Free Band Invoice Template for Quick and Easy Billing

Managing finances is a crucial aspect of any music career, whether you’re an independent artist or part of a group. The process of handling payments, creating statements, and ensuring everything is properly documented can quickly become overwhelming without the right tools. Simplifying these tasks can save time and reduce stress, allowing you to focus on what truly matters – the music.

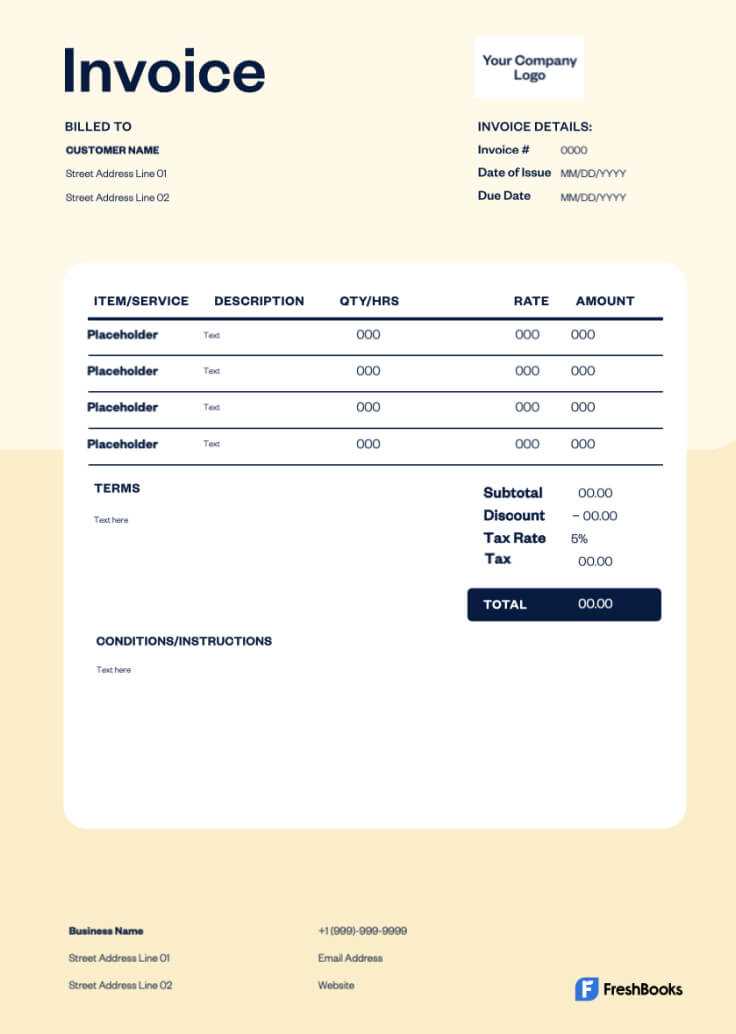

Templates designed for performers offer an efficient way to handle financial records. They provide a structured format for documenting transactions, ensuring that all necessary details are included and nothing important is overlooked. With an easy-to-use system, musicians can streamline their payment processes, leading to quicker turnaround times and a more professional business approach.

In this guide, we’ll explore various options that can help simplify your billing process. Whether you’re just starting out or already have an established career, finding the right tools will ensure that your payments are tracked properly and that you maintain a clear, organized financial record. Keep reading to learn more about how these resources can benefit you.

Free Band Invoice Templates for Musicians

Managing payments and keeping track of earnings is essential for any musician, but it doesn’t have to be complicated. With the right resources, you can streamline your financial tasks, ensuring that all transactions are recorded accurately and professionally. Utilizing well-structured documents designed specifically for musicians can save time, reduce errors, and present you in the best light to clients and venues.

There are numerous options available online that allow you to download customizable documents at no cost. These pre-designed forms offer a quick solution to creating professional statements, making it easier to manage payments, include necessary details, and maintain a consistent format for all your transactions. Whether you’re performing solo or with a group, having a ready-to-use structure simplifies the process and allows you to focus on your craft.

By using these ready-made tools, you can add key elements such as payment terms, contact information, and performance details without needing any advanced design skills. This allows you to create clear, consistent records that protect both you and your clients. From individual shows to ongoing contracts, these resources will ensure that you have everything you need for smooth financial management.

Why Use a Band Invoice Template

For musicians, managing financial transactions can be a challenge, especially when you need to maintain a professional appearance and keep accurate records. Using a structured document can save time, reduce mistakes, and ensure clarity in every transaction. Instead of starting from scratch each time, a ready-made solution offers consistency and ease of use.

Here are some reasons why musicians should rely on pre-designed forms for their financial records:

- Consistency: Using a standard format ensures that all documents look professional and include the necessary details, no matter the client or venue.

- Time-saving: Instead of creating a new document each time, you can simply fill in the relevant information and send it, speeding up the process.

- Accuracy: Structured documents help reduce the risk of missing important information, such as payment terms or performance details, leading to fewer errors.

- Easy Customization: Pre-made formats can be easily customized to fit specific needs, allowing you to add logos, payment methods, or other details that reflect your unique requirements.

- Professionalism: A well-designed document adds credibility to your business dealings and reassures clients that you take financial matters seriously.

By utilizing these tools, musicians can ensure smooth financial transactions and maintain an organized record-keeping system that helps avoid misunderstandings and keeps business operations running efficiently.

How to Customize Your Band Invoice

Customizing your financial documents is essential for ensuring that each one reflects your unique style, brand, and professional needs. Personalization not only helps you stand out but also ensures that all necessary information is clearly presented to clients. Adjusting key elements such as payment terms, contact details, and payment methods allows you to create a document that is both functional and professional.

Key Elements to Personalize

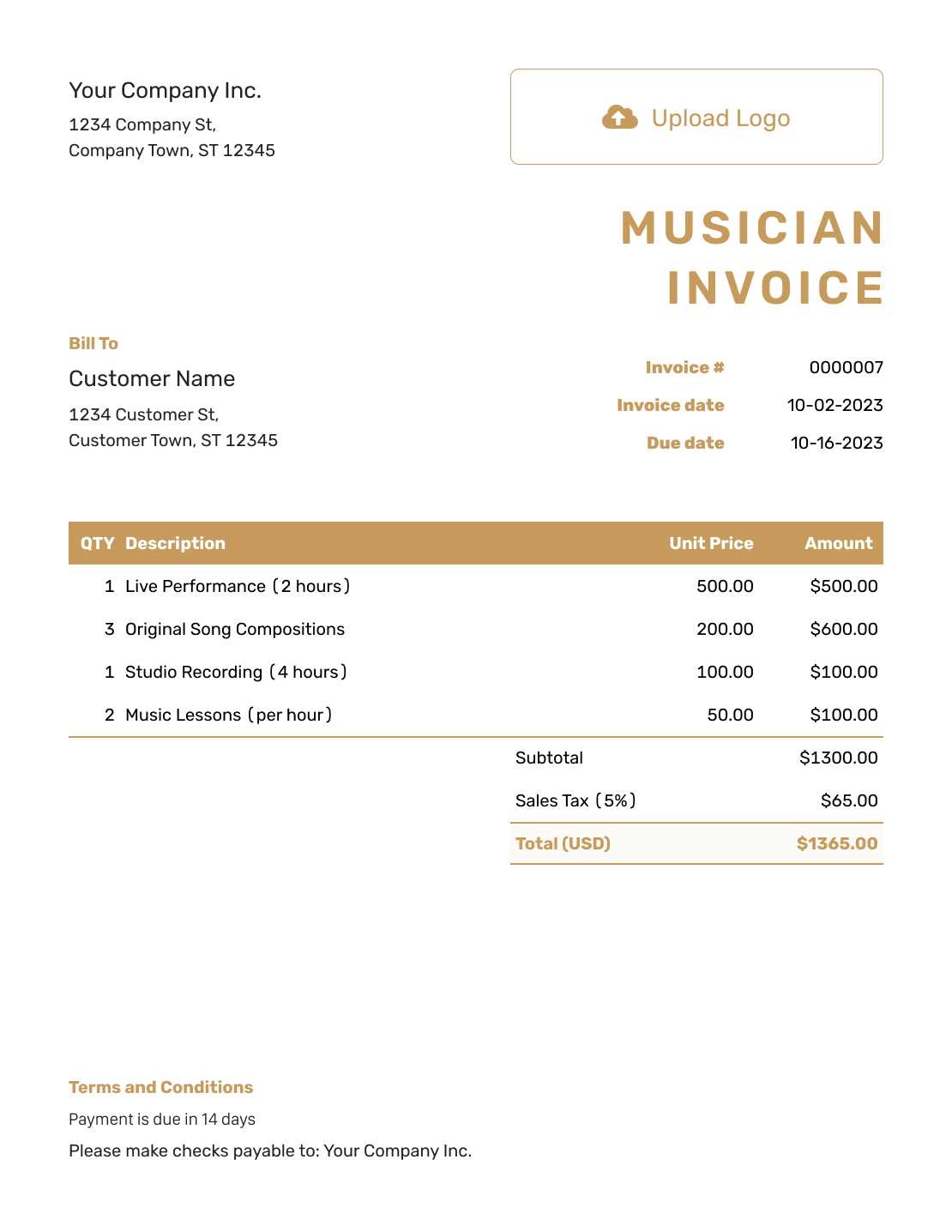

When tailoring your financial documents, consider adjusting the following elements to suit your needs:

| Element | Customization Options |

|---|---|

| Logo | Insert your band or artist logo for a personalized touch. |

| Contact Information | Update with your current phone number, email, or website for easy communication. |

| Performance Details | Include venue names, dates, and specific services provided to ensure clarity. |

| Payment Methods | Specify how clients can pay, whether via bank transfer, PayPal, or other methods. |

| Terms and Conditions | Adjust payment terms, late fees, or cancellation policies to fit your business needs. |

Simple Steps to Modify Your Document

Once you’ve identified the elements you wish to modify, follow these simple steps to make adjustments:

- Open the document in your preferred editing software (e.g., Microsoft Word, Google Docs).

- Replace default text with your personal or business information.

- Customize the layout by adjusting fonts, colors, and adding logos to align with your branding.

- Save the modified document and keep a copy for future use.

- Consider saving multiple versions for different types of clients or events (e.g., one for concerts, one for private events).

By customizing your document, you can create a professional and organized record-keeping system that aligns with your unique business needs. This not only improves your effic

Top Features of a Band Invoice Template

A well-designed financial document for musicians should not only be easy to use but also comprehensive in its features. When choosing the right structure, it’s important to focus on the key elements that will make your job easier, help avoid confusion, and ensure your payments are processed efficiently. Here are the top features you should look for when selecting a document for managing your transactions.

Essential Information Fields

One of the most important aspects of any financial form is ensuring that it includes all the necessary details. Key fields should provide both you and your clients with the clarity needed for smooth transactions. Some of these essential fields include:

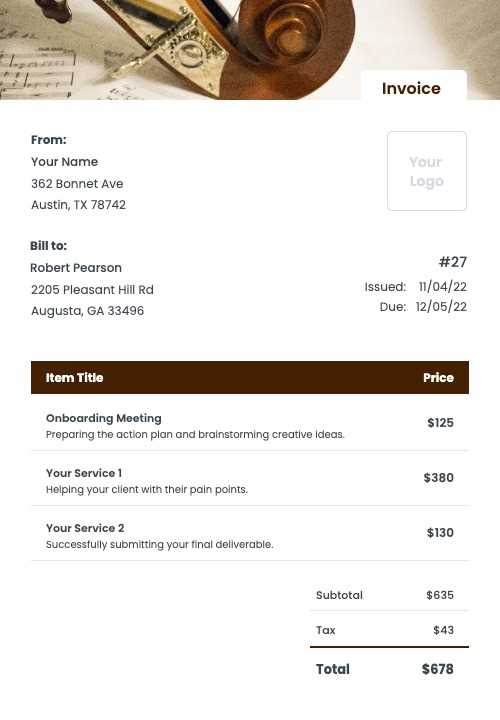

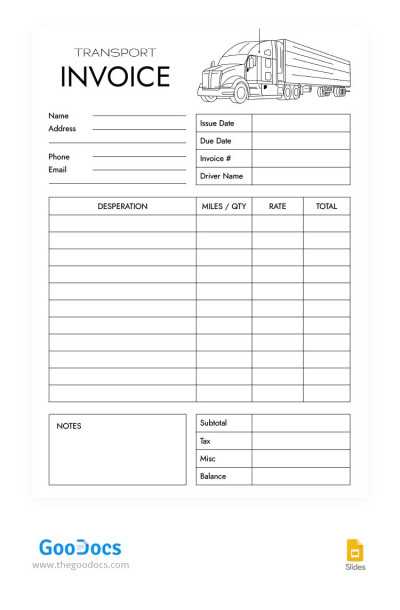

- Performance Details: Include the event date, venue, and type of service provided to ensure there’s no ambiguity.

- Client Information: Have fields for the client’s name, contact details, and billing address.

- Payment Terms: Clearly state when payments are due, and if applicable, any late fees or discounts for early payment.

- Itemized Breakdown: List services provided, rates, and any additional charges for transparency.

Design Flexibility

The ability to adjust the design to match your personal or band’s branding is another significant feature. Customization options can help present a professional appearance while maintaining a consistent identity across all documents. Look for structures that allow you to:

- Insert Your Logo: Including a logo helps reinforce your brand image and makes the document feel more personal.

- Adjust Layouts: Ensure you can easily tweak the layout to fit your needs, such as changing fonts, colors, or adding additional fields if necessary.

- Multiple Payment Methods: Provide different payment options such as bank transfers, PayPal, or checks to suit your clients’ preferences.

These features help streamline your financial management, creating a more efficient and organized system for tracking payments and maintaining a professional image.

Best Free Band Invoice Template Resources

Finding the right resources for managing your financial documents can make a significant difference in how you handle payments and maintain a professional image. There are several online platforms that offer high-quality, customizable solutions without any cost. These tools can simplify the process of creating structured records and ensure that all the necessary details are included, saving you time and effort.

Below are some of the best resources that provide easy-to-use documents for musicians:

| Platform | Features |

|---|---|

| Google Docs | Offers several customizable document formats that can be edited and saved directly in the cloud for easy access and sharing. |

| Invoice Generator | Simple and intuitive tool that allows you to quickly create and download professional-looking forms, with options to add specific details. |

| Microsoft Word | Provides pre-made forms that you can download and personalize, with full editing control for any adjustments you need. |

| Canva | Offers visually appealing, customizable designs with drag-and-drop functionality, ideal for musicians looking to add a personal touch. |

| Wave | Cloud-based platform that allows you to create, send, and track your documents while managing payments in one place. |

These resources provide a range of options depending on your needs, from simple document generation to more advanced tracking and customization features. Whether you’re just starting out or looking to upgrade your current system, these platforms will ensure that you have the right tools for the job.

Benefits of Digital Band Invoices

Transitioning to digital payment records offers numerous advantages for musicians, making the process more efficient, organized, and professional. With the increasing reliance on technology, using electronic documents provides a convenient way to track payments, reduce paperwork, and ensure everything is stored securely. Here are some key benefits of switching to digital solutions for managing your financial transactions.

- Convenience: Digital forms can be created, sent, and accessed from anywhere, eliminating the need for physical paperwork and allowing you to handle finances on the go.

- Faster Processing: Electronic documents can be delivered instantly via email, speeding up the process and reducing the wait time for clients to receive their statements.

- Better Organization: Digital records can be easily stored, categorized, and retrieved, helping you maintain an organized financial system and reducing the risk of losing important documents.

- Eco-friendly: Going paperless reduces waste, making it an environmentally friendly option that aligns with sustainable business practices.

- Automated Tracking: Many digital solutions offer features that track payments automatically, alerting you when a client has made a payment or when a balance is due.

- Professional Appearance: Electronic documents can be designed to look polished and consistent, enhancing your image and providing a more professional experience for your clients.

By adopting digital tools for your financial records, you can not only simplify the billing process but also improve efficiency, reduce overhead, and ensure your business runs smoothly in an increasingly digital world.

How to Add Band Payment Terms

Clearly stating the payment terms in your financial documents is crucial for ensuring that both you and your clients have the same expectations regarding payment deadlines and conditions. Properly outlining these terms helps avoid misunderstandings and ensures that you get paid on time. Here’s how you can effectively include payment conditions in your transaction records.

Essential Payment Terms to Include

When adding payment conditions, it’s important to cover all aspects of the transaction. This includes when payments are due, any late fees, and acceptable payment methods. The following are common terms that should be included:

| Payment Term | Description |

|---|---|

| Due Date | Specify when payment is expected. For example, “Payment is due within 30 days from the event date.” |

| Late Fees | If you charge a fee for late payments, be clear about the amount and when it will be applied (e.g., “A 5% late fee will be added for payments not received within 30 days”). |

| Deposits | Include any requirements for upfront payments, such as “A 50% deposit is required to secure the booking.” |

| Accepted Payment Methods | List the payment methods you accept, such as bank transfer, PayPal, or checks. |

How to Implement Payment Terms in Your Document

Once you’ve decided on the specific terms, it’s easy to incorporate them into your financial documents. Here’s a step-by-step guide:

- Find an appropriate section in your document where payment terms are usually listed, such as at the bottom or in a dedicated terms and conditions area.

- Write the terms clearly and in a straightforward manner. Avoid any complex language that could cause confusion.

- Ensure the terms are easy to find, as clients should be able to quickly reference the information if needed.

- Review the terms regularly to ensure they still match your current business practices and payment preferences.

Including clear payment conditions helps ensure smooth financial transactions, allowing you to manage your business professionally and efficiently.

Understanding the Elements of Band Invoices

Every well-structured financial document should contain key information that helps both the service provider and the client understand the terms of the transaction. Knowing the essential components of such documents ensures that payments are clear, disputes are minimized, and both parties are on the same page. In this section, we will break down the key elements that make up a professional statement, highlighting their importance and what each one contributes to the document.

Core Components of a Payment Document

Each document should include several important sections to ensure that all necessary details are covered. Below are the core elements that should be present:

| Element | Description | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Includes the name of the performer or group, contact information, and logo (if applicable) for professional branding. | ||||||||||||||||||||||||||||||||||||||||||

| Client Information | Identifies the client or venue with their name, address, and contact details for easy reference. | ||||||||||||||||||||||||||||||||||||||||||

| Event or Service Details | Describes the services rendered, such as performance dates, locations, and any special requirements agreed upon. | ||||||||||||||||||||||||||||||||||||||||||

| Pricing and Charges | Lists the agreed-upon rates, such as hourly rates or flat fees, and any additional charges like travel or equipment rental. | ||||||||||||||||||||||||||||||||||||||||||

| Payment Terms | Outlines when payment is due, any deposit requirements, and penalties for late payments. | ||||||||||||||||||||||||||||||||||||||||||

| Payment Method | Specifies how the

How to Avoid Common Billing MistakesAccurate billing is a critical aspect of maintaining a professional reputation and ensuring smooth financial transactions. Small mistakes in payment documents can lead to misunderstandings, delays, or even lost income. Being mindful of the most common billing errors and taking steps to avoid them can save time, reduce stress, and improve your client relationships. Below are some tips on how to avoid these issues and keep your financial processes running smoothly. Common Billing Errors to Watch For

Steps to Prevent Billing Mistakes

|