Download Simple Invoice Template Excel for Easy and Professional Invoices

In today’s fast-paced business world, managing financial transactions accurately and efficiently is crucial for any entrepreneur or freelancer. Having a reliable method to create and track payments can help maintain professionalism and streamline cash flow. Whether you’re providing services or selling products, the ability to issue clear and precise requests for payment is essential.

Using pre-made tools can significantly reduce the time spent on administrative tasks while ensuring all necessary details are included in each request. These resources are designed to be easy to use, customizable, and adaptable to a variety of business needs. With a few simple steps, you can generate professional-grade documents that are clear, concise, and organized.

Customization is one of the key advantages of these tools, as they allow you to adjust the layout and content according to your specific requirements. From adding your company logo to adjusting payment terms, the flexibility offered helps to create documents that reflect your unique brand and business practices.

By taking advantage of readily available tools, you can focus more on growing your business while ensuring that your financial records are accurate and well-maintained.

Simple Invoice Template Excel Download

Creating a professional document to request payment has never been easier. With the right tools at your disposal, you can generate clean, organized records with just a few clicks. These pre-designed resources can help you stay on top of your financial transactions without the need for complex software or excessive time spent on formatting.

By using easy-to-customize documents, you can tailor each one to suit your needs, adding important details such as payment terms, contact information, and itemized lists. These straightforward solutions are built to help you streamline your billing process and ensure accuracy with minimal effort.

Flexibility is one of the main advantages, as these solutions can be adjusted to fit various industries, whether you are working as a freelancer, small business owner, or contractor. With options to include taxes, discounts, or multiple payment methods, these resources adapt to your specific requirements and preferences.

Once completed, these files can be easily saved, shared, and tracked, ensuring your clients receive clear instructions on how to process their payments. With a few simple steps, you can transform your billing system into a reliable, professional solution that saves you time and reduces errors.

Why Use an Excel Invoice Template?

Using a pre-designed document for payment requests offers numerous advantages, especially for those who want to ensure accuracy while minimizing the time spent on administrative tasks. These customizable solutions provide an easy and efficient way to create professional-looking records without the need for complex software or design skills.

Here are a few reasons why many people prefer these resources:

- Time Efficiency: Instead of starting from scratch each time, you can quickly fill in the necessary details and generate a complete document within minutes.

- Customizability: These tools allow you to adjust the layout, content, and design to match your specific needs and business style.

- Consistency: A standardized format ensures that all payment requests are clear, organized, and professional, regardless of who is handling the task.

- Accuracy: With built-in calculations, the risk of human error is reduced, making it easier to manage taxes, totals, and discounts.

- Convenience: Once the document is ready, it can be saved, shared, and tracked, ensuring that your clients receive the necessary details in a timely manner.

These tools are ideal for freelancers, small business owners, and contractors who need a straightforward, reliable solution for managing financial transactions. By using such resources, you can focus more on your work and less on paperwork, all while ensuring your records are accurate and professional.

Benefits of Downloading Free Invoice Templates

Accessing ready-made resources for creating payment requests can save both time and effort, especially when the documents are tailored to meet professional standards. By utilizing free resources, business owners and freelancers can avoid the hassle of designing their own from scratch, all while ensuring accuracy and clarity in their financial records.

Here are the key benefits of using free pre-made solutions:

- Cost-Effective: These resources are available at no charge, eliminating the need for expensive software or hiring a professional to create custom documents.

- Time-Saving: With the layout and structure already set, you can quickly enter the relevant details and generate a polished document in a fraction of the time.

- Ease of Use: Designed for simplicity, these solutions are user-friendly, allowing anyone–regardless of technical skill level–to produce professional documents with minimal effort.

- Customization: Many free resources are flexible, allowing you to adjust the content and design to suit your specific business needs, from adding your logo to modifying payment terms.

- Professional Appearance: These documents are designed to look clean and organized, which helps establish credibility with clients and customers.

- Instant Access: You can access and start using these documents immediately, without waiting for downloads or installations, making them a convenient choice when you need to send a request quickly.

By taking advantage of these free resources, you can focus more on growing your business and less on managing administrative tasks, while ensuring that your payment requests are accurate and professionally presented.

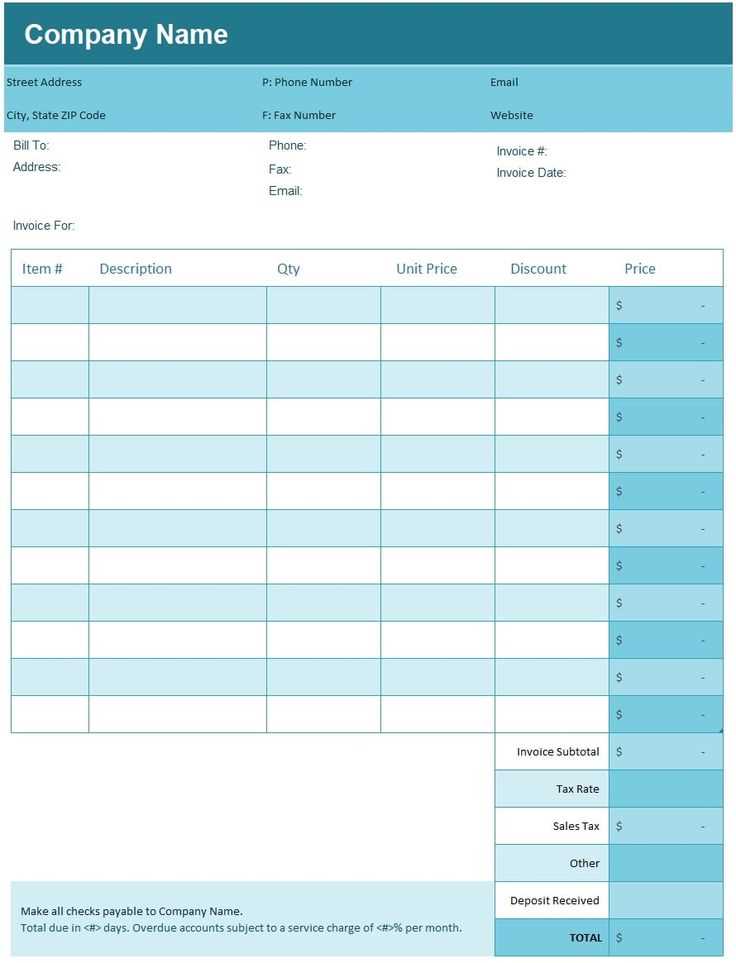

How to Customize Your Excel Invoice

Personalizing a billing document allows you to tailor it to your specific needs, ensuring that it reflects your business identity and provides all the necessary details. Customizing these pre-designed resources is a straightforward process, and it can be done quickly without any technical expertise. By making a few simple adjustments, you can create a professional-looking document that meets both your requirements and those of your clients.

Here’s how you can easily customize your document:

- Edit Company Information: Replace the placeholder details with your business name, logo, address, and contact information to give the document a professional look.

- Adjust Payment Terms: Modify the payment deadlines, late fees, or any other terms to suit your preferred business practices.

- Add Custom Items: Customize the itemized list by adding, removing, or adjusting the descriptions, quantities, and prices of the services or products you provide.

- Include Discounts and Taxes: If applicable, add sections for tax rates or discounts to ensure the totals are calculated accurately and clearly presented.

- Choose a Design: Alter fonts, colors, and borders to match your branding or to give the document a more personalized touch.

With these changes, you can quickly adapt the document to fit the specific needs of each client or project, ensuring that your payment requests are both clear and aligned with your business goals.

Top Features of an Invoice Template

When selecting a pre-made document for requesting payments, it’s important to consider the features that can make the process easier and more efficient. The right solution not only helps save time but also ensures accuracy and professionalism in every transaction. Here are the key features that make these documents effective for business use:

- Automatic Calculations: Many resources include built-in formulas that automatically calculate totals, taxes, and discounts, reducing the risk of human error.

- Customizable Fields: These tools allow you to easily adjust fields for specific client information, services, quantities, and prices to suit each job or project.

- Professional Layout: A clean, well-organized design helps ensure that your payment request looks polished and easy to read for clients.

- Payment Terms Section: Including sections for payment deadlines, late fees, and methods of payment ensures clear communication of expectations.

- Tax and Discount Calculators: The ability to add tax rates or discounts directly within the document ensures accurate billing and can help you manage pricing more effectively.

- Multi-Currency Support: Some resources allow you to specify different currencies, making it easier to work with international clients.

- Itemized Lists: The ability to create detailed, itemized lists helps clients understand what they are being charged for, improving transparency.

- Personal Branding Options: Customizing the look with your logo, brand colors, and fonts can make the document reflect your business identity.

These features make it easier to manage financial transactions, reduce errors, and maintain a professional appearance. By choosing a solution with these attributes, you can create effective, customized payment requests quickly and efficiently.

Step-by-Step Guide to Creating Invoices

Creating a payment request may seem like a complex task, but with the right approach, it can be done quickly and accurately. By following a simple process, you can ensure that all necessary details are included and the document is both clear and professional. Here’s a step-by-step guide to help you generate a complete and effective payment request.

1. Set Up Your Document

The first step is to open the file and prepare your layout. Start by adding the following key sections:

- Your Business Information: Include your business name, address, phone number, and email at the top of the document.

- Client’s Information: Add the name, address, and contact details of the person or company you are billing.

- Unique Reference Number: Assign a reference number to the request to help keep track of the document for future reference.

2. Itemize Your Services or Products

Next, create a detailed list of the services or goods provided. Be sure to include the following:

- Description: Clearly describe the service or product to ensure the client understands exactly what they are paying for.

- Quantity: Specify the amount or units of each item or service.

- Price: Enter the price per unit or service, along with any applicable taxes or fees.

- Total Cost: Calculate the total cost for each line item and include the sum at the bottom of the list.

3. Add Payment Details

Once you’ve listed the items, it’s time to include the payment terms:

- Payment Due Date: Specify when the payment should be made to avoid delays.

- Accepted Payment Methods: List the types of payment you accept (e.g., bank transfer, PayPal, check).

- Late Fee Policy: Mention any late fees that will be applied if the payment is not made on time.

4. Review and Finalize

Before sending the request, double-check all the information for accuracy. Verify that all numbers are correct, and ensure that there are no typos or missing details. Once everything looks good, save the file and it’s ready to be sent.

By following these steps, you can quickly and efficiently create clear, professional payment requests that ensure your clients know exactly what they owe and when the payment is due.

Free vs Paid Invoice Templates in Excel

When selecting a solution for creating payment requests, you may come across both free and paid options. While both types can help streamline the billing process, they come with different features and benefits. Understanding the differences between free and paid resources can help you make an informed decision based on your specific business needs.

Free options are often a great starting point for small businesses, freelancers, or anyone looking to create professional documents without a financial investment. These resources typically offer the basics, allowing you to generate and customize documents quickly and easily. However, they may come with some limitations:

- Limited customization: Free options may have fewer design choices and customizable features compared to paid versions.

- Basic functionality: While sufficient for many small-scale needs, these resources may lack advanced features such as automated calculations, multi-currency support, or detailed financial tracking.

- Less support: Free solutions typically offer minimal customer support or troubleshooting assistance.

Paid options often come with additional benefits and features designed for businesses that need more robust capabilities. These resources usually offer:

- Advanced features: You may gain access to more complex functionalities, such as automatic calculations, customizable tax rates, and multi-line items.

- Better design flexibility: Paid options often provide more design templates and greater ability to tailor the layout and appearance to match your brand.

- Customer support: Paid tools usually come with dedicated customer support, ensuring that any issues or questions can be resolved quickly.

- Ongoing updates: Many paid solutions are regularly updated, meaning you’ll have access to the latest features and security enhancements.

While free resources can work well for individuals or small businesses with basic billing needs, paid options may be a better choice if you require more features, customization, or support. The decision largely depends on your specific requirements and how much you’re willing to invest in streamlining your financial processes.

Best Practices for Using Excel Invoices

To ensure smooth and efficient financial transactions, it’s important to follow a set of best practices when generating payment requests. A well-organized and accurate document not only helps maintain professionalism but also ensures timely payments and clear communication with clients. By implementing a few key strategies, you can enhance the effectiveness of your billing process.

1. Keep Your Documents Organized

Staying organized is essential for tracking and managing your financial records. Consider the following tips:

- Use clear naming conventions: Label your files with descriptive names that include the client name and invoice number to easily locate them later.

- Maintain a consistent format: Always use the same layout for each payment request to avoid confusion and make it easier for clients to review your documents.

- Create a separate folder: Store all payment requests in one location for easy access and organization, and ensure that each document is appropriately saved with version numbers if necessary.

2. Double-Check Information

Accuracy is crucial when preparing a billing document. To prevent errors, ensure that the following details are correct:

- Client details: Verify that the client’s name, address, and contact information are accurate and up-to-date.

- Product/service details: Double-check that all descriptions, quantities, and prices match the agreed-upon terms and services provided.

- Totals and taxes: Ensure that totals, taxes, and discounts are calculated correctly, and that there are no errors in the math.

3. Use Professional Formatting

A clean, easy-to-read document reflects well on your business and enhances your credibility. Keep the following in mind:

- Clarity: Use clear headings, consistent fonts, and readable text sizes to ensure all details are easy to find and understand.

- Branding: Add your company logo, colors, and other branding elements to the document for a professional look that reflects your business identity.

- Spacing: Ensure there’s enough space between sections, so the document doesn’t appear crowded or overwhelming.

4. Automate Where Possible

Automation can save you significant time and reduce the likelihood of errors. Consider using the following:

- Formulas for calculations: Use automatic formulas to calculate totals, taxes, and discounts, so that you don’t need to manually update each entry.

- Pre-filled information: Set up your document to automatically pull in recurring information, such as your business details or payment terms, to avoid having to re-enter this information each time.

5. Maintain a Payment Record

Tracking payments is an essential part of the invoicing process. Here’s how to stay on top of payments:

- Mark paid invoices: Once a payment is received, update the document by marking it as “paid” and noting the payment date.

- Monitor overdue payments: Keep an eye on unpaid requests and follow up with clients who haven’t settled their bills by the due date.

- Keep a backup: Always save a copy of each document, even once it’s been paid, to maintain an accurate record of your financial transactions.

By following these best practices, you can ensure that your billing process runs smoothly, payments are received on time, and your financial records remain organized and professional.

How to Track Payments with Excel

Efficiently monitoring payments is crucial for managing cash flow and keeping financial records organized. With the right system in place, you can easily track which clients have paid, which are overdue, and when to follow up. Using a spreadsheet to track payments is a practical approach that helps you stay on top of outstanding amounts and maintain accurate records.

Here’s how you can set up a simple payment tracking system using a spreadsheet:

| Client Name | Payment Due Date | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|---|

| Client A | 01/10/2024 | $500 | $500 | 02/10/2024 | Paid |

| Client B | 05/10/2024 | $300 | $0 | Pending | |

| Client C | 10/10/2024 | $400 | $400 | 11/10/2024 | Paid |

| Client D | 15/10/2024 | $250 | $250 | 15/10/2024 | Paid |

In this table, you can track key information about each transaction:

- Client Name: Identify the client or customer for each payment.

- Payment Due Date: Record when the payment is expected to be received.

- Amount Due: Enter the total amount that the client owes.

- Amount Paid:

Common Mistakes When Using Invoices

While creating payment requests may seem straightforward, many businesses and freelancers make mistakes that can lead to confusion, delayed payments, or even lost revenue. Understanding these common errors can help you avoid them and ensure that your documents are both professional and clear, improving the overall efficiency of your billing process.

1. Missing or Incorrect Client Information

One of the most frequent mistakes is failing to include or incorrectly entering client details. An inaccurate address or misspelled name can cause delays in processing or lead to misunderstandings. To avoid this:

- Double-check client details: Ensure that you have the correct company name, contact person, address, and email.

- Use consistent and professional formatting: Keep the layout of the client information section uniform across all documents.

2. Incorrect Amounts or Calculations

Errors in pricing, quantities, or calculations are another common issue. A mistake in the total due can lead to confusion and disputes, and may even harm client trust. Here are some tips to prevent these issues:

- Automate calculations: Use built-in formulas to ensure that totals, taxes, and discounts are automatically calculated.

- Review all amounts: Double-check that each line item is correct and that the sum total matches the expected amount.

3. Unclear Payment Terms

Another mistake is failing to clearly communicate payment terms, such as deadlines, accepted payment methods, and penalties for late payments. Not specifying these details can result in delays and confusion. To avoid misunderstandings:

- Clearly state payment deadlines: Make sure that the due date is visible and easily understood.

- List accepted payment methods: Specify whether you accept credit cards, bank transfers, checks, or other methods.

- Include late fee details: If applicable, note any late fees or penalties for overdue payments.

4. Failing to Follow Up on Unpaid Requests

Many businesses fail to follow up on overdue payments, which can lead to cash flow issues. If a payment is not received by the due date, it’s important to send a reminder or take further action. Here’s how to manage overdue payments:

- Set up reminders: Create a schedule to remind clients about upcoming or overdue

Excel Templates for Small Businesses

For small businesses, managing finances, tracking expenses, and maintaining an organized workflow are crucial for success. Using well-structured documents can significantly streamline these processes. Ready-made solutions, like pre-designed spreadsheets, can help entrepreneurs create professional records and manage day-to-day tasks without the need for complex software or expensive tools.

1. Managing Finances and Cash Flow

One of the most important tasks for any small business is keeping track of income and expenses. Pre-designed spreadsheets offer a simple way to track payments, calculate totals, and monitor cash flow. These tools typically include built-in formulas that automatically update calculations, reducing the chance of errors. Here’s how they can benefit your business:

- Budgeting: Use templates to set up monthly or yearly budgets and track spending against your planned amounts.

- Cash flow tracking: Monitor incoming and outgoing payments to ensure your business maintains a positive cash flow.

- Expense categorization: Organize expenses into categories, helping you easily identify areas for cost-saving.

2. Streamlining Client Billing and Payments

Tracking payments from clients can become cumbersome as your business grows. Pre-built spreadsheets make it easy to send professional-looking payment requests and record payments received. These tools typically feature:

- Customizable fields: Personalize the document with your business information and payment terms.

- Automatic calculations: With built-in formulas, you can automatically calculate taxes, discounts, and totals.

- Payment tracking: Record when payments are received, and track any outstanding balances to avoid overdue accounts.

3. Inventory and Product Management

Keeping track of inventory is essential for small businesses that sell physical products. Spreadsheet solutions designed for inventory management can help you monitor stock levels, reorder products, and track sales. Key features include:

- Stock level monitoring: Track how much of each product you have in stock and when to reorder.

- Sales reporting: Use built-in charts and graphs to visualize your sales data and identify trends.

- Supplier details: Keep a list of suppliers, including contact details and pricing, to streamline your procurement process.

By using spreadsheets designed for small businesses, you can s

Save Time with Pre-made Invoice Templates

Time is one of the most valuable resources for any business, especially for small business owners and freelancers who handle multiple tasks every day. The process of creating billing documents from scratch can be time-consuming, and any way to speed it up without compromising professionalism is a welcome solution. Pre-designed billing solutions help save time by providing ready-to-use formats that are easy to customize, ensuring that you can focus on other important aspects of your business.

Using pre-made formats not only accelerates the process of creating payment requests but also helps eliminate repetitive tasks. These solutions are often structured with the essential fields already included, such as client details, product/service descriptions, payment terms, and totals. All you need to do is fill in the necessary information and make any specific adjustments related to each client or transaction.

Key benefits of using pre-designed billing solutions include:

- Reduced setup time: Ready-made structures eliminate the need to design documents from scratch, allowing you to quickly generate and send billing requests.

- Consistency: Using a consistent format for all payment requests helps maintain a professional appearance and reduces the chance of errors.

- Customization options: Pre-designed options can easily be adapted to fit your business’s branding, payment terms, and specific services offered.

- Automation of calculations: Many pre-made options come with built-in formulas to calculate totals, taxes, and discounts, saving you from manually doing the math each time.

By adopting pre-made solutions, you streamline your billing process, reduce the risk of errors, and ultimately save valuable time. This efficiency allows you to focus on growing your business, fostering client relationships, and managing other key areas of your operations.

How to Manage Invoice Data Effectively

Efficiently handling payment records is essential for maintaining a smooth financial workflow. Without a proper system to manage billing data, it’s easy to lose track of payments, deadlines, and client details. By organizing and tracking your financial documents systematically, you can avoid mistakes, improve cash flow, and ensure timely follow-ups with clients. Here are some key strategies for managing payment data effectively:

1. Organize Data with Clear Categorization

One of the first steps to managing payment records is organizing the information in a way that is both accessible and logical. Categorizing your data will help you quickly locate any document when needed. Consider the following organization methods:

- By client: Create separate files or sheets for each client, where you can track their specific payment history, terms, and contact information.

- By date: Organize records by due date or payment date, allowing you to easily spot overdue or upcoming payments.

- By payment status: Track the status of each request, such as “Paid,” “Pending,” or “Overdue,” to monitor progress easily.

2. Use Automation Tools to Track Payments

Manual tracking can be time-consuming and prone to errors. By automating aspects of your record-keeping process, you can save time and reduce mistakes. Some tools offer built-in features such as:

- Automatic calculations: Use formulas to automatically calculate totals, taxes, and discounts to ensure accuracy.

- Payment reminders: Set reminders or automatic follow-up emails for clients with overdue payments.

- Real-time updates: Automated systems can update payment statuses as soon as a transaction is recorded, keeping your records up to date.

3. Maintain Consistency and Standardization

Consistency in how you manage and store payment records helps avoid confusion and errors down the road. Standardizing the process ensures that every record is complete and easy to understand. To maintain consistency:

- Use uniform formats: Ensure that every document follows the same structure, including consistent fields such as client name, amount due, payment terms, and due dates.

- Adopt a consistent naming system: Use a naming convention for files that makes it easy to locate a specific record. For example, “

Why Excel is Ideal for Invoicing

For many small businesses and freelancers, creating billing documents doesn’t need to be complex or require expensive software. A spreadsheet program offers a perfect balance of simplicity and functionality, making it an ideal tool for handling payment requests. It combines customization flexibility with automation, allowing users to generate and manage records efficiently, without the need for advanced technical skills.

One of the biggest advantages of using spreadsheets for payment management is the ease of calculation. Built-in formulas can automatically calculate totals, taxes, discounts, and other essential figures, reducing the risk of manual errors. In addition, users can customize layouts to suit their needs, ensuring that each document meets specific requirements while maintaining a professional appearance.

Another benefit is the accessibility and low cost of spreadsheet software. Most businesses already have access to a spreadsheet program, and there is no need for additional investments in specialized invoicing tools. Additionally, these documents can be saved, shared, and edited across different devices, making them incredibly versatile for managing transactions on the go.

With spreadsheets, you also have full control over your data. You can track payment statuses, categorize expenses, and store historical records without relying on third-party systems. This level of organization ensures you always know the status of your transactions, helping with both current financial planning and long-term business analysis.

Invoicing Tips for Freelancers and Contractors

As a freelancer or contractor, managing your finances efficiently is critical to maintaining a healthy cash flow and ensuring timely payments. Creating clear, professional payment requests is key to ensuring you get paid on time and avoid any misunderstandings with clients. Here are some essential tips to help you streamline the process and stay organized:

1. Set Clear Payment Terms

Before sending any payment requests, it’s important to establish clear payment terms with your clients. This includes specifying the due date, payment methods, and any late fees that may apply. Defining these terms upfront can help prevent confusion and ensure that both parties are on the same page. Key details to include in your payment request:

- Due date: Clearly state the deadline for payment to avoid delays.

- Accepted payment methods: Indicate whether you accept bank transfers, checks, credit card payments, or other methods.

- Late fees: Consider including a late fee clause for overdue payments, which can encourage timely payments from clients.

2. Maintain Consistency and Professionalism

Consistency in your payment requests helps you maintain a professional appearance and fosters trust with your clients. Use the same format for every request, keeping the structure organized and easy to read. This includes having consistent headings, itemized breakdowns of services provided, and clear payment instructions. You should also ensure the following:

- Accurate client details: Make sure the client’s name, address, and contact information are correct to avoid confusion.

- Itemized list of services: Break down your services into specific items or tasks to justify the charges and provide transparency.

- Contact details: Always include your business name, address, phone number, and email, ensuring clients can reach you easily if they have questions.

By keeping your payment requests clear, professional, and well-organized, you’ll build stronger relationships with clients and streamline the payment process.

How to Protect Your Invoice Files

Keeping your financial documents secure is essential, especially when they contain sensitive information such as client details, payment amounts, and other private data. Protecting these files not only prevents unauthorized access but also ensures compliance with privacy regulations. There are several measures you can take to safeguard your records and ensure they remain confidential and intact.

1. Use Password Protection and Encryption

One of the most effective ways to secure your documents is by encrypting them and adding password protection. This ensures that only authorized individuals can open or modify your files. Most spreadsheet software and document editors offer encryption features that allow you to set a strong password for access. Key steps include:

- Choose a strong password: Use a combination of letters, numbers, and symbols to create a difficult-to-guess password.

- Enable encryption: When saving or sharing documents, make sure to enable encryption to further protect the content.

- Limit access: Only share passwords with trusted individuals and never se

Where to Find High-Quality Excel Templates

Finding professional and customizable tools for managing your financial documents can save you a lot of time and effort. Whether you’re a freelancer, a small business owner, or a contractor, the right pre-made resources can streamline your workflow and ensure accuracy in your payment records. Fortunately, there are many platforms where you can find high-quality resources suited to your needs. Here are some reliable sources:

1. Microsoft Office Templates

One of the best places to start is Microsoft’s own collection of pre-made resources. With a wide selection of options, Microsoft Office provides many free resources directly within their applications. These tools are designed to integrate seamlessly with the software you already use. Key benefits include:

- Ease of use: Templates are designed to be user-friendly and can be customized with minimal effort.

- Free options: Many resources are available at no cost, making them ideal for those with a tight budget.

- Compatibility: Templates work across different devices and software versions, ensuring easy access and consistency.

2. Online Template Marketplaces

Various online platforms offer an extensive range of high-quality resources, often with advanced features and designs. These sites usually have a mix of free and paid options to suit a variety of budgets and needs. Some popular mark