Invoice Template for Contractors to Simplify Billing

When it comes to managing payments, having the right documents can make all the difference. Professionals in various fields need to ensure that their financial transactions are organized, clear, and efficient. A well-structured payment request form is crucial for maintaining a smooth business operation, enabling both parties to understand the terms and amounts involved.

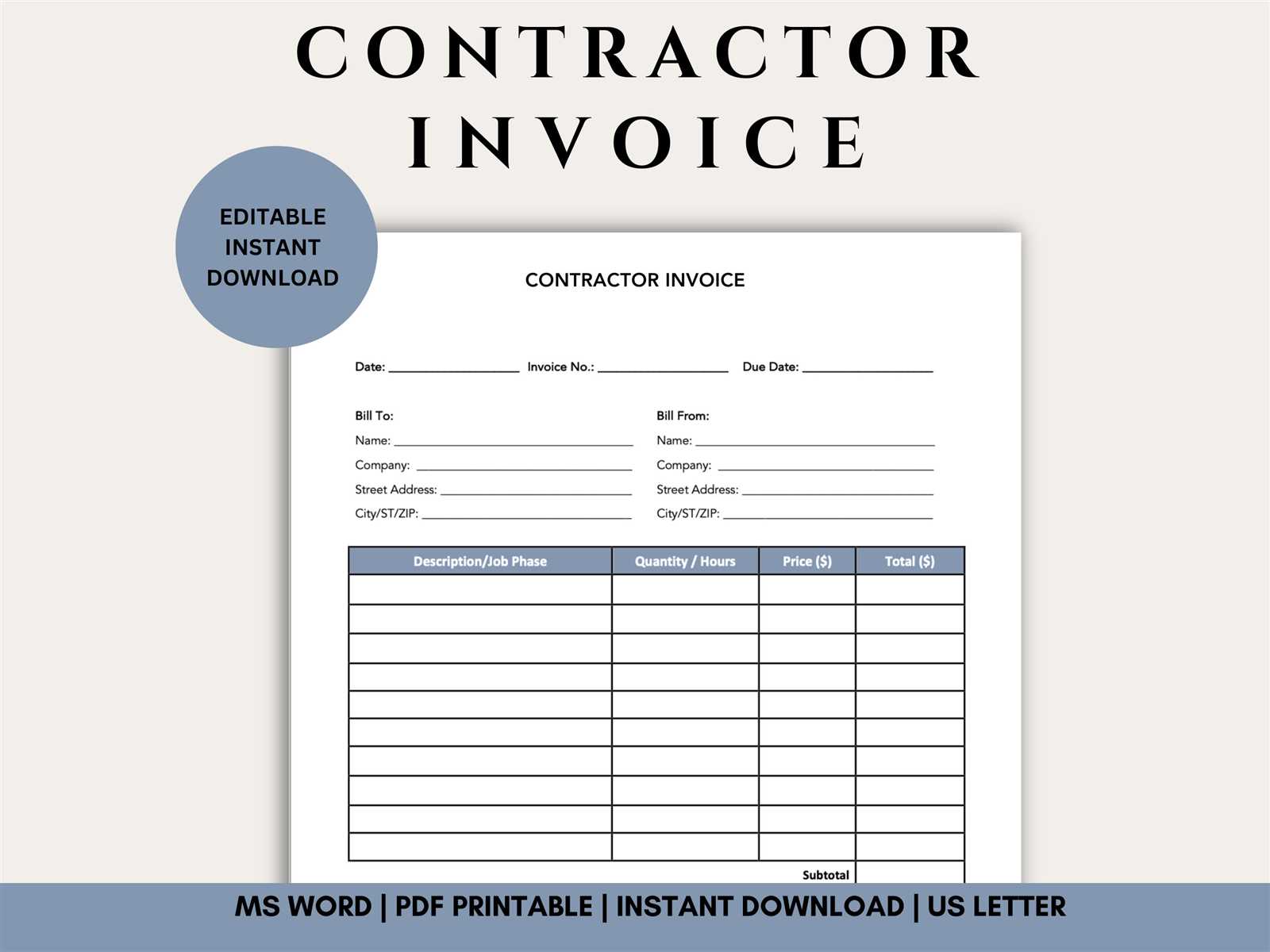

Creating customized billing forms that reflect the specifics of each job or service is essential. These documents serve not only as a record but also as a professional touch that builds trust with clients. Whether you’re working on a small task or a large-scale project, ensuring that the payment request is clear, concise, and properly formatted can prevent misunderstandings and delays.

Properly designed forms can save time, reduce errors, and create a more professional image. By integrating essential elements like payment terms, service details, and total amounts due, you can easily track outstanding payments and manage your finances. Additionally, with the right tools, you can personalize these forms to meet the specific needs of your business and clients.

Comprehensive Guide to Billing Documents

Efficient financial management starts with clear and professional payment requests. These essential documents are key for ensuring transparency between service providers and clients, helping both parties stay organized and on track. Having a structured, well-designed format ensures that all necessary details are included, minimizing the chance for confusion and disputes.

Creating an effective payment request involves more than just filling in amounts and dates. It requires attention to detail, ensuring that each form clearly communicates the terms of the agreement, the scope of the work, and the deadlines. A good format makes it easy for both the sender and receiver to understand the payment process.

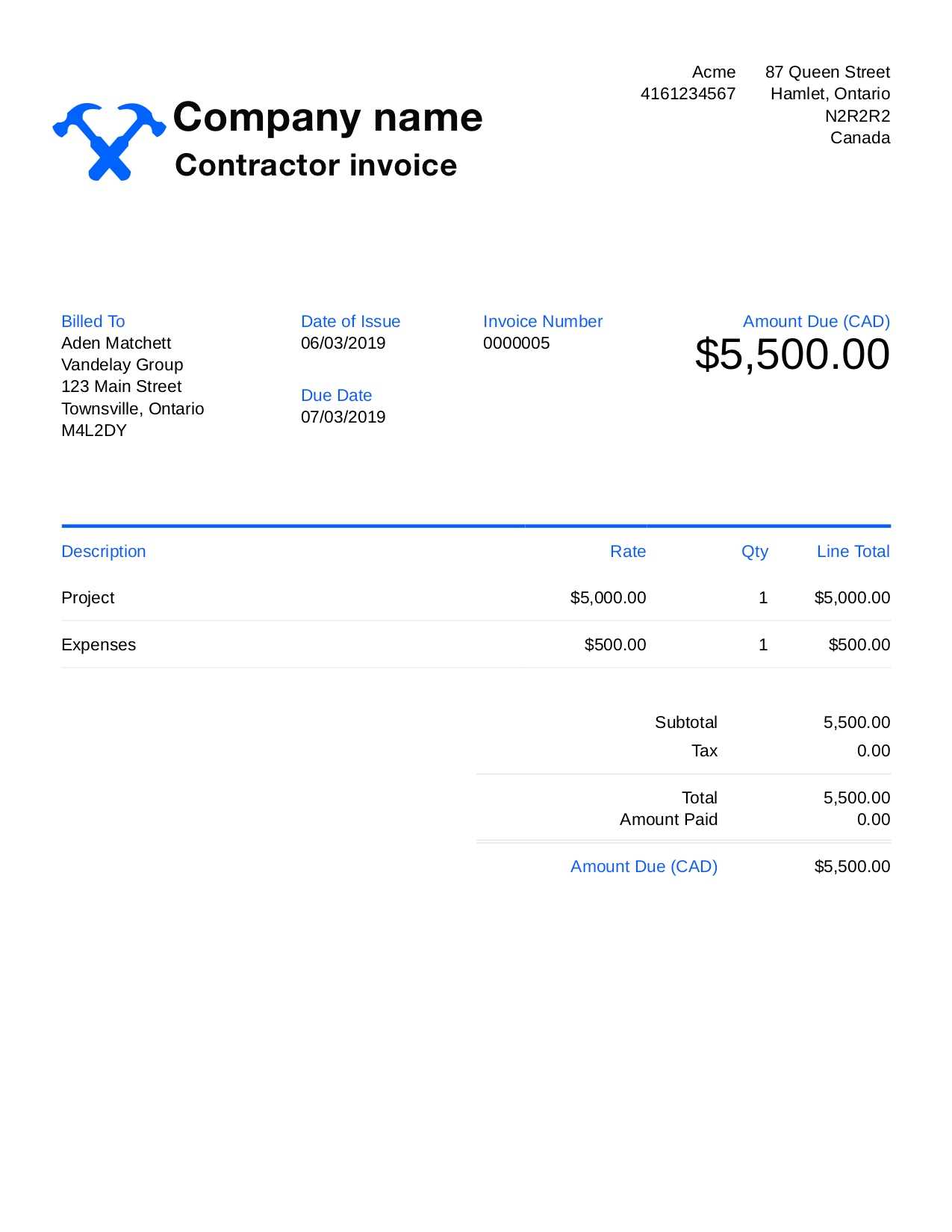

Key Elements to Include in Payment Requests

A properly designed payment form includes several important components. These typically include a clear description of the services rendered, the agreed-upon payment amount, and the date by which the payment is due. Adding a unique reference number can help track documents, especially when dealing with multiple clients or projects. Additionally, including contact information and payment instructions can further streamline the process.

Benefits of Customizing Your Documents

Customizing your billing forms allows you to reflect the specific needs of each project or job. Personalized details, such as hourly rates, materials used, or specific terms, give clients a clearer picture of what they are paying for. By tailoring your forms to suit the work at hand, you also reinforce your professionalism and attention to detail, making a lasting positive impression.

Why Professionals Need Structured Payment Forms

In the business world, keeping financial records organized is essential for smooth operations. Clear and well-structured payment documents not only help avoid misunderstandings but also streamline the billing process. Without a standardized approach, service providers risk confusion with clients regarding amounts due, payment terms, and deadlines.

Professionals, especially those offering specialized services, benefit from having a predefined format to manage their financial transactions. These organized forms provide clarity and ensure that both parties are aligned on the terms of the agreement. Without a consistent structure, tracking payments and ensuring timely compensation becomes significantly harder.

- Time-saving: Having a ready-to-use format reduces the time spent on creating new documents from scratch, allowing professionals to focus on their work.

- Accuracy: A structured form ensures that important details like pricing, work description, and payment terms are consistently included, reducing the chance of errors.

- Professionalism: Well-organized documents reflect a higher level of professionalism, fostering trust with clients and enhancing the business’s reputation.

- Efficiency in Tracking: Using a standardized format makes it easier to track outstanding payments and manage financial records effectively.

How to Create a Payment Request for Service Providers

Creating a payment request document is an essential step in ensuring clear communication about the amount due for work completed. This process involves organizing necessary details in a structured way so both parties understand the terms of payment. A well-crafted document serves not only as a record of the transaction but also as a professional communication tool that reflects your business practices.

Steps to Craft a Clear Payment Request

Follow these simple steps to create an effective payment request document:

- Include Your Contact Information: Make sure your name, business name, and contact details are prominently displayed at the top. This allows clients to easily reach out for any clarifications.

- List the Services Provided: Be specific about the work you completed. Include a brief description of each task, along with the agreed-upon rates or costs associated with the services.

- Specify Payment Terms: Include the due date, any late fees for overdue payments, and preferred payment methods (e.g., bank transfer, check, or online payment).

- Clearly State the Total Amount Due: The total should be easy to find and clearly broken down, showing any taxes, fees, or discounts.

Tips for Personalizing Your Document

To make your payment requests stand out and fit your unique business needs, consider adding personalized touches:

- Use a Professional Design: A clean, polished layout reflects your brand’s professionalism and helps make a positive impression.

- Add a Unique Reference Number: Including a unique identification number for each document helps track payments and organize your records more effectively.

- Attach Terms and

Key Elements of a Payment Request Document

Creating an effective payment request involves more than simply listing the amount due. It’s important to ensure that all necessary details are included in the document so that both parties understand the terms clearly. A well-structured payment request protects both the service provider and the client by outlining the scope of work, payment terms, and other critical elements.

Essential Information to Include

Here are the key components that should always be present in a professional payment document:

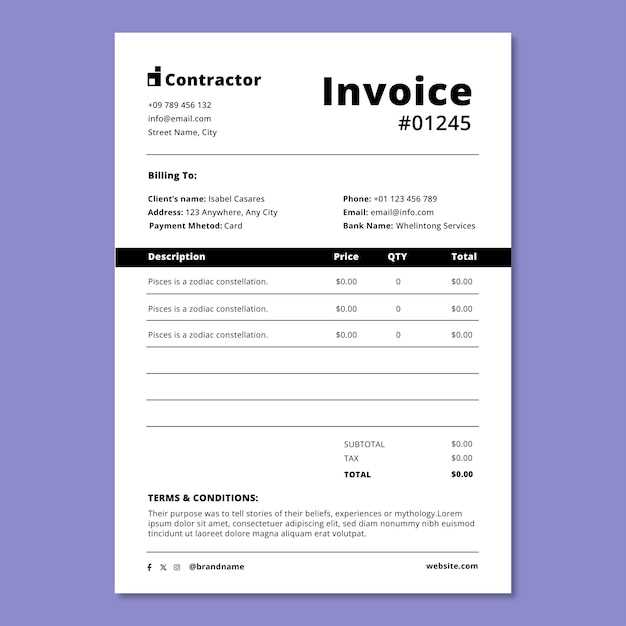

- Contact Information: Both the service provider’s and client’s contact details should be clearly displayed at the top of the document. This ensures that there’s no confusion about who is responsible for payment.

- Unique Reference Number: Including a unique identifier helps track the document in case of future reference or disputes.

- Description of Work: A clear and concise description of the services rendered should be provided. This can include details about each task, the rate charged, and the number of hours worked, if applicable.

- Payment Amount: The total amount due must be highlighted. This should be broken down into individual components, such as labor costs, materials, and taxes.

- Due Date: Clearly state when the payment is expected. If there are any penalties for late payment, include this information as well.

Additional Considerations

While the basics are essential, there are additional elements that can improve the clarity and professionalism of the document:

- Terms and Conditions: Include any legal or contractual terms that apply to the work performed, such as warranties, dispute resolution, or payment methods.

- Payment Methods: Specify how the client can pay, whether through bank transfer, online payment, or another method.

- Tax Information: Depending on the region, you may need to include tax identification numbers or other tax-related details to comply with local laws.

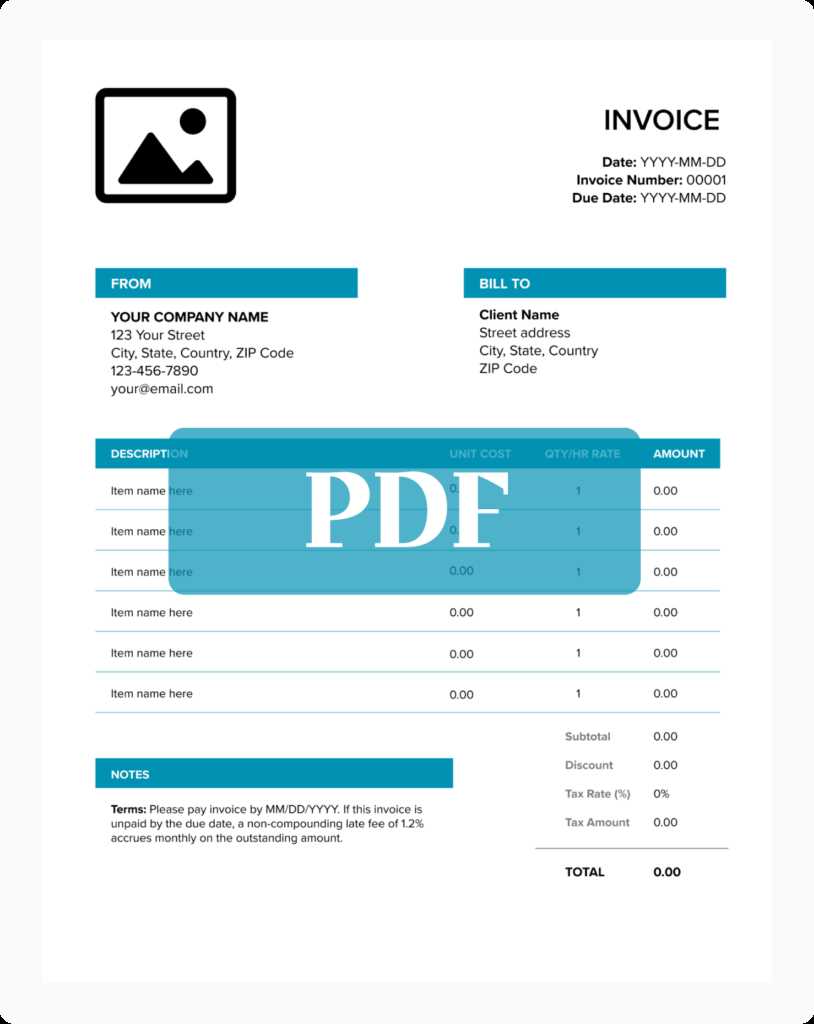

Choosing the Right Billing Document Format

Selecting the correct structure for your financial documents is essential for ensuring clarity and efficiency in your business transactions. A suitable format not only helps you organize the necessary details but also reflects your professionalism. The right structure makes it easier for clients to understand the charges and terms, while also allowing you to track payments and manage records effectively.

Factors to Consider When Selecting a Format

When choosing the most suitable format, there are several important factors to keep in mind:

- Clarity: The format should make the information easy to read and understand. Avoid overly complicated designs or cluttered layouts.

- Customization: Ensure that the structure can be easily tailored to suit different jobs or services. This flexibility will help you accommodate varying pricing models or project requirements.

- Professional Design: A clean, polished format reinforces a professional image. Clients are more likely to trust a service provider who presents their billing documents in an organized, professional way.

- Compliance: Make sure the format adheres to any legal or tax requirements, such as including your business identification number or tax rates, depending on your region.

Comparing Different Options

Here’s a comparison of some common document formats, highlighting their key features:

Format Customization Ease of Use Professional Appeal Basic Text Document Moderate High Low Spreadsheet High Moderate Moderate Online Billing System High High High Customizing Your Billing Document Format

Personalizing your financial documents allows you to create a format that reflects your unique business practices while maintaining professionalism. Customizing the layout and content ensures that your billing records align with the specific needs of your projects and clients. A tailored approach makes it easier for both parties to understand the payment structure and ensures a smooth transaction process.

Key Areas for Personalization

Here are some essential aspects to consider when customizing your payment request format:

- Logo and Branding: Including your company’s logo and brand colors helps maintain a consistent business identity. This makes your document instantly recognizable to clients.

- Service Descriptions: Modify the sections describing the work done to match the nature of your services. Provide clear, concise descriptions of each task or project stage to avoid confusion.

- Payment Terms: Customize the payment terms to suit each project. This may include different deadlines, late fees, or payment methods depending on the specific arrangement with your client.

- Itemized List: An itemized breakdown allows for a detailed overview of costs, whether it’s hourly rates, material costs, or other charges, making it easier for clients to understand how the total amount was calculated.

Benefits of Customization

Personalizing your billing format offers several advantages:

- Professional Appearance: Tailored documents give your business a polished, professional image that can help foster trust with clients.

- Improved Clarity: Customizing sections ensures that the information is relevant to each specific job, helping clients understand exactly what they’re paying for.

Benefits of Using a Predefined Billing Format Utilizing a predefined structure for your financial documents brings multiple advantages, streamlining the process and ensuring consistency across all transactions. Instead of starting from scratch each time, a ready-made format allows you to focus on the core details, saving you valuable time while maintaining professionalism in your billing practices.

By relying on a standardized layout, you reduce the risk of missing important details or making errors in your calculations. This consistency is not only efficient but also helps build trust with clients, as they become familiar with the format and can quickly find the information they need. A well-structured document reflects reliability and attention to detail, strengthening your business reputation.

- Time Efficiency: Predefined structures allow you to quickly input the necessary details, saving time compared to creating a new document from scratch.

- Consistency: Using a standard format ensures that all documents follow the same layout, making them easy to read and understand for clients.

- Reduced Errors: With key fields already set up, the chances of forgetting important information or making miscalculations are minimized.

- Professional Image: A consistent and polished format enhances the image of your business, presenting you as organized and reliable.

- Customization Options: Predefined formats are flexible enough to accommodate any specific requirements, allowing for adjustments without losing structure or clarity.

Common Mistakes to Avoid in Billing Documents

When creating billing records, it’s crucial to avoid common mistakes that can lead to confusion or delayed payments. Small errors or overlooked details can disrupt the smooth flow of business transactions and harm the professional relationship with clients. By paying attention to these common pitfalls, you can ensure that your documents are clear, accurate, and professional.

- Missing Contact Information: Always include both your and the client’s full contact details. Missing or incorrect contact information can cause delays in communication and payment processing.

- Incorrect Payment Amounts: Double-check all calculations to ensure the total amount is accurate. Errors in the total can cause misunderstandings and may lead to non-payment or payment disputes.

- Unclear Service Descriptions: Provide a detailed description of the services rendered. Vague or incomplete descriptions can cause confusion and prevent clients from understanding what they’re being charged for.

- Omitting Payment Terms: Make sure to clearly state payment deadlines and accepted payment methods. Failing to include this information can lead to delayed payments or disputes over payment terms.

- Failure to Number Documents: Without a unique document number, it’s difficult to track payments and reference past transactions. Each document should have a distinct identifier.

- Not Including Taxes or Additional Fees: If applicable, be sure to list any taxes or additional charges clearly. Leaving these out can lead to disputes when clients see unexpected charges later.

- Ignoring Late Payment Fees: If late fees apply, specify them upfront. Failure to mention these can cause frustration if a client pays late, and they may not take the fees seriously.

Free vs Paid Billing Formats

When choosing a format for your financial documents, you have the option to use free or paid versions. Both options offer distinct advantages, but the choice largely depends on the specific needs of your business. Free options are accessible and cost-effective, while paid versions often provide additional features and customization that can enhance the professionalism and functionality of your records.

Free billing formats are typically basic and suitable for small businesses or individuals who need a straightforward way to organize transactions. However, these formats may lack advanced features or flexibility. On the other hand, paid options offer more comprehensive tools, such as customizable fields, advanced reporting, and better customer support, which can save time and improve your overall billing process.

Advantages of Free Formats

- No Cost: Free options don’t require any financial investment, making them ideal for startups or businesses with tight budgets.

- Simple to Use: Basic formats are often easy to set up and use, allowing users to quickly create and send documents without much technical knowledge.

- Good for Low-Volume Transactions: If your business handles a limited number of transactions, a free format can be sufficient to manage your billing needs effectively.

Advantages of Paid Formats

- Customization: Paid formats often offer more options for personalization, allowing you to tailor documents to your business’s branding and client requirements.

- Advanced Features: Features like automated calculations, tax integrations, and invoice tracking make paid options more powerful and efficient for businesses with higher transaction volumes.

- Better Support: Many paid services offer customer support, ensuring that you can get help if you encounter any issues or need guidance on using the system.

How to Add Payment Terms to Billing Documents

Including clear payment terms in your financial records is essential for ensuring smooth transactions between you and your clients. By specifying when and how payments are due, you set clear expectations and reduce the risk of delayed or missed payments. Payment terms can vary depending on the nature of your work and the agreement with your clients, but having them outlined from the start makes the process more transparent for both parties.

Essential Payment Terms to Include

There are several key payment terms you should consider when preparing your billing documents:

- Due Date: Specify the exact date by which the payment should be made. This helps prevent confusion and ensures clients are aware of their obligations.

- Late Fees: Include any penalties for late payments, such as a percentage of the total amount due for each day past the deadline.

- Payment Methods: Clearly state the acceptable payment methods (e.g., bank transfer, credit card, checks) to avoid any misunderstandings.

- Discounts for Early Payment: Offer a discount for clients who pay early. This can incentivize faster payments and improve cash flow.

How to Communicate Payment Terms Effectively

To avoid confusion and ensure your clients are fully aware of your payment expectations, it’s important to present the payment terms clearly:

- Positioning: Place the payment terms in a prominent position, such as near the top or bottom of the document, so they are easy to find and reference.

- Be Specific: Use clear, unambiguous language when outlining payment expectations. For example, instead of “payment is due soon,” specify an exact date.

- Consistency: Use the same terms for all your transactions to avoid confusion. This ensures that clients know what to expect from each agreement.

Including Tax Information in Billing Documents

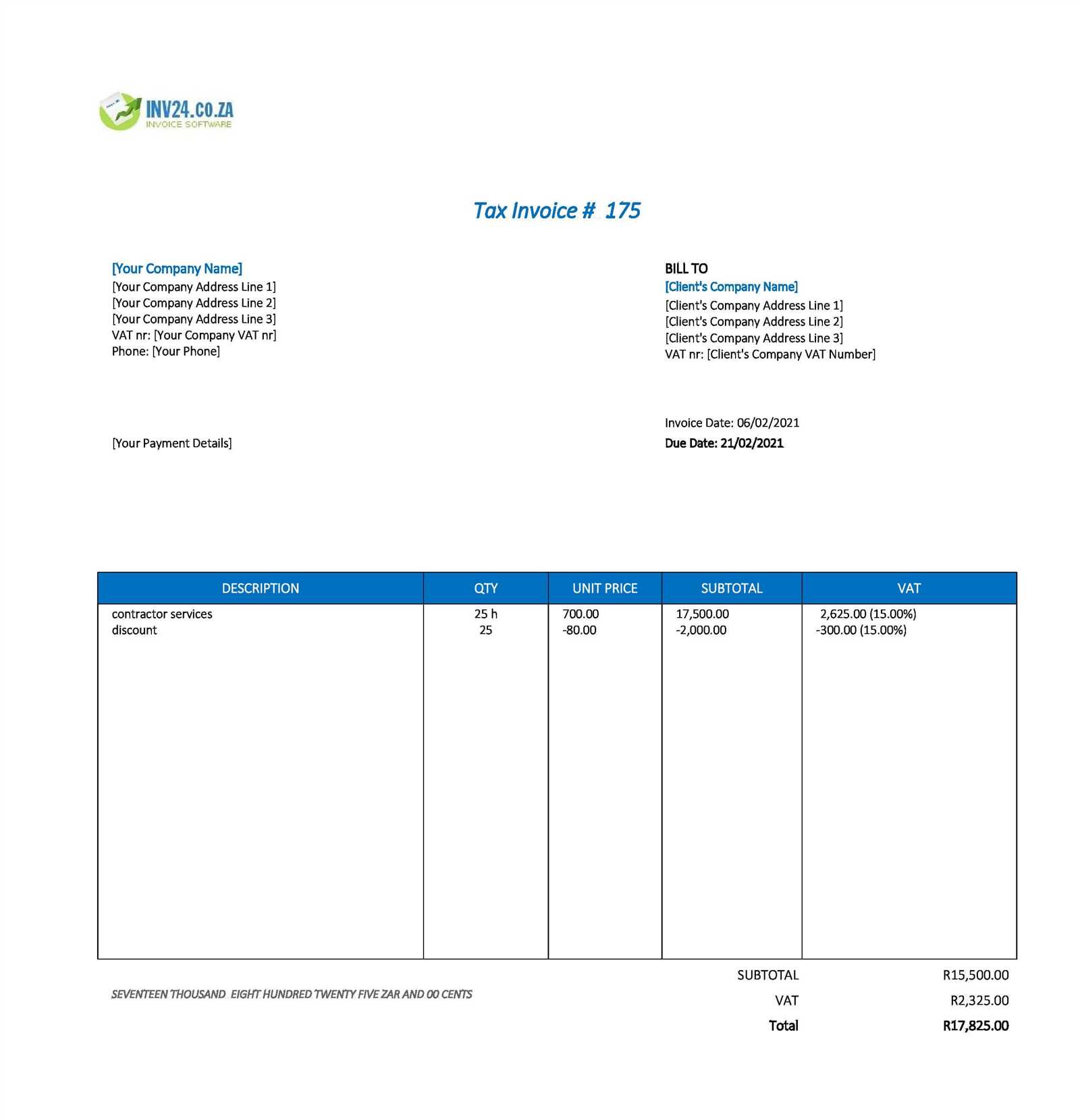

Accurately including tax details in your financial documents is crucial for compliance with local regulations and for transparency with your clients. Taxes can vary depending on the location, type of service, and other factors, making it essential to clearly outline this information in your records. By properly including tax information, you not only ensure that your documents are legally sound, but you also help your clients understand the breakdown of their payments.

Key Tax Details to Include

There are several key elements related to taxes that should always be included in your billing documents:

- Tax Rate: Specify the exact percentage of tax that is applied to the transaction. This ensures that both parties understand the amount being charged for taxes.

- Taxable Amount: Clearly indicate the total amount before tax, so clients can see how much of the total charge is subject to taxation.

- Tax ID Number: If required, include your business’s tax identification number. This is particularly important for businesses that operate in regions with strict tax reporting requirements.

- Breakdown of Taxes: If applicable, provide a clear breakdown of any taxes being charged, especially if multiple rates or types of taxes apply to different services or products.

Why Including Tax Information Matters

Properly detailing tax information can help avoid confusion and disputes. Clients need to see how their payments are structured, including the tax amounts, to ensure they are being charged correctly. Additionally, it helps businesses stay compliant with tax regulations, reducing the risk of fines or legal issues.

- Regulatory Compliance: Most jurisdictions require businesses to provide tax details in billing documents to meet local tax laws.

- Transparency: A clear tax breakdown promotes trust and professionalism by ensuring that clients are fully informed about how much they are paying and why.

Billing Formats for Different Types of Work

When managing billing documents, it’s important to customize the format based on the type of service or project you are working on. Each industry or profession may require specific information, categories, or sections that are unique to the work being provided. By adapting your records to fit the nature of the job, you can ensure clarity and accuracy for both you and your clients.

Service-Based Work

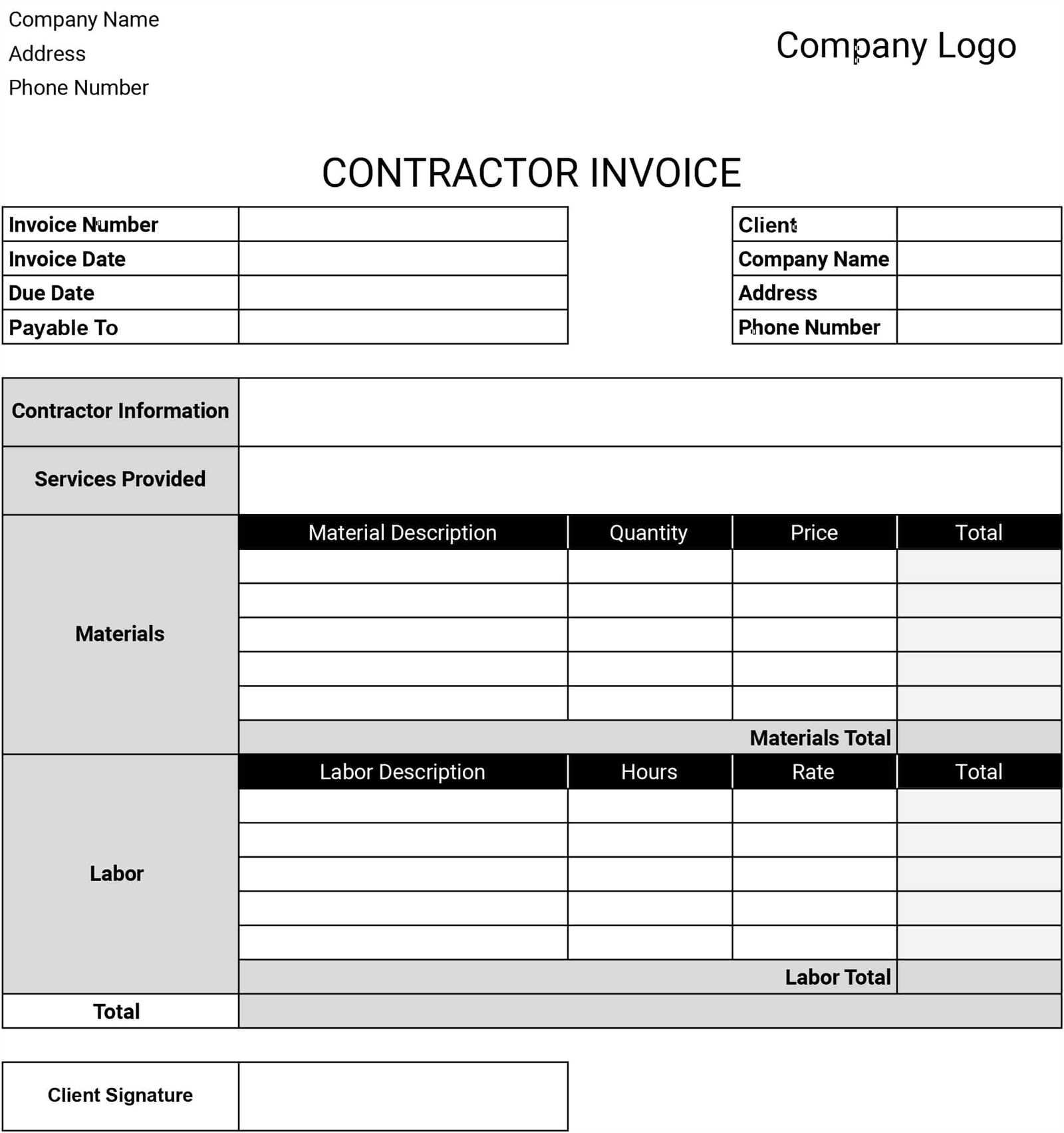

For service-oriented tasks, such as consulting, design work, or maintenance, the billing document should focus on the time spent, the services rendered, and any relevant hourly or flat rates. It’s important to clearly outline the duration of each task, any project milestones, and the final amount due.

- Hourly Rates: Clearly state the number of hours worked and the rate per hour.

- Service Description: Provide a detailed description of the service delivered, including specific tasks completed.

- Service Dates: Include the dates or period in which the service was rendered to establish a clear timeframe.

Project-Based Work

For project-based work, such as construction, renovations, or other long-term engagements, the billing documents should reflect the scope of the project, progress milestones, and payment schedules. It’s also helpful to include any upfront deposits and the remaining balance due upon completion.

- Project Phases: Break the project into manageable stages or phases, and include the amount due upon the completion of each phase.

- Materials and Supplies: If materials are included, provide a breakdown of the cost of materials along with labor charges.

- Due Dates: Clearly specify when payments are expected for each phase or milestone.

Best Tools for Creating Billing Documents

Choosing the right tools to manage your billing process is crucial for ensuring efficiency and accuracy. With the right software or platform, you can streamline the process, customize documents to suit different needs, and even automate certain tasks like tracking payments or generating recurring bills. There are several options available, from simple online tools to comprehensive accounting systems.

Online Platforms

Online tools offer simplicity and flexibility, making them ideal for small businesses or freelancers. These platforms often include user-friendly interfaces and ready-made formats that can be customized to fit your business needs. They allow you to quickly create, send, and track documents without the need for complex software installation or maintenance.

- FreshBooks: A popular option for freelancers and small businesses, FreshBooks provides easy-to-use tools for generating bills, tracking payments, and managing client information.

- Wave: A free online accounting software that includes tools for creating professional billing documents, tracking expenses, and generating reports.

- Zoho Invoice: An intuitive platform that helps businesses manage billing, expenses, and payments. It also offers mobile access for on-the-go invoicing.

Accounting Software Solutions

For businesses with more complex financial needs, comprehensive accounting software may be the best choice. These tools not only handle the creation of billing documents but also integrate other essential business functions, such as payroll, financial reporting, and tax management.

- QuickBooks: One of the most widely used accounting platforms, QuickBooks allows you to create customizable billing documents while offering a complete suite of accounting features.

- Xero: Known for its simplicity and powerful features, Xero makes managing finances and generating professional documents easy, especially for growing businesses.

How to Send Invoices Professionally

Sending billing documents in a professional manner not only reflects well on your business but also ensures that your clients understand the details and expectations clearly. The method of delivery, the tone of communication, and the organization of the document all contribute to creating a professional image and fostering positive client relationships.

Choose the Right Delivery Method

The way you send your billing documents can significantly impact the client’s experience. Electronic methods are often the quickest and most efficient, especially for clients who expect fast processing. Email is widely used, but online platforms and apps can also streamline the process, allowing for faster tracking and responses.

- Email: Sending via email is one of the most common and professional ways to deliver documents. Always attach the file in a PDF format to maintain its layout and readability.

- Online Platforms: Platforms like accounting software or cloud services often include secure features for sending and storing documents, ensuring both parties have access to them at any time.

Craft Clear and Professional Communication

Accompany the document with a polite and straightforward message. A professional tone helps set the right expectations and maintain a positive rapport with your client. Make sure to include important details, such as the total amount due, payment due date, and any relevant terms.

- Subject Line: Use a clear and concise subject line, such as “Billing Statement for [Service Provided]” or “Payment Due for [Project Name].”

- Body of the Email: Write a short, polite message. Example: “Dear [Client Name], attached is the billing document for the [specific project/service]. Please let me know if you have any questions. The total amount due is [amount], with a due date of [due date].”

Follow Up Appropriately

After sending the document, it’s important to monitor whether the payment is processed on time. If the payment is overdue, follow up with a friendly reminder. A gentle nudge ensures that your client is aware of the payment terms without creating tension.

How to Track Invoice Payments

Efficiently tracking payment status is essential for maintaining good financial management. Monitoring when clients settle their balances helps avoid overdue payments and ensures your cash flow remains steady. Using a systematic approach will enable you to stay organized and follow up appropriately when necessary.

Implement Payment Tracking Systems

To keep track of payments, it’s important to have a system in place. You can choose between manual methods or automated software, depending on your preferences and business needs. Both options allow you to monitor which clients have paid and which still owe balances.

- Spreadsheets: A simple way to track payments is by using a spreadsheet. Record the client, amount, due date, and payment received. Update the status as soon as a payment is received.

- Accounting Software: Many businesses use accounting tools that automate the tracking process. These systems can automatically update payment statuses, send reminders, and generate reports.

Set Up Reminders and Follow-Ups

Keeping track of payment deadlines is crucial for timely collections. Setting up automated reminders or follow-up emails can help prompt clients who haven’t made their payments yet.

- Automated Email Reminders: Most accounting tools offer automated emails that remind clients of their upcoming or overdue payments.

- Manual Follow-Ups: If you prefer a personal touch, you can send a polite follow-up email, reminding clients of the outstanding balance and requesting prompt payment.

How to Ensure Timely Payments with Invoices

Securing timely payments is crucial to maintaining smooth operations and positive cash flow. To avoid delays, clear communication and well-organized documents are key. Implementing the right strategies and following up promptly can help ensure that clients pay within the specified time frame.

Provide Clear Payment Terms

Clearly stating payment expectations from the outset is vital. When you outline payment terms, including the due date, accepted payment methods, and penalties for late payments, you reduce the chances of misunderstandings and late fees.

Payment Term Description Due Date Clearly specify when the payment should be made, whether it’s upon completion or within a certain number of days. Late Fees State any penalties for overdue payments to encourage timely action from clients. Payment Methods List all available payment methods such as bank transfers, credit cards, or online platforms. Send Reminders and Follow-Up Emails

Sending reminders before the due date and following up after the deadline is a great way to keep payments on track. Automated or manual reminders can be an effective tool to prompt clients to pay on time, reducing the risk of delayed payments.

Legal Considerations for Contractor Invoices

When issuing payment requests, understanding the legal aspects ensures that both parties are protected and all requirements are met. There are certain guidelines and rules to follow when creating billing documents that can help avoid disputes and ensure compliance with local laws.

Essential Legal Information to Include

It’s important to include all the necessary legal details in your billing documents. Failing to do so could result in delays or challenges in collecting payments. Here are some essential elements:

Information Importance Client and Business Details Both the service provider and the client’s names, addresses, and contact details must be clearly listed to ensure there is no confusion about who the payment is due from and to. Agreement Terms It is crucial to outline the terms of the contract, including the agreed price, payment schedule, and deadlines, to ensure mutual understanding and avoid misunderstandings. Legal Jurisdiction Clarifying which jurisdiction (location) governs the agreement can be important in case of any legal disputes or disagreements over payment terms. Tax Identification Including your tax identification number (TIN) ensures that the transaction complies with tax laws and allows both parties to fulfill their tax obligations accurately. Protecting Your Rights

To further safeguard your rights, it’s recommended to always use formal contracts in conjunction with your billing requests. This provides a written record of both parties’ obligations and protects your legal standing in case of non-payment or disputes.