How to Create an Effective SMS Invoice Template

In today’s fast-paced world, efficient communication is key to managing financial transactions. Sending detailed billing information directly to clients via mobile messages has become a practical and effective solution for many businesses. This method offers a quick and professional way to ensure customers receive payment reminders, details of charges, and other essential documents without the delay of traditional methods.

By adopting a streamlined approach to digital billing, businesses can reduce administrative time and ensure faster payments. Integrating a simple, yet customizable, system allows you to send concise and clear payment requests that are accessible at any time. Whether you are a freelancer, small business owner, or part of a larger organization, using modern communication tools for billing purposes can enhance efficiency and improve client satisfaction.

Embracing new methods of managing finances can help businesses stay ahead in a competitive market. Adapting to modern solutions for invoicing and payment reminders not only saves time but also helps create a more professional image for your business. An effective mobile billing system ensures that your clients have all the information they need to process payments quickly and easily.

SMS Invoice Template Overview

Managing billing and payment requests has never been easier with the advent of mobile messaging solutions. A streamlined approach to sending financial details through short and direct messages has proven to be an efficient way for businesses to stay on top of their transactions. This method ensures that clients receive timely reminders, clear payment instructions, and all relevant information directly to their phones, minimizing delays and improving payment processing times.

By adopting a messaging-based billing system, businesses can save time on administrative tasks while maintaining a professional image. This approach allows for quick communication of essential financial details, reducing the need for paper-based correspondence or lengthy email exchanges. A well-structured message can provide all necessary information in a concise format, making it easier for clients to process payments and understand the charges involved.

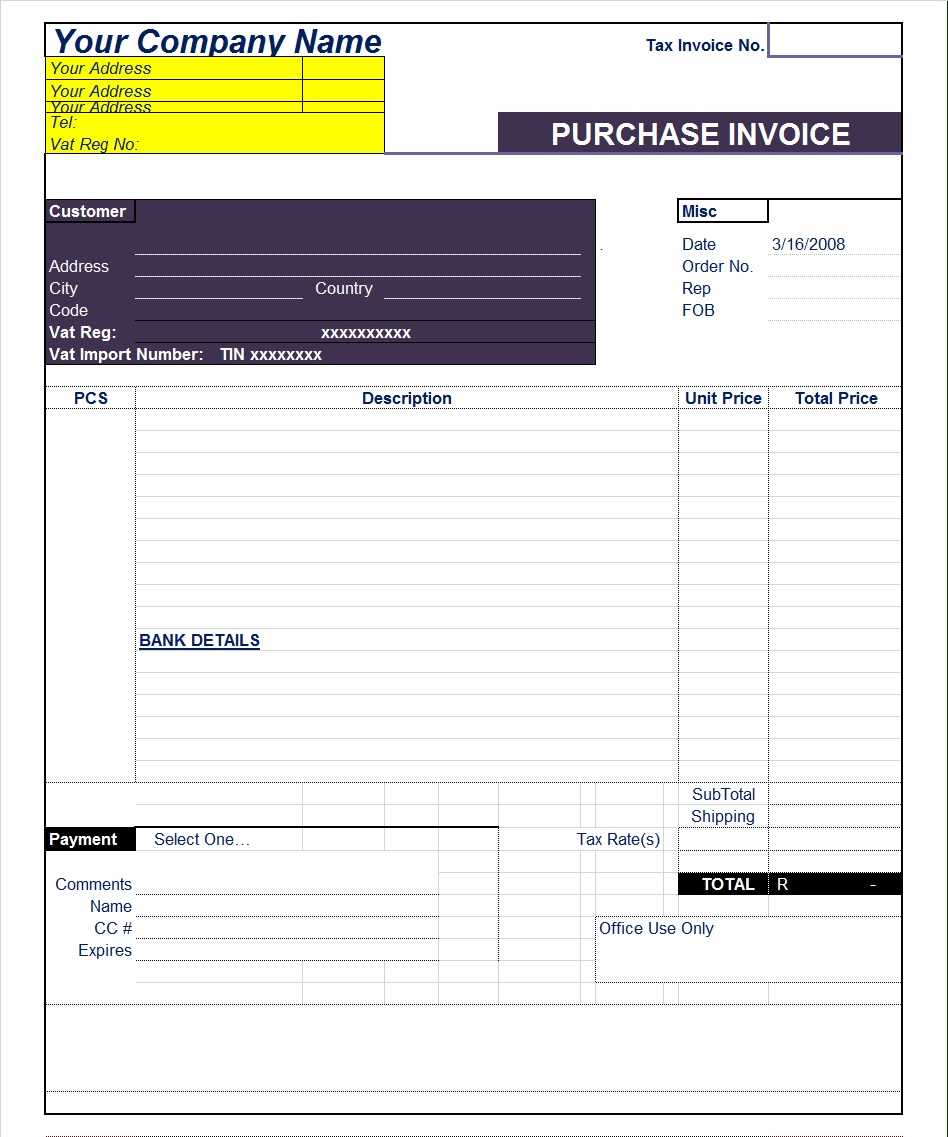

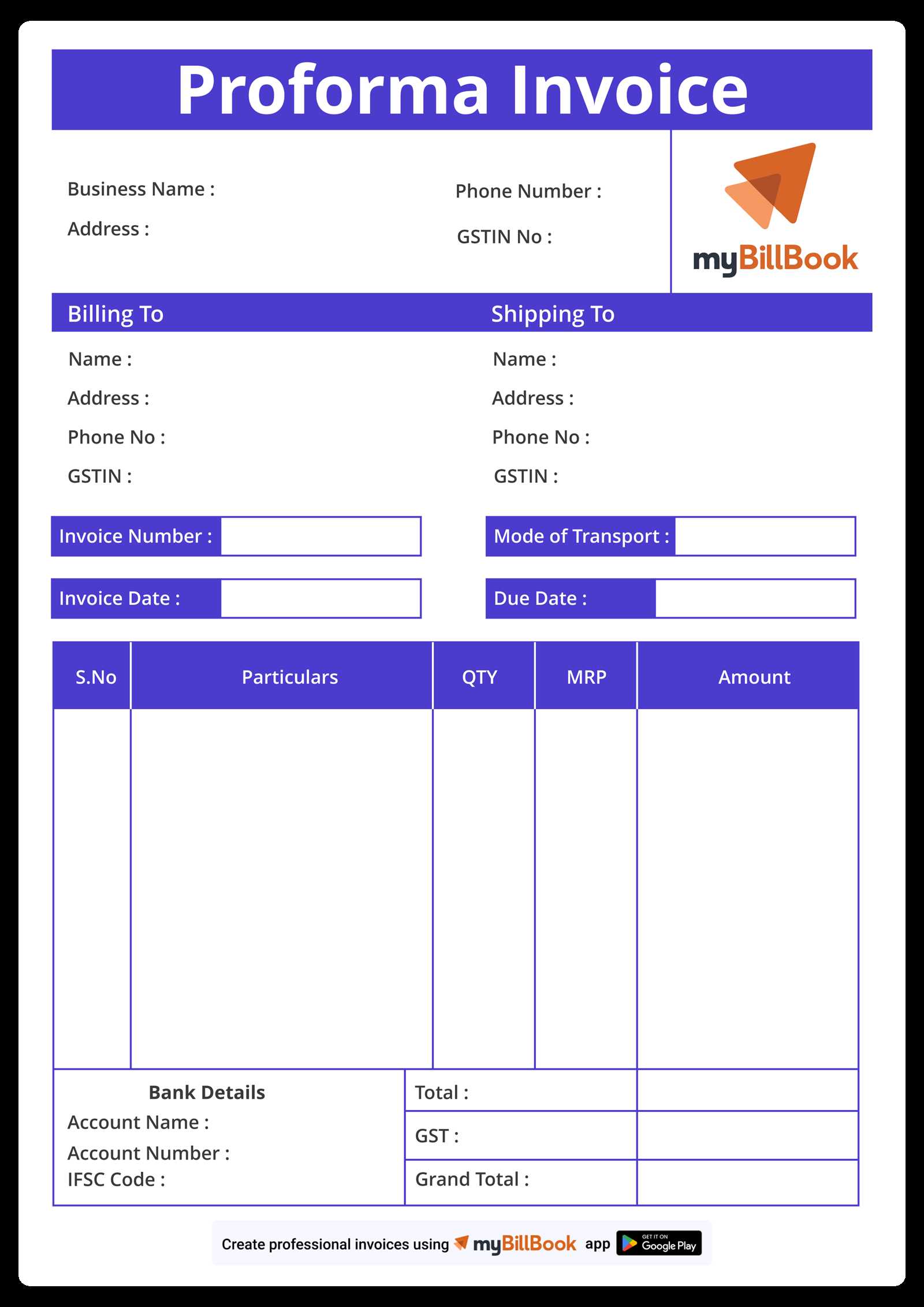

The key advantage of this approach is the ability to deliver detailed yet straightforward payment notifications, which can be customized to suit the specific needs of the business. Below is an example of what a well-organized message may include:

| Component | Description |

|---|---|

| Business Name | The name of your business or organization. |

| Client Name | The name of the recipient or customer. |

| Amount Due | The total amount the client is required to pay. |

| Payment Deadline | The date by which payment should be made. |

| Payment Method | Details on how the client can submit payment. |

| Contact Information | A way for the client to reach out for questions or concerns. |

Using a clear, structured message format helps to ensure the recipient understands the essential details and can act on the request swiftly. By offering a simple and efficient way to manage financial communication, businesses can build stronger, more reliable relationships with their clients while keeping operations running smoothly.

Why Use SMS Invoices for Billing

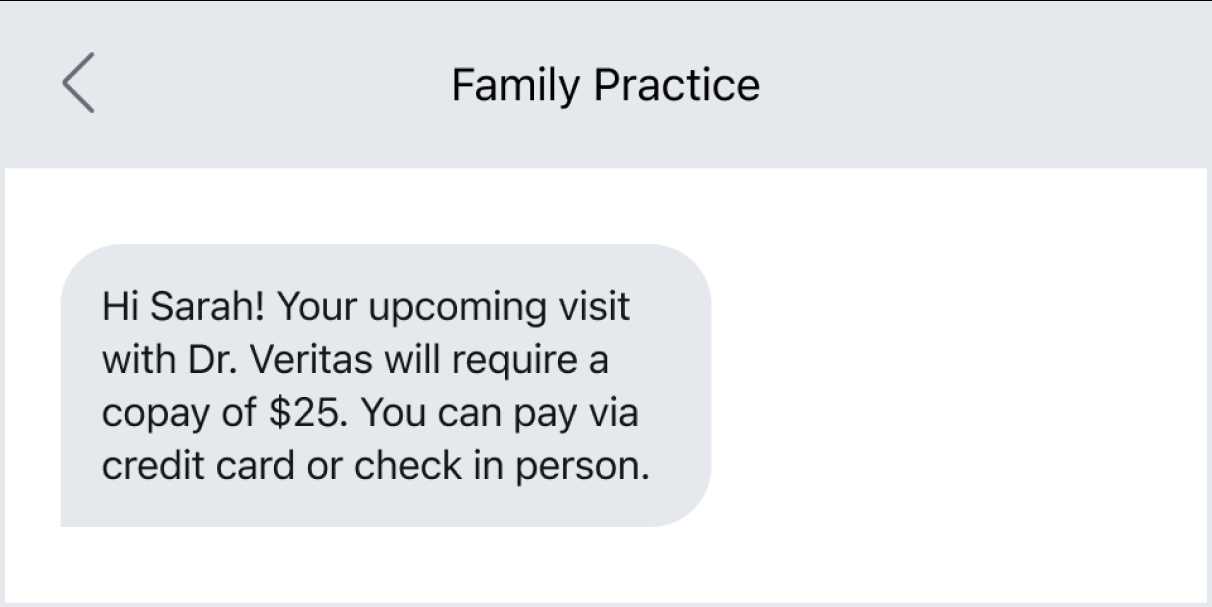

In today’s fast-paced business environment, ensuring timely and efficient communication with clients is crucial. Using mobile messaging to send payment reminders and billing details offers several advantages over traditional methods. It allows businesses to reach clients instantly, providing them with the necessary information directly to their phones, ensuring faster responses and reducing delays in payment processing.

Speed and Efficiency

One of the primary reasons to choose mobile messages for billing is the speed and efficiency it provides. Unlike paper invoices or emails that may get lost or delayed, text messages are typically read within minutes of being received. This ensures that clients are immediately aware of their outstanding balances and can make payments without unnecessary delays.

Improved Client Engagement

Sending payment details via mobile messaging also improves engagement with your clients. Unlike email inboxes that may go unchecked for days, most people regularly check their text messages. This higher engagement rate can lead to faster payment cycles, reducing the need for follow-ups and reminders.

Here are some of the key benefits of using mobile messages for billing:

| Benefit | Description |

|---|---|

| Instant Delivery | Messages are delivered instantly, ensuring prompt receipt by clients. |

| High Open Rate | Text messages have a much higher open rate compared to emails or mailed invoices. |

| Cost-Effective | Mobile messaging reduces costs associated with paper, postage, and administrative work. |

| Convenient Payment | Clients can process payments easily from their mobile devices, improving convenience. |

| Reduced Errors | Clear, concise messages reduce the chance of errors or miscommunication. |

Using mobile messaging for payment reminders and billing also allows businesses to streamline their operations, reduce overhead costs, and offer a more convenient experience for clients. By adopting this method, companies can ensure a smoother, faster, and more reliable billing process.

Key Features of an SMS Invoice

When sending payment reminders and billing details via text messages, it is essential to ensure that the message contains all the necessary information in a clear and concise manner. A well-crafted mobile message for billing should be informative, professional, and easy for clients to understand. The key features of an effective billing message contribute to a smooth transaction process and improved customer satisfaction.

Clear and Concise Information: The most important aspect of a billing message is the clarity of the information provided. A well-structured message should include the amount due, payment due date, and instructions for making the payment. Avoiding overly complicated language or unnecessary details will help ensure the recipient understands the request quickly.

Personalization: Adding a personal touch to the message can enhance customer experience and improve engagement. Including the recipient’s name or referring to their previous transactions adds a level of professionalism and shows that the business values the relationship with the client.

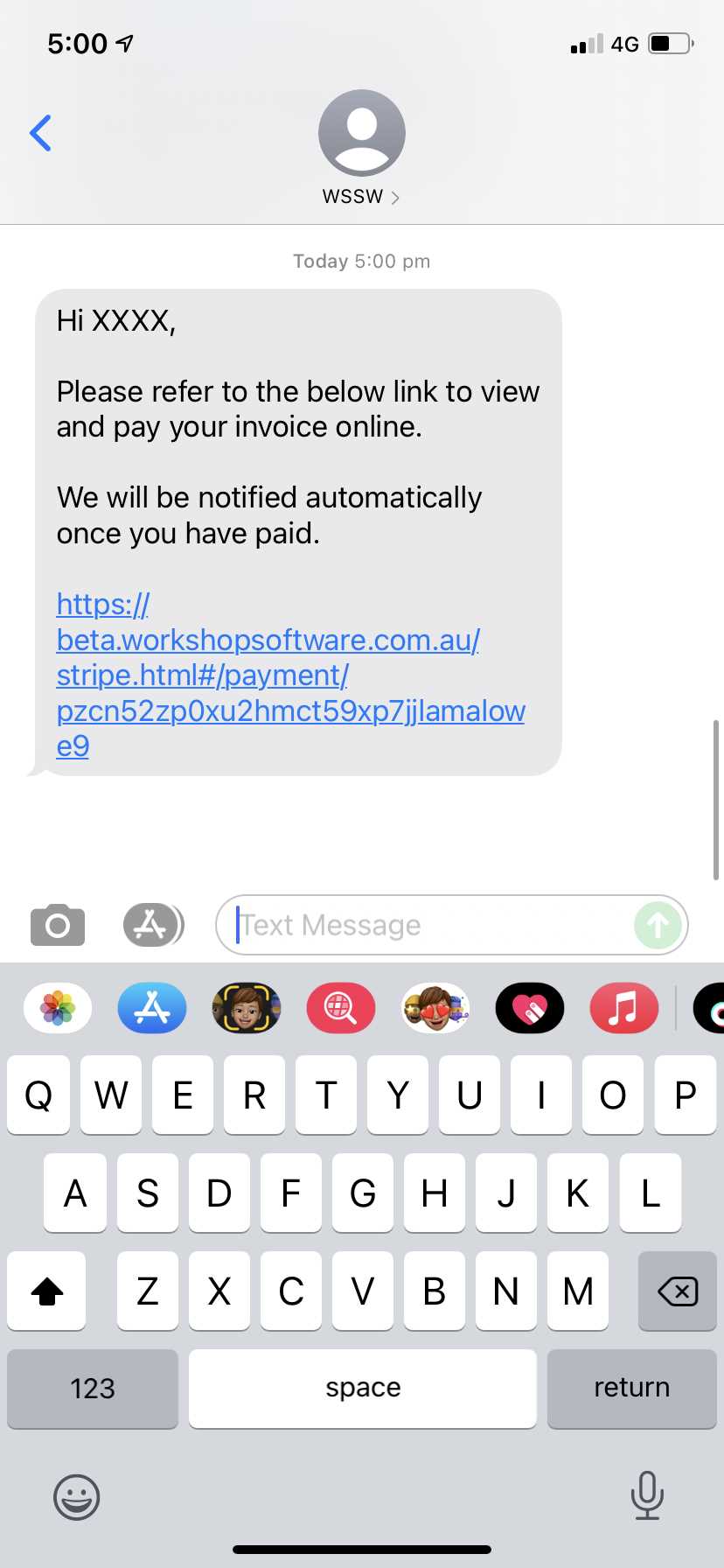

Payment Instructions: A key feature of an effective billing message is providing easy-to-follow instructions for making a payment. This could include a link to a payment portal, mobile payment options, or bank account details. Ensuring the process is as seamless as possible will increase the likelihood of prompt payment.

Professional Tone: While a mobile message is short and direct, it should maintain a professional tone. The message should reflect the brand’s image and convey the necessary information without sounding too casual or impersonal. A well-written message enhances the credibility of the business and fosters trust with the customer.

Easy-to-Read Formatting: Short, clear sentences with proper spacing make the message easier to read. Use bullet points or line breaks where needed, especially when listing key information such as amounts or payment methods. A well-organized message makes it simpler for the client to process the payment quickly.

To summarize, the most effective billing messages incorporate the following features:

| Feature | Description | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Clear Payment Details | Amount due, due date, and payment instructions are clearly stated. | ||||||||||||||||||||||||||

| Step | Action |

|---|---|

| 1. Personalize the Message | Include the recipient’s name and any relevant reference numbers (e.g., invoice number, order number) to make the message feel tailored to the client. |

| 2. Provide Clear Payment Details | State the amount due, the due date, and any applicable taxes or fees clearly. This ensures there’s no confusion. |

| 3. Offer Simple Payment Instructions | Give easy-to-follow steps or a direct link for making the payment. Include acceptable payment methods, such as credit card, bank transfer, or mobile payment apps. |

| 4. Maintain a Professional Tone | Write the message in a respectful and formal tone, reflecting the professionalism of your business. |

| 5. Keep It Brief | Limit the message to the most essential information to ensure it’s easy to digest. Avoid unnecessary details that could overwhelm the recipient. |

| 6. Add Contact Information | If the client has any questions or issues with the payment, include a phone number or email address where they can contact you. |

By following these steps, you can create a mobile payment request that is clear, professional, and user-frie

Benefits of SMS Invoicing for Businesses

For businesses looking to improve their billing processes, using mobile messaging as a method to send payment requests offers numerous advantages. The ability to deliver quick, concise, and direct payment notifications can streamline financial communication, reduce delays, and improve overall efficiency. This method is particularly useful in a fast-paced digital world, where speed and convenience are critical for maintaining positive client relationships and ensuring timely payments.

Faster Payment Processing

One of the main benefits of using mobile messages for billing is the speed with which payments can be processed. Traditional methods, such as paper invoices or emails, often involve delays due to delivery times or overlooked messages. In contrast, mobile messages are typically read within minutes of being received, enabling clients to act immediately. This quick communication results in faster payments, reducing the time spent chasing overdue accounts and improving cash flow for the business.

Cost-Effectiveness and Efficiency

Sending payment reminders via text messages is far more cost-effective than traditional invoicing methods. Businesses can significantly reduce costs associated with printing, postage, and administrative time spent managing paper invoices. Additionally, mobile payment notifications often require less manual intervention, allowing staff to focus on other critical tasks. This increased efficiency leads to better resource allocation and ultimately saves the business money.

Other key benefits of using mobile messaging for billing:

- High Read Rate: Text messages have a higher open rate than emails, ensuring that payment notifications are seen promptly.

- Improved Customer Experience: Clients appreciate the convenience of receiving payment reminders directly on their mobile devices, making it easier for them to complete transactions on the go.

- Reduced Errors: Automated billing messages minimize human error, ensuring that details are accurate and consistent every time.

- Real-Time Updates: Any changes to payment terms or amounts can be communicated instantly, ensuring clients always have the latest information.

- Global Reach: Mobile messaging is accessible worldwide, making it easier for businesses to handle international clients without additional overhead costs.

By adopting mobile messaging for billing, businesses not only streamline their operations but also create a more efficient and customer-friendly experience. The combination of speed, cost savings, and improved communication makes it a smart choice for any organization looking to enhance their billing processes.

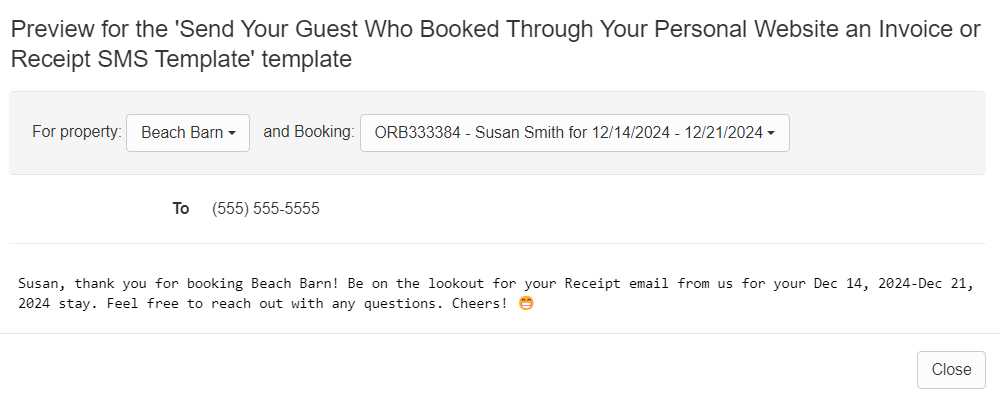

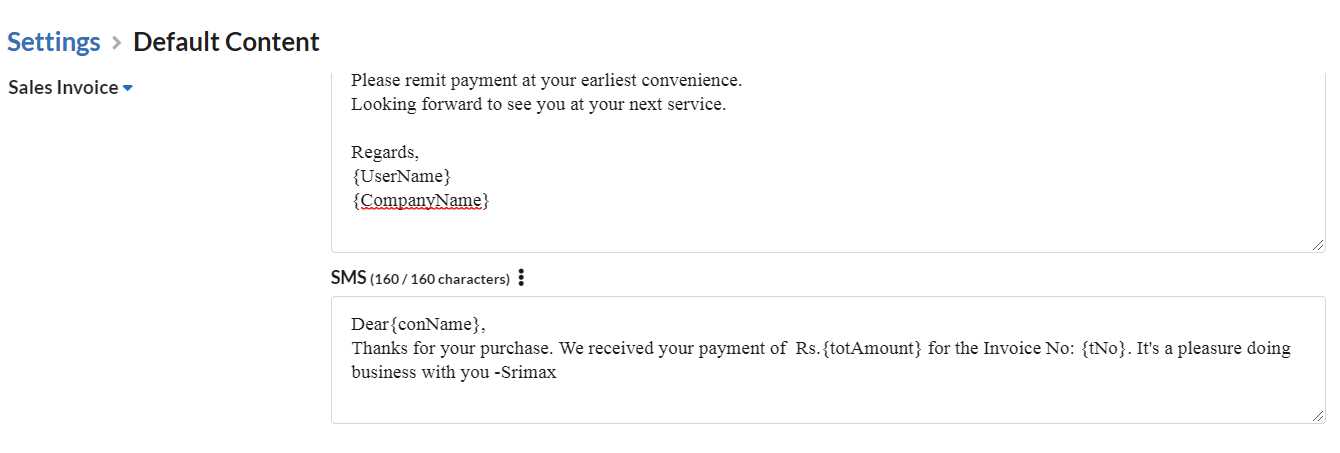

Customizing Your SMS Invoice Template

Customizing your mobile billing messages is essential for ensuring they align with your brand and provide a tailored experience for your clients. A well-personalized payment request not only conveys professionalism but also helps foster stronger customer relationships. By adjusting the content, tone, and design of your messages, you can create a more effective and engaging communication tool for your business.

The customization process allows you to adjust several key aspects of the message to fit your needs. This includes incorporating your company’s branding, adding specific payment instructions, and personalizing the message with client details. Whether you’re sending out a regular reminder or a special notification, a customized approach ensures that your clients receive a message that feels unique and relevant to them.

Here are a few ways to personalize your billing messages:

- Include Your Business Name and Logo: Make sure your company’s name or logo appears at the beginning of the message. This helps reinforce your brand identity and adds a level of professionalism to the communication.

- Client-Specific Information: Personalize each message with the client’s name, the details of their purchase, or a reference number. This makes the message feel more relevant and personalized, improving client engagement.

- Clear Payment Instructions: Customize the payment options based on your preferred methods, whether that’s a link to an online portal, bank transfer details, or mobile payment options. Ensure these instructions are easy to follow and available in the client’s preferred language or format.

- Friendly, Brand-Aligned Tone: Adjust the tone of the message to reflect your company’s voice. Whe

Best Practices for SMS Invoice Communication

Effective communication is key when it comes to sending payment reminders and billing details via mobile messaging. To ensure that your messages are professional, clear, and well-received by your clients, it’s important to follow best practices that streamline the process and avoid common mistakes. By adhering to these guidelines, businesses can enhance customer satisfaction, reduce misunderstandings, and increase the likelihood of timely payments.

1. Be Clear and Concise

The success of any billing message lies in its clarity. Avoid long-winded explanations and stick to the essentials: the amount due, the due date, and the payment instructions. Keeping the message brief and to the point helps clients quickly understand the details and take action. It also ensures the message fits within the character limits of a standard text message.2. Use a Professional Tone

While text messages are informal by nature, it’s important to maintain professionalism in your billing communication. A respectful, business-like tone helps build trust and reflects the seriousness of the payment request. Ensure your message is polite, even if you are sending a reminder for an overdue payment.3. Personalize Your Message

Personalization goes a long way in making the communication feel more tailored and considerate. Include the recipient’s name or a specific reference to their purchase, service, or account. This simple touch makes the message feel less like a generic reminder and more like a direct communication with the client.4. Provide Clear Payment Instructions

Make it as easy as possible for clients to pay by offering clear, straightforward payment options. Include a link to a payment portal or provide bank account details if necessary. If you have multiple payment methods available, briefly mention them, and provide any necessary instructions for completing the transaction.5. Send Timely Reminders

Timing is crucial when sending payment reminders. Send messages well before the payment due date to give your clients enough time to process the payment. You may also want to send a gentle reminder closer to the due date, but avoid bombarding clients with too many messages. Finding the right balance in frequency helps prevent frustration and keeps the communication effective.6. Keep Track of Communication

It’s important to track the messages sent to each client for transparency and follow-up purposes. Keeping a record of when messages were sent, what information was included, and whether the payment was made helps prevent misunderstandings and allows for efficient follow-up if necessary.7. Be Mindful of Privacy

Respect your clients’ privacy by ensuring that their personalHow to Automate SMS Invoice Sending

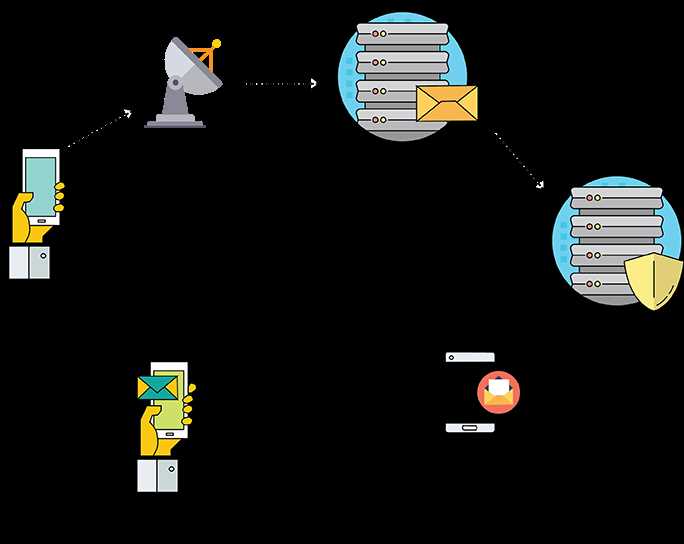

Automating the process of sending payment reminders and billing notifications via mobile messaging can significantly streamline your business operations. By eliminating manual tasks, businesses can save time, reduce errors, and ensure timely delivery of payment requests to clients. Automation also helps maintain consistent communication with clients, making it easier to manage large volumes of transactions efficiently.

There are several ways to set up automated billing messages, ranging from simple scheduling tools to more advanced software solutions that integrate with your existing payment systems. The key to successful automation is ensuring that the process is both accurate and customizable, so that messages are sent with the correct information and at the right time.

Steps to Automate Mobile Billing Reminders

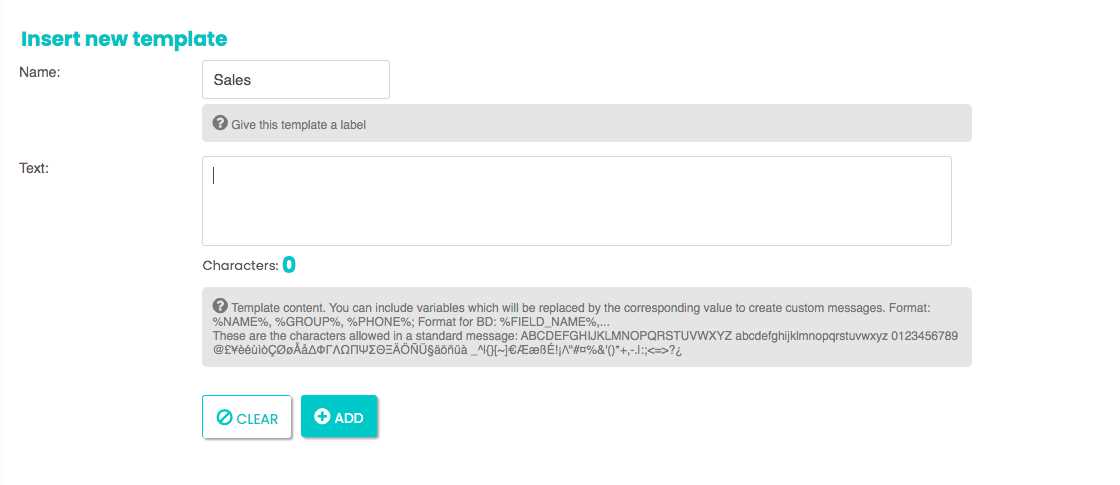

- Choose an Automation Platform: The first step in automating your billing messages is selecting the right platform. There are many software tools available that can integrate with your customer database and send automated messages based on predefined criteria. Some popular platforms include CRM systems, billing software, and dedicated messaging services.

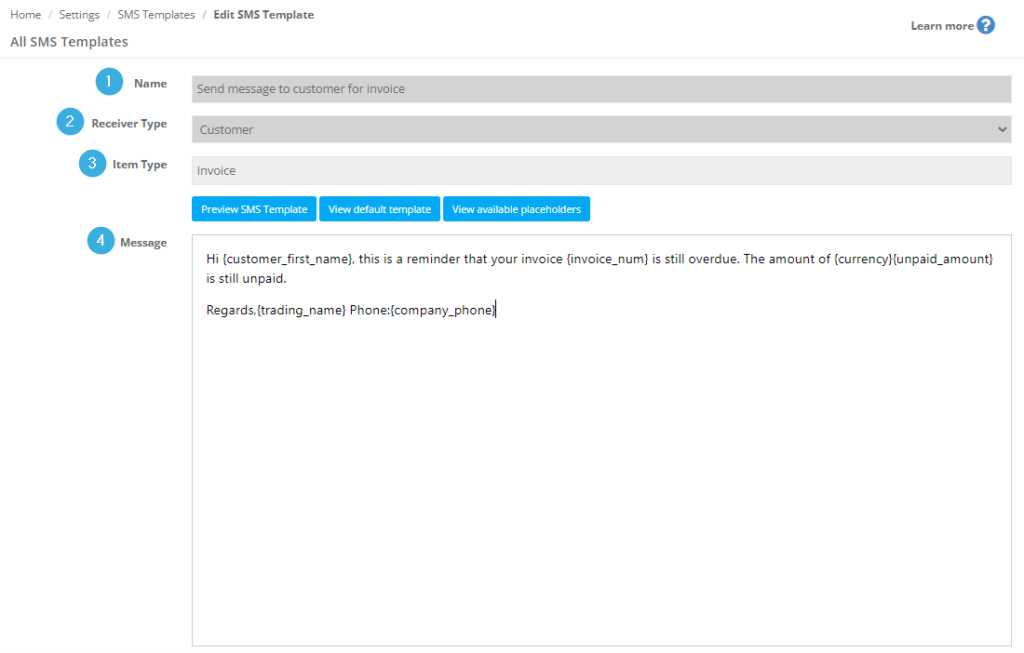

- Set Up Message Templates: Create standardized message templates that include placeholders for key details, such as the client’s name, the amount due, payment methods, and due dates. These templates allow you to send personalized messages automatically without the need to manually enter information each time.

- Define Trigger Events: Automate when messages are sent by defining specific triggers. For example, you can set up automatic reminders to be sent when a payment is due, when a payment is overdue, or after a specific number of days have passed since the last reminder. This ensures timely communication and reduces the need for manual follow-up.

- Integrate with Payment Systems: Connect your messaging automation tool to your payment platform or accounting software to pull client details and payment information automatically. This integration helps ensure that the correct amount, due date, and other relevant data are included in each message.

- Test and Optimize: Before fully launching your automated billing system, run tests to ensure that the messages are being sent correctly and that all information is accurate. You can also optimize the system over time by analyzing response rates and adjusting message content or delivery timing to improve results.

Best Practices for SMS

Designing a Professional SMS Invoice

Designing a professional billing message is essential to ensure that your clients receive clear, concise, and accurate information. A well-structured and thoughtfully composed message helps establish trust and credibility, while also ensuring that clients can easily understand and act on the payment request. The design of your mobile billing communication should be simple, direct, and in line with your brand’s professional image.

When designing a mobile payment reminder or request, it is important to focus on key elements that promote clarity and encourage prompt action. This includes structuring the message properly, using professional language, and ensuring that all relevant details are included without being overwhelming. Here are several tips to help you design an effective and professional billing message:

Key Elements of a Professional Mobile Payment Message

- Clear and Concise Information: Always include the most important details first: the amount due, payment due date, and available payment methods. These should be easy to find and understand at a glance.

- Simple and Structured Layout: Use short, clear sentences. Divide the information into separate lines or bullet points to make it more digestible. Avoid large blocks of text that may confuse or overwhelm the recipient.

- Personalization: Personalize the message by addressing the client by name and, if possible, including relevant details such as the service provided, order number, or account reference. This makes the message feel more tailored and helps build a stronger customer relationship.

- Professional Language: While mobile messages are informal by nature, always maintain a polite and professional tone. Your message should reflect your brand’s identity and convey respect for your client.

- Clear Call-to-Action: Always include a clear instruction on how to proceed with the payment. Whether it’s a link to an online payment portal or instructions for bank transfer, make sure the recipient knows exactly how to complete the payment process.

Best Practices for Message Design

- Avoid Overloading with Information: Stick to the essentials. Too much information can make the message difficult to read. Keep it short and to the point.

- Use Professional Formatting: Although SMS is a limited platform, formatting matters. Break the message into logical sections, such as greeting, payment details, and call to action.

- Include Contact Information: Provide a contact number or email in case the client has any questions or issues with the payment. This helps foster trust and offers an addit

Legal Considerations for SMS Invoices

When sending payment requests through mobile messaging, businesses must ensure they are compliant with legal requirements to avoid potential legal issues and protect both the company and the client. There are several important factors to consider, such as data protection, client consent, and the appropriate handling of financial information. Understanding and following legal guidelines is critical to maintaining trust and safeguarding your business against regulatory penalties.

Data Privacy and Protection: One of the most significant legal considerations when sending payment notifications via mobile is protecting your client’s personal and financial information. Depending on your location, data protection laws like the General Data Protection Regulation (GDPR) in the EU or California Consumer Privacy Act (CCPA) in the U.S. may apply. Ensure that all client data is stored securely, and that any personal information shared via text message is kept to a minimum.

Obtaining Client Consent: Before sending any type of billing message, businesses must obtain explicit consent from clients to receive communication via mobile messaging. This consent must be documented and provide clear information on the type of messages they will receive. Additionally, clients should always have the option to opt-out of receiving such messages in the future.

Content Compliance: Ensure that the content of your payment messages complies with relevant advertising and consumer protection laws. This includes providing accurate and non-misleading information, such as the amount owed, due dates, and any applicable terms or fees. Misleading or deceptive messages can lead to legal disputes or penalties under consumer protection regulations.

Payment Processing and Security: When including payment options in your mobile messages, make sure that the transaction process adheres to financial regulations. Ensure that any payment platforms used are secure and that the financial information of your clients is protected from potential data breaches. You may also need to comply with standards such as Payment Card Industry Data Security Standard (PCI DSS) when handling credit card information.

Record Keeping and Documentation: It’s important to maintain records of all mobile payment messages sent, as well as any responses received. This documentation serves as proof of communication and can be vital in case of disputes. Legal requirements vary by region, but keeping accurate records is generally recommended to avoid any misunderstandings or complications in the future.

Regional and International Considerations: If your business operates internationally, you must be aware of the different legal requirements across various regions. Different countries and regions may have distinct rules regarding mobile messaging for business purposes, so it’s crucial to stay informed about local laws. This includes respecting opt-in and opt-out rules, as we

SMS Invoice Template for Freelancers

Freelancers often manage their own billing and payment processes, which can be time-consuming and complex. However, sending clear and professional payment requests is essential to maintaining positive client relationships and ensuring prompt payments. One effective way to streamline this process is by using a concise and informative mobile billing message that outlines all necessary details in a clear and structured format.

Creating a streamlined and professional payment message for freelance services can help improve the efficiency of your business operations. Here is an example of a well-structured mobile billing message for freelancers:

Item Details Freelancer’s Name [Your Name] Client’s Name [Client’s Name] Service Provided [Description of Service] Amount Due [Amount] Due Date [Due Date] Payment Instructions [Payment Method & Link] This example demonstrates the essential components that should be included in a freelance payment message. By personalizing each message with specific details, such as the client’s name, service provided, and the amount due, you create a professional and personalized billing experience. The inclusion of clear payment instructions ensures that the client knows exactly how to proceed, whether through a link to an online payment platform or other payment methods.

With a well-designed mobile message, freelancers can easily send professional and timely payment requests without relying on complex invoicing systems. This approach not only saves time but also ensures that clients have all the information they need to complete the payment promptly, leading to better cash flow and stronger client relationships.

Choosing the Right SMS Platform

Selecting the right messaging platform is crucial for sending payment reminders and billing notifications effectively. With a variety of platforms available, it is important to choose one that aligns with your business needs, provides reliable delivery, and ensures that your messages are well-received by clients. A good platform can help automate your billing process, increase efficiency, and enhance customer satisfaction.

When evaluating different messaging services, there are several factors to consider. You’ll want to ensure the platform is secure, user-friendly, and offers the necessary features to customize your messages. Below are key considerations to help you make the right choice:

Key Factors to Consider

- Reliability and Delivery Rates: Ensure the platform has high delivery rates and reliable message sending capabilities. A service with low failure rates is essential to guarantee your messages reach clients on time, especially when dealing with payment deadlines.

- Customization Options: Choose a platform that allows you to personalize your messages. The ability to customize text, include client-specific details, and adjust formatting is essential for creating professional and engaging communication.

- Automation Features: Many platforms offer automation tools, allowing you to schedule messages, send reminders, and trigger messages based on client actions or due dates. Look for a service that integrates well with your existing billing or customer management system to save time.

- Security and Compliance: Ensure the platform follows industry standards for data protection and compliance, especially if you handle sensitive financial or personal information. Look for services that support encryption and secure communication protocols.

- Scalability: Consider the platform’s ability to grow with your business. Choose a service that can handle an increasing volume of messages as your business expands and can be adapted to meet new needs or customer demands.

- Cost: Evaluate the pricing structure of the platform. While cost should not be the only factor, it is important to find a solution that fits within your budget while offering the features you need. Compare pricing plans and ensure there are no hidden fees.

Popular Platforms to Consider

- Twilio: A well-known platform offering robust API integrations, reliability, and scalability for businesses of all sizes.

- Plivo: A versatile option with powerful automation tools and excellent customer support.

- Sendinblue: A comprehensive communication platform that supports both email and messaging, w

Integrating SMS Invoices with Payment Systems

Integrating billing messages with payment platforms is a powerful way to streamline the entire transaction process, from sending notifications to receiving payments. By connecting your payment system with automated messaging, you can offer your clients a seamless experience that allows them to receive, review, and pay their bills directly from the text message. This integration reduces the time and effort involved in traditional billing processes and ensures that payments are processed more efficiently.

Incorporating payment links and options within your messaging system enhances convenience for both businesses and clients. Clients can simply click on a link to make payments, view their billing history, or follow any specific instructions provided in the message. Below are some key steps and benefits of integrating your billing communications with payment systems:

Steps for Integration

- Choose a Compatible Payment Gateway: Select a payment gateway that supports mobile payments and integrates seamlessly with your messaging platform. Popular gateways such as PayPal, Stripe, and Square offer easy integration and wide-reaching payment options.

- Embed Payment Links: Include a secure payment link in the message that directs clients to a payment page. This page should be easy to navigate and mobile-friendly, ensuring a smooth payment experience for the client.

- Automate Payment Confirmations: Set up automated confirmation messages to notify clients when their payment has been successfully processed. This helps maintain transparency and provides assurance to the client that their payment was received.

- Track Payment Status: Integrate real-time tracking to monitor when payments are made and whether they’ve been successfully processed. You can set up notifications for both your business and the client to stay updated on the transaction status.

- Ensure Data Security: Ensure that all payment transactions are encrypted and secure. Use trusted security protocols, such as SSL or PCI-DSS compliance, to protect sensitive client data during the transaction process.

Benefits of Integrating SMS with Payment Systems

- Improved Efficiency: Integration eliminates the need for manual invoicing and follow-up. Automated billing and payment reminders increase efficiency and reduce administrative workload.

- Faster Payments: With direct links to payment portals, clients can settle bills more quickly, which helps improve cash flow for your business.

- Enhanced Customer Experience: By offering a seamless, user-friendly payment process, clients are more likely to engage positively with your business, leading to higher satisfaction and retention rates.

- Reduced Errors: Automation and integration help minimize

Tracking and Managing SMS Invoices

Managing and tracking billing messages is essential to ensure that payments are received on time and that clients are properly informed of their financial obligations. A robust system for tracking these communications helps businesses stay organized and ensures that no payment request is overlooked. It also allows you to monitor the status of each transaction, helping to prevent errors and delays in the billing process.

To efficiently manage your billing communications, it is crucial to implement tools and processes that enable you to track sent messages, monitor payment status, and follow up with clients as needed. Below are key strategies and best practices for effectively tracking and managing your billing messages:

Tracking Sent Messages

- Use a Messaging Platform with Delivery Reports: Many messaging platforms provide delivery reports, which allow you to see whether your messages were successfully delivered to clients. This ensures that your payment requests have been received and helps you identify any failed deliveries.

- Automate Message Logs: Set up automated logging of all outgoing messages, including timestamps and recipient details. This will allow you to quickly reference past communications and follow up on any outstanding payments.

- Integrate with Customer Relationship Management (CRM) Tools: By integrating your messaging system with CRM software, you can track not only the delivery of messages but also the status of each customer’s payment history, providing a unified view of all your client interactions.

Managing Payment Status

- Real-time Payment Tracking: Set up systems to track payments in real time. Many payment gateways offer APIs that can be integrated with your messaging system to automatically update payment status once a transaction is completed.

- Automated Follow-ups: Schedule automatic reminders for clients who have not completed their payment. This can help maintain timely payments and reduce the need for manual intervention.

- Payment Confirmation Messages: Send automated confirmation messages once the payment is successfully received. This helps reassure clients and provides a record of the transaction for both parties.

- Monitor Outstanding Payments: Keep track of overdue payments by setting up alerts or automated reports. This ensures that you can follow up with clients who have not yet paid their bills and helps prevent delays in cash flow.

Improving Cli

Common Mistakes to Avoid with SMS Invoices

Sending payment reminders and billing messages can be a highly effective way to streamline transactions, but it’s important to ensure that the process is handled correctly. Even small errors in the communication can lead to confusion, delayed payments, or a negative experience for your clients. Avoiding common pitfalls when sending mobile billing requests can help you maintain professionalism, enhance client satisfaction, and improve cash flow.

Here are some of the most frequent mistakes businesses make when sending payment requests via mobile messaging and how to avoid them:

1. Lack of Clear Payment Instructions

Always ensure that your payment instructions are clear and easy to follow. Failing to provide concise details on how and where to pay can lead to confusion. Include a secure payment link or clear instructions on accepted payment methods, such as bank transfer, credit card, or a payment platform like PayPal. Without these instructions, clients may delay payments simply because they are unsure of how to complete the transaction.

2. Sending Messages Without Personalization

Personalize your messages to make them more engaging and professional. Sending generic payment reminders without including client-specific information, such as the client’s name, the service provided, or the due amount, can make the message feel impersonal. Personalizing messages helps build rapport and reassures clients that they are receiving communication relevant to them.

3. Forgetting to Include Key Details

Ensure all essential details are included in each message. Omitting important information such as the amount due, the payment deadline, or the reference number can lead to confusion. A complete message should clearly state the services rendered, the amount owed, the due date, and any applicable payment instructions or links to complete the payment.

4. Overloading the Message with Information

Keep the message concise and to the point. Long, cluttered messages can overwhelm recipients and increase the likelihood of them ignoring or misinterpreting the content. Focus on the most important details: payment amount, due date, and payment method. Additional information, such as terms and conditions, can be included in a follow-up or a separate document.

5. Not Automating Follow-ups

Don’t neglect follow-up messages. If clients don’t pay by the due date, timely reminders can help speed up the process. Many messaging platforms allow you to automate follow-up reminders, which can ensure that you don’t forget to re

How to Handle Payment Disputes via SMS

Disputes over payments can arise at any time, and handling them effectively is essential for maintaining positive relationships with clients. When addressing payment disagreements through mobile messages, it’s important to stay professional, clear, and concise. The goal is to resolve the issue quickly, ensuring that the client feels heard while also protecting your business’s interests.

Here are some strategies for effectively managing payment disputes through mobile communication:

1. Stay Professional and Courteous

- Maintain a calm tone: Regardless of the dispute’s nature, ensure that your message is polite and professional. Avoid using aggressive language or making accusatory statements. Keep the conversation neutral and focused on finding a resolution.

- Show empathy: Acknowledge the client’s concerns. Showing that you understand their position can go a long way in de-escalating the situation.

2. Acknowledge the Dispute and Ask for Details

- Respond promptly: As soon as a payment dispute is raised, reply quickly to show that you are taking the matter seriously. Delay in communication can make the situation worse.

- Request clarification: If the client hasn’t already explained the reason for the dispute, ask for specific details. You might want to inquire about any discrepancies, misunderstandings, or issues they may have encountered with the payment process.

- Provide documentation: If relevant, refer to transaction records, contracts, or other supporting documentation to help clarify the situation. This will give both parties a clearer picture of the dispute.

3. Offer a Solution

- Propose a fair resolution: Based on the details provided, offer a solution that addresses the client’s concerns. Whether it’s a partial refund, a discount, or an alternative payment arrangement, suggest an option that balances both parties’ needs.

- Set clear expectations: Ensure that the client understands the next steps. Let them know how long it will take to resolve the issue and what actions are required from both sides.

- Stay flexible: Sometimes, negotiating a middle ground may be necessary. If the client presents a reasonable request, be open to adjusting your solution accordingly.

4. Avoid Overloading with Information

- Be concise: While it’s important to address the situation thoroughly, keep your message concise and to the point. Long, complex explanations can overwhelm the client and may make the resolution process more complicated.

- Provide actionable next steps: Ensure that your message includes clear instructions on how to proceed. Avoid unnecessary details that might distract from resolving the dispute.

5. Follow Up

- Check for confirmation: After you’ve proposed a solution, follow up to ensure the client is satisfied with the resolution. Confirm that they have received the necessary information and that any agreed-upon changes or refunds have been processed.

- Provide an update: If the dispute is still being resolved, keep the client updated on the progress. Regular updates can help maintain trust and show that you are actively working to resolve the matter.

In conclusion, handling payment disputes via mobile messages requires a balance of professionalism, empathy, and clear communication. By staying calm, offering practical solutions, and ensuring timely follow-up, you can effectively resolve disputes and maintain positive relationships wit

Future of SMS Invoicing in Business

The future of mobile-based billing is becoming increasingly integral to modern business practices. As technology continues to advance, businesses are exploring new ways to enhance payment processes, offering faster, more convenient options for customers. Mobile messaging has already proven to be a powerful tool for reaching clients quickly and efficiently, and its role in payment collection is expected to grow significantly in the coming years.

With the rise of mobile technology, customers now expect more streamlined, user-friendly payment experiences. Mobile messaging platforms, once used primarily for communication, are increasingly being leveraged to handle financial transactions, providing businesses with a more efficient and cost-effective solution. The future of mobile billing looks promising, with several trends shaping how businesses will interact with their clients in terms of payments.

1. Integration with Digital Wallets

As mobile payments become more prevalent, integration with digital wallets and payment systems will become a standard feature. By linking mobile payment requests directly to digital wallets, businesses can offer a seamless, one-click payment experience, making it easier for clients to pay on the go. With the rapid adoption of apps like Apple Pay, Google Pay, and other mobile wallet services, businesses will have more opportunities to tap into this growing market.

2. Increased Automation and AI Integration

Automation and artificial intelligence (AI) will play a larger role in payment communication. Future systems will automatically generate payment reminders, track outstanding balances, and even predict when clients are likely to make payments. AI-powered chatbots and virtual assistants will be used to handle customer queries related to payment status, helping businesses save time while enhancing customer satisfaction.

3. Enhanced Security Features

As mobile billing becomes more widespread, the importance of security will continue to grow. Businesses will need to implement advanced encryption and security protocols to protect client data from fraud and breaches. Blockchain technology, for example, could play a key role in securing mobile payments, ensuring that transactions are both transparent and tamper-proof. Customers will also expect businesses to be fully compliant with data protection regulations, su