Free Consultant Invoice Template for Easy and Professional Billing

Managing payments efficiently is a crucial aspect of running a successful freelance or professional service business. A well-organized system for requesting payment can save you time, reduce errors, and enhance your business’s image. With the right tools, creating detailed payment requests becomes a quick and easy process, allowing you to focus on what truly matters–serving your clients and growing your work.

Using pre-made formats designed for financial documentation can streamline this process significantly. These resources are particularly helpful when you need to ensure consistency across all transactions, maintain a professional appearance, and avoid missing essential details. By customizing these documents to fit your specific needs, you can maintain a polished and organized approach to billing.

Efficiency and professionalism are the key advantages of using structured formats for requesting payments. Whether you’re just starting or have years of experience, using a clear, reliable method for handling transactions is a vital part of building trust with clients and ensuring timely compensation for your work.

Free Consultant Invoice Templates for Professionals

For any professional offering services, managing the financial side of your business efficiently is essential. Using ready-made billing forms can help streamline the process of requesting payments, ensuring clarity and reducing the chances of errors. These resources are particularly valuable for individuals who need an effective way to communicate their charges to clients without wasting time creating documents from scratch.

Many online platforms offer these resources at no cost, providing easy access to high-quality formats designed specifically for different types of work. They often include essential details such as itemized services, payment terms, and contact information, ensuring that every request is complete and professional. Utilizing such tools allows you to focus on the core aspects of your business while keeping financial paperwork organized.

Why Use Pre-designed Billing Formats

Pre-designed billing formats offer several advantages for professionals. They ensure that important components, like payment terms and item descriptions, are consistently included. This not only saves time but also helps maintain a high level of professionalism with each transaction. Consistency in financial communications builds trust with clients and increases the likelihood of timely payments.

How to Customize Your Payment Requests

One of the best features of ready-made billing forms is their flexibility. You can adjust these documents to reflect your specific services, rates, and business style. Whether you’re a freelancer working on short-term projects or a professional handling long-term contracts, these forms can be tailored to fit your needs. Customizing the information ensures accuracy and avoids any confusion between you and your clients.

Why Use a Free Invoice Template

For any professional managing their own business, having a reliable system to request payment is essential. Using pre-designed documents can make this process more efficient and ensure that every transaction is recorded clearly and accurately. These resources provide an organized structure, reducing the time and effort needed to create custom documents from scratch while maintaining a professional image.

Here are some key reasons why using such resources is beneficial for service providers:

- Time Efficiency: Pre-made documents save you from the hassle of creating billing records from scratch each time. Instead, you can focus on the work that matters most–your clients.

- Consistency: Using a standard format ensures that your billing process remains consistent, reducing the risk of mistakes or missed details.

- Professional Appearance: Ready-to-use documents are designed with a polished, business-ready look, making a positive impression on clients.

- Ease of Use: Many resources are straightforward to use, even for those with limited experience with financial paperwork.

How It Simplifies the Billing Process

With pre-designed forms, you don’t need to worry about forgetting critical information or formatting mistakes. Most come with spaces for all essential details, such as service descriptions, rates, and payment terms. This built-in structure allows you to send accurate, well-organized payment requests with minimal effort. Additionally, many of these resources are editable, allowing you to customize them as needed for different clients or services.

Cost-Effective Solution for Small Businesses

Many platforms offer these billing forms at no cost, which is especially useful for freelancers and small business owners. Instead of investing in expensive accounting software, you can access these documents without any additional expense. This makes them a cost-effective tool for professionals looking to keep their administrative costs low while ensuring their financial communications are organized and clear.

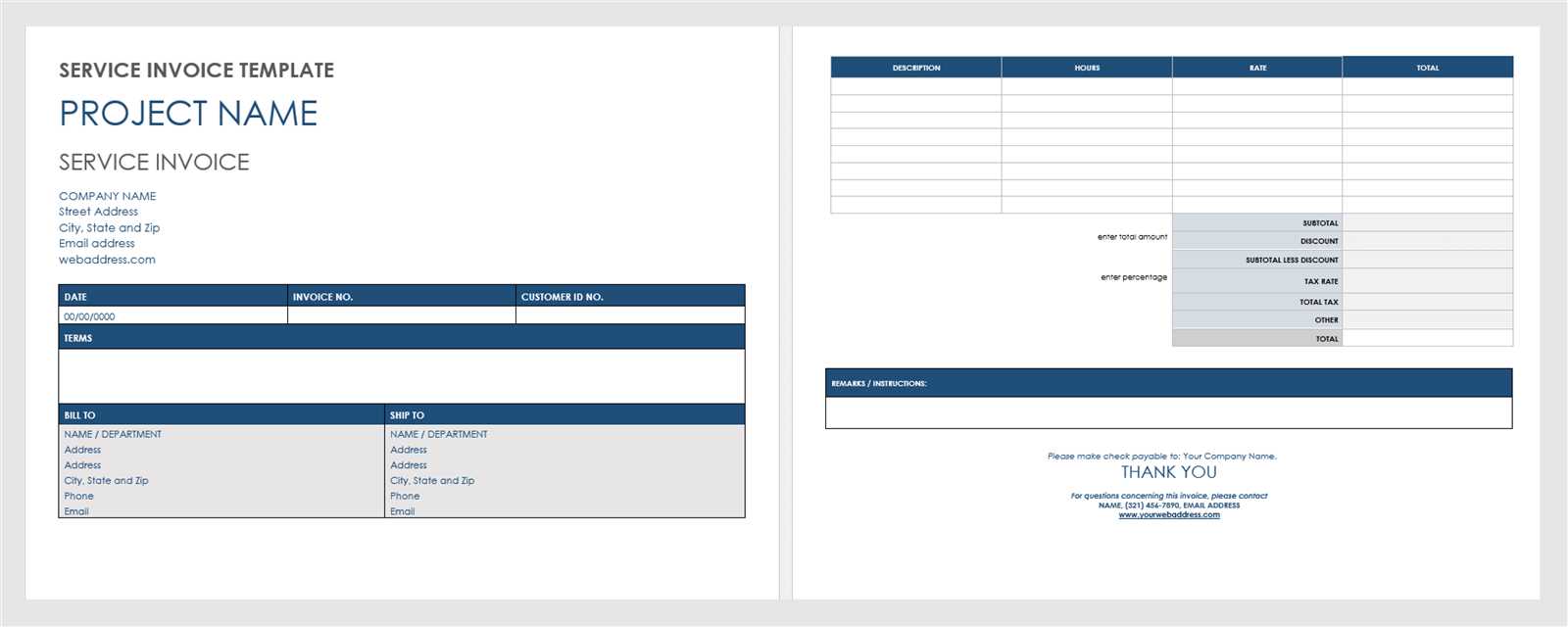

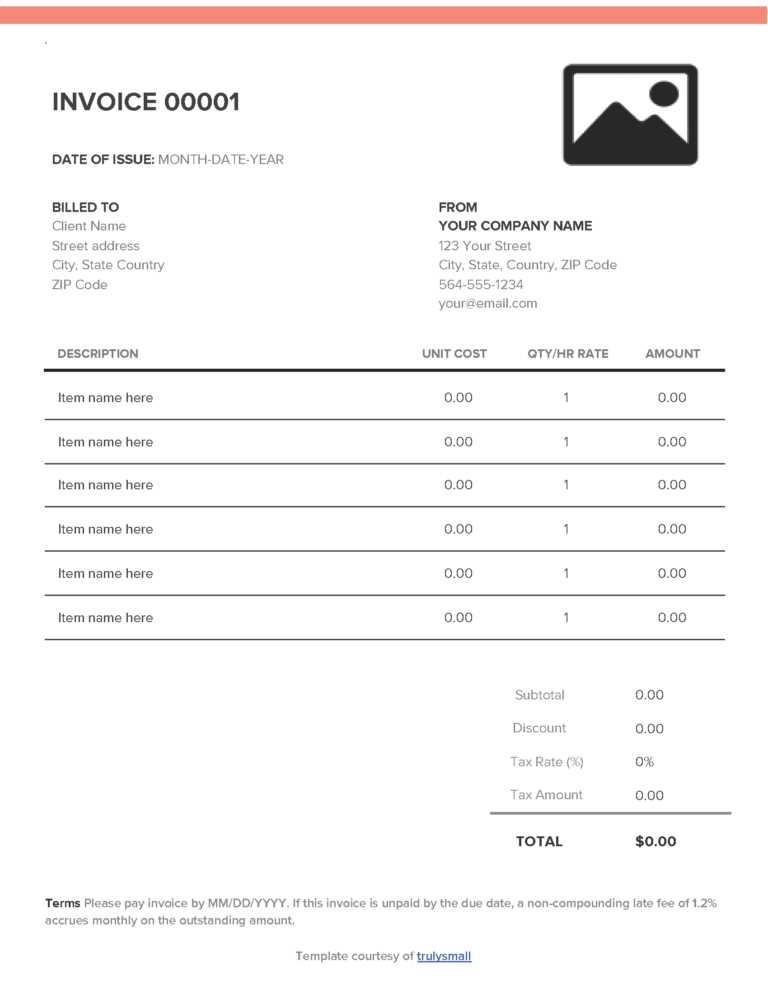

How to Create a Custom Consultant Invoice

Customizing a billing document allows you to personalize it according to the services you offer and the specific needs of your clients. Creating a tailored financial request ensures that all relevant information is clearly outlined, preventing any confusion and promoting transparency. A personalized document also enhances your professional image and reinforces the seriousness with which you handle your business transactions.

To make your own customized payment request, follow these essential steps:

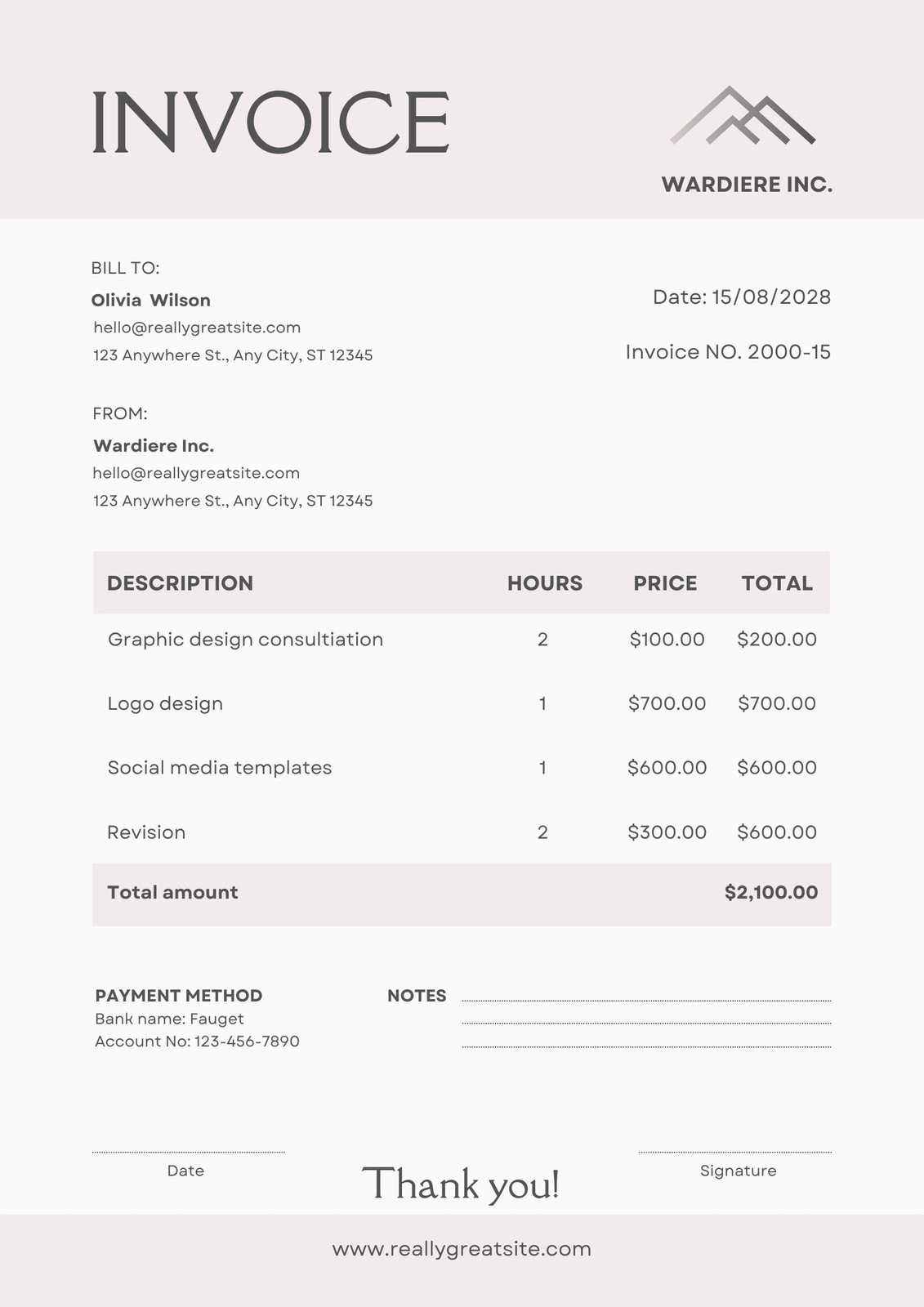

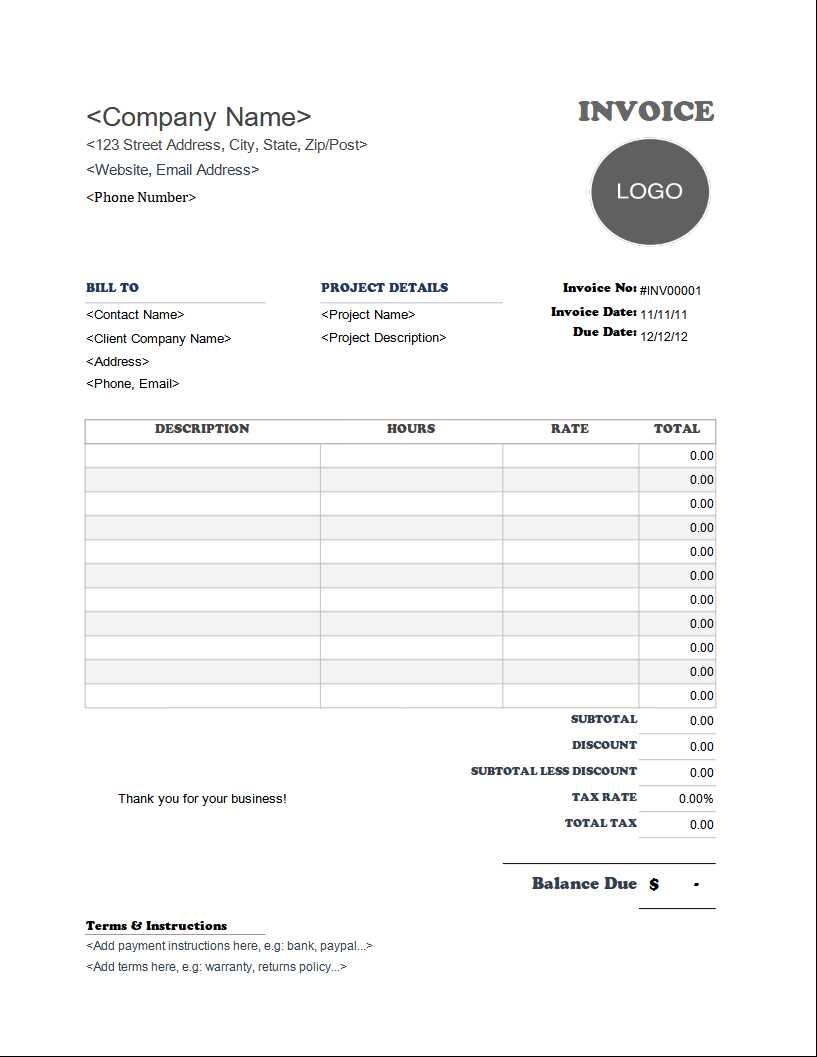

- Start with Your Business Information: Include your name or company name, contact details, and logo (if applicable). This helps clients easily recognize the document and provides them with all necessary contact details.

- Include Client Information: Add the client’s full name, company name (if applicable), and address. This ensures that the payment request is directed to the right person and helps avoid any confusion about who is being billed.

- Clearly List Services Rendered: Provide a detailed description of the work completed, including dates, hours worked, and individual service rates. This ensures transparency and prevents disputes.

- Specify Payment Terms: Clearly state the due date, payment method options, and any late fees or discounts for early payment. This sets expectations and encourages timely compensation.

- Sum Up the Total Amount: Ensure that the total amount due is highlighted clearly. Include any applicable taxes or additional fees so that the client can see the final amount they owe.

By following these steps, you can create a tailored, professional document that reflects your business needs and ensures a smooth transaction process. Personalization is key to building long-term client relationships and streamlining your payment collection process.

Top Features of Consultant Invoice Templates

Effective billing documents are designed to make the payment process smoother for both service providers and clients. The key features of a well-structured financial request not only ensure clarity but also enhance professionalism. These essential elements are included to guarantee that the document captures all necessary details, reduces errors, and fosters a smooth transaction experience.

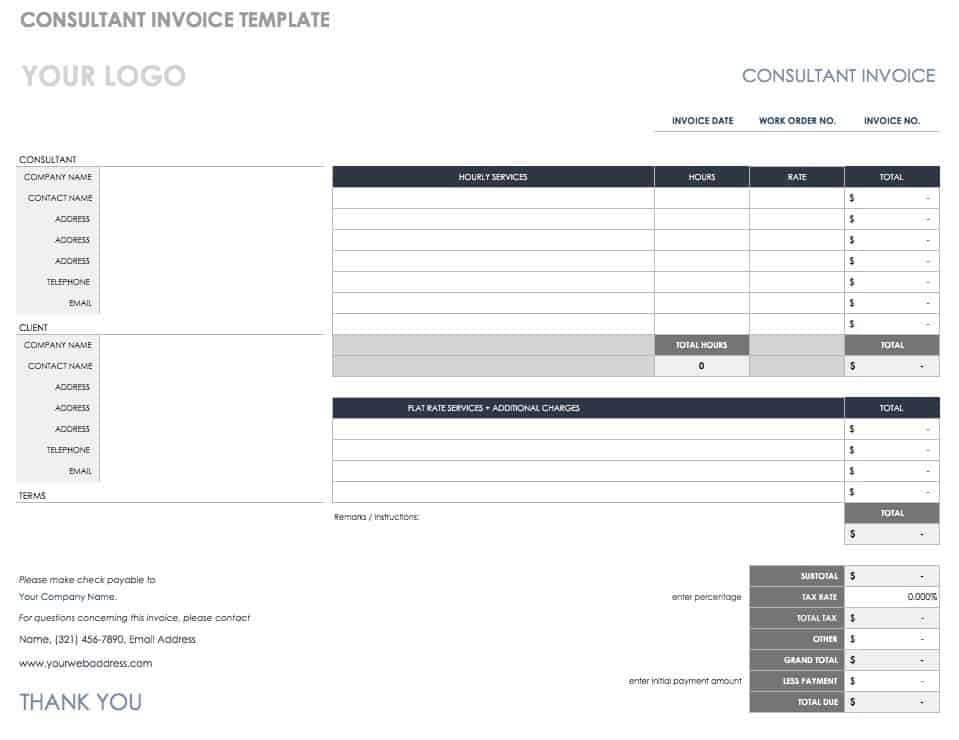

Here are the top features that make billing documents highly effective:

- Clear Contact Information: A professional document includes both your details and those of your client. This helps avoid confusion and ensures that the payment reaches the right recipient without delay.

- Itemized List of Services: Breaking down the services provided with specific descriptions and rates helps ensure transparency and reduces the likelihood of disputes. Clients appreciate when the work they are being charged for is clear and easy to understand.

- Flexible Payment Terms: Including payment due dates, methods, and any applicable late fees or early payment discounts allows you to set clear expectations. This encourages prompt payment and maintains your professional reputation.

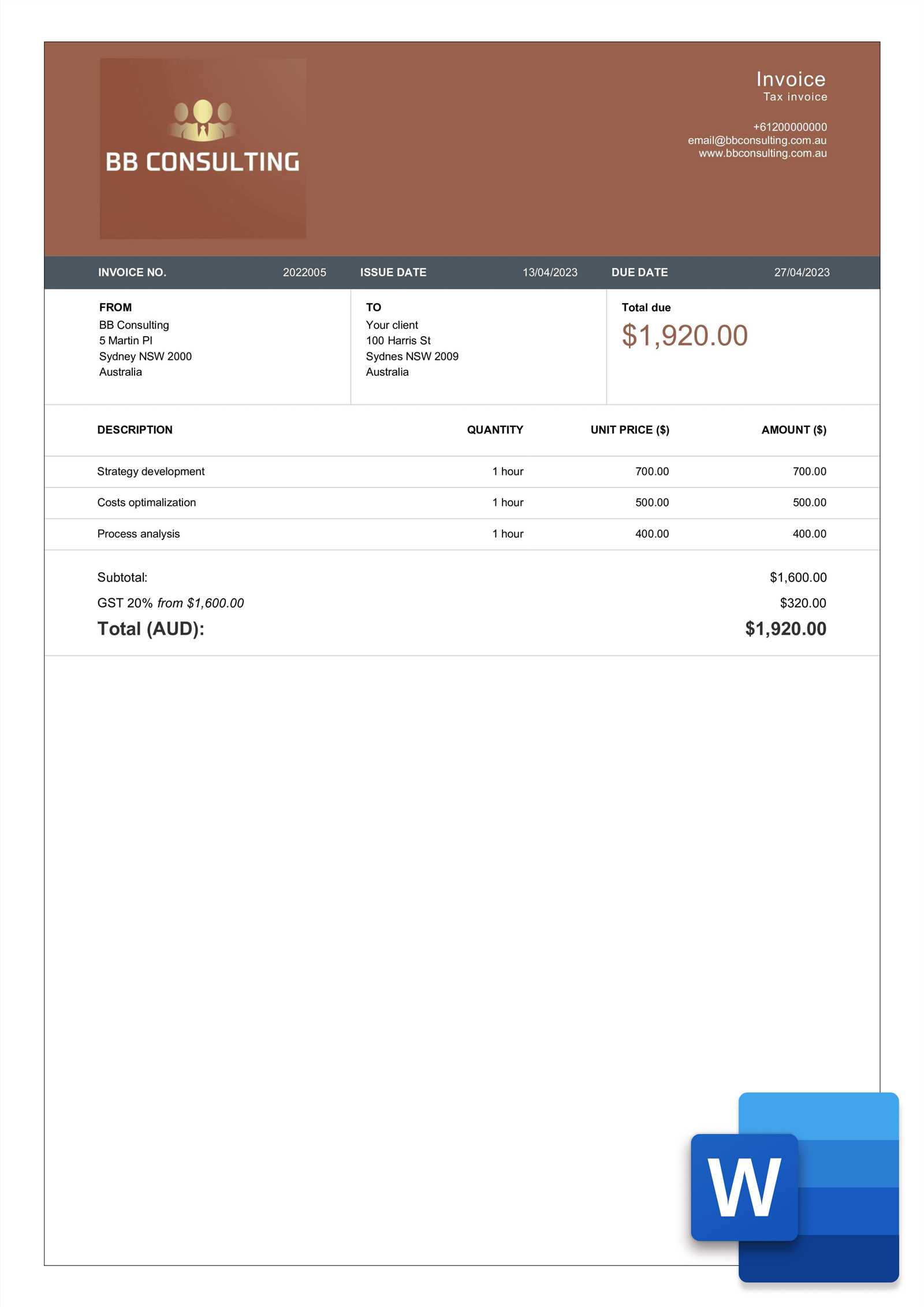

- Tax and Fee Calculations: Including fields for taxes and additional charges ensures that your financial documents are complete and accurate. This feature makes it easy to calculate and show the total amount owed.

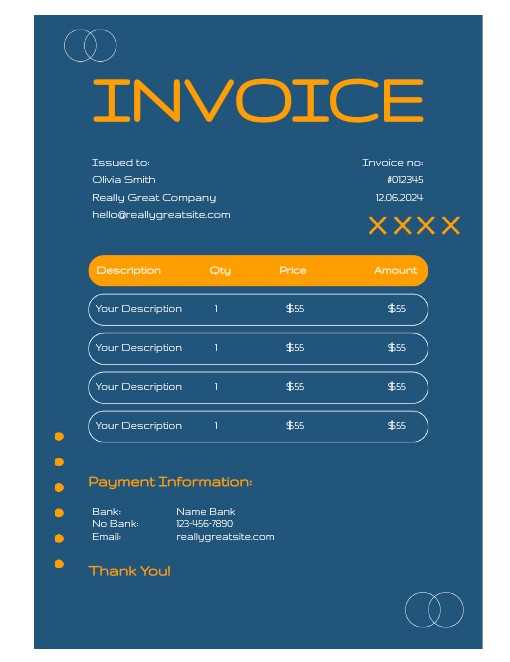

- Customizable Design: A well-designed document is easy to read and visually appealing. The ability to adjust fonts, colors, and layout ensures that the request can reflect your business’s unique style while maintaining clarity.

- Professional Look: Using a clean, organized layout adds a level of professionalism to your communications. A polished appearance helps establish trust with clients and presents your business as organized and reliable.

These features combine to create an efficient, reliable tool that simplifies the billing process, reduces administrative work, and helps maintain strong professional relationships.

Common Mistakes in Consultant Invoices

When preparing a payment request, even small errors can lead to confusion, delays, or disputes with clients. It’s important to pay attention to the details to ensure that your financial communications are clear, accurate, and professional. Common mistakes often stem from missing information, unclear terms, or incorrect calculations, which can make the payment process more difficult for both parties.

Here are some of the most frequent mistakes to avoid when preparing financial documents:

- Incomplete Client Details: Missing or incorrect contact information for either party can cause confusion and delays in processing payments. Always double-check that your client’s name, company name (if applicable), and address are correct.

- Unclear Service Descriptions: Failing to provide a clear breakdown of the work completed can lead to misunderstandings. Always describe your services in detail, including dates, hours worked, and any additional charges.

- Incorrect Payment Terms: Not specifying the payment due date, accepted payment methods, or late fees can cause delays or lead to disputes. Make sure these terms are outlined clearly and unambiguously.

- Forgetting Taxes and Additional Charges: Excluding taxes or extra fees, such as travel or materials, can result in undercharging. Always calculate and include all applicable charges in the total amount due.

- Mathematical Errors: Simple calculation mistakes can throw off the entire document and cause complications with payment. Double-check all sums, including subtotals, taxes, and totals, to ensure accuracy.

- Missing Payment Instructions: If your payment details are unclear or not included, clients may have difficulty completing the transaction. Ensure that payment instructions are clear, including bank details or online payment links.

How to Avoid These Mistakes

To avoid these issues, take the time to review your documents carefully before sending them. Using a standardized format can help ensure that all necessary information is included. Additionally, leveraging software or pre-designed resources can reduce human error and make the process faster and more efficient.

Ensuring Accuracy and Professionalism

Always strive to present a document that is not only accurate but also professional in appearance. Clear, well-organized documents reflect positively on your business and foster trust with clients, leading to smoother transactions and long-term relationships.

Benefits of Using Digital Invoice Templates

Utilizing digital tools for creating payment requests offers a wide range of advantages over traditional methods. With a digital document, you can streamline the process, reduce human error, and maintain a more professional appearance. These resources are especially helpful for managing your financial transactions more efficiently, ensuring that every request is sent quickly and accurately. Digital formats also provide flexibility, allowing for easy customization and repeat usage.

Here are some of the key benefits of using digital billing documents:

| Benefit | Description |

|---|---|

| Time Efficiency | Digital resources eliminate the need for manual entry, saving time in document creation. You can reuse templates and adjust them as needed without starting from scratch each time. |

| Accuracy | Digital formats reduce the risk of errors, such as incorrect calculations or missing information. Many platforms include built-in features to help with totals, taxes, and formatting. |

| Professional Appearance | Using pre-designed digital documents ensures that your requests maintain a polished and uniform look, enhancing your business’s credibility and trustworthiness with clients. |

| Easy Customization | With digital formats, you can easily adjust the content and layout to suit your specific needs, from adding service details to including unique payment terms for different clients. |

| Quick Delivery | Digital documents can be sent instantly via email or through online payment systems, speeding up the billing process and encouraging faster payment from clients. |

| Environmentally Friendly | By using digital tools, you reduce the need for paper and other physical materials, helping to lower your business’s environmental impact. |

Incorporating digital documents into your billing routine not only saves time but also contributes to a more organized and efficient way of handling payments. These resources allow you to present a professional, streamlined image while simplifying administrative tasks.

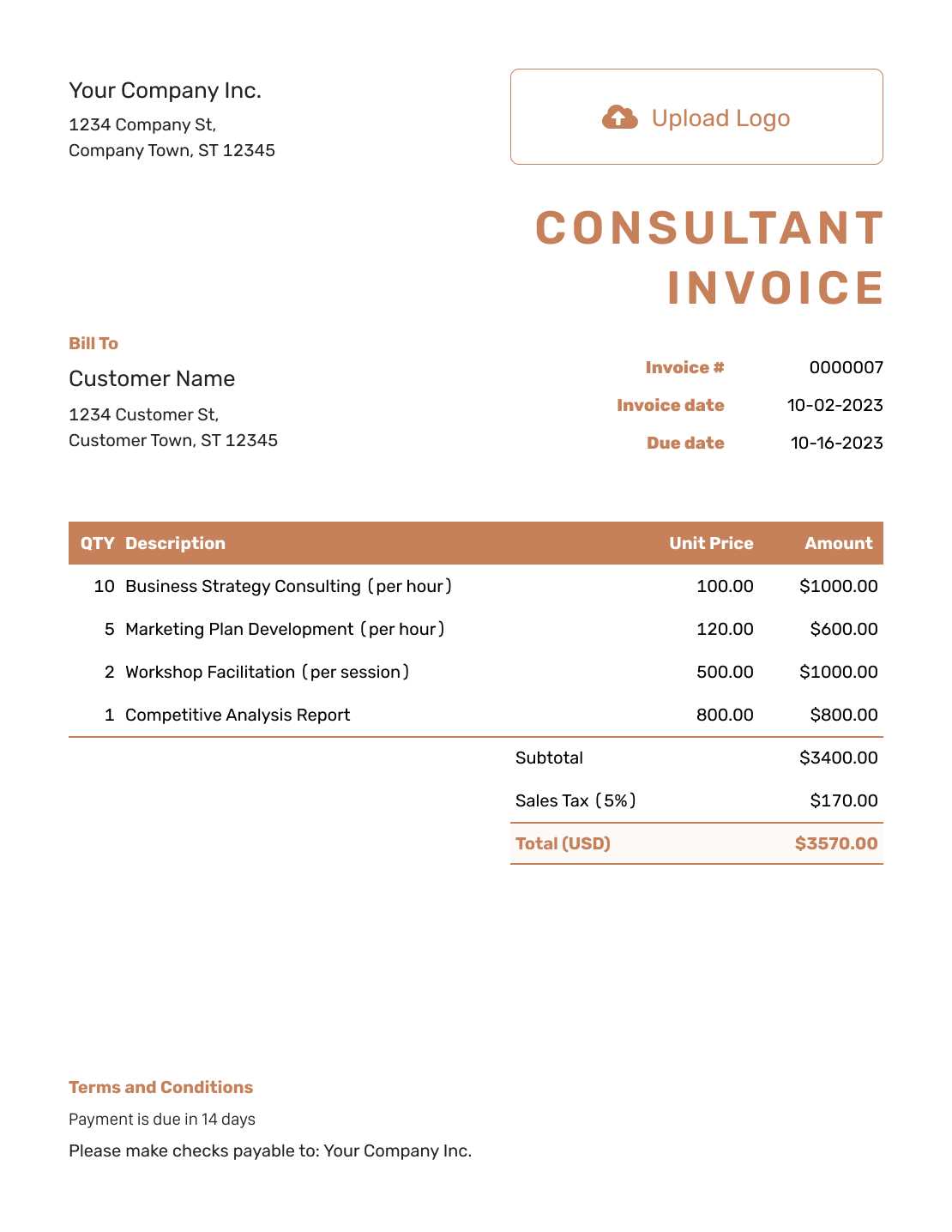

How to Personalize Your Consultant Invoice

Customizing your payment request is essential to ensuring that it reflects your brand and provides clear information to your clients. By personalizing the document, you can make it unique to your business while also maintaining professionalism. Personalization helps build trust with clients and ensures that important details are not overlooked.

Here are some ways to tailor your billing document to better suit your business:

Include Your Business Branding

Start by adding your company’s logo, color scheme, and fonts to the document. This gives it a professional and cohesive look, making it clear that it is part of your official business. Incorporating your branding elements also helps clients quickly identify the document as belonging to your company, which adds credibility and strengthens brand recognition.

Customizing Service Descriptions and Terms

Ensure that each service provided is clearly described, with relevant details such as the scope of work, hours worked, and agreed-upon rates. You can also include any unique payment terms or conditions that might apply to specific projects. For example, if you offer discounts for early payment or charge additional fees for rush jobs, make sure these terms are included in the document.

- Personalized Greeting: Addressing the client by name at the beginning of the document adds a personal touch, showing that you value the relationship.

- Payment Instructions: Customizing the payment instructions based on your preferred method (e.g., bank transfer, online payment platform) makes it easier for clients to settle their bills.

By adjusting the content and style of your payment request, you create a document that aligns with your business identity while providing clients with the essential information in a professional manner. This level of personalization helps enhance client satisfaction and streamlines the payment process.

Free Invoice Templates vs Paid Versions

When it comes to creating billing documents, many professionals are faced with a choice between using no-cost options and purchasing premium solutions. Both options offer benefits, but the choice depends on your business needs, volume of transactions, and level of customization required. Understanding the differences between free resources and paid tools will help you make the best decision for your business.

Here’s a breakdown of the advantages and drawbacks of using free versus paid resources for your payment requests:

Advantages of Free Resources

- Cost-Effective: The most obvious benefit is that there’s no cost involved. Free options are ideal for startups, freelancers, or businesses with minimal billing needs who want to avoid additional expenses.

- Simplicity: Many free options are easy to use, with basic layouts and functions that don’t overwhelm users with unnecessary features.

- Quick Access: Free resources are often available immediately, meaning you can start creating your billing documents right away without a waiting period.

Advantages of Paid Solutions

- Advanced Features: Paid options often come with additional functionalities, such as automatic calculations, built-in tax rates, and customizable design options that can help create a more tailored and professional-looking document.

- Integration with Accounting Systems: Many premium solutions integrate with other business software, allowing for better tracking of payments, generating financial reports, and syncing with accounting tools.

- Customer Support: With paid versions, you often get access to customer support, which can be invaluable if you encounter technical issues or need help with specific features.

Choosing between a free or paid solution depends on your specific needs. If you have basic billing requirements and are looking to keep costs low, free options may suffice. However, if you need advanced features, enhanced customization, or integration with other business tools, a paid solution could be a more effective choice.

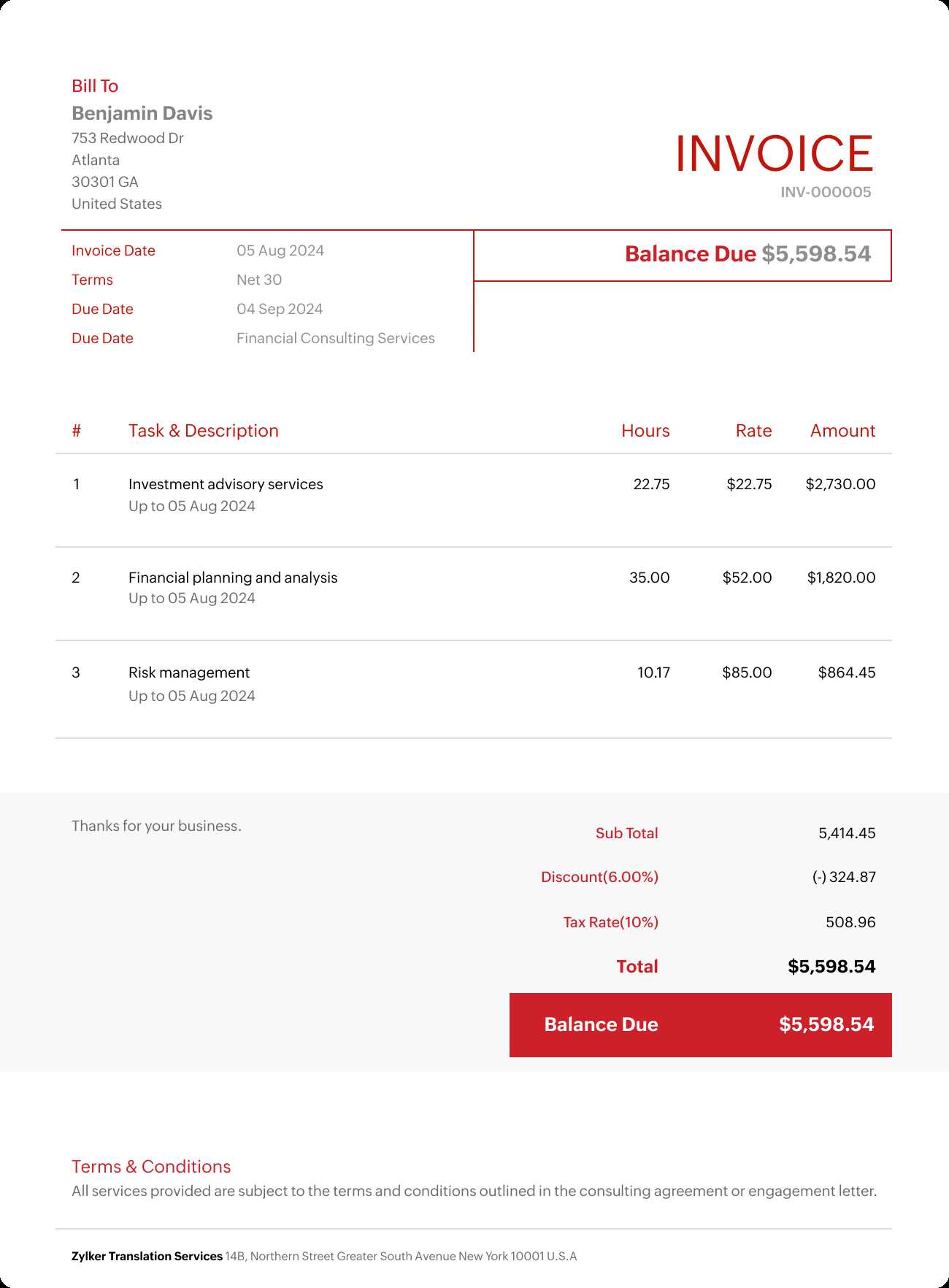

Essential Information to Include in Your Invoice

When preparing a payment request, it is crucial to include all necessary details to ensure clarity and prevent confusion. A well-structured document not only helps clients understand what they are being charged for but also facilitates prompt and accurate payment. Including the right information ensures that your request is professional, complete, and easy for both parties to process.

Here are the key components to include in your billing document:

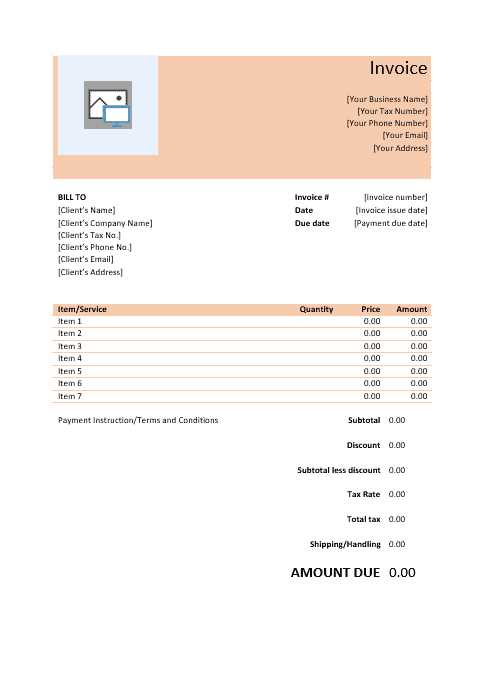

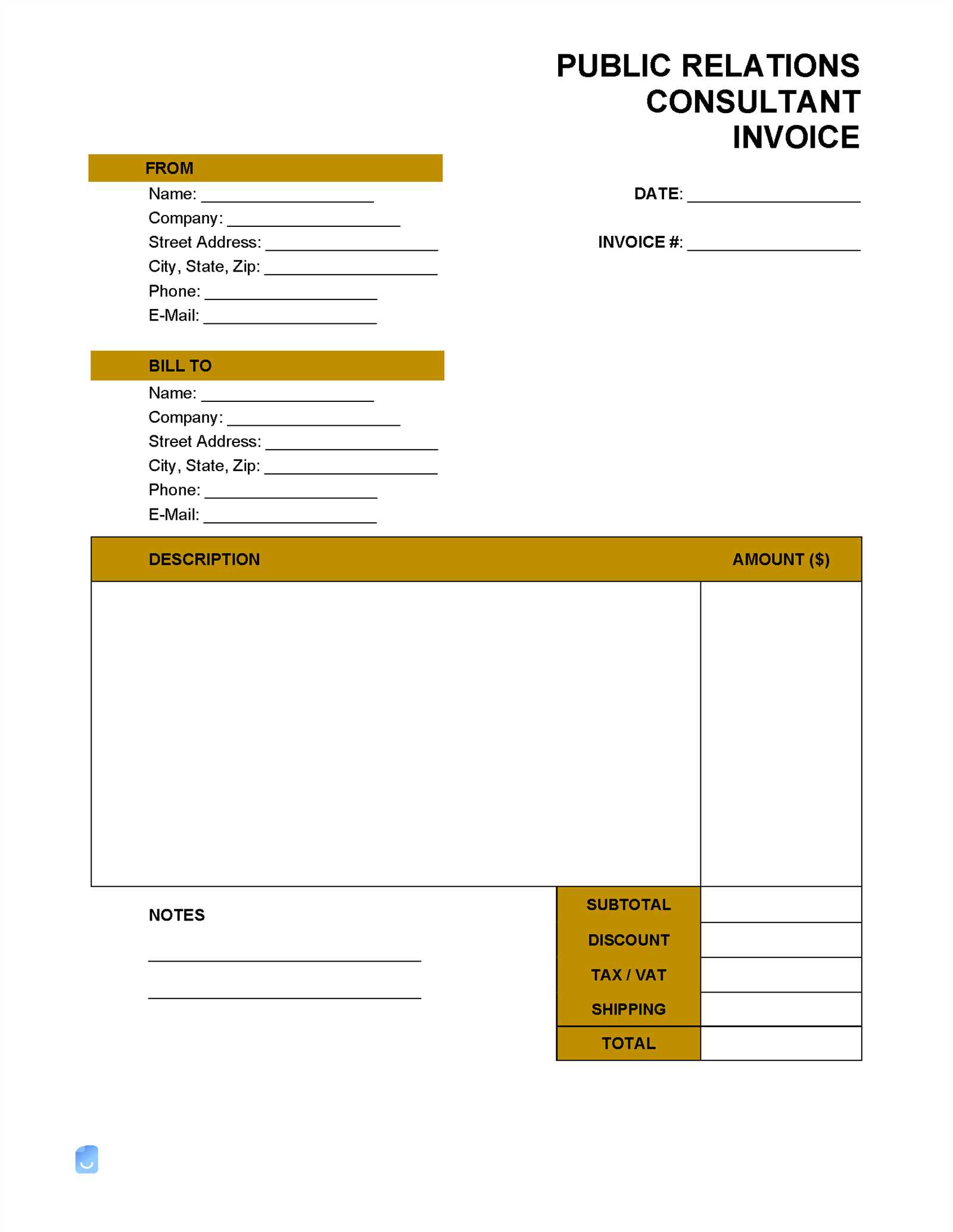

- Your Business Information: Clearly display your name or company name, address, phone number, and email. This helps clients identify the sender and easily reach out if needed.

- Client’s Information: Include the client’s full name, company (if applicable), and their contact details. This ensures the request is directed to the correct individual or department.

- Unique Reference Number: Assign a unique number to each payment request for easy tracking. This also helps both you and your client keep records organized.

- Service Description: Provide a detailed description of the work completed, including dates, hours worked, and individual rates. This breakdown offers transparency and prevents misunderstandings.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or early payment discounts. Setting clear terms helps manage expectations and encourages timely payment.

- Amount Due: Clearly state the total amount owed, including any taxes or additional charges. This helps avoid confusion and ensures clients understand the final sum they are responsible for.

- Additional Notes: If there are any specific instructions or important information (such as cancellation policies or warranties), make sure these are included to avoid any misunderstandings.

Including these elements in your financial request ensures that your document is thorough and professional. A complete and well-organized payment request not only speeds up the payment process but also contributes to building trust and maintaining positi

How to Download Free Invoice Templates

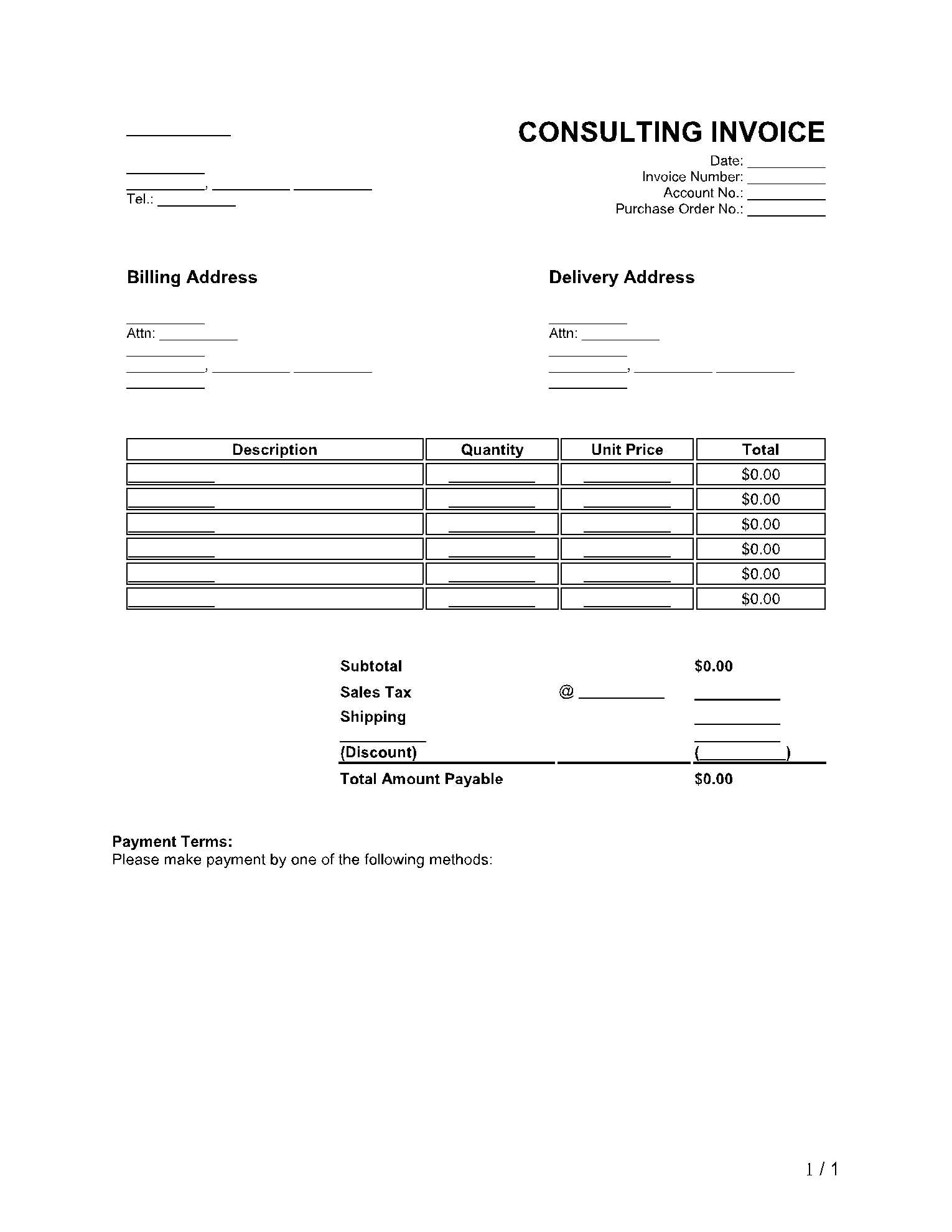

For professionals looking to streamline their billing process, downloading pre-designed documents can save time and ensure consistency. These ready-made resources can be easily customized to meet your specific needs, making the payment request process quicker and more efficient. In this section, we’ll walk you through the steps to download and use these helpful tools, so you can get started with minimal effort.

Here’s how you can easily download and begin using these documents:

- Step 1: Search for Reliable Sources: Start by searching for trustworthy platforms that offer downloadable billing documents. Many websites and online marketplaces provide a wide range of options for different industries and business needs.

- Step 2: Select the Right Format: Choose the format that best suits your needs. Common formats include Word documents, Excel spreadsheets, and PDF files. Consider how you want to edit or send your document before making a selection.

- Step 3: Choose a Design That Fits Your Brand: Many platforms offer multiple designs, ranging from simple and minimalist to more elaborate and branded options. Pick one that aligns with your business style and the professional image you want to project.

- Step 4: Download the File: Once you’ve selected the perfect document, simply click the download button. Make sure the platform is reputable to ensure that the file is free of malware and safe to use.

- Step 5: Customize Your Document: After downloading, open the file in the appropriate software (Word, Excel, etc.) and tailor it with your business details, client information, and service descriptions. Personalize the layout and terms to suit your specific needs.

By following these simple steps, you can quickly gain access to helpful, customizable tools that will enhance your billing process and allow you to focus on more important tasks.

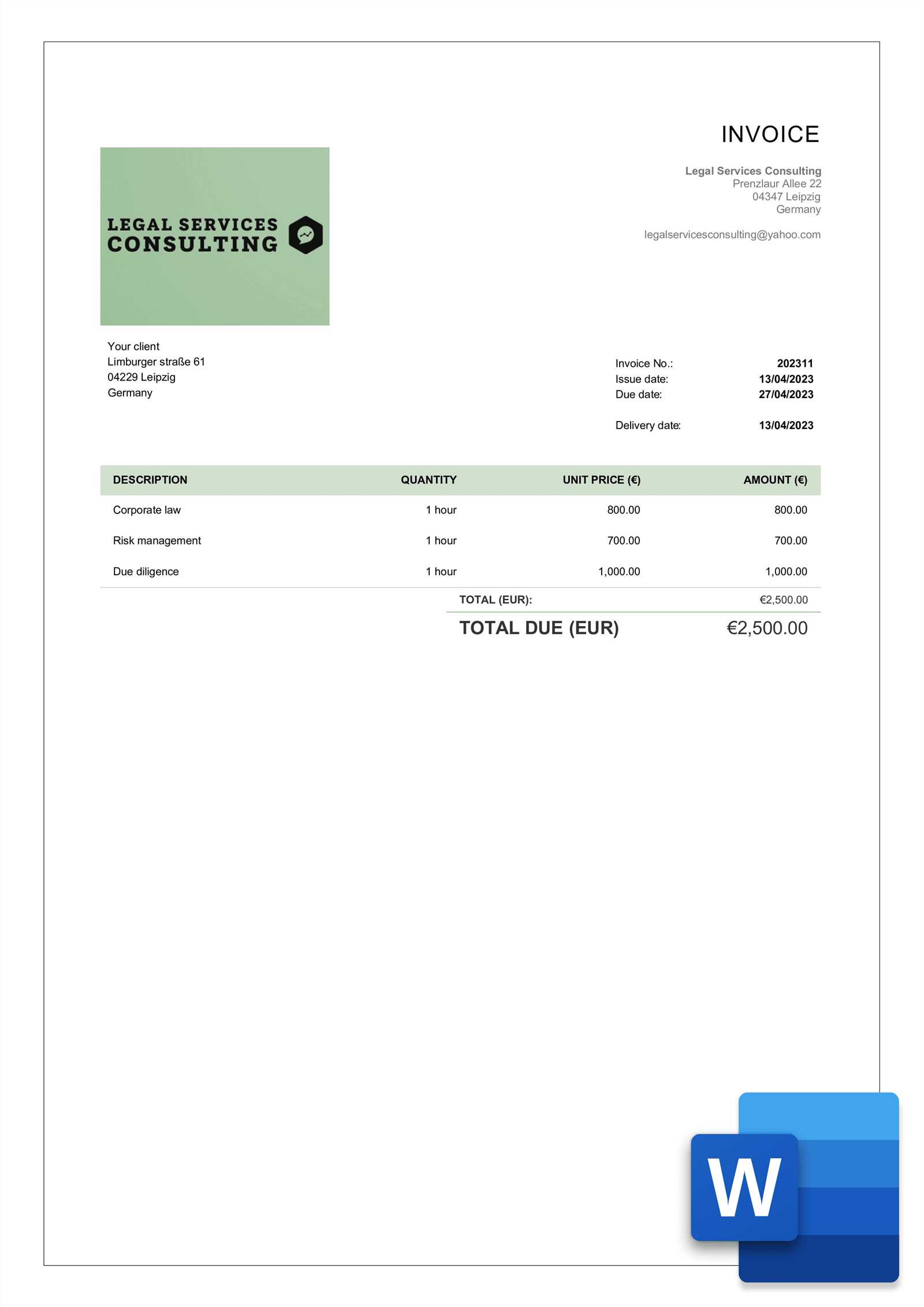

Choosing the Right Invoice Format for Consultants

Selecting the appropriate document format for your payment requests is essential for maintaining a professional image and ensuring smooth transactions. Different formats offer various features that can cater to your specific needs, whether you’re handling simple tasks or complex projects. The right format can also help organize your financial details in a way that makes sense to both you and your clients.

When choosing the best layout, consider the following factors:

- Project Complexity: For more straightforward work, a simple format with basic details (such as hourly rates and hours worked) might suffice. For larger, more intricate projects, you may need a format that allows for detailed breakdowns and multiple sections.

- Customization Needs: Choose a format that allows you to adjust the layout to fit your specific requirements. This might include adding sections for travel expenses, materials, or different payment milestones, depending on the nature of your work.

- Client Preferences: Some clients may prefer certain formats, especially if they have their own accounting system. Always ask if there are any preferred formats or specific information that should be included.

- Professional Appearance: A clean, easy-to-read format conveys professionalism and helps ensure that your clients can quickly process the payment request. Look for designs that are simple but polished, with clear headings and organized sections.

- Ease of Use: The format should be simple to fill out, allowing you to quickly add the necessary information. If you’re using a digital solution, consider formats that integrate with accounting software or provide automated calculations to save time.

Ultimately, the right format should help you communicate the details of your work in a way that is clear, professional, and suited to your specific business needs. Whether you choose a basic or more detailed layout, the goal is to create a document that facilitates smooth transactions and builds trust with your clients.

Improving Client Relationships with Professional Invoices

Creating well-organized and professional payment requests not only ensures you get paid on time but also plays a crucial role in building strong, long-lasting relationships with your clients. A polished document reflects your attention to detail and reinforces your reputation as a reliable and trustworthy professional. The way you present your financial information can have a significant impact on how your clients perceive you, and can help foster a positive, transparent working relationship.

Here are a few ways in which well-crafted documents can enhance client relationships:

- Building Trust: Clear, accurate, and professional payment requests reassure clients that they are working with someone who is organized and dependable. This helps establish trust and makes them more likely to continue doing business with you.

- Transparency: A detailed breakdown of the services rendered and any associated costs provides clarity and prevents misunderstandings. When clients understand exactly what they are being charged for, it reduces the chances of disputes.

- Timely Payments: Well-prepared documents with clear payment terms can encourage prompt payments. When clients know exactly when and how to pay, it reduces confusion and helps you maintain steady cash flow.

- Professional Image: High-quality, well-designed documents create a lasting impression. Clients are more likely to view you as a professional who takes their business seriously, which can lead to more opportunities and referrals.

- Positive Communication: A polite, respectful tone in your payment requests can contribute to positive interactions. Personalizing the message and offering assistance if they have any questions can show that you care about their experience beyond just the transaction.

By taking the time to present your financial details clearly and professionally, you not only streamline your administrative processes but also contribute to a positive client experience that can lead to long-term success and repeat business.

Invoice Payment Terms Every Consultant Should Know

Setting clear payment terms is crucial to ensure smooth transactions and prevent misunderstandings with clients. These terms define the expectations around when and how payments should be made, as well as any consequences for late payments. Understanding and clearly communicating these terms not only helps protect your cash flow but also strengthens your professional relationships by setting mutual expectations upfront.

Here are some common payment terms you should consider when creating your billing documents:

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days of the issue date. This is one of the most common terms and is often used for clients with established relationships or ongoing projects. |

| Net 15 | Payment is due within 15 days. This term is useful for businesses that prefer quicker turnover of their accounts receivable. |

| Due on Receipt | The payment is due as soon as the client receives the billing document. This term ensures prompt payment, especially for smaller or one-time projects. |

| Late Fee | Specify a penalty for overdue payments. This could be a fixed amount or a percentage of the total amount due for each day the payment is delayed. |

| Deposit Required | Request a deposit before starting the work, especially for large projects. This helps ensure commitment from the client and provides upfront cash flow. |

| Early Payment Discount | Offer a discount to clients who pay ahead of the due date. This encourages prompt payments and can help speed up your cash flow. |

Establishing clear, specific payment terms upfront helps to avoid confusion and ensures that both you and your clients are on the same page regarding expectations. By incorporating these terms into your payment documents, you are protecting your business and promoting a professional, trustworthy image.

How to Track Payments Using Invoice Templates

Effectively tracking payments is crucial for managing your business finances and ensuring timely cash flow. Using structured payment request documents can simplify this process by providing clear records of all transactions. With the right system in place, you can easily monitor which payments have been made, which are outstanding, and when they are due.

Here are some practical ways to use payment request documents for tracking payments:

- Include a Payment Status Field: Add a section to your document where you can mark the payment status (e.g., “Paid,” “Pending,” “Overdue”). This makes it easy to see at a glance the status of each transaction.

- Record Payment Dates: Always note the date when the payment is received. This helps you maintain an accurate record and can be useful when reviewing past transactions or resolving discrepancies.

- Use Unique Reference Numbers: Assign each document a unique number or code. This allows you to track individual transactions and helps avoid confusion when multiple payments are due or when clients have recurring agreements.

- Set Up Reminders for Overdue Payments: Include payment due dates in your document and set up reminders or follow-up dates. This ensures you stay on top of outstanding payments and can take prompt action if needed.

- Monitor Partial Payments: If clients make partial payments, record these amounts and update the remaining balance. This helps keep everything transparent and ensures you can easily track what’s left to be paid.

By incorporating these tracking elements into your billing documents, you can stay organized and maintain a clear overview of your finances. Consistent record-keeping not only helps you manage cash flow more effectively but also minimizes the risk of missed payments or errors in your accounting.

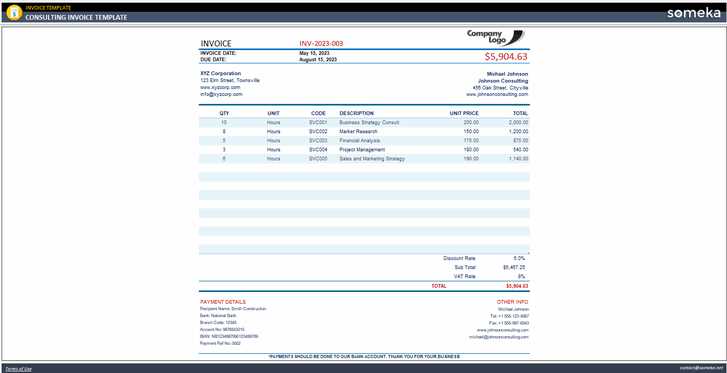

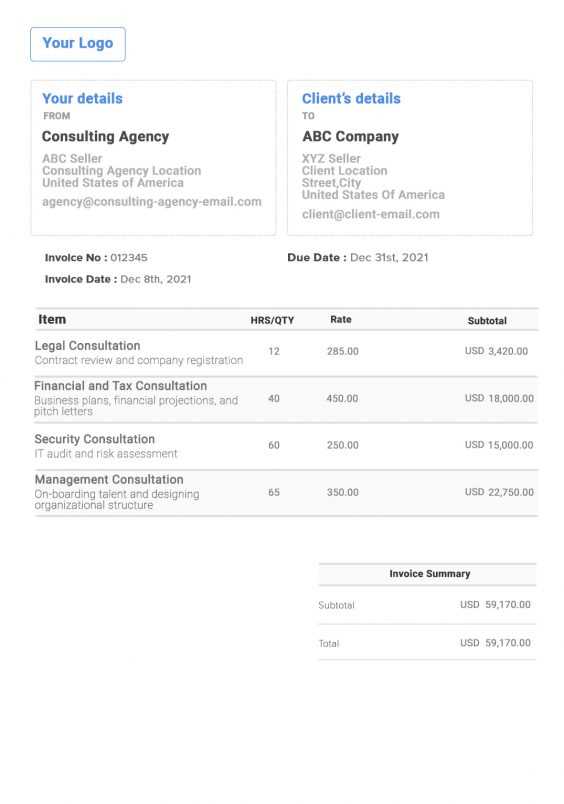

Free Invoice Templates for Various Consultant Types

Different professionals have different needs when it comes to creating billing documents. Whether you’re offering strategic advice, technical services, or creative solutions, having a document format tailored to your specific work can help streamline the billing process. Choosing the right layout ensures that all necessary details are included while reflecting your area of expertise and the type of service you provide.

Here are some popular formats that cater to various types of professionals:

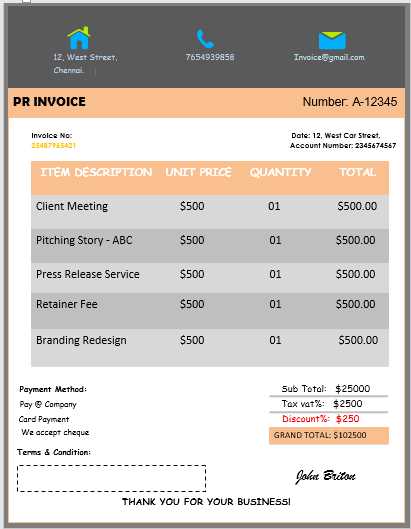

- Business Consultants: For business advisors, a billing document often includes charges for strategic planning, market research, and meetings. A clear breakdown of hourly rates, project phases, and deliverables is essential for clarity.

- IT Specialists: Those providing technical services may need to outline time spent on troubleshooting, software installations, or system updates. Including detailed descriptions of each task, along with any materials or software costs, is important.

- Marketing Experts: Marketing consultants may have variable pricing structures based on campaign complexity, deliverables, and time commitment. Their billing documents often include charges for advertising campaigns, content creation, and market analysis.

- Creative Professionals: For designers, writers, or photographers, invoices typically break down services by hours worked or project completion. Including licensing fees, usage rights, and material costs ensures that clients understand the full scope of the work.

- Financial Advisors: Financial consultants may require a more detailed record of services like tax preparation, investment advice, and financial planning. Their documents often reflect ongoing service fees or commission-based charges.

Choosing the right document for your field not only saves time but also helps you communicate more effectively with your clients. By selecting a design that aligns with your services, you make it easier for clients to understand your charges, which can lead to faster payments and better professional relationships.

How to Stay Organized with Invoice Templates

Staying organized is key to managing your finances and ensuring smooth business operations. When it comes to billing clients, a well-organized system helps you track payments, follow up on overdue accounts, and maintain a professional appearance. Using structured documents for payment requests can streamline this process, making it easier to keep everything in order and reduce the risk of errors.

Organizing Your Billing Process

By using a consistent format for your payment requests, you can easily keep track of what has been paid and what is still outstanding. Here are some ways to stay organized:

- Use Unique Reference Numbers: Assign a unique reference number to each request. This helps you easily locate and track specific transactions in your records.

- Track Payment Status: Include a field to mark whether the payment is pending, partially paid, or completed. This will help you stay on top of any overdue payments.

- Set Up a Filing System: Organize your documents in folders or directories by client name, project, or date. This makes it easy to locate any past records when needed.

- Maintain a Payment Log: Keep a log of all issued documents, including their status. A simple spreadsheet can help you track payments and dates more efficiently.

Using Digital Tools to Stay Organized

Digital tools can make managing your payment records even easier. Here’s how you can integrate digital documents into your organizational system:

| Tool | Benefit |

|---|---|

| Accounting Software | Automates tracking, sends reminders for overdue payments, and integrates with your bank for easy reconciliation. |

| Cloud Storage | Allows you to store and access all of your payment records from any device, ensuring they’re backed up and easily retrievable. |

| Excel or Google Sheets | Helps you manually track payments and statuses, with the ability to add custom filters and formulas for quick updates. |

By incorporating these strategies and digital tools, you’ll be able to stay organized and manage your finances more effectively. Keeping accurate records and tracking payments in real-time can help you avoid late payments, reduce administrative work, and maintain posit