Best Retail Invoice Template Excel for Efficient Invoicing

Managing sales transactions effectively is crucial for any business. A well-organized document for recording purchases ensures accuracy and smooth financial operations. Whether you’re handling a few transactions or thousands, having a structured system in place can save time and prevent errors.

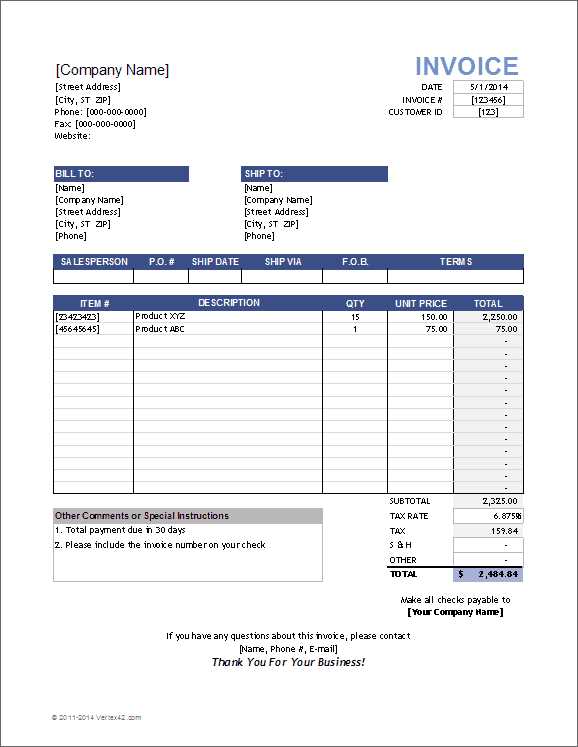

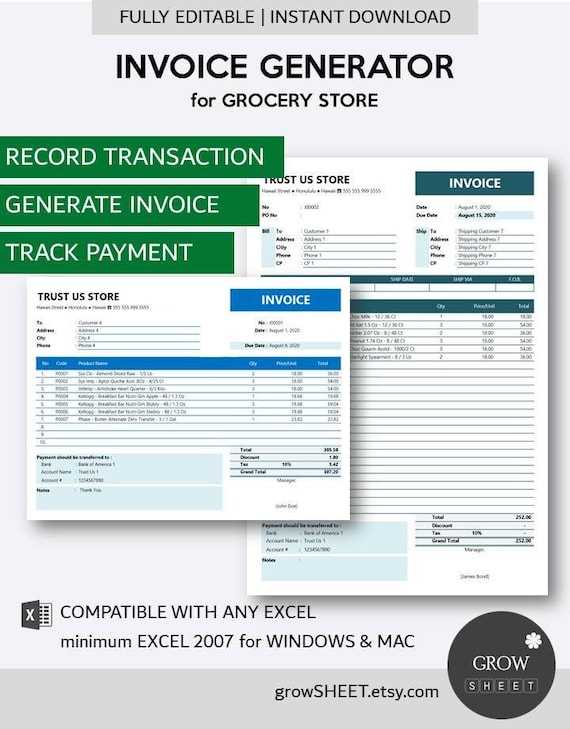

Creating personalized billing forms allows business owners to maintain professional standards while also adapting to specific needs. With the right tool, these forms can be tailored to include necessary fields such as payment terms, item descriptions, and totals, making the entire process more efficient.

Customizable spreadsheets offer the flexibility to adjust layouts, add calculations, and track payments. They provide an easy way to streamline the administrative side of transactions without the need for specialized software. These solutions allow small business owners and freelancers to focus more on their work and less on paperwork.

By utilizing these tools, you can ensure that your records are clear, accurate, and ready for tax season or any necessary audits. Efficient billing helps establish trust with customers and keeps your business operations running smoothly.

What is a Retail Invoice Template

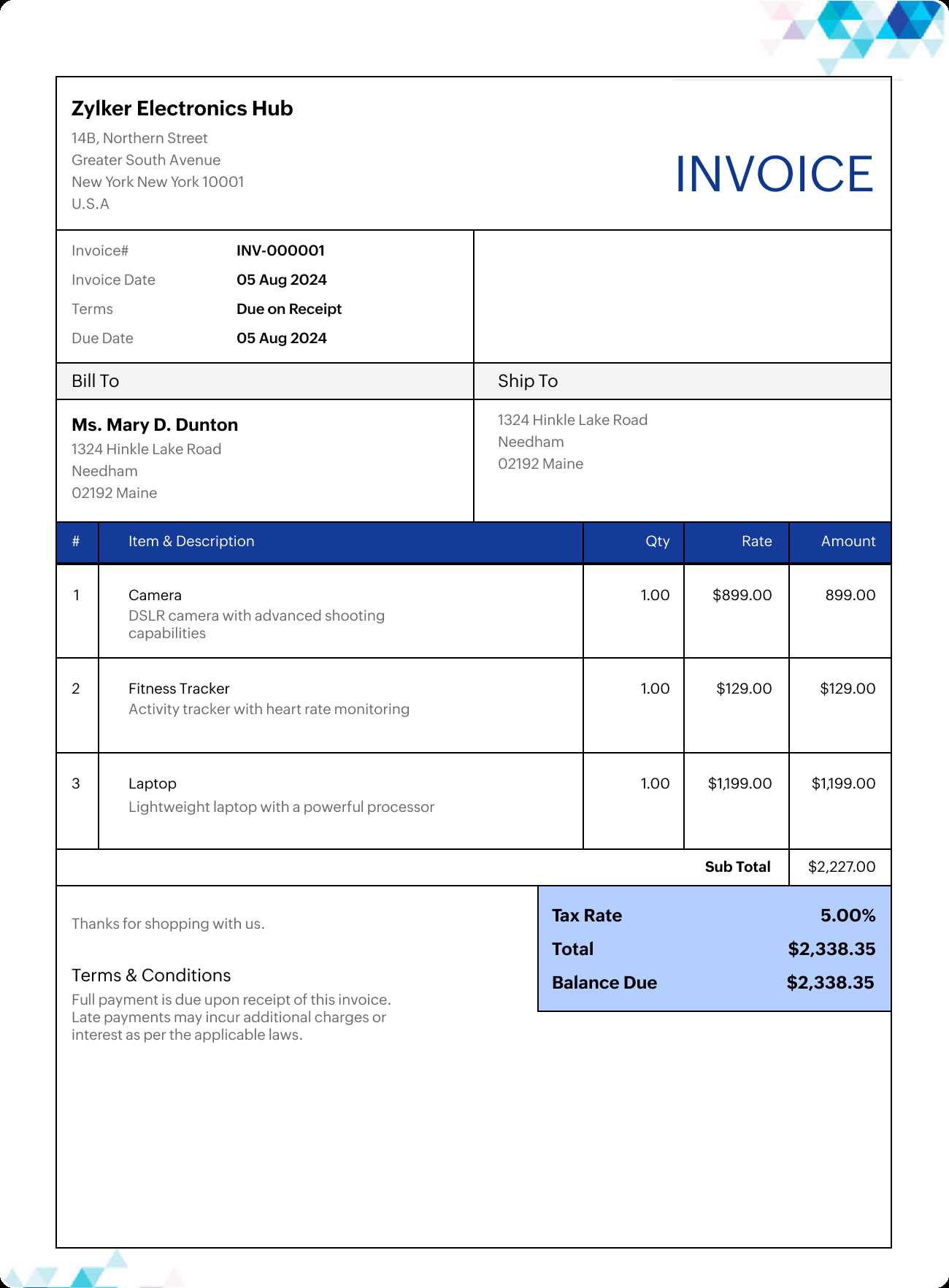

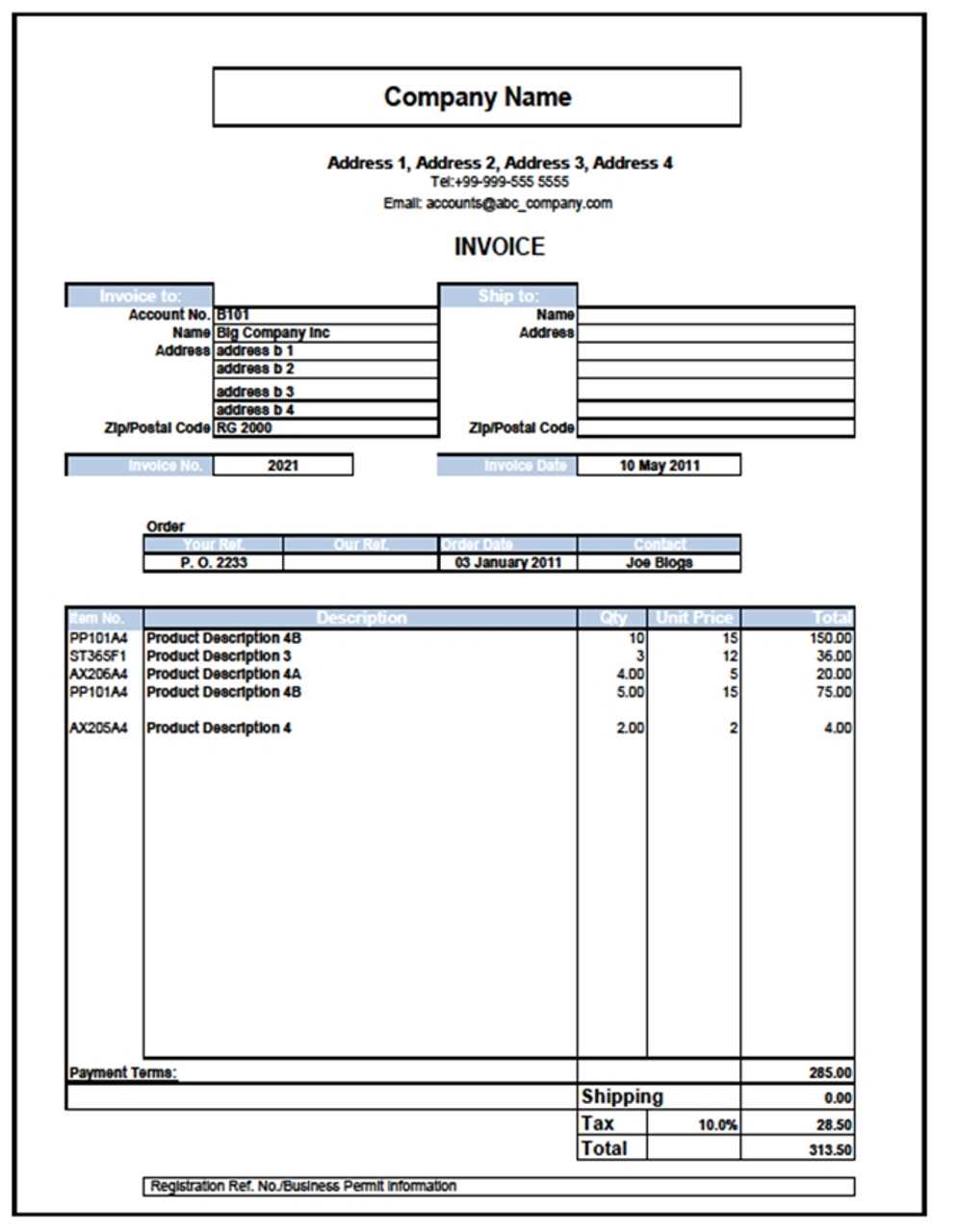

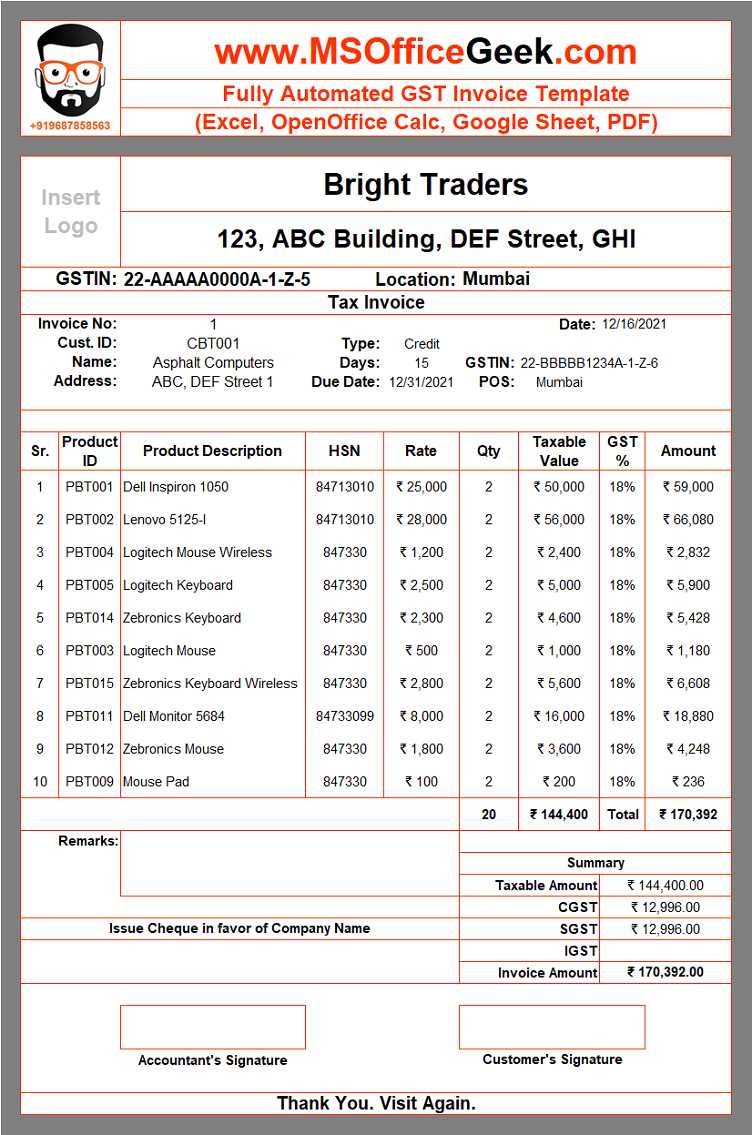

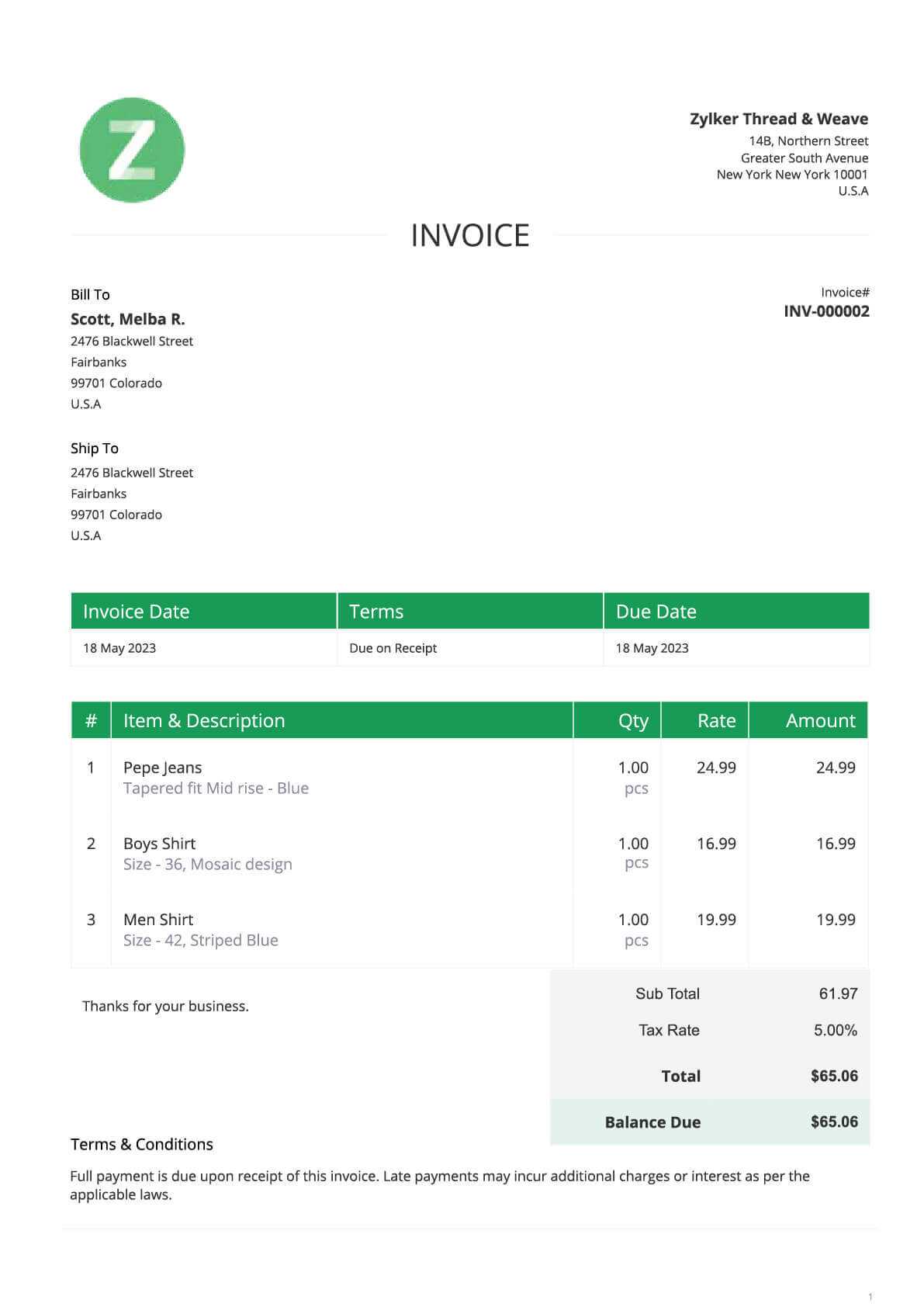

At its core, a billing document serves as a formal record of a transaction between a business and its customers. It lists the goods or services provided, along with corresponding costs, and often includes important details like payment terms and due dates. This structured document helps businesses keep track of sales, ensures transparency with clients, and simplifies the process of payment collection.

For businesses of all sizes, having a well-organized system for generating these records is essential. A customizable form that can be easily updated and adjusted to meet specific needs helps streamline the financial workflow and reduce the chance of errors. Using an easily accessible tool like a spreadsheet allows for quick modifications and automates many of the repetitive tasks associated with creating billing documents.

Key Features of an Efficient Billing Record

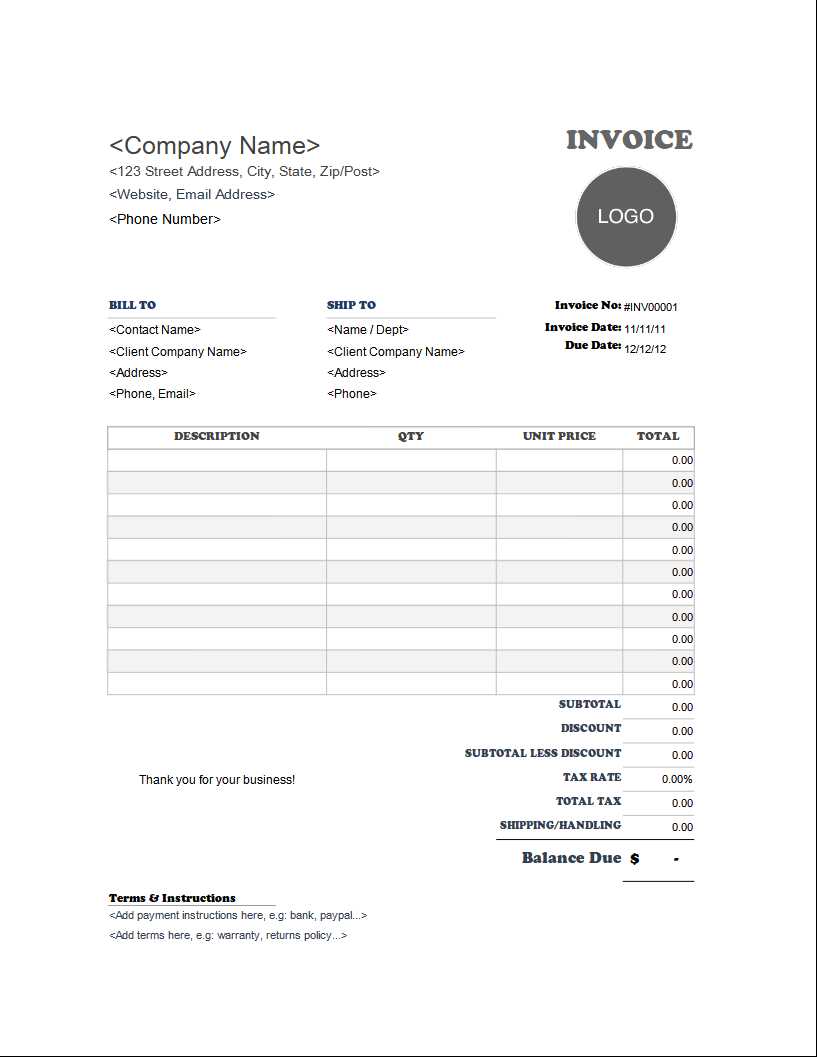

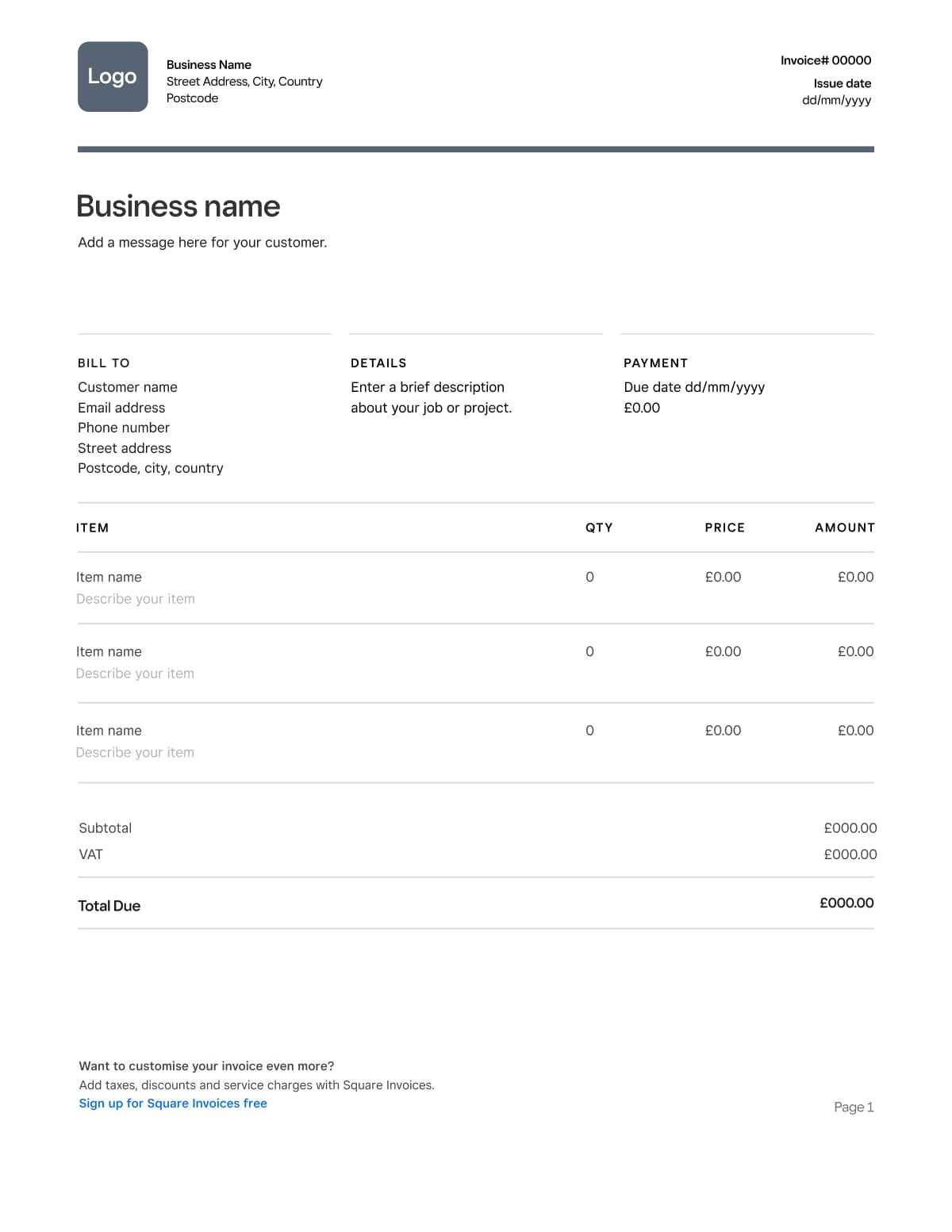

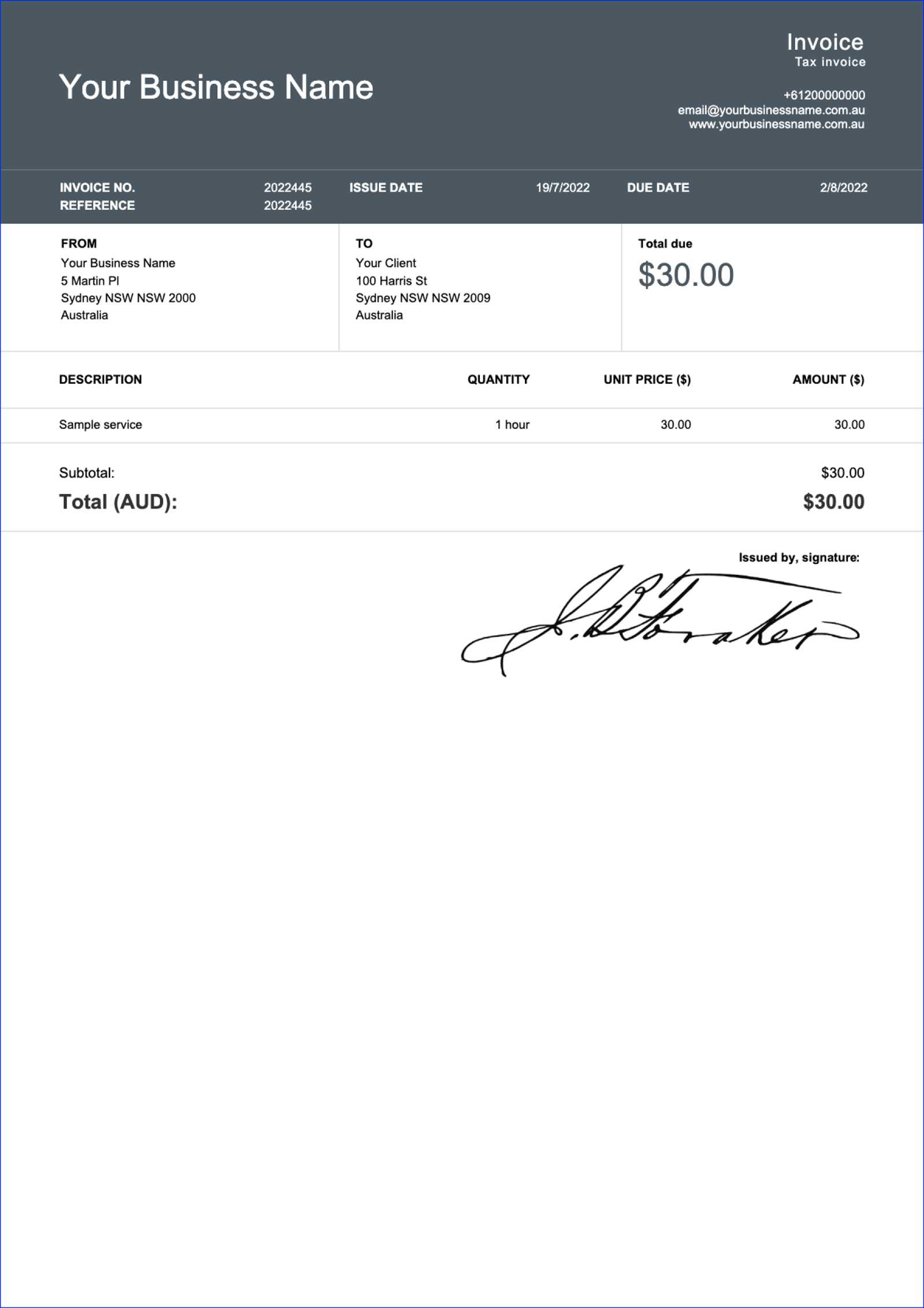

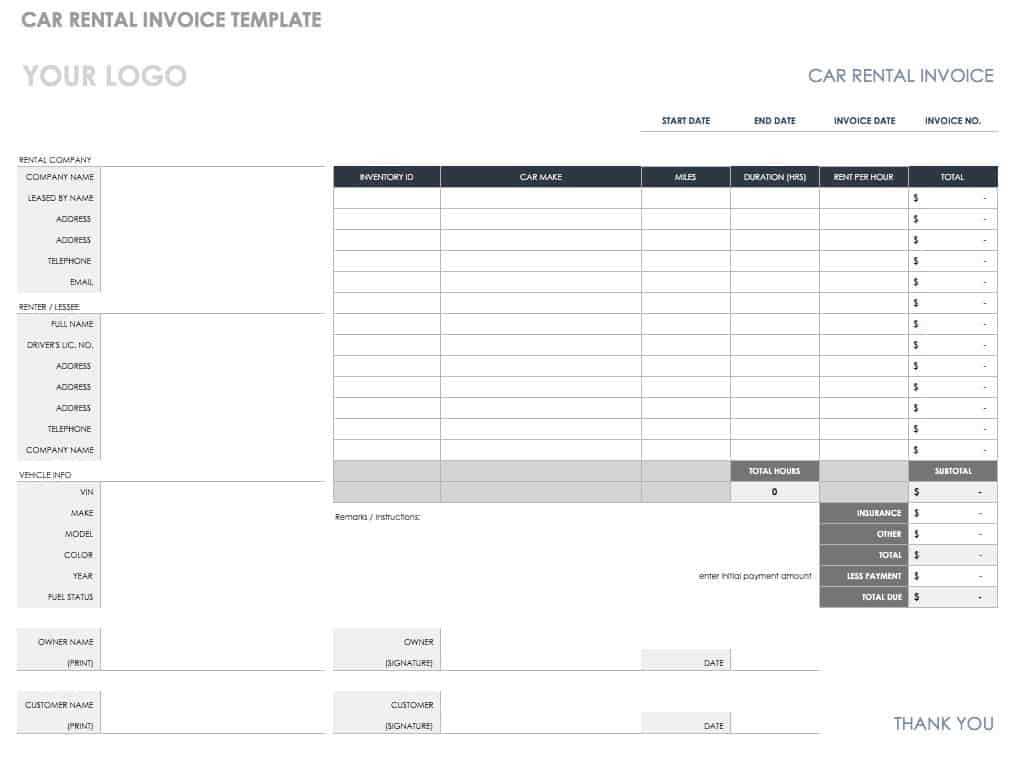

Such documents typically contain fields for essential information such as the names and addresses of both the buyer and seller, a list of items or services sold, individual prices, and the total amount due. Other important elements include payment instructions, tax calculations, and a unique reference number for tracking purposes.

How These Forms Improve Business Operations

Having a reliable, customizable system in place not only saves time but also enhances professionalism. Clients are more likely to trust a business that provides clear, detailed records, and these forms can help maintain consistent communication regarding financial transactions. Furthermore, the ability to generate these documents in a few clicks simplifies the administrative workload significantly.

Why Use an Excel Invoice Template

Many businesses, regardless of size, rely on digital tools to handle administrative tasks efficiently. One of the most effective ways to manage payment records is by using a customizable document. Such tools allow for easy updates and adjustments, making them a practical solution for simplifying the billing process. Here’s why many prefer using spreadsheet-based solutions for these important tasks:

- Time-saving automation – Pre-designed structures enable quick calculations and consistent formatting, reducing manual work and the risk of errors.

- Customization – Adjusting layouts and adding new fields as needed is simple, ensuring that the document meets specific business requirements.

- Cost-effective solution – Unlike specialized accounting software, using a spreadsheet is often free or low-cost, making it accessible for small businesses and freelancers.

- Convenient tracking – You can easily store and organize multiple records, making it simple to track past transactions and monitor outstanding payments.

- Easy sharing – These documents can be quickly saved, emailed, or printed, making it easy to send to clients or keep digital records for accounting purposes.

These advantages make it clear why many businesses choose to rely on a spreadsheet for their billing needs. The flexibility and user-friendliness offered by such tools help streamline the entire process, saving time and enhancing accuracy.

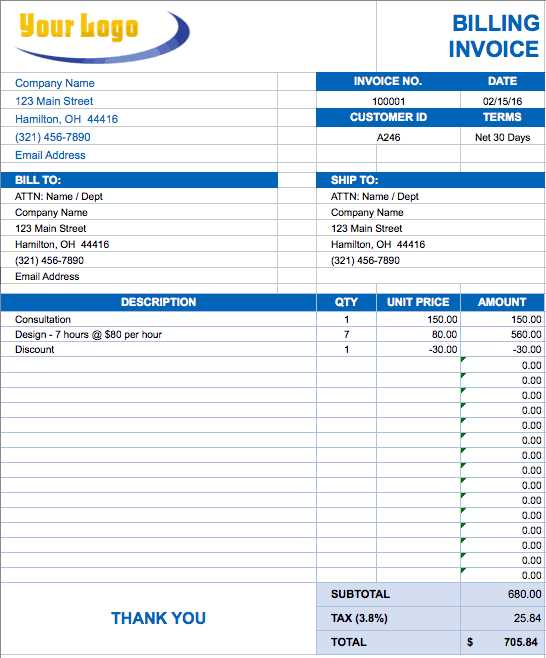

Benefits of Customizable Invoice Templates

Having the ability to personalize billing documents offers significant advantages for businesses. Customization allows companies to adapt their records to specific needs, ensuring that every detail is captured accurately and in the desired format. From adding business logos to modifying sections for different payment terms, these tailored solutions can enhance both functionality and professionalism.

Increased Flexibility

Customizable documents provide businesses with the freedom to create layouts that suit their particular workflow. This flexibility enables them to:

- Incorporate company branding, such as logos and colors, to maintain a professional appearance.

- Add specific fields like discounts, payment methods, or customer notes.

- Modify the structure to suit different types of transactions or industries.

Improved Accuracy and Efficiency

When businesses can adjust the document format to their needs, they can also streamline processes. This results in:

- Fewer errors, as fields are designed to suit each transaction.

- Faster processing, since businesses can pre-fill common information or automate calculations.

- Better tracking of outstanding payments and transaction histories with customized reference numbers and data fields.

By utilizing tailored records, businesses can save time, improve communication with clients, and maintain accurate financial documentation, all while projecting a polished image.

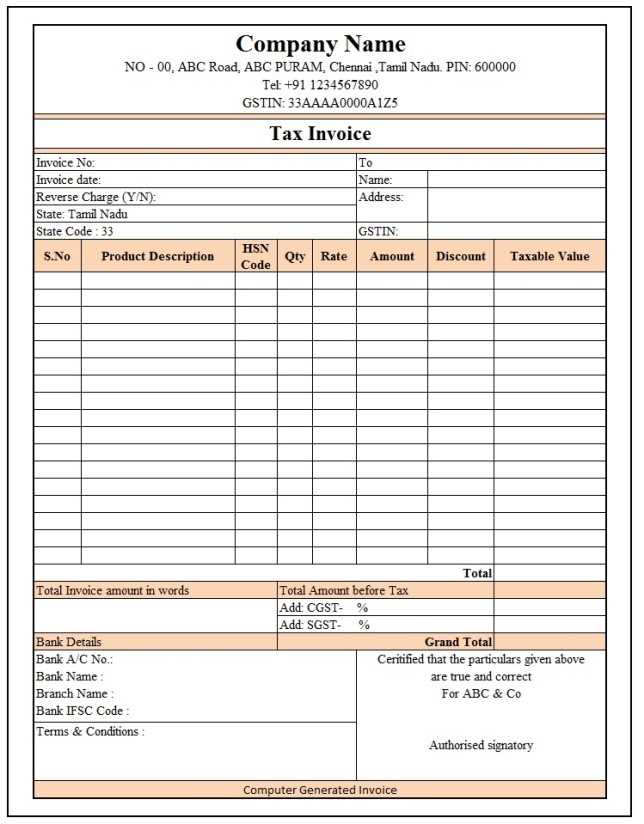

How to Create a Retail Invoice in Excel

Creating a billing document in a spreadsheet is a simple process that allows you to efficiently capture transaction details, calculate totals, and organize your records. With a few basic steps, you can design a professional-looking form that suits your business needs and simplifies your financial workflow.

Start with a Blank Sheet – Open a new spreadsheet to begin. Start by setting up the key sections: business information, customer details, list of products or services, and payment terms.

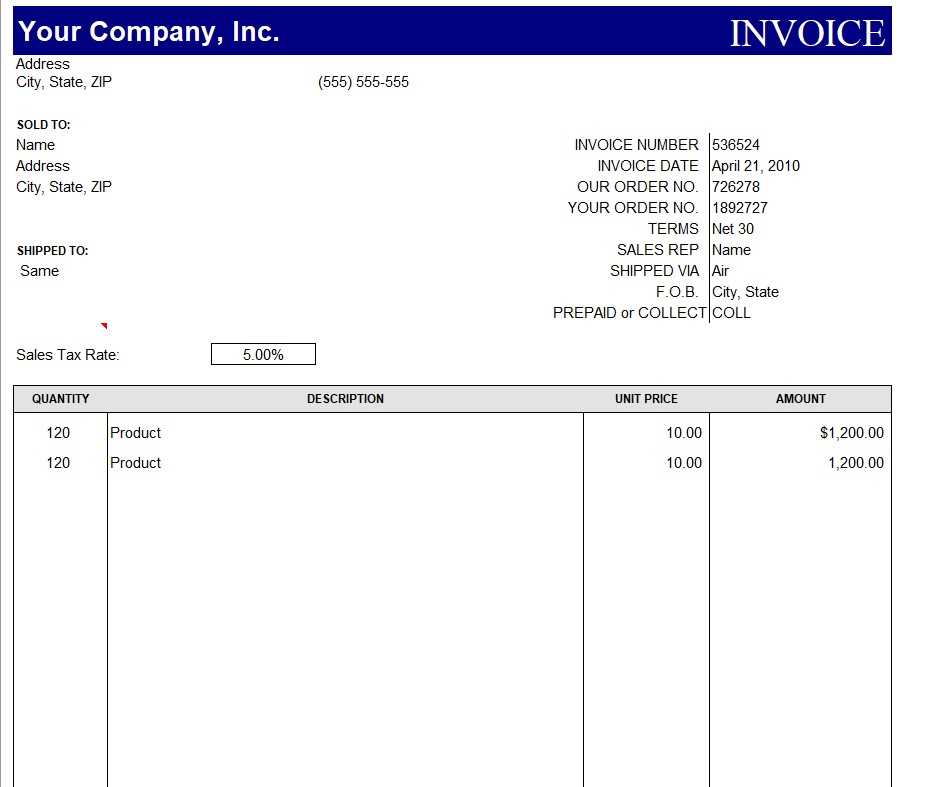

Add Essential Fields – At a minimum, include the following:

- Company name, address, and contact information – These should be placed at the top for easy identification.

- Customer details – Include the client’s name, address, and contact information.

- Itemized list – A table with product names, quantities, unit prices, and total amounts.

- Subtotal, tax, and total – Include automatic formulas for quick calculations.

- Payment instructions – Specify terms, such as due date and accepted payment methods.

Format for Readability – Adjust the column widths and use bold text for headers. Make sure the layout is clear, with enough space for each entry. You can also highlight important fields like the total amount due to draw attention.

Automate Calculations – Use basic functions to automatically calculate totals. For example, multiply unit price by quantity for each item and sum these values to get the subtotal. Then, apply tax rates and add any applicable discounts to calculate the final amount.

Once your form is set up, save it as a reusable file. You can quickly update details for each new transaction, streamlining your billing process and maintaining accuracy in your financial records.

Key Elements of a Retail Invoice

A well-structured billing document is essential for maintaining accurate financial records and ensuring smooth transactions with clients. It should clearly communicate all relevant information, from business details to payment terms, to avoid misunderstandings and streamline the payment process. Below are the key components that should be included in every transaction record.

Essential Information for Clear Communication

Every document should contain certain mandatory fields to ensure it serves its purpose effectively. These include:

- Business Information – The name, address, and contact details of the company issuing the document. This should be prominently displayed at the top.

- Customer Details – Information about the recipient, including their name, address, and contact information, to ensure the correct person or company receives the bill.

- Document Reference Number – A unique number or code to identify each record, making it easier to track and reference specific transactions.

- Date of Issue – The date when the document is generated, which is critical for payment timelines and record keeping.

Transaction and Payment Details

These components ensure that the financial aspects of the transaction are clear and accurate:

- Itemized List – A detailed description of each product or service provided, including quantities, unit prices, and any relevant specifications.

- Subtotal – The total cost before taxes and additional charges, calculated by multiplying the quantity by the unit price for each item.

- Taxes and Fees – A breakdown of any applicable taxes, service fees, or other charges that need to be added to the total.

- Grand Total – The final amount due, including all items, taxes, and additional fees.

- Payment Terms – Clear instructions regarding how and when the payment should be made, including accepted methods and any applicable discounts or late fees.

By including all of these key elements, a billing document becomes a comprehensive and professional tool that supports the smooth exchange of goods or services, while ensuring clarity and accountability for both the business and its customers.

Excel Features for Invoicing Efficiency

Using spreadsheets for managing billing records brings numerous advantages, particularly when it comes to efficiency and accuracy. The built-in features of these tools allow businesses to automate calculations, store essential data, and customize layouts to suit specific needs. These capabilities make the entire billing process smoother and more reliable.

Automated Calculations and Formulas

One of the most powerful features for creating effective billing documents is the ability to automate calculations. For example, businesses can use simple formulas to calculate totals, taxes, and discounts automatically. This minimizes errors and speeds up the process.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 3 | $10 | =B2*C2 |

| Product B | 2 | $15 | =B3*C3 |

| Subtotal | =SUM(D2:D3) | ||

Data Organization and Customization

Spreadsheets also allow for easy data storage and organization, enabling businesses to create detailed records for each transaction. Furthermore, businesses can customize the layout to include specific fields such as tax rates, shipping details, and payment methods, tailoring each document to meet their unique requirements.

These features help streamline the entire process, reduce manual effort, and ensure the accuracy of financial documents, making spreadsheet tools an invaluable asset for efficient billing.

Improving Business Workflow with Excel

Efficient workflows are the backbone of any successful business, allowing tasks to be completed more quickly, accurately, and with less effort. Using digital tools for routine tasks–such as generating financial records, managing client information, or tracking payments–can significantly improve productivity. A customizable spreadsheet offers a range of features that help automate repetitive processes, organize data, and facilitate quicker decision-making.

Data Automation – One of the biggest advantages of using a spreadsheet is the ability to automate calculations. By setting up simple formulas, businesses can instantly calculate totals, taxes, discounts, and other variables, saving time and reducing human error. For example, sales figures, prices, and tax rates can be linked to update automatically, allowing for faster processing of financial records.

Organizing Information – Spreadsheets allow businesses to store vast amounts of data in an organized manner. Whether it’s customer details, product listings, or payment records, information can be categorized and easily searched or filtered. This makes retrieving past records or finding specific data points more efficient, eliminating the need to sift through paper documents or multiple files.

Collaboration and Sharing – Many businesses rely on team collaboration for tasks like tracking payments or processing sales. Spreadsheets provide a central platform for sharing information across departments or with clients. Whether it’s updating an order status or reviewing a financial report, stakeholders can access the most up-to-date data without confusion.

Customizable Layouts – Another key benefit of using spreadsheets is the ability to adapt the layout to meet specific business needs. Different fields, categories, and sections can be added or removed based on the requirements of each project, making it easier to manage multiple types of tasks within the same system.

By integrating these features, businesses can streamline operations, reduce administrative workload, and maintain consistency across different processes, ultimately improving overall efficiency and performance.

Free vs Premium Invoice Templates

When choosing a solution for creating business records, one of the key decisions is whether to use free tools or invest in a premium option. Both choices offer distinct advantages, but the right option depends on a business’s specific needs, volume of transactions, and desired features. Below, we’ll compare the benefits of free versus paid tools to help you decide which is the best fit for your operations.

Advantages of Free Solutions

Free tools are an excellent option for small businesses, freelancers, or those just starting out. They typically offer:

- No upfront costs – Free solutions are, as the name suggests, available at no charge, making them an appealing choice for startups and small-scale operations.

- Basic functionality – Most free tools provide the essential features needed to create and send billing documents, such as customizable fields, calculations, and standard layouts.

- Ease of access – Many free options are available online and require little setup, meaning businesses can get started quickly without having to commit to a paid plan.

Benefits of Premium Options

While free tools offer basic functionality, premium solutions can bring additional value, especially for businesses with higher demands. Some of the key benefits of premium options include:

- Advanced customization – Premium tools often come with more extensive customization options, allowing businesses to create more complex and branded documents.

- Automation features – Paid options may offer advanced automation, such as automatic tax calculations, recurring billing cycles, and integration with other accounting software, which can save time and reduce errors.

- Customer support – Many premium tools offer dedicated customer support, ensuring that any issues or questions can be quickly addressed, which is essential for businesses relying on timely invoicing.

- Security and compliance – Premium options often come with better security features, ensuring that your financial data and customer information are protected and meet compliance standards.

Ultimately, the choice between free and premium tools depends on the specific

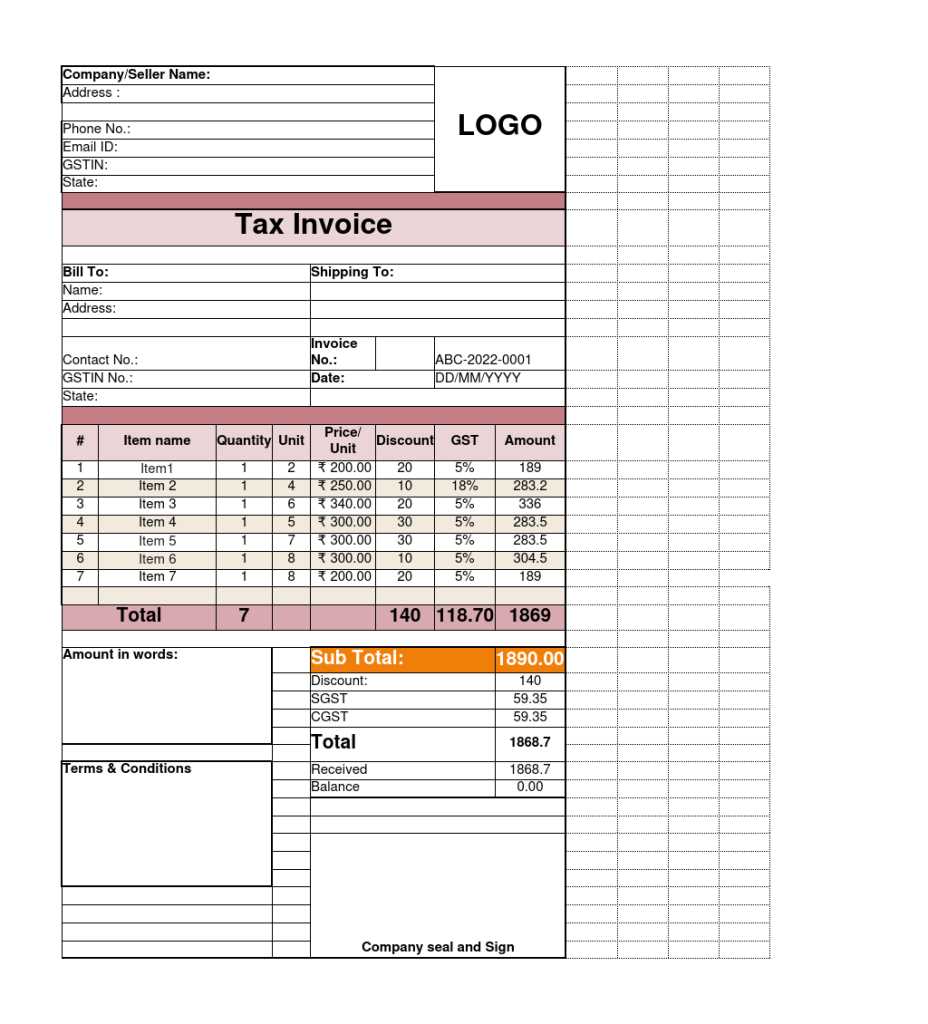

How to Add Taxes in Excel Invoices

Including taxes in billing records is essential for compliance and accurate payment processing. Calculating taxes manually can be time-consuming and prone to errors, but using a spreadsheet allows you to automate this process with simple formulas. By adding tax rates directly into your document, you can ensure that taxes are correctly applied to each transaction, and totals are updated automatically.

Here’s how to add taxes in a spreadsheet:

| Item | Quantity | Unit Price | Subtotal | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|---|---|

| Product A | 3 | $10 | =B2*C2 | 10% | =D2*E2 | =D2+F2 |

| Product B | 2 | $15 | =B3*C3 | 10% | =D3*E3 | =D3+F3 |

| Grand Total | =SUM(G2:G3) | |||||

In this example, the tax rate is applied as a percentage to the subtotal for each item. The “Tax Amount” column multiplies the subtotal by the tax rate, and the “Total” column adds the tax amount to the subtotal for each product. Finally, the “Grand Total” at the bottom sums up all the totals, including taxes.

By using this method, you can easily apply taxes to each transaction, and any changes in tax rates or item prices will automatically adjust the final amounts without needing

Automating Invoice Generation in Excel

Automating the process of creating billing documents can save businesses significant time and reduce the potential for errors. With the right setup in a spreadsheet, you can streamline the entire procedure, from data entry to generating finalized records. By using formulas, pre-set fields, and even macros, you can automate much of the work, making the task more efficient and error-free.

Steps for Automating Billing Documents

To automate the generation of your financial records, you can follow these key steps:

- Set Up Basic Fields: Create fields for essential information such as customer details, item descriptions, unit prices, quantities, and totals. These fields will be the foundation for automation.

- Use Formulas for Calculations: Use formulas to calculate totals, taxes, and discounts automatically. For example, multiply the unit price by the quantity to calculate the subtotal, then apply a tax rate to generate the tax amount.

- Predefine Data Entry Fields: Define drop-down lists for common values such as payment methods, tax rates, or product categories. This minimizes the need for manual typing and ensures consistency.

Advanced Automation Techniques

For more advanced automation, consider these additional techniques:

- Using Macros: Create macros to perform repetitive tasks, such as generating new billing documents from a template. A macro can automatically pull customer information, add relevant products, and even save the file with the appropriate name.

- Linking Data Sources: If you store customer or product data in separate spreadsheets or databases, you can link them to your billing document. This allows for automatic population of customer details, product prices, and inventory levels, reducing manual input and the risk of errors.

- Conditional Formatting: Use conditional formatting to highlight overdue payments or to flag any missing information, ensuring that no critical data is overlooked during the process.

By setting up these automation features, you can significantly speed up the process of generating billing records, ensure greater consistency, and minimize the risk of errors. This approach is especially beneficial for businesses that regularly create similar documents, as it frees up time to focus on other tasks.

Design Tips for Professional Invoices

Creating a well-designed document for billing purposes not only enhances the professional image of your business but also ensures that key information is presented clearly and efficiently. A clean, organized layout makes it easier for clients to understand the details of their transactions, which can lead to faster payments and improved customer satisfaction. Below are some essential design tips to help you craft professional-looking documents.

Keep the Layout Simple and Clean

A cluttered or overly complex document can confuse your client and make it harder to find important details. To create a clear and user-friendly layout:

- Use ample white space: Leave enough space between sections, such as the business details, customer information, itemized list, and total. This will make the document easier to read and less overwhelming.

- Organize information logically: Structure your document so that important details, like the total amount due, are easily accessible. Typically, the company details should be at the top, followed by customer information, product or service descriptions, and then the total at the bottom.

- Limit fonts and colors: Stick to one or two fonts, and use color sparingly to emphasize key sections such as totals or due dates. This helps maintain a professional appearance while ensuring readability.

Highlight Important Information

To make sure your clients can quickly identify crucial details, consider emphasizing certain parts of the document:

- Bold key headings: Use bold or larger font sizes for headings like “Subtotal,” “Tax,” and “Total.” This ensures that these amounts stand out and are easy to find.

- Use lines or borders: Separate different sections with lines or subtle borders to create a visual distinction between each part of the document.

- Include your branding: Add your business logo and brand colors to reinforce your company’s identity and give the document a polished, cohesive look.

By following these design principles, you can create billing documents that look polished, convey professionalism, and help ensure that your clients can quickly process the information they need to make payments.

Tracking Payments with Excel Templates

Efficiently tracking payments is crucial for maintaining healthy cash flow and ensuring that all financial transactions are properly recorded. Using a digital tool to monitor payments allows businesses to keep an organized record of outstanding balances, paid amounts, and due dates. By incorporating a payment tracking system into a spreadsheet, you can easily update and review payment statuses without manual calculations or risk of overlooking transactions.

Here are some steps to help you track payments effectively using a digital document:

- Create a Payment Status Column: Include a column to mark the payment status, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly see the current state of each transaction at a glance.

- Link Payments to Specific Transactions: Each record should be associated with a specific transaction or billing document. By including reference numbers or dates, you can easily track which payments are tied to which items or services.

- Record Payment Amounts: Add a column for payments made. Each time a payment is received, enter the amount and the date it was processed. This will help you maintain a clear record of all transactions.

In addition to basic tracking, you can also incorporate these advanced features:

- Automated Payment Calculations: Use formulas to automatically calculate outstanding balances by subtracting the payment amount from the total due. This reduces manual work and ensures accurate balances.

- Conditional Formatting: Highlight overdue payments by using conditional formatting. For example, payments that have not been received by the due date can be automatically flagged in red, making them easy to spot.

- Summarize with a Dashboard: Create a summary or dashboard view that shows total payments received, outstanding balances, and upcoming due dates. This gives you an at-a-glance overview of your business’s financial status.

By integrating these features into your payment tracking system, you can improve accuracy, reduce manual effort, and ensure timely follow-ups with clients, ultimately helping to streamline your financial operations.

Managing Multiple Invoices in Excel

When dealing with numerous billing records, it becomes essential to have an organized system to track each one efficiently. Managing multiple financial documents can quickly become overwhelming, but using a digital tool can simplify the process by providing structure and automation. A well-organized spreadsheet allows you to manage, update, and access all records from one central location, helping you keep track of payments, due dates, and other crucial details with ease.

Organizing Records for Easy Access

One of the most important aspects of managing multiple financial records is ensuring that they are well-organized and easy to navigate. Here are some key strategies:

- Use Separate Sheets or Tabs: Create separate sheets or tabs for each client, project, or billing period. This prevents a single sheet from becoming too cluttered and allows for easy filtering and searching.

- Include Unique Identifiers: Use unique reference numbers or dates for each record. This makes it easy to cross-reference and find specific documents, even when dealing with a large volume of transactions.

- Group by Status: Group records by their payment status–whether paid, pending, or overdue. This way, you can quickly assess which transactions require action.

Using Formulas and Automation

Automation is another powerful way to manage multiple records without the need for manual updates. Here are a few ways to leverage automation:

- Use Lookup Functions: Implement functions like VLOOKUP or INDEX-MATCH to pull in client or transaction data from other sheets, minimizing the need to enter information multiple times and reducing the risk of errors.

- Apply Conditional Formatting: Set up rules to highlight overdue payments, unpaid balances, or any discrepancies automatically. This makes it easier to focus on what needs attention without manually checking each entry.

- Calculate Totals Automatically: Use SUM or SUMIF formulas to automatically calculate totals, taxes, and discounts across multiple records. This ensures consistency and accuracy in your calculations.

By organizing your documents efficiently and incorporating formulas and automation, you can significantly reduce the time and effort spent managing multiple financial records, ultimately improving workflow and ensuring greater accuracy.

Common Mistakes to Avoid in Invoices

Creating accurate billing records is essential for ensuring timely payments and maintaining professional relationships with clients. However, even small errors can lead to confusion, delayed payments, or disputes. Avoiding common mistakes in these documents will help you maintain clarity and accuracy while streamlining your payment process. Below are some common pitfalls to watch out for when preparing your financial records.

Key Mistakes to Avoid

When creating billing documents, it’s crucial to pay attention to the details. Here are some of the most frequent mistakes:

- Incorrect or Missing Details: Failing to include key information such as the client’s name, contact details, or your business’s payment terms can cause confusion and delay payments. Always double-check the accuracy of your contact details and payment terms.

- Wrong Calculation of Totals: Errors in calculating the subtotal, taxes, or the final amount due can lead to misunderstandings and delayed payments. Ensure that you use formulas to double-check your calculations and keep everything consistent.

- Omitting a Due Date: Without a clear payment deadline, clients may delay payments. Always include a specific due date to set clear expectations for when payment should be made.

- Inaccurate Tax Rates: Applying the wrong tax rate or failing to calculate taxes correctly can lead to discrepancies. Always verify the current tax rates and ensure that they are properly applied to each item or service listed.

- Using Vague Descriptions: Listing products or services with vague descriptions can cause confusion and disputes. Always provide clear, specific details about what was sold or provided to avoid misunderstandings.

How to Prevent These Mistakes

To prevent these issues from arising, follow these best practices:

- Double-Check All Information: Always review all details before sending. Verify client information, product details, quantities, and pricing before finalizing any document.

- Use Automation: Implement automated systems for calculating totals, applying taxes, and updating payment statuses. Automation helps to eliminate human error and maintain consistency across multiple records.

- Keep Consistent Formatting: Maintain a consistent layout and design across all documents. This makes it easier to spot errors and ensures that your records are professional and easy to read.

- Stay Updated on Legal and Tax Changes: Regularly check for changes in local tax laws or other legal requirements that may affect your billing records. Keeping your documents u

Integrating Excel with Accounting Software

For businesses looking to streamline their financial operations, integrating spreadsheet tools with accounting software can offer significant efficiency gains. By syncing data between these two systems, you can automate processes, reduce manual input, and ensure better accuracy across all financial records. This integration allows for seamless tracking of transactions, expenses, and reports, making it easier to manage financial data in real-time.

Here’s how integrating spreadsheets with accounting software can improve your workflow:

- Eliminate Data Duplication: By linking your financial spreadsheet with accounting software, you ensure that data entered into one system is automatically updated in the other. This prevents the need to manually transfer information between multiple platforms, reducing the risk of errors.

- Real-Time Financial Tracking: Integration allows you to monitor cash flow, expenses, and balances in real-time, providing up-to-date insights into the financial health of your business. This helps you make informed decisions quickly and avoid cash shortages.

- Automate Reporting: Accounting software can automatically generate financial reports based on the data synced from your spreadsheet. This reduces the time spent manually compiling reports and ensures that you have accurate, up-to-date financial information at your fingertips.

To successfully integrate these systems, follow these key steps:

Steps to Integrate Spreadsheets with Accounting Software

- Select Compatible Tools: Choose accounting software that supports data imports and exports from spreadsheet applications. Many popular accounting systems have direct integrations with spreadsheet tools, making the process straightforward.

- Set Up Data Mapping: Ensure that the fields in your spreadsheet correspond correctly to the categories in your accounting software. For example, map the “total amount” field in your spreadsheet to the “amount due” field in the accounting system.

- Sync Data Regularly: Schedule regular syncing between the spreadsheet and accounting software to ensure that all data remains consistent and up-to-date. Many tools allow for automatic updates, making the process hands-off once set up.

For example, if you’re using a tool like QuickBooks or Xero, you can export data directly from a spreadsheet and import it into the software for further processing, or even set up automatic syncing for real-time updates. This integration streamlines your workflow, ensures consistency,