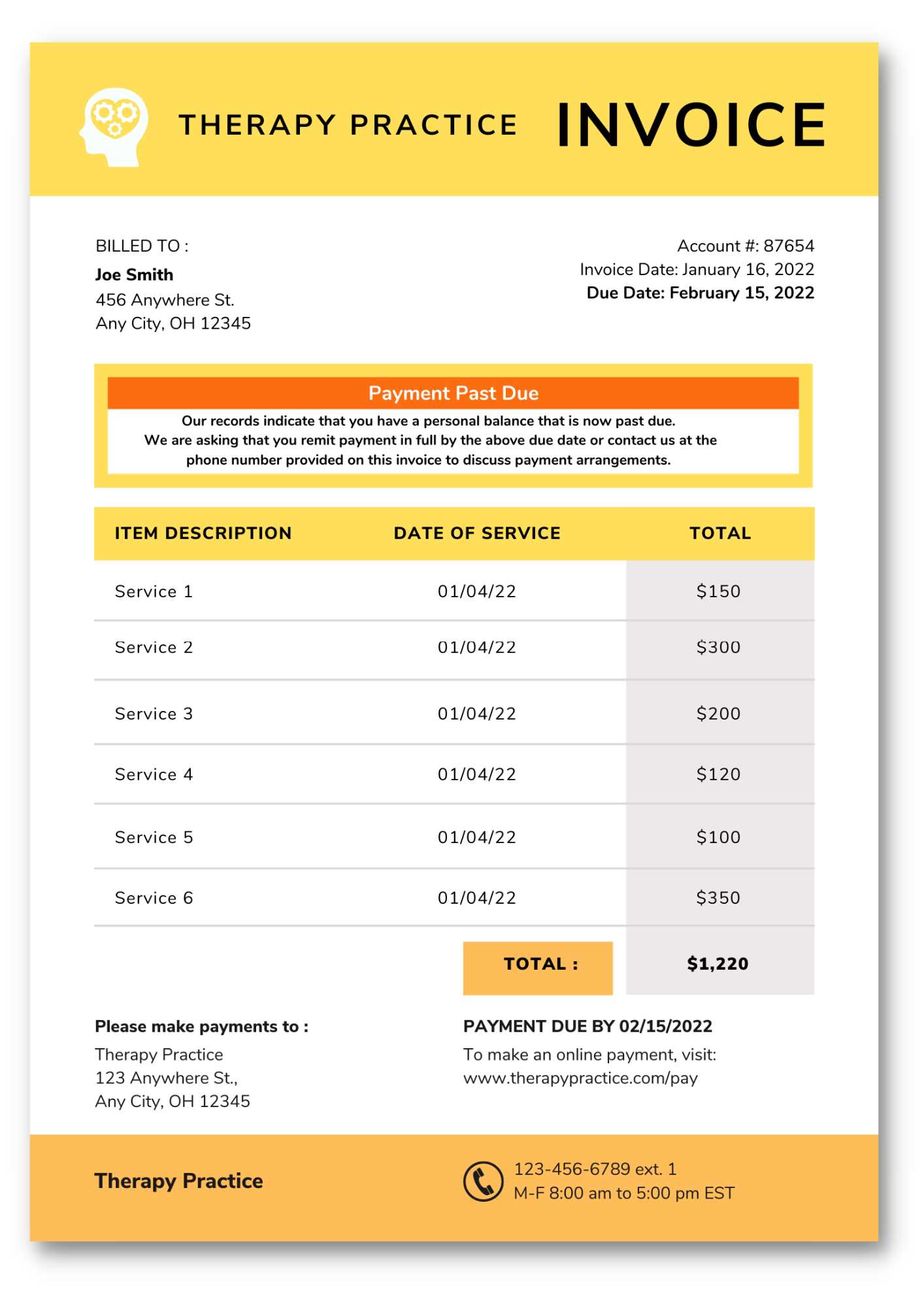

Balance Due Invoice Template for Efficient Payment Management

Effective financial management is essential for businesses of all sizes, and ensuring timely payment collection is a key part of that process. A well-organized document that helps you track outstanding amounts is a crucial tool in maintaining smooth operations. By using ready-made formats, companies can streamline the billing process and keep their accounts in order.

These ready-to-use forms simplify the task of reminding clients about payments while maintaining a professional image. They help you avoid confusion and reduce delays, allowing for quicker processing of receivables. Moreover, customizing such forms can ensure they reflect your brand’s identity and meet your specific needs.

With the right approach, managing customer payments becomes less time-consuming, letting you focus on growing your business. Having a reliable system for handling overdue amounts not only improves cash flow but also enhances customer relationships by providing clarity and transparency.

Balance Due Invoice Template Overview

In any business, keeping track of payments and ensuring that amounts owed are collected on time is vital for smooth financial operations. One of the most effective ways to achieve this is through the use of pre-structured documents designed to remind clients of unpaid amounts. These documents outline key payment details and provide a professional means of communication between businesses and their customers.

Using a pre-made structure allows businesses to save time and effort. It provides a clear format for listing amounts outstanding, due dates, and other relevant information, all while maintaining consistency. Additionally, such tools can be easily customized to suit specific needs and ensure they match a company’s branding, making them more effective in maintaining professionalism.

Key Features of the Document

| Feature | Description |

|---|---|

| Contact Information | Details of the company and the recipient, including names, addresses, and phone numbers. |

| Outstanding Amount | The total sum that has not been paid yet, clearly highlighted. |

| Payment Terms | Details on how and when payment should be made, including accepted methods. |

| Invoice Number | A unique number assigned to each document for reference and tracking. |

| Due Date | The date by which the payment is expected, helping clients prioritize payments. |

Why Use This Structured Document?

Implementing such an organized system not only makes managing unpaid bills more efficient but also helps foster a better relationship with customers. It reduces the chance of misunderstandings and provides both parties with a clear point of reference for follow-up actions. Ultimately, a well-designed document is a simple yet powerful tool that supports business cash flow and helps to avoid unnecessary delays.

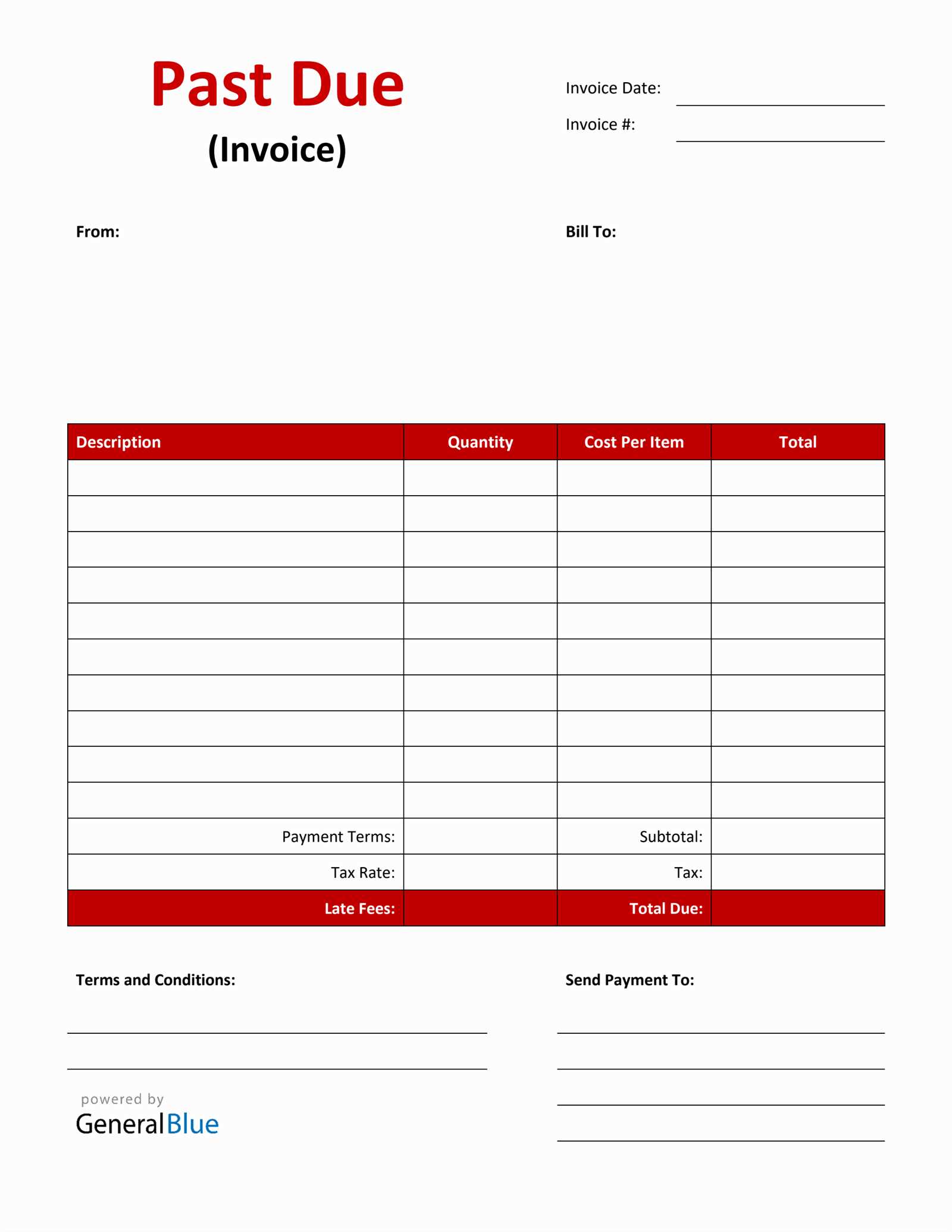

How to Create a Balance Due Invoice

Creating a document to remind clients of unpaid amounts is an important step in managing finances. A well-organized form ensures all the essential information is presented clearly and professionally, helping businesses collect payments more efficiently. By following a few simple steps, you can create a document that outlines what is owed, who owes it, and when it should be paid.

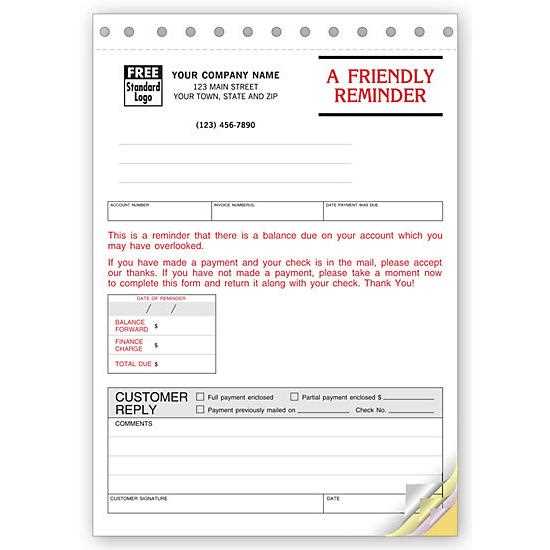

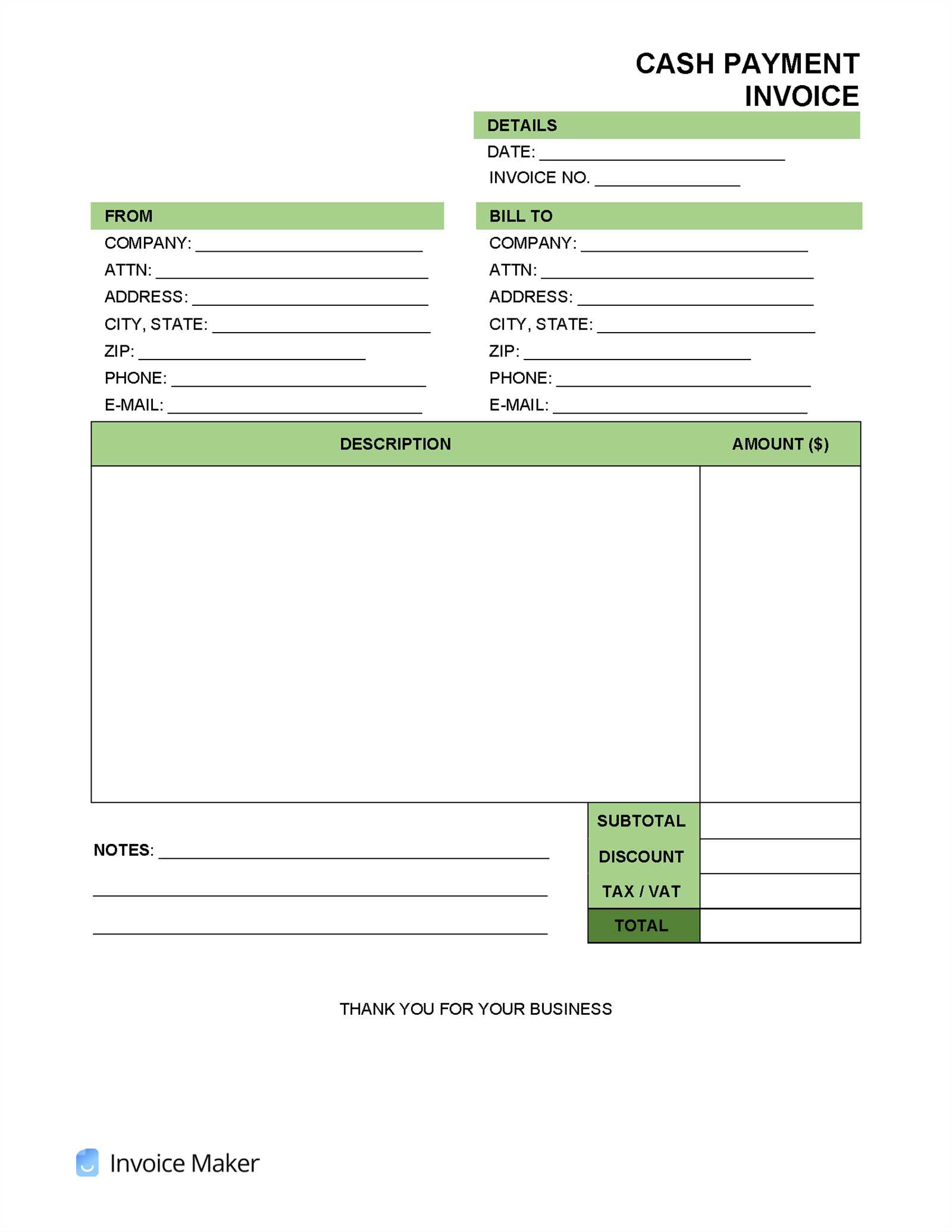

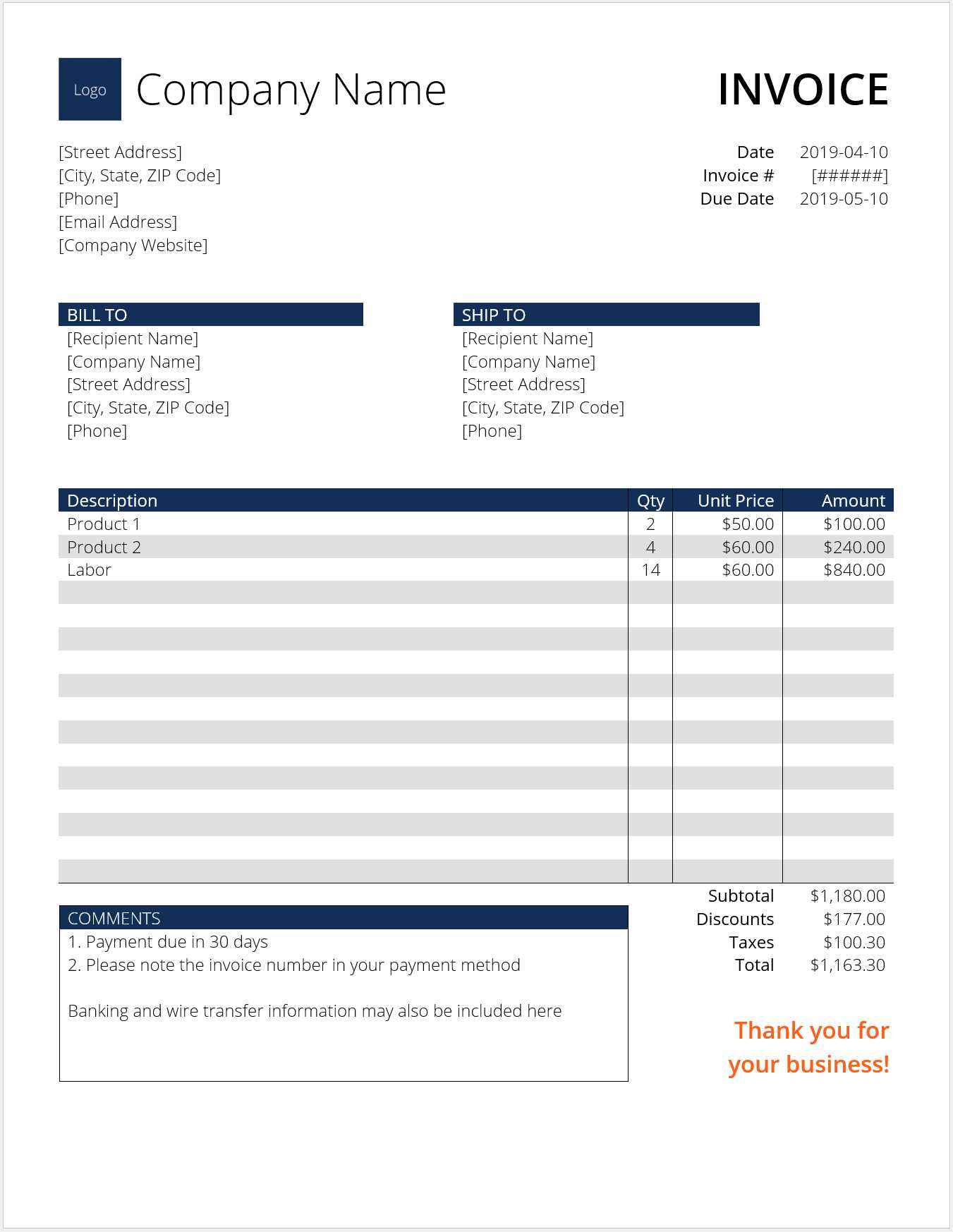

The first step is to include your company’s contact details at the top, such as name, address, phone number, and email. This makes it easy for clients to reach out if they have any questions or need clarification. Then, clearly state the client’s information, ensuring you have their full name or company name, address, and contact details as well.

Next, include a unique reference number for the document. This number will help both parties track the payment more easily. Be sure to list the total amount owed in a clear, bold font, and provide a breakdown if necessary, explaining the charges or services rendered.

In addition, make sure to mention the payment terms, including the accepted methods and the expected payment date. This information removes ambiguity and provides clear expectations for both parties. Finally, finish the form with a thank you note or a reminder about the importance of making timely payments.

Key Components of a Balance Due Invoice

When creating a document to request payment, it’s important to include all the necessary information that both the business and the client will need. This ensures that the process remains clear, organized, and professional. Each section of the document serves a distinct purpose, helping to avoid confusion and ensuring that payments are made promptly.

Essential Elements

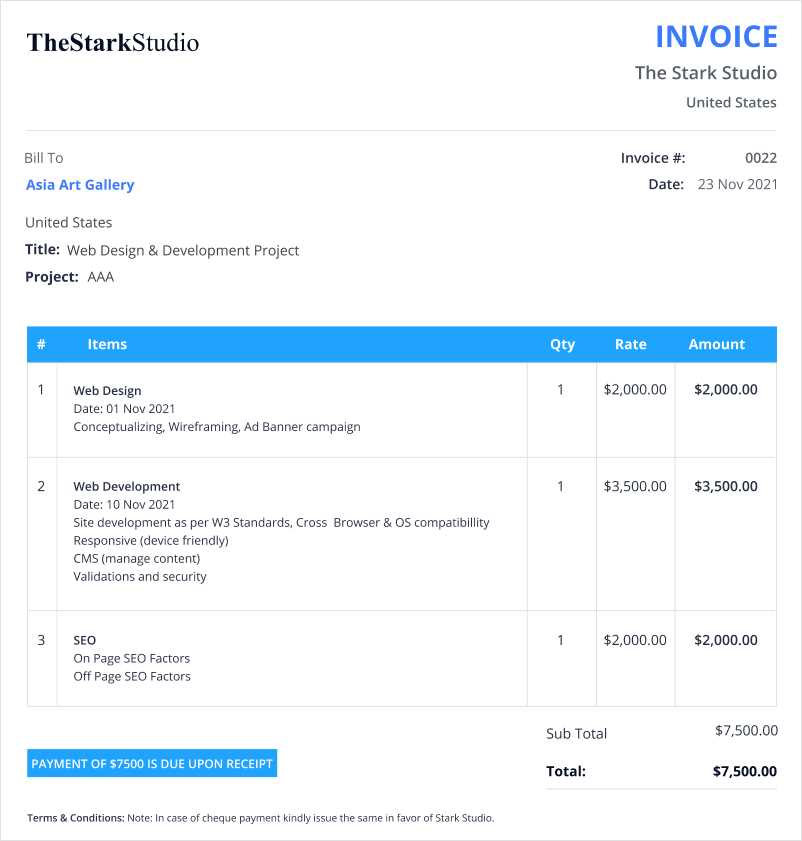

- Company Information: At the top of the document, include your company name, address, phone number, and email address.

- Client Information: Below your details, list the recipient’s name or company name and their contact information, including address and phone number.

- Document Number: Assign a unique reference number to each document for easy tracking and record-keeping.

- Amount Owed: Clearly state the total amount the client owes, preferably in a bold or larger font.

- Itemized List of Charges: If applicable, provide a breakdown of the goods or services provided, along with individual costs for transparency.

- Payment Terms: Specify the accepted payment methods (e.g., bank transfer, credit card) and any terms regarding late payments, such as interest or fees.

- Due Date: Mention the date by which the payment should be made to avoid delays.

Additional Considerations

- Notes or Comments: Add any necessary notes, such as instructions for payment or a brief thank-you message to the client.

- Legal Information: If required, include any legal disclaimers or terms about the agreement or service provided.

- Follow-up Information: Provide contact information for follow-up questions or concerns regarding the payment.

Why Use a Balance Due Invoice Template

Using a pre-designed document to request payment from clients offers numerous advantages that can help streamline the billing process. With a standardized format, businesses can save valuable time while ensuring that all necessary details are included, reducing the risk of errors. This tool simplifies the task of collecting payments and maintaining financial organization, making it a must-have for many businesses.

Efficiency and Time-Saving

One of the key benefits of using a pre-made structure is the significant amount of time saved. Rather than creating a new document from scratch each time, you can simply fill in the relevant details, such as client information, amount owed, and payment terms. This eliminates the need for repeated formatting and ensures that your payment reminders are consistently professional and accurate.

Professional Appearance and Consistency

Pre-designed documents maintain a professional look and feel that can help reinforce your brand’s image. By using a uniform format, you present your business as organized and trustworthy, which can positively influence your client relationships. Additionally, this consistency helps ensure that every payment request includes the necessary information, reducing confusion and improving communication.

Benefits of Customizable Invoice Templates

Having a customizable document for payment requests offers a range of advantages that go beyond basic functionality. These adaptable forms allow businesses to tailor each document to their specific needs, ensuring that every payment reminder aligns with company branding and client expectations. Customization increases flexibility and improves the overall experience for both the business and the client.

Personalization and Branding

Customizable forms give businesses the opportunity to incorporate their brand identity into each document. By adding your company logo, using your brand’s color scheme, and including a personalized message, you ensure that each request reflects the professionalism and values of your business. This helps reinforce your brand in the minds of clients and fosters stronger relationships.

Flexibility in Structure

Another key benefit of using adaptable formats is the flexibility they offer in terms of content structure. You can modify the layout, add or remove sections, and adjust the details to fit the specific nature of each transaction. This ensures that the document is always relevant and meets the requirements of both your business and the customer. Whether it’s adjusting payment terms or including additional service details, customization ensures the document works for you.

Common Mistakes in Balance Due Invoices

When creating documents to request payment, businesses often make several common errors that can lead to confusion, delays, or even missed payments. These mistakes can affect the professionalism of the request and create unnecessary misunderstandings with clients. Understanding and avoiding these pitfalls is essential to ensuring that payment reminders are clear, effective, and reliable.

Common Errors to Avoid

| Error | Consequence | How to Avoid |

|---|---|---|

| Missing Contact Information | Clients may struggle to reach out for questions or clarifications. | Ensure both your company and the client’s contact details are listed clearly. |

| Unclear Payment Terms | Clients may misunderstand how or when to pay, leading to delays. | Clearly state accepted payment methods and the expected payment date. |

| Incorrect Amounts | Incorrect figures can lead to disputes or delayed payments. | Double-check the totals and provide an itemized breakdown if necessary. |

| Lack of Reference Number | Without a reference, tracking payments becomes difficult. | Assign a unique reference number to each document for easier tracking. |

| Missing Legal or Follow-Up Information | Failure to include legal terms or contact info could lead to confusion or legal issues. | Include any relevant legal disclaimers and your contact information for follow-ups. |

Ensuring Accuracy and Professionalism

Taking the time to avoid these common mistakes will help create a smoother payment process, strengthen your relationship with clients, and ensure that your business remains professional and efficient. Accuracy and clarity are key to effective financial communication.

How to Avoid Late Payments with Invoices

Ensuring that payments are made on time is a critical part of maintaining a healthy cash flow. Late payments can disrupt your business operations, causing unnecessary stress and financial strain. One of the most effective ways to minimize delays is by creating clear, concise documents that outline payment expectations and deadlines. Properly managing the process from the start can encourage prompt payments and prevent issues down the road.

Set Clear Expectations from the Start

Clear communication is key to avoiding late payments. When sending a document requesting payment, always specify the exact payment date and provide details on the accepted methods of payment. Additionally, ensure that your clients understand the consequences of not paying on time, such as potential late fees or service interruptions. Setting these expectations upfront helps clients prioritize your payment and reduces the chances of delays.

Follow Up and Send Reminders

Even with clear instructions, some clients may still forget or delay payments. It’s important to follow up regularly to remind them of the outstanding amount. Sending a polite reminder a few days before the payment is expected can help keep it top of mind. For clients who repeatedly miss deadlines, you can implement a more structured follow-up process, which might include automatic reminders or escalated actions.

What Information Should Be on the Invoice

For a payment request document to be effective, it must include all the necessary details to ensure clarity and avoid confusion. The right information not only helps the client understand what is being requested, but also makes the payment process more efficient. Here are the key pieces of information that should always be included.

- Your Company Information: Include your business name, address, phone number, and email. This makes it easy for clients to reach out if they have any questions.

- Client Information: Include the name or business name of the recipient, along with their address and contact details.

- Document Number: Assign a unique reference number to each request for easy tracking and record-keeping.

- Issue Date: Clearly state the date the request was issued to help track payment timelines.

- Amount Owed: The total amount that is owed should be clearly highlighted to avoid any misunderstandings.

- Detailed Breakdown: List the individual products or services provided, along with their costs, to provide full transparency.

- Payment Terms: Outline acceptable payment methods (e.g., credit card, bank transfer) and any terms for late payments or penalties.

- Due Date: Clearly specify the expected date of payment to ensure timely processing.

- Thank You or Notes: A brief thank you message or additional instructions can make the document feel more personable.

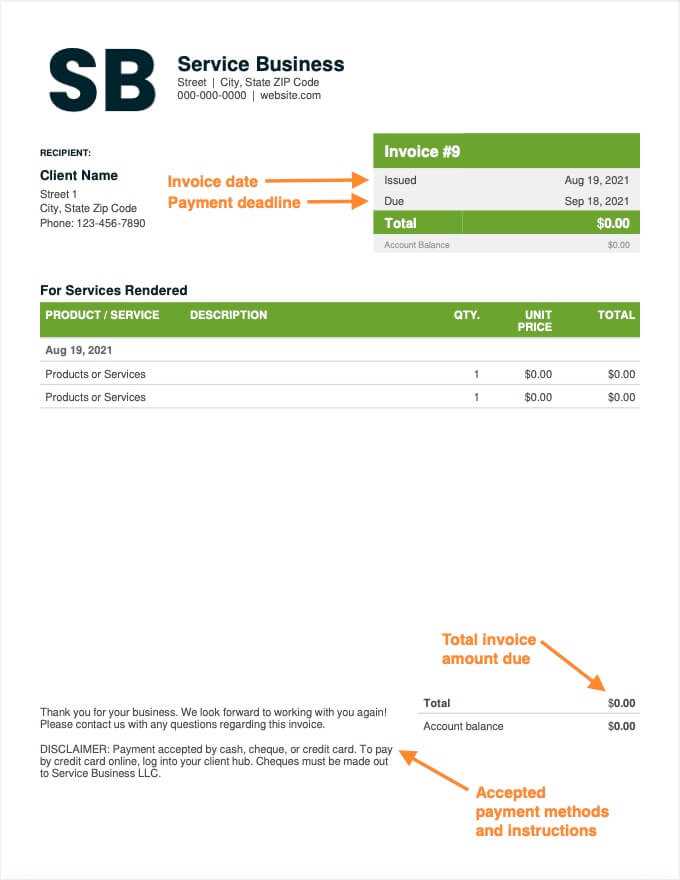

Tips for Professional Invoice Design

A well-designed document for payment requests not only ensures clarity but also reinforces your business’s professionalism. The layout and appearance can significantly impact how your clients perceive your business and the importance of timely payment. By focusing on a few key design elements, you can create documents that are easy to understand and visually appealing, while also maintaining a professional tone.

Key Design Tips for a Professional Look

- Keep It Simple and Clean: Avoid clutter. Use white space effectively to create a balanced layout. A clean, easy-to-read design improves the likelihood that your document will be taken seriously.

- Use Your Brand’s Colors and Fonts: Incorporating your company’s brand colors and fonts helps reinforce your identity and makes the document feel more personal and aligned with your business.

- Organize Information Logically: Arrange details in a logical order. Begin with your company information, followed by client details, itemized charges, and payment terms. This ensures the recipient can quickly find what they need.

- Highlight Important Details: Make key elements, like the amount owed and payment date, stand out by using bold text or larger fonts. This draws the client’s attention to the most critical parts of the document.

- Ensure Readability: Use legible fonts and a font size that is easy to read. Avoid overly decorative fonts that can make the document look unprofessional or hard to interpret.

- Include Clear Contact Information: Always make sure your contact details are clearly visible, including your phone number, email, and website, if applicable. This ensures the client knows how to reach you with any questions or concerns.

- Add a Personal Touch: While maintaining professionalism, don’t forget to add a polite message or thank-you note. It shows courtesy and can strengthen customer relations.

How to Calculate Balance Due on Invoices

Accurately calculating the remaining amount owed on a payment request is a crucial step in ensuring that your business receives the correct amount from clients. Whether you are dealing with partial payments, discounts, or adjustments, understanding how to determine the final amount helps prevent errors and ensures financial transparency. The process involves simple arithmetic but requires careful attention to detail to avoid discrepancies.

Steps for Accurate Calculation

To calculate the amount remaining, follow these steps:

- Start with the Total Amount: Begin by noting the original total price of the goods or services provided.

- Account for Payments Already Made: Subtract any partial payments the client has already made from the original amount. If payments have been made through multiple transactions, add them together before subtracting.

- Apply Any Discounts or Adjustments: If there are any applicable discounts, promotions, or price adjustments, subtract these amounts from the total. Make sure to apply them before calculating the remaining balance.

- Include Any Additional Fees: If late fees or additional charges have been applied, add them to the amount owed.

Final Calculation Example

Let’s say your original amount is $500. If the client has made a payment of $200 and there is a 10% discount, you would subtract $200 and then calculate the discount:

- Original amount: $500

- Payment made: $200

- Discount: 10% of $500 = $50

- Remaining amount = $500 – $200 – $50 = $250

The final amount owed would be $250.

Formatting Options for Balance Due Invoices

Choosing the right formatting options for your payment request documents can enhance their readability and professionalism. The layout and design elements you choose can significantly impact how your client perceives the document and whether they pay on time. By using clear, structured formatting, you can ensure that all necessary details are easy to find and understand, reducing the likelihood of misunderstandings or delays in payment.

Essential Formatting Considerations

- Font Choice: Use a simple, clean font that is easy to read. Common professional fonts include Arial, Helvetica, and Times New Roman. Avoid overly decorative fonts, as they can make the document look unprofessional.

- Font Size: Make sure the text size is large enough to be legible. Typically, body text should be between 10-12pt, while headings can be larger to stand out.

- Whitespace: Proper use of whitespace ensures the document doesn’t feel cluttered. It helps create a clean, organized appearance, making it easier for clients to navigate the information.

- Alignment: Align text consistently. Left alignment is typically the easiest to read for documents. Ensure that all headings, amounts, and key information are aligned properly to maintain a professional appearance.

- Tables for Itemized Charges: Use tables to break down the services or products provided. This helps keep the document organized and makes it easier for the client to see what they are being charged for.

Advanced Formatting Options

- Bold and Italics: Use bold text to highlight important details like the total amount owed or payment terms. Italics can be used for secondary information, such as notes or reminders.

- Color Scheme: Stick to a simple color scheme that aligns with your branding. Use colors sparingly, such as for headings or key figures like totals, to create emphasis without overwhelming the reader.

- Branding Elements: Incorporate your company logo, and if possible, use your brand colors to give the document a personalized and professional look.

- Footer Section: Consider adding a footer with your contact information, payment instructions, or terms and conditions. This ensures the client has all the necessary information for follow-up or clarifi

When to Send a Balance Due Invoice

Knowing the right time to send a payment request is crucial for maintaining a smooth cash flow. Timing plays an important role in ensuring that clients receive the necessary reminders without feeling overwhelmed. Sending your document at the appropriate moment can help you get paid on time and maintain positive relationships with clients. There are specific scenarios when it is most effective to send these documents, depending on the terms of your agreement and the nature of your business.

Optimal Timing for Payment Requests

Scenario When to Send Reason Upon Completion of Work Send immediately after the work or service is completed. It ensures clients are aware of the amount owed right after the service is provided. On or Before the Agreed Payment Date Send a few days before the agreed date to remind clients. Helps avoid delays and reminds clients of their obligation to pay. After Partial Payments Send once a partial payment has been made. Updates the client on the remaining amount and provides clarity on what is still owed. When Payment is Overdue Send as soon as the payment deadline passes without payment. Provides a polite reminder and encourages prompt payment after a missed deadline. By carefully selecting when to send your payment request documents, you can help prevent payment delays and foster a more efficient billing process. Be sure to communicate clearly and professionally at each stage of the payment cycle to ensure timely payments and positive client interactions.

Integrating Templates with Accounting Software

Integrating your payment request documents with accounting software streamlines the financial management process and reduces the risk of errors. When your payment requests are automatically generated and linked to your accounting system, it ensures that all transactions are recorded accurately and in real time. This integration can save time, improve efficiency, and make it easier to track outstanding amounts, generate reports, and maintain overall financial health.

Benefits of Integration

- Automated Record-Keeping: Automatically syncing payment requests with accounting software ensures all transactions are logged, reducing manual data entry and the risk of errors.

- Efficient Tracking: Real-time updates allow you to easily track which amounts have been paid and which are still outstanding, helping to manage cash flow more effectively.

- Consistency Across Documents: Integration ensures that the format and structure of your documents remain consistent, reducing the need for manual adjustments and ensuring professional presentation.

- Time Savings: With integration, creating payment requests and reconciling accounts is much faster, allowing you to focus more on running your business and less on administrative tasks.

How to Integrate with Accounting Software

Many accounting software platforms, such as QuickBooks, Xero, and FreshBooks, offer integration with document creation tools. Here’s a basic outline of how to integrate:

- Choose Compatible Software: Ensure your accounting software supports integration with your document creation tools.

- Sync Client Information: Import your client details from your accounting software to avoid duplicate entry and ensure that all information is up to date.

- Automate Document Generation: Set up your software to automatically generate and send payment requests based on your established terms and agreements.

- Enable Real-Time Syncing: Make sure all payment data is synchronized between your software and your payment request documents to maintain accuracy and consistency.

By integrating your payment request documents with accounting software, you can create a seamless financial workflow that saves time and reduces the potential for errors.

Legal Considerations for Balance Due Invoices

When creating a document that requests payment, it’s important to be aware of the legal aspects involved in the process. While these documents are a standard business practice, they also serve as a formal record of an agreement between you and your client. Ensuring that the document complies with legal standards helps protect both parties and can serve as evidence in case of disputes. Understanding your rights and obligations, as well as including necessary legal elements, is essential for maintaining a legally sound business operation.

Key Legal Elements to Include

- Clear Payment Terms: Be explicit about the amount owed, the payment methods accepted, and any additional charges such as late fees or interest. Make sure these terms are agreed upon beforehand, ideally outlined in a signed contract.

- Late Fees and Penalties: If you plan to charge fees for delayed payments, ensure that these terms are clearly stated and agreed to before the transaction. Be aware of local laws governing the maximum allowable late fees in your jurisdiction.

- Legal Jurisdiction: Specify the jurisdiction under which the agreement falls. This ensures that if any legal action is required, both parties are clear on the governing laws and the location for potential legal proceedings.

- Compliance with Local Laws: Ensure that your payment requests comply with local business regulations, which may include requirements for certain disclosures or protections for clients. For example, consumer protection laws may require specific language when dealing with individuals rather than businesses.

- Record of Agreement: Keep a copy of all signed contracts, communications, and documents related to the transaction as they can serve as legal proof in case of a dispute.

Protecting Yourself in Case of Disputes

Even with the best intentions, disputes can arise over payment. To protect yourself legally, always ensure that:

- Contracts are in Writing: Having a written agreement outlining the scope of work, payment terms, and deadlines can help protect both parties in the event of a dispute.

- You Follow Up Professionally: In case of non-payment, sending formal reminders and documenting all communications will provide evidence if the issue escalates to legal action.

- Dispute Resolution Methods are Defined: Consider including a dispute resolution clause in your contracts, such as arbitration or mediation, to resolve issues without resorting to litigation.

- Assign Unique Reference Numbers: Ensure each document you send includes a unique identifier or reference number. This helps you quickly track and match payments with the correct transaction.

- Record Payment Details: When a payment is received, note the amount, date, and method of payment (e.g., bank transfer, credit card, or check). Keep detailed records for future reference and to avoid discrepancies.

- Update Your Records: After receiving a payment, update your financial system or bookkeeping records immediately. This ensures your accounts are always up to date and accurately reflect what has been paid and what is still owed.

- Include a Payment Status Field: On each document, include a section to indicate the payment status (e.g., “Paid,” “Partial Payment,” or “Outstanding”). This provides a clear overview of the client’s payment history at a glance.

- Accounting Software: Many accounting platforms, such as QuickBooks, Xero, and FreshBooks, automatically track payments, update records, and generate reports. These tools can reduce the chances of human error and save time.

- Spreadsheets: If you’re managing finances manually, using a spreadsheet program like Microsoft Excel or Google Sheets can help you track payments, sort data, and create payment summaries.

- Payment Management Apps: Consider using apps designed for managing payments and invoices, such as PayPal or Stripe. These platforms offer built-in tracking features and allow you to view payment histories in real time.

- Faster Payment Processing: A clear and professional payment request ensures that clients understand the amount owed and the payment terms. This clarity reduces confusion, resulting in quicker payment processing.

- Accurate Record-Keeping: When your payment requests are consistently formatted and tracked, you can easily monitor outstanding payments and take timely action to follow up on overdue amounts.

- Reduced Errors: By using a standardized format, you eliminate the risk of missing key information, such as payment amounts, due dates, or payment methods. This helps to avoid disputes and delays caused by incomplete or incorrect details.

- Automated Reminders: Many software tools allow you to automatically send follow-up reminders based on pre-set schedules. This ensures that you don’t forget to remind clients of upcoming or overdue payments, reducing manual tracking and increasing the chances of timely payments.

How to Track Payments with Invoices

Tracking payments effectively is essential for maintaining accurate financial records and ensuring that your business receives the appropriate compensation for services or products provided. By systematically recording payment details and updating your accounts, you can easily monitor outstanding amounts and prevent errors in your financial management. Implementing a clear and organized approach will help you maintain an efficient workflow and reduce the risk of missing payments.

Steps to Track Payments

Here are key steps to follow when tracking payments related to your transactions:

Tools for Tracking Payments

Using the right tools can streamline the payment tracking process and improve accuracy:

By following a systematic approach and using the right tools, you can easily track payments, maintain accurate records, and ensure that your business runs smoothly. Effective payment tracking will help minimize delays, improve cash flow, and keep your financial operations on track.

Improving Cash Flow with Invoice Templates

Effective management of cash flow is vital for maintaining the financial health of any business. One of the key factors in optimizing cash flow is ensuring that payments are processed quickly and accurately. Using well-structured payment request documents can play a crucial role in achieving this. By streamlining the billing process and reducing payment delays, you can improve the predictability of your cash flow and keep your operations running smoothly.

How Structured Payment Requests Help

Best Practices to Optimize Cash Flow

- Set Clear Payment Terms: Specify when payment is expected and what methods are accepted. Include any late fees or penalties for overdue amounts. This will help encourage prompt payment from clients who are aware of the consequences of missing deadlines.

- Send Payment Requests Promptly: Send your payment requests as soon as a transaction is completed or at the agreed-upon time. The quicker you send the document, the sooner clients can process the payment.

- Offer Multiple Payment Options: Providing several ways to pay, such as credit cards, bank transfers, or online payment systems, makes it easier for clients to pay quickly and reduces barriers to payment.

- Follow Up Professionally: If payments are not received by the agreed-upon date, follow up with a polite reminder. Using automated reminders can save you time and ensure that clients don’t forget about the payment.

By leveraging well-organized payment requests and implementing best practices, you can significantly enhance your business’s cash flow. Efficient billing and prompt payments not only improve financial stability but also f