Download and Customize Software Invoice Template in Word

Managing financial transactions efficiently requires a reliable method for generating payment requests. A well-structured document can ensure clarity, prevent errors, and enhance professionalism. With the right tools, crafting an accurate record for each service provided becomes a seamless task.

For those looking to streamline the billing process, utilizing pre-designed layouts offers a significant advantage. These structures allow for quick adaptation, saving time and ensuring consistency across all communication. Customizing these formats to suit specific business needs can be done effortlessly with popular software options.

Whether you are a freelancer, small business owner, or part of a larger team, having a streamlined way to prepare financial documents is essential. Leveraging adaptable formats makes the entire process more organized and efficient, while also maintaining a high standard of presentation in all client interactions.

Software Invoice Template Word Overview

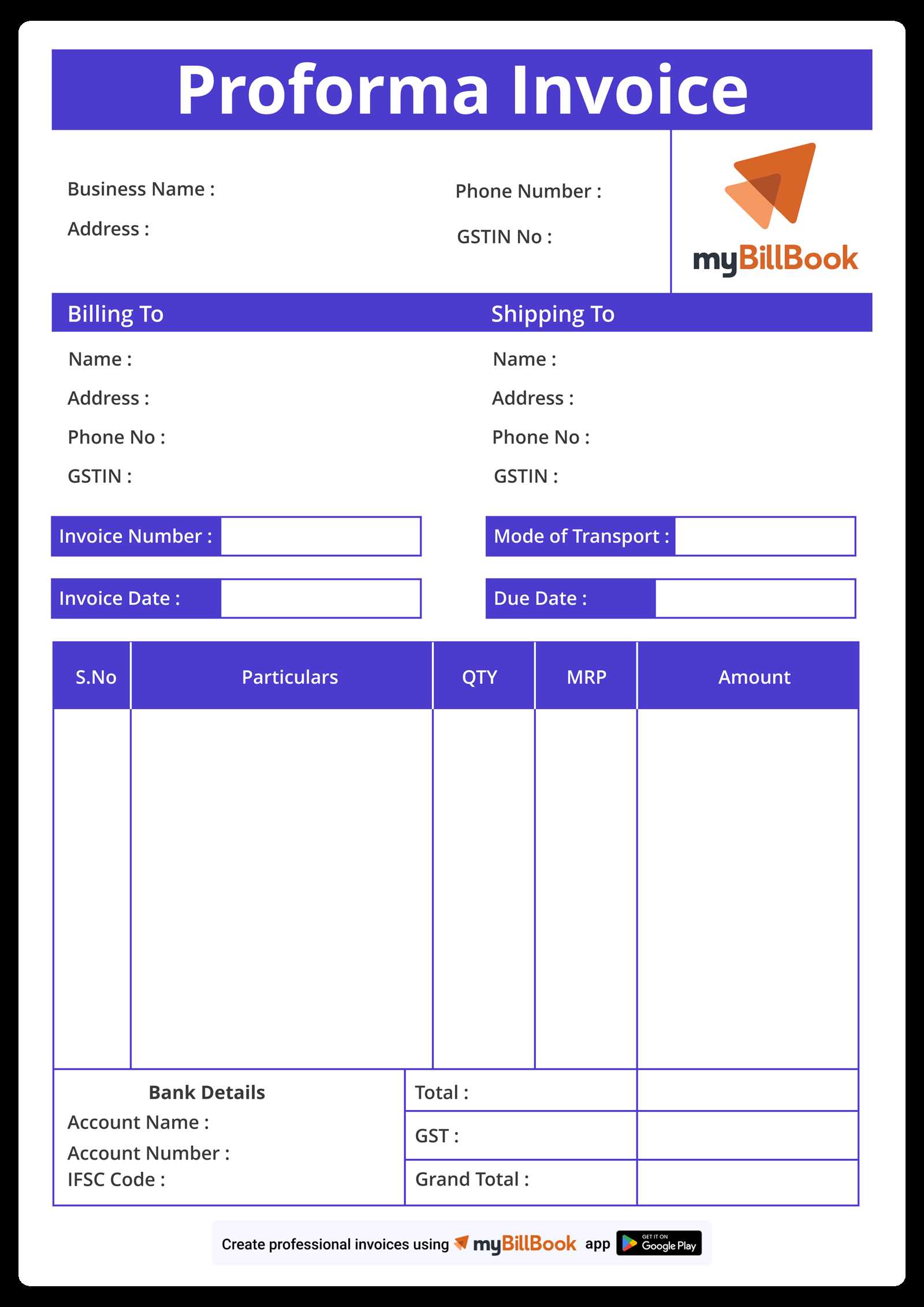

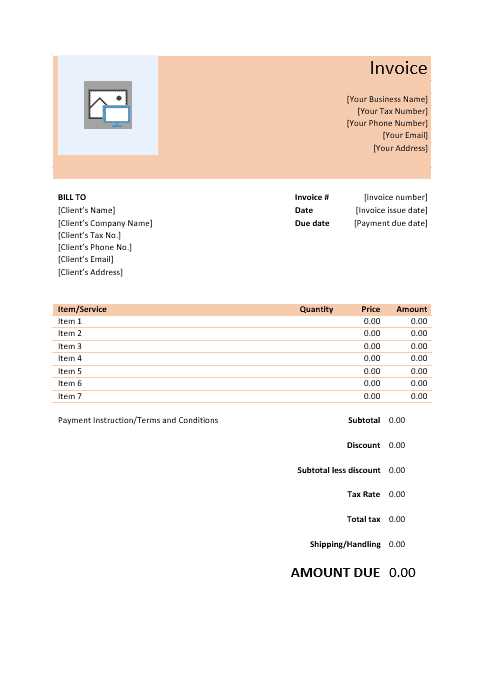

Creating professional billing documents can be a time-consuming task, but using pre-designed formats simplifies the process significantly. These ready-to-use layouts are designed to meet the needs of individuals and businesses alike, allowing for quick generation of payment requests with consistent structure and appearance. With customizable features, these formats can be adjusted to fit specific business requirements, offering both efficiency and flexibility.

These formats are particularly useful for those who require a streamlined approach to managing financial records. Whether you’re a freelancer, consultant, or small business owner, having access to a well-organized document layout can save valuable time while ensuring accuracy. Pre-built structures include all the essential fields, such as item descriptions, pricing, and payment terms, which can easily be tailored for individual projects or clients.

Moreover, these layouts are compatible with a variety of commonly used software programs, making them accessible for a wide range of users. With just a few simple edits, you can have a polished and professional document ready to send to clients or customers, enhancing the overall business experience.

Benefits of Using a Word Invoice

Utilizing ready-made billing documents offers numerous advantages for businesses and individuals who want to simplify their financial processes. The ease of use, customization options, and flexibility are key factors that make these documents a popular choice. By leveraging pre-designed structures, users can quickly generate accurate and professional-looking records, reducing errors and saving valuable time.

One of the main benefits is the ability to easily personalize each document. With customizable fields for client details, service descriptions, and payment terms, users can tailor the layout to match their specific business needs. Additionally, these documents can be easily saved, shared, or printed, providing multiple options for managing financial transactions.

| Benefit | Description |

|---|---|

| Time-Saving | Quickly create well-structured records without starting from scratch. |

| Customizable | Personalize fields such as client names, services, and payment information. |

| Professional Look | Consistent and clean formatting enhances your business’s image. |

| Easy Distribution | Share or print documents easily for various business needs. |

Incorporating these pre-built formats into your routine not only simplifies the process but also ensures a higher level of professionalism when communicating with clients or customers. This can ultimately lead to improved business efficiency and customer satisfaction.

How to Create a Software Invoice

Creating a billing document from scratch can seem challenging, but with the right approach, it becomes a straightforward task. A well-organized structure ensures that all essential information is included and easily understood. The process typically involves selecting an appropriate format, filling in key details, and adjusting the layout to suit specific needs.

Start by opening a blank document or using a pre-existing layout. Then, include the essential elements such as the business name, client information, service descriptions, pricing, and payment terms. Customize the document to reflect your specific services or products. Once all fields are populated, save the file and prepare it for distribution to clients.

| Step | Action |

|---|---|

| Step 1 | Select an appropriate format or start from scratch. |

| Step 2 | Include essential details such as contact information and payment terms. |

| Step 3 | Input services, quantities, and prices accurately. |

| Step 4 | Review the document for any errors and ensure clarity. |

| Step 5 | Save and share the document as needed. |

By following these steps, you can create a clear and professional billing document that effectively communicates payment details and ensures smooth transactions.

Customizing Invoice Templates in Word

Adapting a pre-designed document for your specific needs allows for a more personalized and professional touch. By modifying existing structures, you can align the layout with your brand, adjust the content to match your offerings, and ensure that all necessary details are included. Customization options can range from changing colors and fonts to adding company logos or adjusting the layout for better clarity.

To make the most of a pre-designed structure, begin by editing the core fields such as client information, service descriptions, and payment terms. You can also add or remove sections based on what is most relevant for your business. Adjusting design elements such as logos, colors, and fonts ensures that the document aligns with your brand identity and looks professional.

Moreover, it’s important to ensure that the final version is clear, concise, and easy to read. Well-structured details help clients understand the charges and terms without confusion, which can facilitate quicker payments and enhance customer satisfaction. With the right modifications, these documents can be perfectly tailored for any client or project.

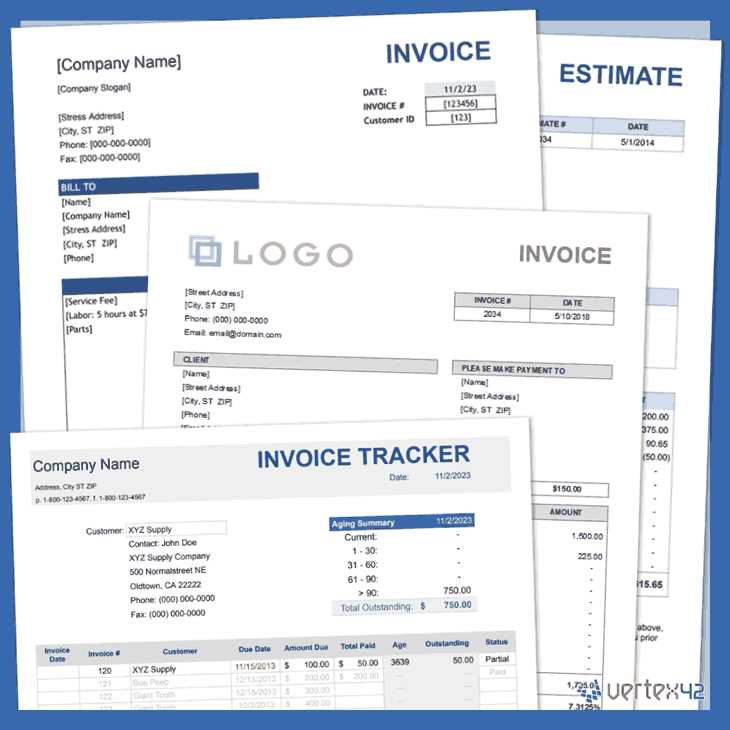

Free Software Invoice Templates for Word

Many businesses and freelancers benefit from using free, pre-designed billing documents that streamline the payment process. These easily accessible resources help users avoid the hassle of starting from scratch, offering clean and professional layouts that can be quickly filled out and customized to fit specific needs. Most of these resources are available for download without any cost, making them ideal for small businesses or individuals on a budget.

These free documents are often available in a variety of formats, allowing users to choose one that suits their industry or the nature of the services provided. Customization is usually simple, with options to add logos, change fonts, or adjust the layout. Accessing these free resources can save time and ensure that you maintain a consistent, professional appearance for every transaction.

| Feature | Benefit |

|---|---|

| Free Access | No cost involved, making it budget-friendly. |

| Customizable | Easily adjust to suit your business’s branding and needs. |

| Variety of Layouts | Choose from multiple designs that suit different industries. |

| Time-Saving | Pre-designed layouts reduce the need for manual creation. |

Whether you are working on a one-time project or handling recurring transactions, these free resources offer a practical solution for businesses looking to streamline their billing process. By using these free, customizable documents, you can ensure efficiency and consistency while maintaining a professional approach to client communications.

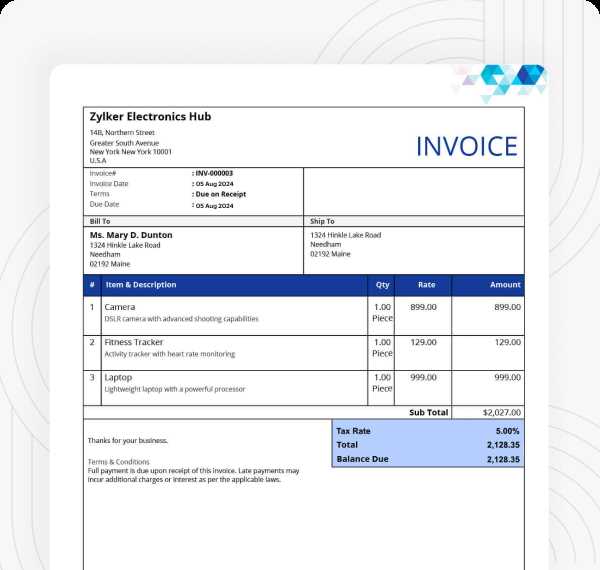

Key Features of a Good Invoice

A well-crafted billing document is essential for maintaining professionalism and ensuring clarity in financial transactions. It should include all necessary details to avoid confusion and ensure prompt payment. A good record should be clear, organized, and complete, providing both the service provider and client with all the relevant information they need.

Key features of a well-designed document include accurate contact details, a breakdown of the services provided, clear payment terms, and a detailed total amount due. It should also be easy to read and free from any ambiguity, ensuring that both parties can quickly understand the terms. Moreover, maintaining a professional appearance with clean formatting and branding helps to reinforce the credibility of the business.

| Feature | Description |

|---|---|

| Accurate Contact Information | Include both the service provider’s and client’s names, addresses, and contact details. |

| Service Breakdown | Clearly list each item or service provided, including quantities and prices. |

| Payment Terms | State the payment due date, late fees, and accepted payment methods. |

| Clear Total Amount | Ensure the total due is clearly stated, including taxes or discounts. |

| Professional Appearance | Use consistent formatting, branding, and design for a polished look. |

By incorporating these features, businesses can create clear and effective billing documents that enhance their professional image and streamline payment processes. A well-designed document helps prevent misunderstandings and facilitates smooth financial transactions between businesses and their clients.

Saving and Sharing Your Invoice Template

Once your billing document is created and customized, it’s important to save it properly and ensure it can be easily shared with clients or colleagues. A well-organized document storage system not only keeps things efficient but also ensures that you can quickly access and reuse your formats for future transactions. The process of saving and sharing involves selecting the right file format and distribution method to ensure the document reaches the intended recipient without issues.

Choosing the Right File Format

When saving your billing document, selecting a commonly used file format is crucial for easy sharing and compatibility. Most people prefer PDF format for its universal accessibility and the fact that it preserves the layout. However, you might also consider saving the document in editable formats, such as DOCX, in case further modifications are needed in the future. Always keep a backup in case of file corruption or loss.

Sharing Your Document Efficiently

Sharing the document can be done in several ways. The most common method is through email, where you can attach the file and send it directly to your client. If you need to share with multiple people or require a more formal method, consider using cloud storage services like Google Drive or Dropbox, where the document can be accessed via a shared link. Cloud storage options provide the benefit of easy collaboration and document tracking.

Efficient management of your billing documents ensures that you can quickly generate and distribute accurate payment records, making your business processes more streamlined and professional.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s easy to overlook small details that can lead to confusion or delays in payment. Even minor mistakes can affect the clarity of the document and create friction between you and your clients. Being aware of common errors can help ensure that your records are clear, professional, and effective in facilitating smooth financial transactions.

One frequent mistake is failing to include complete contact information for both parties, which can lead to miscommunication or delays. Another common issue is unclear payment terms, such as missing due dates or vague late fee policies. It’s important to be precise in every section to avoid confusion and ensure prompt processing.

Additional mistakes include incorrect item descriptions or pricing errors, which can cause clients to question the accuracy of the charges. Always double-check the details before sending out your document. Neglecting to provide a clear total amount due or listing the wrong payment methods can also complicate the transaction process. Clear and accurate records help maintain professionalism and build trust with clients.

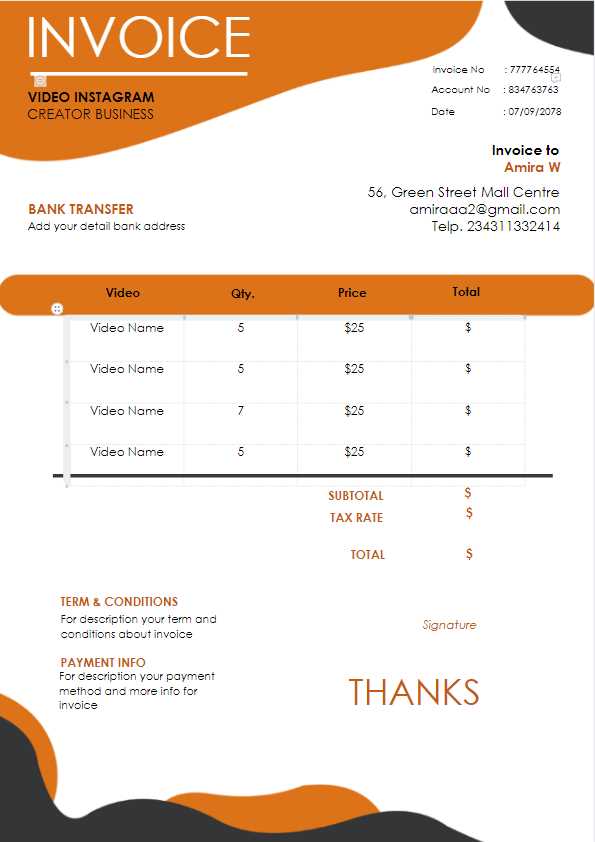

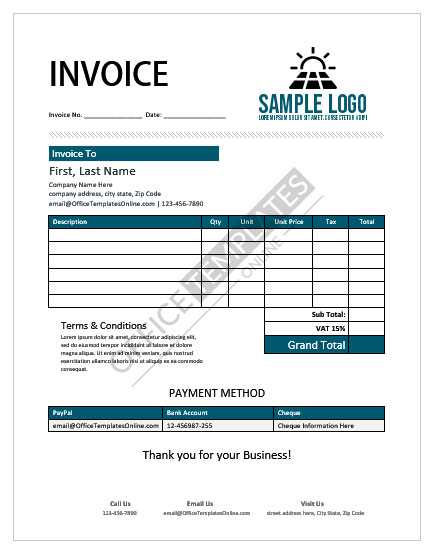

How to Add Logo to Invoice

Incorporating your company’s logo into billing documents is an essential part of establishing a professional and branded appearance. It helps reinforce your business identity and adds a personal touch to the transaction. The process of adding a logo is relatively simple, whether you’re using a pre-designed document or creating one from scratch.

Choosing the Right Image File

Before inserting your logo, ensure that the image is of high quality and appropriately sized. The logo should be clear and visible without overwhelming the layout of the document. Common image formats, such as PNG or JPEG, are typically used for logos. Be sure to select a resolution that maintains clarity when the document is printed or viewed on different devices.

Inserting the Logo into the Document

Once the logo file is ready, the next step is placing it in the document. Typically, logos are positioned at the top of the page, either centered or aligned to the left or right, depending on your design preference. Most document editing tools allow you to easily drag and drop the image into the header or desired section. Adjust the size and alignment to ensure that it complements the overall design and does not obstruct important details.

By adding a logo to your billing documents, you enhance the professionalism of your communications and ensure that your clients instantly recognize your brand when they receive your documents.

Automating Your Billing Documents in Word

Automating your billing documents can save valuable time and reduce human error, especially when managing multiple clients or projects. By utilizing built-in features and simple automation tools, you can streamline the process, ensuring that each document is generated quickly and consistently. With a few adjustments, you can create a system that automatically populates essential information and maintains a professional appearance.

Here are some methods for automating your billing records:

- Using Fields: Many document editors offer built-in fields that can automatically fill in data such as the date, client name, and payment terms. Once set up, these fields can automatically update each time a new document is created.

- Macros: Macros are a powerful tool that can automate repetitive tasks. By recording a series of actions, you can create custom workflows that insert pre-filled data, format the document, or even send it via email.

- Pre-set Lists: Keep a list of common products, services, or charges saved in the document, so when creating a new billing record, you can simply select from drop-down menus to insert these items quickly.

By integrating these automation techniques, you can not only save time but also maintain consistency across all your documents, reducing the likelihood of mistakes. Automation allows you to focus more on client relationships and less on administrative tasks, which can help improve your overall workflow efficiency.

Legal Aspects of Billing Documents

When creating billing documents for your business, it’s essential to understand the legal requirements that ensure both the document’s validity and your compliance with local regulations. A well-structured document not only serves as a record of the transaction but also protects both parties by clearly outlining the agreed terms. In this section, we will explore key legal considerations that should be included in any financial record.

Compliance with Tax Regulations

One of the primary legal aspects of billing documents is ensuring that they comply with tax regulations. Depending on your location, certain details must be included to meet tax reporting requirements. This may include your tax identification number, the applicable tax rates, and the total amount of tax charged. Failure to include these details could result in penalties or difficulties with tax authorities.

Terms of Service and Payment Conditions

Clearly defining the terms of service and payment conditions within the document is also crucial. This includes outlining the agreed-upon due dates, any late payment fees, and payment methods. By explicitly stating these terms, you can avoid misunderstandings and potential legal disputes. Additionally, it’s important to keep accurate records of transactions for future reference, in case any discrepancies arise.

By adhering to these legal aspects, you can ensure that your billing documents are not only functional but also legally sound, providing protection and clarity for both parties involved.

Billing Document for Freelancers

For freelancers, creating professional billing documents is essential for ensuring timely payments and maintaining a positive client relationship. A well-structured document not only outlines the services provided but also helps in managing finances and tracking payments. Freelancers often need flexibility in their billing, which makes having a custom record that suits different project needs particularly important.

When crafting a billing document, freelancers should include the following essential elements:

- Client Information: Including accurate details about the client, such as their name, address, and contact information, is vital for clarity and future reference.

- Clear Description of Services: Each service provided should be described in detail, including the hourly rate or project cost, and the total amount due.

- Payment Terms: Clearly stating payment due dates, accepted payment methods, and any late fees will help avoid confusion and ensure timely compensation.

In addition, it’s important for freelancers to personalize their records with their own branding, such as a logo or custom formatting. This not only makes the document look more professional but also helps establish a stronger brand identity. By maintaining consistency and clarity in billing records, freelancers can enhance their professional reputation and minimize any potential disputes over payments.

Tips for Professional Billing Document Design

Creating a visually appealing and clear billing document is essential for establishing credibility and ensuring that your clients understand the charges. A well-designed record not only looks professional but also helps in conveying the necessary details in a straightforward manner. Below are some tips to enhance the design of your billing documents.

1. Keep It Simple and Clean

The layout of your document should be clean and easy to read. Avoid cluttering the page with unnecessary details or over-complicating the design. Focus on the most important information that the client needs to see at a glance, such as the total amount due, services rendered, and payment terms. Here are some key design principles:

- Use a clear, legible font that is easy to read, even in small sizes.

- Leave enough white space around key sections to improve readability.

- Use bold or italics sparingly to highlight important details like payment due dates.

2. Organize Information Logically

Effective organization is key to making your document user-friendly. Arrange the information in a logical order, starting with the client’s details, followed by the services provided, and concluding with the total amount due and payment instructions. To help with this, use well-structured tables and sections. For example:

- Client and business information at the top of the document for quick reference.

- Breakdown of services in a detailed table, including descriptions, rates, and amounts.

- Summary section with the total amount due and payment terms clearly visible.

By following these tips, you will create a billing document that is not only functional but also visually attractive, reinforcing your professionalism and improving client satisfaction.

Billing Document Compatibility with Applications

When creating billing documents, it’s important to consider how they will integrate with various applications and platforms. Compatibility ensures that the document can be easily edited, shared, and processed without any issues. Whether you’re using accounting software or a simple text editor, having a flexible document format that works seamlessly across different tools will save time and reduce errors.

Different applications may have specific requirements for document formats. For example, some may prefer editable formats for easy adjustments, while others may require a PDF for final submission. It’s essential to choose a format that ensures smooth interaction between your billing document and the software you’re using. Below is a simple table outlining common formats and their compatibility:

| File Format | Compatibility | Best Use |

|---|---|---|

| Universal, viewable on any platform | Final, non-editable documents for clients | |

| Excel/CSV | Compatible with accounting and spreadsheet software | Editable records, calculations, and analysis |

| Text Document (.docx, .txt) | Most word processing applications | Simple edits, informal use, and custom formatting |

Ensuring your billing document is compatible with the tools you use will streamline your workflow and make it easier to maintain accurate records. By understanding the different formats and their uses, you can choose the best option for each situation, ensuring efficiency and consistency in your business operations.

How to Adjust Document for Tax Rates

Adjusting a billing document to reflect different tax rates is an essential task when customizing your records. Whether you’re working with variable tax percentages or specific regional rates, ensuring that the correct tax is applied to your calculations is crucial for accuracy and legal compliance. Here’s how to easily adjust your document to accommodate various tax rates and ensure that the final amount is calculated properly.

1. Identify Tax Categories

Start by identifying the different tax categories that apply to your services or products. These may vary depending on the location, type of product or service, and your business’s tax obligations. You might need to account for different tax rates based on the country, state, or even local jurisdiction.

| Tax Category | Rate | Region |

|---|---|---|

| Standard Sales Tax | 10% | California |

| Reduced Sales Tax | 5% | New York |

| Service Tax | 15% | Texas |

2. Modify the Document Calculation

Once you’ve determined the applicable tax categories, it’s time to adjust your document. Here’s how to apply the tax rate to each item or service:

- Calculate the tax: Multiply the item price by the tax rate to determine the amount to be added.

- Update the totals: Add the calculated tax to the item’s cost to update the total due.

- Check for additional fees: Ensure that any other fees (such as shipping or handling) are correctly accounted for in the final total, including tax adjustments.

By adjusting your document to reflect accurate tax rates, you ensure that your clients are billed correctly and that your business complies with applicable tax regulations.

Tracking Payments Using Billing Documents

Efficiently tracking payments is a crucial aspect of maintaining financial accuracy in your business. By organizing and monitoring payment status through structured records, you can ensure that outstanding balances are addressed promptly and that your revenue streams remain healthy. Here’s how to use your billing documents to track payments effectively and keep your accounts up to date.

1. Include Payment Terms and Due Dates

To start tracking payments effectively, ensure that the billing record includes clear payment terms and due dates. This allows both you and your client to be aware of when the payment is expected and any penalties for overdue payments.

| Payment Term | Due Date | Payment Status |

|---|---|---|

| Net 30 | 2024-12-01 | Pending |

| Due on Receipt | 2024-11-10 | Paid |

| Net 45 | 2024-12-15 | Pending |

2. Track Payment Status in the Record

Once a payment is received or processed, update the status of each bill to reflect whether it has been paid, is pending, or is overdue. This simple practice helps you maintain a clear overview of all financial transactions and reduces the risk of missed payments.

- Mark Paid: Once the payment has been received, update the status to “Paid.”

- Pending Payments: If the payment is still due, keep it marked as “Pending” until processed.

- Overdue Notifications: Make sure to send reminders for overdue payments to avoid confusion and ensure timely settlement.

By using your structured documents to track payment statuses, you ensure that all financial obligations are met and that your business operations remain smooth and well-managed.

Ensuring Invoice Accuracy and Clarity

Maintaining precision and transparency in financial documentation is essential to avoid misunderstandings and ensure smooth transactions. Clear and error-free records help both the issuer and the recipient quickly understand the details of the exchange, reducing the chances of disputes and delays. In this section, we’ll explore methods to ensure your billing documents are both accurate and easy to understand.

One of the first steps to ensure clarity is double-checking all numerical values and ensuring that all services or products are listed correctly. Accurate calculations for quantities, rates, and totals are essential, and even small mistakes can lead to confusion or dissatisfaction. Clear itemization helps the recipient easily comprehend what they are being billed for.

Additionally, be sure to include comprehensive details such as the payment terms, due dates, and any applicable tax information. These elements should be written in a way that is straightforward, with no room for ambiguity. Providing full transparency on these points will prevent future questions or issues regarding payment.

Lastly, always ensure that your documents are professionally formatted. A neat, organized structure enhances readability, making it easier for clients to quickly find the information they need. Clean and well-presented records also reflect positively on your professionalism, fostering trust and confidence in your business dealings.

Best Practices for Invoice Management

Efficient management of billing documents is crucial for maintaining smooth cash flow and healthy business relationships. Implementing best practices in this area not only helps ensure timely payments but also minimizes errors and confusion. Below are key strategies to improve the management of your financial records.

- Organize and Categorize Your Records: Keep all your billing documents well-organized. Categorizing them by client, date, or project makes it easier to retrieve specific records when needed.

- Automate Payment Reminders: Set up automated reminders for due payments. This helps avoid delays and shows clients that you are on top of your business operations.

- Keep Detailed Records: Maintain a record of each transaction, including dates, services provided, amounts, and any correspondence with clients regarding the payment. This documentation can be helpful in case of disputes.

- Establish Clear Payment Terms: Ensure your clients understand your payment expectations by clearly stating your payment terms (such as due dates and late fees) on each document.

- Track Payment Status: Regularly monitor which bills have been paid and which are still outstanding. Keeping track of payments in real-time helps you quickly follow up on overdue accounts.

- Stay Consistent with Formatting: Using a standardized format for all documents helps maintain professionalism and makes it easier for both you and your clients to read and understand.

By adopting these best practices, you can streamline the process of managing your financial documents, ensuring timely payments and fostering better relationships with your clients.