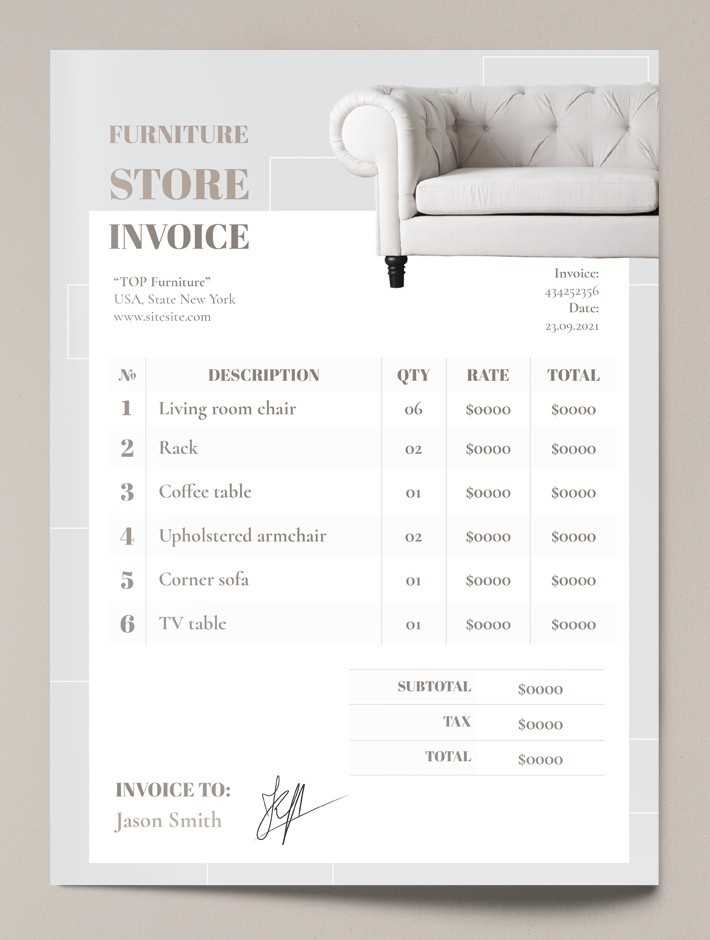

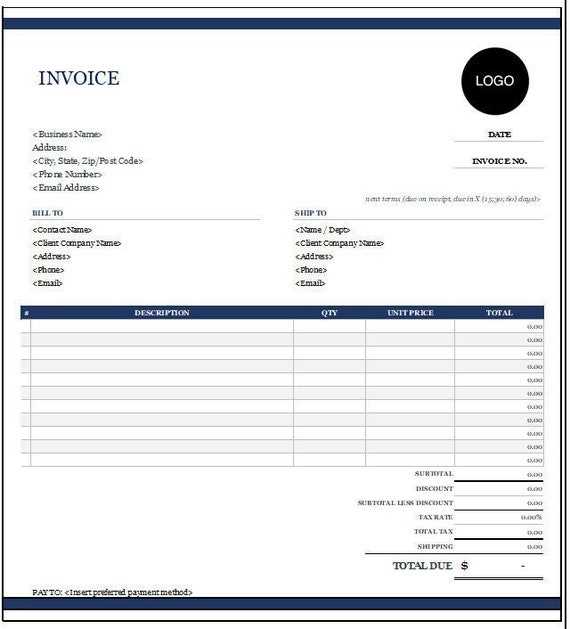

Free Clothing Store Invoice Template Download for Streamlined Billing

For businesses seeking to streamline their payment processes, finding an efficient way to manage customer transactions is essential. Accessible tools designed to simplify billing can save time and help establish a professional standard, creating a seamless experience for both the business and its clients. With the right resources, handling payment requests can be as straightforward as it is effective.

Organizing payment details and crafting clear, itemized records can enhance credibility while reducing the chances of errors. Using pre-designed resources tailored for business transactions can

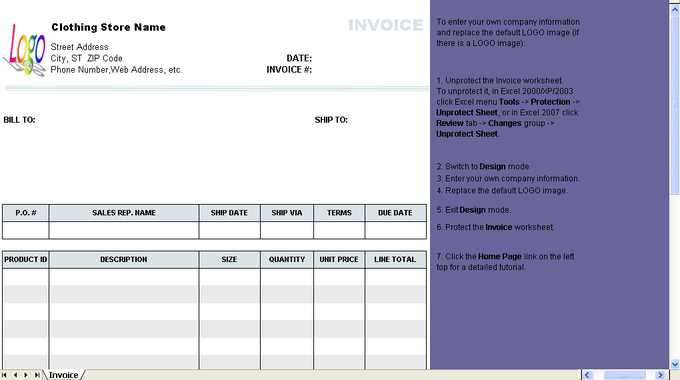

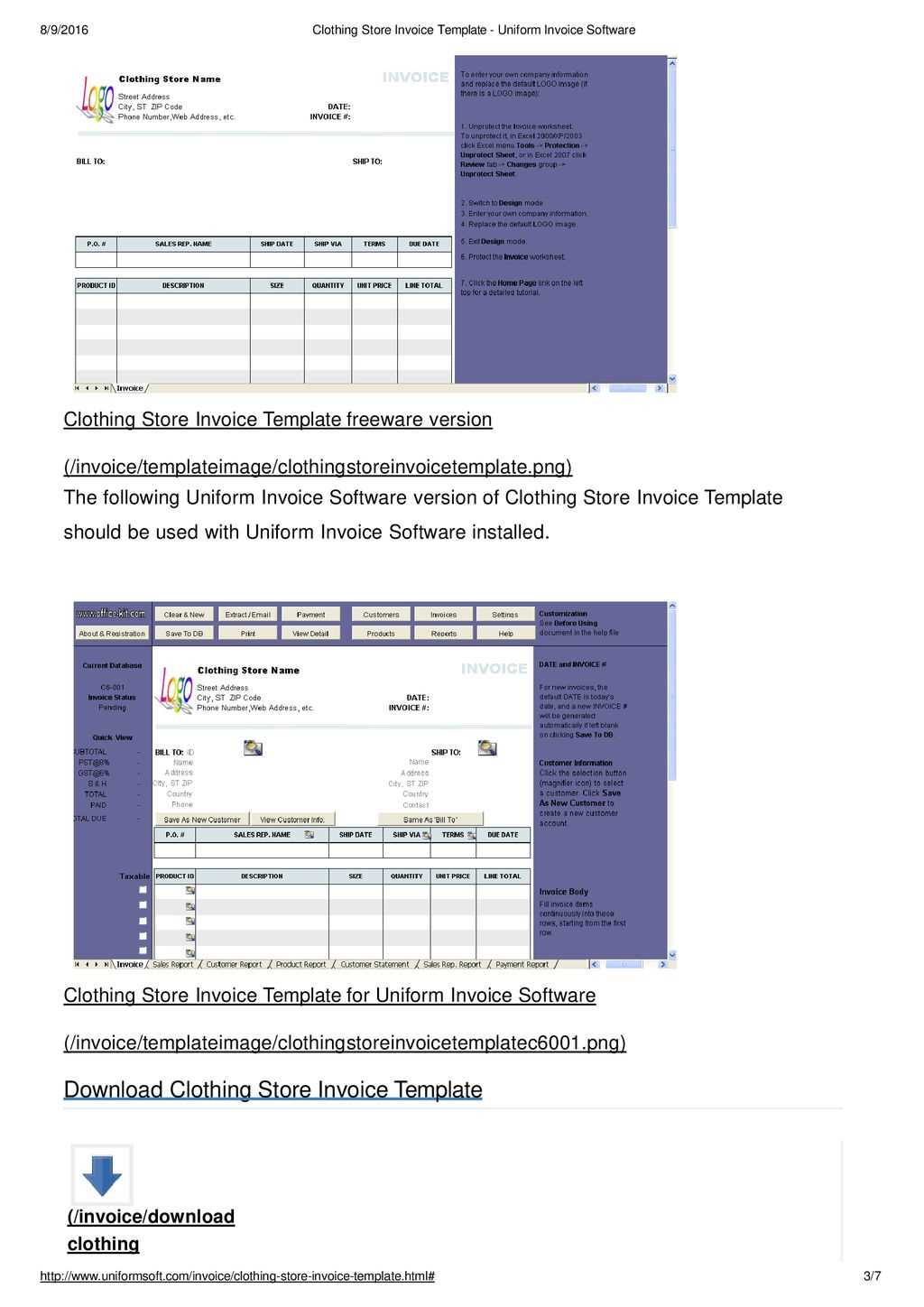

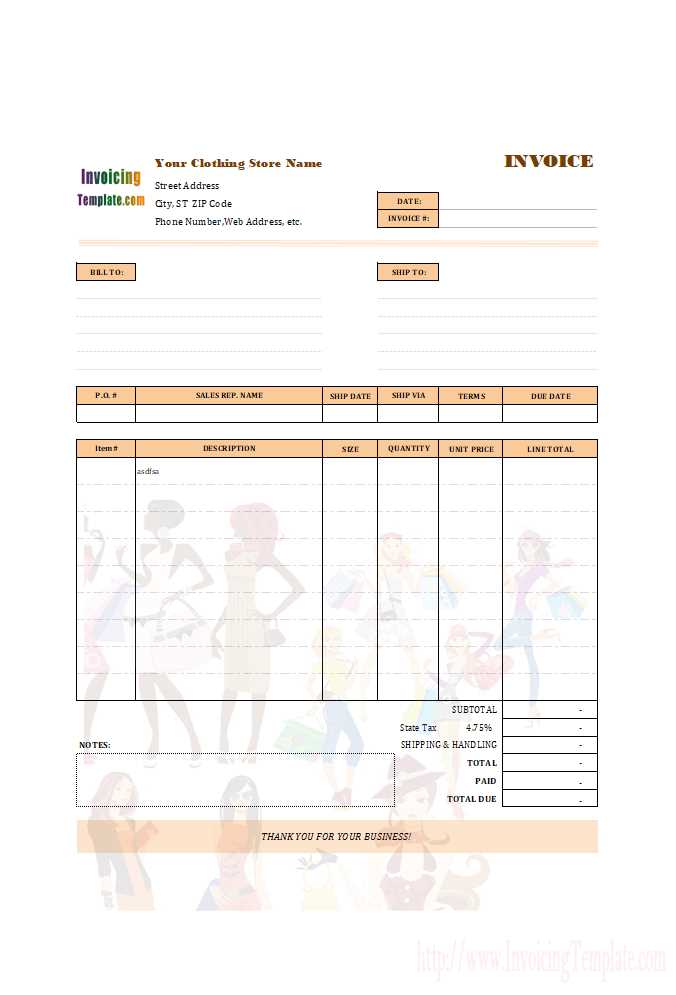

Clothing Store Invoice Templates for Quick Billing

For businesses aiming to make transaction handling faster and simpler, using well-structured billing tools can be a game-changer. These resources help in creating professional, efficient records that ensure clarity for both parties. With a properly organized system, keeping track of sales becomes easier, supporting seamless interactions with customers and improved cash flow management.

Advantages of Ready-Made Billing Resources

Adopting pre-designed solutions for payment records offers multiple benefits for businesses:

- Time Efficiency: Reduces the time spent on designing and formatting records, allowing more focus on core business activities.

- Consistency: Maintains a professional appearance with standardized formats, which enhances credibility.

- Accuracy: Minimizes com

How to Choose the Right Invoice Template

Finding an efficient billing resource that meets business needs is essential for smooth and organized payment processing. The right tool should not only be easy to use but also align with the unique requirements of the business, providing clear, detailed records for each transaction. A well-chosen option can significantly reduce administrative workload while improving customer relations through clear documentation.

Key Factors to Consider

- Business Type and Size: Choose a format that supports the volume of sales and specific items the business handles regularly. Tailoring resources to the business size helps maintain accuracy and organization.

- Customization Options: Opt for tools that

How to Choose the Right Invoice Template

Finding an efficient billing resource that meets business needs is essential for smooth and organized payment processing. The right tool should not only be easy to use but also align with the unique requirements of the business, providing clear, detailed records for each transaction. A well-chosen option can significantly reduce administrative workload while improving customer relations through clear documentation.

Key Factors to Consider

- Business Type and Size: Choose a format that supports the volume of sales and specific items the business handles regularly. Tailoring resources to the business size helps maintain accuracy and organization.

- Customization Options: Opt for tools that allow adjustments in design, such as logos and color schemes, for better brand representation. This can make the documents look professional and unique.

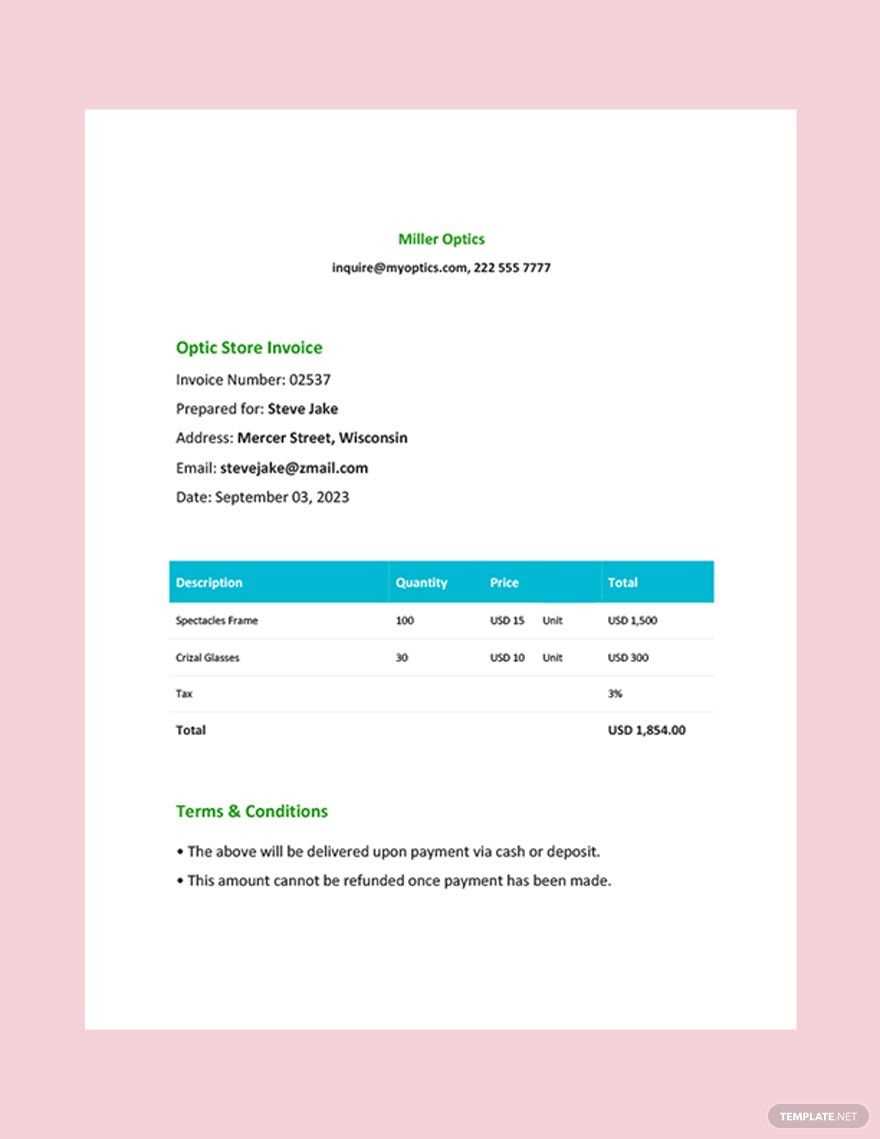

- Required Fields: Ensure that the layout includes essential sections like item descriptions, quantities, prices, taxes, and payment terms. Clear structure helps prevent misunderstandings with clients.

- Compatibility: Select a resource that integrates well with existing software or systems, such as accounting platforms, to make data entry and tracking easier.

Steps to Select the Best Option

- Identify Business Needs: Define the specific billing requirements, including any unique terms or fields, to help narrow down the choices.

- Review Available Formats: Explore different formats and select one that offers flexibility and ease of use.

- Test for Usability: Choose a few options and test them for ease of customization and compatibility with other systems. This ensures a seamless experience.

With careful selection, businesses can simplify their payment process, making it both efficient and professional. The right choice can streamline administrative tasks and support a consistent, positive experience for customers.

Benefits of Using an Invoice Template

For businesses looking to improve their billing processes, using a structured format can be invaluable. By implementing pre-designed resources, companies can simplify administrative tasks, enhance record accuracy, and project a more professional image. Such tools not only support quick payment tracking but also make it easier to organize important transaction details in a consistent way.

Below are some key advantages of utilizing ready-made billing resources:

Benefit Description Time Savings Pre-made formats reduce the time spent on creating and formatting billing records, allowing staff to focus on core business activities. Professional Appearance With structured formats, businesses can present a polished and consistent look, enhancing trust and credibility with clients. Customizing Your Clothing Store Invoice

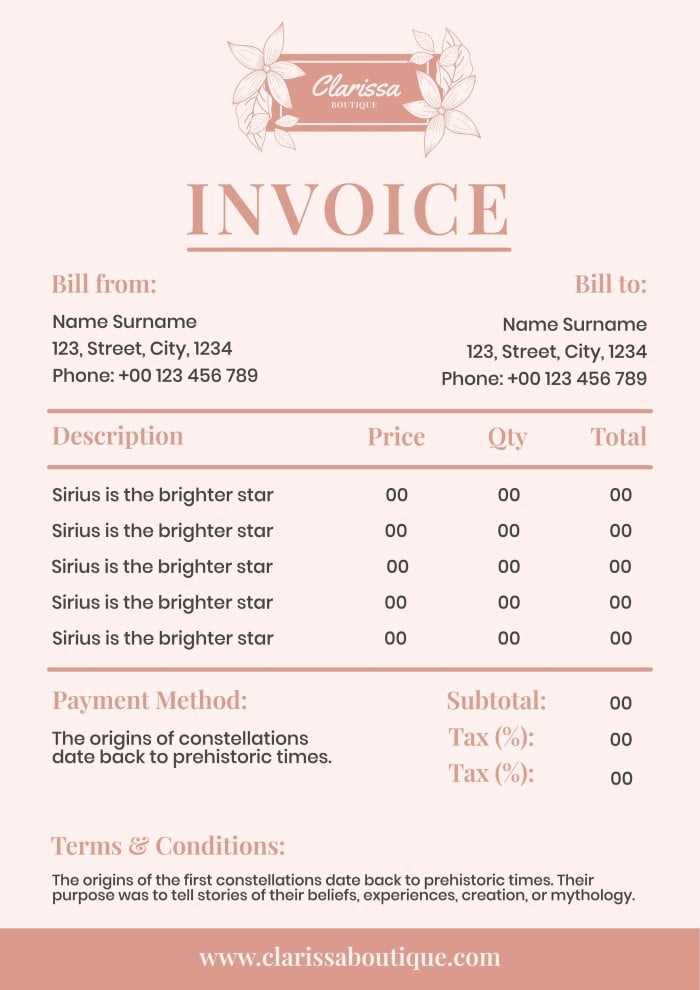

Tailoring billing documents to reflect the business’s brand can enhance professionalism and leave a memorable impression on clients. By adjusting key elements in the document layout, businesses can ensure that each detail aligns with their visual identity and functional needs. Customization allows for a unique, branded experience that communicates the business’s values.

Here are several customizable elements that can make your billing records both functional and visually appealing:

Customization Option Description Logo and Brand Colors Incorporate your business logo and color scheme to make the document instantly recognizable and cohesive with other materials. Font Style Select fonts that align with your brand’s Best Practices for Accurate Invoicing

Ensuring precision in billing documents is crucial for maintaining a smooth transaction process and building trust with clients. Accurate documentation helps prevent errors that could lead to payment delays or disputes. Following some essential practices can improve clarity and consistency, making it easier for businesses to manage payments effectively.

Essential Steps

Best Practices for Accurate Invoicing

Ensuring precision in billing documents is crucial for maintaining a smooth transaction process and building trust with clients. Accurate documentation helps prevent errors that could lead to payment delays or disputes. Following some essential practices can improve clarity and consistency, making it easier for businesses to manage payments effectively.

Essential Steps for Accuracy

Practice Description Clear Item Descriptions Provide detailed names and descriptions for each item or service, making it easy for clients to understand what they are being charged for. Consistent Formatting Use a standardized format for all records to ensure information is organized and easily readable. Accurate Tax Calculations Double-check tax rates and calculations to avoid discrepancies that could confuse clients or cause compliance issues. Double-Check Dates and Totals Verify that all dates, quantities, and totals are correct to avoid errors that may delay payment processing. Include Payment Instructions Provide clear instructions for payment, including accepted methods and account details, to make the process straightforward for clients. Additional Tips for Accuracy

- Use Automation Tools: Leverage software tools to reduce manual errors and streamline repetitive tasks.

- Keep Records Organized: Store all documents systematically, making it easier to track payments and address any discrepancies.

By implementing these practices, businesses can ensure their billing process is clear, reliable, and conducive to timely payments. Consistent attention to detail builds a professional reputation and reinforces trust with

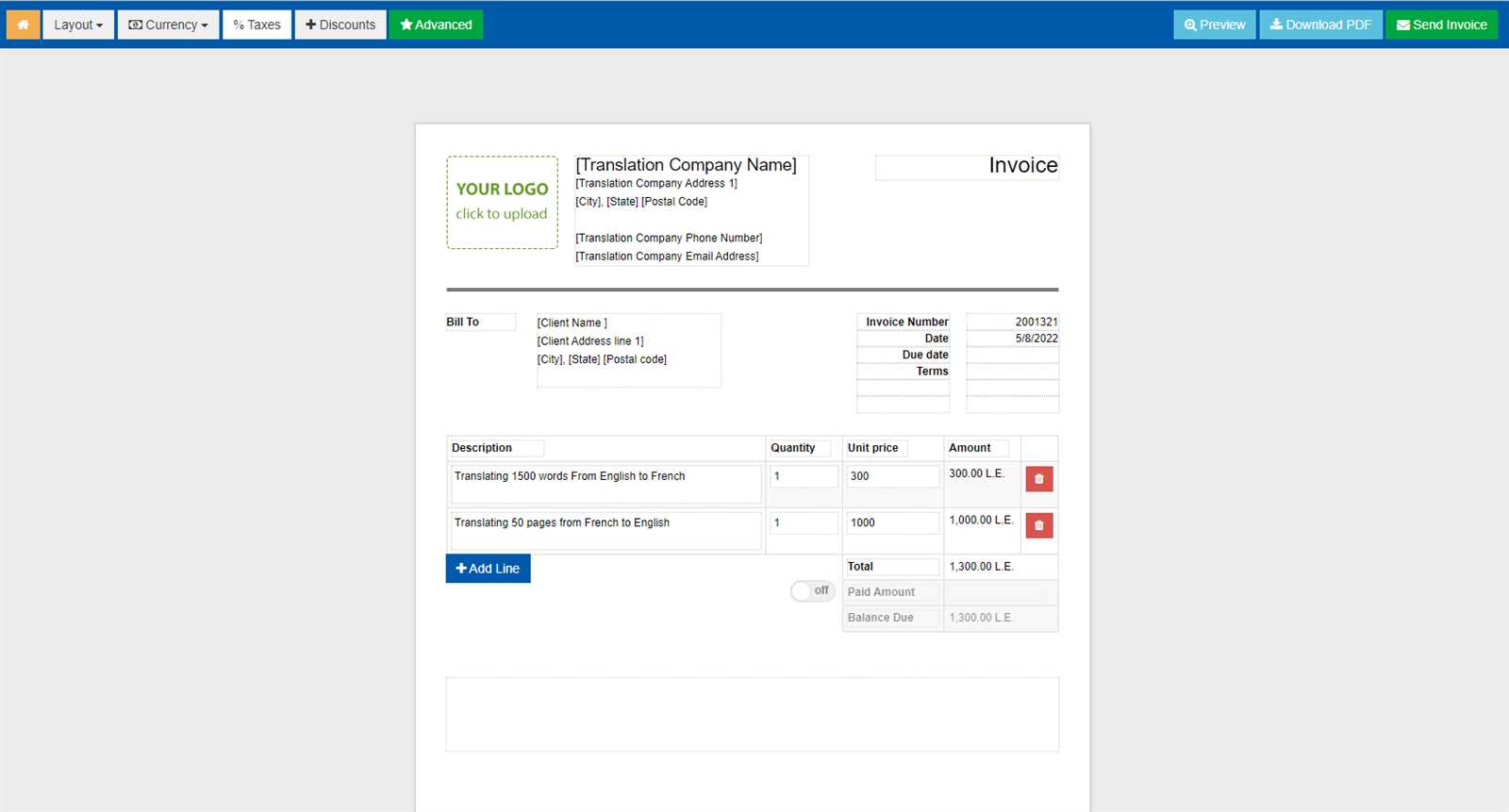

Step-by-Step Guide to Downloading Templates

Acquiring ready-made documents for business needs can save time and improve workflow efficiency. Whether you need a design for billing or another business task, the process of obtaining these resources is simple and straightforward. Follow this guide to ensure a smooth experience while getting exactly what you need.

Here’s a clear breakdown of the steps to acquire a useful document template:

- Choose a Trusted Source: Start by selecting a reliable website or platform offering high-quality documents suited to your needs. Look for sites with good reviews and easy access to resources.

- Browse Available Options: Review the various formats and styles available. Consider your specific requirements to find the most suitable document.

- Select Your Document: After choosing the right style, click on the file to open the details. Check if it meets your expectations before proceeding.

- Click the Access or Obtain Button: Look for a button or link that lets you acquire the file. This may be labeled as “Get Now,” “Access Document,” or similar.

- Confirm the File Format: Ensure that the document is in a format you can easily edit and use, such as Word, PDF, or Excel.

- Complete the Download: Follow any prompts to save the document to your device. Be sure to save it in a location you can easily find later.

By following these steps, you’ll quickly and easily obtain the right resources for your business tasks, saving time and effort while maintaining professionalism.

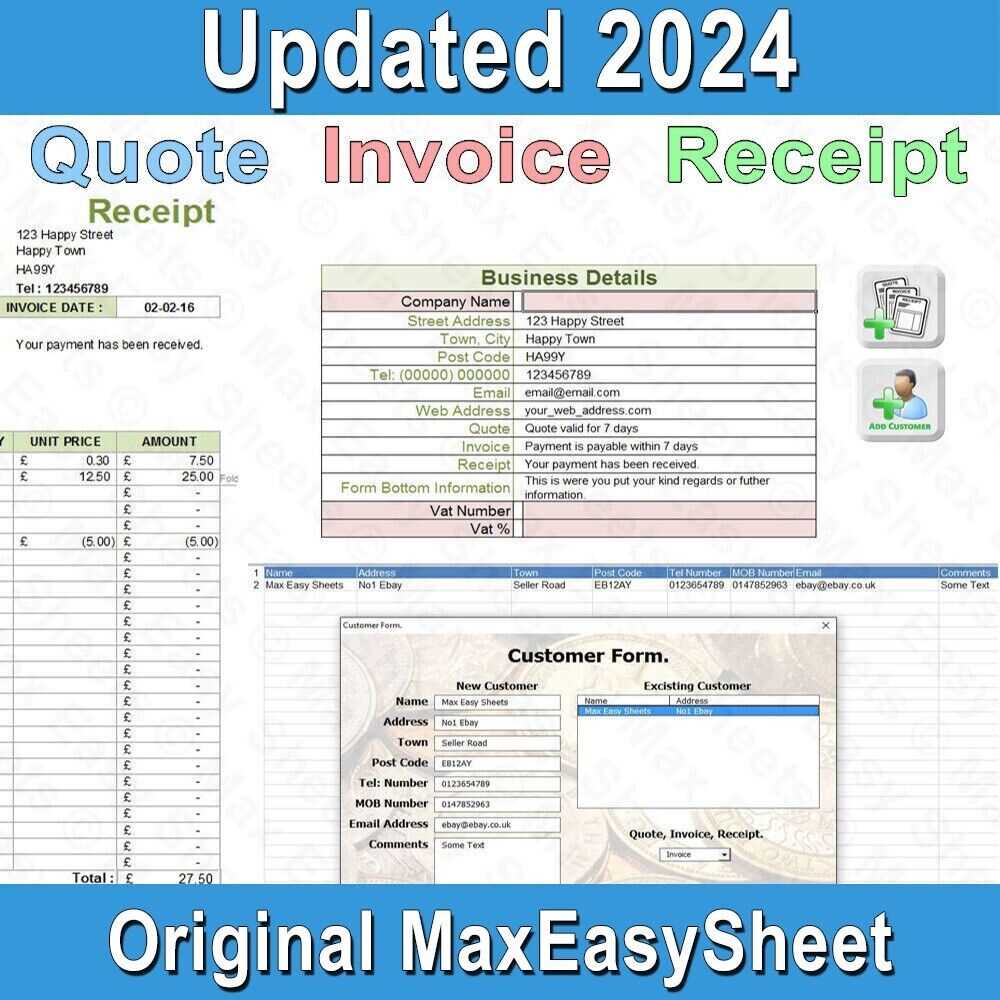

Top Software for Managing Invoices

Managing financial records and ensuring efficient billing processes is essential for any business. Software tools designed to simplify these tasks provide valuable assistance by automating key functions, reducing errors, and saving time. In this section, we will explore some of the most popular and effective programs for managing financial documents and keeping track of payments.

Best Tools for Streamlining Billing

Here are some of the leading software options available for managing financial documents:

- QuickBooks: A comprehensive solution for managing finances, including invoicing, expense tracking, and reporting. Known for its user-friendly interface and integration with various accounting systems.

- FreshBooks: Ideal for small businesses, this tool offers invoicing, time tracking, and project management features, all in one platform. Its intuitive design makes it easy to use, even for non-accountants.

- Wave: A free financial tool that provides invoicing, accounting, and receipt scanning capabilities. Best for entrepreneurs and small businesses with basic accounting needs.

- Zoho Invoice: A powerful yet simple solution for managing billing. It offers customization options, recurring invoicing, and automatic payment reminders, making it great for businesses of any size.

- Invoice2go: Focuses on creating professional-looking documents, making it easy to design, manage, and send bills from anywhere. Its mobile-friendly nature allows businesses to manage finances on the go.

Why Choose Billing Software?

Utilizing dedicated software for managing financial documents can streamline operations, enhance accuracy, and help businesses maintain a professional image. These tools automate many repetitive tasks, such as generating and sending bills, which can save time and reduce human error.

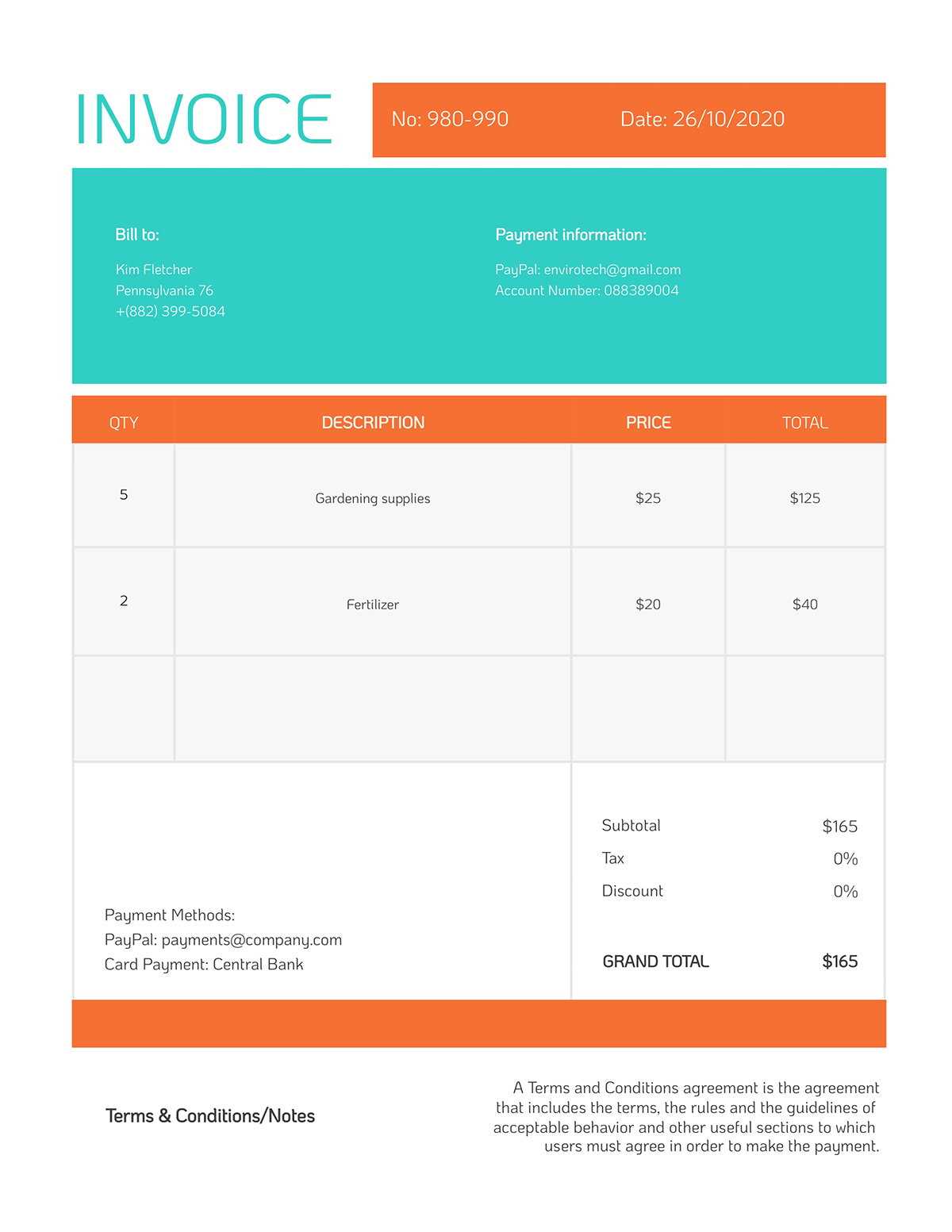

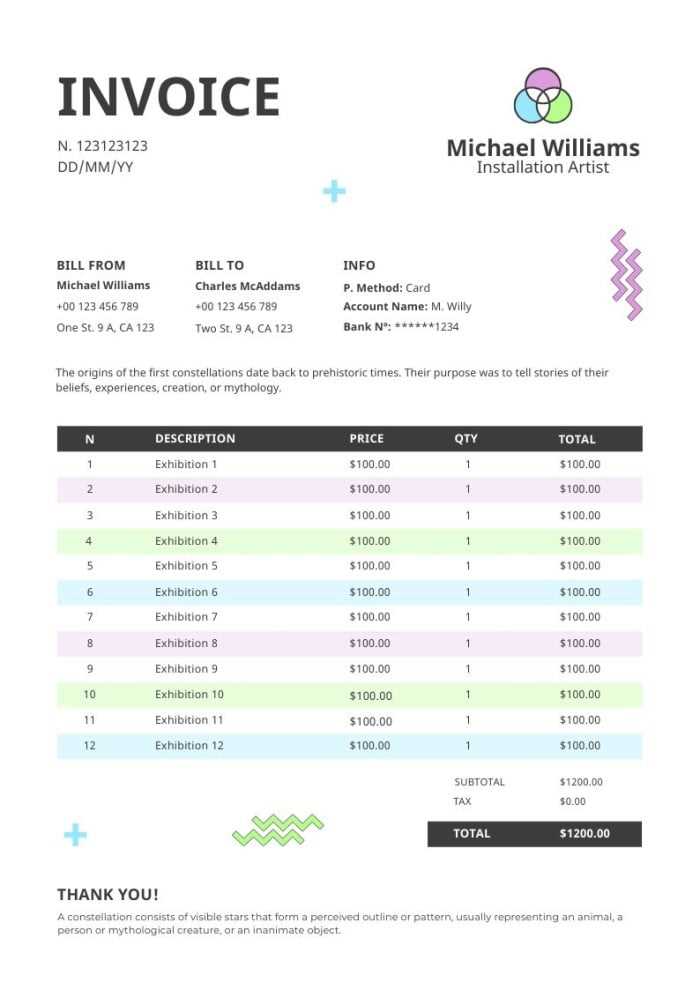

Tips for Professional Invoice Design

Creating a polished and professional document for billing purposes is crucial for maintaining a strong brand image. A well-designed document not only looks more credible but also ensures that all necessary details are presented clearly. In this section, we’ll discuss practical tips for designing professional financial documents that make a lasting impression on clients and help ensure timely payments.

Key Elements of a Well-Designed Document

When designing a document for billing, it’s essential to focus on clarity and ease of use. Here are some key aspects to consider:

- Clear Structure: Use a logical layout that highlights important details, such as business contact information, payment terms, and itemized costs. A clean structure helps the recipient quickly understand the charges.

- Branding: Incorporate your company logo, colors, and fonts to maintain a cohesive brand identity. This makes the document feel professional and consistent with your other marketing materials.

- Legible Fonts: Choose easy-to-read fonts for both headings and body text. Avoid overly decorative fonts that can make the document difficult to read, especially in important sections like pricing or due dates.

- Contact Information: Ensure that all necessary contact details are included and easy to find. This includes your business name, address, phone number, and email. Making this information accessible can improve communication with clients.

- Whitespace: Leave enough spacing between different sections and around text to prevent the document from feeling overcrowded. Proper use of whitespace improves readability and enhances the overall design.

Practical Design Tips

Consider these additional design tips to further enhance your billing document:

- Professional Colors: Stick to a simple color palette that aligns with your branding. Avoid using too many colors, as this can make the document look cluttered.

- Consistent Alignment: Ensure that all text is aligned consistently throughout the document. This makes it appear organized and polished.

- Section Dividers: Use subtle lines or shading to separate different sections of the document. This helps to clearly define where each section begins and ends, making the document easier to navigate.

Ensuring Compliance with Invoice Standards

Maintaining compliance with legal and regulatory requirements is essential when creating financial documents. Adhering to proper standards ensures that your records are accurate, professional, and in line with industry rules. In this section, we will explore key factors to consider for compliance and how to integrate them into your billing processes.

Essential Components for Legal Compliance

To ensure your financial documents are compliant, certain elements must be included. These elements not only meet legal requirements but also provide transparency and clarity for your clients:

- Business Identification: Include the name, address, and tax identification number of your business. This helps verify the legitimacy of your company and ensures the document complies with tax laws.

- Client Details: Provide the client’s full name, address, and contact information. This is necessary for both transparency and for tax and auditing purposes.

- Date of Issue: Clearly state the date on which the document was issued. This helps establish payment timelines and ensures that deadlines are met.

- Clear Payment Terms: Define the terms of payment, including due dates, accepted payment methods, and any applicable late fees. This avoids confusion and helps maintain professionalism in your business dealings.

- Itemized Charges: List each product or service provided, including quantities, descriptions, unit prices, and total amounts. This ensures the client understands the breakdown of costs and helps avoid disputes.

- Tax Information: If applicable, include the correct tax rates and calculations. Ensure that taxes are calculated correctly according to local laws, and mention any exemptions if relevant.

Additional Considerations for Compliance

Besides the basic elements, there are other considerations to make sure your financial documents remain compliant:

- Legal Language: Use clear and concise language in the document, avoiding jargon that could confuse the recipient. This helps ensure that the terms are understandable and enforceable.

- Electronic Record Keeping: If your documents are issued electronically, ensure that they are stored securely and can be accessed for future reference. This is essential for legal and auditing purposes.

- Audit Readiness: Keep a record of all documents issued, including copies of any agreements, payments, and communication. Having these on hand is crucial if your business undergoes an audit.

How to Organize Invoice Records Efficiently

Proper organization of financial documents is crucial for smooth business operations. Efficient record-keeping ensures quick access to important information, reduces the risk of errors, and helps maintain compliance with legal requirements. This section will provide tips on how to effectively manage and organize your financial records for long-term success.

To keep your business operations running smoothly, it is important to implement a structured approach to organizing records. Here are some strategies to help you maintain order and ensure easy retrieval when needed:

- Use Digital Solutions: Transitioning to digital storage systems can simplify organization by making records easily searchable and accessible. Cloud storage solutions offer secure and remote access to your files from anywhere, reducing the risk of losing important documents.

- Categorize Documents: Organize records into clear categories based on the type of transaction. For example, separate documents for purchases, sales, refunds, and credits. This will make it easier to find relevant information when needed.

- Maintain a Consistent Filing System: Whether you use folders on your computer or physical filing cabinets, it is important to maintain a consistent naming and categorization convention. Use clear labels and organize documents by date or transaction type for easy retrieval.

- Implement a Document Management Software: For businesses with large volumes of financial records, investing in document management software can streamline the process. These tools allow for quick indexing, tagging, and automated backup, ensuring all your records are up to date and stored securely.

- Keep Regular Backups: Protect your records from data loss by keeping regular backups. Ensure that all financial documents are copied to a secondary location or cloud service, so you can recover them in case of a system failure or unexpected event.

- Review and Archive Older Documents: Over time, the volume of documents will grow. Set aside time to review older records and archive or delete those that are no longer needed. This will reduce clutter and make room for new, active records.

By following these steps, you can ensure that your financial records are well-organized, easy to access, and secure. Implementing efficient systems will save time, reduce stress, and allow for better management of your business’s finances.

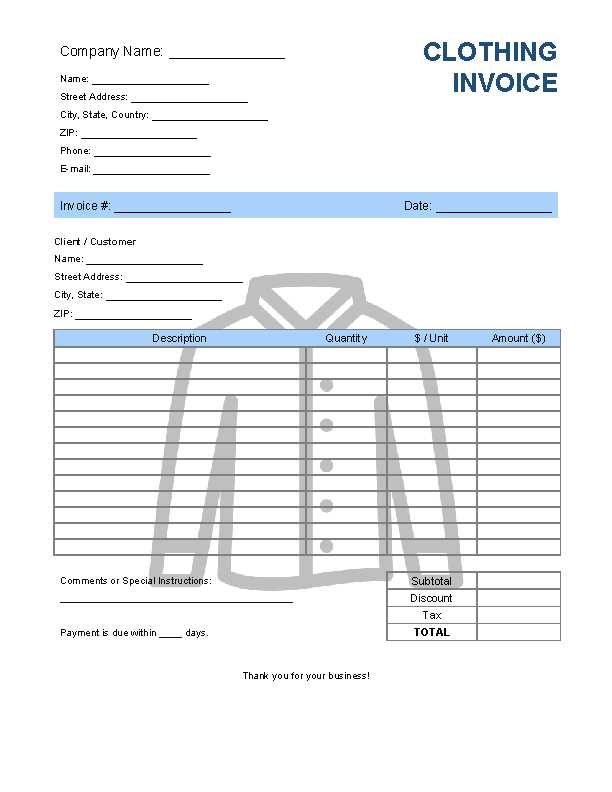

Simple Invoices for Small Clothing Stores

For small businesses, simplicity and efficiency are key when managing financial transactions. Keeping the billing process straightforward can help reduce errors and save time, especially when dealing with multiple customers. In this section, we’ll explore how simple financial records can make transactions smoother and more organized for small businesses.

Why Simple Invoices Matter

For smaller businesses, overly complex billing methods can be time-consuming and confusing. A simple format allows for faster processing, reduces the potential for mistakes, and ensures that both the seller and customer have a clear understanding of the transaction. A basic layout with the right details will suffice for most small-scale operations.

Essential Elements of a Basic Document

A well-structured, basic bill should include the following key elements:

- Business Information: Clearly state your business name, address, and contact details.

- Customer Information: Include the customer’s name, address, and contact number for easy identification.

- Date and Reference Number: Include the transaction date and a unique reference number for easy tracking.

- Item Description and Pricing: List the items sold, their quantity, and corresponding prices.

- Total Amount: Clearly show the total amount due, including any applicable taxes or discounts.

- Payment Terms: Specify the payment method and terms, such as due date and acceptable forms of payment.

By focusing on these basic yet essential elements, you can create clear and easy-to-understand documents that meet the needs of your business and your customers.

Improving Cash Flow with Prompt Billing

For businesses of any size, managing cash flow effectively is crucial to sustaining operations and driving growth. One of the most important aspects of maintaining a healthy cash flow is ensuring that payments are collected in a timely manner. By implementing quick and efficient billing practices, businesses can improve their financial stability and reduce the risk of cash flow disruptions.

The Importance of Timely Payment Requests

Prompt billing ensures that customers are invoiced as soon as services are rendered or goods are delivered. This reduces the delay between completing a transaction and receiving payment. By keeping the process simple and clear, customers are more likely to pay on time, leading to quicker cash inflows and more predictable revenue streams.

How Quick Billing Affects Financial Health

When businesses delay requesting payments, they risk late fees, administrative delays, and poor customer relationships. On the other hand, swift and clear billing leads to:

- Improved Cash Flow: By reducing the time between offering goods or services and receiving payment, businesses have more liquidity to cover operating costs.

- Stronger Customer Relationships: Clear, timely billing reflects professionalism and can improve customer trust and loyalty.

- Reduced Risk of Bad Debts: Prompt payments help reduce the likelihood of overdue accounts that could lead to bad debt.

Ensuring that billing occurs promptly, with all the necessary details clearly outlined, is a simple yet effective way to strengthen financial operations and boost overall business performance.

Common Mistakes

Many businesses encounter challenges when managing financial documentation. While creating and managing such documents, it’s easy to overlook key details that can result in delays or errors in payment processing. Understanding common pitfalls can help prevent issues that might disrupt cash flow or damage relationships with clients.

Incorrect or Missing Information

One of the most frequent mistakes is providing inaccurate or incomplete details. Common errors include:

- Incorrect customer details (name, address, contact information).

- Missing or incorrect pricing, quantities, or descriptions of the goods or services provided.

- Failure to include payment terms or due dates.

These mistakes can cause confusion and delay payments. Ensuring that all details are clear and accurate is essential to streamline the process.

Failure to Follow Up

Another common mistake is not following up with clients on overdue payments. Even with clear and accurate documentation, sometimes clients may overlook or delay payments. Regularly following up ensures timely collections and maintains positive business relationships.

Avoiding these mistakes by double-checking all entries and staying on top of follow-ups can enhance the effectiveness of managing financial transactions and improve cash flow.