Car Purchase Invoice Template for Simple and Professional Transactions

When engaging in the exchange of a vehicle, having the right documentation in place is crucial for ensuring a smooth and legally compliant process. This document serves as a formal record of the transaction, protecting both the buyer and the seller from future disputes or misunderstandings.

The key to a successful agreement lies in creating an accurate, clear, and professional record of the deal. By customizing this form to meet specific needs, all the important details can be captured and organized effectively, making the entire process more streamlined and reliable.

Understanding the basic components of such a document is essential. It helps prevent errors, ensures transparency, and provides a solid foundation for any future transactions related to the vehicle. Whether you’re a dealer or a private seller, mastering this process will help establish trust and prevent complications down the road.

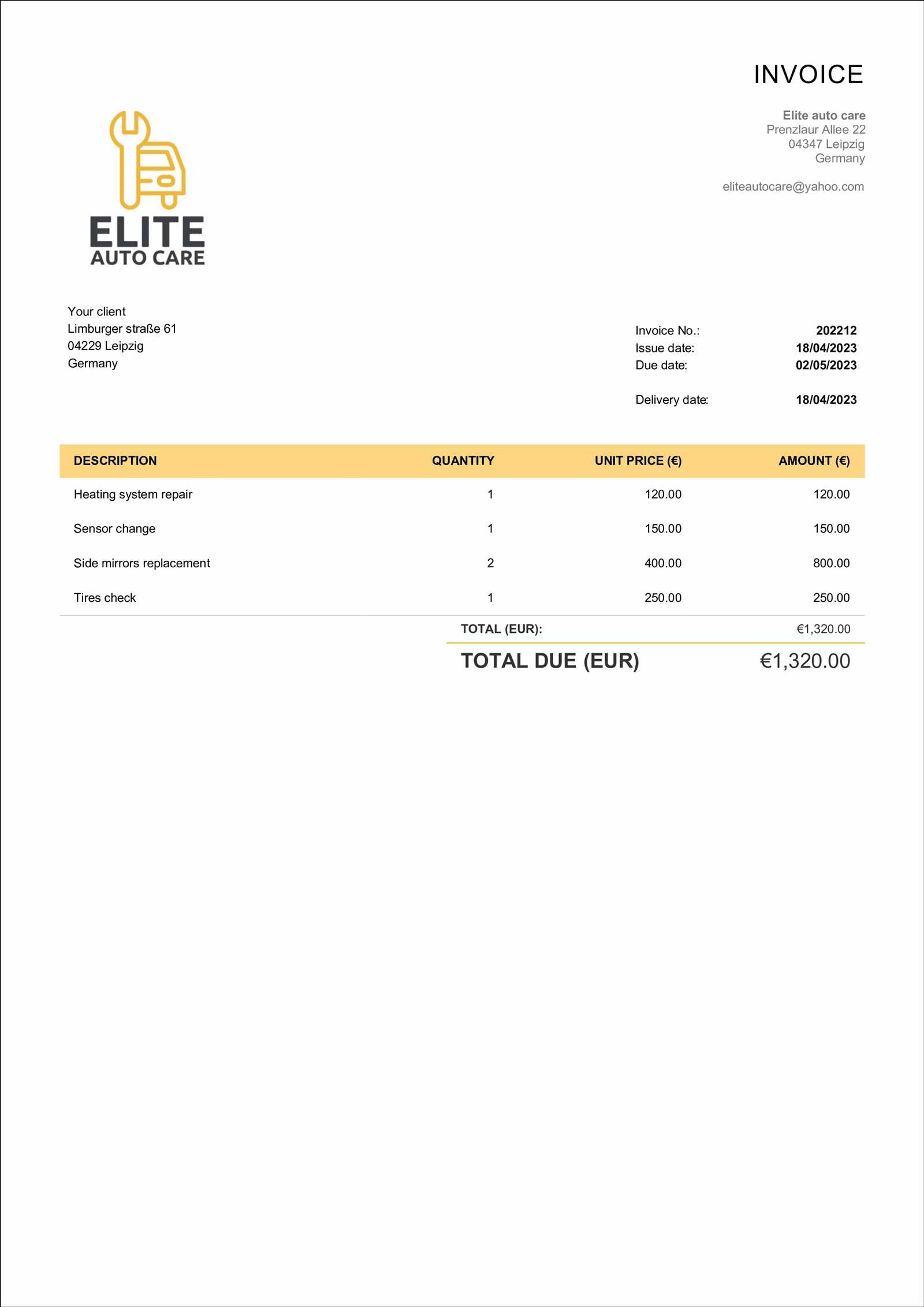

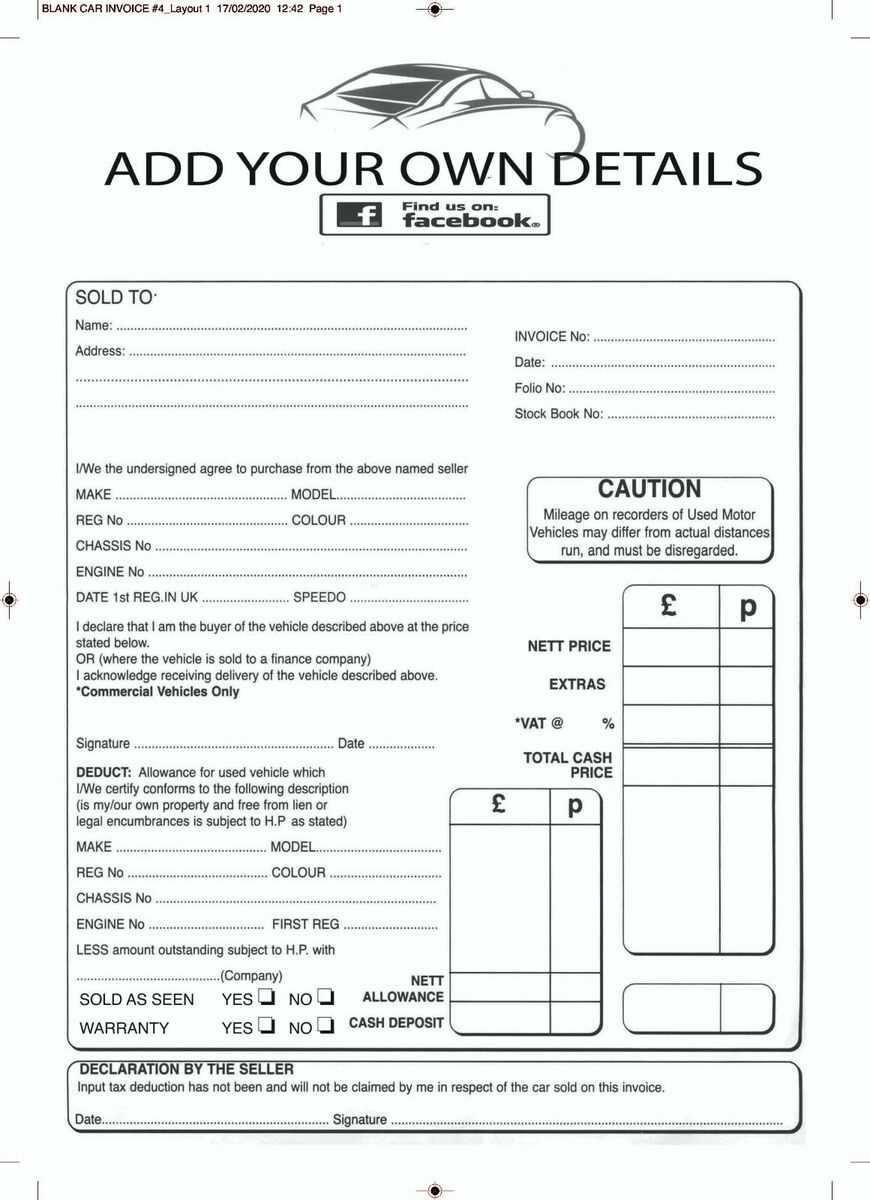

Car Purchase Invoice Template Overview

In any vehicle transaction, documenting the agreement is essential for clarity and legal protection. A well-constructed document not only records the exchange but also ensures both parties understand the terms and conditions of the deal. This record serves as an official proof of the exchange and outlines the specific details of the transaction.

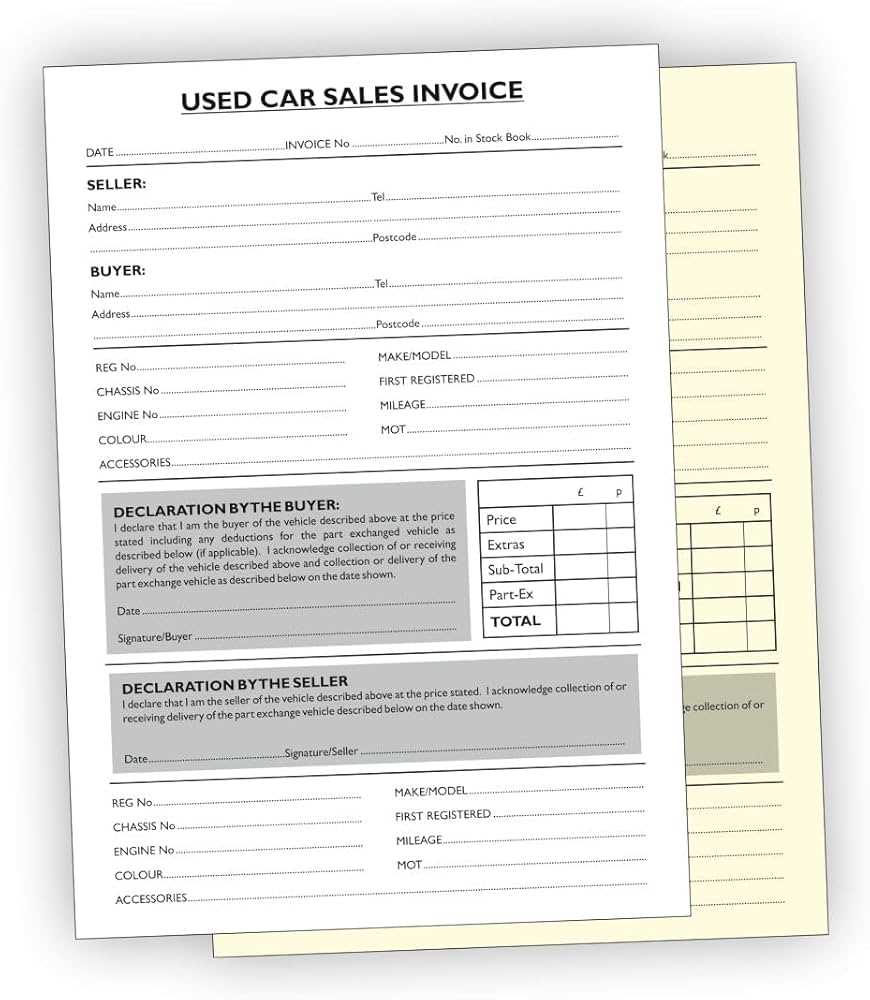

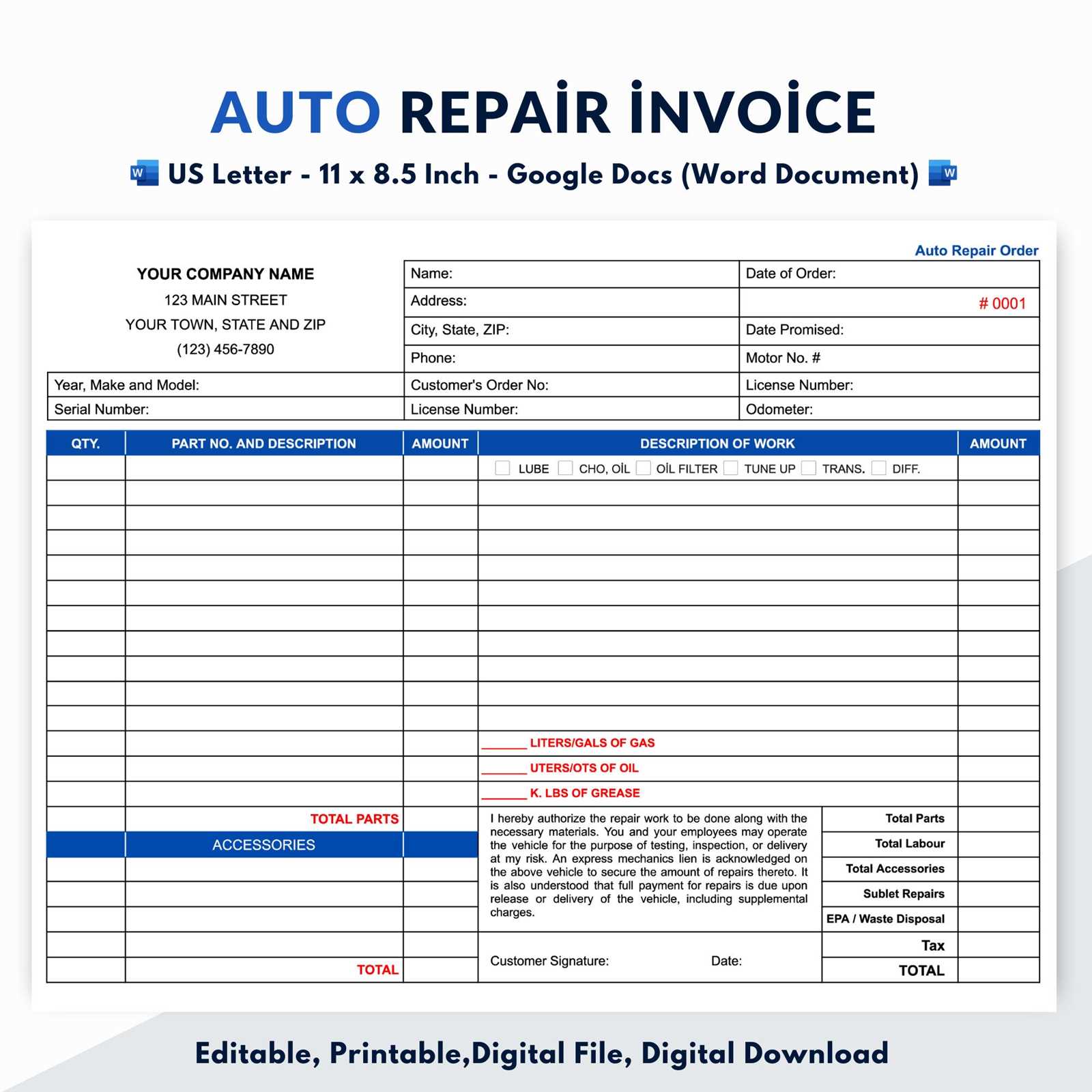

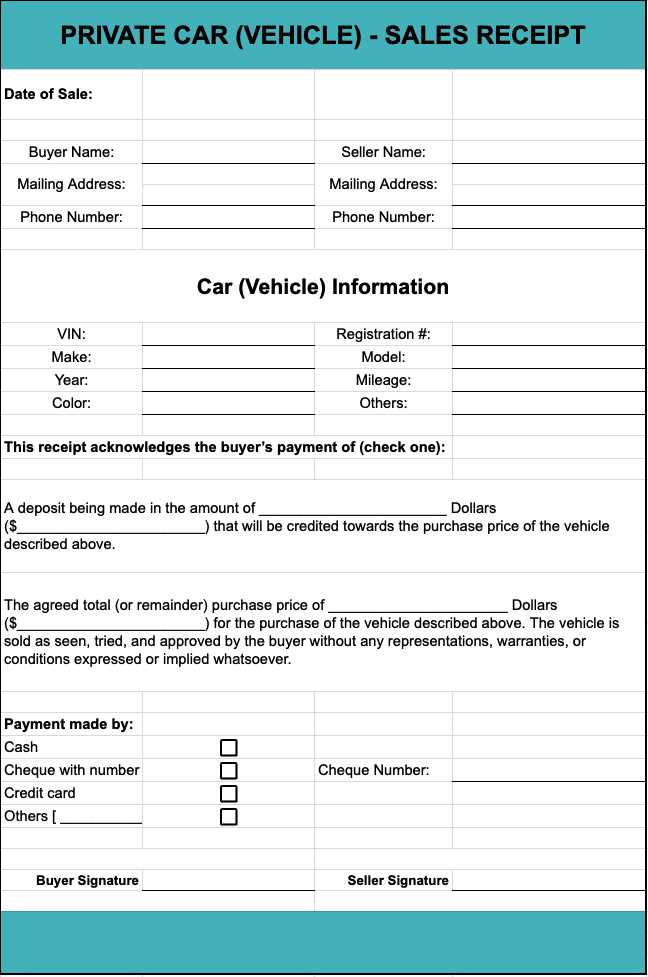

Such a document typically includes several key elements that are important for maintaining transparency. These elements help to prevent misunderstandings and serve as a reference point in case any disputes arise later. Below are the main sections commonly found in this type of paperwork:

- Seller Information – The name, address, and contact details of the individual or business selling the vehicle.

- Buyer Information – The name, address, and contact details of the individual or business purchasing the vehicle.

- Vehicle Details – Important specifications such as the make, model, year, VIN (Vehicle Identification Number), and odometer reading.

- Transaction Amount – The total cost agreed upon for the exchange, including any applicable taxes or additional fees.

- Payment Terms – Information on the method of payment, payment schedule, or deposit amount if relevant.

- Signatures – Both parties must sign to confirm the details and validity of the agreement.

Creating a clear and thorough record of the transaction ensures that both the buyer and seller have a mutual understanding of the terms. By using a professional document that includes all the necessary details, both parties can avoid confusion and create a lasting, trustworthy transaction history.

Why You Need a Purchase Invoice

Having a well-documented record of any vehicle transaction is essential for both legal and practical reasons. This formal document ensures that the exchange is clear, transparent, and recognized by authorities, helping to avoid potential issues down the line. Without it, disputes may arise regarding the terms of the agreement, payment details, or ownership transfer.

Legal Protection for Both Parties

One of the primary reasons for creating this record is to provide legal protection. In case of a dispute over the vehicle’s condition, ownership, or payment terms, having a properly documented transaction can serve as proof. It can also be used to resolve conflicts in a court of law, should the need arise. Additionally, if the buyer needs to register the vehicle or transfer ownership, having the transaction documented is often required by local authorities.

Clarity and Transparency in Transactions

By providing all the details of the transaction in writing, both the buyer and seller have a clear understanding of the agreement. This includes the vehicle’s condition, the agreed-upon price, and the payment method. Such transparency reduces the chances of misunderstandings and ensures that both parties are on the same page regarding the deal’s terms.

Essential Elements of an Invoice

For any vehicle transaction, it is crucial to include all relevant details in the documentation to ensure a smooth process. A well-structured document serves as a complete record of the exchange, outlining the key aspects of the deal. This ensures both parties are clear on their responsibilities and the terms of the transaction.

The following elements are fundamental to creating a comprehensive record of the sale:

- Seller Information: This should include the name, address, and contact details of the individual or business facilitating the sale.

- Buyer Information: Similarly, the buyer’s full details, including name, address, and contact information, must be recorded.

- Vehicle Specifications: The vehicle’s make, model, year, VIN (Vehicle Identification Number), and mileage are essential for identifying the item being exchanged.

- Transaction Amount: The agreed-upon price for the vehicle, including any taxes or additional fees, should be clearly stated.

- Payment Details: This section specifies the method of payment, whether it’s a lump sum, installment plan, or other arrangement.

- Signatures: The document must include the signatures of both parties, confirming that they agree to the terms outlined.

Incorporating these key details ensures that the exchange is documented comprehensively. This clarity helps prevent confusion or disputes after the transaction has been completed, making it easier to resolve any issues that may arise in the future.

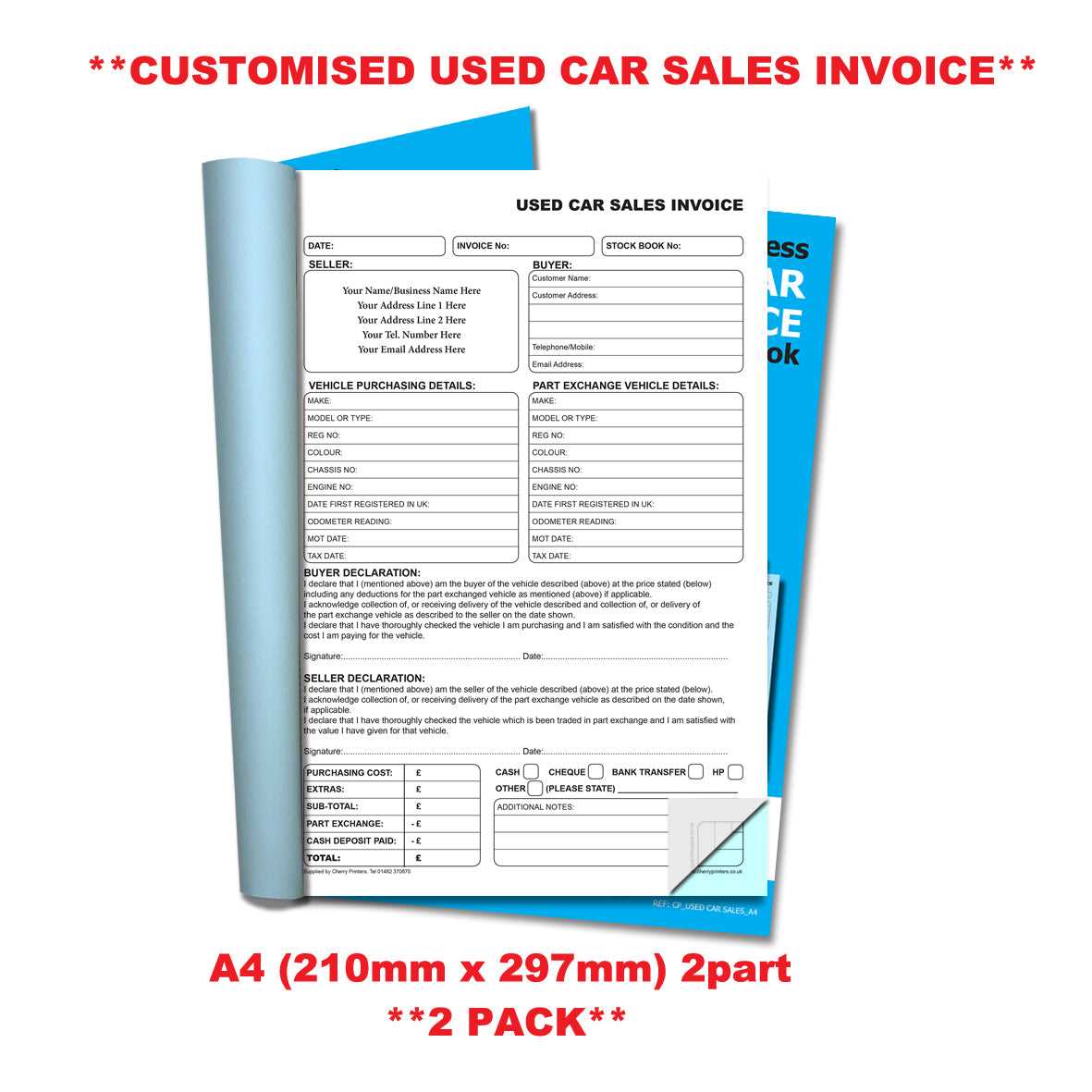

How to Create an Invoice Template

Designing a professional document to record the details of a vehicle transaction is an important step for both buyers and sellers. A custom form ensures that all necessary information is captured in a clear and organized manner. With the right structure, you can create a document that serves as a reliable reference for future transactions, minimizing the risk of misunderstandings.

Step-by-Step Guide to Structuring the Document

The first step in creating this document is to organize the layout to accommodate all essential information. A clean structure ensures that each detail has its place, making it easy for both parties to fill in the required fields. Below is an example of how the layout can be divided:

| Section | Details to Include |

|---|---|

| Header | Title of the document, such as “Vehicle Transaction Record”, along with your business name and logo if applicable. |

| Seller Details | Full name, address, and contact details of the seller. |

| Buyer Details | Full name, address, and contact details of the buyer. |

| Vehicle Details | Make, model, VIN, year, and mileage of the vehicle. |

| Transaction Details | Price agreed, any taxes or fees, and payment terms (full payment or installment). |

| Signatures | Space for both parties to sign, confirming agreement. |

Customizing the Layout for Different Needs

Once the basic structure is set, you can adjust the template to fit specific needs. For example, you may need to add additional sections for warranty details, delivery terms, or payment schedules depending on the nature of the transaction. The ability to personalize the form ensures that it meets the requirements of both the buyer and seller.

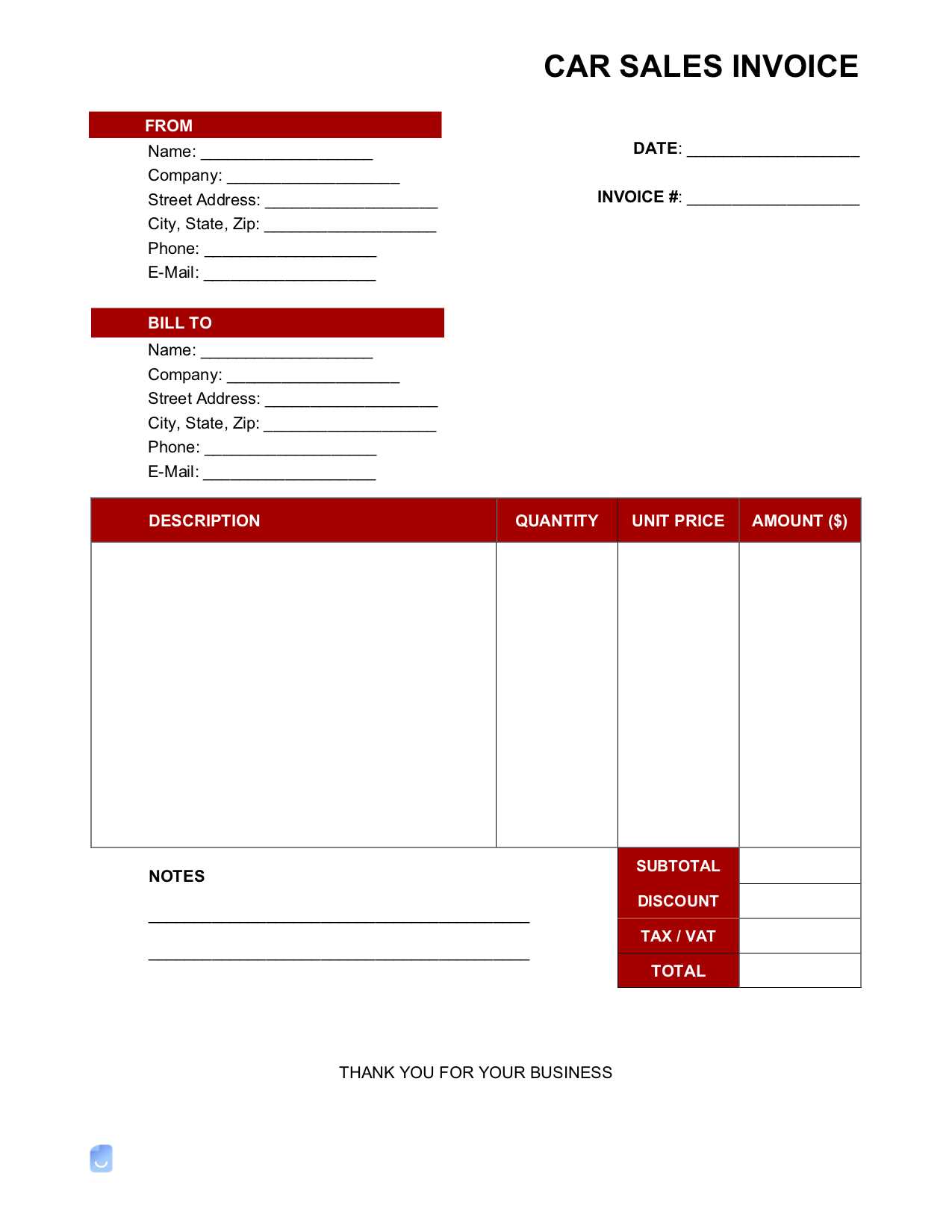

Customizing Your Invoice Template

Personalizing your document for vehicle transactions ensures that it reflects the unique aspects of each deal while maintaining clarity and professionalism. Customization allows you to tailor the structure to include specific details relevant to the sale, which can vary depending on whether it’s a private sale, dealership transaction, or other special conditions.

To create a truly useful and functional record, consider the following options for customization:

- Branding: Include your business logo, name, and contact information to give the document a professional appearance and make it easily identifiable.

- Transaction Type: Adjust sections to reflect the nature of the transaction, such as adding installment payment plans or discount terms if applicable.

- Legal Clauses: Add terms that protect both parties, such as warranty details, return policies, or “as-is” statements if the vehicle is sold without a warranty.

- Additional Costs: If the transaction involves fees beyond the basic price, such as taxes, registration costs, or delivery charges, ensure these are clearly outlined in separate sections.

By making these adjustments, you ensure that the document meets both your legal and business needs while providing the buyer with all necessary details for future reference. A customized form also helps prevent errors and misunderstandings by accommodating the specific requirements of each transaction.

Free vs Paid Invoice Templates

When creating a formal document to record vehicle transactions, one of the first decisions you’ll need to make is whether to use a free or paid version. Each option has its advantages and disadvantages, depending on your specific needs and the level of professionalism you wish to achieve.

Advantages of Free Options

Free resources are a great starting point, especially for individuals or small businesses looking for a quick and budget-friendly solution. While these documents often provide basic features, they can still be customized to suit your needs. Here are some benefits:

- Cost-effective: Free options are ideal if you have a limited budget or don’t want to invest in additional software or services.

- Easy to Use: Many free forms are simple and straightforward, making them accessible even to those with limited experience in document design.

- Quick Setup: Downloading and filling out a free form can be done in minutes, which is convenient when you need to finalize a transaction quickly.

Benefits of Paid Options

While free templates are often sufficient, paid options offer additional features that can enhance the professionalism and functionality of your document. These paid solutions are generally more versatile and may include advanced customization tools, detailed tracking, and integrations with other business systems. Some advantages include:

- Advanced Features: Paid templates may include automatic calculations for taxes, total amounts, and other fees, reducing the risk of errors.

- Custom Branding: You can fully customize the document to reflect your company’s branding, making it more professional and recognizable.

- Better Support: With paid options, you often receive customer support in case you encounter technical issues or need help with customization.

Ultimately, the choice between free and paid forms depends on your business needs, budget, and how professional you want the document to appear. While free options work for simple transactions, investing in a paid version can save time and ensure that all aspects of the deal are captured accurately.

Common Mistakes in Car Invoices

When creating a formal document to record a vehicle transaction, several errors can arise that may complicate the process or lead to misunderstandings between the buyer and seller. These mistakes often stem from missing or inaccurate information, which can affect the legitimacy of the agreement or cause issues in the future. Recognizing and avoiding these common errors is essential for ensuring a smooth and transparent transaction.

Here are some of the most frequent mistakes that people make when drafting such documents:

- Incorrect Vehicle Details: Failing to include accurate specifications, such as the vehicle’s make, model, year, VIN, and mileage, can lead to confusion. Always double-check this information to ensure it matches the actual vehicle.

- Omitting Payment Terms: Not clearly stating the payment method, installment schedule, or due dates can create misunderstandings. Be specific about how and when payment is expected.

- Missing Signatures: Without both parties’ signatures, the document is not legally binding. Make sure that both the seller and buyer sign the document to validate the transaction.

- Not Including Additional Fees: If the transaction involves taxes, delivery charges, or registration costs, these must be outlined clearly. Omitting such fees can lead to disputes or confusion about the final amount due.

- Ambiguous Terms: Using vague or unclear language in the agreement can create confusion about the terms. Be specific and precise in describing conditions, warranties, or return policies to avoid future disagreements.

Avoiding these common mistakes helps ensure that the document is both legally valid and clear to both parties. By thoroughly reviewing and verifying all details before finalizing the transaction, you can prevent errors that could lead to problems later on.

Legal Requirements for Vehicle Invoices

When completing a transaction involving a vehicle, it is essential that the formal record complies with legal standards. These documents must include specific information to be considered valid, ensuring that both parties are protected under the law. Failing to meet legal requirements can result in complications such as invalid agreements or disputes regarding ownership and payment.

Here are the key legal elements that should be included in any document related to a vehicle sale:

- Accurate Identification: The document must include accurate details about the buyer, seller, and the vehicle being sold. This includes full names, addresses, and the vehicle’s identification number (VIN).

- Clear Terms of Agreement: The terms of the transaction, such as price, payment methods, and delivery conditions, should be clearly outlined to avoid any ambiguity that could lead to legal challenges.

- Signatures: The document must be signed by both parties to indicate agreement to the terms. Without signatures, the agreement may not be legally binding.

- State and Local Requirements: Different jurisdictions may have specific requirements for documenting vehicle transactions. It’s essential to understand and comply with local laws, such as sales tax, title transfer, and registration fees.

- Warranty and Condition Disclosures: If the vehicle is sold as-is or with a warranty, this must be clearly stated in the document. This protects both parties in the event of a dispute over the vehicle’s condition after the sale.

By ensuring that these elements are included, you can safeguard the transaction and ensure that both parties have a clear understanding of their rights and responsibilities. Adhering to these legal requirements minimizes the risk of disputes and ensures the sale is recognized as valid under the law.

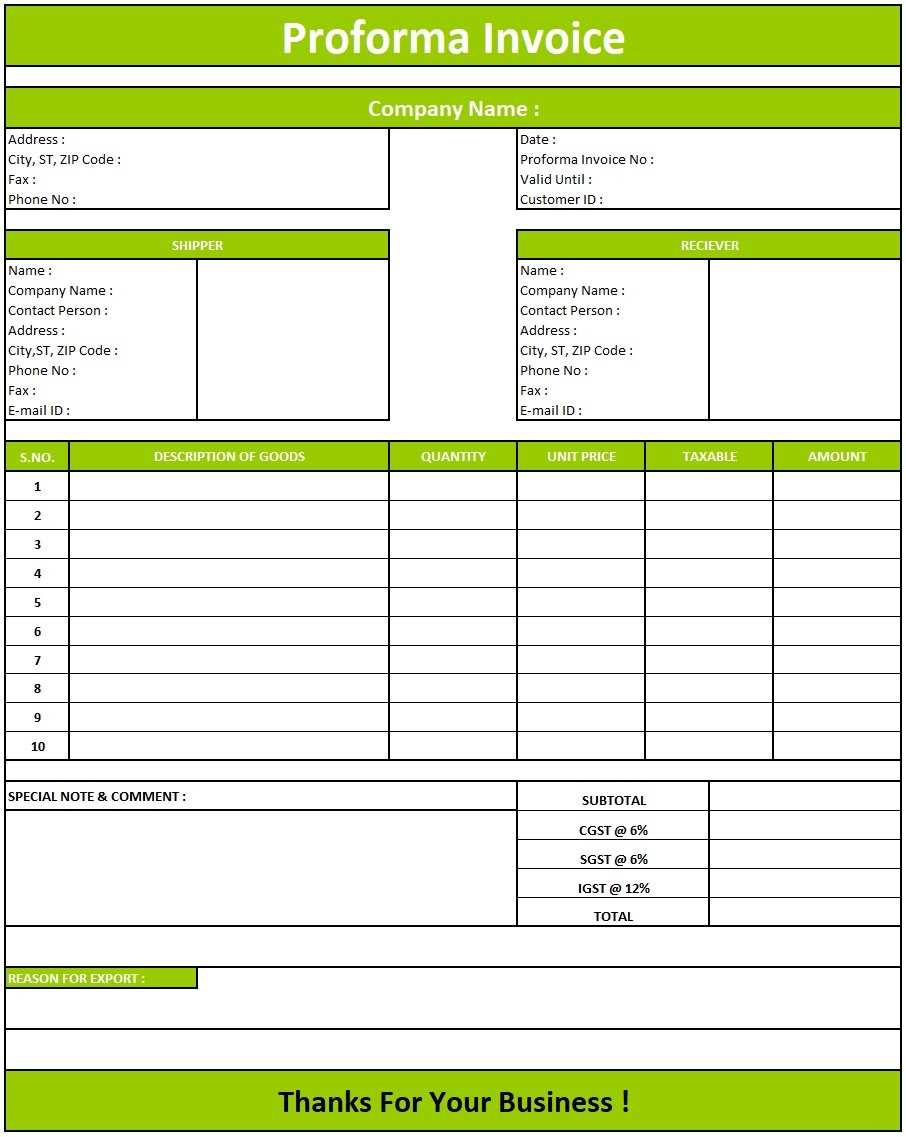

How to Include Sales Tax Details

When finalizing a transaction, it’s crucial to include accurate details about sales tax to ensure compliance with local tax regulations. Including this information not only helps in maintaining transparency but also prevents any legal issues that may arise due to improper documentation of taxes.

Steps to Include Sales Tax

Here’s how you can accurately include tax details in your document:

- Determine the Applicable Tax Rate: Research the appropriate sales tax rate for your region or the location where the transaction takes place. Rates can vary depending on state, county, or city regulations.

- Calculate the Tax Amount: Multiply the agreed transaction amount by the applicable sales tax rate to determine the tax amount. Ensure the calculation is clear and easy to follow.

- Itemize Tax Separately: Clearly list the tax amount as a separate line item, distinct from the total cost of the vehicle or goods involved. This provides transparency and allows both parties to easily see the tax being applied.

- Include Any Exemptions: If certain products or transactions are exempt from tax, make sure to indicate this in the document. Be specific about the reason for exemption, whether it’s based on the buyer’s status or the nature of the sale.

Example of Tax Inclusion

An example of how to structure the tax section might look like this:

| Description | Amount |

|---|---|

| Sale Price | $20,000 |

| Sales Tax (8%) | $1,600 |

| Total Amount Due | $21,600 |

By clearly detailing the sales tax in the document, you avoid confusion and ensure both parties are aware of the financial obligations involved in the transaction.

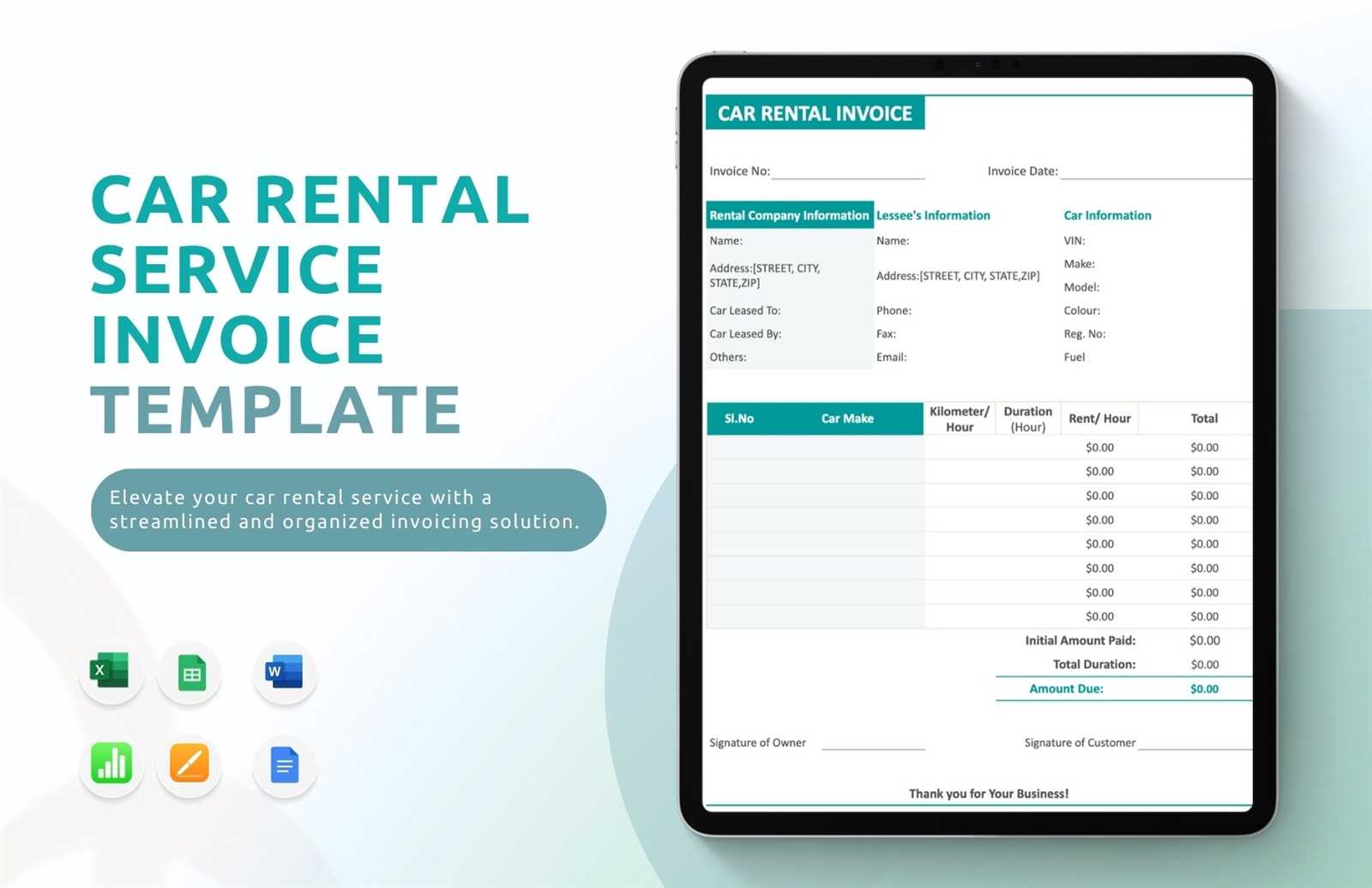

Tracking Payments in the Invoice

Properly documenting and tracking payments is an essential part of any transaction. Accurate records help both parties understand the financial status of the deal, ensuring that payments are made on time and any outstanding balances are clearly communicated. Including a payment tracking section can prevent confusion and disputes during the transaction process.

How to Track Payments

Here are the key steps for properly tracking payments:

- Record Payment Dates: It’s important to note the date on which each payment is received. This provides a clear timeline for both the buyer and seller, showing when partial payments were made or if the final payment has been completed.

- List Payment Methods: Indicate the method used for each payment, whether it’s cash, check, bank transfer, or any other method. This helps verify the source and traceability of the funds.

- Show Remaining Balance: If the full amount is not paid upfront, clearly display any outstanding balance. Indicate how much has been paid and how much remains, along with the due date for any remaining amounts.

- Include Payment Terms: Clearly outline any terms related to payments, such as interest on overdue balances or penalties for late payments. This avoids misunderstandings and clarifies expectations from the beginning.

Example of Payment Tracking Section

An example payment tracking section in the document might look like this:

| Description | Amount | Payment Date | Balance Due |

|---|---|---|---|

| Initial Amount | $15,000 | 01/10/2024 | $0 |

| First Installment | $5,000 | 15/10/2024 | $10,000 |

| Second Installment | $5,000 | 01/11/2024 | $

Invoice Format for Car DealersWhen documenting a sale for a vehicle dealership, the format of the formal document is crucial for maintaining clarity and ensuring compliance with industry standards. A well-structured record not only supports smooth transactions but also safeguards both the seller and the buyer by including all necessary details about the deal. Dealers must ensure that this record is thorough, transparent, and legally binding. Here is a general overview of the key elements that should be included in a well-designed document for dealership transactions:

By adhering to these guidelines and including these essential components, vehicle dealers can create a clear and professional document that protects all parties involved and facilitates a smooth transaction process. Digital vs Printed Car InvoicesWhen it comes to documenting a transaction, choosing between digital and printed records is an important consideration. Both formats offer distinct advantages and may suit different business needs. Understanding the differences between these two options can help businesses make the right choice based on convenience, legal requirements, and efficiency. Here’s a comparison of the two formats: Digital RecordsDigital documents are becoming increasingly popular for businesses due to their convenience and ease of use. Some of the key benefits of using digital records include:

Printed RecordsDespite the rise of digital technology, printed records remain a common choice for many businesses, especially for customers who prefer physical documentation. The advantages of printed documents include:

Ultimately, the decision between digital and printed formats depends on the specific needs of the business and its clients. Many businesses opt to provide both options, offering clients the flexibility to choose based on their preferences and requirements. How to Issue a Car Purchase InvoiceIssuing a formal document for a vehicle transaction is an essential process that helps ensure clarity, accuracy, and legal compliance. This record not only confirms the sale but also provides a reference for both the buyer and the seller. Issuing such a document requires attention to detail and the inclusion of key elements that will be crucial for future reference or legal matters. Follow these steps to properly issue a document for a vehicle transaction:

By following these steps, you can ensure that the transaction is properly documented and both parties are protected under the agreed terms. Always double-check the accuracy of all information to prevent any issues in the future. Handling Refunds and AdjustmentsManaging returns, refunds, and adjustments is a crucial aspect of ensuring customer satisfaction and maintaining clear financial records. Whether it’s a pricing error, change in transaction terms, or a refund due to dissatisfaction, it’s important to handle these situations in a structured and professional manner to maintain trust and transparency with clients. Here are the key steps to manage refunds and adjustments effectively:

By following these steps, businesses can handle adjustments and refunds efficiently while ensuring that all legal and financial obligations are met. Proper documentation and transparent communication are essential to maintaining a smooth process and fostering positive relationships with customers. Invoice Management Tips for SellersEffective management of sales records is essential for any seller to maintain accuracy, ensure prompt payments, and meet regulatory requirements. Organizing and tracking these documents efficiently not only simplifies accounting but also enhances customer satisfaction and helps prevent disputes. Here are some key tips for managing these documents effectively:

By implementing these strategies, sellers can not only improve operational efficiency but also build trust with customers and ensure that their financial and legal obligations are met in a timely and organized manner. Best Practices for Car Transaction Records

Properly managing sales documents is crucial for both buyers and sellers to ensure transparency, accuracy, and compliance with legal standards. By following best practices, parties involved can prevent future disputes, maintain clear records, and streamline the process of handling transactions. These practices also help ensure financial accuracy, protect both the buyer’s and seller’s interests, and keep a clear trail of every transaction. Ensure Clear and Complete DetailsOne of the most important aspects of managing transaction documents is making sure they contain all the necessary information. This includes the details of the buyer, seller, item description, price, and terms of the transaction. Each document should clearly outline the agreed-upon terms and any special conditions or warranties. This clarity helps avoid confusion and ensures that both parties are on the same page. Use Reliable Tracking SystemsUtilizing a reliable tracking system is essential for keeping transaction records organized. Digital tools or specialized software can make it easier to log, manage, and track all documents related to a sale. Using these tools also provides a more secure, streamlined method of accessing past records when necessary, especially during audits or when verifying payment statuses. By maintaining accurate and well-organized records, businesses can ensure smoother operations, build customer trust, and adhere to legal and financial requirements with ease. |