Comprehensive Guide to Invoice and Quote Templates for Your Business

Efficient business operations rely on clear and consistent communication, especially when it comes to financial agreements. Having standardized forms to outline payment details and service agreements ensures both parties understand the terms without confusion. These ready-to-use documents offer a structured approach, saving time while maintaining professionalism.

By utilizing pre-designed formats, businesses can eliminate the risk of errors or omissions that often arise from creating financial statements from scratch. Customizable layouts allow for quick adaptation, making it easier to cater to different clients and industries. With these resources, companies can focus on what matters most–delivering value to their customers while keeping everything organized and transparent.

Invoice and Quote Templates Overview

In any business, clear documentation is essential for smooth transactions. Professional forms that outline payment terms, project details, or service agreements are crucial for setting expectations and avoiding misunderstandings. These documents not only serve as records but also help establish trust and professionalism between businesses and their clients.

Pre-designed formats are highly effective tools for managing these financial and service-related communications. They are structured to include all necessary information while allowing room for customization based on the nature of the transaction. Such forms ensure consistency and accuracy, which is vital for maintaining organized records and streamlining administrative tasks.

These ready-to-use solutions can be adapted across various industries, helping businesses maintain a professional image while saving valuable time. Whether you are a freelancer, a small business owner, or part of a larger corporation, utilizing these forms helps to minimize errors and speed up the process of finalizing agreements and payments.

What are Invoice and Quote Templates?

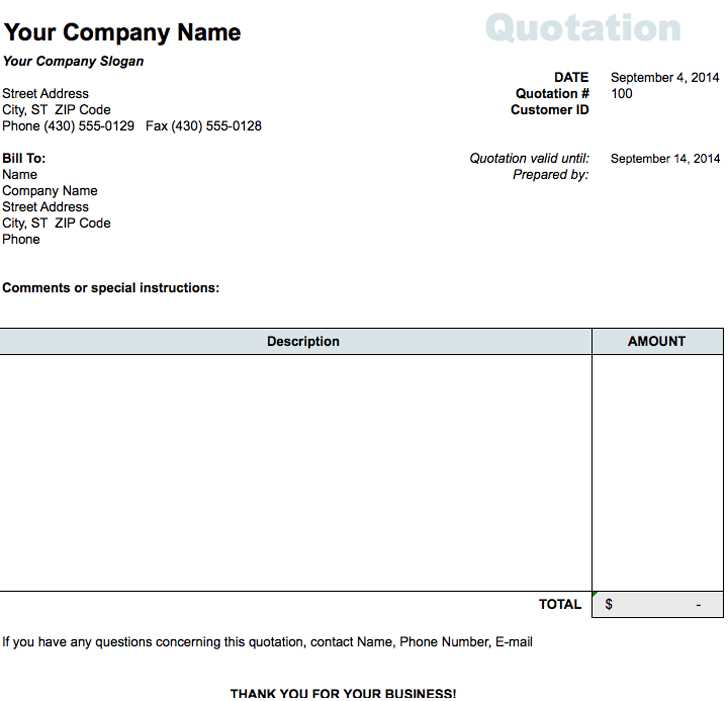

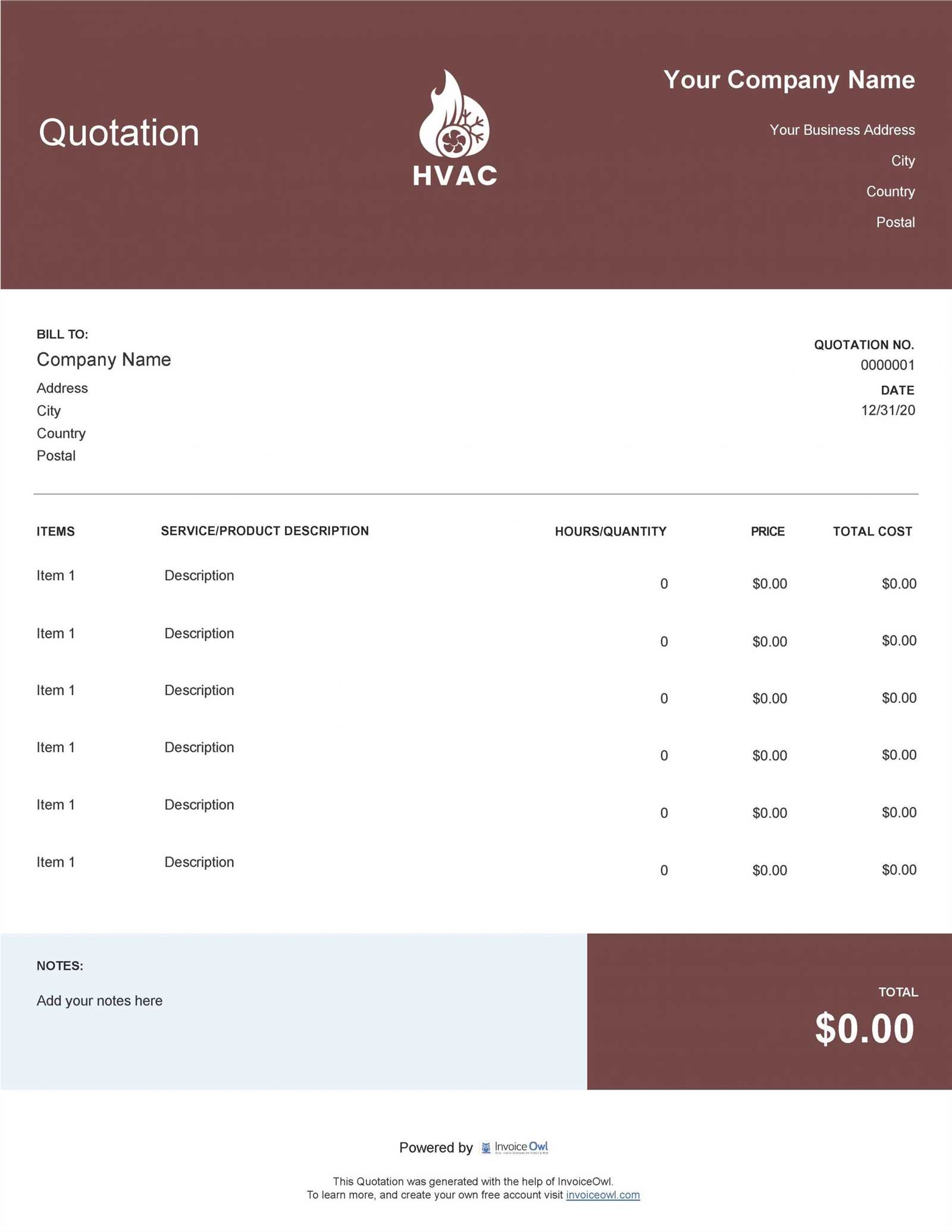

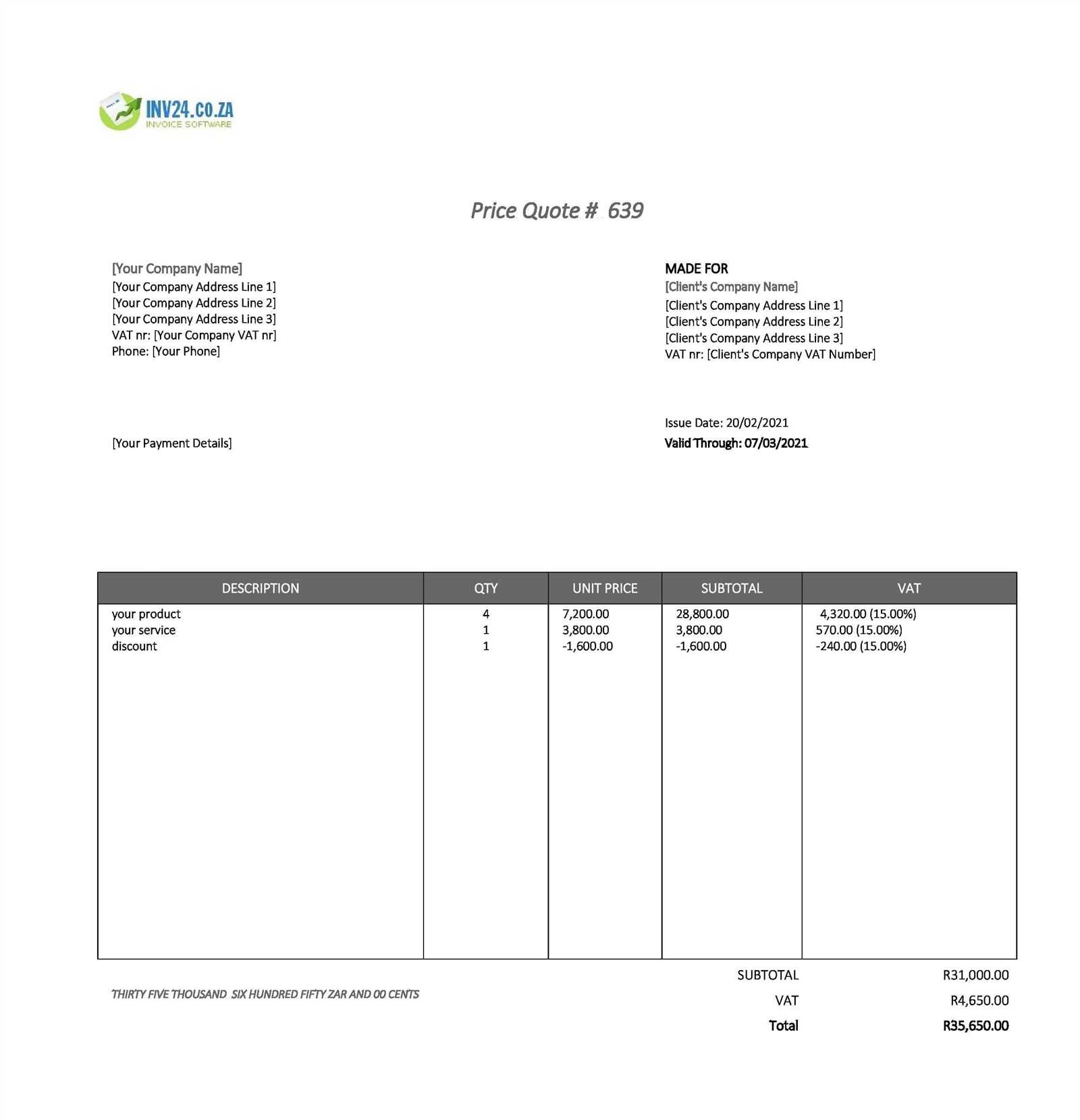

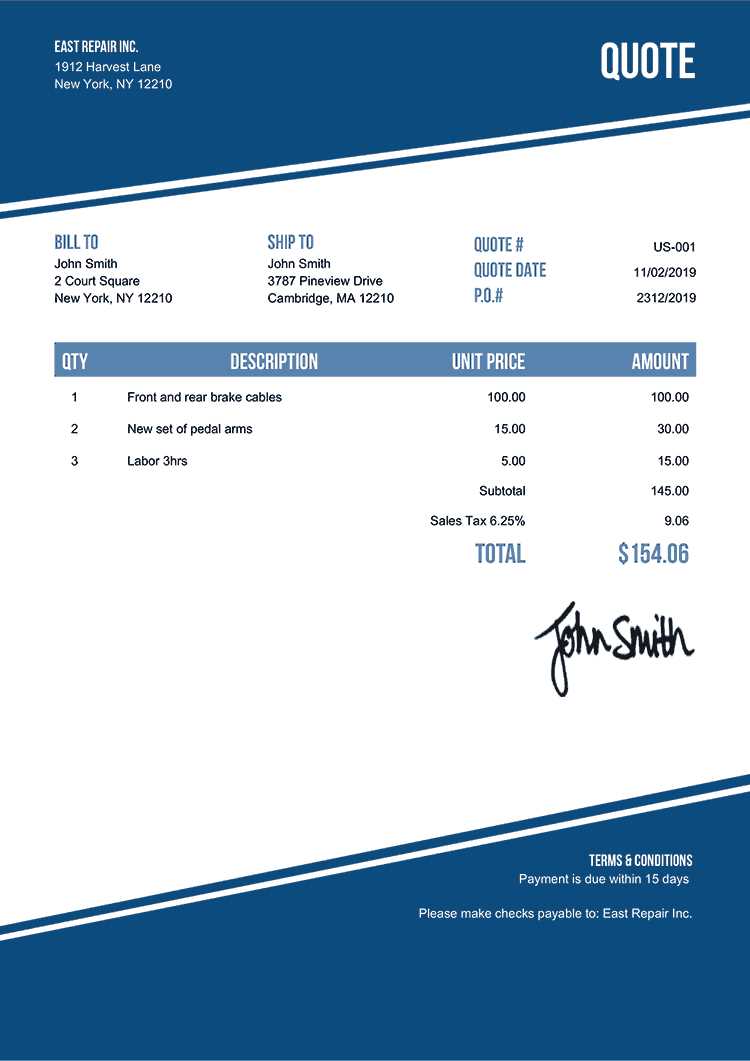

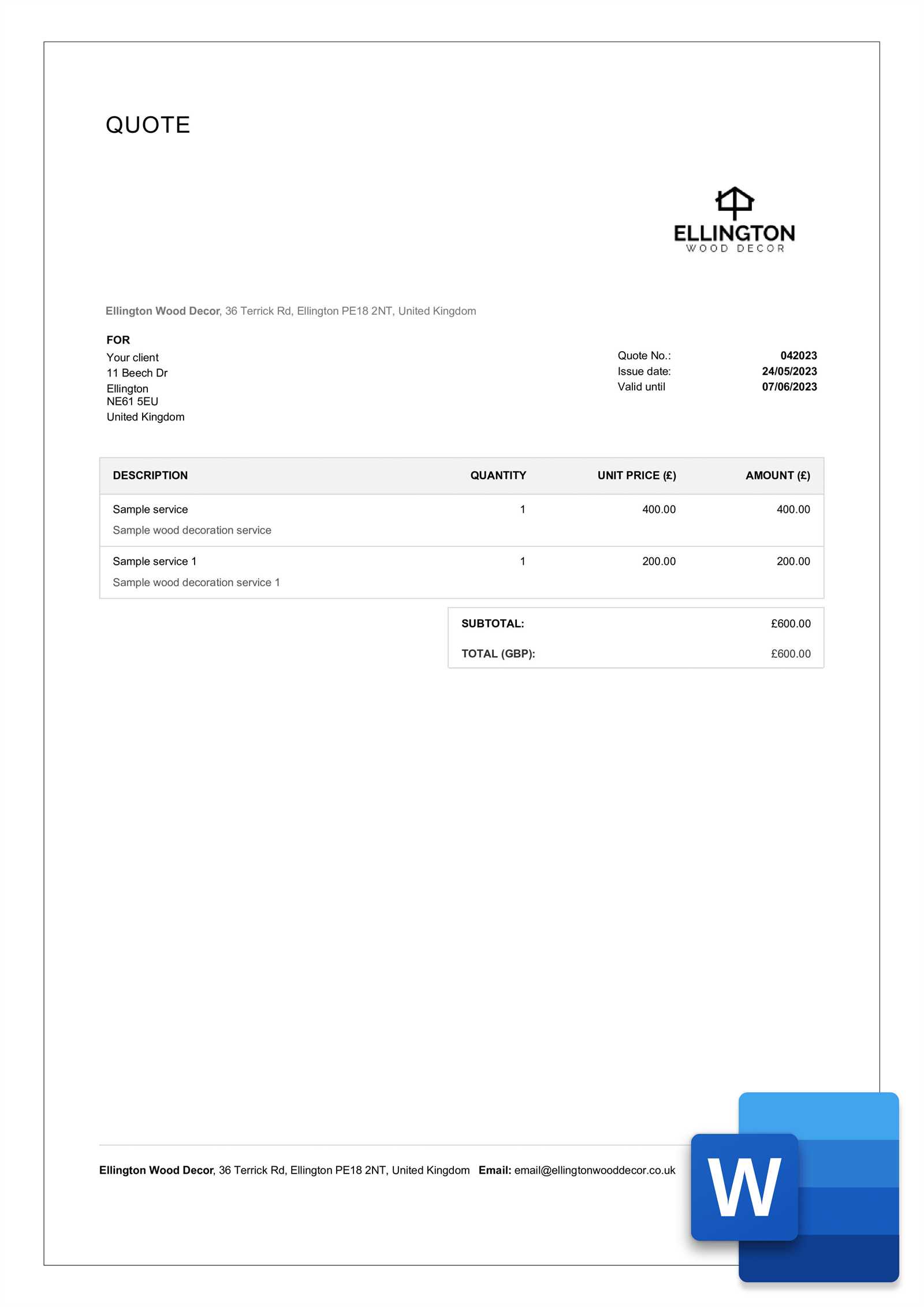

These are pre-designed documents used by businesses to outline terms of agreements, payment details, and the scope of services or products provided. They provide a structured format that can be easily customized based on specific needs, ensuring that all necessary information is clearly communicated between parties involved in a transaction.

Such resources are widely used for both requesting payment and offering estimates for future work. They typically include fields for client information, descriptions of services or goods, pricing, payment terms, and due dates. The purpose of these documents is to ensure consistency, reduce the risk of errors, and speed up administrative processes.

By using these ready-made structures, businesses can maintain professionalism and clarity in their dealings. These forms allow for quick adjustments, so businesses can tailor the details according to the particular transaction while ensuring nothing essential is overlooked.

Benefits of Using Templates for Business

Utilizing pre-designed forms offers numerous advantages for businesses of all sizes. These structured documents eliminate the need to create financial or service-related records from scratch, saving both time and effort. With a standardized format, businesses can streamline their operations and ensure that important information is always included, reducing the risk of errors and omissions.

One key benefit is the professional appearance these forms provide. Customizable layouts allow businesses to tailor documents to their brand, enhancing credibility and trust with clients. Consistency across all communications, whether for billing or estimates, further reinforces a business’s attention to detail and commitment to clear, effective communication.

Additionally, using pre-built structures helps businesses stay organized. By automating the process of generating these documents, employees can focus on other critical tasks, leading to increased productivity. Furthermore, these ready-made solutions ensure that businesses remain compliant with industry standards and legal requirements, reducing the likelihood of disputes or misunderstandings.

How Templates Improve Professionalism

Using pre-designed documents to handle transactions and service agreements elevates the perception of a business in the eyes of clients. A well-structured, polished form signals to customers that the business is organized and capable, fostering confidence in the services offered. Whether it’s a payment request or a project estimate, the clarity provided by these forms demonstrates attention to detail and reliability.

Consistency Across Client Interactions

When businesses use consistent formats for all their communications, they project a unified, professional image. Clients will recognize the structure and understand the expectations, making the interaction feel seamless and trustworthy. Consistency also helps reduce confusion, ensuring all parties are on the same page with regard to terms, pricing, and deadlines.

Enhanced Trust and Credibility

Pre-designed structures give businesses an edge when it comes to building credibility. Customized fields, clear descriptions, and well-organized sections make documents easy to read and understand. This straightforward approach instills a sense of transparency and professionalism, showing that the business is serious about its operations and values clear communication with its clients.

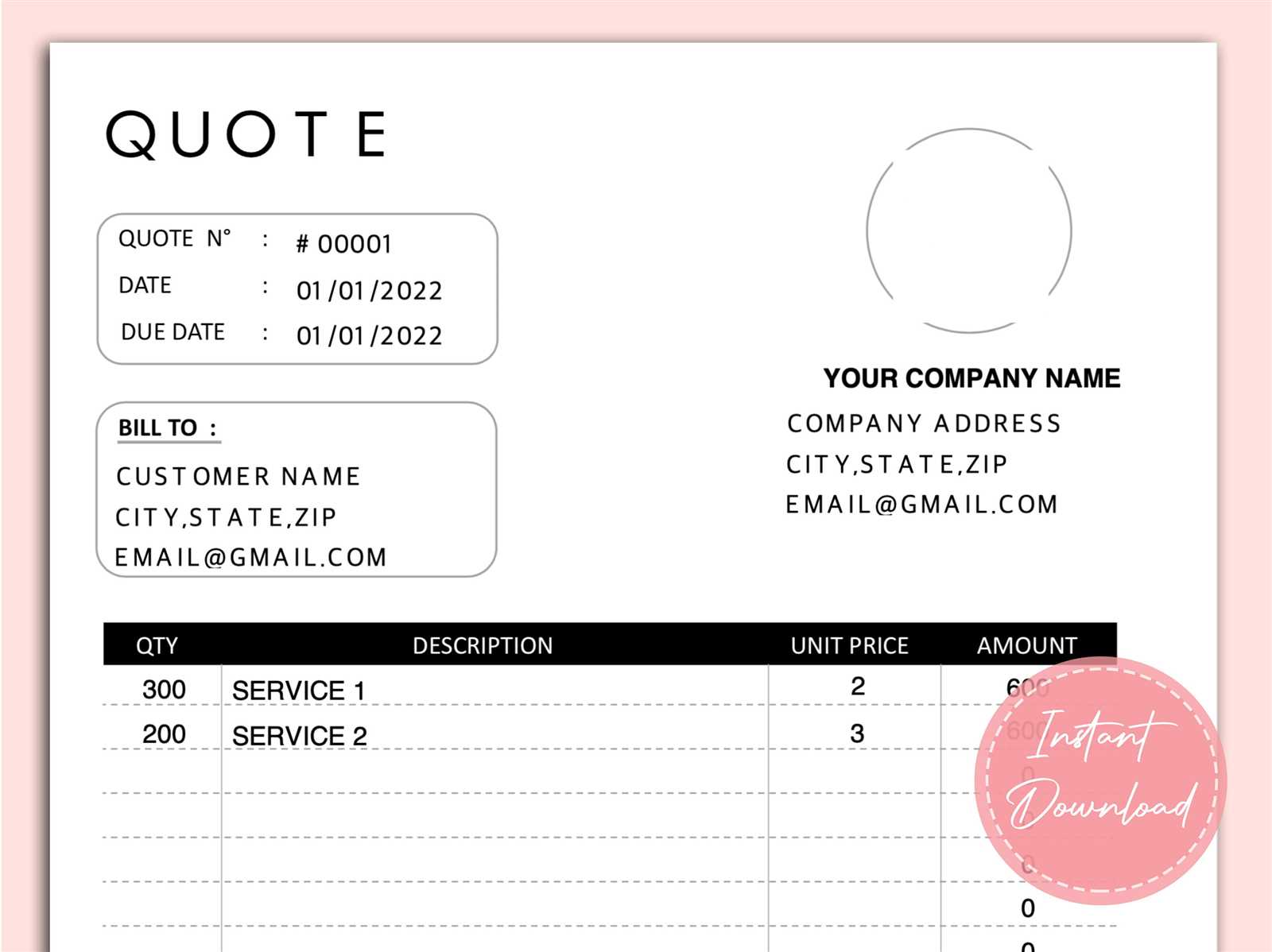

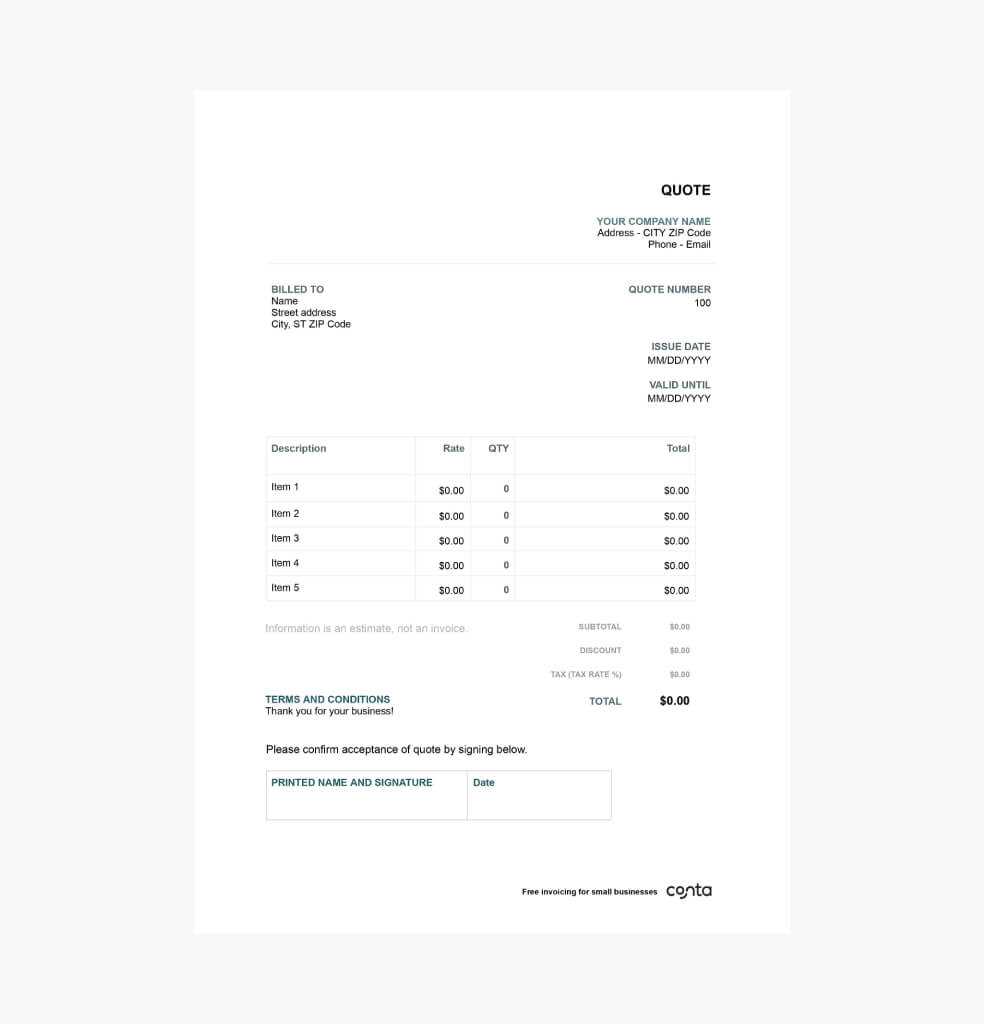

Customizing Your Invoice and Quote Templates

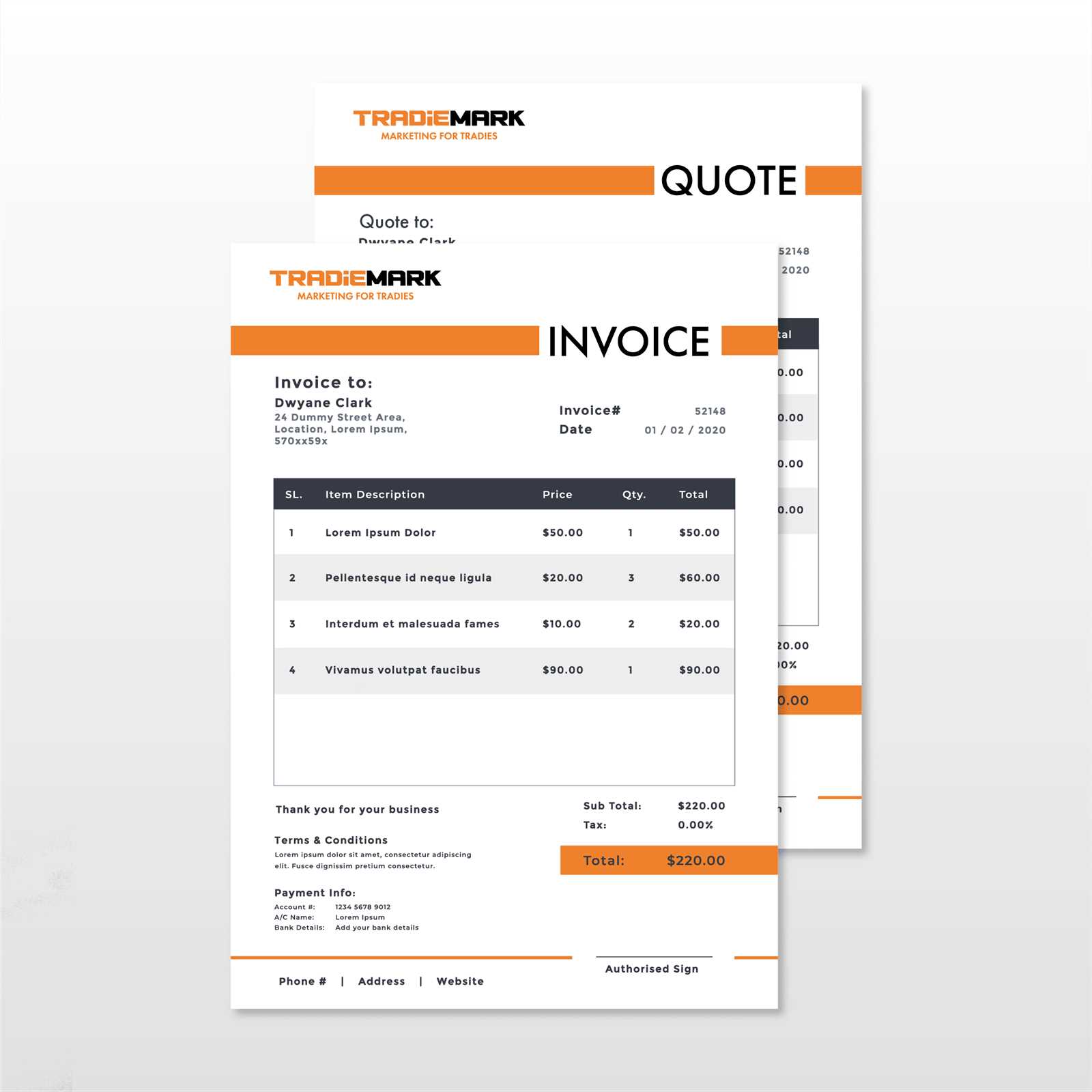

Personalizing pre-designed documents allows businesses to align them with their brand and unique needs. Customization ensures that all relevant details are included while maintaining a professional and consistent appearance. By adapting the layout, business owners can enhance clarity and create a more tailored experience for their clients.

Here are some key aspects to consider when modifying these forms:

- Branding: Add your company logo, colors, and font styles to reinforce your brand identity.

- Contact Information: Include your business’s name, address, phone number, and email for easy communication.

- Service Descriptions: Adjust the sections to accurately describe the products or services being provided, making them clear and specific.

- Payment Terms: Customize payment deadlines, methods, and any applicable discounts or late fees to suit your business practices.

- Legal Details: Ensure that any necessary legal disclaimers or clauses are included for transparency and compliance.

By customizing these forms, businesses can make a positive impression while ensuring that all relevant information is easily accessible and organized for clients’ convenience.

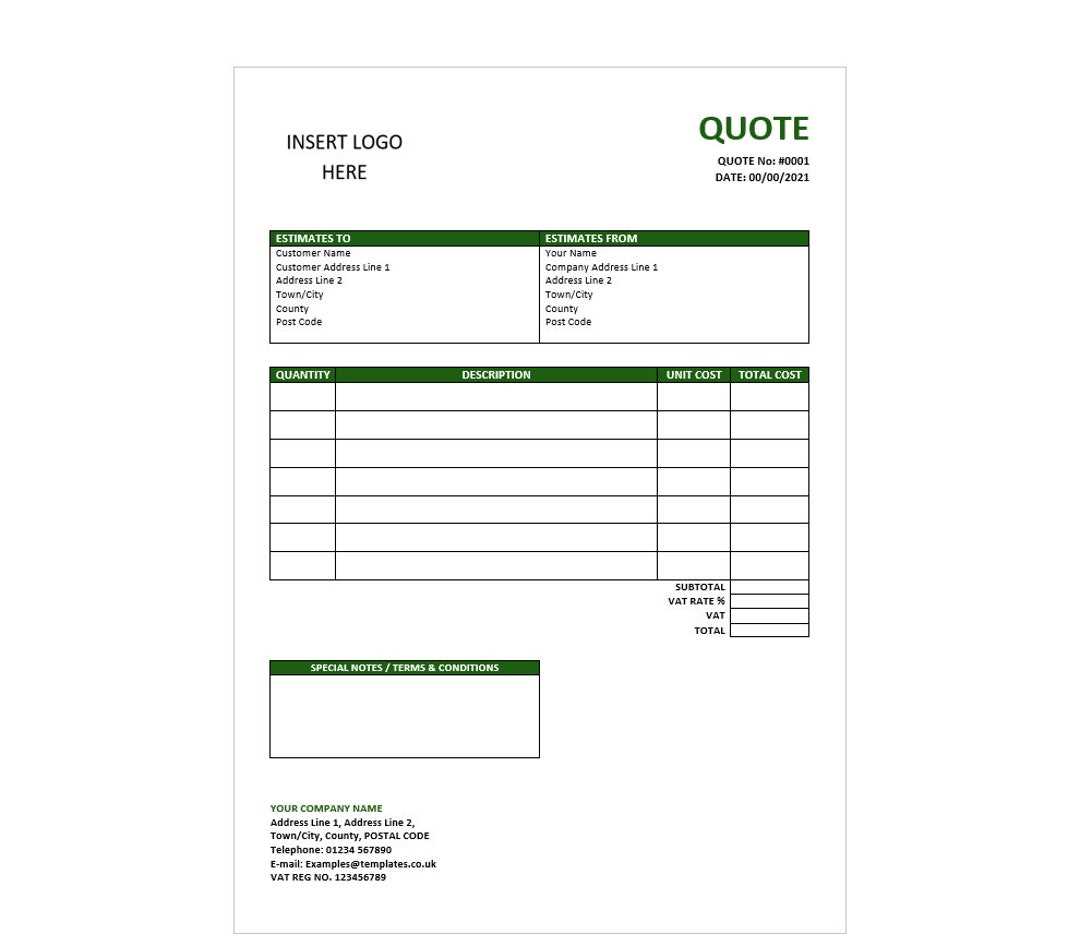

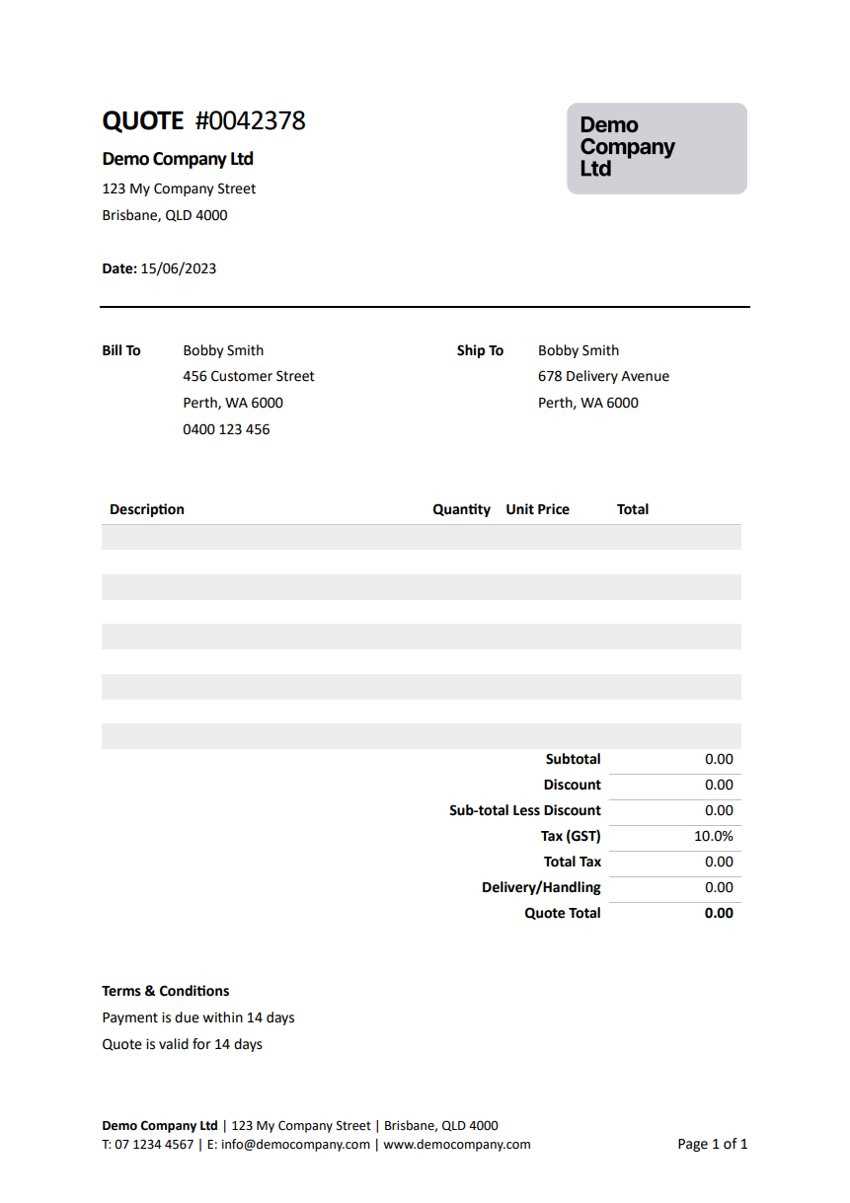

Key Elements in an Invoice Template

When creating a professional document for payment requests, certain components must be included to ensure clarity and effectiveness. These elements provide both the business and the client with a clear understanding of the terms and expectations. A well-structured document not only facilitates smooth transactions but also reduces the likelihood of misunderstandings or disputes.

Basic Information

At the top of the document, you should include essential contact details, such as the business name, client name, addresses, and phone numbers. This section ensures that both parties can easily reach each other for any follow-up or clarifications. Including an identification number or reference number for the transaction helps keep records organized and traceable.

Service or Product Details

Clearly describing the goods or services provided is crucial for transparency. Each item or service should be listed with a detailed description, quantity, unit price, and total amount. This helps the client understand exactly what they are being charged for, reducing the chances of confusion or disputes over what was provided.

Additionally, specifying payment terms, such as due dates, payment methods, and any discounts or penalties for late payments, ensures that both parties are aligned on the financial aspects of the transaction. These elements are necessary for setting clear expectations and avoiding potential delays in payment.

Essential Sections for a Quote Template

When preparing a document that outlines the estimated cost of goods or services, it is important to include key sections that provide clarity and transparency for the client. These sections help establish a detailed breakdown of expected charges, timelines, and terms of the proposed work. A well-structured estimate sets clear expectations and can assist in closing deals more effectively.

Some of the most essential sections to include are:

- Client Information: Clearly list the name, address, and contact details of the client, ensuring all communications are directed appropriately.

- Service or Product Description: Provide a clear, detailed list of the goods or services being offered, along with any specifications or customizations that may apply.

- Estimated Costs: Break down the costs for each service or item, including any applicable taxes, fees, or discounts, so the client can easily understand the pricing structure.

- Project Timeline: Specify expected start and completion dates for the work or delivery of products, providing a clear schedule for the client.

- Payment Terms: Outline the proposed payment structure, including deposit requirements, due dates, and acceptable payment methods.

By including these sections, businesses can ensure that all relevant details are covered, making it easier for clients to make informed decisions about moving forward with a project or purchase.

Free vs Premium Invoice Templates

When choosing pre-designed documents for managing payment requests and service estimates, businesses are often faced with the decision between free and paid options. Each comes with its advantages, but the best choice depends on the specific needs and goals of the business. While free solutions offer accessibility, premium options provide advanced features and customization that may better align with professional requirements.

Free options are generally straightforward and easy to use, making them an excellent choice for small businesses or freelancers just starting out. They often provide basic structures that cover essential information, helping businesses get up and running quickly without any upfront costs. However, these free resources may have limited features, fewer customization options, and might not offer the polished look or specific functionality needed as a business grows.

Premium solutions, on the other hand, offer more advanced capabilities, including a greater range of design options, professional layouts, and customizable fields. These paid resources can help businesses create a more branded, consistent experience for clients. Additionally, premium options often come with added benefits like customer support, regular updates, and integration with accounting software, making them a more scalable choice for businesses that require a more polished, comprehensive approach.

How to Choose the Right Template

Selecting the right pre-designed document for your business needs involves considering several factors to ensure it aligns with your objectives and branding. Whether you’re looking for simplicity or advanced features, the right choice will depend on your specific requirements, the nature of your transactions, and how you want to present your business to clients.

Here are key factors to consider when making your selection:

| Factor | Considerations |

|---|---|

| Customization | Does the design allow you to add your logo, brand colors, and adjust layout elements to match your company’s style? |

| Complexity | Is the structure simple enough for small tasks or does it need advanced features, like itemized pricing or multiple sections for detailed breakdowns? |

| Industry-Specific Needs | Does the document format cater to your specific industry requirements, such as legal terms or specific tax considerations? |

| Integration | Can the design integrate with your existing systems, such as accounting or CRM software? |

| Support and Updates | Will you have access to customer support or future updates to keep the document up-to-date with changing standards? |

By evaluating these factors, businesses can choose the most suitable option that not only meets their needs but also contributes to maintaining professionalism and efficiency in all transactions.

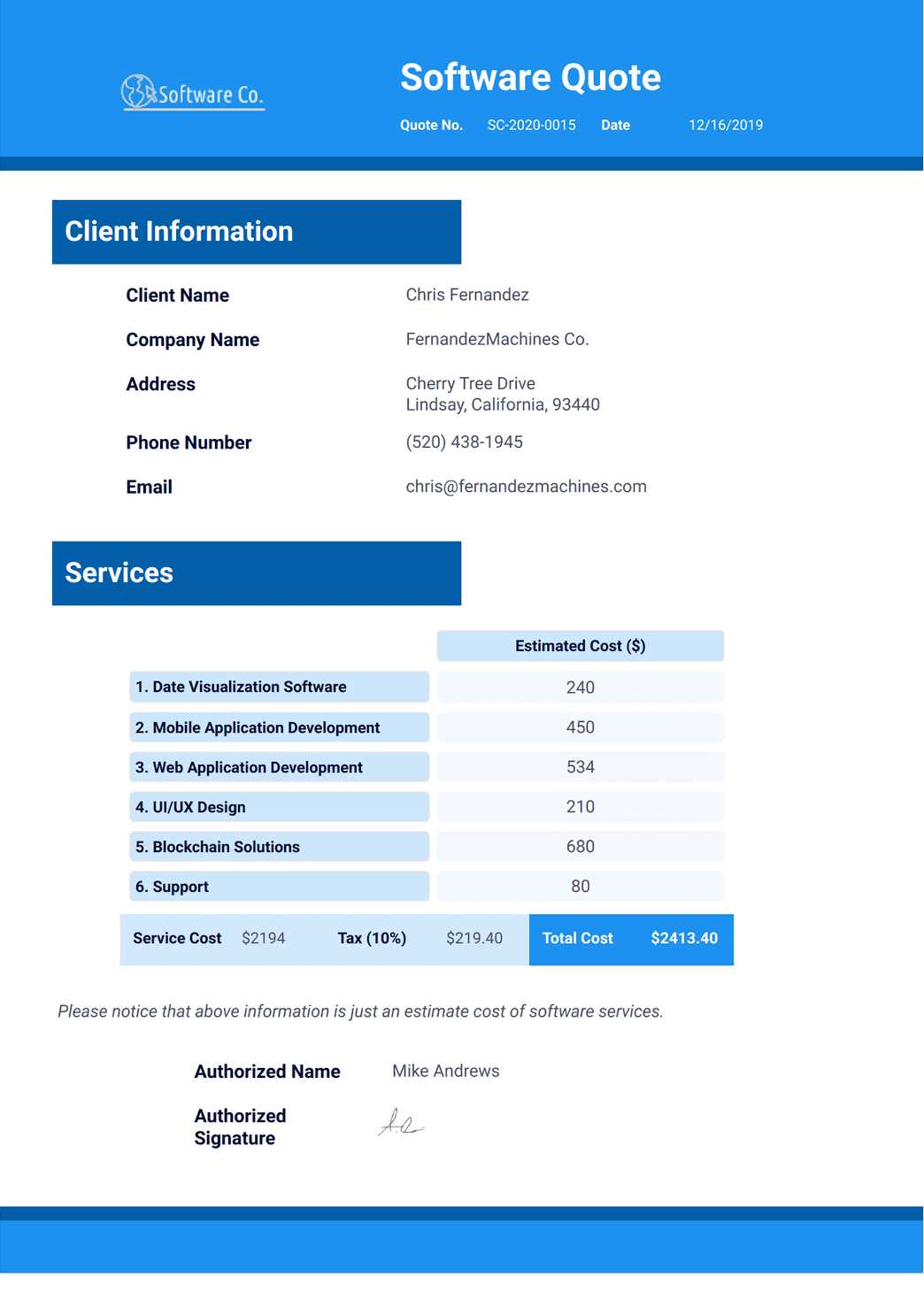

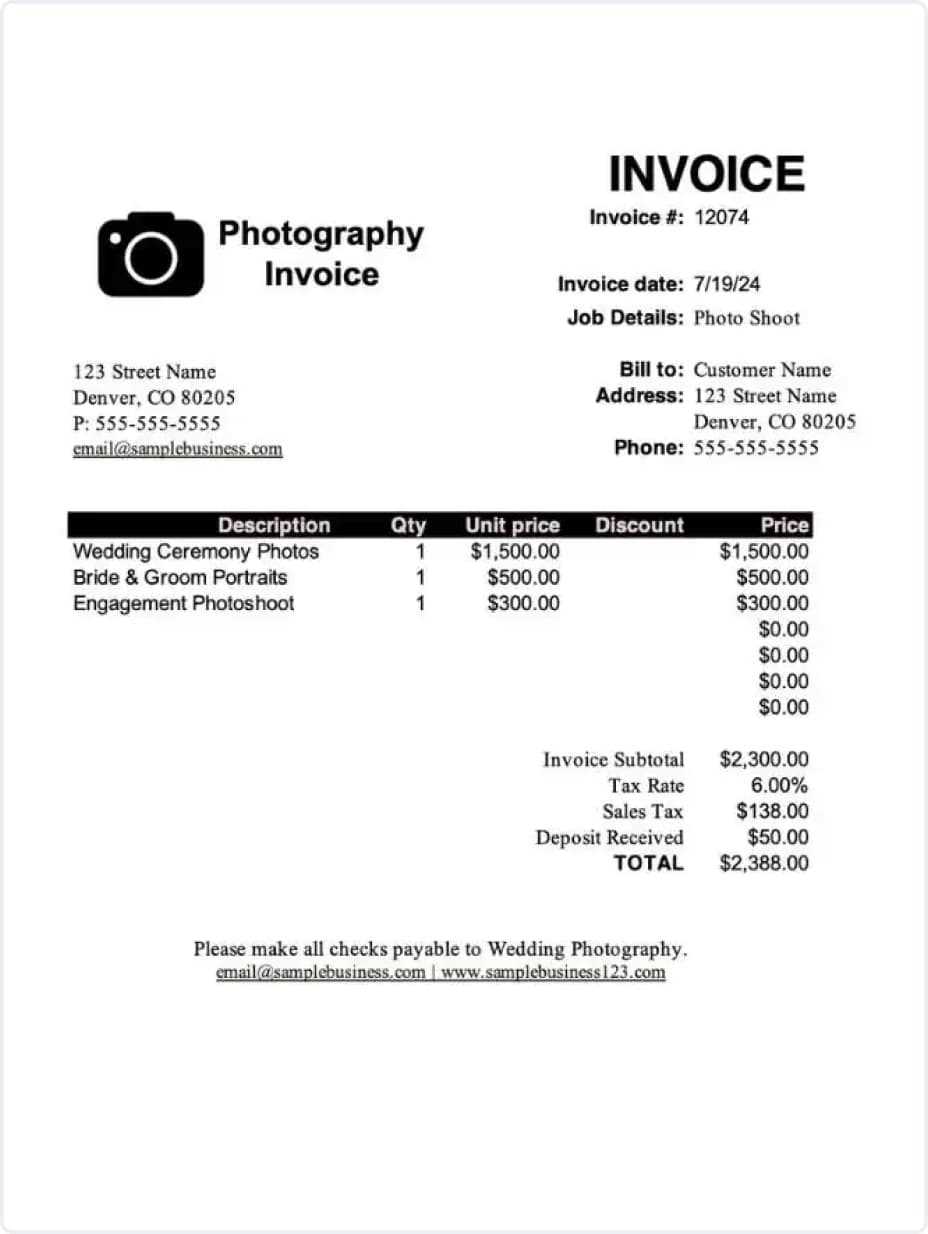

Invoice and Quote Templates for Different Industries

Different industries have unique requirements when it comes to structuring documents for payment requests or service estimates. Tailoring these forms to fit the specifics of each sector ensures that all relevant information is included, helping businesses stay organized and professional. Customizing the layout and content can also address industry-specific needs, from legal disclaimers to service breakdowns.

Creative Services

For industries like design, marketing, or consulting, detailed descriptions of the work provided are essential. These forms should allow for customization of services offered, including creative deliverables, timelines, and milestones. Additionally, these documents often include terms related to intellectual property rights, payment upon completion, or partial payments for long-term projects. Using a template that includes space for project details helps maintain clarity between service providers and clients.

Retail and Wholesale

In retail or wholesale, it’s important to focus on the specific items being sold, including quantity, unit price, and any applicable taxes or discounts. Forms used in this sector should include clear spaces for product details and allow for bulk pricing or itemized lists. These documents often need to include shipping information, stock availability, and estimated delivery times, making customization important for managing client expectations and ensuring smooth transactions.

By customizing these forms according to industry requirements, businesses can ensure that they maintain professionalism, accuracy, and transparency in every transaction.

Best Tools for Creating Templates

Creating professional, customized documents for financial transactions and service proposals is made easier with the right tools. Whether you’re looking for basic forms or advanced solutions with integrations and automation, the right tool can help you streamline your processes. These platforms offer flexibility, design options, and user-friendly features to meet various business needs.

Online Platforms for Easy Customization

Several web-based tools provide intuitive interfaces that allow businesses to quickly generate tailored forms. Platforms like Canva and Zoho offer pre-built designs that can be easily adjusted for any industry. With drag-and-drop features, users can add their company logo, change fonts, and customize colors to align with their brand identity. These tools are ideal for businesses that need quick, simple solutions without complex setup or additional software installations.

Software for Advanced Features

For more detailed or automated processes, software like QuickBooks and FreshBooks provide comprehensive solutions that not only help you design professional-looking documents but also manage invoicing, payments, and reporting. These tools integrate with accounting systems, making it easier to track finances and ensure accurate record-keeping. They are perfect for businesses that require ongoing, large-scale management of financial documentation.

By selecting the right tool based on your specific needs, you can ensure that your business remains efficient, professional, and well-organized in all transactions.

Legal Considerations for Templates

When creating documents for financial transactions or service proposals, it’s crucial to ensure that the content complies with local laws and industry regulations. These documents serve as official records and may be subject to legal scrutiny, so understanding the key legal aspects is essential for avoiding disputes and protecting both parties involved. Businesses must include the necessary legal clauses, payment terms, and disclaimers to ensure they are legally binding and enforceable.

Below are some key legal considerations to keep in mind when preparing these forms:

| Legal Element | Considerations |

|---|---|

| Payment Terms | Ensure that clear terms regarding payment deadlines, late fees, and acceptable payment methods are outlined to avoid future disputes. |

| Tax Information | Include accurate tax rates and any necessary tax identification numbers, as required by local tax authorities. |

| Legal Disclaimers | Include clauses for warranties, liability limits, and cancellation policies to protect your business from legal claims. |

| Confidentiality Agreements | If applicable, include terms regarding the confidentiality of the information shared during the transaction. |

| Governing Law | Specify the jurisdiction and laws that will govern the document in case of a dispute. |

By ensuring that your forms include these legal elements, you can avoid common legal pitfalls and provide a solid foundation for fair and transparent business dealings.

Automation and Invoice Generation Tools

Automation tools can significantly streamline the process of creating financial documents, saving time and reducing human error. These platforms allow businesses to quickly generate customized records, send them directly to clients, and even track payments–all with minimal manual effort. By automating repetitive tasks, businesses can focus on more strategic activities, such as customer relations and business development.

Key features to look for in automation tools include:

- Customizable Fields: Allows for easy adjustment of details such as services, prices, payment terms, and client information.

- Integration with Accounting Systems: Syncs with your accounting software to streamline tracking and reconciliation of payments.

- Recurring Billing: Automatically generates and sends regular payment requests for subscription-based or ongoing services.

- Client Notifications: Sends reminders or alerts for upcoming due dates or overdue payments, helping to reduce late payments.

- Cloud Storage: Provides a central location to securely store and access all records, making it easier to manage and retrieve documents when needed.

Popular tools that help businesses automate these processes include:

- FreshBooks: Ideal for small to medium-sized businesses, offering a user-friendly interface and a range of automation features.

- QuickBooks: Provides comprehensive accounting and document generation features, suitable for businesses of all sizes.

- Zoho Invoice: Known for its customizable options and integration with other Zoho business tools.

- Wave: A free solution for businesses looking for a simple, cloud-based option with automation capabilities.

By adopting these automation tools, businesses can increase efficiency, reduce administrative workloads, and ensure timely, accurate documentation for every transaction.

How to Send Invoices and Quotes Digitally

Sending professional documents electronically has become the standard in modern business. Digital transmission offers speed, convenience, and cost-effectiveness while ensuring that all details are captured accurately and promptly. By leveraging various platforms and tools, businesses can deliver these essential documents to clients quickly, with minimal manual effort, and in a secure manner.

Choosing the Right Method

There are several ways to send financial documents digitally, each with its benefits depending on your business needs:

- Email: The most common method for sending documents. Simply attach the file and send it directly to your client. Ensure the file format is compatible (PDF is widely preferred) and that the document is password-protected if necessary.

- Cloud-based Platforms: Tools like Google Drive, Dropbox, or OneDrive allow you to upload documents and share access through a link. This is especially useful for larger files or when you need to share multiple documents at once.

- Dedicated Business Software: Using accounting or invoicing platforms such as QuickBooks or FreshBooks lets you automatically generate and send these forms directly from the system, saving time and ensuring accuracy.

Ensuring Security and Professionalism

While sending documents digitally offers many advantages, security and professionalism should remain a priority. Here are a few tips:

- Secure File Formats: Always send documents in secure, non-editable formats like PDF to prevent unauthorized alterations.

- Branding: Customize the document to reflect your company’s logo, colors, and contact information, ensuring a consistent brand presence.

- Password Protection: For sensitive documents, consider using password protection or encrypted email services to ensure secure transmission.

By utilizing the right methods and ensuring secure transmission, businesses can streamline the process of sending essential records and improve client satisfaction with timely, professional communications.

Common Mistakes to Avoid in Templates

When creating professional documents for financial transactions or service proposals, it’s easy to make errors that can lead to confusion, missed payments, or legal issues. These mistakes often stem from oversights in design, information accuracy, or the overall structure of the document. Avoiding these common pitfalls ensures that all records are clear, accurate, and legally compliant.

1. Incorrect or Missing Information

One of the most common mistakes is failing to include essential details such as contact information, payment terms, or service descriptions. Missing or incorrect data can lead to misunderstandings and delays in payment. Double-check all fields for accuracy before sending out any document.

2. Inconsistent Formatting

Inconsistency in font style, size, or layout can make a document look unprofessional and harder to read. Stick to a simple, clean design with consistent formatting throughout. This ensures that the document appears polished and easy for clients to navigate.

3. Overcomplicating the Design

While customization can enhance the visual appeal, cluttering the document with excessive design elements or irrelevant information can detract from its purpose. Keep it straightforward, focusing on the key details that the client needs to understand.

4. Failing to Include Legal Clauses

Neglecting to include essential legal clauses, such as payment terms, taxes, or cancellation policies, can lead to disputes or non-payment. Ensure that all necessary legal information is clearly stated and up-to-date with current regulations.

5. Not Providing a Clear Payment Method

Failing to specify how payments should be made (e.g., bank transfer, credit card, or online payment) can cause confusion. Always include clear payment instructions to ensure that clients know how to settle their accounts promptly.

By paying attention to these details, businesses can avoid common mistakes and maintain a smooth, professional transaction process.

Managing Template Version Control

As your business grows, the need for organized management of your document templates becomes increasingly important. Ensuring that all forms are up-to-date, accurate, and easily accessible across different team members requires a solid version control system. This helps prevent confusion caused by outdated or inconsistent forms and ensures that everyone is working with the most current version.

Why Version Control is Important

Without proper version management, your team might end up using outdated documents, leading to errors or miscommunication with clients. Additionally, if there are changes in legal requirements, payment terms, or branding, keeping track of revisions becomes essential. By using version control, you ensure that every update is documented, and previous versions are archived for reference, preventing mistakes from being repeated.

Best Practices for Managing Versions

- Label Versions Clearly: Always use a consistent naming convention that includes the version number and the date of the update (e.g., “v2.0_2024-11-06”). This makes it easy to identify the latest file.

- Keep an Archive: Maintain an archive of old versions, particularly if you need to refer to previous formats or document clauses. This can be stored securely on cloud platforms or internal servers.

- Track Changes: When editing forms, use tools that allow you to track changes, such as cloud-based document editors or specialized software. This ensures that all alterations are documented and can be reviewed later.

- Set Permissions: Ensure that only authorized team members can make updates to the documents. This helps maintain consistency and prevents unauthorized alterations that may introduce errors.

By maintaining clear version control, you safeguard your business from confusion and ensure that all client interactions are conducted using the most accurate and professional documentation possible.

Integrating Templates with Accounting Software

Integrating your financial documents with accounting software can greatly enhance the efficiency of your business operations. By automating the process of generating, sending, and tracking these documents, businesses can save time, reduce errors, and streamline workflows. Integration ensures that all financial data is synced seamlessly, which helps maintain accurate records and simplifies tasks like bookkeeping, reporting, and tax preparation.

Benefits of Integration

Connecting document creation tools with accounting software offers several advantages, including:

- Automatic Data Sync: Data entered into one system is automatically transferred to the other, eliminating the need for double entry and reducing the risk of mistakes.

- Real-Time Updates: Any changes made to client details, pricing, or payment terms are instantly reflected in both the documents and the accounting system.

- Time-Saving: With integration, documents can be generated automatically based on predefined templates, saving time on manual creation and customization.

- Improved Accuracy: Integration reduces human error by ensuring that the data in your documents is always up-to-date with the latest information from your accounting software.

- Streamlined Reporting: With all financial data in one system, generating financial reports, tracking expenses, and assessing business performance becomes much easier.

Popular Tools for Integration

Several accounting platforms offer built-in integrations or third-party tools to seamlessly connect with document management systems. Some of the most popular options include:

- QuickBooks: Known for its comprehensive accounting features, QuickBooks integrates with several document generation tools to automate financial workflows.

- Zoho Books: Zoho offers integrations with its own suite of business tools, making it easy to generate and send forms directly from the platform.

- FreshBooks: FreshBooks offers seamless integration with accounting features to automate the generation of financial records and track payments in real-time.

- Wave: A free tool that integrates with various cloud-based document systems for easy creation and tracking of business records.

Integrating your document creation process with accounting software not only makes it more efficient

How Templates Save Time and Money

Using pre-designed forms for essential business documents can significantly reduce the amount of time spent on administrative tasks, while also cutting down on operational costs. By eliminating the need to create these documents from scratch each time, businesses can speed up the process of communicating with clients and streamline financial workflows. The result is improved efficiency, fewer mistakes, and ultimately, cost savings.

Time Savings Through Automation

One of the key benefits of using standardized formats is the automation of repetitive tasks. Instead of manually entering client details, product or service descriptions, or pricing information each time a new document is created, these fields can be pre-set within the form. This allows businesses to generate new documents in just a few clicks, saving hours of work over time. Additionally, automation reduces human error, ensuring that each document is accurate and consistent.

- Faster Document Generation: Custom fields and auto-population capabilities make creating new documents faster and more efficient.

- Reduced Manual Work: By using pre-built structures, staff spend less time on repetitive tasks, freeing them up to focus on higher-value work.

- Less Time Spent on Revisions: With standardized formats, there is less room for error, reducing the need for revisions and updates.

Cost Savings from Increased Efficiency

By speeding up the document creation process, businesses reduce the amount of time spent on administrative tasks, which directly leads to cost savings. Furthermore, reducing the potential for errors or omissions in financial documentation can prevent costly mistakes such as delayed payments or client disputes. Moreover, the use of digital systems often lowers printing and postage expenses, especially for companies that rely on physical document delivery.

- Reduced Labor Costs: Less time spent creating and revising documents means employees can focus on more profitable activities.

- Lower Operational Costs: With fewer errors and a faster process, companies avoid costly corrections and delays.

- Digital Delivery Savings: Sending documents digitally eliminates the need for paper, printing, and postage costs.

Ultimately, the use of standardized business documents helps companies operate more efficiently, reducing time spent on administrative work and cutting down costs, all while maintaining a high level of professionalism and accuracy.