Consultant Invoice Template for Easy and Professional Billing

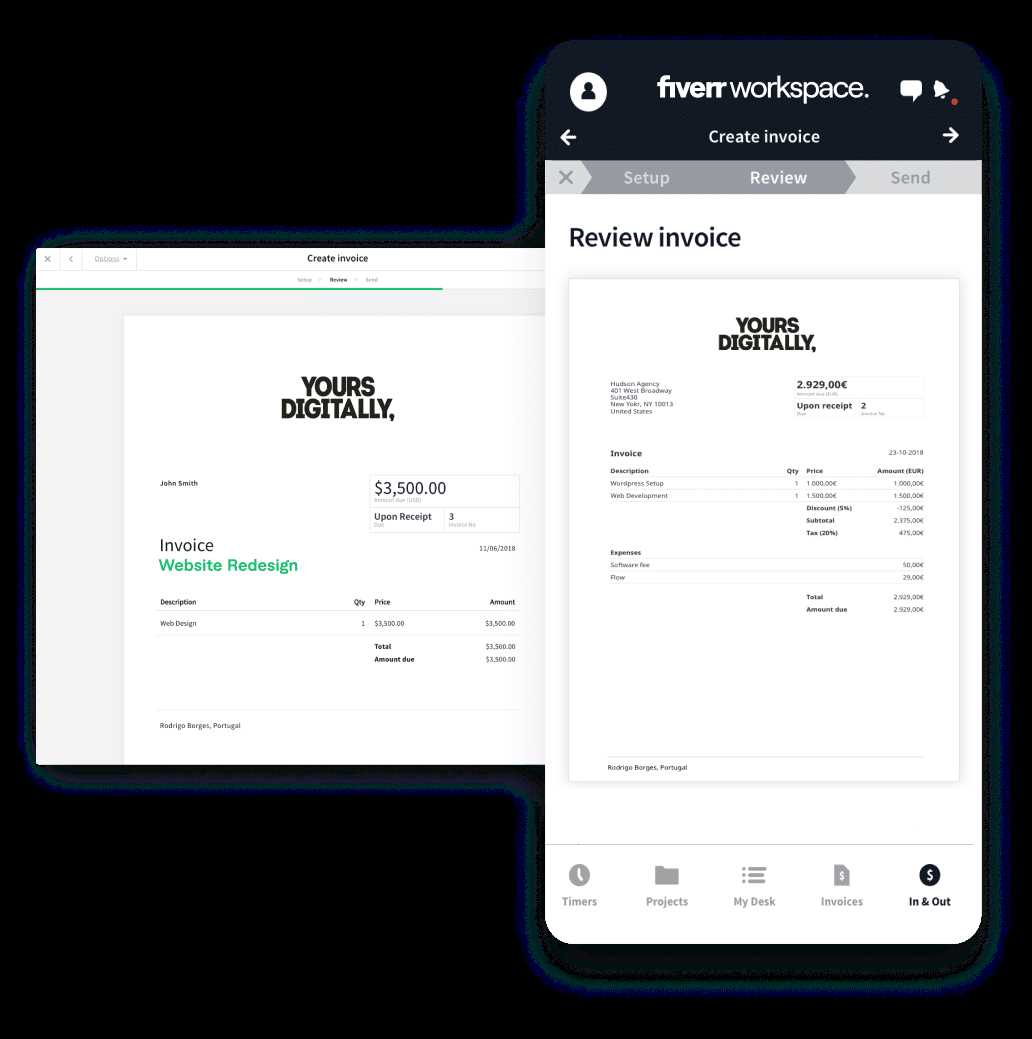

When providing professional services, it’s essential to have a reliable system for requesting payments. A well-structured document helps both parties keep track of work completed and payment terms. By using an organized billing format, you can ensure clarity and avoid misunderstandings.

Creating a clear and efficient request for payment not only speeds up the process but also reflects professionalism. With the right layout, you can present your charges, payment due dates, and other relevant details in a way that is easy to understand for your clients. This approach fosters trust and ensures timely compensation for the work you’ve done.

Whether you are an independent worker or running a small business, mastering this process is crucial for maintaining smooth financial operations. In this guide, we’ll explore how to create a document that covers all essential aspects while also being flexible enough to adapt to different project types and client preferences.

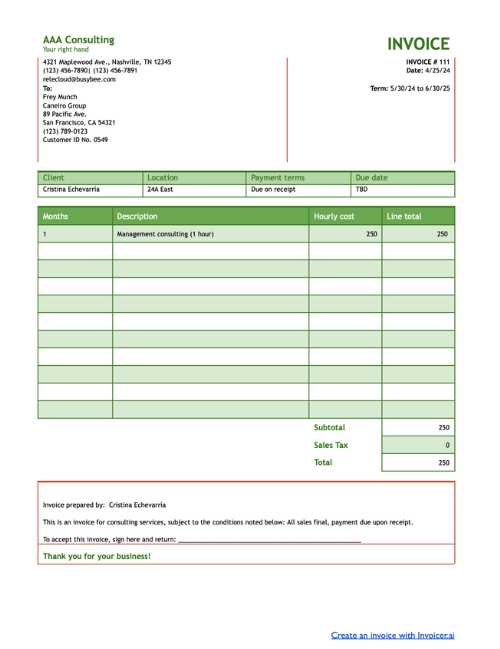

Consultant Invoice Template Overview

When managing professional projects, having a standardized approach to billing is crucial. A well-organized document can help both service providers and clients stay aligned on payments, ensuring that all essential information is communicated clearly and effectively. This document serves as the official record of the work completed, the amount owed, and the terms of payment.

Key Features of a Billing Document

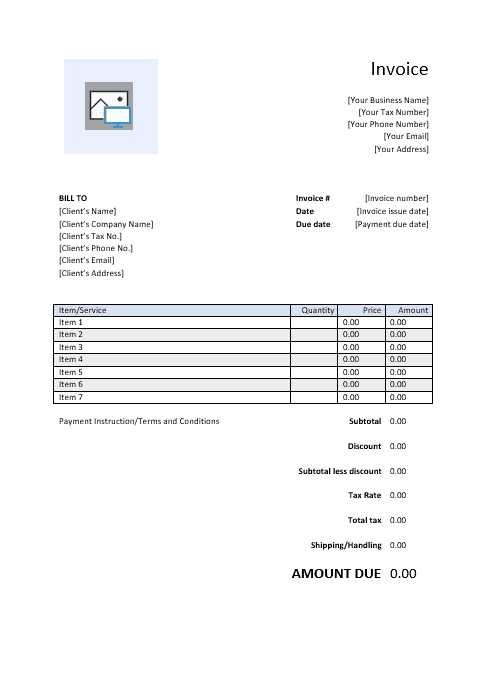

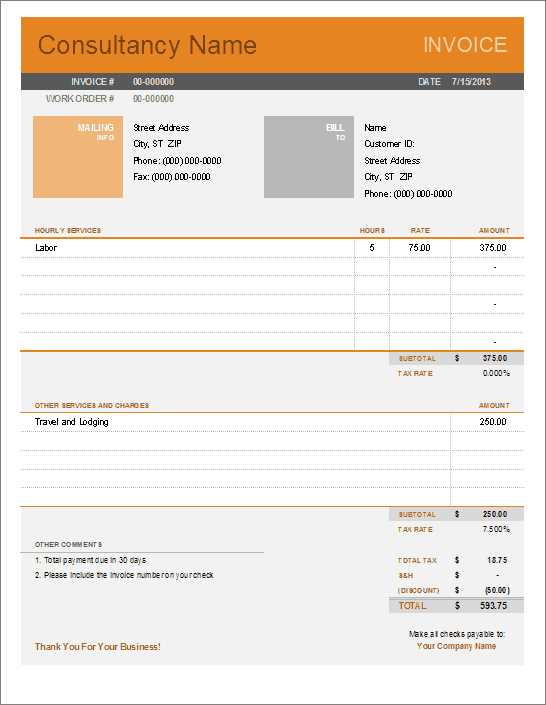

Every document used for payment requests should include a few fundamental details to make the process smooth and straightforward. Some of the most important elements include:

- Client information: Contact details for the person or company being billed.

- Work description: A clear summary of services provided or tasks completed.

- Amount owed: A breakdown of costs for transparency and easy reference.

- Payment terms: Specify when payment is due, accepted methods, and any late fees.

- Business details: Contact information for the service provider and, if applicable, company registration details.

Benefits of Using a Structured Billing Document

Implementing a consistent format for requesting payments offers several advantages:

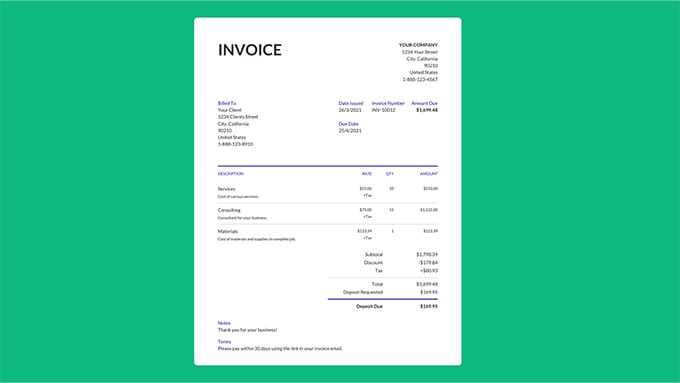

- Time efficiency: It speeds up the billing process by eliminating confusion and delays.

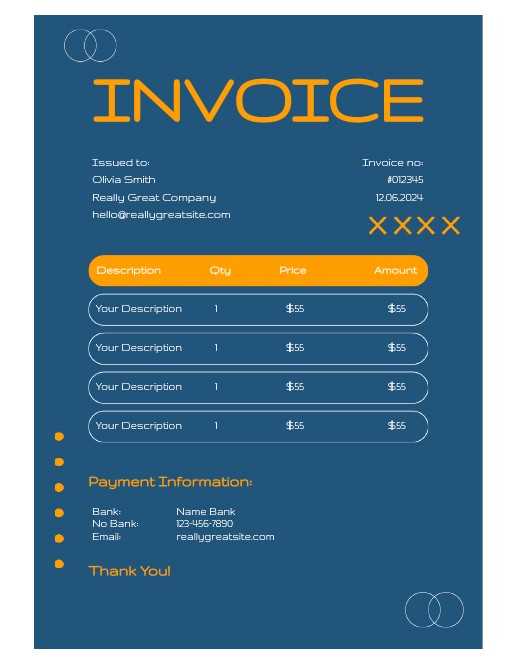

- Professional appearance: A polished, organized request demonstrates professionalism to clients.

- Clear communication: The terms are clearly outlined, reducing the risk of disputes or misunderstandings.

- Improved cash flow: Properly structured documents often result in quicker payment turnaround.

In the following sections, we’ll explore how to create an effective document for your needs, ensuring it includes all the necessary components while remaining adaptable to various client types and business models.

Why Consultants Need an Invoice Template

For professionals offering specialized services, managing financial transactions effectively is essential for smooth business operations. Having a consistent method for requesting payments not only saves time but also ensures clarity for both parties. A well-designed document makes the entire billing process more efficient, helping to avoid errors, delays, and confusion about the work completed and the amount owed.

Benefits of Using a Structured Payment Request

Implementing a standard payment request format offers several key advantages:

- Professionalism: A consistent format presents a polished, business-like image.

- Efficiency: It simplifies the billing process, reducing the time spent on manual creation.

- Clarity: Clear details ensure both the service provider and client understand the charges, payment terms, and deadlines.

- Record Keeping: Using a standardized document makes it easier to track payments and organize financial records.

How a Structured Format Helps Prevent Mistakes

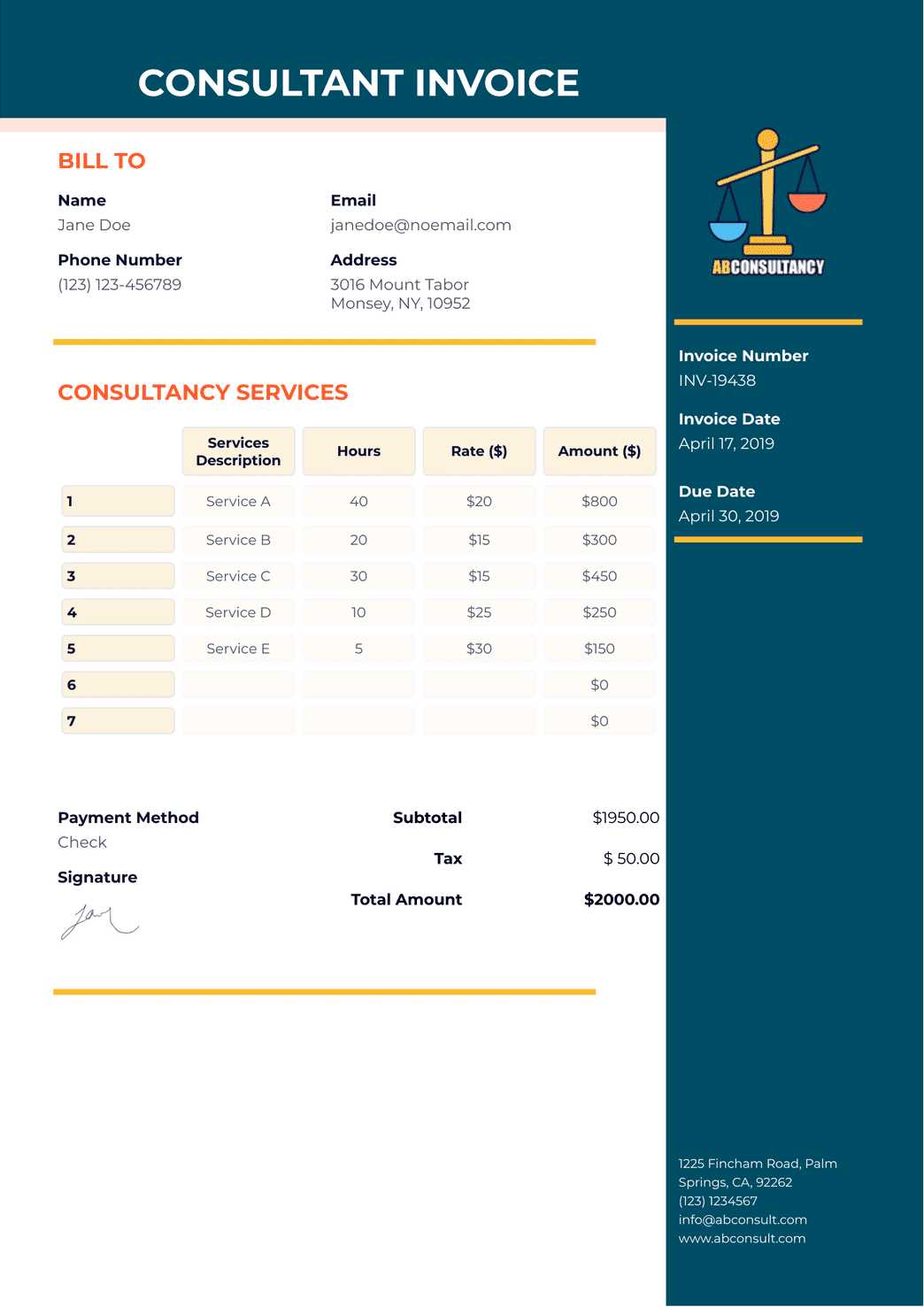

When working without a preset structure, it’s easy to overlook important details or miscommunicate terms, which could lead to delays or disputes. The table below highlights common mistakes that can be avoided by using a pre-designed document.

| Error | Consequence | How to Avoid | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing payment due date | Confusion over when payment is expected | Clearly state payment terms and deadlines | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unclear description of services | Disputes about the scope of work | Provide detailed descriptions of services rendered | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inconsistent format | Time spent recreating or adjusting documents | Use a standard format for every request | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Missing business details | Client unsure who to contact for queries | Always include your business name and contact informa

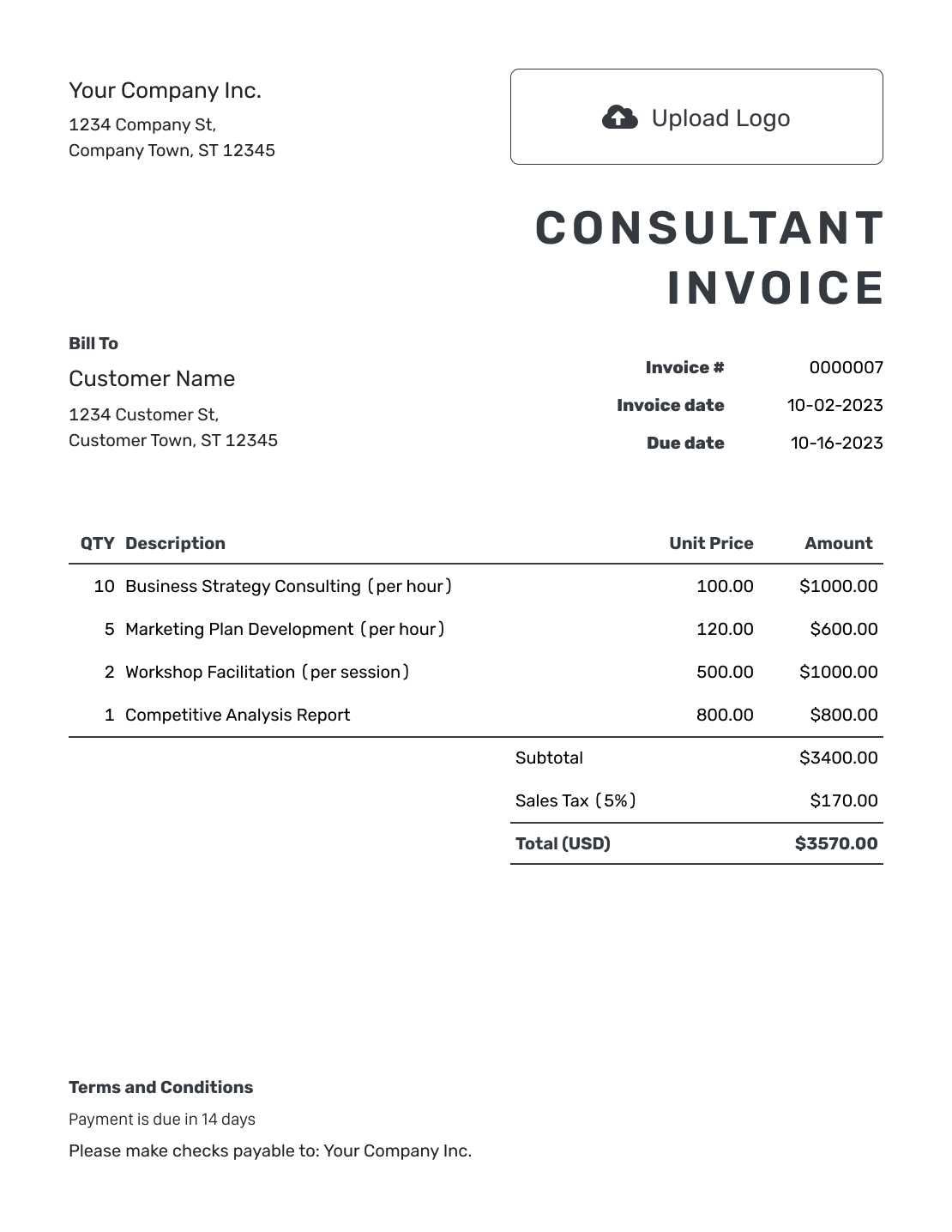

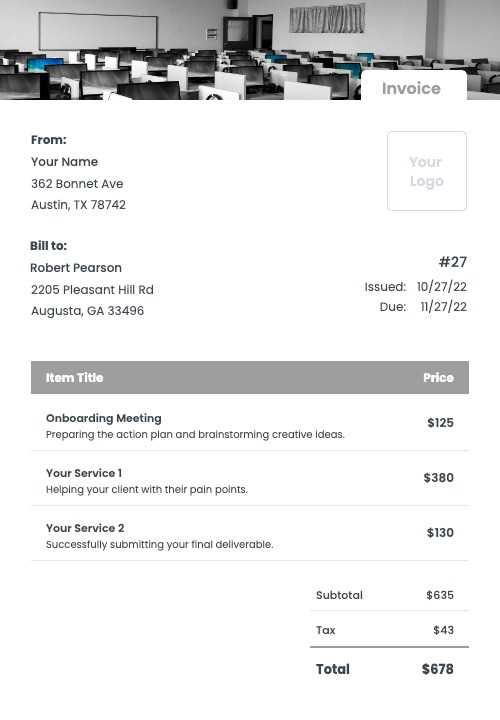

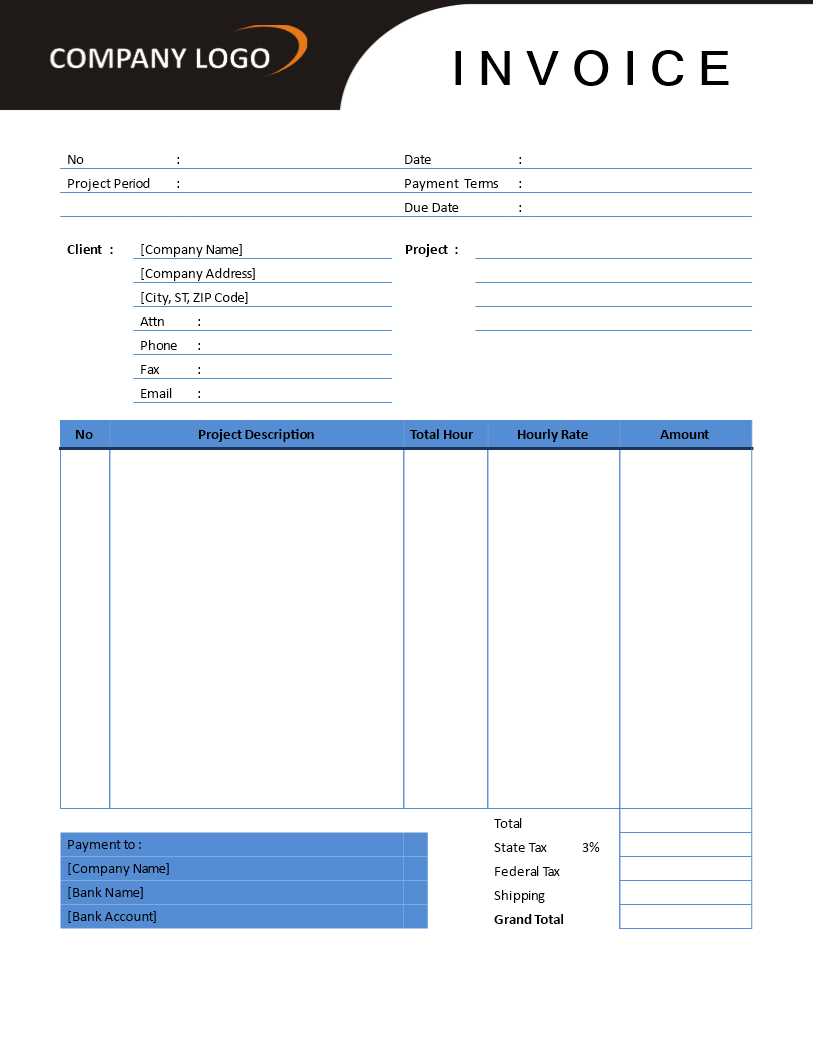

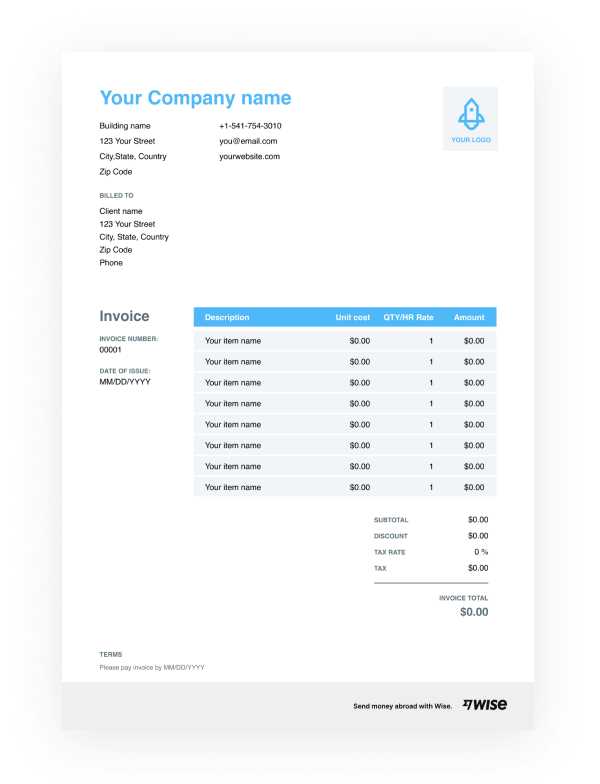

How to Create a Consultant InvoiceCreating a professional request for payment is an important task for any service provider. A clear and well-structured document ensures that all relevant details are communicated effectively, reducing the chances of errors and misunderstandings. To craft a proper request for payment, it’s essential to follow a specific format that covers all the necessary components and meets both your needs and your client’s expectations. Step-by-Step Process for Creating a Payment Request

Follow these simple steps to ensure your payment request includes all the essential information:

Tips for a Polished and Professional RequestTo ensure your payment request looks professional and is easy for clients to understand, follow these tips:

|