Free Blank Service Invoice Template for Easy Use

When managing business transactions, having a structured document to request payment is essential for smooth operations. A well-designed billing form ensures clarity and helps maintain professionalism with clients. By using a customizable form, you can easily capture all necessary details to reflect the services or products provided.

These documents serve as a formal agreement between you and your clients, outlining the work completed and the payment required. Whether you’re a freelancer, contractor, or small business owner, a customizable document streamlines your workflow and eliminates unnecessary confusion when it’s time to settle accounts.

With the right resources, you can create these important files without hassle. In this guide, you’ll discover how to set up a document that meets your needs, saving you time and ensuring accuracy in every transaction.

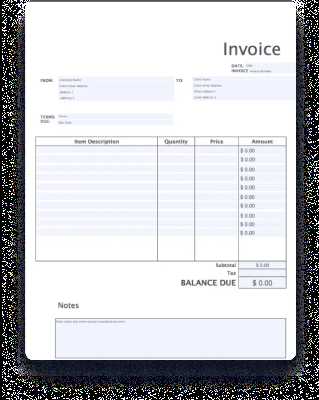

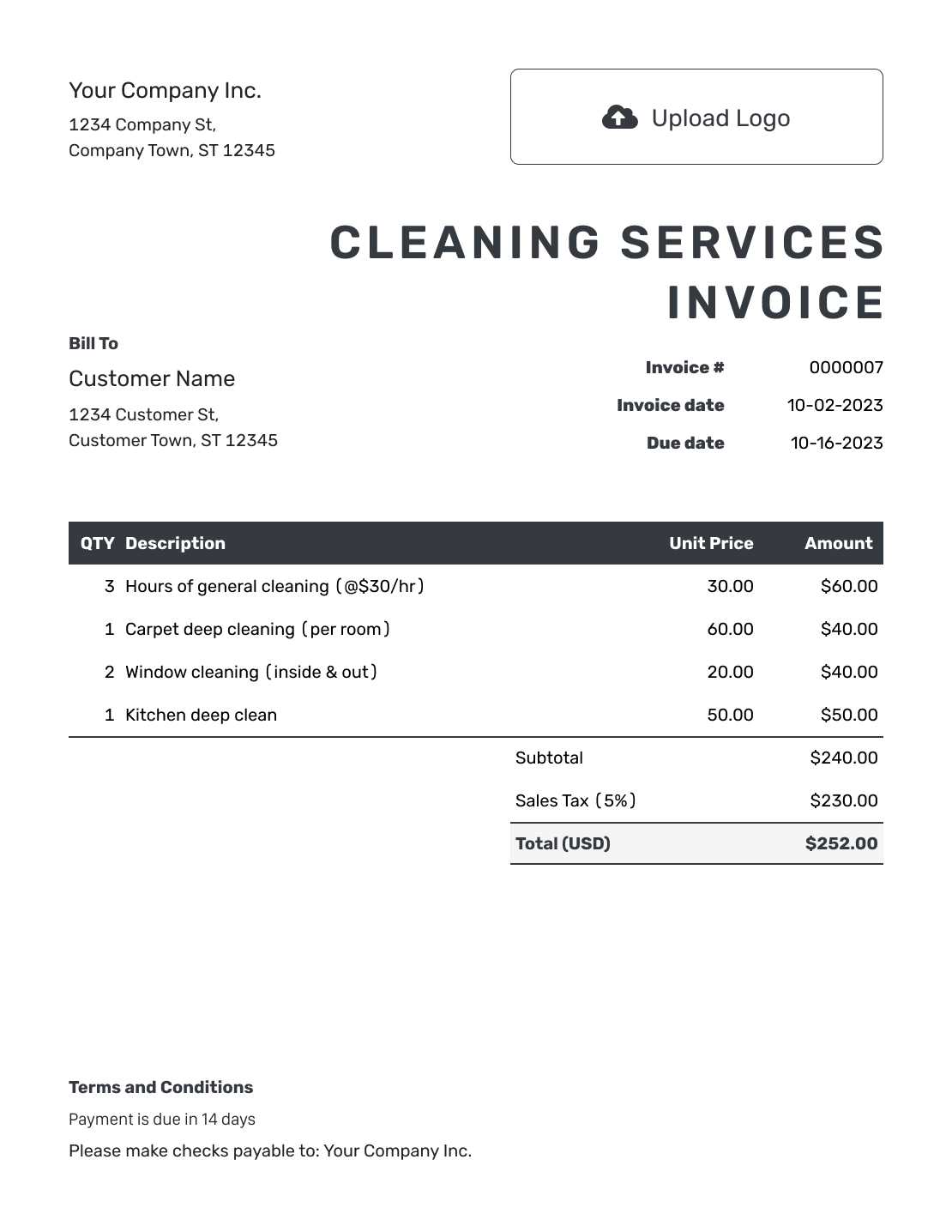

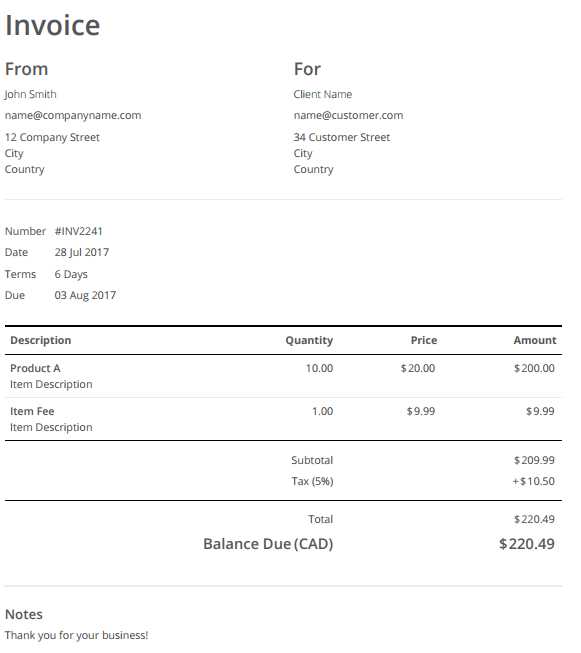

Free Blank Service Invoice Template

For any business, having a reliable document to request payments is crucial for keeping financial transactions clear and organized. A structured format that can be easily modified allows businesses to efficiently document the details of a transaction and ensure accuracy in billing. By utilizing a ready-made format, professionals can focus more on their work and less on administrative tasks.

How to Use a Customizable Billing Document

With a customizable billing form, it’s possible to tailor each section to meet the specific needs of different clients or projects. The key is to include essential fields like contact information, dates, services rendered, and payment terms. By adapting the document to your business type, you ensure that every detail is covered in an organized and professional manner.

Basic Elements to Include

| Field | Description |

|---|---|

| Client Information | Name, address, and contact details of the client. |

| Work Details | Description of the tasks or items provided, including quantities and rates. |

| Payment Terms | Details on due dates, payment methods, and any late fees. |

| Subtotal & Total | Breakdown of charges, taxes, and the final amount due. |

Using a predefined format ensures consistency in your billing process and minimizes the risk of errors. With just a few adjustments, it can be tailored for any project or client, making it a valuable tool for both small and large businesses.

How to Create a Service Invoice

Creating a professional billing document is an essential skill for any business. It not only helps you keep track of transactions but also ensures that your clients receive clear and accurate details about the charges. By following a structured approach, you can quickly generate a document that meets both your needs and your client’s expectations.

Steps to Design Your Billing Document

The first step in designing an effective document is to include all necessary elements in a clear and organized manner. Start by gathering essential information such as the client’s name, contact details, and the agreed-upon payment terms. The next step is to specify the work completed or products provided, including the quantities and rates. Always double-check that the charges are accurate and align with the initial agreement.

Important Sections to Include

Client Details: Include the client’s full name, address, and contact information. Make sure this section is easy to find, as it helps both you and your client reference the transaction.

Work Description: Clearly outline the tasks or items provided. Use precise language to describe the services delivered, and provide the applicable rates and quantities for each.

Payment Terms: Set clear terms for payment, including the due date and acceptable payment methods. It’s important to mention any applicable late fees or discounts for early payment, if relevant.

By following these steps and including these details, you will create a clear and professional billing document that helps ensure timely payments and reduces the risk of confusion or disputes.

Top Features of an Invoice Template

When creating a billing document, it’s essential to have the right features to ensure clarity, professionalism, and accuracy. A well-designed form includes specific elements that help both the business and the client understand the transaction and ensure timely payments. These key features improve the document’s efficiency and streamline the payment process.

Essential Elements for a Complete Document

A well-structured billing document includes several important sections that provide a full overview of the transaction. From client information to payment terms, these components ensure transparency and ease of understanding for both parties.

Key Features in a Billing Document

| Feature | Description |

|---|---|

| Contact Information | Clear details for both parties to easily identify and communicate. |

| Itemized List | Breakdown of services or goods provided, with associated rates and quantities. |

| Payment Instructions | Clear terms on how and when payments are to be made, including late fees if applicable. |

| Unique Identification | A reference number or code to distinguish each transaction for easy tracking. |

| Due Date | The date by which payment should be made to avoid delays or additional charges. |

These features not only improve the document’s functionality but also give it a professional appearance. Whether you are working with clients on small projects or large contracts, including these components will help ensure that all necessary details are communicated clearly and accurately.

Why Use a Blank Invoice Template

Using a standardized document for billing purposes offers many advantages. It simplifies the process of requesting payment and ensures that all important information is included in a consistent format. By utilizing a pre-designed form, businesses can save time, reduce errors, and maintain a professional appearance when dealing with clients.

Time-Saving and Efficiency

One of the biggest benefits of using a ready-made form is the amount of time it saves. Instead of creating a new document from scratch for every transaction, you can quickly modify an existing layout to fit the specific details of each job. This streamlined approach makes managing multiple transactions much easier.

Consistency and Professionalism

Consistency is key in building trust with clients. Using a uniform billing format helps clients recognize your brand and understand your business practices. A well-organized, professional document reflects your commitment to quality and attention to detail. By relying on a proven structure, you ensure that every transaction is handled with the same level of professionalism.

Incorporating a standard form also reduces the likelihood of missing important details, such as payment terms or client contact information, which could otherwise lead to confusion or delayed payments.

Benefits of Customizing Your Invoice

Personalizing your billing document can have a significant impact on your business’s efficiency and customer relationships. By adapting the document to suit your needs, you can ensure that it reflects your brand and the specifics of each transaction. This level of customization makes the process smoother and more professional for both you and your clients.

Enhanced Professional Image

When you tailor your billing document to match your business identity, it presents a polished and cohesive brand image. Customizing the design, layout, and content helps convey professionalism and attention to detail. Clients will appreciate the thoughtfulness behind a tailored document, leading to stronger business relationships and repeat customers.

Greater Flexibility and Accuracy

With a customizable layout, you can easily adjust sections to reflect the unique aspects of each transaction. This flexibility ensures that all relevant information is included, such as customized payment terms, job details, or discounts. It reduces the risk of errors or omissions, ensuring your clients receive accurate and clear billing information. Customizing your document also makes it easier to handle different types of transactions or payment schedules, offering a higher level of service to your clients.

By tailoring your billing documents, you improve not only operational efficiency but also the overall client experience, fostering trust and enhancing the professionalism of your business.

Essential Details to Include in Invoices

When creating a billing document, it’s important to ensure that all necessary information is included to avoid confusion and facilitate smooth transactions. A well-constructed form captures all the essential details that both the business and the client need to complete the process efficiently. By focusing on the right components, you help ensure clarity and reduce the chance of payment delays or disputes.

Key Information to Include

The document should contain specific sections that cover all aspects of the transaction. Some of the most important elements include:

- Client and Business Information: Make sure the client’s name, address, and contact details are clearly displayed, along with your business’s information.

- Unique Reference Number: Include a unique identifier for each transaction to help both parties track and reference the details.

- Work Description: Clearly outline the services or products provided, including quantities and rates.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees or discounts that apply.

- Total Amount Due: Provide a breakdown of the charges, including taxes and the final amount the client owes.

Why These Details Matter

Including these essential components ensures that both parties understand the financial agreement and can easily follow up on the transaction if needed. It also helps prevent misunderstandings about payment amounts or terms. By clearly communicating these points, you establish trust and demonstrate professionalism to your clients.

Having these details in place guarantees that your transaction records are accurate and transparent, making it easier to manage payments and keep financial records organized.

How to Download Free Templates

Accessing customizable billing forms online is a straightforward process, allowing businesses to save time while ensuring consistency in their financial documents. Many websites offer ready-to-use options that can be downloaded, edited, and tailored to suit individual needs. Whether you’re a small business owner or an entrepreneur, getting the right document is easy and can help streamline your administrative work.

To begin downloading these forms, simply visit a trusted source that provides editable files. Often, these forms are available in various formats, such as Word, PDF, or Excel, making it easy for you to select the one that fits your needs. Most platforms require you to navigate to the appropriate section, choose your preferred layout, and download the file directly to your device.

Once the form is downloaded, you can easily make modifications such as adding company branding, changing payment terms, or including specific services. This ensures that your billing documents are tailored to your business practices, enhancing the professionalism of your transactions.

Tips for Organizing Your Invoices

Efficient management of your billing documents is crucial for smooth business operations and financial tracking. Keeping these records well-organized ensures that you can quickly access the necessary details for audits, payments, or disputes. Whether you handle a few transactions or manage a large volume, having a structured approach to organizing your records can save time and reduce errors.

Use a Consistent Naming System

One of the simplest ways to stay organized is by using a consistent naming convention for each document. This can include the date, client name, or a unique reference number. A standardized naming format helps you quickly locate specific documents without having to search through dozens of files.

Store Documents Digitally

Keeping your documents in digital format not only helps save physical space but also makes it easier to categorize and search through them. Use cloud storage or dedicated software to store all your records securely. This allows for easier access, backup, and sharing when necessary.

Track Payment Statuses: Maintain a clear system for tracking which transactions have been paid, pending, or overdue. This could be done with a simple spreadsheet or through invoicing software. Regularly updating this system ensures that you stay on top of payments and follow up promptly with clients when needed.

By implementing these organizational strategies, you improve not only the accuracy of your financial records but also the overall efficiency of your business operations.

Free Invoice Templates vs Paid Options

When deciding between no-cost and paid billing documents, it’s important to weigh the benefits and drawbacks of each. Both options can meet the needs of businesses, but the choice depends on the complexity of your requirements and the level of customization you need. Understanding the key differences can help you make the right decision for your business’s financial management.

Advantages of Free Options

Free billing forms can be an excellent starting point for small businesses or freelancers. Here are some of the benefits:

- No upfront cost: The most obvious advantage is that they come at no cost, which can be beneficial for startups or businesses with limited budgets.

- Easy to use: Most free templates are simple and straightforward, allowing you to create a basic record without much effort.

- Variety of formats: Free forms are available in various formats, such as Word, PDF, or Excel, allowing you to choose the one that works best for your needs.

Drawbacks of Free Options

While free options can be great for basic needs, there are some limitations to keep in mind:

- Limited customization: Many free forms come with limited design or formatting flexibility, making it difficult to match your business’s branding.

- Basic features: Free templates typically lack advanced features such as automated calculations, integrated payment options, or client tracking.

- Generic designs: Free forms are often used by many businesses, so they might lack a unique or professional appearance.

Benefits of Paid Options

Paid solutions, on the other hand, offer a range of enhanced features and customization options:

- Highly customizable: Paid versions often allow for more flexibility in design, so you can tailor the document to match your business’s branding and needs.

- Advanced features: Many paid options come with features like automated tax calculations, integrated payment systems, and client management tools.

- Professional appearance: Paid templates are typically designed to be visually appealing, which can help present a polished image to your clients.

When to Choose Each Option

Consider opting for free forms if you’re just starting out and need a simple, no-cost solution. However, if your business requires more complex billing systems, or if you want to ensure a professional look and f

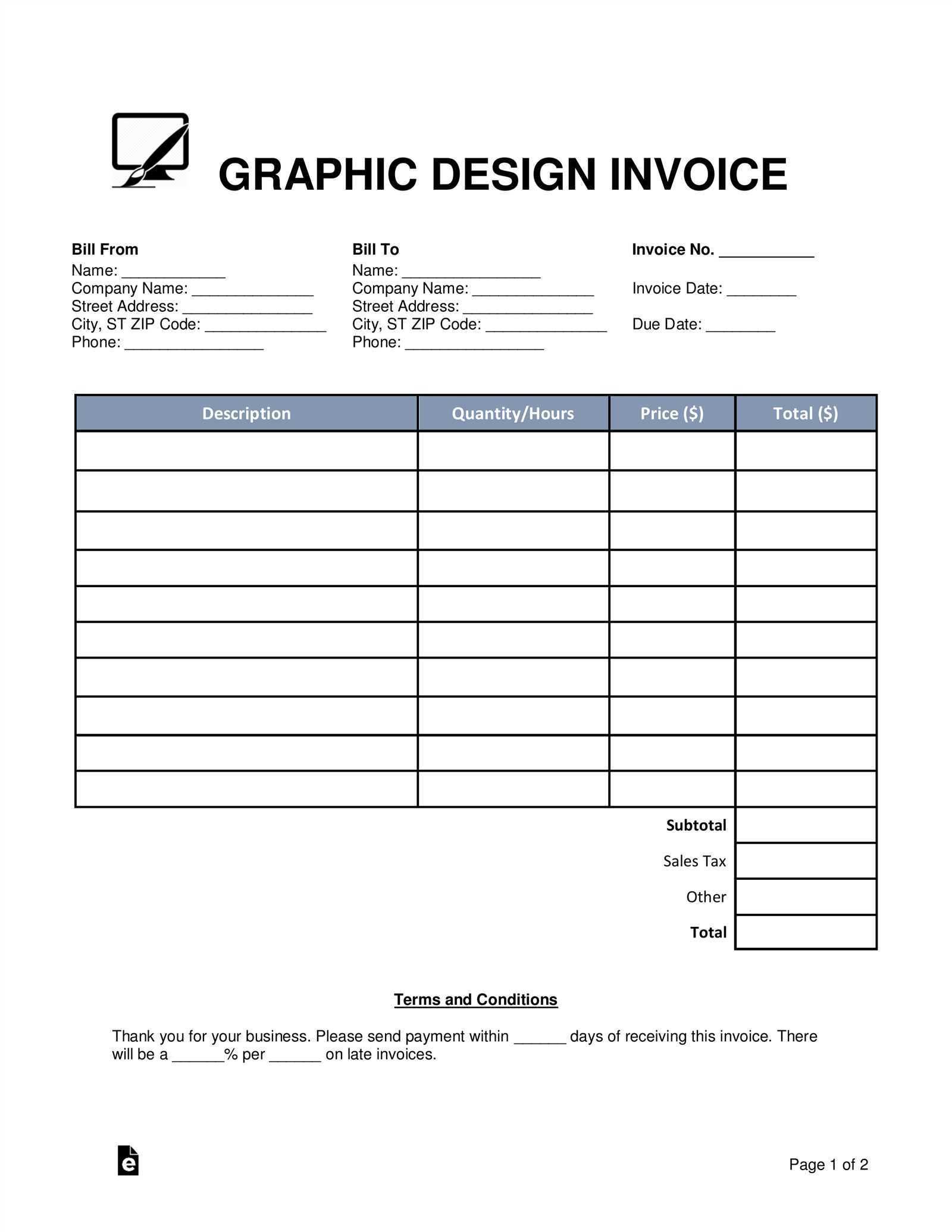

How to Personalize Your Layout

Customizing the design of your billing document is an essential step in ensuring it reflects your business’s unique identity. A personalized layout not only makes your document look professional but also helps you stand out and create a lasting impression with clients. By adjusting various elements, you can align the form with your brand and make it more visually appealing and functional.

Key Elements to Personalize

When modifying the layout of your document, consider focusing on the following aspects:

- Logo and Branding: Add your company logo and choose colors that match your brand. This gives your document a professional and cohesive look.

- Header and Footer: Customize the header with your business name, contact details, and payment terms. Similarly, the footer can be used for additional information, such as a website link or legal disclaimers.

- Fonts and Typography: Select fonts that are easy to read and consistent with your brand’s visual identity. Avoid using too many different font styles in one document.

- Layout Structure: Adjust the sections and their placement to ensure everything is easy to navigate. Keep essential information like the total amount and due date prominently displayed.

Tips for a Professional Appearance

To ensure that your personalized document maintains a polished and professional look, consider the following tips:

- Consistency: Ensure that all elements of the layout follow a consistent design language. This includes colors, fonts, and spacing.

- Minimalism: Keep the layout clean and simple. Avoid overcrowding the document with too much information or unnecessary design elements.

- Whitespace: Use ample whitespace to make the document look more organized and easy to read.

By focusing on these aspects, you can create a tailored document that not only meets your functional needs but also enhances the overall client experience.

Common Mistakes When Creating Invoices

Creating accurate and professional billing documents is essential for smooth business transactions. However, even small mistakes can lead to confusion, payment delays, and financial discrepancies. Understanding and avoiding common errors can ensure that your billing process is smooth and efficient, saving you time and preventing issues with clients.

Common Errors to Avoid

Here are some of the most frequent mistakes when preparing billing documents:

- Missing Client Information: Failing to include complete client details such as their name, address, and contact information can lead to confusion or miscommunication.

- Incorrect or Missing Dates: Ensure that the issue date and due date are clearly stated. Missing or incorrect dates can result in delayed payments and misunderstandings about payment terms.

- Unclear Payment Terms: Always specify the payment due date and acceptable methods of payment. Vague or missing payment terms can cause unnecessary delays or disputes.

- Not Including Itemized List: Providing a detailed breakdown of goods or services rendered helps avoid confusion. Clients appreciate clarity about what they are being charged for.

- Failing to Include a Unique Reference Number: Every billing document should have a unique number for tracking purposes. Without it, both you and your client may face difficulties when referencing or organizing past records.

How to Avoid These Mistakes

To ensure that you are creating accurate and clear records, follow these simple guidelines:

- Double-check client information: Always confirm that the client’s details are correct before sending the document.

- Review dates: Make sure both the issue and due dates are visible and accurate to avoid confusion.

- Clarify payment methods and terms: Clearly outline the acceptable methods of payment and specify the due date.

- Provide a detailed description: Always itemize the products or services provided with clear descriptions and costs.

- Use sequential numbering: Number each billing document in a consistent and sequential manner to avoid confusion and simplify tracking.

By taking the time to review these details, you can minimize errors and ensure that your clients receive a professional, accurate, and clear billing document.

Legal Requirements for Service Invoices

When creating billing documents, it is essential to understand the legal obligations that apply to these documents. Properly prepared records not only ensure clear communication with clients but also help maintain compliance with local tax regulations and business laws. Failure to include required details or adhere to legal standards can result in fines, disputes, or delayed payments.

Key Legal Elements to Include

There are several crucial components that must be included in all business records for them to be legally valid and compliant. These elements ensure that the document is transparent and meets legal expectations:

- Business Information: It is mandatory to include the full name, address, and registration number of your business. This information verifies your identity as the seller.

- Client Details: Make sure to include the name, address, and contact information of the client or customer receiving the goods or services.

- Clear Description of Goods/Services: Each item or service provided must be described in detail, including quantities, prices, and dates. This makes it easier for both parties to verify the transaction.

- Tax Information: If applicable, ensure that any taxes or VAT are listed separately. This includes the tax rate and the total amount of tax charged.

- Unique Reference Number: Each document should have a unique number for tracking purposes, which is essential for both business and tax reporting.

- Payment Terms: Clearly outline the due date and any applicable payment conditions, such as late fees or discounts for early payment.

Why Compliance Matters

Complying with the legal requirements for billing documents protects both your business and your clients. These records are often used as proof of transaction for tax purposes, audits, or resolving disputes. Adhering to the legal standards not only helps you avoid legal issues but also fosters trust and professionalism in your business relationships.

By ensuring that you include all legally required details, you can protect your business from potential legal challenges and maintain smooth, efficient transactions with clients.

Integrating Billing Documents with Accounting Software

In today’s fast-paced business environment, efficiency is key. Integrating billing documents with accounting software can streamline your financial processes, reducing the need for manual entries and ensuring accuracy. By linking your billing system to accounting tools, you can automate various tasks, including invoicing, tracking payments, and generating financial reports.

Benefits of Integration

Integrating your billing documents with accounting software offers several advantages, making it easier to manage your business’s finances:

- Time-saving: Automating the data entry process eliminates the need to manually input transaction details into accounting systems, saving valuable time.

- Increased Accuracy: Direct integration reduces human errors that can occur when transferring information between different platforms.

- Real-time Updates: When billing records are updated, the accounting software immediately reflects these changes, ensuring that your financial information is always up to date.

- Efficient Tax Reporting: Automated systems make it easier to track tax-related information, reducing the complexity of filing taxes and minimizing errors.

Steps to Integrate Billing Documents with Accounting Software

To make this integration seamless, follow these steps:

- Choose the Right Accounting Software: Select software that is compatible with the billing documents you use. Ensure that it supports the automation of key processes like tracking payments and generating financial reports.

- Link Your Billing System: Connect your billing tool or document system with the accounting software. This may involve setting up an API or importing files directly.

- Configure Automatic Sync: Set up automatic syncing so that your financial data, including transactions and payment statuses, is updated in real-time without manual intervention.

- Test the Integration: Before fully relying on the system, conduct tests to ensure that everything works smoothly, including the transfer of data and accuracy of calculations.

By integrating your billing documents with accounting software, you can simplify your financial management and reduce the chances of costly errors, ultimately leading to more efficient operations and better business insights.

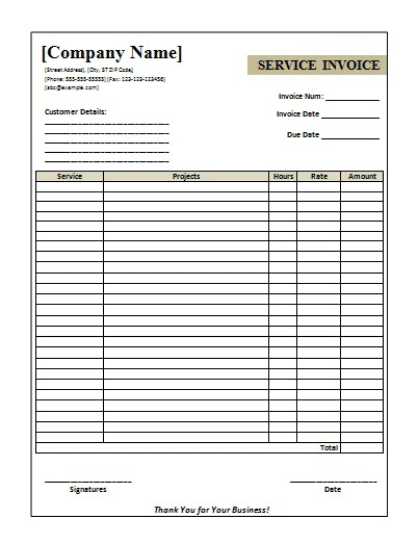

Using Templates for Different Service Types

When offering various types of professional assistance or products, customizing your documentation can help maintain clarity and consistency. Tailoring the structure of your records for each specific offering allows for smoother communication and better organization. Different categories of work may require distinct details, and using pre-designed documents can streamline the process of generating and managing these records.

Advantages of Tailoring Documents by Service Type

Personalizing records for various services or products provides numerous benefits, such as:

- Clearer Breakdown of Charges: For different work types, breaking down individual components allows for transparent billing and clear communication between the provider and the client.

- Improved Client Understanding: Each specific service often has unique needs or terms. Customizing your documentation makes it easier for clients to understand the specific charges and their relevance.

- Consistency Across Services: Using predefined formats ensures consistency in how each job or product is documented, helping to streamline both internal tracking and external communications.

- Professional Appearance: Custom templates for various offerings give your records a polished and professional look, enhancing the image of your business.

Customizing Templates for Specific Services

Here are some key considerations for adapting your forms for different types of services or products:

- Identify Key Components: Depending on the nature of the work, identify which details are essential for each type of service or product, such as hours worked, materials used, or shipping details.

- Adjust Format for Complexity: More complex services, such as consulting or project-based work, may require more comprehensive documentation compared to simpler tasks, such as repairs or product purchases.

- Client-Specific Customizations: Customize your records with specific client requirements, such as payment terms or unique product specifications, which help to ensure that the agreement is clear and complete.

- Adapt for Different Pricing Models: If you offer different pricing models, such as hourly rates, flat fees, or tiered pricing, tailor the template accordingly to capture the necessary details accurately.

By using different formats and details for each type of offering, you can create a smoother workflow and maintain consistency across your business. Customizing your documentation will help enhance the professionalism of your operations and improve client satisfaction.

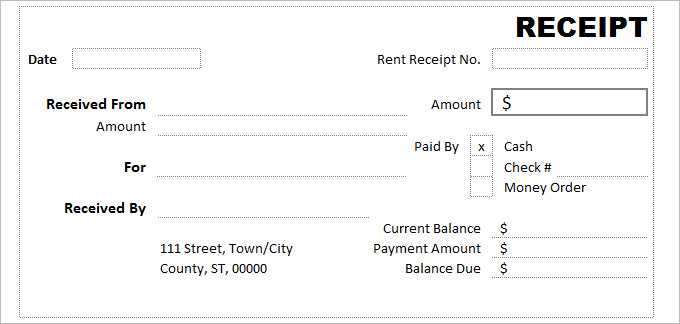

Tracking Payments with Invoice Templates

Effective tracking of payments is crucial for maintaining accurate financial records and ensuring timely transactions. By using well-organized forms, businesses can easily track outstanding amounts, received payments, and the status of each transaction. A structured record helps avoid confusion and provides clear documentation for both the provider and the client.

Key Elements for Tracking Payments

To efficiently monitor payments, certain details must be included in the records. These details allow you to keep track of which payments have been made and which are still pending:

- Payment Due Date: Clearly specifying the due date helps to set expectations and ensures timely follow-ups if necessary.

- Amount Due: Including the exact amount that needs to be paid avoids misunderstandings and ensures the correct payment amount is settled.

- Paid Amount: Tracking the amount that has already been paid helps in reconciling the balance and provides a clear view of outstanding amounts.

- Payment Method: Recording how payments are made (bank transfer, cheque, online payment, etc.) ensures you have accurate records for auditing and tracking purposes.

- Payment Status: Including a field to mark whether a payment has been completed, partially paid, or is still pending can simplify follow-up and account management.

Using Organized Forms to Monitor Payments

When your payment records are organized properly, tracking becomes much easier. Here are some ways to use your forms effectively to track payments:

- Regular Updates: Update your records regularly to reflect any changes in the payment status, especially after receiving partial payments or making new transactions.

- Clear Payment History: Keep a running total of payments received to avoid confusion. A payment history section helps you quickly see the overall status of the account.

- Follow-Up Reminders: Include a column for follow-up notes or reminders to track which clients need further communication about their payments.

- Automate Tracking: Many accounting software options allow you to automate payment tracking, which can save time and reduce human error.

By properly organizing and tracking payments through your documentation, you can ensure better financial management and reduce errors in your accounting processes. This method not only benefits your business but also builds trust with clients who can easily verify the status of their payments at any time.

How to Print and Send Invoices Efficiently

Efficiently printing and sending payment requests is essential for smooth financial operations. Whether you’re handling a small business or managing multiple clients, adopting a streamlined process saves time and reduces errors. Proper documentation ensures clients receive the necessary details promptly and helps maintain professional relationships.

Steps for Efficient Printing

Before sending the documents to clients, it’s crucial to ensure the file is formatted correctly and printed without issues. Here are a few best practices:

- Check the Layout: Review the document’s layout to ensure that all necessary fields, like client name, services rendered, and amounts, are visible and well-organized.

- Choose the Right Printer Settings: Use high-quality settings to ensure the text is clear, especially for financial documents that must be legible.

- Use Professional Paper: If you prefer sending printed copies, consider using professional-quality paper to enhance your company’s image.

- Print in Bulk: For multiple clients, printing in bulk can save time. Set up a batch printing system, if possible, to expedite the process.

Sending Payment Requests to Clients

Once printed, or if you’re sending digital copies, sending the documents in a timely and secure manner is important. Here’s how to do it efficiently:

- Opt for Email: Sending payment documents via email is fast and convenient. Attach the document as a PDF file to ensure it can’t be altered.

- Use Email Templates: Set up pre-written email templates with personalized fields to reduce repetitive typing and maintain consistency across all communications.

- Use Registered Mail for High-Value Transactions: For large amounts or important contracts, consider sending hard copies through registered mail to ensure delivery and receipt confirmation.

- Provide Clear Instructions: In your communication, clarify payment instructions, deadlines, and available methods to prevent delays.

By following these steps, businesses can improve the speed and accuracy of sending payment requests. Whether you choose to print or email, ensuring your clients have clear and timely documents enhances both professionalism and operational efficiency.