Prepayment Invoice Template for Simplified Billing

When running a business, managing payments and maintaining clear financial agreements with clients is crucial for smooth operations. One effective way to ensure that both parties are on the same page regarding payment terms is by using structured documents that outline the amount to be paid in advance. These documents help secure a portion of the payment upfront, reducing the risk of non-payment once the work is completed.

Creating a clear and professional document for this purpose is essential for businesses of all sizes. It not only sets expectations but also protects both the service provider and the client. By offering a predefined format, companies can simplify the billing process, avoid confusion, and establish transparent terms. These documents are especially useful when working on large projects or with new clients, ensuring that funds are received before work begins.

In this guide, we will explore the key elements and best practices for creating effective payment requests. Whether you’re new to using these documents or seeking to improve your current process, this information will help you create a functional and legally sound agreement with your clients. With the right tools, managing financial transactions can become more efficient and straightforward.

Prepayment Invoice Template Overview

For businesses offering goods or services, it’s essential to secure payment upfront, especially when the scope of work is extensive or when working with new clients. A well-structured document serves as a formal request for partial payment before starting the job, helping businesses maintain cash flow and reduce financial risk. This approach ensures that both parties have agreed to the terms of payment and sets clear expectations from the outset.

These documents are designed to outline the agreed-upon amount to be paid in advance, as well as the remaining balance, payment deadlines, and relevant terms. By using such a document, companies can avoid misunderstandings or delays in receiving funds, while providing clients with a professional and transparent means of processing payments.

Key Features of a Payment Request Document

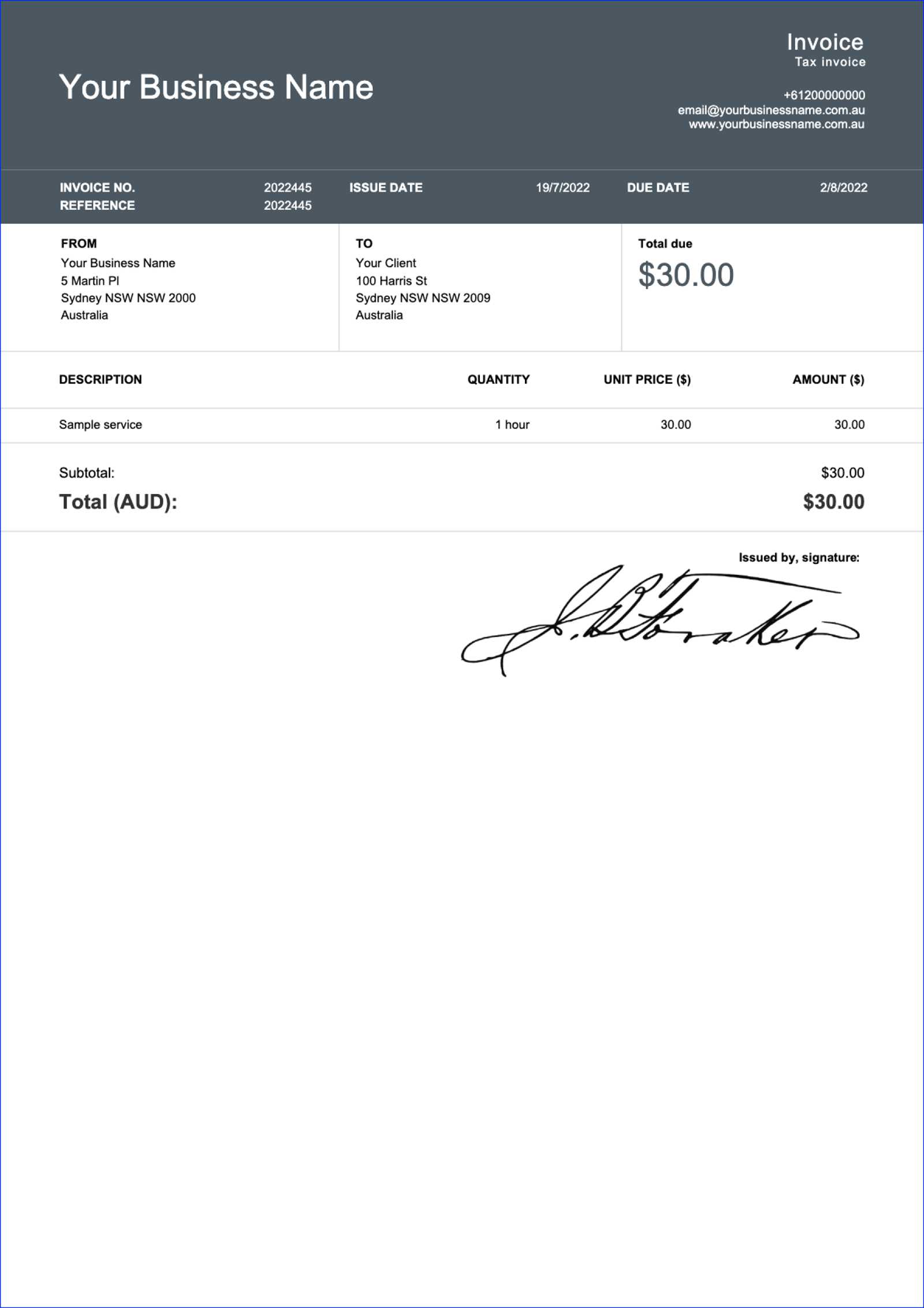

Typically, a payment request will include critical details such as the client’s name, the service or product description, the total amount due, and the percentage or fixed amount required upfront. It will also include clear instructions for payment methods, due dates, and any applicable terms regarding refunds or cancellation policies. Having these details clearly outlined in writing helps prevent potential disputes and ensures both parties are aligned on expectations.

Why You Need a Well-Structured Document

Incorporating a professionally formatted document into your business workflow not only helps streamline financial processes but also improves your reputation as a trustworthy business partner. With clear, concise terms, you provide clients with peace of mind and set the stage for successful collaborations. This form of agreement is particularly useful in industries such as construction, consulting, and freelancing, where project scope can evolve over time.

What is a Prepayment Invoice?

In many business transactions, it’s common practice to request a portion of the payment upfront before beginning work or delivering products. This type of financial document outlines the agreed-upon amount that must be paid in advance, ensuring that the provider receives compensation before committing significant resources to the project. The document serves as an official request for payment and helps protect the business from potential financial losses.

Typically, such a document will include key details about the transaction, including the service or product being provided, payment terms, and the amount due. By establishing clear terms at the outset, both parties can avoid confusion and set mutual expectations. Below is a breakdown of the essential components usually found in such a document:

| Component | Description |

|---|---|

| Client Information | Details of the client, including name, address, and contact information. |

| Service/Product Description | A clear breakdown of the goods or services being provided. |

| Amount Due | The total sum of money expected from the client, including any upfront payment. |

| Payment Terms | Detailed terms about when and how the payment should be made. |

| Due Date | The deadline for the initial payment to be made. |

By including these components, businesses can ensure clarity and transparency with their clients, establishing a clear understanding of the financial arrangement and helping to reduce the likelihood of disputes. This approach not only strengthens the professional relationship but also fosters trust between both parties.

Benefits of Using a Prepayment Invoice

Requesting a portion of the total payment before starting work offers several key advantages for businesses. This method ensures a higher level of financial security, fosters trust with clients, and improves cash flow management. By clearly outlining payment terms and upfront costs, both parties can avoid misunderstandings and ensure the project progresses smoothly.

Improved Cash Flow

One of the most significant benefits of requesting an advance is the improvement it brings to cash flow. This early payment allows businesses to cover initial costs and reduces the financial burden of waiting for full payment upon project completion. Some specific advantages include:

- Ensuring funds are available for project-related expenses.

- Minimizing delays caused by late payments.

- Allowing for smoother operations and resource allocation.

Risk Reduction

When clients pay a portion upfront, businesses mitigate the risk of non-payment or late payments. This is especially important for long-term projects where the scope can change. Key risk-reducing benefits include:

- Securing a financial commitment from the client.

- Reducing the chances of financial loss if the client cancels or defaults.

- Establishing a professional and transparent financial agreement from the beginning.

By using this approach, businesses can protect themselves from potential cash flow disruptions while building a more structured relationship with their clients. This system also encourages prompt payments and aligns client expectations with the business’s needs. Ultimately, it ensures that both parties remain satisfied throughout the course of the project.

How to Create a Prepayment Invoice

Creating a formal request for an upfront payment is an essential part of maintaining clear financial agreements with clients. This document ensures that both the service provider and client are aligned on the amount to be paid in advance, as well as the terms for the remainder of the balance. Properly drafting such a document is key to setting the right expectations and avoiding future disputes.

Step-by-Step Guide to Crafting a Payment Request

To create a professional and effective financial document, you need to include several key elements. These components not only ensure clarity but also make the document legally sound. Here’s how you can structure it:

- Client Information: Include the client’s name, address, and contact details.

- Service/Product Description: Clearly describe the goods or services to be provided, including any specific deliverables.

- Amount Due: Specify the total amount required, including the initial advance payment. Make sure to state if it’s a percentage or fixed amount.

- Payment Instructions: Provide clear instructions on how the client should make the payment (e.g., bank transfer, credit card).

- Due Date: Indicate when the payment is due, ensuring the client understands the deadline.

- Terms and Conditions: Include any relevant terms, such as refund policies, cancellation fees, or penalties for late payment.

Best Practices for Drafting Your Document

While the structure is important, how you present the information matters just as much. Keep the language clear, concise, and professional to avoid any misunderstandings. Make sure the document is easy to read and organized logically, with each section clearly labeled. Also, consider offering multiple payment options to make the process as convenient as possible for your client.

By following these steps, you ensure that your request for advance payment is transparent, professional, and legally enforceable, protecting both your business and your client.

Essential Elements of a Prepayment Invoice

When drafting a formal document requesting an advance payment, it’s crucial to include specific information that clearly outlines the terms of the transaction. These key components ensure transparency, help avoid misunderstandings, and establish a professional agreement between you and your client. Including all relevant details also provides legal protection for both parties, making the document an essential tool for any business.

Key Components to Include

Here are the most important elements that should be included in the document to ensure it’s both clear and effective:

- Client and Business Information: Include full contact details of both parties, including names, addresses, and phone numbers. This helps ensure that both sides know how to get in touch if necessary.

- Detailed Description of Services or Products: Specify what goods or services will be provided, along with a clear breakdown of any related costs. This will help your client understand exactly what they’re paying for.

- Amount Due: Clearly state the total sum to be paid, including any upfront payment required. Break down the total amount to show the portion due in advance and the balance due later.

- Payment Methods: Include the payment options available to the client, such as bank transfers, online payment systems, or credit card payments. Make it as easy as possible for them to make the payment.

- Due Date: Specify the deadline for the advance payment. This ensures the client knows when to submit their payment, preventing delays in the start of the project.

- Terms and Conditions: Include any necessary terms, such as cancellation policies, refunds, or penalties for late payments. This section helps set clear expectations on both sides and protects against disputes later on.

Why These Elements Matter

Each of these components plays a crucial role in ensuring a smooth transaction. By being thorough and transparent, you not only protect your business but also build trust with your clients. Clear terms help avoid confusion and establish a professional tone, ensuring that both parties know what to expect throughout the duration of the project.

Common Mistakes When Issuing Prepayment Invoices

When requesting an upfront payment from a client, it’s easy to overlook some important details that can lead to confusion, delays, or disputes. Even small errors in the way the document is structured or the terms are explained can have a significant impact on the payment process. Avoiding these mistakes is essential for maintaining a professional relationship and ensuring smooth financial transactions.

Here are some of the most common errors businesses make when creating and sending a payment request:

Not Clearly Stating Payment Terms

One of the biggest mistakes is failing to clearly outline the payment terms. If the amount due, due date, or the method of payment is vague or unclear, it can lead to delays and misunderstandings. Always specify:

- Exact Amount Due: Specify the exact sum required, including whether it’s a fixed amount or a percentage of the total project cost.

- Payment Method: Be specific about the acceptable methods of payment (e.g., bank transfer, online payment platform, credit card).

- Due Date: Set a clear and realistic deadline for the advance payment.

Not Including Relevant Details

Another common mistake is leaving out essential information about the project itself. Without a proper breakdown of the goods or services to be provided, the client may not fully understand what they’re paying for. Ensure that the document includes:

- Clear Descriptions: Detail the scope of work, product features, or services being provided.

- Associated Costs: Break down the costs, particularly if there are different charges for various stages of the project.

- Refund and Cancellation Policies: Include terms for cancellations or refunds to avoid future disputes.

Overcomplicating the Document

While it’s important to include all relevant details, some businesses overcomplicate the payment request with unnecessary clauses or legal jargon. Clients should be able to quickly understand the terms without sifting through lengthy text. Keep the document:

- Simple and Concise: Use clear language and avoid unnecessary technical terms.

- Well-Organized: Break the document into logical

Prepayment Invoice vs Regular Invoice

When managing payments in business, it’s important to understand the key differences between various types of billing documents. Two commonly used formats are those that request an upfront payment and those that ask for full payment upon completion of the project. While both serve the purpose of securing payment, they differ in timing, purpose, and the level of risk they help mitigate. Understanding when and why to use each type is crucial for managing cash flow and client relationships effectively.

The main difference between the two lies in when the payment is expected. One document requests a portion of the total amount in advance, often before work begins, while the other seeks the full payment after the work is completed. Below is a comparison of these two types of billing documents:

Aspect Upfront Payment Request Final Payment Request Purpose Secures initial payment to cover costs before starting the project. Requests full payment after work is completed or goods are delivered. Payment Timing Paid at the beginning or partway through the project. Paid upon project completion or delivery of products/services. Risk Management Reduces the risk of non-payment by securing funds in advance. Higher risk as payment is due after the work is completed. Common Use Cases Projects where resources need to be allocated upfront (e.g., custom work, large orders). Standard billing when the client has already received or is about to receive the full service/product. Clarity Clearly outlines the upfront costs and payment schedule. Details the full amount owed for services rendered or goods delivered. As illustrated in the table, the primary distinction is the timing of the payment. Choosing the right approach depends on the nature of the work, the relationship with the client, and the financial stability of the business. For businesses that require large investments of time or resources before the work is completed, an upfront payment request helps ensure that costs are covered. On the other hand, a final payment request is typically used once the service or product has been fully delivered.

When Should You Use a Prepayment Invoice?

Requesting a portion of the payment upfront is a common practice in many industries, but knowing when to use this approach is key to managing your cash flow and minimizing financial risk. There are certain situations where asking for an advance makes sense, especially when the project requires a significant investment of time, resources, or effort before completion. This method ensures that both you and the client are committed to the agreement, fostering trust and clarity from the outset.

Here are some scenarios where requesting an advance is particularly useful:

Situation Reason for Upfront Payment Large-Scale Projects When a project requires significant time, resources, or materials, securing an upfront payment ensures that costs are covered as the work progresses. Custom Work For bespoke products or services, an advance guarantees commitment from the client and compensates for the time spent designing or preparing unique solutions. New or High-Risk Clients If you’re working with a new client or one with whom you have little history, requesting an advance helps mitigate the risk of non-payment. Long-Term Projects For projects that span several months or more, an initial payment helps maintain steady cash flow and ensures that both parties are aligned on the timeline and expectations. International Transactions When working with clients in different countries, upfront payments help safeguard against potential complications with currency exchange or cross-border payment delays. Using an upfront payment request in these situations not only protects your business but also establishes a clear and transparent financial arrangement with the client. It helps ensure that work can proceed smoothly without financial obstacles, making it an essential tool in certain business transactions.

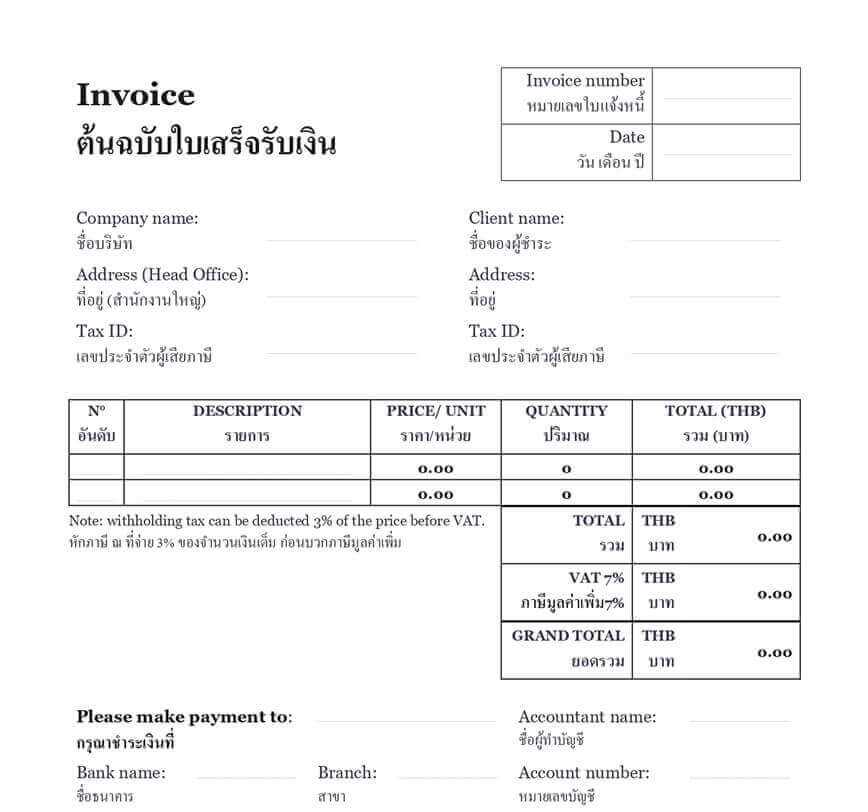

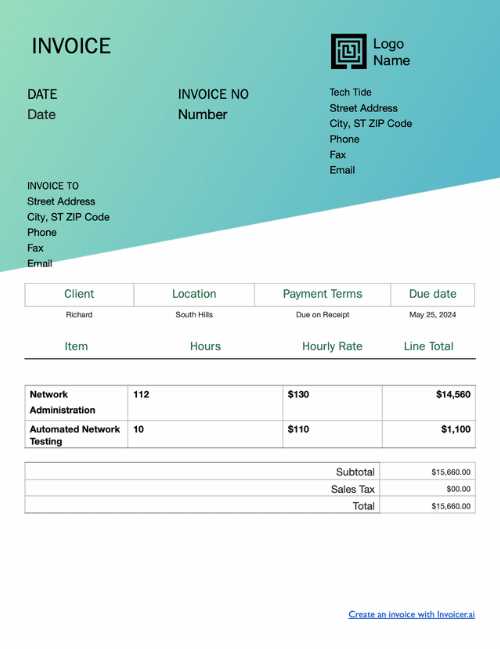

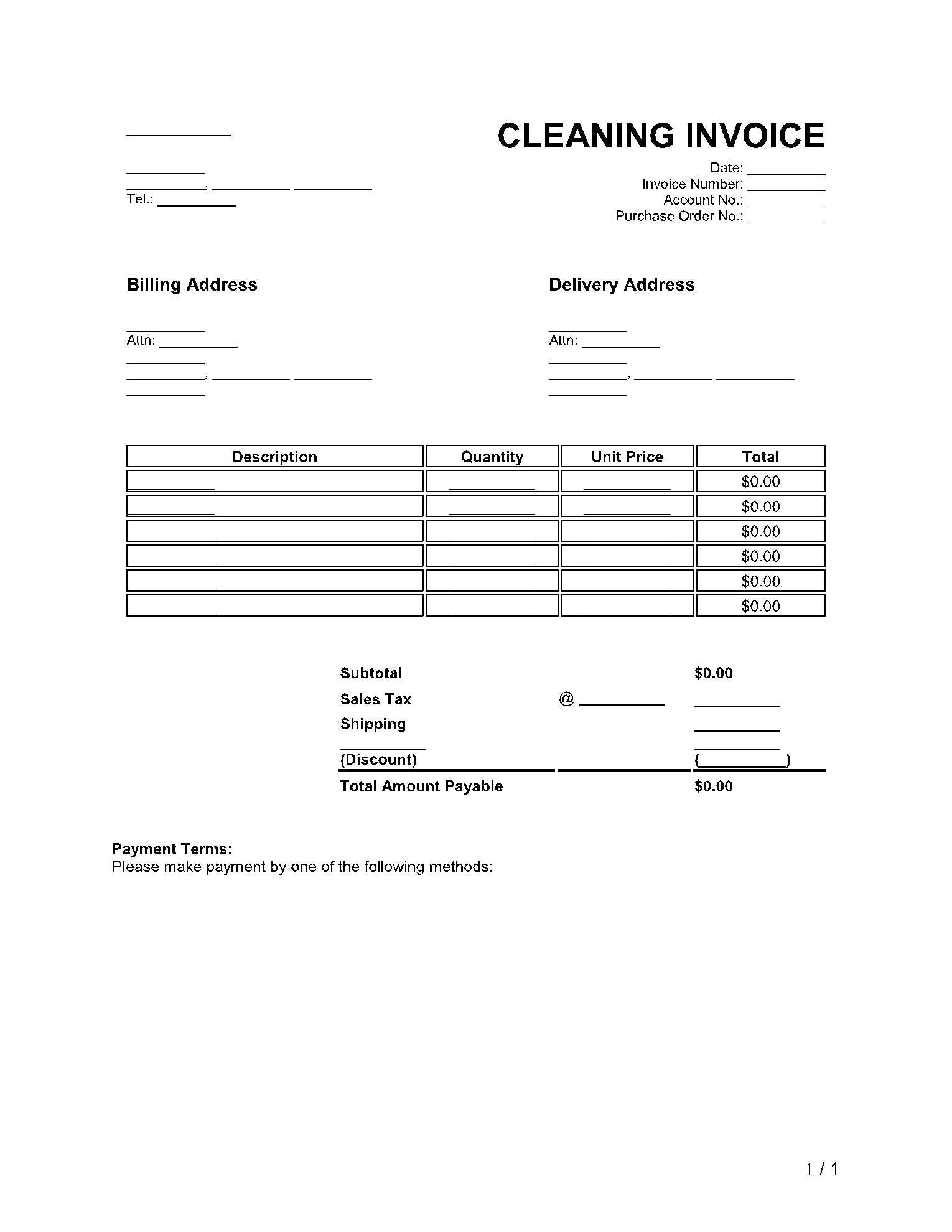

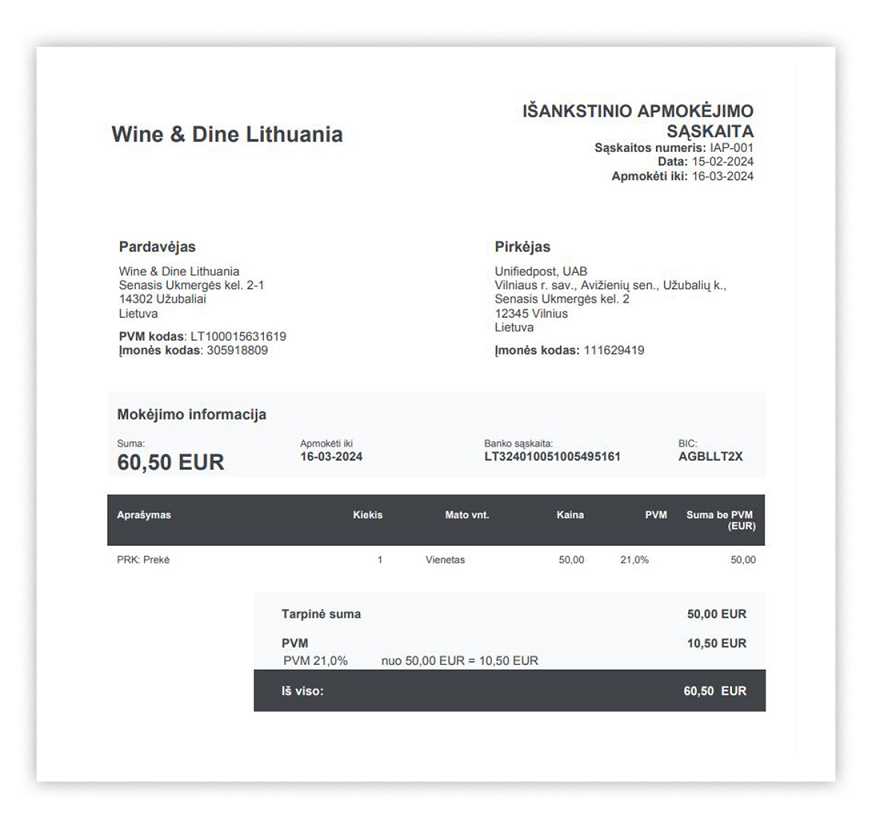

Prepayment Invoice Templates for Different Industries

Across various industries, businesses often require an upfront payment to secure their services, especially when the work involves substantial effort or resources. The way this payment request is structured can differ depending on the industry, as each sector has unique needs, standards, and expectations. Understanding how to craft the right kind of document for your industry can help streamline your billing process and improve client relationships.

Common Industries That Use Upfront Payment Requests

Here are some examples of industries that frequently use these financial documents and how they differ in structure based on their specific needs:

- Construction: In construction, payment documents often include milestones or progress payments, with a percentage due upfront to cover initial material and labor costs. These documents need to be detailed, with a breakdown of the work phases and payment schedules.

- Consulting and Freelance Work: Consultants and freelancers usually request a fixed advance or a percentage of the total project cost before starting the work. The document should outline the project scope, timelines, and deliverables, with clear terms on how remaining payments will be handled.

- Event Planning: Event planners often require an upfront deposit to reserve their services, especially for large events. The payment request typically includes the total estimated cost of the event, with a breakdown of services provided (e.g., venue, catering, entertainment). It is important to have refund policies clearly outlined.

- Software and Technology Services: When developing custom software or providing IT solutions, a portion of the fee is commonly requested upfront to cover initial development costs. These documents should specify the project phases, expected timelines, and the exact payment amounts required for each milestone.

- Creative Services (Design, Photography, etc.): Creative professionals like photographers, designers, or writers often request a deposit before starting the work. The document should outline the scope of the project, deliverables, and a timeline for completion, with detailed pricing for the work and potential additional charges.

Why Industry-Specific Structure Matters

Each industry has its own set of risks, client expectations, and payment structures. For example, in construction, clients may be more familiar with progress payments tied to milestones, while in consulting, a flat rate or hourly rate is more common. Customizing the financial document based on industry standards helps ensure both the service provider and client understand the terms, fostering a better working relationship.

Understanding these nuances and adjusting your payment request accordingly can help prevent misunderstandings, ensure timely payments, and es

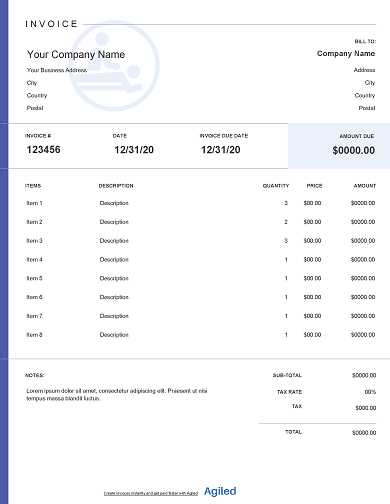

How to Customize a Prepayment Invoice Template

Customizing a request for upfront payment is essential to ensure that it aligns with your business needs and reflects the specific terms of each project. A personalized document not only improves professionalism but also helps prevent confusion or disputes with clients. By adjusting key elements of the document, you can make sure that it accurately represents your services, payment structure, and terms of agreement.

Here are the key steps to effectively customize your document:

- Include Your Business Information: Ensure that your business name, contact details, and logo are prominently displayed. This establishes a professional appearance and helps clients easily identify the source of the document.

- Define the Scope of Work: Clearly describe the goods or services being provided. Break down the scope into specific tasks or deliverables, so both parties know exactly what the upfront payment covers.

- State the Payment Amount and Terms: Specify the total cost and the amount required upfront. If applicable, mention the payment schedule for the remainder. Make sure the due date is clearly stated to avoid delays.

- Provide Payment Methods: Offer multiple payment options for convenience, such as bank transfer, credit card, or online payment platforms. This ensures your clients can pay using their preferred method.

- Outline the Project Timeline: Include estimated start and end dates for the project. This helps set expectations about when work will begin and when the client can expect completion.

- Clarify Terms and Conditions: Include any relevant policies, such as refund conditions, cancellation fees, and penalties for late payment. Customizing these clauses based on the nature of the project can prevent future misunderstandings.

Once you’ve customized the document, review it for clarity and accuracy. A well-structured payment request ensures transparency and reduces the chances of issues arising later. Tailoring it to fit the specifics of each client and project can also build trust and lead to smoother transactions.

Best Practices for Prepayment Invoicing

When requesting an upfront payment for services or products, it’s essential to follow best practices to ensure a smooth transaction and avoid misunderstandings. Properly structuring the request helps set clear expectations, strengthens client relationships, and minimizes the risk of payment delays or disputes. By following a few key guidelines, you can create professional, transparent, and effective billing documents that serve both your business and your clients’ needs.

Clear Communication and Transparency

One of the most important aspects of requesting an upfront payment is clear communication. Clients should fully understand the terms of the payment, what the money will cover, and when they can expect to receive services or products in return. Here are some tips to ensure transparency:

- Provide Detailed Descriptions: Always outline the specific services, products, or milestones that the advance payment covers. Avoid generalities to prevent confusion later.

- State Payment Terms Clearly: Specify the total amount required, the percentage due upfront, and the exact payment due date. Ensure the client understands the timeline and what is expected of them.

- List Accepted Payment Methods: Offer multiple ways for your clients to pay, including bank transfers, credit cards, and online payment systems. Make the payment process as convenient as possible.

Legal Protection and Formality

In addition to clear communication, it’s important to ensure that the request for an advance payment is legally sound and covers potential risks. Here are some practices to help protect both your business and the client:

- Include Refund and Cancellation Policies: Clearly state the terms for cancellations, refunds, or changes to the agreement. This helps set expectations on both sides in case something goes wrong.

- Set Expectations for Late Payments: Specify any penalties or interest charges for late payments. This reinforces the importance of timely payments and helps you manage your cash flow.

- Use a Professional Format: Always use a clean, formal, and organized layout. Include your business details, a unique reference number for the request, and a clearly formatted payment breakdown to avoid confusion.

By following these best practices, you ensure that both you and your clients are on the same page from the start, reducing the likelihood of financial disputes and creat

Legal Considerations for Prepayment Invoices

When requesting an upfront payment from clients, there are several important legal factors to keep in mind. These documents establish a formal agreement between you and your client, so ensuring that the terms are clear and legally enforceable is essential. The legal considerations help protect both parties and ensure that payment expectations, obligations, and rights are well-defined throughout the transaction.

Terms and Conditions of Agreement

One of the first steps in creating a solid legal foundation for a payment request is to include clear and precise terms and conditions. These terms outline the obligations of both parties and help prevent disputes over payment expectations. Some key elements to include are:

- Clear Scope of Services: Describe in detail the services or products that the payment will cover. This helps ensure there are no misunderstandings about what is being paid for.

- Payment Deadlines: Clearly state the due date for the upfront payment and any future payments, if applicable. Specify any penalties for late payments or missed deadlines.

- Refund and Cancellation Policies: Clearly outline the circumstances under which a refund will be issued and the process for canceling the agreement. These terms protect both the business and the client if the arrangement is not completed.

Consumer Protection Laws

In many jurisdictions, consumer protection laws govern transactions, especially when dealing with upfront payments. These laws are designed to prevent businesses from exploiting clients or engaging in unfair practices. When issuing a payment request, be sure to:

- Comply with Local Regulations: Different countries and regions have varying rules about how and when a business can request an upfront payment. Ensure your document aligns with local laws to avoid legal issues.

- Provide Transparent Information: Make sure that all terms, including any fees, charges, or penalties, are presented in an easy-to-understand way. Avoid fine print or misleading language that could violate consumer rights.

- Offer Protection Against Non-Delivery: Include terms that reassure clients they are protected if services or goods are not delivered as promised. Offering a refund or other resolution mechanisms can help build trust with clients.

By paying attention to these legal considerations, you can help ensure that your payment request is both legally sound and fair to all parties involved, minimizing potential conflicts and enhancing professionalism in your business transactions.

How to Send Prepayment Invoices Effectively

Sending an upfront payment request is more than just issuing a document; it’s about creating a professional, clear, and timely communication that ensures your clients understand the terms and feel comfortable proceeding with the transaction. An effective process for sending these requests can help foster trust, reduce confusion, and encourage timely payments, which is critical for maintaining smooth cash flow.

Ensure Clear Communication

One of the most crucial elements in sending a successful payment request is clarity. Make sure the document outlines the details in a way that is easy to understand, without any ambiguity. Here are a few tips to ensure clarity:

- Highlight Key Information: Emphasize the total amount due, payment deadlines, and the services or products covered by the upfront payment. Make it easy for clients to identify the most important details.

- Use Simple Language: Avoid jargon or overly complicated terms. Your client should have no trouble understanding what is being requested and why it’s necessary.

- Provide Contact Information: Include your contact details in case the client has questions or concerns. This creates an open line of communication and can help resolve any issues quickly.

Choose the Right Timing and Delivery Method

The timing and method of delivery play a key role in ensuring that the request is received promptly and acted upon. Consider the following:

- Send Requests in Advance: Aim to send the document well before the work or service begins. This gives clients enough time to process the payment and reduces the risk of delays.

- Use Professional Channels: Email is often the best option for sending these documents, as it provides both a formal and trackable method of delivery. Ensure the document is attached or included in a secure format, such as a PDF.

- Follow Up Promptly: If payment isn’t received by the due date, follow up immediately. A polite reminder can help prompt the client without damaging the relationship.

By being clear, timely, and professional in your communication, you can increase the likelihood of receiving payment on time, while also building a reputation for reliability and professionalism in your business dealings.

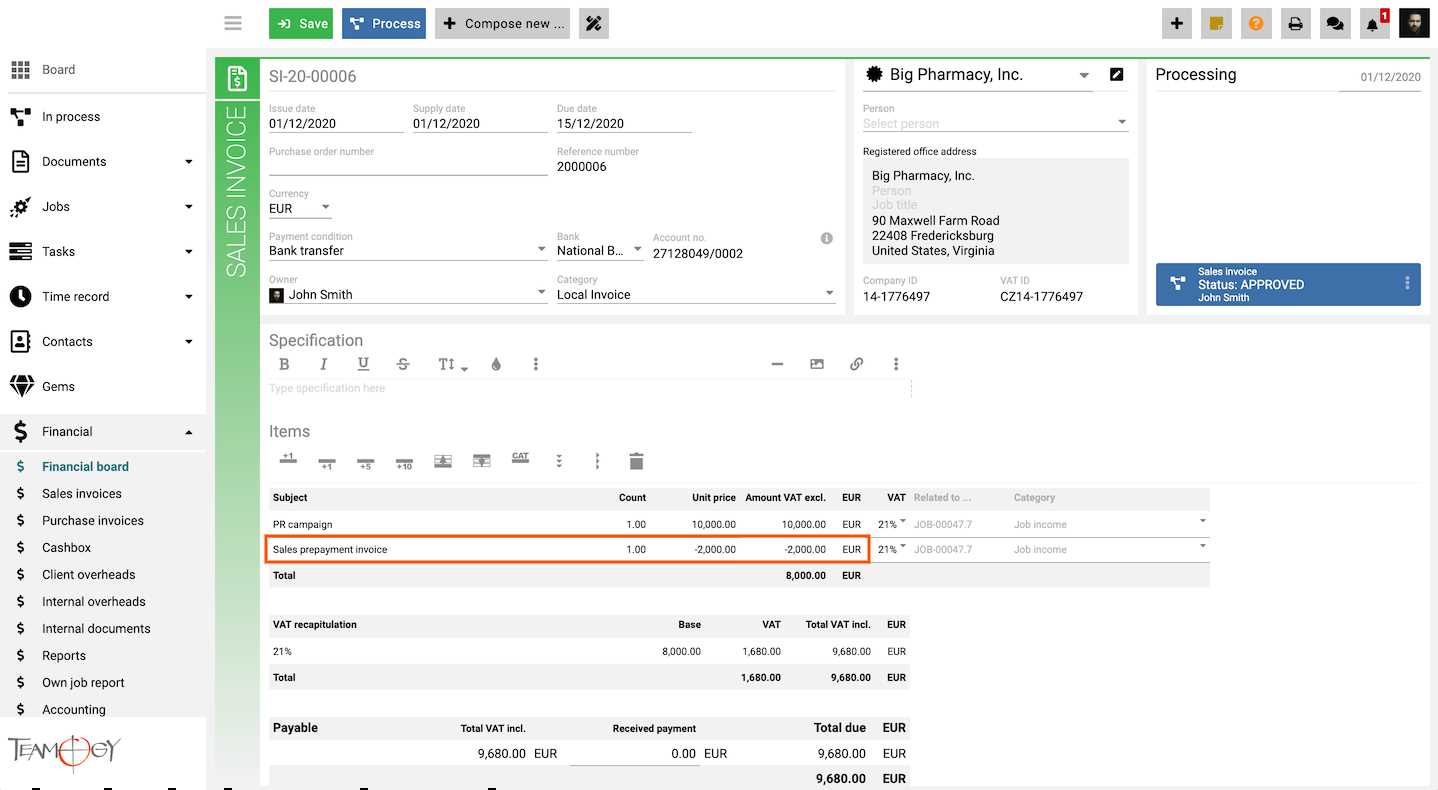

Tracking Prepayment Invoices and Payments

Efficiently tracking advance payments and their associated requests is critical to maintaining accurate financial records and ensuring smooth business operations. Without a reliable system, it’s easy to lose track of which clients have paid, which ones still owe, and whether the amounts match what was originally agreed upon. By implementing effective tracking practices, you can stay on top of your cash flow and avoid disputes or misunderstandings.

Steps to Track Payments Effectively

Tracking payments and requests accurately involves several key steps to ensure nothing falls through the cracks. Here are some best practices to follow:

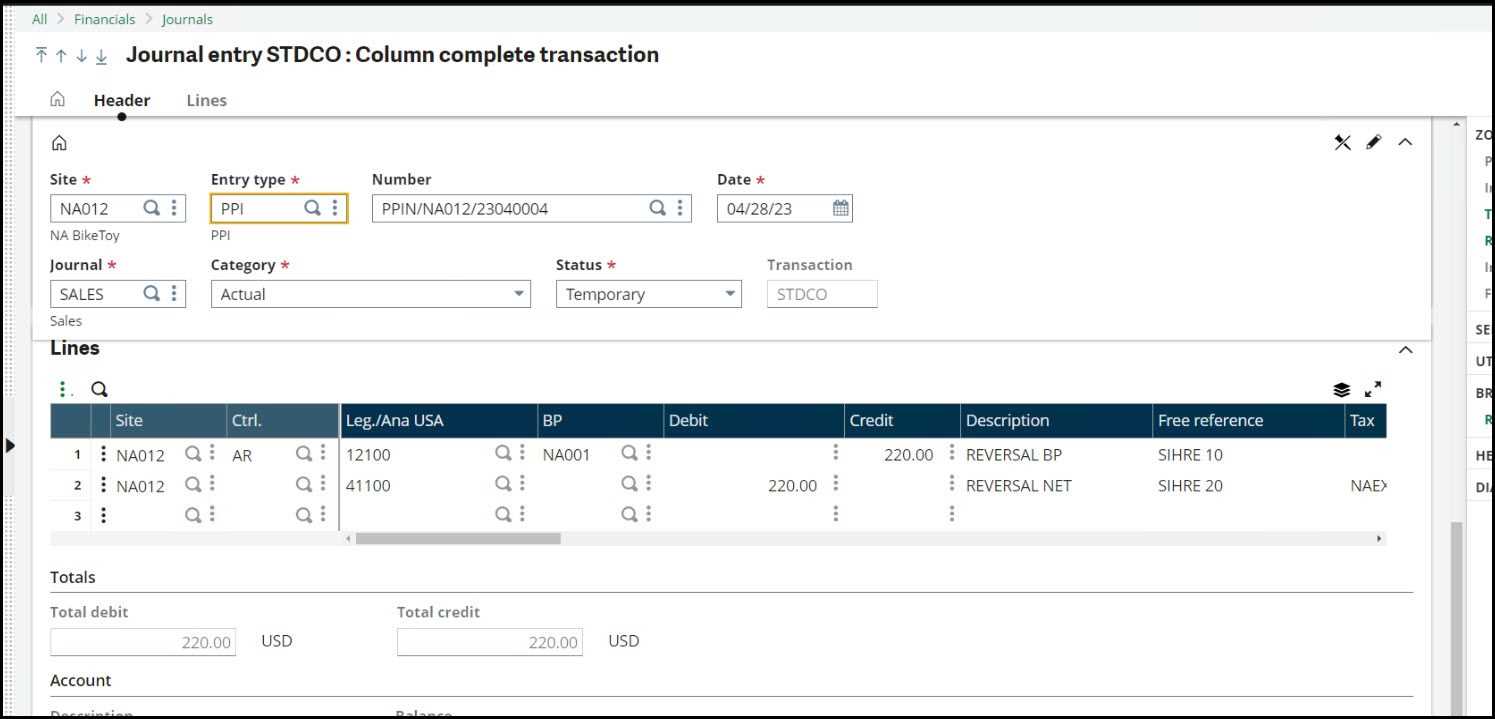

- Use a Centralized System: Invest in accounting software or a dedicated tracking tool to store all records in one place. This ensures that all payment requests, statuses, and amounts are easily accessible and up-to-date.

- Assign Unique Reference Numbers: Each payment request should have a unique reference number that allows both you and the client to easily track the status. This helps with record-keeping and minimizes confusion during follow-ups.

- Update Payment Status Regularly: After receiving a payment, immediately mark it as “paid” in your system. This allows you to monitor progress and avoid sending unnecessary reminders.

- Track Partial Payments: If a client makes a partial payment, make sure this is clearly recorded in your system, noting the outstanding balance. This ensures both you and the client are aware of what’s left to be paid.

Organize Your Payment Data

Proper organization of payment records is key to keeping everything in order. Here’s how to manage your payment data effectively:

- Create a Payment Schedule: Break down the payment timeline into clear milestones, especially for long-term projects. This allows you to track when specific payments are due and monitor whether clients are staying on schedule.

- Maintain Clear Documentation: Always keep copies of your requests and receipts, whether in digital or paper form. This ensures you have a full record of all transactions, which is vital for accounting and any future reference needs.

- Reconcile Accounts Periodically: Regularly review your accounts to ensure that all payments a

How Prepayment Invoices Improve Cash Flow

Requesting an upfront payment for goods or services offers businesses a valuable tool for improving cash flow and reducing financial risk. By securing funds before delivering the product or service, companies can ensure that they have the necessary resources to begin work, cover expenses, and avoid cash shortages. This proactive approach to payment helps stabilize finances and allows for smoother business operations.

Immediate Access to Funds

One of the primary benefits of requesting advance payments is the immediate influx of cash, which can be used to fund ongoing projects, cover operational costs, and pay suppliers or employees. Here’s how it positively impacts cash flow:

- Reduces Financial Gaps: Receiving funds in advance helps businesses cover costs before completing a project, eliminating the need to wait for final payments.

- Prevents Cash Flow Gaps: Having upfront capital ensures that companies do not experience delays in their cash cycle, which is especially important for businesses with tight margins or project-based work.

- Mitigates Financial Risks: By collecting money before providing the full service or product, businesses can avoid the risk of clients failing to pay after delivery or service completion.

Enhanced Planning and Resource Allocation

Advance payments also allow businesses to better plan their finances, allocate resources efficiently, and prepare for future expenses. Here’s how:

- Improved Budgeting: Knowing that a portion of the funds has already been secured allows businesses to plan their spending with more accuracy and certainty.

- Flexible Resource Management: With upfront capital, businesses can allocate funds to cover materials, labor, or overhead costs, ensuring that resources are available when needed.

- Reduces Reliance on Credit: Relying on advance payments decreases the need to take out loans or use credit lines, which can incur high-interest rates and lead to financial strain.

By incorporating advance payment requests into business practices, companies can gain greater financial stability, reduce uncertainty, and ensure that they can continue to operate efficiently, even in uncertain economic times.

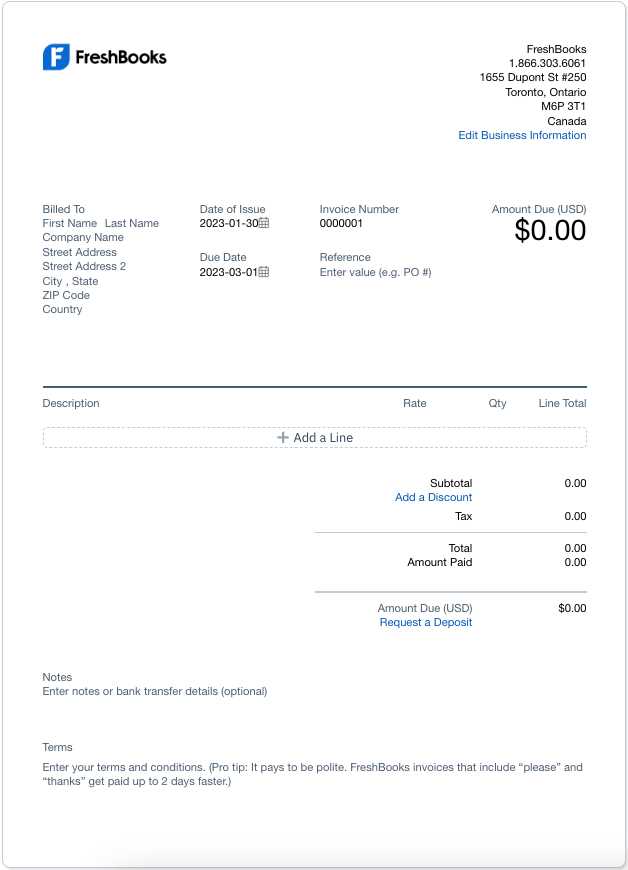

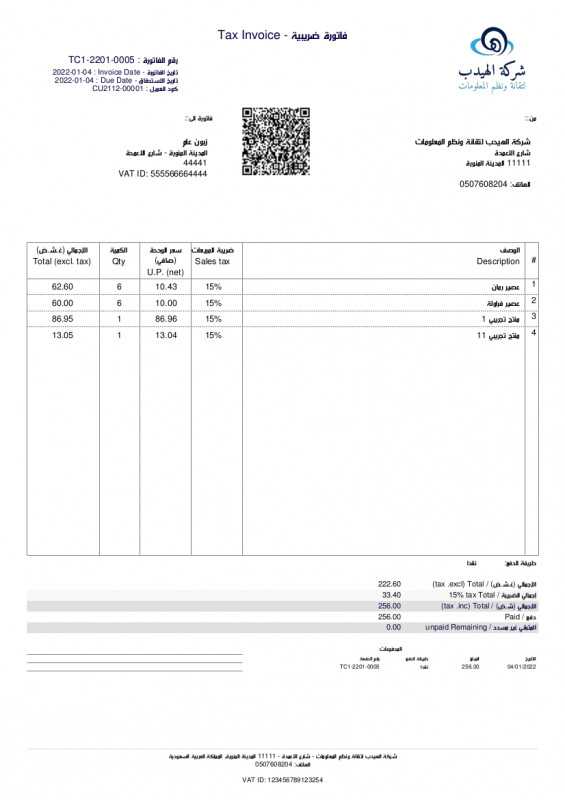

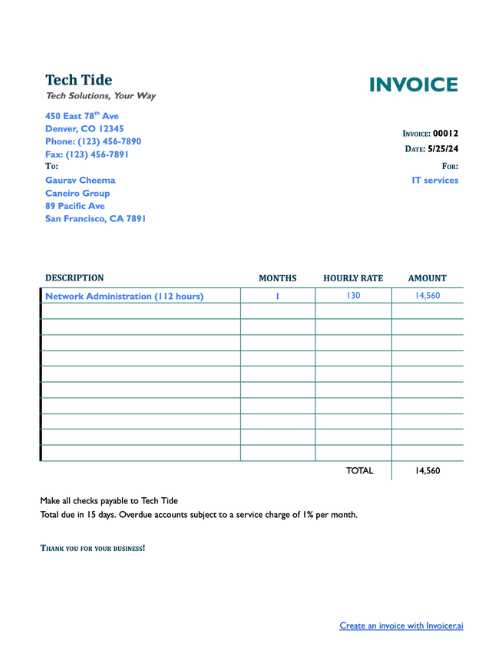

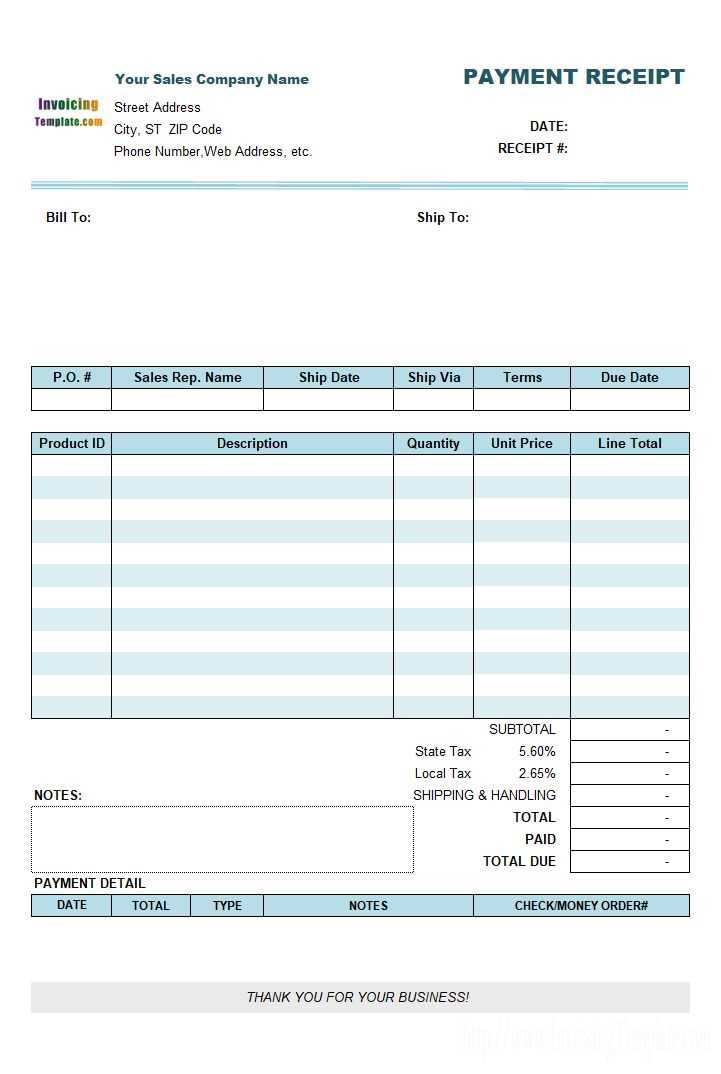

Free Prepayment Invoice Templates Online

There are numerous online platforms offering free resources that help businesses streamline the process of requesting advance payments. These resources can be incredibly useful for small business owners or freelancers who want to ensure professionalism without investing in expensive software. Using readily available, customizable documents can save time and effort while maintaining clarity in transactions.

Advantages of Using Free Resources

Free pre-designed documents can offer several benefits to businesses looking for a cost-effective way to manage upfront payment requests:

- Cost-Effective: Free resources eliminate the need to purchase specialized accounting software or hire professionals to create custom documents.

- Easy to Use: Most free templates are user-friendly, with straightforward fields that allow you to easily input your company details, payment amounts, and other relevant information.

- Time-Saving: Using pre-made documents speeds up the billing process, allowing businesses to focus on their core operations rather than spending time on administrative tasks.

Where to Find Free Templates

There are many websites offering free access to customizable prepayment request documents. Here are a few places where you can find these resources:

- Online Business Platforms: Websites like Zoho, Wave, and Invoice Generator offer free, downloadable templates for creating payment requests, including those that require upfront deposits.

- Google Docs and Microsoft Office: Both platforms provide free templates that can be easily customized for business needs. You can quickly modify the documents to fit your style and requirements.

- Freelance Websites: Sites like Fiverr and Upwork often offer free or low-cost templates designed by other freelancers, which can be an excellent resource for entrepreneurs.

By using these free resources, businesses can maintain professionalism while saving time and money, ensuring that their financial transactions are clear and effective from the start.