Customizable Numbers Invoice Template for Effortless Invoicing

Efficient billing is essential for any business, whether you are a freelancer, a small company, or a large organization. Creating professional and accurate financial documents can be a time-consuming task, but with the right tools, it becomes much simpler. A customizable solution can save you time while ensuring that your documents are clear, consistent, and tailored to your specific needs.

In this guide, we’ll explore how you can easily generate professional invoices with a versatile and easy-to-use software. By understanding how to make the most of this solution, you’ll be able to create documents that not only look great but also function seamlessly, helping you stay organized and track payments effortlessly.

Efficient design and automation will allow you to focus on what matters most: running your business. Instead of manually calculating totals and formatting every document from scratch, you can rely on pre-made structures that do the heavy lifting for you. This approach enhances productivity while maintaining a professional appearance across all your transactions.

Numbers Invoice Template Overview

Creating polished and professional financial documents is a key aspect of running a successful business. The right solution can simplify this task by providing a structured and customizable format that adapts to your specific needs. Whether you are billing clients for services rendered or tracking payments, having a reliable document format ensures accuracy and consistency in all your transactions.

With a user-friendly solution, you can easily generate documents that reflect your business’s brand while automating the most tedious tasks, such as calculations and layout adjustments. The flexibility of this tool means that it can be tailored to suit a variety of industries and individual preferences. You can easily modify fields, adjust design elements, and save your work for future use.

Efficiency and convenience are at the core of this tool, helping you focus on your core business activities. By using a ready-to-go structure, you can reduce the time spent on administrative tasks and ensure that each document is professional, accurate, and aligned with your business standards.

What is a Numbers Invoice Template

An essential tool for businesses, a customizable document format allows users to create professional billing records quickly and accurately. These structured files are designed to automate the process of organizing financial data, from client information to the breakdown of services provided. They enable anyone, from freelancers to larger enterprises, to generate consistent and clear records that can be easily shared and stored.

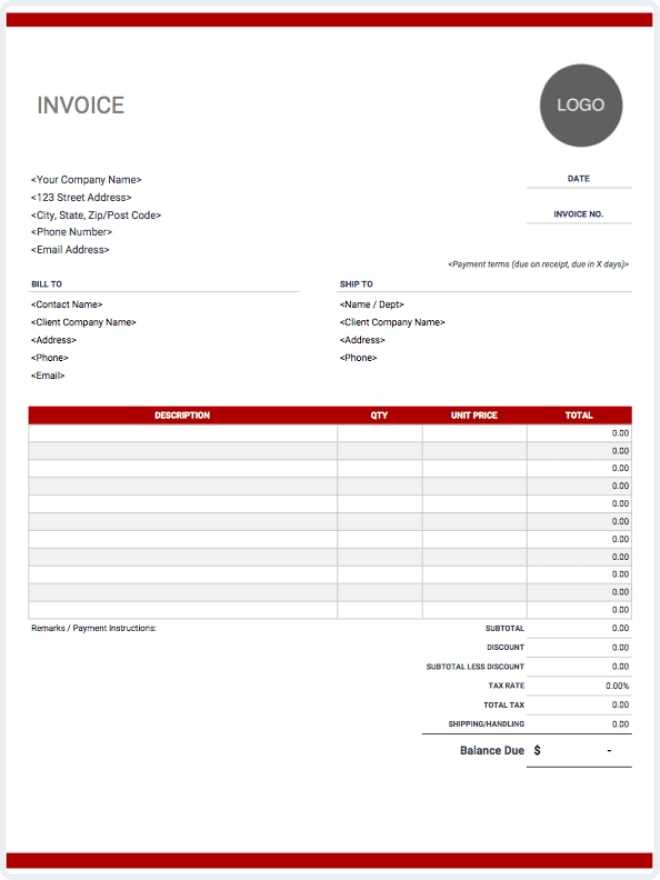

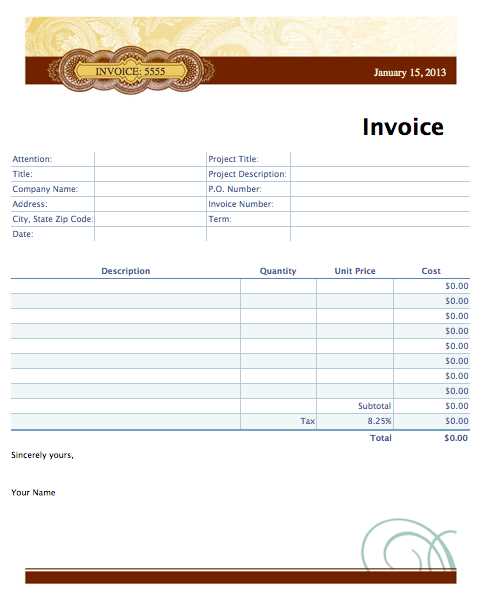

Such a solution often includes pre-set fields for important details like payment terms, dates, and itemized services, reducing the time spent on manual entries. It also helps to maintain a standardized appearance across all documents, making them look polished and ensuring that no critical information is overlooked. Additionally, the flexibility of the format means that it can be tailored to suit specific business needs, whether you’re invoicing for one-time projects or ongoing services.

With this streamlined approach, creating accurate, professional documents becomes both efficient and simple, allowing businesses to focus on growth while minimizing the complexities of financial record-keeping.

Benefits of Using Numbers for Invoicing

Choosing the right tool for creating financial records can greatly enhance your business’s efficiency. Using a flexible, spreadsheet-based solution for generating billing documents offers numerous advantages, especially in terms of customization, automation, and ease of use. With a variety of built-in features, this approach allows users to quickly create accurate records while maintaining a professional appearance.

One key benefit is the ability to automate calculations and reduce the risk of errors. By setting up formulas, you can instantly calculate totals, taxes, and discounts without having to manually adjust the figures. Additionally, the built-in design options ensure that every document looks polished and consistent without requiring advanced design skills.

Customization and Flexibility

The versatility of spreadsheet software allows for complete customization of your financial documents. You can modify layouts, add or remove fields, and adjust fonts or colors to reflect your brand. This flexibility is especially useful for businesses that need to tailor their documents to specific client needs or industry standards.

Time-Saving Features

Another advantage is the time-saving potential of using a spreadsheet-based approach. With pre-set fields and automated calculations, you can quickly create and send out multiple billing documents. You can even save your work and reuse it for future transactions, reducing the time spent on each new document.

| Benefits | How It Helps |

|---|---|

| Automation | Automatically calculates totals, taxes, and discounts |

| Customizability | Allows you to adjust layouts and branding |

| Time Efficiency | Reduces manual work by reusing documents and pre-set fields |

| Consistency | Ensures a professional and uniform appearance across all records |

By leveraging these features, businesses can streamline their billing process, ensuring that each document is both accurate and professional while saving valuable time and effort.

How to Create a Simple Invoice

Creating a straightforward billing document is easier than it seems. With the right tools, you can set up a clean and functional record that includes all the necessary details for clients to review and process payments. A simple yet effective format helps streamline the billing process, ensuring accuracy and professionalism every time.

The key steps involve inputting basic information such as your business details, the client’s information, a list of services or products provided, and the total amount due. By following a logical structure and using automated calculations, you can avoid common errors and present a polished document that reflects your business’s professionalism.

Step 1: Add Business and Client Information

Start by including your company’s name, address, and contact details at the top of the document. Below that, add the client’s information, including their name, address, and any relevant contact details. This ensures both parties have clear reference points for the transaction.

Step 2: List Services or Products Provided

Next, provide a detailed list of the products or services you’ve provided, including a brief description, quantity, unit price, and total amount for each item. This section allows both you and the client to easily identify the work completed or products delivered, ensuring transparency.

Step 3: Calculate the Total Amount Due

After listing all items, automatically calculate the subtotal, applicable taxes, and any discounts. Ensure the final amount is clearly visible at the bottom of the document, alongside the payment terms and due date. This ensures there is no confusion regarding the total balance owed.

By following these steps, you can create a simple yet effective billing document in no time, ensuring a smooth transaction process with your clients.

Customizing Your Numbers Invoice Template

Personalizing your billing documents allows you to tailor them to your specific business needs and enhance the professional image of your company. Customization ensures that the documents you send out are not only functional but also aligned with your brand identity. Whether you’re adjusting the layout, adding custom fields, or including specific payment instructions, these simple changes can make a big impact on the clarity and effectiveness of your records.

Many tools offer a range of customization options that allow you to modify almost every aspect of your document. This includes the design elements, the content structure, and the automated features, ensuring that your records are uniquely suited to your business and client relationships.

Adjusting the Layout and Design

- Change fonts and colors: Customize the text style and color scheme to match your brand’s aesthetic.

- Rearrange sections: Move elements like contact details, item descriptions, or totals to create a more user-friendly document layout.

- Add a logo: Include your company’s logo at the top to make your document instantly recognizable.

Adding Custom Fields and Information

- Additional service details: Include extra fields to describe specific terms or conditions related to your services or products.

- Payment methods: Add a section for different payment options or banking details to give clients flexibility in how they pay.

- Notes or discounts: Create fields to offer special promotions or include custom notes to your clients for better communication.

By making these adjustments, you not only create a more personalized document but also improve the functionality and clarity of your records. These changes can enhance the client experience, help ensure faster payments, and reinforce your business’s professional image.

Key Features of Numbers Invoice Templates

Modern business billing tools come with a variety of built-in features designed to simplify the process of creating and managing financial documents. These features allow users to automate key aspects of the document creation, ensuring accuracy and professionalism in every transaction. By using a customizable structure, businesses can streamline their workflow, saving valuable time while maintaining a high level of consistency.

The most effective tools offer a combination of automation, flexibility, and user-friendly design, enabling businesses to create tailored documents that meet their specific needs. From calculations to layout customization, these features are built to enhance both the functionality and the visual appeal of each record.

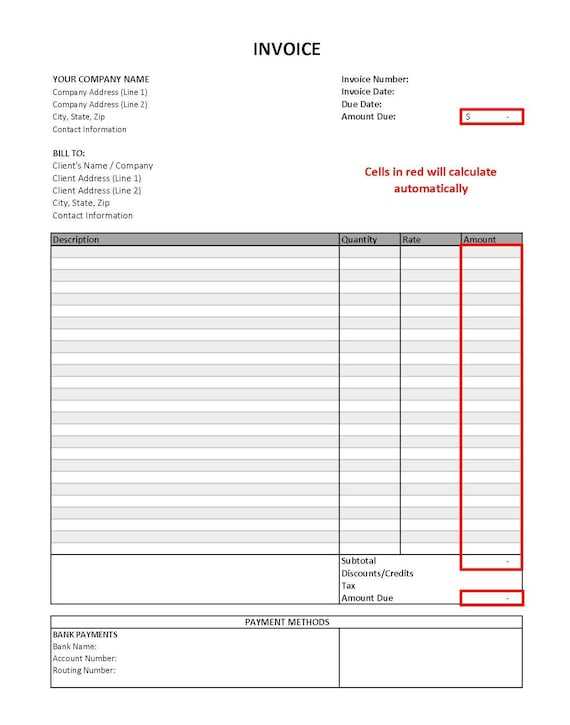

Automated Calculations

One of the most important features is the ability to automate mathematical operations. Whether it’s adding up totals, calculating taxes, or applying discounts, the tool can instantly perform these tasks, eliminating the need for manual adjustments and reducing the risk of errors.

Customizable Layouts

Another key feature is the ability to adjust the document layout to fit your brand and client needs. You can easily add logos, adjust text alignment, and choose the best format for your specific business requirements.

| Feature | Benefit |

|---|---|

| Automated Calculations | Instantly calculates totals, taxes, and discounts, saving time and reducing errors |

| Customizable Fields | Add or remove sections to suit the nature of your services or products |

| Professional Design | Ensure your records have a polished, consistent appearance |

| Recurring Templates | Easily reuse and modify documents for ongoing transactions with clients |

With these features, businesses can c

Why Choose Numbers Over Excel

When it comes to creating and managing financial records, there are several tools available, but choosing the right one depends on your business needs and preferences. While spreadsheet programs like Excel are popular, many users find that a more streamlined and user-friendly solution can offer a better experience for basic billing and record-keeping tasks. A key alternative is a simpler, more intuitive option that allows for seamless integration with other tools, offering a more straightforward approach to creating and managing financial documents.

Here are some reasons why many businesses prefer this alternative over more traditional spreadsheet software:

- Ease of Use: The interface is more intuitive, with drag-and-drop features and a cleaner design, making it easier for users to get started without needing advanced spreadsheet skills.

- Better Integration with Apple Devices: For those already using Apple products, this solution integrates seamlessly with macOS and iOS devices, making it easier to work across different platforms.

- Pre-Designed Layouts: Unlike Excel, which requires manual adjustments and formatting, this alternative offers a range of pre-designed layouts and templates that you can easily customize, reducing the time spent on formatting.

- Automatic Synchronization: Changes made on one device are automatically updated on all your other Apple devices, ensuring that you’re always working with the latest version of your document.

In summary, this alternative offers a more user-friendly, efficient experience for businesses looking to simplify their document creation and financial tracking, especially for those who value ease of use and integration with their existing devices.

Steps to Download an Invoice Template

Getting started with creating professional billing documents can be quick and easy when you have the right format. Downloading a ready-to-use structure allows you to save time on formatting and start customizing your records right away. By following a few simple steps, you can access a pre-designed document that fits your business needs and can be easily modified to suit your style.

Here’s a step-by-step guide to help you download a structured document format that will make your billing process more efficient and effective:

Step 1: Find a Trusted Source

Start by locating a reliable website or platform that offers a variety of customizable record formats. Many platforms offer both free and paid options, so choose one based on your specific needs. Ensure that the source is reputable and that the formats are compatible with the software you’re using.

Step 2: Select the Right Format

Once you’ve found a trusted platform, browse through the available options and select the format that best fits your requirements. Look for a clean, professional design with the necessary fields, such as client information, services, and totals. Many platforms allow you to preview the design before downloading, so take advantage of that feature to ensure it suits your preferences.

| Step | Action |

|---|---|

| Step 1 | Find a reputable platform offering customizable record formats |

| Step 2 | Select the format that fits your business needs |

| Step 3 | Download the file to your device |

| Step 4 | Open the file in your preferred software and begin customization |

Once you’ve selected the right format, simply click the download button, and the file will be saved to your device. After downloading, you can easily open it in your chosen application, make the necessary adjustments, and start using it for your billing needs.

Best Practices for Professional Invoices

Creating clear, accurate, and professional financial documents is crucial for maintaining a strong relationship with clients and ensuring timely payments. A well-structured billing record not only reflects your business’s professionalism but also makes it easier for clients to process and understand their payments. By following a few best practices, you can improve the effectiveness of your records, reduce confusion, and streamline your billing process.

1. Include All Essential Information

One of the most important aspects of a professional billing document is ensuring that all relevant details are clearly stated. At a minimum, each document should include:

- Your business name, address, and contact information

- Client’s name and contact details

- A unique reference number or identifier for the record

- A detailed list of the goods or services provided

- The total amount due, including taxes and any discounts applied

- Payment terms and due date

2. Maintain Consistency in Design

The design and layout of your document should be clean and consistent. Use a uniform font style, size, and color throughout to ensure that the document is easy to read. A well-organized layout not only improves the readability of the information but also makes a positive impression on your clients. Some tips for maintaining consistency include:

- Aligning text and numbers properly to avoid clutter and confusion

- Using clear headings and subheadings to organize the content logically

- Incorporating your logo at the top of the page to reinforce your brand

By following these best practices, you can create billing documents that not only look professional but also ensure a smooth, efficient process for both you and your clients.

Managing Client Information in Numbers

Efficient management of client information is key to maintaining organized business operations and ensuring smooth transactions. By systematically organizing client data in a structured format, you can quickly access important details such as contact information, transaction history, and specific preferences. This helps to reduce errors, streamline communication, and improve the overall client experience.

In many software solutions, you can create a central database or a simple spreadsheet where client information is stored and updated as needed. This allows you to maintain consistency across all your records, whether you’re billing for services, tracking payments, or managing ongoing projects. You can easily customize the layout to suit your business needs, adding columns for various data points like phone numbers, email addresses, or special notes about the client’s preferences or past interactions.

By keeping all relevant client data in one accessible location, you simplify your workflow and ensure that you’re always prepared for the next step in the business process. Whether you’re sending a follow-up message or preparing a new document, organized client information helps you stay efficient and responsive to their needs.

Automating Calculations in Your Invoice

Automating calculations in your financial documents can significantly reduce manual errors and save valuable time. By setting up formulas to handle basic arithmetic tasks like adding totals, calculating taxes, or applying discounts, you ensure greater accuracy and efficiency in your billing process. This approach allows you to focus on other important tasks, while the system handles all the number crunching for you.

Here are some common calculations you can automate to streamline your billing process:

- Subtotal Calculation: Automatically sum the prices of all the items or services listed, ensuring that the total is accurate without manual input.

- Tax Calculation: Set up a formula to apply the appropriate tax rate to the subtotal, ensuring that tax amounts are always calculated correctly.

- Discount Application: Use formulas to apply any discounts to the subtotal, automatically adjusting the final amount.

- Total Amount Due: Automatically calculate the final balance due by factoring in the subtotal, taxes, and any discounts.

By incorporating these automated calculations, you eliminate the possibility of errors from manual entries and provide a more professional experience for your clients. Additionally, it ensures that your records are always up to date and accurate, allowing you to easily manage multiple transactions or recurring billing without the need to redo calculations each time.

Adding Taxes and Discounts in Numbers

Incorporating taxes and discounts into your financial documents is essential for ensuring that your pricing reflects the final amount due. Whether you’re adding sales tax or offering a promotional discount, automating these calculations can save time and reduce the risk of errors. By setting up the right formulas, you can instantly adjust the totals, providing an accurate reflection of the cost for your clients.

Adding Sales Tax

When adding tax to your billing records, you can set up a formula to apply the appropriate percentage to the subtotal or individual items. Most financial tools allow you to input the tax rate once, and then it will automatically calculate the amount for you across all relevant items. This eliminates the need to manually compute taxes for each transaction, ensuring consistency and accuracy.

Applying Discounts

Similarly, discounts can be easily applied by setting up a formula that deducts the appropriate amount from the total before calculating the final balance. You can specify a fixed amount or a percentage, and the system will automatically adjust the final total accordingly. This makes it easier to offer promotions or special deals without needing to calculate each discount manually.

By automating both taxes and discounts, you streamline the entire billing process and ensure that your documents are always up-to-date with the latest pricing information. This helps maintain transparency and trust with your clients while reducing the chances of errors in your financial records.

Design Tips for Better Invoices

A well-designed billing document not only helps convey professionalism but also ensures that all the important information is easy to read and understand. The clearer and more organized your document is, the easier it will be for your clients to process and pay. A clean, attractive layout can improve your business’s image and even speed up payment times by reducing confusion.

Here are some key design tips to make your records stand out and work more effectively:

- Keep It Simple: A clean, minimalistic design helps the client focus on the most important details without being distracted by unnecessary elements.

- Use Consistent Branding: Include your business logo and stick to your brand’s color scheme and fonts to make your document instantly recognizable and professional.

- Ensure Readability: Choose clear fonts with good contrast against the background, and make sure the text size is appropriate for easy reading.

- Highlight Key Information: Use bold text or larger font sizes for critical details, such as the amount due, due date, and payment instructions.

- Logical Layout: Organize your content in a way that makes sense. Group related information together, such as contact details, itemized charges, and payment terms, to avoid confusion.

- Include White Space: Don’t overcrowd your document. Adequate spacing between sections makes it easier for the reader to navigate and increases the overall visual appeal.

By following these design principles, you can create professional, well-organized billing records that not only look great but also ensure that your clients have no trouble processing their payments. Good design can help reinforce your business’s credibility and make the billing process as seamless as possible.

How to Track Payments Using Numbers

Tracking payments is a vital part of managing your business’s cash flow. Whether you’re monitoring client transactions or ensuring that all outstanding balances are cleared, keeping accurate records can help you stay on top of your finances. With the right setup, you can easily track payments and update balances in real time, ensuring that no details are overlooked.

By creating a structured system, you can track when payments are made, how much has been paid, and what remains outstanding. This system allows for quick updates and easy monitoring of all financial activity related to your clients and transactions.

| Client | Amount Due | Amount Paid | Payment Date | Balance Remaining |

|---|---|---|---|---|

| Client A | $500 | $500 | 01/15/2024 | $0 |

| Client B | $800 | $300 | 01/20/2024 | $500 |

| Client C | $1,200 | $0 | Pending | $1,200 |

As seen in the table above, by including columns for the client, amount due, amount paid, payment date, and balance remaining, you can easily track payments and identify any outstanding balances. You can set up formulas to automatically calculate the balance remaining, ensuring that your records are updated with each new payment.

This approach not only keeps you organized but also helps in managing client relationships by giving you an accurate and up-to-

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for smooth business operations and maintaining good client relationships. However, there are several common mistakes that can lead to confusion, delays, or even disputes. Avoiding these errors will help ensure that your documents are clear, complete, and professional.

1. Missing or Incorrect Information

One of the most critical mistakes is failing to include all the necessary details. If a document is missing important information like the client’s name, payment terms, or itemized charges, it can lead to misunderstandings or delays in payment. Ensure that the following are always included:

- Correct client and business details

- A unique reference number

- Accurate descriptions of goods or services

- Clear payment terms and due date

2. Miscalculations and Inaccurate Totals

Errors in calculations, such as incorrect totals, taxes, or discounts, can damage your credibility and lead to disputes. Double-check all numbers before sending the document. Automating calculations where possible can minimize human error and save time.

- Ensure that the subtotal is correct

- Verify tax rates and apply them consistently

- Check for any discounts and apply them accurately

- Confirm the final amount due matches the sum of all calculations

3. Unclear Payment Terms

Not specifying payment terms clearly can cause confusion. Be explicit about when payment is due and how it should be made. Common mistakes include vague terms like “due soon” or “ASAP.” Instead, use specific terms like “Due in 30 days” or “Payment required by [date].” You can also specify acceptable payment methods (e.g., bank transfer, credit card, PayPal). This helps avoid delays and makes the payment process smoother for both parties.

4. Lack of Consistency

Using inconsistent formatting or layouts in your billing documents can create a disorganized impression. Consistency helps improve readability and gives a professional appearance. Ensure that all your documents follow the same layout and structure every time.

- Use consistent fonts, font sizes, and colors

- Align text and numbers properly

- Maintain the same header and footer styles across all documents

By avoiding these common mistakes, you can ensure that your billing process runs smoothly, and you maintain a positive relationship with your clients. Clear, accurate, and professional documents are essential for reducing confusion and getting paid on time.

Saving and Exporting Your Invoice

Once your billing document is complete, it’s important to save and export it in a way that makes it easy to access and share. Properly saving your work ensures that you have a backup, while exporting it in the right format allows for easy distribution to clients. Whether you’re sending it via email or keeping it for your records, knowing how to save and export your documents effectively can streamline your workflow.

Here are the key steps to ensure your documents are saved and exported properly:

| Step | Action |

|---|---|

| 1. Save Your Work | Always save your document in a location where you can easily find it later, such as a dedicated folder for client files. Consider using cloud storage for easy access from anywhere. |

| 2. Choose the Right File Format | Export your document in a widely-used file format, such as PDF or Excel. PDFs are ideal for sharing with clients because they preserve the formatting and prevent any changes to the document. |

| 3. Name Your File Clearly | Use a clear naming convention, such as “ClientName_Date” (e.g., “JohnDoe_01152024”), to make it easy to locate specific documents later. |

| 4. Secure Your Document | If necessary, consider adding a password to protect sensitive information when exporting or sharing the document. |

By following these steps, you ensure that your documents are stored securely and are easily accessible for future reference. Additionally, exporting in a format suitable for your client’s needs makes it easier for them to process and make payments on time. Whether you’re sending it through email or storing it in your records, saving and exporting your document effectively is key to smooth business operations.

Using Templates for Recurring Invoices

For businesses that deal with regular payments or subscription-based services, automating the process of creating new billing documents each period is a huge time-saver. By using a pre-designed structure, you can quickly generate consistent documents for clients who are billed on a recurring basis, without needing to input the same information repeatedly. This not only speeds up your workflow but also ensures that all essential details are included every time, reducing the risk of errors.

How Recurring Billing Works

With recurring billing, the same amount is typically charged to a client on a regular basis–weekly, monthly, or annually. By using a pre-designed structure, you can ensure that the document will automatically update with the correct date, amounts, and client information for each new cycle. This approach saves time and helps maintain consistency across all of your transactions.

Key Elements to Include in Recurring Billing Documents

When setting up a recurring billing structure, it’s essential to include a few key components in your document to ensure clarity and transparency for both you and your client:

| Component | Description |

|---|---|

| Client Information | Always include the client’s name, contact details, and account number (if applicable) to avoid confusion. |

| Billing Period | Specify the start and end dates for each billing cycle to avoid misunderstandings about payment timing. |

| Payment Amount | Clearly state the agreed-upon payment amount for each billing cycle. |

| Due Date | Ensure the due date is set for each cycle and clearly mentioned on the document. |

| Payment Method | Detail the payment methods your client can use to pay (e.g., bank transfer, credit card, PayPal). |

By creating a structured system for recurring charges, you can minimize manual input and streamline your business operations. Setting up this process from the start will help you efficiently handle multiple clients on a regular basis, reducing the likelihood of errors and improving cash flow management.