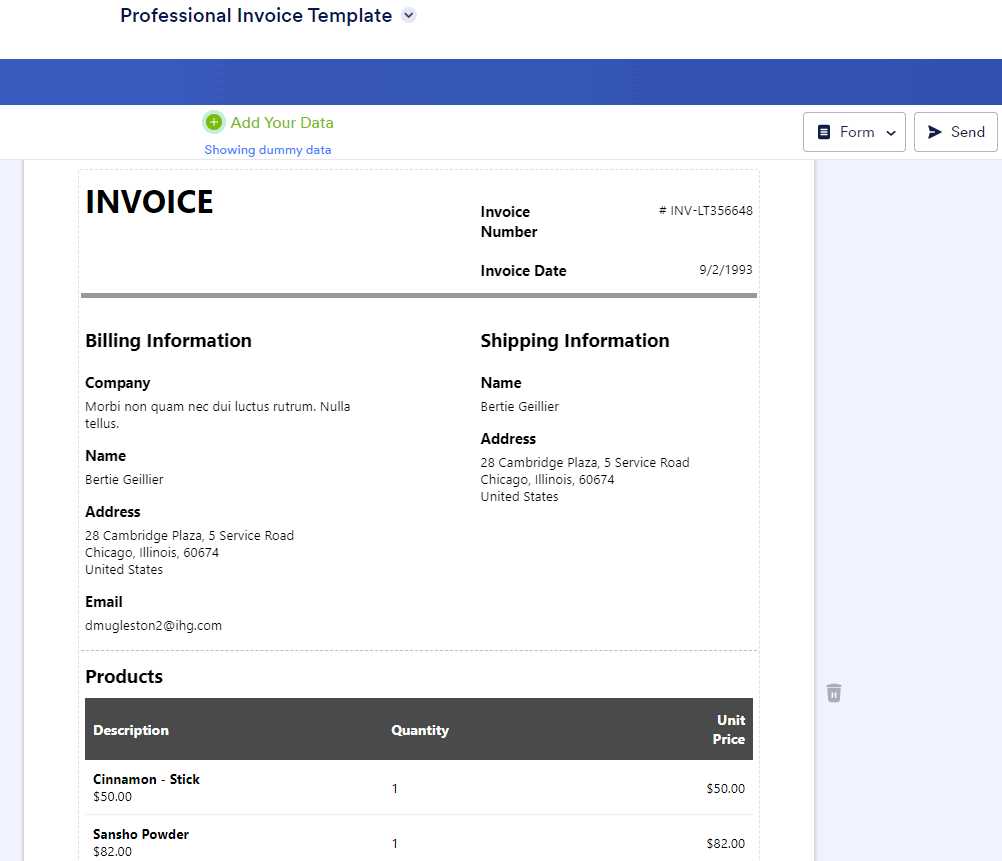

Free Invoice Generator and Customizable Invoice Templates Online

Managing payments and maintaining a professional appearance in financial transactions is essential for any business. A streamlined approach to creating payment requests can save time and reduce errors. By using a simple tool designed to automate the process, you can easily produce consistent, high-quality documents that meet your business needs.

Customization and ease of use are key when selecting a solution for generating payment forms. A good system allows you to tailor each document according to your specific requirements, whether you’re an independent contractor or part of a growing company. These tools simplify the creation process, ensuring that each form is clear, accurate, and ready for submission in just a few clicks.

For businesses of all sizes, utilizing a reliable method for creating professional documents is a time-saver. It ensures that all necessary details are included, reduces the risk of mistakes, and enhances client trust. With such tools, you can focus more on your work while leaving the paperwork to a system that handles it efficiently.

Why Use an Invoice Generator Online

Automating administrative tasks is essential for improving efficiency in any business. Instead of spending valuable time on manual paperwork, leveraging an automated tool to create billing documents ensures that every aspect is handled quickly and accurately. Such tools are designed to simplify the process, making it easy to produce professional records without requiring advanced skills or complex software.

One of the key advantages is consistency. When you use a digital platform, all the necessary elements are already included, ensuring that each document is formatted correctly and includes all required details. This eliminates human error and provides a polished result that is ready to be sent out immediately.

Time-saving is another important reason to consider using such tools. Instead of designing documents from scratch or manually filling out the same fields repeatedly, a streamlined system allows you to generate forms in minutes. This can significantly reduce the time spent on administrative tasks, allowing you to focus more on growing your business and serving clients.

Benefits of Free Invoice Templates

Utilizing pre-designed forms can greatly enhance the efficiency and professionalism of your billing process. These ready-made solutions eliminate the need for creating documents from scratch, allowing businesses to produce polished, error-free records quickly. By simply filling in the required details, you can generate accurate and consistent financial documents with minimal effort.

Cost-effectiveness is one of the most significant advantages of using these pre-made solutions. With no need to invest in expensive software or hire additional help, you can get started with minimal financial outlay. This is especially beneficial for small businesses or freelancers looking to streamline their processes without unnecessary overhead.

Convenience is another key benefit. These tools often allow users to customize the documents to their needs, adding branding elements or adjusting layout preferences. This flexibility ensures that your records reflect the unique identity of your business while adhering to professional standards.

How to Create Invoices with Ease

Creating professional billing records doesn’t have to be complicated. By using simple tools designed for this purpose, you can generate accurate documents in minutes. These tools are built to guide you through the process step by step, ensuring that all necessary information is included without any hassle.

Step-by-Step Process for Generating Documents

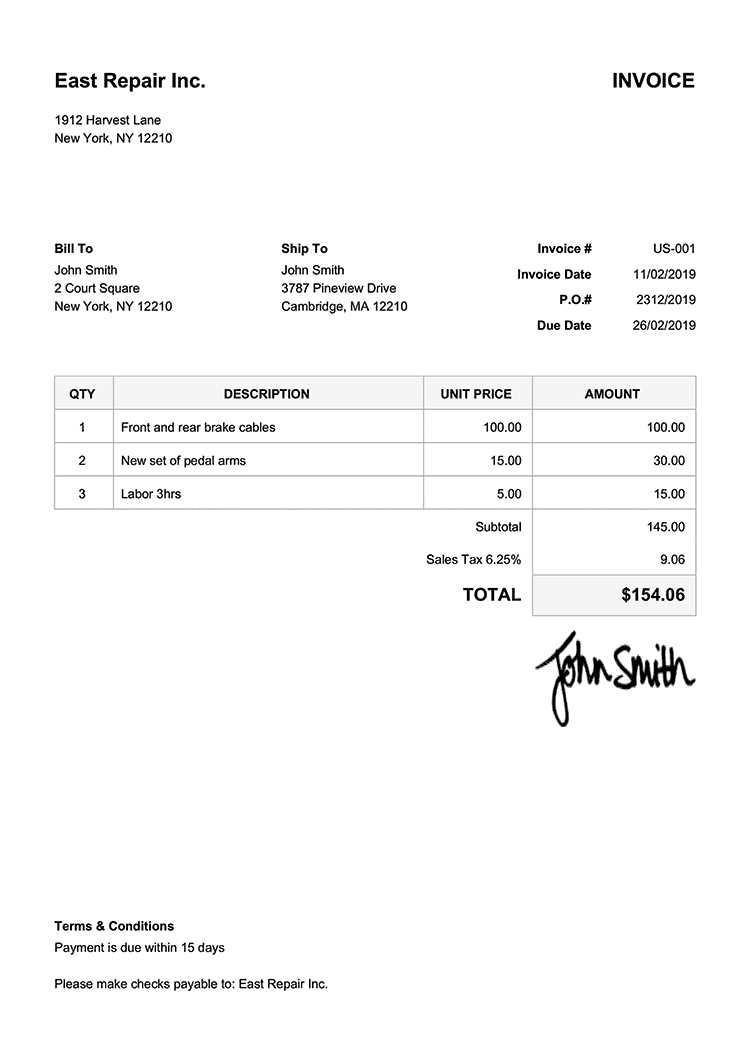

The first step is to select a format that suits your needs. Many systems offer a variety of layouts, so you can choose one that best represents your business style. After that, entering basic details such as client information, payment terms, and services rendered is typically all that’s required. Once completed, the document is ready to be saved or sent directly to the client.

Maximizing Efficiency and Accuracy

Using a system designed for document creation reduces the risk of errors and ensures uniformity in your records. By automating the process, you can focus on other aspects of your business while ensuring that each transaction is properly documented. The tool will also allow you to customize details, so you can adjust things like payment terms or add additional notes specific to each client.

Automation significantly speeds up the process, eliminating manual data entry and allowing for faster, more efficient billing. With this approach, what once took hours can now be done in just a few minutes.

Customizing Your Invoice Design

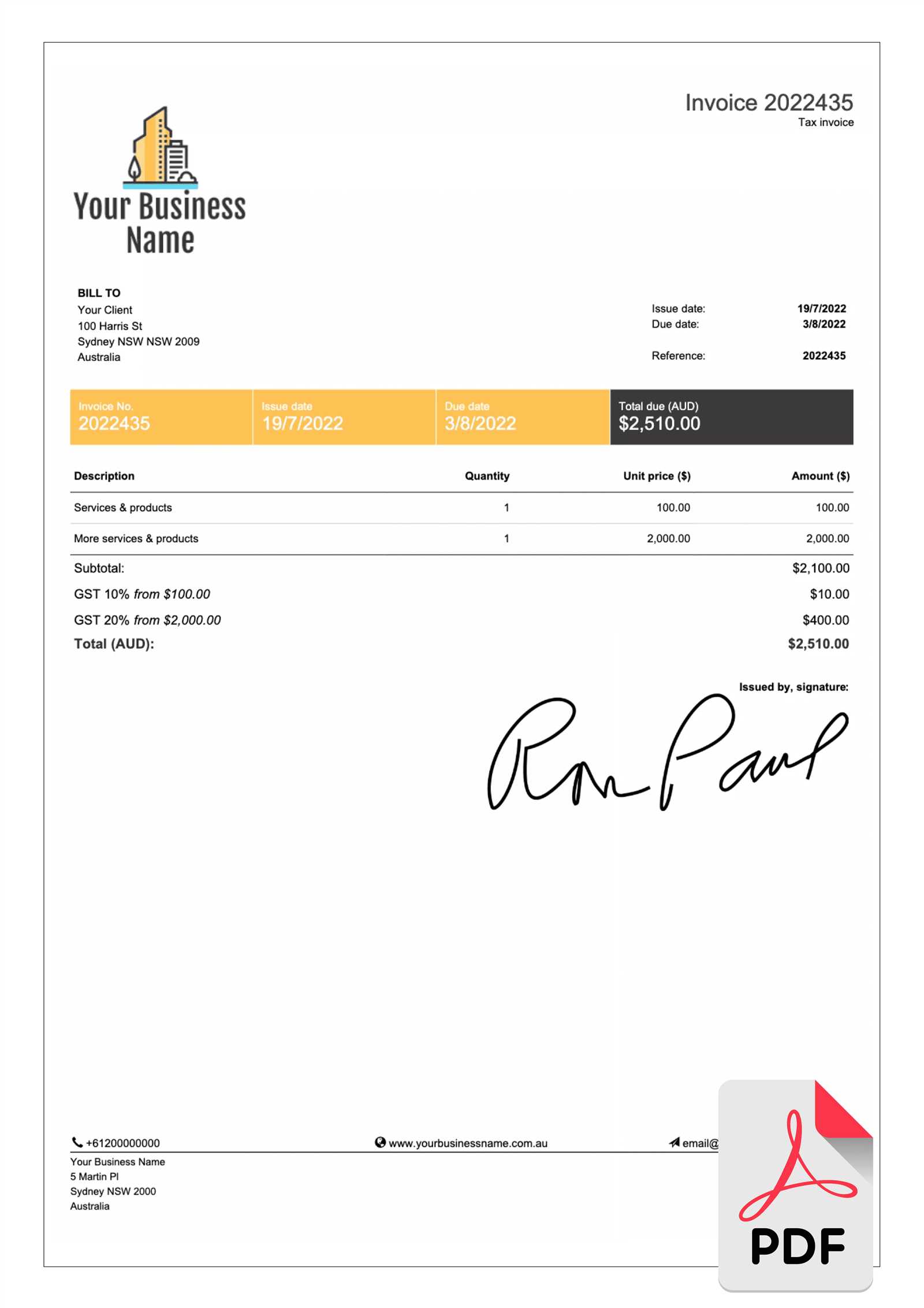

Personalizing your billing documents is an essential step in maintaining a professional and branded appearance. Customization allows you to reflect your unique business identity, making the process not only more efficient but also visually appealing. With the right tools, adapting the design of your records is a quick and straightforward task.

Here are some key elements you can adjust to customize your billing forms:

- Logo and Branding: Add your company logo, brand colors, and font choices to give the document a professional look that aligns with your business identity.

- Layout and Structure: Choose a layout that is easy to read and logically structured, ensuring that all important details stand out clearly for your clients.

- Payment Terms: Customize the payment section to reflect your terms, including due dates, late fees, and other relevant policies.

- Additional Information: Include extra fields like project numbers, references, or custom notes that help provide more context for your clients.

When you adjust the design of your financial documents, you ensure that each transaction aligns with your brand’s professional image, while also making it easier for your clients to process their payments correctly and on time. Consistency in design also helps build trust and strengthens your business’s credibility.

Top Features of Invoice Generators

When choosing a tool to streamline your billing process, it’s essential to look for features that enhance efficiency, accuracy, and customization. The right tool can save you time, reduce human errors, and ensure that every transaction is recorded professionally. Here are some of the most valuable features to look for in a billing document creation system:

- Easy-to-Use Interface: A user-friendly design that allows even non-technical users to create and send documents without difficulty.

- Customizable Fields: The ability to adjust sections, such as client details, service descriptions, and payment terms, ensuring your documents are tailored to each situation.

- Automated Calculations: Built-in features that automatically calculate totals, taxes, and discounts, minimizing the chance of manual errors.

- Multiple Payment Methods: The option to include various payment options like bank transfers, credit card payments, or digital wallets, making it easier for clients to pay you.

- Invoice Tracking: Real-time tracking of the status of payments, so you can quickly see whether a document has been viewed, paid, or is overdue.

- Cloud Storage: Secure cloud-based storage to easily access and manage all your documents from anywhere, at any time.

These features help simplify the billing process, ensuring that your business runs smoothly while maintaining a professional appearance. The right tool will not only make the task quicker but also improve your financial record-keeping

Save Time with Invoice Automation

Automating the billing process can significantly reduce the time spent on administrative tasks. By using automated systems, businesses can eliminate the repetitive work of manually filling out forms, calculating totals, and tracking payment statuses. This leads to quicker processing and frees up time to focus on core business activities.

Here are some ways automation helps save time:

- Automatic Calculations: Built-in formulas quickly calculate totals, taxes, and discounts, ensuring accuracy without the need for manual input.

- Pre-filled Client Information: Once entered, client details are saved for future use, allowing for quicker creation of new records without re-entering information.

- Recurring Billing: Automating repeat payments ensures that clients are invoiced regularly without the need to manually create documents each time.

- Instant Delivery: Many systems allow for immediate delivery via email, reducing the need for physical mail or delays in sending payment requests.

- Tracking and Reminders: Automation can send reminders for unpaid bills or overdue payments, reducing follow-up time and improving cash flow management.

By streamlining repetitive tasks, businesses can save valuable time and minimize errors. Automation ensures that each transaction is handled efficiently, letting you focus on what really matters–growing your business.

Secure Online Tools for Invoicing

When handling financial documents, security is paramount. Using a secure platform to create and manage billing records ensures that sensitive information, such as client details and payment terms, remains protected. Advanced encryption and secure servers are essential to prevent unauthorized access and safeguard your business transactions.

Encryption plays a critical role in protecting both your business and client data. The best systems use end-to-end encryption, which means that all your sensitive information is encrypted before being sent over the internet, making it nearly impossible for third parties to intercept or view your records.

Two-factor authentication is another important security feature that adds an extra layer of protection. By requiring both a password and a secondary verification method, it prevents unauthorized users from accessing your account, even if they have your login credentials.

Additionally, cloud-based systems often use high-level security protocols, such as regular backups and data redundancy, ensuring that your documents are safe from hardware failure or loss. These tools are also designed to comply with international data protection regulations, giving you peace of mind that you are meeting legal and privacy standards.

By choosing secure tools for generating and managing your billing records, you can protect both your business and your clients, reducing the risk of fraud or data breaches while maintaining professionalism in your financial processes.

How to Choose the Best Invoice Template

Selecting the right format for your billing documents is crucial to maintaining a professional image and ensuring clarity for your clients. The design should be functional, easy to read, and reflect your business style. It’s important to consider the level of customization, the layout, and the type of details that need to be included.

Key Factors to Consider

When evaluating different designs, there are several factors that can help you choose the most suitable option for your needs:

| Factor | Description |

|---|---|

| Customization | Ensure that the design allows you to personalize client information, payment terms, and service details according to your requirements. |

| Clarity and Readability | The layout should be clear and straightforward, with bold headings and well-organized sections to make the document easy to understand at a glance. |

| Branding | Choose a design that can accommodate your company’s logo, colors, and fonts to reflect your unique brand identity. |

| Mobile Compatibility | Make sure the format is easy to view on various devices, especially if your clients may access it through their phones or tablets. |

Additional Tips

Look for formats that are simple to use and automate calculations such as totals and taxes. This not only saves time but also reduces the possibility of human error. Additionally, it’s always good to choose a layout that offers flexibility in terms of adding extra sections, like notes or references, to suit different transaction types.

By considering these factors, you can select a design that not only makes the billing process easier but also ensures that your communications are professional and aligned with your business’s values.

Free vs Paid Invoice Solutions

When deciding between a no-cost or a premium billing solution, businesses must weigh the pros and cons based on their specific needs. While free tools offer basic functionality and can be a great starting point, paid options often provide more advanced features and better customer support. Understanding the differences between the two can help you make an informed decision about which solution is best for your business.

Free solutions are ideal for small businesses or freelancers who only need to create basic documents on an occasional basis. These tools typically offer simple templates and limited customization options. While they can be effective for straightforward transactions, they may lack advanced features like automated reminders, payment tracking, or integrations with accounting software.

On the other hand, premium tools often provide enhanced functionality that can streamline the billing process significantly. Features such as recurring billing, professional branding, and detailed financial reporting are common in paid solutions. Additionally, customer support, data security, and cloud storage are usually more robust, which can be crucial for businesses dealing with a higher volume of transactions or sensitive information.

Ultimately, the choice between free and paid tools depends on your business’s needs. If you’re just starting and have limited billing requirements, a free tool might be sufficient. However, as your business grows, investing in a paid solution may be worthwhile for the added convenience, security, and efficiency it provides.

Invoice Generator for Small Businesses

For small businesses, managing payments and tracking transactions efficiently is essential for growth and cash flow. A streamlined approach to creating billing documents can save valuable time and reduce the chances of errors. With the right tool, small business owners can quickly generate professional-looking records without the need for complicated software or manual entry.

Why Small Businesses Need a Billing Solution

As a small business owner, it’s important to have a system in place that simplifies your billing process. Here are some reasons why a dedicated tool can be beneficial:

- Time-saving: Automates repetitive tasks, such as adding client information, calculating totals, and organizing transaction details.

- Professional Appearance: Produces clean, branded records that enhance your business’s credibility with clients.

- Improved Accuracy: Reduces the risk of human error when calculating totals or inputting client data.

- Better Record-Keeping: Easily track all transactions in one place, making it simple to access past records for reference or tax purposes.

Key Features for Small Business Billing Solutions

When selecting a billing tool for a small business, certain features are crucial for ensuring efficiency and ease of use:

- Customizable Fields: Ability to personalize forms to suit your specific business needs, from service descriptions to payment terms.

- Recurring Billing: Automate regular transactions for subscription-based services or long-term clients.

- Multiple Payment Options: Support for various payment methods, such as credit cards, bank transfers, or e-wallets.

- Cloud Storage: Secure storage options to keep all your records safe and accessible from anywhere.

By adopting a billing solution tailored for small businesses, you can not only save time but also improve the professionalism of your financial documents. This allows you to focus on growing your business while ensuring that every transaction is properly documented and organized.

How to Track Invoice Payments Online

Tracking payments for your financial records is essential to ensure your business maintains a steady cash flow and avoids late payment issues. With the right tools, you can easily monitor which transactions have been completed, which are still pending, and which are overdue. Automating this process helps save time, reduce errors, and improve your overall financial management.

Using automated tracking systems is one of the most effective ways to stay on top of payments. These systems can automatically update the payment status whenever a transaction is processed, giving you real-time information without the need for manual tracking. Once a payment is made, the system can mark the transaction as paid, and send confirmation to both you and your client.

Payment reminders are another key feature that can help ensure timely payments. Many platforms allow you to set up automatic reminders that notify clients before a due date or follow up on overdue transactions. This proactive approach can help reduce the number of late payments, improving cash flow and reducing the need for manual intervention.

For better organization and clarity, many systems offer the option to sort payments by their status, such as “paid,” “pending,” or “overdue.” This allows you to quickly assess your financial standing and prioritize actions based on payment status.

Finally, some platforms integrate with accounting software or provide detailed reporting tools, making it easier to track all financial activity in one place. This seamless integration ensures that your records are always up to date and ready for tax season or financial audits.

Improving Invoice Accuracy with Templates

Ensuring that your financial documents are accurate is crucial for maintaining a professional reputation and avoiding misunderstandings with clients. Using pre-designed forms can significantly reduce human error, ensuring that all necessary fields are filled correctly and consistently. With a well-structured design, you can eliminate the risk of missing important details or miscalculating totals.

Pre-built formats help streamline the process by providing a consistent structure for every transaction. These formats typically come with predefined sections for key details, such as client information, services rendered, payment terms, and totals. With these fields already laid out, you’re less likely to forget critical elements or make mistakes in data entry.

Automated calculations are another significant advantage. Many systems with pre-designed forms include built-in formulas that automatically calculate totals, taxes, discounts, and other adjustments. This eliminates the need for manual calculations, reducing the chances of math errors that could impact your financial accuracy.

By using a consistent structure across all your billing records, you also ensure that your documents are clear and easy to read for your clients. This clarity helps prevent confusion and minimizes the likelihood of disputes over charges, further boosting your business’s professionalism.

Ultimately, leveraging predefined designs and automated tools not only speeds up the billing process but also ensures the precision of your financial records. This simple approach can make a big difference in maintaining your credibility and improving client satisfaction.

Integrating Invoice Tools with Accounting Software

Integrating billing tools with accounting systems is a smart way to streamline your financial processes, reduce manual work, and maintain accurate records. By connecting these platforms, you can ensure that all transactions are automatically recorded, minimizing the risk of errors and saving valuable time spent on data entry.

Automation is one of the main benefits of integrating billing software with accounting systems. When a payment is made, the details can be automatically transferred to your accounting software, ensuring that both systems are up to date without any manual input. This seamless data flow ensures that every transaction is accurately logged, making it easier to track revenue, expenses, and profits.

Real-time updates are another key advantage. By linking both platforms, any changes made in one system are instantly reflected in the other. This means that if a client’s payment status is updated or a new record is added, it will immediately be available in your accounting software, allowing you to keep accurate financial records at all times.

Additionally, this integration often enables better reporting capabilities. You can generate detailed financial reports, such as profit and loss statements or tax summaries, without needing to manually transfer data between systems. This reduces the chance of mistakes and allows for more accurate financial analysis.

Overall, integrating your billing tools with accounting software simplifies financial management and ensures that all your records are accurate, timely, and easily accessible. This approach not only saves time but also helps maintain consistency across your business’s financial documentation.

Creating Professional Invoices in Minutes

Generating high-quality financial documents doesn’t have to be time-consuming or complicated. With the right tools, you can create polished, professional records in just a few minutes. By using a streamlined process and customizable options, you can quickly prepare accurate, client-ready documents that reflect your business’s professionalism and attention to detail.

Steps to Create Professional Documents Efficiently

Follow these simple steps to generate a professional document quickly and accurately:

- Select a Layout: Choose a clean, simple layout that suits your brand. Many platforms offer a variety of designs that are easy to customize and look professional.

- Enter Client Information: Fill in your client’s details, including their name, contact information, and the products or services they purchased.

- Apply Calculations: Automatically calculate totals, taxes, and discounts, ensuring everything is accurate without needing to do the math manually.

- Double-Check Details: Quickly review the document for any errors or missing information. Most tools will highlight incomplete fields or potential issues.

- Send with Ease: Once you’re satisfied with the document, send it directly to your client via email or export it for printing.

Key Features for Fast Document Creation

To make the process even quicker, many tools include the following features:

| Feature | Description |

|---|---|

| Customizable Fields | Predefined sections allow you to quickly add and adjust details such as client info, service descriptions, and payment terms. |

| Pre-filled Client Data | Once entered, client information is stored for future use, making it easy to create documents for repeat customers without retyping details. |

| Automated Calculations | Built-in formulas automatically calculate amounts, taxes, and totals, reducing errors and saving time. |

Instant

How to Avoid Common Invoice MistakesBilling errors can lead to payment delays, misunderstandings, and a lack of trust between you and your clients. By paying attention to detail and implementing best practices, you can minimize mistakes and ensure smooth financial transactions. Properly managing your billing documents not only saves time but also helps maintain a professional reputation. Accurate Information is the cornerstone of any billing document. Always double-check the client’s contact details, the list of services provided, and the payment terms before sending the document. A small mistake, such as an incorrect address or misspelled name, can cause confusion and delay the payment process. Clear Payment Terms are essential for avoiding misunderstandings. Always specify the due date and any late payment penalties clearly in the document. If your payment terms are flexible, make sure both you and your client agree on the conditions beforehand to avoid disputes later on. Calculations are another area where errors frequently occur. Automated systems can help you avoid manual calculation mistakes, but it’s still important to review the totals, taxes, and discounts carefully. Many tools offer built-in calculations, which can reduce the likelihood of errors and save you time. Consistent Format ensures that your documents are easy to understand and professional. Use a clean and simple layout that organizes all important information clearly. An overly complicated or cluttered document can confuse your clients and cause delays in payment processing. By following these steps and ensuring attention to detail, you can avoid common billing errors and build strong, professional relationships with your clients. Ensuring Legal Compliance with Invoices

Maintaining legal compliance when issuing financial documents is crucial for any business. Failing to follow the necessary regulations can result in penalties, disputes, and even legal action. Ensuring that your billing practices align with local and international laws helps protect both your business and your clients. One of the most important aspects of legal compliance is including all required information in your documents. This typically includes details such as your business name, registration number, tax identification number, and the correct tax rates. Some countries or regions may have additional requirements, so it’s essential to stay informed about local regulations that apply to your business. Tax Information is another critical element. You must correctly apply any relevant taxes and display them clearly on the document. This includes sales tax, VAT, or any other applicable tax rates depending on your location and the nature of the transaction. Properly calculating and displaying tax rates helps ensure that your business complies with tax laws and avoids unnecessary complications during audits. Payment Terms should also be specified in a way that adheres to local legal standards. Clearly outlining your payment terms, due dates, and any late fees helps protect your rights in case of non-payment. It’s important to make these terms easily understandable to avoid confusion and ensure they are enforceable in legal situations. By ensuring that your financial documents meet all legal requirements, you minimize the risk of disputes and create a strong foundation for your business operations. Taking the time to implement proper billing practices demonstrates professionalism and a commitment to compliance, fostering trust with your clients and authorities alike. |