Free Sample Commercial Invoice Template for Easy Billing

Accurate documentation plays a crucial role in ensuring smooth financial transactions between businesses and clients. When preparing financial statements, having a well-structured and clear format can save time and reduce the risk of mistakes. Whether you are shipping products internationally or offering services, creating a clear and professional statement is essential for maintaining good relationships with customers and ensuring timely payments.

In this guide, we will explore different formats and tools that can help you design the perfect billing document. By using the right structure, you can ensure that all necessary details are included and presented clearly. With customizable layouts, businesses can easily adapt documents to fit their specific needs, ensuring accuracy and efficiency.

Streamlining your billing process is more than just about numbers; it’s about creating a reliable record of transactions that can be referenced when needed. Whether you’re dealing with clients locally or globally, using a well-prepared form can significantly reduce confusion and potential disputes. Learn how to create, modify, and use these formats effectively to improve your business operations.

Why Use a Billing Document Format

Having a standardized document for financial transactions provides numerous advantages for both businesses and their clients. A consistent format helps ensure that all necessary details are included and presented in a professional and easy-to-understand manner. By using a predefined layout, businesses can streamline their processes, reduce errors, and improve communication with customers, leading to smoother operations and faster payments.

One of the main reasons to use a structured form is to ensure that all essential information is included in every transaction. This helps avoid confusion and ensures that both parties understand the terms of the sale, such as pricing, quantities, shipping details, and payment conditions. Without a standardized approach, important details may be overlooked, leading to misunderstandings or delays in payment.

| Benefit | Description |

|---|---|

| Consistency | A uniform format ensures that every document looks professional and contains the same key information. |

| Efficiency | Using a ready-made structure saves time when creating financial documents and helps avoid mistakes. |

| Accuracy | A predefined format minimizes the chances of omitting important details or making calculation errors. |

| Compliance | Structured documents ensure that you meet legal requirements and industry standards for business transactions. |

Incorporating a defined layout into your business processes simplifies both creation and tracking of transactions. This organization not only helps maintain order within your own records but also improves customer satisfaction, as clients are more likely to trust a clear, professional document. Ultimately, it contributes to a more effective and reliable business operation.

Benefits of Customizing Billing Formats

Customizing billing documents allows businesses to tailor them to their specific needs, improving clarity, brand recognition, and efficiency. A personalized layout can help ensure that important details are not overlooked and that the document reflects the company’s identity. Customization offers a way to streamline processes while maintaining professional and legally compliant records.

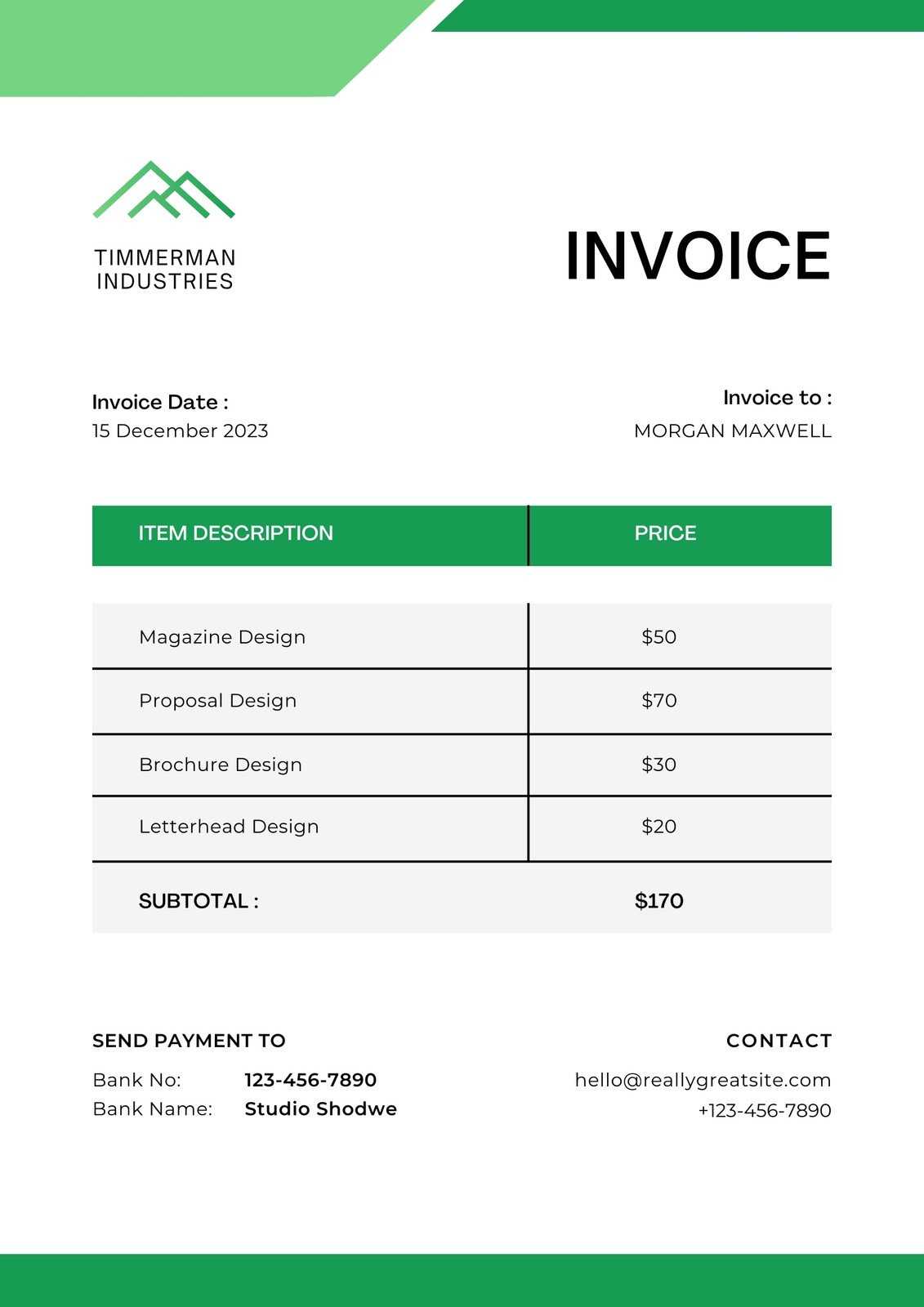

Improved Brand Consistency

By adding logos, brand colors, and fonts, businesses can ensure that all financial documents match their overall branding. This consistency builds trust with clients and creates a more professional image.

- Establishes a clear corporate identity.

- Enhances brand recognition through visual consistency.

- Helps clients easily identify the business in communications.

Increased Efficiency

Custom formats allow businesses to include only the most relevant information, reducing clutter and making the document easier to understand. This leads to faster processing times for both the sender and the recipient.

- Faster document creation by reusing a familiar structure.

- Less time spent correcting errors due to clearer organization.

- Enables quick updates to meet changing business needs.

Ultimately, customizing your billing records leads to more efficient business operations and a stronger relationship with clients. By investing time into creating a format that works best for your specific needs, you ensure that your financial documentation is as effective and professional as possible.

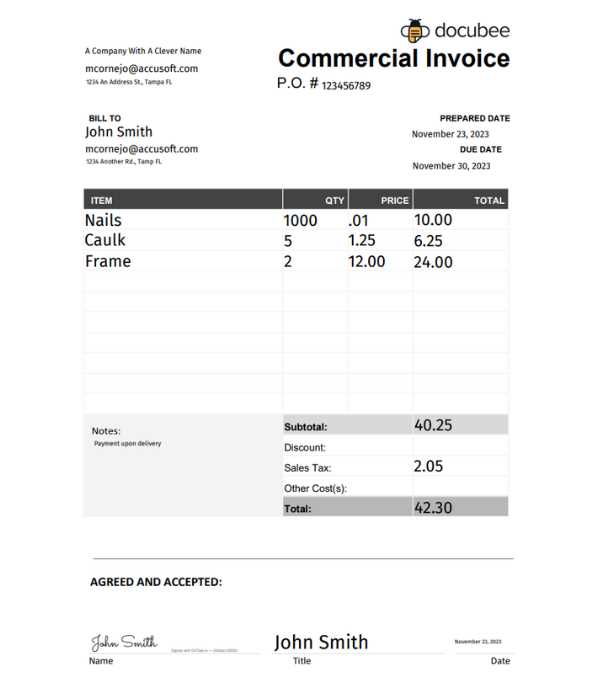

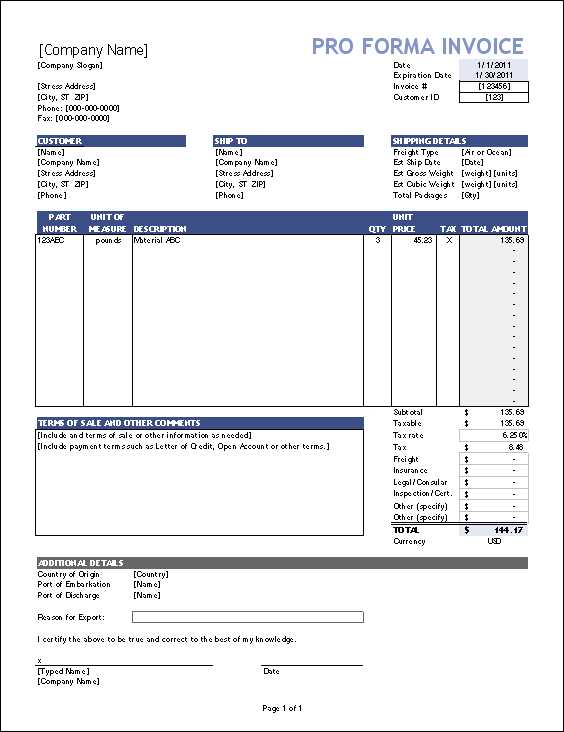

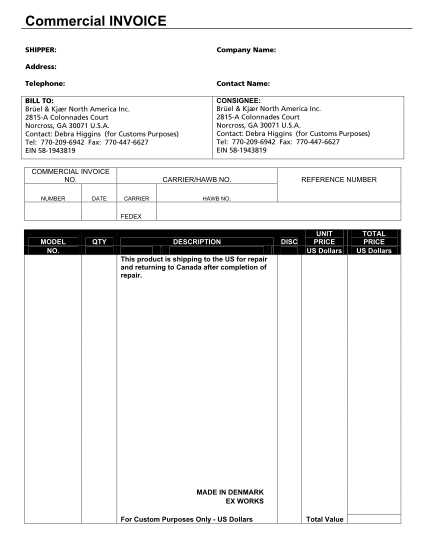

How to Create a Billing Document

Creating a clear and professional financial record is essential for smooth transactions and effective communication with clients. Whether you’re selling products, providing services, or shipping goods, having a well-organized document helps ensure that both parties are on the same page regarding prices, terms, and delivery details. Below are the key steps to follow when preparing your own.

1. Include Your Business Details

Start by providing your company’s full name, address, phone number, and email address. This ensures that the recipient can easily identify your business and contact you if necessary. Be sure to include your tax identification number if applicable, as it may be required for legal or accounting purposes.

2. Add Client Information

Next, include the recipient’s information, such as their name, address, and contact details. If the document is for a corporate client, include the company’s name and any relevant department or contact person.

3. List Products or Services

Clearly outline the products or services provided, including item descriptions, quantities, and unit prices. This section should be precise and easy to read, ensuring there is no confusion about what is being charged.

4. Specify Payment Terms

Clearly state the payment terms, including the due date, method of payment (e.g., bank transfer, credit card), and any late fees or discounts. This helps set expectations and encourages timely payment.

5. Include Shipping Information

For goods being shipped, make sure to provide delivery details, such as the shipping method, tracking number, and expected delivery date. This allows both parties to track the progress of the shipment and ensures there are no misunderstandings regarding delivery times.

6. Calculate Totals

Ensure that the final amount is clearly visible, including the subtotal, taxes, and shipping costs. Be transparent about all charges to avoid any confusion or disputes later on.

7. Add Terms and Conditions

If necessary, include any additional terms and conditions related to the sale, such as return policies, warranties, or limitations of liability. This helps protect both you and the client and ensures that all parties are aware of their rights and responsibilities.

By following these steps and ensuring that all necessary details are included, you will create a comprehensive and professional financial document that facilitates smooth transactions and promotes trust with your clients.

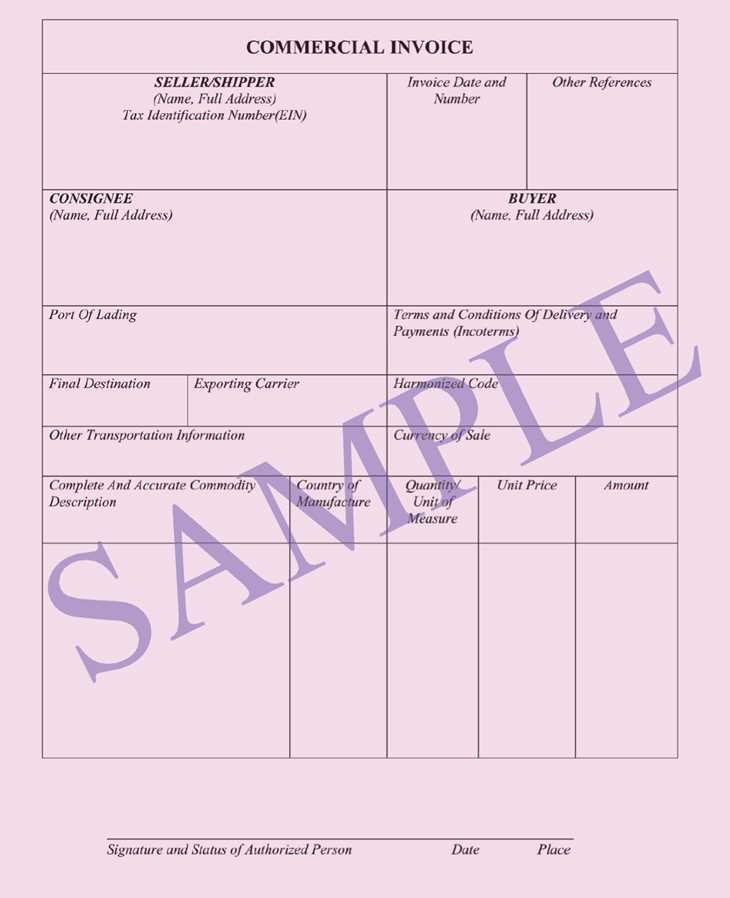

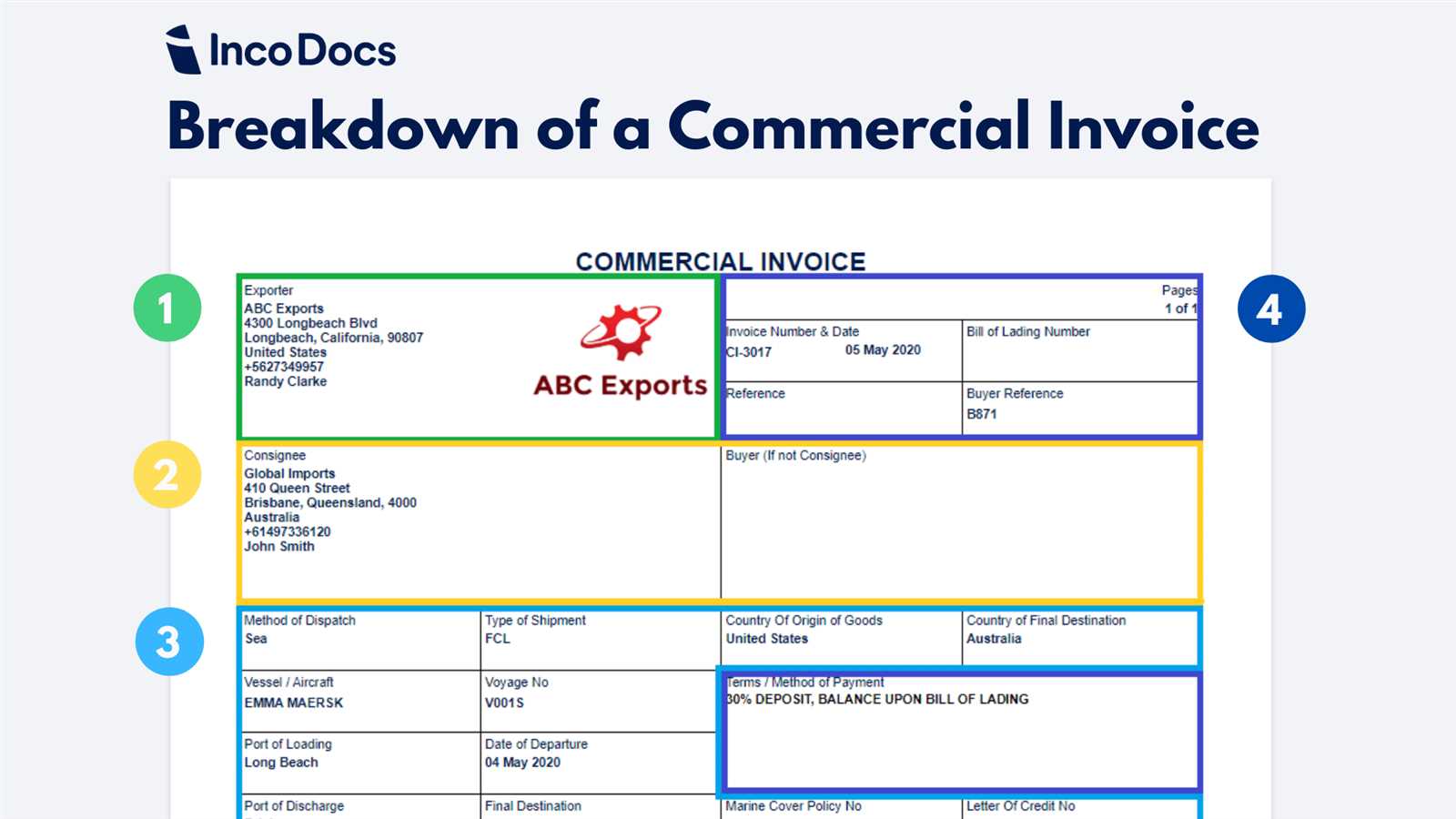

Essential Elements of a Billing Document

For a financial document to be effective, it must contain all the necessary information that ensures both parties are clear about the transaction details. A well-structured record provides transparency, minimizes errors, and ensures smooth payment processing. Below are the key elements that every document should include to ensure its completeness and accuracy.

1. Seller and Buyer Information

- Seller’s Details: Full name, business address, phone number, and email. It’s important to include your tax identification number if required by law.

- Buyer’s Details: Name, address, contact information, and any specific department or individual the document is addressed to.

2. Transaction Information

- Unique Document Number: A reference number that distinguishes the document from others for tracking and record-keeping purposes.

- Date of Issue: The date when the document is created and sent to the recipient.

- Payment Terms: Include payment methods (e.g., credit card, bank transfer) and due date, along with any applicable discounts or late fees.

3. Detailed List of Products or Services

- Description of Goods/Services: Provide a clear description of each item or service, including model numbers or specifications where necessary.

- Quantity and Unit Price: Indicate the number of units sold and the price per unit for easy calculation of the subtotal.

- Total Amount: Calculate and display the total cost for each product or service.

4. Shipping and Delivery Details

- Shipping Method: Specify the type of delivery (e.g., standard, express) and the carrier used.

- Tracking Information: If applicable, include the tracking number to allow the buyer to monitor their order’s progress.

- Delivery Date: Provide an estimated or actual delivery date to manage expectations.

5. Tax and Additional Charges

- Sa

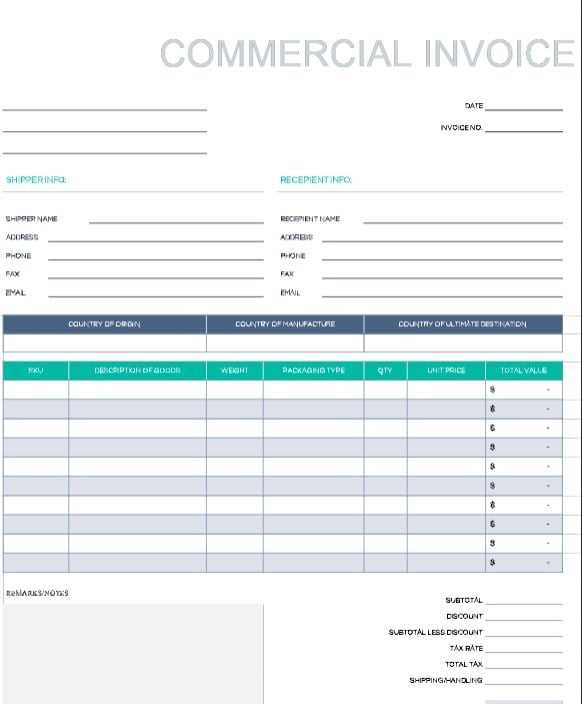

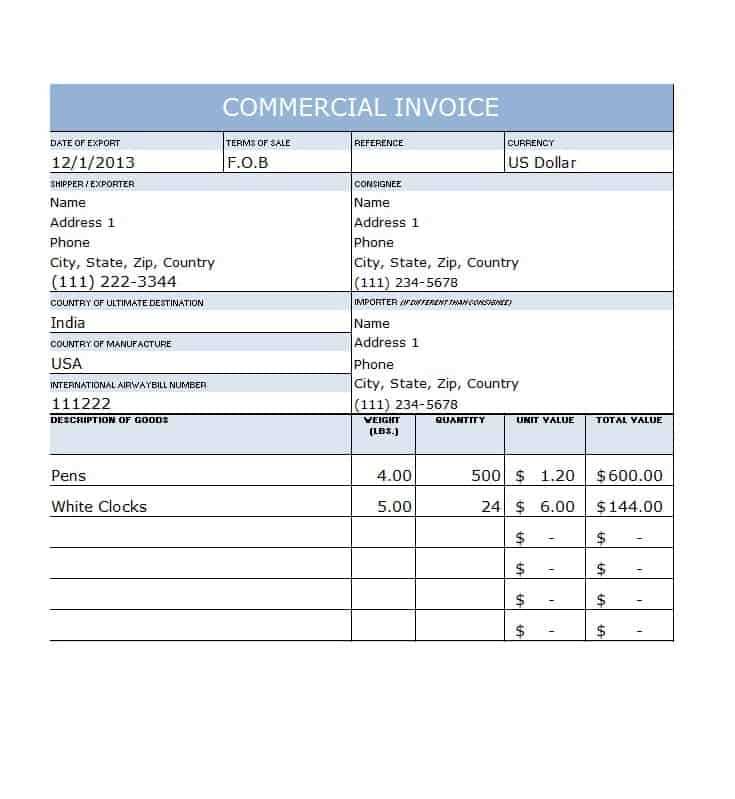

Understanding Billing Formats and Layouts

Choosing the right structure for your financial documents is crucial for ensuring clarity and efficiency in transactions. The layout of a document can impact how easily the information is understood and how quickly payments are processed. A well-organized design not only helps businesses present their records professionally but also improves communication with clients and reduces the chance of errors. Different types of formats and layouts serve specific needs, depending on the nature of the transaction and the industry involved.

Types of Layouts

- Traditional Layout: This layout typically includes all necessary information in a simple, straightforward manner. It includes sections for both buyer and seller details, a list of products or services, total amounts, and terms of payment.

- Itemized Layout: Used when detailed breakdowns are necessary, this format lists each item or service with unit prices, quantities, and extended totals. It’s ideal for businesses that sell multiple products or complex services.

- Minimalist Layout: Focuses on only the essential details, removing any excess information. This is suitable for simple transactions or ongoing services where a concise record is enough.

Important Considerations in Layout Design

- Clarity: Organize the document in a way that makes it easy for both the sender and recipient to understand. Use headings, clear sections, and ample white space to prevent clutter.

- Legibility: Ensure the text is readable with an appropriate font size and style. Avoid using too many different fonts, as this can create confusion and distract from the key information.

- Branding: Incorporating your business’s branding, such as logos and colors, helps maintain a consistent image across all business documents. This adds professionalism and helps clients easily identify your business.

Choosing the Right Format for Your Business

- Industry Standards: Certain industries may require specific layouts to meet compliance or customer expectations. Always check if there are any regulations that dictate the structure of your financial documents.

- Flexibility: Some businesses may need to customize their layouts for different types of transactions. Ensure your format allows for easy updates or modifications based on your business needs.

- Client Preferences: Some clients may have preferences regarding the format or structure of your document. It’s helpful to ask if they have specific requirements to ensure your document meets their expectations.

By understanding the various formats and layouts, businesses can choose the best design to suit their needs, enhance customer satisfaction, and ensure smooth transaction processes. The right structure not only improves communication but also promotes pro

Key Fields in a Billing Document

Every financial document should include specific fields to ensure it is complete, accurate, and legally binding. These key sections help both the seller and the buyer understand the terms of the transaction, such as payment conditions, product details, and delivery information. Below are the most important fields that should be included in any business document related to sales or services.

1. Seller and Buyer Information

One of the most crucial sections of a financial document is the identification of both parties involved. These fields should clearly list the contact details of both the seller and the buyer, ensuring that both sides can reach each other if any issues arise.

- Seller’s Information: Company name, address, phone number, email, and business identification number.

- Buyer’s Information: Customer’s name or company, address, and contact details.

2. Transaction and Payment Details

This section provides essential information related to the transaction, including the amount due and the payment conditions. Clear details in this area help prevent misunderstandings and ensure timely payment.

- Document Number: A unique reference number for tracking and record-keeping purposes.

- Date of Issue: The date when the document is created and sent.

- Due Date: The date by which payment is expected.

- Payment Terms: Accepted payment methods, such as credit card, bank transfer, or check, as well as any discounts or penalties for early or late payments.

3. Product and Service Information

This section should provide a clear breakdown of the goods or services provided. It is essential for ensuring that both parties are aligned on what has been delivered or sold.

- Item Description: A clear and detailed description of the products or services, including any necessary codes, models, or specifications.

- Quantity and Unit Price: The number of items or hours sold, along with the price per unit.

- Total Price: The extended price, calculated by multiplying quantity by unit price.

4. Additional Charges and Taxes

Most transactions include additional charges such as taxes, shipping fees, or handling costs. These should be clearly outlined to avoid confusion about the final amount due.

- Taxes: Sales tax or VAT applied based on the local regulations.

- Shipping Costs: Any fee

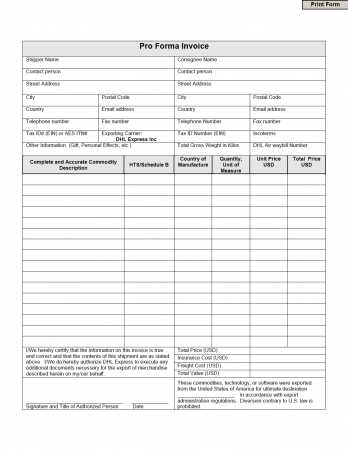

How to Include Shipping Information

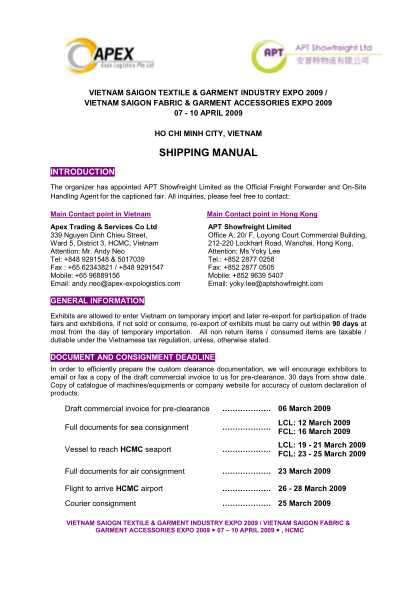

Including detailed shipping information in a financial document is essential to ensure both the sender and recipient are clear about the delivery process. Properly documenting shipping details helps avoid misunderstandings, ensures timely deliveries, and provides both parties with a reference point in case of any issues with the shipment. Below are the key elements to include when adding shipping information to your document.

1. Shipping Method and Carrier

Clearly specify the method used to send the goods, whether it’s ground shipping, express delivery, or freight. Include the name of the carrier or shipping service provider for easy tracking and customer reference.

- Shipping Method: Indicate whether the shipment is standard, expedited, or freight, based on the client’s request or the nature of the goods.

- Carrier Name: List the company or service provider handling the shipment (e.g., UPS, FedEx, DHL, or postal services).

2. Tracking Information

If applicable, always include a tracking number so that both the sender and the recipient can monitor the progress of the shipment. This ensures transparency and allows the buyer to track their order in real time.

- Tracking Number: Provide the unique code assigned by the carrier to track the shipment’s status.

- Tracking Link: Some carriers offer a direct link to their website for real-time tracking; including this link makes it easier for your client to check the shipment’s progress.

3. Shipping Date and Estimated Delivery

It’s important to include the exact shipping date, as well as an estimated delivery date to set the right expectations for the buyer. If the shipment is delayed or scheduled for future delivery, provide an updated timeline.

- Shipping Date: The date when the goods were dispatched from your location.

- Estimated Delivery Date: The expected date when the goods should arrive at the recipient’s address, based on the carrier’s delivery schedule.

By including comprehensive shipping information, you create a clear and transparent record of the delivery process. This not only helps build trust with

Why Accurate Product Descriptions Matter

Providing clear and accurate descriptions for the products or services listed in any financial document is crucial for establishing transparency and avoiding misunderstandings. An incorrect or vague product description can lead to confusion, disputes, and delays, all of which can harm both business relationships and financial operations. Ensuring that your descriptions are precise not only helps with customer satisfaction but also contributes to smoother transactions and compliance with legal or industry standards.

1. Reduces the Risk of Disputes

When the description of a product or service is inaccurate or incomplete, it can lead to discrepancies between what the buyer expected and what they received. This can result in claims for returns, refunds, or adjustments, all of which take time and resources to resolve. Clear descriptions minimize these risks by setting the right expectations from the start.

- Precise Specifications: Provide exact details about the product, such as dimensions, weight, color, or material.

- Clear Terms: Outline any conditions or features that may apply, such as warranties, guarantees, or usage restrictions.

2. Enhances Customer Confidence

When customers can easily understand what they are purchasing, it builds trust and ensures they feel confident in their decision. A detailed product description gives potential buyers all the information they need to make an informed choice, increasing the likelihood of a positive transaction.

- Transparency: Offering a detailed, honest description ensures the customer knows exactly what to expect.

- Credibility: Businesses that provide accurate and thorough information are perceived as more professional and reliable.

3. Streamlines Order Fulfillment

Accurate product descriptions help streamline the fulfillment process by ensuring that the correct items are picked, packed, and shipped. When the description matches the physical product, there is less chance of errors in inventory management and shipping, leading to faster processing and fewer returns.

- Improved Inventory Management: Clear product descriptions help with tracking and organizing stock more efficiently.

- Efficient Fulfillment: A well-defined description allows for easier picking and packing in warehouses, speeding up the shipping process.

Ultimately, accurate product descriptions are a fundamental aspect of any successful transaction. They ensure both the buyer and seller are aligned, reduce the potential for issues, and foster a positive experience for all parties involved.

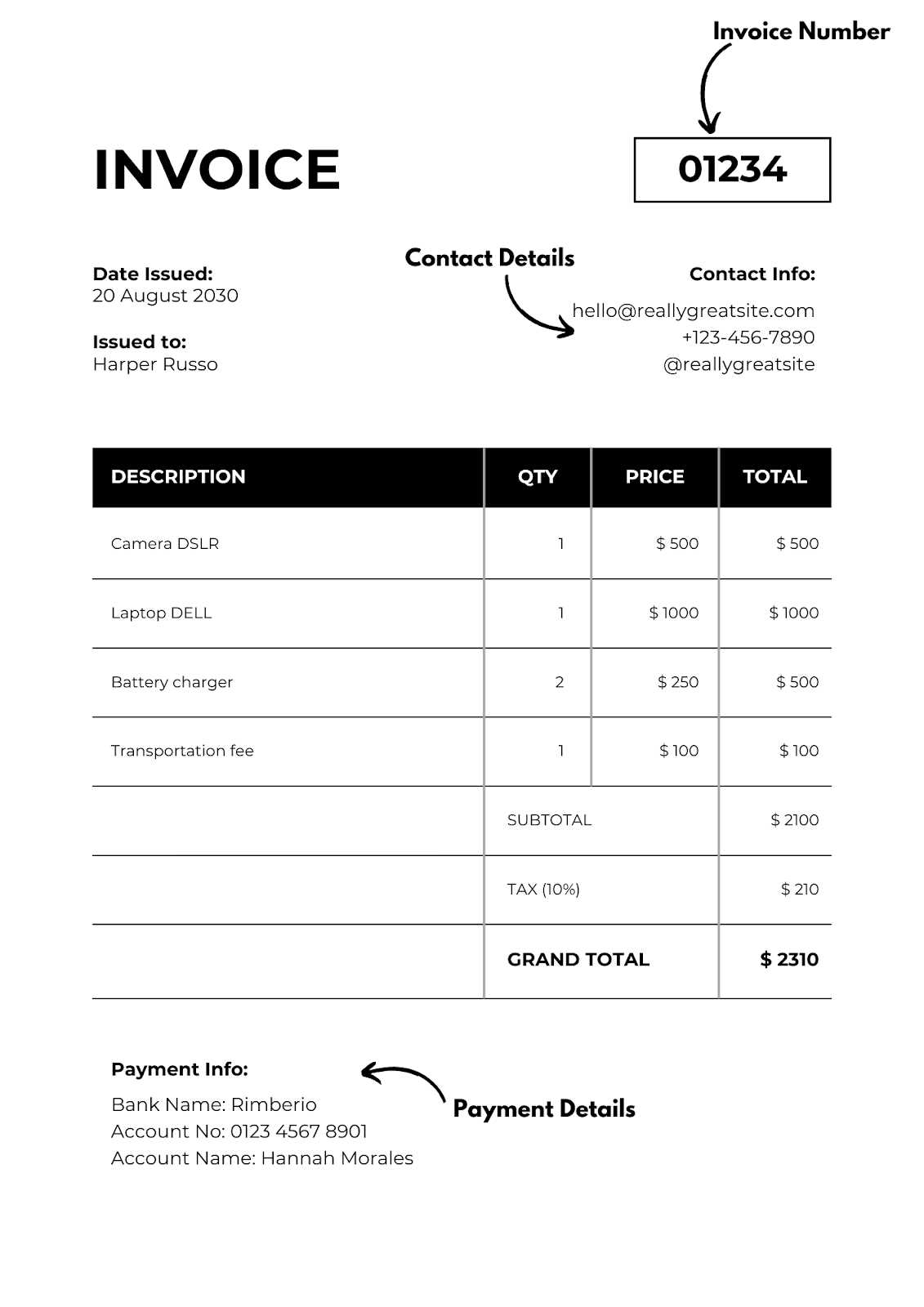

Tips for Proper Document Numbering

Proper numbering of financial documents is essential for maintaining organized records and ensuring smooth administrative processes. An effective numbering system helps both the business and the client track transactions easily, avoid confusion, and comply with tax or legal requirements. Below are some useful tips for setting up and managing a clear and consistent numbering system.

1. Use Sequential Numbers

One of the most important aspects of a numbering system is consistency. Assigning unique, sequential numbers to each document ensures that they are easily traceable and helps avoid duplication. This can be as simple as starting with “1” and continuing numerically as new records are created.

2. Include a Year or Date Code

Incorporating the year or date into the document number helps organize records chronologically. This approach can simplify sorting and searching for specific documents over time. For example, using a format like “2024-001” can instantly indicate the year and the order of the document within that year.

3. Use Prefixes or Suffixes for Categorization

For businesses dealing with multiple types of transactions, adding a prefix or suffix to the document number can help categorize them. For example, “S-100” could indicate a sale, while “R-100” might indicate a return. This way, you can quickly identify the type of document without opening it.

4. Avoid Gaps in Numbering

It’s important to avoid skipping numbers or leaving gaps in your numbering sequence. This practice can create confusion and make it difficult to keep accurate records. If a document is voided or canceled, make a note in your records and move on to the next available number.

5. Keep It Simple and Scalable

While creativity in numbering can be useful, it’s important to keep the system simple and scalable. Choose a format that can accommodate an increasing number of transactions without becoming overly complex. The simpler the structure, the easier it will be to maintain as your business grows.

6. Implement a Digital Tracking System

If possible, using accounting or invoicing software can automatically assign numbers to each document. This minimizes human error and ensures that numbers are generated sequentially and consistently. Many software systems also allow for easy search and retrieval of past records.

By following these guidelines, businesses can ensure that their financial documentation is well-organized, easy to track, and free of errors, ultimately leading to smoother operations and better customer relationships.

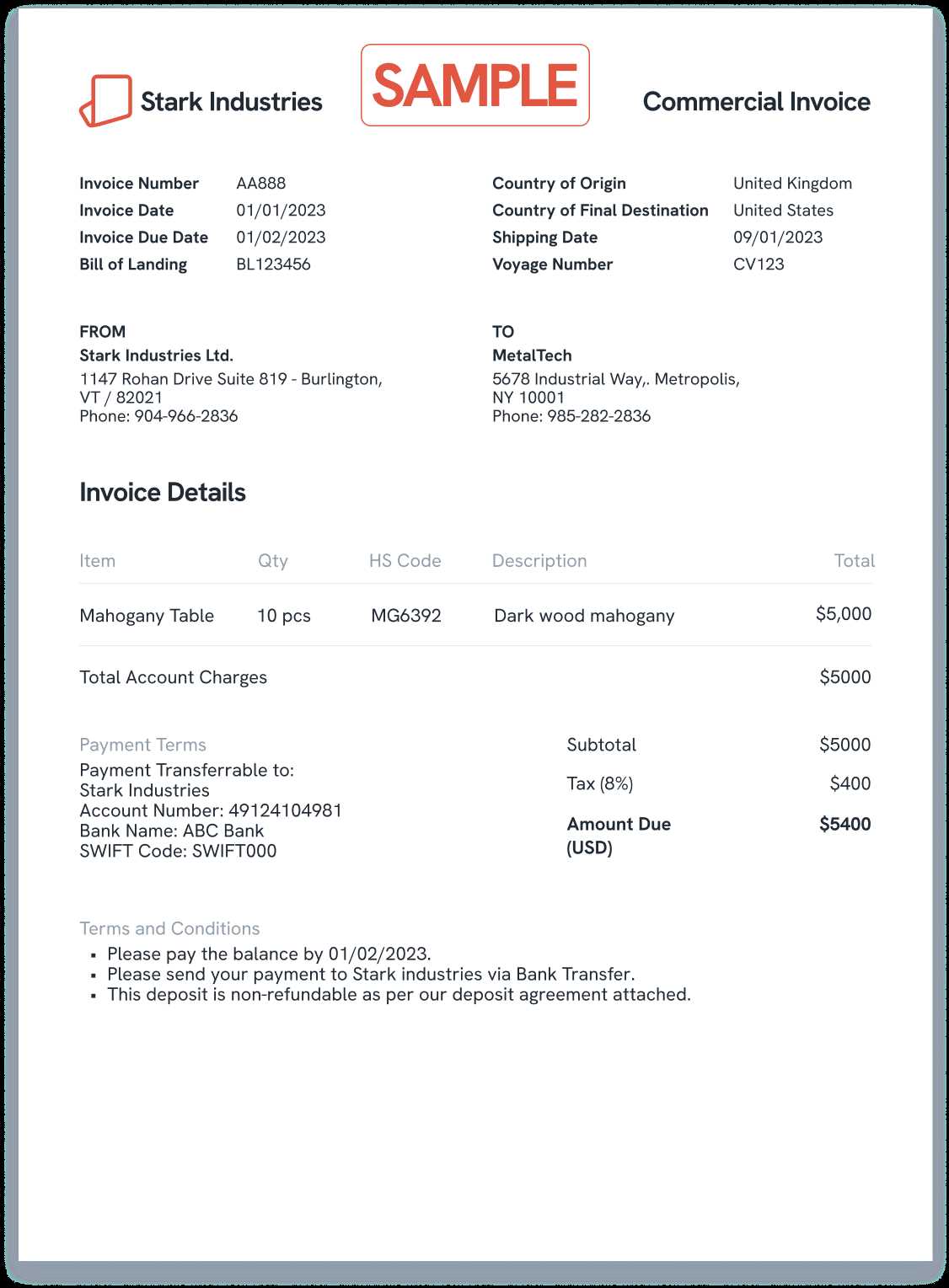

How to Calculate Total Costs on a Billing Document

Accurately calculating the total cost for a transaction is crucial for both businesses and clients. This total amount typically includes the cost of the goods or services provided, as well as any additional fees such as taxes, shipping, and discounts. By following a clear and methodical approach, you can ensure that all costs are correctly calculated and transparent for both parties.

1. Calculate the Subtotal

The subtotal is the sum of the cost of all the goods or services listed in the document before any additional charges or discounts are applied. To calculate the subtotal:

- Multiply the quantity of each item by its unit price.

- Sum the extended prices for all items or services.

For example, if you sold 5 items at $20 each, the subtotal would be 5 * 20 = $100.

2. Add Taxes and Other Fees

Once the subtotal is calculated, any applicable taxes or additional fees need to be added to the total amount. This can include sales tax, VAT, shipping, handling, and any other service charges. Make sure to calculate these based on the correct rates or amounts for your location and business terms.

- Sales Tax or VAT: Multiply the subtotal by the appropriate tax rate. For example, if the tax rate is 8%, you would calculate 100 * 0.08 = $8 in taxes.

- Shipping Charges: Add any shipping or delivery fees. For example, if the shipping cost is $10, this amount would be added directly to the total.

- Other Fees: Include any additional charges, such as handling, insurance, or packaging, if applicable.

3. Apply Discounts (if any)

If a discount is offered (e.g., for early payment, bulk purchase, or promotions), subtract this amount from the subtotal or total before taxes. Ensure that the discount is applied correctly–whether it’s a percentage of the subtotal or a fixed amount.

- Percentage Discount: For example, a 10% discount on a $100 subtotal would be 100 * 0.10 = $10 off.

- Fixed Discount: If the discount is a fixed amount, simply subtract it from the subtotal after taxes have been added.

4. Calculate the Final Total

Finally, to calculate the final total, add up the subtotal, taxes, shipping, and any other fees, and then subtract the discount (if any). This will give you the total amount due.

- Example Calculation:

Subtotal: $100

Sales Tax (8%): $8

Shipping: $10

Discount (10%

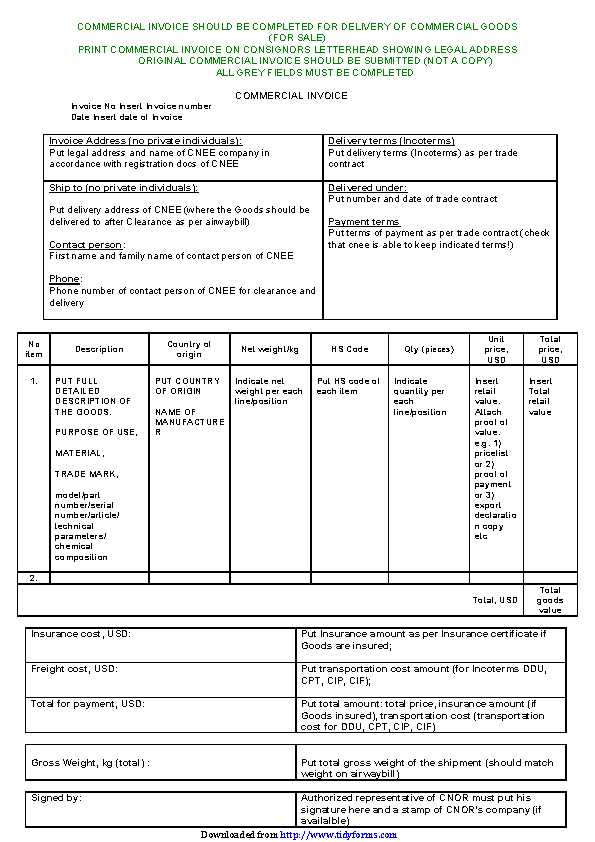

Using a Template for International Billing Documents

When conducting business across borders, it’s essential to use standardized formats to ensure clarity and compliance with international laws. A structured format for your financial documents can help streamline the process and ensure that both parties understand the terms of the transaction. Whether you’re selling goods or providing services to clients overseas, a well-organized document can facilitate smooth and efficient communication, reduce errors, and minimize misunderstandings.

1. Include Currency and Exchange Rates

For international transactions, clearly stating the currency being used is crucial. Many businesses use templates to easily incorporate the correct currency symbol and exchange rate for the specific region. This eliminates any ambiguity regarding the cost and payment requirements for both parties.

- Currency Symbol: Ensure the correct currency is specified (e.g., USD, EUR, GBP). For added clarity, the full name of the currency should also be listed.

- Exchange Rate: If the transaction involves currency conversion, make sure to include the applicable exchange rate used for the conversion on the date of the transaction. This helps prevent confusion regarding the final amount owed.

2. Account for International Shipping and Taxes

International transactions often involve additional charges, such as higher shipping fees or customs duties. A well-structured document can automatically calculate these additional costs, making it easier to see a clear breakdown of the total amount due.

- Shipping Costs: Include any international shipping fees, which can vary greatly depending on the destination and method of delivery.

- Customs and Import Duties: Some countries require import taxes or customs duties. Be sure to outline these additional costs, which can be handled by either the seller or the buyer depending on the agreement.

Using a structured format for international transactions not only ensures that all the necessary details are included, but it also helps maintain consistency in your accounting and record-keeping processes. By using a template, businesses can avoid overlooking important information, thus reducing the risk of errors and delays in cross-border trade.

Invoice Formats for Different Industries

Each industry has its own unique needs when it comes to documenting transactions. Whether you are in construction, retail, consulting, or hospitality, the way you structure your financial documents can vary significantly to reflect the specific requirements of your business. Customizing your documents based on industry standards not only ensures compliance but also helps create a professional image that your clients will appreciate. Below are some examples of how invoicing structures differ across various sectors.

1. Retail and E-commerce

In retail and e-commerce, the focus is often on fast transactions, clear pricing, and quick payment processing. These invoices are typically straightforward, listing products or services, their prices, and any applicable taxes or shipping fees.

- Product Descriptions: A brief list of items purchased with clear quantities and prices.

- Shipping Information: Delivery methods, costs, and expected delivery dates.

- Discounts and Promotions: Any applicable discounts should be clearly outlined, often as a line item.

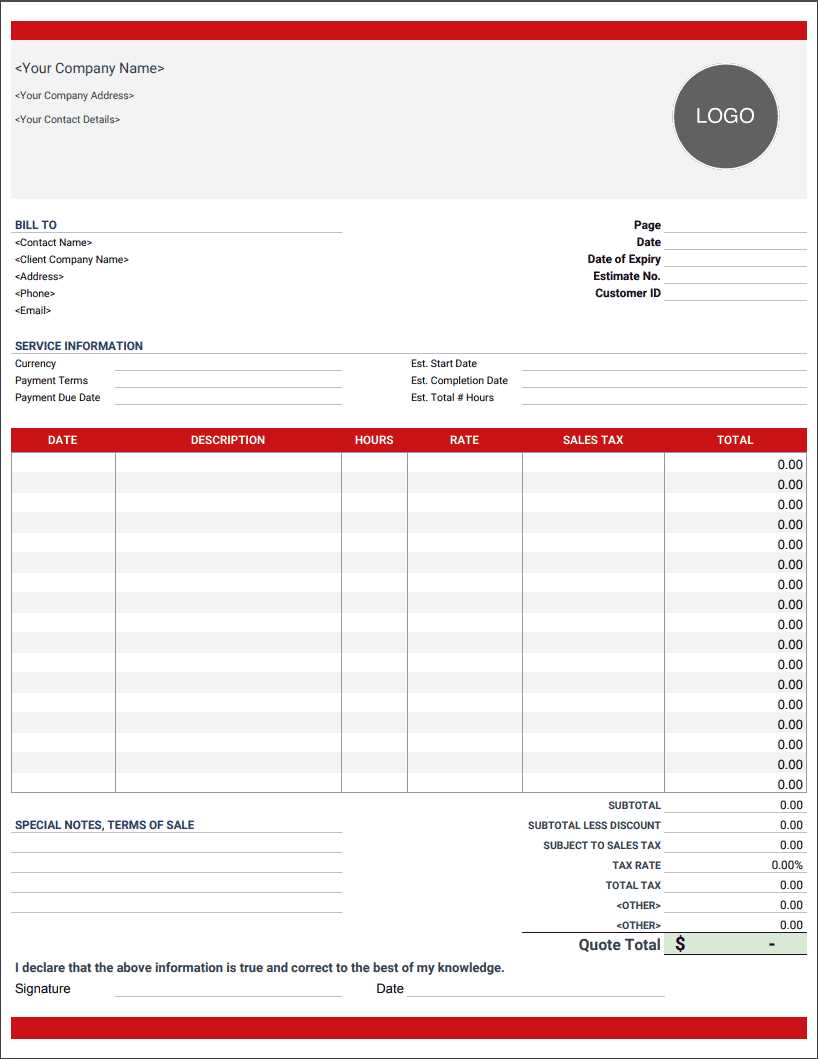

2. Consulting and Professional Services

For consultants and service providers, the focus is on labor hours, project scope, and hourly rates. These documents usually include detailed descriptions of the services provided and may involve longer payment terms depending on the agreement.

- Hourly Rates or Project Fees: Clearly state the rates for services rendered or a flat fee for the entire project.

- Time Tracking: Include the total number of hours worked or milestones achieved during the project.

- Terms and Conditions: Payment due dates, late fees, and any specific terms for services rendered.

3. Construction and Manufacturing

In industries like construction or manufacturing, invoices often involve larger transactions and detailed descriptions of materials, labor costs, and project stages. These documents may also include terms related to construction codes, permits, and other regulatory details.

- Material and Labor Costs: Detailed lists of all materials, equipment, and

Common Mistakes in Billing Documents

Creating accurate and clear billing documents is essential for maintaining smooth financial transactions. However, even experienced businesses can make mistakes when preparing these documents. These errors can lead to delays in payment, confusion with clients, and potential legal issues. Below are some common mistakes that businesses should be mindful of when preparing billing statements and how to avoid them.

1. Incorrect or Missing Information

One of the most frequent errors is failing to include all the necessary details or entering incorrect information. Missing or inaccurate data can cause confusion and delay payments. It’s important to double-check all fields to ensure that everything is accurate.

- Client Details: Ensure the recipient’s name, address, and contact information are correct.

- Business Information: Verify your own business name, address, tax ID, and other relevant details are included correctly.

- Transaction Dates: Always specify the correct issue and due dates for clarity.

2. Not Including Payment Terms

Payment terms define when and how you expect to be paid. Failing to clearly state payment terms can lead to misunderstandings and late payments.

- Due Date: Specify when the payment is due, whether it’s immediately or within a certain period, such as 30 days.

- Late Fees: If you charge late fees, ensure they are clearly outlined in the document.

- Accepted Payment Methods: Indicate the payment methods you accept (bank transfer, credit card, etc.).

3. Failing to Include a Detailed Breakdown

Invoices should clearly outline what the client is being charged for. A vague or unclear breakdown can lead to disputes and delays in processing payments.

- Itemized List: List each product or service with its corresponding price, quantity, and description.

- Additional Costs: Don’t forget to include shipping, taxes, or other fees as separate line items.

- Discounts: If applicable, make sure discounts or adjustments are clearly noted, along with the amount deducted.

4. Miscalculations and Arithmetic Errors

Simple arithmetic mistakes, like incorrect t

How to Avoid Billing Errors

Billing errors can create confusion, delay payments, and strain relationships with clients. To maintain smooth financial operations, it’s crucial to ensure accuracy and consistency when preparing your financial documents. Adopting systematic approaches and paying attention to detail can help reduce the risk of mistakes. Below are key practices to help you avoid common errors and improve the overall billing process.

1. Double-Check Client Information

Incorrect client details are a common cause of errors in billing documents. Always verify that the recipient’s name, address, and contact information are accurate. Missing or incorrect contact details can delay delivery or cause the payment to be processed incorrectly.

- Check for Typos: Ensure there are no spelling mistakes in the client’s name or address.

- Use Up-to-Date Information: Always use the most current contact and shipping details provided by the client.

2. Standardize Your Document Format

Consistency is key when generating financial documents. Using a standardized structure helps ensure that no critical information is overlooked, and it also makes it easier to track payments. Whether you use a manual system or accounting software, ensure that each document follows the same layout and includes the same details.

- Consistent Section Layout: Include the same key sections (e.g., client details, item descriptions, totals) in each document.

- Numbering System: Use a sequential numbering system to prevent duplicate or missing document numbers.

3. Verify Product or Service Details

Ensure that the description, quantity, and price of the products or services listed are accurate. Misunderstandings in product details or pricing can lead to disputes and delays in payment.

- Detailed Descriptions: Include clear, specific details for each item or service.

- Correct Pricing: Double-check that the unit prices and totals match the agreed-upon amounts.

4. Double-Check Tax Rates and Shipping Fees

Incorrect tax calculations or missed shipping charges can lead to discrepancies and unpaid balances. Always ensure that the correct rates are applied to the document, and that any additional fees are clearly listed.

- Accurate Tax Rates: Use the appropriate tax rates for the region or country in which the transaction is taking place.

- Clear Shipping Costs: If applicable, clearly break down the cost of shipping and any additional fees.

5. Set Clear Payment Terms

Ambiguous payment t

Free vs Paid Billing Document Formats

When it comes to creating billing statements, businesses often face the decision of choosing between free or paid document formats. Each option comes with its own set of advantages and limitations. The right choice depends on factors such as business size, frequency of transactions, and the complexity of the services or products offered. Below, we compare free and paid options to help you make an informed decision based on your needs.

Free Document Formats

Free billing document formats are often a go-to for small businesses, startups, or individuals just beginning to manage their financial transactions. These options are easy to access and can be useful for those who need a basic structure without added features. However, they may come with limitations in customization and advanced functionalities.

- Pros:

- Cost-effective: No initial investment required.

- Easy to use: Most free formats are simple and easy to fill out, requiring little to no experience.

- Available in multiple formats: Many free options are available in formats such as PDF, Word, or Excel.

- Cons:

- Limited customization: Free templates may not allow for much design flexibility or tailored features.

- Lack of automation: Most free versions do not integrate with payment processing or accounting systems.

- Basic features: Some free formats may lack essential features such as tax calculations or multi-currency support.

Paid Document Formats

Paid billing document formats often offer more advanced features and greater flexibility. These solutions are ideal for businesses with higher transaction volumes, complex pricing structures, or those seeking professional-grade documents. While they come at a cost, they may offer significant time-saving benefits in the long run.

- Pros:

- Customization options: Paid formats offer a higher degree of flexibility in terms of design, layout, and branding.

- Automation and integration: These options often come with built-in features for automatic tax calculations, discounting, and direct integration with accounting or payment systems.

- Advanced features: More sophisticated features such as multi-currency support, recurring billing, and advanced reporting are typically included.

- Cons:

- Cost: The most significant drawback is the upfront cost or ongoing subscription fees.

Best Tools for Customizing Billing Documents

When it comes to creating professional billing documents that reflect your brand and meet your specific business needs, customization is key. While there are many options available for designing these documents, the right tools can save you time and ensure accuracy. Below are some of the best tools that allow businesses to personalize their financial statements, making them both functional and aligned with their brand identity.

1. Microsoft Excel

Microsoft Excel is one of the most widely used tools for creating customizable billing documents. With its advanced calculation features and ability to design personalized layouts, Excel offers great flexibility for businesses of all sizes.

- Customization: Easily design your own layout and structure with tables, columns, and colors.

- Automation: Use built-in formulas to automatically calculate totals, taxes, and discounts.

- Templates: Excel offers a variety of pre-built templates that you can modify to suit your needs.

2. Google Sheets

Google Sheets is a free, cloud-based alternative to Excel that offers many of the same features. It’s ideal for businesses looking for a cost-effective and collaborative solution to creating customizable billing documents.

- Cloud Access: Share and edit documents in real-time with your team.

- Easy Integration: Easily integrate with other Google tools and external apps like payment processors.

- Templates: Google Sheets offers a variety of free templates that can be customized to your preferences.

3. QuickBooks

QuickBooks is a popular accounting software that includes comprehensive tools for customizing billing documents. It’s a great choice for businesses that need both financial management and professional-looking statements.

- Professional Templates: Choose from a wide selection of customizable billing formats that can include company logos, payment terms, and detailed item lists.

- Automation: Automatically calculate taxes, shipping, and discounts for seamless billing.

- Integration: Syncs easily with accounting and inventory software for accurate, real-time data.

4. Zoho Invoice

Zoho Invoice is an online invoicing software designed for small businesses and freelancers. It allows you to easily customize your documents, track payments, and even manage recurring transactions.

- Customization: Fully customize your layout, add logos, and use cu

Ensuring Compliance with Billing Regulations

When managing financial transactions, it’s essential for businesses to adhere to the various legal and regulatory requirements that govern billing documents. Compliance helps to avoid penalties, disputes, and ensures smooth business operations. Different regions, industries, and even specific clients may have unique rules that must be followed to ensure your documents meet all necessary standards. Here are some key considerations to keep in mind when creating legally compliant financial documents.

1. Know the Local Tax Regulations

Tax regulations differ by country and sometimes even by region. It is critical to understand the local tax laws, including which taxes need to be applied, the rates, and any exemptions or deductions that may apply to your transactions. Failing to apply the correct tax rates or not including tax-related information in the billing statement can result in non-compliance.

- VAT/GST: In many countries, businesses must charge VAT (Value-Added Tax) or GST (Goods and Services Tax). Ensure these taxes are correctly calculated and displayed.

- Tax Identification Number: In some regions, businesses are required to list their tax ID number on each transaction document.

- Exemption Clauses: Some transactions may be tax-exempt. Make sure to document these exemptions correctly.

2. Include Mandatory Information

Different jurisdictions have specific information that must be included on a business transaction document to make it legally binding. While these requirements may vary, here are some common items you should include:

Information Required Description Business Information Full business name, address, and contact details. Recipient Details Full name, address, and contact information of the customer or client. Unique Reference Number A unique reference or serial number for each document to avoid confusion. Date of Issue The date the document is issued to the client. Payment Terms Clearly state the due date and any penalties for late payments. Tax Details Include any relevant tax information, such as VAT or sales tax rates.

- Cost: The most significant drawback is the upfront cost or ongoing subscription fees.