Excel Spreadsheet Invoice Template for Simple and Efficient Billing

Managing financial transactions efficiently is crucial for any business, whether you’re a freelancer or a large organization. A well-organized system for recording payments, tracking costs, and ensuring accuracy can save time and reduce errors. Using a simple, customizable tool can help you keep your records in order without the need for complex software.

By setting up a structured document for generating payment requests, you can automate many of the manual tasks involved in billing. This allows for easy updates, quick calculations, and a polished presentation of your business transactions. With the right structure, you can customize the details to fit your needs and maintain a consistent, professional appearance in all your financial dealings.

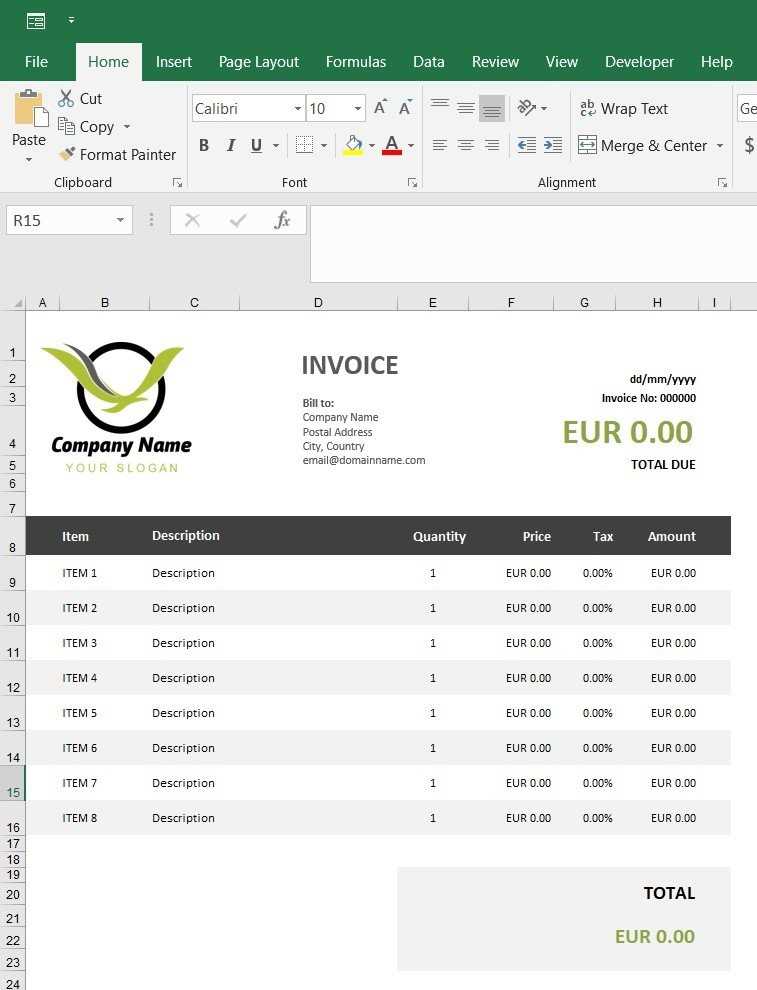

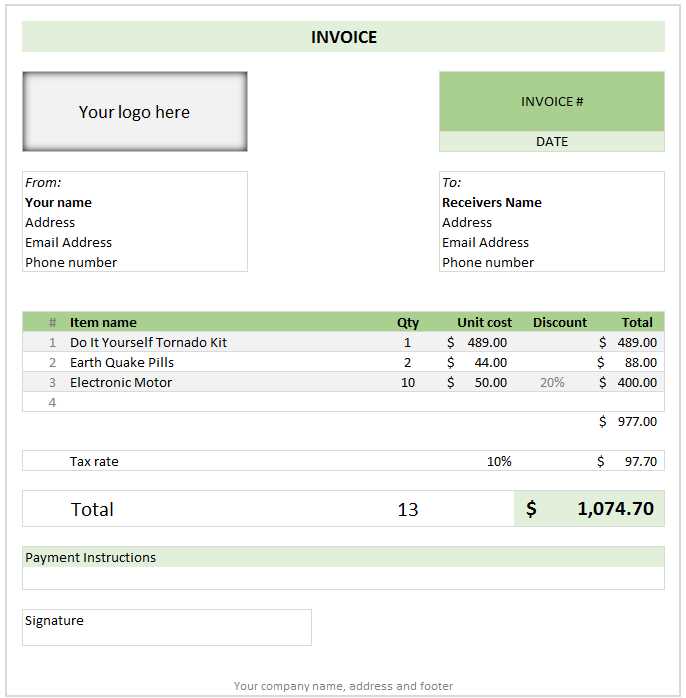

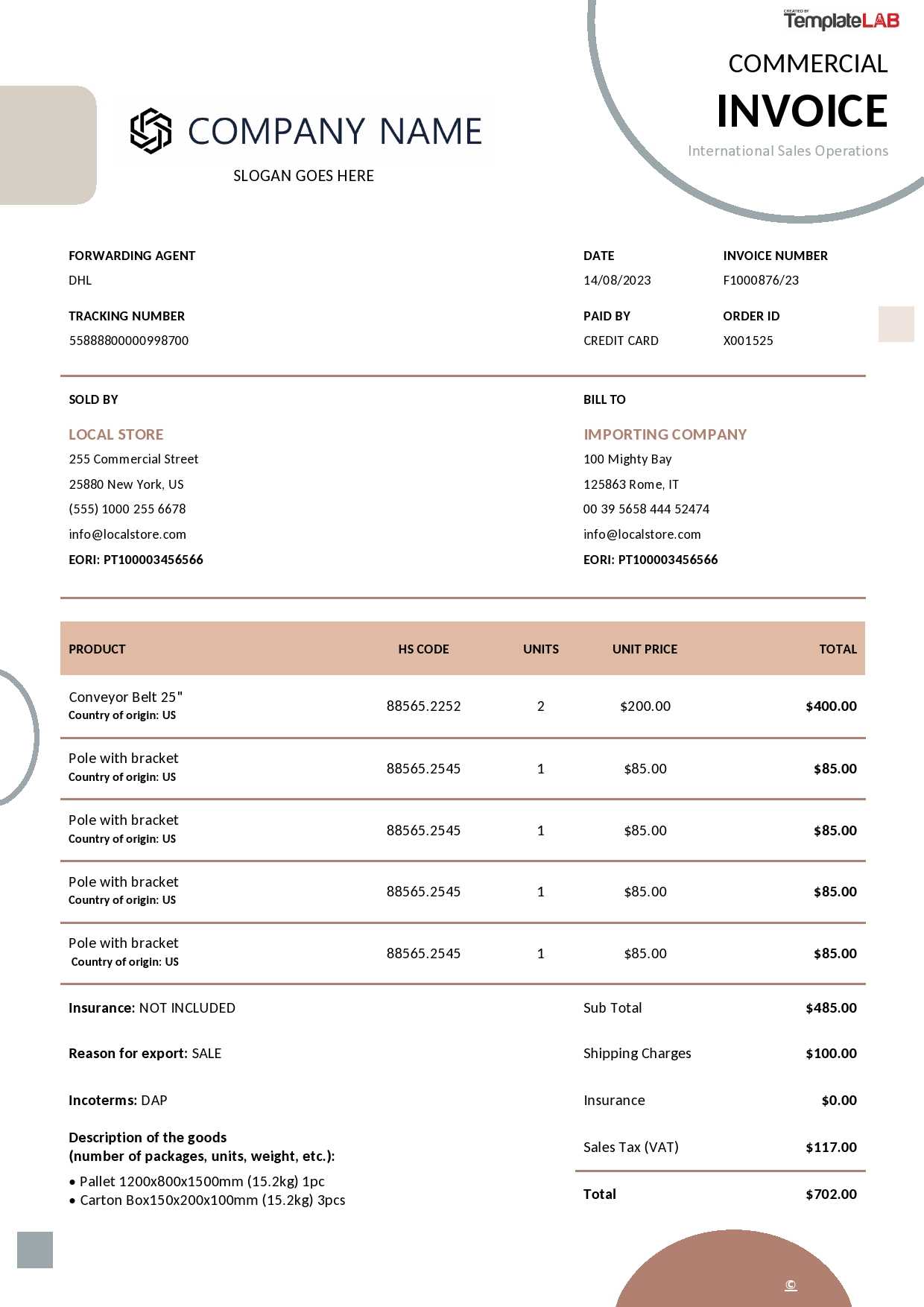

Excel Spreadsheet Invoice Template Overview

When it comes to managing payment requests, having a clear and efficient system is essential for maintaining a smooth workflow. A customizable document designed for tracking transactions allows businesses to streamline their billing process while maintaining a professional and organized approach. This tool provides flexibility, enabling users to input various details such as client information, product or service descriptions, and payment terms in a structured format.

By incorporating simple formulas and automatic calculations, this method reduces the likelihood of errors and ensures accuracy in financial records. Whether you’re an independent contractor or running a small business, using this adaptable document can save valuable time and effort. It also offers a polished appearance for sending to clients, promoting clarity and professionalism in all financial communications.

Why Use an Excel Invoice Template

Utilizing a structured, customizable document for billing can greatly enhance the efficiency of your financial management process. This tool allows for quick input of all necessary transaction details, offering a streamlined approach that saves time and reduces the likelihood of errors. With automated calculations for totals, taxes, and discounts, the process becomes more accurate and less prone to manual mistakes.

Another key advantage is the flexibility it offers. You can easily adjust the layout to suit your business needs, whether you’re working with simple transactions or more complex invoicing scenarios. Additionally, this solution provides a professional look for all outgoing documents, fostering trust and clarity with your clients. It helps to keep all records in one place, making it easier to track payments, monitor outstanding balances, and ensure timely collections.

Steps to Create Your Invoice

Creating a detailed payment request is a simple but essential task for maintaining accurate financial records. By following a few straightforward steps, you can quickly set up a document that captures all relevant information, ensuring that the billing process is both clear and professional. Whether you’re working with a one-time client or managing recurring charges, these steps will help you stay organized and efficient.

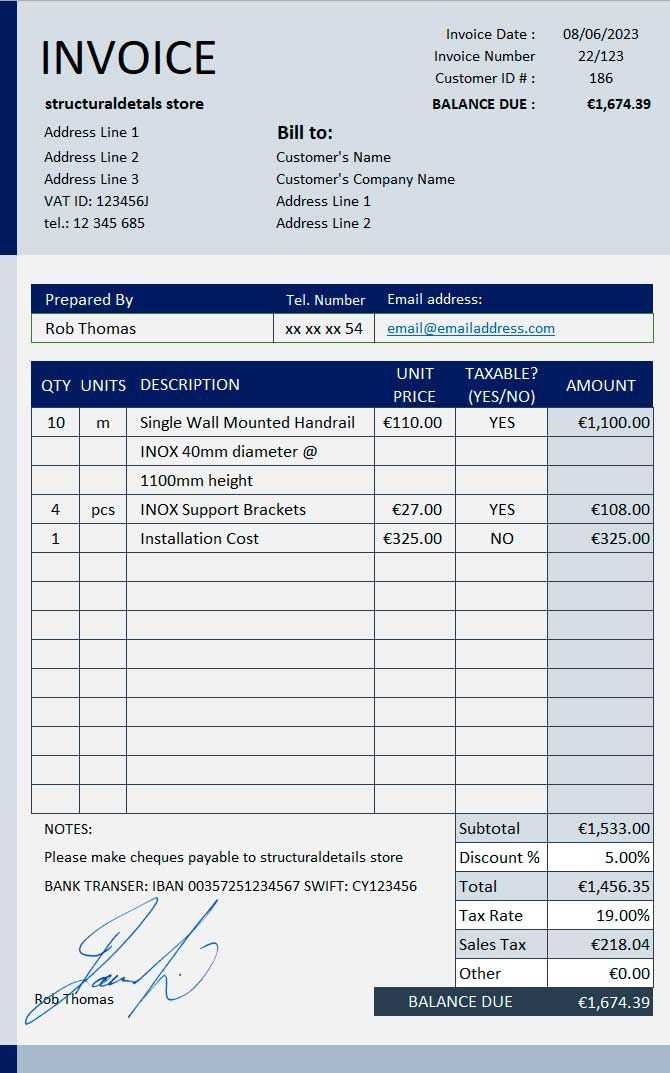

Step 1: Add Your Business Information

Start by including your company’s name, address, and contact details at the top of the document. This makes it easy for clients to reach you and confirms your professional identity. Be sure to also include the date of issue, along with a unique reference number for each transaction to keep things organized.

Step 2: List Client Information and Payment Details

Next, add the client’s name, address, and contact information. Clearly state the services or products provided, including quantities, descriptions, and individual rates. Then, calculate the total amount due and specify any payment terms, such as due dates and accepted methods of payment. This transparency ensures that clients understand exactly what they are being charged for and when the payment is expected.

Customizing Your Template for Business Needs

To fully meet the requirements of your business, tailoring your billing document is essential. Adjusting the layout, content, and functionality allows you to cater to specific needs, whether you are handling diverse products, offering services, or managing various payment terms. A customized approach ensures that the document reflects your brand and simplifies your accounting tasks.

Here are some aspects to consider when making the document truly your own:

| Customization Aspect | Description |

|---|---|

| Branding | Incorporate your company logo, colors, and fonts to maintain a consistent brand image. |

| Payment Terms | Adjust payment deadlines, late fees, and accepted payment methods to suit your business policies. |

| Item Details | Modify columns to list product names, descriptions, quantities, and prices according to your inventory or services offered. |

| Tax Calculations | Set up tax rates and formulas to automatically calculate applicable taxes on goods or services provided. |

| Discounts and Offers | Include sections to apply discounts, promotional offers, or special pricing for specific clients or bulk orders. |

By customizing the document, you make it more aligned with your specific business operations, improving the accuracy and professionalism of every transaction you process.

How to Add Itemized Details in Excel

Including a detailed breakdown of the products or services provided is crucial for transparency and accuracy in your financial records. By adding itemized information, you give clients a clear understanding of what they are being charged for, making the billing process more straightforward and professional. This also helps in managing your own inventory or services, as it provides a detailed record of each transaction.

Follow these steps to add detailed item descriptions to your document:

- Step 1: Create columns for each relevant detail, such as product/service name, description, quantity, unit price, and total cost.

- Step 2: List each item on a new row, ensuring all information is clearly presented and easy to read.

- Step 3: For each item, calculate the total by multiplying the quantity by the unit price. You can easily do this by applying a formula to automate the process.

- Step 4: Include a column for any discounts or additional fees that may apply to specific items or services.

- Step 5: Finally, calculate the subtotal for all items before applying any taxes or final charges.

By following these simple steps, you ensure that each transaction is clearly outlined, which helps both you and your clients keep track of the services or products exchanged, making it easier to resolve any issues that may arise.

Calculating Totals and Taxes Automatically

Automating the calculation of totals and taxes is an essential feature of a well-organized financial document. By using formulas, you can eliminate the need for manual calculations, reducing the risk of errors and ensuring accuracy in every transaction. With automated totals and tax calculations, the process becomes more efficient, saving time and effort for both you and your clients.

Calculating the Total Amount

To calculate the total amount due, you can simply multiply the quantity of each item by its unit price and then sum up the results. This process ensures that all charges are accounted for correctly, and the total is updated instantly whenever changes are made to the details.

Applying Taxes Automatically

Incorporating tax calculations into your document is straightforward. By setting up a tax rate in a specific cell, you can automatically apply it to the total amount. This allows for consistent tax calculations, especially when working with different tax rates for different regions or product types.

| Step | Formula | Explanation |

|---|---|---|

| Total Calculation | =Quantity * Unit Price | Multiply quantity by unit price for each item. |

| Subtotal Calculation | =SUM(Total Column) | Sum all the individual totals to get the subtotal. |

| Tax Calculation | =Subtotal * Tax Rate | Apply the tax rate to the subtotal to calculate the tax. |

| Final Amount | =Subtotal + Tax | Add the tax to the subtotal to get the final amount. |

With these simple formulas, you can automate all the calculations, ensuring that your records are accurate and up-to-date with minimal effort.

Using Excel Formulas for Efficient Billing

Automating calculations is key to streamlining your billing process and minimizing the chances of errors. By incorporating simple formulas into your billing documents, you can ensure that totals, taxes, and discounts are calculated accurately with just a few inputs. This not only saves time but also improves the reliability of your financial records.

Key Formulas for Billing Documents

- Sum Formula: Automatically calculate the total amount for each item by multiplying quantity and unit price.

- Subtotal Formula: Use the

SUMfunction to quickly add up the individual amounts for all items. - Tax Calculation: Apply the tax rate by multiplying the subtotal by the tax percentage to get the correct amount.

- Discounts: Use a formula to apply any applicable discounts based on predefined conditions, such as a percentage off the total amount.

- Final Amount: Add the tax and subtract any discounts from the subtotal to calculate the final amount due.

Benefits of Using Formulas

- Time-Saving: Once set up, formulas eliminate the need for manual calculations, updating totals automatically whenever changes are made.

- Accuracy: By automating calculations, you reduce the risk of human error, ensuring that your financial records are always accurate.

- Flexibility: Formulas can be customized to fit your specific needs, whether you’re calculating taxes, discounts, or other adjustments.

Integrating these formulas into your billing document ensures that all calculations are handled automatically, helping you maintain consistent accuracy and efficiency in your financial workflow.

Setting Up Payment Terms in Excel

Clearly defining payment terms is essential for maintaining smooth financial operations and ensuring that payments are made on time. By specifying due dates, late fees, and accepted payment methods in your billing documents, you can avoid confusion and set clear expectations for your clients. Setting up these terms automatically within your document simplifies tracking and enforcement, making the payment process more predictable and efficient.

Essential Payment Terms to Include

- Due Date: Specify the date by which the payment is expected. This helps to set a clear deadline for your client.

- Late Fees: Indicate any penalties for overdue payments. You can set a percentage or flat fee for late payments to encourage timely settlements.

- Accepted Payment Methods: List the payment options available, such as bank transfer, credit card, or online payment systems.

- Discounts for Early Payment: If applicable, offer incentives for clients who pay ahead of the due date, such as a percentage discount.

- Partial Payment Option: Define terms for clients who may wish to pay in installments, including the amount and frequency of payments.

Automating Payment Terms in Your Document

- Set Up Conditional Formatting: Use conditional formatting to highlight overdue payments automatically.

- Payment Reminders: Add automated reminders or notifications to alert clients as the due date approaches or if payment is late.

- Payment Tracking: Implement formulas to track partial payments or calculate the remaining balance due after a payment is made.

By incorporating these terms into your document and automating relevant calculations, you ensure that both you and your clients are on the same page, making the payment process clear and efficient.

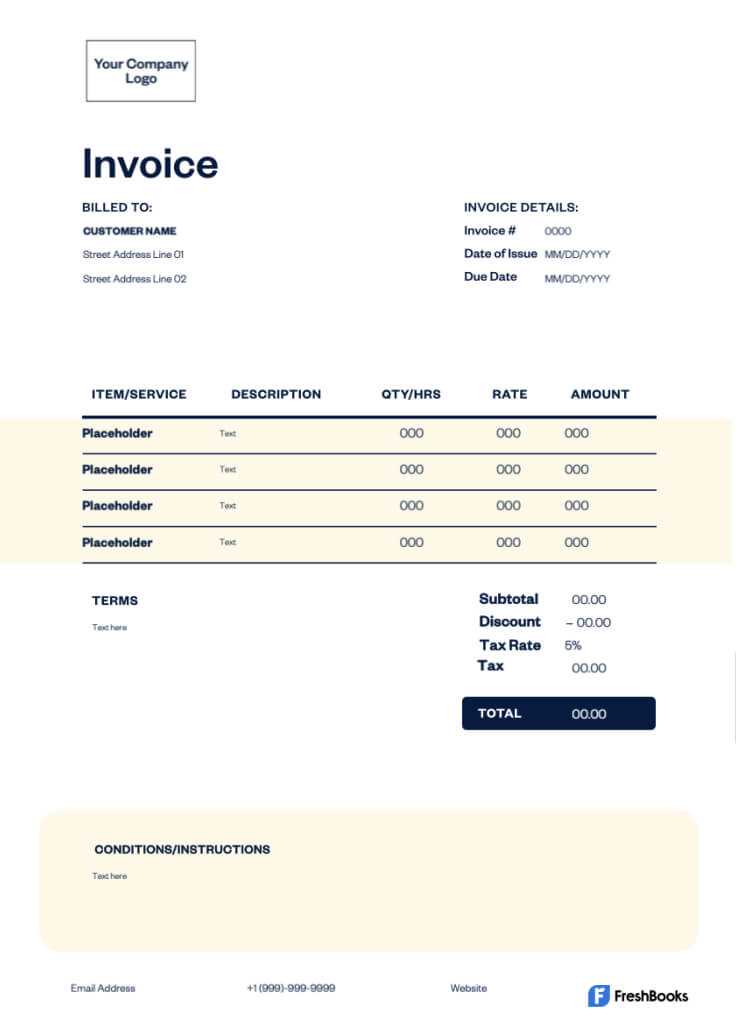

Creating a Professional Invoice Design

A well-designed document plays a significant role in creating a professional impression and enhancing the clarity of your financial communications. An organized layout with clear headings, easy-to-read fonts, and strategically placed information can ensure that your clients understand the details of the transaction quickly. A polished design not only reflects well on your business but also helps to streamline the billing process, making it easier to track and manage payments.

Key Elements of a Professional Design

- Company Branding: Include your logo, business name, and contact information in a prominent place to ensure your document is easily identifiable and consistent with your brand image.

- Clear Layout: Organize the document with distinct sections, such as contact details, itemized list, total amounts, payment terms, and notes. This helps clients find the information they need at a glance.

- Legible Fonts: Choose easy-to-read fonts for both headings and body text. Avoid overly decorative fonts that might distract from the key information.

- Professional Colors: Use a clean, simple color scheme that aligns with your branding and enhances readability. Ensure there is enough contrast between the background and text.

- Itemized List: Present charges in a clear and concise manner with rows for item descriptions, quantities, unit prices, and totals. This breakdown helps to avoid confusion about what is being charged.

Design Tips for Enhancing Clarity

- Spacing and Alignment: Use sufficient spacing between sections and align text consistently for a neat, organized look.

- Highlighting Important Information: Bold or highlight critical details such as the total amount due or payment terms to draw attention to these key points.

- Footer Section: Include a footer with additional notes or payment instructions, if necessary, but keep it uncluttered and professional.

A well-thought-out design can set the tone for a positive business relationship, ensuring that your billing documents are not only functional but also reflect the professionalism of your brand.

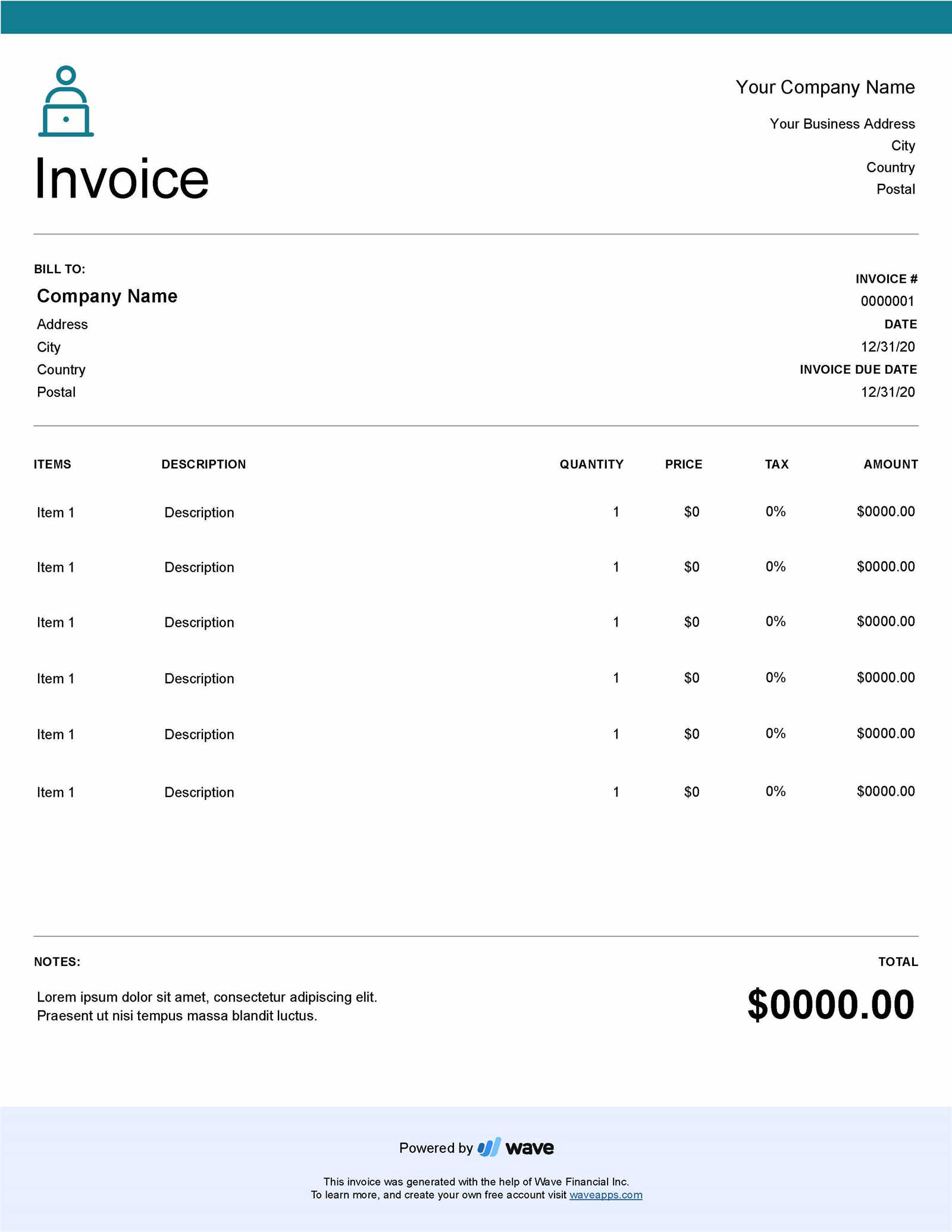

Excel Template vs Online Invoice Tools

When it comes to managing billing, businesses often face the decision of choosing between a customizable document format and specialized online solutions. While both approaches serve the same purpose, they come with their unique advantages and limitations. Understanding the strengths and weaknesses of each option can help you determine the best choice for your needs, whether you prioritize flexibility or convenience.

Advantages of Customizable Documents

Customizable documents, typically created in programs like spreadsheet software, offer a high degree of flexibility. These allow you to design and adjust every aspect of the layout, from the structure to the data formulas. This makes them ideal for businesses that have unique billing needs or prefer to work offline. Additionally, once you have set up a document, it can be reused across multiple clients with minimal adjustments.

- Highly Customizable: Tailor the document to reflect your brand and business needs.

- No Ongoing Costs: Once created, you do not have to pay for additional subscriptions or services.

- Offline Accessibility: Work on your documents even without an internet connection.

Benefits of Online Invoice Solutions

Online tools, on the other hand, are built specifically for invoicing and often come with features that automate many aspects of the billing process. These tools can help track payments, send reminders, and sometimes even integrate with accounting software. For businesses that want a seamless and time-saving solution, online tools may be a more efficient option, especially for those with a high volume of transactions.

- Automation: Automatically calculate totals, taxes, and apply discounts.

- Cloud-Based: Access and manage your invoices from any device with an internet connection.

- Integrated Features: Many tools offer built-in payment processing and tracking capabilities.

In conclusion, the choice between customizable documents and specialized online tools depends on your specific needs. If flexibility and a one-time setup are most important, customizable documents may be the way to go. However, if you require automation and convenient cloud-based features, online tools might be the better choice for you.

Advantages of Using Excel for Invoicing

Using a digital document for billing can greatly enhance efficiency and accuracy. With customizable features and a wide range of built-in functions, this tool allows businesses to quickly generate professional documents tailored to their needs. Whether you’re managing a small business or handling personal transactions, the flexibility and control offered by these solutions make them a popular choice for many.

One of the main advantages of using this approach is the ability to fully customize each document. You can easily adjust the layout, add or remove sections, and update the content based on the specifics of each transaction. This flexibility allows you to design a document that aligns with your branding and operational requirements without needing specialized software or third-party tools.

Another key benefit is the integration of calculation features. With built-in formulas, you can automatically calculate totals, taxes, and discounts, reducing the risk of human error and speeding up the process. You also have the option to set up automatic updates for recurring charges or partial payments, making the document even more efficient for frequent transactions.

Additionally, using this method doesn’t require an internet connection, so you can work on documents offline, making it convenient for situations where internet access is limited. And since many people are already familiar with the software, there’s no need to invest time learning new tools or systems.

In summary, the ability to customize, automate calculations, and work offline are just a few reasons why this approach is favored by businesses seeking a reliable, cost-effective solution for managing their billing process.

How to Save and Share Your Invoice

Once your document is created and the details are finalized, it’s important to know how to properly save and share it with your clients. Efficient file management ensures that the document remains accessible and secure, while proper sharing methods make it easy for clients to receive and review the details. Whether you’re sending it electronically or saving it for later use, there are several ways to streamline this process.

Saving Your Document

To ensure that your work is preserved, saving your document in a widely accessible format is essential. Most commonly, you can save your file as a PDF, which ensures that the layout and content remain consistent across all devices. This format also prevents accidental edits and is universally compatible with email systems, file sharing platforms, and cloud storage services. Another option is to save it in Excel-compatible formats, such as .xls or .xlsx, if you need to make future modifications.

Sharing Your Document

Once your document is saved, sharing it is the next step. If you’re sending the file via email, attach the saved PDF or file directly to your message. Be sure to include a clear subject line, such as “Payment Request for [Client Name],” and add a brief message explaining the document. If you’re sharing it through a file-sharing service or cloud storage, simply upload the file and provide the recipient with a link to download it. Ensure that you manage permissions appropriately, giving access only to those who need it.

Secure and Convenient Sharing

For added security, consider using password protection for sensitive documents or encrypting the file before sharing. Many file-sharing platforms offer these options to prevent unauthorized access. When using email, always double-check the recipient’s address to ensure the document reaches the correct person.

In conclusion, properly saving and securely sharing your completed document ensures that your transactions are efficient, organized, and accessible to your clients when they need them.

Tips for Managing Multiple Invoices

Handling numerous billing documents can quickly become overwhelming, especially as your business or personal transactions grow. Organizing and managing these documents efficiently is crucial to ensuring smooth operations and timely payments. Here are some practical tips to help streamline the process of managing multiple billing statements.

- Use Clear Naming Conventions: Name each document clearly, including the client’s name, date, and invoice number. This makes it easier to locate specific documents and ensures consistency when sorting files.

- Create a Centralized System: Organize your files in a centralized location, whether on your computer or in a cloud-based storage service. Group documents by client, date, or project to help you track everything more easily.

- Automate Recurring Entries: For businesses that issue regular billing, consider setting up automatic entries for standard charges. This will save time and reduce the risk of errors, as you won’t need to input the same information repeatedly.

- Track Payments and Due Dates: Use a system to monitor payments and due dates. Set reminders or use built-in tools that can automatically highlight overdue amounts or upcoming payment deadlines to ensure you don’t miss anything.

- Batch Sending: When it’s time to share multiple documents with clients, consider using batch emailing or a bulk file-sharing tool. This saves time and reduces the chance of sending the wrong document to the wrong client.

lessCopy code

By staying organized and leveraging simple strategies, you can easily manage multiple billing documents without getting overwhelmed. These techniques not only help you keep track of payments and due dates but also ensure that your clients receive accurate and timely statements.

Tracking Payment Status in Excel

Keeping track of payment statuses is essential for managing finances and ensuring timely cash flow. Whether you’re handling a few transactions or dealing with a larger number, it’s crucial to have a system in place that clearly indicates which payments have been received, which are pending, and which are overdue. Here are some strategies for tracking payment statuses efficiently within your records.

- Create a Payment Status Column: Add a specific column to your record that identifies whether a payment has been completed, is pending, or is overdue. You can use simple indicators like “Paid,” “Pending,” or “Overdue” for easy reference.

- Use Conditional Formatting: Applying conditional formatting can help visually distinguish between different payment statuses. For instance, you can color code cells: green for paid, yellow for pending, and red for overdue. This visual cue allows you to quickly assess the status of payments at a glance.

- Set Up Automated Date Tracking: Track payment due dates alongside payment statuses to ensure you stay on top of upcoming deadlines. Using simple formulas, you can set alerts or conditional formatting rules that highlight items approaching their due date.

- Use Filters for Easy Sorting: To better manage multiple transactions, utilize filtering features to sort your data by payment status, date, or amount. This allows you to focus on specific groups of payments, making it easier to follow up on overdue transactions or verify completed payments.

- Record Payment Dates: Keep track of when payments were received by adding a payment date column. This helps you easily identify whether a payment has been processed within the expected time frame, and allows you to reconcile your records more efficiently.

vbnetCopy code

By incorporating these simple tracking methods, you can manage payment statuses with ease, ensuring that you stay organized and on top of your financial records. These strategies can also help you quickly address any late payments and maintain strong relationships with your clients.

Using Excel for Recurring Invoices

Managing regular payments can be time-consuming if done manually each time, especially for clients who are billed on a recurring basis. By automating and organizing recurring transactions within your records, you can save time and reduce the risk of errors. Below are some key strategies for using an efficient system to handle periodic billing and streamline your workflow.

Set Up Recurring Billing Schedules

- Automate Payment Dates: By entering specific dates for recurring charges, you can ensure that your billing schedule remains consistent. This will help avoid confusion and ensure timely payments from clients.

- Utilize Date Functions: Excel’s built-in date functions can help you automatically calculate the next billing date based on the initial entry. For example, if a service is billed monthly, a formula can add 30 days to the date of the previous bill.

- Custom Reminders: Set up reminders by incorporating conditional formatting to highlight upcoming payment dates or overdue charges. This helps keep you on track without manually checking each account.

vbnetCopy code

Tracking Payments for Recurring Clients

- Payment Status Indicators: Mark each transaction with clear indicators such as “Paid,” “Pending,” or “Overdue.” This will provide an easy overview of which accounts have been paid and which still require action.

- Use Filters and Sorting: Use filters to sort payments by client, date, or payment status. This can be especially helpful when dealing with multiple clients with different billing cycles.

- Payment History: Include a column for recording payment history so that you can keep track of when and how much each client has paid over time. This can help you identify patterns and take prompt action for any missed payments.

sqlCopy code

By leveraging these strategies, you can effectively manage recurring transactions and simplify your workflow. An organized approach will not only save time but also ensure that your clients are billed consistently and accurately, reducing the risk of missing payments or errors in the billing process.

How to Protect Your Invoice Template

When managing financial documents, it’s essential to ensure that your records remain secure and intact. Protecting your document from accidental edits or unauthorized access is key to maintaining accurate and professional billing practices. Below are steps to help you safeguard your files and prevent unwanted changes.

1. Locking Cells to Prevent Editing

One of the most effective ways to protect important fields within your document is by locking certain cells. This ensures that only the sections you want to remain editable can be changed, while the rest stays secure.

- Highlight Cells: Select the cells that need protection (such as total amounts, tax rates, and company information).

- Enable Locking: Use the “Protect Sheet” function, which will lock the chosen cells from editing, but leave the others open for changes.

- Set a Password: Adding a password will further restrict access to the protected document, preventing unauthorized users from unlocking or editing the protected cells.

2. Setting Permissions for Viewing and Editing

If you’re working with sensitive data or sharing the file with others, it’s crucial to set permissions for who can view or make changes to your document.

- Use Read-Only Mode: This ensures that recipients can only view the content and can’t alter it. This is particularly useful when sending completed documents to clients.

- Restricting Editing: By allowing specific users to only edit certain parts of the document, you can prevent modifications to critical fields or sections.

3. Saving and Backing Up Your Document

Regularly saving and backing up your document is crucial in case of data loss or accidental changes.

- Use Cloud Storage: Save your file on cloud platforms such as Google Drive or Dropbox, so you can access the document from anywhere while ensuring that it’s backed up securely.

- Regular Backups: Make it a habit to back up your file regularly, especially after major changes or updates.

4. Protecting Data with Encryption

Encrypting your files is an extra layer of security, ensuring that even if someone gains unauthorized access to your document, the data will remain unreadable without the proper decryption key.

- Enable File Encryption: Most document management software offers built-in encryption features. Activating these will make it significantly harder for unauthorized users to access your files.

By following these steps, you can better protect your financial records and reduce the likelihood of unauthorized changes, ensuring your billing p

Best Practices for Invoice Record Keeping

Proper documentation and organization of your financial records are essential for maintaining transparency and accuracy in your business operations. Keeping track of billing documents not only helps in streamlining your workflow but also ensures compliance during audits and tax filings. Below are best practices to efficiently manage and store these records.

1. Consistent Organization and Naming Conventions

Keeping your records well-organized is the foundation of effective record-keeping. Establishing a consistent naming convention for your files will make it easier to locate and manage them. This should include:

- Descriptive File Names: Use clear and concise names that identify the document’s purpose, date, and client name. For example, “JohnDoe_Invoice_2024-11-06.pdf” helps you quickly identify the content and its relevance.

- Organized Folders: Create separate folders for different categories, such as “Completed Orders,” “Pending Payments,” or “Tax Records,” to ensure easy access and minimize clutter.

- Consistent Formatting: Use the same date format and structure for all your documents, making it easier to search and sort them by year, month, or client.

2. Backing Up Your Records Regularly

Data loss can happen unexpectedly, so regular backups are essential to ensure that you don’t lose critical business information. Consider the following methods:

- Cloud Storage: Store your files on cloud platforms like Google Drive, Dropbox, or OneDrive for secure and remote access. Cloud storage provides automatic backups and syncing, ensuring that your documents are always safe and accessible from any device.

- External Backups: In addition to cloud storage, maintain physical backups on external hard drives or other secure storage devices. This will safeguard your records in case of a technical failure or loss of internet access.

- Regular Backup Schedule: Set up a routine for backing up your files to ensure they are updated consistently. It’s recommended to back up your files weekly or after important updates.

3. Archiving Older Records

As your business grows, so will the number of documents you accumulate. To maintain a manageable file system, consider archiving older records that are no longer actively needed.

- Set Retention Periods: Determine how long you need to keep your financial records before archiving them. For example, keep documents from the past 3-5 years

Troubleshooting Common Invoice Issues

When creating billing documents, there can be several technical and formatting challenges that arise, which can affect the accuracy and presentation of the records. Identifying and resolving these common issues will help ensure smooth operation and prevent delays in billing. Below are some typical problems and their solutions to keep your business operations running efficiently.

1. Incorrect Calculations and Totals

One of the most common issues with creating financial records is incorrect totals, often due to errors in formulas or data entry. Here’s how to troubleshoot:

- Check Formulas: Ensure that all formulas used for calculations are correct and refer to the right cells. Double-check basic math functions like SUM, multiplication, or percentage formulas.

- Data Formatting: Incorrectly formatted cells, such as using text format for numbers, can result in inaccurate calculations. Make sure the cells for numbers are set to “Number” or “Currency” format.

- Fix Cell References: Verify that all references in formulas are absolute (using $ symbols) or relative depending on the required outcome. A common mistake is not locking specific cells, which causes formula errors when copied to other rows.

2. Missing or Incorrect Client Information

For billing documents to be effective, they must contain accurate and up-to-date client information. If you encounter issues with missing or incorrect details, try these steps:

- Automate Client Information: If you regularly bill the same clients, consider using data validation or drop-down lists to automatically fill in their details, reducing manual errors.

- Update Client Records: Ensure that your client information is regularly updated. You can maintain a separate database with client contact details and import it into your record documents when necessary.

- Check Formatting: Verify that the text in fields such as names, addresses, and payment details is formatted correctly. Sometimes, missing spaces or special characters can cause alignment issues in documents.

3. Formatting and Layout Issues

Improper formatting can make your billing documents look unprofessional, potentially leading to confusion for the recipient. To fix layout issues, consider the following:

- Adjust Column Widths: Ensure that columns are wide enough to fit the content, especially for longer descriptions or item names. Cells with too much text can cause text to overflow or be cut off.

- Align Text and Numbers Properly: Text such as client names and addresses should be left-aligned, while monetary values should be right-aligned for clarity. This makes your document easier to read.

- Use Consistent Fonts and Styles: Stick to a simple font style and size throughout the document. Consistency is key to professionalism. Avoid excessive use of bold or italic formatting, as this can make the document harder to read.

4. Inconsistent or Missing Branding

Branding is crucial for creating a professional and consistent image across all business communications. If your billing document lacks clear branding or includes outdated logos, here’s what to do:

- Update Logos: Ensure that your company logo is p