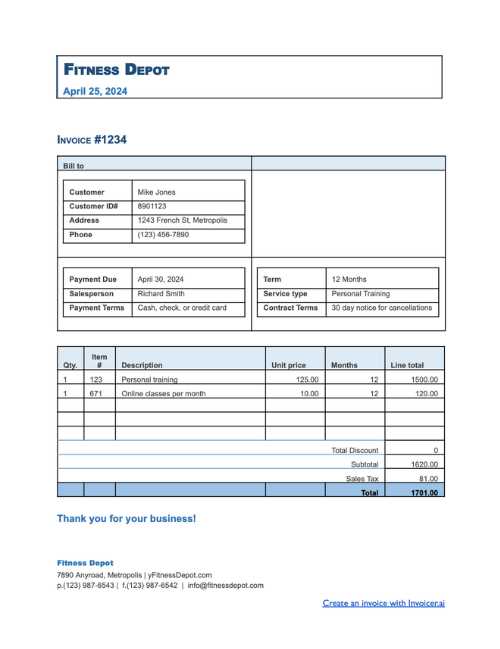

Each document should contain basic contact details for both parties, including names, addresses, phone numbers, and emails. This information allows for easy identification and direct communication if needed. Additionally, assigning a unique reference number to each document is helpful for tracking and managing records.

Details of Services or Products

List each item or service provided along with a brief description, quantity, and rate. These details ensure that the client understands exactly what they’re paying for. Including individual and total costs helps maintain transparency, so clients can see a clear breakdown of the charges.

With these essential elements in place, you create a structured and professional document that sup

How to Design an Invoice Layout

Creating a well-organized billing format is essential for clarity and professionalism. A thoughtfully designed structure not only enhances readability but also ensures that each element is easy to locate. This process involves selecting an arrangement that both represents your brand and meets your practical needs.

Start by defining sections for essential details, such as business information, payment terms, and itemized costs. Group related items together to create a logical flow, guiding the viewer through the document. This clear arrangement minimizes any potential confusion and ensures a smooth transaction process.

Use clean, simple fonts and ensure adequate spacing between sections to avoid overcrowding. Incorporating subtle branding elements, like logos or color accents, can give y

Tips for Adding Personal Branding

Integrating unique branding elements into your financial documents enhances recognition and creates a lasting impression with clients. A customized look sets your work apart and reflects your professionalism, making each record feel consistent with your overall brand identity. Simple adjustments can make a big impact on the way clients perceive your business.

Incorporate Logo and Color Scheme

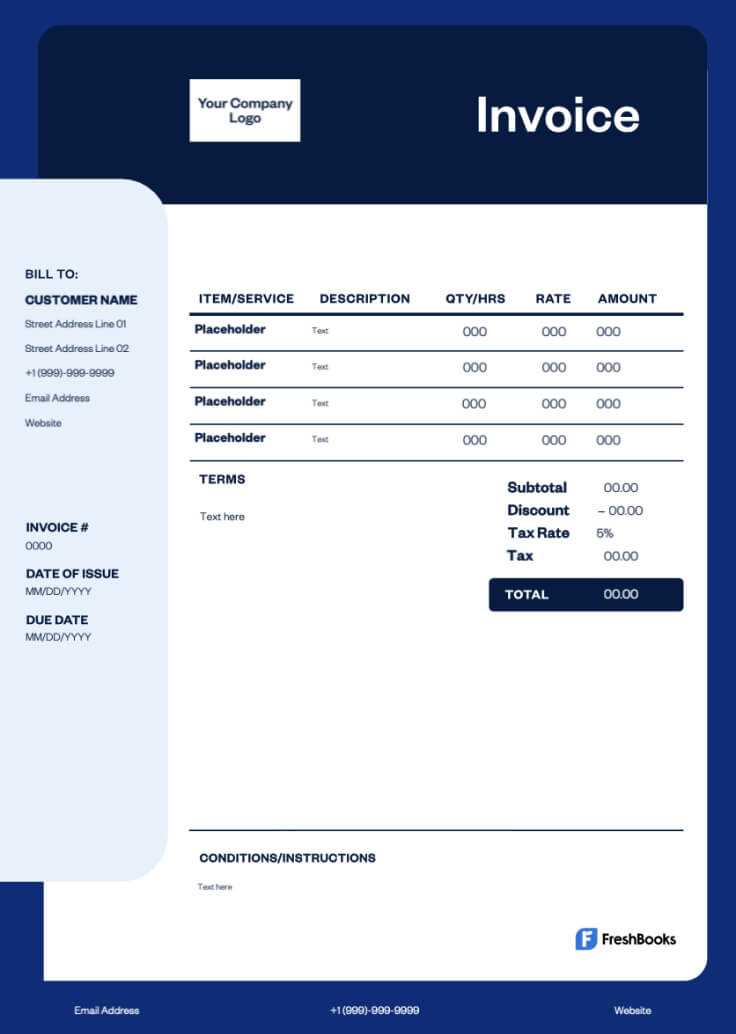

Adding a logo at the top of the document instantly identifies your business and strengthens brand recognition. Use colors that align with your brand palette to create visual cohesion, but keep the design clean and uncluttered. Subtle accents in headers or section dividers can emphasize information without overwhelming the layout.

Choose Fonts and Layouts that Reflect Your Style

Selecting professional fonts and a streamlined arrangement further reinforces your brand’s tone.

Understanding Essential Invoice Sections

Comprehending the critical components of a billing document is vital for ensuring accuracy and clarity in financial transactions. Each section serves a specific purpose, contributing to a complete understanding of the services provided and the payment required. By familiarizing yourself with these segments, you can create more effective and user-friendly documents.

The primary components typically include header information, which identifies the sender and recipient, and establishes the context for the transaction. Additionally, an itemized list detailing products or services is crucial, providing transparency regarding the charges incurred. Including payment terms and due dates ensures that all parties are aligned on expectations, fostering timely transactions.

By mastering these fundamental sections, you create a more organized and professional presentation that benefits both your business and your clients.

Best Tools for Invoice Creation

Utilizing the right software can significantly streamline the process of generating billing documents, making it easier to manage financial transactions. Various tools are available, each offering unique features tailored to different business needs. Selecting the appropriate option enhances efficiency and professionalism, allowing you to focus on what you do best.

Many users find cloud-based solutions particularly beneficial, as they allow for easy access from anywhere and often include customizable formats. Additionally, accounting software with integrated billing features can simplify record-keeping and automate calculations, reducing the risk of errors. Other popular choices include mobile apps that enable users to create and send documents on the go, ensuring timely communication with clients.

By exploring these various tools, you can find the best fit for your workflow, ultimately improving your business operations and client interactions.

Step-by-Step Guide to Invoice Design

Creating an effective billing document involves a systematic approach that ensures clarity and professionalism. By following a structured process, you can develop a layout that is not only functional but also visually appealing. Here’s a comprehensive guide to help you design your document effectively.

- Define Your Brand Elements: Choose colors, fonts, and logos that reflect your brand identity. Consistency in these elements enhances recognition.

- Choose a Layout: Decide on a format that organizes information logically. Common structures include two-column layouts or single-page designs.

- Include Essential Information: Ensure that key details such as your business name, client information, and transaction specifics are clearly presented.

- Organize the Content: Group related items together, such as services provided and their corresponding costs. Use headings and subheadings to create a clear hierarchy.

- Incorporate Payment Terms: Clearly state your payment conditions, including due dates and accepted methods. This helps manage client expectations.

- Review and Test: Before finalizing, double-check for errors and test the document by sending it to yourself or a colleague. Ensure everything appears as intended.

By following these steps, you can design a clear, professional, and visually appealing billing document that effectively communicates your services and facilitates prompt payments.

Choosing the Right Template Format

Selecting an appropriate format for your billing document is crucial to ensure functionality and ease of use. The right structure not only enhances readability but also ensures that all necessary information is clearly presented. Here are some factors to consider when choosing a format:

Format Type Advantages Considerations PDF Widely accepted, maintains formatting across devices Not easily editable, requires additional software for changes Word Document Easy to edit and customize, familiar format for many Formatting may change between different versions or systems Online Templates Accessible from anywhere, often includes built-in features Dependent on internet access, potential subscription costs Spreadsheet Ideal for calculations, can automatically update totals May appear less formal, requires knowledge of spreadsheet software By evaluating these formats based on your specific needs, you can select the most effective option for creating your documents, ensuring clarity and professionalism in your financial communications.

Popular Formats for Printable Invoices

When it comes to creating documents for billing purposes, choosing the right format is essential for both functionality and ease of use. Several widely used formats cater to different needs, making it crucial to understand the benefits of each. Here are some of the most popular options:

- PDF: This format is favored for its ability to preserve the layout and design of the document across various devices and operating systems. It is ideal for professional presentations and ensures that the content remains unchanged.

- Word Document: Known for its flexibility, this format allows users to easily modify content and customize designs. It is widely accessible, making it a common choice for many users.

- Excel Spreadsheet: Particularly useful for documents that require calculations, this format allows automatic updates to totals and subtotals. It is beneficial for users who need to manage numerical data efficiently.

- Online Editable Formats: Many platforms offer cloud-based templates that can be edited and saved online. This format provides convenience and accessibility, allowing users to access their documents from any device.

- Plain Text Files: While less visually appealing, this format ensures compatibility across all devices and platforms. It is straightforward and can be easily converted to other formats if necessary.

Understanding these formats will help you select the best option for your specific needs, ensuring that your billing documents are effective and professional.

Integrating Payment Options in Invoices

Incorporating diverse payment methods into billing documents enhances convenience for clients and promotes timely transactions. By offering various options, businesses can cater to different preferences, increasing the likelihood of receiving payments promptly. It is essential to understand the various methods available and how to implement them effectively.

Popular Payment Methods

Offering multiple payment options can significantly improve the customer experience. Some of the most commonly accepted methods include:

- Credit and Debit Cards: This widely used method allows for quick transactions and is often preferred for its simplicity and speed.

- Online Payment Platforms: Services like PayPal and Stripe enable secure and instant payments, making them an attractive option for many clients.

- Bank Transfers: Direct transfers can be an effective option for larger transactions, though they may take longer to process.

- Mobile Payment Apps: Applications such as Venmo and Square Cash offer convenience for clients who prefer to pay using their smartphones.

Best Practices for Integration

To ensure seamless integration of payment options, consider the following best practices:

- Clarity and Transparency: Clearly outline the available payment methods in your documents to avoid confusion and facilitate smooth transactions.

- Security Measures: Ensure that any online payment options are secure and trustworthy to build confidence with your clients.

- Follow-Up Reminders: Implement a system for sending reminders to clients about upcoming or overdue payments to encourage timely settlement.

By effectively integrating various payment methods into your billing documents, you can streamline the payment process and improve overall client satisfaction.

How to Keep Invoices Organized

Maintaining an orderly system for billing documents is crucial for efficient financial management. An organized approach helps ensure that transactions are processed smoothly, making it easier to track payments and outstanding balances. Implementing effective strategies can greatly simplify this task and enhance overall productivity.

Utilizing Digital Tools

One of the most effective ways to keep billing documents organized is by leveraging technology. Consider the following digital solutions:

- Cloud-Based Software: Programs like QuickBooks or FreshBooks allow for easy access and management of documents from anywhere, facilitating collaboration and reducing paperwork.

- Spreadsheets: Using software such as Microsoft Excel or Google Sheets can help create a customized tracking system, making it easier to categorize and update records as needed.

- Document Management Systems: Specialized tools designed for organizing and retrieving files can streamline the storage process, allowing for quick access to necessary documents.

Establishing a Filing System

A well-structured filing system is essential for physical documents. Consider the following tips:

- Sort by Date or Client: Organizing documents chronologically or by client can make it easier to find specific records when needed.

- Label Clearly: Use clear and descriptive labels for folders or files to ensure you can quickly identify the contents.

- Regular Reviews: Schedule periodic reviews of your documents to remove outdated or unnecessary records, keeping your system streamlined.

By adopting these strategies, you can effectively maintain an organized approach to managing your billing documents, leading to improved efficiency and reduced stress in your financial operations.

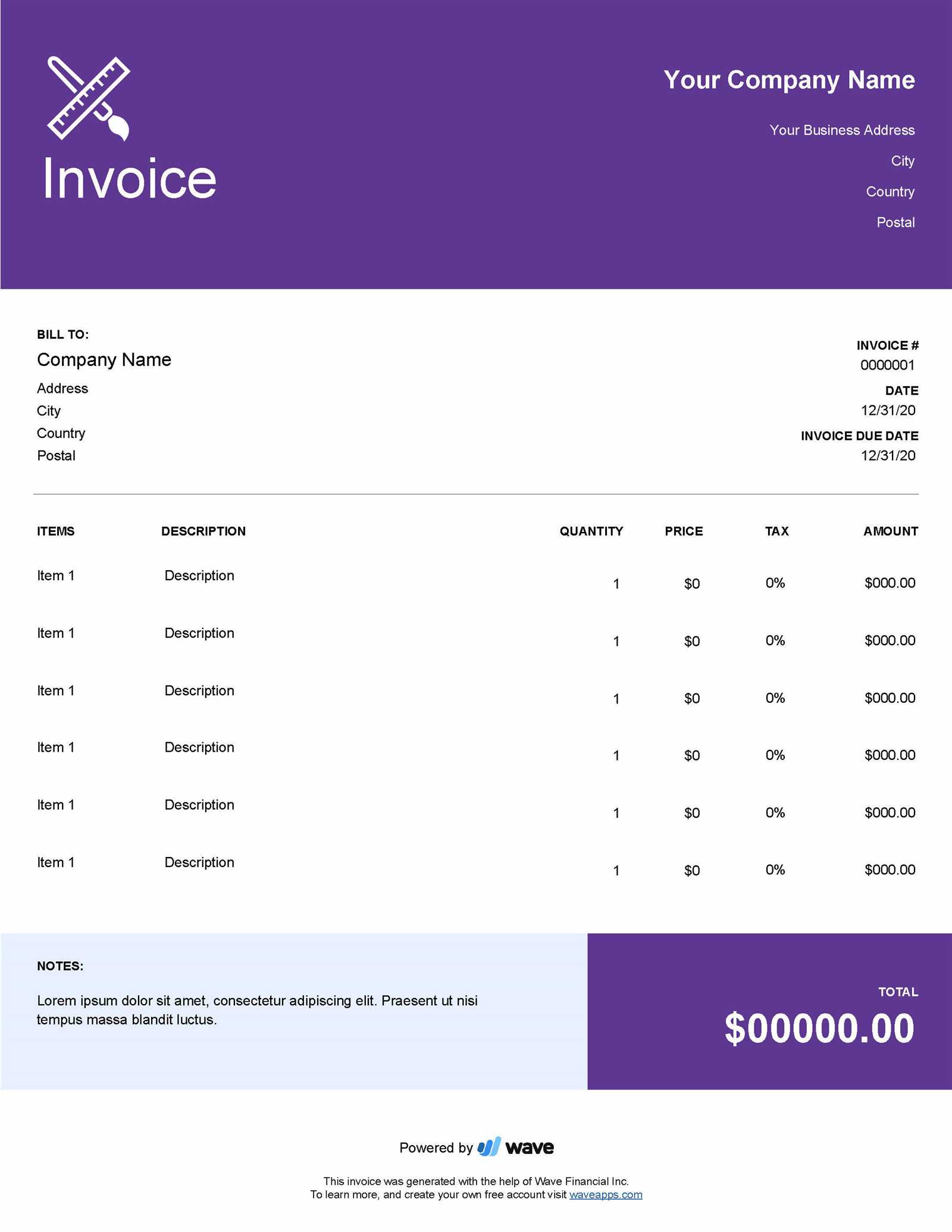

Top Software for Invoice Management

In today’s fast-paced business environment, utilizing effective software solutions for managing billing documents is essential. The right tools can streamline processes, enhance accuracy, and improve overall efficiency. With numerous options available, selecting the best software can significantly impact how transactions are handled.

Here are some of the leading software solutions that cater to various needs in document management:

1. QuickBooks: This comprehensive accounting software offers robust features for invoicing, expense tracking, and financial reporting. Its user-friendly interface makes it accessible for both small businesses and larger enterprises.

2. FreshBooks: Known for its simplicity and efficiency, FreshBooks is ideal for freelancers and small business owners. It provides easy invoice creation, time tracking, and payment processing, ensuring a seamless experience.

3. Zoho Invoice: Part of the larger Zoho suite, this software offers customizable invoicing solutions along with expense tracking and client management. Its integration with other Zoho applications enhances functionality.

4. Xero: A cloud-based accounting platform, Xero offers features for invoicing, bank reconciliation, and financial reporting. Its collaboration capabilities make it suitable for businesses that require real-time access for multiple users.

5. Wave: This free software is perfect for small businesses and freelancers looking for basic billing features without the costs. Wave provides tools for invoicing, accounting, and receipt scanning, making it a budget-friendly choice.

Choosing the right software can significantly enhance the management of billing documents, leading to better organization and improved cash flow.

Protecting Client Data in Invoices

Ensuring the security of client information in financial documents is a critical responsibility for any business. As data breaches and identity theft become more prevalent, taking proactive measures to safeguard sensitive information is essential. Proper handling of personal and financial details not only builds trust but also complies with legal requirements.

Key Strategies for Data Protection

Implementing robust security practices can significantly reduce the risk of data exposure. Here are some effective strategies:

- Use Secure Platforms: Ensure that any software or online service used for creating and sending documents employs encryption and complies with data protection regulations.

- Limit Access: Control who has access to sensitive information. Only authorized personnel should be able to view or manage client data.

- Regular Backups: Maintain regular backups of all financial records in secure locations. This ensures data recovery in the event of a breach or technical failure.

- Educate Staff: Conduct training sessions to raise awareness about data security practices and potential threats, such as phishing scams and malware.

- Implement Strong Passwords: Require strong, unique passwords for accounts that access client information and change them regularly.

Legal Considerations

Compliance with data protection laws, such as GDPR or CCPA, is crucial. Understand the regulations applicable to your region and ensure that your practices align with these standards to protect client information effectively.

By adopting these measures, businesses can foster a secure environment that protects client data, ultimately enhancing reputation and trust.

Common Mistakes in Document Templates

Creating financial documents can be a straightforward task, but several common pitfalls can lead to confusion, miscommunication, and potential financial loss. Being aware of these mistakes can help ensure that the final product is both professional and effective.

Frequent Errors to Avoid

Here are some of the most common errors encountered when designing or using these types of documents:

- Inaccurate Information: Failing to verify the accuracy of dates, amounts, and client details can lead to misunderstandings and payment delays.

- Lack of Clarity: Using vague descriptions for services or products can confuse clients about what they are being charged for, potentially leading to disputes.

- Missing Terms and Conditions: Not including payment terms, due dates, and late fees can result in delayed payments and complicate collections.

- Poor Formatting: A cluttered or unprofessional layout can detract from the document’s credibility. Consistent fonts, clear headings, and organized sections enhance readability.

- Ignoring Legal Requirements: Overlooking local regulations regarding financial documentation can have serious repercussions. Ensure compliance with applicable laws to avoid penalties.

Best Practices for Improvement

To mitigate these common issues, it is advisable to establish a checklist for creating these documents. Regularly review templates to ensure they meet current business needs and legal standards. Seeking feedback from clients can also help identify areas for improvement.

Improving Efficiency with Automated Invoices

Streamlining financial documentation processes can significantly enhance operational efficiency for businesses. By utilizing automation, organizations can minimize manual tasks, reduce errors, and accelerate the overall workflow.

Benefits of Automation

Implementing automated systems for generating financial documents offers several advantages:

- Time Savings: Automation reduces the time spent on creating and sending documents, allowing staff to focus on more strategic tasks.

- Consistency: Automated tools ensure uniformity in formatting and content, promoting a professional appearance across all documents.

- Error Reduction: By minimizing human input, the risk of mistakes related to data entry or calculations is significantly decreased.

- Faster Processing: Automated systems can quickly generate and dispatch documents, expediting the billing process and improving cash flow.

- Enhanced Tracking: Automation often includes features for tracking document status, making it easier to monitor payments and follow up as needed.

Steps to Implement Automation

To successfully integrate automated systems into your financial workflow, consider the following steps:

- Identify the current challenges and inefficiencies in your existing processes.

- Research available software solutions that offer automation features tailored to your needs.

- Test the chosen software to ensure it aligns with your requirements and integrates well with your existing tools.

- Train staff on the new system to maximize adoption and utilization.

- Monitor the implementation process and gather feedback for continuous improvement.

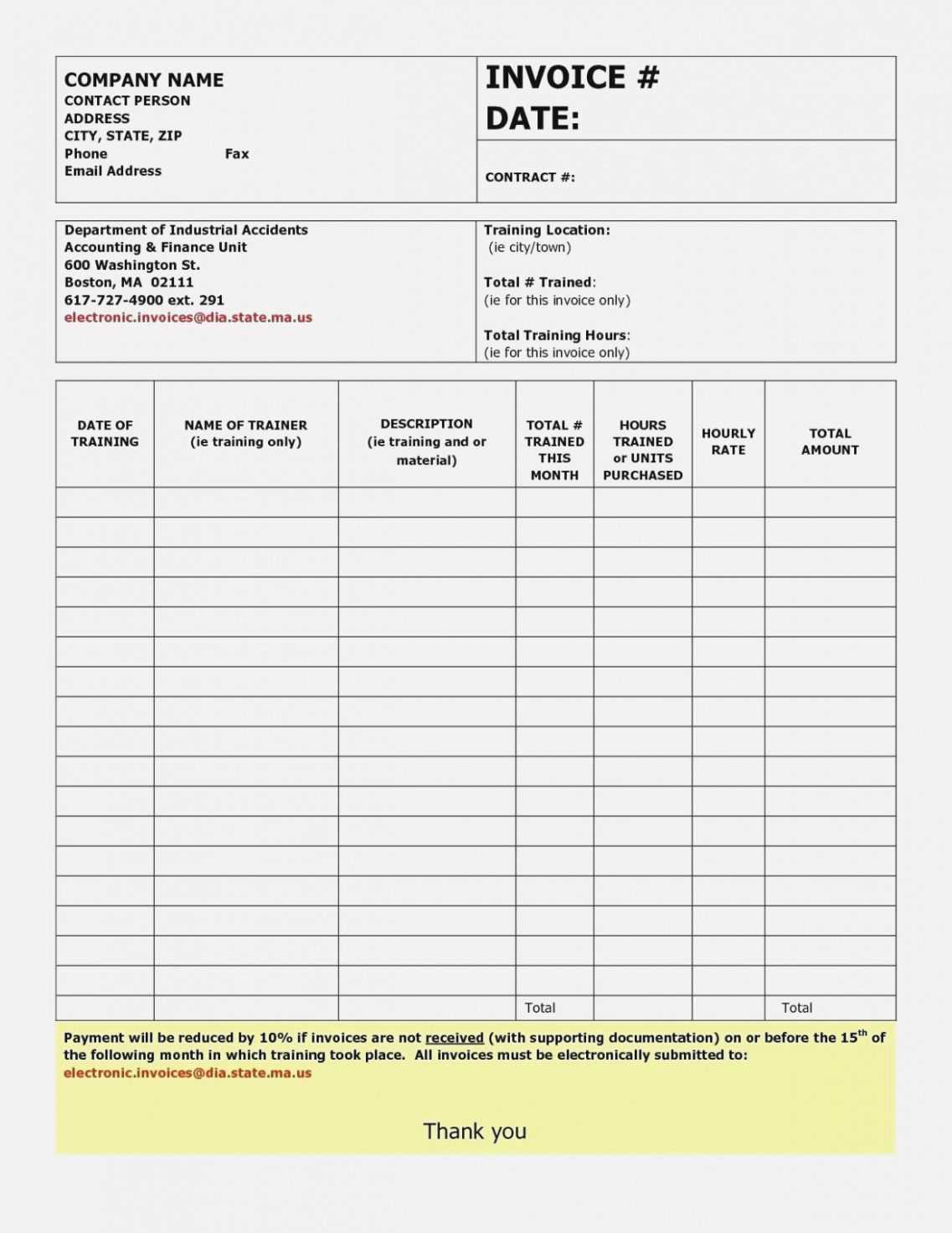

Creating Invoices for Freelance Work

For independent professionals, generating accurate billing documents is essential for ensuring timely payments and maintaining a professional image. These documents should clearly outline the services rendered, payment terms, and any other relevant information that facilitates a smooth transaction.

Essential Components Description Contact Information Include your name, address, phone number, and email, along with the client’s details. Service Description Clearly detail the work performed, including specific tasks or projects. Payment Amount List the charges for each service, along with the total due. Payment Terms Specify when payment is due and acceptable payment methods. Invoice Number Assign a unique identifier to each document for tracking purposes. Date of Issue Include the date when the document is generated. By incorporating these key elements, freelancers can create comprehensive billing documents that promote transparency and professionalism, ultimately leading to better client relationships and timely compensation.