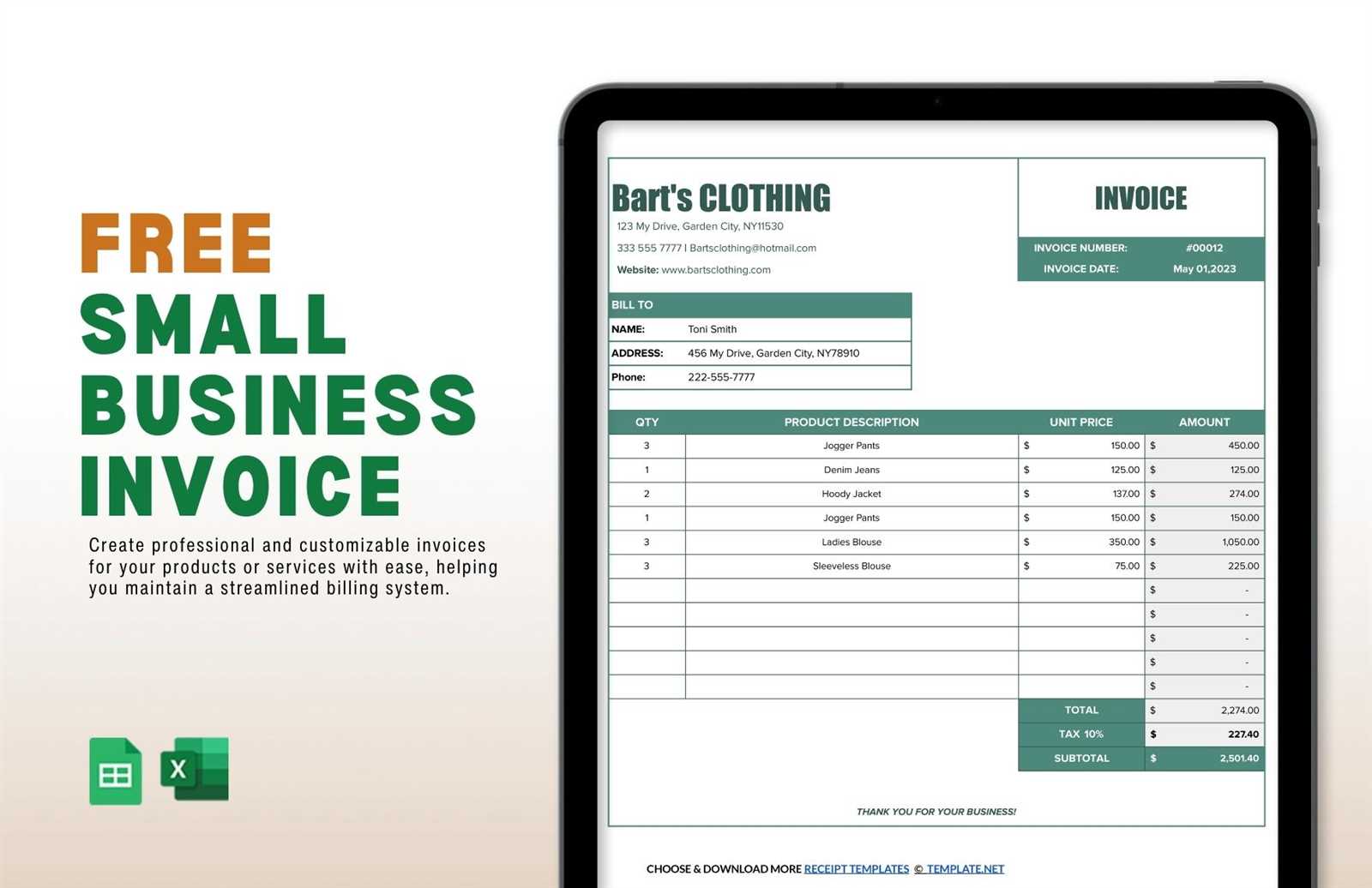

Free Small Invoice Template for Quick and Easy Billing

Managing financial transactions is a crucial aspect of running any business, regardless of its size. Having a structured and professional way to record payments, requests, and outstanding balances not only enhances your credibility but also simplifies accounting tasks. Whether you’re a freelancer, small business owner, or service provider, using a pre-designed document for financial records can save time and ensure consistency in your operations.

By utilizing ready-made documents for billing, you can eliminate the guesswork and reduce the risk of errors. These resources offer essential fields to include important details such as payment terms, services rendered, and contact information. Customization options are also available, allowing you to tailor the format to suit your business’s unique needs.

Efficient record-keeping helps maintain clear communication with clients and ensures prompt payments. A polished, easy-to-read format can strengthen your professionalism and boost client trust. In this article, we’ll explore the importance of using standardized billing tools and how they can benefit your workflow.

Small Invoice Template Guide

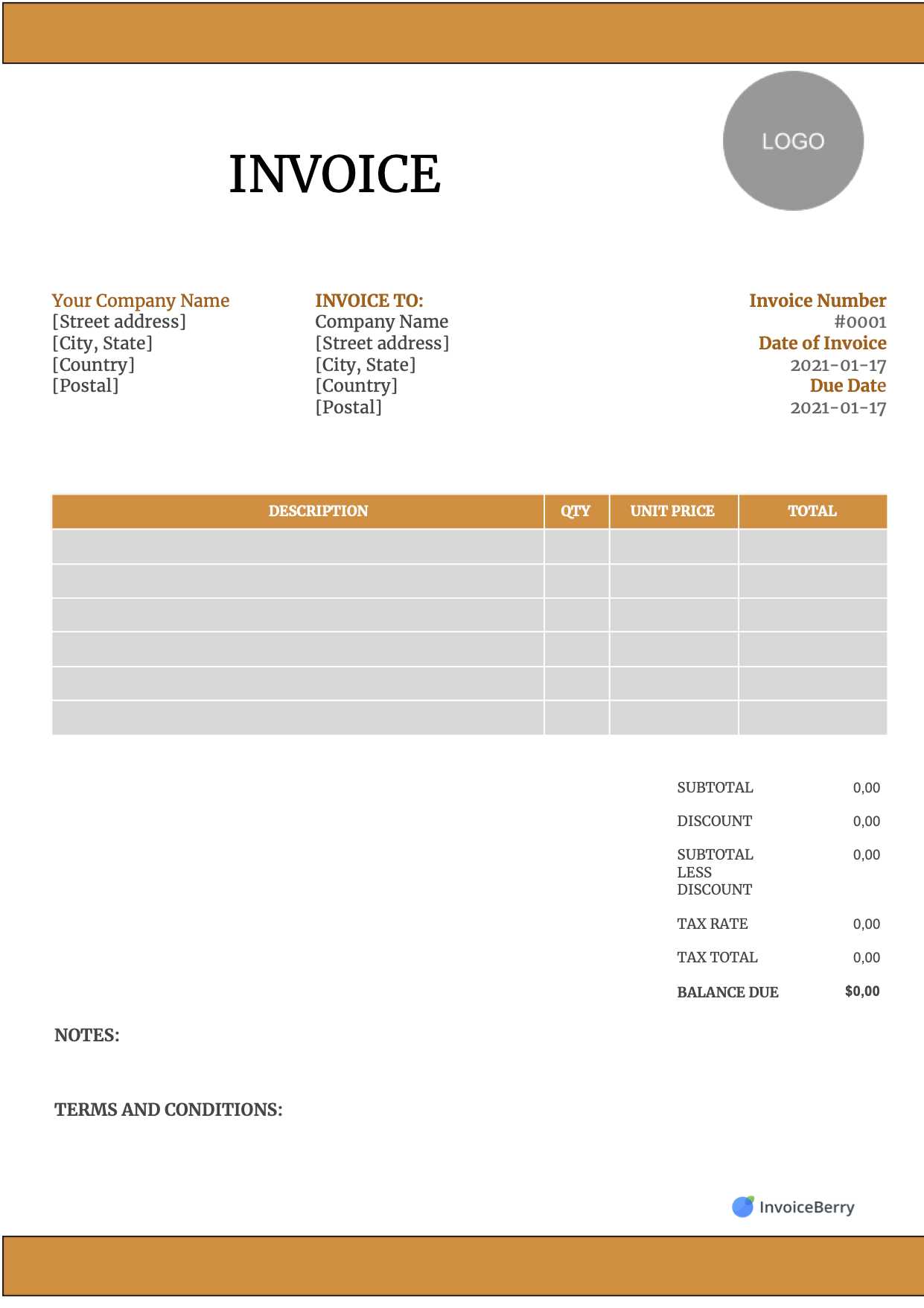

Creating clear and professional billing documents is essential for ensuring smooth financial transactions. A well-organized billing form serves as an official record of services provided, helping both the provider and the client stay on the same page. It should be easy to understand and contain all the necessary information for prompt payments and accurate bookkeeping.

In this guide, we’ll cover the key components that make a billing document effective, along with helpful tips for customizing it to suit your business needs. With a properly structured form, you can streamline your billing process and avoid common mistakes that could lead to payment delays or confusion.

Essential Elements of a Billing Document

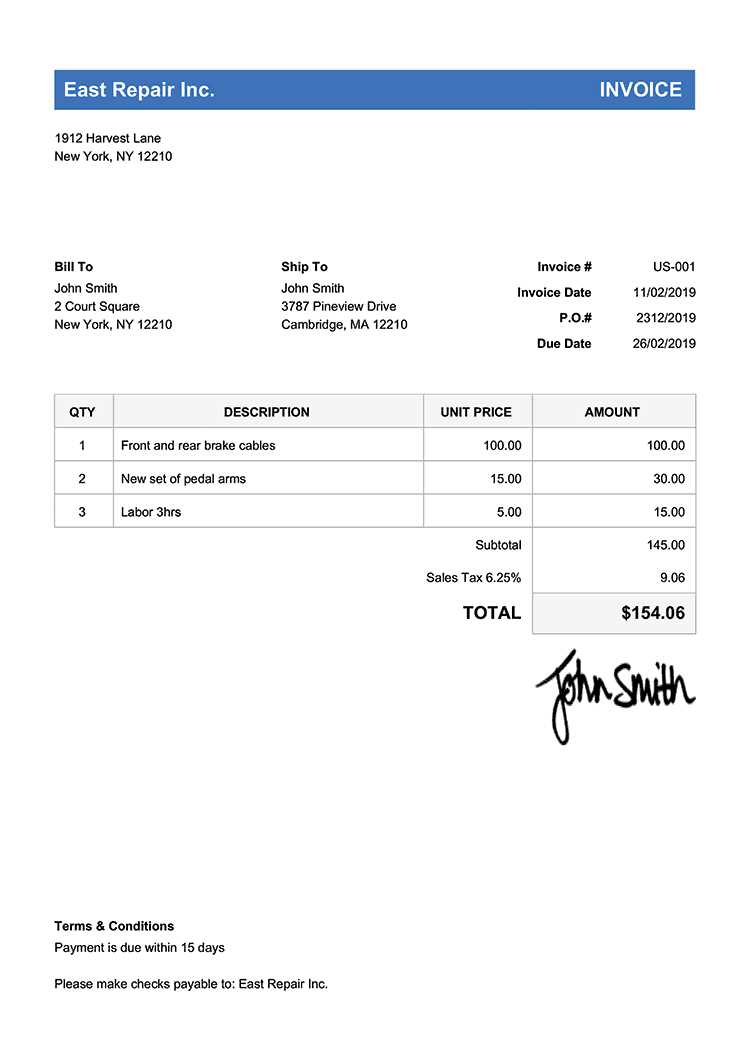

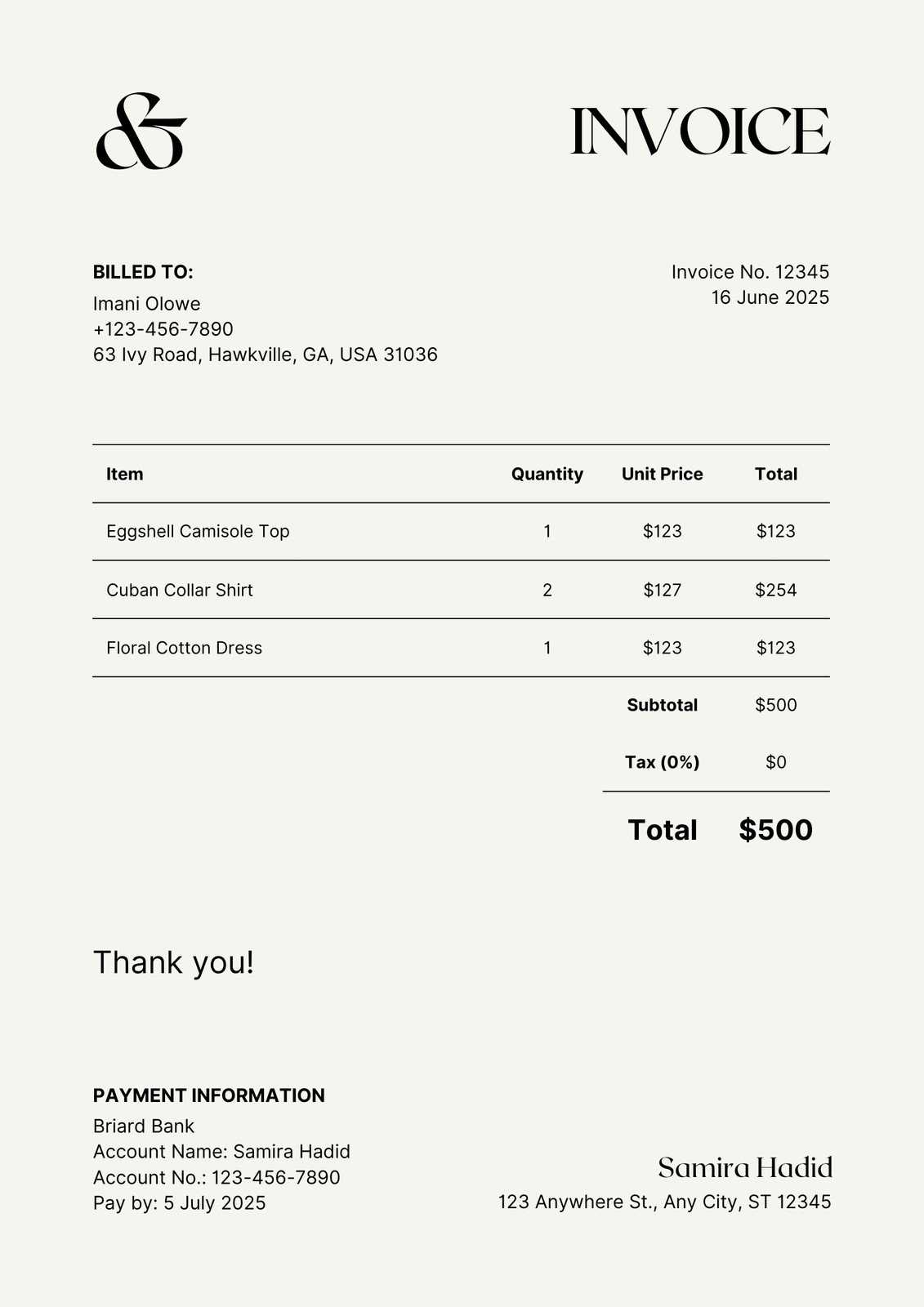

- Business Information: Your company name, address, and contact details should be clearly displayed at the top.

- Client Information: Include the client’s name, address, and contact details for accurate records.

- Itemized List of Services: Clearly break down the services or products provided, including quantities, rates, and totals.

- Payment Terms: Define the payment deadline, accepted payment methods, and any late fees or discounts.

- Invoice Number: Use a unique identifier for each document to keep track of transactions.

Customization Tips for Your Billing Forms

- Ensure that your branding is visible. Customize the layout with your company’s logo and color scheme for a professional touch.

- Adapt the layout to match the type of business you have. For example, freelancers might prefer a simpler format, while service-based businesses may need to include more detailed descriptions.

- Always double-check the accuracy of the information, such as the correct amount and payment terms, before sending the document to clients.

By following these guidelines and customizing your billing forms accordingly, you will create an efficient, organized, and professional tool that enhances both client relations and your financial workflow.

What Is a Small Invoice Template?

In business, clear documentation of transactions is crucial for both legal and financial purposes. A pre-designed form used to record the details of a financial transaction is an essential tool for any entrepreneur or small business owner. It ensures that all necessary information is included and helps maintain consistency across all records.

This document typically includes essential fields such as item descriptions, quantities, pricing, and payment terms. It serves as an official request for payment, helping clients understand what they are being charged for and when payment is due. Whether you are providing a product or a service, such a form is a key part of professional business operations.

Key Features of a Billing Form

- Clear Description of Services: A detailed list of what was provided to the client, including unit price and total cost.

- Contact Information: Your business details, along with those of the client, for easy reference.

- Payment Instructions: Clear terms outlining the payment due date, accepted payment methods, and any applicable fees.

Why Use Pre-designed Billing Forms?

- Efficiency: Pre-made forms save time, ensuring you don’t miss essential fields.

- Professionalism: Using a standardized format enhances your business’s image and builds trust with clients.

- Organization: Keeping all records in a consistent format makes tracking payments and managing finances easier.

Using a pre-structured form to document charges ensures that no critical details are overlooked and can make your billing process more efficient and professional.

Benefits of Using Invoice Templates

Utilizing pre-designed forms for billing can offer a wide range of advantages for businesses of all sizes. By simplifying the process of documenting financial transactions, these tools help ensure that important details are consistently included, reducing the risk of errors or omissions. With a structured format, business owners can streamline their workflow and focus more on their core tasks.

These ready-made documents not only save time but also improve the professionalism of your interactions with clients. When both the layout and content are standardized, it’s easier to maintain an organized and efficient billing system, which ultimately leads to faster payments and fewer disputes.

Time Efficiency

- Quick Setup: Ready-to-use forms can be filled out in minutes, cutting down on the time spent creating billing documents from scratch.

- Consistent Format: Reusing the same structure ensures that every document is uniform and easy to understand.

Improved Accuracy

- Less Room for Error: Pre-built forms have all the necessary fields, minimizing the chances of missing critical information.

- Clear Payment Terms: By including payment instructions upfront, clients are less likely to misunderstand deadlines or amounts due.

By integrating such tools into your billing routine, you not only save valuable time but also foster trust and transparency with your clients, ensuring smoother financial interactions.

How to Customize Your Invoice Template

Customizing a billing document allows you to tailor it to your business needs, ensuring that it reflects your branding and clearly communicates all relevant details to clients. Personalizing this tool not only helps maintain a consistent professional appearance but also ensures that the document includes all necessary fields that suit the nature of your services or products.

By adjusting the layout and content, you can make your forms more user-friendly, while ensuring they meet legal and business requirements. The following steps will guide you through the process of adapting a standard billing form to better align with your specific needs.

Essential Customization Steps

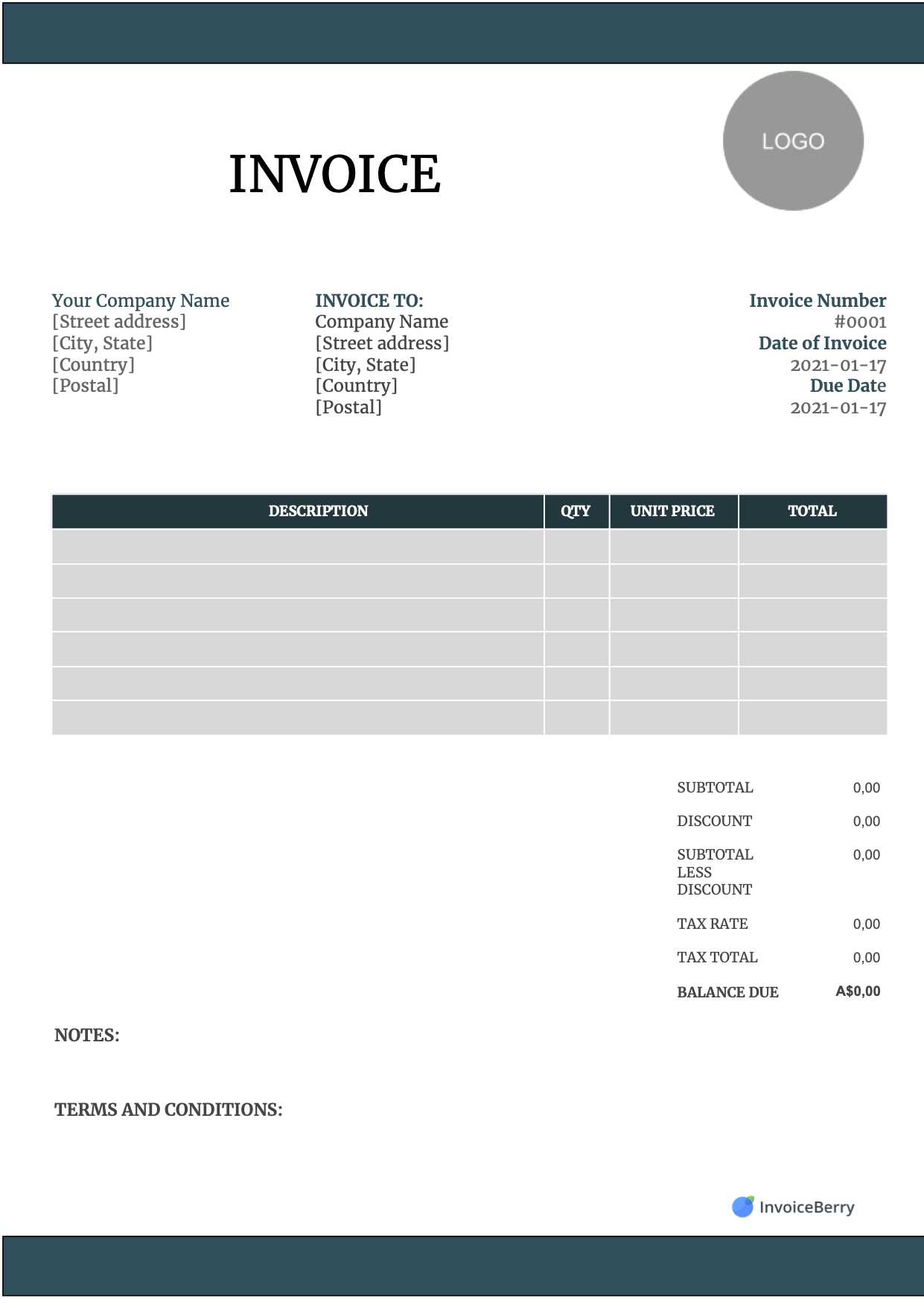

- Branding: Incorporate your company logo, brand colors, and fonts to make the form recognizable and cohesive with your other business materials.

- Adjusting Layout: Depending on the nature of your business, you may want to modify the document’s structure, such as adding or removing sections (e.g., a description field for services rendered or a section for applicable taxes).

- Payment Terms: Clearly outline payment deadlines, accepted methods, and penalties for late payments to avoid misunderstandings.

- Personalized Fields: Add custom fields that are relevant to your specific business needs, such as customer reference numbers or service duration.

Tips for Streamlining Customization

- Ensure all essential details are included and clearly formatted for easy readability.

- Use software or online tools to easily edit and adjust the form to your specifications.

- Regularly update your forms to reflect any changes in your pricing, terms, or branding.

By taking the time to personalize your billing forms, you ensure that each transaction is professionally documented, improving both efficiency and customer satisfaction.

Best Practices for Invoice Design

Creating a well-organized and aesthetically pleasing billing document is essential for ensuring clear communication and professionalism. A clean, easy-to-read format not only enhances the client’s experience but also reduces the likelihood of errors, misunderstandings, or delayed payments. By following a few design best practices, you can create a document that reflects your brand and improves the efficiency of your payment process.

The structure of your document should be intuitive, with clear sections for all necessary details. Ensuring consistency and readability is key to creating an effective tool for both you and your clients. Below are some of the best practices to consider when designing your billing forms.

Key Design Principles

- Simplicity: Avoid clutter by using a minimalist approach. Focus on the most important information and keep the layout clean.

- Consistency: Use consistent fonts, colors, and spacing throughout to maintain a professional appearance.

- Readable Fonts: Choose legible fonts and appropriate font sizes to ensure all text is easy to read, especially important details like payment terms and totals.

- Logical Flow: Organize the document in a logical order–typically, starting with your company details, followed by client information, services provided, and payment terms.

Tips for Effective Customization

- Use bold or larger fonts for headings to help clients quickly identify key sections, such as “Total Amount Due” or “Payment Terms.”

- Incorporate your logo and company branding colors to make the document align with your overall business identity.

- Ensure there is enough white space between sections to avoid overcrowding and make the form easy to navigate.

- Consider adding a section for notes or special instructions, allowing you to communicate any relevant information in a personalized way.

By incorporating these best practices into your design, you can create a professional and user-friendly billing document that enhances client trust, reduces confusion, and helps ensure timely payments.

Key Elements of an Invoice

When creating a billing document, it’s essential to include specific details that ensure clarity and provide all necessary information for both the business and the client. These key components not only help to avoid confusion but also ensure that both parties are aligned on the services rendered, payment expectations, and deadlines.

Whether you’re sending a document for a one-time project or an ongoing service, including the right information helps maintain professionalism and streamlines the payment process. Below are the fundamental elements that should always be included in a well-crafted billing document.

Essential Components

- Business Information: Include your business name, address, contact information, and logo at the top of the document for easy identification.

- Client Information: Clearly list the client’s name, address, and contact details to ensure the document is properly addressed and tracked.

- Unique Identifier: Use a specific reference number to easily track and organize each document for your records.

- Description of Services: Provide a detailed list of the products or services provided, including quantities, unit prices, and total costs.

- Payment Terms: Specify the payment due date, any early payment discounts, or late payment penalties to avoid misunderstandings.

Additional Information to Consider

- Tax Details: If applicable, include any sales tax or VAT information to clarify the total amount due.

- Payment Instructions: Outline accepted payment methods and any necessary account details for smooth transaction processing.

- Notes or Special Instructions: Provide space for additional information, such as terms and conditions or a thank you note, to personalize the document.

By including these essential elements, you ensure that your billing documents are clear, professional, and complete, helping you build trust with clients and streamline the payment process.

Free Invoice Templates for Small Businesses

For many entrepreneurs and small business owners, managing finances can be a time-consuming task. Using pre-designed documents to record transactions is an efficient way to ensure accuracy and professionalism without the need to create forms from scratch. Fortunately, there are many free resources available that offer customizable options to suit different business needs.

These free resources not only save time but also provide flexibility, allowing you to adjust the format and content to match the unique requirements of your business. Whether you are just starting out or need a simple solution for routine transactions, free billing forms can be a cost-effective way to manage your payments.

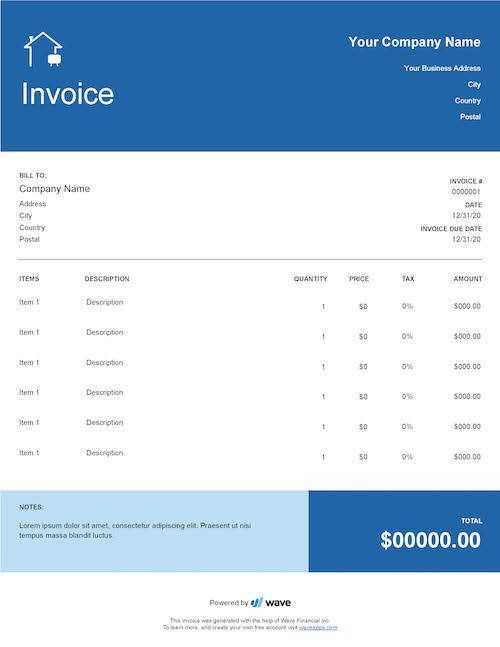

Where to Find Free Resources

- Online Platforms: Websites like Microsoft Office and Google Docs offer a wide range of editable templates that you can easily download and customize.

- Accounting Software: Some accounting tools, like Wave or Zoho, provide free templates as part of their basic services, making it easy to integrate billing into your workflow.

- Freelancer Communities: Platforms such as Fiverr or Upwork may offer free or affordable templates designed by experienced professionals for specific industries.

Benefits of Using Free Resources

- Cost-Effective: Free templates eliminate the need for expensive software or professional design services.

- Quick Customization: Most templates are easy to modify, allowing you to add or remove sections to match your business model.

- Professional Appearance: Even though they are free, many templates are designed to look polished and professional, enhancing your business image.

By using these free resources, you can create clear and well-organized billing documents, ensuring both your business and clients remain on track with payments.

How to Create an Invoice from Scratch

Creating a billing document from scratch can seem daunting, but by following a structured approach, it becomes a manageable task. The key is to ensure that all essential information is included and presented clearly. While there are many tools and resources available, knowing how to manually construct a document gives you full control over the details and format.

To help guide you through the process, we’ll outline the main components of a complete document and show you how to organize the information effectively. Below is a simple layout you can follow when creating your own billing form:

| Section | Details |

|---|---|

| Business Information | Your business name, address, phone number, and email should be placed at the top of the document. |

| Client Information | Include the client’s full name, address, and contact details for accurate billing. |

| Unique Identifier | Assign a unique reference number to each document for tracking purposes. |

| Details of Products/Services | List the products or services provided, including quantities, unit prices, and totals. |

| Payment Terms | Clearly specify the payment due date, method of payment, and any late fees or discounts. |

| Notes or Special Instructions | Add any additional details that might be relevant, such as delivery terms or a thank you message. |

After structuring the document, make sure to review it for accuracy before sending it to your client. This ensures all information is correct and easy to follow, which helps avoid confusion and encourages timely payment.

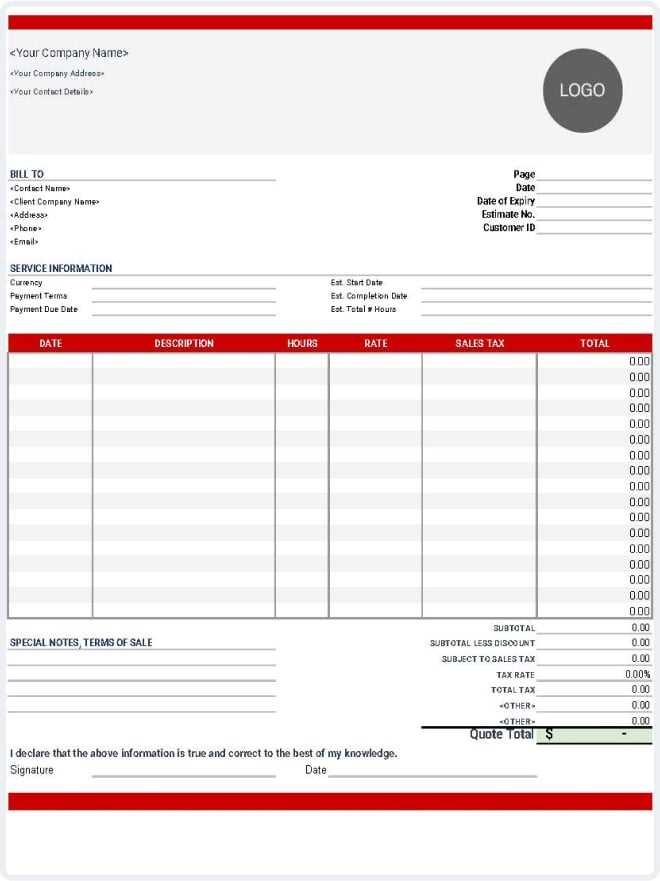

Choosing the Right Invoice Format

When it comes to billing, selecting the right format for your financial documents is essential for maintaining clarity and professionalism. The structure you choose should align with the type of work or services you offer, as well as how you want to present your business to clients. A well-organized document not only ensures that all necessary information is included but also helps streamline the payment process.

There are various formats available, each suited to different business models. Choosing the right one depends on your specific needs, whether you’re sending simple one-time payments or managing ongoing projects. Below are some factors to consider when deciding on the most suitable format for your business.

Considerations for Choosing the Format

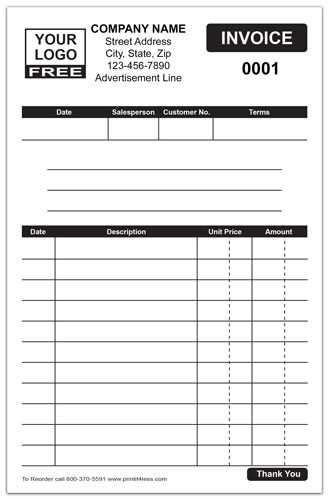

- Business Type: For service-based businesses, a detailed breakdown of hours worked or tasks completed is often necessary. For product-based businesses, a list of items with quantities and unit prices is more relevant.

- Complexity of Transactions: If your transactions are simple, a basic format will suffice. For more complex projects, including multiple items or services, a more detailed layout is advisable.

- Client Preferences: Some clients may prefer a minimalist format, while others may require detailed descriptions and additional sections for taxes, discounts, and payment terms.

- Legal Requirements: Depending on your location and industry, there may be specific legal requirements for how you must structure your billing documents. Ensure your format meets these standards.

Types of Formats to Consider

- Basic Format: A simple, easy-to-read layout that includes essential fields like contact details, a brief description of services, and payment information.

- Detailed Format: Includes additional sections such as itemized lists of products or services, taxes, discounts, and special instructions.

- Recurring Billing Format: For businesses that offer subscription or recurring services, this format typically includes details on payment frequency, renewal dates, and any automatic charges.

By carefully considering your business needs and client preferences, you can select a format that ensures both clarity and professionalism in your billing process.

Common Mistakes in Invoice Creation

Creating a billing document may seem straightforward, but there are several common errors that can cause confusion or delays in payment. These mistakes often stem from overlooking key details or misunderstanding the client’s needs. Addressing these issues early can improve the accuracy of your financial records and maintain professional relationships with clients.

By being aware of frequent pitfalls, you can avoid unnecessary complications and ensure that each transaction is properly documented and processed. Below are some of the most common mistakes to watch out for when preparing a billing document.

Common Errors to Avoid

- Missing Contact Information: Failing to include your business’s name, address, phone number, and email can cause confusion and delay payments. Make sure both your details and those of the client are clearly listed.

- Incorrect or Missing Dates: Not specifying the correct date of the transaction or payment due date can lead to misunderstandings about when payment is expected. Always include both the issue date and the due date.

- Omitting a Unique Identifier: Not assigning a reference number to each document can make it difficult to track payments or resolve disputes. Every document should have a unique number for reference.

- Unclear Payment Terms: If your payment terms are not clearly outlined, clients may be confused about when and how to pay. Always specify the accepted payment methods, due dates, and any late fees or discounts.

- Incorrect Calculations: Errors in arithmetic can lead to overcharging or undercharging. Double-check your math, especially when dealing with multiple items or tax rates.

- Failure to Include Tax Details: If applicable, you must include tax amounts, such as VAT or sales tax, on the document. Omitting this can cause legal issues and confuse clients about the total amount due.

How to Avoid These Mistakes

- Review the document carefully before sending it to ensure all information is accurate and complete.

- Use software tools that automatically calculate totals and taxes to minimize the risk of math errors.

- Standardize your format to include essential fields and ensure consistency across all documents.

By paying attention to these common mistakes and taking steps to prevent them, you can ensure that your billing process runs smoothly and professionally, ultimately fostering positive relationships with clients and ensuring timely payments.

Saving Time with Pre-made Templates

For any business, efficiency is key, especially when it comes to administrative tasks like managing financial records. Using pre-designed documents for billing can significantly reduce the time spent on paperwork and help streamline your workflow. Instead of starting from scratch every time you need to create a document, these ready-made solutions allow you to quickly input the necessary details and focus more on your core tasks.

Pre-made forms are customizable and eliminate the need for repetitive formatting, ensuring you have a professional and organized document every time. With these templates, you save valuable time that can be better spent growing your business. Below is a comparison of how using pre-designed forms can reduce time spent on administrative work:

Time Saved with Pre-made Forms

| Traditional Method | Using Pre-made Forms |

|---|---|

| Manually creating each document from scratch | Quickly filling in required fields and adjusting minimal details |

| Reformatting each document to ensure consistency | Using a standardized, ready-to-go format for every transaction |

| Tracking payments and managing due dates manually | Automated calculations and clear payment terms included in the template |

| Spending time ensuring professional design and layout | Templates are designed to look professional, requiring no extra effort |

Benefits of Using Pre-made Forms

- Efficiency: Pre-designed documents allow you to focus on adding key details instead of worrying about formatting or design.

- Consistency: Using the same format for all transactions ensures uniformity and reduces the chance of errors.

- Professional Appearance: Ready-made solutions are often designed to look polished, enhancing your business’s reputation.

- Less Stress: With all the heavy lifting already done, you can handle administrative tasks quickly and with less effort.

By integrating pre-made forms into your workflow, you can significantly reduce the amount of time spent on billing, improve consistency, and maintain a professional appearance in all your business dealings.

Legal Requirements for Invoices

When creating billing documents, it is essential to adhere to legal standards and regulations to ensure that your transactions are properly documented and compliant with tax laws. Different countries and industries have specific requirements regarding what information must be included, how taxes should be calculated, and how documents should be presented. Understanding these rules not only helps avoid legal issues but also ensures transparency and trust with clients.

Whether you’re a freelancer, small business owner, or part of a larger organization, it is critical to include all necessary details to make sure your document is valid. Below are some of the key legal requirements that apply to most businesses when creating a billing statement.

Essential Legal Elements

- Business Identification: Your business name, registration number (if applicable), and tax identification number must be clearly stated on the document.

- Client Information: The full name and address of the client are often required, especially for businesses that deal with larger clients or operate internationally.

- Unique Reference Number: Every billing document should include a unique identifier or invoice number for tracking and record-keeping purposes.

- Transaction Date: The date when the goods or services were delivered or the agreement was signed must be indicated clearly on the document.

- Amount Due: The total amount due, including any applicable taxes, should be specified. It must also be broken down to show the base amount and the applicable tax rates.

- Tax Information: If applicable, businesses must include details about taxes such as VAT, sales tax, or other relevant charges. The tax rate and the total tax amount must be clearly shown.

Additional Legal Considerations

- Payment Terms: Clearly state the payment due date, along with any late fees or discounts for early payments, to avoid misunderstandings.

- Currency and Payment Methods: Specify the currency in which payment is expected and the accepted payment methods (bank transfer, credit card, etc.).

- Terms and Conditions: Depending on the jurisdiction, you may need to include terms related to refunds, warranties, or dispute resolution.

By ensuring that all of these elements are included and accurate, you can avoid legal pitfalls and m

How to Track Invoice Payments Effectively

Managing and tracking payments is an essential aspect of any business’s financial health. Without a proper system in place, it can become difficult to keep track of outstanding payments, leading to missed deadlines and cash flow issues. The key to staying on top of payments is developing a clear process to monitor due amounts, received payments, and outstanding balances.

Implementing an efficient payment tracking system helps ensure that you get paid on time and that any issues are addressed promptly. There are several ways to track payments, ranging from manual record-keeping to automated tools that streamline the process. Below are some strategies to help you manage your payments effectively.

Effective Payment Tracking Methods

- Maintain Detailed Records: Always keep a record of each transaction, including the payment due date, amount, client details, and payment terms. This will help you stay organized and prevent any oversight.

- Use Accounting Software: Many accounting platforms provide automated tracking features that allow you to easily monitor payments, send reminders for overdue balances, and generate reports for better financial visibility.

- Manual Tracking: If you prefer a more hands-on approach, create a simple spreadsheet or ledger to track payments. Include columns for the client name, invoice number, payment due date, amount owed, amount paid, and outstanding balance.

- Set Up Payment Reminders: Automate reminders for clients as their payment due dates approach. This can be done through invoicing software or by setting manual reminders in your calendar or task management system.

Best Practices for Payment Tracking

- Update Records Regularly: Ensure that you update your payment records as soon as you receive a payment, so there is no confusion about the status of each transaction.

- Communicate Clearly: Send clear and professional payment reminders to clients if payments are overdue, and be polite but firm when following up.

- Keep Backup Documentation: Keep copies of all payment receipts, transaction confirmations, and related correspondence to avoid disputes and ensure you have evidence of each payment made.

By using a consistent and well-organized method to track payments, you can significantly improve cash flow management, reduce overdue payments, and maintain good relationships with your clients.

Software for Easy Invoice Generation

Creating billing documents manually can be time-consuming and error-prone. Thankfully, a variety of software tools are available that streamline the process, making it easy to generate accurate, professional documents quickly. These tools not only save time but also reduce the likelihood of mistakes and help you manage your financial records more efficiently. By using the right software, you can create and send documents instantly, track payments, and maintain a consistent format across all transactions.

Below is a comparison of some popular software options designed to simplify the process of generating billing documents. Each tool offers unique features that cater to different business needs, from basic invoicing to more advanced accounting capabilities.

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, automatic payment reminders, tax calculations, integrated accounting features. | Businesses looking for comprehensive accounting and invoicing capabilities in one platform. |

| FreshBooks | Easy-to-use interface, time tracking, expense management, automatic recurring billing. | Freelancers and small businesses in need of simple, streamlined billing and financial tracking. |

| Zoho Invoice | Invoice creation, client management, customizable templates, multi-currency support. | Small businesses that require multi-currency support and a highly customizable invoicing solution. |

| Wave | Free invoicing, automatic billing, receipt scanning, integrated accounting. | Freelancers and startups looking for a free invoicing and accounting solution with essential features. |

| PayPal Invoicing | Quick invoice creation, PayPal integration, automatic payment tracking, mobile access. | Businesses and freelancers who frequently use PayPal for payments and need a quick invoicing solution. |

Choosing the right software depends on the complexity of your needs and your budget. Whether you need a simple invoicing tool or a comprehensive financial management system, these tools can help

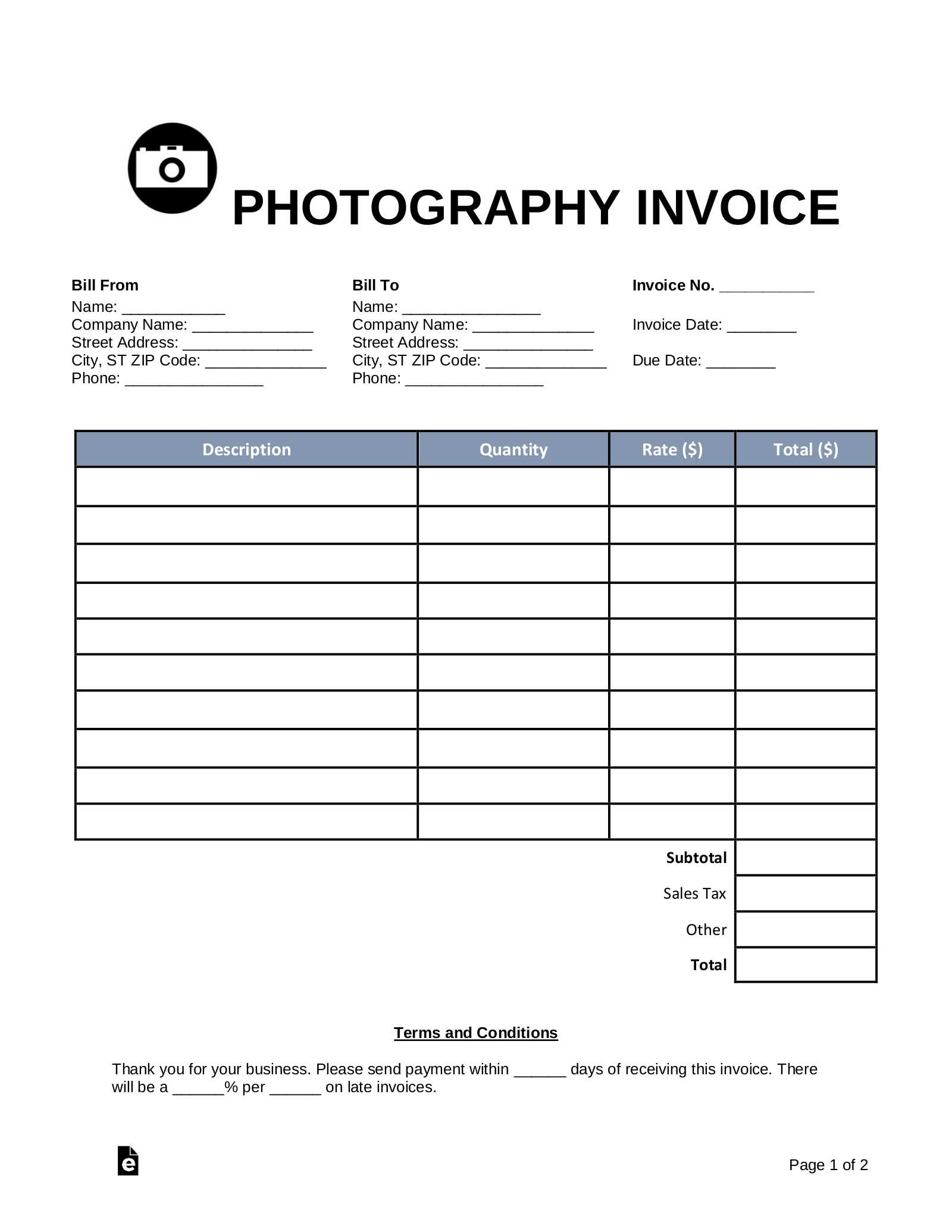

Ensuring Professionalism in Your Invoices

Maintaining professionalism in your financial documents is crucial for building trust with clients and ensuring timely payments. A well-structured and visually appealing document not only reflects the quality of your services but also demonstrates your attention to detail and commitment to your business. Regardless of the size of the transaction, professionalism in your billing process can leave a lasting impression and improve client relationships.

To ensure your documents convey a professional image, it’s important to focus on clarity, accuracy, and consistency. Below are some key aspects to consider when creating business documents that reflect professionalism.

Key Elements for a Professional Appearance

- Clear Layout: Use a clean and organized design that is easy to navigate. Important information such as client details, transaction description, and total amount should be easy to find.

- Consistent Branding: Include your business logo, consistent fonts, and a color scheme that aligns with your brand identity. This makes your document look polished and aligned with your other marketing materials.

- Accurate Information: Double-check all the details, from pricing to dates. Errors in amounts, tax rates, or contact information can cause confusion and damage your professional reputation.

- Professional Language: Use formal language and avoid slang or overly casual phrases. A courteous tone should be maintained throughout the document, especially in sections related to payment terms and deadlines.

Best Practices to Uphold Professionalism

- Use a Standardized Format: Create a consistent format for all your billing documents. This helps ensure that no essential detail is ever overlooked and makes the process more efficient.

- Include Clear Payment Instructions: Ensure your payment terms and methods are clearly explained. This reduces misunderstandings and encourages prompt payments.

- Offer Multiple Payment Options: Provide clients with various ways to pay (bank transfer, credit card, online payment systems) to make the process as convenient as possible.

- Follow Up Professionally: If payments are overdue, send polite reminders with a professional tone. Include the original document for reference and maintain a diplomatic approach.

By incorporating these practices, you can create documents that not only ensure clarity and professionalism but also improve the overall efficiency of your business operations. A

When to Use a Small Invoice Template

Knowing when to use a pre-designed document for billing is important for streamlining your administrative tasks. Pre-designed forms help you save time and maintain consistency, especially when dealing with simple transactions. These forms are especially useful in situations where the process is straightforward and doesn’t require complex customization or detailed calculations. Understanding when and how to use these forms effectively can help you stay organized while ensuring that your financial communications remain professional.

Using ready-made forms is ideal for businesses that frequently issue documents for smaller transactions, routine payments, or clients with straightforward needs. Below are some scenarios where opting for pre-designed forms can make your billing process more efficient.

When to Choose Pre-designed Billing Documents

- Routine Transactions: If your business involves regular, recurring services or product sales, using pre-designed forms for each transaction can save time and effort while maintaining consistency.

- Simple Transactions: For straightforward, low-value transactions where customization is minimal, these forms can provide a quick and easy way to document payments without the need for extensive formatting.

- Freelancers and Contractors: Independent workers or service providers can benefit from these forms when dealing with clients who do not require complex billing processes.

- Small Businesses: Small companies with fewer transactions or a limited range of products or services often use these forms to keep operations simple and cost-effective.

Advantages of Using Pre-designed Billing Documents

- Time Efficiency: Instead of starting from scratch with every new transaction, pre-designed forms allow you to quickly fill in the necessary details, reducing the time spent on administrative tasks.

- Consistency: Using the same format for all transactions ensures a uniform appearance, making it easier for clients to recognize and understand the documents.

- Professionalism: Ready-made documents are often designed to look polished, enhancing your business’s image without requiring extra design work or investment in software.

In summary, pre-designed forms are ideal for routine, straightforward transactions where simplicity and efficiency are priorities. They can help save time, ensure consistency, and maintain professionalism in you