How to Set Up an Invoice Template in Xero

When managing your business’s financial operations, it is essential to present professional and consistent documents to clients. Customizing these documents can help reinforce your brand identity and ensure all necessary information is included for smooth transactions.

Personalizing these documents involves tailoring their appearance and content to suit your specific needs. By adjusting details such as business contact information, payment terms, and design elements, you can create a more streamlined and efficient process for both you and your clients.

Efficiency plays a key role in maintaining smooth operations. Once configured, these documents can be reused for future transactions, saving valuable time and effort. Setting up a structured system for these files ensures that your financial processes remain organized and clear.

How to Set Up Invoice Template in Xero

Creating a personalized document for client transactions is an essential part of maintaining a professional and organized approach to business. By configuring the structure of your billing paperwork, you can ensure that each document is tailored to your business’s unique needs, displaying all relevant details in a consistent format.

Accessing the Document Settings

Begin by navigating to the appropriate section in your accounting platform where you can manage your business forms. From here, you can customize the layout, adding your logo, business contact details, and any other necessary information that should appear on each document.

Customizing Content and Appearance

After accessing the settings, adjust the structure of the document. This includes selecting fields to display, such as payment terms, tax rates, and item descriptions. You can also modify fonts, colors, and overall design to reflect your brand. Once configured, the changes will be applied to all future documents, providing a consistent and professional appearance.

Understanding Xero Invoice Templates

Managing billing documents effectively is crucial for maintaining a smooth flow in your business. The software platform provides tools for creating and customizing these documents to suit your specific requirements. By using the available options, you can easily format your paperwork to include all necessary details in a streamlined and professional manner.

Key Features of Billing Documents

Once you’ve accessed the document settings, you can utilize various features to enhance the clarity and functionality of your paperwork. These elements include:

- Adding your business logo and contact information

- Setting payment terms and due dates

- Incorporating tax rates and discounts

- Organizing product or service descriptions clearly

Benefits of Customizing Billing Documents

By personalizing these documents, you can:

- Ensure brand consistency across all financial documents

- Save time with automatic generation for each client transaction

- Provide clear and professional communication with clients

Benefits of Customizing Your Invoices

Tailoring your billing documents to fit your business needs offers several advantages that help streamline operations and enhance client relationships. Personalization not only improves the overall look but also ensures that critical information is clearly presented, helping to avoid confusion and delays in payment.

Professional Appearance

Customizing your documents allows you to create a polished and professional image. This can significantly improve how clients perceive your business, leading to stronger trust and credibility. Some key aspects to consider include:

- Incorporating your company logo for branding

- Choosing a consistent color scheme that reflects your identity

- Maintaining uniform font styles for readability

Efficiency and Accuracy

When documents are customized to reflect your specific needs, the process of creating and sending them becomes more efficient. This leads to:

- Faster document generation for each client interaction

- Reduced errors by ensuring that all essential details are automatically included

- Streamlined communication and clearer expectations for payment

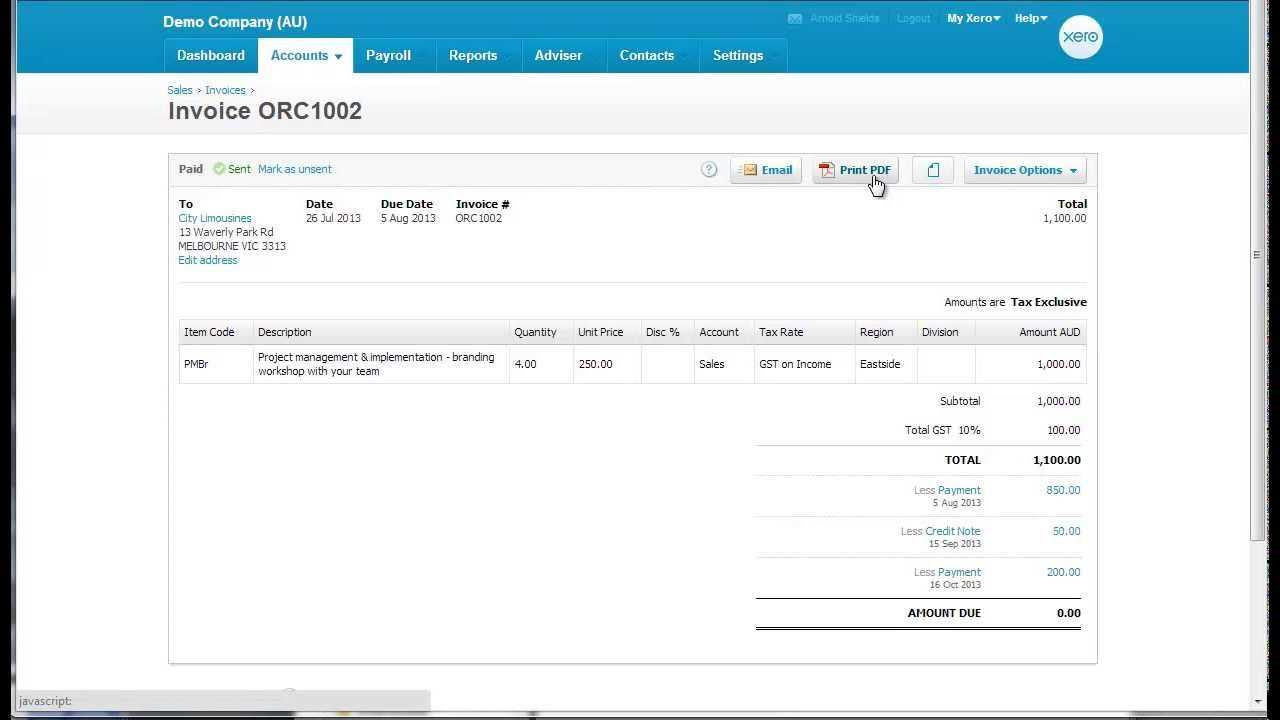

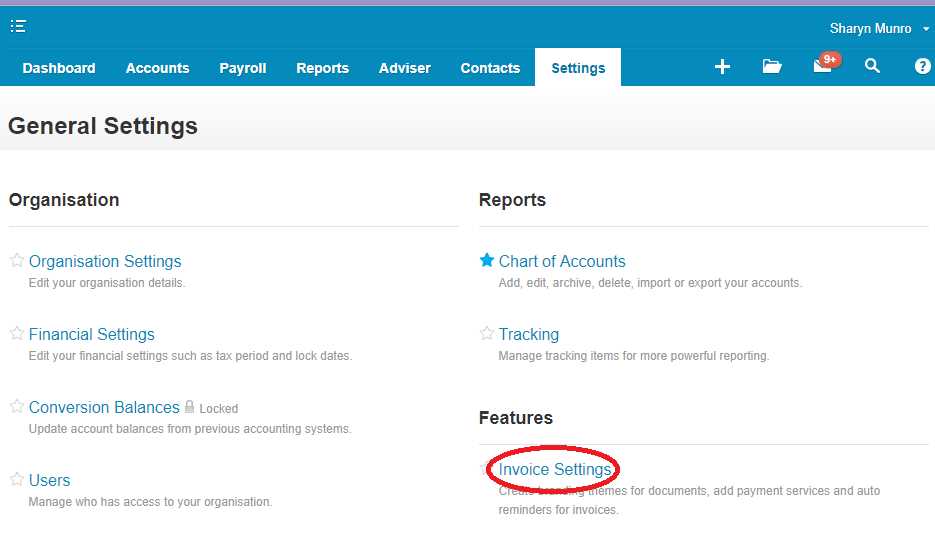

Accessing Xero Invoice Settings

To begin personalizing your business documents, the first step is to navigate to the settings section within your accounting platform. This area allows you to adjust various aspects of your financial documents, ensuring they are tailored to your specific requirements and preferences.

Locating the Settings Menu

Once you are logged into your account, find the section dedicated to financial management or document settings. From here, you will have the option to modify the appearance and content of your business forms.

Choosing the Correct Document Type

After accessing the settings area, select the document type you wish to customize. Each document type will have its own set of customizable fields, such as the layout, content, and details to include. Once selected, you can proceed with making adjustments as needed.

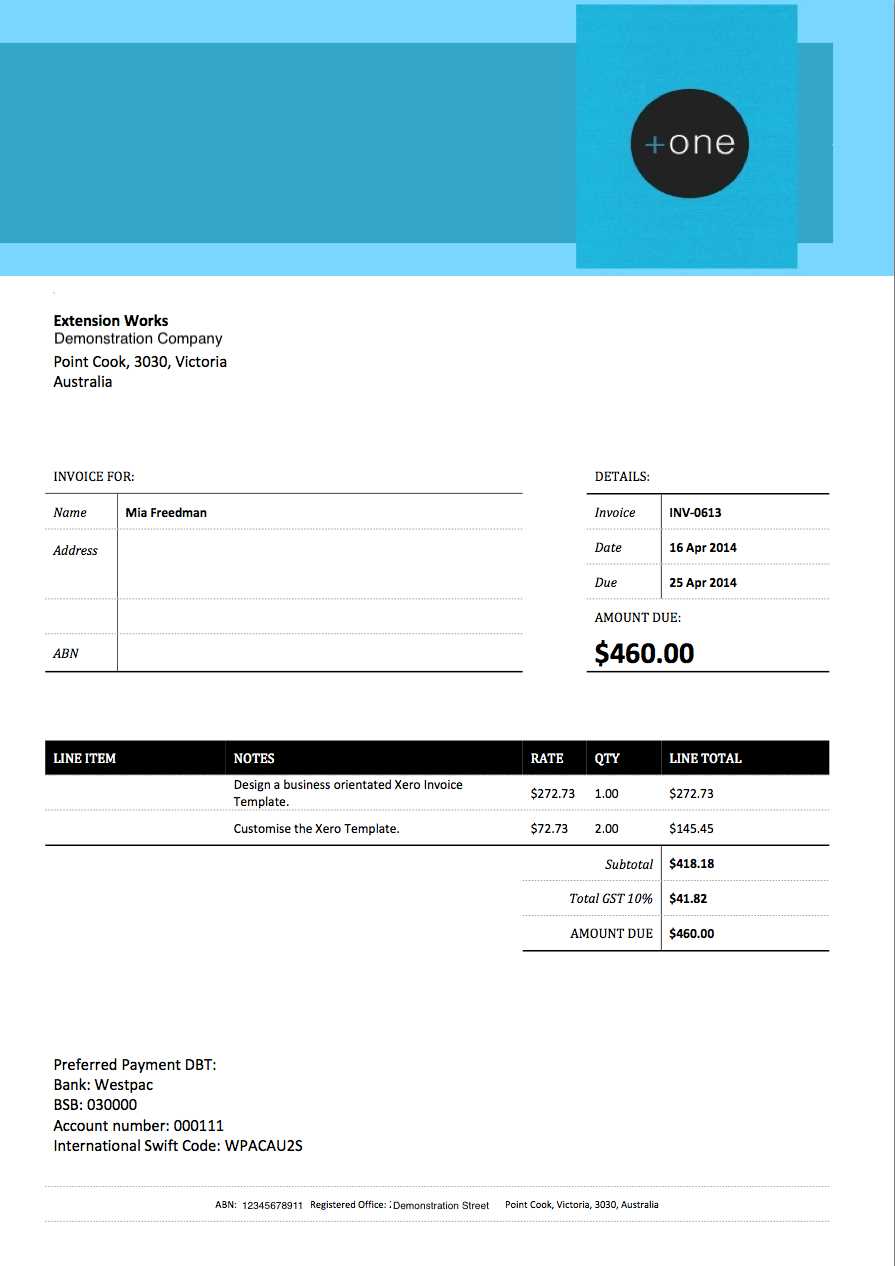

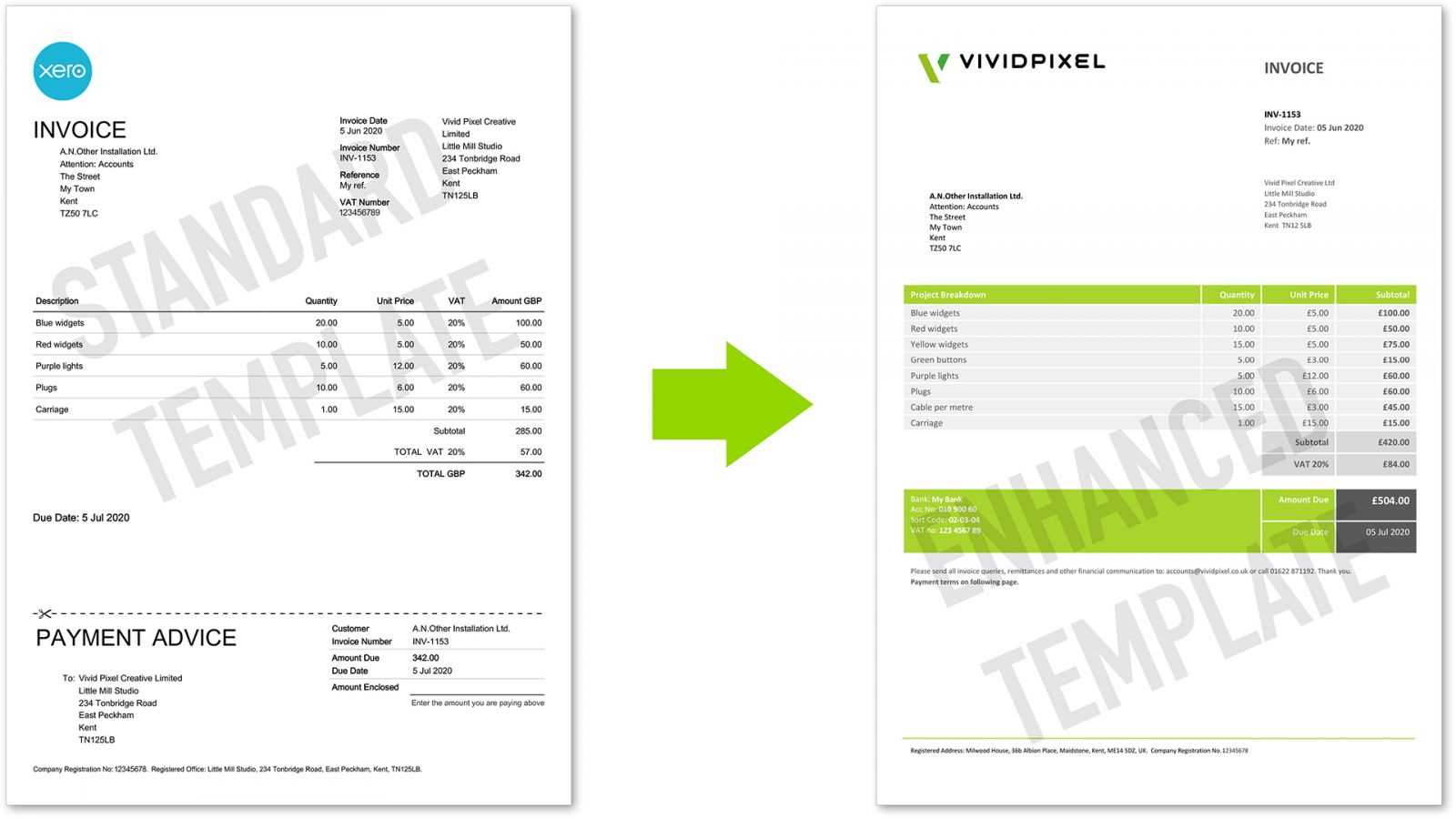

Choosing a Template Style

Selecting the right layout for your financial documents is essential to ensure they are clear, professional, and easy for clients to understand. The style of your documents plays a crucial role in reflecting your brand’s identity while providing a user-friendly experience for your clients.

Types of Available Layouts

Different layouts offer varying features and designs that can enhance the presentation of your documents. You may choose from the following options:

- Basic layout with minimal details

- Professional, branded designs with company logo

- Customizable layouts for tailored content and structure

Matching Style to Brand Identity

When selecting a design, consider your brand’s colors, fonts, and overall visual identity. A consistent look across all communications helps reinforce your brand and provides a cohesive experience for your clients. Customizable options allow you to make the necessary adjustments for the perfect fit.

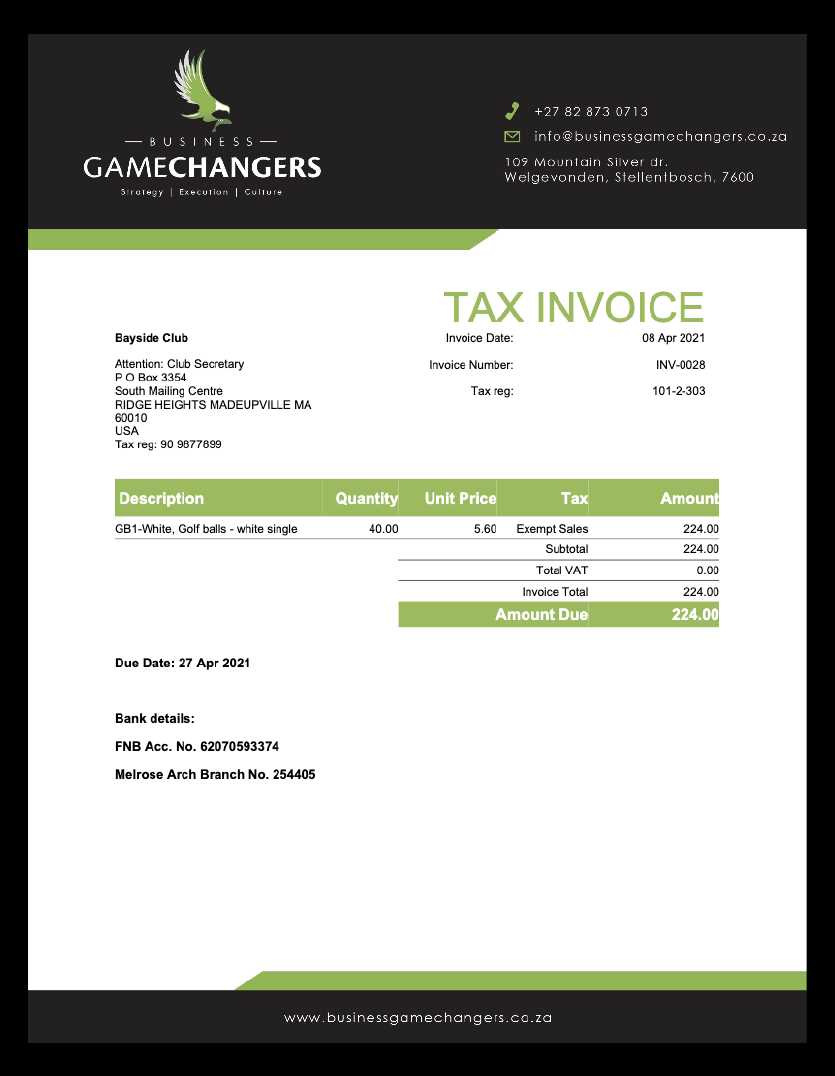

Adding Your Business Details

Incorporating your company information into financial documents ensures that clients can easily recognize the source of the communication and access important contact details. Including essential elements such as your business name, address, and tax identification number is crucial for maintaining transparency and professionalism.

To enhance the look and effectiveness of your documents, you should also add:

- Business Name: Clearly display your company name at the top of the document for recognition.

- Contact Information: Include your phone number, email, and physical address for ease of communication.

- Tax Identification Number: Essential for compliance with financial regulations and ensuring accurate reporting.

By adding these details, you create a more reliable and legitimate document that reinforces your brand and makes it easier for clients to reach out when needed.

Including Payment Terms on Invoices

Clarifying payment expectations on your financial documents is essential to ensure smooth transactions and minimize delays. By explicitly stating the terms of payment, you provide clear guidelines for when and how payments are to be made, which helps avoid confusion and strengthens client relationships.

Key Elements to Include

When specifying payment terms, make sure to include the following details to avoid any ambiguity:

- Due Date: Clearly indicate the date by which payment should be received.

- Late Fees: If applicable, state any penalties for overdue payments to encourage timely action.

- Accepted Payment Methods: List all payment options available to your clients, such as bank transfers, credit cards, or online platforms.

Communicating Terms Effectively

Ensure that the payment terms are easily visible and prominent on your documents. This clarity not only improves professionalism but also reduces the likelihood of delayed payments or disputes, keeping your business operations running smoothly.

Customizing the Invoice Design

Tailoring the appearance of your financial documents helps create a professional and cohesive look that aligns with your brand identity. Adjusting colors, fonts, and layout elements allows you to present a more personalized experience for your clients while maintaining consistency across all communications.

Design Elements to Adjust

There are several design components that you can modify to make your documents stand out:

- Logo Placement: Add your company logo to the top of the document for brand recognition.

- Color Scheme: Select colors that match your branding to make your document visually appealing.

- Font Styles: Choose readable and professional fonts that represent your business’s tone.

- Layout Structure: Customize how information is displayed, including sections for billing details and payment information.

Optimizing for Readability

While personalizing the design, ensure that the document remains clean and easy to read. The content should be clearly organized, with important details such as payment information and deadlines standing out. A well-designed document enhances professionalism and ensures that the recipient can quickly grasp key details without confusion.

Adding Tax and Discounts to Templates

Incorporating applicable taxes and discounts into your financial documents ensures that the amounts are accurate and transparent. These elements not only reflect the true cost of goods or services but also help comply with legal requirements and provide clarity for both businesses and clients.

Tax Calculation

When applying tax, it’s important to specify the rates and ensure they are correctly calculated. Depending on your region and business type, tax rates may vary, and including these calculations clearly is essential for both parties involved.

Discount Application

Discounts can be added to reduce the total cost, whether they are based on volume, early payment, or promotional offers. Make sure to show the original price, the discount amount, and the final price after the discount to avoid confusion.

| Item Description | Unit Price | Discount | Tax | Total |

|---|---|---|---|---|

| Product A | $100 | 10% | $10 | $90 |

| Product B | $150 | $0 | $15 | $165 |

| Total | $255 |

This example clearly shows how to list both discounts and taxes alongside each item, ensuring full transparency on the final price for the client.

Setting Up Invoice Item Categories

Organizing the products and services you offer into categories allows for easier management and clearer communication with clients. By grouping related items, you can streamline the creation process and ensure consistency across your documents. This helps both businesses and customers by providing clarity on pricing, quantities, and the types of goods or services involved.

Benefits of Categorization

By categorizing your items, you can quickly access and add products or services to financial documents. It also helps with tracking and reporting, as well as managing inventory or service details more effectively. Categorizing your offerings enhances accuracy and saves time.

Steps to Organize Your Items

To categorize your goods or services, begin by grouping similar items together. You can create broad categories such as “Office Supplies,” “Consulting Services,” or “Maintenance” and then add specific products or services under each heading. This makes it easier to select relevant items when creating transactions.

By establishing clear categories, you ensure that every item is listed under its appropriate group, which improves the efficiency of your business processes. This structure also helps clients understand the breakdown of charges more easily, leading to greater transparency and satisfaction.

Creating and Managing Invoice Numbers

Properly numbering your financial documents is essential for organization, tracking, and ensuring compliance with legal or tax requirements. By establishing a clear and consistent numbering system, businesses can easily monitor transactions and maintain an efficient record-keeping process. This method also minimizes the risk of duplicate or missing entries, providing both clarity and reliability in your accounting practices.

Importance of a Numbering System

Each financial document should have a unique identifier. A well-structured numbering system helps avoid confusion, simplifies record searches, and enables better reporting. By adhering to a consistent format, you can ensure that all documents are sequentially organized, facilitating audits and improving overall financial tracking.

Managing Number Sequences

When managing numbers, it’s important to decide whether the sequence should be based on chronological order, project numbers, or customer IDs. Many businesses prefer automatic sequences, while others choose to manually input numbers based on specific criteria. Regardless of the system, ensure that numbers are consistent and clear for all documents to avoid discrepancies in your accounting records.

Additionally, consider setting up a system that accommodates gaps or exceptions, such as invoices that may not follow the regular sequence due to cancellations or refunds. This allows you to keep your numbering consistent without affecting the integrity of your financial records.

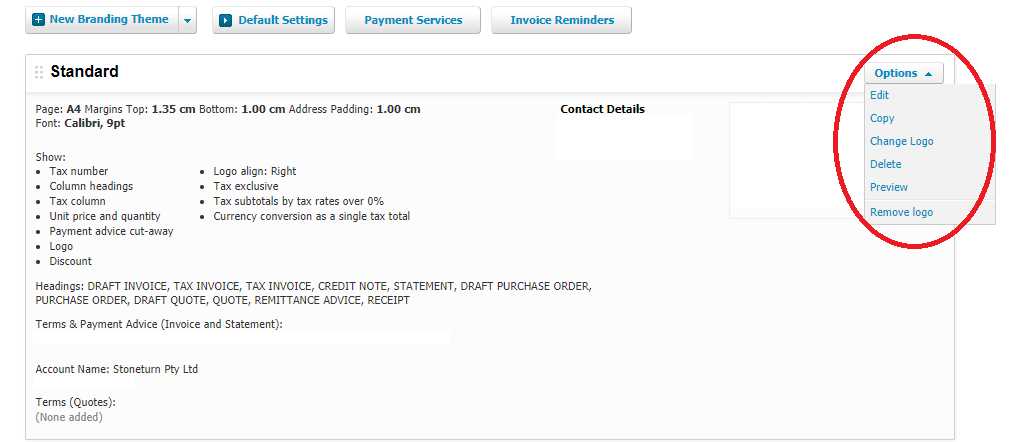

Previewing and Testing the Template

Before finalizing your document layout, it’s crucial to review and test the design to ensure everything appears correctly. This step allows you to spot any errors, such as formatting issues, missing information, or misaligned elements, before the document is sent to clients or used in transactions. Testing gives you the confidence that your design will appear professional and meet the necessary standards for your business.

Reviewing Layout and Content

After configuring your design, take the time to preview it in different formats to ensure it displays well across various devices and mediums. Check for issues like text overflow, incorrect margins, or inconsistent fonts. Make sure that all critical information, such as business details, payment terms, and item descriptions, are clearly visible and formatted correctly.

Testing Functionality

Testing involves more than just visual inspection. Ensure that all clickable elements, such as links or payment options, are functional. For example, verify that any calculations for totals, taxes, or discounts are accurate. It’s also advisable to simulate the process of generating the document to confirm that the system produces consistent results every time. Running a few mock tests will help identify any inconsistencies in your setup, providing a smoother experience for both you and your clients.

Saving and Using Your Invoice Template

Once you’ve customized the design and layout, the next step is to save your configuration for future use. This allows you to apply the same format repeatedly, ensuring consistency and saving time when creating new documents. By saving your work, you ensure that all the settings, styles, and content are preserved, enabling quick access whenever needed.

Saving the Design

After finalizing your design, it’s important to securely store it for later use. Follow these steps:

- Click on the save option once you’re satisfied with the setup.

- Give the document format a clear and identifiable name for easy reference.

- Confirm that the settings have been saved properly by reviewing the saved document.

Using the Saved Configuration

Once saved, your design is ready for use. Here’s how to efficiently implement it:

- Access your saved layout from the dashboard or menu where it is stored.

- Whenever a new transaction or task arises, simply apply your saved settings.

- For new entries, ensure that the correct format is selected each time to maintain uniformity.

By saving and reusing your personalized setup, you’ll maintain a professional appearance in all of your documents while saving valuable time. This streamlined process helps maintain accuracy and ensures that your business operations remain efficient.

How to Duplicate an Invoice Template

Replicating an existing document format can be a time-saving strategy when you need a similar structure for different tasks. Duplicating your current design ensures that you don’t have to start from scratch each time, and it allows you to maintain consistency across multiple items. With a few simple steps, you can create an exact copy of your current setup, modify it as needed, and use it without losing the original settings.

Steps to Duplicate Your Format

To efficiently replicate your document design, follow these steps:

- Navigate to the section where your current configuration is stored.

- Select the duplicate option from the settings or actions menu.

- Give the new version a unique name to distinguish it from the original.

- Review the newly created format to ensure all elements have been copied correctly.

Modifying the Duplicated Design

Once the copy is created, it can be modified to suit new requirements:

- Make any necessary adjustments to the layout or design elements.

- Change details such as branding or contact information to reflect the new context.

- Save your changes, and the new version will be ready for use in your future tasks.

By duplicating your established format, you streamline the process of creating new documents while preserving all the professional design elements you’ve already configured.

Applying Templates to Client Invoices

Once you have designed and saved a format for your documents, it’s important to know how to apply it efficiently to client-specific records. Using pre-configured layouts for different clients ensures consistency and professionalism, saving you time on customizing each document individually. This process allows for quick generation of personalized documents, which can be tailored further if necessary.

Follow the steps outlined below to associate your saved format with a specific client’s record:

| Step | Action |

|---|---|

| 1 | Select the client for whom you want to apply the design. |

| 2 | Choose the option to create or generate a new document. |

| 3 | From the list of available formats, select the one you previously configured. |

| 4 | Review the document to ensure the correct details are populated and the layout is applied properly. |

| 5 | Save the new document or send it directly to the client. |

This method ensures that all client documents maintain a consistent and professional look, while also reducing the time spent on manual adjustments.

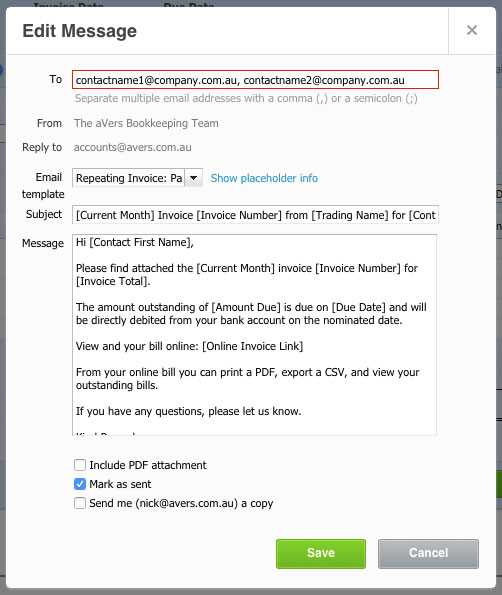

Setting Up Automated Invoice Reminders

Efficiently managing client payments can be streamlined by automating follow-up communications for overdue bills. This system ensures that clients receive timely reminders, reducing the risk of missed payments. By configuring reminders in advance, you can maintain consistent communication without the need to manually send messages each time.

Configuring Reminder Schedules

To establish a reminder system, first, specify the timeframe after which reminders will be sent. You can choose different intervals, such as a few days, weeks, or months after the due date. These reminders can be scheduled to be sent automatically, ensuring no overdue document is overlooked.

Personalizing the Reminder Messages

It’s essential to customize the content of the reminder messages. A professional and polite tone can improve client relationships while prompting timely payments. You can modify the text to include payment instructions, due dates, and other relevant details.

Managing Multiple Invoice Templates

When running a business with varying client needs or service offerings, it may be necessary to use different document designs for different situations. Efficiently managing several layouts allows you to cater to specific requirements, whether for different industries, clients, or types of transactions. By organizing and controlling your templates, you can ensure that the right layout is applied in every instance without confusion.

Organizing Your Document Layouts

To manage multiple designs effectively, it’s important to categorize your layouts based on usage. For example, you may create distinct formats for clients in different sectors or for different types of services. This enables you to quickly select the correct design for each scenario, saving time and minimizing errors.

Assigning Layouts to Clients or Transactions

Once you’ve set up different designs, the next step is to assign each to the appropriate client or transaction. This can be done automatically by linking specific layouts to client profiles or by manually selecting the layout when preparing a new document. It ensures that clients receive documents formatted to their preferences or business requirements.

| Template Name | Assigned Client | Usage Type |

|---|---|---|

| Standard Invoice | Client A | General Services |

| Consulting Invoice | Client B | Consulting Services |

| Product Invoice | Client C | Product Sales |

Common Mistakes to Avoid in Xero

While using accounting software can greatly streamline your financial processes, it’s easy to make errors if certain features and settings are overlooked. Understanding the common pitfalls can help ensure smooth operations, accurate records, and efficient use of the system. By being aware of these typical mistakes, you can avoid costly errors and keep your workflow organized.

1. Ignoring Regular Software Updates

Many users neglect to update their system regularly, which can result in missing out on important features, security patches, and improvements. Keeping the software up to date ensures optimal performance and prevents issues caused by outdated versions.

2. Not Reconciling Transactions Promptly

Failing to reconcile your accounts regularly can lead to discrepancies in your financial records. It’s important to match your bank transactions with those in your accounting system as soon as possible to keep everything accurate and balanced.

3. Incorrectly Categorizing Expenses

Misclassifying expenses or income can cause problems when generating reports or preparing taxes. Take the time to accurately assign transactions to the correct categories, as it will prevent confusion and ensure that your financial statements are reliable.

4. Overlooking User Permissions

If your team is involved in managing finances, it’s crucial to set proper user permissions. Not restricting access can lead to accidental changes or unauthorized actions that could compromise the integrity of your data.

5. Failing to Backup Data

Always back up your data to avoid losing important information. Accidental deletions or system errors can result in the loss of crucial financial data, so a regular backup schedule is essential for safeguarding your records.

Being mindful of these common mistakes will help maintain the accuracy and efficiency of your financial management system, ensuring that your accounting tasks are handled smoothly and correctly.