Ultimate Corporate Invoice Template for Easy and Professional Billing

Managing business transactions efficiently requires having a clear and standardized approach to requesting payments. A well-structured billing document not only ensures clarity between you and your clients but also promotes timely payments. These documents serve as the official record of the services or goods provided, and as such, they should reflect professionalism and precision.

Using a pre-designed format can save you time and reduce errors, allowing you to focus on other aspects of your business. These formats are customizable to suit your specific needs, ensuring consistency in how you present financial information. Whether you’re running a small business or handling a larger enterprise, having an effective billing system in place is crucial to maintaining smooth operations.

In this guide, we will explore how to create and optimize a professional document for billing purposes. From layout design to key elements like payment terms and tax inclusion, we’ll provide tips for making your documents both functional and visually appealing. The right structure can also enhance your credibility and make a lasting impression on clients.

Corporate Invoice Template Overview

When managing financial transactions in any business, having a consistent and organized approach to requesting payment is essential. A well-designed document for billing serves as a formal agreement between the service provider and the client, ensuring both parties are on the same page regarding the amount due and payment terms. The structure and layout of this document are key to ensuring clarity and professionalism, allowing for smooth business operations.

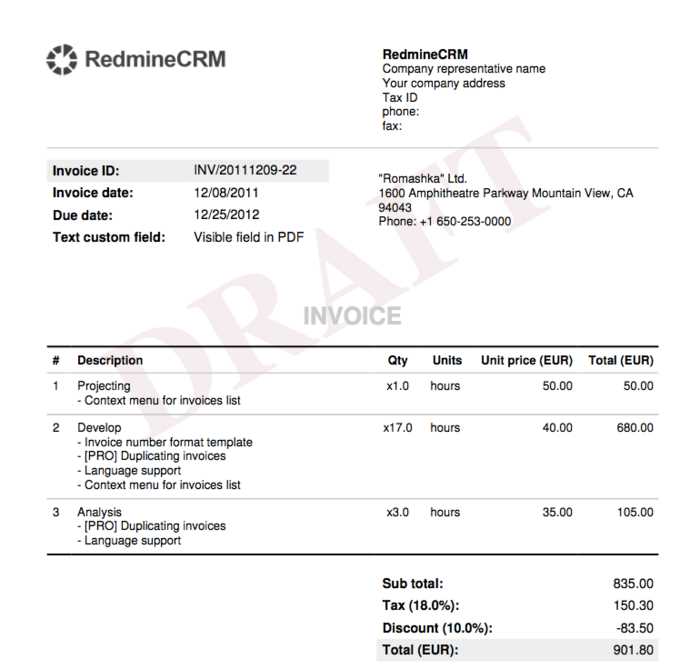

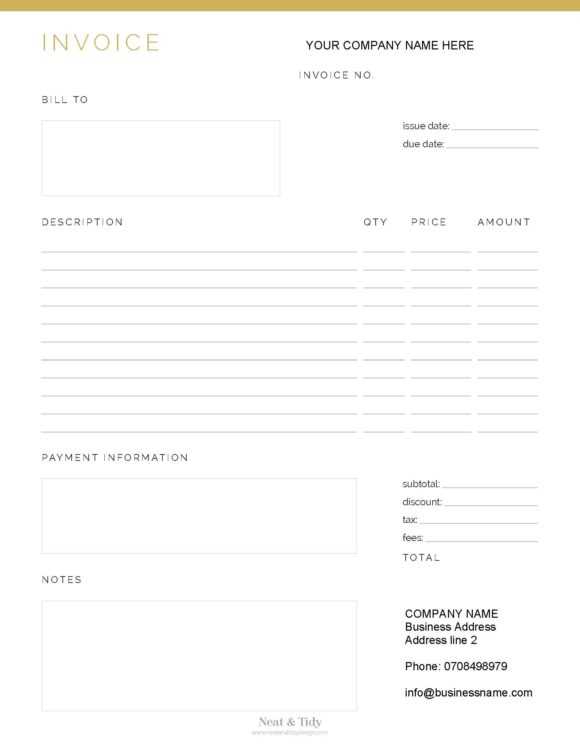

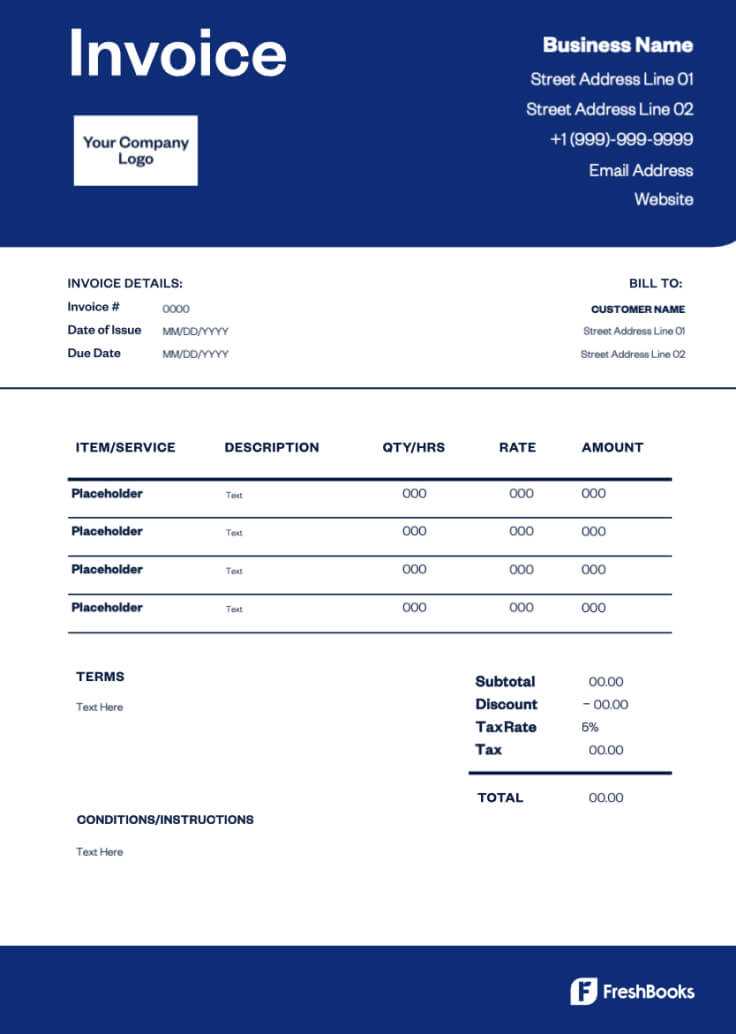

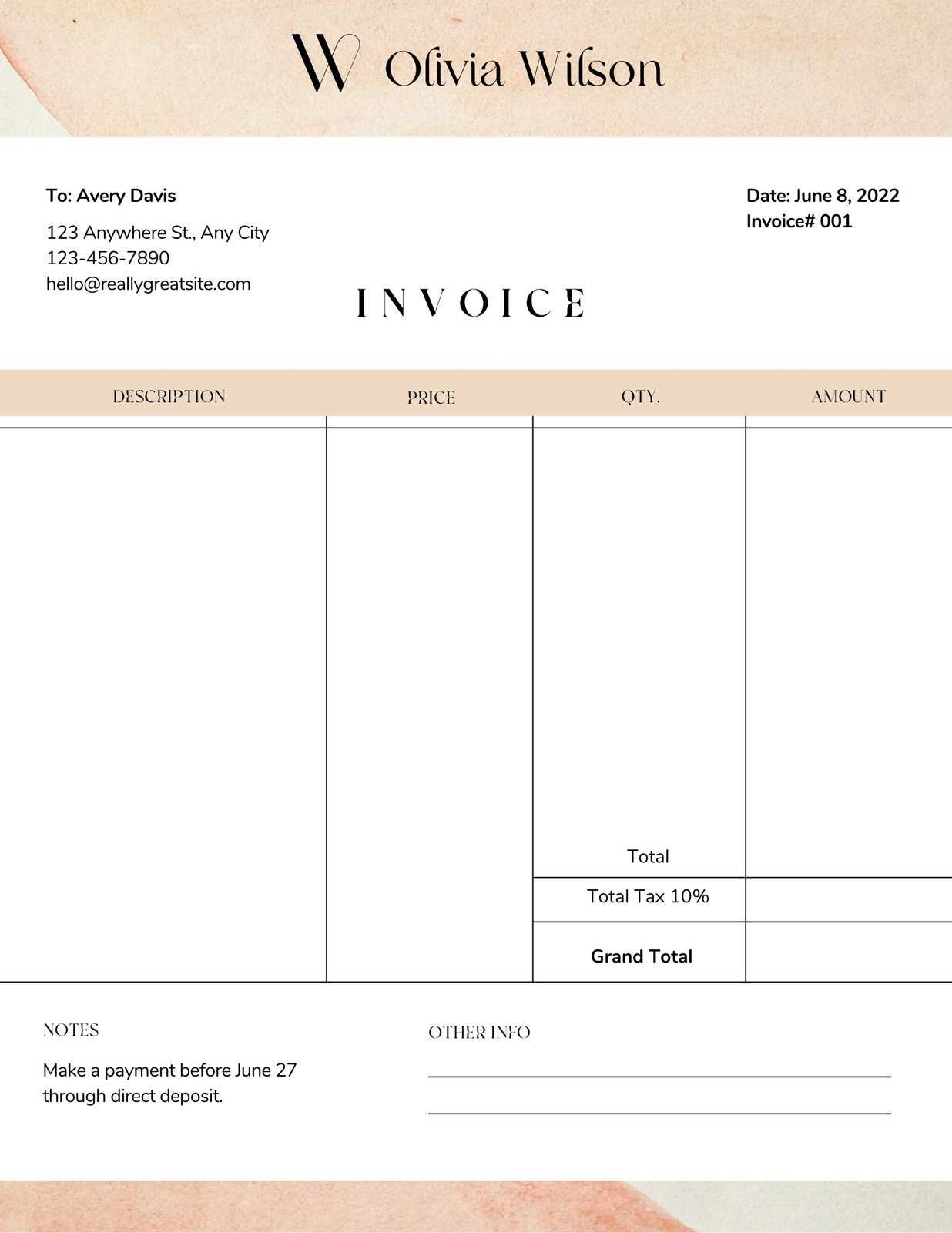

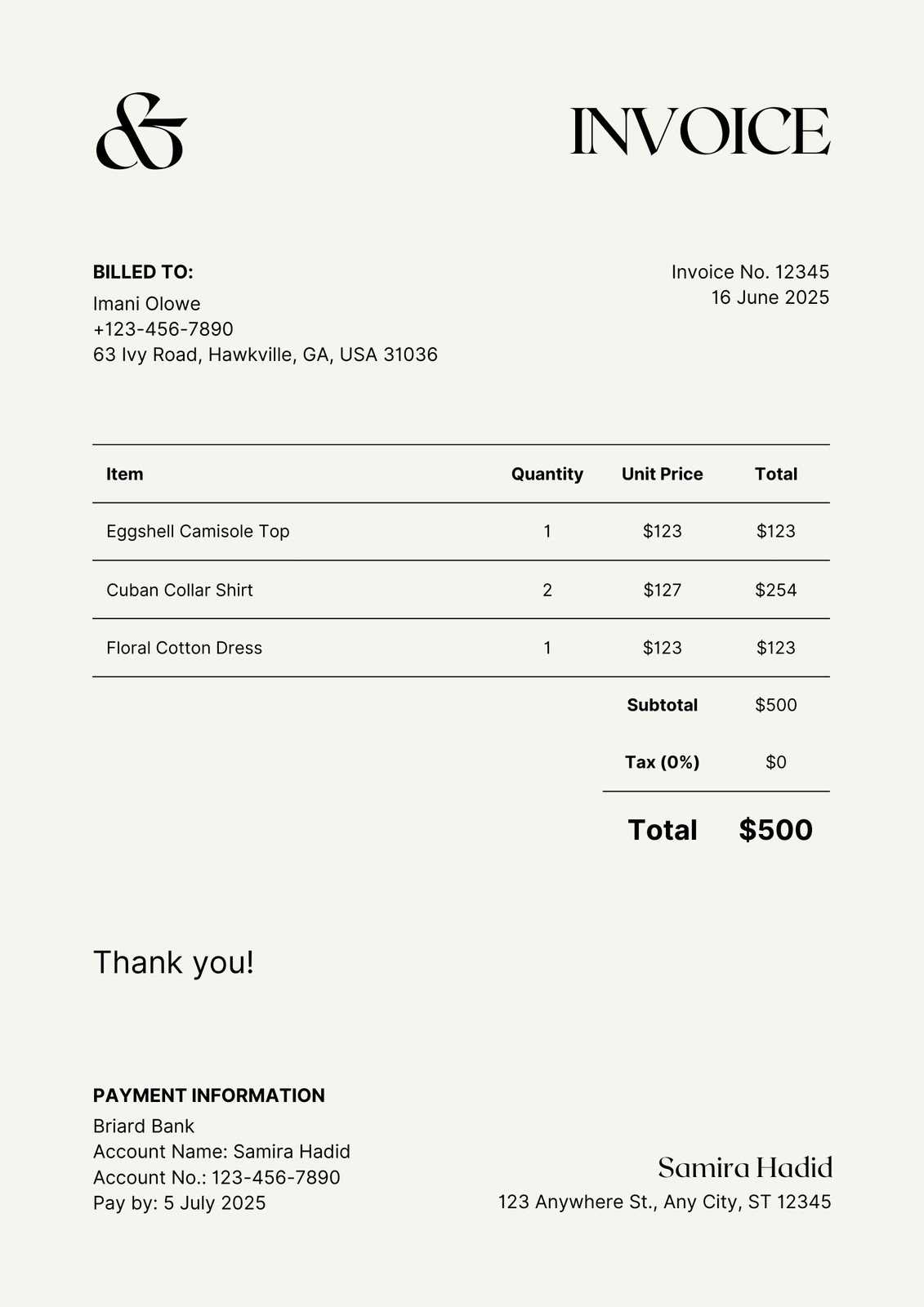

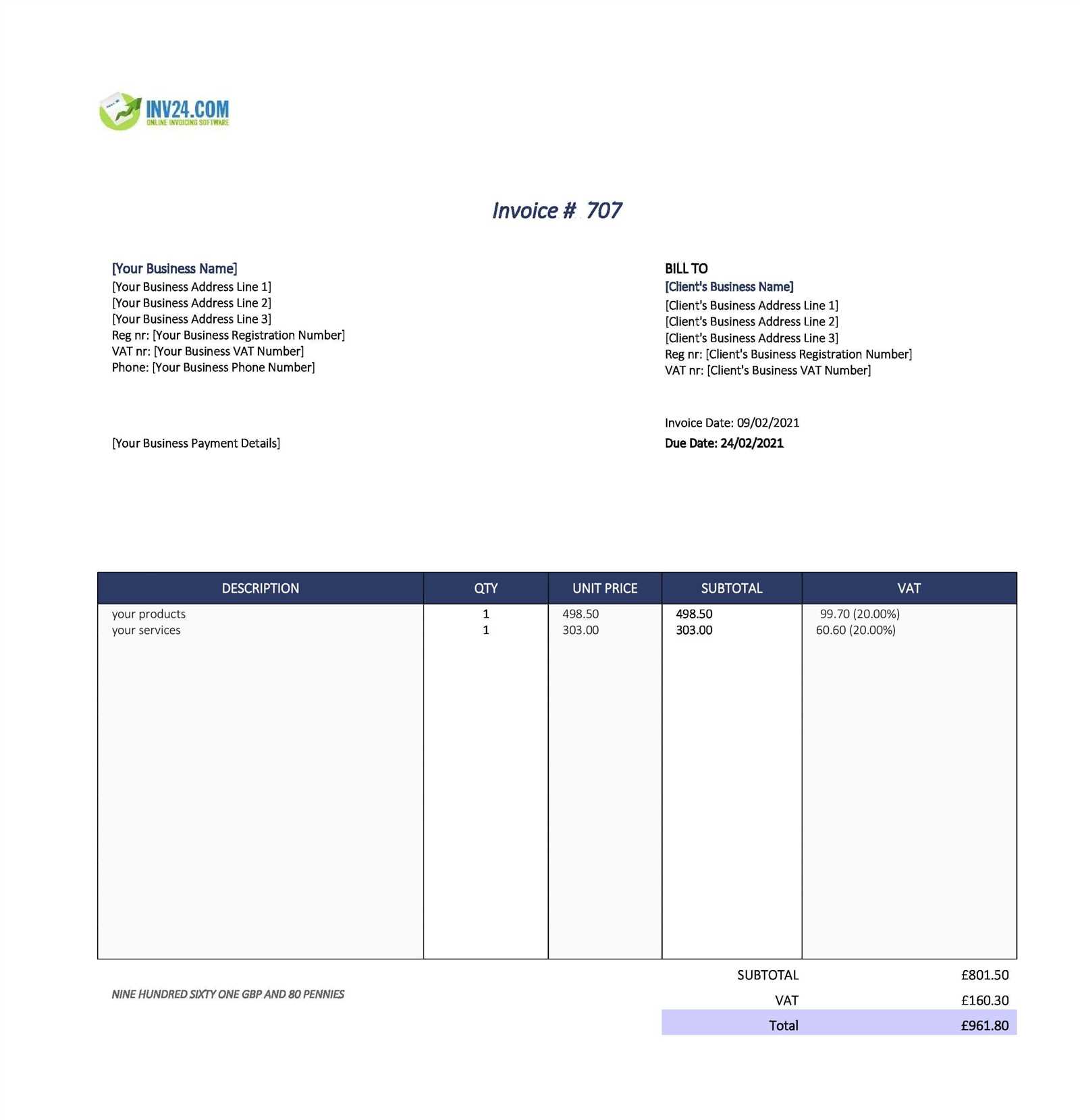

These billing documents often include several key elements: contact information, a breakdown of goods or services provided, the total amount owed, payment terms, and due dates. The goal is to make it as easy as possible for clients to understand the charges and submit payment without confusion. A standardized layout not only improves accuracy but also reduces the risk of mistakes that can delay payment processing.

In the following section, we’ll explore the main components of a well-organized billing document, how to customize it for your specific business needs, and how to implement it effectively in your workflow. Whether you’re a freelancer, small business owner, or part of a larger organization, having an optimized billing solution is vital to maintaining financial health and client satisfaction.

Why Use a Corporate Invoice Template

Having a consistent and professional way of requesting payment is crucial for maintaining smooth business operations. Using a standardized document helps ensure that all the necessary information is included and presented clearly. It eliminates the potential for errors, reduces time spent on creating each document from scratch, and ensures a uniform look for all transactions.

By relying on a pre-designed format, businesses can save valuable time and effort. Customizing the document to fit the specific needs of your business is easy, and it helps maintain a professional image. Additionally, standardized documents reduce confusion and make it easier for clients to understand the charges and payment terms.

The table below highlights the key reasons why using a standardized format is beneficial for your business:

| Benefit | Explanation |

|---|---|

| Time Savings | Pre-designed layouts save time by eliminating the need to create new documents for every transaction. |

| Consistency | A uniform document style ensures a professional and recognizable appearance for all clients. |

| Accuracy | Using a template reduces the risk of forgetting important details or making errors in calculations. |

| Improved Cash Flow | Clear, professional documents encourage faster payments and fewer disputes over charges. |

In summary, using a well-structured billing document helps streamline your administrative processes, ensures clear communication, and boosts client confidence. Whether for small transactions or large-scale business operations, a consistent approach to payment requests is essential for maintaining a professional reputation and optimizing business efficiency.

Key Elements of an Invoice Template

A well-organized billing document is essential for ensuring clear communication between businesses and clients. To achieve this, it’s important that the document includes all the necessary details in a consistent and easy-to-understand format. Each section plays a crucial role in helping both parties understand the transaction and avoid any misunderstandings.

Essential Information for Every Billing Document

There are several key components that should always be present in any professional payment request. These elements provide the necessary details for tracking, verifying, and processing payments smoothly.

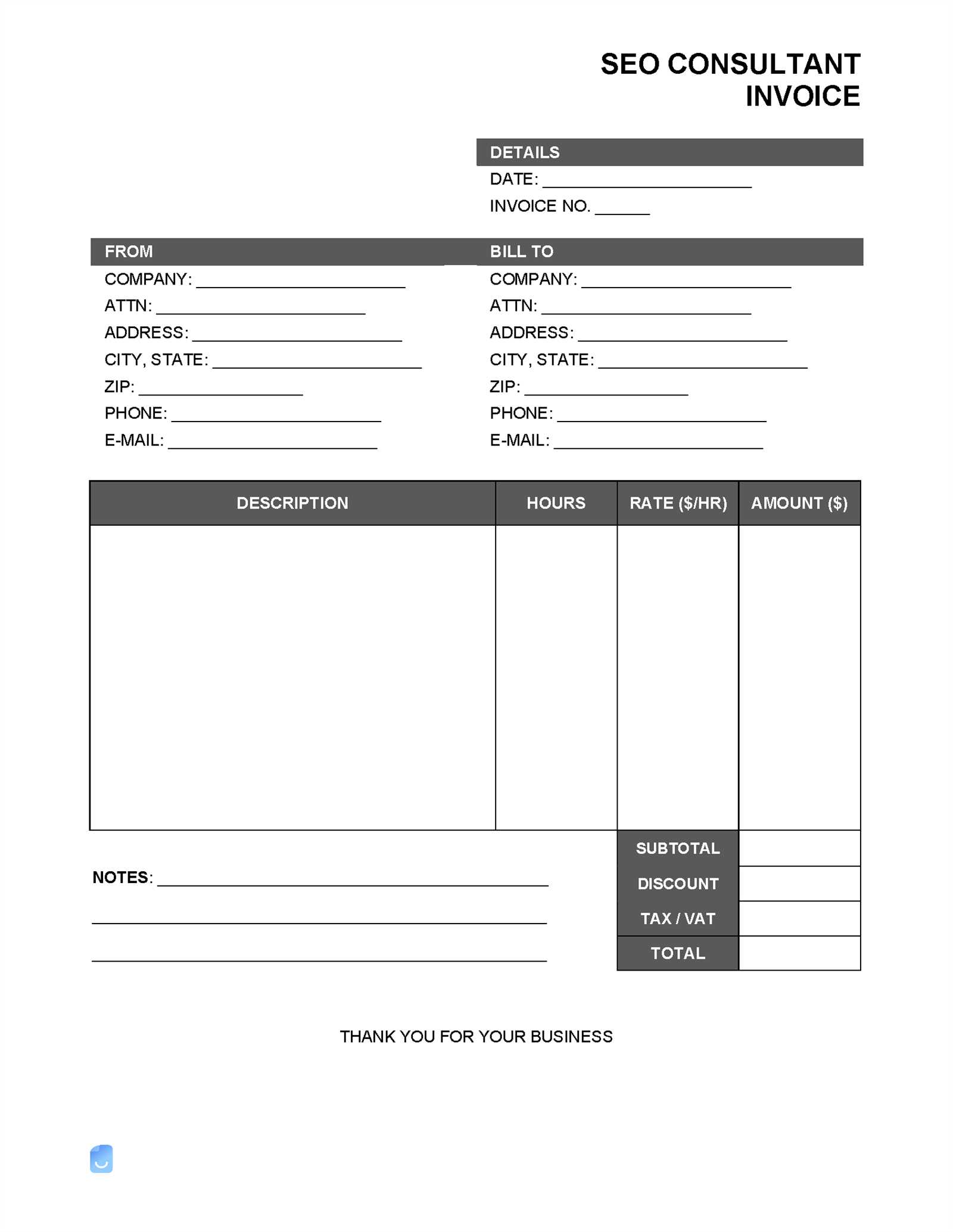

- Business and Client Information: Clear contact details for both the business and the client, including names, addresses, and phone numbers, help ensure that the document is easily identifiable and traceable.

- Unique Reference Number: A distinct reference number for each transaction helps both the business and client keep track of the document for future reference.

- Description of Services or Products: A detailed breakdown of the items or services provided, including quantities, rates, and a brief description, ensures transparency and avoids disputes.

- Total Amount Due: The amount owed should be clearly listed, along with any applicable taxes or additional charges to ensure there are no misunderstandings regarding the final price.

- Payment Terms: Terms such as the due date, late fees, and accepted payment methods should be outlined clearly to set expectations for both parties.

Optional Elements to Include

In addition to the core components, there are several optional elements that can further enhance the document’s clarity and professionalism:

- Discounts or Promotions: If applicable, including any discounts or special offers can provide the client with a clearer understanding of the final cost.

- Notes or Special Instructions: This section can be used to communicate any specific instructions or additional details related to the transaction.

- Payment Instructions: Providing detailed instructions on how to complete the payment, such as bank account details or online payment links, can make the process easier for clients.

By including these essential and optional elements, businesses can create billing documents that are clear, professional, and effective in ensuring smooth transactions. A well-structured document fosters trust and helps maintain strong relationships with clients.

How to Customize Your Invoice Template

Customizing your billing document allows you to align it with your business’s unique needs and branding. By making small adjustments to the layout, design, and information presented, you can create a more professional and personalized experience for your clients. A well-customized document not only reflects your brand identity but also makes it easier for clients to understand the charges and payment instructions.

Here are the key areas you should focus on when personalizing your payment request format:

| Customization Area | What to Modify |

|---|---|

| Branding | Include your logo, brand colors, and business name at the top of the document to make it immediately recognizable. |

| Contact Information | Ensure that all business and client contact details are correct and up-to-date, including phone numbers, addresses, and emails. |

| Description of Services or Goods | Modify the description sections to reflect your specific products or services, adding itemized breakdowns or relevant details as needed. |

| Payment Terms | Adjust payment terms to reflect your standard policies, including the due date, acceptable methods, and late fees if applicable. |

| Footer Section | Customize the footer to include additional notes, promotional offers, or tax information, depending on your business needs. |

By tailoring these areas to your business, you can create a payment request that is both functional and in line with your brand. A well-structured, customized document not only promotes professionalism but also helps clients feel more confident in completing their payments quickly and accurately.

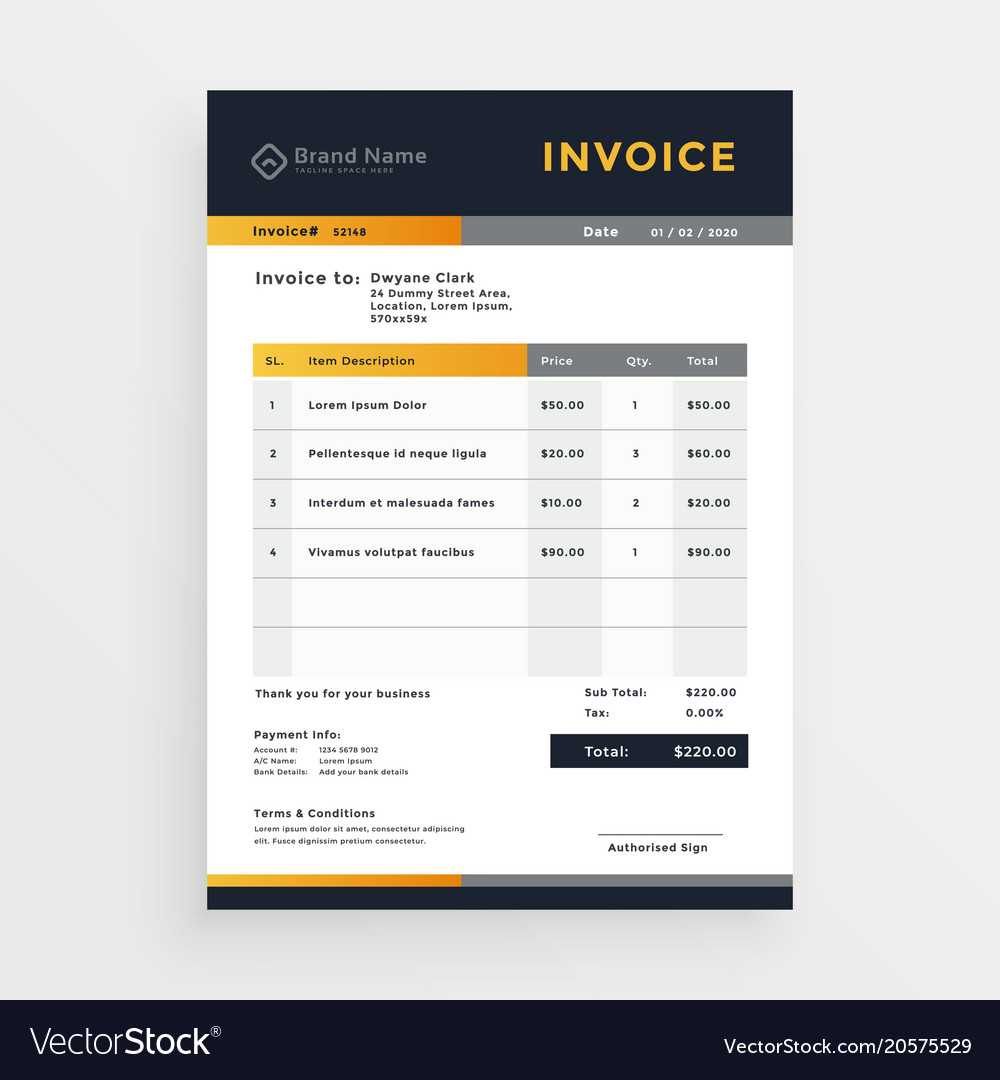

Benefits of Using a Professional Template

Utilizing a professionally designed document for billing offers numerous advantages that help streamline your financial processes and enhance your business’s credibility. A standardized layout ensures consistency across all transactions and promotes a more efficient workflow, ultimately saving time and reducing errors. By using a polished and organized document, you create a positive impression on clients while maintaining a clear and transparent record of all business dealings.

Here are some key benefits of adopting a professional payment request format:

- Time Efficiency: With a pre-made layout, you eliminate the need to design a new document from scratch for every transaction, allowing you to focus on other critical business tasks.

- Consistency: A standardized format ensures that every document looks professional and contains all the necessary details, no matter the size or scope of the transaction.

- Clarity and Transparency: Well-organized documents make it easier for clients to understand the charges, reducing the chance of disputes or delays in payment.

- Professional Appearance: A polished, professional document boosts your business image, making your company appear more organized and trustworthy in the eyes of clients.

- Improved Cash Flow: Clear and accurate documents help clients make timely payments, which positively impacts your cash flow and financial stability.

- Legal Protection: Properly formatted records serve as an official contract, which can provide legal protection in case of disputes regarding payments or terms.

In summary, using a professional payment request format not only saves time but also helps maintain a high level of professionalism. It ensures clarity, reduces errors, and fosters better relationships with clients, all of which contribute to smoother financial operations and increased business success.

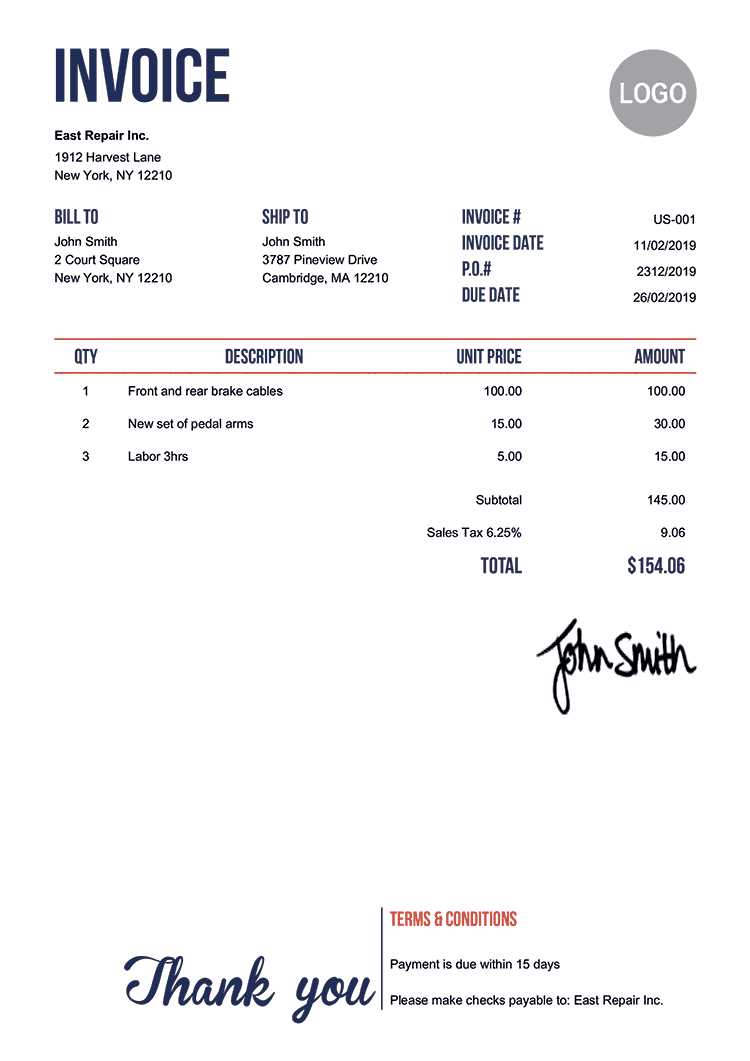

Common Mistakes to Avoid in Invoicing

When creating a billing document, it’s important to avoid common errors that could lead to confusion, payment delays, or disputes with clients. Simple mistakes in formatting or missing information can create unnecessary problems and harm your business’s reputation. By being aware of these pitfalls, you can ensure that your financial transactions run smoothly and professionally.

The table below highlights some of the most common mistakes and how to avoid them:

| Common Mistake | How to Avoid It | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incorrect Contact Information | Double-check that both your business and the client’s contact details are correct and up to date. | ||||||||||||||||||||||||

| Missing Payment Terms | Always include clear payment instructions, including due dates, accepted payment methods, and late fees. | ||||||||||||||||||||||||

| Not Including a Unique Reference Number | Assign a unique reference number to each document to help both you and your client track and manage payments. | ||||||||||||||||||||||||

| Failure to Specify Tax Rates | Clearly outline any applicable taxes, including rates and amounts, to avoid misunderstandings and ensure compliance. | ||||||||||||||||||||||||

| Unclear Description of Services or Goods | Provide detailed, accurate descriptions of what was provided, including quantities, unit prices, and total amounts. | ||||||||||||||||||||||||

| Not Following Up on Unpaid Documents | Always follow up on overdue pay

How to Ensure Accurate BillingEnsuring accuracy in billing is crucial for maintaining trust with your clients and keeping your business operations running smoothly. Errors in financial documents can lead to delays, confusion, or even disputes that can harm your professional relationships. By implementing a few key practices, you can significantly reduce the chances of mistakes and ensure that all charges are correct and clearly communicated. Here are some essential tips to help you maintain accurate billing:

By following these simple practices, you can create accurate and professional billing documents that minimize errors and foster trust with your clients. A well-structured and precise document promotes timely payments and smooth business operations. Creating a Template for Different IndustriesDifferent industries often require specific formats for financial documents to accurately reflect the nature of their transactions. Whether you’re in construction, design, or consulting, it’s essential that your billing documents are tailored to suit the particular needs of your sector. Customizing these documents allows you to include relevant information that clients in your industry will expect, making the process smoother for both parties. Each industry has its own set of requirements for what should be included in a payment request, as well as how it should be structured. The following table outlines some key industry-specific elements that should be considered when creating a billing document:

When you customize your financial document to reflect your industry’s specific needs, it not only enhances the professionalism of your business but also helps to build trust with clients. Clear, relevant details will also reduce the chances of confusion or disputes, leading to faster and smoother transactions. Free vs Premium Invoice TemplatesWhen choosing a format for your billing documents, one of the main decisions is whether to use a free or premium option. Both have their advantages and limitations, and understanding these differences can help you make the right choice for your business. While free options can be a great starting point, premium layouts often offer additional features and customization that may better suit your long-term needs. Free options typically provide basic functionality and are easy to access. They can be a good fit for small businesses or individuals just getting started. However, these formats often lack advanced customization options and may not be as polished or professional as their paid counterparts. Premium options, on the other hand, often come with more advanced features, including customizable fields, better design elements, and industry-specific layouts. These formats are ideal for businesses looking to create a more tailored and professional experience for their clients. They may also include additional tools for tracking payments, integrating with accounting software, and ensuring compliance with tax regulations. The table below summarizes the key differences between free and premium options:

|