Journalist Invoice Template for Simple and Professional Billing

Efficient financial management is essential for any freelance professional. Whether you’re providing written content, reporting, or other creative services, ensuring timely and accurate payment is crucial. The process begins with a well-structured document that outlines your work and payment details, helping both parties stay organized and transparent.

Crafting clear and concise payment requests is not just about formatting; it’s about presenting all necessary information in a straightforward manner. This includes specifying the services rendered, the agreed-upon rates, and other terms of the arrangement. The right structure can minimize confusion and help avoid delays in payment.

Using a well-designed document allows you to focus on your work without worrying about administrative tasks. With the right approach, managing payments becomes less of a hassle, enabling you to maintain professional relationships with your clients while securing your earnings in an organized way.

Understanding the Payment Request Document

Creating a professional document for billing is a crucial step for any freelancer or service provider. It ensures that all the terms of your agreement with a client are clearly communicated and sets expectations regarding payment. A well-structured document serves as a formal request, detailing the work completed, agreed fees, and other essential information to facilitate smooth transactions.

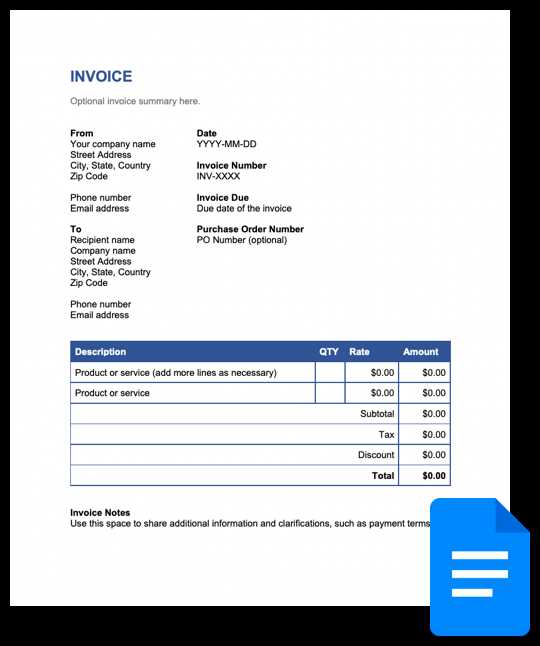

Key components of a well-organized document include your contact information, a description of the services provided, the total amount due, and payment instructions. This format helps both you and your client stay aligned on the scope of the work and the agreed payment schedule. By presenting all necessary details in an easy-to-read manner, you avoid confusion and create a professional image.

Customizing this document to your specific needs can make it more relevant to your line of work. Different types of freelance jobs may require varying amounts of detail, from brief summaries for small tasks to in-depth descriptions for complex projects. Ensuring the content is accurate and clear will also help in case of any future disputes or questions about the work performed.

Why You Need a Professional Billing Document

Having a formal and clear document for requesting payment is essential for any independent professional. It not only ensures that you get paid on time but also establishes a level of professionalism with your clients. A well-crafted billing statement helps both you and your client stay organized and minimizes any potential misunderstandings regarding compensation.

Benefits of Using a Professional Billing Statement

- Clarity: A properly structured document ensures that the services provided and the agreed fee are clearly outlined, reducing the risk of confusion.

- Professionalism: Sending a formal request for payment enhances your credibility and shows clients that you take your work seriously.

- Legal Protection: Having a written record of your agreement can be valuable in case of disputes or misunderstandings about payment terms.

- Time-Saving: With a consistent and organized approach, you can streamline the process of sending payment requests, saving time on administrative tasks.

How a Clear Request Helps Your Business

- Establishes Trust: When clients see you as organized and professional, they are more likely to respect your payment terms and continue working with you.

- Prevents Delays: A detailed document with specific payment instructions encourages timely payments, reducing the likelihood of delays.

- Improves Cash Flow: Consistent use of a structured document helps ensure you get paid promptly, which is crucial for maintaining steady cash flow in your business.

Key Elements of a Payment Request Document

Creating a clear and effective document for requesting payment is more than just listing the amount due. A well-designed document includes several key elements that ensure both you and your client are on the same page regarding the services provided and the compensation expected. Understanding these components will help you craft a professional request that reduces the chance of disputes or confusion.

Essential Components of a Payment Request

- Contact Information: Both your details and the client’s should be included, making it easy to identify the parties involved in the transaction.

- Service Description: A brief, clear description of the work you completed ensures there’s no ambiguity about what is being paid for.

- Total Amount Due: The agreed-upon amount should be prominently displayed, along with any applicable taxes or fees.

- Payment Terms: Specify the payment methods accepted, the due date, and any late payment penalties if applicable.

- Unique Reference Number: Including a reference number for the payment request makes it easier to track and manage multiple transactions.

Additional Information to Include

- Dates: The date the work was completed and the date the request is being sent should be clearly marked.

- Notes or Special Instructions: Any additional details, such as agreed-upon deadlines or specific payment instructions, should be included to prevent any confusion.

- Thank You Message: A polite note expressing gratitude can help maintain a positive professional relationship with the client.

How to Customize Your Payment Request

Personalizing your payment request is crucial to reflect your unique business needs and the specifics of your working relationship with clients. By adjusting the content and design of your request, you can create a more professional and tailored document that accurately represents your services. Customization allows you to highlight important details and align the format with your personal or business branding.

Begin with the basic structure, but feel free to modify the sections to suit the nature of your work. For instance, if you often work with hourly rates, you can include a section to track hours worked and the corresponding charges. If you work on retainer or project-based fees, ensure the relevant terms are clearly specified.

Consider adding your logo or a specific color scheme to make your document more recognizable and consistent with your brand. Including payment instructions or a preferred method can also be customized depending on your preferences and the convenience of your clients.

Lastly, don’t forget to make adjustments based on client-specific agreements. If certain clients prefer more detailed descriptions of services or specific payment terms, ensure those are reflected each time you send a request for payment. Customizing your request ensures clarity and demonstrates professionalism, helping you build trust with your clients.

Tips for Streamlining Your Billing Process

Efficient billing is key to maintaining a smooth workflow and ensuring timely payments. By simplifying the process, you can save valuable time and reduce the risk of errors. Streamlining your payment requests not only makes your administrative tasks easier but also improves your cash flow by helping you get paid faster and more consistently.

Automate whenever possible. Use software or online tools that allow you to generate payment requests quickly and track payments. This can significantly reduce manual effort and ensure that all details are accurate and consistent.

Standardize your documents. Creating a set format for your payment requests means you won’t have to reinvent the wheel each time. This allows you to focus more on the work itself rather than spending time on administrative tasks.

Set clear payment terms. Be upfront with clients about due dates, accepted payment methods, and late fees, if applicable. Having these terms clearly outlined in every document helps avoid confusion and delays.

Send requests promptly. Don’t wait too long after completing work to send your payment request. The sooner you send it, the sooner you’ll receive payment. Establish a routine and send your requests regularly, so clients are accustomed to timely billing.

Keep accurate records. Having a clear record of every transaction helps you stay on top of your finances and quickly resolve any potential payment issues.

Choosing the Right Payment Request Format

Selecting the correct format for your billing documents is crucial for ensuring clarity and efficiency in your financial transactions. The format you choose should align with your business style, the nature of the services provided, and the preferences of your clients. A well-structured document can make it easier to communicate payment terms and prevent potential misunderstandings.

Considerations for Selecting a Format

- Client Preferences: Some clients may prefer a specific style or format, so it’s important to inquire about their preferences.

- Complexity of Work: For simple tasks, a basic layout might suffice. For more detailed projects, a more comprehensive format may be needed.

- Payment Methods: Ensure the format you choose allows for clear payment instructions, especially if you accept multiple methods.

- Branding: Consider using a format that reflects your business identity, including your logo and contact information.

Popular Format Options

| Format Type | Advantages | Best For |

|---|---|---|

| Basic Layout | Simple, easy to understand, and quick to create | Small tasks or quick projects |

| Detailed Format | Includes sections for hourly rates, project descriptions, and breakdowns of charges | Long-term or complex work |

| Online Billing System | Automated reminders, easy tracking, and digital payments | Frequent billers or clients preferring digital transactions |

Choosing the right format depends on your workflow and client expectations. Whether you prefer a straightforward approach or a more detailed one, it’s essential to ensure that the document is clear, professional, and easy to follow.

Common Mistakes to Avoid in Payment Requests

When preparing a formal document for requesting payment, small errors can lead to confusion and delays. It is important to avoid common mistakes that can make your request unclear or even cause payment disputes. A well-constructed request ensures that your client knows exactly what they owe and how to pay, while maintaining your professional image.

Frequent Errors in Payment Requests

- Missing Contact Information: Omitting your details or the client’s contact information can lead to confusion or difficulties in processing the payment.

- Incorrect or Vague Service Descriptions: Not providing enough detail about the work completed may leave your client uncertain about what they are paying for.

- Unclear Payment Terms: Failing to specify the due date, payment methods, or penalties for late payments can result in delays and misunderstandings.

- Mathematical Errors: Incorrect totals, taxes, or rates can lead to disputes and mistrust. Always double-check the calculations before sending.

- Failure to Include a Unique Reference Number: Not including a reference number makes it difficult to track and reconcile payments, especially for repeat clients.

How to Avoid These Mistakes

- Review Before Sending: Always proofread the document to ensure there are no errors in contact details, calculations, or payment terms.

- Be Specific: Provide clear, concise descriptions of the work performed, including rates and quantities, to prevent ambiguity.

- Use Tools: Consider using invoicing software that can automatically generate accurate documents with all the necessary fields pre-populated.

How to Calculate Rates on Payment Requests

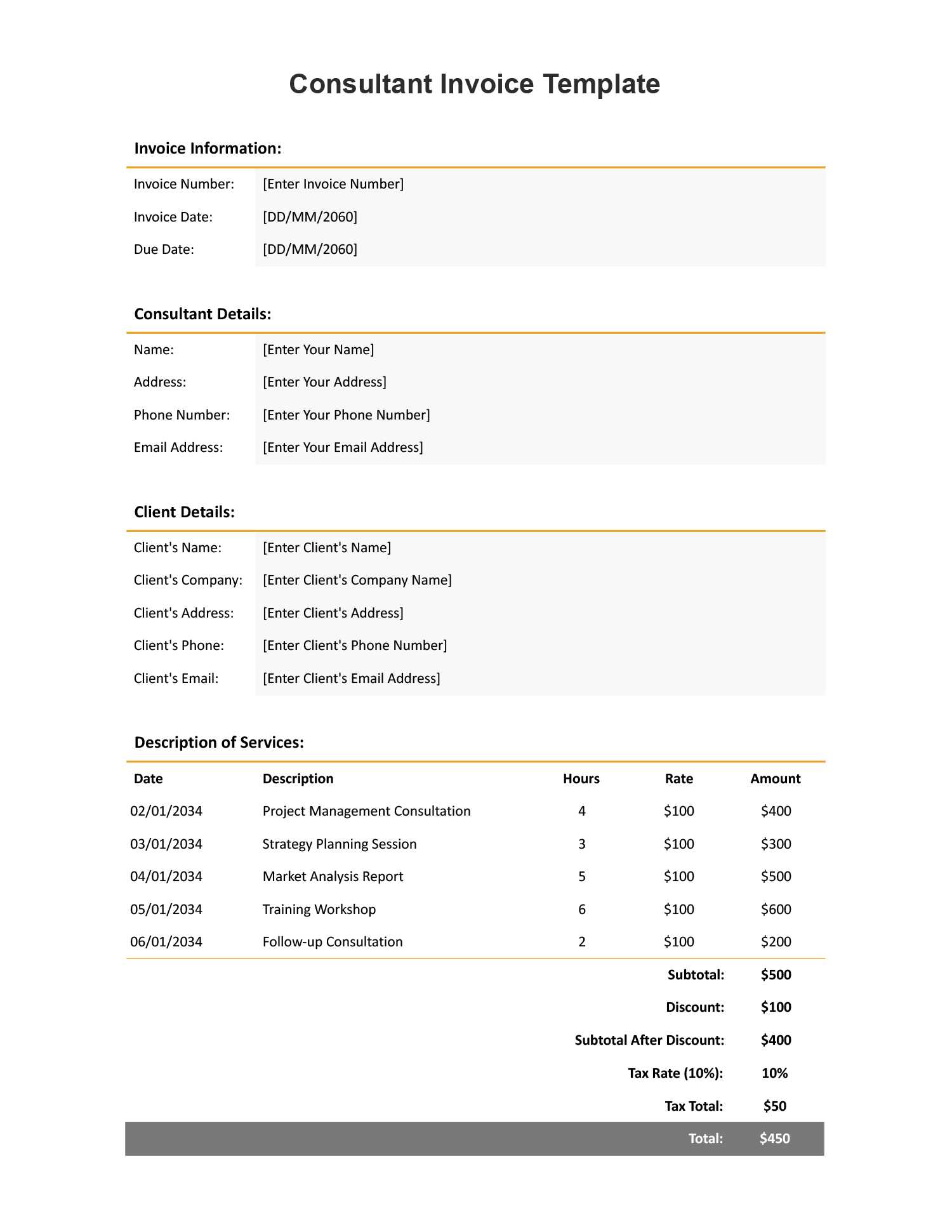

Calculating the correct rate for your work is essential to ensure you are fairly compensated. Whether you charge per hour, per project, or based on other criteria, having a clear and consistent method for determining rates will help maintain transparency and prevent confusion with clients. Understanding how to calculate these rates is key to building trust and managing your finances effectively.

Factors to Consider When Setting Rates

- Time Spent: If you charge by the hour, accurately tracking the time spent on each task is crucial. Be sure to account for all time worked, including research, communication, and revisions.

- Complexity of the Work: For more complex tasks, you may want to increase your rate to reflect the extra effort, skills, or expertise required.

- Industry Standards: Research what others in your field are charging to ensure your rates are competitive and reasonable.

- Expenses: Don’t forget to factor in any additional costs you may have incurred while completing the work, such as travel, software, or materials.

How to Calculate Your Rates

- Hourly Rate Calculation: To determine your hourly rate, consider your desired annual income and divide it by the number of hours you plan to work each year. Add any business-related expenses and desired profit margin to this total.

- Project-Based Rate: For project-based work, evaluate the scope of the project, the time required, and any special requirements. Set a fixed price that covers your time and expenses while ensuring a fair profit.

- Retainer or Package Rates: For ongoing work, consider offering package pricing or retainers to ensure predictable income while providing flexibility for your clients.

By carefully calculating and considering these factors, you can establish fair and transparent rates that reflect the value of your work while meeting both your financial needs and your clients’ expectations.

Legal Requirements for Payment Requests

When creating a document to request payment for services rendered, it’s important to ensure compliance with local laws and regulations. There are certain legal elements that must be included in the request to avoid disputes or issues with tax authorities. Understanding these requirements will not only help protect your business but also maintain transparency with clients.

First and foremost, your document must clearly identify both parties involved: the service provider and the client. This includes full names, addresses, and contact details. Additionally, you should specify the services provided and the agreed-upon compensation to ensure clarity regarding the terms of the transaction.

Another crucial aspect is the inclusion of your tax identification number (TIN) or business registration number if applicable. This helps ensure that you are recognized as a legitimate business entity for tax purposes. Depending on your location, you may also be required to charge VAT (Value Added Tax) or other taxes, which should be clearly indicated on the document.

Finally, make sure to include payment terms, including the due date, preferred payment methods, and any late fees or penalties for overdue payments. By adhering to these legal requirements, you create a professional and legally sound document that minimizes the potential for conflicts and ensures you receive timely compensation for your work.

Best Practices for Payment Request Clarity

Clear and concise documentation is essential when requesting compensation for services. A well-organized and easy-to-understand request can prevent misunderstandings and ensure prompt payment. By following certain best practices, you can make sure that your request contains all necessary information and is presented in a way that leaves no room for confusion.

Use Simple and Precise Language

Avoid jargon or overly technical terms that might confuse the recipient. Instead, use straightforward language to describe the work completed and the payment terms. Clarity in communication is key to ensuring the client fully understands what they are being asked to pay for.

Break Down Charges Clearly

Instead of providing a lump sum amount, break down the costs by category or task. This helps your client understand what they are being charged for and why. For example, if you are charging by the hour, list the number of hours worked and the rate for each hour.

Highlight Key Information

Important details, such as the total amount due, payment due date, and payment instructions, should be clearly visible. Consider bolding or underlining these sections to make them stand out. This ensures that the most critical information catches the client’s attention immediately.

Organize the Layout

A clean and professional layout can significantly enhance the clarity of your request. Use headings, bullet points, and tables to organize information effectively. Ensure that the document flows logically, with each section easy to identify and navigate.

By following these best practices, you ensure that your payment request is not only clear but also professional, reducing the chances of delays or confusion in the payment process.

How to Add Tax Information Correctly

Including accurate tax details in your payment request is essential for legal compliance and transparency. Whether you are required to collect sales tax or VAT, it’s important to properly calculate and display the tax information to avoid complications for both you and your clients. Correctly adding tax information ensures that your documents meet legal standards and helps clients understand the total cost they are expected to pay.

Understand Your Tax Obligations

Before adding tax to your payment request, it’s important to determine which taxes apply to your services. Different regions and countries have varying tax laws, and some services may be exempt from certain taxes. Make sure you understand your local tax regulations and whether you are required to charge sales tax, VAT, or any other applicable taxes on your services.

Steps to Add Tax Information

- Include Your Tax Identification Number (TIN): If applicable, include your TIN or VAT number at the top of the document. This helps clients and tax authorities identify you as a legitimate business.

- Specify the Tax Rate: Clearly state the tax rate being applied, whether it is a percentage or flat fee. This should be shown separately from the service charges to avoid confusion.

- Break Down the Tax Amount: Show the tax amount separately, so the client can easily see how much of the total is due to taxes. This helps with transparency and gives the client a clear understanding of the breakdown.

- Ensure Accuracy: Double-check that the tax calculations are correct. Mistakes in tax rates or amounts could lead to delays in payment or issues with tax authorities.

By following these guidelines, you can ensure that your payment request is tax-compliant and that your clients understand the full cost of the services provided. Proper tax information also helps you maintain accurate records for tax reporting purposes.

Tracking Payments with Your Document

Keeping track of payments is crucial for maintaining financial clarity and ensuring timely compensation for your services. By organizing and recording payment statuses, you can stay on top of your financial transactions and avoid overlooking any pending payments. Proper documentation helps both you and your clients track the progress of payment and provides a transparent view of all transactions.

One effective way to track payments is by incorporating a payment status section in your document. This allows you to update the status of each payment and keep a clear record of when payments are received or due. Below is an example of how you can structure the payment tracking section:

| Payment Number | Amount Due | Payment Date | Status |

|---|---|---|---|

| 1 | $500 | January 10, 2024 | Paid |

| 2 | $300 | February 15, 2024 | Pending |

| 3 | $250 | March 5, 2024 | Paid |

Including this table or similar format allows you to easily monitor and update payment statuses. It also provides a clear overview for your clients to see when payments were made and when the next one is due. By regularly updating the payment information, you can ensure that both parties are on the same page, reducing the likelihood of payment disputes.

When to Send a Payment Request

Timing is crucial when it comes to requesting payment for your services. Sending a payment request too early or too late can create confusion or delays in compensation. Understanding the right moment to send a request helps maintain good professional relationships and ensures that you are paid promptly. Proper timing can also help streamline your cash flow and minimize the risk of late payments.

The optimal time to send a payment request generally depends on the nature of the service and the agreed-upon terms. For ongoing services, it’s often best to send a request on a regular schedule, such as weekly, bi-weekly, or monthly. For one-time projects, sending a request as soon as the work is completed or upon reaching a certain milestone is typically the best approach. It is essential to adhere to the payment terms set with the client to avoid misunderstandings.

In general, it is a good practice to send the payment request promptly after the completion of the work, ensuring that all details are accurately reflected. This clarity helps prevent delays in payment processing and avoids any confusion for both you and your client.

Invoice Templates for Different Freelance Roles

Freelancers in various industries often require different styles of payment requests to best suit the nature of their work and the expectations of their clients. While the core elements of a payment request remain consistent–such as service descriptions, amounts due, and payment terms–different roles may benefit from slight modifications to better reflect the type of work performed. Customizing your document can ensure a more professional presentation and help clarify any specific details relevant to your field.

For example, a writer might need to break down their charges by word count or per article, while a designer might list charges for specific design elements like logo creation or website layouts. Each role may have unique considerations, such as intellectual property rights or specific milestones, which should be clearly outlined in the payment request to avoid misunderstandings.

Here are some examples of how different freelancers can tailor their payment requests:

- Writers: A breakdown by word count, article length, or content type (e.g., blog post, press release) might be necessary.

- Designers: Detailing hourly rates or flat fees for each design element or phase of a project ensures transparency.

- Photographers: Charges based on hours worked, number of images, or usage rights can be specified.

- Developers: Payment requests may include milestones based on project phases such as coding, testing, and deployment.

By tailoring the structure and details of your payment requests, you can make the process smoother for both you and your clients, ensuring clear communication and prompt payments.

How to Handle Late Payments

Late payments can be a common challenge for freelancers, but handling them professionally and strategically is key to maintaining positive relationships with clients while ensuring that you are compensated on time. It’s important to set clear expectations upfront and have a plan in place for addressing delays in payments. Taking the right steps can prevent financial strain and preserve your professional reputation.

If a payment becomes overdue, the first step is to reach out to the client in a polite and professional manner. A gentle reminder can often resolve the issue, as there may be an administrative delay or simple oversight. It’s crucial to stay calm and avoid sounding confrontational, as this helps maintain a constructive dialogue.

Should the delay persist, consider sending a more formal notice, outlining the overdue amount and reminding the client of the agreed-upon payment terms. This could be accompanied by a late fee, if stipulated in your terms, to encourage prompt payment.

In more extreme cases, you may need to explore additional options, such as involving a collection agency or taking legal action, but these should be last resorts. It is always better to maintain a good working relationship, but sometimes you need to be firm to ensure you are compensated fairly for your work.

Using Invoice Software for Freelancers

In today’s digital age, streamlining the payment request process has become easier with the help of specialized software. For freelancers, managing billing can sometimes be a complex task, especially when dealing with multiple clients and varying payment schedules. Using software designed for creating and tracking payment requests offers an efficient and professional solution. These tools automate the creation, tracking, and follow-up of requests, saving time and reducing the risk of errors.

Why Choose Software for Payment Requests?

Invoice software provides several advantages for freelancers, particularly when it comes to organization and accuracy. With the ability to store client details, track payment histories, and send automated reminders, these tools simplify the entire process. Additionally, many software options allow for customization, enabling users to adjust the layout and content of the documents to fit their specific needs.

Key Features of Invoice Software

When selecting payment request software, there are several important features to consider:

- Automation: Automatically generate and send requests, reducing administrative workload.

- Customization: Personalize payment requests to reflect your brand and include all relevant details.

- Tracking: Monitor payment status and send reminders to clients as needed.

- Security: Ensure your sensitive client and financial data is protected with secure platforms.

- Integrations: Sync the software with other tools you use, such as accounting software or time-tracking apps.

Using software for payment requests can greatly enhance the efficiency and professionalism of your freelance business, making it easier to focus on the work itself while leaving the administrative tasks to automation.