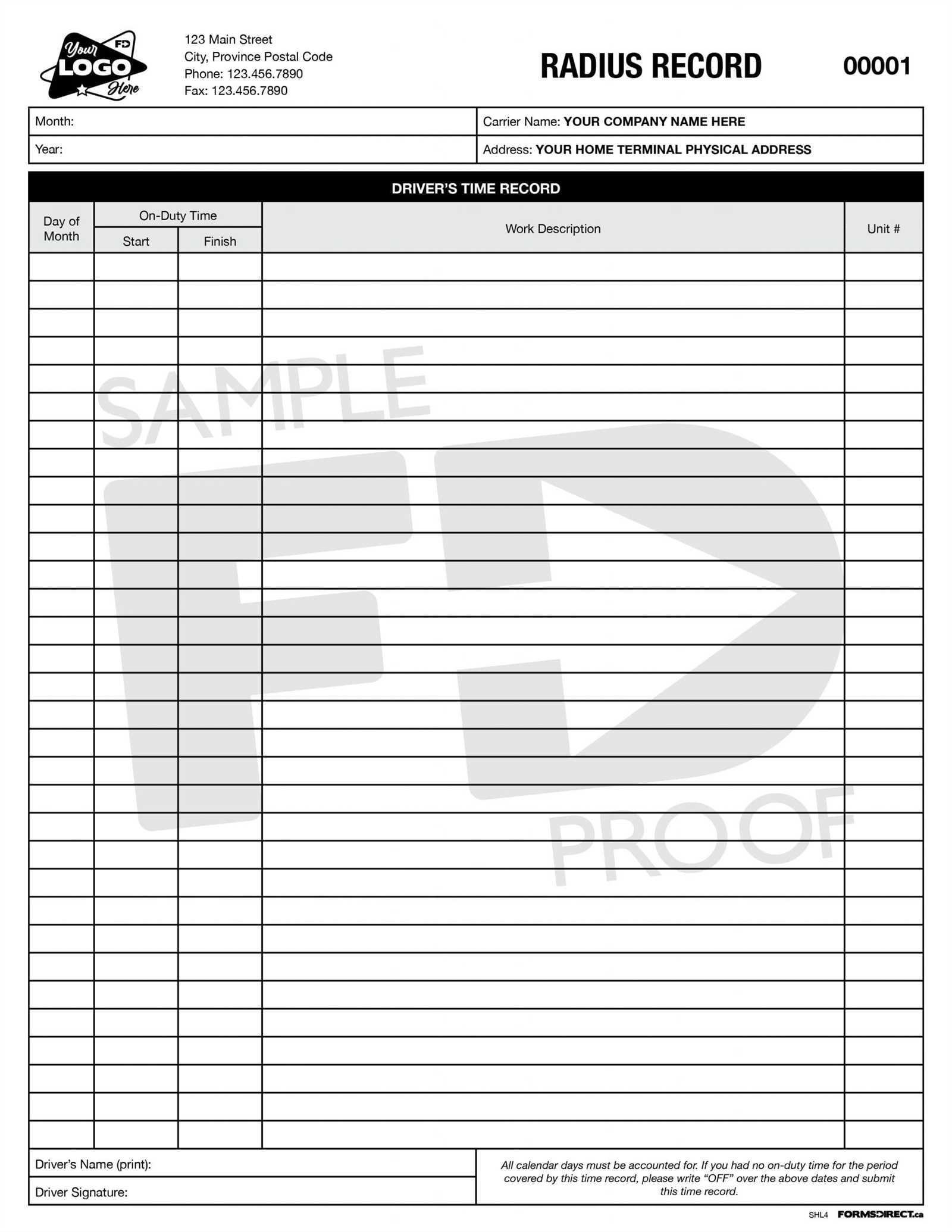

Free Driver Invoice Template for Simplified Billing and Payments

For those offering transportation or delivery services, managing payments efficiently is crucial for maintaining a smooth business operation. One of the most effective ways to ensure clients are billed correctly is by using a well-structured document that outlines services provided, payment terms, and other important details. This tool helps streamline the financial side of the business and reduces the chance of errors or misunderstandings.

When designing a billing document, it’s essential to include key information such as service dates, rates, and any applicable taxes. By offering a clear and professional presentation, service providers can improve their payment collection process while making the experience more transparent for their clients. Whether you work as an independent contractor or as part of a larger organization, having a reliable method to generate these records is a must for ensuring timely compensation.

Utilizing a customizable format can save valuable time, providing flexibility to adjust details for each transaction while maintaining consistency. With the right setup, you’ll be able to create accurate, professional billing statements quickly, contributing to a more efficient workflow and fostering trust with your customers.

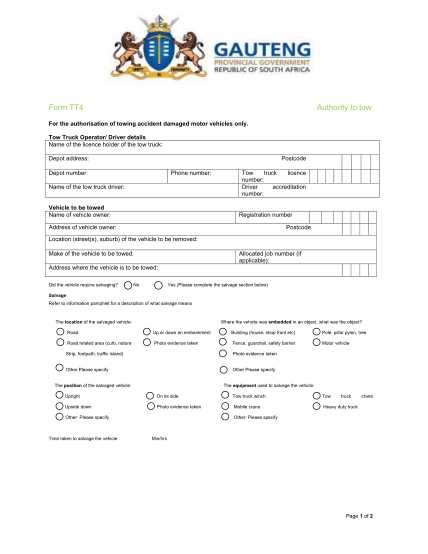

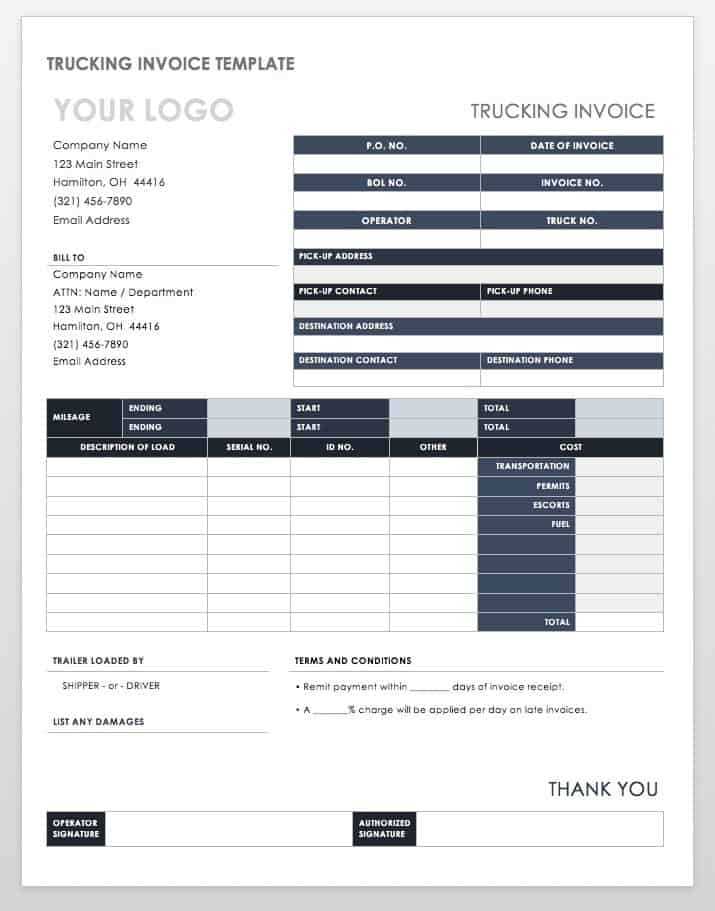

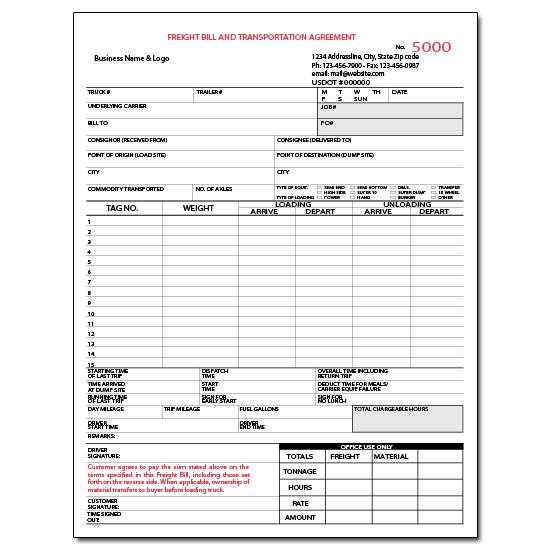

Driver Invoice Template Overview

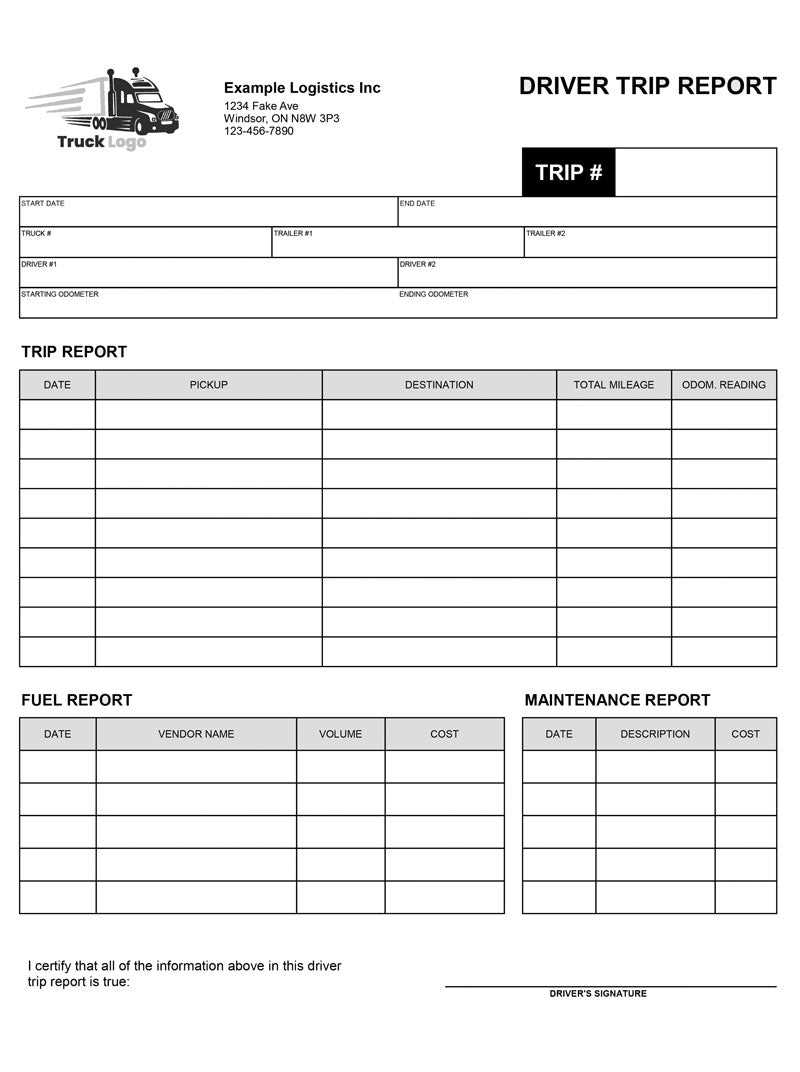

Creating a professional document for billing clients is an essential part of managing financial transactions in the transportation industry. This tool helps service providers generate accurate, clear, and well-organized records that outline the services rendered, payment expectations, and other critical details. A well-structured document not only ensures proper compensation but also builds trust with clients, promoting timely payments.

By using a reliable and customizable format, you can tailor each record to fit the specifics of each job, such as distance traveled, hours worked, or any additional services provided. Having this document in place saves time and helps avoid errors, ensuring that all necessary information is included and presented in a professional manner.

Key Benefits of Using a Billing Record

Efficiency is one of the primary advantages of using this type of document. It allows you to quickly fill in details for each job without starting from scratch each time. With the right format, even complex calculations, such as mileage rates or hourly fees, can be easily managed.

How to Use and Customize the Document

Customizability is crucial when it comes to billing documents. A flexible system allows service providers to adjust the layout and content based on specific needs, such as adding taxes, discounts, or payment instructions. This adaptability ensures that each record accurately reflects the specifics of the transaction, avoiding confusion or disputes.

Why Use a Billing Document for Transportation Services

Having a standardized document for billing clients is crucial for any professional offering transportation services. It provides a clear and organized way to present the work completed, ensuring both the provider and the client are on the same page regarding fees, services, and payment terms. Using a ready-made format helps simplify the process, reduce errors, and maintain consistency across all transactions.

Here are some key reasons why utilizing such a document is beneficial:

- Time-saving: With a pre-designed structure, you can quickly fill in relevant details for each job without the need to start from scratch every time.

- Accuracy: A consistent format ensures that no important information is missed, helping to prevent mistakes in calculations or missed details.

- Professionalism: A well-organized document conveys a professional image to clients, fostering trust and confidence in your services.

- Transparency: Providing a clear breakdown of services and charges helps avoid misunderstandings and disputes over payment.

- Legal Protection: A formal billing document serves as proof of the transaction, which can be useful in case of payment disputes or audits.

By incorporating a simple and effective system for generating these records, you can streamline your administrative tasks, allowing you to focus more on the actual services provided and less on the paperwork involved.

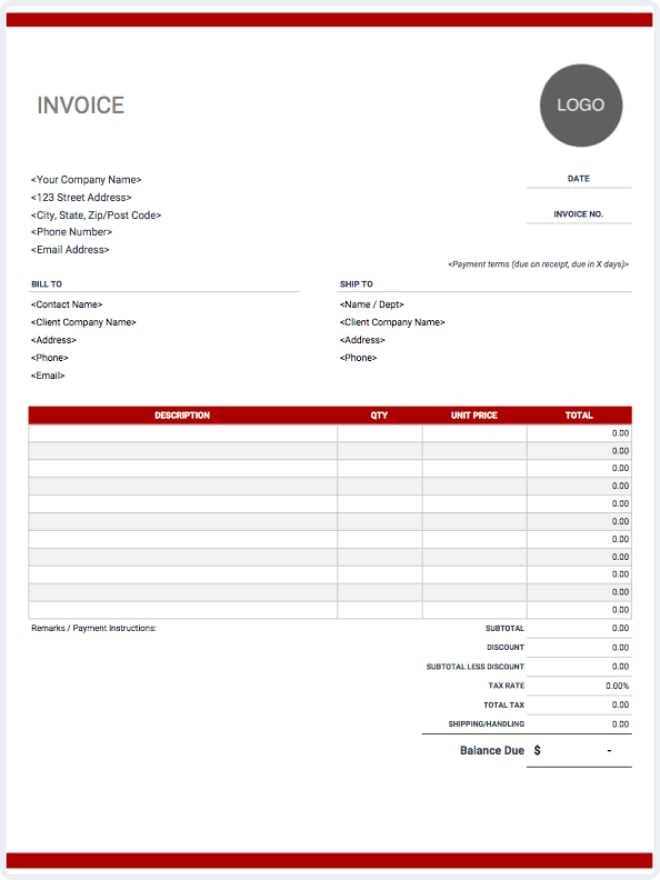

Key Elements of a Billing Document for Transportation Services

For a billing document to be effective and professional, it must include several essential components that ensure clarity, accuracy, and transparency. A well-structured record will not only help facilitate timely payments but also build trust with clients by providing a clear breakdown of the services rendered and their associated costs. Including the right elements ensures that both the service provider and the client have a shared understanding of the transaction.

Essential Information to Include

To make sure the document is comprehensive and legally sound, it should contain the following key details:

- Service Provider Details: Include the name, contact information, and business details of the service provider. This allows the client to easily reach out with any questions or issues regarding payment.

- Client Information: The client’s name and contact details should be clearly listed so the document can be easily matched to the correct account.

- Service Description: Clearly outline the services provided, including any relevant details such as mileage, hours worked, or any additional fees for special services.

- Payment Terms: Specify the payment methods accepted, due date, and any penalties for late payments. This ensures both parties know when and how the payment should be made.

- Itemized Breakdown: A clear breakdown of costs associated with each service allows for better transparency and understanding. Include rates, distance, time, or any extra charges for services.

- Invoice Number: A unique number helps keep track of records and facilitates easier reference for both the provider and the client.

- Taxes and Additional Fees: If applicable, clearly state any taxes or additional charges that may apply to the total cost of the services provided.

Why These Elements Matter

Each of these elements plays a vital role in making the document both functional and professional. Clear itemization of services helps avoid misunderstandings, while including essential client and service provider information ensures that the document is legally binding and traceable. Having a well-organized, detailed record gives both parties peace of mind and helps ensure a smooth payment process.

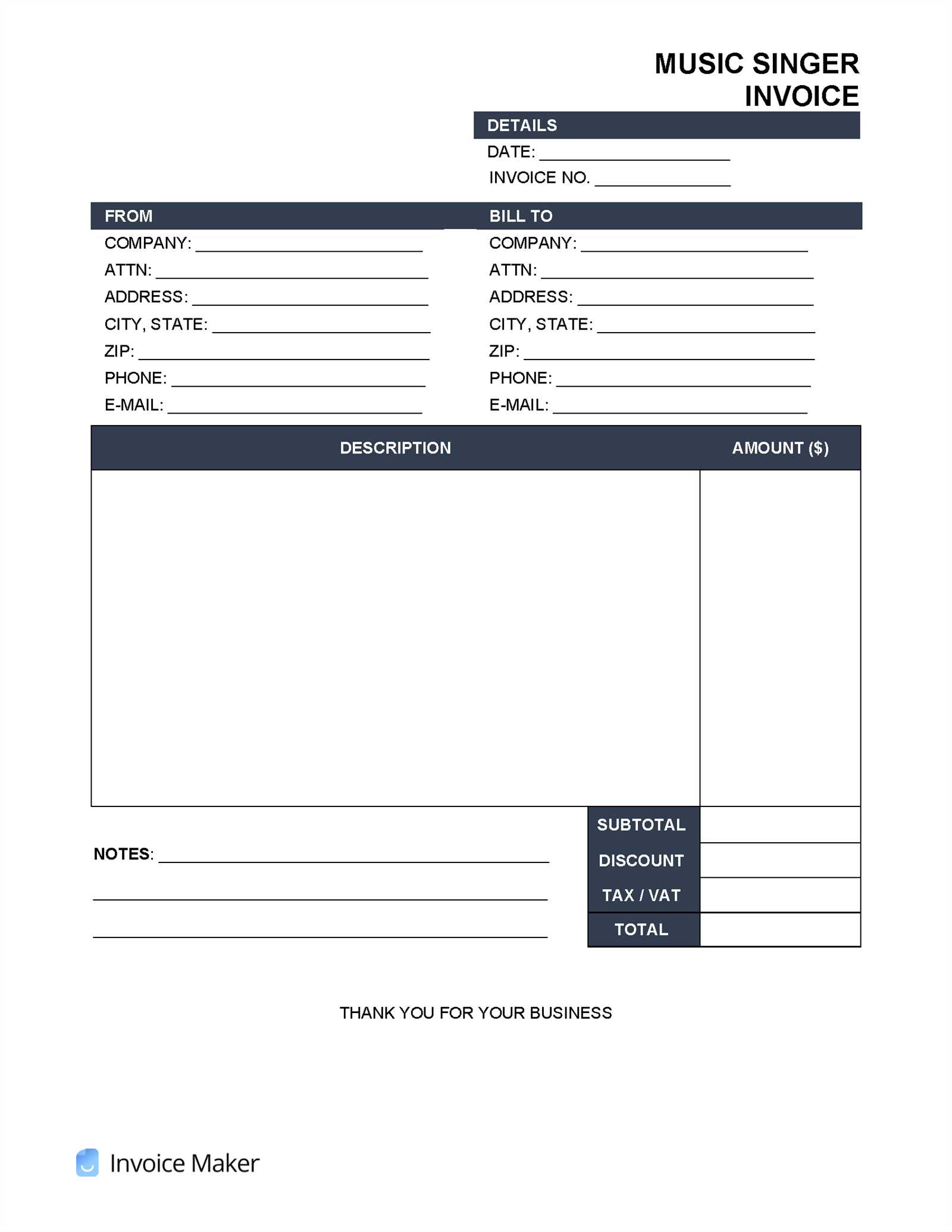

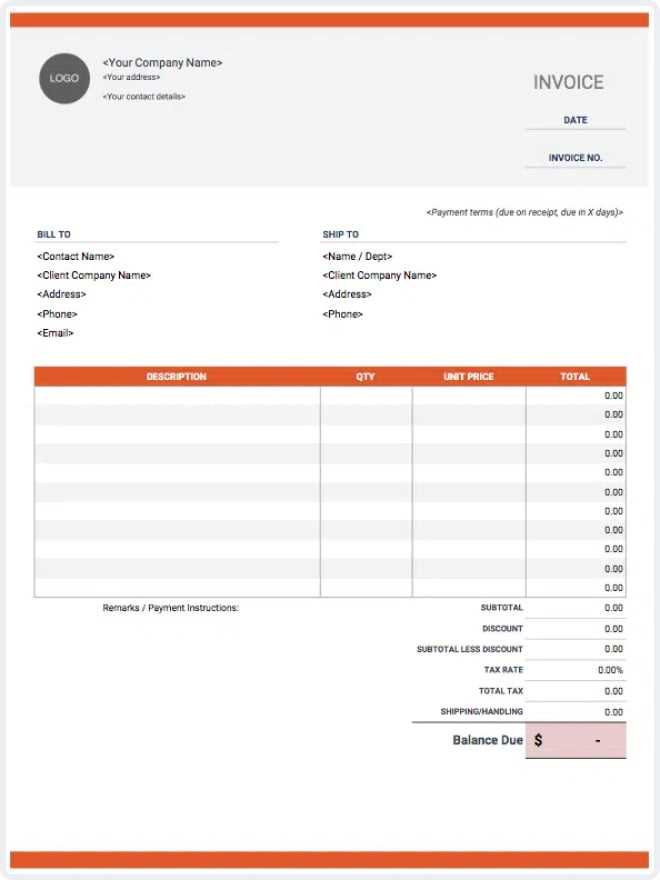

How to Customize Your Billing Document

Personalizing your billing document to match the specifics of your business is crucial for maintaining consistency and professionalism. Customization allows you to align the format with your branding, make adjustments for unique services, and ensure that all necessary information is included. A flexible structure can be tailored to suit the needs of each client and transaction, improving both efficiency and clarity.

Steps for Customization

Follow these steps to create a billing document that fits your specific needs:

- Choose a Structure: Select a layout that suits your business type. You can go for a simple list of services or a more detailed breakdown depending on your offerings.

- Add Business Information: Ensure that your company name, logo, and contact details are included at the top for easy identification. This makes the document look more professional and gives clients clear ways to contact you.

- Include Client Information: Each document should have space to enter the client’s name, address, and contact details. This is important for proper record-keeping and future reference.

- Define Service Descriptions: Clearly explain each service provided. Customize the list of services so clients can easily understand the specifics of what they are being charged for.

- Set Payment Terms: Include a section for payment due dates, methods, and any late fees. Adjust this to reflect your payment policies and make sure it’s easy for clients to follow.

- Add Extra Charges: If you offer additional services or have special pricing structures, create sections that allow for customization of charges, such as rush fees, tolls, or discounts.

- Customize Branding: Adjust fonts, colors, and layout to match your company’s brand guidelines. A visually consistent document helps strengthen your business’s identity.

Why Customization Matters

By tailoring your billing document, you not only provide a more personalized experience for your clients but also streamline your internal processes. Customization helps you maintain a professional appearance and ensures that the document reflects the unique services you offer. It allows for flexibility while also reducing the chance of errors and confusion, ultimately ensuring smoother transactions.

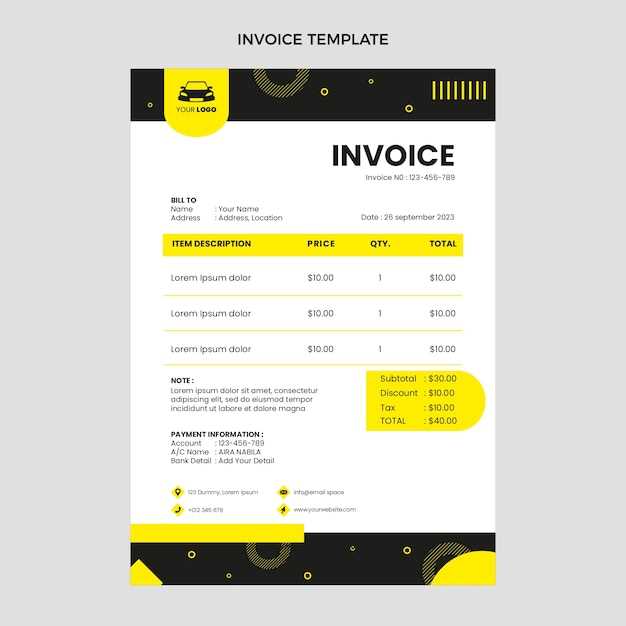

Choosing the Right Billing Format

Selecting the appropriate format for your billing documents is essential for maintaining clarity and professionalism. The format you choose will influence how easily your clients can understand the charges and process the payment. A well-chosen structure ensures that all important information is presented in an easy-to-follow manner, which can speed up the payment process and reduce the likelihood of errors or misunderstandings.

Types of Formats to Consider

There are several formats available, each with its own benefits depending on your business needs. Here are some of the most common options:

- Simple Layout: This format is ideal for businesses that offer straightforward services with a few line items. It focuses on clarity and simplicity, listing each service with corresponding fees in an easy-to-read format.

- Detailed Breakdown: A more in-depth format that provides an itemized list of services, including time, mileage, additional fees, and taxes. This format is beneficial for complex services that require transparency and accuracy.

- Hourly Rate Format: Best suited for businesses that charge based on time. This format lists the hours worked, the hourly rate, and the total amount due. It’s a great option for consultants or other time-based service providers.

- Project-Based Format: If you’re working on a specific project with multiple milestones, this format allows you to itemize charges based on each project phase or deliverable. It’s ideal for larger or ongoing projects with variable pricing.

- Recurring Service Format: For businesses that provide regular, repeat services, this format is designed to outline the agreed-upon schedule and pricing for recurring work, such as weekly or monthly services.

Factors to Consider When Choosing a Format

When deciding on the best structure for your billing documents, consider the following factors:

- Business Type: Choose a format that reflects the nature of your services, whether it’s simple, time-based, or project-based.

- Client Preferences: Some clients ma

Benefits of Using Digital Billing Documents

Switching from paper to digital billing can significantly improve efficiency, reduce errors, and streamline business operations. Digital documents offer greater flexibility, easier tracking, and enhanced security compared to their traditional counterparts. By using electronic records, service providers can save time, reduce costs, and provide a better experience for clients.

Key Advantages of Digital Billing

Here are some of the main benefits of transitioning to digital billing formats:

Benefit Description Time Savings Digital documents can be created, customized, and sent in a fraction of the time it takes to prepare paper records, allowing for faster turnaround times. Reduced Costs By eliminating the need for paper, printing, and postage, digital records help reduce overhead costs associated with physical billing methods. Accuracy Automation tools can help prevent common errors, such as miscalculations or missing details, making digital billing more reliable and precise. Easy Access and Storage Digital files can be stored in cloud-based systems or local drives, allowing for easy access, retrieval, and organization. No more searching through physical folders. Faster Payments Clients can quickly receive and process digital records, speeding up payment cycles. The option for electronic payment methods can further accelerate transactions. Environmental Impact Going paperless reduces the environmental footprint by eliminating the need for paper production and waste. Improved Client Experience

Sending digital records allows clients to review their statements quickly and efficiently. With the added option of paying directly through secure online portals, clients are more likely to make timely payments. Additionally, the professional and modern appearance of digital documents enhances the overall client experience, improving relationships and encouraging repeat business.

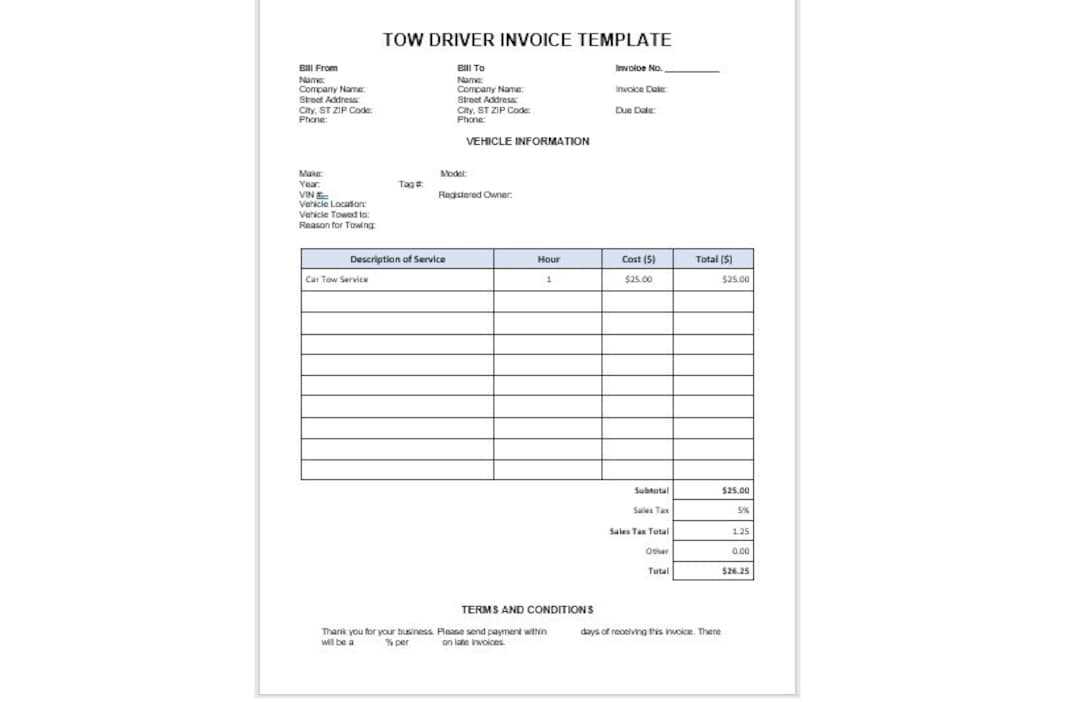

How to Calculate Service Fees

Accurately calculating service fees is an essential part of providing clear and fair billing for any transportation business. Fees can vary depending on factors such as distance, time spent, and additional services provided. Understanding how to calculate these charges correctly ensures that the service provider is compensated appropriately while maintaining transparency with the client.

Factors to Consider When Calculating Fees

To determine the correct amount for each service, you must consider the following variables:

- Base Rate: This is the starting charge for the service, often determined by the time spent or distance traveled. It can be a flat fee or an hourly rate.

- Distance Traveled: For services based on distance, calculate the total miles or kilometers traveled. Many businesses charge a specific rate per mile or kilometer.

- Time Spent: If billing is based on time, multiply the number of hours or minutes worked by the agreed-upon rate.

- Additional Charges: Include any extra fees for services such as waiting time, tolls, parking, or rush services. These should be itemized separately to maintain transparency.

- Taxes: Don’t forget to apply the appropriate tax rates to the total amount. Tax calculations vary by region and should be clearly indicated on the bill.

Example of Fee Calculation

Let’s consider a simple example to demonstrate the calculation:

Service Cost Base Rate (Flat Fee) $50 Distance (100 miles at $1/mile) $100 Time (3 hours at $20/hour) $60 Additional Charges (Tolls, Parking) $15 Total Before Tax $225 Sales Tax (10%) $22.50 Total Due $247.50 By following a structured approach to calculating charges, you ensure that the final amount is fair, clear, and easy to understand for both parties involved.

What to Include in Payment Terms

Payment terms are a critical part of any billing document, as they clearly outline the expectations for when and how payments should be made. Clearly defined payment terms help avoid confusion and ensure a smooth transaction process between service providers and clients. By setting expectations upfront, both parties can agree on timelines and methods, which reduces the risk of delays or disputes.

Essential Elements of Payment Terms

When drafting payment terms, be sure to include the following key details:

- Due Date: Specify the exact date by which payment is expected. This helps clients know when they need to settle the balance and ensures timely payment processing.

- Accepted Payment Methods: List the payment methods you accept, such as credit/debit cards, bank transfers, checks, or online payment platforms like PayPal.

- Late Payment Fees: Outline any penalties or interest charges for overdue payments. This encourages clients to pay on time and helps cover the costs of delayed transactions.

- Early Payment Discounts: If applicable, include any discounts for clients who settle their balance ahead of the due date. Offering a discount can encourage prompt payments.

- Partial Payments: Specify whether partial payments are allowed and the conditions under which they can be made. If partial payments are accepted, outline the amounts and payment schedule.

- Currency: Clearly state the currency in which payments should be made, especially if you work with international clients.

Why These Terms Matter

Including these elements in your payment terms ensures that both you and your clients are on the same page regarding the payment process. It establishes a professional and transparent relationship, helping prevent misunderstandings and providing a clear path for collecting payment. By making payment expectations explicit, you also reduce the chances of late payments and maintain cash flow for your business.

Billing Document for Freelancers

Freelancers often work with a variety of clients and may have different rates, services, and payment terms for each project. Having a structured and professional billing document ensures that payments are processed smoothly and that the freelancer is compensated fairly for the work completed. A well-designed billing record can help freelancers maintain clear communication with clients and keep track of their earnings.

Why Freelancers Need a Structured Record

For independent workers, especially those in fields such as transportation, consulting, or creative services, having a formalized way to present charges is essential. A billing record not only provides clients with a clear breakdown of services but also helps the freelancer stay organized and ensures compliance with tax regulations. Here’s why it’s important:

- Clear Communication: A detailed record ensures both parties understand what services were provided and the costs associated with them.

- Professionalism: Using a formal format helps convey professionalism, making clients more likely to view the freelancer as a reliable, organized partner.

- Timely Payments: A properly structured document can expedite payment by clearly outlining payment terms and methods, reducing the chance of misunderstandings or delays.

- Financial Organization: Keeping track of all work completed and payments received is crucial for managing finances and preparing for taxes.

Essential Elements for Freelance Billing Records

Freelancers should ensure their billing document includes the following key components to keep things clear and organized:

- Freelancer’s Information: Include your full name, business name (if applicable), and contact details, so clients know who the bill is from and how to get in touch if needed.

- Client’s Information: Ensure the client’s name and contact details are included for easy reference.

- Service Description: Detail the specific services provided, including dates, hours worked, or distance traveled, depending on the nature of the job.

- Payment Terms: Clearly state when payment is due, accepted methods of payment, and any late fees that may apply.

- Total Amount Due: Include the total amount owed, including any taxes or additional charges.

With these elements in place, freelancers can ensure they are paid fairly and promptly while maintaining a professional relationship with their clients. Having a clear and structured billing document not only benefits the freelancer but also enhances the client’s experience by providing them w

How to Add Taxes to Your Billing Document

Incorporating taxes into your billing records is essential for complying with local tax laws and ensuring your business remains legally sound. The process of adding taxes is relatively simple but must be done accurately to avoid issues with clients or tax authorities. Whether you are dealing with sales tax, value-added tax (VAT), or other types of taxes, knowing how to calculate and clearly show these charges is important for transparency and professionalism.

Steps to Add Taxes

Follow these steps to properly include taxes in your billing document:

- Determine the Tax Rate: Research the applicable tax rate for your region or the region where the services were provided. Tax rates can vary depending on the type of service and the location, so make sure to use the correct rate.

- Calculate the Tax Amount: Multiply the taxable amount (total cost of the services or products) by the tax rate to determine the total tax owed. For example, if the taxable amount is $200 and the tax rate is 10%, the tax would be $20.

- Add the Tax to the Total: Once the tax amount is calculated, add it to the subtotal of your bill. This ensures that the total amount due includes both the service charges and the applicable taxes.

- Clearly State the Tax Details: Clearly itemize the tax in the document by specifying the tax rate, tax amount, and the total due. This provides transparency and allows the client to easily see how the tax is calculated.

Example of Adding Taxes

Here’s an example of how taxes can be applied:

Service Description Amount Service Fee $500 Tax (10%) $50 Total Due $550 By following these steps, you ensure that your billing documents are accurate, professional, and comply with tax regulations. Always make sure to check local tax laws to ensure you’re applying the correct rate and reporting taxes properly.

Common Mistakes to Avoid in Billing

Creating accurate and professional billing documents is crucial for any business. However, errors in billing can lead to delayed payments, client dissatisfaction, and potential legal issues. By recognizing and avoiding common mistakes, you can ensure smooth transactions and maintain good relationships with your clients. Below are some of the most frequent errors businesses make when creating billing records and how to avoid them.

Key Mistakes to Watch Out For

Here are some common mistakes in the billing process, along with tips on how to avoid them:

Mistake How to Avoid It Incorrect Contact Information Ensure that both your contact details and the client’s information are accurate and up-to-date. Double-check phone numbers, email addresses, and billing addresses to avoid delays. Missing or Inaccurate Dates Always include the correct service dates and issue dates on your document. This helps prevent confusion, especially when the client has multiple services or projects running. Failure to Specify Payment Terms Clearly outline your payment due date, accepted methods, and any late fees in the document. Without these, clients may delay payments or misunderstand your expectations. Not Itemizing Charges Always break down the charges for each service or product provided. A detailed list helps the client understand what they are paying for and reduces the chance of disputes. Overlooking Taxes If applicable, ensure you calculate and list taxes correctly. Check the local tax rates and include them in the total amount due to avoid discrepancies later on. Not Following Up on Unpaid Bills Set a reminder to follow up on overdue payments. Timely reminders are professional and help maintain a steady cash flow. Free vs Paid Billing Document Formats

When it comes to creating billing records, businesses often have to choose between using free or paid solutions. Both options offer their own set of benefits and limitations, depending on the complexity of the services provided and the needs of the business. Understanding the key differences between these options can help you decide which solution is best suited for your specific requirements.

Benefits of Free Billing Formats

Free billing formats are an attractive option, especially for small businesses or freelancers just starting. They often come with basic features and can be used without any financial commitment. Here are some advantages of using free solutions:

- No Cost: As the name suggests, these formats are free to use, which makes them ideal for businesses on a tight budget.

- Easy to Use: Most free formats are simple and intuitive, making them easy to set up and use without technical knowledge.

- Basic Functionality: They typically include essential elements like service descriptions, totals, and due dates, which can cover most basic billing needs.

Drawbacks of Free Billing Formats

While free formats have many advantages, there are also some downsides to consider:

- Limited Customization: Many free formats have limited options for personalization. Customizing logos, colors, or adding complex fields may not be possible.

- Lack of Advanced Features: Free formats might not include advanced features such as tax calculations, payment tracking, or recurring billing.

- Ads or Watermarks: Some free solutions include ads or watermarks on the document, which may not look professional when sent to clients.

Advantages of Paid Billing Formats

Paid billing formats, on the other hand, offer more flexibility and advanced features, making them a popular choice for growing businesses that need more customization and functionality. Some benefits of using paid formats include:

- Customization Options: Paid formats usually allow full customization, enabling you to personalize everything from the design to the layout, making your billing documents reflect your brand.

- Advanced Features: These solutions often include features like tax calculations, automatic totals, payment reminders, and integration with accounting software.

- Professional Look: Paid formats tend to have a polished and professional appearance, which enhances your business’s credibility when dealing with clients.

Drawbacks of Paid Billing Formats

While paid solutions offer many features, there are some potential drawbacks:

- Cost: The most obvious downside is the price. Businesses must pay for these solution

Best Software for Creating Billing Documents

Choosing the right software to create billing records can significantly streamline the process, save time, and help maintain consistency in your business’s financial operations. With the wide range of options available, it can be difficult to know which software best meets your needs. The ideal choice depends on your business size, complexity of services, and additional features you may require, such as integration with accounting tools or the ability to send automated reminders.

Top Software Options for Creating Billing Documents

Here are some of the most popular and reliable software solutions for creating professional billing records:

Software Key Features Best For FreshBooks Easy invoicing, time tracking, payment processing, expense tracking, customizable designs Small businesses and freelancers who need a comprehensive solution QuickBooks Comprehensive accounting tools, automated billing, tax calculation, client management Growing businesses looking for a full-service accounting and billing platform Zoho Invoice Customizable invoices, automatic payment reminders, multi-currency support, mobile app Businesses with international clients who need an easy-to-use, budget-friendly solution Wave Free invoicing, accounting, receipt scanning, payment processing, integration with bank accounts Freelancers and small businesses on a budget who still need essential features Invoicely Multi-currency support, customizable templates, subscription billing, client management Freelancers and small businesses needing a simple yet effective billing to Tracking Payments and Outstanding Billing Records

Keeping track of payments and monitoring unpaid bills is a crucial part of managing finances in any business. Effective tracking helps ensure timely payments, improves cash flow, and minimizes the risk of overdue accounts. By using the right tools and methods, businesses can streamline this process and ensure that all transactions are properly accounted for. In this section, we’ll explore the best practices for tracking payments and managing outstanding accounts.

Why Tracking Payments is Important

Monitoring payments allows businesses to stay on top of their financial status, avoid misunderstandings with clients, and prevent delays in the payment process. When payments are accurately recorded, it’s easier to spot overdue accounts and follow up with clients promptly, which can help maintain positive business relationships. Additionally, tracking helps businesses maintain proper financial records for tax and auditing purposes.

Best Practices for Tracking Payments

- Use a Payment Management System: Utilize software or online tools that allow you to easily track both paid and outstanding accounts. Many billing systems offer features like automatic payment tracking, due date reminders, and real-time status updates.

- Set Clear Payment Terms: Clearly outline the payment terms, such as due dates, late fees, and acceptable payment methods, in every billing document. This reduces confusion and sets expectations with clients.

- Record Payments Immediately: As soon as a payment is received, update your records to reflect the transaction. This will help you avoid any discrepancies and ensure that you have an up-to-date view of your financial situation.

- Send Payment Reminders: If a payment is overdue, don’t hesitate to send a polite reminder. Many software systems can automate this process, sending gentle reminders to clients at regular intervals.

- Keep Detailed Notes: For any outstanding accounts, keep detailed notes about previous communications, agreed payment terms, and follow-up actions. This helps in case you need to escalate the situation or resolve any issues later on.

How to Manage Outstanding Accounts

For accounts that remain unpaid past their due date, it’s important to take action promptly to prevent further delays. Here’s how to handle overdue accounts effectively:

- Review the Billing Record: Double-check your records to ensure that the billing details are correct and that there are no misunderstandings about the amount or the services rendered.

- Communicate with the Client: Contact the client directly to inquire about the payment. A friendly, profes

Importance of Document Numbering

Assigning unique identifiers to each billing record is a critical aspect of maintaining an organized and professional business. Proper numbering not only helps you keep track of transactions but also ensures that your records remain consistent and easy to reference. In this section, we’ll explore why numbering your billing documents is important for business efficiency, legal compliance, and client communication.

Benefits of Numbering Billing Documents

Numbering your billing documents provides several practical advantages that contribute to a more streamlined financial process:

- Organization and Tracking: Assigning a number to each billing document allows you to easily organize and track payments, as well as identify any outstanding balances. It helps you maintain an accurate financial record without the risk of losing track of individual transactions.

- Improved Client Communication: A unique number makes it easier to reference specific transactions with clients. When discussing a payment, both parties can quickly refer to the document by its assigned number, reducing the chances of confusion or disputes.

- Legal and Tax Compliance: In many jurisdictions, businesses are required to issue sequentially numbered billing documents for legal and tax purposes. This practice helps maintain a clear audit trail for regulatory requirements.

- Prevention of Duplicate Billing: A sequential numbering system ensures that no document is issued more than once. It reduces the risk of accidentally sending duplicate records and collecting incorrect payments from clients.

Best Practices for Numbering Billing Documents

To make the most of your numbering system, consider the following best practices:

- Start with a Clear Format: Decide on a numbering structure that works for your business. Many businesses use a simple sequential number (e.g., 001, 002, 003), while others might include the year or month (e.g., 2024-001, 2024-002) for additional clarity.

- Use a Consistent Pattern: Maintain consistency in your numbering system. This makes it easier to track documents over time and helps avoid confusion or errors when referencing past transactions.

- Automate the Process: If possible, use accounting or billing software that automatically generates unique numbers for each new billing document. This minimizes the chance of human error and saves time in your administrative process.

- Keep a Record of Numbered Documents: Maintain a log or digital record of all issued numbers. Thi

When to Send a Billing Document

Determining the right time to issue a billing document is essential for maintaining smooth cash flow and avoiding payment delays. The timing of your billing can influence how quickly you get paid and how well you manage your financial records. In this section, we will discuss the optimal moments to send your billing documents and how to align them with your business processes.

Factors to Consider When Sending Billing Records

Several key factors affect when you should send a billing document. These factors can help ensure that both you and your clients are on the same page regarding payment terms:

- Completion of Service or Delivery: It’s important to send your billing document as soon as the service is completed or the product is delivered. This is typically the most logical time to request payment, as the client has already received what they paid for.

- Agreement Terms: Always align your billing with the terms set forth in your agreement. If you’ve agreed to bill after a set period (e.g., weekly, monthly), ensure that you send the document on the agreed-upon schedule.

- Payment Terms: Make sure your payment terms (such as “due upon receipt” or “net 30”) are clear in your document. This helps clients understand when they need to make the payment and reduces any confusion around due dates.

- Client Expectations: If your client prefers to receive billing documents on a regular schedule or at specific intervals, ensure that you accommodate these preferences to maintain a positive business relationship.

Best Practices for Timely Billing

Sending your billing documents on time can help you maintain a steady cash flow and avoid overdue payments. Here are some best practices for ensuring timely billing:

Timing Event Recommended Action Upon Completion of Work Send the billing document immediately after the service is completed or product is delivered, ensuring that payment terms are clearly stated. At Regular Intervals If you’re billing on a recurring basis, set remind How to Handle Late Payments

Managing overdue payments effectively is a key part of maintaining healthy cash flow and strong business relationships. While late payments are common, having a clear strategy for handling them can help you recover funds while keeping clients satisfied. In this section, we will explore practical steps to address late payments and minimize their impact on your business.

1. Send a Friendly Reminder

The first step in dealing with a late payment is to send a polite reminder. Often, clients may forget about the payment or be delayed for reasons beyond their control. A gentle nudge can often resolve the issue quickly without causing friction. Make sure your reminder includes the following:

- Clear payment details: Reference the amount due, the original due date, and any relevant details about the transaction.

- Payment methods: List available methods of payment to make it as easy as possible for the client to settle the balance.

- Friendly tone: Keep the tone professional and courteous, as this will help maintain a good relationship.

2. Offer Flexible Payment Terms

If your client is experiencing financial difficulties or simply missed the payment, offering flexibility can help. You might propose a payment plan or allow them a little extra time to pay. Providing an alternative solution can demonstrate your willingness to work with the client, which can strengthen your business relationship in the long run.

3. Charge Late Fees

If your payment terms include a late fee, applying it after the agreed grace period can encourage timely payments in the future. Be sure to communicate clearly in advance that late fees will apply, and include them in the payment terms. This will help clients understand that there are consequences for not paying on time.

4. Escalate if Necessary

If the payment remains overdue despite your reminders and flexible terms, you may need to take more formal action. Here are a few steps you can take:

- Send a formal notice: A more assertive written notice can help signal the seriousness of the situation. Include a specific deadline for payment and outline any further actions you might take if the debt remains unpaid.

- Hire a collection agency: If the amount is significant and the client is unresponsive, consider hiring a collection agency. While this may involve fees, it could be a more efficient way to recover the payment.

- Legal action: As a last resort, you might need to pursue legal action to recover the debt. Consult with a lawyer to understand your options and the best way forward.

5. Learn from the Experience

To avoid future late payments, take the time to analyze what went wrong. Review your payment terms and communication strategies. Did you make the payment expectations clear upfront? Did you follow up promptly? By learning from each late payment, you can implement changes that will reduce the likelihood of future issues.

By addressing late payments effectively and professionally, you can ensure that your business remains