2 Page Invoice Template Free Download for Easy Billing

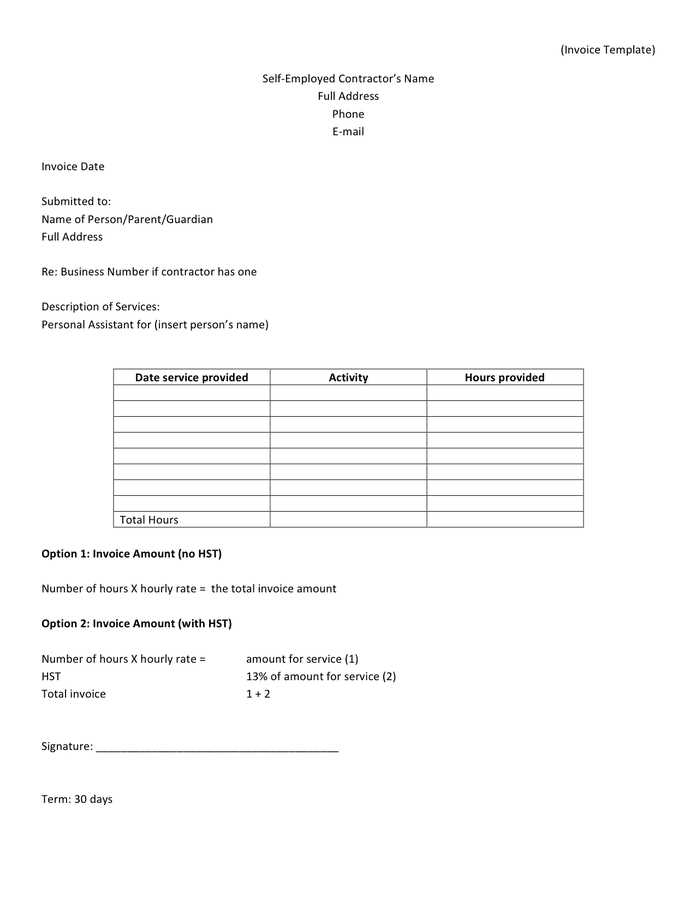

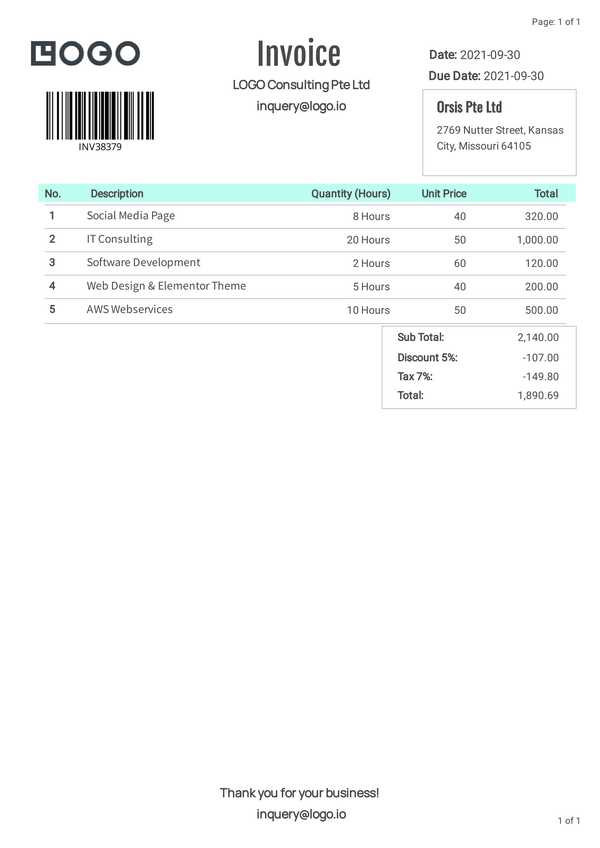

How to Customize a 2 Page Invoice

Customizing a document for billing purposes allows you to adapt it to your business needs. By adjusting the layout, content, and design, you can create a professional and efficient form that reflects your brand and makes it easier to manage payments. Understanding how to personalize such a form is key to ensuring clarity and smooth transactions with clients.

Here are some important steps to customize a standard billing document:

| Step | Action | Explanation |

|---|---|---|

| 1 | Adjust the Header | Include your business name, logo, and contact information to make the document easily recognizable and professional. |

| 2 | Modify the Client Details Section | Ensure there is enough space to include the recipient’s name, address, and other necessary contact information. |

| 3 | Include Payment Terms | Clarify payment deadlines, accepted methods, and any discounts or penalties for late payments to avoid confusion. |

| 4 | Organize Service or Product Listings | Ensure that each item is clearly described, including quantity, unit price, and total cost. This will help both you and your client keep track of the services or products provided. |

| 5 | Adjust the Footer | Include additional business information such as your tax identification number, business registration number, or any legal disclaimers necessary. |

By

How to Customize a 2 Page Invoice

Customizing a document for billing purposes allows you to adapt it to your business needs. By adjusting the layout, content, and design, you can create a professional and efficient form that reflects your brand and makes it easier to manage payments. Understanding how to personalize such a form is key to ensuring clarity and smooth transactions with clients.

Here are some important steps to customize a standard billing document:

| Step | Action | Explanation |

|---|---|---|

| 1 | Adjust the Header | Include your business name, logo, and contact information to make the document easily recognizable and professional. |

| 2 | Modify the Client Details Section | Ensure there is enough space to include the recipient’s name, address, and other necessary contact information. |

| 3 | Include Payment Terms | Clarify payment deadlines, accepted methods, and any discounts or penalties for late payments to avoid confusion. |

| 4 | Organize Service or Product Listings | Ensure that each item is clearly described, including quantity, unit price, and total cost. This will help both you and your client keep track of the services or products provided. |

| 5 | Adjust the Footer | Include additional business information such as your tax identification number, business registration number, or any legal disclaimers necessary. |

By following these steps, you can create a document that is both functional and visually appealing, making your billing process smoother and more professional.

Why Choose a 2 Page Layout

Opting for a layout that spans multiple sections offers several advantages for businesses that require more space to detail transactions. A longer format allows for a clearer presentation of information, providing both the service provider and the client with a well-organized document. This can be particularly beneficial for complex transactions that involve multiple items or detailed terms.

Here are a few reasons why a longer format may be the right choice:

- Better Organization: With more space, you can neatly categorize details, separating services, taxes, and payment instructions into clear sections. This ensures that nothing is overlooked and reduces the risk of errors.

- Improved Clarity: When you have more room to break down information, each component becomes easier to understand. Whether it’s individual charges, taxes, or payment terms, the extra space makes the document more readable.

- Professional Appearance: A well-structured, multi-section document gives off a polished, professional vibe. It helps instill trust and confidence in clients, especially when dealing with larger or ongoing projects.

- Detailed Breakdown: A larger format allows for a detailed breakdown of the transaction, which can help avoid misunderstandings. It’s particularly useful for contracts or complex agreements.

- Flexibility for Customization: With more space, you can tailor the document to reflect your branding, include additional instructions, or even add personalized messages without feeling cramped.

This approach is ideal for businesses that need to provide clear, thorough documentation while maintaining a professional presentation. With careful layout and structure, a multi-section document enhances both functionality and appearance, benefiting both the issuer and the recipient.

Why Choose a 2 Page Layout

Opting for a layout that spans multiple sections offers several advantages for businesses that require more space to detail transactions. A longer format allows for a clearer presentation of information, providing both the service provider and the client with a well-organized document. This can be particularly beneficial for complex transactions that involve multiple items or detailed terms.

Here are a few reasons why a longer format may be the right choice:

- Better Organization: With more space, you can neatly categorize details, separating services, taxes, and payment instructions into clear sections. This ensures that nothing is overlooked and reduces the risk of errors.

- Improved Clarity: When you have more room to break down information, each component becomes easier to understand. Whether it’s individual charges, taxes, or payment terms, the extra space makes the document more readable.

- Professional Appearance: A well-structured, multi-section document gives off a polished, professional vibe. It helps instill trust and confidence in clients, especially when dealing with larger or ongoing projects.

- Detailed Breakdown: A larger format allows for a detailed breakdown of the transaction, which can help avoid misunderstandings. It’s particularly useful for contracts or complex agreements.

- Flexibility for Customization: With more space, you can tailor the document to reflect your branding, include additional instructions, or even add personalized messages without feeling cramped.

This approach is ideal for businesses that need to provide clear, thorough documentation while maintaining a professional presentation. With careful layout and structure, a multi-section document enhances both functionality and appearance, benefiting both the issuer and the recipient.

Common Mistakes in Invoice Templates

Even with a well-designed document for billing, it’s easy to overlook certain details that can lead to confusion or delays in payments. Mistakes in layout, content, or formatting can create misunderstandings and even cause clients to question the accuracy of the charges. Identifying and addressing these common errors can help streamline your process and ensure smoother transactions.

Here are some frequent mistakes that should be avoided:

- Missing Contact Information: Always include full details for both parties–yours and the recipient. Missing email addresses or phone numbers can delay communication and cause misunderstandings.

- Incorrect Dates: Double-check the dates on the document, including the issue date and payment due date. An incorrect or inconsistent date can confuse clients or lead to delayed payments.

- Unclear Descriptions: Ambiguous or incomplete item descriptions can lead to confusion about what exactly is being charged. Be specific about the services or products provided to avoid disputes.

- Omitting Payment Terms: Failing to include clear payment instructions, such as methods of payment and due dates, can create frustration for your clients and delay processing.

- Inconsistent Formatting: A disorganized layout, such as inconsistent font sizes or misaligned columns, can make the document difficult to read and unprofessional in appearance.

- Missing Tax Information: Ensure that any taxes or additional fees are clearly stated. Failing to itemize taxes or other charges can lead to confusion or disputes with the client.

- Not Including Unique Identifiers: Without a unique reference number, it can be difficult to track the document, especially if you issue multiple records over time. Include a number or code to ensure easy reference and follow-up.

- Not Proofreading: Simple typographical or calculation errors can undermine the professionalism of your document. Always proofread before sending to avoid such issues.

By taking the time to review your document carefully and correcting these common mistakes, you can avoid confusion, ensure timely payments, and present a more professional image to your clients.

Common Mistakes in Invoice Templates

Even with a well-designed document for billing, it’s easy to overlook certain details that can lead to confusion or delays in payments. Mistakes in layout, content, or formatting can create misunderstandings and even cause clients to question the accuracy of the charges. Identifying and addressing these common errors can help streamline your process and ensure smoother transactions.

Here are some frequent mistakes that should be avoided:

- Missing Contact Information: Always include full details for both parties–yours and the recipient. Missing email addresses or phone numbers can delay communication and cause misunderstandings.

- Incorrect Dates: Double-check the dates on the document, including the issue date and payment due date. An incorrect or inconsistent date can confuse clients or lead to delayed payments.

- Unclear Descriptions: Ambiguous or incomplete item descriptions can lead to confusion about what exactly is being charged. Be specific about the services or products provided to avoid disputes.

- Omitting Payment Terms: Failing to include clear payment instructions, such as methods of payment and due dates, can create frustration for your clients and delay processing.

- Inconsistent Formatting: A disorganized layout, such as inconsistent font sizes or misaligned columns, can make the document difficult to read and unprofessional in appearance.

- Missing Tax Information: Ensure that any taxes or additional fees are clearly stated. Failing to itemize taxes or other charges can lead to confusion or disputes with the client.

- Not Including Unique Identifiers: Without a unique reference number, it can be difficult to track the document, especially if you issue multiple records over time. Include a number or code to ensure easy reference and follow-up.

- Not Proofreading: Simple typographical or calculation errors can undermine the professionalism of your document. Always proofread before sending to avoid such issues.

By taking the time to review your document carefully and correcting these common mistakes, you can avoid confusion, ensure timely payments, and present a more professional image to your clients.

Professional Design Tips for Invoices

A well-designed billing document not only ensures clear communication but also enhances the professionalism of your business. A clean, organized layout helps clients quickly understand the details of the transaction, fostering trust and minimizing the risk of errors. Here are some design tips to make your billing documents more polished and effective.

- Keep It Simple: Avoid clutter by using plenty of white space. A simple, minimalistic design helps important details stand out and makes the document easier to read.

- Use Consistent Branding: Incorporate your company’s logo, colors, and fonts to align with your overall brand identity. This reinforces your business image and adds a professional touch.

- Organize Information Clearly: Use clear headings, bullet points, and separate sections to group related information. This makes it easy for your clients to find the details they need quickly.

- Choose Readable Fonts: Select simple, easy-to-read fonts like Arial or Helvetica. Avoid using too many different fonts or overly decorative styles that can make the document hard to read.

- Highlight Key Details: Important information like the total amount due, payment terms, and due date should be clearly visible. Use bold text or color to make these elements stand out.

- Align Text Properly: Ensure that all text is properly aligned, especially in tables. Consistent alignment creates a tidy, professional appearance and helps prevent confusion.

- Use Tables for Clarity: When listing items, services, or charges, use tables to organize the information. This makes it easier to track individual charges and totals at a glance.

- Incorporate Contact Information: Clearly display both your business’s and the client’s contact information at the top of the document. This makes it easy to get in touch if there are any issues.

- Ensure Proper Spacing: Adequate spacing between lines, sections, and rows in tables ensures that the document does not feel cramped, enhancing readability and making the information easy to dige

Professional Design Tips for Invoices

A well-designed billing document not only ensures clear communication but also enhances the professionalism of your business. A clean, organized layout helps clients quickly understand the details of the transaction, fostering trust and minimizing the risk of errors. Here are some design tips to make your billing documents more polished and effective.

- Keep It Simple: Avoid clutter by using plenty of white space. A simple, minimalistic design helps important details stand out and makes the document easier to read.

- Use Consistent Branding: Incorporate your company’s logo, colors, and fonts to align with your overall brand identity. This reinforces your business image and adds a professional touch.

- Organize Information Clearly: Use clear headings, bullet points, and separate sections to group related information. This makes it easy for your clients to find the details they need quickly.

- Choose Readable Fonts: Select simple, easy-to-read fonts like Arial or Helvetica. Avoid using too many different fonts or overly decorative styles that can make the document hard to read.

- Highlight Key Details: Important information like the total amount due, payment terms, and due date should be clearly visible. Use bold text or color to make these elements stand out.

- Align Text Properly: Ensure that all text is properly aligned, especially in tables. Consistent alignment creates a tidy, professional appearance and helps prevent confusion.

- Use Tables for Clarity: When listing items, services, or charges, use tables to organize the information. This makes it easier to track individual charges and totals at a glance.

- Incorporate Contact Information: Clearly display both your business’s and the client’s contact information at the top of the document. This makes it easy to get in touch if there are any issues.

- Ensure Proper Spacing: Adequate spacing between lines, sections, and rows in tables ensures that the document does not feel cramped, enhancing readability and making the information easy to digest.

By following these design tips, you can create billing documents that not only look professional but also function effectively, improving both client experience and payment processing.

Professional Design Tips for Invoices

A well-designed billing document not only ensures clear communication but also enhances the professionalism of your business. A clean, organized layout helps clients quickly understand the details of the transaction, fostering trust and minimizing the risk of errors. Here are some design tips to make your billing documents more polished and effective.

- Keep It Simple: Avoid clutter by using plenty of white space. A simple, minimalistic design helps important details stand out and makes the document easier to read.

- Use Consistent Branding: Incorporate your company’s logo, colors, and fonts to align with your overall brand identity. This reinforces your business image and adds a professional touch.

- Organize Information Clearly: Use clear headings, bullet points, and separate sections to group related information. This makes it easy for your clients to find the details they need quickly.

- Choose Readable Fonts: Select simple, easy-to-read fonts like Arial or Helvetica. Avoid using too many different fonts or overly decorative styles that can make the document hard to read.

- Highlight Key Details: Important information like the total amount due, payment terms, and due date should be clearly visible. Use bold text or color to make these elements stand out.

- Align Text Properly: Ensure that all text is properly aligned, especially in tables. Consistent alignment creates a tidy, professional appearance and helps prevent confusion.

- Use Tables for Clarity: When listing items, services, or charges, use tables to organize the information. This makes it easier to track individual charges and totals at a glance.

- Incorporate Contact Information: Clearly display both your business’s and the client’s contact information at the top of the document. This makes it easy to get in touch if there are any issues.

- Ensure Proper Spacing: Adequate spacing between lines, sections, and rows in tables ensures that the document does not feel cramped, enhancing readability and making the information easy to digest.

By following these design tips, you can create billing documents that not only look professional but also function effectively, improving both client experience and payment processing.

Tips for Streamlining Your Billing Process

Making your billing process more efficient can save time, reduce errors, and improve cash flow. A streamlined approach ensures that all necessary steps are completed quickly and accurately, while minimizing unnecessary delays. By implementing the right strategies, you can ensure smoother transactions and faster payments.

- Automate Recurring Billing: Use software to automate the creation and sending of regular documents. This can save time and reduce the chance of forgetting to bill a client or miscalculating amounts.

- Standardize Your Format: Develop a consistent structure for all your billing documents. By standardizing the layout and information included, you can make the process quicker and easier for both you and your clients.

- Set Clear Payment Terms: Clearly state payment deadlines, methods, and late fees. Having these terms upfront reduces confusion and encourages clients to pay on time.

- Incorporate Payment Links: Include links to online payment portals directly within the billing document. This makes it easier for clients to pay immediately and reduces the chances of delays.

- Offer Multiple Payment Options: Provide clients with a variety of payment methods, such as credit card, bank transfer, or online payment systems. This flexibility can help speed up the payment process.

- Keep Records Organized: Use a digital system to store and organize your billing records. Having everything in one place will make it easier to track payments, manage overdue accounts, and access past documents when needed.

- Send Documents Promptly: Send your billing documents as soon as the work or service is completed. The quicker you send them, the sooner you are likely to receive payment.

- Communicate Proactively with Clients: If there’s an issue with payment or a client is late, contact them early to resolve the issue. Open communication can often speed up the payment process.

- Use Clear Descriptions and Itemization: Break down each charge clearly to avoid confusion. Clients are more likely to pay quickly when they understand exactly what they are being billed for.

By following these tips, you can make your billing process smoother, reducing errors and delays while ensuring timely payments and more satisfied clients.

Tips for Streamlining Your Billing Process

Making your billing process more efficient can save time, reduce errors, and improve cash flow. A streamlined approach ensures that all necessary steps are completed quickly and accurately, while minimizing unnecessary delays. By implementing the right strategies, you can ensure smoother transactions and faster payments.

- Automate Recurring Billing: Use software to automate the creation and sending of regular documents. This can save time and reduce the chance of forgetting to bill a client or miscalculating amounts.

- Standardize Your Format: Develop a consistent structure for all your billing documents. By standardizing the layout and information included, you can make the process quicker and easier for both you and your clients.

- Set Clear Payment Terms: Clearly state payment deadlines, methods, and late fees. Having these terms upfront reduces confusion and encourages clients to pay on time.

- Incorporate Payment Links: Include links to online payment portals directly within the billing document. This makes it easier for clients to pay immediately and reduces the chances of delays.

- Offer Multiple Payment Options: Provide clients with a variety of payment methods, such as credit card, bank transfer, or online payment systems. This flexibility can help speed up the payment process.

- Keep Records Organized: Use a digital system to store and organize your billing records. Having everything in one place will make it easier to track payments, manage overdue accounts, and access past documents when needed.

- Send Documents Promptly: Send your billing documents as soon as the work or service is completed. The quicker you send them, the sooner you are likely to receive payment.

- Communicate Proactively with Clients: If there’s an issue with payment or a client is late, contact them early to resolve the issue. Open communication can often speed up the payment process.

- Use Clear Descriptions and Itemization: Break down each charge clearly to avoid confusion. Clients are more likely to pay quickly when they understand exactly what they are being billed for.

By following these tips, you can make your billing process smoother, reducing errors and delays while ensuring timely payments and more satisfied clients.

Tips for Streamlining Your Billing Process

Making your billing process more efficient can save time, reduce errors, and improve cash flow. A streamlined approach ensures that all necessary steps are completed quickly and accurately, while minimizing unnecessary delays. By implementing the right strategies, you can ensure smoother transactions and faster payments.

- Automate Recurring Billing: Use software to automate the creation and sending of regular documents. This can save time and reduce the chance of forgetting to bill a client or miscalculating amounts.

- Standardize Your Format: Develop a consistent structure for all your billing documents. By standardizing the layout and information included, you can make the process quicker and easier for both you and your clients.

- Set Clear Payment Terms: Clearly state payment deadlines, methods, and late fees. Having these terms upfront reduces confusion and encourages clients to pay on time.

- Incorporate Payment Links: Include links to online payment portals directly within the billing document. This makes it easier for clients to pay immediately and reduces the chances of delays.

- Offer Multiple Payment Options: Provide clients with a variety of payment methods, such as credit card, bank transfer, or online payment systems. This flexibility can help speed up the payment process.

- Keep Records Organized: Use a digital system to store and organize your billing records. Having everything in one place will make it easier to track payments, manage overdue accounts, and access past documents when needed.

- Send Documents Promptly: Send your billing documents as soon as the work or service is completed. The quicker you send them, the sooner you are likely to receive payment.

- Communicate Proactively with Clients: If there’s an issue with payment or a client is late, contact them early to resolve the issue. Open communication can often speed up the payment process.

- Use Clear Descriptions and Itemization: Break down each charge clearly to avoid confusion. Clients are more likely to pay quickly when they understand exactly what they are being billed for.

By following these tips, you can make your billing process smoother, reducing errors and delays while ensuring timely payments and more satisfied clients.

Choosing the Right Software for Invoices

Selecting the right software for managing your billing documents is crucial for improving efficiency, accuracy, and professionalism. The right tool can simplify the creation, tracking, and management of financial records, saving you time and reducing the risk of errors. When choosing software, consider factors such as ease of use, customization options, and integration with other business tools.

Here are some key features to look for when selecting software for your billing needs:

- Ease of Use: The software should have an intuitive interface that allows you to quickly create and send documents without requiring extensive training or technical knowledge.

- Customization Options: Look for a program that lets you customize the layout, branding, and content of your documents. This ensures your billing records align with your business identity.

- Automation Features: Choose software that automates repetitive tasks like sending reminders, calculating totals, or generating recurring documents. Automation helps save time and reduce human error.

- Cloud-Based Access: Cloud-based tools allow you to access your billing records from any device, which is especially useful for businesses that need to manage documents on the go or collaborate with a team.

- Integration Capabilities: Ensure the software integrates well with other tools you use, such as accounting software or CRM systems. This reduces the need for manual data entry and improves accuracy.

- Security Features: Billing documents often contain sensitive information. Ensure the software provides robust security features, such as encryption and secure cloud storage, to protect your data.

- Customer Support: A good software provider should offer reliable customer support, whether through live chat, email, or phone. This is essential if you encounter issues or need assistance with advanced features.

By carefully evaluating these factors, you can choose the software that best meets your needs and helps streamline your billing process. The right solution will make managing financial records more efficient and less time-consuming, allowing you to focus on growing your business.

Choosing the Right Software for Invoices

Selecting the right software for managing your billing documents is crucial for improving efficiency, accuracy, and professionalism. The right tool can simplify the creation, tracking, and management of financial records, saving you time and reducing the risk of errors. When choosing software, consider factors such as ease of use, customization options, and integration with other business tools.

Here are some key features to look for when selecting software for your billing needs:

- Ease of Use: The software should have an intuitive interface that allows you to quickly create and send documents without requiring extensive training or technical knowledge.

- Customization Options: Look for a program that lets you customize the layout, branding, and content of your documents. This ensures your billing records align with your business identity.

- Automation Features: Choose software that automates repetitive tasks like sending reminders, calculating totals, or generating recurring documents. Automation helps save time and reduce human error.

- Cloud-Based Access: Cloud-based tools allow you to access your billing records from any device, which is especially useful for businesses that need to manage documents on the go or collaborate with a team.

- Integration Capabilities: Ensure the software integrates well with other tools you use, such as accounting software or CRM systems. This reduces the need for manual data entry and improves accuracy.

- Security Features: Billing documents often contain sensitive information. Ensure the software provides robust security features, such as encryption and secure cloud storage, to protect your data.

- Customer Support: A good software provider should offer reliable customer support, whether through live chat, email, or phone. This is essential if you encounter issues or need assistance with advanced features.

By carefully evaluating these factors, you can choose the software that best meets your needs and helps streamline your billing process. The right solution will make managing financial records more efficient and less time-consuming, allowing you to focus on growing your business.