Free Proforma Invoice Template Excel for Easy Billing

Managing financial transactions and keeping track of payments can be a complex task, especially when dealing with multiple clients or projects. Having an organized system in place to generate detailed billing documents is essential for smooth business operations. A well-structured document can ensure clarity and prevent misunderstandings between service providers and clients.

With the help of pre-designed formats in spreadsheet software, creating customized billing records becomes an easy and efficient process. These formats allow you to enter the necessary details such as itemized lists, pricing, and payment terms, while automatically calculating totals and taxes. This saves time and minimizes errors, allowing businesses to focus on more important tasks.

Whether you’re a freelancer, small business owner, or part of a larger organization, having the right tools can make invoicing straightforward. In this guide, we will explore how to use these digital formats to create accurate, professional documents that streamline your billing workflow.

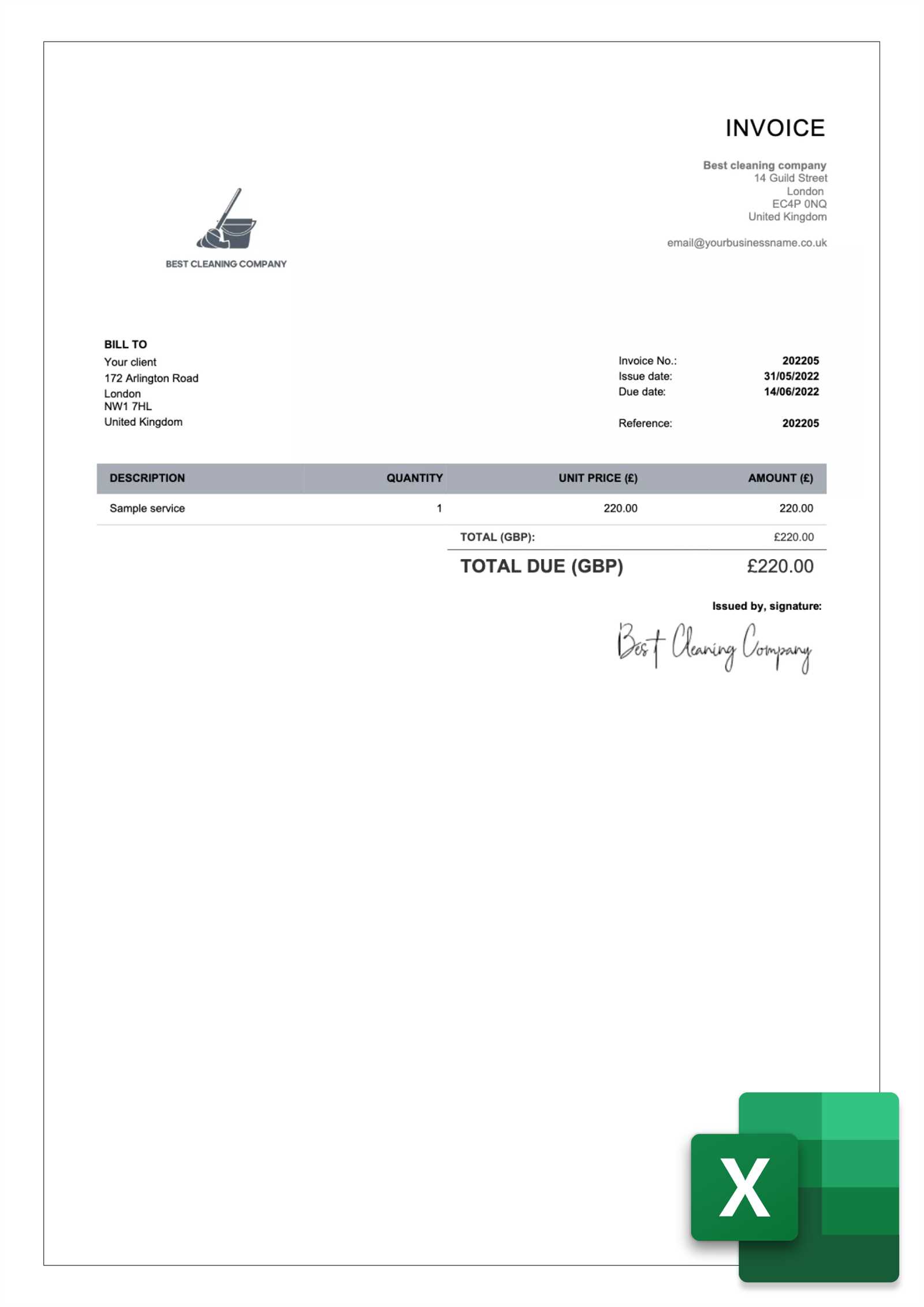

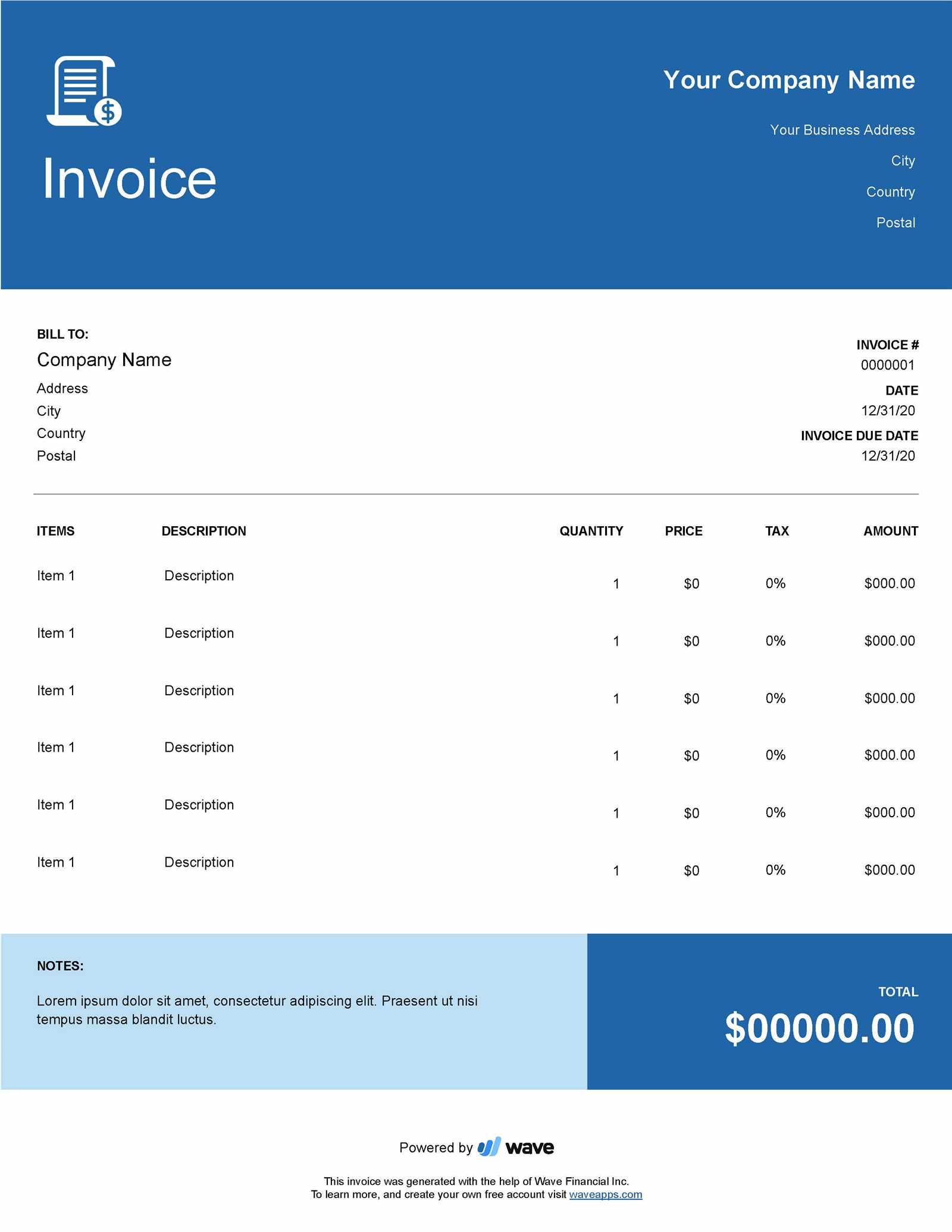

Free Proforma Invoice Template Excel

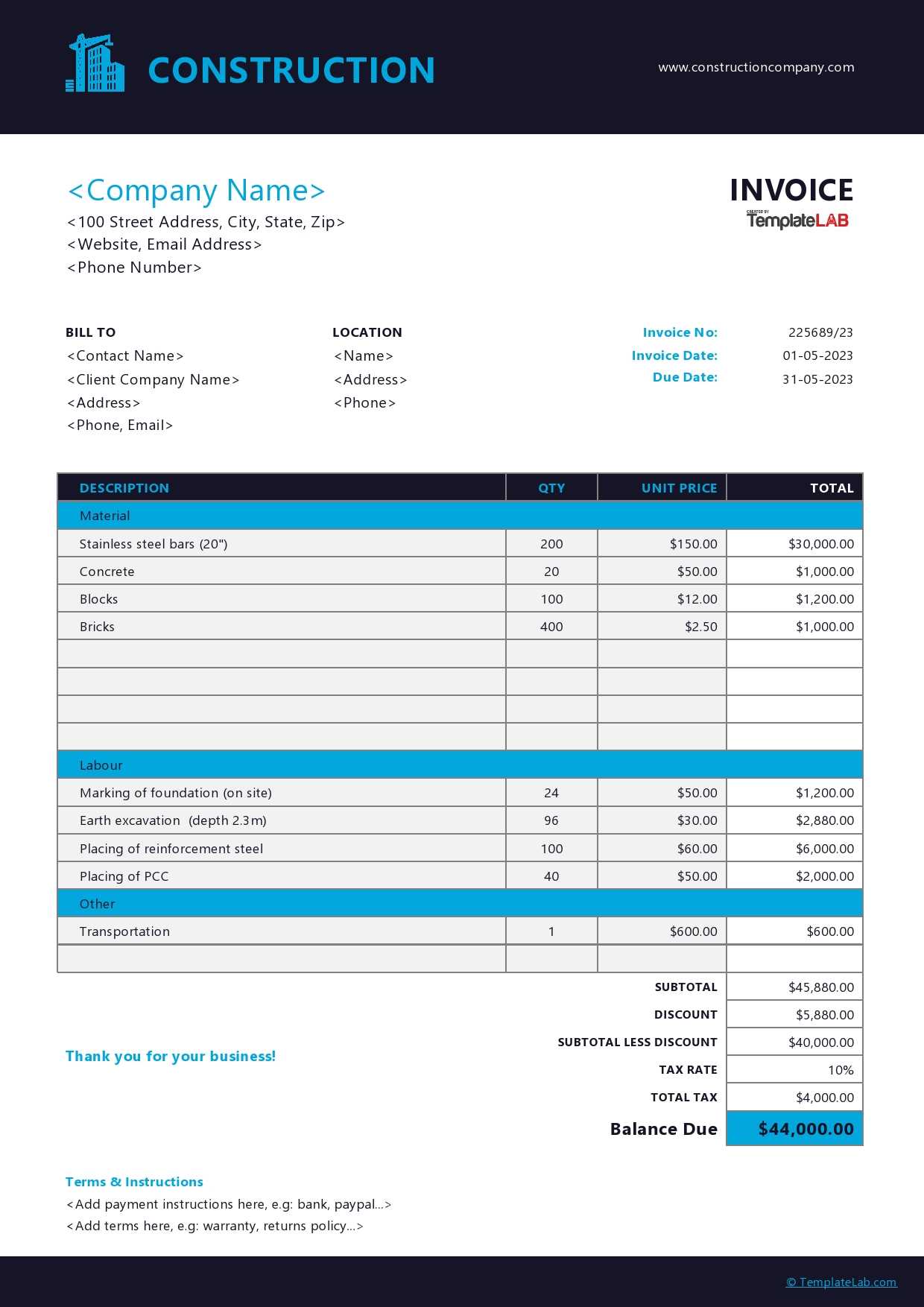

For businesses, having an efficient system to create and manage billing records is crucial. A digital document that outlines transaction details, including items, quantities, and pricing, helps keep financial operations clear and organized. By using a pre-structured format, you can easily generate and update these documents without having to create each one from scratch. These formats also offer customization options, making them suitable for various types of transactions and industries.

Benefits of Using Digital Billing Formats

Using pre-designed spreadsheets offers several advantages. The most significant benefit is the time saved by not having to manually calculate totals, taxes, and discounts. With built-in formulas, the software automatically handles these tasks, reducing human error. Additionally, these formats allow for quick adjustments to suit different business needs, such as changing rates or adding new products or services.

How to Customize and Use the Format

Once you download the appropriate file, customization is simple. You can enter your business details, client information, and specific items or services rendered. The layout will adjust to fit the information, making it easy to generate a professional-looking document. With just a few clicks, you can save, print, or send the completed file to clients for payment.

Why Use a Proforma Invoice Template

Having a structured document to outline the details of a transaction before the final billing is essential for businesses. It serves as a preliminary statement that provides clarity for both the service provider and the client. This type of record helps to avoid confusion about the terms, quantities, and prices involved in a deal, ensuring both parties are on the same page before payment is processed.

Improved Organization and Efficiency

Utilizing a pre-designed layout helps to streamline the billing process. Instead of manually crafting each document from scratch, a ready-made format allows for quick customization. This is especially useful for companies dealing with high volumes of transactions, as it reduces the time spent on administrative tasks and increases overall efficiency.

Clear Communication with Clients

One of the key advantages of using such a structure is the enhanced transparency it provides. By outlining all terms in a clear, standardized format, you ensure that clients fully understand the services provided, expected costs, and any other relevant details. This can reduce the likelihood of misunderstandings or disputes later on.

Benefits of Excel for Invoice Creation

Using a spreadsheet program for generating financial documents provides a versatile and efficient way to manage transactions. The ability to quickly input, calculate, and modify data makes it an ideal tool for creating detailed billing records. With various built-in features and customizable options, this software simplifies the process of producing accurate and professional-looking documents.

Streamlined Calculations and Customization

One of the most significant advantages of using spreadsheet software is its ability to automate complex calculations. With formulas and functions like sum, tax calculation, and automatic total adjustments, it minimizes the risk of human error. Customization options also allow users to tailor the document to their specific business needs, such as adjusting pricing, adding discounts, or changing item descriptions.

Organizing Data Efficiently

Spreadsheets offer easy ways to manage and track financial data in an organized manner. You can set up different sheets for clients, transactions, and payment statuses, creating a clear overview of your financial history. This organization makes it easier to track unpaid bills, monitor outstanding balances, and ensure timely payments.

| Feature | Benefit |

|---|---|

| Automatic Calculations | Reduces human error and speeds up the process |

| Customization | Tailor documents to business needs and client preferences |

| Data Organization | Helps track payments, balances, and financial records effectively |

How to Customize Your Template

Personalizing your document format to fit your specific business needs is a straightforward process. With digital tools, you can modify key sections, add necessary details, and adjust calculations to ensure your records reflect accurate and professional information. Customization ensures that each document aligns with your branding and business requirements while maintaining consistency across all communications.

Adjusting the Layout and Structure

The first step in customizing your format is adjusting the layout. You can easily modify headers, footers, and section titles to match your company’s branding. This includes adding your business name, logo, and contact details at the top of the page, and ensuring that the document looks professional while remaining clear and easy to read. You can also alter the font style, size, and color to match your company’s visual identity.

Updating Fields and Adding New Information

Once the layout is set, it’s important to update the content fields. You can add your unique services or products, modify pricing structures, and include payment terms or delivery details as needed. Most digital formats allow you to insert dynamic fields that automatically calculate totals based on your inputs, streamlining the process of creating consistent and error-free documents.

Simple Steps to Create Proforma Invoices

Creating accurate billing documents is essential for maintaining clear communication with clients and ensuring smooth transactions. By following a few straightforward steps, you can quickly generate professional records that outline the services or goods provided, along with their respective costs. These steps will help you produce detailed and accurate documents, making it easier to manage payments and track financial records.

Step 1: Gather Required Information

Before you begin, gather all necessary details for the transaction. This includes client information, a list of products or services provided, quantities, unit prices, and any applicable taxes or discounts. Having this data organized will make the document creation process faster and more efficient, ensuring that you don’t miss any crucial details.

Step 2: Input Data into Your Document

Next, enter the gathered information into your digital file. Start by filling in the client’s contact details and the items or services provided. Most digital formats will automatically calculate totals, but double-checking the figures is always a good practice. Be sure to include any specific terms, such as payment deadlines or delivery dates, to clarify expectations.

Download and Use Excel Templates

Downloading pre-designed files for financial records can significantly speed up the process of generating accurate documents. These files are readily available and can be easily customized to meet the specific needs of your business. Once downloaded, they can be modified to include your business details, client information, and any other relevant data for quick and efficient record creation.

Steps to Download and Set Up

- Search for a suitable file that fits your requirements.

- Download the file and open it in your spreadsheet software.

- Customize the fields such as business name, client details, and service descriptions.

- Ensure the calculations, such as totals and taxes, are set up correctly.

Benefits of Using Pre-Designed Files

- Time-saving: Skip the setup process and start adding your data immediately.

- Professional presentation: The document layout is already designed to look polished and consistent.

- Customization: Easily adjust the layout, colors, and fields to match your business needs.

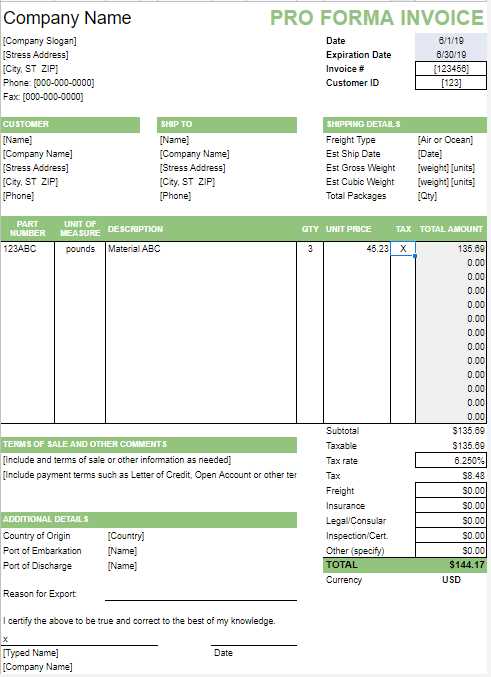

Essential Features of Proforma Invoices

A well-structured financial document serves as a vital tool in ensuring both the service provider and the client have a clear understanding of the transaction. The document should include key details such as the products or services rendered, their prices, and any relevant terms or conditions. These features ensure transparency, avoid misunderstandings, and create a foundation for the final billing process.

Key Elements to Include

Every record should contain essential elements to be both informative and professional. These include:

- Client and Business Information: Include the names, addresses, and contact details of both parties to ensure clear communication.

- Detailed Description: Provide a clear breakdown of the goods or services, including quantities, unit prices, and total costs.

- Terms and Conditions: Clarify payment terms, delivery schedules, and any discounts or additional fees that may apply.

- Dates: Include the date of issue and any deadlines for payment or delivery to avoid confusion.

Why These Features Matter

These features are crucial for maintaining a smooth business operation. They help prevent disputes by setting clear expectations for both parties. Additionally, having all the necessary details in one document ensures that the final payment process is quick and hassle-free, allowing businesses to keep their cash flow on track.

How to Calculate Invoice Totals in Excel

Calculating the total cost of a transaction is a critical step in any billing process. Using a spreadsheet program, you can easily automate these calculations to ensure accuracy and save time. By applying simple formulas, you can quickly calculate the subtotal, taxes, discounts, and the final amount due, all within the same document.

Step 1: Input Item Details

Start by entering the list of items or services, along with their respective quantities and unit prices. Each row should represent a different item or service, and the columns will hold the description, quantity, price per unit, and the total cost for that item. This initial setup is crucial for accurate calculations.

Step 2: Apply Calculation Formulas

Once you have entered the item details, you can calculate the total cost for each item by multiplying the quantity by the unit price. In most spreadsheet programs, you can use the following formula:

Cost per item = Quantity * Unit price

For the overall total, you can use the sum formula to add up the individual item costs. To calculate the total amount with taxes or discounts, apply the necessary formulas to account for those adjustments:

Total = Sum of item costs + Tax – Discount

Using these formulas will give you an accurate and automated way to determine the final amount due.

Common Mistakes in Invoice Creation

Creating accurate and professional billing documents is essential for smooth transactions and maintaining a good relationship with clients. However, there are several common mistakes that can cause confusion, delay payments, or lead to disputes. These errors can often be avoided by paying attention to detail and following a clear structure when preparing financial records.

Missing or Incorrect Information

One of the most frequent mistakes is leaving out key details such as the client’s contact information, product descriptions, or service terms. This can cause confusion or delays in payment. It’s important to include accurate and complete information, such as quantities, prices, dates, and payment terms, to avoid any misunderstanding.

Calculation Errors

Another common mistake is making errors in calculations. Incorrect totals, taxes, or discounts can lead to financial discrepancies and erode trust. It’s essential to double-check calculations, or better yet, automate them using formulas to reduce the risk of human error.

Not Setting Clear Payment Terms

Failing to specify clear payment terms, such as due dates or late payment penalties, can result in delayed payments or confusion. Always make sure to state the payment deadline and any relevant conditions to ensure both parties are on the same page.

How to Include Payment Terms

Clearly defined payment terms are essential to ensure that both parties understand the expectations surrounding payment. Including these terms in your billing documents helps prevent misunderstandings and ensures timely payments. By specifying when payments are due, acceptable payment methods, and any penalties for late payments, you set the foundation for smooth financial transactions.

Specify the Payment Due Date

Start by clearly stating when the payment is due. Typically, this can range from a few days to several weeks, depending on the nature of the transaction. Make sure to use a clear date format and specify whether the payment is due upon receipt, within a set number of days, or on a particular date.

Outline Late Payment Penalties

If applicable, include any penalties for late payments. For example, a percentage of the total amount due might be added for each day or week the payment is delayed. Clearly stating this will encourage prompt payment and help manage your cash flow. Be sure to mention any interest rates or flat fees for overdue payments.

Lastly, always ensure that the payment terms are easy to understand and located in a prominent area of the document so they’re not overlooked by the client.

Organizing Your Invoices in Excel

Keeping your financial documents organized is crucial for maintaining efficient business operations. Proper organization ensures that you can quickly locate important records, track outstanding payments, and avoid mistakes. Using a spreadsheet program to manage these documents allows you to structure and categorize them in a way that suits your business needs.

Creating a Structured System

To stay organized, create a dedicated file for your financial documents and set up separate sheets for different categories, such as completed transactions, pending payments, and overdue amounts. You can use columns to capture key details like transaction dates, client names, amounts due, and payment status. This structure will make it easier to sort and filter through your records when needed.

Using Sorting and Filtering Tools

Utilizing the sorting and filtering features of your spreadsheet program can help you quickly find the information you need. For example, you can filter by payment status to view all outstanding balances or sort by date to track recent transactions. This will help you stay on top of your finances and ensure timely follow-ups with clients.

Additionally, color coding or using conditional formatting can help highlight overdue amounts or upcoming due dates, making it even easier to prioritize tasks and avoid late payments.

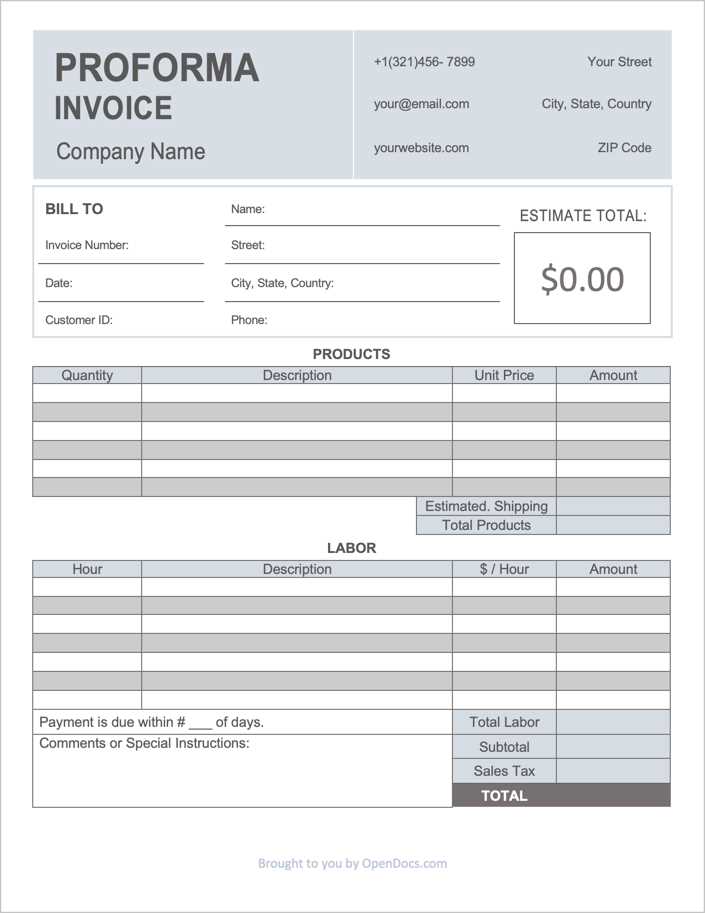

Best Practices for Proforma Invoices

When preparing billing documents, it’s important to follow best practices to ensure clarity, accuracy, and professionalism. Adopting a consistent approach in structuring these records helps maintain smooth business operations and fosters trust with clients. By following these best practices, you can streamline your process and minimize errors, ensuring all the necessary details are communicated effectively.

Include Clear and Complete Information

Always ensure that your documents contain all the necessary details. This includes item descriptions, quantities, unit prices, and total amounts, along with any applicable taxes or discounts. Clearly display the client’s contact information, along with your own, to avoid confusion. Providing a detailed breakdown of the services or products involved helps set clear expectations for both parties.

State Payment Terms and Conditions

Clearly define the terms of payment within the document. This includes specifying the due date, accepted payment methods, and any late fees that may apply. Stating these terms up front will prevent misunderstandings and ensure that both you and your client are aware of the financial expectations. Providing such details helps build a foundation for timely payments and a smooth transaction process.

By following these practices, you’ll create effective billing documents that are both clear and professional, promoting transparency and helping your business maintain a positive reputation with clients.

Tracking Payments with Excel Invoices

Accurately tracking payments is essential for managing cash flow and ensuring that clients pay on time. By organizing financial records in a spreadsheet, businesses can monitor payment statuses and quickly identify overdue amounts. A well-structured system can help track which payments have been received, which are pending, and which are overdue, ensuring nothing falls through the cracks.

Setting Up a Payment Tracking System

To start tracking payments effectively, you can create a simple system using columns for key information. Here’s an example of what your spreadsheet might include:

- Invoice Number: A unique identifier for each transaction.

- Client Name: The name of the customer or business you’re invoicing.

- Amount Due: The total amount that needs to be paid.

- Payment Status: A column indicating whether the payment is “Pending,” “Paid,” or “Overdue.”

- Payment Date: The date the payment was received.

- Notes: Additional details such as partial payments, discounts, or reasons for late payments.

Using Formulas to Automate Payment Tracking

To further streamline the tracking process, you can use formulas in your spreadsheet to automatically calculate totals or highlight overdue payments. For example:

- Conditional Formatting: Highlight overdue payments in red, so they’re easy to spot.

- SUM Function: Use this to calculate the total amount due across multiple records or to find out how much has been paid so far.

- IF Function: Create conditions that mark payments as “Paid” or “Overdue” based on the payment date.

By organizing your financial data and utilizing formulas, you can easily track payment statuses, ensuring that all dues are paid on time and your business operates smoothly.

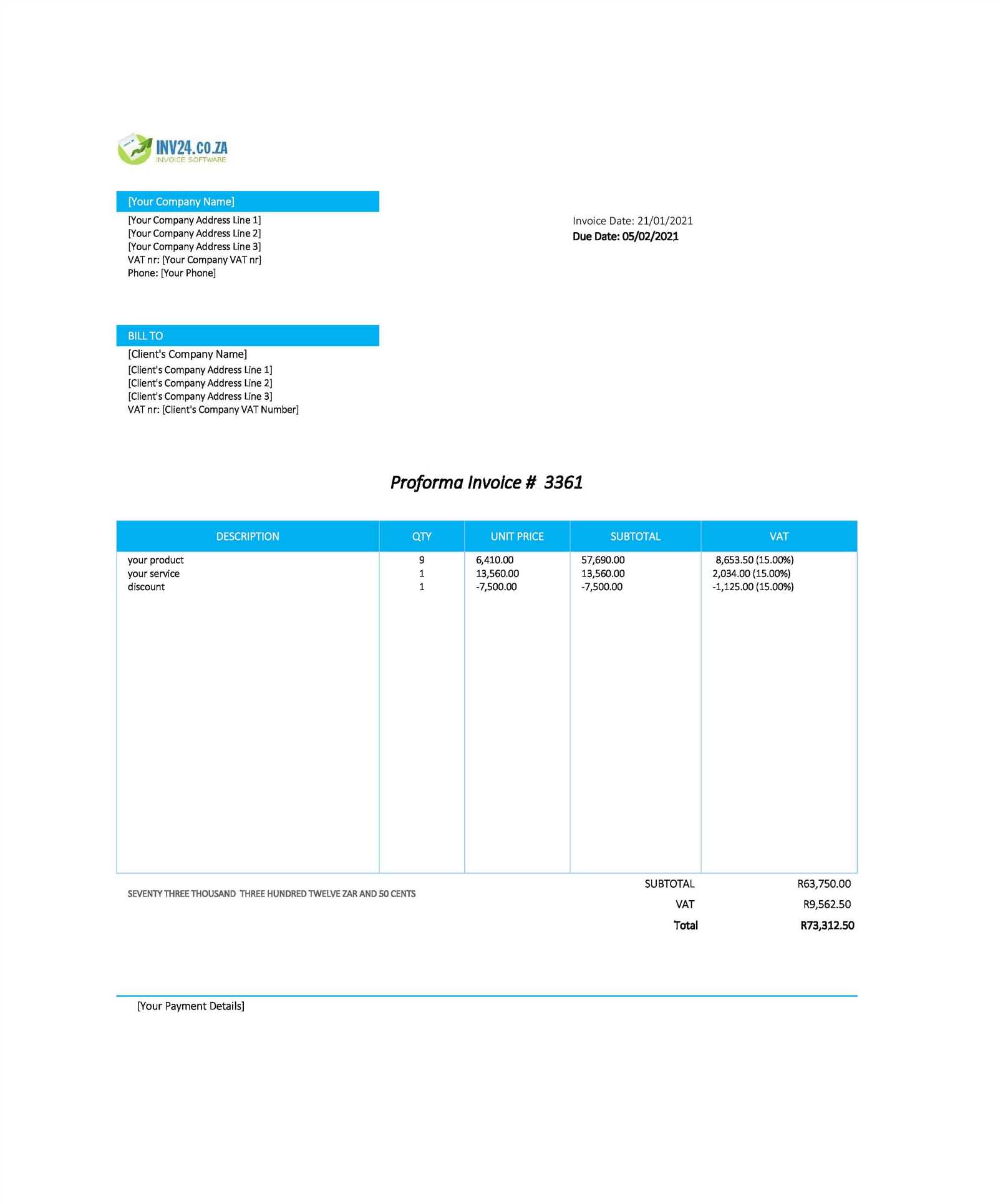

Proforma vs Commercial Invoice Differences

When it comes to billing documents, there are several types that serve different purposes in the business world. Two commonly used forms are documents that outline the value of goods or services but differ in terms of their legal function and intent. Understanding the key distinctions between these two documents is essential for businesses to choose the right one for their needs, especially when dealing with international trade and customs procedures.

Purpose and Usage

The main difference between these two documents lies in their purpose. One document is primarily used as a preliminary document, often provided before the actual transaction takes place, while the other is a formal and legally binding statement used for payment and customs declaration.

- Preliminary Document: The first document is typically issued to provide an estimate or outline of what a customer will owe, without actual payment being due at that time.

- Legal Declaration: The second is an official record that serves as the actual bill for the goods or services, confirming the transaction and becoming part of the financial record of both the buyer and the seller.

Customs and International Transactions

Another significant difference is in the realm of international trade. Customs authorities often accept one of these documents to process shipments and determine tariffs or taxes, but the roles they play are different.

- Customs Procedure: The preliminary document is used for customs clearance to provide an estimated value for goods being shipped, while the final document is used for invoicing after the goods have been delivered.

- Tariffs and Taxes: The legal document provides accurate pricing for customs, whereas the preliminary one might only be used as a pro forma statement for cost estimation.

By understanding the differences between these two types of records, businesses can ensure they use the correct form in the appropriate situation, avoiding any potential confusion or issues with customers, suppliers, and regulatory bodies.

How to Share Your Invoice with Clients

Sharing payment documents with clients is an essential step in ensuring timely payments and maintaining transparency in business transactions. There are several methods available, each offering different benefits depending on the client’s preferences and the business’s needs. Understanding how to effectively deliver these documents can streamline the billing process and help avoid any misunderstandings.

Methods of Delivery

There are various ways to send payment documents to clients. The most common methods include digital delivery via email, online invoicing platforms, and traditional postal mail. Each of these options has its own advantages and considerations for the recipient.

- Email: This is one of the quickest and most efficient methods for sending a payment document. You can attach the document as a PDF file, ensuring the client receives a secure and professional-looking copy.

- Online Payment Systems: Using platforms like PayPal, Stripe, or other invoicing services can provide clients with an easy way to pay directly through the document link. This method also provides real-time tracking and confirmation of payment.

- Postal Mail: Although slower and less efficient, some clients prefer receiving hard copies of payment documents through the post. This is especially common for clients who are not comfortable with digital transactions or reside in areas with limited internet access.

Document Format Considerations

When sharing your document, the format in which it is sent plays a crucial role in ensuring clarity and ease of understanding. The most commonly accepted format for sharing such records is PDF, due to its compatibility across devices and its ability to preserve the document’s layout and content. However, spreadsheets can also be sent when more detailed data is required, such as itemized lists or calculations.

| Format | Advantages |

|---|---|

| Universally accessible, professional appearance, easy to print, preserves formatting. | |

| Spreadsheet | Useful for complex calculations or itemized lists, editable by the client for verification. |

| Paper | Preferred by some clients who require hard copies for their records. |

By selecting the right delivery method and format, businesses can enhance the client experience, reduce payment delays, and maintain efficient financial operations.

How to Save and Archive Your Invoices

Storing payment records securely is an essential practice for any business. Properly archiving documents not only ensures compliance with legal requirements but also helps you stay organized for future reference, audits, or tax purposes. There are multiple methods available to safely store and retrieve these records, each offering distinct advantages for both physical and digital formats.

Methods for Storing Documents

Choosing the right storage method depends on your business needs and the volume of records you generate. Some businesses may prefer traditional paper filing, while others may opt for digital solutions. Below are some common methods to consider:

- Cloud Storage: Cloud platforms like Google Drive, Dropbox, or OneDrive provide a convenient way to store files digitally. These services offer automatic backups and easy access from anywhere, ensuring that documents are safe and accessible at any time.

- Local Computer Storage: For businesses that prefer not to rely on external services, storing files directly on your computer or an external hard drive can be a secure and manageable option. It’s important to back up files regularly to avoid data loss.

- Physical Filing Systems: While increasingly less common, some businesses still prefer to keep hard copies of important documents. Using filing cabinets or storage boxes for paper records can be a simple and reliable solution, but it requires more space and organization.

Best Practices for Organizing Your Files

Regardless of the storage method you choose, maintaining an organized system is key to efficient management. Here are a few tips to help you stay organized:

- Consistent Naming Conventions: Use clear, consistent file naming systems to make it easy to search and retrieve documents. For example, include dates, client names, or project details in the file name to ensure easy identification.

- Organize by Category: For digital records, create folders based on categories such as client names, dates, or payment status. This system allows you to quickly navigate through your records without confusion.

- Regular Backups: For both physical and digital storage, always back up your records at regular intervals. This ensures that even if a document is lost or damaged, you can recover it from a backup.

- Access Control: Limit access to sensitive financial documents by setting permissions or using password protection for digital files. This minimizes the risk of unauthorized access or data breaches.

By implementing a secure storage system and staying organized, you’ll ensure that your records are easy to ac

Top Tips for Professional Invoice Design

Creating a well-designed document is crucial for maintaining a professional image and ensuring clear communication with clients. A polished, easy-to-read layout can help prevent misunderstandings and make the payment process smoother. Whether you’re designing from scratch or customizing a ready-made format, following certain design principles will improve the overall impact and clarity of your documents.

1. Keep the Layout Clean and Simple

A cluttered document can confuse your clients and detract from the key information. Aim for a minimalistic approach, focusing on the essentials. Use clear headings, enough white space, and well-organized sections to separate different parts of the document. This simplicity will make it easier for your clients to review and process the document quickly.

2. Choose Professional Fonts and Colors

Fonts and colors play a major role in how your document is perceived. Stick to professional, easy-to-read fonts such as Arial or Helvetica. Avoid using too many different fonts or overly decorative styles.