Download a Free Generic Invoice Template for Excel

Handling business transactions often requires streamlined organization and consistency. Using a reliable spreadsheet tool offers a structured way to simplify financial records, save time, and minimize errors in regular billing activities. This approach provides a flexible, straightforward solution for anyone managing payments and finances.

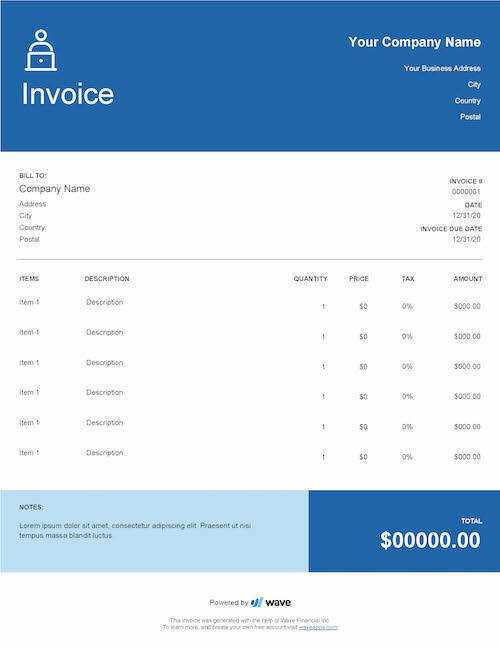

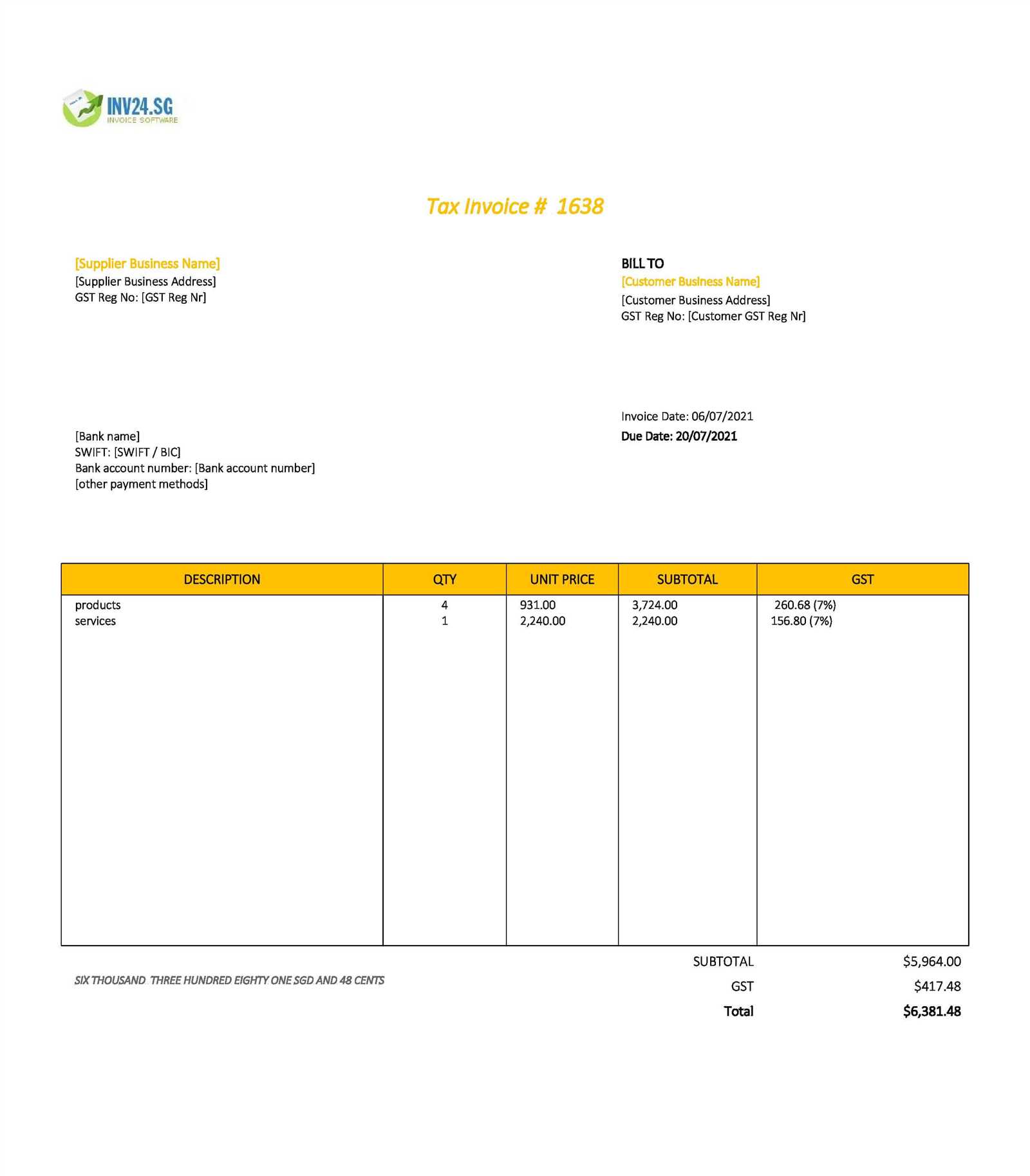

Creating a well-organized financial document requires certain essential elements: clear itemization, accurate totals, and a user-friendly layout that ensures readability. A well-designed layout not only helps you present details clearly but also builds professionalism and trust with clients.

With customizable spreadsheet layouts, businesses can add branding, modify formats, and adapt structures to suit specific needs. This flexibility means users can adjust elements as necessary to maintain a unique, branded look while ensuring a smooth, intuitive experience for both parties involved in a transaction.

How to Use a Generic Invoice Template in Excel

Creating a professional document for billing clients or tracking payments can be easily managed with a spreadsheet tool. This method allows for efficient handling of transaction details while providing a customizable framework that fits individual business needs. With a few simple steps, anyone can start using this organized approach to manage and record essential financial data.

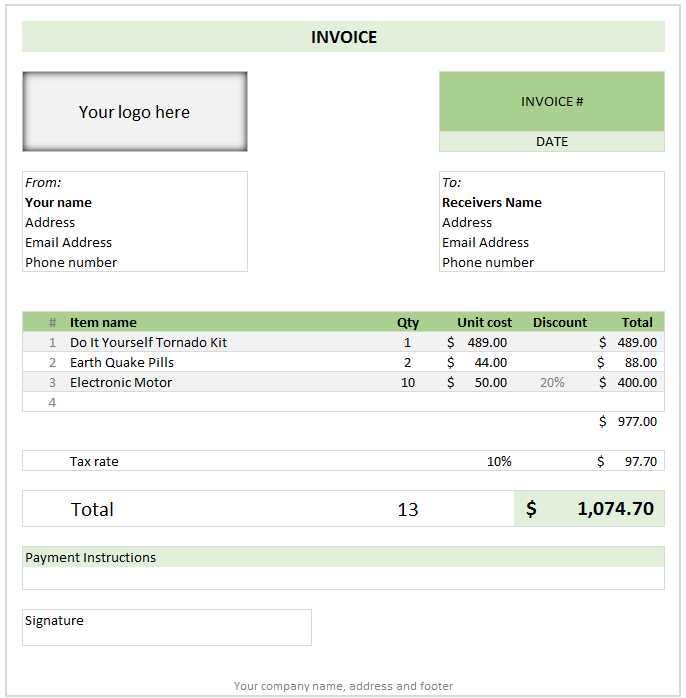

To begin, open your spreadsheet program and select a ready-made layout or create a blank one that fits your style. Make sure to include key information fields, such as item descriptions, quantities, and prices, which will make your billing transparent and straightforward. Organizing data in this manner enhances readability and ensures clarity for both sender and recipient.

Next, take advantage of automatic calculations by setting up basic formulas in relevant sections. For example, use sum functions to total amounts or apply tax rates. Automating these tasks reduces manual effort, minimizes errors, and speeds up the entire

Benefits of Using Excel for Invoicing

Choosing a versatile spreadsheet tool for managing billing tasks offers a range of advantages for both small businesses and freelancers. This approach provides a straightforward way to organize financial records while maintaining accuracy and flexibility, essential for efficient business operations. By leveraging this type of software, users can simplify the process of tracking payments and maintaining a clear, professional appearance in all financial documentation.

One major advantage is the ability to customize layouts to suit specific business needs. With flexible formatting options, it’s easy to add or adjust fields for details such as services provided, hours worked, and tax rates. This ensures that documents align with unique preferences and legal requirements, without needing complex software.

Additionally, automated calculations make handling financial data faster and reduce the potential for human error. By using built-in functions to

Setting Up Your First Invoice Template

Creating a personalized layout for billing clients is simple with a spreadsheet tool, allowing you to organize all essential payment information in one place. By following a few key steps, you can design a document that is both professional and easy to use, meeting your business needs with a clear structure and customizable options.

Basic Structure and Essential Fields

Begin by setting up a clean structure that includes important sections for payment processing. Start with a few main fields to ensure clarity and completeness:

- Header: Add your company name, address, and contact information at the top.

- Client Information: Include fields for the client’s name, address, and contact details.

- Description of Services or Products: List items clearly, with spaces for quantities, rates, and

Essential Elements to Include in an Invoice

When organizing a structured document for billing, it’s important to include specific details that ensure clarity and professionalism. These essential elements help streamline the payment process, provide transparency for clients, and maintain accurate records for your business.

Key Details to Incorporate

A well-organized billing document typically includes the following information:

- Header Information: Clearly display your company’s name, logo, address, and contact details at the top. This establishes your brand identity and makes it easy for clients to reach you.

- Client Details: Add the client’s name, address, and contact information to personalize the document and ensure it reaches the right person.

- Unique Document Number: Assign a distinct number to each re

Essential Elements to Include in an Invoice

When organizing a structured document for billing, it’s important to include specific details that ensure clarity and professionalism. These essential elements help streamline the payment process, provide transparency for clients, and maintain accurate records for your business.

Key Details to Incorporate

A well-organized billing document typically includes the following information:

- Header Information: Clearly display your company’s name, logo, address, and contact details at the top. This establishes your brand identity and makes it easy for clients to reach you.

- Client Details: Add the client’s name, address, and contact information to personalize the document and ensure it reaches the right person.

- Unique Document Number: Assign a distinct number to each record to simplify tracking and referencing. This number helps both you and the client in organizing records.

- Service or Product Description: Provide a detailed breakdown of each item or service provided, including descriptions, quantities, and unit prices. This transparency builds trust and allows clients to understand each charge.

- Dates: Include both the issue date and the due date. The issue date establishes when the record was created, while the due date clarifies when payment is expected.

Financial Summary

At the end of the document, include a clear summary of costs and payment terms:

- Subtotal: Sum of all individual items or services without taxes.

- Taxes and Additional Fees: List applicable taxes or extra fees, calculated based on local regulations or service agreements.

- Total Amount: Final amount due, including all fees and taxes, for straightforward payment processing.

- Payment Instructions: Provide details about accepted payment methods, bank information, or online payment links to simplify the payment process.

By including these elements, you ensure that your billing document is both comprehensive and easy to understand. This professional structure not only speeds up transactions but also fosters trust with your clients.

Adding Company Logo and Branding

Incorporating your business’s unique style into billing documents is a great way to create a consistent and professional image. Adding brand elements, such as your logo and color scheme, helps reinforce your identity and makes your records instantly recognizable to clients.

Here are a few steps to help integrate your brand:

- Insert Your Logo: Place your company’s logo at the top of the document to make it visually distinct. This central element of your branding sets a professional tone and emphasizes your identity.

- Choose a Color Scheme: Apply a color palette that matches your business’s branding. Using consistent colors for headers, borders, or totals can enhance readability and align the document with your visual style.

- Font Selection: Pick fonts that reflect your brand’s personality–whether formal or modern. Ensure that the fonts remain legible and professional to maintain clarity for clients.

- Contact Information Placement: Position your addre

Common Invoice Mistakes to Avoid

When creating billing records, it’s easy to overlook certain details, which can lead to confusion or delays in payments. Ensuring accuracy and clarity is crucial to maintaining professionalism and smooth financial transactions. Below are some common errors to watch out for when preparing documents for your clients.

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s contact details are accurate. Incorrect addresses or phone numbers can lead to communication issues or delays in payments.

- Omitting Key Information: Leaving out essential elements such as the due date, payment terms, or a unique reference number can cause confusion. Make sure every field is filled out clearly and comprehensively.

- Inaccurate Calculations: Manual errors in summing up amounts or applying taxes can lead to overcharges or undercharges. Use automated features to perform calculations and verify totals before sending the document.

- Unclear Payment Instructions: If the instructions for making payments are not clearly stated, clients may not know how to pay. Be explicit about the available methods and any necessary account details.

- Inconsistent Formatting: Avoid inconsistent fonts, text sizes, or misaligned sections. A poorly formatted document can appear unprofessional and make it harder for clients to find the information they need.

- Failure to Include Terms and Conditions: Always ensure that your payment terms, such as late fees or early payment discounts, are clearly outlined. Lack of these details can cause misunderstandings or disputes later on.

By being mindful of these common mistakes, you can create more accurate, professional documents that facilitate smoother financial transactions and foster stronger relationships with your clients.

How to Automate Invoice Calculations

Automating the calculation process in your billing records not only saves time but also reduces the risk of errors. By setting up automatic formulas, you can ensure that totals, taxes, and discounts are calculated correctly every time, allowing you to focus on other important tasks.

Setting Up Automated Calculations

To get started, follow these steps to automate the most common calculations in your billing system:

- Subtotal Calculation: Use the SUM function to add the prices of all items or services provided. This will automatically update as you add or remove line items.

- Tax Calculation: Apply a percentage formula to calculate taxes based on the subtotal. For example, multiplying the subtotal by the applicable tax rate ensures accuracy without manual input.

- Discount Application: Set up conditional formulas to automatically apply discounts if certain criteria are met, such as volume-based discounts or early payment incentives.

- Total Amount: Use a simple addition formula to add the subtotal, tax, and any discounts. This provides the final amount due without needing to recalculate manually.

Implementing Conditional Logic

In addition to basic calculations, conditional logic can further enhance your automation. For instance, you can set rules that adjust the payment terms based on the amount due or automatically apply late fees for overdue payments.

- Late Fee Calculation: Use an IF function to apply a late fee if the payment is past the due date. The formula can check if the current date exceeds the due date and then add the penalty to the total.

- Payment Term Adjustments: You can create a formula that adjusts the payment terms for certain customers based on their history or agreement.

By automating calculations, you not only make your billing process more efficient but also ensure accuracy and consistency in every document you create.

Formatting Tips for Professional Invoices

Creating a clean, organized, and visually appealing document is essential for maintaining professionalism in your billing process. Proper formatting not only makes it easier for your clients to understand but also helps establish your brand identity. Below are key tips to enhance the appearance of your financial records.

Essential Formatting Guidelines

- Keep It Simple: Use a clean, minimalistic design to ensure that the information is easy to read and doesn’t overwhelm the viewer. Avoid clutter by limiting the number of fonts and colors.

- Use Clear Headings: Make sure each section of the document is clearly labeled (e.g., “Total Due,” “Payment Terms”) using bold or slightly larger text to guide the reader’s eye.

- Align Text Properly: Align text in a logical way. For example, right-align numbers and prices to keep them organized and easy to compare. Left-align text for descriptions and item names to maintain clarity.

- Consistent Font Style: Choose professional, easy-to-read fonts like Arial, Helvetica, or Times New Roman. Stick to a single font style for the entire document to maintain consistency.

- Leave White Space: Proper spacing between sections and around text helps improve readability. Avoid crowding information too closely together, as it may make the document harder to follow.

Branding Your Document

- Incorporate Your Logo: Place your business logo at the top of the page to help reinforce your brand identity. Ensure it’s not too large, as it may distract from the key details.

- Use Brand Colors: If your business has established brand colors, consider incorporating them in headers or key information. This creates consistency across all communication materials.

- Contact Information: Always include your contact information in a consistent format. This should be easily visible, typically at the top or bottom of the document.

By following these formatting tips, you’ll ensure your billing records look polished, professional, and are easy to understand. A well-structured document not only reflects your attention to detail but also builds trust with your clients.

Best Practices for Organizing Invoices

Effective organization of financial documents is essential for maintaining a smooth workflow and ensuring that you can quickly access the information you need. Whether for personal or business use, proper categorization and storage help prevent confusion and streamline accounting processes. Below are some best practices for organizing your billing records efficiently.

- Use Clear Naming Conventions: Name your files systematically with consistent formats, such as including the client name, date, and reference number. This makes it easy to identify specific documents when searching.

- Implement a Folder System: Create folders for different clients, projects, or time periods. This allows for quick access to the relevant files without digging through a disorganized pile of documents.

- Track Payment Status: Maintain a separate folder or spreadsheet that tracks the status of payments, such as “Paid,” “Pending,” or “Overdue.” This helps you stay on top of outstanding balances and follow up on late payments.

- Store Backup Copies: Always back up digital files to a secure cloud service or external hard drive. This ensures that your documents are safe from data loss due to hardware failure or other unforeseen issues.

- Maintain a Consistent Format: Use the same layout and structure for every document. Consistency makes it easier to review your files and ensures that no essential information is missed or overlooked.

- Set Up a Regular Review Schedule: Periodically review your stored records to ensure that everything is organized properly and up to date. This habit will help you avoid backlog and ensure compliance with accounting standards.

By implementing these best practices, you can keep your financial documents well-organized, making it easier to manage your accounts and track payments efficiently.

Tracking Payments Using Excel Templates

Monitoring and recording payments is crucial for keeping your financial records accurate and up-to-date. By using well-structured documents, you can easily track which payments have been received and which are still pending. Below are steps and tips for setting up an efficient system to monitor payments.

Setting Up a Payment Tracking System

- Create Columns for Key Details: Set up columns for the client name, due date, amount, payment status, and date received. These fields will allow you to track the important elements of each transaction.

- Assign Payment Statuses: Include categories such as “Paid,” “Pending,” “Overdue,” and “Partially Paid” to clearly track the status of each transaction.

- Include Reference Numbers: Add a reference number or payment ID for each transaction. This helps you easily match payments with the corresponding records and provides a clear audit trail.

- Use Conditional Formatting: Apply conditional formatting to highlight overdue payments or unpaid balances. This makes it easier to spot issues and take appropriate action quickly.

Advanced Features for Tracking

- Calculate Outstanding Balances Automatically: Set up formulas that calculate the outstanding amount based on partial payments or discounts applied. This will give you real-time data on how much is left to be paid.

- Set Payment Reminders: Create a column that includes a “reminder date” to notify you when a follow-up is needed for overdue payments.

- Generate Reports: Use built-in reporting features to analyze payment trends, identify slow-paying clients, and track revenue over time.

By using a structured system, you can stay organized and ensure that you never miss a payment or forget to follow up with clients. This approach provides you with a clear overview of your financial situation and helps you manage cash flow effectively.

Free vs Paid Excel Invoice Templates

When it comes to managing financial documents, there are both free and paid options available for creating and tracking transactions. While free options might seem appealing, paid solutions often provide additional features that can improve efficiency and professionalism. Below is a comparison of the two to help you decide which option is best suited for your needs.

Feature Free Options Paid Options Customization Basic design with limited customization options Highly customizable with more advanced features Ease of Use Simple but may require more manual input User-friendly with automated features Support Limited or no customer support Access to customer support and updates Professional Design Basic design, often lacks branding options Polished design with options for branding Advanced Features Basic functionality with no automation Advanced features such as payment tracking, reporting, and more Ultimately, choosing between free and paid options depends on your specific needs. If you have a simple business model and just need something to track basic information, free solutions may work well. However, if you are looking for a more polished, professional setup with advanced functionality and customer support, investing in a paid solution can be a better choice.

How to Save Invoices as PDF in Excel

Converting financial documents into a PDF format ensures they are secure, easily shareable, and retain their original formatting. Many people use spreadsheet programs to create these records, and saving them as PDFs is a simple process that helps maintain professionalism and ease of access for recipients. Here’s how you can save your records in PDF format.

Step Action 1 Open your document in the spreadsheet program. 2 Click on the “File” tab located at the top left of the screen. 3 Select “Save As” or “Export” from the drop-down menu. 4 Choose the location where you want to save the file. 5 From the file format options, select “PDF” as the desired file type. 6 Click “Save” or “Export” to save your document as a PDF. Once saved, you can easily share, print, or store the document in PDF format. This process is quick and ensures that your financial records maintain their integrity and professionalism when sent to clients or kept for your own records.

Managing Recurring Invoices with Excel

For businesses that provide ongoing services or have regular transactions with clients, creating repetitive financial documents can be time-consuming. By using a spreadsheet program, you can streamline the process of managing these recurring entries. Automating the calculations and formatting makes it easier to ensure consistency and accuracy every time.

Start by setting up a master document where you can input the necessary information, such as client details, service descriptions, and payment amounts. Afterward, you can use formulas to calculate totals and apply taxes or discounts. Once the structure is ready, you can easily duplicate the sheet for each billing cycle, reducing the need for repetitive manual entry.

Here are some ways to efficiently manage recurring records:

- Use built-in date functions: Excel allows you to set dates for future cycles, so you never miss a payment schedule.

- Use templates for faster duplication: Save a format that can be easily duplicated for each new cycle.

- Incorporate automatic calculations: Use formulas to automatically update amounts when prices or quantities change.

- Track payment status: Use a separate column to monitor whether payments have been received or are still pending.

By organizing these details within the program, you save time and reduce the risk of errors, ultimately improving your workflow and keeping your financial records accurate and up-to-date.

Excel Add-Ons to Improve Invoicing

Enhancing your workflow can be achieved by integrating additional tools into your spreadsheet program. These add-ons can significantly boost productivity by automating repetitive tasks, providing more advanced features, and ensuring accuracy in your financial records. They are designed to simplify processes like calculating totals, managing payments, and customizing document layouts.

Here are a few powerful add-ons that can help streamline your process:

- Invoicing Automation Tools: These add-ons allow you to set up automatic invoicing cycles, reducing manual entry and ensuring timely billing for recurring clients.

- Financial Functions Add-Ons: These can help you perform advanced calculations, such as currency conversion, tax rates, and discounts, directly within the document.

- Template Customization Tools: Use these to create unique designs for your financial documents, adding your branding, logos, and professional formatting with minimal effort.

- Payment Tracking Integrations: Some add-ons allow you to sync your document with payment processing services, giving you a clear view of outstanding and completed payments.

Integrating these add-ons will not only save time but also improve the professionalism and accuracy of your financial processes. Whether you’re handling one-time transactions or regular payments, these tools can help ensure you stay organized and efficient.

How to Share Invoices with Clients

Sharing financial documents with clients is a critical part of maintaining smooth business operations. Ensuring that your documents are easily accessible, professional, and secure is important for both you and your clients. There are several methods to distribute these records efficiently, whether through email, cloud storage, or printed copies.

Common Methods for Sharing

Depending on the needs of your clients and the tools at your disposal, there are different ways to deliver documents securely and quickly:

Method Advantages Considerations Email Fast, convenient, and widely accepted Ensure file format compatibility (PDF is preferred) Cloud Storage Easy access and sharing; real-time updates Requires a cloud service subscription or setup Printed Copies Ideal for clients who prefer physical copies Costs and time involved in printing and mailing Tips for Secure Sharing

When sending financial documents, especially through email or cloud platforms, security is a top priority. Here are a few best practices:

- Use password protection: Protect your files with strong passwords, especially when sharing sensitive data.

- Ensure encryption: Use encrypted email or secure file sharing platforms for added protection.

- Verify recipient details: Always double-check email addresses or sharing permissions to prevent accidental sharing with the wrong party.

By using these methods and tips, you can ensure that your financial documents are shared in a way that is both efficient and secure, maintaining a professional relationship with your clients.